1. Introduction

Digital transformation influences significatively the enterprises and the way that they are doing their activities, especially regarding the electronic commerce [

1], known as e-commerce . One of the essential factors for this evolution is the extensive usage of Web 2.0 instruments [

2], which facilitates collaboration, co-creation and interactions with the consumers [

3]. The economic environment, organizations and consumers behavior [

4] were highly impacted by the power of digital transformation. The digitalization of the economy at the level of the European Union states is a priority, showed through diverse initiatives and programs [

5], integrating web 2.0 instruments in the digital transformation and sustainable development policies. Therefore the analysis of how e-commerce development is influenced by the Web 2.0 tools is mandatory in the context of rapid digitalization due to the pandemic and economic sustainability.

Social media and online advertisement [

6] role in influencing the customer behavior is extensively studied in the literature, but the concrete economic outcome of utilizing these instruments are insufficiently studied for European countries. Scientific literature from the field is concentrated on themes related with social effects and comportments, but the economic performance subject is not explored in a quantitative and comparative way. Taking into consideration that the results of these technologies are not enough studied from the economic point of view, we plan to study how Web 2.0 tool adoption influences the e-commerce performance in the EU states.

The bibliometric review is confirming the gap related with quantitative analysis, because the majority of the works are qualitative, interview or study case based, focused on a single company, industry or country. Also the focus until now was on consumer behavior and on technology advancements, without providing enough attention to the measurable economic effects generated by the relationship web 2.0 instruments and e-commerce. This study has the objective to contribute to the literature, through applying econometric models on panel data gathered from the 27 EU states, a period 2015-2023.

The structure of the article contains the following: critical review of the scientific literature with a focus on web 2.0, e-commerce, sustainability, bibliometric review, identification of the gaps from literature and development of the hypotheses; research methodology based on quantitative approach of panel data regression based on Eurostat database; research results with focus on Coefficients for Fixed Effects and Random Effects variables, Random Effects Estimation Summary, Random Effects – Parameter Estimates, Fixed Effects – Parameter Estimates, Robust standard errors, clustered by both country and year, Robust standard errors – Parameter Estimates, Dynamic panel model (Arellano-Bond style) – Parameter Estimates; discussions with the focus on novelty findings and conclusions. The scope of this paper is to analyze the relationship between Web 2.0 tools and the level of turnover generated by e-commerce, applying robust econometric models based on panel data regression with Random effects and with fixed effects (Arellano-Bond).

3. Research Methodology

A quantitative approach based on panel data regression was followed for the research. The data sources used were Eurostat databases on: enterprises' total turnover from e-commerce sales (data set: value of e-commerce sales by size class of enterprise; unit of measure: percentage of turnover) as an expression of e-commerce development, pay to advertise on the internet, use of social networks (e.g. Facebook, LinkedIn, Xing, Viadeo, Yammer, etc.), use enterprise's blog or microblogs (e.g. Twitter, Present.ly, etc.), use multimedia content sharing websites (e.g. YouTube, Flickr, Picasa, SlideShare, etc.; data set: social media use by type, internet advertising and size class of enterprise, unit of measure: percentage of enterprises).

Data from the period 2015-2023 were selected for the dependent variable and the four independent variables for the 27 countries of the European Union. The period was chosen taking into account the years in which all data were available for all five variables of the model. Also, the 27 countries represent the majority of the most advanced and representative in Europe both in terms of the development of Web 2.0 and its tools as well as digital infrastructure and e-commerce. The time interval chosen for the panel data regression is particularly relevant for the purpose of the research conducted because it represents the maturity period of Web 2.0 tools and their potential effects on e-commerce development.

In order to choose the most appropriate regression model between Fixed Effects model estimated with entity and time effects and Random Effects model the Hausman test was applied [

51]. The results obtained from the Hausman test showed that the Random Effects model is preferred, more efficient and statistically justified. However, we also preferred to apply the Fixed Effects model given that countries likely have unobserved characteristics affecting e-commerce. In both the Random Effects model and the Fixed Effects model, enterprises' total turnover from e-commerce sales was considered as the dependent variable and pay to advertise on the internet, use of social networks (e.g. Facebook, LinkedIn, Xing, Viadeo, Yammer, etc.), use enterprise's blog or microblogs (e.g. Twitter, Present.ly, etc.), use multimedia content sharing websites (e.g. YouTube, Flickr, Picasa, SlideShare, etc.) were considered as independent variables.

Although the same variables (pay to advertise on the internet, use of social networks) were obtained in the Fixed Effects model as in the Random Effects model as those that positively influence enterprises' total turnover from e-commerce sales, several statistical tests were applied for the fixed effects regression model: Breusch – Pagan test for heterodasticity [

52]. Woolridge test for serial correlation [

53] and Pesaran Test for cross-sectional dependence [

54]. Since the Woolridge test indicated that serial correlation is present in the panel data residuals and the Pesaran Test showed that there is cross – sectional dependence, a re-estimated fixed effects model using robust standard errors, clustered by both country and year was first re-estimated. For the serial correlation problem, we estimated a dynamic panel model (Arellano – Bond style) adding a lagged dependent variable.

4. Research Results

To confirm the research hypotheses and to quantify the positive influence of Web 2.0 tools on the essential elements that illustrate the development of e-commerce (such as enterprises’ total turnover from e-commerce sales), panel data regression was used. To choose the regression model between Fixed Effects model estimated with entity and time effects and Random Effects model the Hausman test is highly relevant and was applied, as it shows which is the most appropriate estimation method. The null hypothesis in the case of Hausmann Test is: Random Effects estimator is consistent and efficient (i.e. unobserved heterogeneity is uncorrelated with regressors). Alternative hypothesis is: Only Fixes Effects estimator is consistent (i.e. unobserved heterogeneity is correlated with regressors). Hausman test coefficients for Fixed Effects and Random Effects variables are presented in the

Table 2. Coefficients for Fixed Effects and Random Effects variables.

Hausman test outputs (Hausman statistic= -664.7443; Degrees of freedom =4; P-value=1.000) fail to reject null hypothesis at 5% level and suggests that the random effects model is preferred (more efficient) and statistically justified. The random effects model could be used, is more efficient but assumes no correlation with unobservable.

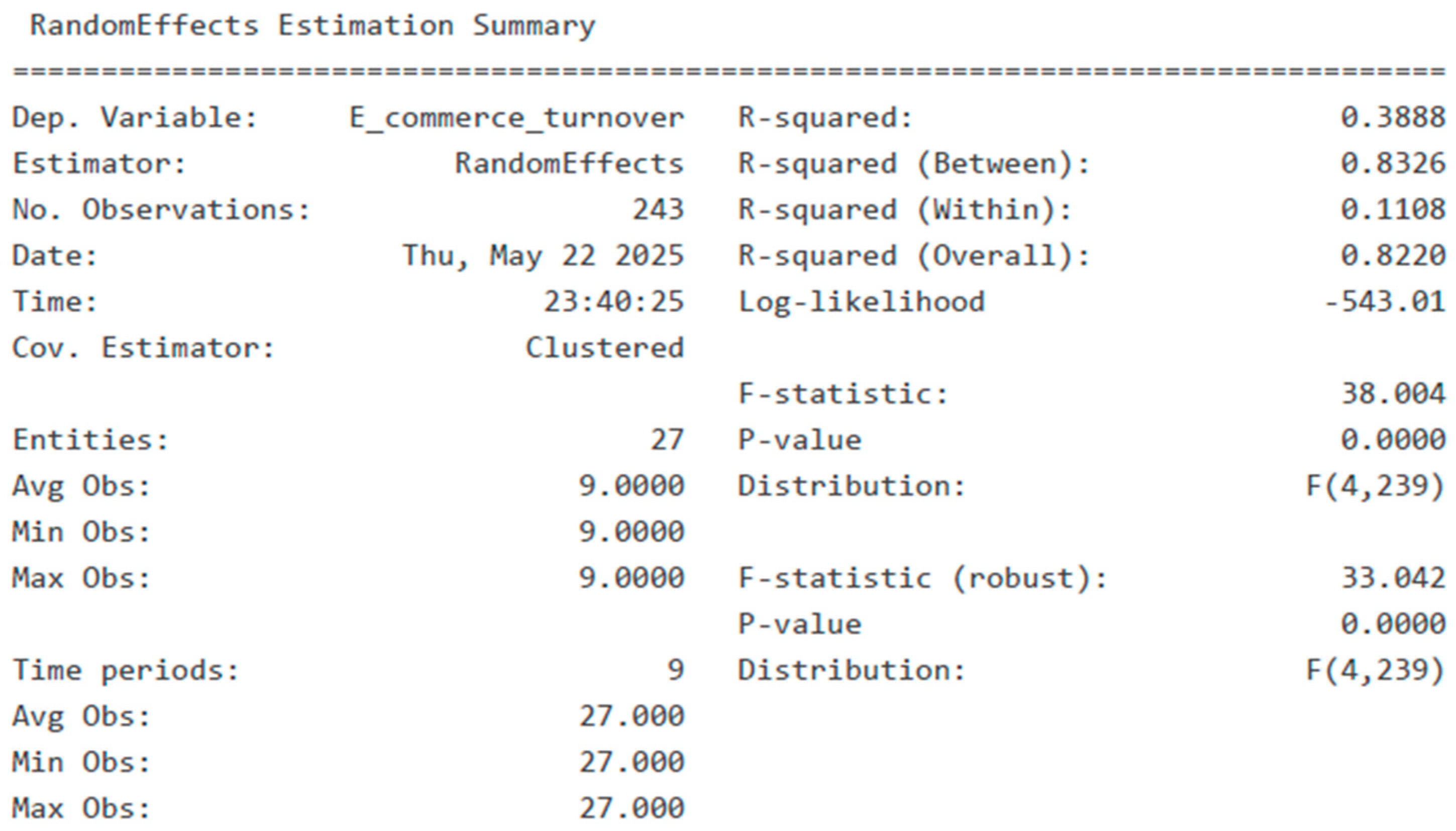

The Random Effects model estimates the impact of various online activities on e-commerce turnover across countries and years. The dependent variable is e-commerce turnover and the independent variables are: pay to advertise on the internet; use social networks; use enterprise's blog or microblogs and use multimedia content sharing websites. Random Effects estimation summary is presented in figure below. The model explains 83,3% variation between countries because R2 (between) is 0.8326. The value of R2 (within), 0.1108, shows that the model explains 11.1% of variation within countries over time. The F-statistic value (38.004; p<0.001) indicates that the model is highly significant overall.

Figure 1.

Random Effects Estimation Summary. Source: own calculations.

Figure 1.

Random Effects Estimation Summary. Source: own calculations.

Random effects parameter estimates are presented in

Table 3. The most influential factor and the strongest predictor in the model is the percentage of enterprises paying to advertise online (β=0.2754; p<0.001). For every 1 percentage point increase in online advertising, e-commerce turnover rises by about 0.28 percentage points.

Social networks usage (β=0.0793; p=0.0016) is also significant at 1% level : a 1 percentage point increase in enterprise use of social networks is associated with 0.08 percentage point increase in e-commerce turnover. The use of enterprise's blog or microblogs (β=0.1177; p=0.3464) and multimedia content sharing websites (β=0.0174; p=0.1184) does not have a statistically significant effect on e-commerce turnover in this model.

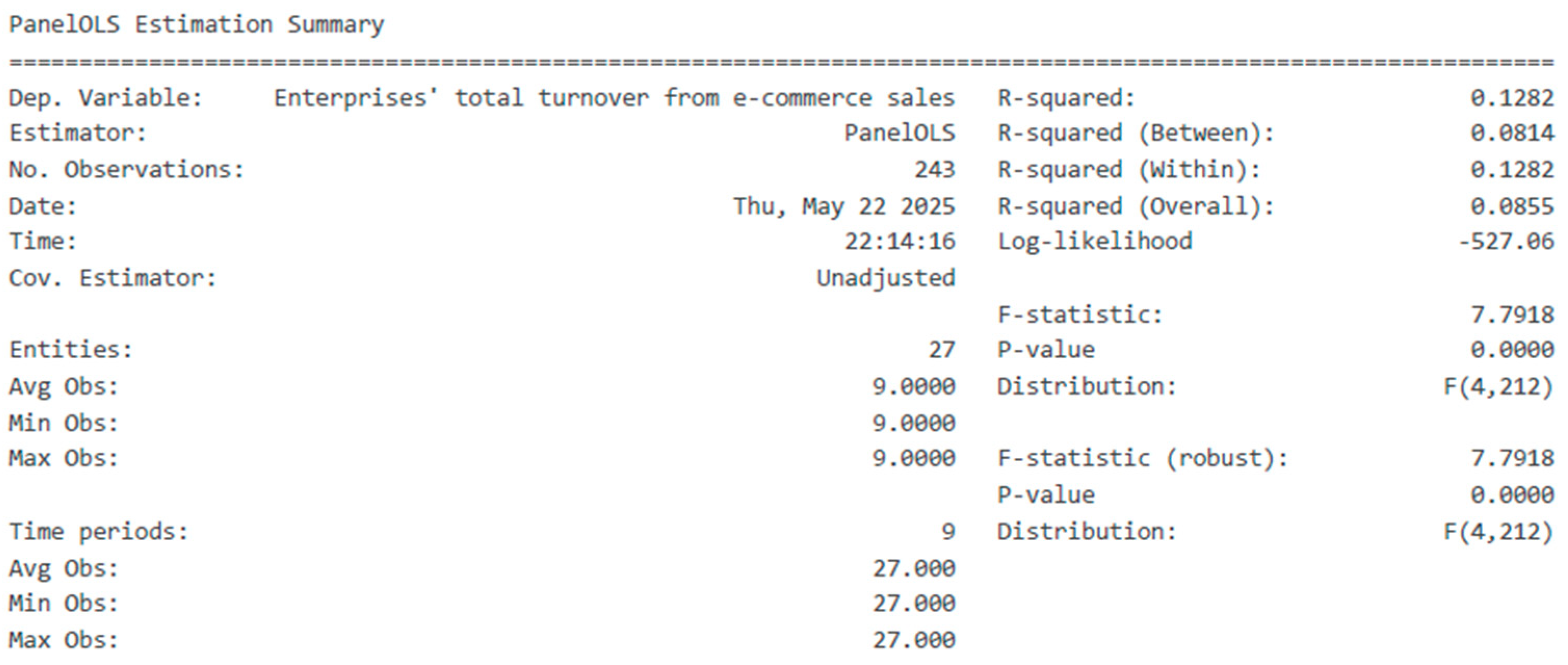

Although the results obtained from the Hausman test justify the choice of the Random Effects model, we also considered that Fixed Effect model appears to be theoretically sound given that countries likely have unobserved characteristics affecting e-commerce. The Estimation summary for Fixed Effect model is presented in Table below. And in this model the dependent variable is represented de enterprises’ total turnover from e-commerce sales, and the independent variables are pay to advertise on the internet; use social networks; use enterprise's blog or microblogs and use multimedia content sharing websites. This analysis uses a model with country (entity) fixed effects. There are 243 observations across 27 countries with an average 9 years per country.

Figure 2.

Panel OLS Estimation Summary. Source: own calculations.

Figure 2.

Panel OLS Estimation Summary. Source: own calculations.

The R2 (Within) is about 0.13, indicating that the model explains around 13% of the variation in turnover within countries over time. The R2 (Overall) is 0.0855, meaning about 8.6% of total variance in turnover is explained by the model. The F-statistic value is 7.79 (p<0.001) indicating the model is statistically significant.

Parameter estimates for Fixed Effects model are presented in

Table 4. The constant (intercept) is 7.29 and is the estimated average value of enterprises’ total turnover from e-commerce sales when all independent variables are zero, after accounting for country fixed effects. The p-value of 0.0023 is less than 0.05, deci the intercept is statistically significant at 5% level. In the context of this fixed effects model, the intercept represents the baseline level of e-commerce turnover for a country, after controlling for the effects of the independent variables and the country-specific fixed effects. 95% confidence interval (2.6437, 11.9393) means 95% confidence that the true intercept lies within this range.

For the variable Pay to advertise on the internet the positive and significant coefficient (0.1583) and p-value 0.0191 (statistically significant at the 5% level) suggests that online advertising is associated with higher e-commerce sales. For each 1 percentage point increase in the share of enterprises that pay to advertise on the internet, the total turnover from e-commerce sales increases by about 0.16 units, holding other factors constant. The effect of the use of social network (coefficient 0.0741; p =0.0034) is statistically significant at 1% level, indicating that the social network engagement is positively linked to e-commerce performance. A one percentage point increase in the use of social networks by enterprises is associated with a 0.07 unit increase in e-commerce turnover.

For the variable use enterprise's blog or microblogs (e.g. Twitter, Present.ly, etc.) the coefficient is positive (0.0390) but not statistically significant (p=0.6621). This means there is no strong evidence that using blogs or microblogs by enterprises has a measurable effect on e-commerce turnover in this dataset. Similarly, the use of multimedia content sharing websites (β=0.0151;p=0.3123) does not show a statistically significant relationship with e-commerce turnover.

Activities like paying for online advertising and using social networks are both positively and significantly associated with higher e-commerce sales among enterprises, after accounting for country – specific effects. In contrast, using blogs/microblogs and multimedia sharing sites does not show a significant impact on e-commerce turnover in this analysis.

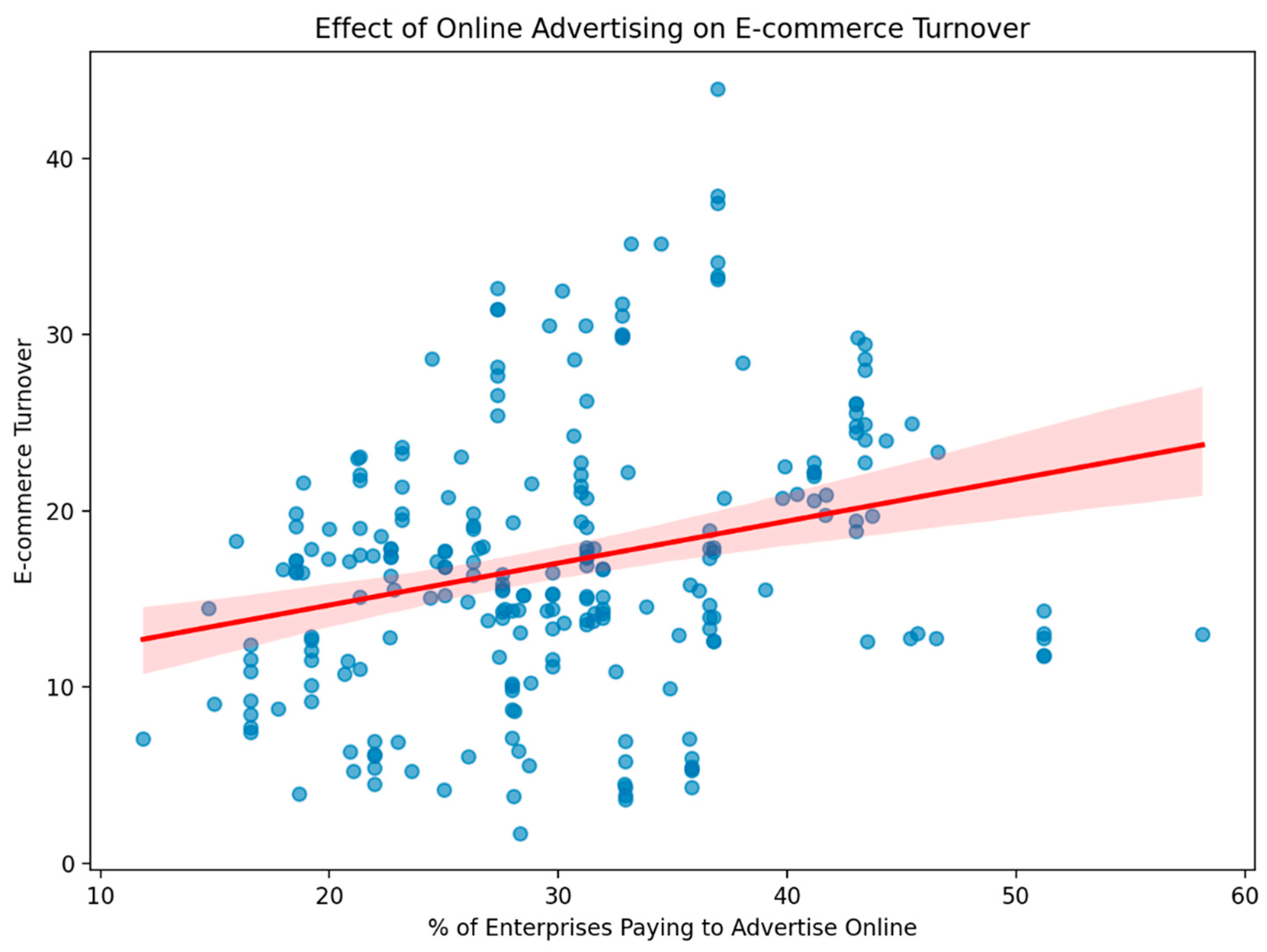

The scatter plot showing the relationship between the percentage of enterprises that pay to advertise online and their total turnover from e-commerce sales is presented in

Figure 3. Each point represents a country -year observation and red line is the fitted regression line with a 95% confidence interval.

In the previous figure there is clear positive trend: as more enterprises engage in online advertising, e -commerce turnover trends to increase. This visual pattern supports the regression results, which found a statistically significant positive effect of online advertising on e-commerce sales.

The scatter plot showing the relationship between the percentage of enterprises using social networks (Facebook, LinkedIn etc.) and their total turnover from e-commerce sales is presented in

Figure 4. The visualization reveals a positive relationship between social network usage and e-commerce turnover, which aligns with the regression findings. The positive trend line confirms that, on average, countries with higher rates of enterprise social network usage tend to have higher e-commerce turnover, supporting the hypothesis that social media engagement contributes to online sales success.

Several statistical tests were applied for the fixed effects regression model: Breusch – Pagan test for heterodasticity, Woolridge test for serial correlation and Pesaran Test for cross-sectional Dependence. The Breusch – Pagan test results (LM statistic = 8.45; LM p – value= 0,076; F-statistic= 2.15; F p-value= 0.0758) suggest that we failed to reject null hypothesis of homoskedasticity (p-value=0,076) so there’s no strong evidence of heteroskedasticity in the model.

The results of Woolridge Test for serial correlation (coefficient rho=0.3346; test statistic = 4.9175; p-value=0.00) shows significant serial correlation (p<0.001), meaning the residuals are correlated across time periods within countries. The Pesaran CD test indicates strong cross-sectional dependence (p<0.001) suggesting that shocks affecting one country also affect other countries. These violations of standard panel regression assumptions suggest the possibility to use other models and approaches: robust standard errors (clustered by country and/or time) and a dynamic panel model to address serial correlation.

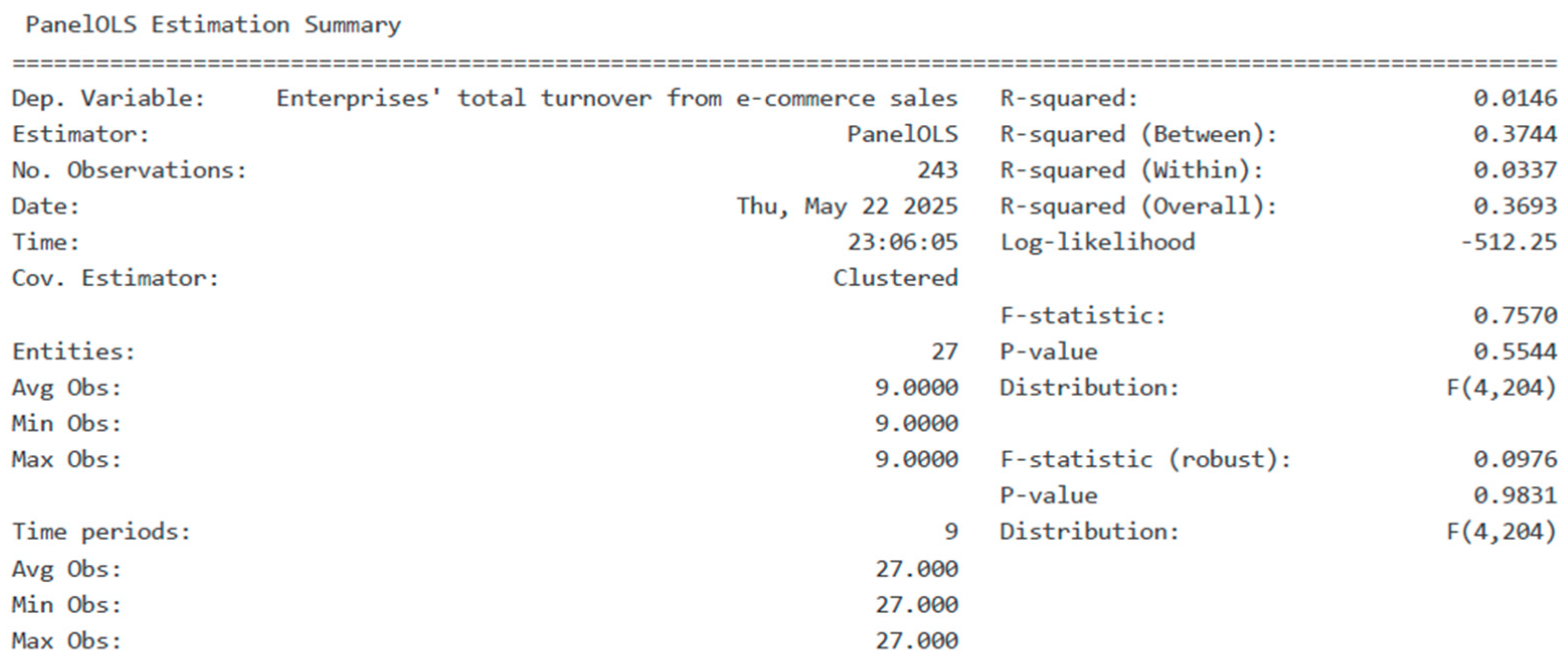

First, the fixed effects model is re-estimated using robust standard errors, clustered by both country and year. This approach helps correct the standard errors for both types of correlation, making the inference more reliable. The results are presented in below figure.

Figure 5.

PanelOLS Estimation Summary. Source: own calculations.

Figure 5.

PanelOLS Estimation Summary. Source: own calculations.

The value of R2 (within), 0.0337 shows that the independent variables explain only 3.37% of the variation within each entity. R2 (between), with a value of 0.3744 shows that the model explains 37.34% of the variation of each entity (differences between countries). The value of R2 , 0.0146, shows that the model explains, in total, only 1.46% of the variation of the dependent variable. The statistical significance tests, the F statistic tests (0.7579; p-value=0.9831) and F statistic (robust.) – 0.0976; p-value=0.9831 , with p-values well above the standard significance threshold (0.05) so we cannot reject the null hypothesis that all coefficients are 0. In practice, the model is not statistically significant even at the robust level.

The model explains very little of the variation in turnover from e-commerce sales. There is no statistical evidence that the included predictors have a relevant common effect. From this perspective, the data on parameter estimates included in

Table 5 are relevant.

None of the variables analyzed is, in this model, statistically significant at a 5% threshold, which suggests that, in the current form of the model, we cannot confidently state that these variables influence e-commerce turnover form e-commerce sales. The only variable with a slightly more pronounced effect is Pay to advertise on the internet which presents a positive coefficient (0.1125) and p=0.1010. The other three variables analyzed did not have significant effects, which may suggest an inefficient use of these channels.

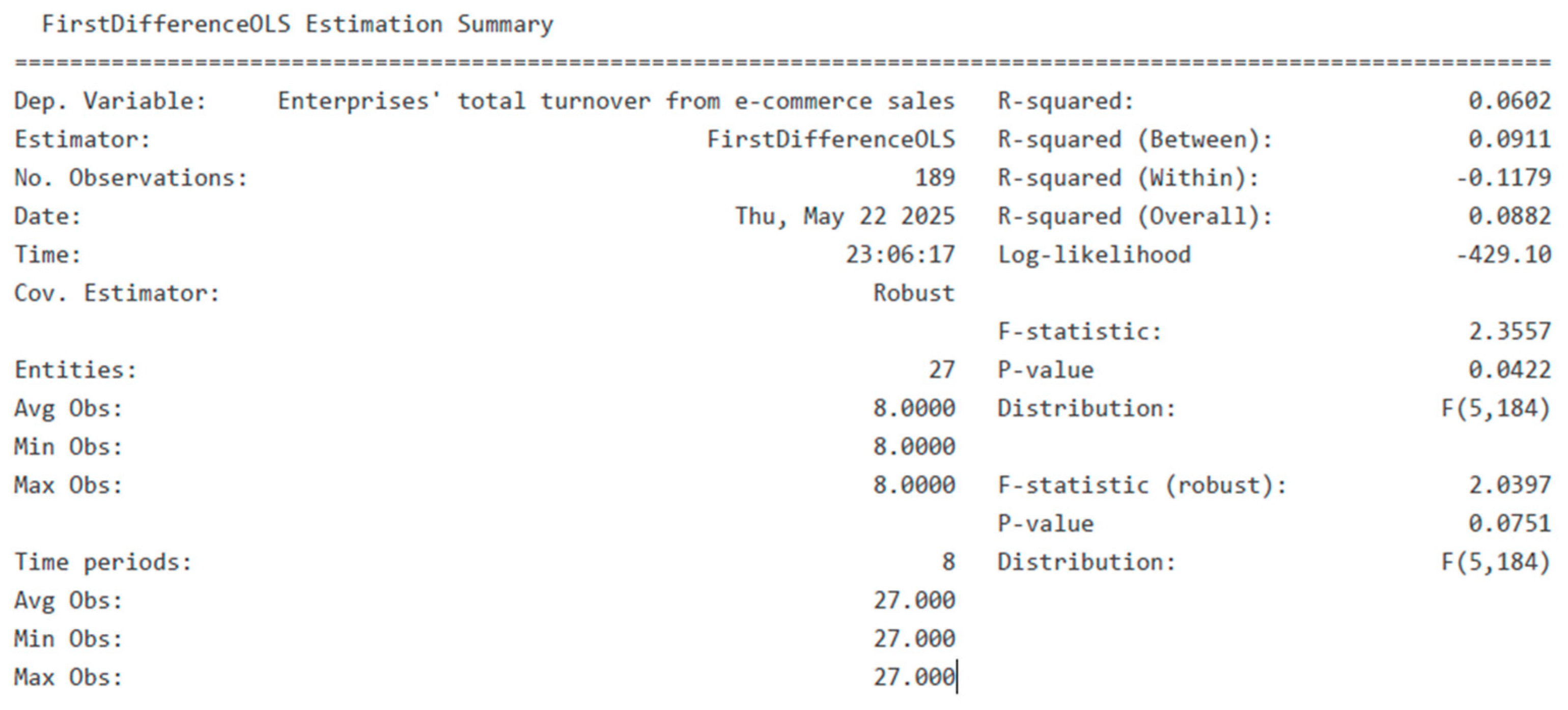

To further address serial correlation we estimated a dynamic panel model (Arellano-Bond style) by including a lagged dependent variable and using first – difference estimation. This helps the account for the persistence in turnover over time and provides more robust results in the presence of serial correlation. The dynamic panel model (Arellano-Bond style) First differences are presented in the figure below.

Figure 6.

First differences OLS Estimation Summary. Source: own calculations.

Figure 6.

First differences OLS Estimation Summary. Source: own calculations.

The estimated model provides mixed results in terms of the quality of fit and the statistical significance of the regression. The negative value of R2 (within), for the internal variation of entities over time, shows that the model used does not efficiently explain the variation within the units of analysis (countries over time). The value of 0.0882 of R2 (overall) shows that approximately 8.8% of the total variation of the dependent variable is explained by the independent variables (a relatively modest value, but better than in the first model analyzed). The F-test (F-statistic = 2.3557, p-value=0.0422) is significant at the 5% level, which means that the model, as a whole, is statistically significant and that at least one independent variable has a significant effect on the dependent variable. The model is statistically significant at the global level, but has a modest explanatory power. Parameter estimates for the dynamic panel model (Arellano-Bond style) are presented in the Table below.

Table 6.

Dynamic panel model (Arellano-Bond style) – Parameter Estimates.

Table 6.

Dynamic panel model (Arellano-Bond style) – Parameter Estimates.

| |

Parameter |

Std.Err |

T-stat |

P-value |

Lower CI |

Upper CI |

| Pay to advertise on the internet |

0.1565 |

0.0641 |

2.4413 |

0.0156 |

0.0300 |

0.2830 |

| Use social networks (e.g. Facebook, LinkedIn, Xing, Viadeo, Yammer, etc.) |

-0.0057 |

0.0230 |

-0.2468 |

0.8053 |

-0.0510 |

0.0396 |

| Use enterprise's blog or microblogs (e.g. Twitter, Present.ly, etc.) |

0.0040 |

0.1372 |

0.0291 |

0.9768 |

-0.2667 |

0.2747 |

| Use multimedia content sharing websites (e.g. YouTube, Flickr, Picasa, SlideShare, etc`.) |

-0.0008 |

0.0086 |

-0.0964 |

0.9233 |

-0.0178 |

0.0161 |

| Lag turnover |

-0.1728 |

0.0923 |

-1.8730 |

0.0627 |

-0.3548 |

0.0092 |

| |

|

|

|

|

|

|

The only statistically significant effect (at 5%) in the dynamic panel (first – difference) model is for „Pay to advertise on the internet”. A one percentage point change in enterprises paying for internet advertising is associated with 0.1565 percentage point change in e-commerce turnover. Other variables (use social networks, blogs/microblogs, multimedia content sharing) are not statistically significant. The lagged dependent variable (previous year’s turnover) shows a marginally significant negative effect, suggesting mean reversion.

5. Discussions

The results obtained in the case of the random effects model and the dynamic panel model (Arellano – Bond) show that the effect of “paying to advertise on internet” on enterprises' total turnover from e-commerce sales is positive and significant, which confirms the first research hypothesis and a large part of the results of previous studies [

42,

43,

44]. Internet advertising has proven, in all its forms in the context of Web 2.0, a decisive tool for increasing the revenues of enterprises in the 27 countries of the European Union.

Also, the research results (in the case of the random effects model) confirm the second research hypothesis regarding the influence of social media use on enterprises' total turnover from e-commerce sales (positive and statistically significant influence in the case of the random effects model, positive but statistically insignificant influence in the case of the fixed effects model). The positive influence of social media on the development of e-commerce thus confirms some of the results of previous studies [

6,

45]. However, the research results only partially reflect the extent of the effects of social media on the development of e-commerce, revealed by other qualitative or quantitative approaches of previous studies in this regard.

A novel element of the research conducted, one of the key findings, revealed by the results obtained is that use enterprise's blog or microblogs (e.g. Twitter, Present.ly, etc.) and use multimedia content sharing websites (e.g. YouTube, Flickr, Picasa, SlideShare, etc) do not influence enterprises' total turnover from e-commerce sales to a valid and statistically significant extent. Thus, the third and fourth hypotheses are not confirmed by the results of the research conducted. Also, the research results regarding use enterprise's blog or microblogs (e.g. Twitter, Present.ly, etc.) and use multimedia content sharing websites (e.g. YouTube, Flickr, Picasa, SlideShare, etc.) do not support and do not agree with other similar studies [

46,

47,

50], which is explainable since European enterprises are not among the most important innovators in this field nor the owners of the most important multimedia content sharing websites (e.g. YouTube, Flickr, Picasa, SlideShare, etc.). Probably an inclusion of data from other geographical areas (North America, Asia) where e-commerce is even more developed compared to European countries would improve the chances of confirming these two research hypotheses.

The analysis of the obtained results and the comparison with other specialized studies show the theoretical and practical implications of the study presented in this article. The most important theoretical implications of our study concern the need to expand the role of perception on online advertising and the use of social media by European enterprises in the development of e-commerce. The amplification and re-conceptualization of online contacts with consumers in the context of Web 2.0 thus becomes essential from a theoretical perspective for the development of e-commerce. From a pragmatic perspective, of the practical implications of the research carried out, it becomes evident both the need to focus the relationship with customers/consumers towards certain components of the online environment such as social media in relation to others (microblogs). From the perspective of managerial practice, the results reconfirm and emphasize the need to restructure the commercial operational areas of contemporary organizations towards their virtual side, to increase the role of social media and social virtual networks in amplifying e-commerce and the organizations' revenues from sales in the virtual space.

The study conducted and the explanatory and generalizable power of the results are affected by a series of limitations due to the geographical space from which the research data come and the fact that they mainly reflect the organizational approach and less the individual one. Therefore, one of the future directions of the research is to extend it by considering data for other geographical spaces representative of the development of Web 2.0 and e-commerce.

6. Conclusions

This literature review showcases the role of Web 2.0 tool for e-commerce development at the level of the European Union. Our study contributes to answer the questions identified in the literature gap, by using a regression analysis based on panel data gathered from Eurostat which has the power to show relevant perspectives for the digital transformation of EU, for the period 2015-2023. By applying fixed-effects models and a dynamic Arellano-Bond model, the research provides robust empirical evidence of the real and measurable impact of Web 2.0 technologies on e-commerce revenue.

This paper brings both a theoretical and practical contribution, integrating the sustainability perspective for e-commerce development. From the theoretical point of view, the study is showing the importance of interactivity between companies and consumers in the digital environment [56], using web 2.0 tools. From the practical point of view, the results suggest the need to prioritize social media strategies and update commercial operations in order to respond to the need of the clients. The bibliometric review showed a lack of studies applied for economic effectiveness of web 2.0 tools on e-commerce.

The first two research hypothesis were confirmed both through the existing literature and through the econometrical analysis, highlighting the positive and statistic significant effect of internet advertising [57] and social media usage on the total turnover of e-commerce sales. On the other hand, blogs, microblogs and multimedia content sharing platforms were not considered statistical significant, underlining the discrepancy between available technological resources and the actual integration in the digital economy. The main contribution of the research is related with providing quantitative outcomes, in a field dominated by qualitative outcomes or individual country, company, industry approaches.

This articles is integrating the Web 2.0 instruments into the econometric framework, unlike other studies which investigate only the determinants of e-commerce [

20]. Used combined techniques are capturing both dynamics of e-commerce and country heterogeneity, providing relevant perspectives for public policy, digital marketing and companies in general. Among Web 2.0 tools, online paid advertising and usage of social media are the ones contributing to the increase of e-commerce revenue, while the other variables, blogs, microblogs, multimedia platforms are not considered relevant, the outcomes is confirmed by applying dynamic and robust models. The results highlight that online paid advertisement and social media usage variables have significative, positive effect on e-commerce performance, confirming the first and second hypothesis. Use of enterprise's blog or microblogs and use of multimedia content sharing websites do not influence enterprises' total turnover from e-commerce sales to a valid and statistically significant extent. Thus, the third and fourth hypotheses are not confirmed by the results of the research conducted, possibly due to limited innovation and platform ownership in Europe region. Web 2.0 instruments has an active role in the digital economy of European Union, as it is considered a digital infrastructure with measurable economic effects.

Future research can be extended by including the diversity of economic sectors, types of organizations, by including additional control variables and by exploring the transitions from Web 2.0 to Web 3.0. The outcomes of the quantitative research validate the hypothesis related with the fact that Web 2.0 instruments, especially paid online advertising and usage of social media, have a positive influence on the turnover generated by electronic commerce. This finding can be applied only to the 27 member states EU and ca not be generalized. Therefore, in the future the research can be extended to other regions like America and Asia.