1. Introduction

The exponential growth of e-commerce (electronic

commerce) in the digital age has revolutionized the retail industry and

business landscape [20]. By 2025, global

e-commerce sales are projected to surpass USD 7.4 trillion, nearly doubling

from 2020 levels, as reported by [12]. This

digital transformation has been accelerated by advancements in technology, the

widespread adoption of mobile devices, and shifts in consumer behavior toward

online platforms. E-commerce is also transforming the way firms operate. For

instance, by redefining inventory management, distribution, and customer

services, e-commerce is fostering new supply networks, services, and business

models. These have often been associated with efficiency improvements, better

asset utilization, faster delivery to market and consumers, and improved

customer service. Furthermore, e-commerce, social media, and visual

advertisements are changing consumer behaviour from offline to online shopping

and presenting them opportunity to purchase goods and services online. As competition

intensifies, companies must leverage digital indicators, website traffic, user

engagement, conversion rates, customer demographics, and purchasing behavior [13].

Website traffic in businesses has emerged as a

critical performance metric that reflects not only user engagement but also

potential revenue streams. For instance, a study of [5]

found that website traffic has a positive impact on total revenue. It is

recommended that e-commerce website operators actively develop traffic sources

such as Direct, Organic Search, Referral, and Paid Search. Additionally, using

Google Analytics 4 for further analysis of the relative impact of different

traffic sources on total revenue can provide valuable insights. Businesses with

high monthly website visits often see correspondingly high transaction rates,

especially when coupled with data-driven

marketing strategies. Businesses with high monthly

website visits often see correspondingly high transaction rates, especially

when coupled with data-driven marketing strategies. To align these marketing

strategies with CLV goals, organizations must have a deep understanding of

customer needs and preferences. By leveraging customer data, behavior

analytics, and segmentation techniques, organizations can identify customer

segments with high CLV potential and tailor marketing strategies accordingly [4]. It is crucial to ensure that marketing

initiatives focus not only on short-term transactions but also on cultivating

long-term relationships and customer loyalty [2].

Traffic is thus not merely a vanity metric; it can influence core financial

outcomes when integrated into a broader digital performance model.

However, while total revenue and market

capitalization have traditionally served as primary indicators of firm success,

newer metrics, such as earnings per visit and revenue per visit, offer a more

refined lens into operational efficiency. These indicators reveal how

effectively companies convert digital attention into economic value. However,

there remains limited empirical analysis linking these metrics directly to

traffic volume in the context of e-commerce, creating a need for further

investigation.

Current research on financial performance in

e-commerce tends to focus on either internal managerial strategies or external

market trends. For instance, [15] found that

e-commerce participation increases firm productivity by up to 30% and exports

by 50% in developing Asian economies. Similarly, [16]

highlight that while e-commerce can significantly improve financial

performance, its impact is often mediated by country-specific factors such as

market maturity and institutional readiness. Moreover, few studies have

holistically examined how online visibility, as measured by website traffic,

correlates with a range of financial indicators. For instance, [19] studied the revenue growth and number of

visitors to websites of banking establishments, indicating that sources of

revenue for banking establishments come from services provided through means

other than the main web platform.

Development status plays a significant role in

shaping a firm’s digital and financial landscape. Companies in developed

nations typically benefit from superior internet infrastructure, stable

economic conditions, and a larger digital customer base. In contrast, firms in

developing countries often face challenges such as limited digital adoption and

reduced consumer purchasing power. Several Studies highlighted that the biggest

challenge of adopting and using e-commerce in developing countries is infrastructural

barriers which include inadequate telecommunications, such as poor network

quality, internet speed quality and the cost of internet and bandwidth [11] affecting the adoption of e-commerce in

developing countries, making it difficult for organisations to survive in a

digital-based market [14]. These differences

suggest that development status may moderate the relationship between website

traffic and financial performance.

This study investigates the relationship between

website traffic and financial performance across leading e-commerce companies,

with specific attention to the moderating role of development status.

Additionally, this study controls for country development status to isolate and

interpret the relationships between variables more accurately. It also provides

a nuanced understanding of how digital engagement translates to profitability.

These insights will be valuable for investors. Digital marketers and policymakers

seeking to optimize digital strategies between companies in different economic

environments.

1.1. Rationale

The rapid growth of e-commerce has transformed the

global economy, reshaping how businesses operate and how consumers purchase

goods and services. Website traffic has emerged as a critical metric in

assessing a company’s digital presence, reflecting consumer interest, brand

visibility, and potential market reach. At the same time, financial performance

remains the ultimate indicator of business success, encompassing profitability,

revenue growth, and market competitiveness. While it is widely assumed that higher

website traffic correlates with stronger financial outcomes, the relationship

may not be straightforward, particularly when accounting for differences in a

country’s development status. Emerging economies may face challenges in

monetizing online traffic due to infrastructure limitations, lower purchasing

power, or evolving digital ecosystems, whereas developed economies may benefit

from mature markets and established online consumer behaviors. Understanding

this dynamic is crucial for stakeholders, including investors, policymakers,

and e-commerce managers, as it offers insights into how digital engagement

translates into financial returns under different economic contexts. This study

seeks to bridge the gap in the literature by examining the relationship between

website traffic and financial performance while distinguishing patterns based

on development status.

1.2. Problem Statement

Despite the recognized importance of online

engagement in driving business outcomes, there is limited empirical research

that examines how website traffic relates to financial performance in the

e-commerce sector, especially when comparing companies across developed and

developing economies. Existing studies often focus on single-market contexts or

treat e-commerce performance as uniform across regions, overlooking the

potential influence of development status on this relationship. This lack of

comparative analysis leaves a critical gap in understanding whether high

website traffic universally leads to improved financial outcomes or if its

impact varies depending on economic maturity. Consequently, e-commerce

stakeholders risk applying generalized strategies that may not align with the

market realities of their operational environment. Addressing this gap is

essential to provide evidence-based guidance for optimizing digital strategies

and achieving sustainable growth across diverse economic contexts.

1.3. Hypothesis

Hypothesis 1:

H0 (Null): There is no significant correlation between website traffic and financial performance indicators (market cap, revenue, earnings, net margin, revenue per visit, and earnings per visit), controlling for country development.

H1 (Alternative): There is a significant positive correlation between website traffic and financial performance indicators, controlling for country development.

Hypothesis 2:

H0 (Null): The correlation between website traffic and financial performance does not differ between developed and developing countries.

H1 (Alternative): The correlation between website traffic and financial performance differs significantly between developed and developing countries.

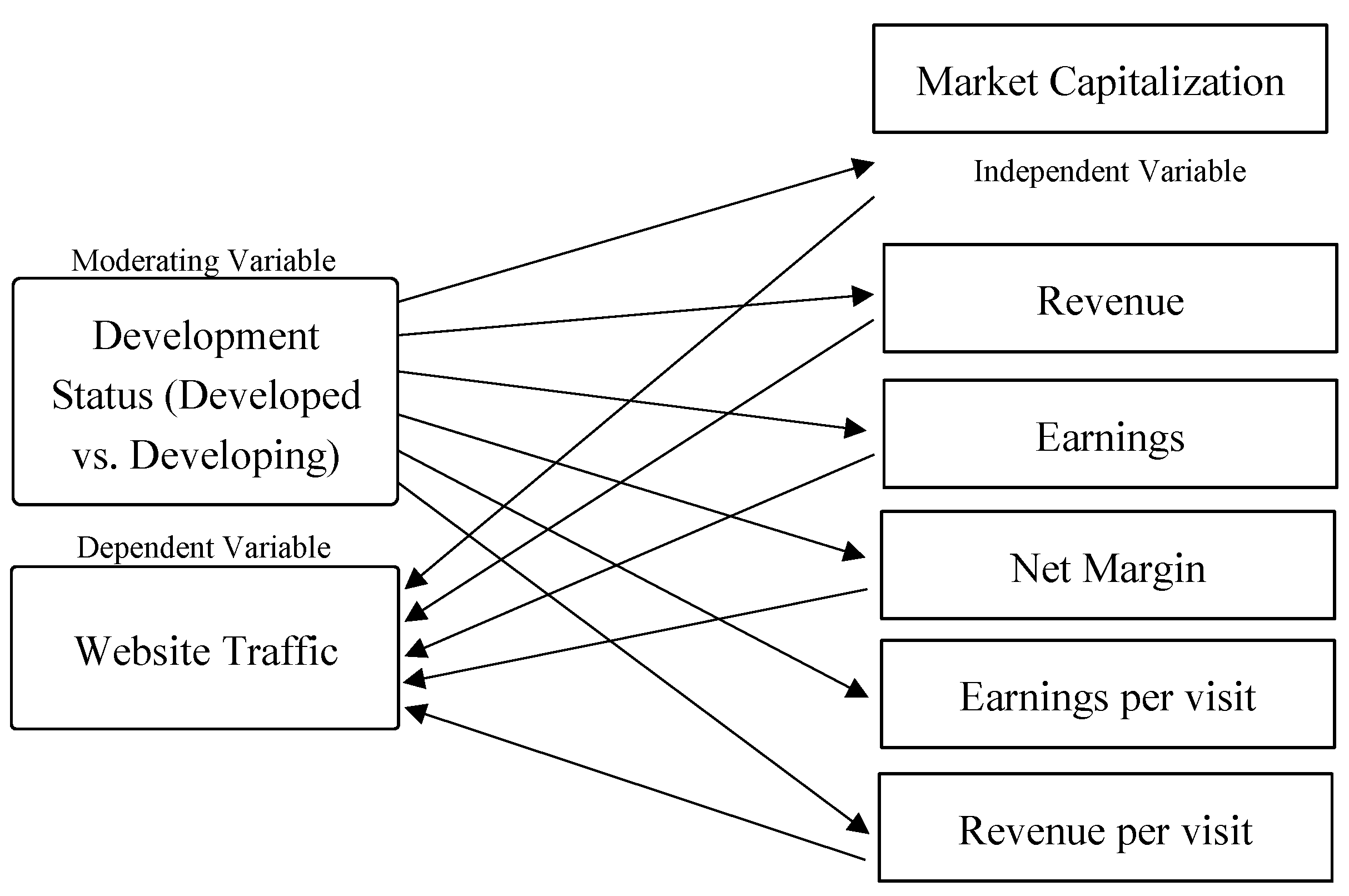

1.4. Conceptual Framework

The dependent variable in this study is website

traffic, while the independent variables are market capitalization, revenue,

earnings, net margin, earnings per visit, and revenue per visit. Development

status (developing vs. developed) serves as a moderating variable affecting the

strength or direction of the relationships between independent variables and

the dependent variables. This study aims to assess the influence of the

selected financial performance indicators in relation to the economic status of

the country among leading e-commerce companies (

Figure

1).

2. Methodology

2.1. Data Collection

Data in this study were obtained from various

reputable online sources. Website traffic data were sourced from Semrush (

https://www.semrush.com/),

a recognized web analytics platform that provides visitor volumes and

engagement metrics using the website’s domain name. All website traffic figures

were recorded for June 2025 to maintain temporal consistency. On the other

hand, financial performance indicators including country, market

capitalization, revenue, earnings, were retrieved from CompaniesMarketCap.com (

https://companiesmarketcap.com/e-commerce/largest-e-commerce-companies-by-market-cap/),

a publicly accessible database that compiles financial performance information

on the largest e-commerce companies worldwide. The reporting period for

financial indicators varied by company, with some data reflecting fiscal year

2024 and others fiscal year 2025, depending on the most recent information

available at the time of collection. To obtain the net margin, revenue per

visist, and earnings per visit, the following formula were used. Net Margin was

calculated as:

Revenue per visit was calculated as:

Earnings per visit was calculated as:

Only companies with complete and consistent data

across both sources were included in the analysis to ensure comparability and

accuracy.

2.2. Statistical Analysis

This study employed a correlational research design

to examine the relationships between website traffic and selected financial

performance indicators such as market capitalization, revenue, earnings, net

margin, revenue per visit, and earnings per visit. Descriptive statistics,

including means and standard deviations, were computed to summarize the

variables. In addition, Partial Spearman’s rank-order correlation () was used to assess the strength and direction of

the monotonic relationship

between website traffic and each financial

performance indicator while controlling for development status (developed vs.

developing). A spearman correlation matrix was also used to determine

differences.

Spearman’s correlation was chosen because variables

were not normally distributed, as checked by the histogram, and the method is

suitable for ordinal or non-parametric data. Statistical significance was set

at , and all analyses were conducted using JAMOVI

software version 2.6.17.

3. Results

3.1. Descriptive Statistics

Descriptive statistics for website performance and

financial metrics were computed separately for companies in developed and

developing countries (

Table 1). For

website visits in June 2025, developed countries (n = 38) averaged 181 million

visits (SD = 440 million), whereas developing countries (n = 12) averaged 26.6

million visits (SD = 34.5 million). Conversely, market capitalization was

higher for developed countries (M =

$125 billion, SD =

$406 billion) than for

developing countries (M =

$53.9 billion, SD =

$91.6 billion). The Average

revenue was also greater in developed countries (M =

$55.9 billion, SD =

$155

billion) compared to developing countries (M =

$34.5 billion, SD =

$57.5

billion). In terms of earnings, developing countries reported a higher mean (M

=

$12.1 billion, SD =

$25.5 billion) than developed countries (M =

$4.11

billion, SD =

$13.9 billion). The net margin was negative on average for

developed countries (M = −1.93%, SD = 30.60), but highly positive for

developing countries (M = 4,675%, SD = 16,191%). Revenue per visit was higher

in developed countries (M =

$20,657, SD =

$115,623) compared to developing

countries (M =

$3,043, SD =

$6,031). Similarly, earnings per visit were greater

for developed countries (M =

$1,915, SD =

$11,150) than for developing

countries (M =

$892, SD =

$559).

3.2. Relationship Between Website Traffic and Financial Performance Indicators (Market Cap, Revenue, Earnings, Net Margin, Revenue Per Visit, and Earnings Per Visit), Controlling for Country Development

A Spearman’s rho partial correlation analysis was

conducted to examine the associations among website visits, market

capitalization, revenue, earnings, net margin, revenue per visit, and earnings

per visit, while controlling for country category (

Table 2). Based on the data gathered (n=50),

there is a strong positive relationship (

ρ = 0.634, p < .001) between

website visits and market capitalization, suggesting that firms with higher

traffic tend to have greater market value. This relationship is highly

significant. Market capitalization, or market cap, is the current market value

of all of a company’s outstanding stock shares. Market cap is often used to

indicate a company’s size and worth in comparison to its peers [6].

Similarly, website visits show a strong positive

correlation with revenue (ρ = 0.590, p < .001), earnings (ρ =

0.602, p < .001), and net margin (ρ = 0.574, p < .001),

implying that increased website traffic is associated with higher financial

performance in terms of sales, profits, and profitability ratios. A study by [8] found that traffic affects the sales volume of

an e-commerce platform. Web traffic data is correlated not only with online

sales but also with total sales and net income of the entire company. The

correlation between traffic data and business performance data may also apply

to traditional companies as well as revenue growth is also significantly

correlated with contemporaneous growth in web traffic. Moreover, the study of [7] states that website traffic sources are often

associated with higher purchase intent, which in turn leads to higher sales and

earnings, as they usually yield consumers who have already familiarized

themselves with the brand.

A moderate positive relationship was also found

between website visits and earnings per visit (ρ = 0.337, p = .018),

which is statistically significant at the 5% level. However, website visits and

revenue per visit exhibit a weak negative and non-significant correlation (ρ

= –0.118, p = .420), suggesting no meaningful association. Market

capitalization displays a very strong positive correlation with revenue (ρ =

0.850, p < .001). This is supported by the study of [17], which found that there was a significant

positive relationship between revenue and market capitalization in 2017. This

suggests that revenue may be used as the main variable in the valuation of

companies using platform business models.

Earnings (ρ = 0.731, p < .001) and

earnings per visit (ρ = 0.631, p < .001) also demonstrate a moderate

to high positive relationship, indicating that larger firms in terms of market

value tend to generate higher revenues and earnings while also converting

traffic into per-visit profitability, significant values of the relationship

further validated that the relationship is real and not due to random chance.

Study of [1] states that dividends and net

income after taxes (a key earnings measure) have a positive relationship with

market capitalization, while earnings per share show no significant

correlation.

Market capitalization also positively correlated

with net margin (ρ = 0.585, p < .001) and revenue per visit (ρ =

0.456, p < .001), highlighting the overall financial strength of firms

with higher valuations. For instance, findings showed that the frequency of

website visits significantly affects the financial performance measures of

banks, such as return on assets (ROA), return on equity (ROE), market value

(Tobin’s Q), net interest margin (NIM), and return on investment (ROI). In

addition, the ESG performance of banks attracts more website visitors and

enhances them with the idea of dealing with banks that enhance financial performance.

The findings indicate that banking websites as a tool for public relations

attract visitors and thus turn them into customers by changing the behavioural

intention of individuals, which affects their decisions to engage in banking

transactions and thus raises the level of financial performance of banks [3].

Revenue is strongly associated with earnings (ρ

= 0.694, p < .001), net margin (ρ = 0.480, p < .001), revenue

per visit (ρ = 0.662, p < .001), and earnings per visit (ρ =

0.693, p < .001), all highly significant, suggesting that increased

sales revenue consistently translates into higher profitability measures.

Similarly, earnings show a very strong positive correlation with net margin (ρ

= 0.834, p < .001) and earnings per visit (ρ = 0.878, p < .001),

while its association with revenue per visit is positive but not significant (ρ

= 0.269, p = .062). The study of [9] shows

that with respect to earnings quality, firms with revenue-supported increases

in earnings have more persistent earnings, exhibit less susceptibility to

earnings management, and have higher future operating performance. With respect

to response coefficients, firms with revenue-supported increases in earnings

have both higher ERCs and lower book value response coefficients. On the other

hand, [10] findings state that business size,

debt-to-equity ratio, and revenue growth significantly affect the net profit

margin of SMEs, guiding better financial management.

Net margin is highly correlated with earnings per

visit (ρ = 0.767, p < .001) but unrelated to revenue per visit (ρ

= 0.016, p = .912), implying that profitability margins are more influenced

by how traffic converts into earnings rather than revenue alone. Findings of [18] found that: 1) The t value of the net profit

margin of 5.378 is greater than the t table of 2.00665 and the significant

value of 0.000 is less than 0.05, it can be concluded that the net profit

margin has a significant effect on stock prices; 2) It is obtained that the t

value of earning per share is 3.349 which is greater than the t table of

2.00665 and a significant value of 0.002 is less than 0.05, so it can be

concluded that earning per share has a significant effect on stock prices.

Finally, revenue per visit is moderately associated with earnings per visit (ρ

= 0.472, p < .001), suggesting that efficiency measures at the per-visit

level tend to move together. Further studies are necessary to obtain more

reliable and robust results.

3.3. Correlation Differences Between Website Traffic and Financial Performance Among Developed and Developing Countries

A series of Spearman’s rank-order correlations were conducted to examine the relationships between website visits and financial performance indicators (market capitalization, revenue, earnings, net margin, revenue per visit, and earnings per visit) for developed and developing countries separately.

Table 3 presents the results for developed and developing countries.

For developed countries (n = 38), website visits were significantly and positively correlated with market capitalization (ρ = .644, p < .001), revenue (ρ = .622, p < .001), earnings (ρ = .573, p < .001), and net margin (ρ = .564, p < .001). However, website visits were not significantly correlated with revenue per visit (ρ = –.164, p = .323) or earnings per visit (ρ = .313, p = .056). Strong positive correlations were also observed between market capitalization and revenue (ρ = .836, p < .001), market capitalization and earnings (ρ = .762, p < .001), and earnings and earnings per visit (ρ = .888, p < .001).

For developing countries (n = 12), website visits were significantly and positively correlated with market capitalization (ρ = .622, p = .035), earnings (ρ = .776, p = .005), and net margin (ρ = .657, p = .024), but not with revenue (ρ = .566, p = .059), revenue per visit (ρ = .021, p = .956), or earnings per visit (ρ = .371, p = .237). As in developed countries, market capitalization was strongly correlated with revenue (ρ = .874, p < .001). Notably, revenue was strongly associated with revenue per visit in developing countries (ρ = .797, p = .003), whereas this relationship was weaker in developed countries (ρ = .596, p < .001). Earnings were also strongly associated with net margin (ρ = .846, p < .001) and earnings per visit (ρ = .804, p = .003).

Overall, the results indicate that in developed countries, website traffic is broadly and consistently associated with financial outcomes, especially market capitalization, revenue, and earnings. In contrast, in developing countries, website visits have a weaker association with revenue but a stronger link to earnings and profitability efficiency measures, suggesting that traffic translates into profit more selectively in less mature markets.

4. Discussion

The present study examined the relationship between website traffic and financial performance indicators among leading e-commerce companies, controlling for country category. The study also investigates the correlation differences between developing and developed countries. Developed countries in this study include the United States of America, Japan, South Korea, Germany, Sweden, Australia, the United Kingdom, Poland, France, Singapore, and Israel. On the other hand, developing countries include China, Malaysia, India, Brazil, Argentina, Chile and Africa.

The findings demonstrate that website visits are broadly and consistently correlated with financial performance in developed economies, whereas in developing economies, the associations are fewer but in some cases stronger, particularly between traffic and earnings. This suggests that in mature markets, website traffic translates into a wide range of financial outcomes, while in emerging markets, its effects are more selective, emphasizing profitability efficiency rather than revenue expansion.

In developed countries, website visits were strongly associated with market capitalization, revenue, and earnings, highlighting the systemic role of digital engagement in sustaining market value and sales growth. These findings are consistent with prior studies that argue digital presence and consumer visibility are integral to revenue streams and firm valuation (Chen et al., 2022; Gao, 2023). Conversely, in developing countries, the correlation between website visits and revenue was not statistically significant, suggesting that high traffic does not consistently translate into sales. Instead, website visits were more strongly tied to earnings and net margin, implying that firms operating in these contexts rely on more efficient conversion mechanisms to translate digital engagement into profitability.

The stronger association between revenue and revenue per visit in developing countries compared to developed countries suggests that emerging market firms may extract greater efficiency from each website visitor. This finding underscores the adaptive strategies of firms in resource-constrained environments, where digital engagement must be carefully leveraged to yield tangible financial returns. At the same time, the lack of consistent significant relationships across multiple financial indicators in developing countries reflects infrastructural and market limitations, echoing previous research that emphasized the challenges of digital adoption in less mature economies (Noor et al., 2023; Hendricks et al., 2024).

Despite providing important insights, this study has several limitations. First, the analysis was limited to a sample of 50 e-commerce companies with complete data, which may restrict the generalizability of results across the broader global market. Second, financial indicators were sourced from different fiscal periods (2024 and 2025), which may introduce minor inconsistencies in cross-company comparisons. Third, correlation analysis cannot establish causality, meaning that while website traffic is associated with financial performance, it cannot be concluded that traffic directly drives financial outcomes. Fourth, the study focused only on website traffic volumes and did not include engagement metrics such as bounce rate, session duration, or conversion rates, which may also shape financial performance. Finally, the sample size disparity between developed (n=38) and developing (n=12) countries limits statistical power for cross-group comparisons, and results should therefore be interpreted with caution. Future studies should expand the dataset to include more firms from diverse regions, integrate time-series data to capture changes over time, and employ advanced econometric models (e.g., regression or structural equation modeling) to test causality. Including additional digital metrics would also provide a more nuanced picture of how online engagement translates into financial performance.

5. Conclusions

This study contributes to the understanding of how website traffic relates to financial performance in the global e-commerce industry, highlighting differences between developed and developing economies. In developed countries, website visits are consistently linked to key financial indicators, particularly market capitalization, revenue, and earnings, reinforcing the importance of digital engagement in driving financial success. In contrast, in developing countries, website visits show weaker associations with revenue but stronger ties to earnings and profitability efficiency, indicating that traffic conversion into profit is more selective in emerging markets.

These findings have practical implications for e-commerce stakeholders. Firms in developed economies should continue to expand digital engagement strategies as traffic is broadly associated with financial growth. Meanwhile, firms in developing economies may benefit from focusing on improving conversion efficiency, ensuring that limited traffic is effectively monetized. For policymakers, strengthening digital infrastructure and consumer adoption in developing countries may help firms translate traffic into sustainable revenue growth.

In conclusion, website traffic is an important but context-dependent indicator of financial performance. Its value is more comprehensive in developed economies but more strategically significant in developing economies, where profitability hinges on efficient traffic conversion.

Supplementary Materials

The following supporting information can be downloaded at the website of this paper posted on Preprints.org.

Data Availability Statement

The data that support the findings of this study are confidential and are not publicly available due to privacy restrictions. Access to the dataset may be granted upon reasonable requests and with permission from the corresponding data owner.

Acknowledgments

The author thanks the reviewers for their comments, which helped to improve the presentation of this manuscript

Conflicts of Interest

The author declares no conflict of interest associated in this study.

References

- Alawneh, A. (2018). Dividends, net income after taxes and earnings per share and their impact on the market capitalization of listed companies Amman Stock Exchange during the period 1978-2016. International Journal of Economics and Finance, 10(10), 69. [CrossRef]

- Ali, N. , & Shabn, O. S. (2024). Customer lifetime value (CLV) insights for strategic marketing success and its impact on organizational financial performance. Cogent Business & Management, 11(1). [CrossRef]

- Amosh, H. A. , & Khatib, S. F. A. (2022). Websites visits and financial performance for GCC Banks: The moderating role of environmental, social and governance performance. Global Business Review. [CrossRef]

- Berger, P. D. , & Nasr, N. I. (2021). Customer lifetime value: Marketing models and applications. Journal of Interactive Marketing, 12(1), 17–30. [CrossRef]

- Chen, C. P. T. C., Cho, T. S., & Chen, S. L. (2020, June 25). Traffic analysis of e-commerce websites: Exploring the mediating effect of consumer behavior. International Journal of Organizational Innovation. Available online: https://www.ijoi-online.org/index.php/current-issue/522-traffic-analysis-of-e-commerce-websites-exploring-the-mediating-effect-of-consumer-behavior.

- Fernando, J. , Silberstein, S., & Rathburn, P. (2025). Market capitalization: What it means for investors. Investopedia. https://www.investopedia.com/terms/m/marketcapitalization.

- Filippou, G. , Georgiadis, A. G., & Jha, A. K. (2023). Establishing the link: Does web traffic from various marketing channels influence direct traffic source purchases? Marketing Letters, 35(1), 59–71. [CrossRef]

- Gao, Y. (2023). Study of the relationship between traffic and sales on e-commerce platforms based on QCA approach. Frontiers in Economics and Management, 4(3), 45–59. [CrossRef]

- Ghosh, A. , Gu, Z., & Jain, P. C. (2004). Sustained earnings and revenue growth, earnings quality, and earnings response coefficients. SSRN Electronic Journal. [CrossRef]

- Gunanto, A. , & Preda, L. (2023). Financial harmony in diversity: Exploring the dynamics of SMEs' finance through the lens of business size, debt-to-equity ratio, and revenue growth toward the perfection of net profit margin. SAR Journal - Science and Research. [CrossRef]

- Hendricks, S. , & Mwapwele, S. D. (2023). A systematic literature review on the factors influencing e-commerce adoption in developing countries. Data and Information Management, 8(1), 100045. [CrossRef]

- Howart, J. (2025). 79+ brand new e-commerce statistics for 2025. Exploding Topics. https://explodingtopics.

- Kanellos, N. , Karountzos, P., Giannakopoulos, N. T., Terzi, M. C., & Sakas, D. P. (2024). Digital marketing strategies and profitability in the agri-food industry: Resource efficiency and value chains. Sustainability, 16(14), 5889. [CrossRef]

- Kiel, D. , Müller, J. M., Arnold, C., & Voigt, K. (2017). Sustainable industrial value creation: Benefits and challenges of Industry 4.0. International Journal of Innovation Management, 21(08), 1740015. [CrossRef]

- Kinda, T. (2019). E-commerce as a potential new engine for growth in Asia. IMF Working Paper, 19(135), 1. [CrossRef]

- Noor, L. S. , Deriawan, D., & Oktrivina, A. (2023). E-commerce and financial performance: Identification on trends, benefits and challenges. ATESTASI Jurnal Ilmiah Akuntansi, 6(1), 528–543. [CrossRef]

- Pomykalski, P. (2019). Revenue and valuation of companies with digital platform business models. Management Sciences, 24(1), 11–18. [CrossRef]

- Ramadhan, A. , & Nuraliati, A. (2020). The effect of net profit margin and earning per share on share prices. Almana: Jurnal Manajemen dan Bisnis, 4(3), 420–430. [CrossRef]

- Rincón, J. S. R. R. , Tarazona, A. R. R. R., Martínez, A. M. M. M., & Acosta-Prado, J. C. (2022). Positioning and web traffic of Colombian banking establishments. Journal of Theoretical and Applied Electronic Commerce Research, 17(4), 1473–1492. [CrossRef]

- Zhan, Y. (2024). E-commerce: The evolution of retail in the digital age [Opinion article]. Business Studies Journal, 16(2), 1–2. https://www.abacademies.org/articles/ecommerce-the-evolution-of-retail-in-the-digital-age-17343.

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).