1. Introduction

The advancement of internet and communication technologies, especially smartphones, has fueled the growth of e-commerce and financial technology (FinTech). This has led to various innovations and the engagement of new stakeholders in payment processing [

1]. By integrating digital innovations, FinTech creates lasting value, provides firms with competitive advantages, reduces costs, expands customer reach, and improves risk management efficiency [

2]. Furthermore, FinTech significantly impacts the financial market by transforming capital dynamics and mitigating information asymmetry. It revolutionizes saving, investing, spending, and capital-raising processes, while addressing issues such as moral hazard and adverse selection [

3].

The rise of FinTech is pivotal in reshaping global banking and finance, profoundly impacting billions of people worldwide and influencing economies globally [

4]. A developed FinTech ecosystem can attract top talent and inspire new business concepts, fostering growth across sectors such as wealth management, electronic payments, trading platforms, insurance, and regulatory compliance [

5]. During the COVID-19 pandemic, FinTech has mitigated the economic impact by enabling the swift and efficient deployment of targeted fiscal measures to beneficiaries, including the unbanked, and reducing the need for physical interactions and cash use [

6]. With the many potential benefits of FinTech, it is important to promote and understand the factors that influence its development.

The development of FinTech within the ASEAN region has been remarkable. The FinTech market in the ASEAN region is one of the fastest-growing globally, with investments surging by over 40% in 2018 [

7]. The low penetration of banking services and the openness of customers to FinTech products make the ASEAN region an ideal environment for FinTech, leading to significant developments in the financial sector and marking it as a promising area for growth [

8,

9].

FinTech services have significant expansion potential in the ASEAN region, particularly for crowdfunding, neobanks, and InsurTech, due to a positive entrepreneurial climate and asset investment interest [

10]. According to Karim et al. [

11] findings, the ASEAN region, with a

$2.3 trillion market and 600 million customers, is viewed by companies as a prime expansion opportunity, with 76% of surveyed FinTech executives citing the large potential client base as their main motivation for doing business there. The region's commitment to digital transformation and financial inclusion has positioned ASEAN as a vibrant landscape for FinTech innovation, promising continued growth and opportunities in the years to come.

Despite the rapid development and significant potential of FinTech in the ASEAN region, there has been limited research on the factors driving the emergence and growth of numerous FinTech companies in these countries. Understanding these underlying factors is crucial for stakeholders aiming to leverage FinTech for economic development and financial inclusion. This research aims to fill that gap by identifying and analyzing the key determinants of FinTech development in ASEAN, thereby providing insights that can guide policymakers, investors, and entrepreneurs in fostering a robust FinTech ecosystem in the region.

The driving factors for FinTech development are highly varied [

12], encompassing a broad spectrum of elements that collectively contribute to the sector's growth. This study focuses on researching these diverse factors to understand their impact on FinTech development. By investigating both economic and non-economic aspects, the study aims to uncover the critical drivers behind the rapid expansion of FinTech in the ASEAN region. This comprehensive approach ensures a holistic view of the FinTech landscape, highlighting the importance of creating an enabling environment for sustainable growth.

Haddad and Hornuf [

13] have studied the influence of economic and non-economic factors on the development of FinTech. However, their research did not distinguish between FinTech development in developed and developing countries, leading to a significant gap in understanding, especially considering the vastly different economic contexts. Anh [

14] examined the factors that influence the emergence of FinTech in Vietnam through a comparison with FinTech in Singapore, which is considered successful in managing FinTech. However, this study refers to the practice of managing FinTech in Singapore, which is considered advanced and does not reflect the economic realities of Vietnam. Singapore's economic ecosystem vastly differs from Vietnam's, and non-economic supporting factors also significantly differ.

This study aims to fill that gap by focusing specifically on the factors influencing FinTech development in developing countries in the ASEAN region. It contributes to understanding the influence of economic and non-economic factors in developing (middle-income) countries, specifically the ASEAN 4 countries: Indonesia, Malaysia, Thailand, and the Philippines, plus Vietnam. These five ASEAN countries were chosen because they are not yet classified as developed countries and have equivalent income sizes, namely the middle-income group. By addressing this distinction, the research will provide a clearer picture of the unique drivers and challenges faced by FinTech in these developing economies, offering targeted insights for policymakers and stakeholders in the region. Additionally, this research explores the mediating role of variables such as access to finance, technological readiness, and human development index. By examining how these mediators influence the relationship between economic and non-economic factors and overall FinTech development, the study aims to uncover deeper insights into the mechanisms that drive FinTech success in these countries. This comprehensive approach will help to identify effective strategies for fostering a robust FinTech ecosystem in the ASEAN region.

2. Literature Review

2.1. FinTech Development

FinTech has long been a central topic of discussion in the financial industry, political and regulatory circles, and academic research. In the decade since the financial crisis, FinTech startups have introduced innovative solutions to traditional banking, insurance, and asset management, using advanced technology to address issues in financial services, particularly in customer experience and insight [

1]. FinTech involves using digital technologies in financial services, fundamentally redefining how financial entities operate [

3]. This transformation presents both challenges and opportunities, offering greater flexibility, enhanced functionality in certain banking areas, and service aggregation [

15].

The development of FinTech can be observed through the growth in the number of FinTech companies in a country, reflecting a positive market response to their presence [

13,

14]. The evolution of FinTech is not a recent phenomenon and can be categorized into four stages. The first stage, FinTech 1.0, occurred from 1866 to 1967 and was influenced by the global financial era from 1866 to 1913. The second stage, FinTech 2.0, spanned from 1967 to 2008 and was marked by the rise of the digitalization of financial services. The third stage, FinTech 3.0, began in 2008 and continues to the present in developed countries such as the USA and UK. Concurrently, the fourth stage, FinTech 3.5, also began in 2008 and continues to the present, but it is specific to developing countries in Asia and Africa [

16].

As newcomers to the financial industry, FinTechs emerged due to specific triggers. Theories related to FinTech evolution factors [

17,

18,

19,

20] identify these triggers as divided into two categories: the demand side, which includes shifts in consumer preferences and technological evolution, and the supply side, which involves changes in market structure. This dual influence highlights the dynamic nature of FinTech development and underscores the importance of understanding the multifaceted factors driving its growth.

In this study, the factors examined as FinTech development drivers encompass economic and non-economic elements. Economic factors include macroeconomic indicators, general banks' conditions, and finance access. These aspects play a crucial role in shaping the financial landscape in which FinTech companies operate, influencing their ability to secure funding, scale their operations, and integrate into existing financial systems. On the other hand, non-economic factors such as internet usage, the level of innovation, technological readiness, total population, and the human development index. This dual focus on economic and non-economic elements highlights the complex interplay of conditions that foster the growth of FinTech.

2.2. Macroeconomic Indicator

Macroeconomic indicators such as Gross Domestic Product (GDP) and inflation play pivotal roles in the development of FinTech. Yartey [

21] highlights that income levels, particularly GDP, serve as a strong proxy for capital market development. This view is supported by Haddad and Hornuf [

13] which reveals that GDP is a key element in forming the economic development ecosystem that triggers the emergence of FinTech in a country. In advanced economies and capital markets, the demand for FinTech startups is significantly greater due to better access to the necessary financing for their growth and development. Additionally, individuals in these developed economies are more likely to require services such as asset management and financial education tools [

13].

In Lithuania, GDP and the financial stability of banks exert a notably strong influence on the growth of the FinTech sector, as demonstrated by Taujanskaitė and Kuizinaitė [

22]. Mustafa et al. [

23] also emphasize that a stable macroeconomic environment is crucial for the sound functioning of the financial sector, with key indicators such as GDP significantly affecting financial inclusion. Aggarwal and Goodell [

24] find that GDP per capita, urbanization, trade, and financial inclusion are strong determinants of mobile phone technology adoption, a key enabler for FinTech services.

Research by Bobbo et al. [

25] in the USA shows that while economic growth positively influences FinTech development, inflation has a negative impact. This is because high inflation rates can erode purchasing power and create economic instability, which is detrimental to the growth of FinTech services. Conversely, Mumtaz and Smith [

26] find that inflation significantly influences FinTech by driving the increased use of foreign exchange products, particularly in countries with less stable currencies.

Economic theories suggest that favorable economic conditions lead to an increased demand for credit, which in turn fosters the development of the FinTech credit market. Wang et al. [

27] indicate that as the economy grows and GDP per capita rises, the demand for credit from both traditional banks and FinTech platforms increases. Their research also shows that economic and technological development indicators boost FinTech credit, with economic indicators having a stronger positive effect in countries with lower inflation rates.

Moreover, GDP is directly linked to mobile technology, as businesses utilize mobile technology to facilitate transactions, potentially enhancing FinTech development and boosting production activities within a country [

26]. A well-developed economic environment is essential for vibrant FinTech development, as factors such as economic growth, policy, tax rates, ease of doing business, and costs influence FinTech companies. These companies tend to locate where these conditions best meet their business needs due to their high international mobility [

28].

2.3. Condition of General Bank

FinTech is revolutionizing the competitive landscape of the banking industry, disrupting traditional value chains of financial institutions [

29]. Over the past decade, the banking sector has experienced declining profitability due to reduced leverage, fee income, and net interest margins. These trends, accelerated by the 2008 financial crisis, have coincided with advances in digital technology that have increased competitiveness by enabling mobile service distribution [

30].

Research by Haddad and Hornuf [

13] highlights that the health of general banks in a country significantly influences FinTech development. To address the challenges posed by technology-driven firms, banks are adopting innovations from FinTechs to gain new advantages. They have established FinTech incubators and accelerators to foster innovation while retaining control through minority stakes in these developed or supervised firms [

31].

Research by Taujanskaitė and Kuizinaitė [

22] also shows that the financial stability of banks plays a crucial role in the growth of the FinTech sector. Banks are actively engaging with FinTech companies by launching incubation programs, establishing venture funds, and forming strategic partnerships [

15]. Collaborating with FinTech startups can help banks improve existing business models, especially as the financial services industry transitions from traditional banking to shadow banking [

32,

33].

A robust banking system and openness to financial innovations create significant opportunities for FinTech growth [

34]. Cornelli [

35] have found that FinTech credit is more advanced in countries with lower levels of banking intermediation and coverage. While banks negatively impact FinTech development in developing countries, they positively influence it in developed nations. In developed financial markets, banks with significant market power are likely to collaborate with FinTech companies, viewing them not as threats but as sources of innovation and consultancy. This collaboration leads banks to support FinTech development through specialized accelerators or startups [

36].

2.4. Internet Use

The advancement of information and communication technology (ICT), especially the Internet of Things, is significantly impacting various facets of human life and business transformation [

37]. Internet usage is a crucial medium connecting FinTech companies with customers, influencing the marketing and operational capabilities of these firms. Kowalewski and Pisany [

36] found that higher internet usage in a country enhances FinTech marketing opportunities, demonstrating a positive impact of technology-related factors on FinTech development. Their research indicated that the coefficients for mobile-cellular telephone usage and fixed broadband subscriptions are positive and statistically significant.

The proliferation of smartphones and improved internet speeds have enabled the real-time delivery of financial services to customers via mobile devices, further boosting FinTech adoption [

1]. Haddad and Hornuf [

13] identified that the number of internet users and customers significantly stimulates FinTech development. The ability to leverage big data and advanced analytics, powered by internet connectivity, allows FinTech companies to offer personalized financial solutions and improve risk assessment models. Secure internet servers and widespread mobile phone usage create a robust infrastructure for FinTech startups to flourish [

13].

The positive correlation between internet usage and FinTech growth is also evident in the way digital platforms facilitate broader financial inclusion. Sahay et al. [

6] observed that enhanced digital infrastructure, characterized by widespread internet access and mobile phone penetration, leads to increased adoption of digital payment systems and credit services. This digital ecosystem not only supports existing financial institutions in reaching underserved populations but also empowers new FinTech entrants to introduce innovative products and services. Consequently, countries with higher internet penetration rates are better positioned to harness the benefits of FinTech innovations, driving economic growth and improving financial accessibility for their populations.

2.5. Level of Innovation

Innovation serves as a fundamental driver of FinTech development, influencing the financial sector in numerous ways. The innovation ecosystem presents both opportunities and threats, as noted by Adner [

38], emphasizing that while financial innovation can enhance service offerings, it also disrupts traditional financial systems. FinTech is a direct output of such innovation, embodying modern financial services that leverage technological advancements to meet the evolving needs of consumers and businesses.

The evolution of FinTech has garnered significant attention over time due to the dual nature of financial innovation—creating new opportunities while posing challenges to the existing financial industry [

38]. Innovation in FinTech can take various forms, including technical, commercial, organizational, social, and financial. Specifically, financial innovation emerges from the growth of FinTech companies, which introduce novel solutions to enhance efficiency, accessibility, and personalization in financial services [

39].

Gao [

40] indicates that the innovative capacity of a region significantly influences its FinTech development. For instance, higher mobile phone subscriptions and well-developed communication infrastructure are crucial determinants of FinTech growth, as highlighted by Stolbov and Shchepeleva [

12]. Their findings suggest that regions with a greater propensity for innovation are more likely to foster a thriving FinTech market. Additionally, Gao [

40] points out that a high volume of innovations and a strong innovative capacity are key drivers of FinTech advancement in the United States, underscoring the importance of an innovation-rich environment for the sector's development.

Innovation can promotes financial inclusion by creating more accessible and user-friendly financial services. The development of mobile banking, peer-to-peer lending platforms, and digital payment systems exemplifies how innovative solutions can address the needs of underserved populations. Sahay et al. [

6] highlighted that innovations in digital infrastructure are strongly linked to increased use of FinTech services, particularly in regions with limited traditional banking infrastructure.

2.6. Total Population

The total population of a country plays a crucial role in the development of FinTech, as a larger population base often translates to a higher potential market for financial technology services [

41]. Larger populations offer a broader customer base for FinTech companies, providing opportunities for these firms to scale their operations and tailor their offerings to meet the needs of different demographic segments. Moreover, a growing population can lead to increased economic activity and greater demand for financial inclusion, driving the adoption of innovative financial solutions that cater to the needs of previously unbanked or underbanked populations [

42].

The total population of a country is a significant determinant of FinTech development, as highlighted by Haddad and Hornuf [

13]. The population forms the customer base for FinTech products, particularly those with internet access, making it a crucial factor in the sector's growth. In developing countries, the FinTech 3.5 stage is marked by several demographic and economic characteristics. These include a large number of young people with mobile devices, a rapidly expanding middle class, and a shift from traditional trust-based financial behavior to convenience-driven behavior. Additionally, these regions often experience damage to physical banking infrastructure, opening up new market opportunities for FinTech companies to provide alternative financial services [

16].

Population growth in developing countries presents a market opportunity for FinTech firms, particularly because a significant portion of the population remains unbanked or underbanked. This lack of connection to traditional banks creates challenges for financial institutions in assessing credit risk for new customers. FinTech companies can fill this gap by leveraging innovative technologies and alternative data sources to offer financial services to these underserved populations [

43].

Furthermore, a large and growing population, especially one that is increasingly urbanized and tech-savvy, provides a fertile ground for FinTech innovations [

44]. As more people gain access to mobile devices and the internet, the demand for convenient, digital financial solutions rises, driving the expansion of FinTech services. This trend is particularly pronounced in regions with a young demographic, as younger individuals are typically more open to adopting new technologies and are key drivers of digital transformation in financial services [

45,

46].

2.7. Access to Finance

Access to finance is a pivotal factor in the development and growth of the FinTech sector. Kowalewski and Pisany [

36] highlight that improving access to finance can substantially enhance FinTech development. Long-term growth in the FinTech sector necessitates facilitating access to financing, as securing funding for expansion remains a major hurdle for scaling up businesses [

47]. This is particularly true in developing countries, where financial institutions are difficult to access, and mobile payment services have emerged as vital tools for financial inclusion [

48].

Haddad and Hornuf [

13] emphasize that access to financing is critical for promoting the formation of FinTech companies and serves as an indicator of financial market development. When traditional bank financing is obstructed, companies often seek alternative funding sources, such as FinTech platforms, to grow their businesses. Research by Kliber [

34] indicates that the determinants of FinTech funding are similar to those of other startups, though entrepreneurs in emerging markets face greater constraints due to uncertainties and limited credit availability. Ensuring adequate access to finance is fundamental to fostering a robust and dynamic FinTech ecosystem, especially for startups and young companies that may struggle to raise capital during crises [

34].

In this study, access to finance is also examined as an important mediating variable in the relationship between macroeconomic indicators, condition of general banks, and FinTech growth. As noted by Haddad and Hornuf [

13], access to financing can stimulate the formation of FinTech firms, suggesting that favorable economic indicators can create an environment where financial institutions are more willing to provide necessary funding. Beck et al. [

49] found that national economic indicators, including inflation and economic growth, significantly influence companies' ability to secure financing from banks, particularly for small and medium-sized enterprises. Similarly, Aggarwal and Goodell [

24] identified GDP as a critical determinant of access to capital financing, venture capital, and debt. A stable economy enhances trust, reducing financing obstacles and facilitating smoother access to financial resources for businesses, which in turn can drive FinTech development by providing the necessary capital for innovation and growth.

Furthermore, this research explores how access to finance mediates the relationship between the condition of general banks and FinTech development. Aggarwal and Goodell [

24] also explored how the health and quality of bank credit determine the ease of financing access. The stability and quality of banks influence their capacity to extend credit, with healthier banks more likely to distribute greater amounts of financing, whether in the form of ventures, capital, or debt. When banks are financially robust, they can better support the financial needs of businesses, including those in the FinTech sector. This mediating role of access to finance highlights the importance of a stable banking system in fostering a supportive environment for FinTech innovation and expansion, emphasizing the need for policies that strengthen both economic stability and banking health to promote FinTech development.

2.8. Technology Readiness

Technology readiness is a pivotal factor in the development of FinTech. Recent studies indicate that the digital revolution has fundamentally transformed financial markets and services, fostering substantial growth in the FinTech sector [

50,

51]. Kliber et al. [

34] found that these technological factors have positively impacted the sector, underlining the importance of robust technological infrastructure for FinTech development

Emerging technologies such as artificial intelligence, big data, blockchain, and cloud computing have driven rapid advancements in FinTech [

52]. Research by Wang et al. [

27] highlights the critical role of technological infrastructure in FinTech growth, demonstrating that improved network facilities, including grassroots internet sites and expanded coverage, enable remote areas to benefit from the Internet, thereby strengthening the foundation for FinTech development. Additionally, the correlation between technology readiness and FinTech growth is evident as FinTech companies leverage advanced technology and data analytics to target niche markets, enhance consumer satisfaction, and cater to lower-income groups [

6].

Countries with strong Information and Communications Technology (ICT) service clusters and overall ICT readiness experience more rapid FinTech formation, as globally competitive ICT providers attract FinTech entrepreneurs and accelerate industry growth [

53]. The availability of the latest technology in an economy is another key driver of FinTech demand. FinTech startups depend on these technologies to develop faster payment services, streamline operations, enhance information sharing, and reduce banking transaction costs [

13].

This research also examines technology readiness as a mediating variable in the relationship between internet use, level of innovation, and FinTech development. Manyika and Roxburgh [

37] emphasized that internet usage is foundational to a country's technological infrastructure ecosystem, facilitating business transformation and enhancing technological readiness. The proliferation of internet access enhances the ability of FinTech companies to offer their services more effectively. When coupled with high technology readiness, which includes secure internet services and advanced network infrastructure, the positive impact of internet use on FinTech development is significantly amplified. The availability and use of the internet form the backbone of technological readiness, enhancing the positive effects of internet usage on FinTech development [

54].

Innovation, encompassing advancements in artificial intelligence, blockchain, big data, and cloud computing, is a driving force behind FinTech growth. However, the successful implementation and scaling of these innovations depend heavily on the technological infrastructure available. Razavi et al. [

54] found that the availability of the latest technology, internet customers, and the absorption of company technology are pivotal in enhancing technological readiness. Hence, regions with high technological readiness are better equipped to support and benefit from innovative FinTech solutions, making the relationship between innovation and FinTech development more robust [

52,

53].

2.9. Human Development Index

The Human Development Index (HDI) is a comprehensive measure of a country's average achievement in key dimensions of human development: a long and healthy life, knowledge, and a decent standard of living [

55]. The HDI emphasizes that the abilities and well-being of people should be the primary criteria for assessing a country's development, rather than economic growth alone. This index provides a broader perspective on national development by highlighting disparities in human development even among countries with similar Gross National Income (GNI) per capita.

Research has shown a strong correlation between human capital and the adoption of mobile phone technology, which is integral to FinTech services [

24]. Kiliç and Özcan [

56] demonstrates the mutual influence between human resource development and financial development, particularly in countries with micro-enterprises and developing capital markets. Higher levels of human capital, as the HDI indicates, are crucial for the effective utilization and growth of FinTech services. This is because educated and experienced founding teams attract venture capital, signaling potential positive returns [

47].

Further, the HDI is closely linked to FinTech development, as a highly skilled workforce with expertise in both financial and technological services is essential for driving innovation and growth in the sector [

57]. Strong education policies and flexible labor legislation contribute to a pool of qualified local employees, enabling FinTech companies to recruit and expand as needed [

28]. Therefore, a country's HDI reflects its general human development and serves as a key indicator of its potential to foster and sustain FinTech development.

This research also examines the Human Development Index (HDI) as a mediating variable between total population and FinTech development. Population growth can significantly impact human development, often leading to higher poverty rates and diminished human development [

52]. As the population increases, challenges such as resource allocation, education, and healthcare become more pronounced, negatively affecting the HDI. Zgheib et al. [

58] found a direct influence of population on HDI, indicating that as the population grows, there are notable effects on the dimensions of human development. By incorporating HDI as a mediating variable, this research aims to understand how variations in human development, driven by population changes, subsequently influence the development and adoption of FinTech services.

2.10. Theoretical Framework and Hypotheses

FinTech has emerged as a transformative force in the financial sector, redefining traditional banking, payment systems, and financial services. As FinTech development gains momentum in ASEAN-4 countries and Vietnam, it is essential to understand the underlying factors that drive its expansion. This study integrates economic and non-economic perspectives to examine FinTech growth, emphasizing the mediating role of financial access, technological readiness, and the human development index.

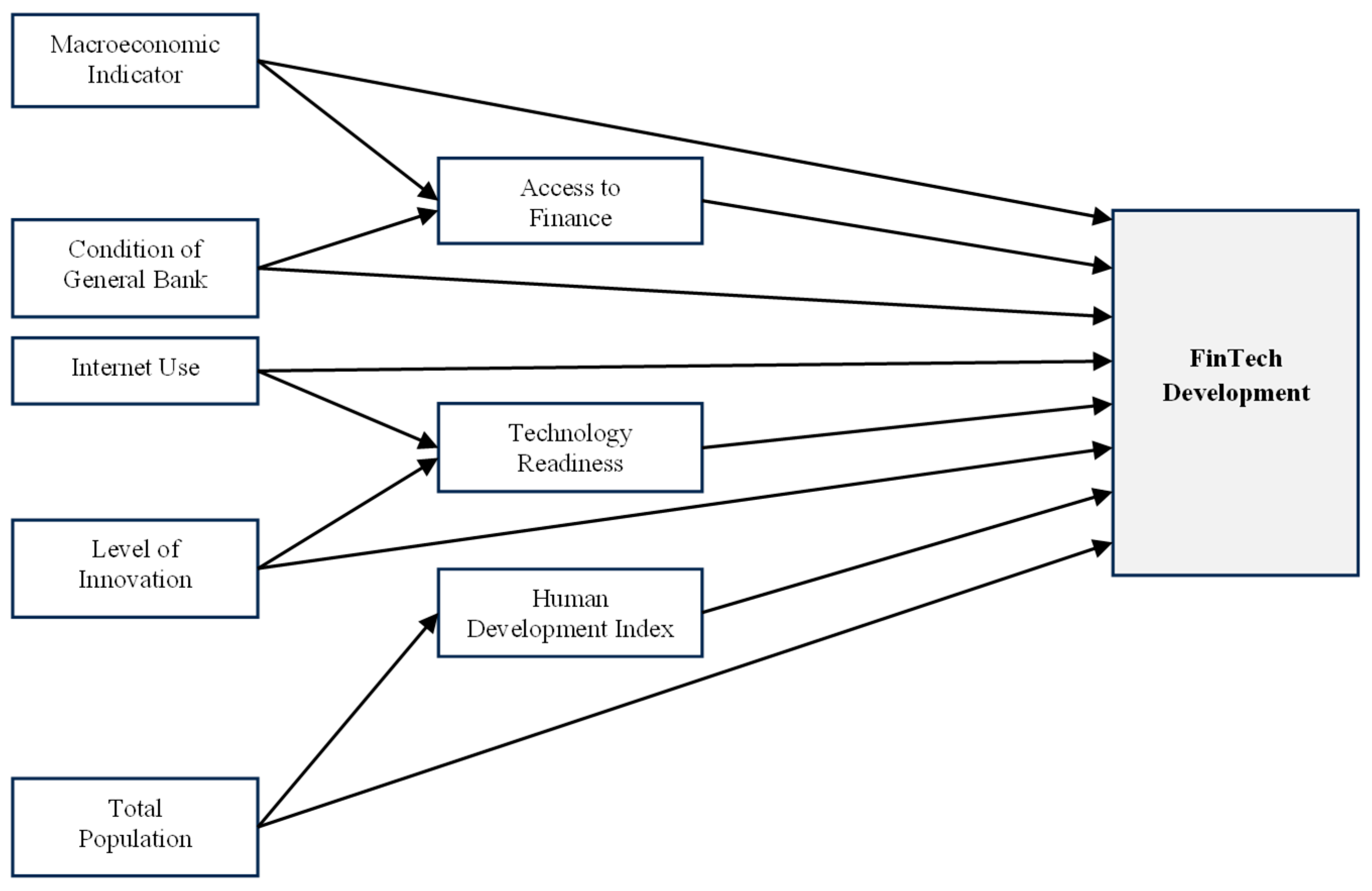

Economic factors such as macroeconomic indicators, banking conditions, and access to finance shape the financial environment in which FinTech operates. Simultaneously, non-economic factors, including internet penetration, innovation levels, population dynamics, and human development, contribute to technological adoption and digital transformation. The proposed research model (

Figure 1) explores these relationships, hypothesizing direct and mediated effects on FinTech development. The hypotheses formulated in this study provide a structured framework for examining these linkages, offering insights into the mechanisms that drive FinTech growth in emerging economies.

H1. Macroeconomic indicators influence access to finance;

H2. Macroeconomic indicators influence FinTech development;

H3. The condition of general bank influences access to finance;

H4. The condition of general banks influences FinTech development;

H5. Internet use influences technology readiness;

H6. Internet use influences FinTech development;

H7. Level of innovation influences technology readiness;

H8. Level of innovation influences FinTech development;

H9. Total population influences the human development index;

H10. Total population influences FinTech development;

H11. Access to finance influences FinTech development;

H12. Technology readiness influences FinTech development;

H13. Human Development Index influences FinTech development;

H14. Access to finance mediates the relationship between macroeconomic indicators and FinTech development;

H15. Access to finance mediates the relationship between the condition of the general bank and FinTech development;

H16. Technology readiness mediates the relationship between internet use and FinTech development;

H17. Technology readiness mediates the relationship between the level of innovation and FinTech development;

H18. The human development index mediates the relationship between total population and FinTech development.

3. Materials and Methods

3.1. Research Materials

This study focuses on the ASEAN-4 countries—Indonesia, Malaysia, Thailand, and the Philippines—along with Vietnam. These countries were selected due to their classification as developing nations and similar middle-income status. The study utilizes secondary data from publicly available and published reports, covering the period from 2008 to 2018. Detailed proxy measurements for each variable and their corresponding data sources are outlined in

Table 1.

Three composite variables are used in this study: macroeconomic indicators, the condition of general banks, and internet use. Composite variables combine two or more related measures to enhance statistical analysis and interpretation [

59]. The use of composite variables is a common practice to control the Type I error rate, handle multicollinearity in regression analysis, or organize multiple highly correlated variables into more digestible or meaningful information [

60]. These composite variables are calculated based on index values provided by the Indonesian Central Statistics Agency, following the methodology established by the UNDP. The composite index formula is expressed as follows:

Each component index ranges between 0 (worst condition) and 1 (best condition). The values are rescaled to a range of 0 to 100 to enhance interpretability, as recommended by the Indonesian Central Statistics Agency. The component indices are calculated using the formula:

where

X (i): Indicator-i

X (i) max: Maximum value X (i)

X (i) min: Minimum value X (i)

3.2. Research Methods

To analyze the collected data, descriptive statistical analysis is employed, summarizing key characteristics such as mean, median, minimum, maximum, standard deviation, and variance coefficient. The results of this descriptive analysis for all studied variables are presented in

Table 2.

This study employs Structural Equation Modeling (SEM) using SmartPLS3 software for hypothesis testing. SEM is particularly useful for examining complex relationships among variables and validating the proposed research model. Given that this study relies entirely on secondary data, a formative measurement model is used rather than a reflective one. The formative approach ensures that each indicator contributes uniquely to the construction of the latent variables, aligning with the theoretical framework of this research.

4. Results

4.1. Structural Model Evaluation

The structural model evaluation was conducted to assess the strength of the relationships between latent variables and to determine the influence between variables in the model. The model's explanatory power was first evaluated using R-square and Q-square values, which indicate the coefficient of determination and predictive relevance, respectively. As shown in

Table 3, macroeconomic indicators and the condition of general banks explain 44.1% of the variance in access to finance. Internet use and the level of innovation account for 46.3% of the variance in technological readiness. The total population explains 35.5% of the variance in the Human Development Index. All independent variables collectively explain 68.5% of the variance in FinTech development. The Q-square values for all models are greater than 0, confirming their predictive relevance.

The f-square effect size was also examined to determine the magnitude of influence that independent variables have on dependent variables. Following the categorization by Hair et al. [

61], the effect sizes of 0.02, 0.15, and 0.35 correspond to small, moderate, and large influences, respectively. As detailed in

Table 4, macroeconomic indicators have a moderate influence on access to finance, while the condition of general banks exert a large influence. Similarly, the level of innovation has a moderate effect on technological readiness, whereas internet use has a large effect. The total population significantly influences the Human Development Index. Among all variables influencing FinTech development, the condition of general banks and access to finance demonstrate a moderate effect, whereas other factors exhibit a small effect size.

4.2. Direct Effect Hypothesis Test

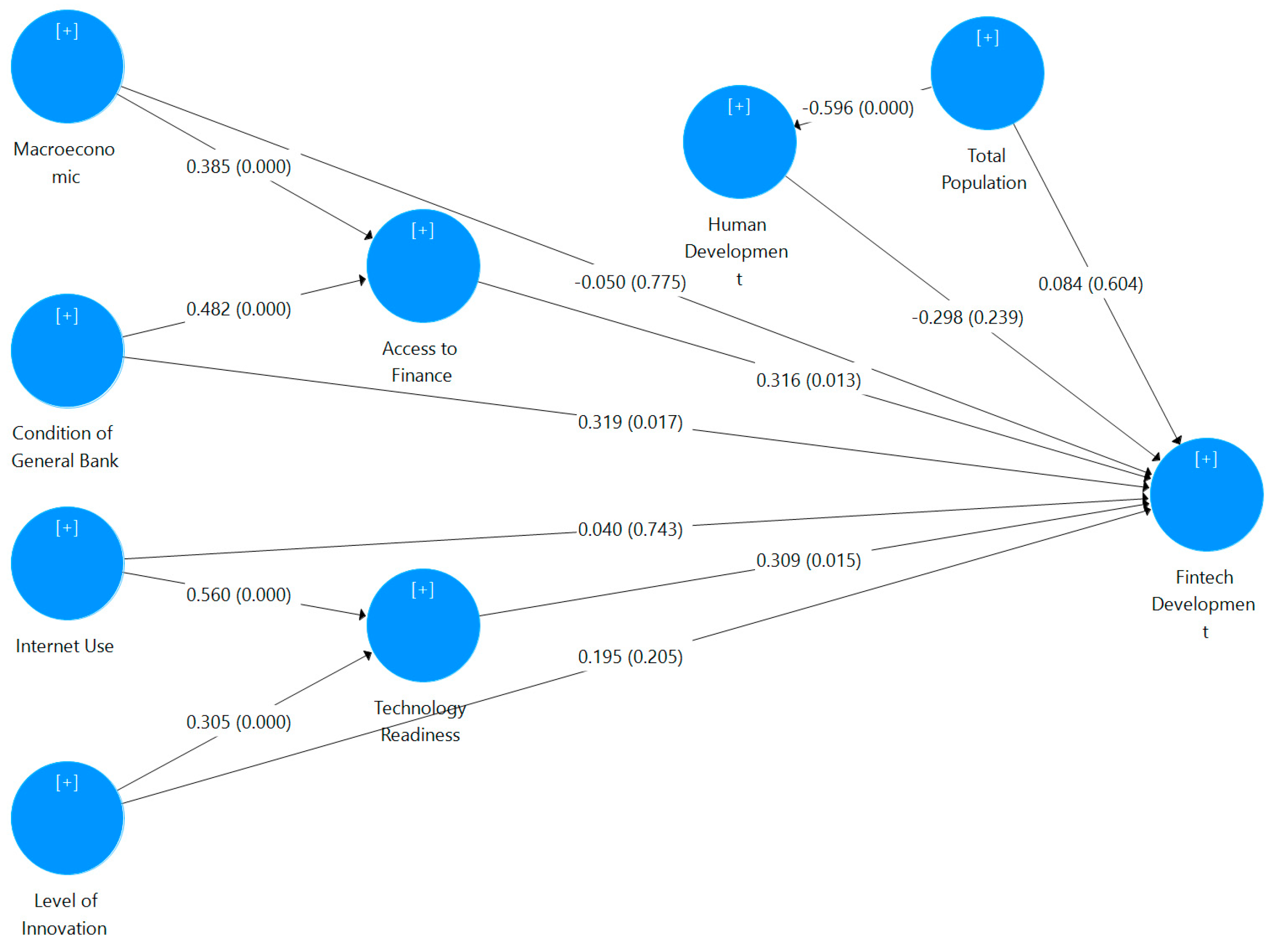

The hypothesis testing results for direct effects (

Table 5 and

Figure 2) confirm that macroeconomic indicators and the condition of general banks positively affect access to finance, supporting H1 and H3. Internet use and the level of innovation positively influence technological readiness, supporting H5 and H7. The total population negatively affects the Human Development Index, supporting H9. Furthermore, only the condition of general banks, access to finance, and technology readiness directly and positively impact FinTech development, supporting H4, H11, and H12.

4.3. Mediation Hypothesis Test

Furthermore, the mediation hypothesis test results (

Table 6) indicate that four out of five mediation hypotheses are significant (H14, H15, H16, H17). Access to finance fully mediates the relationship between macroeconomic indicators and FinTech development and partially mediates the relationship between the condition of general banks and FinTech development. Technology readiness is proven to fully mediate the relationship between internet use and the level of innovation in FinTech development. The Human Development Index cannot mediate the total population and FinTech development relationship.

4. Discussion

This research confirms the positive influence of the condition of general banks on FinTech development, aligning with prior studies [

13,

22,

31]. Strong and stable banks create a conducive environment for FinTech growth by fostering innovation through incubators, accelerators, and strategic partnerships [

13]. Banks also retain influence through minority stakes in FinTech startups and venture funding initiatives [

22,

31]. These findings reinforce the notion that traditional banks' health significantly impacts the FinTech sector's expansion.

In the era of digitalization, banks can transform potential threats from FinTech into opportunities by investing in infrastructure and skill development. Collaborations with FinTech startups—through service agreements, mergers, and acquisitions—further strengthen the financial ecosystem [

39]. A well-capitalized and stable banking sector enhances public trust in financial institutions, indirectly supporting FinTech adoption by introducing financial literacy through traditional banking channels. Thus, a strong banking foundation facilitates FinTech proliferation, financial inclusion, and digital innovation.

This research highlights the critical mediating roles of access to finance and technology readiness in FinTech development. While macroeconomic indicators, internet usage, and innovation levels do not directly impact FinTech growth, their influence becomes significant when mediated by these factors. This finding underscores the necessity of policies that improve financial accessibility and technological infrastructure to sustain the FinTech sector in ASEAN-4 countries.

Access to finance significantly drives FinTech development, consistent with the findings of Kowalewski and Pisany [

36], who emphasize that improving financial accessibility stimulates FinTech expansion. The ability to secure funding remains a critical challenge for scaling FinTech businesses [

47]. This study supports Haddad and Hornuf [

13], who argue that access to finance is not only vital for FinTech startups but also serves as an indicator of broader financial market development. Consequently, enhancing financial access fosters innovation, encourages entrepreneurship, and accelerates FinTech sector growth.

This research also finds that macroeconomic indicators influence FinTech development indirectly through access to finance. Economic factors such as inflation and growth shape financial accessibility, with stable economies facilitating investor confidence and enabling smoother access to funding [

49,

62]. A favorable economic environment, characterized by strong policies, business-friendly regulations, and tax incentives, can attract both local and foreign investments in FinTech [

28]. These factors collectively reduce financing barriers, creating an environment conducive to FinTech expansion.

The findings confirm that technology readiness plays a crucial role in FinTech development, aligning with prior research [

13,

34,

53]. Countries with strong Information and Communications Technology (ICT) infrastructures foster FinTech growth by attracting entrepreneurs and enabling digital transformation [

53]. Wang et al. [

27] further emphasize that technological infrastructure—such as internet coverage and network facilities—directly enhances FinTech adoption and innovation.

This research also establishes that technological readiness fully mediates the effect of internet usage on FinTech development. The most influential elements of technological readiness include the availability of advanced technology, internet penetration, and firms' ability to integrate new technologies [

54]. As digitalization accelerates, higher internet adoption enhances technological readiness, which subsequently fuels FinTech expansion [

37].

Furthermore, technological readiness fully mediates the relationship between innovation and FinTech development. While innovation is crucial for financial technology advancements, its impact is significantly strengthened when a country possesses a strong technological infrastructure [

52,

53]. Without adequate ICT readiness, even the most innovative FinTech solutions face adoption barriers, highlighting the importance of digital infrastructure in supporting the sector's growth.

This study finds no significant effect of total population or Human Development Index (HDI) on FinTech development. Although a larger population is often expected to drive FinTech adoption by increasing the customer base, the findings suggest that mere population size is insufficient to boost the sector without supporting financial and technological infrastructures.

Similarly, HDI, which reflects a country's education, health, and living standards, does not directly correlate with FinTech development. While higher HDI levels could theoretically foster a more financially literate population, other factors—such as access to finance, technological readiness, and macroeconomic stability—play a more decisive role in shaping the FinTech landscape in ASEAN-4 countries. These results indicate that FinTech expansion requires an enabling ecosystem rather than simply demographic advantages or human capital improvements.

5. Conclusions

This research contributes to understanding FinTech development by emphasizing the crucial roles of banking stability, access to finance, and technology readiness. While macroeconomic conditions, internet use, and innovation alone do not directly drive FinTech growth, their influence becomes significant through financial accessibility and digital infrastructure. The study's findings highlight the need for policies that strengthen financial inclusion, ICT investments, and economic stability to accelerate FinTech adoption.

The results also challenge assumptions about the role of population size and human development in driving FinTech growth. Instead of demographic factors, the findings suggest that a country's ability to provide accessible financial services and robust technological infrastructure plays a more decisive role in shaping the success of the FinTech sector.

These insights provide valuable implications for policymakers, financial institutions, and technology firms seeking to foster a sustainable FinTech ecosystem in the ASEAN-4 region. By addressing gaps in financial access and digital infrastructure, countries can create an environment that supports innovation and drives long-term FinTech growth.

Despite its contributions, this study has limitations that present opportunities for future research. Future studies could expand the scope beyond ASEAN-4 countries to include broader economies, allowing for comparisons across different financial and regulatory environments. Additionally, while this research focuses on macroeconomic and institutional factors, future investigations could explore micro-level influences such as consumer trust, digital literacy, and behavioral aspects of FinTech adoption. The role of government regulations, financial openness, and policy interventions also warrants further examination, particularly in emerging markets. Exploring these areas will provide a more comprehensive understanding of the drivers and barriers to FinTech development across diverse economic landscapes.

Author Contributions

Conceptualization, A.W., and A.S.; methodology, A.W., and A.Z.A.; software, A.Z.A.; validation, A.W., A.S., and A.Z.A; formal analysis, A.W., and A.Z.A.; investigation, A.S.; resources, A.W.; data curation, A.Z.A; writing—original draft preparation, A.W., and A.S.; writing—review and editing, A.W., and A.Z.A.; visualization, A.Z.A.; supervision, A.W.; project administration, A.W. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Data Availability Statement

Acknowledgments

The authors are highly grateful to the experts and scholars who gave suggestions to help us improve the manuscript.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Chemmanur, T. J.; Imerman, M. B.; Rajaiya, H.; Yu, Q. Recent Developments in the Fintech Industry. J. Financ. Manag. Mark. Institutions, 2020, 08 (01), 2040002. [CrossRef]

- Hua, X.; Huang, Y.; Zheng, Y. Current Practices, New Insights, and Emerging Trends of Financial Technologies. Ind. Manag. Data Syst., 2019, 119 (7), 1401–1410. [CrossRef]

- Sangwan, V.; Harshita; Prakash, P.; Singh, S. Financial Technology: A Review of Extant Literature. Stud. Econ. Financ., 2020, 37 (1), 71–88. [CrossRef]

- Foster, K.; Blakstad, S.; Gazi, S.; Bos, M. BigFintechs and Their Impacts on Macroeconomic Policies. Dialogue Glob. Digit. Financ. Gov. Pap. Ser., 2021, 1–17. [CrossRef]

- Palmié, M.; Wincent, J.; Parida, V.; Caglar, U. The Evolution of the Financial Technology Ecosystem: An Introduction and Agenda for Future Research on Disruptive Innovations in Ecosystems. Technol. Forecast. Soc. Change, 2020, 151. [CrossRef]

- Sahay, M. R.; von Allmen, M. U. E.; Lahreche, M. A.; Khera, P.; Ogawa, M. S.; Bazarbash, M.; Beaton, M. K. The Promise of Fintech: Financial Inclusion in the Post COVID-19 Era; International Monetary Fund: Washington, D.C, 2020.

- Spiess, R. Southeast Asia’s fintech revolution https://southeastasiaglobe.com/5-countries-leading-southeast-asias-fintech-revolution/ (accessed Jan 5, 2020).

- Alois, J. Robocash Report Says ASEAN is Best Market for Near Term Fintech Development https://www.crowdfundinsider.com/2018/12/142758-robocash-report-says-asean%0Ais-best-market-for-near-term-fintech%0Adevelopment/?utm_source=Triggermail&utm_medium=email&utm_campaign=P%0A ostBlast%28bii-fintech%29 (accessed Jul 17, 2019).

- Soon, L. N.; Thung, B. ASEAN FinTech Census 2018; 2018.

- Imam, T.; McInnes, A.; Colombage, S.; Grose, R. Opportunities and Barriers for FinTech in SAARC and ASEAN Countries. Journal of Risk and Financial Management. 2022, pp 1–37. [CrossRef]

- Karim, S.; Naz, F.; Naeem, M. A.; Vigne, S. A. Is FinTech Providing Effective Solutions to Small and Medium Enterprises (SMEs) in ASEAN Countries? Econ. Anal. Policy, 2022, 75, 335–344. [CrossRef]

- Stolbov, M.; Shchepeleva, M. Does One Size Fit All? Comparing the Determinants of the FinTech Market Segments Expansion. J. Financ. Data Sci., 2023, 9, 100095. [CrossRef]

- Haddad, C.; Hornuf, L. The Emergence of the Global Fintech Market: Economic and Technological Determinants. Small Bus. Econ., 2019, 53 (1), 81–105. [CrossRef]

- Anh, D. T. N. Fintech Ecosystem in Vietnam, University of Turku, 2018.

- Romānova, I.; Kudinska, M. Banking and Fintech: A Challenge or Opportunity? In Contemporary Issues in Finance: Current Challenges from Across Europe; Contemporary Studies in Economic and Financial Analysis; Emerald Group Publishing Limited, 2016; Vol. 98, pp 21–35. [CrossRef]

- Arner, D. W.; Barberis, J. N.; Buckley, R. P. The Evolution of Fintech: A New Post-Crisis Paradigm? Ssrn, 2015, No. January. [CrossRef]

- Bernanke, C. B. S. Federal Reserve Board - Financial Innovation and Consumer Protection. https://www.federalreserve.gov/newsevents/speech/bernanke20090417a.htm.

- Awrey, D. Toward a Supply-Side Theory of Financial Innovation. J. Comp. Econ., 2013, 41 (2), 401–419. [CrossRef]

- de Haan, J.; Oosterloo, S.; Schoenmaker, D. European Financial Markets and Institutions, 3rd editio.; Cambridge University Press: Cambridge, 2015.

- The Financial Stability Board. Financial Stability Implications from Fintech: Supervisory and Regulatory Issues That Merit Authorities’ Attention; 2017.

- Yartey, C. A. The Determinants of Stock Market Development in Emerging Economies: Is South Africa Different? IMF Work. Pap., 2008, 08 (32), 1. [CrossRef]

- Taujanskaitė, K.; Kuizinaitė, J. Development of FinTech Business in Lithuania: Driving Factors and Future Scenarios. Business, Manag. Econ. Eng., 2022, 20 (1), 96–118.

- Mustafa, J. A.; Marei, A.; Al-Amarneh, A.; Al-Abbadi, A. The Role of Fintech Payment Instruments in Improving Financial Inclusion. Inf. Sci. Lett., 2023, 12 (6), 2659–2670.

- Aggarwal, R.; Goodell, J. W. Research in International Business and Finance Cross-National Differences in Access to Finance : Influence of Culture and Institutional Environments ଝ. Res. Int. Bus. Financ., 2014, 31, 193–211. [CrossRef]

- Bobbo, A.; Fankem, G. S. G.; Yeyouomo, A. K. Determinants of FinTech Development: Evidence from Sub-Saharan African Countries. J. Financ. Serv. Res., 2024. [CrossRef]

- Mumtaz, M. Z.; Smith, Z. A. Empirical Examination of the Role of Fintech in Monetary Policy. Pacific Econ. Rev., 2020, 25 (5), 620–640. [CrossRef]

- Wang, X.; Hou, S.; Kyaw, K.; Xue, X.; Liu, X. Exploring the Determinants of Fintech Credit: A Comprehensive Analysis. Econ. Model., 2023, 126, 106422. [CrossRef]

- Rupeika-Apoga, R.; Wendt, S. FinTech in Latvia: Status Quo, Current Developments, and Challenges Ahead. Risks. 2021, pp 1–23. [CrossRef]

- Anagnostopoulos, I. Fintech and Regtech: Impact on Regulators and Banks. J. Econ. Bus., 2018, 100, 7–25. [CrossRef]

- Broby, D. Financial Technology and the Future of Banking. Financ. Innov., 2021, 7 (1). [CrossRef]

- Hornuf, L.; Klus, M. F.; Lohwasser, T. S.; Schwienbacher, A. How Do Banks Interact with Fintech Startups? Small Bus. Econ., 2021, 57 (3), 1505–1526. [CrossRef]

- Jagtiani, J.; John, K. Fintech: The Impact on Consumers and Regulatory Responses. J. Econ. Bus., 2018, 100, 1–6. [CrossRef]

- Teigland, R.; Siri, S.; Larsson, A.; Puertas, A. M.; Bogusz, C. I. The Rise and Development Og FinTech; Teigland, R., Siri, S., Larsson, A., Puertas, A. M., Bogusz, C. I., Eds.; Routledge, Swales & Willis Ltd, Exeter, Devon, UK, 2018.

- Kliber, A.; Będowska-Sójka, B.; Rutkowska, A.; Świerczyńska, K. Triggers and Obstacles to the Development of the FinTech Sector in Poland. Risks. 2021, pp 1–27. [CrossRef]

- Cornelli; Frost, G. J.; Gambacorta, L.; Rau, P. R.; Wardrop, R.; Ziegler, T. Fintech and Big Tech Credit: A New Database; 887; Basel, 2020.

- Kowalewski, O.; Pisany, P. The Rise of Fintech: A Cross-Country Perspective. Technovation, 2023, 122, 102642. [CrossRef]

- Manyika, J.; Roxburgh, C. The Great Transformer: The Impact of the Internet on Economic Growth and Prosperity. McKinsey Glob. Inst., 2011, 1–10.

- Adner, R. Match Your Innovation Strategy to Your Innovation Ecosystem. Harv. Bus. Rev., 2006, 84 (4), 98–107. [CrossRef]

- Boustani, N. M. Traditional Banks and Fintech: Survival, Future and Threats. In ICT for an Inclusive World Industry 4.0—Towards the Smart Enterprise; Baghdadi, Y., Harfouche, A., Musso, M., Eds.; Springer International Publishing: Cham, 2020; pp 345–359. [CrossRef]

- Gao, J. Comparison of Fintech Development between China and the United States. Int. J. Innov. Sci. Res. Technol., 2022, 7 (4), 1150–1155.

- Makina, D. 14 - The Potential of FinTech in Enabling Financial Inclusion. In Extending Financial Inclusion in Africa; Makina, D. B. T.-E. F. I. in A., Ed.; Academic Press, 2019; pp 299–318. [CrossRef]

- Peterson, E. W. F. The Role of Population in Economic Growth. SAGE Open, 2017, 7 (4), 1–15. [CrossRef]

- Tapanainen, T. Toward Fintech Adoption Framework for Developing Countries-A Literature Review Based on the Stakeholder Perspective. J. Inf. Technol. Appl. Manag., 2020, 27 (5), 1–22. [CrossRef]

- Wulandari, R.; Susilowati, E.; Safitri, N.; Ikhsan, M. A Literature Review on Fintech Innovations: Examining the Evolution, Impact, and Challenges. SEIKO J. Manag. Bus., 2023, 6 (2), 438–448.

- Olson, K. E.; O’Brien, M. A.; Rogers, W. A.; Charness, N. Diffusion of Technology: Frequency of Use for Younger and Older Adults. Ageing Int., 2011, 36 (1), 123–145. [CrossRef]

- Berkowsky, R. W.; Sharit, J.; Czaja, S. J. Factors Predicting Decisions About Technology Adoption Among Older Adults. Innov. Aging, 2017, 1 (3), igy002. [CrossRef]

- Zarrouk, H.; El Ghak, T.; Bakhouche, A. Exploring Economic and Technological Determinants of FinTech Startups’ Success and Growth in the United Arab Emirates. J. Open Innov. Technol. Mark. Complex., 2021, 7 (1), 50. [CrossRef]

- Ernst; Young. Mobile Money the Next Wave of Growth; 2015.

- Beck, T.; Demirgüç-kunt, A.; Maksimovic, V. Bank Competition and Access to Finance : International Evidence. J. Econ. Lit., 2003, 36 (3), 627–648.

- Ding, N.; Gu, L.; Peng, Y. Fintech, Financial Constraints and Innovation: Evidence from China. J. Corp. Financ., 2022, 73, 102194. [CrossRef]

- Lavrinenko, O.; Čižo, E.; Ignatjeva, S.; Danileviča, A.; Krukowski, K. Financial Technology (FinTech) as a Financial Development Factor in the EU Countries. Economies. 2023, pp 1–20. [CrossRef]

- Lee, C.-C.; Ni, W.; Zhang, X. FinTech Development and Commercial Bank Efficiency in China. Glob. Financ. J., 2023, 57, 100850. [CrossRef]

- Laidroo, L.; Avarmaa, M. The Role of Location in FinTech Formation. Entrep. Reg. Dev., 2020, 32 (7–8), 555–572. [CrossRef]

- Razavi, S. M.; Abdollahi, B.; Ghasemi, R.; Shafie, H. Relationship between “Innovation” and “Business Sophistication”: A Secondary Analysis of Countries Global Competitiveness. Eur. J. Sci. Res., 2011, 79 (1), 29–39.

- United Nations Development Programme (UNDP). Human Development Index (HDI) http://hdr.undp.org/en/content/human-development-index-hdi.

- Kiliç, C.; Özcan, B. The Impact of Financial Development on Energy Demand: Evidence from China. Emerg. Mark. Financ. Trade, 2018, 54 (2), 269–287. [CrossRef]

- Hua, X.; Huang, Y. Understanding China’s Fintech Sector: Development, Impacts and Risks. Eur. J. Financ., 2021, 27 (4–5), 321–333. [CrossRef]

- Zgheib, P. W.; Ahmed, Z. U.; Beldona, S.; Gebara, V. The Impact of Population Growth on Human Development Index: A Comparative Analysis of Middle Eastern Countries. World Rev. Sci. Technol. Sustain. Dev., 2006, 3 (3), 258–269. [CrossRef]

- Ley, P. Quantitative Aspects of Psychological Assessment; Gerald Duckworth & Co.: United Kingdom, 1972.

- Song, M. K.; Lin, F. C.; Ward, S. E.; Fine, J. P. Composite Variables: When and How. Nurs. Res., 2013, 62 (1), 45–49. [CrossRef]

- Hair, J. F.; Hult, G. T. M.; Ringle, C.; Sarstedt, M. A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM), 2nd ed.; Los Angeles: Sage, 2016.

- Mottaleb, K. A. Determinants of Foreign Direct Investment and Its Impact on Economic Growth in Developing Countries. Munich Pers. RePEcP Arch., 2007, 9457 (9457), 1–15.

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).