1. INTRODUCTION

Fintech, or the applications of financial technology, has been the subject of much interest and popularity in recent decades (Anyfantaki, 2016; Baber, 2020; Propson & Zhang, 2024). These fintechs combine cutting-edge technology and creative business structures to improve and facilitate the provision of financial services (Mittal, 2020). Fintech's emergence is one of the most significant developments in finance, driven by the worldwide economic recession and technological breakthroughs (Firmansyah et al., 2022).

Advancements in technology, with their boundless creativity, have driven the rise of the fintech industry, moving it from its periphery to the forefront of the financial services industry (Stein et al., 2022). Fintech, a product of this hyper-technological growth, has ushered in a new era of value generation. Financial services were significantly impacted by the digital revolution, indicating the considerable influence of technology (Feyen et. al, 2023). Thus, fintechs play a crucial role in financial inclusion, allowing those traditionally disadvantaged to have wider avenues for finance, regardless of where they live.

Financial institutions can significantly enhance their operations by embracing financial and technological advances and fostering innovative thinking (Branzoli et al., 2021). The advent of digital technology is not just a possibility but an inevitability that will cause a global transformation in the banking industry. It will enable banks to evolve from their traditional brick-and-mortar model to a cutting-edge, tech-savvy one (Ebrahim et al., 2020 ; Iwedi et al., 2022). This shift poses challenges but also presents opportunities for traditional banks that provide financial services (Al-Ajlouni & Al-Hakim, 2019).

Financial technology aims to enhance and mechanize the provision of financial services. Therefore, electronic banking, an internet platform, makes it simple for clients to access financial services and products. It is crucial to remember that advancements in information technology have made it easier for bank customers to obtain financial services, keeping them well-informed ( Yun et al., 2013; Xue et al., 2011). The banking industry's technological advancements give consumers more power to make financial decisions (Karthika et al., 2022). As FinTech continues to outshine traditional banking methods, consumers are increasingly making the shift (Rajan et al., 2022). The research of Davis Davis (1986); Moore & Benbasat (1996); Goodhue & Thompson (1995); Compeau et al. (1999); and Thompson et al. (1991) all underline the significant impact of user attitudes, technology features, and the surrounding environment on technology adoption. They suggest that people's beliefs, attitudes, and perspectives are powerful determinants of their use of financial technologies.

Additionally, the rise of FinTech is advancing financial inclusion and economic engagement, although it does come with inherent risks in emerging nations, impacting both individuals and the systemic level (Innes & Andrieu, 2022). Therefore, this study aims to explore the adoption of fintech in emerging economies by employing a structural equation model.

A thorough and meticulous evaluation of numerous ideas and empirical research on adopting technology was conducted to determine the limitations of earlier studies. Theoretical models such as DIT (Rogers, 1995), TRA (Fishbein & Ajzen, 1975), TPB (Ajzen, 1991), TAM (Davis et al., 1989), and TAM2 (Venkatesh & Davis, 2000) have been established to study technology adoption. As demonstrated in their detailed aspects, each model uses its constructs or variables independently. But, if a researcher wishes to look at technology adoption from several angles, they must integrate two or more models and their constructs. Research methodology may become more complicated as a result of this strategy, and it may have low predictive potential. For instance, regarding consumers' adoption of new technology, Aboelmaged & Gebba (2013) found that the combined model of TAM and TPB components has low predictive potential. Thus, they have recommended that, to anticipate technology adoption, future studies should consider more factors than just TAM and TPB.

Hence, a new model that addresses these issues and offers a more insightful understanding of technology adoption has been identified and put into use. Venkatesh et al., (2003) have developed a comprehensive model, the Unified Theory of Acceptance and Use of Technology, or UTAUT. This method encourages researchers to explore technology adoption from various perspectives. It integrates a comprehensive set of factors from various models that are both theoretically and empirically relevant. It is important to note that this approach to conceptualizing technology acceptance is very flexible, enabling the easy addition of new components to the conceptual framework. Therefore, this study utilized an extended Unified Theory of Use and Acceptance of Technology (UTUAT) model, which incorporated constructs such as user innovativeness and reliability. It demonstrates the model's comprehensive nature and potential to address various aspects of technology adoption.

Several researchers have employed the extended UTUAT model and it is a powerful tool in examining people's tech acceptance. For example, Wang et al. (2009) used this model to study the factors influencing mobile learning, adding crucial variables like perceived usefulness (PU) and self-management of learning (SML). Their findings highlighted the role of the extended UTUAT model in understanding the determinants of mobile learning among users. Similarly, Chao, (2019) extended the UTUAT model by introducing new variables, including mobile self-efficacy, perceived enjoyment, perceived danger, satisfaction, and trust, as moderator variables. Chao's study on the behavioural intention to use m-learning (mobile learning) further underscored the applicability of the extended UTUAT model, revealing a significant relationship between these variables. Moreover, other studies by Batucan et al., (2022), Abbad (2021), Sakib et al.(2024), Ahmed et al.(2021), and Tomic et al. (2023) have also utilized the UTUAT theories with additional variables, known as the extended model of UTUAT theory. Thus, this study addresses the knowledge gaps overlooked in previous research.

Statistical techniques, including regression analysis and descriptive analysis, were used in most studies conducted in Ethiopia on the adoption of technology. Some of them are Worku (2010), Teka & Sharma, (2017), Jerene & Sharma (2018), who used descriptive analysis, and Dagnew (2019), who used both descriptive and regression analysis. However, researchers like Muche (2020) and Tiwari (2021) used structural equation models. The statistical analysis tools used to investigate fintech acceptance are still insufficient. So, this study has used a structural equation model (SEM) by incorporating various statistical measurements and indicators to examine the variable's relationship to the investigation. Complex relationships between variables can be modeled using structural equation modeling, a multivariate statistical framework. It entails the use of methods such as factor analysis and regression. Utilizing techniques for solving systems of linear equations, path analysis and latent growth curve modeling are also used (Stein et al., 2022). In addition, as far as the researcher knows, no study has employed the UTUAT methodology to look into technology adoption of Ethiopians, specifically customers in the banking sector.

In developing nations like Ethiopia, the use of financial technology is still relatively new, and the banking industry has recently begun using new technologies. In Ethiopia, consumers of both public and commercial banks have accepted ATMs as the most widely used financial technology (Takele & Sira, 2013). Furthermore, numerous scholars concur that ATM adoption in low-income nations is relatively recent (Olatokun & Igbinedion, 2009). Therefore, bank consumers are still in the early phases of electronic banking. However, Ethiopia's financial landscape may be greatly impacted by the recent expansion of banking services, especially the use of mobile banking (Jerene & Sharma, 2020; Jerene & Sharma, 2018).

1. LITERATURE REVIEW

1.1. Theoretical Background

The new model called UTAUT, or the Unified Theory of Acceptance and Use of Technology, was created by Venkatesh et al. in 2003. It was developed by combining the theoretical underpinnings of eight models that focus on the factors influencing the uptake of new technology. These are social cognitive theory, technological acceptance model, motivational model, theory of reasoned action, theory of planned behavior, and PC utilization model. Four fundamental ideas have been covered, including performance expectancy (PE), social influence (SI), facilitating conditions (FC), and effort expectancy (EE). Wang et al. (2022), Or (2023) and Yu (2012) state that the variables included in this model are widely employed in examining people's acceptance of technology since they have drawn the interest of several scholars and researchers.

Performance Expectancy

According to Venkatesh et al. (2003), PE (Performance Expectancy) measures the advantage that technology offers consumers based on how well it performs in a particular task. It demonstrates consumers' advantages of adopting technology for a certain purpose. In the banking industry's financial technology environment, clients' perceptions of the advantages of fintech use will enhance their banking activities in conducting financial transactions. According to research, people's intentions to use technology are strongly predicted by their performance expectations (Chao, 2019). According to research by Ahmad et al. (2021), performance expectancy substantially impacts the adoption of financial technology for payment services. If clients understand the advantages of technology, they will typically have a favourable intention to use fintech (Mazhar et al., 2014).

H1: PE has statistical significant and positive effect on customer’s behavioral intention

Effort Expectancy

Effort Expectancy, or EE, measures how easy it is for people to use technology for their intended purpose (Venkatesh et al., 2003). Yu, (2012) asserts that using a specific technology is a person's comfort level. Customers' confidence in the ease of use of technology is measured by their effort expectancy (Thusi & Maduku, 2020). Amnas et al., (2023) state that several factors influence effort expectancy, including task complexity, user-friendliness, and perceived technological interaction. Bajunaied et al., (2023) studied customers' behavioral intention to adopt FinTech. Then, the study found that effort expectancy positively influences an individual’s intention to use recent technologies. To sum up, most of the studies argued that effort expectancy would positively affect an individual’s intention to adopt fintech.

H2: EE has a statistical significant and positive influence on behavioral intention

Social Influence

According to Venkatesh et al. (2003), SI (social influence) is a person's feeling about how their family members will react to the technology they use. Farzin and Fattahi (2018) point out that people often choose actions supported by their social networks, making the audience feel more understood. Xie et al. (2021), Amnas et al. (2023) and, Hassan et al. (2022) assert that social influence can positively impact people's intentions to adopt fintech. It is especially true when people think that important members of their network of friends or groups see adopting technology favourably and promote its use. People may choose to use technology on their own if they depend on the experiences or knowledge of others or if they use it because friends, family, or specialists do. Farzin and Fattahi (2018) note that people often find advice from their social connections more important than other advertising channels; hence, their peers' suggestions and opinions can significantly impact consumers' technology use behaviour, making them feel more understood. Hence, the study has developed hypothesis for social influence.

H3: SI has a statistical significant and positive influence on Behavioral intention

Facilitating Conditions

According to Venkatesh et al. (2003), FC (facilitating conditions) plays a crucial role in customer's perceptions of the availability of resources and support to execute the behaviour. It includes resources from users (like mobile devices), network coverage, operating systems, apps, computers, and operators (Mahardika et al., 2019). Moreover, the possession of the necessary abilities is crucial for the effective utilization of current technologies. As highlighted by Amnas et al. (2023), enabling conditions influence customers' adoption of fintech. The study by Hamzah et al. (2023) and Hassan et al. (2022) demonstrated that favourable and enabling conditions are a key factor in influencing drivers of mobile fintech services. Research by Alalwan et al. (2017) found a strong correlation between FC and behavioural intention regarding customers' use of mobile banking services in Jordanian banks, underscoring the practical implications of the research. The consensus from most studies is that users are more likely to embrace and use the technology if greater FC is available.

H4: FC has a statistical significant and positive influence on Behavioral Intention

H5: FC has a statistical significant and positive influence on Actual Usage Behavior

Trialability

Pennings (2012) asserts that an innovation's trial out rate or capacity for testing can aid in its adoption. When technology can be used or taken for a 'test drive,' it is more likely to be used. When adopting new technology quickly, evaluating its feasibility and usefulness is best before going full steam ahead (Koksal, 2016). Evidence suggests that clients want to embrace and utilize the technology if they have sufficient time to experiment with fintech solutions. Wang (2014) emphasizes the impact of technology accessibility on the perspectives of individuals or businesses, reducing the chances of a system being overlooked during implementation. According to a study by Farzin et al. (2021), trialability significantly and favourably influenced users' intentions to use technology.

H6 : TL has a statistical significant and positive influence on behavioral intention

User Innovativeness

Organizations may seek to identify clients with high levels of perceived personal creativity and direct them into a group to enhance and produce products driven by technological innovation (Ciftci et al., 2021). User-innovativeness is the extent to which a person adopts novel technologies early on. It is the willingness of an individual to try out new products or technological advancements. Because they can tolerate uncertainty, people with inventive behavior and experience are more inclined to employ new technologies. Furthermore, it indicates that the user is open to testing fintech services through applications. According to a study by Setiawan et al. (2021), user innovation significantly influences fintech adoption use. Thus, the hypothesis is developed as follows:

H7 : UI has a statistical significant and positive influence on intention.

H8 : UI has a statistical significant and positive influence on Actual Usage Behavior

Behavioral Intention

Research has also indicated that consumers are more inclined to use technology when they are feeling upbeat, which may have an impact on their readiness to do so (Lien et al., 2018). Since it can encourage actual technology use behaviour, customers' willingness to adopt the technology can be very important (Yu, 2012). As Farah et al. (2018) point out that a person's tendency to adopt actually suggests that they may engage in certain behaviours. Arahita & Hatammimi, (2015) suggested that customer attitudes could influence technology use behaviour. It is a process that is believed to occur before actual utilization. According to research Venkatesh et al. (2012), people's attitudes toward certain behaviours determine how they use technology. Therefore, it was assumed that as follows:

H9: BI has a statistical significant and positive influence on Actual Usage Behavior

3. RESEARCH METHODOLOGY

3.1. Sampling and Data Type

The study's sample population consists of bank clients of Ethiopian commercial banks who have used financial technology platforms for at least one year. The representative respondents of the sample were selected from six banking districts in Ethiopia based on the fintech adoption rate. These are East Addis, North Addis, South Addis, Adama, Shashamane, and Jimma districts. A purposive sampling technique is used to select these banking districts. Then, the survey subjects were bank customers who were actively using fintech. A Simple random sampling technique was used to select each target respondent. The data collection instrument used for this study is a seven-point Likert scale ranging from “strongly disagree” to “strongly agree.” It has two major parts. The first part of the questionnaire was about the general information of respondents, and the second part focused on the formation of fintech adoption and its influencing factors. The total number of sample sizes is 440. Thus, for this study, 440 questionnaires were distributed among bank customers, and only 10 questionnaires were found unreturned. It indicates that 430 (98%) completed questionnaires were collected and used for data analysis.

Table 1 show that the study has 315 (73.3%) male and 115 (26.7%) female respondents. For this study, the age group of respondents was categorized into five groups. The first group is 18-30 age with a total of 161 (37.4%) respondents; the second group 31-40 age, 153 (35.6%); the third group is 41-50 age, 68 (15.8%); the fourth group 51-60, 32 (7.4%) and the fifth group above 60 age, 16 (3.7%) of respondents. Thus, the study included respondents from a younger age group.

The study investigated bank customers' experience using fintech. It identified that most respondents have 3-5 years (129, 30%) and 6-8 years (122, 28.4%) of financial technology experience. Furthermore, most bank customers using financial technology have an education status degree and masters; the total number of respondents is 201(46.7%) and 134 (31.2%), respectively.

The result of descriptive statistics for variables is shown in

Table 2. The variables are actual use of technology (AU), behavioral intention (BI), user innovativeness (UI), facilitating conditions (FC), traliability (TL), social influence (SI), effort expectancy (EE), and performance expectancy (PE).The result shows that the mean value of all variables is above 4, and the value of all variable's standard deviation is below 2. That indicates most of the respondents agreed on the determinants of fintech adoption. The standard deviation proved that there is little variation in the views of customers.

4. RESULT

3.1. Measurement Model Assessment

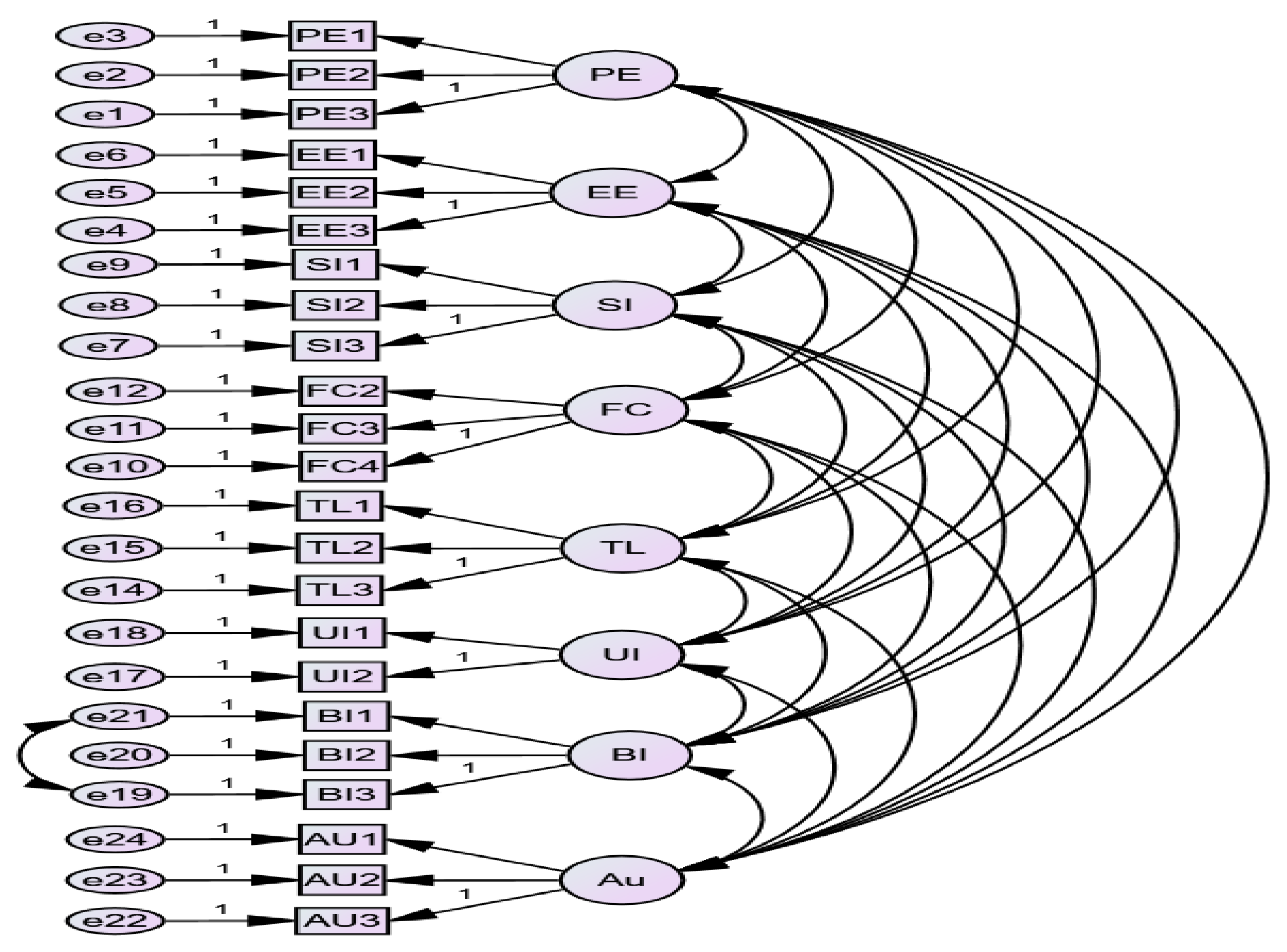

The study has developed a measurement model consistent with previous research (Farzin & Fattahi, 2018). The study used the structural analysis model based on basic stages. After the measurement model had been assessed, the structural model was examined in light of the suggested hypotheses (variable relationships). As shown in

Figure 1, the study used a confirmatory (CFA) measurement model to assess the validity and reliability of the investigation before examining exogenous and endogenous construct relationships.

After a rigorous process, we achieved the final measurement model that fulfilled the model's needs. This is a significant milestone in our research journey. The measurement model goodness of fit result of (

Figure 1) is presented in

Table 3, and it indicated that except for p-value, other goodness of fit measure indices are found within the range of recommended fit index benchmark value (Hu & Bentler, 1999; Hair et al., 2014).

3.1. Reliability and Validity Measurement

Confirmatory factor analysis, a cornerstone of this research, was rigorously tested. The results, including discriminant validity, internal consistency reliability, convergent validity, and composite reliability (CR), are robust.

Table 4 presents the value of all loading factors. As per Hair et al. (2012), indicator validity specifies that the latent variable explains the indicator's variance, and loading factors above 0.7 are considered acceptable. Our results confirm this. The reliability of all model constructs, as measured by Cronbach's α, exceeds the estimated threshold of 0.7 (in the range of 0.711 to 0.870), confirming the internal reliability of the model constructs. Also, the study's model constructs have composite reliability values ranging from 0.760 to 0.871, which shows how reliable and robust the model constructs are given that the composite reliability index value is higher than 0.7.

This section of the study examines the convergent and discriminant validity of the investigation, with significant implications for our understanding of the research constructs.

Table 5 shows that the average variance extracted (AVE) exceeds every research construct's recommended threshold (0.5). Thus, the result indicates that the measurement model has strong convergent validity. Additionally,

Table 5 confirms the validity of the discriminant. Thus, the square roots of the average variance extracted are higher than the correlations below the original diameter. The discriminant validity of the data suggests no correlation between the variables under investigation, which emphasizes how unique each variable measure is. The AVE is greater than the square of the inter-scale of the correlation in the model.

3.1. The structural model validity and Hypothesis Testing

The Structural Model Validity

The model is accepted since all structural model fitness measurement indices have fulfilled the required threshold, except the P-value (demonstrated in

Table 6). Hair et al. (2010) stated that, the chi-square statistical value measures the observed and estimated covariance matrix differences. It should be insignificant (>0.05), indicating no significant difference between the observed and estimated covariance. On the other hand, it shows problems with the model because a p-value below 0.05 indicates a statistical difference between two covariance matrices and fitness (Hair et al., 2010). However, when sample sizes grow larger (more than 250), the significance of the statistical test or the p-value result becomes less significant. Journal of information and communication technology

Setiawan et al. (2021) stated that SEM is used to conduct multivariate statistical analysis. This statistical tool meticulously explores the relationship between variables, guided by the covariance matrix. The model analysis, a rigorous process, is employed to test the hypotheses regarding these relationships within the structural equation. This process is undertaken following a thorough validity and reliability analysis of the Fintech adoption model in an empirical investigation, ensuring the precision and accuracy of the results.

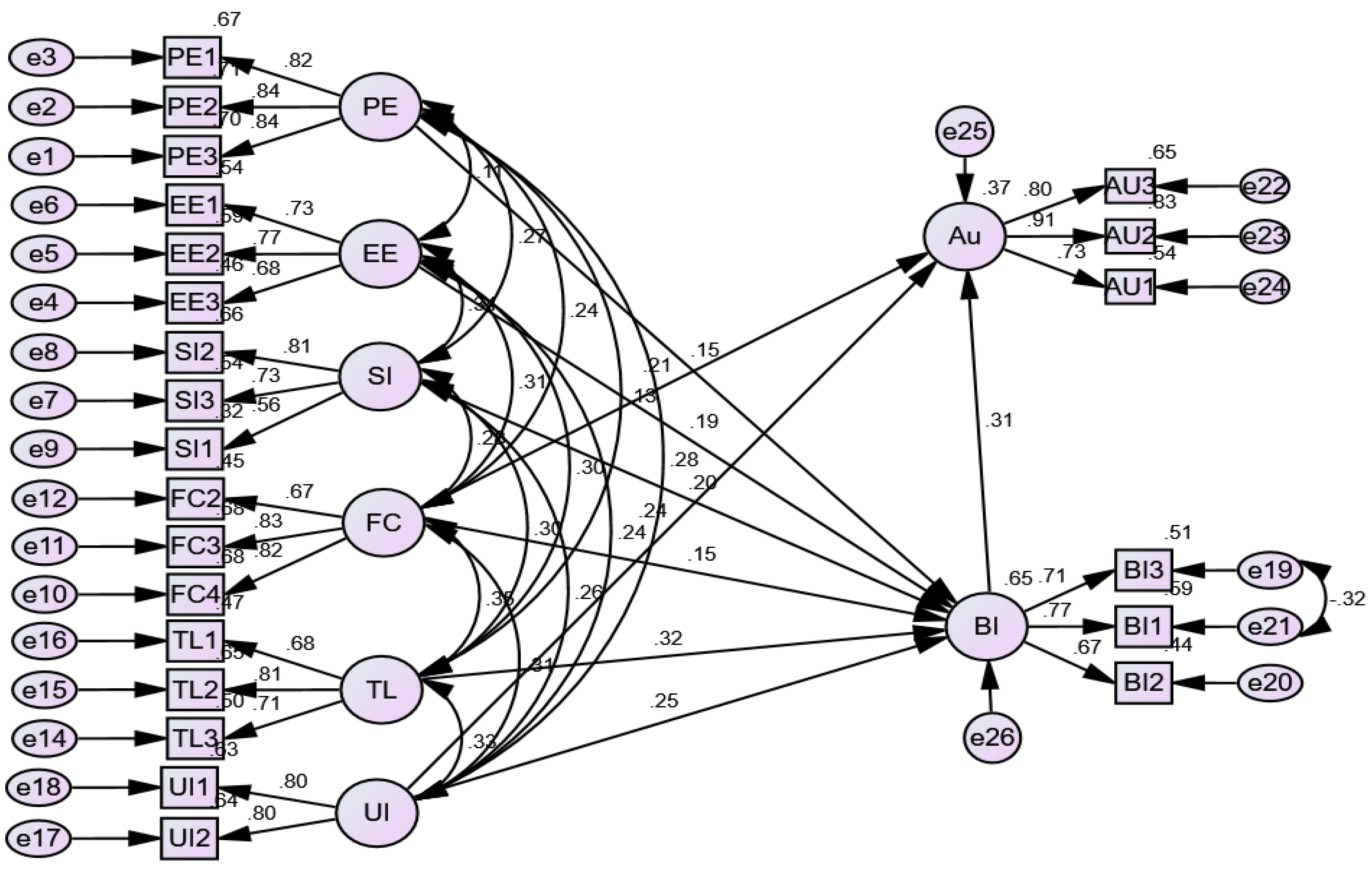

The goodness of measure indices of the re-specified model was assessed based on the validity of empirical study. Also, the structural path coefficients of each relation of variables are analyzed. The result of structural equation model in

Figure 2 shows that 65% of variance on behavioral intention is due to a change in PE, EE, SI, FC, TL, and UI. Furthermore, 37% of variation on actual use is due to a change FC, UI and BI. Accordingly,

Table 7 shows the structural model relationship result of between the exogenous and endogenous latent constructs is discussed below.

3.1. Discussion of the Result

The survey result shows that PE positively and significantly influences behavioral intention (β=0.153 and P=0.001). It shows that the performance of fintech is the driving force influencing customer’s willingness to use it. The study confirmed that bank customers are more likely to intend to use the fintech service if PE is high. PE greatly influences customers’ belief in using fintech if it is higher. Chao (2019) and Ahmad et al. (2021) found that PE positively impacts customers' intention to use fintech application services. Generally, the survey results demonstrate that higher PE significantly increases the likelihood of individuals intending to adopt fintech services. So, the result is in line with the technology acceptance model developed by (Venkatesh et al., 2003).

The empirical survey result showed EE significantly and positively influences customers' intention to use fintech services (β=0.187 and P=0.000). Studies have found that the least possible effort is favorable to use banking technologies to simplify their operations for their active customers (Farah et al., 2018). Therefore, it implies that the chance of technology acceptance has much more growth and significant improvement if the customer believes that the new innovative technology is easy to use for banking services. Amnas et al. (2023) studied Fintech adoption determinants and confirmed that EE impacts bank customers’ intentions. Thus, the study proved that EE has provided an advantage for customers of banking services.

As the result of the study, it was highlighted there is a fact that SI (social influence) is a predictor variable on intention (β=0.200 and P=0.000). It shows that the new fintech, which very important persons endorse, may be more likely to be accepted. In addition, people pay attention more attention to individuals around their circle (Mbrokoh, 2016). Hussain et al., (2019) state that customers accept suggestions from people to minimize the risk of using fintech technologies because customers think their recommendations and opinions are valuable to them. It is also in line with a study conducted by (Yohanes et al., 2020), which stated that a good reputation for an application must be built to get more client references.

The study findings revealed that Fintech Facilitating Conditions (FC) significantly impact customers' intention to accept it (β=0.154 and P=0.003). The study demonstrates that facilitating conditions influence customers' intention to adopt fintech services. It is in line with the study conducted by (Amnas et al. , 2023 and Hamzah et al., 2023) on fintech adoption, providing a robust validation of our findings. It shows that customers are more likely to intend to use fintech as facilitating conditions improve. Therefore, ensuring robust facilitating conditions such as adequate resources, technical support, and compatibility can enhance customers' acceptance and adoption of fintech services. Also, the research findings demonstrated that FC is an influencing factor in use behavior (β=0.206 and P=0.000), which aligns with previous studies' findings (Venkatesh et al., 2003).

The survey result shows that the Traliability of technology is the basic issue for fintech adoption in emerging economies like Ethiopia (β=0.320 and P=0.000) (i.e., TR has a significant and positive influence on intention). The result demonstrates that, as potential users are given more opportunities to experiment with fintech services on a limited basis, their intention to adopt these services increases significantly. It was also elaborated by (Koksal, 2016; Farzin et al., 2021). Therefore, enhancing the trialability of fintech by providing opportunities for potential users to test and experience the services can greatly boost their intention to adopt fintech in Ethiopia.

The study discovered that user innovativeness plays a significant role in financial technology adoption and positively influences customers’ intentions (β=0.320 and P=0.000). The findings align with previous research (Setiawan et al., 2021). They proved that user innovativeness significantly impacts the intention of fintech. The result indicates that more innovative users are more likely to adopt financial technologies. This can be attributed to their openness to new experiences, comfort with technology, and willingness to try out new solutions. Hence, the study identified that user innovativeness would strongly influence customers' intentions.

Additionally, the study found that user innovativeness significantly influences the customer's technology use behavior (β=0.241 and P=0.000). These users are generally more comfortable with the uncertainties associated with new technologies. The findings align with previous studies (Reid et al., 2012; Hirunyawipada & Paswan, 2006). So, the research hypothesis is supported.

The study's findings have practical implications, as it was found that behavioral intention strongly influences bank customers' technology usage (β=0.306 and P=0.000). This means that a person's readiness to perform a certain behavior, such as using technology in banking services like online banking, mobile banking apps, ATMs, and other digital financial services, directly influences their actual usage.

5. CONCLUSION

The study examined factors influencing bank customers' adoption of fintech in Ethiopia. The study used the UTUAT model approach by incorporating two additional variables; trialability, and user innovativeness. Also, to examine the relationship between variables, SEM was implemented using Amos software. Thus, based on the findings, the study supports the hypotheses that various factors, including PE, EE, SI, FC, TR, and UI, significantly influence the adoption and usage of fintech services. By addressing these factors, stakeholders play a crucial role in enhancing the acceptance and utilization of fintech, particularly in emerging economies like Ethiopia. Their responsibility lies in encouraging innovation and creating an environment that supports technological experimentation, which can foster higher fintech adoption rates. Ensuring that fintech services are accessible and easy to use is also a key part of their role, as it can significantly impact their uptake.

6. THEORETICAL IMPLICATIONS

The study used extended UTUAT by incorporating in two extra constructs, trialability, and user innovativeness, which can contribute to understanding the theoretical aspect of fintech. Adding these two major constructs as influencing factors and examining their relation with both behavioral intention and use behavior of technology enables the study to provide compressive implications for examining the influencing level of factors to use fintech for banking services. The study identifies the relative importance of factors such as performance expectancy, trialability effort expectancy, user innovativeness, and social influence in adopting fintech. Thus, the study can clarify future research for refining existing theories related to financial technology adoption. Additionally, the study identified that innovative users often explore the full range of features offered by new technologies. They are more likely to experiment with advanced functionalities and integrate the technology into various aspects of their lives. These users frequently customize and adapt technologies to better meet their personal needs. However, most researchers have neglected the influence of user innovativeness on customers' fintech use behavior. Furthermore, it can motivate practitioners and researchers to comprehensively analyze how trialability and user innovativeness influence customers' attitudes.

7. PRACTICAL IMPLICATIONS

This study has significant implications for practitioners, policymakers, and researchers in the FinTech industry. The key findings of this study revolve around the factors influencing to use FinTech services, with particular relevance to financial institutions (banks), FinTech firms, and various industry stakeholders. The study identifies trialability, user innovativeness, and social influence as the most influential factors affecting the behavioral intention of FinTech among consumers. As a result, it is recommended that FinTech companies implement pilot programs to allow potential users to trial FinTech services on a limited basis before full commitment. This approach helps users become familiar with the technology and build confidence in its use. Additionally, set up in-branch kiosks or dedicated staff to demonstrate fintech services to customers. Providing hands-on experience in a familiar environment can reduce apprehensions about new technologies. Fintech industries should engage with local communities through events, seminars, and workshops to introduce fintech services. Having community leaders and respected individuals advocate for the technology can enhance acceptance. Given the significant role of performance expectancy in FinTech adoption, service providers should prioritize building FinTech's performance and communicate the specific benefits and performance improvements that FinTech services offer. The study revealed that effort expectancy has a significant influence on intention. A careful analysis of the different risks that consumers connect with technology and the implementation of effective mitigation strategies by service providers can help ensure the seamless adoption and continued use of this technology. It entails strong data security protocols, regulatory compliance, open procedures, and efficient customer service. Gaining and keeping users can be accomplished by building a solid reputation and exhibiting a dedication to user safety. Considering that protecting consumers and financial rules is not just the right thing to do, it also helps to establish credibility. It is imperative to guarantee the availability of requisite infrastructure and circumstances to facilitate the implementation of FinTech. Increasing availability of computers and cell phones, access to the internet, and knowledge of technology initiatives might all be part of this, particularly in underprivileged communities. Maintaining a close eye on and improving the services' quality can result in happy users and increased platform confidence.

8. LIMITATIONS AND FURTHER STUDY

Despite the study's fruitful results and findings on fintech adoption in Ethiopia, it has some limitations. The geographical area within which the investigation was carried out may have impacted the results. The results might not be applicable everywhere because Fintech uptake and usage might differ greatly between nations and regions. The study results may not be applicable universally because the adoption of FinTech may have significant variation across regions and countries. Hence, future research should focus on studying fintech adoption in different areas and cultures. Also, this study did not analyze important factors such as price value, hedonic motivation, and habit. Therefore, future studies should integrate these variables to understand the issue. The study has focused on investigating fintech adoption of existing technologies, in general, in Ethiopia's banking industry. Future studies may have room to investigate the adoption rate and its influencing factors further. Since the information was gathered all at once, it offers a momentary view of the attitudes and actions of users. Data collected on a longitudinal basis could offer more detailed information regarding the factors and their influence on adopting fintech over time. Additionally, applying qualitative research methods is important to provide a deeper understanding and to create more motivation for customers to adopt Fintech. Hence, future research should incorporate data-gathering tools such as in-depth interviews and focus group discussions.

References

- Abbad, M.M.M. Using the UTAUT model to understand students’ usage of e-learning systems in developing countries. Education and Information Technologies 2021, 26, 7205–72. [Google Scholar] [CrossRef] [PubMed]

- Ahmad, S.; Urus, S.T.; Nazatul, S.; Syed, F.; Nazri, M. Technology Acceptance of Financial Technology (Fintech) for Payment Services Among Employed Fresh Graduates. 2021. [CrossRef]

- Ahmed, R.R.; Štreimikienė, D.; Štreimikis, J. the Extended Utaut Model and Learning Management System During Covid-19: Evidence From PLS-SEM and Conditional Process Modeling. Journal of Business Economics and Management 2021, 23, 82–104. [Google Scholar] [CrossRef]

- Ajzen, I. The Theory Of Planned Behavior. Organizational Behavior and Human Decision Processes 1991, 50, 179–211. [Google Scholar] [CrossRef]

- Al-Ajlouni, A.; Al-Hakim, D.M.S. (2019). Financial Technology in Banking Industry: Chall-enges and Opportunities. SSRN Electronic Journal, 20 September. [CrossRef]

- Alalwan, A.A.; Dwivedi, Y.K.; Rana, N.P. (2017). Factors influencing adoption of mobile banking by Jordanian bank customers : Extending UTAUT2 with trust.

- Amnas, M.B.; Selvam, M.; Raja, M.; Santhoshkumar, S.; Parayitam, S. Understanding the Determinants of FinTech Adoption: Integrating UTAUT2 with Trust Theoretic Model. Journal of Risk and Financial Management 2023, 16, 1–23. [Google Scholar] [CrossRef]

- Anyfantaki, S. The evolution of financial technolog y (fintech). Economic Bulletin 2016, 44, 47–61. [Google Scholar]

- Arahita, C.L.; Hatammimi, J. Factors Affecting the Intention to Reuse MobileBanking Service. International Journal of Research in Business and Social Science (2147- 4478) 2015, 4, 15–23. [Google Scholar] [CrossRef]

- Ariff, M.S.M.; Yun, L.O.; Zakuan, N.; Ismail, K. The Impacts of Service Quality and Customer Satisfaction on Customer Loyalty in Internet Banking. 1st World Congress of Administrative & Political Sciences 2013, 81, 469–473. [Google Scholar] [CrossRef]

- Baber, H. FinTech, Crowdfunding and Customer Retention in Islamic Banks. Vision 2020, 24, 260–268. [Google Scholar] [CrossRef]

- Bajunaied, K.; Hussin, N.; Kamarudin, S. Behavioral intention to adopt FinTech services: An extension of unified theory of acceptance and use of technology. Journal of Open Innovation: Technology, Market, and Complexity 2023, 9, 100010. [Google Scholar] [CrossRef]

- Batucan, G.B.; Gonzales, G.G.; Balbuena, M.G.; Pasaol KR, B.; Seno, D.N.; Gonzales, R.R. An Extended UTAUT Model to Explain Factors Affecting Online Learning System Amidst COVID-19 Pandemic: The Case of a Developing Economy. Frontiers in Artificial Intelligence 2022, 5(April), 1–13. [Google Scholar] [CrossRef]

- Chao, C.M. Factors determining the behavioral intention to use mobile learning: An application and extension of the UTAUT model. Frontiers in Psychology 2019, 10, 1–14. [Google Scholar] [CrossRef]

- Ciftci, O.; Berezina, K.; Kang, M. Effect of Personal Innovativeness on Technology Adoption in Hospitality and Tourism : Meta-analysis. Springer International Publishing. 2021. [CrossRef]

- Compeau, D.; Higgins, C.A.; Huff, S. Social cognitive theory and individual reactions to computing technology: A longitudinal study. MIS Quarterly: Management Information Systems 1999, 23, 145–158. [Google Scholar] [CrossRef]

- Dagnew, D.K. Factors Affecting E- Banking Adoption in Ethiopia : from Commercial Bank Customers ’ Perspective in Case Of Gondar City. The International Journal of Research Publication 2019, 9, 71–80. [Google Scholar]

- Davis, F.D. (1986). A technology acceptance model for empirically testing new end-user information systems: Theory and results [Massachusetts Institute Of Technology]. https://doi.org/oclc/56932490.

- Davis, F.D.; Bagozzi, R.P.; Warshaw, P.R. User Acceptance of Computer Technology: A Comparison of Two Theoretical Models. Management Science 1989, 35, 982–1003. [Google Scholar] [CrossRef]

- Ebrahim, R.; Kumaraswamy, S.; Abdulla, Y. (2020). FinTech in Banks: Opportunities and Challenges. In Innovative Strategies for Implementing FinTech in Banking (pp. 100–109). IGI Global. [CrossRef]

- Farah, M.F.; Byblos, L.; Abbas, A.K. (2018). Mobile-banking adoption : empirical evidence from the banking sector in Pakistan. International Journal of Bank Marketing. [CrossRef]

- Farzin, M.; Fattahi, M. eWOM through social networking sites and impact on purchase intention and brand image in Iran. Journal of Advances in Management Research 2018, 15, 161–183. [Google Scholar] [CrossRef]

- Farzin, M.; Sadeghi, M.; Yahyayi Kharkeshi, F.; Ruholahpur, H.; Fattahi, M. Extending UTAUT2 in M-banking adoption and actual use behavior: Does WOM communication matter? Asian Journal of Economics and Banking 2021, 5, 136–157. [Google Scholar] [CrossRef]

- Feyen, E.; Natarajan, H.; Saal, M. (2023). Fintech and the Future of Finance: Market and Policy Implications. In Fintech and the Future of Finance: Market and Policy Implications. [CrossRef]

- Firmansyah, E.A.; Masri, M.; Anshari, M.; Besar, M.H. A. Factors Affecting Fintech Adoption: A Systematic Literature Review. FinTech 2022, 2, 21–33. [Google Scholar] [CrossRef]

- Fishbein, M.A.; Ajzen, I. (1975). Belief, attitude, intention and behaviour: An introduction to theory and research. In Addison-Wesley.

- Goodhue, D.L.; Thompson, R.L. Task-Technology Fit and Individual Performance. MIS Quarterly 1995, 19, 213–236. [Google Scholar] [CrossRef]

- Hair, J.F.; Black, W.C.; Babin, B. Multivariate data analysis : a global perspective (7th ed Upp). Pearson education. http://lib.ugent.be/catalog/rug01:001321386.

- Hair, J.F.; Black, W.C.; Babin, B.J.; Anderson, R.E. Multivariate Data Analysis. International Journal of Multivariate Data Analysis 2018, 1. [Google Scholar]

- Hair, J.F.; Sarstedt, M.; Pieper, T.M.; Ringle, C.M. The Use of Partial Least Squares Structural Equation Modeling in Strategic Management Research: A Review of Past Practices and Recommendations for Future Applications. Long Range Planning 2012, 45, 320–340. [Google Scholar] [CrossRef]

- Hamzah, N.; Othman, Y.H.; Cheumar, M.T. The Influence of Facilitating Condition and Perceived Usefulness on Intention to Use Mobile Applications in Uganda. Malaysian Journal of Social Sciences and Humanities (MJSSH) 2023, 8, e002257. [Google Scholar] [CrossRef]

- Hassan, M.S.; Islam, M.A.; Sobhani, F.A.; Nasir, H.; Mahmud, I.; Zahra, F.T. Drivers Influencing the Adoption Intention towards Mobile Fintech Services: A Study on the Emerging Bangladesh Market. Information (Switzerland) 2022, 13, 1–16. [Google Scholar] [CrossRef]

- Hirunyawipada, T.; Paswan, A.K. Consumer innovativeness and perceived risk : implications for high technology product adoption. Journal of Consumer Marketing 2006, 23, 182–198. [Google Scholar] [CrossRef]

- Hu, L.; Bentler, P.M. Structural Equation Modeling : A Multidisciplinary Journal Cutoff criteria for fit indexes in covariance structure analysis : Conventional criteria versus new alternatives. A Multidisciplinary Journal 1999, 6, 37–41. [Google Scholar] [CrossRef]

- Hussain, Q.; Feng, H.; Grzebieta, R.; Brijs, T.; Olivier, J. The relationship between impact speed and the probability of pedestrian fatality during a vehicle-pedestrian crash: A systematic review and meta-analysis. Accident Analysis and Prevention 2019, 129(January), 241–249. [Google Scholar] [CrossRef]

- Iwedi, M.; Chituru, W.; Nkwadochi, C. Effect of Digitalization of Banking Services on the Nigeria Economy. Banking and Insurance Academic Journal 2022, 2, 1–9. [Google Scholar]

- Jerene, W.; Sharma, D. The Induction of Banking Technology Adoption in Ethiopia : Evidence From Public Bank. Journal of Emerging Technologies and Innovative Research 2018, 5, 497–504. [Google Scholar]

- Jerene, W.; Sharma, D. The adoption of financial technology in Ethiopia : a study of bank customers perspective. Journal of Banking and Financial Technology 2020, 0123456789. [Google Scholar] [CrossRef]

- Karthika, M.; Neethu, K.; Lakshmi, P. Impact of Fintech on the Banking Sector. Integrated Journal for Research in Arts and Humanities 2022, 2, 109–112. [Google Scholar] [CrossRef]

- Koksal, H.M. The intentions of Lebanese consumers to adopt mobile banking. International Journal of Bank Marketing 2016, 34, 327–346. [Google Scholar] [CrossRef]

- Koksal, M. The intentions of Lebanese consumers to adopt mobile banking. International Journal of Bank Marketing 2016, 34, 327–346. [Google Scholar] [CrossRef]

- Lien, C.H.; Wu, J.J.; Hsu, M.K.; Wang, S.W. Positive moods and word-of-mouth in the banking industry: A moderated mediation model of perceived value and relational benefits. International Journal of Bank Marketing 2018, 36, 764–783. [Google Scholar] [CrossRef]

- Mahardika, H.; Thomas, D.; Ewing, M.T.; Japutra, A. Experience and facilitating conditions as impediments to consumers’ new technology adoption. International Review of Retail, Distribution and Consumer Research 2019, 29, 79–98. [Google Scholar] [CrossRef]

- Mazhar, F.; Institutet, K.; Shamim, S.; Malhi, S.M. Drug utilization evaluation of antiepileptics in three selected multidisciplinary teaching hospitals of Pakistan. International Journal of Pharmacy and Pharmaceutical Sciences 2014, 6, 59–66. [Google Scholar]

- Mbrokoh, S. Journal of Internet Banking and Commerce Exploring the Factors that Influence the Adoption of Internet Banking in Ghana. Journal of Internet Banking and Commerce 2016, 21, 1–20. [Google Scholar]

- Moore, G.C.; Benbasat, 1. Integrating Diffusion of Innovations and Theory of Reasoned Action models to predict utilization of information technology by end-users. Transactions of the Japan Society of Mechanical Engineers Series A 1996, 57, 291–297. [Google Scholar] [CrossRef]

- Muche, B. Factors affecting bank customers usage of electronic banking in Ethiopia: Application of structural equation modeling (SEM). Cogent Economics and Finance 2020, 8, 1–27. [Google Scholar] [CrossRef]

- Olatokun, W.M.; Igbinedion, L.J. (2009). The Adoption of Automatic Teller Machines in Nigeria : An Application of the Theory of Diffusion of Innovation. Issues in Informing Science and Information Technology. [CrossRef]

- Or, C. The Role of Attitude in the Unified Theory of Acceptance and Use of Technology: A Meta-analytic Structural Equation Modelling Study. International Journal of Technology in Education and Science 2023, 7, 552–570. [Google Scholar] [CrossRef]

- Propson, D.; Zhang, B. (2024). The Future of Global Fintech: Towards Resilient and Inclusive Growth. January.

- Rajan, N.; George, A.; Saravanan, S.V.; Kavitha, J.; Gopalakrishnan, C.S. An Analysis on Customer Perception towards Fintech Adoption. Journal of Logistics, Informatics and Service Science 2022, 9, 146–158. [Google Scholar] [CrossRef]

- Reid, M.; Chao, C.; Reid, M.; Mavondo, F.T. Consumer Innovativeness Influence on Really New Product Adoption Consumer innovativeness influence on really new product adoption. Australasian Marketing Journal (AMJ) 2012, 20, 211–217. [Google Scholar] [CrossRef]

- Sakib, M.N.; Akter, M.; Sahabuddin, M.; Fahlevi, M. (2024). An application of the extended UTAUT model to understand the adoption of cashless transactions: evidence from developing country. Journal of Science and Technology Policy Management. [CrossRef]

- Setiawan, B.; Nugraha, D.P.; Irawan, A.; Nathan, R.J.; Zoltan, Z. User Innovativeness and Fintech Adoption in Indonesia. Journal of Open Innovation: Technology, Market and Complexity 2021, 7, 1–18. [Google Scholar] [CrossRef]

- Stein, C.M.; Morris, N.J.; Noc, N.L. (2022). Fintech – A new paradigm of growth, McKinsey & Company. In International Conference on Economics and Administrative Sciences.

- Takele, Y.; Sira, Z. Analysis of factors influencing customers ’ intention to the analysis of factors influencing customers ’ intention to the adoption of e-banking service channels in bahir dar city : an integration of TAM, TPB and PR. European Science Journal 2013, 9, 402–417. [Google Scholar]

- Teka, B.M.; Sharma, D. Influence of Demographic Factors on Users’ Adoption of Electronic Banking in Ethiopia. Journal of Internet Banking and Commerce, /: 1–17. https, 1881. [Google Scholar]

- Thompson, R.L.; Higgins, C.A.; Howell, J.M. Personal Computing: Toward a Conceptual Model of Utilization Utilization of Personal Computers Personal Computing: Toward a Conceptual Model of Utilization. Source: MIS Quarterly 1991, 15, 125–143. [Google Scholar]

- Thusi, P.; Maduku, D.K. South African millennials’ acceptance and use of retail mobile banking apps: An integrated perspective. Computers in Human Behavior 2020, 111, 106–405. [Google Scholar] [CrossRef]

- Tomić, N.; Kalinić, Z.; Todorović, V. Using the UTAUT model to analyze user intention to accept electronic payment systems in Serbia. Portuguese Economic Journal 2023, 22, 251–270. [Google Scholar] [CrossRef]

- Venkatesh, V.; Davis, F.D. Theoretical extension of the Technology Acceptance Model: Four longitudinal field studies. Management Science 2000, 46, 186–204. [Google Scholar] [CrossRef]

- Venkatesh, V.; Morris, M.G.; Davis, G.B.; Davis, F.D. User acceptance of information technology: Toward a unified view. MIS Quarterly: Management Information Systems 2003, 27, 425–478. [Google Scholar] [CrossRef]

- Venkatesh, V.; Thong JY, L.; Xin, X.u. Consumer a cceptance and use of information technology : Extending The Unified Theory. MIS Quarterly 2012, 36, 157–178. [Google Scholar] [CrossRef]

- Wang, H.-L. Theories for competitive advantage. Being Practical with Theory: A Window into Business Research 2014, 33–43. [Google Scholar]

- Wang, J.; Li, X.; Wang, P.; Liu, Q.; Deng, Z.; Wang, J. Research Trend of the Unified Theory of Acceptance and Use of Technology Theory : A Bibliometric Analysis. Sustainability 2022, 14, 1–20. [Google Scholar] [CrossRef]

- Worku, G. Electronic-Banking in Ethiopia- Practices, Opportunities and Challenges. Journal of Internet Banking and Commerce 2010, 15, 1–8. [Google Scholar]

- Xie, J.; Ye, L.; Huang, W.; Ye, M. Understanding FinTech Platform Adoption : Impacts of Perceived Value and Perceived Risk. Journal of Theoretical and Applied Electonic Commerce Research 2021, 16, 1893–1911. [Google Scholar] [CrossRef]

- Xue, M.; Hitt, L.M.; Chen, P.; Xue, M.; Hitt, L.M.; Chen, P. Determinants and Outcomes of Internet Banking Adoption Determinants and Outcomes of Internet Banking Adoption. Management Science 2011, 57, 291–30. [Google Scholar] [CrossRef]

- Yohanes, K.; Junius, K.; Saputra, Y.; Sari, R.; Lisanti, Y.; Luhukay, D. Unified Theory of Acceptance and Use of Technology ( UTAUT ) Model Perspective to Enhance User Acceptance of Fintech Application. International Conference on Information Management and Technology 2020, 643–648. [Google Scholar]

- Yu, C.S. Factors affecting individuals to adopt mobile banking: Empirical evidence from the utaut model. Journal of Electronic Commerce Research 2012, 13, 105–121. [Google Scholar]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).