Keywords electric vehicles (EV); EV ownership experience; early majority preferences; EV sales perditions

1. Introduction

From January 2019 till June 2024 only 577 EVs dealership sales were registered in Kuwaiti [

1]. Assuming same sales trajectory from 2010 till 2019 we estimate that only 30 EVs were sold before 2019. Several EV’s drivers still have foreign license plates on their EVs, especially Tesla owners as there is no Tesla dealership in Kuwait. Tesla owners have usually purchased their EV in the neighboring countries such as Kingdom of Saudi Arabia or United Arab Emirates where Tesla has a dealership and from other dealerships in these countries as these dealerships offer more variety of EVs. We estimate that these foreign registered EVs do not exceed 100 vehicles because of issues with insurance and registration. Hence, only around 700 EVs are thought to be currently on the street in Kuwait which is only 0.03 percent of the total car populations of 2.42 million cars registered in Kuwait as of month of June 2024. [

2]. This number is extremely low, especially in comparison to the most advanced EV nation and fellow oil producer Norway, that already has replaced 25.5% of its passengers’ cars to EVs. That is 900 times more than EVs in Kuwait as of middle of 2024. [

3] Norway’s EVitization of its passenger’s cars has as the result permanently lowered its carbon footprint 3%.and led to significant improvements in air quality, a development that has yet to transpire in Kuwaiti [

4].

1.1. Industry Insight

In order to gain insight in the reason why Kuwait had about the lowest EV adoption rate in the world we consulted Mohammed Navfal an automotive and future mobility industry expert for the reasons [

5]

1. According to Mr. Navfal EVs are gaining popularity as the world shifts towards a more sustainable and environmentally friendly future. Governments and automakers around the world are investing heavily in the development and production of electric vehicles, and this trend is likely to continue in the coming years. In general, the future of EVs in Kuwait and other countries will depend on a number of factors, including government policies, consumer preferences, and the availability of charging infrastructure. If Kuwait's government takes active steps to encourage the adoption of EVs, such as offering incentives or building charging stations, this could lead to an increase in demand for electric vehicles. In addition, automakers are continually developing new EV models with longer ranges, faster charging times, and lower prices, making electric vehicles more accessible to a wider range of consumers. This trend is likely to continue, and we can expect to see more affordable and practical electric vehicles in the market in the coming years. The pace of adoption will depend on various factors, and it will take some time for EVs to become the dominant mode of transportation in many countries. Another EV dealers in Kuwait convey similar stories [

6,

7,

8,

9,

10,

11].

1.2. Governmental Push Policies

Supportive or punitive policies, practices and regulations with direction from the national government appears to be paramount to build a market for EVs, so called “Push Strategies”. For example, United States (US) with directives from its Environmental Protection Agency (EPA) has regulated the average fuel efficiency and in the case of passenger’s cars the efficiency requirement has increased 23% from 15.4 km/l in 2015 to 22/1 in 2025 which is equivalent to only 4.55 Liters per 100 km in average. Such a high average fuel efficiency target can clearly not by achieved without us of zero emission vehicles. [

12] Ten US states including Oregon and California require starting from 2018 that 2% of all new cars to be Zero Emission Vehicles (ZEV) with 2% increase annually from 2018 and imposing hefty penalty for violations. California is leading the way as is aiming for 100% ZEV by 2035 [

13]. People’ s Republic of China implemented 4 step fuel efficiency regulation from 2016-2020 that accomplished to increased aggregate fuel efficiency from 14.5km/l in 2015 to 20/l in 2020 or 5 liters per 100 km. [

14] China enforcement of its energy policy require that 8 million units of new Plug-in-Hybrid EV (PHEV), Fuel Cell EV (FCEV) or Battery EV (BEV) to be annually sold by the year 2025 [

15]. In European Union the European Commission has issued directives that strengthen CO2 emission requirement from 130 g/km in 2015 to 95g/km in 2021 which is 27% reduction. [

16] Japan, however, seems to be having of “Kodak moment”

2 as Japan was in the forefront of Electric Hybrids with Toyota Prius as one of the stars as well as Nissan Leaf was one of the first hit EV, but now Japanese EV automakers are playing catch up to US, China and Europe in EV adoptions. One of the reasons why Japan has fallen behind is lack of punitive and incentive governmental policy for EV owners and makers as the Japanese government seems to have preferred hydrogen and fuel cell cars which got all their attention at the expense of EV resulting in only 2% EVs as of end of 2020 [

17]. The following graph (

Figure 1) clearly shows how Japan has fallen behind and how governmental policies, punitive or incentive system play in building up a home market for EV adoption, which appears to be the foundation for exporting success [

18]. South Korea seems to mirror Japan in as governmental policies only started to push EVs from 2022. A mere 5.96% of automobiles in South Korea where considered environ mentally friendly or “green”, which included hydrogen, hybrid, PHEV, or full-electric. Most sales came from last year as the sales skyrocketed due to government pushing EVs as well as attractive EV offering from Hyundai/Kia.[

18]

According to the forecast from Bloomberg, Japan clearly losing out, Korea trying hard to catch up and China is likely to rise as the winner of the EV adoption race [

19]. Bloomberg also predicts that those countries that have traditionally not produced cars will also enter the EV race as EVs apart from its battery are much simple than internal combustion engine cars (ICE) to make because of the fact that EVs only have about 20 moving parts versus over 2000 in ICE. Kuwait’s neighbors Kingdom of Saudi Arabia (KSA) and Qatar are likely to be among these nations. KSA recently bought controlling stake in US Lucid Motors with the intention of producing quarter of the production in KSA or total of half a million vehicles by 2030 and first car by 2025[

20]. Similarly, Investment Promotion Agency Qatar is exploring if the country can be EV manufacturing hub for the Middle East and North Afrika (MENA) region in cooperation with the German Volkswagen and the Chinese Gaussin and Yutong, with whom the Qatari government has already partner up with. [

21].

1.3. EV Plans of Kuwaiti Government in Contrast with Neighboring Qatar

The Government of Kuwait will be required to take the initiative in the transition to zero emission/high voltage vehicles in order to replace internal combustion engine (ICE) vehicles, as stated by Mr. Navfal and other automobile dealers. government of Kuwait has committed to taking urgent action to combat climate change and its impacts through the State of Kuwait National Determined Contribution (NDC) to sustainable goals of the United Nations and its master plan, Vision 2035 for the State of Kuwait, especially in the light of that Kuwait was the third largest emitter of CO2 in 2022, following Qatar and Bahrain [

22,

23,

24]. The reduction that results from the transition to zero-emission vehicles is not addressed in these documents. This is in stark contrast to the neighboring country of Qatar, which, similar to Kuwait, has a vision of reducing its CO2 output and is in the process of transitioning its entire public transportation system to electric. The Qatari government anticipates that the percentage of new vehicles that are electric vehicles (EVs) will reach 10% by 2030, in accordance with the Qatar Electric Vehicle Strategy 2021. The Transition to electric vehicles (EVs) by both public and private entities will make a substantial contribution to Qatar's commitment to the Paris Agreement. [

25]

1.4. Total Lack of Fast Charging Station – Waiting for the Solid-State Batteries

Kuwait as well as Qatar face similar problem in public fast-charging EV, that is with Direct Current to Direct Current (DC to DC) 300-500 MW, that is charging in extreme temperatures has the summer heat frequently exceeds 50 C. While Kuwait is still studying this case, Qatar has taken more active approach. According to Kuwaiti charging equipment provider as of August 2024 there were only 43 public charging stations, out of which 41 were slow around 5 hours Alternative Current (AC) charging stations and only two small demonstration DC stations. The equipment provider ChargedKW estimates that this number will five-fold in 2 years to over 120 stations. [

26,

27,

28].

Qatar, only half of the size and population of Kuwait has as of 2024 over 200 DC to DC stations installed where 300 more are in commission with the target of 600 fast charging stations installed by end of 2025 [

29]. Kuwait is looking and learning from the experience of Qatar in efficiency, durability and safety in fast charging in extreme temperatures. According to Abdulaziz Al Kous, senior engineer at Ministry of Electricity and Water (MEWRE) – Ultra-fast charging stations in the gulf region still do not reach full capacity during summer months and there is considerably more work needed to develop fast charging stations for extreme heat conditions, that goes for the battery technology used in the electric vehicles as they play a crucial role in the charging efficiency against climate challenges. This development might include shaded charging facility and air- or water-cooled (or more efficient liquid coolant) fast charging equipment. The EV vehicles also need to be tested for at least 70C heat which is are the maximum heat condition that can occur under the vehicle depending on the battery cooling system

3. From the perspective of the Kuwaiti government's movement itself, MEWRE published its standards and regulations for electric vehicle chargers in 2022. Up until now it gave more than 100 certificates for a variety of EV slow and fast chargers for many company’s providers. It also made a system where anyone can apply online for an installation permit. Since then, MEWRE is building a database for all the types and models that are applicable to be installed in Kuwait. That will help them study and monitor more efficiently of each type/model and further diagnose the challenges. Now MEWRE is also adopting the EV chargers to be installed in their new green buildings, expecting that to be expanded to all their buildings in the next years and some additional benefits to encourage their employees to adapt the Electrical Vehicles. MEWRE further supported the expansion of EV chargers by setting the electrical tariff for EV chargers for residential in Kuwait it is as low as 0.002KWD/kWh which equivalent to 0.0065USD/kWh which considered one of the lowest tariffs in the world. Based on the current observations and the upcoming projects one should be optimistic of the upcoming future of EVs in Kuwait as the market and public appeal grow bigger with time. [

30]

However, the next generation of EV batteries might solve problem of fast charging in the extreme heat condition. The Kuwait Institute for Scientific Research (KISR) has conducted and continues to conduct, extensive research into the potential of solid-state batteries as a viable solution to withstand the extreme temperatures typical of the Arabian Gulf region [

30,

32,

33,

36]. These types of batteries are a more thermally stable and a secure alternative to lithium-ion batteries. Solid-state batteries, in contrast to liquid lithium-ion batteries, utilize solid electrolytes that may possess distinct thermal properties. Solid-state battery electrode-solid electrolyte interactions may be compromised by elevated temperatures, although typically they exhibit a lower thermal conductivity than liquid electrolytes. This instability may result in an increase in heat and resistance during charging and discharging. Solid electrolytesthat undergo thermal degradation or reaction are particularly susceptible to this phenomenon. Certain solid electrolytes may become less stable at elevated temperatures, which can result in heat-generating side reactions. be released by specific solid-state batteries with sulfide-based electrolytes at elevated temperatures, resulting in increased heating and safety concerns. Cooling systems are incorporated into lithium-ion batteries in high-performance applications, such as electric vehicles, to regulate heat. The potential for future applications of solid-state batteries is substantial due to their superior energy density and safety. However, in order to achieve widespread adoption, thermal management challenges must be resolved. Research and development are being implemented to enhance the thermal characteristics and performance of solid-state battery materials and designs. [

31,

32,

33,

34].

1.5. Combination of EV Sales in Kuwait Last 6 Years, Brand and Prices

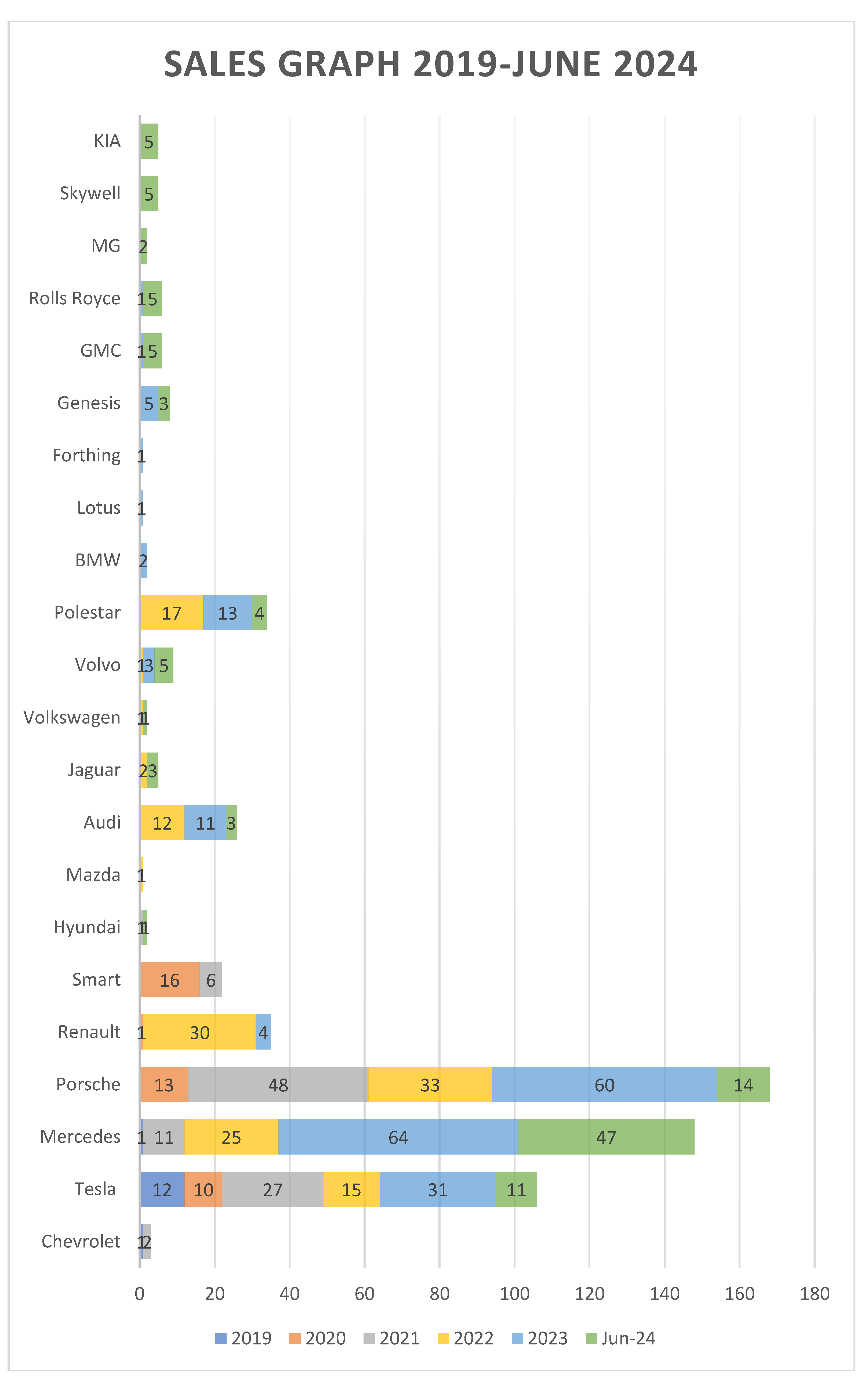

Eng. Navfal collected supply and sales date from the Union of Automotive Agents of EV sales from 2019 till August 2024. According to the data, Porsche Taycan was far the most popular EV sold in Kuwait, which is in start difference to other countries. [

1]. However, the drivers of Porsche Taycan EV are even more different from typical EV driver worldwide who are likely to be 30–50-year upper middle-class males that are environmentally conscious and well-educated, often motivated by sustainability and cost-saving benefits. [

35,

36,

37]. Porsche Taycan EV drivers in Kuwait are almost exclusively males in their sixties, that are wealthy as the most sold Taycan are full options with the price tag around USD 200,000. The motivation of drives of Taycan is not so much environmental concern but rather the torque for getting to 100 km in less than 2 second and much faster than those of Ferrari or similar luxury vehicles. The owners of Taycan usually own 3 more cars and use this vehicle for the lack of better word more as a toy than primary mode of transportation. [

28]. See

Figure 1 and attachment A for further breakdown of models within a brand that was sold.

Figure 1.

Source: Sales Graph 2019-June 2024 Source: Union of Automotive Agents of EV.

Figure 1.

Source: Sales Graph 2019-June 2024 Source: Union of Automotive Agents of EV.

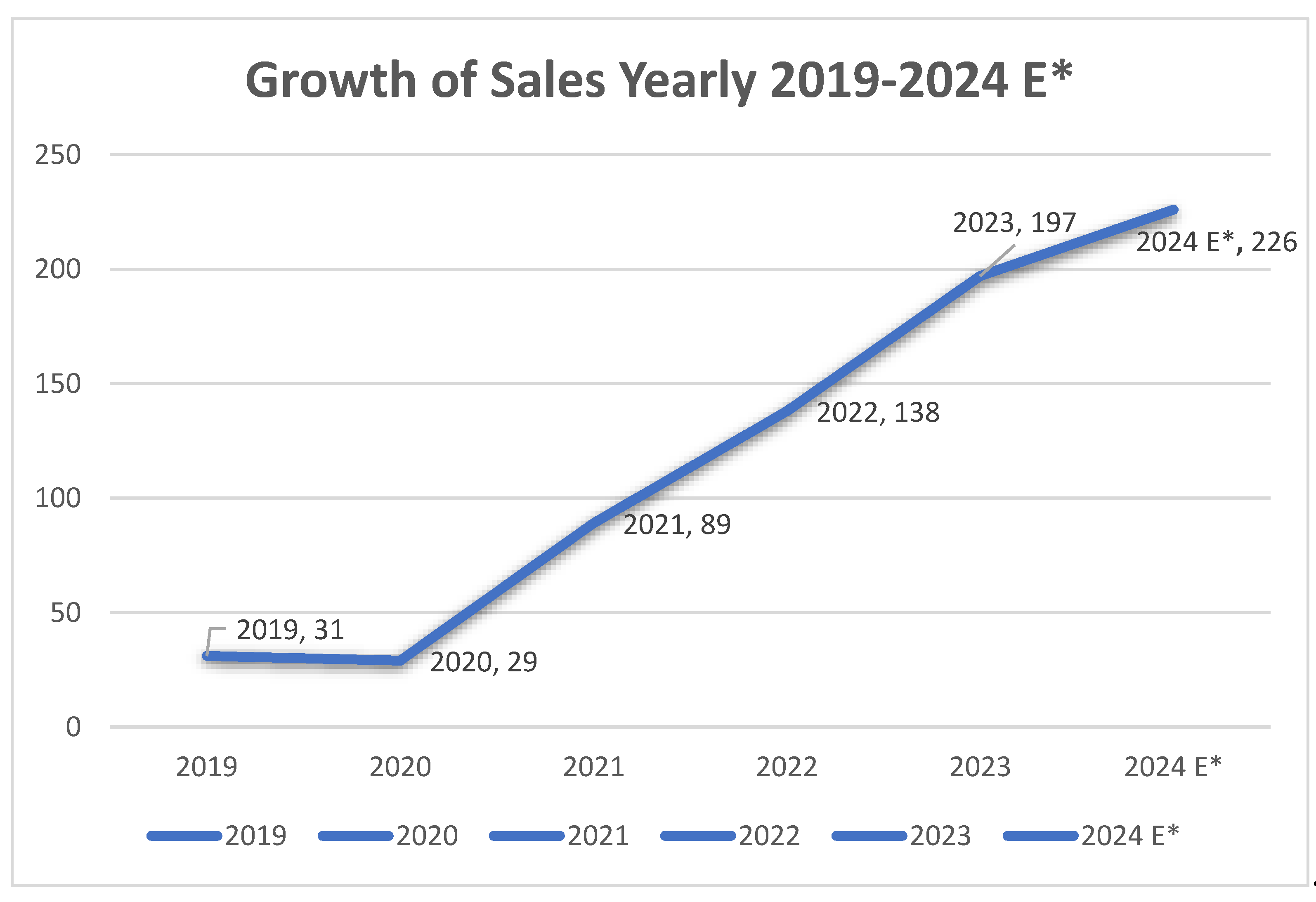

After a small decline in 2020, there has been consistent and rapid growth in sales each year from 2021 onward. The sales growth from 2021 to 2024 is particularly steep, with a strong increase from 89 to 226 units in just three years. The estimate for 2024 suggests continued confidence in rising sales. Preference of Kuwait EV drivers for power over price can clearly be seen in the following

Table 2 where the average EV sold in Kuwait has about 350 kW motor and over 80 kwh battery back. See

Table 2.

The government of Kuwait does not give any preferential treatment in any time or form to Electric Vehicles or electric transport as of middle of 2024. All cars are subject to 5% import taxation regardless of type or shape. The price of EVs is 20-30% higher than ICE, which reflects the in the extra production cost for the EV battery. As most EV sold in Kuwait have rather large battery the bigger the price differential will be compared to ICE with similar body see

Table 1. This is in stark difference to the early adapting nations such as Scandinavian countries where dues to tax incentive systems EVs are even cheaper than ICE [

1]

Table 1.

Price of EV models which are currently being sold in Kuwait Source: Kuwait Automotive Union [

1].

Table 1.

Price of EV models which are currently being sold in Kuwait Source: Kuwait Automotive Union [

1].

| EV Model |

USD Price |

EV Model |

USD Price |

| Polestar 2 Single Motor |

51,300 |

Volvo C40 Recharge Single Motor |

53,300 |

| Polestar 2 Dual Motor |

57,000 |

Volvo C40 Recharge Dual Motor |

61,000 |

| Porsche Taycan |

91,000 |

Volvo XC40 Recharge Single Motor |

55,000 |

| Porsche Taycan 4S |

109,000 |

Volvo XC40 Recharge Dual Motor |

60,000 |

| Porsche Taycan GTS |

136,000 |

Volvo EX30 Single Motor |

34,950 |

| Porsche Taycan Turbo |

152,000 |

Volvo EX30 Dual Motor |

45,000 |

| Porsche Taycan Turbo S |

194,000 |

Volvo EX90 Electric |

79,900 |

| Porsche Taycan 4 Cross Turismo |

100,000 |

Cadillac Lyriq Single Motor |

58,590 |

| Porsche Taycan 4S Cross Turismo |

110,000 |

Cadillac Lyriq Dual Motor |

64,000 |

| Porsche Taycan Turbo Cross Turismo |

160,000 |

BYD Atto 3 |

38,000 |

| Audi e-tron GT quattro |

107,995 |

BYD Tang EV |

70,000 |

| Audi RS e-tron GT |

139,900 |

Skywell ET 5 |

45,000 |

| Audi Q8 e-tron |

74,400 |

Hyundai Ioniq 5 |

41,450 |

| Audi Q8 Sportback e-tron |

89,500 |

Hyundai Ioniq 6 |

45,000 |

| Audi SQ8 Sportback e-tron |

96,000 |

Jaguar I-Pace R-Dynamic S |

73,000 |

| Genesis G70 Electrified |

65,000 |

Jaguar I-Pace R-Dynamic SE |

78,400 |

| Genesis G80 Electrified |

80,000 |

Jaguar I-Pace R-Dynamic HSE |

89,500 |

| Mercedes Benz EQE 350+ |

76,000 |

Kia EV5 |

50,000 |

| Mercedes Benz EQS 450+ |

105,000 |

Kia EV6 |

48,500 |

| Mercedes Benz EQS580 4Matic |

126,000 |

Kia EV9 |

73,000 |

| Mercedes Benz EQA 350 4Matic |

55,000 |

MG 4 |

40,000 |

| Mercedes Benz EQB 350 4Matic |

58,000 |

Hummer EV3X SUV |

105,000 |

| Mercedes Benz EQE 350 4Matic |

76,000 |

Hummer EV Edition 1 SUV |

104,000 |

| Mercedes Benz EQE 500 4Matic |

96,000 |

Hummer EV3X Pickup |

115,000 |

| Mercedes AMG EQE 53 4Matic+ |

120,000 |

Hummer EV Edition 1 Pickup |

109,000 |

| Mercedes Benz EQS 450 4Matic |

110,000 |

Lotus Eletre |

84,000 |

| Mercedes Benz EQS 580 4Matic |

130,000 |

Lotus Eletre S |

120,000 |

| Mercedes Maybach EQS 680 |

180,000 |

Lotus Eletre R |

145,000 |

| Mercedes Benz EQV |

70,000 |

Rolls Royce Spectre |

558,000 |

| Bolt EVLT |

27,495 |

Renault Twizy |

12,000 |

| Smart Fortwo Coupe |

26,740 |

Renault Zoe ZE40 |

34,000 |

| Smart Limited 1 |

21,900 |

Mazda MX-30 |

33,470 |

| Smart Fortwo Cariolet |

28,850 |

Volkswagen 1D.4 Crozz |

41,160 |

| BMW I3s |

44,450 |

|

Table 2.

Features of EV sold in Kuwait Source: Kuwait Automotive Union [

1].

Table 2.

Features of EV sold in Kuwait Source: Kuwait Automotive Union [

1].

| Brands |

Power |

WLTP |

Battery |

| POLESTAR |

Polestar 2 Single Motor |

170kW |

478km |

69kWh |

| Polestar 2 Dual Motor |

300kW |

487km |

78kWh |

| PORSCHE |

Porsche Taycan |

300kW |

503km |

83.7kWh |

| Porsche Taycan 4S |

390kW |

452km |

71kWh |

| Porsche Taycan GTS |

440kW |

502km |

83.7kWh |

| PorscheTaycanTurbo |

500kW |

506km |

83.7kWh |

| Porsche Taycan Turbo S |

560kW |

467km |

83.7kWh |

| Porsche Taycan 4 Cross Turismo |

350kW |

488km |

83.7kWh |

| Porsche Taycan 4S Cross Turismo |

420kW |

488km |

83.7kWh |

| Porsche Taycan Turbo Cross Turismo |

500kW |

483km |

83.7kWh |

| AUDI |

Audi e-tron GT quattro |

350kW |

488km |

83.7kWh |

| Audi RS e-tron GT |

440kW |

472km |

93.4kWh |

| Audi Q8 e-tron |

250kW |

491km |

95kWh |

| Audi Q8 Sportback e-tron |

300kW |

600km |

114kWh |

| Audi SQ8 Sportback e-tron |

370kW |

513km |

114kWh |

| GENESIS |

Genesis G70 Electrified |

360kW |

455km |

77.4kWh |

| Genesis G80 Electrified |

272kW |

427km |

87.1kWh |

| MERCEDES |

Mercedes Benz EQE 350+ |

215kW |

654km |

90.6kWh |

| Mercedes Benz EQS 450+ |

245kW |

783km |

107.8kWh |

| Mercedes Benz EQS580 4Matic |

385kW |

676km |

107.8kWh |

| Mercedes Benz EQA 350 4Matic |

215kW |

432km |

66.5kWh |

| Mercedes Benz EQB 350 4Matic |

215kW |

419km |

66.5kWh |

| Mercedes Benz EQE 350 4Matic |

215kW |

558km |

90.6kWh |

| Mercedes Benz EQE 500 4Matic |

300kW |

521km |

90.6kWh |

| Mercedes AMG EQE 53 4Matic+ |

460kW |

470km |

90.6kWh |

| Mercedes Benz EQS 450 4Matic |

256kW |

596km |

108.4kWh |

| Mercedes Benz EQS 580 4Matic |

400kW |

529km |

108.4kWh |

| Mercedes Maybach EQS 680 |

484kW |

600km |

108.4kWh |

| Mercedes Benz EQV |

150kW |

347km |

90kWh |

| VOLVO |

VolvoC40RechargeSingle Motor |

175kW |

476km |

78kWh |

| Volvo C40 Recharge Dual Motor |

300kW |

533km |

78kWh |

| Volvo XC40 Recharge Single Motor |

175kW |

476km |

78kWh |

| Volvo XC40 Recharge Dual Motor |

300kW |

500km |

78kWh |

| Volvo EX30 Single Motor |

200kW |

480km |

69kWh |

| Volvo EX30 Dual Motor |

315kW |

460km |

69kWh |

| Volvo EX90 Electric |

300kW |

600km |

111kWh |

| CADILLAC |

Cadillac Lyriq Single Motor |

255kW |

500km |

102kWh |

| Cadillac Lyriq Dual Motor |

373kW |

480km |

102kWh |

| BYD |

BYD Atto 3 |

150kW |

345km |

49.92kWh |

| BYD Tang EV |

380kW |

430km |

86.4kWh |

| SKYWELL |

Skywell ET 5 |

150kW |

460km |

72kWh |

| HYUNDAI |

Hyundai Ioniq 5 |

125kW |

384km |

58kWh |

| Hyundai Ioniq 6 |

111kW |

429km |

53kWh |

| JAGUAR |

Jaguar I-Pace R-Dynamic S |

294kW |

470km |

90kWh |

| Jaguar I-Pace R-Dynamic SE |

294kW |

470km |

90kWh |

| Jaguar I-Pace R-Dynamic HSE |

294kW |

470km |

90kWh |

| KIA |

Kia EV5 |

160kW |

530km |

82kWh |

| Kia EV6 |

168kW |

528km |

77.4kWh |

| Kia EV9 |

283kW |

541km |

99.8kWh |

| MG |

MG 4 |

150kW |

450km |

64kWh |

| GMC |

Hummer EV3X SUV |

619kW |

482km |

200kWh |

| Hummer EV Edition 1 SUV |

619kW |

482km |

200kWh |

| Hummer EV3X Pickup |

745kW |

530km |

200kWh |

| Hummer EV Edition 1 Pickup |

745kW |

539km |

200kWh |

| LOTUS |

Lotus Eletre |

450kW |

600km |

112kWh |

| Lotus Eletre S |

450kW |

535km |

112kWh |

| Lotus Eletre R |

675kW |

450km |

112kWh |

| ROLLS ROYCE |

Rolls Royce Spectre |

430kW |

466km |

107kWh |

| CHEVROLET |

Bolt EVLT |

150kW |

414km |

65kWh |

| RENAULT |

Renault Twizy |

12.6kW |

100km |

6.1kWh |

| Renault Zoe ZE40 |

68kW |

300km |

41kWh |

| SMART |

Smart Fortwo Coupe |

60kW |

133km |

17.6kWh |

| Smart Limited 1 |

60kW |

133km |

17.6kWh |

| Smart Fortwo Cariolet |

60kW |

132km |

17.6kWh |

| MAZDA |

Mazda MX-30 |

107kW |

200km |

35.5kWh |

| VOLKSWAGEN |

Volkswagen 1D.4 Crozz |

150kW |

522km |

77kWh |

| BMW |

BMW I3s |

135kW |

285km |

42.2kWh |

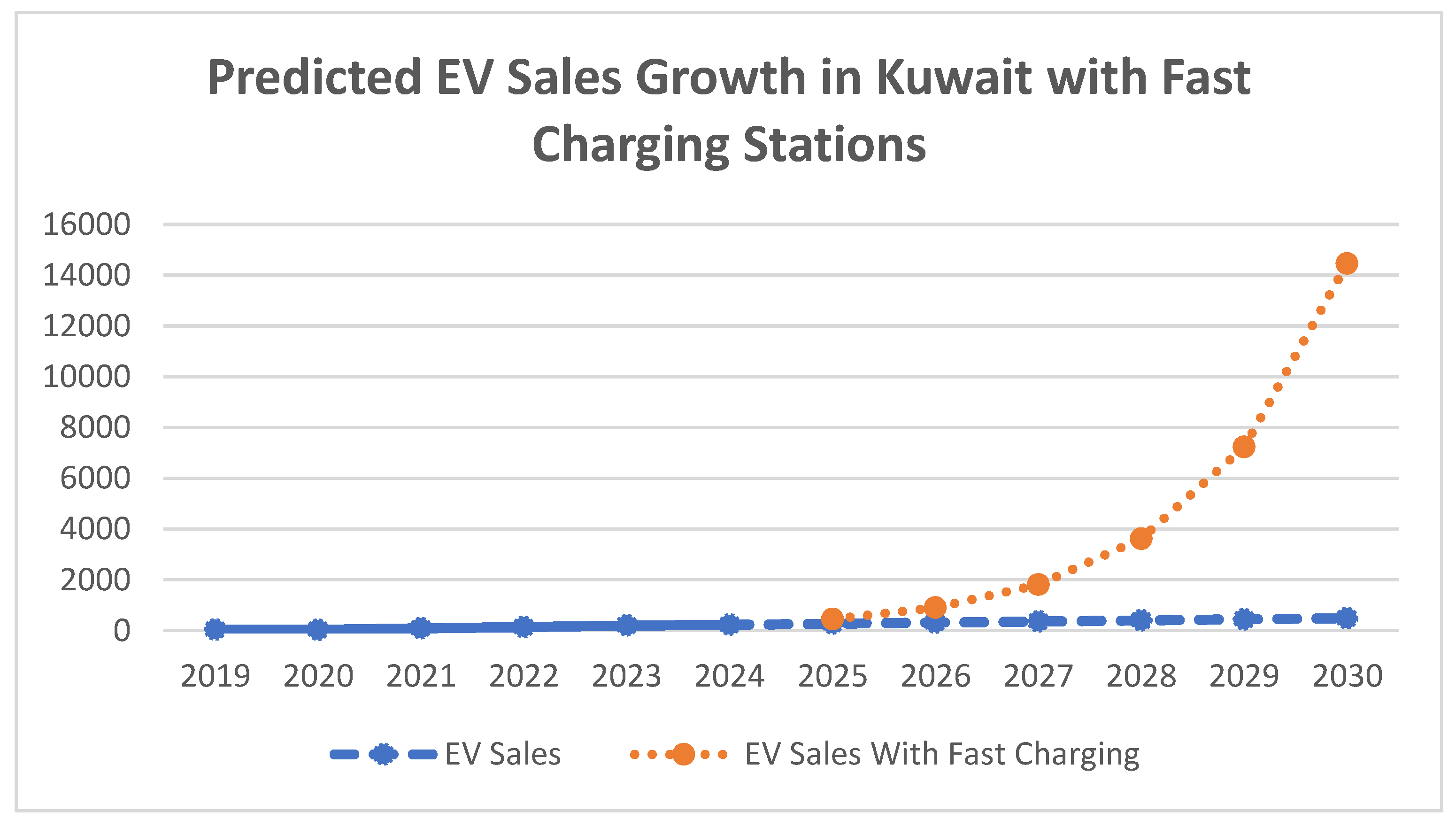

1.6. Predictions of EV Sales with and Without Fast Charging Stations

The electric vehicle (EV) market has shown significant growth over the past few years, with sales increasing across various brands, as illustrated in the

Figure 2. However, one of the critical factors driving EV adoption is the availability of fast charging infrastructure. The data suggests that automakers like Tesla, Porsche, and Mercedes-Benz, which have robust fast charging networks or compatibility with existing ones, have experienced substantial growth in EV sales compared to brands with limited or slower charging solutions.

Figure 2.

Source: Specification of most sold EVs in Kuwait (Tesla is omitted as there are no Tesla Dealership in Kuwait) Source: Union of Automotive Agents.

Figure 2.

Source: Specification of most sold EVs in Kuwait (Tesla is omitted as there are no Tesla Dealership in Kuwait) Source: Union of Automotive Agents.

To express the growth of EV sales in the scenarios, we can use the standard formula: y = mx + c

Where:

y: Predicted value (EV sales in this case).

m: Slope (rate of change or growth rate).

x: Independent variable (time, in years).

c: Intercept (initial sales at the starting point).

Below are the linear regression formulas for different scenarios:

Scenario 1: Basic EV Sales Growth (No additional infrastructure)

EV salest = m ⋅ t + c

Where:

m: Growth rate (slope).

c: Initial sales in the starting year.

Explanation: From the data between 2019 and 2024, the sales of EVs show a clear growth trend. Using a linear model, the calculated average growth rate to be around 49.25 EVs per year. Starting from 29 EVs sold in 2020, the predicted sales for 2025 is about 275 EVs, and for 2030, it's estimated to reach 522 EVs per year. This steady increase reflects a consistent rise in demand for EVs.

Scenario 2: EV Sales Growth with Fast Charging Stations

EVsalest = a . (2t – t0)

Where:

a: The initial value (in this case, the value for 2024, which is 226).

t0: The reference year (in this case, 2024).

t: The year for which we want to predict the sales.

2: Represents the doubling factor.

Explanation: Using the formula, predictions for EV sales growth from 2025 to 2030, assuming that fast charging stations will significantly boost demand. Starting with 226 EVs sold in 2024, the model shows that sales could reach 452 EVs in 2025 and grow rapidly to 2,712 EVs by 2030. This is due to the doubling effect introduced by fast charging stations, which accelerates sales each year.

Figure 3.

Source: Predicted EV Sales Growth in Kuwait with Fast Charging Stations (2025-2030) based on qualitative interviews with dealers and owners of EV in Kuwait.

Figure 3.

Source: Predicted EV Sales Growth in Kuwait with Fast Charging Stations (2025-2030) based on qualitative interviews with dealers and owners of EV in Kuwait.

1.6.2. EV Fast Lane in and out of Down Town Area to the Suburbs

The main difference in the early adopting nations Norway vs. other Scandinavian nations is the adoption of free fast lane where EVs can use the bus and taxi fast lane and tall road, ferries as well as parking infrastructures free of charge, mainly in and out of main area of employment in the capital and to the suburbs where majority of the population lives. This not only saves suburbs dwellers of Oslo the capital of Norway up to one hour per day in commuting time but also considerable amount of money the EV drivers other vice would have to pay. Over one third of passenger cars in Norway are now plug in vehicles, whereas next country in EV adoption, Iceland only has 20% and Sweden and Denmark only about 12% plug in ration for all passengers’ cars. [

38] The difference is no charge-designated EV fast lanes from the suburbs to the city-centers. [

39,

40,

41,

42,

43,

44]. Thus, it would be fair to assume if the largest freeways in and out of the suburbs to the city-center in Kuwait, Freeway 30 and Freeway 40 would have a designated fast lane for EV the demand would take a jump.

2. Hypothesis and Purpose

This qualitative and exploratory investigation is to capture the perspectives of both EV automotive dealers as well as EV owners and to demonstrate importance of governmental policy, strategy and implementation such as installing fast charging stations to break the path dependency of the ICE vehicles for the benefit of the environment measured in lowering CO2 emission and improvement of air quality. This is followed up by in-depth interviews to investigate the attitudes of 12 Kuwaiti EV owners toward EV use and to document their ownership experiences. From the interviews we gathered valuable insights on how to proceed promoting the EVitisation of transport in Kuwait. Finally, we give our projection about who will be likely to buy EVs (customer groups) in the near future in Kuwait and in what quantity given a) no policy change or infrastructural buildup. b) future sales with a rapid buildup of fast charging stations, c) other incentives like: fast lanes for EV from suburbs to inner city, financial purchasing incentives, mandates for public transportation (including taxi serves) to go electric, and support from car dealers to provide battery warranty for the lifetime of the car (that the charging performance of the battery will not go under certain minimum for about 12 years) along with variety of models and price ranges offered by dealers, as well as buildup of quality support network for quick service and parts and auxiliary on stock. We call the first scenario Business-As-Usual, the second scenario Logarithmic growth and the third one the Ketchup Effect. Finally, we explored with some designed features in university setting semi-structed focused groups, which internal and external features would be likely to resonate with future EV buyers in Kuwait.

This paper is the 9

th paper in a series called “Breaking the ICE reign: mixed method study of attitudes toward purchasing and using EVs in Kuwait” which is administered by the Middle East Center of the London School of Economics and funded by the Kuwaiti Foundation for Scientific Progress (KFAS). This is an applied piece of research which we hope would benefit KFAS (and other stakeholders) to advice the policy makers on decisions regarding objective 13 of Kuwait Vision 2035 on suitability of transport within the State of Kuwait. [

45]

3. Literature Review

3.1. EV Policy Paper on Sustianble Transports

The majority of studies have investigated the best practices of governmental policy implementation of EVs in industrialized nations the socalled Global North and, to a lesser extent, in fast developing nations such as the Gulf Coperation Council Countries (GCC) and Middle East and North America (MENA). However, a few studies have examined these polity implementation in the region. Al Buenain et al explored Qatar’s case and found out that even though Qatar produces all its electricity from burning natural gas, a significant carbon reduction is achived from electromobility. The research stresses the nececity for “practical incentives and subsidies” from the government to break the path dependency on gasoline to eletromobility.[

46]. Shareeda, Al-Hashimi and Hamdan concluded that in Baharain governmental financial incentives was needed in form of tax incentives or price reduction in order for EVs to be priced equvelent to ICE cars aslo that infrastructure such as fast charging network was paramount for rapid EVitizaton.[

46]. Kiani stressed that public incentive system was need in the United Arab Emerates on both national govenmental level as well as local as well as awareness campain educating the public about the benefits of EV transport benefits. [

47].

Due to population growth in developing countries, the concept of sustainable mobility is gaining prominence among academics, leaders, managers, and governments worldwide. The usage of the combusion engine in transport has increased significantly, accompanied by the growth of greenhouse gases (GHG) emitted by traffic [

48,

49,

50,

51,

52,

53]. Therefore, the solution to the current environmental problem should center on sustainable mobility and greener, healthier technologies, such as electric vehicles with limited or negative greenhouse gas emissions. In order to persuade people to purchase more eco-friendly products, such as electric vehicles, it would also be crucial to shift the market towards with amendment, directive and support from governments so the adoption of greener modes of transort by promoting sound environmental behavior and sustainable mobility [

54,

55,

56,

57,

58,

59,

60].

4. Methodology and Data Gathering

4.1. The Methodology for Deep Interviews

This research methodology is founded on the use of qualitative approaches. For data collection, in-depth interviews with EV car dealers and EV car proprietors were conducted. A comprehensive description of the qualitative methodologies used in the data collection procedure. The current study's design and analysis were informed by the methodology proposed by the Vancouver School of Doing Phenomenology [

61,

62,

63] (and approved by the Research Ethics Committee of London School of Economics and Political Science on November 24, 2021). This consists of the seven steps depicted in

Figure 1 - abbreviated adoption. These measures include:

Table 4.

Source: Localized and abbreviated by Authors from Vancouver School of Doing Phenomenology.

Table 4.

Source: Localized and abbreviated by Authors from Vancouver School of Doing Phenomenology.

| Scope & Validation |

Data from semi-structured interviews with automobile dealers was utilized to create a qualitative questionnaire with 10 open-ended questions and verified by a "dry-run" of 5 Australian University faculty members for common terminology. |

| Trust Building |

As taped and transcribed interviews ware required trust had to be built in the framework of Arab hospitality and mutual respect. Personal reference and official introduction via company hierarchy was achieved by correspondence and phone conversations. Agreement for the interview was assumed by allowing the recording but exact citations needed a formal permission. |

| Dialogue |

Interviewer visited interviewee at their locations. The interviewer began the open-ended questionnaire in the calmest atmosphere possible, giving the interviewee time to answer each question without any haste, hints, or suggestions that might have compromise data integrity. |

| Transcription |

The interviewer's notes on body language, tone of voice, and other non-verbal indicators are put in for each interview. The transcripts were also carefully interpreted (e.g., attention to interview jargon and terminology). |

| Construction |

Finding a description that captures the result and its meaning. |

| Verification |

Final verification and interpretation with certain interviews. |

| Externalization |

Externalization to clarify the findings and promote additional study. |

Table 5.

Source: Extracted answers obtained from Interviewees.

Table 5.

Source: Extracted answers obtained from Interviewees.

5. Discussion of the Findings

5.1. Summary of EV Owners' Feedback and Insight

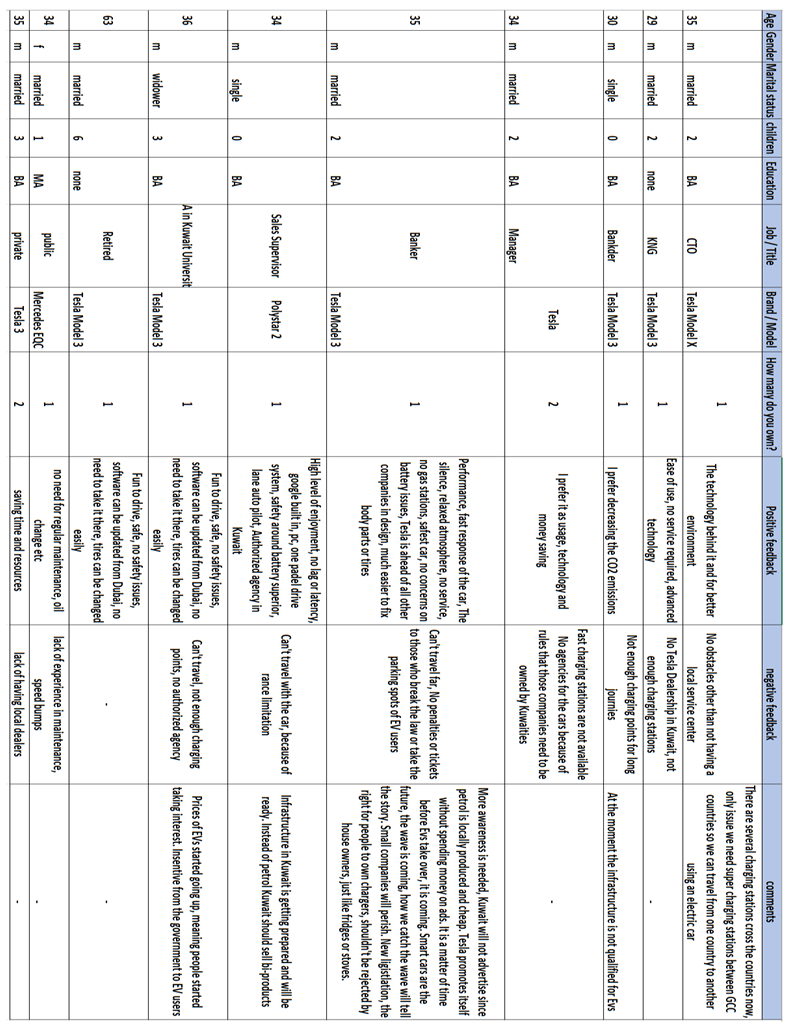

In-depth thematic analysis was conducted through interviews with 10 electric vehicle (EV) owners, consisting of 8 Tesla owners, 1 Polestar owner, and 1 Mercedes owner. The key findings from the analysis are as follows:

The age distribution of the EV owners interviewed ranged from 29 to 63 years old, with the majority falling in their late 20s to mid-30s, specifically at ages 29, 30, 34, 34, 34, 35, 35, 35, 36, and 63. Regarding gender, most of the participants were male, indicating a potential gap in marketing efforts towards women and suggesting a need for more targeted campaigns aimed at female audiences. In terms of marital status, seven of the owners were married, two were single, and one was a widower. Most of the owners (eight) had only one vehicle, while two individuals owned two cars.

5.2. Key Reasons for Preferring EV’s

Electric vehicle (EV) owners in Kuwait have shared several compelling reasons for choosing this technology. A major motivation is the environmental benefit, as EVs are considered a cleaner option compared to traditional vehicles, helping to reduce emissions and support a more sustainable future for the region. Additionally, EVs are valued for their advanced technology, offering features such as cutting-edge software, user-friendly interfaces, and innovative energy management systems. Owners also appreciate the low maintenance requirements of EVs, as they have fewer moving parts, resulting in lower upkeep costs.

Economic efficiency is another key factor, with EVs offering reduced fuel expenses and the potential for government incentives in Kuwait. The superior performance of EVs, such as instant torque and smooth acceleration, while their quiet operation contributes to a more enjoyable driving experience. Improved safety features, including advanced structural designs and low centers of gravity, also make EVs more attractive.

Driving enjoyment is another reason many Kuwaitis choose EVs, with drivers highlighting the smooth, powerful ride they provide. The availability of authorized dealerships ensures easy vehicle maintenance, while convenient software updates allow owners to improve performance without frequent trips to service centers. Finally, the ease of tire changes adds to the appeal, offering owners peace of mind that regular vehicle upkeep is simple and accessible in Kuwait. Therefore, these factors make EVs a popular choice for drivers in Kuwait seeking modern, efficient, and high-performance vehicles.

5.3. Challenges Faced by EV Owners

Despite the many benefits of owning an electric vehicle (EV), owners in Kuwait face several challenges that affect their overall satisfaction. One significant issue is that speed bumps, especially in areas with lower ground clearance, can make driving uncomfortable, particularly for EVs. Another challenge is the lack of local charging station centers and services, which means owners often have to travel long distances or experience delays when seeking fast charging stations or even for maintenance or repairs. In addaition, the limited number of authorized dealerships in the state of Kuwait further exacerbates this problem, restricting access to spare parts and professional support.

One of the main key concerns is the insufficient number of charging stations, which creates inconvenience for everyday use and increases range anxiety among owners, especially for those who live far from their work and need to drive long distances inside Kuwait. Finally, many EV owners express frustration with the difficulty of using their vehicles for long-distance travel. The lack of adequate charging infrastructure and the long charging times make EVs less practical for road trips across the region. These challenges highlight the need for further improvements in EV infrastructure and services in Kuwait to improve the ownership experience.

5.4. Top Concerns and Highlights from EV Owners' Feedback

Electric vehicle (EV) owners in Kuwait have shared positive feedback about several key features that make EVs an appealing choice. One of the main attractions is the advanced technology, which includes cutting-edge software, user-friendly interfaces, and innovative energy management systems, offering a sophisticated and modern driving experience. Another major advantage is that EVs are environmentally friendly and operate quietly, reducing emissions and contributing to a cleaner, quieter environment—especially in busy urban areas like Kuwait.

In terms of cost, many owners highlight the economic benefits of EVs, noting the long-term savings on fuel and maintenance. However, despite these advantages, EV owners in Kuwait face significant challenges. A major concern is the limited availability of service centers and authorized dealers, which makes it difficult for owners to get timely repairs and support. The lack of charging stations is another issue, severely limiting the ability to use EVs for long-distance travel. The shortage of charging infrastructure restricts the practical use of EVs for road trips, which is a critical barrier to wider adoption.

While the benefits of owning an EV in Kuwait are clear, improving infrastructure is essential to address these challenges and ensure a more seamless ownership experience.

5.5. Recommendation from EV’s Owners

To improve EV adoption and the ownership experience, Kuwait’s EV owners have offered several recommendations. First, they suggest increasing public awareness of the advantages of EVs. Many believe that better education on the environmental, economic, and technological benefits of EVs could encourage more people to switch from traditional vehicles to electric ones. Emphasizing benefits like lower emissions, cost savings, and advanced features could help build public interest and confidence in EVs.

Another key recommendation is to accelerate the development of EV infrastructure, particularly by adding more charging stations and establishing additional service centers. Expanding the network of fast-charging stations across Kuwait would help reduce range anxiety and make EVs more practical for both daily use and long-distance travel. Increasing the number of local service centers and authorized dealerships would also improve accessibility to maintenance and repairs. Implementing these recommendations would greatly enhance the EV ownership experience in Kuwait and help promote the wider adoption of electric vehicles.

6. Critical Factors for Expanding EV Usage in Kuwait

The future of EV adoption in Kuwait depends not just on infrastructure improvements but also on government policies and incentives. While countries like Norway and China have implemented successful strategies to promote EVs, Kuwait has not yet introduced significant initiatives to match this global trend. In 2023, Norway’s tax exemptions, subsidies, and toll reductions led to over 80% of new car sales being electric, while China’s rebates and purchase tax exemptions have made it the world’s largest EV market. In contrast, Kuwait’s lack of government financial support has slowed its EV adoption, despite growing interest in sustainable transport solutions.

To accelerate the transition, Kuwait could introduce tax breaks, subsidies, and exemptions on electric vehicle imports. These incentives would help offset the higher initial cost of EVs, making them more accessible, especially for middle-income consumers. Non-financial incentives, such as reduced registration fees, free parking, and toll waivers for EV owners, particularly in urban areas, could also encourage adoption. Scrappage schemes, where consumers receive rebates for trading in older combustion-engine vehicles, have proven effective in other countries like Germany and France and could work similarly in Kuwait.

The government could also support corporate fleet electrification by offering tax breaks or financial incentives for companies investing in EVs or charging infrastructure. Public-private partnerships would be essential in expanding the nation’s charging network, addressing range anxiety, and making EV ownership more practical. Introducing emissions regulations and setting targets for zero-emission vehicles would further push automakers and consumers toward EVs, creating a regulatory framework that aligns with global efforts to reduce carbon emissions.

6.1. Advancements in Battery Technology

Breakthroughs in battery technology, especially solid-state batteries, have the potential to greatly improve EV performance and speed up adoption. These next-generation batteries offer significant advantages over traditional lithium-ion batteries, including enhanced safety, efficiency, and longer lifespans. Solid-state batteries also store more energy in smaller spaces, leading to faster charging times and longer driving ranges—two major considerations for consumers.

In Kuwait, where long distances and limited charging infrastructure are concerns, solid-state batteries could reduce range anxiety and make EVs more practical. Additionally, their superior thermal stability makes them ideal for Kuwait’s extreme heat, where temperatures can exceed 50°C. Unlike lithium-ion batteries, which tend to overheat and degrade in high heat, solid-state batteries perform better and remain cooler, potentially increasing battery lifespan and reducing the frequency of replacements. This resilience would be particularly appealing to consumers concerned about how EVs would fare in Kuwait’s harsh climate.

KISR is actively contributing to the advancement of energy research in the region. KISR is involved in projects to develop energy storage solutions and optimize charging infrastructure compatible with Kuwait’s energy grid. Additionally, KISR is working with global partners to test fast-charging stations and explore the feasibility of integrating renewable energy sources like solar power into the EV charging infrastructure [

30,

32,

33,

36] Their efforts position Kuwait to remain at the forefront of EV technology and make electric vehicles a more viable option for local consumers.

6.2. Renewable Energy Integration

Integrating renewable energy, particularly solar power, into Kuwait’s growing EV infrastructure could be a game-changer in reducing dependence on fossil fuels. With abundant sunshine year-round, Kuwait is perfectly positioned to leverage solar energy to reduce the carbon footprint of EV charging. Solar-powered charging stations would not only provide clean energy but also help alleviate concerns about the impact of EV charging on the national energy grid, particularly during peak demand periods.

In addition to environmental benefits, solar charging stations would offer significant economic advantages. By investing in solar infrastructure, Kuwait could reduce its domestic oil consumption for electricity generation, preserving more oil for export. As solar energy becomes more cost-competitive, the long-term savings from reducing reliance on imported fossil fuels could offset the initial costs of building these charging stations.

Integrating renewable energy into the EV infrastructure would also place Kuwait in a leadership position within the Gulf region, alongside countries like the UAE and Saudi Arabia, which are already making significant investments in renewable energy and EV infrastructure. Kuwait’s ample sunshine provides a unique opportunity to harness solar energy to accelerate EV adoption, while also meeting its carbon reduction goals and enhancing its global reputation as an environmentally-conscious nation.

6.3. Fleet Electrification and Corporate Adoption

Integrating renewable energy, particularly solar power, into Kuwait’s growing EV infrastructure could play a transformative role in reducing dependence on fossil fuels. With abundant sunshine year-round, Kuwait is perfectly positioned to leverage solar energy to reduce the carbon emission of EV charging. Solar-powered charging stations would not only provide clean energy but also help alleviate concerns about the impact of EV charging on the national energy grid, particularly during peak demand periods.

In addition to environmental benefits, solar charging stations would offer significant economic advantages. By investing in solar infrastructure, Kuwait could reduce its domestic oil consumption for electricity generation, preserving more oil for export. As solar energy becomes more cost-competitive, the long-term savings from reducing reliance on imported fossil fuels could offset the initial costs of building these charging stations.

Integrating renewable energy into the EV infrastructure would also place Kuwait in a leadership position within the Gulf region, alongside countries like the UAE and Saudi Arabia, which are already making significant investments in renewable energy and EV infrastructure. Kuwait’s ample sunshine provides a unique opportunity to harness solar energy to accelerate EV adoption, while also meeting its carbon reduction goals and enhancing its global reputation as an environmentally-conscious nation.

7. Conclusions

Kuwait’s shift toward electric vehicles presents both challenges and opportunities. As of June 2024, only 597 EVs were registered, representing just 0.024% of the country’s total vehicle population of 2.42 million. This low adoption rate, particularly compared to countries like Norway, highlights the gap Kuwait must address to meet its sustainability goals. However, with advancements in technology, supportive government action, and shifting consumer preferences, Kuwait is well-positioned to accelerate EV adoption in the next decade.

A key barrier to EV adoption in Kuwait is the lack of charging infrastructure. With only 43 slow-charging stations and 2 fast-charging stations as of 2024, the current network is insufficient. However, experts predict a five-fold increase in charging stations by 2026, which will help alleviate range anxiety and make EVs more practical. The Kuwaiti government’s commitment to expanding the charging network to over 120 stations by 2029 is a critical step in encouraging broader EV adoption.

In addition to infrastructure, government incentives will be vital in making EVs more affordable for consumers. As demonstrated by countries like Norway and China, subsidies, tax rebates, and reduced import tariffs have been effective in accelerating EV adoption. The development of such infrastructure will be essential to address one of the most critical concerns raised by consumers and encourage a shift towards electric vehicles.

Beyond infrastructure, government incentives will play a crucial role in accelerating EV adoption. Countries like Norway and China have shown very good examples of incentives such as subsidies, tax breaks, and lowered import tariffs are highly effective in making electric vehicles (EVs) more accessible and appealing to consumers. For example in Norway, a combination of tax exemptions, toll reductions, and free parking has helped EVs reach over 80% of new car sales. Similarly, China has implemented various subsidies, rebates, and support for local EV production, allowing it to become the world’s largest EV market. These policies demonstrate how government support can accelerate EV adoption by significantly lowering costs for consumers and encouraging a shift away from fossil-fuel-based vehicles. Kuwait must consider implementing similar measures to offset the current price differential between EVs and traditional internal combustion engine vehicles (ICEVs), which remain 20-30% more expensive in the Kuwaiti market. The introduction of scrappage schemes, where consumers are rewarded for trading in their ICEVs for EVs, could further incentivize adoption. Moreover, non-financial incentives such as reduced registration fees, free parking, and waived tolls could make EV ownership more appealing, especially in urban areas.

Another critical factor that will influence the pace of adoption is technological innovation, particularly in battery technology. The Kuwait Institute for Scientific Research (KISR) is playing a pivotal role in advancing battery research and optimizing charging infrastructure in collaboration with global partners. The development of solid-state batteries, which offer greater thermal stability and efficiency, could address concerns about the performance of EVs in Kuwait’s extreme climate. Coupled with solar-powered charging stations, Kuwait could leverage its abundant sunshine to create a more sustainable and cost-efficient charging network. This would not only reduce the reliance on fossil fuels but also position Kuwait as a leader in sustainable energy solutions within the region.

Looking ahead, fleet electrification offers a promising avenue for the large-scale adoption of EVs in Kuwait. By transitioning corporate fleets and public transportation, such as buses and taxis, to electric, Kuwait can set a strong example for the wider population while significantly reducing emissions. Similar efforts in cities like London, Shanghai, and Los Angeles have led to measurable improvements in air quality and reduced fuel costs. Encouraging businesses to adopt EV fleets through tax breaks and financial support could catalyze broader adoption and drive the demand for more robust charging infrastructure, benefiting all EV users in the long run.

The adoption of electric vehicles (EVs) in Kuwait can be accelerated through advances in battery technology and sustainable infrastructure. The Kuwait Institute for Scientific Research (KISR) is driving innovation in battery research and optimizing EV charging solutions, potentially with solid-state batteries that withstand extreme heat. Solar-powered charging stations could harness Kuwait's ample sunlight, reducing fossil fuel dependency and positioning the country as a leader in sustainable energy. Transitioning corporate fleets and public transport to EVs, supported by incentives, could further encourage widespread adoption and reduce emissions, following successful examples from cities like London, Amsterdam, and Shanghai.

In conclusion, while the adoption of EVs in Kuwait has been slow, the country has the potential to accelerate its transition to electric mobility over the coming years. The expansion of charging infrastructure, government incentives, and technological advancements will be key drivers in this shift. With the continued efforts of organizations like KISR and government ministries, Kuwait is well-positioned to overcome current barriers and achieve a more sustainable, environmentally friendly transportation system by 2030. For Kuwait to realize its full potential in the EV market, it must adopt a multi-faceted approach that combines infrastructure development, policy support, and consumer education to ensure a greener and more efficient future.

Author Contributions

A.O. is this study's project leader and is responsible for its conception, methodology, formal analysis, and data collection administration as well as collection of funds. M.N. is responsible providing data from databanks and industrial data collection. H.H. and A.K. were responsible for editing, formatting, for the literature review, conceptualization, synthesis, methodology, validation, data curation, and writing and preparation of the original document. All authors have read and agreed to the published version of the manuscript.

Funding

This paper is a part of wider study called “Breaking the ICE's reign: A mixed-method study of attitudes towards buying and using EVs in Kuwait”. This study was funded by the Kuwait Foundation for the Advancement of Sciences and administrated by the London School of Economics and Political Science—Middle East Center (grant number: KFAS-MEC LSE 2021 001), and it received approval from the LSE Research Ethics Committee.

Institutional Review Board Statement

This study has been approved by the London School of Economics and Political Science Ethics Committee (00558000004KJE9AAO, dated 24 November 2021). Consent Form Statement: As directed by the LSE Ethics Committee, an informed statement about the utilization and purpose of the study was included in the questionnaire.

Acknowledgments

We acknowledge the use of AI tools were utilized for proofreading, grammar refinement, and stylistic editing of key sections to enhance clarity and coherence. Additionally, several tables/figures were enhanced using AI-based graphic design software to achieve a more professional, visually appealing presentation, ensuring that complex data was presented in a comprehensible format.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Union of Automotive Agents in Kuwait database. Collected by Mohammed Navfal, KIA Kuwait. Received by email 29 March 2023.

- CEIC, Kuwait number of Register Vehicles 2021. Available online: https://www.ceicdata.com/en/indicator/kuwait/number-of-registered-vehicles#:~:text=Kuwait%20Number%20of%20Registered%20Vehicles%20was,2%2C456%2C606%20Unit%20in%20Dec%202021. (accessed on 13 November 2024).

- OFV Statistics, Bilsalget i oktober 2024. 2024. Available online: https://ofv.no/bilsalget/bilsalget-i-oktober-2024 (accessed on 11 November 2024).

- Alvik SBakkenakken, B. 2021. How Norway EVs have cut Emission globally. DNV.com (accessed on 17.12. 2021) How Norway’s EVs have cut emissions globally – DNV.

- Naval, M. Automotive and future mobility industry expert, interview online 29 March 2023 Kuwait.

- Abdullah, E. (2022) Nissan Dealership Kuwait, In person Interview February 23, 2022.

- Nadim, M. (2021) BMW Dealership, Phone interview 15th of November 2021.

- Al Faqsh, Faraj Tayseer (2021), Volvo Dealership Kuwait. In Person Interview 15th of November 2021.

- Najjar, S. Porsche Dealership Kuwait 2021. In person Interview 8th of November 2021.

- Shalash, M. (2021), Audi Dealership Kuwait. In Person Interview 15th of November 2021.

- Eddine Jamal, M. (2021), Mercedes Dealership Kuwait. In Person Interview 8th of November 2021.

- United States Environmental Protection Agency. Highlights of the Automotive Trends Report. Available online: https://www.epa.gov/automotive-trends/highlights-automotive-trends-report.

- California Air Resources Board 2022. California moves to accelerate to 100% new zero-emission vehicle sales by 2035. Available online: https://ww2.arb.ca.gov/news/california-moves-accelerate-100-new-zero-emission-vehicle-sales-2035 (accessed on 24 April 2023).

- SIPA Center on Global Energy Policy (Columbia University New York) Guide to Chinese Climate Policy. Available online: https://chineseclimatepolicy.energypolicy.columbia.edu/en/fuel-efficiency. (accessed on 24 April 2023).

- Scholarly Community Encyclopedia, New Energy Vehicles in China. Available online: https://encyclopedia.pub/entry/37552 (accessed on day month year).

- European Environmental Agency 2022 CO2 performance of new passenger cars in Europe. Available online: https://www.eea.europa.eu/ims/co2-performance-of-new-passenger (accessed on 25 April 2023).

- Economist April 20th 2023. How Japan is losing the global electric-vehicle race, Toyota, Honda and Nissan, innovators of yesteryear, are playing catch-up. Available online: https://www.economist.com/asia/2023/04/16/how-japan-is-losing-the-global-electric-vehicle-race (accessed on 24 April 2023).

- Johnson, William. South Korea EV registration jumps in 2022. Available online: https://www.teslarati.com/south-korea-ev-registration-jumps-2022/ (accessed on 24 April 2023).

- Bloomberg New Energy Finance 2022 Electric Vehicle Outlook 2022. Available online: https://about.bnef.com/electric-vehicle-outlook/ (accessed on 24 April 2023).

- Financial Times 2023 Saudi Arabia taps petrodollar surplus to launch homegrown electric-vehicle industry Available online https://financialpost.com/financial-times/saudi-arabia-petrodollar-homegrown-electric-vehicle-industry#:~:text=Key%20to%20the%20Saudi%20electric,affordable%20end%20of%20the%20market. (accessed on 24 April 2023).

- Invest Qatar. What is driving Qatar’s EV growth? Available online: https://www.invest.qa/en/media-and-events/news-and-articles/what-is-driving-qatars-ev-growth (accessed on 24 April 2023).

- Djoundourian, S. Response to the Arab World to Climate Change Challenges and the Paris Agreement. Int. Environ. Agreem. Politics Law Econ. 2021, 21, 469–491. [Google Scholar] [CrossRef]

- Kuwait Voluntary National Review. 2019 Report on the Implementation of 2030 High Level Political Forum on Sustainable Development. Central Statistical Bureau. Available online: https://www.arabdevelopmentportal.com/publication/kuwait-voluntary-national-review (accessed on 20 August 2022).

- Ottesen, A.; Banna, S.; Alzougool, B. Attitudes of Drivers towards Electric Vehicles in Kuwait. Sustainability 2022 14, 12163. [CrossRef]

- United States Official Website of the International Trade Administration 2022, QATAR ELECTRIC VEHICLES CHALLENGES AND OPPORTUNITIES. Available online: https://www.trade.gov/market-intelligence/qatar-electric-vehicles-challenges-and-opportunities#:~:text=Qatar's%20EV%20strategy%20aims%20to,in%20motion%20in%20September%202021. (accessed on 24 April 2023).

- Ottesen, A.; Banna, S.; Alzougool, B. How to Cross the Chasm for the Electric Vehicle World’s Laggards—A Case Study in Kuwait. World Electr. Veh. J. 2023, 14, 45. [Google Scholar] [CrossRef]

- Ottesen, A.; Banna, S.; Alzougool, B. Women Will Drive the Demand for EVs in the Middle East over the Next 10 Years. Energies 2023, 16, x. [Google Scholar] [CrossRef]

- Ottesen, A.; Toglaw, S.; AlQuaoud, F.; Simovic, V. How to Sell Zero Emission Vehicles when the Petrol is almost for Free: Case of Kuwait. J. Manag. Sci. 2022, 9, 1–20. [Google Scholar] [CrossRef]

- Penisula, January 14 2024 Kahramaa sets up 200 EV charging stations. Available online: https://thepeninsulaqatar.com/article/14/01/2024/kahramaa-sets-up-200-ev-charging-stations (accessed on 1 August 2024).

- AlKous, A. State of Kuwait Fast Charging System, Future of Sustainable Transport – Conference Talk at Australian University, West Misref Kuwait, 14th of December 2023.

- Yang, J.; Yang, P.; Wang, H. , Enhancing the Storage Performance and Thermal Stability of Ni-Rich Layered Cathodes by Introducing Li2MnO3. Energies 2024, 17, 810. [Google Scholar] [CrossRef]

- Hamwi, H.; Rushby, T.; Mahdy, M.; Bahaj, A.S. Effects of High Ambient Temperature on Electric Vehicle Efficiency and Range: Case Study of Kuwait. Energies 2022, 15, 3178. [Google Scholar] [CrossRef]

- Hamwi, H.; Alasseri, R.; Aldei, S.; Al-Kandari, M. A Pilot Study of Electrical Vehicle Performance, Efficiency, and Limitation in Kuwait’s Harsh Weather and Environment. Energies 2022, 15, 7466. [Google Scholar] [CrossRef]

- Alrajhi, J.M.; Alardhi, M.; Alhaifi, K.K.; Alkhulaifi, K.; Khalfan, A.; Alhaifi, N.A.; Alazemi, J. Prediction of Electric Vehicle Charging Stations Distribution in Kuwait. Int. J. Traffic Transp. Eng. 2023, 12, 5–9. [Google Scholar] [CrossRef]

- Statista. "Electric Vehicle Drivers: Global Demographics.". Available online: https://www.statista (accessed on 23 August 2023).

- International Energy Agency (IEA). Global EV Outlook 2023. Available online: https://www.iea.org/ (accessed on 23 August 2023).

- McKinsey & Company. The future of mobility is at an inflection point. Available online: https://www.mckinsey (accessed on 23 August 2023).

- Norsk Ebilforeigning (2024) [Passenger car stock in Norway by fuel] (in Norwegian). Norsk Elbilforening (Norwegian Electric Vehicle Association) available on line at: Elbilbestand - Norsk elbilforening. Accessed on 13th November 2024.

- Kolhe, M.L.; Chathuri Madusha, T.P. The scenario of electric vehicles in Norway. In Electric Vehicles: Prospects and Challenges; Elsevier: Amsterdam, The Netherlands, 2017; pp. 317–339. [Google Scholar]

- Liu, C.; Zhao, L.; Lu, C. Exploration of the characteristics and trends of electric vehicle crashes: a case study in Norway. Eur. Transp. Res. Rev. 2022, 14, 6. [Google Scholar] [CrossRef]

- Patil, G.; et al. Sustainable Decarbonization of Road Transport: Policies, Current Status, and Challenges of Electric Vehicles. Sustainability 2024, 16, 8058. [Google Scholar] [CrossRef]

- Hou, X.; Su, M.; Liu, C.; Li, Y.; Ma, Q. Examination of the Factors Influencing the Electric Vehicle Accident Size in Norway (2020–2021). World Electr. Veh. J. 2024, 15, 3. [Google Scholar] [CrossRef]

- Diouf, B. The electric vehicle transition. Environmental Science: Advances 2024, 3, 332–345. [Google Scholar] [CrossRef]

- Ryghaug, M.; Skjølsvold, T.M. Sustainability transitions in consumption-production systems: How policies and actor strategies affect electric vehicle diffusion and wider sustainability transitions. Proc. Natl. Acad. Sci. USA 2023, 120, e2310070120. [Google Scholar] [CrossRef] [PubMed]

- Kuwait Voluntary National Review (2019). Report on the Implementation of the 2030 Agenda to the UN High-Level Political Forum on Sustainable Development, Retrieved 12.24.2021 [online]. Available online: https://www.reuters.com/business/autos-transportation/australia-accelerate-rollout-charging-stations-electric-cars-2021-11-08/https://sustainabledevelopment.un.org/content/documents/23384Kuwait_VNR_FINAL.PDF (accessed on 25 April 2023).

- Al-Buenain, A.; Al-Muhannadi, S.; Falamarzi, M.; Kutty, A.A.; Kucukvar, M.; Onat, N.C. The Adoption of Electric Vehicles in Qatar Can Contribute to Net Carbon Emission Reduction but Requires Strong Government Incentives. Vehicles 2021, 3, 618–635. [Google Scholar] [CrossRef]

- Shareeda, A.; Al-Hashimi, M.; Hamdan, A. Smart cities and electric vehicles adoption in Bahrain. J. Decis. Syst. 2021, 30, 321–343. [Google Scholar] [CrossRef]

- Kiani, A. Electric Vehicle Market Penetration Impact on Greenhouse Gas Emissions for Policy-Making: A Case Study of the United Arab Emirates. Int. Sch. Sci. Res. Innov. 2017, 11, 424–431. [Google Scholar]

- Kim, M.-K.; Oh, J.; Park, J.-H.; Joo, C. Perceived value and adoption intention for electric vehicles in Korea: Moderating effects of environmental traits and government supports. Energy 2018, 159, 799–809. [Google Scholar] [CrossRef]

- Bridi, R.M.; Naeema, H. (2020) An analysis of potential adopter attitudes regarding electric vehicles: the case of university students in the United Arab Emirates. Acta Universitatis Carolinae Geographica 2020, 55(1), 38–48. Available online: chrome-exten-si-on://efaidnbmnnnibpcajpcglclefindmkaj/viewer.html?pdfurl=https%3A%2F%2Fkarolinum.cz%2Fdata%2Fclanek%2F7901%2FGeogr_55_1_0038.pdf&clen=299975&chunk=true.

- Kim, S.; Choi, J.; Yi, Y.; Kim, H. Analysis of Influencing Factors in Purchasing Electric Vehicles Using a Structural Equation Model: Focused on Suwon City. Sustainability 2022, 14, 4744. [Google Scholar] [CrossRef]

- Khurana, A.; Kumar, V.V.R.; Sidhpuria, M. A Study on the Adoption of Electric Vehicles in India: The Mediating Role of Attitude. Vis. J. Bus. Perspect. 2019, 24, 23–34. [Google Scholar] [CrossRef]

- Thananusak, T.; Rakthin, S.; Tavewatanaphan, T.; Punnakitikashem, P. Factors affecting the intention to buy electric vehicles: Empirical evidence from Thailand. Int. J. Electr. Hybrid Veh. 2017, 9, 361. [Google Scholar] [CrossRef]

- Shetty, D.K.; Shetty, S.; Rodrigues, L.R.; Naik, N.; Maddodi, C.B.; Malarout, N.; Sooriyaperakasam, N. Barriers to widespread adoption of plug-in electric vehicles in emerging Asian markets: An analysis of consumer behavioral attitudes and perceptions. Cogent Eng. 2020, 7, 1796198. [Google Scholar] [CrossRef]

- De Oliveira, B.; Ribeiro da Silva, M.; Jugend, H.; De Camargo Fiorini, D.; Carlos Eduardo, P. Factors influencing the intention to use electric cars in Brazil. Transp. Res. Part A Policy Prac. 2022, 155, 418–433. [Google Scholar] [CrossRef]

- Eneizan, B. The adoption of electrics vehicles in Jordan based on theory of planned behavior. Am. J. Econ. Bus. Manag. 2019, 2, 1–14. [Google Scholar] [CrossRef]

- Abu-Alkeir, N. Education Influencing Consumers Buying Intentions Towards Electric Cars: The Arab Customers’ Perspective. Int. J. Mark. Stud. 2020, 12, 2. [Google Scholar] [CrossRef]

- Haider, S.W.; Zhuang, G.; Ali, S. Identifying and bridging the attitude-behavior gap in sustainable transportation adoption. J. Ambient Intell. Humaniz. Comput. 2019, 10, 3723–3738. [Google Scholar] [CrossRef]

- Khazaei, H.; Tareq, M.A. Moderating effects of personal innovativeness and driving experience on factors influencing adoption of BEVs in Malaysia: An integrated SEM–BSEM approach. Heliyon 2021, 7, e08072. [Google Scholar] [CrossRef]

- Moeletsi, M. (2021) Future Policy and Technological Advancement Recommendations for Enhanced Adoptions of Electric Vehicles in South Africa: Survey and Review. Journal of Sustainability 2021, 13, 12535. [Google Scholar] [CrossRef]

- Spiegelberg, H. (1984), ‘The phenomenological movement: a historical introduction ‘, Kluwer Academic Publishers.

- Kvale, S. (1989) Issues of validity in qualitative research. Studentlitteratur, Lund.

- Small, M.L. 2011 “How to Conduct a Mixed Methods Study: Recent Trends in a Rapidly Growing Litera-ture Annual Review of Sociology 37:55-84 retrieved from How to Conduct a Mixed Methods Study: Recent Trends in a Rapidly Growing Literature (harvard.edu).

- Charged Kuwait – Where-to-Charged. (2024). Avaialble online at https://chargedkw.com/where-to-charge/. Accessed on 13. 24. Available online: https://chargedkw.com/where-to-charge/ (accessed on 13 July 2024).

| 1 |

Mohammed Navfal is currently working as an expert for KIA in Kuwait, formerly for Mazda Kuwait. He offers here is personal opinions and not the option of his employers. |

| 2 |

Kodak Moment refers here to that Kodak Company invented the digital camera, but the company did not emphasis the technology which later led to their demise. |

| 3 |

Abdulaziz Al Kous is working currently on MEWRE, EV regulatory approval committee. He offers here is personal opinions and not the option of his employers. |

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).