Submitted:

20 January 2025

Posted:

21 January 2025

You are already at the latest version

Abstract

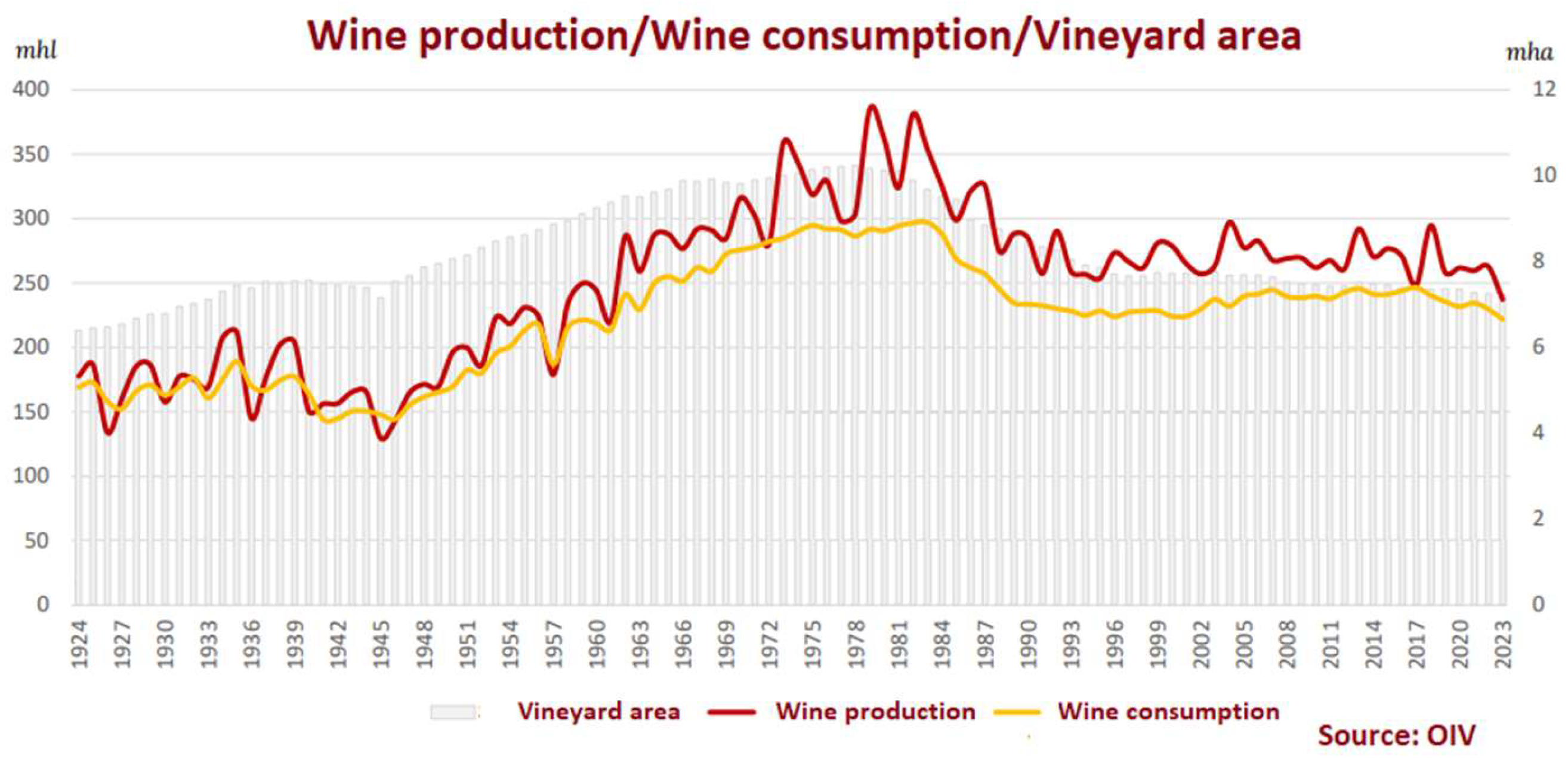

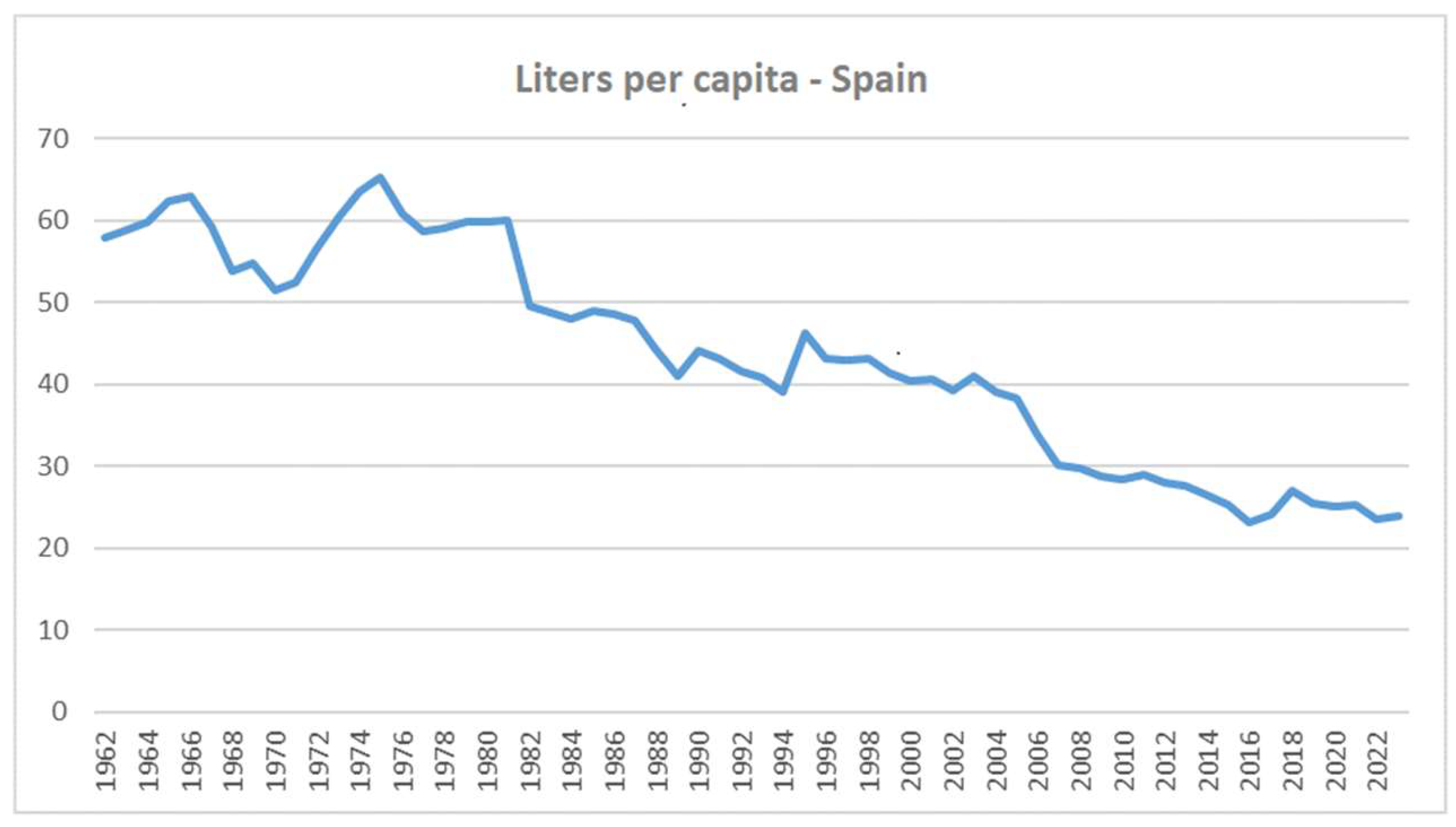

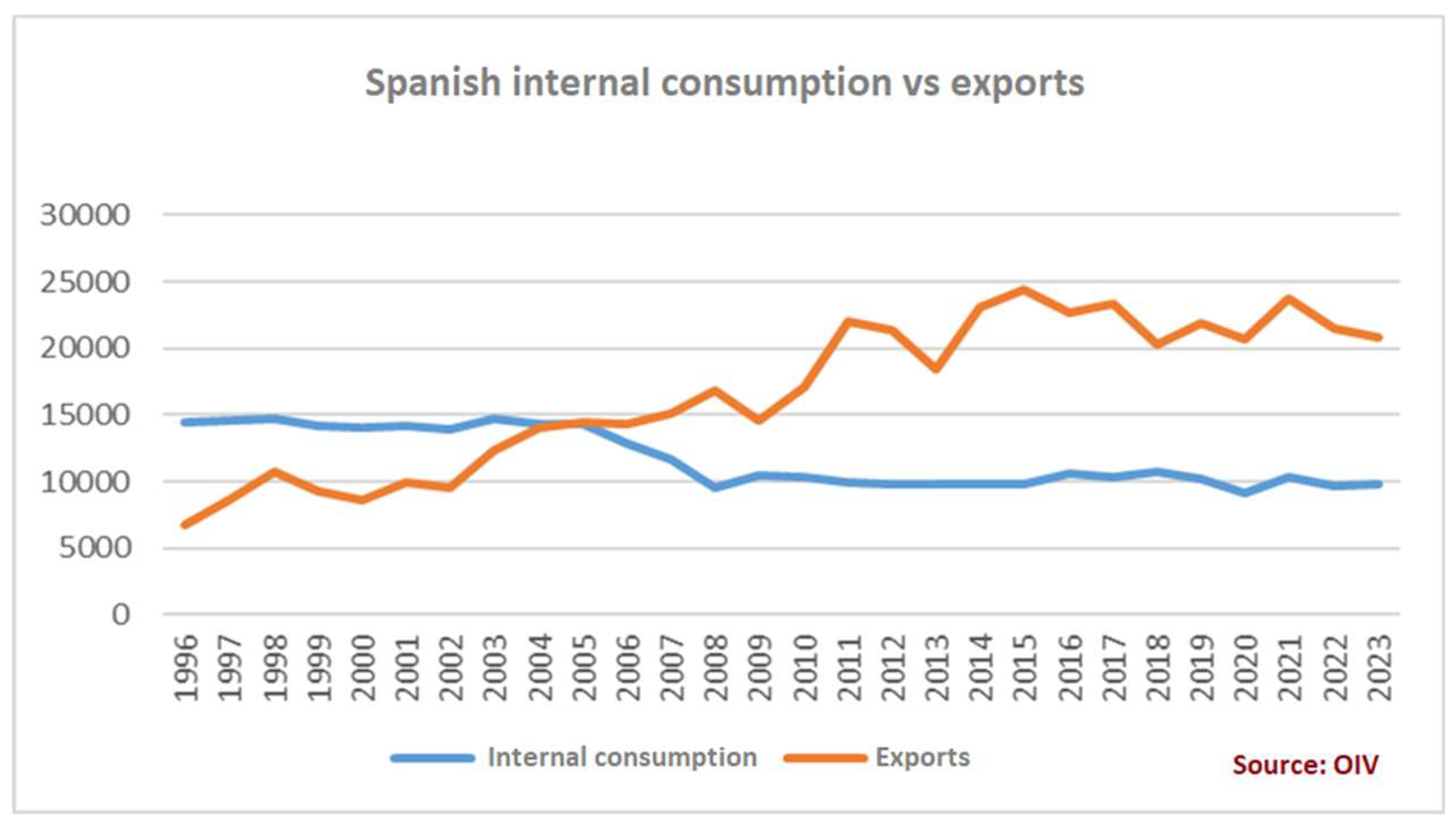

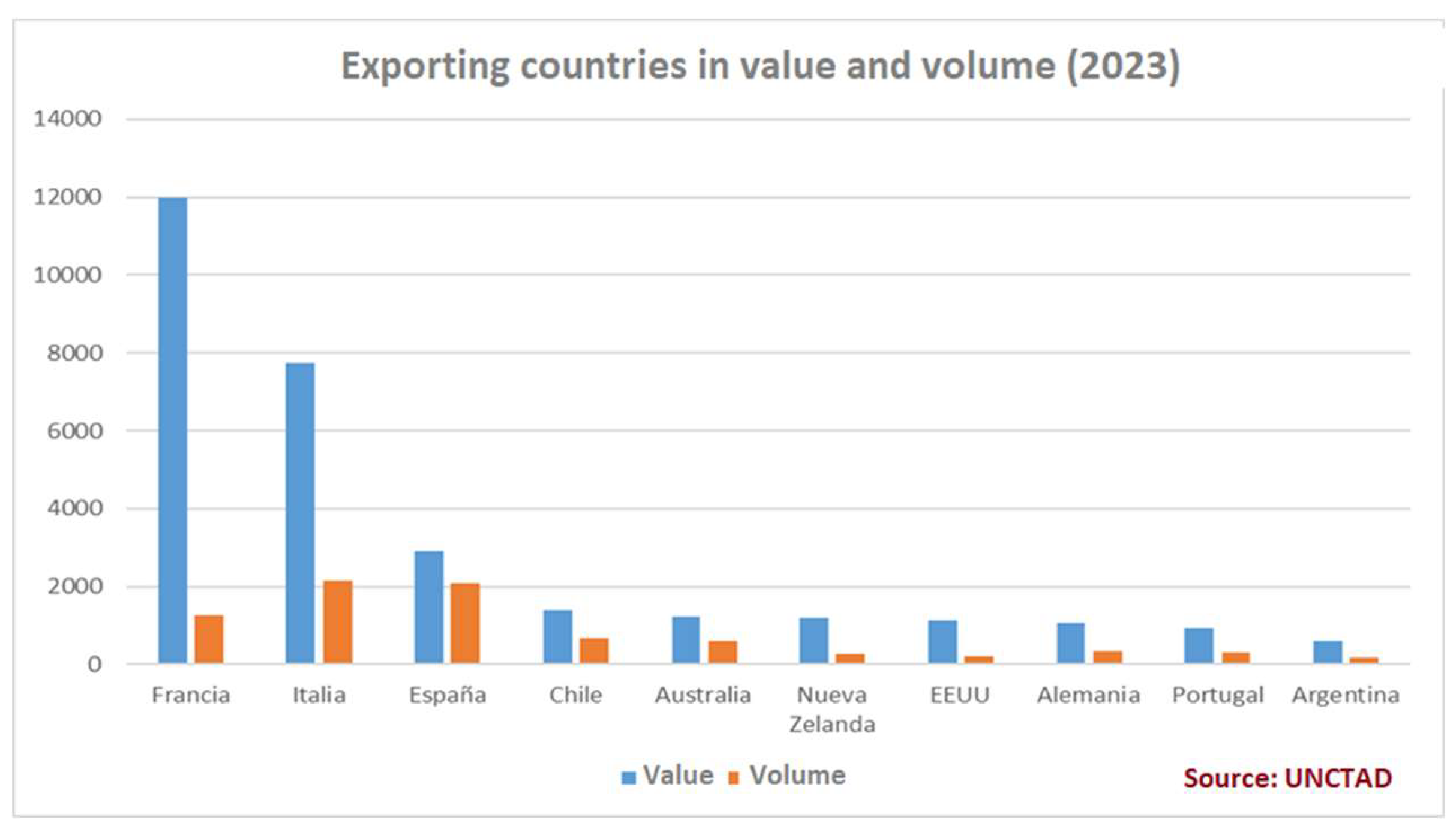

Since 1975, when per capita wine consumption in Spain peaked, the continued decline in domestic consumption has led to significant changes in the wine sector, particularly in production and marketing strategies. By 2005, the industry shifted towards mass exportation, focusing on bulk wine, as domestic demand fell. Since then, Spain has become the leading global producer of bulk wine by volume. However, emerging consumer trends, prioritizing health, sustainability, and low-alcohol beverages, present both challenges and opportunities for the sector. This study explores the potential for Spain’s bulk wine industry to adapt by transitioning to dealcoholized wines, leveraging recent technological advancements and aligning with shifting consumer preferences. In this context, it is crucial to examine what additional factors might influence the transition of Spanish wine producers to dealcoholized wine production and how consumer acceptance of these products in Spain compares to other international markets. In this context, it is crucial to examine what additional factors might influence the transition of Spanish wine producers to dealcoholized wine production and how consumer acceptance of these products in Spain compares to other international markets. Data collection was conducted through dual surveys targeting both consumers and producers, administered in December 2024 via the Sobrelias.com platform, with a total of 602 responses (387 from consumers and 215 from producers). Statistical analyses, including ANOVA and PERMANOVA, were performed to assess the influence of variables such as health-conscious consumption habits, demographic segmentation (age groups), and gender on market dynamics. To date, no prior academic research has addressed this specific intersection of bulk wine exports and consumer trends, highlighting the novelty of this study. A multiple linear regression model quantified the potential for market growth based on these factors.

Keywords:

1. Introduction

1.1. Emerging Consumption Habits in Younger Generations

1.2. Legislative Adaptations and Their Implications for Spain

1.3. The Role of Women in the Wine Sector

2. Materials and Methods

3. Results

3.1. Health-Conscious Consumption

3.2. Demographics: The Role of Younger Generations

3.3. Gender Influence: The Role of Women

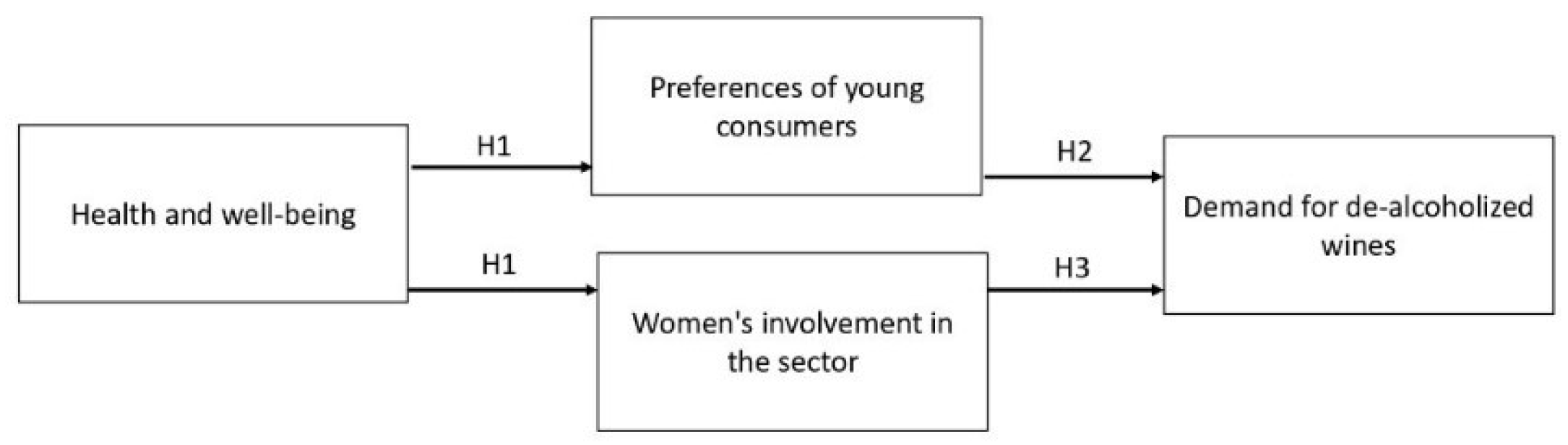

3.4. Quantitative Analysis: Multiple Linear Regression

- Ŷ: Probability of market emergence and growth for dealcoholized wines

- K: Constant

- a, b, c: Parameters

- X1: Probability of adopting health-conscious consumption habits

- X2: Probability of younger generations (18–35 years) contributing to market growth

- X3: Probability of women playing a pivotal role in the dealcoholized wine market

| Variable | X1 (Health Conscious Habits) | X2 (Younger Generation) | X3 (Women) |

| Influence of health-conscious habits * | 63.05% | 65.63% | 68.48% |

| Willingness to try dealcoholized wines | 78.04% | 87.50% | 84.24% |

| Willingness to change consumption habits | 57.63% | 64.38% | 74.55% |

| Current consumption of non-alcoholic beverages | 59.95% | 52.50% | 54.54% |

| Current consumption of non-alcoholic beverages | 51.42% | 54.38% | 58.97% |

- Multiple Correlation Coefficient (R): 0.999999987

- Coefficient of Determination (R²): 0.999999974

- Adjusted R²: 0.999999896

- Standard Error: 3.68808×10¯5

| Source | Degrees of Freedom | Sum of Squares | Mean Squares | FFF-Statistic | Critical FFF-Value | Source |

| Regression | 3 | 0.05237872 | 0.01745957 | 12,836,086 | 0.00020518 | Regression |

| Residuals | 1 |

1.3602×10¯9 |

1.3602×10¯9 |

Residuals | ||

| Total | 4 | 0.05237872 | Total |

- Intercept: t = −1.348498

- Health-Conscious Habits: t = 498.50916, p = 0.001277

- Younger Generations: t = 358.30742t, p = 0.0017767

- Women: t = 483.57563, p = 0.0013165

4. Discussion

4.1. Health-Conscious Consumption

4.2. Demographics: The Role of Younger Generations

4.3. Gender Influence: The Role of Women

4.4. Implications for Market Expansion

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Drinking Cultures (Editado por, T. Wilson) Oliver Smith 2007. Volumen 58, número 2 Junio de 2007 Páginas 339-340.

- Balogh, J.; Jámbor, A. The role of culture, language and trade agreements in global wine trade. Agris -Line Pap. Econ. Inform. 2018, 10, 17–29. [Google Scholar] [CrossRef]

- Dreßler, M. Destination-centric wine exports: offering design concepts and sustainability. Beverages 2023, 9, 55. [Google Scholar] [CrossRef]

- Sam, F.; Tengzhen, M.; Salifu, R.; Wang, J.; Jiang, Y.; Zhang, B.; …; Shunyu, H. Techniques for dealcoholization of wines: their impact on wine phenolic composition, volatile composition, and sensory characteristics. Foods 2021, 10, 2498. [Google Scholar] [CrossRef]

- Sam, F.; Tengzhen, M.; Liang, Y.; Qiang, W.; Atuna, R.; Amagloh, F.; …; Shunyu, H. Comparison between membrane and thermal dealcoholization methods: their impact on the chemical parameters, volatile composition, and sensory characteristics of wines. Membranes 2021, 11, 957. [Google Scholar] [CrossRef]

- Catarino, M.; Mendes, A. Dealcoholizing wine by membrane separation processes. Innov. Food Sci. Emerg. Technol. 2011, 12, 330–337. [Google Scholar] [CrossRef]

- AAWE Per capita wine consumption in Spain (1866–2015). American Association of Wine Economists. Available online: https://wine-economics.org/infographic/per-capita-wine-consumption-in-portugal-spain-1866-2015/ (accessed on 20 November 2024).

- Sánchez-García, E. , Martínez-Falcó, J., Alcon-Vila, A., & Marco-Lajara, B. Developing green innovations in the wine industry: an applied analysis. Foods 2023, 12, 1157. [Google Scholar] [PubMed]

- OIV. Organización Internacional de la Viña y el Vino. Available online: https://www.oiv.int/es/what-we-do/country-report?oiv (accessed on 10 November 2024).

- Demanda de vino y bebidas alcohólicas en la Unión Europea: ¿un mercado monolítico? 4: Lorena Mitchell, 2016 Clasificación JEL: D12, F1, F15 Páginas, 2016; D12.

- Cortijo, M. (2023). Sustainability determinants in the iberian wine industry. nm.

- Liu, A.; Song, H. Analysis and forecasts of the demand for imported wine in china. Cornell Hosp. Q. 2021, 62, 371–385. [Google Scholar] [CrossRef]

- Anderson, K.; Pinilla, V. Wine's belated globalization, 1845–2025. Applied Economic Perspectives and Policy 2021, 44, 742–765. [Google Scholar] [CrossRef]

- OEMV Annual wine production and export statistics. Observatorio Español del Mercado del Vino. Available online: https://www.oemv.es/exportaciones-espanolas-de-vino-ano-2023 (accessed on day month year).

- Barisan, L.; Boatto, V.; Rossetto, L.; Salmaso, L. The knowledge of italian wines on export markets. Br. Food J. 2015, 117, 117–138. [Google Scholar] [CrossRef]

- UNCTAD Top 10 wine-exporting countries by volume and value. United Nations Conference on Trade and Development, 2023. Available online: https://unctad.org/publication/world-investment-report-2023 (accessed on day month year).

- Castillo, J.S.; García, M.C. C. Analysis of international competitive positioning of quality wine from Spain. Cienc. Investig. Agrar. 2013, 40, 491–501. [Google Scholar] [CrossRef]

- Behmiri, N.; Correia, L.; Gouveia, S. Drivers of wine production in the european union: a macroeconomic perspective. New Medit 2019, 18, 85–96. [Google Scholar] [CrossRef]

- Sellers, R.; Mas, F. Rentabilidad de las empresas vinculadas a las marcas colectivas en el sector vinícola. Universia Bus. Rev. 2013, 38, 68–83. [Google Scholar]

- OIVE (Organización Interprofesional del Vino de España). Informe 2023. Available online: https://interprofesionaldelvino.es/wp-content/uploads/2024/02/Informe-Relevancia-economica-y-social-del-sector-vitivinicola-en-Espana_2023.pdf (accessed on day month year).

- Alonso, A.; Bressan, A. Micro and small business innovation in a traditional industry. Int. J. Innov. Sci. 2016, 8, 311–330. [Google Scholar] [CrossRef]

- Thomé, K.; Paiva, V.; Gois, T. Wine international market structure and competitiveness. Int. J. Wine Bus. Res. 2023, 35, 561–579. [Google Scholar] [CrossRef]

- OFDT La consommation d’alcool et ses conséquences en France en 2023. Available online: https://www.ofdt.fr/communique-de-presse/la-consommation-d-alcool-et-ses-consequences-en-france-en-2023-2439 (accessed on day month year).

- Gallenti, G.; Troiano, S.; Marangon, F.; Bogoni, P.; Campisi, B.; Cosmina, M. Environmentally sustainable versus aesthetic values motivating millennials’ preferences for wine purchasing: evidence from an experimental analysis in italy. Agric. Food Econ. 2019, 7. [Google Scholar] [CrossRef]

- Sogari, G.; Pucci, T.; Aquilani, B.; Zanni, L. Millennial generation and environmental sustainability: the role of social media in the consumer purchasing behavior for wine. Sustainability 2017, 9, 1911. [Google Scholar] [CrossRef]

- Sogari, G.; Mora, C.; Menozzi, D. Factors driving sustainable choice: the case of wine. Br. Food J. 2016, 118, 632–646. [Google Scholar] [CrossRef]

- EUR-Lex. Reglamento (UE) 2021/2117. Available online: https://eur-lex.europa.eu/legal-content/ES/ALL/?uri=CELEX%3A32021R2117 (accessed on 29 November 2024).

- EUR-Lex Comunicación de la, U.E. Diario Oficial de la UE 15/01/2024. Available online: https://eur-lex.europa.eu/legal-content/ES/TXT/PDF/?uri=OJ:C_202400694 (accessed on 27 November 2024).

- Fraga, H.; Malheiro, A.; Moutinho-Pereira, J.; Santos, J. An overview of climate change impacts on european viticulture. Food Energy Secur. 2012, 1, 94–110. [Google Scholar] [CrossRef]

- Meloni, G. and Swinnen, J. (2016). Bugs, tariffs and colonies: the political economy of the wine trade 186001970. SSRN Electronic Journal.

- Longo, R.; Blackman, J.; Torley, P.; Rogiers, S.; Schmidtke, L. Changes in volatile composition and sensory attributes of wines during alcohol content reduction. J. Sci. Food Agric. 2016, 97, 8–16. [Google Scholar] [CrossRef]

- Ashenfelter, O.; Storchmann, K. Climate change and wine: a review of the economic implications. J. Wine Econ. 2016, 11, 105–138. [Google Scholar] [CrossRef]

- Bianco, A.; Estrella-Orrego, M.; Boatto, V.; Gennari, A. Is mercosur promoting trade? insights from argentinean wine exports. Span. J. Agric. Res. 2017, 15, e0108. [Google Scholar] [CrossRef]

- Benedetto, G.; Corinto, G. The role of women in the sustainability of the wine industry: two case studies in italy. 2015, 173-187.

- Nieto-Villegas, R.; Rabadán, A.; Cañete, R. A gender approach to wine innovation and organic wine preferences. Ciência E Técnica Vitivinícola 2022, 37, 60–70. [Google Scholar] [CrossRef]

- Thach, L.; Lease, T.; Barton, M. Exploring the impact of social media practices on wine sales in us wineries. J. Direct Data Digit. Mark. Pract. 2016, 17, 272–283. [Google Scholar] [CrossRef]

- Statista. Gen Z: The more sober generation; Buchholz, K. Available online: https://www.statista.com/chart/30783/alcohol-consumption-by-generation/ (accessed on 22 November 2024).

- Mintel. UK Lifestyles of Gen Z Consumer Report. Available online: https://store.mintel.com/report/uk-lifestyles-of-generation-z-market-report (accessed on 26 November 2024).

- Saliba, A.; Ovington, L.; Morán, C. Consumer demand for low-alcohol wine in an australian sample. Int. J. Wine Res. 2013, 1. [Google Scholar] [CrossRef]

- Mintel. Gen Z: Sober curious generation. Available online: https://www.mintel.com/insights/food-and-drink/gen-z-sober-curious-generation (accessed on 26 November 2024).

- Gallup. Young adults in U.S. drinking less than in prior decades; Saad, L. Available online: https://news.gallup.com/poll/509690/young-adults-drinking-less-prior-decades.aspx (accessed on 19 November 2024).

- Bose, S.; Hossain, S.; Sobhan, A.; Handley, K. Does female participation in strategic decision-making roles matter for corporate social responsibility performance? Account. Financ. 2022, 62, 4109–4156. [Google Scholar] [CrossRef]

- Burgess, A.; Yeomans, H.; Fenton, A. More options…less time in the hustle culture of generation sensible: Individualization and drinking decline among twenty-first-century young adults. Br. J. Sociol. 2022, 73. [Google Scholar] [CrossRef] [PubMed]

- Liguori, L.; Albanese, D.; Crescitelli, A.; Matteo, M.; Russo, P. Impact of dealcoholization on quality properties in white wine at various alcohol content levels. J. Food Sci. Technol. 2019, 56, 3707–3720. [Google Scholar] [CrossRef]

- Forbes, S. The influence of gender on wine purchasing and consumption. Int. J. Wine Bus. Res. 2012, 24, 146–159. [Google Scholar] [CrossRef]

- Meillon, S.; Urbano, C.; Guillot, G.; Schlich, P. Acceptability of partially dealcoholized wines – measuring the impact of sensory and information cues on overall liking in real-life settings. Food Qual. Prefer. 2010, 21, 763–773. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).