Submitted:

03 December 2025

Posted:

05 December 2025

You are already at the latest version

Abstract

Keywords:

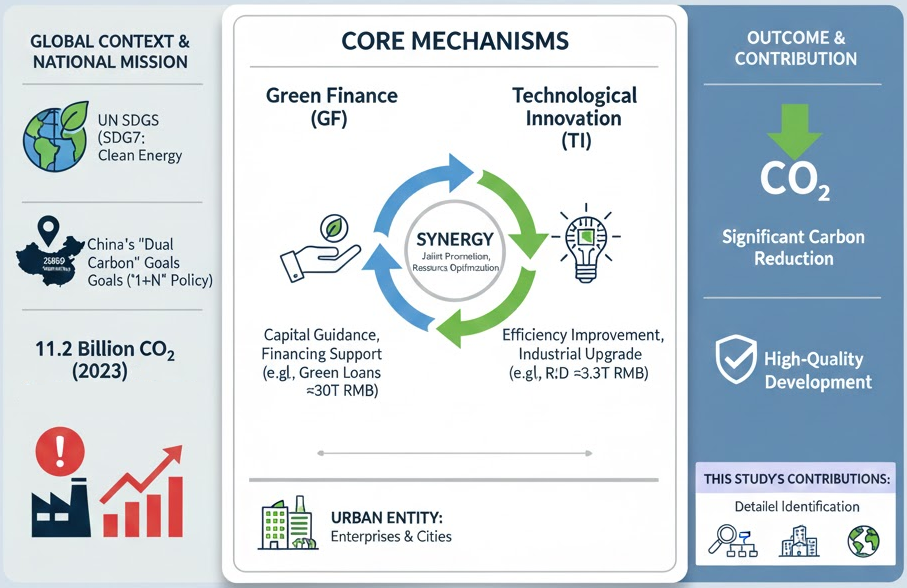

1. Introduction

2. Literature Review and Theoretical Analysis

2.1. Green Finance

2.1.1. The Concept and Development Trend of Green Finance

2.1.2. Green Finance and Carbon Emissions

2.2. Technological Innovation

2.2.1. The Connotation of Technological Innovation

2.3. Green Finance, Technological Innovation and Carbon Reduction

3. Data and Model Setting

3.1. Data Preparation

| Variable | Explain | Data source |

| CO2 | carbon dioxide | China energy statistics yearbook, IEA, |

| GF | Green finance | China Statistical Yearbook, China National Bureau of Statistics, |

| Dig | digital economy | China Statistical Yearbook, China National Bureau of Statistics, |

| GTI | Green technology innovation | Number of green patents (Lg(x+1)) |

| IS | industrial structure | Added value of secondary industry/tertiary industry |

3.1.1. Core Explained Variable: Urban Carbon Emission

| Variable symbol | Variable definition and assignment basis | Unit |

| EC | Total carbon dioxide emissions from energy consumption | Ten thousand tons () |

| i | Industry category (covering primary, secondary and tertiary industries) | \ |

| Eij | The terminal consumption of the first kind of energy in I industry | Kilogram standard coal () |

| rj | Carbon emission coefficient of the first kind of energy | |

| 44/12 | Molecular weight conversion coefficient from carbon (c) to carbon dioxide (c) | \ |

3.1.2. Core Explanatory Variable: The Construction of Green Financial Indicators

3.1.3. Mechanism Variable: The Development Level of Digital Economy

| Primary index | Secondary index | Calculation method |

| Digital economy | Digital inclusive finance index | China Digital inclusive finance Index |

| Internet related output | Per capita telecommunications business volume | |

| Internet penetration | Internet users per 100 people | |

| Number of mobile internet users | Number of mobile phone users per 100 people | |

| Number of internet-related employees | Proportion of computer service and software employees |

| variable | variable declaration | N | Min | Max | Average | Std. | Median |

| CO2 | Log10CO2 emission (ton) | 7416 | 4.970 | 8.488 | 7.197 | 0.483 | 7.249 |

| GF | Green financial index | 7320 | 0.013 | 0.719 | 0.286 | 0.113 | 0.280 |

| Dig | Digital economy index | 6653 | 0.000 | 0.940 | 0.039 | 0.066 | 0.012 |

| GDP | Log10 regional GDP | 6576 | 3.013 | 5.132 | 4.181 | 0.456 | 4.202 |

| GDP1 | Log10 added value of primary industry | 6576 | 2.233 | 3.813 | 3.210 | 0.344 | 3.247 |

| GDP2 | Log10 added value of secondary industry | 6576 | 2.592 | 4.755 | 3.823 | 0.462 | 3.864 |

| GDP3 | Log10 added value of tertiary industry | 6576 | 2.565 | 4.879 | 3.818 | 0.494 | 3.817 |

| POP | population size | 6744 | 2.770 | 8.136 | 5.885 | 0.676 | 5.926 |

| URB | Urbanization rate | 6744 | 0.015 | 1.000 | 0.357 | 0.196 | 0.303 |

| RETAIL | Commodity retail | 6744 | 0.077 | 1.013 | 0.360 | 0.101 | 0.349 |

| EDUEXP | Education expenditure level | 6744 | 0.015 | 0.627 | 0.187 | 0.050 | 0.183 |

| MOBPEN | Mobile phone penetration rate | 6744 | 0.000 | 10.166 | 0.769 | 0.765 | 0.692 |

| ISU | Overall upgrading of industrial structure | 6744 | 1.729 | 2.846 | 2.250 | 0.152 | 2.246 |

| OPEN | Level of opening to the outside world | 6744 | 0.000 | 0.032 | 0.003 | 0.003 | 0.002 |

| HC | Human capital level | 6744 | 0.000 | 0.185 | 0.015 | 0.022 | 0.008 |

| FII | Financial investment | 6744 | 0.010 | 41.677 | 5.132 | 3.664 | 4.268 |

| IS | industrial structure | 6744 | 0.085 | 0.849 | 0.397 | 0.095 | 0.388 |

| HCL | Medical and health level | 6744 | 0.051 | 1.377 | 0.387 | 0.182 | 0.363 |

| ED | Economic density | 6744 | 1.115 | 12.063 | 6.677 | 1.497 | 6.707 |

| GIL | Degree of government intervention | 6744 | 0.027 | 1.027 | 0.168 | 0.099 | 0.143 |

| WHR | Harmless treatment rate of domestic garbage (%) | 6744 | -222.000 | 854.000 | 80.112 | 32.826 | 97.000 |

| LgGF | Lg (Green Finance +1) | 7320 | 0.005 | 0.235 | 0.107 | 0.039 | 0.107 |

| SO2 | Log10_ SO2 emission from industrial SO2 (ton) | 5746 | 2.903 | 7.293 | 6.845 | 0.435 | 6.977 |

| LagGF | Lagging the first phase of green finance | 7015 | 0.041 | 0.657 | 0.281 | 0.110 | 0.276 |

| distance | Log10 Hangzhou spherical distance | 7084 | 1.993 | 3.402 | 2.949 | 0.290 | 3.022 |

| AIS | Advanced industrial structure | 6744 | 0.095 | 6.387 | 0.974 | 0.506 | 0.857 |

| FIL | Future industrial level | 4274 | 0.373 | 3.480 | 1.779 | 0.553 | 1.730 |

| GI | The number of green inventions Sqr obtained in that year | 6704 | 0.000 | 75.875 | 3.654 | 5.795 | 2.000 |

3.2. Model Assumptions

3.2.1. Benchmark Regression Model

3.2.2. Interaction Effect Model

3.2.3. Intermediary Variable Model

4. Empirical Analysis

4.1. Benchmark Regression

4.2. Robustness Test

4.2.1. Replacing Core Explanatory Variables

4.2.2. Replace the Interpreted Variable

4.2.3. Eliminate Sudden Point Regression

4.3. Endogenous Problem Handling

4.3.1. Tool Variable Method

4.4. Mechanism Analysis

4.4.1. Intermediary Effect

4.4.2. Synergistic Emission Reduction Effect

4.5. Heterogeneity Analysis

4.5.1. Grouping Regression

4.6. Quantile Regression

5. Conclusions and Policy Recommendations

5.1. Main Conclusions

5.2. Policy Recommendations

Funding

Data Availability Statement

Conflicts of Interest

References

- United Nations. (2015).Transforming our world: The 2030 Agenda for Sustainable Development.https://sdgs.un.org/2030agenda.

- The Central Committee of the Communist Party of China,&the State Council. (2021). Opinions on completely, accurately and comprehensively implementing the new development concept and doing a good job in carbon neutrality in peak carbon dioxide emissions. Chinese Government Network.https://www.gov.cn/zhengce/2021-10/24/content_5644613.htm.

- People’s Bank of China, Ministry of Finance, Development and Reform Commission, Ministry of Environmental Protection, China Banking Regulatory Commission, China Securities Regulatory Commission and China Insurance Regulatory Commission. (2016). Guiding Opinions on Building a Green Financial System. China Government Network.https://www.gov.cn/xinwen/2016-09/01/content_5104132.htm.

- National People’s Congress. (2021). The 14th Five-year Plan for People’s Republic of China (PRC)’s National Economic and Social Development and the Outline of the Long-term Goals in 2035. China Government Network.https://www.gov.cn/xinwen/2021-03/13/content_5592681.htm.

- Ministry of Science and Technology, et al. (2022). The 14th Five-Year National Science and Technology Innovation Plan. China Government Network.https://www.gov.cn/zhengce/content/2022-04/01/content_5682976.htm.

- National Bureau of Statistics. (2024). Statistical Bulletin on National Economic and Social Development in 2023. National Bureau of Statistics Network.https://www.stats.gov.cn/sj/zxfb/202402/t20240228_1947915.html.

- People’s Bank of China. (2024). China Green Finance Development Report in 2023. China People’s Bank Network.http://www.pbc.gov.cn/goutongjiaoliu/113456/113469/5377065/index.html.

- Ministry of Science and Technology, et al. (2025). Statistical Bulletin of National Science and Technology Investment in 2024. Chinese Government Network.Statistical Bulletin of National Science and Technology Investment in 2024-Ministry of Science and Technology of the People’s Republic of China.

- China National Intellectual Property Administration. (2024). Patent Statistics Annual Report of China in 2023 [Data Statistics Column]. China National Intellectual Property Administration Net.https://www.cnipa.gov.cn/col/col61/index.html.

- Ministry of Industry and Information Technology. (2024). China Industrial Green Development Report in 2023 [Interpretation/Release]. Ministry of Industry and Information Technology Network.https://www.miit.gov.cn/jgsj/jns/index.html.

- International Energy Agency (IEA). (2024).CO2 emissions in 2023: A new record high, but is the peak in sight? .https://www.iea.org/reports/co2-emissions-in-2023.

- Li, H.; Chen, C.; Umair, M. Green finance, enterprise energy efficiency, and green total factor productivity: evidence from China. Sustainability 2023, 15(14), 11065. [Google Scholar] [CrossRef]

- Yan, M.; Gong, X. Impact of green credit on green finance and corporate emissions reduction. Finance Research Letters 2024, 60, 104900. [Google Scholar] [CrossRef]

- Lin, Z.; Liao, X.; Jia, H. Could green finance facilitate low-carbon transformation of power generation? Some evidence from China. International Journal of Climate Change Strategies and Management 2023, 15(2), 141–158. [Google Scholar] [CrossRef]

- Chen, M.; Song, L.; Zhu, X.; Zhu, Y.; Liu, C. Does green finance promote the green transformation of China’s manufacturing industry? Sustainability 2023, 15(8), 6614. [Google Scholar] [CrossRef]

- Zhang, M.; Li, B.; Yin, S. Is technological innovation effective for energy saving and carbon emissions reduction? Evidence from China. Ieee Access 2020, 8, 83524–83537. [Google Scholar] [CrossRef]

- Liu, Y.; Tang, L.; Liu, G. Carbon dioxide emissions reduction through technological innovation: Empirical evidence from Chinese provinces. International Journal of Environmental Research and Public Health 2022, 19(15), 9543. [Google Scholar] [CrossRef] [PubMed]

- Zhang, H.; Wang, Y.; Wang, W. Does renewable energy technology innovation achieve the synergistic effect of pollution and carbon reduction? In Renewable Energy; 2025; p. 123329. [Google Scholar]

- Wang, X.; Su, H.; Liu, X. The impact of green technological innovation on industrial structural optimization under dual-carbon targets: The role of the moderating effect of ca rbon emission efficiency. Sustainability 2025, 17(14), 6313. [Google Scholar] [CrossRef]

- Zhu, X. Have carbon emissions been reduced due to the upgrading of industrial structure? Analysis of the mediating effect based on technological innovation. Environmental Science and Pollution Research 2022, 29(36), 54890–54901. [Google Scholar] [CrossRef]

- Zhang, L.; Saydaliev, H. B.; Ma, X. Does green finance investment and technological innovation improve renewable energy efficiency and sustainable development goals. Renewable Energy 2022, 193, 991–1000. [Google Scholar] [CrossRef]

- Kumar, B.; Kumar, L.; Kumar, A.; Kumari, R.; Tagar, U.; Sassanelli, C. Green finance in circular economy: a literature review. Environment, development and sustainability 2024, 26(7), 16419–16459. [Google Scholar] [CrossRef]

- Zhang, Y. Role of green finance, green bonds, public private partnership, and technology innovation in carbon neutrality and sustainable development. Heliyon 2024, 10(18). [Google Scholar] [CrossRef]

- Nasir, N.; Ahmed, W. Green finance initiatives and their potential to drive sustainable development. In InClimate change and finance: navigating the challenges and opportuni ties in capital markets; Springer Nature Switzerland: Cham, 2024; pp. 3–29. [Google Scholar]

- Fu, C.; Lu, L.; Pirabi, M. Advancing green finance: a review of sustainable development. Digital Economy and Sustainable Development 2023, 1(1), 20. [Google Scholar] [CrossRef]

- Nedopil, C., & Song.

- Ahmad, F., Boumaiza, A., Sanfilippo, A., & Al-Fagih, L. (2025). A Detailed Comprehensive Role of Digital Technologies in Green Finance Initiative for Net-Zero Energy Transition.Advanced Energy and Sustainability Research, 2500066.

- Xiao, Y.; Lin, M.; Wang, L. Impact of green digital finance on sustainable development: evidence from China’s pilot zones. Financial Innovation 2024, 10(1), 1–32. [Google Scholar] [CrossRef]

- Liu, W.; Zhu, P. The impact of green finance on the intensity and efficiency of carbon emissions: the moderating effect of the digital economy. Frontiers in Environmental Science 2024, 12, 1362932. [Google Scholar] [CrossRef]

- Xianfeng, Han; Jian, Xiao; Mingfang, Dong. The carbon reduction effect of green finance development. Resource Science 2023, 45(04), 843–856. [Google Scholar]

- Ran, C.; Zhang, Y. The driving force of carbon emissions reduction in China: Does green finance work. Journal of Cleaner Production 2023, 421, 138502. [Google Scholar] [CrossRef]

- Umar, M.; Safi, A. Do green finance and innovation matter for environmental protection? A case of OECD economies. Energy Economics 2023, 119, 106560. [Google Scholar] [CrossRef]

- Wang, Y.; Cui, L.; Zhou, J. The impact of green finance and digital economy on regional carbon emission reduction. International Review of Economics & Finance 2025, 97, 103748. [Google Scholar]

- Chen, Xiaolong; Wang, Guanghui; Liang, Chenlu. Beyond traditional pathways: How green finance drives dual carbon-pollution reduction by heterogeneous innovation and spatial spillovers in Chinese ci ties. Journal of Cleaner Production 2025, 530, 146812–146812. [Google Scholar] [CrossRef]

- Hou, Mengyang; Xie, Yalin; Lu, Weinan; Cui, Xuehua; Xi, Zenglei; Han, Yuxin. Green finance drives the synergy of pollution control and carbon reduction in China: Dual perspective of effect and efficiency. Energy 2025, 330, 136873–136873. [Google Scholar] [CrossRef]

- Wu, G.; Liu, X.; Cai, Y. The impact of green finance on carbon emission efficiency. Heliyon 2024, 10(1). [Google Scholar] [CrossRef]

- Huang, J.; He, W.; Dong, X.; Wang, Q.; Wu, J. How does green finance reduce China’s carbon emissions by fostering green technology innovation? Energy 2024, 298, 131266. [Google Scholar] [CrossRef]

- Sharif, A.; Saqib, N.; Dong, K.; Khan, S. A. R. Nexus between green technology innovation, green financing, and CO2 emissions in the G7 countries: the moderating role of social globalisation. Sustainable Development 2022, 30(6), 1934–1946. [Google Scholar] [CrossRef]

- Sethi, L.; Behera, B.; Sethi, N. Do green finance, green technology innovation, and institutional quality help achieve environmental sustainability? Evidence from the developing economies. Sustainable Development 2024, 32(3), 2709–2723. [Google Scholar] [CrossRef]

- Chen, D.; Hu, H.; Chang, C. P. Green finance, environment regulation, and industrial green transformation for corporate social responsibility. Corporate Social Responsibility and Environmental Management 2023, 30(5), 2166–2181. [Google Scholar] [CrossRef]

- Wang, X.; Wang, Q. Research on the impact of green finance on the upgrading of China’s regional industrial structure from the perspective of sustainable development. Resources Policy 2021, 74, 102436. [Google Scholar] [CrossRef]

- Lin, H.; Chen, J.; Cai, Z. To What Extent Does Green Finance Influence Carbon Intensity: The Role of Green Innovation and Industrial Structure. International Journal of Finance & Economics 2024. [Google Scholar]

- Lu, Y.; Xia, Z. Digital inclusive finance, green technological innovation, and carbon emissions from a spatial perspective. Scientific Reports 2024, 14(1), 8454. [Google Scholar] [CrossRef] [PubMed]

- Li, K.; Lin, W.; Jiang, T.; Mao, Y.; Shi, W. Driving carbon emission reduction in China through green finance and green innovation: an endogenous growth perspective. Environmental Science and Pollution Research 2024, 31(9), 14318–14332. [Google Scholar] [CrossRef]

- Hu, J. Synergistic effect of pollution reduction and carbon emission mitigation in the digital economy. Journal of environmental management 2023, 337, 117755. [Google Scholar] [CrossRef]

- Shang, Y.; Raza, S. A.; Huo, Z.; Shahzad, U.; Zhao, X. Does enterprise digital transformation contribute to the carbon emission reduction? Micro-level evidence from China. International Review of Economics & Finance 2023, 86, 1–13. [Google Scholar] [CrossRef]

- Chen, J.; Guo, Z.; Lei, Z. Research on the mechanisms of the digital transformation of manufacturing enterprises for carbon emissions reduction. Journal of Cleaner Production 2024, 449, 141817. [Google Scholar] [CrossRef]

- Lin, B.; Ma, R. Green technology innovations, urban innovation environment and CO2 emission reduction in China: Fresh evidence from a partially linear functional-coefficient panel model. Technological forecasting and social change 2022, 176, 121434. [Google Scholar] [CrossRef]

- Li, H.; Su, Y.; Ding, C. J.; Tian, G. G.; Wu, Z. Unveiling the green innovation paradox: Exploring the impact of carbon emission reduction on corporate green technology innovation. Technological Forecasting and Social Change 2024, 207, 123562. [Google Scholar] [CrossRef]

- OECD. OECD Digital Economy Outlook 2020; OECD Publishing, 2020. [Google Scholar] [CrossRef]

- Williams, L. D. Concepts of Digital Economy and Industry 4.0 in Intelligent and information systems. International Journal of Intelligent Networks 2021, 2, 122–129. [Google Scholar] [CrossRef]

- Xia, L.; Baghaie, S.; Sajadi, S. M. The digital economy: Challenges and opportunities in the new era of technology and electronic communications. Ain Shams Engineering Journal 2024, 15(2), 102411. [Google Scholar] [CrossRef]

- SHI, Y. Digital economy: Development and future. Bulletin of Chinese Academy of Sciences (Chinese Version) 2022, 37(1), 78–87. [Google Scholar]

- Chang, X.; Yang, Z.; Abdullah. Digital economy, innovation factor allocation and industrial structure transformation—A case study of the Yangtze River Delta city cluster in China. Plos one 2024, 19(4), e0300788. [Google Scholar] [CrossRef]

- Hao, X.; Li, Y.; Ren, S.; Wu, H.; Hao, Y. The role of digitalization on green economic growth: Does industrial structure optimization and green innovation matter? Journal of environmental management 2023, 325, 116504. [Google Scholar] [CrossRef] [PubMed]

- China Institute of Information and Communication. (2024). White Paper on Global Digital Economy (2024).http://www.caict.ac.cn/kxyj/qwfb/bps/202407/t20240705_484245.htm.

- Nosova, S.; Norkina, A.; Makar, S.; Fadeicheva, G. Digital transformation as a new paradigm of economic policy. Procedia Computer Science 2021, 190, 657–665. [Google Scholar] [CrossRef]

- Bresciani, S.; Huarng, K. H.; Malhotra, A.; Ferraris, A. Digital transformation as a springboard for product, process and business model innovation. Journal of Business Research 2021, 128, 204–210. [Google Scholar] [CrossRef]

- Favoretto, C.; Mendes, G. H. D. S.; Filho, M. G.; Gouvea de Oliveira, M.; Ganga, G. M. D. Digital transformation of business model in manufacturing companies: challenges and research agenda. Journal of Business & Industrial Marketing 2022, 37(4), 748–767. [Google Scholar]

- Marcon, É.; Le Dain, M. A.; Frank, A. G. Designing business models for Industry 4.0 technologies provision: Changes in business dimensions through digital transformation. Technological Forecasting and Social Change 2022, 185, 122078. [Google Scholar] [CrossRef]

- Xue, J.; Li, G.; Ivanov, D. Digital transformation in the blockchain era: Balancing efficiency and resilience in operations management. International Journal of Production Economics 2025, 282, 109525. [Google Scholar] [CrossRef]

- He, Z.; Huang, H.; Choi, H.; Bilgihan, A. Building organizational resilience with digital transformation. Journal of Service Management 2023, 34(1), 147–171. [Google Scholar] [CrossRef]

- Chen, J.; Guo, Z.; Lei, Z. Research on the mechanisms of the digital transformation of manufacturing enterprises for carbon emissions reduction. Journal of Cleaner Production 2024, 449, 141817. [Google Scholar] [CrossRef]

- Zhao, Y.; Xia, S.; Zhang, J.; Hu, Y.; Wu, M. Effect of the digital transformation of power system on renewable energy utilization in China. Ieee Access 2021, 9, 96201–96209. [Google Scholar] [CrossRef]

- UNEP. (2018). Inclusive green economy report. United Nations Environment Programme.

- https://www.unep.org/.

- Shan, S.; Genç, S. Y.; Kamran, H. W.; Dinca, G. Role of green technology innovation and renewable energy in carbon neutrality: A sustainable investigation from Turkey. Journal of environmental management 2021, 294, 113004. [Google Scholar] [CrossRef] [PubMed]

- Wang, Z.; Sami, F.; Khan, S.; Alamri, A. M.; Zaidan, A. M. Green innovation and low carbon emission in OECD economies: Sustainable energy technology role in carbon neutrality target. Sustainable Energy Technologies and Assessments 2023, 59, 103401. [Google Scholar] [CrossRef]

- OECD. Green innovation and industrial transition. In Organisation for Economic Co-operation and Development; 2021. [Google Scholar]

- https://www.oecd.org/.

- WIPO. Green technology book: Solutions for climate change; World Intellectual Property Organization, 2022. [Google Scholar]

- https://www.wipo.int/.

- Marín-Vinuesa, L. M.; Scarpellini, S.; Portillo-Tarragona, P.; Moneva, J. M. The impact of eco-innovation on performance through the measurement of financial resources and green patents. Organization & Environment 2020, 33(2), 285–310. [Google Scholar]

- IPCC. (2022). Climate change 2022: Mitigation of climate change. Contribution of Working Group III to the IPCC Sixth Assessment Report. Intergovernmental Panel on Climate Change.

- https://www.ipcc.ch/report/ar6/wg3/.

- Yu, C. H.; Wu, X.; Zhang, D.; Chen, S.; Zhao, J. Demand for green finance: Resolving financing constraints on green innovation in China. Energy policy 2021, 153, 112255. [Google Scholar] [CrossRef]

- Hasan, M. M.; Du, F. Nexus between green financial development, green technological innovation and environmental regulation in China. Renewable Energy 2023, 204, 218–228. [Google Scholar] [CrossRef]

- Wang, T.; Liu, X.; Wang, H. Green bonds, financing constraints, and green innovation. Journal of Cleaner Production 2022, 381, 135134. [Google Scholar] [CrossRef]

- Wang, Y.; Lei, X.; Long, R.; Zhao, J. Green credit, financial constraint, and capital investment: Evidence from China’s energy-intensive enterprises. Environmental Management 2020, 66(6), 1059–1071. [Google Scholar] [CrossRef]

- Hao, Y.; Ye, B.; Gao, M.; Wang, Z.; Chen, W.; Xiao, Z.; Wu, H. How does ecology of finance affect financial constraints? Empirical evidence from Chinese listed energy-and pollution-intensive companies. Journal of Cleaner Production 2020, 246, 119061. [Google Scholar] [CrossRef]

- Gao, J.; Wu, D.; Xiao, Q.; Randhawa, A.; Liu, Q.; Zhang, T. Green finance, environmental pollution and high-quality economic development—a study based on China’s provincial panel data. Environmental Science and Pollution Research 2023, 30(11), 31954–31976. [Google Scholar] [CrossRef]

- Ge, T.; Cai, X.; Song, X. How does renewable energy technology innovation affect the upgrading of industrial structure? The moderating effect of green finance. Renewable Energy 2022, 197, 1106–1114. [Google Scholar] [CrossRef]

- Wang, Y.; Zhao, N.; Lei, X.; Long, R. Green finance innovation and regional green development. Sustainability 2021, 13(15), 8230. [Google Scholar] [CrossRef]

- Kong, T.; Sun, R.; Sun, G.; Song, Y. Effects of digital finance on green innovation considering information asymmetry: An empirical study based on Chinese listed firms. Emerging Markets Finance and Trade 2022, 58(15), 4399–4411. [Google Scholar] [CrossRef]

- Du, M.; Zhang, R.; Chai, S.; Li, Q.; Sun, R.; Chu, W. Can green finance policies stimulate technological innovation and financial performance? Evidence from Chinese listed green enterprises. Sustainability 2022, 14(15), 9287. [Google Scholar] [CrossRef]

- Irfan, M.; Razzaq, A.; Sharif, A.; Yang, X. Influence mechanism between green finance and green innovation: exploring regional policy intervention effects in China. Technological Forecasting and Social Change 2022, 182, 121882. [Google Scholar] [CrossRef]

- Wang, X.; Wang, Q. Research on the impact of green finance on the upgrading of China’s regional industrial structure from the perspective of sustainable development. Resources Policy 2021, 74, 102436. [Google Scholar] [CrossRef]

- Lee, C. C.; Wang, C. S.; He, Z.; Xing, W. W.; Wang, K. How does green finance affect energy efficiency? The role of green technology innovation and energy structure. Renewable Energy 2023, 219, 119417. [Google Scholar] [CrossRef]

- Sharif, A.; Saqib, N.; Dong, K.; Khan, S. A. R. Nexus between green technology innovation, green financing, and CO2 emissions in the G7 countries: the moderating role of social globalisation. Sustainable Development 2022, 30(6), 1934–1946. [Google Scholar] [CrossRef]

- Sethi, L.; Behera, B.; Sethi, N. Do green finance, green technology innovation, and institutional quality help achieve environmental sustainability? Evidence from the developing economies. Sustainable Development 2024, 32(3), 2709–2723. [Google Scholar] [CrossRef]

- Wang, Q.; Zhang, F. Does increasing investment in research and development promote economic growth decoupling from carbon emission growth? An empirical analysis of BRICS countries. Journal of Cleaner Production 2020, 252, 119853. [Google Scholar] [CrossRef]

- Shan, Y.; Huang, Q.; Guan, D.; Hubacek, K. China CO2 emission accounts 2016–2017. Scientific data 2020, 7(1), 54. [Google Scholar] [CrossRef]

- Feng Zixuan, Jiang Guoliang, Xu Yi, Song Jian & Zhao Fang. (2025). Spatial and temporal evolution characteristics and influencing factors of the coupling and coordination of green finance and new energy development. Geographical Science, 45(07), 1536-1548. [CrossRef]

- Zhao Tao, Zhang Zhi & Liang Shangkun. (2020). Digital Economy, Entrepreneurial Activity and Highquality Development -Empirical Evidence from China. Managing the World, 36(10), 65- 76. [CrossRef]

- Yi, M.; Liu, Y.; Sheng, M. S.; Wen, L. Effects of digital economy on carbon emission reduction: New evidence from China. Energy Policy 2022, 171, 113271. [Google Scholar] [CrossRef]

- Liu, W.; Zhu, P. The impact of green finance on the intensity and efficiency of carbon emissions: the moderating effect of the digital economy. Frontiers in Environmental Science 2024, 12, 1362932. [Google Scholar] [CrossRef]

- Wu, X. Q.; Wen, H. X.; Nie, P. Y.; Gao, J. X. Utilizing green finance to promote low-carbon transition of Chinese cities: insights from technological innovation and industrial structure adjustment. Scientific Reports 2024, 14(1), 16844. [Google Scholar] [CrossRef] [PubMed]

- Li Jing, Chen Shu, Wan Guanghua & Fu Chen Mei. (2014). Spatial correlation of regional economic growth in China and its explanation-based on network analysis method. Economic Research, 49(11), 4-16.

- Yu Yongjun, Lu Yuqi. (2005). Study on the Centrality of Provincial Capital Cities. Economic Geography, (03), 352-357. [CrossRef]

- Wei Hai-hai, Zhang Pei-kang & Du Yuhong. (2020). How robots reshape the urban labor market: from the perspective of migration tasks. Economic trends, (10), 92-109.

- Li Xiangyang, Chloe Wang & Zhang Yuxin. (2024). Temporal and spatial evolution pattern and its influencing factors of the development of new quality productivity in the Yangtze River Economic Belt. Resources and Environment in the Yangtze River Basin, 33(05), 909-923.

- The State Council. (2013). National Sustainable Development Plan for Resource-based Cities (2013-2020). https://www.gov.cn/zwgk/2013-12/03/content_2540070.htm.

| Primary index | Secondary index | Calculation method |

| Green finance | Green credit | Total credit of environmental protection projects in this province/total credit of this province. |

| Green investment | Investment in environmental pollution control /GDP | |

| Green insurance | Environmental pollution liability insurance income/total premium income | |

| Green bond | Total amount of green bonds issued/total amount of all bonds issued | |

| Green support | Financial environmental protection expenditure/financial budget expenditure | |

| Green fund | Total market value of green funds/total market value of all funds | |

| Green rights and interests | Total amount of carbon trading, energy use right trading, emission right trading/equity market trading. |

| Variable | CO2 | CO2 |

| (1) | (2) | |

| Cons | 5.943*** (50.536) |

6.289*** (58.166) |

| GF | -0.184*** (-4.366) |

|

| Dig | -0.108*** (-3.580) |

|

| Region and time fixed | YES | YES |

| Control variable | YES | YES |

| R2 | 0.315 | 0.125 |

| N | 6653 | 6648 |

| Test | F(7,6342)=35.643,p=0.000*** | F(5,6343)=31.974,p=0.000*** |

| Variable | CO2 |

| Cons | 6.268*** (56.338) |

| lgGF | -0.471*** (-3.468) |

| Control variable | YES |

| Region and time fixed | YES |

| R2 | 0.151 |

| N | 6648 |

| Test | F(7,6341)=24.122,p=0.000*** |

| Variable | SO2 |

| Cons | 6.614*** (36.517) |

| GF | -0.403*** (-6.068) |

| Control variable | YES |

| Region and time fixed | YES |

| R2 | 0.107 |

| N | 5092 |

| Test | F(11,5060)=71.347,p=0.000*** |

| Variable | CO2 |

| Cons | 6.171*** (49.183) |

| GF | -0.163*** (-3.457) |

| Control variable | YES |

| Region and time fixed | YES |

| R2 | 0.152 |

| N | 5817 |

| Test | F(8,5512)=18.944,p=0.000*** |

| Variable | GF (1) |

CO2 (2) |

|---|---|---|

| Cons | -0.338** (-2.716) |

-30.607*** (-18.441) |

| GF | / | -0.285*** (-5.174) |

| LagGF | 0.989*** (240.924) |

/ |

| N | 6371 | 6371 |

| Region and time fixed | YES | YES |

| R2 | 0.941 | 0.330 |

| Test | F(5,6365)=20248.786,p=0.000*** | χ2(5)=3137.772,p=0.000*** |

| variable | GF (1) |

CO2 (2) |

|---|---|---|

| Cons | -18.449*** (-33.539) |

-65.918*** (-4.196) |

| GF | / | -2.221** (-2.705) |

| Distance | -0.022*** (-5.095) |

/ |

| N | 6348 | 6348 |

| R2 | 0.394 | 0.316 |

| Test | F(10,6337)=411.876,p=0.000*** | χ2(10)=4581.182,p=0.000*** |

| variable | CO2 (1) |

AIS (2) |

CO2 (3) |

|---|---|---|---|

| Cons | -31.701*** (-14.216) |

-24.163*** (-9.016) |

-35.838*** (-16.322) |

| GF | -0.471*** (-9.786) |

0.797*** (13.775) |

-0.335*** (-7.004) |

| AIS | -0.171*** (-17.128) |

||

| Region and time fixed | YES | YES | YES |

| Control variable | YES | YES | YES |

| N | 6648 | 6648 | 6648 |

| R2 | 0.449 | 0.335 | 0.472 |

| Test | F(10,6637)=541.177, p=0.000*** | F(10,6637)=333.737, p=0.000*** | F(11,6636)=540.320, p=0.000*** |

| Variable | CO2 (1) |

FIL (2) |

CO2 (3) |

|---|---|---|---|

| Cons | 4.994*** (49.598) |

-2.168*** (-14.594) |

5.146*** (50.112) |

| GF | -0.257*** (-5.327) |

0.374*** (5.246) |

-0.283*** (-5.879) |

| FIL | 0.070*** (6.705) |

||

| Region and time fixed | YES | YES | YES |

| Control variable | YES | YES | YES |

| N | 4210 | 4210 | 4210 |

| R2 | 0.401 | 0.315 | 0.408 |

| Test | F(8,4201)=351.902, p=0.000*** | F(8,4201)=241.625, p=0.000*** | F(9,4200)=321.071, p=0.000*** |

| variable | CO2 (1) |

GI (2) |

CO2 (3) |

|---|---|---|---|

| Cons | -28.993*** (-14.064) |

-204.857*** (-8.249) |

-30.004*** (-14.501) |

| GF | -0.198*** (-4.285) |

2.053*** (3.688) |

-0.188*** (-4.068) |

| GI | -0.005*** (-4.721) |

||

| Region and time fixed | YES | YES | YES |

| Control variable | YES | YES | YES |

| N | 6288 | 6288 | 6288 |

| R2 | 0.476 | 0.630 | 0.478 |

| Test | F(11,6276)=518.302, p=0.000*** | F(11,6276)=972.366, p=0.000*** | F(12,6275)=478.579, p=0.000*** |

| variable | CO2 |

| Cons | 5.996*** (44.896) |

| GF*Dig | -0.339*** (-4.726) |

| Control variable | YES |

| R2 | 0.222 |

| N | 5910 |

| Test | F(7,5631)=24.784,p=0.000*** |

| Variable | entirety | Beijing-Tianjin-Hebei Urban Agglomeration | Yangtze river delta urban agglomeration | triangle of central china |

|---|---|---|---|---|

| Cons | 49.023*** (7.762) |

131.236*** (3.351) |

78.833*** (9.765) |

-53.214** (-2.621) |

| GF | -0.488** (-2.736) |

1.496*** (3.459) |

-1.308*** (-4.133) |

-1.099* (-2.205) |

| Region and time fixed | YES | YES | YES | YES |

| Control variable | YES | YES | YES | YES |

| N | 2232 | 264 | 960 | 1008 |

| R2 | 0.190 | 0.236 | 0.383 | 0.108 |

| Test | F(4,2227)=130.367, p=0.000*** | F(4,259)=20.027, p=0.000*** | F(4,955)=148.226, p=0.000*** | F(4,1003)=30.301, p=0.000*** |

| Variable | entirety | LD | HD |

| Cons | -45.541*** (-14.114) |

-22.107*** (-3.732) |

-11.511* (-2.147) |

| GF | -0.250*** (-3.584) |

0.080 (0.611) |

-0.410*** (-5.491) |

| Region and time fixed | YES | YES | YES |

| Control variable | YES | YES | YES |

| N | 2974 | 1174 | 1800 |

| R2 | 0.514 | 0.451 | 0.409 |

| Test | F(9,2964)=348.161, p=0.000*** | F(9,1164)=106.240, p=0.000*** | F(9,1790)=137.381, p=0.000*** |

| Variable | Entirety | RC | NRC |

| Cons | -5.522** (-3.111) |

-28.029*** (-9.986) |

9.154*** (4.154) |

| GF | -0.374*** (-7.560) |

-1.055*** (-13.697) |

0.084 (1.362) |

| Control variable | YES | YES | YES |

| N | 6648 | 2472 | 4176 |

| R2 | 0.433 | 0.385 | 0.504 |

| Test | F(9,6638)=563.387, p=0.000*** | F(9,2462)=171.530, p=0.000*** | F(9,4166)=470.776, p=0.000*** |

| Variable | 0.100 | 0.200 | 0.300 | 0.700 | 0.800 | 0.900 |

| Cons | -16.625*** (-5.460) |

-19.419*** (-6.960) |

-15.551*** (-6.298) |

-19.157*** (-10.105) |

-20.598*** (-9.477) |

-20.533*** (-9.711) |

| GF | -0.273*** (-3.433) |

-0.255*** (-3.323) |

-0.209** (-3.043) |

-0.457*** (-7.689) |

-0.426*** (-5.990) |

-0.339*** (-4.385) |

| Control variable | YES | YES | YES | YES | YES | YES |

| N | 6648 | 6648 | 6648 | 6648 | 6648 | 6648 |

| R2 | 0.283 | 0.259 | 0.237 | 0.214 | 0.205 | 0.200 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).