Submitted:

02 July 2025

Posted:

25 July 2025

You are already at the latest version

Abstract

Keywords:

1. Introduction

2. Literature Review

2.1. The Concept of Digital Finance

2.2. The Concept of Green Economic Efficiency

2.3. The Development of Green Economic Efficiency Measurement Methods

2.4. The Impact of Digital Finance on the Efficiency of Green Economy

2.5. Research Review

3. Index System Construction, Data Selection and Model Setting.

3.1. Digital Finance Index System Construction

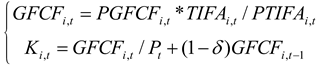

3.1.1. Measurement of Digital Finance

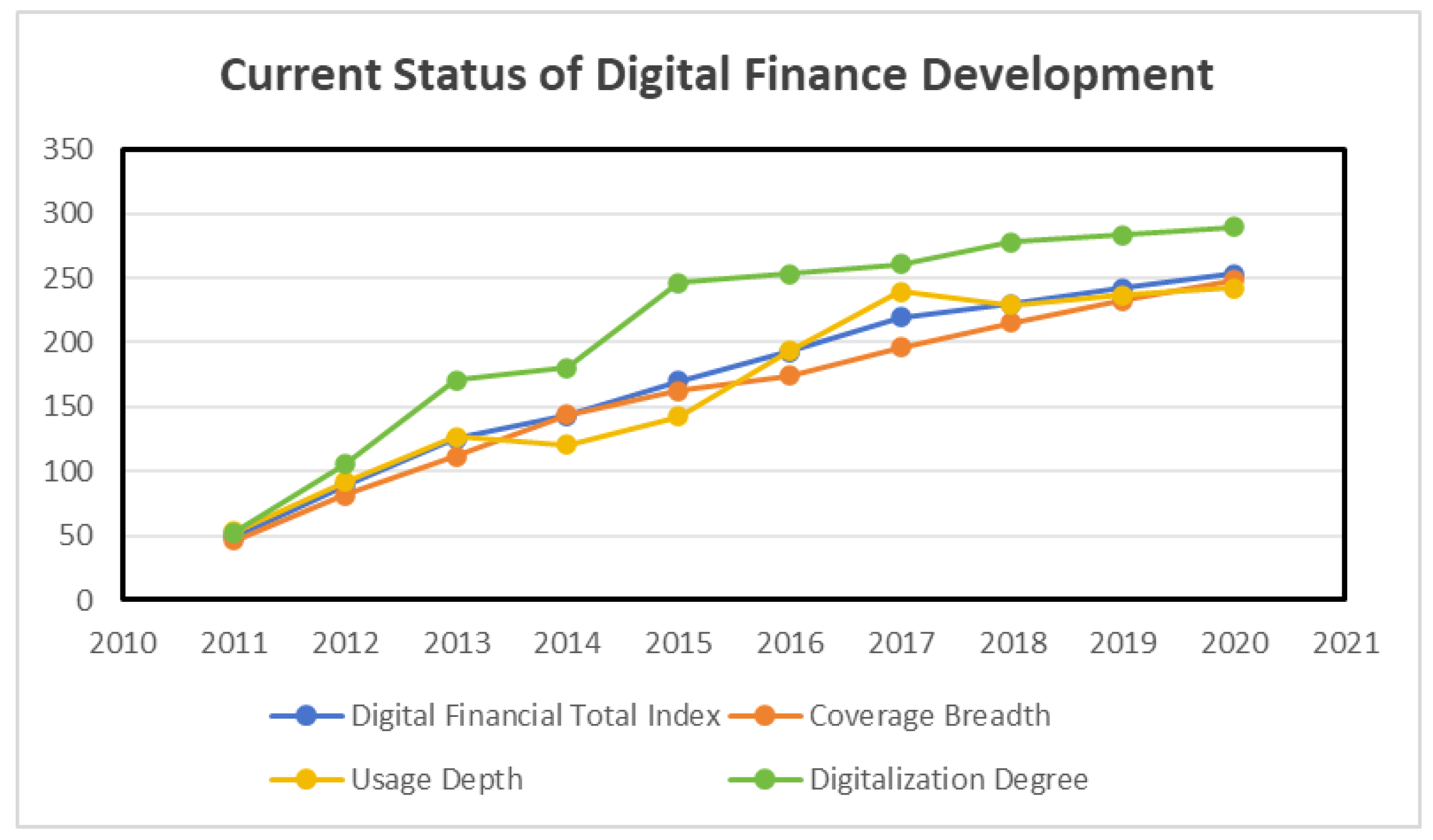

3.1.2. Development Status of Digital Finance

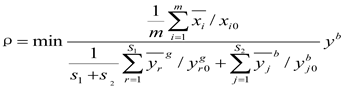

3.2. Measurement of Green Economic Efficiency

3.3. Selection of Other Variables and Data Sources

3.3.1. Control Variables

3.3.2. Data Sources

| Variable type | variable | average/mean value | standard deviation | minimum value | median | maximum | Observational measurement |

| Explained variable | 0.3363 | 0.1265 | 0.1584 | 0.3115 | 1.0064 | 2710 | |

| Explanatory variable | 175.53 | 67.9769 | 35.54 | 185.685 | 296.09 | 2710 | |

| Control variable | 0.0215 | 0.026 | -0.0803 | 0.0152 | 0.1297 | 2710 | |

| 0.018 | 0.02 | 0.0009 | 0.0108 | 0.0986 | 2710 | ||

| 0.0051 | 0.002 | 0.0004 | 0.0048 | 0.0154 | 2710 | ||

| 0.0001 | 0.0001 | 0 | 0.0001 | 0.0004 | 2710 | ||

| 7.30E+03 | 1.00E+04 | 139 | 4.20E+03 | 7.10E+04 | 2710 | ||

| 0.1763 | 0.038 | 0.0908 | 0.1751 | 0.271 | 2710 | ||

| 0.0166 | 0.0152 | 0.0014 | 0.0117 | 0.0795 | 2710 | ||

| 0.5697 | 0.1443 | 0.2886 | 0.5482 | 0.9498 | 2710 | ||

| 478.0212 | 499.2681 | 23.2172 | 344.2498 | 3.40E+03 | 2710 | ||

| 0.0025 | 0.0011 | 0.0009 | 0.0022 | 0.0063 | 2710 |

4. Digital Finance and Green Economy Efficiency Model Design

4.1. OLS Regression Model Design

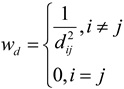

4.2. Digital Finance’s Spatial Dobbin Model Design for Green Economic Efficiency

| Statistical test method | Statistical value | P value |

| 86.187 | 0.000 | |

| 841.581 | 0.000 | |

| 711.109 | 0.000 | |

| 238.867 | 0.000 | |

| 108.395 | 0.000 | |

| 93.80 | 0.000 | |

| 84.53 | 0.000 | |

| 93.80 | 0.000 | |

| 89.02 | 0.000 | |

| 638.60 | 0.000 | |

| 45.62 | 0.001 | |

| 4330.11 | 0.000 |

5. Empirical Analysis

5.1. Descriptive Statistics

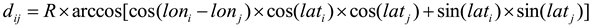

5.1.1. Spatial and Temporal Evolution Analysis of Green Economic Efficiency

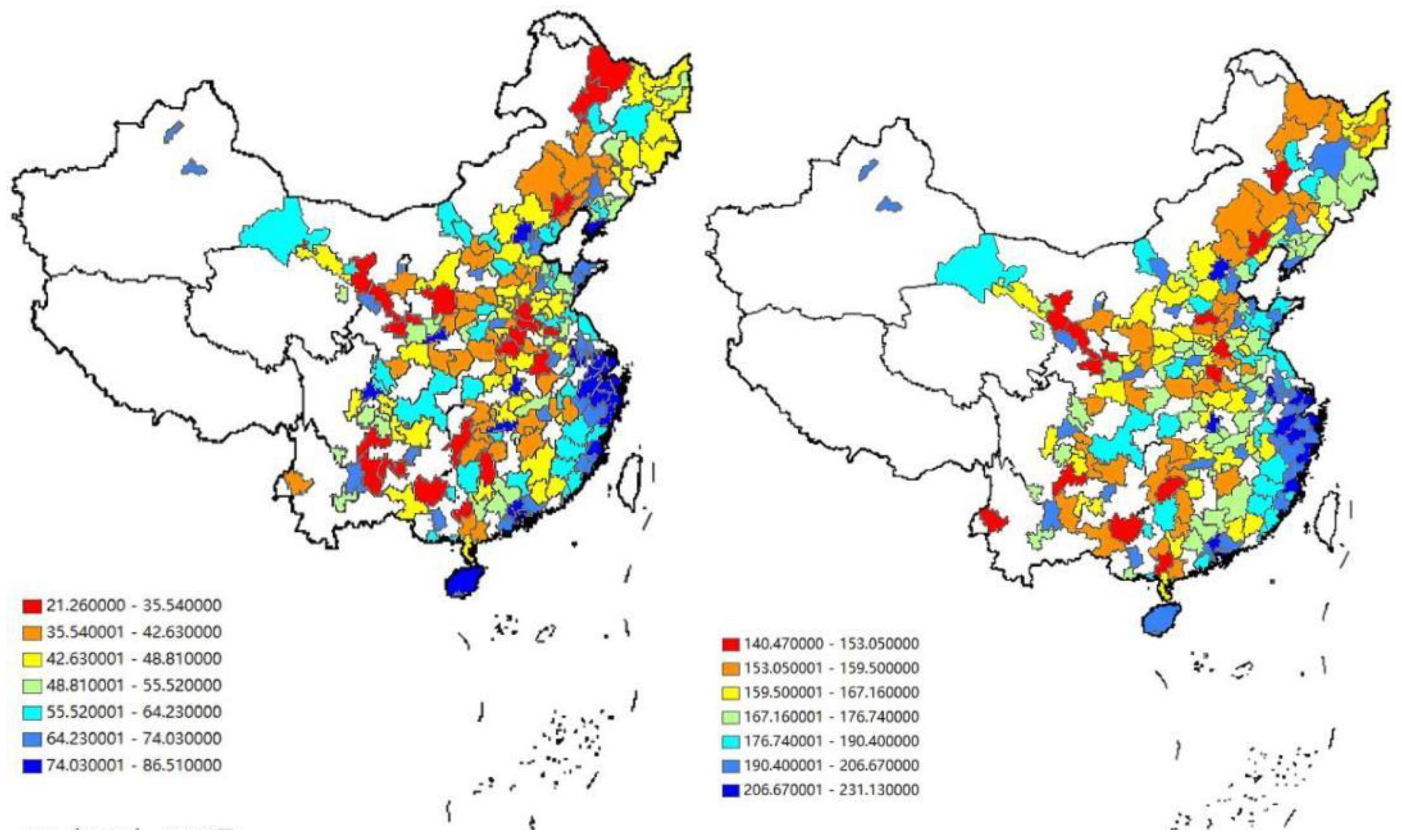

5.1.2. Temporal and Spatial Evolution Analysis of Digital Finance

5.1.3. Nuclear Density Diagram Analysis of Green Economic Efficiency

5.2. The Correlation Between the Level of Digital Finance and the Efficiency of Green Economy

5.2.1. Benchmark Regression

| variable | one | 2 | three |

|---|---|---|---|

| coefficient of regression | 0.505*** (9.491) |

0.912*** (15.338) |

0.915*** (15.467) |

| Control variable | no | be | be |

| Time-fixed effect | no | no | be |

| Individual fixation effect | no | no | be |

| N | 2710 | 2710 | 2710 |

| R2 | 0.031 | 0.335 | 0.368 |

5.2.2. Endogenous Test

5.2.3. Robustness Test

| variable | one | 2 |

|---|---|---|

| coefficient of regression | 0.067** (8.989) |

0.479** (3.508) |

| 2710 | 2710 | |

| 0.143 | 0.146 |

5.3. Heterogeneity Analysis-Grouping Regression

5.3.1. Regional Heterogeneity

| variable | (1) upstate |

(2) Southern region |

| 0.0368** (2.43) |

0.0512*** (3.13) |

|

| Control variable | control | control |

| Fixed time | Yes | Yes |

| Individual fixation | Yes | Yes |

| 1360 | 1350 | |

| 33.32 | 16.27 | |

| 0.198 | 0.108 |

5.3.2. Heterogeneity of Digital Finance Development

5.3.3. Resource-Based Heterogeneity

| variable | (1) | (2) | (3) | (4) | (5) |

| Growth type | Maturity | Recession type | Regenerative type | Non-resource type | |

| 0.00709 | 0.105*** | 0.0409* | 0.0824* | 0.0925*** | |

| (0.14) | (3.33) | (1.79) | (1.97) | (6.16) | |

| Control variable | control | control | control | control | control |

| Fixed time | Yes | Yes | Yes | Yes | Yes |

| Individual fixation | Yes | Yes | Yes | Yes | Yes |

| 130 | 570 | 230 | 130 | 1650 | |

| 1.268 | 7.500 | 5.788 | 10.55 | 50.48 | |

| 0.106 | 0.276 | 0.103 | 0.497 | 0.255 |

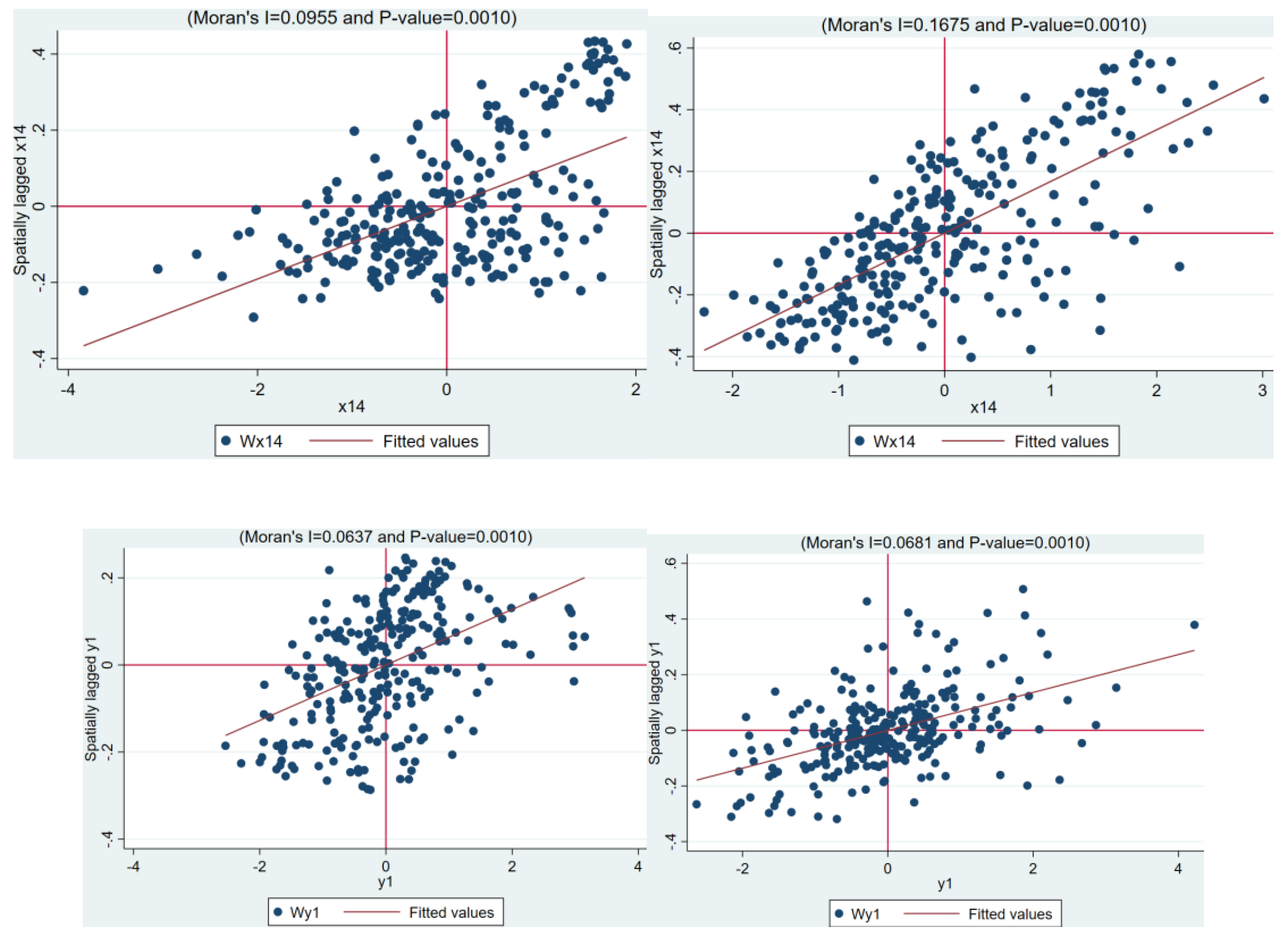

5.4. Analysis of the Spatial Spillover Effect of Digital Finance on the Efficiency of Green Economy

5.4.1. Spatial Dobbin Model Regression

5.4.2. Spatial Effect Decomposition of Green Economic Efficiency

5.4.3. Robustness Test

6. Conclusions and Recommendations

References

- Zhu, X. , Song, B., Ni, Y., Ren, Y., Li, R., Zhu, X.,... & Li, R. (2016). Digital finance—from traditional finance to digital and internet finance. Business Trends in the Digital Era: Evolution of Theories and Applications, 161-190.

- Gomber, P.; Koch, J.-A.; Siering, M. Digital Finance and FinTech: current research and future research directions. J. Bus. Econ. 2017, 87, 537–580. [Google Scholar] [CrossRef]

- Chen, Z.; Li, Y.; Wu, Y.; Luo, J. The transition from traditional banking to mobile internet finance: an organizational innovation perspective - a comparative study of Citibank and ICBC. Financial Innov. 2017, 3, 1–16. [Google Scholar] [CrossRef]

- Li, C.; Wang, Y.; Zhou, Z.; Wang, Z.; Mardani, A. Digital finance and enterprise financing constraints: Structural characteristics and mechanism identification. J. Bus. Res. 2023, 165. [Google Scholar] [CrossRef]

- Li, G.; Zhang, R.; Feng, S.; Wang, Y. Digital finance and sustainable development: Evidence from environmental inequality in China. Bus. Strat. Environ. 2022, 31, 3574–3594. [Google Scholar] [CrossRef]

- Claessens, S.; Glaessner, T.; Klingebiel, D. Electronic Finance: Reshaping the Financial Landscape Around the World. J. Financial Serv. Res. 2002, 22, 29–61. [Google Scholar] [CrossRef]

- Zhao, S.; Hao, D.; Yua, B. Digital trade and common prosperity: evidence from China Province. Cogent Econ. Finance 2025, 13. [Google Scholar] [CrossRef]

- Zhao, S.; Deng, H.; Cao, J.; Gustaf, M. Digital transformation of construction enterprises and carbon emission reduction: evidence from listed companies. Front. Environ. Sci. 2025, 13, 1570182. [Google Scholar] [CrossRef]

- Ketterer, J. A. (2017). Digital finance: New times, new challenges, new opportunities.

- Lin, L.-H.; Lin, F.-C.; Lien, C.-K.; Yang, T.-C.; Chuang, Y.-K.; Hsu, Y.-W. Electronic Payment Behaviors of Consumers under Digital Transformation in Finance—A Case Study of Third-Party Payments. J. Risk Financial Manag. 2023, 16, 346. [Google Scholar] [CrossRef]

- Zhu, X. , Song, B., Ni, Y., Ren, Y., Li, R., Zhu, X.,... & Li, R. (2016). Digital finance—from traditional finance to digital and internet finance. Business Trends in the Digital Era: Evolution of Theories and Applications, 161-190.

- Morgan, P.J. Fintech and Financial Inclusion in Southeast Asia and India. Asian Econ. Policy Rev. 2022, 17, 183–208. [Google Scholar] [CrossRef]

- Chorzempa, M.; Huang, Y. Chinese Fintech Innovation and Regulation. Asian Econ. Policy Rev. 2022, 17, 274–292. [Google Scholar] [CrossRef]

- Fang, F.; Ventre, C.; Basios, M.; Kanthan, L.; Martinez-Rego, D.; Wu, F.; Li, L. Cryptocurrency trading: a comprehensive survey. Financial Innov. 2022, 8, 1–59. [Google Scholar] [CrossRef]

- Bollaert, H.; Lopez-De-Silanes, F.; Schwienbacher, A. Fintech and access to finance. J. Corp. Finance 2021, 68. [Google Scholar] [CrossRef]

- Hendershott, T.; Zhang, X. (.; Zhao, J.L.; Zheng, Z.(. FinTech as a Game Changer: Overview of Research Frontiers. Inf. Syst. Res. 2021, 32, 1–17. [Google Scholar] [CrossRef]

- Loiseau, E.; Saikku, L.; Antikainen, R.; Droste, N.; Hansjürgens, B.; Pitkänen, K.; Leskinen, P.; Kuikman, P.; Thomsen, M. Green economy and related concepts: An overview. J. Clean. Prod. 2016, 139, 361–371. [Google Scholar] [CrossRef]

- Ghisellini, P.; Cialani, C.; Ulgiati, S. A Review on Circular Economy: The Expected Transition to a Balanced Interplay of Environmental and Economic Systems. J. Clean. Prod. 2016, 114, 11–32. [Google Scholar] [CrossRef]

- Beder, S. Environmental economics and ecological economics: the contribution of interdisciplinarity to understanding, influence and effectiveness. Environ. Conserv. 2011, 38, 140–150. [Google Scholar] [CrossRef]

- Mundaca, L.; Neij, L.; Worrell, E.; McNeil, M. Evaluating Energy Efficiency Policies with Energy-Economy Models. Annu. Rev. Environ. Resour. 2010, 35, 305–344. [Google Scholar] [CrossRef]

- Kozluk, T. , & Zipperer, V. (2014). Environmental policies and productivity growth-a critical review of empirical findings. OECD Journal. Economic Studies, 2014(1), 155.

- Loiseau, E.; Saikku, L.; Antikainen, R.; Droste, N.; Hansjürgens, B.; Pitkänen, K.; Leskinen, P.; Kuikman, P.; Thomsen, M. Green economy and related concepts: An overview. J. Clean. Prod. 2016, 139, 361–371. [Google Scholar] [CrossRef]

- Zuo, J.; Zhao, Z.-Y. Green building research–current status and future agenda: A review. Renew. Sustain. Energy Rev. 2014, 30, 271–281. [Google Scholar] [CrossRef]

- Bianzino, A. P. , Chaudet, C., Rossi, D., & Rougier, J. L. (2010). A survey of green networking research. IEEE Communications Surveys & Tutorials, 14(1), 3-20.

- Jelinek, M.; Smircich, L.; Hirsch, P. Introduction: A Code of Many Colors. Adm. Sci. Q. 1983, 28, 331. [Google Scholar] [CrossRef]

- Zhang, X. Green real estate development in China: State of art and prospect agenda—A review. Renew. Sustain. Energy Rev. 2015, 47, 1–13. [Google Scholar] [CrossRef]

- Liu, Y.; Dong, F. How technological innovation impacts urban green economy efficiency in emerging economies: A case study of 278 Chinese cities. Resour. Conserv. Recycl. 2021, 169. [Google Scholar] [CrossRef]

- Ma, L.; Long, H.; Chen, K.; Tu, S.; Zhang, Y.; Liao, L. Green growth efficiency of Chinese cities and its spatio-temporal pattern. Resour. Conserv. Recycl. 2019, 146, 441–451. [Google Scholar] [CrossRef]

- Shuai, S.; Fan, Z. Modeling the role of environmental regulations in regional green economy efficiency of China: Empirical evidence from super efficiency DEA-Tobit model. J. Environ. Manag. 2020, 261, 110227. [Google Scholar] [CrossRef]

- Li, J. , Chen, L., Chen, Y., & He, J. (2022). Digital economy, technological innovation, and green economic efficiency—Empirical evidence from 277 cities in China. Managerial and Decision Economics, 43(3), 616-629.

- Zhao, P.-J.; Zeng, L.-E.; Lu, H.-Y.; Zhou, Y.; Hu, H.-Y.; Wei, X.-Y. Green economic efficiency and its influencing factors in China from 2008 to 2017: Based on the super-SBM model with undesirable outputs and spatial Dubin model. Sci. Total. Environ. 2020, 741, 140026. [Google Scholar] [CrossRef] [PubMed]

- Lv, L.; Zhang, P. Unlocking green potential: How open government data enhances green economic efficiency in China? J. Environ. Manag. 2025, 380, 125043. [Google Scholar] [CrossRef] [PubMed]

- Zhou, K.; Li, Y. Carbon finance and carbon market in China: Progress and challenges. J. Clean. Prod. 2019, 214, 536–549. [Google Scholar] [CrossRef]

- Zhou, F.; Wang, X. The carbon emissions trading scheme and green technology innovation in China: A new structural economics perspective. Econ. Anal. Policy 2022, 74, 365–381. [Google Scholar] [CrossRef]

- Liu, L. , Chen, C., Zhao, Y., & Zhao, E. (2015). China׳ s carbon-emissions trading: Overview, challenges and future. Renewable and Sustainable Energy Reviews, 49, 254-266.

- Sun, L.-Y.; Miao, C.-L.; Yang, L. Ecological-economic efficiency evaluation of green technology innovation in strategic emerging industries based on entropy weighted TOPSIS method. Ecol. Indic. 2017, 73, 554–558. [Google Scholar] [CrossRef]

- Sun, X. Green city and regional environmental economic evaluation based on entropy method and GIS. Environ. Technol. Innov. 2021, 23. [Google Scholar] [CrossRef]

- Ma, X.-F.; Zhang, R.; Ruan, Y.-F. How to Evaluate the Level of Green Development Based on Entropy Weight TOPSIS: Evidence from China. Int. J. Environ. Res. Public Heal. 2023, 20, 1707. [Google Scholar] [CrossRef]

- Ouyang, X.; Wang, J.; Chen, X.; Zhao, X.; Ye, H.; Watson, A.E.; Wang, S. Applying a projection pursuit model for evaluation of ecological quality in Jiangxi Province, China. Ecol. Indic. 2021, 133. [Google Scholar] [CrossRef]

- Chang, L.; Mohsin, M.; Hasnaoui, A.; Taghizadeh-Hesary, F. Exploring carbon dioxide emissions forecasting in China: A policy-oriented perspective using projection pursuit regression and machine learning models. Technol. Forecast. Soc. Chang. 2023, 197. [Google Scholar] [CrossRef]

- Wang, C.-N.; Nguyen, T.T.-V.; Chiang, C.-C.; Le, H.-D. Evaluating renewable energy consumption efficiency and impact factors in Asia-pacific economic cooperation countries: A new approach of DEA with undesirable output model. Renew. Energy 2024, 227. [Google Scholar] [CrossRef]

- Liu, X.; Guo, P.; Guo, S. Assessing the eco-efficiency of a circular economy system in China's coal mining areas: Emergy and data envelopment analysis. J. Clean. Prod. 2019, 206, 1101–1109. [Google Scholar] [CrossRef]

- Lee, S. K. , Mogi, G., & Hui, K. S. (2013). A fuzzy analytic hierarchy process (AHP)/data envelopment analysis (DEA) hybrid model for efficiently allocating energy R& D resources: In the case of energy technologies against high oil prices. Renewable and Sustainable Energy Reviews, 21, 347-355.

- Mardani, A.; Zavadskas, E.K.; Streimikiene, D.; Jusoh, A.; Khoshnoudi, M. A comprehensive review of data envelopment analysis (DEA) approach in energy efficiency. Renew. Sustain. Energy Rev. 2017, 70, 1298–1322. [Google Scholar] [CrossRef]

- Wang, Y.; Li, X.; Kang, Y.; Chen, W.; Zhao, M.; Li, W. Analyzing the impact of urbanization quality on CO2 emissions: What can geographically weighted regression tell us? Renew. Sustain. Energy Rev. 2019, 104, 127–136. [Google Scholar] [CrossRef]

- Hwang, Y.K.; Díez, Á.S. Renewable energy transition and green growth nexus in Latin America. Renew. Sustain. Energy Rev. 2024, 198. [Google Scholar] [CrossRef]

- Zhang, N.; Zhou, P.; Kung, C.-C. Total-factor carbon emission performance of the Chinese transportation industry: A bootstrapped non-radial Malmquist index analysis. Renew. Sustain. Energy Rev. 2015, 41, 584–593. [Google Scholar] [CrossRef]

- Li, J.; Ho, M.S.; Xie, C.; Stern, N. China's flexibility challenge in achieving carbon neutrality by 2060. Renew. Sustain. Energy Rev. 2022, 158. [Google Scholar] [CrossRef]

- Xu, W.; Liu, S. Novel economic models for advancing urban energy management and transition: Simulation of urban energy system in digital twin. Sustain. Cities Soc. 2023, 101. [Google Scholar] [CrossRef]

- Liu, W.; Yang, X.; Zhang, J.; Wu, X.; Wan, L. The spatiotemporal evolution of the effect of industrial agglomeration on industrial green economic efficiency: empirical evidence from pollution-intensive industries in China. Environ. Dev. Sustain. 2023, 26, 9945–9972. [Google Scholar] [CrossRef]

- Yuan, W.; Li, J.; Meng, L.; Qin, X.; Qi, X. Measuring the area green efficiency and the influencing factors in urban agglomeration. J. Clean. Prod. 2019, 241. [Google Scholar] [CrossRef]

- Safi, A.; Kchouri, B.; Elgammal, W.; Nicolas, M.K.; Umar, M. Bridging the green gap: Do green finance and digital transformation influence sustainable development? Energy Econ. 2024, 134. [Google Scholar] [CrossRef]

- Li, G.; Zhang, R.; Feng, S.; Wang, Y. Digital finance and sustainable development: Evidence from environmental inequality in China. Bus. Strat. Environ. 2022, 31, 3574–3594. [Google Scholar] [CrossRef]

- Tian, Y. The heterogeneous dynamic effect of financial development and environmental regulation on Chinese urban green technology management efficiency. Environ. Sci. Pollut. Res. 2022, 29, 32032–32053. [Google Scholar] [CrossRef]

- Si, R.; Wang, Y.; Cao, M.; Wen, H. Does green technology innovation promote green economic growth? –Examining regional heterogeneity between resource-based and non-resource-based cities. Int. Rev. Econ. Finance 2024, 94. [Google Scholar] [CrossRef]

- Ding, J.; Liu, B.; Shao, X. Spatial effects of industrial synergistic agglomeration and regional green development efficiency: Evidence from China. Energy Econ. 2022, 112. [Google Scholar] [CrossRef]

| Indicator type | Primary index | Secondary index | unit |

| invest | Capital factor | Fixed capital stock | ten thousand yuan |

| Resource elements | Total energy consumption | Ten thousand tons of standard coal | |

| Labor elements | Number of employees | ten thousand people | |

| Output index | Expected output | real gdp | ten thousand yuan |

| Unexpected output | Industrial sulfur dioxide emission | Wan t | |

| Industrial smoke and dust emission | Wan t | ||

| Industrial wastewater discharge | Wan t |

| Variable type | variable | symbol | Measurement method |

| Explained variable | Green economic efficiency | Green economy index | |

| Explanatory variable | Digital finance | Digital financial index | |

| Control variable | opening up to the outside world | Proportion of foreign actual investment in GDP | |

| manpower capital | Proportion of students in colleges and universities to the total population of the region | ||

| social security | Number of hospital beds per capita | ||

| Financial development | Proportion of total loan surplus of financial institutions to GDP at the end of the year | ||

| infrastructure | Highway passenger volume | ||

| expenditure on education | Proportion of education expenditure to fiscal expenditure | ||

| Science and technology expenditure | Proportion of science and technology expenditure to fiscal expenditure | ||

| urbanization | Urbanization rate | ||

| Population aggregation | population density | ||

| fiscal expenditure | Percentage of general budget expenditure of local government to local GDP |

| Development level of digital finance | Green economic efficiency | |||||

| age | I value | |||||

| 2011 | 0.095 | 18.412 | 0.000 | 0.068 | 13.362 | 0.000 |

| 2012 | 0.116 | 22.211 | 0.000 | 0.058 | 11.580 | 0.000 |

| 2013 | 0.116 | 22.239 | 0.000 | 0.044 | 8.968 | 0.000 |

| 2014 | 0.101 | 19.367 | 0.000 | 0.051 | 10.244 | 0.000 |

| 2015 | 0.108 | 20.736 | 0.000 | 0.060 | 11.857 | 0.000 |

| 2016 | 0.106 | 20.410 | 0.000 | 0.051 | 10.100 | 0.000 |

| 2017 | 0.124 | 23.704 | 0.000 | 0.061 | 12.078 | 0.000 |

| 2018 | 0.152 | 28.935 | 0.000 | 0.055 | 10.940 | 0.000 |

| 2019 | 0.158 | 29.968 | 0.000 | 0.063 | 12.413 | 0.000 |

| 2020 | 0.167 | 31.758 | 0.000 | 0.064 | 12.528 | 0.000 |

| Variable name | ||

| First stage regression | Second stage regression | |

| -0.0908423*** (-6.58) |

||

| 0.03479588*** (12.91) |

||

| Control variable | control | control |

| Fixed time | Yes | Yes |

| Individual fixation | Yes | Yes |

| 2710 | 2710 | |

| 0.2738 | 0.1500 | |

| First stage statistics | 43.2568 |

| variable | (1) | (2) |

| High-level area | Low-level areas | |

| 0.0519*** (3.06) |

0.0339** (2.33) |

|

| Control variable | control | control |

| Fixed time | Yes | Yes |

| Individual fixation | Yes | Yes |

| 1355 | 1355 | |

| 37.96 | 17.25 | |

| 0.251 | 0.131 |

| variable | Direct effect | Indirect effect | Total effect |

| -0.192*** | 3.033*** | 2.841*** | |

| (0.0447) | (1.014) | (1.011) | |

| Control variable | Yes | Yes | Yes |

| Time-fixed effect | Yes | Yes | Yes |

| Individual fixation effect | Yes | Yes | Yes |

| 2710 | 2710 | 2710 |

| variable | Pure technical efficiency | Scale efficiency | ||||

| Direct effect | Indirect effect | Total effect | Direct effect | Indirect effect | Total effect | |

| -0.177** | 0.488*** | 0.311** | 0.401*** | -0.760*** | -0.358*** | |

| (0.0796) | (0.171) | (0.151) | (0.0690) | (0.137) | (0.121) | |

| Control variable | Yes | Yes | Yes | Yes | Yes | Yes |

| Time-fixed effect | Yes | Yes | Yes | Yes | Yes | Yes |

| Individual fixation effect | Yes | Yes | Yes | Yes | Yes | Yes |

| 2710 | 2710 | 2710 | 2710 | 2710 | 2710 | |

| variable | Green economic efficiency | ||||||||

| Excluding municipalities directly under the central government | Substitution space matrix | Tail shrinking treatment | |||||||

| direct effect |

indirect effect |

Total effect | direct effect |

indirect effect |

Total effect | direct effect |

indirect effect |

Total effect | |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | |

| -0.185 *** |

3.057 *** |

2.872 *** |

-0.195 *** |

0.286 *** |

0.0906 | -0.262 *** |

3.599 *** |

3.337 *** |

|

| (0.045) | (0.976) | (0.972) | (0.0485) | (0.0904) | (0.0825) | (0.0511) | (1.135) | (1.131) | |

| Control variable | control | control | control | control | control | control | control | control | control |

| Fixed time/region | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| observed value | 2670 | 2670 | 2670 | 2710 | 2710 | 2710 | 2710 | 2710 | 2710 |

| 0.008 | 0.008 | 0.008 | 0.181 | 0.181 | 0.181 | 0.008 | 0.008 | 0.008 | |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).