Submitted:

14 February 2025

Posted:

19 February 2025

You are already at the latest version

Abstract

Keywords:

1. Introduction

2. Literature Review and Theoretical Analysis

2.1. Literature Review

2.2. Theoretical Analysis and Research Hypotheses

3. Methodological Approach

3.1. Acquisition of Data Sources

3.2. Introduction to Variables

3.2.1. Explained Variables

3.2.2. Explanatory Variables

3.2.3. Control Variables

3.2.4. Mediating and Moderating Variables

3.3. Data Description

3.4. Empirical Model

3.4.1. Fixed Effects Model

3.4.2. Mediated Effects Model

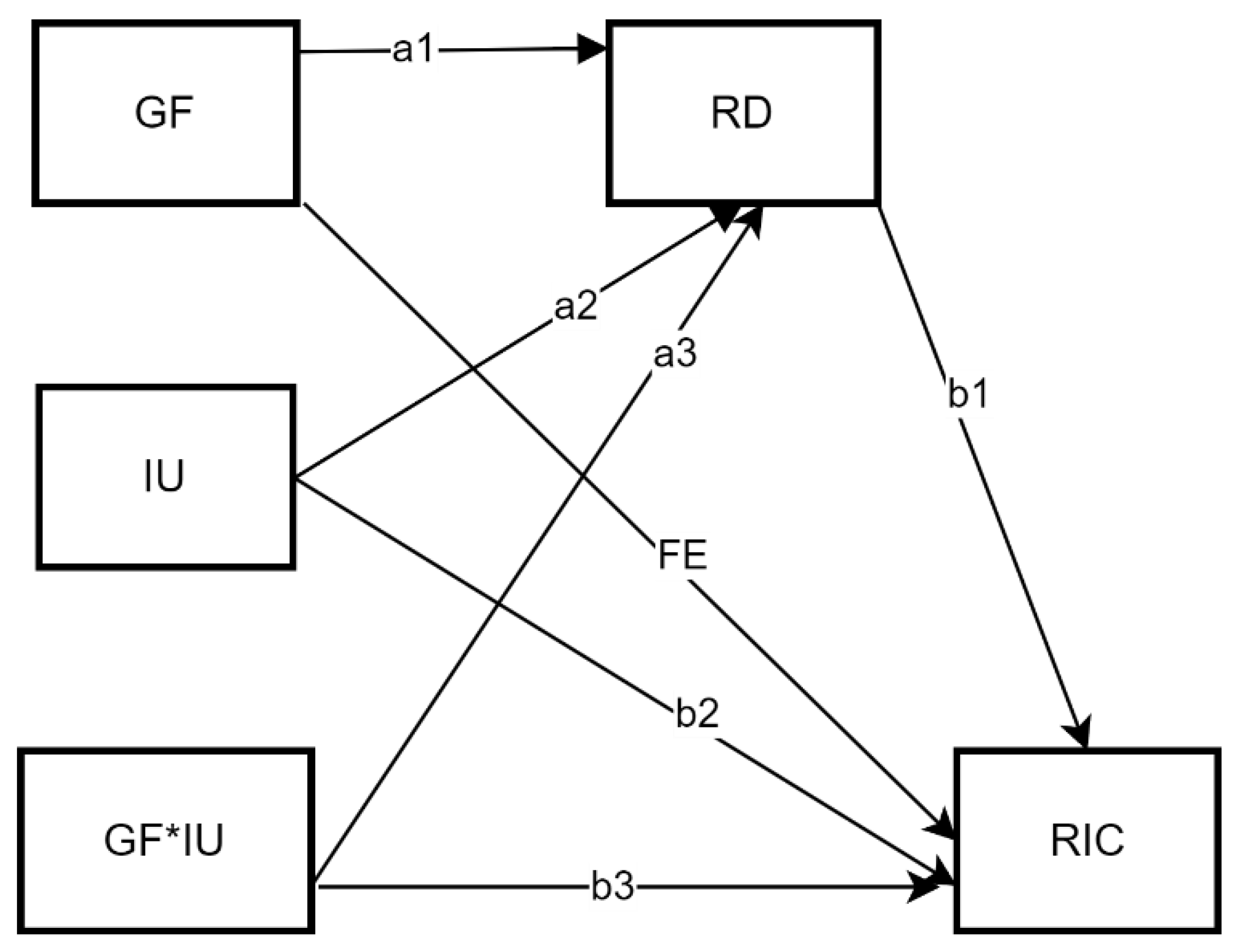

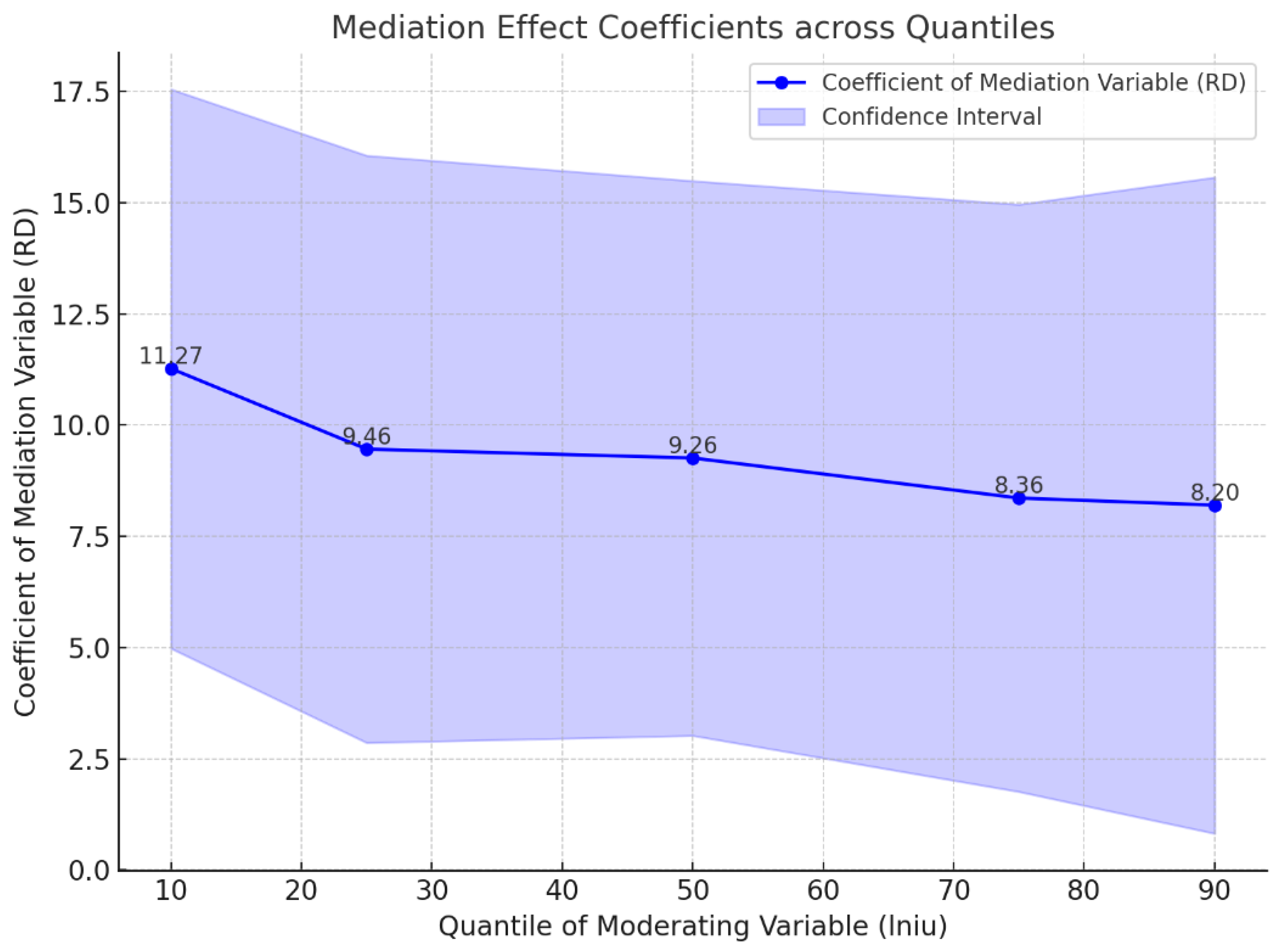

3.4.3. Moderated Mediation Model

4. Empirical Results

4.1. Benchmark Regression Analysis

4.2. Analysis of Mediating Effects

5. Robustness Tests

5.1. Bootstrap Method

5.2. Variable Substitution

5.3. Sample Period Adjustment

5.4. Endogeneity Test

5.4.1. Endogeneity Tests for Relationships Among Variables

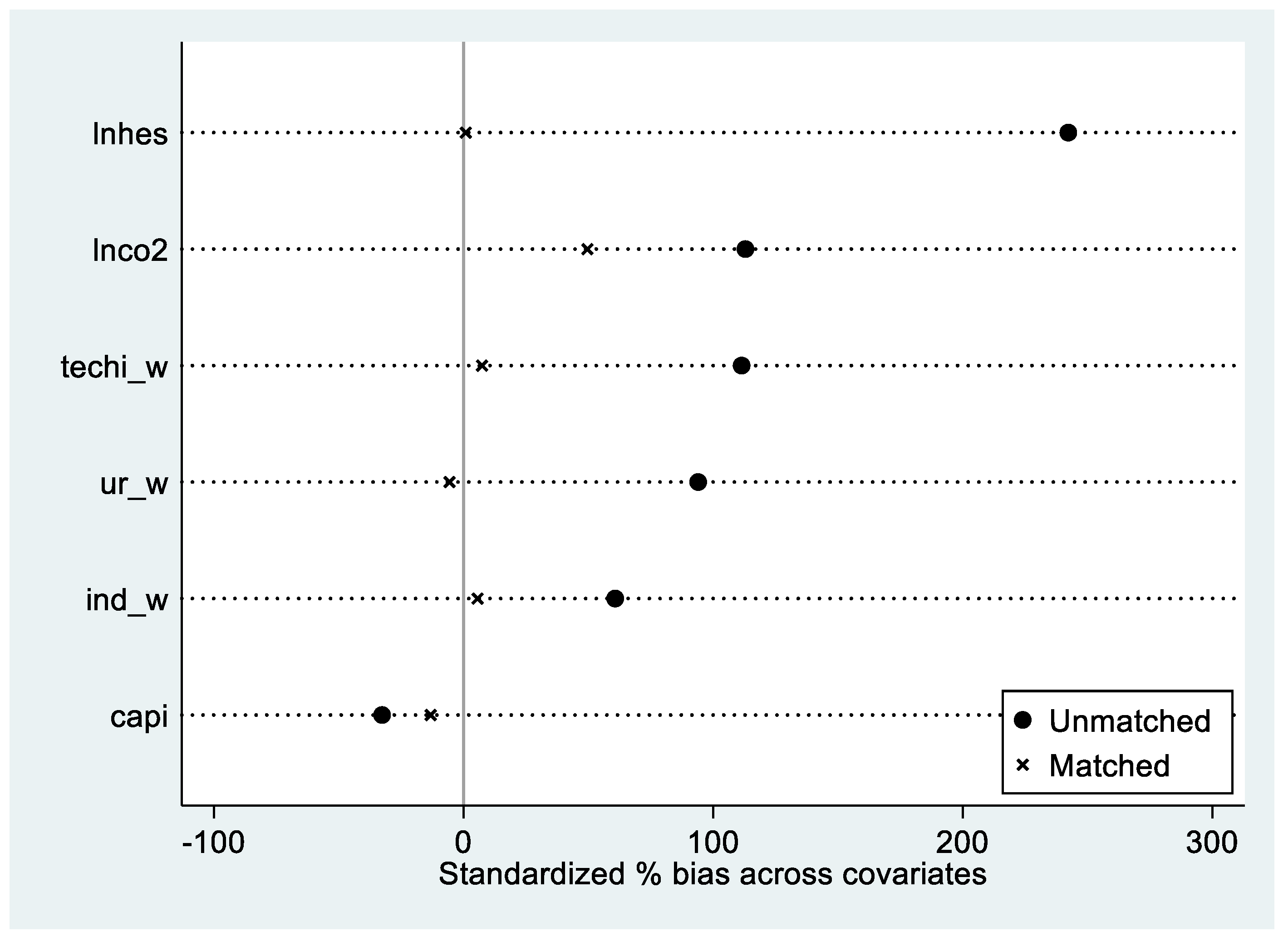

5.4.2. Endogeneity Test for Sample Selection Bias

5.5. Research Discussion

6. Conclusions and Policy Recommendations

6.1. Conclusions

6.2. Policy Recommendations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Li H, Liu J, Wang H. Impact of green technology innovation on the quality of regional economic development. International Review of Economics & Finance 2024, 93,463-76. [CrossRef]

- National Bureau of Statistics of China. (2023). China Statistical Yearbook 2023. Available online: https://data.stats.gov.cn/easyquery.htm?cn=C01 (accessed on November 17, 2024).

- China's R&D expenditure exceeds 3.3 trln yuan in 2023: minister. Xinhua, 5 Mar 2024. Available online: https://english.news.cn/ 20240305/d3d97f55bdf44d40a49d9ae2224ce0dc/c.html (accessed on 26 September 2024).

- Shayegh S, Reissl S, Roshan E, Calcaterra M. An assessment of different transition pathways to a green global economy. Communications Earth & Environment 2023,4(1),448. [CrossRef]

- China Science and Technology Strategy Research Institute. China Regional Science and Technology Innovation Evaluation Report Beijing, China,2024. (In Chinese).

- Climate Bonds Initiative. Global State of the Market Report 2023. Available online:https://www.climatebonds.net/resources/reports/global-state-market-report-2023 (accessed on 26 September 2024).

- People's Bank of China. (2024). China's green loan balance exceeds 30 trillion yuan. People's Daily Overseas Edition. Available online: https://www.gov.cn/lianbo/bumen/202401/content_6928561.htm (accessed on 26 September 2024). (In Chinese).

- Zhou X, Tang X, Zhang R. Impact of green finance on economic development and environmental quality: a study based on provincial panel data from China. Science and Pollution Research 2020,27,19915-32. [CrossRef]

- Liu, J. Y., Xia, Y., Fan, Y., Lin, S. M., & Wu, J. Assessment of a green credit policy aimed at energy-intensive industries in China based on a financial CGE model. Journal of Cleaner Production 2017, 163, 293-302. [CrossRef]

- Huang, Z., Liao, G., & Li, Z. Loaning scale and government subsidy for promoting green innovation. Technological Forecasting and Social Change 2019, 144, 148-156. [CrossRef]

- Cooke P, Uranga MG, Etxebarria G. Regional innovation systems: institutional and organizational dimensions. Research Policy 1997,26(4-5),475-91.

- Xu L, Shu H, Lu X, Li T. Regional technological innovation and industrial upgrading in China: an analysis using interprovincial panel data from 2008 to 2020. Finance Research Letters 2024,105621. [CrossRef]

- Hu B, Guo P, Gao M. Enhancing high-quality development in regional innovation ecosystems. Physics and Chemistry of the Earth, Parts A/B/C 2023,132,103488. [CrossRef]

- Lin B, Zhang A. Digital finance, regional innovation environment, and renewable energy technology innovation: Threshold effects. Renewable Energy 2024,223,120036. [CrossRef]

- Ren X, Shao Q, Zhong R. Nexus between green finance, non-fossil energy use, and carbon intensity: Empirical evidence from China based on a vector error correction model. Journal of Cleaner Production 2020,277,122844. [CrossRef]

- Lv C, Bian B, Lee CC, He Z. Regional gap and the trend of green finance development in China. Energy Economics 2021,102,105476. [CrossRef]

- Meo MS, Abd Karim MZ. The role of green finance in reducing CO2 emissions: an overview. finance in reducing CO2 emissions: an empirical analysis. Borsa Istanbul Review 2022,22(1),169-78.

- Rasoulinezhad E, Taghizadeh-Hesary F. Role of green finance in improving energy efficiency and renewable energy development. Energy Efficiency 2022,15(2),14. [CrossRef]

- Muganyi T, Yan L, Sun HP. Green finance, fintech, and environmental protection: Evidence from China. Ecotechnology 2021,7,100107. [CrossRef]

- Esposito, P., Dicorato, S. L., & Doronzo, E. The effect of ownership on sustainable development and environmental policy in urban waste management: an explicatory empirical analysis of Italian municipal corporations. Business Strategy and the Environment 2021,30(2), 1067-1079. [CrossRef]

- Zhou G, Zhu J, Luo S. The impact of fintech innovation on green growth in China: Mediating effect of green finance. Ecological Economics 2022,193,107308. [CrossRef]

- Lee CC, Lee CC. How does green finance affect green total factor productivity? Evidence from China. Energy economics 2022,107,105863.

- Liu, S., & Wang, Y. Green innovation effect of pilot zones for green finance reform: Evidence of quasi natural experiment. Technological Forecasting and Social Change 2023, 186, 122079. [CrossRef]

- Bao J, He M. Does green credit promote green sustainable development in regional economies? Empirical evidence from 280 cities in China. PLOS ONE 2022,17(11), e0277569. [CrossRef]

- Deng, W., Kharuddin, S., & Ashhari, Z. M. Green finance transforms developed countries’ green growth: Mediating effect of clean technology innovation and threshold effect of environmental tax. Journal of Cleaner Production 2024, 448, 141642. [CrossRef]

- Jiang S, Liu X, Liu Z, Shi H, Xu H. Does green finance promote enterprises' green technology innovation in China? Frontiers in Environmental Science 2022,10,981013.

- Liu F, Xia Z, Lee CC. Does green credit benefit the clean energy technological innovation and how? The policy catering behavior of enterprises. Journal of Cleaner Production 2024,444,141256. [CrossRef]

- Li L, Ma X, Ma S, Gao F. Role of green finance in regional heterogeneous green innovation: evidence from China. Humanities and Social Sciences Communications 2024,11(1),1-3. [CrossRef]

- Cui Y, Zhong C, Cao J, Guo M. Can green finance effectively mitigate PM2.5 pollution? What role will green technological innovation play? Energy & Environment 2023,0958305X231204030.

- Irfan M, Razzaq A, Sharif A, Yang X. Influence mechanism between green finance and green innovation: exploring regional policy intervention effects in China. Technological Forecasting Technological Forecasting and Social Change 2022,182,121882. [CrossRef]

- Sun H, Luo Y, Liu J, Bhuiyan MA. Digital inclusive finance, R&D investment, and green technology innovation nexus. PLOS ONE 2024,19(1), e0297264. [CrossRef]

- Liu C, Dai C, Chen S, Zhong J. How does green finance affect the innovation performance of enterprises? Evidence from China. Environmental Science and Pollution Research 2023,30(35),84516-36. [CrossRef]

- Yulin W, Yahong Z. Green Finance Development and Enterprise Innovation. Journal of Finance and Economics 2023,49(01),49-62.

- Xiao Y, Shi X, Kong L. From green finance to sustainable innovation: how to unleash the potential of China's high-tech industry. Environmental Science and Pollution Research 2023,30(59),123368-82. [CrossRef]

- Liu, Y., Deng, W., Wen, H., & Li, S. Promoting green technology innovation through policy synergy: Evidence from the dual pilot policy of low-carbon city and innovative city. Economic Analysis and Policy 2024, 84, 957-977. [CrossRef]

- Huang Y, Chen C, Lei L, Zhang Y. Impacts of green finance on green innovation: a spatial and nonlinear perspective. Journal of Cleaner Production. Journal of Cleaner Production 2022,365,132548. [CrossRef]

- Jiang P, Xu C, Chen Y. Can green finance reduce carbon emission? A theoretical analysis and empirical evidence from China. Pollution Research 2024,1-6. [CrossRef]

- Schumpeter, Joseph A., and Richard Swedberg. The theory of economic development. Routledge, 2021.

- Funaba, M. Technology Policy and Economic Performance: Lessons From Japan by Christopher Freeman and Evaluating Applied Research: Lessons From Japan by John Irvine (Book Review). Japan quarterly 1988, 35(3), 326.

- Barney, J. Firm resources and sustained competitive advantage. Journal of management 1991, 17(1), 99-120.

- Cooke, P. Regional innovation systems: competitive regulation in the new Europe. Geoforum 1992, 23(3), 365-382. [CrossRef]

- Volz, U. Fostering green finance for sustainable development in Asia. In Routledge handbook of banking and finance in Asia.Routledge,2018; pp. 488-504.

- Meng, Y., Yu, J., Yu, Y., & Ren, Y. Impact of green finance on green total factor productivity: New evidence from improved synthetic control methods. Journal of Environmental Management 2024, 372, 123394. [CrossRef]

- Surminski, S., & Eldridge, J. Flood insurance in England–an assessment of the current and newly proposed insurance scheme in the context of rising flood risk. Journal of Flood Risk Management 2017, 10(4), 415-435. [CrossRef]

- Geddes, A., Schmidt, T. S., & Steffen, B. The multiple roles of state investment banks in low-carbon energy finance: An analysis of Australia, the UK and Germany. Energy policy 2018, 115, 158-170. [CrossRef]

- Dikau, S., & Volz, U. Central bank mandates, sustainability objectives and the promotion of green finance. Ecological Economics 2021,184, 107022. [CrossRef]

- Schoenmaker, D., & Van Tilburg, R. What role for financial supervisors in addressing environmental risks? Comparative Economic Studies 2016, 58, 317-334.

- Tu, W., Zhang, L., Sun, D., & Mao, W. Evaluating high-tech industries' technological innovation capability and spatial pattern evolution characteristics: Evidence from China. Journal of Innovation & Knowledge 2023, 8(1), 100287. [CrossRef]

- Shi, L., Sun, J., Lin, J., & Zhao, Y. Factor decomposition of carbon emissions in Chinese megacities. Journal of Environmental Sciences 2019,75,209-215. [CrossRef]

- He, F., Feng, Y., & Hao, J. Corporate ESG rating and stock market liquidity: Evidence from China. Economic Modelling 2023, 129, 106511. [CrossRef]

- Cortés, K. R., Demyanyk, Y., Li, L., Loutskina, E., & Strahan, P. E. Stress tests and small business lending. Journal of Financial Economics 2020,136(1), 260-279.

- Freund, L. B., Lee, H., & Rendahl, P. The Risk-Premium Channel of Uncertainty: Implications for Unemployment and Inflation, 2022. [CrossRef]

- Rogers E M. Diffusion of Innovations, 3rd ed.; Free Press: New York, United States,1962; 154–196.

- Wernerfelt B. A resource-based view of the firm. Strategic Management Journal 1984,5(2),171-180.

- Wen Z, Ye B. Analyses of mediating effects: the development of methods and models. Advances in Psychological Science 2014,22(5),731. [CrossRef]

- Wen Z, Ye B. Different methods for testing moderated mediation models: competitors or backups? Acta psychologica sinica 2014,46,49-62.

- Kleibergen, F., & Paap, R. Generalized reduced rank tests using the singular value decomposition. Journal of econometrics 2006, 133(1), 97-126. [CrossRef]

- Xu, M., & Yao, Y. The Impact of Green Finance Policy on Corporate R&D Expenses. Highlights in Business, Economics and Management 2023,15, 286-295. [CrossRef]

- Xu, J., Liu, F., & Shang, Y.R&D investment, ESG performance and green innovation performance: evidence from China. Kybernetes 2021,50(3), 737-756. [CrossRef]

- Hossain, M. R., Rao, A., Sharma, G. D., Dev, D., & Kharbanda, A. Empowering energy transition: green innovation, digital finance, and the path to sustainable prosperity through green finance initiatives. Energy Economics 2024,136,107736. [CrossRef]

- Min, S., Kim, J., & Sawng, Y. W. The effect of innovation network size and public R&D investment on regional innovation efficiency. Technological Forecasting and Social Change 2020,155,119998. [CrossRef]

- Fritsch, M., & Slavtchev, V. Determinants of the efficiency of regional innovation systems. Regional studies 2011,45(7), 905-918. [CrossRef]

| Level 1 indicators | Level 2 indicators | Description of indicators | Causality |

|---|---|---|---|

| Regional Innovation capacity (ric) | Knowledge creation 15% | Measuring a region's ability to generate new knowledge. | Positive |

| Knowledge acquisition 15% | Measurement of a region's ability to utilise external knowledge and cooperation between industry, academia and research. | Positive | |

| Enterprise innovation 25% | Measures the ability of firms within a region to apply new knowledge, develop new technologies, utilize innovative processes, and manufacture new products. | Positive | |

| Innovation environment 25% | Measure the ability of a region to provide the appropriate environment for the generation, flow and application of technology. | Positive | |

| Innovation performance 20% |

The ability to measure the benefits of innovation for the economic and social development of a region. | Positive | |

| Level 1 indicators | Level 2 indicators | Level 3 indicators | Description of indicators | Causality |

|---|---|---|---|---|

| Green Finance Development Index (gf) | Green credit 50% | Percentage of interest expenses in energy-intensive industries | Interest expenditure of the six major energy-consuming industrial Industries / Total interest expenditure of industrial industries | Negative |

| Percentage of new bank credit to A-share listed environmental enterprises | New bank credit by A-share listed environmental protection companies / Credit to banks by A-share listed companies | Positive | ||

| Green securities 25% |

Market capitalisation of A-share listed environmental enterprises | Market capitalisation of A-share listed environmental enterprises / Total market capitalisation of A-share listed enterprises | Positive | |

| Percentage of A-share value of A-share listed companies with high energy consumption | Market capitalisation of A-share listed energy-intensive enterprises/Total market capitalisation of A-share listed enterprises | Negative | ||

| Green insurance 15 % | Scale environmental pollution insurance | Agricultural insurance income/Property insurance income | Positive | |

| Percentage of compensation from environmental pollution insurance | Agricultural insurance expenditure/Income from agricultural insurance | Positive | ||

| Green investment 10% |

Percentage of investment in environmental pollution control | Investment in environmental pollution control/GDP | Positive | |

| Percentage of fiscal expenditure on environmental protection | Fiscal expenditure on environmental protection/Total fiscal expenditure | Positive |

| Variable Name | Variable Symbol | Variable Definition |

|---|---|---|

| Regional innovation capacity | ric | Calculated by the weighted integrated evaluation method |

| Green finance development Index | gf | Entropy weighting |

| Industrial structure | ind | Value added of secondary sector/GDP |

| Human capital | lnhes | Logarithmic number of general higher education institutions |

| Urbanisation level | ur | Urban/Resident population |

| Science and technology focus | techi | Local finance science and technology expenditure/Local finance general budget expenditure |

| Carbon footprint | lnco2 | Logarithmic carbon dioxide emissions by province and region |

| Capital investment | capi | Investment in fixed assets/Gross regional product |

| Variable | N | Mean | P50 | Sd | Min | Max |

|---|---|---|---|---|---|---|

| lnric | 420 | 3.359 | 3.315 | 0.309 | 2.820 | 4.197 |

| gf | 420 | 0.152 | 0.136 | 0.063 | 0.072 | 0.45 |

| ind | 420 | 0.418 | 0.427 | 0.083 | 0.16 | 0.62 |

| hes | 420 | 84.14 | 83.5 | 38.48 | 9 | 167 |

| ur | 420 | 0.575 | 0.557 | 0.131 | 0.291 | 0.896 |

| techi | 420 | 0.021 | 0.013 | 0.015 | 0.004 | 0.072 |

| co2 | 420 | 362.3 | 265.9 | 305 | 32.12 | 2100 |

| capi | 420 | 0.138 | 0.128 | 0.057 | 0.0450 | 0.457 |

| Variable | VIF | Tolerance |

|---|---|---|

| gf | 1.30 | 0.770 |

| ind | 1.79 | 0.559 |

| lnhes | 2.19 | 0.456 |

| ur | 2.58 | 0.387 |

| techi | 2.93 | 0.341 |

| lnco2 | 2.10 | 0.475 |

| capi | 1.18 | 0.849568 |

| Mean VIF | 2.01 | / |

| Variable | Model 1 | Model 2 | Model 3 | Model 4 |

|---|---|---|---|---|

| lnric | lnric | lnric | lnric | |

| gf | 1.315*** (0.235) |

0.214*** (0.052) |

0.148 (0.133) |

0.207*** (0.052) |

| ind | 0.742*** (0.118) |

0.757*** (0.133) |

||

| lnhes | 0.174*** (0.017) |

0.142** (0.057) |

||

| ur | 0.337*** (0.089) |

0.252 (0.300) |

||

| techi | 13.187*** (0.850) |

2.097*** (0.477) |

||

| lnco2 | -0.070*** (0.013) |

-0.029* (0.015) |

||

| capi | 0.427*** (0.138) |

0.500*** (0.082) |

||

| Constant | 3.159*** (0.039) |

3.326*** (0.008) |

2.142*** (0.095) |

2.309*** (0.211) |

| N | 420 | 420 | 420 | 420 |

| R^2 | 0.069 | 0.950 | 0.775 | 0.960 |

| Prov FE | NO | YES | NO | YES |

| Year FE | NO | YES | NO | YES |

| r2_a | 0.067 | 0.944 | 0.771 | 0.954 |

| Variable | Model 7 | Model 8 | ||

|---|---|---|---|---|

| rd | lnric | rd | lnric | |

| gf | 0.004* (0.002) |

0.168** (0.068) |

0.063* (0.031) |

1.609* (0.891) |

| rd | 9.464*** (2.781) |

11.469*** (3.368) |

||

| lniu | -0.006*** (0.001) |

0.051 (0.046) |

||

| gf×lniu | 0.015* (0.007) |

0.412* (0.197) |

||

| control variable | YES | YES | YES | YES |

| Constant | 0.015*** (0.004) |

2.171*** (0.203) |

0.026*** (0.005) |

2.299*** (0.293) |

| N | 420 | 420 | 420 | 420 |

| Prov FE | YES | YES | YES | YES |

| Year FE | YES | YES | YES | YES |

| R² | 0.945 | 0.961 | 0.951 | 0.963 |

| R²_a | 0.938 | 0.956 | 0.944 | 0.957 |

| Within_ R² | 0.371 | 0.238 | 0.438 | 0.261 |

| F-statistic | 188.17 | 62.52 | 216.49 | 70.57 |

| Sobel Z | 2.347 | 2.103 | ||

| Sobel Z-p value | 0.019 | 0.035 | ||

| bootstrap Z | 2.13 | 1.98 | ||

| bootstrap Z-p value | 0.033 | 0.048 | ||

| Percentage of intermediary effects | 49% | 39.8% | ||

| Variable | (1) | (2) | (3) | (4) | (5) |

|---|---|---|---|---|---|

| lnric | lnci | lnric | lnric | lnric | |

| gf | 0.207*** | 0.684*** | 0.614*** | 0.573*** | 0.773*** |

| (0.053) | (0.180) | (0.156) | (0.163) | (0.200) | |

| ind | 0.757*** | 1.562*** | 1.286** | 3.019*** | |

| (0.135) | (0.500) | (0.519) | (0.590) | ||

| is | -1.705*** | ||||

| (0.462) | |||||

| lnhes | 0.142** | -0.213 | -0.413 | -0.552 | |

| (0.059) | (0.255) | (0.263) | (0.330) | ||

| hep | -35.255 | ||||

| (26.260) | |||||

| ur | 0.252 | 0.636 | 0.294 | 2.822** | 2.742 |

| (0.301) | (0.760) | (0.842) | (1.094) | (1.694) | |

| techi | 2.097*** | 4.302** | 5.425*** | 2.040 | 4.526* |

| (0.475) | (1.762) | (1.483) | (1.358) | (2.284) | |

| lnco2 | -0.029* | -0.028 | -0.069 | -0.095 | |

| (0.015) | (0.049) | (0.048) | (0.058) | ||

| lnso2 | 0.086* | ||||

| (0.042) | |||||

| capi | 0.500*** | 0.997** | 1.135*** | 0.844** | 0.730* |

| (0.088) | (0.354) | (0.348) | (0.339) | (0.374) | |

| od | -0.521** | ||||

| (0.176) | |||||

| ep | -0.516 | ||||

| (1.455) | |||||

| fd | -0.323 | ||||

| (1.347) | |||||

| lnsize | 0.887* | ||||

| (0.449) | |||||

| Constant | 2.309*** | 3.076** | 3.524*** | -3.983 | 3.066*** |

| (0.213) | (1.060) | (0.454) | (3.251) | (0.887) | |

| N | 420 | 420 | 420 | 420 | 300 |

| Prov FE | YES | YES | YES | YES | YES |

| Year FE | YES | YES | YES | YES | YES |

| R² | 0.960 | 0.868 | 0.871 | 0.880 | 0.893 |

| R²_a | 0.960 | 0.851 | 0.853 | 0.863 | 0.874 |

| Within_ R² | 0.205 | 0.127 | 0.144 | 0.208 | 0.191 |

| F-statistic | 426.23 | 26.57 | 28.25 | 497.77 | 108.14 |

| Variable | GF & RIC | RD & RIC | GF & RD | |||

|---|---|---|---|---|---|---|

| (1) lnric |

(2) lnric |

(3) lnric |

(4) lnric |

(5) lnric |

(6) lnric |

|

| gfl1 | 0.129** (0.062) |

0.175** (0.103) |

||||

| gfl1, lngdp | 0.118** (0.056) |

|||||

| rdl1 | 2.598** (1.019) |

|||||

| rdl1, hep | 2.640** (1.018) |

|||||

| gfl1, fd | 0.170** (0.154) |

|||||

| control variable | YES | YES | YES | YES | YES | YES |

| Constant | -0.022 (0.041) |

-0.016 (0.045) |

0.096* (0.051) |

0.097* (0.051) |

0.143 (0.041) |

0.141 (0.045) |

| Prov FE | YES | YES | YES | YES | YES | YES |

| Year FE | YES | YES | YES | YES | YES | YES |

| First-stage F statistic | 939.513 | 469.257 | 743.148 | 829.754 | 939.513 | 474.851 |

| Kleibergen-Paap rk LM statistic | 11.934*** | 11.941*** | 12.463*** | 12.637*** | 11.934*** | 12.525*** |

| Kleibergen-Paap Wald rk F statistic | 1016.958 (16.38) | 735.997 (19.93) | 770.996 (16.38 | 1133.605 (19.93 | 1016.958 (16.38) | 551.437 (19.93) |

| Hansen J P value | / | (0.270) | / | (0.331) | / | (0.148) |

| N | 390 | 390 | 390 | 390 | 390 | 390 |

| 0.504 | 0.534 | 0.614 | 0.644 | 0.509 | 0.610 | |

| Variable | Heckman | PSM | WLS | |

| selected | lnric | lnric | lnric | |

| gf | 0.498** (5.166) |

0.320* (0.158) |

||

| gfdummy | 0.040** (0.017) |

0.057*** (0.015) |

||

| ind | 10.353* (5.593) |

0.844*** (0.158) |

0.751*** (0.138) |

0.584** (0.208) |

| lnhes | 2.164 (2.934) |

0.070 (0.060) |

0.126** (0.055) |

0.106 (0.068) |

| ur | 11.128 (11.064) |

0.373 (0.297) |

0.155 (0.312) |

0.369 (0.397) |

| techi | -85.195*** (31.270) |

1.028 (0.928) |

2.181*** (0.475) |

2.466*** (0.583) |

| lnco2 | 0.206 (1.135) |

-0.035 (0.020) |

-0.035** (0.015) |

-0.018 (0.019) |

| capi | -8.384* (4.345) |

0.575*** (0.137) |

0.514*** (0.079) |

0.508*** (0.092) |

| mills | -0.007 (0.010) |

|||

| ATT | 0.090*** (0.030) |

|||

| Constant | -11.934 (9.463) |

2.528*** (0.355) |

2.459*** (0.222) |

2.353*** (0.263) |

| Observations | 238 | 238 | 420 | 420 |

| R-squared | 0.534 | 0.934 | 0.960 | 0.960 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).