Submitted:

06 October 2025

Posted:

10 October 2025

You are already at the latest version

Abstract

Keywords:

1. Introduction: The Limits of the P/E Ratio in Cross-Market Comparison

- Earnings growth (g) — the dynamic component of future profitability, and

- Discount rate (r) — the risk- and time-adjusted required rate of return.

2. Theoretical Framework: From P/E to PPP

3. Data and Scope

- P/E ratio

- Expected annual earnings growth (g)

- Long-term discount rate (r)

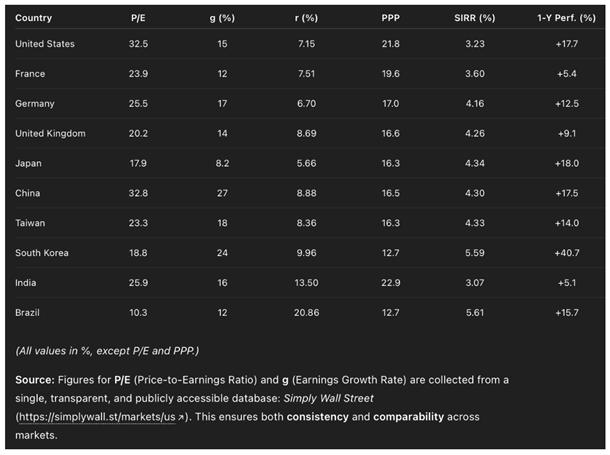

4. Comparative Table of Global Market Valuations (February 7, 2025)

Comment on the Dispersion and Homogeneity of Valuation Metrics

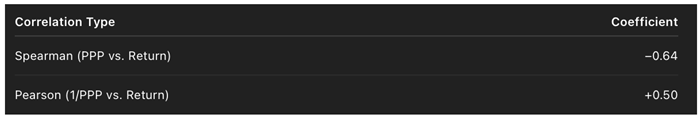

5. Empirical Test: From Explanation to Prediction

6. Discussion: Why PPP and SIRR Outperform P/E

-

PPP restores temporal meaning.P/E is a dimensionless ratio; PPP expresses valuation in years of payback, reintroducing time into valuation analysis.

-

PPP adjusts for growth and risk.Incorporating and ensures that valuations reflect both expected profitability and required returns, enabling cross-market comparability.

-

SIRR transforms valuation into a yield-like measure.It converts PPP into an annualized internal rate of return, allowing direct comparison with bond yields or risk-free benchmarks.

-

Predictive coherence.Markets with high SIRRs consistently show higher realized returns, as they represent undervaluation relative to fundamentals.

7. Conclusion: From Static Ratios to Dynamic Horizons

- Explanatory, by rationalizing observed valuation disparities once growth and risk are included, and

- Predictive, by correctly anticipating relative market performance during 2025.

References

- Bekaert, G.; Harvey, C. R.; Lundblad, C. Liquidity and expected returns: Lessons from emerging markets. The Review of Financial Studies 2007, 20(6), 1783–1831. [Google Scholar] [CrossRef]

- Campbell, J. Y.; Shiller, R. J. The dividend-price ratio and expectations of future dividends and discount factors. The Review of Financial Studies 1988, 1(3), 195–228. [Google Scholar] [CrossRef]

- Damodaran, A. Investment valuation: Tools and techniques for determining the value of any asset, 3rd ed.; Wiley, 2012. [Google Scholar]

- Estrada, J. Adjusting P/E ratios by growth and risk. The Journal of Portfolio Management 2005, 31(2), 88–100. [Google Scholar]

- Fama, E. F.; French, K. R. The cross-section of expected stock returns. The Journal of Finance 1992, 47(2), 427–465. [Google Scholar] [CrossRef]

- Gordon, M. J.; Shapiro, E. Capital equipment analysis: The required rate of profit. Management Science 1956, 3(1), 102–110. [Google Scholar] [CrossRef]

- Harvey, C. R. Predictable risk and returns in emerging markets. The Review of Financial Studies 1995, 8(3), 773–816. [Google Scholar] [CrossRef]

- Loughran, T.; Wellman, J. W. New evidence on the relation between the P/E ratio and stock returns. Financial Analysts Journal 2011, 67(4), 101–112. [Google Scholar]

- Modigliani, F.; Miller, M. H. Dividend policy, growth, and the valuation of shares. The Journal of Business 1961, 34(4), 411–433. [Google Scholar] [CrossRef]

- Penman, S. H. Financial statement analysis and security valuation, 5th ed.; McGraw-Hill Education, 2013. [Google Scholar]

- Sharpe, W. F. Capital asset prices: A theory of market equilibrium under conditions of risk. The Journal of Finance 1964, 19(3), 425–442. [Google Scholar] [PubMed]

- White, G. I.; Sondhi, A. C.; Fried, D. The analysis and use of financial statements, 3rd ed.; Wiley, 2003. [Google Scholar]

- Williams, J. B. The theory of investment value; Harvard University Press, 1938. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).