1. Introduction

The financial market is a complex and dynamic system in which investors must navigate uncertainty and make trade-offs between return and risk. The portfolio selection problem arises when an investor seeks to allocate their wealth among various assets in a manner that aligns with their specific preferences and investment objectives. The foundational methodology for portfolio optimization was introduced in the seminal work of Markowitz [

1], whose theory remains well-documented and widely applied [

2,

3,

4].

Markowitz’s framework focuses on constructing portfolios composed of risky assets, using historical data such as asset returns, variances, and correlations. By analyzing expected returns and covariances derived from historical data, the model provides an optimal strategy for combining assets into an efficient portfolio. The goal is to maximize expected return for a given level of risk or, conversely, to minimize risk for a given return level. Over time, numerous extensions have been introduced to enhance the original risk quantification framework proposed by Markowitz. Konno and Yamazaki [

5] advocated for the use of absolute deviation in place of variance, while Speranza [

6] advanced the concept of semi-absolute deviation to better capture asymmetrical return distributions. Semi-variance also gained traction as an alternative risk measure, as illustrated in the contributions of King and Jensen [

7], King [

8], and Markowitz et al. [

9]. Hamza and Janssen [

2] addressed the limitations of normally distributed returns by proposing a linear programming formulation based on asymmetric risk functions, suitable for large-scale portfolio optimization. In addition, they tackled practical frictions such as transaction costs through separable programming techniques. Yoshimoto [

10] complemented this direction by introducing a nonlinear programming model that integrates transaction costs directly into the optimization process. While these approaches increase model realism, they often come at the cost of heightened computational complexity and reduced tractability for standard solvers. Another line of inquiry has focused on enhancing the interpretability and structural soundness of portfolio models by reconsidering the fundamental assumptions about risk itself. While variance-based measures remain dominant in traditional models, their limitations in capturing asymmetries, tail events, and dynamic correlations have been well documented. In particular, such models may overlook the structural dependencies within asset classes or fail to reflect investor preferences that deviate from mean–variance rationality. This has led researchers to explore more flexible and theoretically grounded alternatives that can account for both uncertainty and diversification in a more comprehensive manner.

The selection of a risk measure plays a crucial role in shaping portfolio structure. Wang and Liu [

11] highlighted that risk measures directly influence allocation outcomes. One particularly promising alternative to variance is entropy. Shannon [

12] introduced a foundational concept of entropy in the context of information theory, which was later extended by Yager [

13] using the maximum entropy principle. Wang and Parkan [

14] developed the minimax disparity model, which minimizes the largest discrepancy in asset weights through a linear entropy-based approach. Philippatos and Wilson [

15] were the first to apply Shannon entropy to portfolio theory, treating it as a diversification metric. They argued that entropy is more flexible than variance, as it can handle non-metric data and does not rely on symmetric probability distributions. Simonelli [

16] further demonstrated the superior performance of entropy over variance and deviation-based metrics. Zhou et al. [

17] provided an extensive review of entropy’s applications in finance, affirming its rising influence. Empirical studies, such as those by Jiang et al. [

18] and Zheng et al. [

4], have implemented Shannon entropy in portfolio models to replace variance, including use cases like electricity purchasing portfolios.In addition, robust optimization frameworks have emerged to address parameter estimation errors in expected returns and covariances. These methods are designed to improve portfolio resilience under uncertainty. Simultaneously, behavioral finance approaches such as Prospect Theory and Behavioral Mean–Variance Optimization have been integrated to account for psychological biases and investor preferences [

19,

20].

Recent advancements in portfolio optimization have embraced increasingly sophisticated frameworks that integrate fuzzy logic, robust modeling, and multi-criteria decision-making principles. Liu and Li [

21] proposed a novel fuzzy multi-objective programming approach based on Pareto optimality, which offers a powerful method for navigating trade-offs in environments characterized by ambiguity and incomplete information.

In parallel, entropy-based models have evolved toward scalable implementations in large-scale financial systems. He and Jiang [

22] introduced a maximum entropy formulation designed to improve stability and computational tractability, while Ke and Zhang [

23] explored the integration of entropy measures into classical mean–variance models, highlighting the synergy between information theory and traditional financial paradigms.

Beyond methodological advances, theoretical developments in risk modeling have contributed to the refinement of portfolio frameworks. Sheraz and Dedu [

24] present stochastic models of fat-tail returns and risk modeling for Bitcoin, laying the groundwork for more rigorous treatment of risk under uncertainty. Complementing these efforts, Lutgens and Schotman [

25] emphasized robust portfolio optimization with multiple expert perspectives, acknowledging the need to account for heterogeneous beliefs in volatile markets. Yu and Lee [

26] addressed portfolio rebalancing through multi-criteria programming, enabling the incorporation of diverse investor objectives and practical constraints. These perspectives converge within the broader field of multi-criteria decision analysis (MCDA), as reviewed by Zopounidis and Doumpos [

27], which offers a flexible and unifying framework for integrating behavioral preferences, structural constraints, and informational entropy into a cohesive portfolio optimization strategy. This interdisciplinary evolution reinforces the relevance of entropy-based models in modern finance, particularly when robustness, diversification, and decision flexibility are of paramount importance. Motivated by these developments, the present paper proposes an entropy-based portfolio optimization model that maximizes second-order Tsallis entropy, with flexible weightings reflecting investor preferences toward return and diversification. As an empirical validation, we apply the model to optimize a cryptocurrency portfolio composed of two or three assets during the period January–March 2025. The cryptocurrency market was selected as the empirical testing ground offering a challenging yet insightful testbed due to its high volatility, dynamic liquidity, and the urgent need for robust diversification tools.

The key contributions of this paper are as follows: (1) An entropy-based portfolio optimization model is developed, by integrating the second-order Tsallis entropy as a structural diversification and liquidity-aware constraint. This approach enhances portfolio robustness against concentration. (2) Analytical solutions of the optimization model are derived, by using the Lagrange multiplier method, ensuring computational tractability even in volatile markets. (3) The proposed model is empirically validated on cryptocurrency portfolios, proving its ability to balance return and diversification, and offering practical utility in liquidity-sensitive asset management.

Compared to Shannon entropy approach, the second-order Tsallis entropy offers a more flexible penalization of portfolio concentration through its quadratic formulation. This property allows a smoother adjustment of diversification levels and ensures greater analytical tractability, particularly in small-sized to medium-sized portfolios. Additionally, second-order Tsallis entropy is mathematically connected to the complement of Onicescu informational energy, which offers an intuitive interpretation of asset dispersion and portfolio balance. These advantages position the proposed model as an effective and computationally manageable tool for robust portfolio construction.

The remainder of the paper is structured as follows:

Section 2 introduces the mean–variance–second order entropy model for portfolio optimization.

Section 3 presents and discusses the computational results.

Section 4 concludes the paper.

2. Materials and Methods

2.1. Mean - Second Order Tsallis Entropy – Variance Model to Porfolio Optimization

In this section, we introduce a portfolio optimization model based on three core components: expected return, variance, and second-order Tsallis entropy. The model aims to maximize a weighted combination of return and entropy, subject to a variance-based risk constraint. The use of second-order Tsallis entropy enhances diversification by penalizing concentration in portfolio weights, and implicitly supports liquidity-aware asset allocation. This formulation offers a tractable yet robust framework suitable for volatile markets such as cryptocurrencies.

We consider a portfolio composed by assets. Let which models the portfolio weight assigned to asset . The portfolio is described by the decision vector . Let .

Definition. The Tsallis Entropycorresponding to the portfolio is given by

We note that, for

, the Tsallis entropy can be expressed in terms of the informational energy introduced by O. Onicescu, given by

, as follows:

For , the Tsallis entropy collapses to Onicescu informational energy complement.

In this context, the entropy measure used in our model should be understood as a diversification proxy derived from the informational energy complement. Although the formulation aligns with the entropy-based optimization structure, the interpretation is closer to the Onicescu entropy version. We have clarified this distinction to prevent potential confusion and provided further reference to the work of Ou and Ho [

28] which discusses these relationships in detail. This formulation offers a tractable yet robust framework suitable for volatile markets such as cryptocurrencies.

Remarks:

Therefore,

- 2.

A lower entropy implies greater concentration (lower diversification), whereas a higher entropy reflects greater diversification, which may contribute positively to portfolio liquidity.

Optimization Problem Formulation

A portfolio optimization problem is based on the model presented in Ke and Zhang [

23], where weightings are assigned to every asset, depending on the importance given by the investor to the return and the entropy (diversification can be useful to liquidity):

where

;

is the number of time units;

is average return of asset

i;

is average return of asset

at the period

t; is the level of the risk and is assumed of investor;

.

We acknowledge that the risk constraint applied here reflects the weighted average of individual asset variances, which does not fully capture portfolio variance unless assets are perfectly uncorrelated. This simplification is commonly used in similar entropy-based models but may not accurately represent risk in real-world cryptocurrency portfolios where asset correlations can be significant and dynamic. Future extensions of this model should incorporate the full covariance matrix to provide a more comprehensive risk estimation.

Solving the Portfolio Optimization Problem

Using the Lagrange multiplier method, we obtain:

The first order conditions are given by:

By assembling the

relationships we have

We obtain

Using relationship (1) we get

where the multiplier

verifies the relation:

2.2. Case Studies

The cryptocurrency price data used in this study were obtained from the Binance exchange through the TradingView historical data platform. The dataset includes daily closing prices for Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) over the January–March 2025 period. Prices were cross-verified with other public data sources to ensure consistency. No missing observations were identified in the selected dataset. This preprocessing approach ensures data reliability and reproducibility of the empirical results.

Given the high volatility, evolving correlation structures, and regime-switching behavior inherent to digital asset markets, cryptocurrencies represent a fertile ground for testing advanced portfolio optimization models. Unlike traditional financial assets, cryptocurrencies are characterized by frequent price swings, low historical depth, and rapidly changing liquidity patterns, all of which challenge conventional assumptions of stationarity and normality. These features create an environment where diversification, structural robustness, and adaptive decision-making become essential. Moreover, the decentralized nature of crypto markets introduces idiosyncratic risks and asymmetries that amplify the need for entropy-based approaches capable of managing uncertainty and concentration effects.

Entropy, in this context, serves not only as a statistical measure but also as a strategic stabilizer in markets where investor sentiment and momentum can dominate fundamentals. By capturing allocation uniformity and penalizing overexposure, second-order entropy allows for more balanced configurations that may mitigate downside risk in turbulent scenarios. To illustrate the practical implications of this framework, we apply our model to two empirical portfolio settings: a two-asset portfolio composed of Bitcoin and Ethereum, followed by a three-asset configuration that includes Solana.

In both scenarios, the optimization is performed over a sample period spanning January to March 2025, using daily return data. The model parameters are calibrated to reflect a moderate investor profile, with equal weighting given to expected return and entropy (i.e., a = b). Risk tolerance is set via an upper bound on variance, consistent across both configurations to ensure comparability.

We selected a three-month period (January–March 2025) to capture recent market conditions marked by high volatility and shifting liquidity patterns, providing a relevant and challenging environment to evaluate the robustness of the proposed model

The two-asset case (n = 2) provides a simplified environment for analytical tractability, offering intuitive insight into how entropy modifies the allocation strategy relative to classical mean–variance solutions. This setup serves as a benchmark, highlighting the tendency of the entropy term to shift weight away from high-return but volatile assets in favor of improved balance. In contrast, the three-asset case (n = 3) introduces an additional degree of freedom and demonstrates how the model scales with portfolio size, accommodating additional correlation effects and diversification pathways.

Case n=2:Portfolio Optimization with Two Cryptocurrencies

In this section, we consider a simple two-asset portfolio composed of Bitcoin (BTC) and Ethereum (ETH), observed over the period 18 January 2025 – 21 March 2025. The purpose of this case study is to demonstrate the implementation of the mean–second-order entropy model described previously.

We choose the investor preference weights a = 0.75 for expected return and b = 0.25 for entropy. The selection of a = 0.75 and b = 0.25 reflects an empirical investor profile that moderately prioritizes expected return over diversification. This structure is frequently adopted in portfolio studies focusing on volatile markets, where a controlled preference toward return is balanced by a diversification term to mitigate concentration risk. However, we recognize that this static preference may not fully capture real-world dynamics, and future work should explore sensitivity analyses with alternative weight configurations. We obtain the model:

Using the formulas presented above we obtain

x2 = 1.5 (0.0133 - 0.0698/2) + γ/0.5 (0.77 - 0.8/2)

+ 0.5 = 0.47 + 0.74γ

where the multiplier γ verify relations :

or (0.53 - 0.74γ)⋅0.033 + (0.47+0.74γ)⋅0.775 = 0.1

We have 0.55γ + 0.38 = 0.1 or γ = - 0.51 and substituting back, the optimal portfolio allocation becomes: x₁ = 0.9074 and x₂ = 0.0926. This result indicates that, under the given preferences and market conditions, the optimal portfolio heavily favors Bitcoin (BTC), allocating approximately 90.74% of the capital to BTC and only 9.26% to ETH.

Case n=3Portfolio Optimization with Three Cryptocurrencies

In this section, we consider a portfolio composed of three major cryptocurrencies: Bitcoin (BTC), Ethereum (ETH), and Solana (SOL), observed over the period 18 January 2025 – 21 March 2025. We apply the mean–second-order Tsallis entropy model as described in the previous sections

We are going to use the mean - second order entropy model .

We choice a = 0.75 and b = 0.25 and we obtain the model:

Using the formulas presented above we obtain

where the multiplier γ verify relations : x₁⋅0.033 + x₂⋅0.775 + x₃⋅0.105 = 0.1

or (0.35 - 0.55γ)⋅0.033 + (0.28 + 0.94γ)⋅0.775 + (0.37 - 0.39γ)⋅0.105 = 0.1.

We have 0.67γ + 0.26 = 0.1 i.e γ = - 0.24

We obtain x₁ = 0.462, x₂ = 0.0344 and x₃ = 0.5036

These numerical applications offer valuable insights into the model’s allocation dynamics, setting the stage for a deeper analysis of performance and diversification outcomes in

Section 3. By comparing distinct portfolio structures under varying dimensionality, the results highlight how entropy interacts with return and variance to shape asset weights. The contrast between concentrated and diversified allocations allows us to assess the extent to which second-order Tsallis entropy serves as an effective mechanism for controlling risk exposure while preserving responsiveness to expected returns. The following section explores these aspects in detail, drawing empirical conclusions from both two- and three-asset configurations.

3. Results and Discussions

The empirical implementation of the mean–second-order entropy–variance optimization model was carried out on two different portfolio configurations involving major cryptocurrencies. The objective was to evaluate how the entropy component influences the allocation structure and risk-return balance under increasing asset dimensionality.

To further test the flexibility of the proposed model, we conducted a sensitivity analysis by varying the investor preference weights (a and b) and the maximum risk constraint. The results indicate that when higher weightings are assigned to entropy, the model favors more diversified allocations, while increased emphasis on expected return results in more concentrated portfolios. Additionally, higher risk tolerance levels lead to more aggressive asset exposures. These patterns confirm the intuitive behavior and adaptability of the model to different investor profiles and market conditions. To further assess the effectiveness of the entropy-driven approach, we compared the results of the proposed model with those obtained from a classical mean–variance optimization framework using the same asset sets. The comparison indicates that while the mean–variance model tends to over-allocate towards assets with the highest expected return, the entropy-based model promotes more balanced allocations that enhance diversification. This demonstrates that the structural diversification induced by the entropy component is not solely a consequence of adding more assets but is actively driven by the entropy constraint embedded in the optimization process.

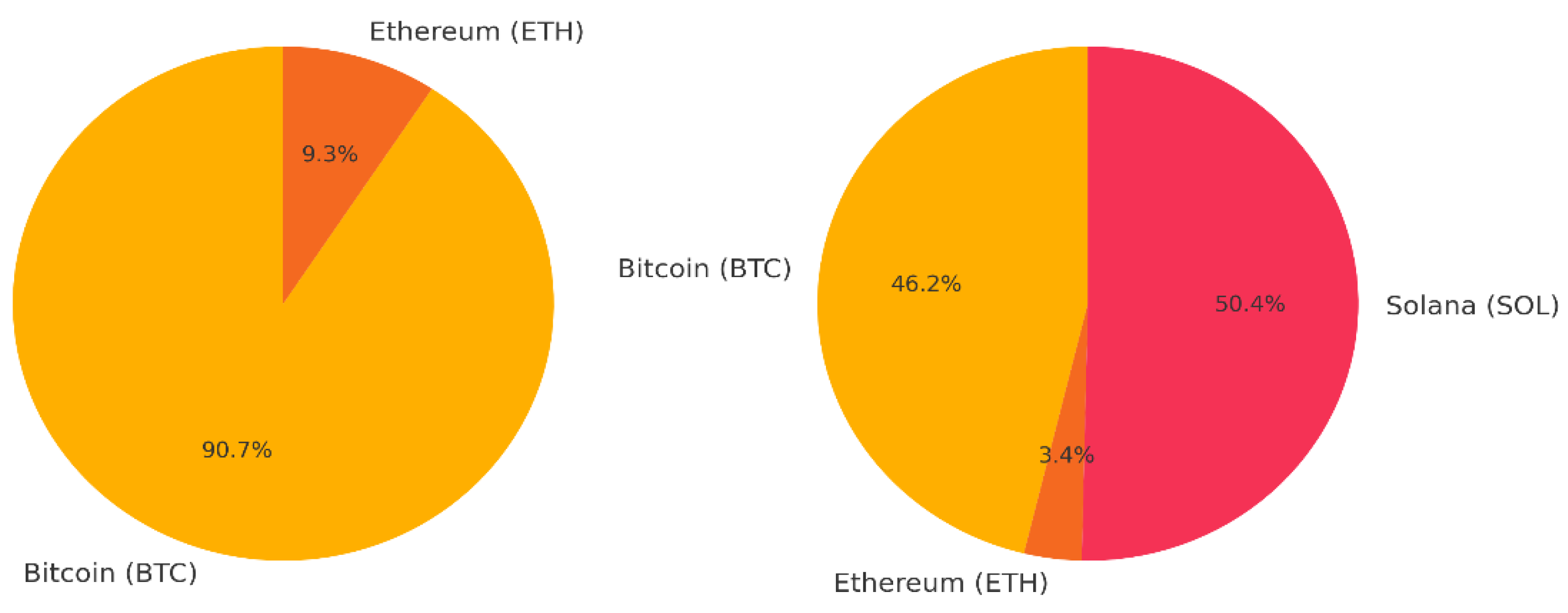

In the first case (n = 2), involving Bitcoin (BTC) and Ethereum (ETH), the results indicate a highly concentrated portfolio. Approximately 90.74% of the capital was allocated to BTC and only 9.26% to ETH. This behavior can be attributed to BTC's superior return-to-risk ratio during the observation period. However, the low entropy value in this case suggests a poor diversification level, which may result in higher liquidity risk or vulnerability to idiosyncratic shocks.

The second case (n = 3), which introduced Solana (SOL) as an additional asset, generated a significantly different allocation structure. The model yielded a much more balanced distribution: 46.2% to BTC, 50.36% to SOL, and 3.44% to ETH. While BTC maintained a strong position due to its performance, SOL gained a substantial share because of its high expected return relative to risk. Meanwhile, ETH received a minimal allocation, reflecting its less favorable volatility-adjusted return profile.

The numerical results corresponding to both scenarios (n = 2 and n = 3) are summarized in

Table 1, which presents the expected returns, variances, and optimal portfolio weights for each asset.

Figure 1 illustrates the final portfolio allocations in both scenarios. The increase in entropy, clearly visible in the transition from Case 1 to Case 2, confirms the model’s ability to promote diversification as more viable assets are included

This comparative outcome illustrates how entropy acts as more than a passive term in the objective function. It serves as a structural force that modulates the optimizer’s tendency to overweight high-return assets at the expense of robustness. In effect, entropy introduces a "soft constraint" on concentration, guiding the portfolio toward a configuration that balances return, risk, and liquidity potential.

From a practical standpoint, this mechanism may be especially valuable in crypto-asset environments, where correlations between coins can shift rapidly and price movements are often nonlinear and asymmetric. Entropy serves here not only as a statistical measure, but also as a strategic hedge against overexposure and poor adaptability. This highlights the versatility of entropy-based models in accommodating evolving market dynamics while preserving a structure consistent with investor goals

Additionally, this approach holds potential for institutional applications, such as crypto index construction or risk-managed digital asset funds. Its ability to integrate return optimization with structural diversification may help mitigate tail risk in volatile markets, a concern often voiced by fund managers and regulators alike.

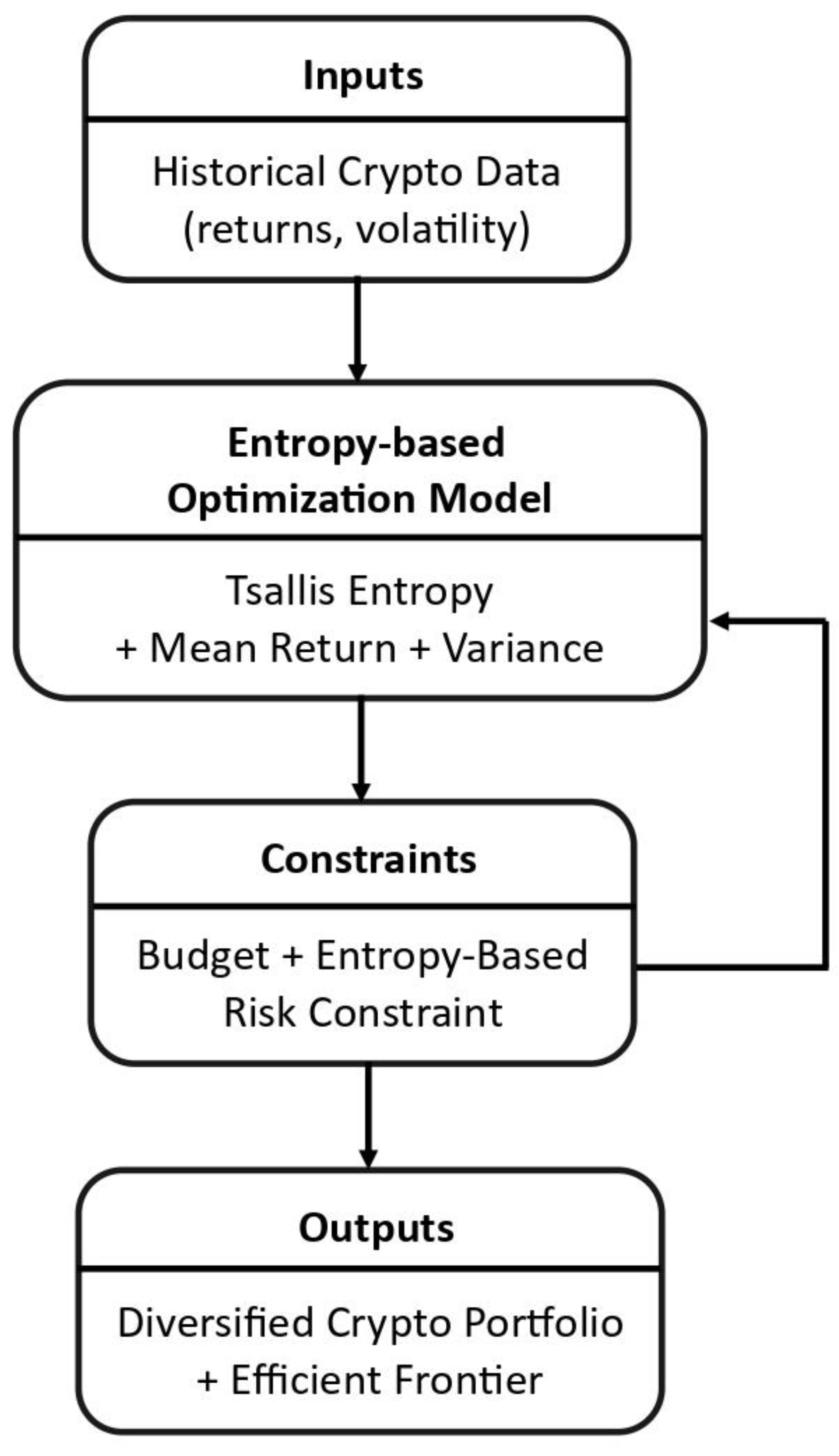

Figure 2 presents a summary diagram of the proposed entropy-based portfolio optimization framework, highlighting its core components, inputs, and outputs. This visual representation complements the empirical findings and clarifies the model's integration of return, risk, and entropy.

Limitations

While the proposed mean–second-order entropy–variance model offers a valuable contribution to portfolio optimization—particularly in the context of cryptocurrency markets—it is not without limitations.

First, the model relies on historical return and covariance estimates, which may not always be reliable in highly volatile and non-stationary environments such as digital asset markets. Entropy, while useful as a diversification metric, does not capture tail risk or extreme events, which are frequent in crypto ecosystems.

Second, the optimization procedure, although computationally feasible in small- and medium-scale cases, may face scalability issues as the asset universe expands significantly. Moreover, the use of second-order entropy assumes symmetric information distribution across portfolio components, which may not always reflect real-world behavior in emerging or illiquid assets.

Third, the model assumes investor preferences are static and encoded via fixed weights (a, b) for the return and entropy objectives. This simplification may not fully capture dynamic portfolio strategies or behavioral shifts in investor priorities over time. Incorporating adaptive or scenario-based weighting mechanisms could improve the model's realism and applicability in practical asset management contexts.

Future research could address these limitations by:

- Incorporating dynamic, forward-looking estimators for return and volatility using machine learning or regime-switching models;

- Extending the entropy component to higher-order measures or adaptive entropy estimators that reflect changing market structures;

Embedding behavioral preferences and adaptive risk-aversion mechanisms into the objective function;

- Exploring integration with decentralized finance (DeFi) instruments, NFT-backed assets, or hybrid portfolios combining digital and traditional securities;

- Testing the model over longer time horizons or across multiple regimes to assess robustness under varying market conditions.

By tackling these aspects, the entropy-based portfolio optimization framework can be further refined and extended toward practical deployment in real-world investment strategies, especially within the rapidly evolving domain of digital finance.

4. Conclusions

This study proposed an enhanced portfolio optimization framework that integrates second-order Tsallis entropy with classical mean–variance modeling, addressing the growing need for diversification and liquidity-aware allocation in dynamic financial markets. By treating entropy as a structural proxy for both diversification and liquidity, the model enables investors to systematically manage concentration risk while maintaining analytical tractability.

The empirical analysis focused on the cryptocurrency market, using a recent three-month period (January–March 2025) to reflect the latest volatility and market conditions. The assets selected—Bitcoin (BTC), Ethereum (ETH), and Solana (SOL)—are among the most liquid and widely traded cryptocurrencies, ensuring that our case studies reflect realistic and implementable portfolio scenarios. In the two-asset configuration (BTC and ETH), the model allocated capital predominantly to the asset with superior risk-adjusted returns, resulting in a relatively concentrated structure. However, in the three-asset portfolio (BTC, ETH, SOL), the inclusion of a third liquid asset enabled greater diversification. Here, entropy played a pivotal role in balancing allocations, facilitating a more uniform portfolio that adhered to the risk constraint while accommodating a new high-performing component. These results validate the role of entropy as an implicit diversification mechanism capable of mitigating overexposure, particularly in markets where volatility, correlation shifts, and non-normal return distributions challenge traditional models. Furthermore, the model retained its computational efficiency, yielding closed-form or semi-analytical solutions for small portfolios and scalable numerical results for larger systems.

Overall, the findings demonstrate that entropy-driven models hold strong potential for robust portfolio construction in emerging financial sectors such as crypto asset management. This framework not only aligns with modern risk management principles but also offers practical utility for investors seeking to balance return maximization with structural resilience.

It is also important to recognize the limits of using entropy as a sole proxy for portfolio liquidity. While entropy provides a structural measure of diversification, true market liquidity is strongly influenced by microstructure factors such as bid-ask spreads, market depth, and trading volumes. Future research should consider integrating microstructure-based liquidity indicators to enhance the precision of liquidity assessment in the optimization process.

Future research directions may include the integration of time-varying entropy estimators, adaptive rebalancing strategies, or hybrid models combining entropy with behavioral factors and predictive analytics. Such advancements could further increase the robustness and responsiveness of portfolio strategies in complex and rapidly evolving financial environments.

By bridging theoretical insights with practical demands, the proposed model contributes meaningfully to the literature on robust portfolio optimization and opens new avenues for institutional adoption in liquidity-sensitive investment contexts.

Author Contributions

Conceptualization, Florentin Șerban and Silvia Dedu; methodology, Florentin Șerban and Silvia Dedu; validation, Florentin Șerban; formal analysis, Florentin Șerban and Silvia Dedu; investigation, Florentin Șerban; resources, Florentin Șerban and Silvia Dedu; data curation, Silvia Dedu; writing—original draft preparation, Florentin Șerban and Silvia Dedu; writing—review and editing, Florentin Șerban and Silvia Dedu; visualization, Florentin Șerban and Silvia Dedu; supervision, Florentin Șerban. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The author declares no conflict of interest

References

- Markowitz, H. (1952). Portfolio selection. The Journal of Finance, 7, 77–91.

- Hamza, F.; Janssen, J. (1996). Linear approach for solving large-scale portfolio optimization problems in a lognormal market. Proceedings of the 6th AFIR, Nuremberg, Germany.

- Markowitz, H. (1991). Foundations of portfolio optimizations. The Journal of Finance, 2, 469–471.

- Zheng, Y.; Zhou, M.; Li, G. (2009). Information entropy-based fuzzy optimization model of electricity purchasing portfolio. IEEE Power & Energy Society General Meeting (PES '09), 1–6.

- Konno, H.; Yamazaki, H. (1991). A mean absolute deviation portfolio optimization model and its applications to Tokyo stock market. Management Science, 37, 519–531.

- Speranza, M. G. (1993). Linear programming models for portfolio optimization. Finance, 14, 107–123. https://iris.unibs.it/handle/11379/4732.

- King, A. J.; Jensen, D. L. (1992). Linear-quadratic efficient frontiers for portfolio optimization model. Applied Stochastic Models and Data Analysis, 8, 195–207.

- King, A. J. (1993). Asymmetric risk measures and tracking models for portfolio optimization under uncertainty. Annals of Operations Research, 45, 165–178.

- Markowitz, H.; Todd, P.; Xu, G.; Yamane, Y. (1993). Computation of mean–semi-variance efficient sets by the critical line algorithm. Annals of Operations Research, 45, 307–318.

- Yoshimoto, A. (1996). The mean-variance approach to portfolio optimization subject to transaction costs. Journal of the Operations Research Society of Japan, 39(1), 99–117.

- Wang, X.; Liu, Y. (2021). A novel approach for determining OWA operator weights based on maximum entropy and linear programming. Information Sciences, 580, 620–635.

- Shannon, C. E. (1948). A mathematical theory of communication. Bell System Technical Journal, 27, 379–423.

- Yager, R. R. (1995). Measures of entropy and fuzziness related to aggregation operators. Information Sciences, 82, 147–166.

- Wang, Z.; Parkan, C. (2005). A minimax disparity model for portfolio selection. European Journal of Operational Research, 163(1), 115–131.

- Philippatos, G. C.; Wilson, C. J. (1972). Entropy, market risk, and the selection of efficient portfolios. Applied Economics, 4, 209–220.

- Simonelli, M. R. (2005). Indeterminacy in portfolio selection. European Journal of Operational Research, 163, 170–176.

- Zhou, R. X.; Cai, R.; Tong, G. Q. (2013). Applications of entropy in finance: A review. Entropy, 15, 4909–4931. https://www.mdpi.com/1099-4300/15/11/4909.

- Jiang, Y.; He, S.; Li, X. (2008). A maximum entropy model for large-scale portfolio optimization. International Conference on Risk Management & Engineering Management (ICRMEM '08), 610–615.

- Dedu, S.; Șerban, F.; Tudorache, A. (2014). Quantitative risk management techniques using interval analysis, with applications to finance and insurance. Journal of Applied Quantitative Methods, 9, 1–15.

- Dedu S., Fulga C. (2011). Value-at-Risk estimation comparative approach with applications to optimization problems. Economic Computation and Economic Cybernetics Studies and Research, 45(4), 5–20.

- iu, P.; Li, X. (2023). A novel approach to fuzzy multi-objective programming with Pareto optimality. Fuzzy Sets and Systems, 467, 45–60.

- He, X.; Jiang, H. (2020). A Maximum Entropy Model for Large-Scale Portfolio Optimization. Proceedings of the 2020 International Conference on Financial Engineering, 45–52.

- Ke, J.; Zhang, C. (2008). Study on the optimization of portfolio based on entropy theory and mean-variance model. IEEE International Conference on Service Operations and Logistics, and Informatics (SOLI 2008), 2668–2672. https://www.researchgate.net/publication/240643459.

- Sheraz M., Dedu S. (2020). Bitcoin Cash: Stochastic models of fat-tail returns and risk modeling. Economic Computation and Economic Cybernetics Studies and Research, 54(3), 43–58.

- Lutgens, F.; Schotman, P. (2010). Robust portfolio optimisation with multiple experts. Review of Finance, 14, 343–383. https://academic.oup.com/rof/article/14/2/343/1569756.

- Yu, J. R.; Lee, W. Y. (2011). Portfolio rebalancing model using multiple criteria. European Journal of Operational Research, 209, 166–175.

- Zopounidis, C.; Doumpos, M. (2020). Multi-criteria decision aid in financial decision making: Methodologies and literature review. Journal of Multi-Criteria Decision Analysis, 27(1–2), 1–24. [CrossRef]

- Ou, Y.-C.; Ho, K.-C. (2019). Portfolio Optimization Using Entropy Measure of Risk. Entropy, 21, 1022. [CrossRef]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).