1. Introduction

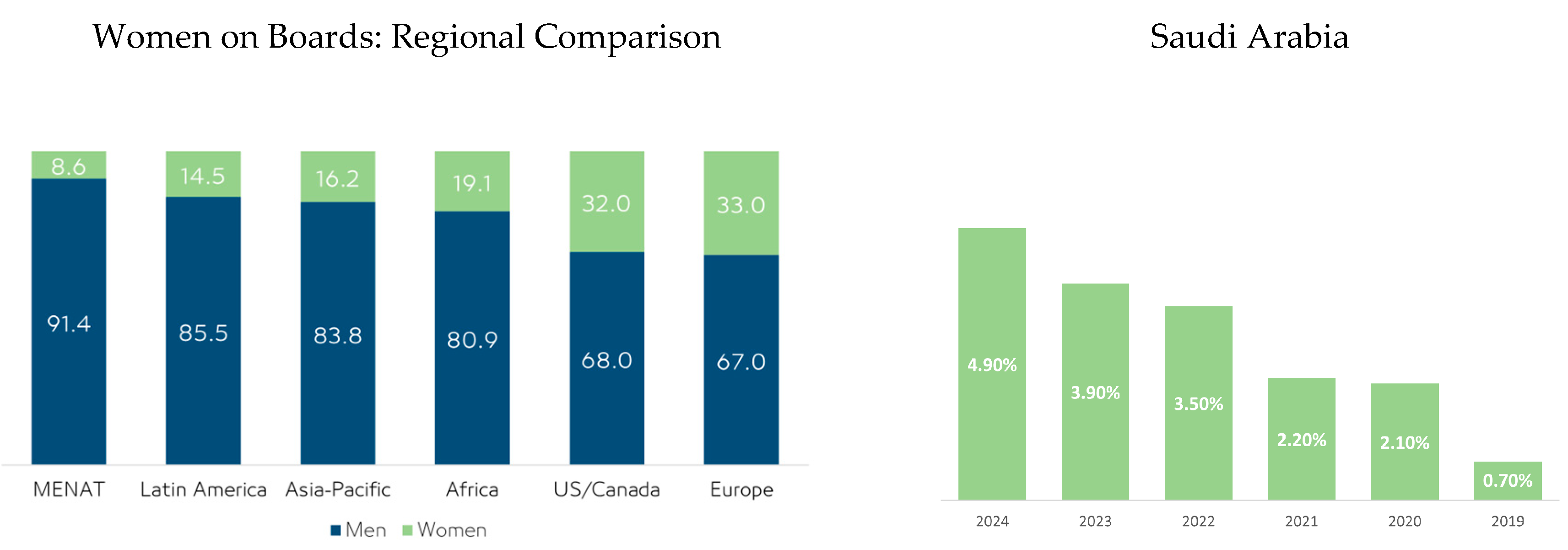

The appointment of women to corporate boards has become a significant governance trend globally, driven by both regulatory initiatives and growing recognition of the potential benefits of gender diversity (Adams & Ferreira, 2009; Terjesen et al., 2009). While this trend has been extensively studied in developed markets, less attention has been paid to emerging economies with distinct institutional and cultural characteristics. Saudi Arabia presents an interesting case, as recent governance reforms under Vision 2030 have encouraged greater female representation in leadership positions, marking a significant departure from historical norms in a traditionally conservative business environment where men have predominantly occupied leadership roles.

Figure 1 shows that only 4.9% of total director seats are held by women in 2024. The increasing inclusion of women is not only a marker of progress in gender equality but also a signal of broader economic and institutional reforms aimed at diversifying the economy and enhancing corporate accountability.

Moreover, Saudi Arabia's evolving regulatory environment, characterized by reform initiatives in corporate governance and transparency, heightens the importance of understanding market sentiments. Investors’ perceptions of female board appointments can offer valuable insights into how these reforms are interpreted in financial terms—implications that resonate with global and local stakeholders. Analyzing market reactions provides a unique lens to gauge the effectiveness of gender diversity policies and their impact on firm value.

How do investors respond to female board appointments in such contexts? Traditional finance theory suggests that if gender diversity enhances board effectiveness and firm performance, markets should react positively to such appointments (Fama, 1970; Carter et al., 2003). However, behavioral perspectives acknowledge that investor reactions may be influenced by prevailing social norms and cognitive biases (Kahneman & Tversky, 2013; Eagly & Karau, 2002). The empirical evidence remains mixed, with studies documenting positive, negative, or neutral market reactions depending on the institutional context (Post & Byron, 2015; Ahern & Dittmar, 2012; Gregory et al., 2013).

This study contributes to the literature by examining market reactions to female board appointments in Saudi Arabian firms using an innovative methodological approach. Building on conventional event study methods, we utilize Jordà's (2005) Local Projection (LP) framework, which offers several advantages for analyzing market responses in complex institutional environments. This approach allows us to trace the dynamic effects of female board appointments on stock returns over multiple horizons without imposing restrictive assumptions about the pattern of market adjustment. Additionally, we complement the analysis by employing Quantile-on-Quantile analysis to investigate how market conditions interact with the phases surrounding women's appointments on board.

These findings contribute to several strands of literature. First, we extend research on board diversity by providing evidence from an institutional context that differs markedly from the developed markets that dominate existing studies (Adams et al., 2015; Kirsch, 2018). Second, we contribute to the literature on market efficiency by documenting a gradual rather than instantaneous price response to corporate governance events, consistent with models of limited attention and information processing constraints (Hirshleifer & Teoh, 2003; Cohen & Frazzini, 2008). Third, we advance the methodological toolkit for corporate governance research by demonstrating the utility of the LP approach for capturing dynamic market responses to board composition changes.

The remainder of this paper is organized as follows:

Section 2 reviews the relevant literature.

Section 3 assesses the relevance of the Saudi Arabian context.

Section 4 describes our primary empirical methodology and presents the findings.

Section 5 details the results derived from the Local Projections method.

Section 6 offers a verification of the Quantile Regression analysis.

Section 7 summarizes and discusses our findings, while

Section 8 concludes.

2. Market Reactions to Women’s Board Appointments: A Theoretical and Empirical Literature Review

This literature review investigates the theoretical foundations and empirical evidence concerning market reactions to women's board appointments, focusing particularly on Saudi Arabia's unique context.

2.1. Theoretical Frameworks on Board Gender Diversity

Several theoretical perspectives offer insights into how gender diversity on corporate boards might influence firm outcomes and, consequently, how markets might react to female board appointments.

Agency theory, which addresses the principal-agent problem between shareholders and managers, suggests that board diversity may enhance monitoring capabilities (Jensen & Meckling, 1976). As some scholars argue, women directors may bring independent perspectives and stronger monitoring orientations, potentially reducing agency costs and enhancing shareholder value (Adams & Ferreira, 2009). This perspective would predict positive market reactions to female board appointments, particularly in contexts with weak governance mechanisms.

The resource dependence theory conceptualizes boards as boundary spanners that connect firms to critical external resources (Pfeffer & Salancik, 2015). Female directors may provide access to unique networks, perspectives, and legitimacy, especially in markets where women constitute significant consumer segments or stakeholder groups (Hillman et al., 2007). This theoretical lens suggests that markets might respond favorably to female board appointments when such appointments enhance a firm's resource acquisition capabilities.

The social identity theory posits that individuals categorize themselves and others into social groups, influencing behavior and interactions (Tajfel, 1974). In boardroom contexts, gender-based social identities may affect group dynamics, potentially affecting decision-making processes (Westphal & Milton, 2000). The critical mass theory further suggests that the impact of women directors becomes more pronounced when their representation reaches a threshold that enables them to influence board decisions substantively rather than merely symbolically (Konrad et al., 2008; Torchia et al., 2011).

Finally, the signaling theory provides a particularly relevant framework for understanding market reactions to female board appointments. According to this perspective, in contexts of information asymmetry, observable actions can signal unobservable qualities or intentions (Spence, 1978). The appointment of women to corporate boards may signal a firm's commitment to progressive governance practices, responsiveness to institutional pressures, or strategic orientation toward diversity and inclusion (Miller & Triana, 2009). Market participants may interpret these signals differently depending on the prevailing institutional environment and cultural context.

2.2. Methodological Approaches in Empirical Research

The event study methodology is the predominant empirical approach to examining market reactions to female board appointments. This approach measures abnormal stock returns surrounding the announcement of board appointments to isolate market reactions attributable to the gender of the appointee. Researchers typically employ various event windows (e.g., [−1,+1], [−2,+2], [−5,+5] days) and different models for calculating expected returns, including the market model, Fama-French three-factor model, and Carhart four-factor model.

For instance, Kang et al. (2010) utilized a standard event study methodology with a market model to examine market reactions to female board appointments in Singapore. Similarly, Campbell and Mínguez-Vera (2010) employed event study methodology to investigate the Spanish market's response to female director appointments, using both the market model and the Fama-French three-factor model to ensure robustness.

Beyond event studies, researchers have employed regression analyses to examine the relationship between female board appointments and various market-based outcomes. These studies often control for firm characteristics (size, industry, performance), board characteristics (size, independence), and director attributes (age, education, experience). Post and Byron (2015) conducted a meta-analysis of 140 studies, employing meta-regression techniques to examine how the relationship between female board representation and firm performance varies across different contexts.

While quantitative methods dominate the literature, some researchers have employed qualitative or mixed-methods approaches to provide deeper insights into the mechanisms underlying market reactions. These studies often involve interviews with investors, board members, and other stakeholders to understand perceptions and decision-making processes. Kakabadse et al. (2015) conducted in-depth interviews with female directors in the UK to understand their experiences and contributions, providing context for interpreting quantitative findings on market reactions. Similarly, Seierstad (2016) employed a mixed-methods approach, combining quantitative analysis of Norwegian firms with qualitative interviews to understand the implementation and consequences of Norway's board gender quota.

2.3. Market Reactions to Female Board Appointments: Global Evidence

Empirical research on market reactions to female board appointments has yielded mixed findings, reflecting the complexity of the relationship and the importance of contextual factors.

Studies examining short-term market reactions, typically using event study methodologies, have produced inconsistent results. Some research documents positive abnormal returns following announcements of female board appointments (Campbell & Mínguez-Vera, 2010; Kang et al., 2010, Adams et al., 2011, Cook and Glass, 2011, Ding and Charoenwong, 2013), suggesting that markets perceive gender diversity as value-enhancing. For instance, Kang et al. (2010) found positive market reactions to female board appointments in Singapore, particularly for firms with strong governance structures.

Conversely, other studies report negative market reactions (Lee & James, 2007, Braegelmann & Ujah, 2020, Gupta et al., 2018, Lucey & Carron, 2011, Friedman, 2020). Ahern and Dittmar's (2012) influential study on Norway's board gender quota found significant negative stock price reactions, which they attributed to the appointment of younger, less experienced directors. Similarly, Dobbin and Jung (2010) documented negative market reactions to female board appointments in the United States, suggesting potential investor biases.

A third strand of research finds no significant market reaction, indicating that investors may view female board appointments as neutral events with respect to firm value. Gregory et al. (2013) found no significant short-term market reaction to female board appointments in the United Kingdom but noted positive long-term performance effects.

What appears is that market reactions are heterogeneous, and various contextual factors can contribute to this. In fact, the regulatory and normative context significantly shapes market reactions. In environments with strong institutional pressure for gender diversity, appointments may be perceived as compliance-driven rather than strategic (Terjesen et al., 2015).

Moreover, firm-specific factors such as size, industry, existing board composition, and financial health moderate market reactions (Post & Byron, 2015). For instance, female board appointments may elicit more positive reactions in consumer-oriented industries where women constitute key stakeholder groups.

The qualifications, experience, and roles of appointed female directors also influence market perceptions (Hillman et al., 2007). Appointments of women with industry-specific expertise or to key committee positions may generate more positive reactions.

Finally, societal attitudes toward gender roles and equality significantly influence how markets interpret female board appointments (Singh et al., 2008). In more gender-egalitarian societies, such appointments may be viewed as normative and elicit minimal market reaction.

3. The Saudi Arabian Context and Relevance

Saudi Arabia presents a unique cultural and institutional landscape that may significantly inform how markets react to women's board appointments, making it a particularly relevant context for studying this phenomenon. One key factor is the country's deeply rooted traditional norms, which have historically positioned leadership roles predominantly in the hands of men (Hamdan, 2005). This longstanding tradition can influence investor perceptions, as market participants may initially interpret female board appointments through the lens of these entrenched societal expectations. While reforms have begun to shift these norms, the pace of change can result in mixed sentiments among stakeholders, including investors, reflecting both optimism for modernization and caution rooted in historical practices.

Institutionally, the Saudi regulatory environment has undergone substantial transformations in recent years, aimed at diversifying its economy under Vision 2030. These reforms are not only changing economic policies but also reshaping corporate governance frameworks. The Saudi Capital Market Authority (CMA) has encouraged gender diversity on boards without imposing mandatory quotas. The Saudi Stock Exchange (Tadawul) has also promoted corporate governance practices, emphasizing board diversity. However, this regulatory push also introduces uncertainty as firms and investors navigate new expectations and transition strategies. Therefore, the resulting market reactions may reflect a tension between regulatory optimism and the challenges of integrating these changes within existing institutional structures.

In addition, the role of state-backed institutions and sovereign wealth funds in Saudi Arabia's economy cannot be understated. These entities often set the tone for market behavior through their investment strategies and public statements. Their support for gender diversity can lend credibility to female board appointments, positively recalibrating market expectations. Conversely, if these institutions appear uncertain or ambivalent about the long-term benefits of increasing female representation, market reactions may be more muted or even skeptical. Besides, the ownership structure of listed companies often features significant family ownership, which may influence corporate governance practices and responses to diversity initiatives.

The Saudi context offers an opportunity to extend existing theories by examining how they apply in a setting characterized by institutional transition and cultural distinctiveness. For instance, signaling theory might operate differently in an environment where female board appointments represent not only corporate governance signals but also alignment with national reform agendas.

The increasing international exposure of Saudi corporations adds another layer of complexity. As these companies become more integrated into the global financial system, they must balance domestic cultural expectations with international standards of corporate governance. This duality can lead to market volatility during the transition period, as investors await evidence that the structural changes will lead to sustainable improvements in performance and governance.

Overall, the interplay of traditional cultural norms, transformative institutional reforms, the strategic influence of state-backed investors, and the pressure to meet global standards creates an environment where market reactions to women's board appointments are influenced by optimism for progress and caution born out of historical context. These complex dynamics underscore the need for a nuanced approach to understanding the evolution of market behavior in Saudi Arabia.

In fine, based on the literature and the specific Saudi Arabian context, we develop the following hypotheses:

Hypothesis 1: Female board appointments in Saudi Arabian firms will elicit significant market reactions, reflecting investors' assessments of their implications for firm value.

Hypothesis 2: The direction of market reactions will depend on whether investors perceive female board appointments as enhancing board effectiveness (positive reaction) or as disruptive to established norms (negative reaction).

Hypothesis 3: Market reactions to female board appointments will evolve over time as investors process information and update their assessments.

4. Primary Empirical Methodology Framework and Results

4.1. Data and Sample Selection

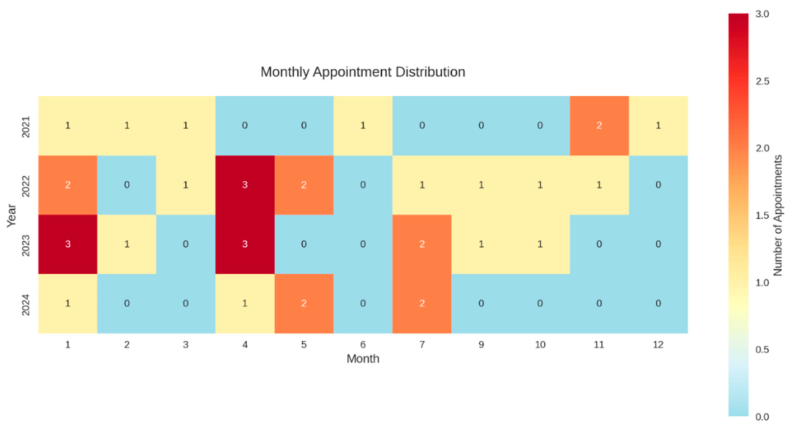

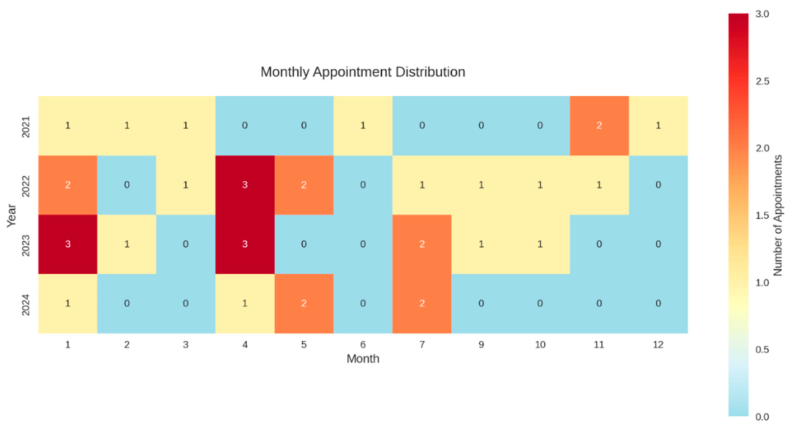

As shown in

Table 1, our sample includes all-female board appointments in publicly listed Saudi companies from January 2021 to July 2024, resulting in 36 distinct appointment events across 34 companies. This board composition data, including details on gender diversity and appointments, was manually gathered from company annual reports, corporate governance reports, and official company websites.

Table 2 illustrates the distribution of these companies across various economic sectors.

To ensure the integrity of our analysis, we performed several criteria checks. To minimize confounding effects, we verified that the appointments did not coincide with other significant corporate announcements (e.g., earnings releases, dividend declarations, merger announcements) within a ±10-day window. Additionally, we verified that the appointed women do not hold multiple new board positions simultaneously to avoid cross-contamination effects.

4.2. Appointed Female Directors' Attributes

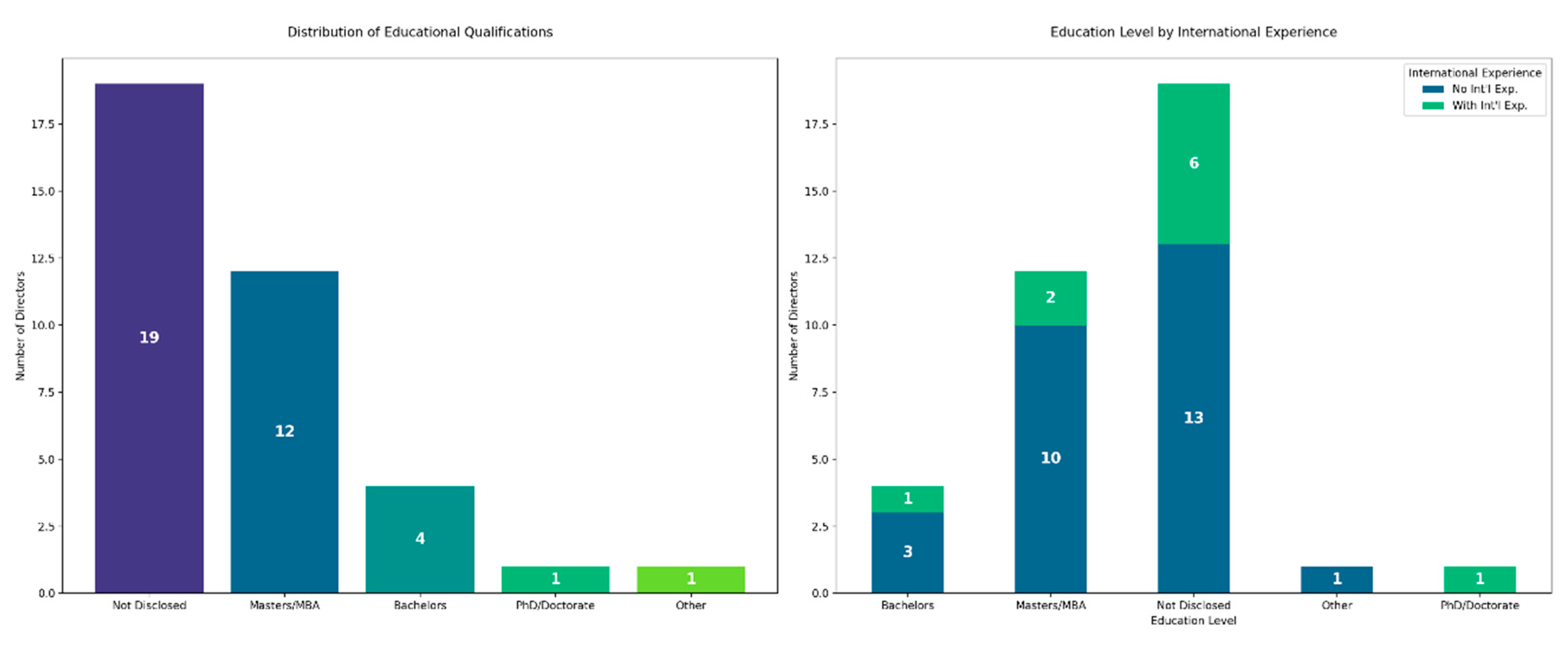

Analyzing female board appointments in Saudi Arabia reveals distinct patterns in directors' educational qualifications and international experience. However, as shown in

Table 3, it is essential to note that many appointments lack disclosed educational qualification information. This highlights potential variations in corporate disclosure practices within the Saudi market, which merits consideration in discussions of corporate transparency and governance practices.

Figure 2 shows that Master's and MBA degree holders represent the largest identified group of appointed women (32.4%), followed by those with bachelor’s degrees (10.8%). Directors with PhD/Doctorate qualifications and other educational credentials comprise 2.7% of appointments. These high academic credentials align with global standards in corporate governance practices, which may bolster investor confidence by signaling a commitment to enhanced managerial capabilities and innovative leadership. Conversely, the analysis indicates that only a subset of these appointments comes with significant international experience. This limited exposure suggests that while some board members bring a global perspective, a considerable proportion remains predominantly domestically experienced. Market participants, aware of this disparity, might interpret the lack of extensive international experience as a potential limitation in navigating complex global business environments. As such, although the academic credentials of these women serve as a positive signal, the relative scarcity of international experience may contribute to a tempered or cautious market reaction. Investors may weigh these factors carefully, balancing the strengths of high academic and professional qualifications against the competitive advantage that international experience can provide in an increasingly globalized market.

The analysis of the relationship between educational credentials and international experience shows that directors with PhD/Doctorate qualifications exhibit the highest level of international experience, as 100% of this group has global exposure. For Master's/MBA holders, 16.7% report international experience, and for bachelor’s degree holders, 25% have international exposure. Among directors with undisclosed educational qualifications, 31.6% possess international experience, surpassing the rates observed in both bachelor’s and master’s degree categories.

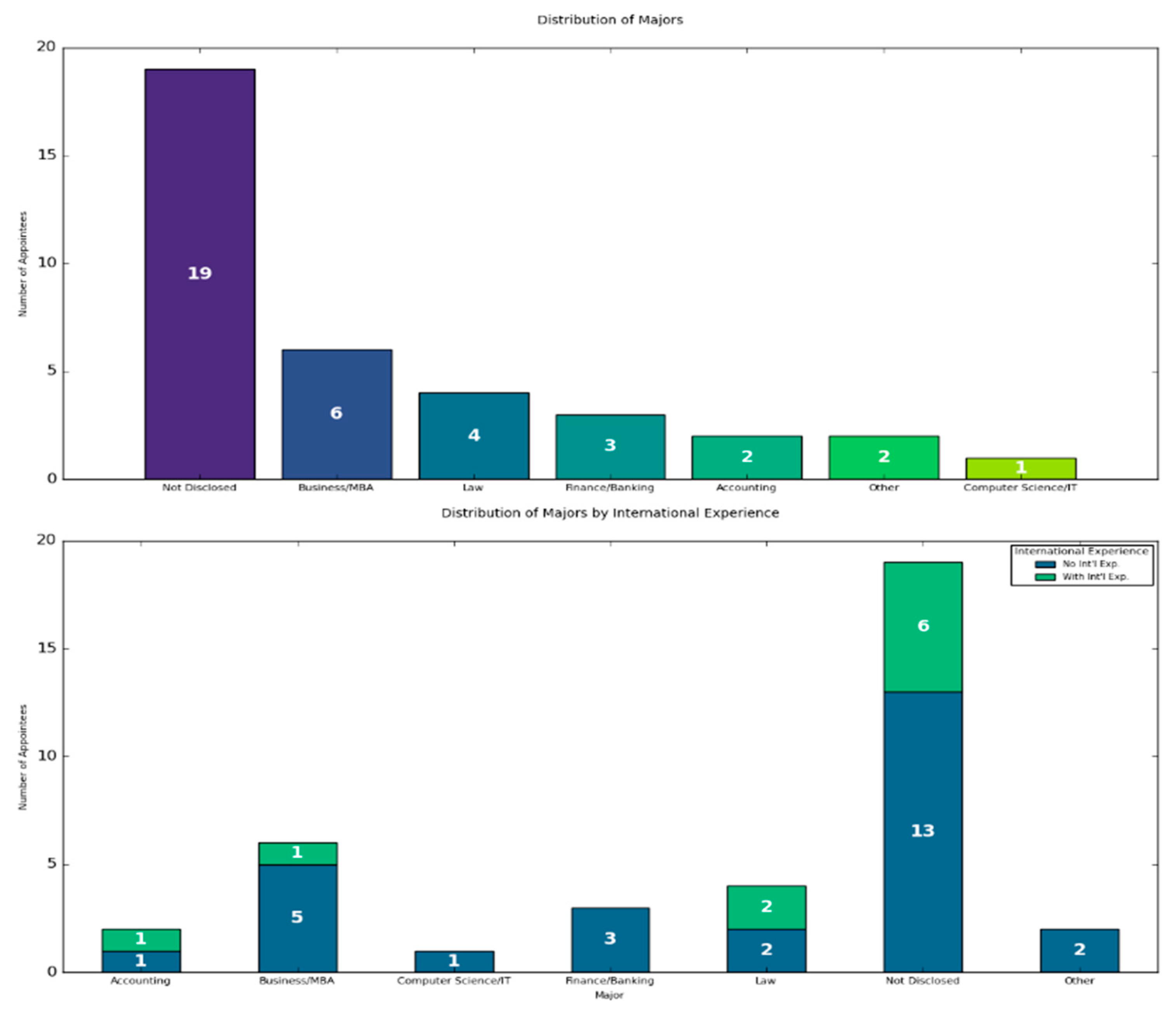

The analysis of academic majors among female board directors in

Figure 3 reveals that a significant proportion of the directors have a background in Business & Economics, among the reported majors. This predominance underscores the emphasis on financial expertise, strategic management, and commercial acumen in board appointments. In contrast, other fields—such as Engineering & Technology, Sciences, Law, and those classified as “Other”—appear with much lower frequency, suggesting that these areas, while represented, play a secondary role in the composition of board expertise.

4.3. Event Study Methodology

The event study methodology is our primary analytical approach, following the seminal work of Brown and Warner (1985) and MacKinlay (1997). This methodology enables us to isolate the market reaction attributable specifically to the announcement of female board appointments by measuring abnormal returns around the event date. The underlying assumption is that markets are sufficiently efficient to incorporate new information into stock prices, allowing us to detect the valuation effects of female board appointments.

We define the event as the official announcement of a female director's appointment to the board of a Saudi-listed company. The event date (t=0) corresponds to the date of the public announcement as reported to the Saudi Stock Exchange (Tadawul). We employ the market model to estimate normal returns, representing the expected returns without the event. For each firm

i and day

t, the normal return is estimated as:

where

is the return of firm

i on day

t,

is the return of the market index (Tadawul All Share Index) on day

t, and

is the error term.

The parameters

and

are estimated using an estimation window of 92 trading days, ending 11 days before the event date (−102, −11) to avoid contamination from potential information leakage. The abnormal return for firm

i on day

t is then calculated as:

where

and

are the estimated parameters from the market model.

Then, to capture the full effect of the announcement, we calculate cumulative abnormal returns (CARs) over the event window (−10,+10). The CAR for firm

i over the event window

is defined as:

We then calculate the average cumulative abnormal return (ACAR) across all N events:

To test the statistical significance of the ACARs, we employ a parametric test that is based on the t-statistic: where is the estimated standard deviation of the ACAR.

Additionally, we employ the non-parametric Wilcoxon signed-rank test and the generalized sign test to account for potential non-normality in the distribution of abnormal returns. This is particularly relevant in emerging markets like Saudi Arabia, where stock returns may exhibit higher volatility and non-normal distributions.

4.4. Empirical Findings

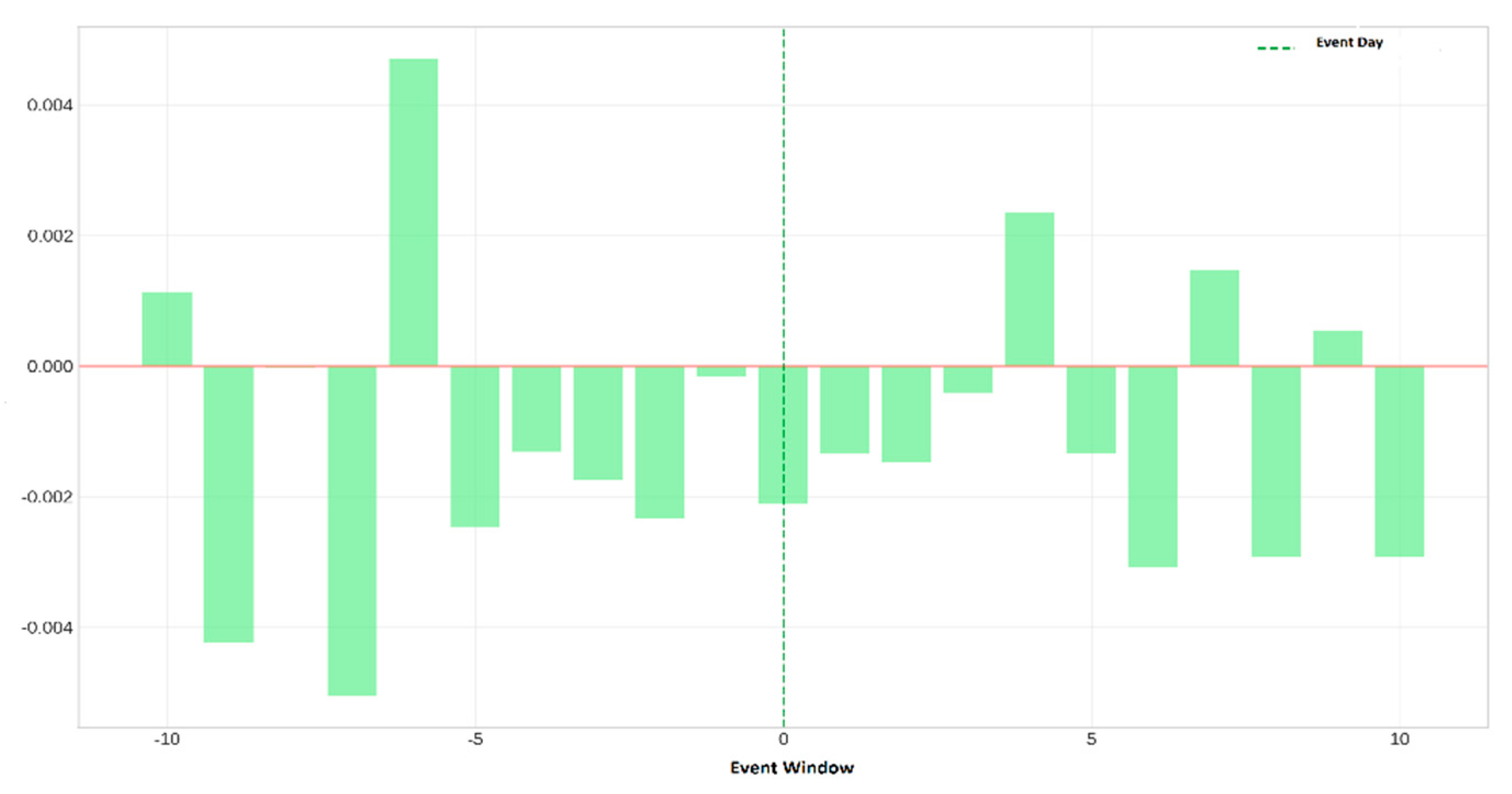

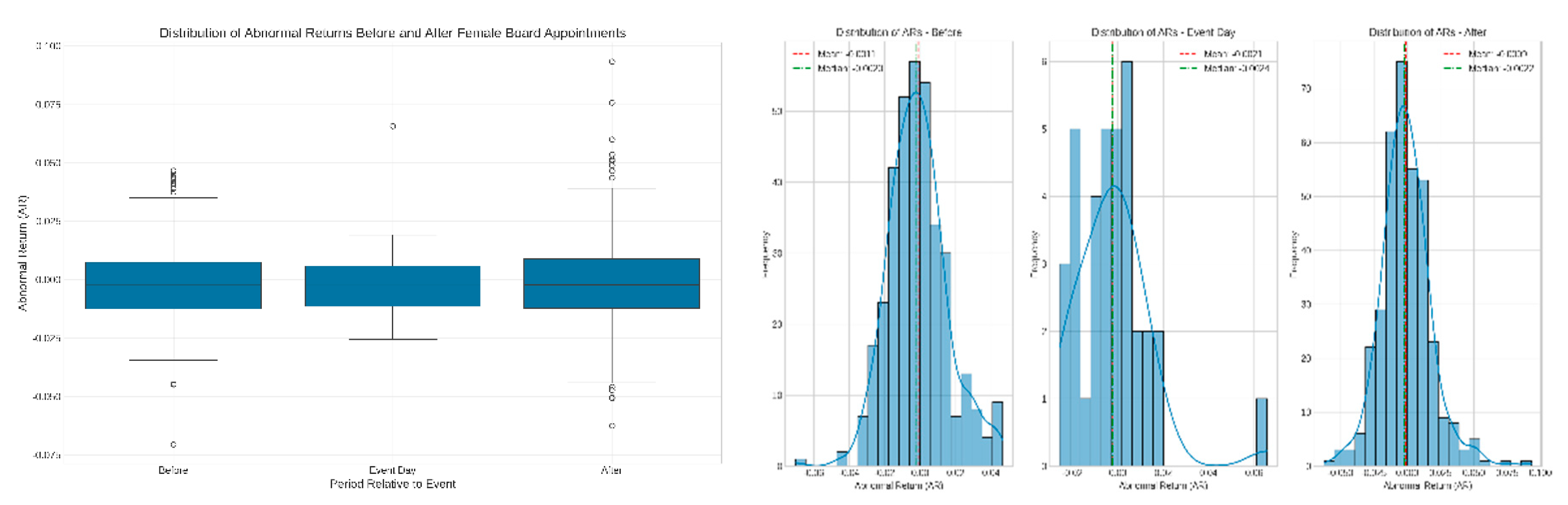

The analysis of average abnormal returns (AR) for each day of the event window in

Figure 4 reveals an interesting trend. On the event day (day 0), the average abnormal return is −0.21%, indicating a slightly negative immediate market reaction to female appointment announcements. This negative reaction continues in the days following the announcement, with negative average abnormal returns for most days of the post-event window.

The temporal evolution and the distribution of the daily average ARs reveal notably considerable volatility throughout the event window. Hence, several observations are worth highlighting.

In fact, two days demonstrate particularly negative average abnormal returns (ARs) in the "Before" period: days −9 (−0.42%) and −7 (−0.50%). These anticipated negative reactions could indicate information leaks or market expectations. Moreover, day −7 exhibits a significant negative average AR of −0.50% (p = 0.034), while Day −6 shows a notable positive average AR (+0.47%, p < 0.05), which may reflect a market correction following the negative reactions of prior days. This observation is intriguing because these two significant days fall within the "Before" period, suggesting that the market begins to respond to female appointments even prior to the official announcement. This may indicate information leaks or anticipations based on rumors or early signals. It could also reflect the semi-strong efficiency of the Saudi market, where private or semi-private information is gradually factored into prices.

The event day (Day 0) reveals a negative average AR (−0.21%), but this value lacks statistical significance according to parametric tests. On the other hand, in the "After" period, we observe a fluctuation of days with both positive and negative average ARs, indicating a phase of adjustment and reassessment by the market. In addition, we observe a decrease in the magnitude of mean ARs from the "Before" period (0.11%) to the "After" period (0.09%), passing through the event day (0.21%). This may suggest a gradual attenuation of the negative reaction. This implies that the market initially revalues companies that appoint women downward, but this revaluation lessens over time.

Additionally, the standard deviation of ARs is slightly higher in the "After" period (90%) compared to the "Before" period (69%), indicating increased volatility following announcements. This observation aligns with the hypothesis that female appointments generate uncertainty in the market, leading to a wider dispersion of returns. The "After" period, as shown in

Figure 5, exhibits greater dispersion and more pronounced positive extreme values than the "Before" period, suggesting that some companies significantly benefit from female appointments despite the overall negative trend. Finally, the distributions are not symmetric, showing a longer tail on the positive side, particularly in the "After" period. This positive asymmetry indicates that, while most reactions are negative, some positive reactions can be especially strong.

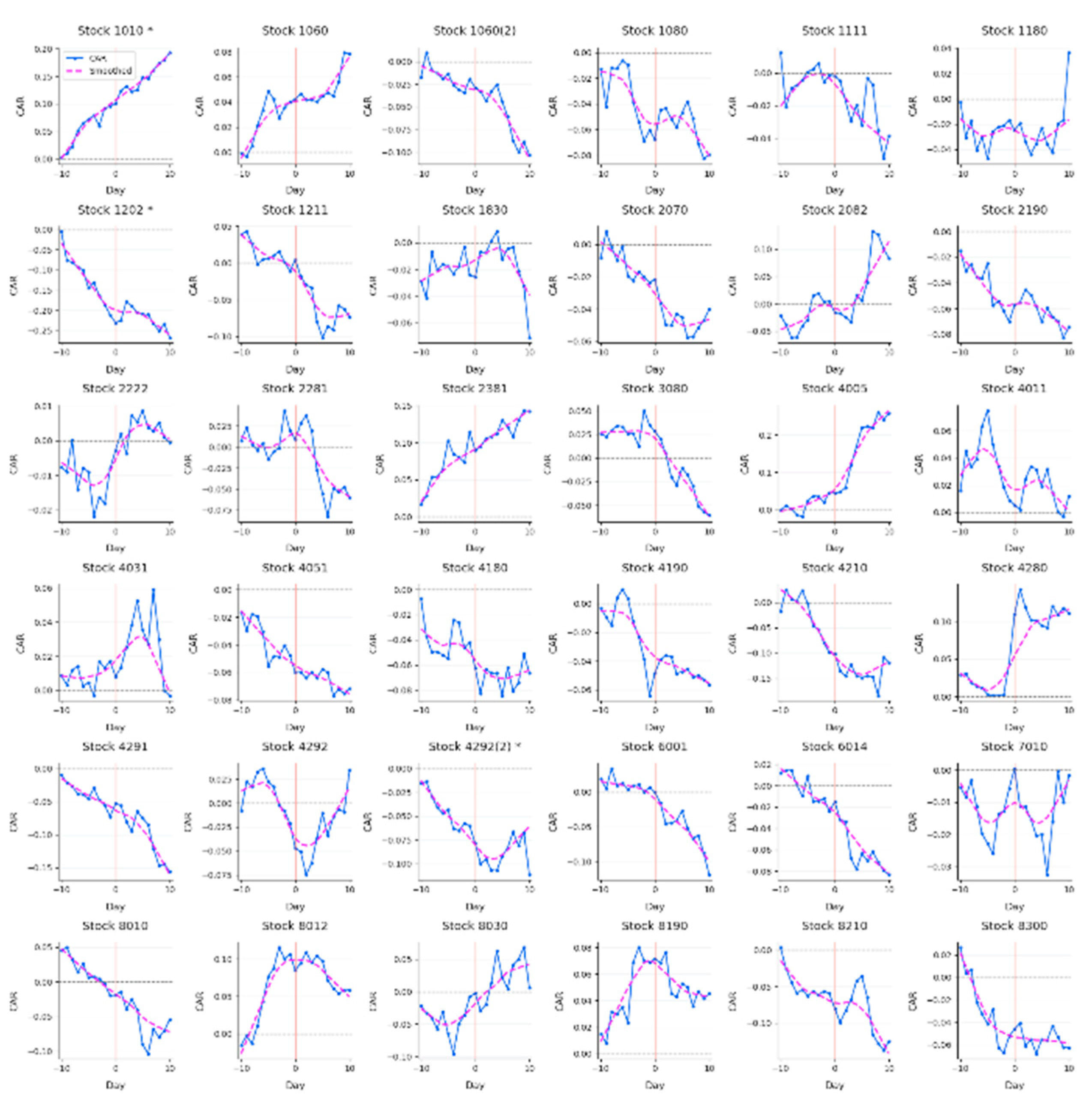

Simultaneously, the cumulative abnormal returns (CAR) for individual companies in

Figure 6 and

Table 4 show considerable variation, ranging from −25.83% to +25.19% over the complete event window (−10, +10). This dispersion suggests that the market reaction to female appointments may depend on company-specific or context-specific factors.

Of the 36 companies in our sample, 23 (64%) reported negative CARs throughout the event window, while 13 (36%) reported positive CARs. This prevalence of negative reactions aligns with the observed negative CAAR (−2.27%). Furthermore, the results indicate that 30 out of 36 companies (83%) have statistically significant CARs at the 5% significance level, as determined by the T-test. Among these companies with significant CARs, 19 have negative CARs, while 11 have positive CARs. This variation in market reactions implies that the effect of female appointments may depend on company-specific factors, such as size, industry sector, prior performance, or specific attributes of the appointed woman (experience, qualifications, etc.).

In summary, the market reactions to female board appointments in Saudi Arabia seem to be shaped by a dual perception: on one side, the academic and professional excellence of many appointees instills optimism, while on the other, the relative lack of international exposure in a considerable number of cases introduces uncertainty about how well these boards can navigate the challenges of global competition and innovation.

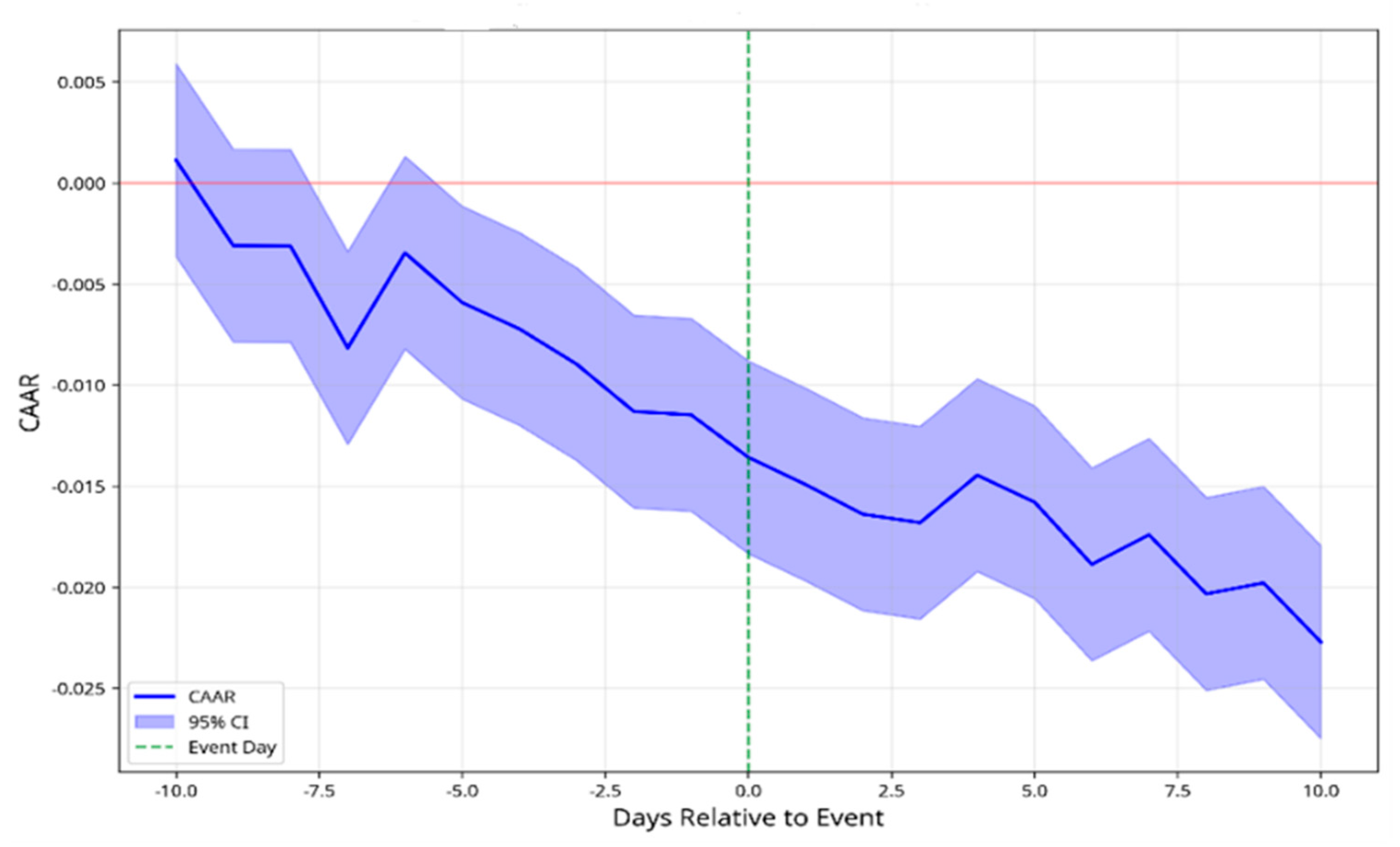

And as mentioned above, the cumulative average abnormal return (CAAR) over the complete event window (−10, +10) is −2.27%. This negative value suggests that, on average, the Saudi market reacts negatively to announcements of female appointments to corporate boards. However, the analysis of the evolution of the CAAR over time in

Figure 7 and

Table 5 shows that the adverse reaction begins even before the official announcement (possibly due to information leaks or anticipations) and continues to intensify after the announcement. On the event day, the CAAR reaches −1.36%, then decreases in the following days to reach −2.27% at the end of the event window. This trend suggests that the market continues negatively integrating information regarding female appointments even after the initial announcement. The persistence of the negative effect could indicate that investors progressively reassess the implications of these appointments for governance and future company performance rather than simply reacting to the announcement itself.

To assess the robustness of our results and examine how the impact of female appointments evolves over different periods, we analyzed several alternative event windows. The results for the different event windows are presented in

Table 6. These results indicate that the negative market reaction occurs across all analyzed event windows, with relatively similar magnitudes in percentage per day. This implies that the adverse effect of female appointments is not merely a short-term phenomenon that quickly dissipates but reflects a more persistent market response.

In addition, the statistical significance varies according to event windows and the tests used. The (−1, +1) window presents the most robust significance, being significant according to the Wilcoxon and T-Statistic tests at the 10% threshold. This could suggest that this window better captures the impact of female appointments by excluding potential noise from periods further from the event, while including enough days to observe the full effect.

4.5. Interpretation of Results

Our results indicate an overall negative reaction of the Saudi market to female appointments to corporate boards. This negative reaction is observed across different event windows and is statistically significant according to some tests. Several interpretations can be proposed to explain this negative reaction.

The first explanation involves cultural and traditional perceptions. Saudi Arabia is a traditionally conservative society where gender roles have historically been well-defined. Investors might view female appointments as a departure from traditional norms, which creates uncertainty about their impact on corporate governance.

The second plausible explanation relates to experience and qualifications. In a market where women have historically been underrepresented in leadership positions, investors may worry about the lack of experience among appointed women, even if they are qualified on paper.

The third point is the perception of symbolic appointments. Investors may view these appointments as primarily driven by political or image considerations rather than merit criteria, which could raise concerns about governance effectiveness.

The fourth interpretation is the resistance to change. The negative reaction may reflect a general resistance to change in corporate governance practices rather than specific opposition to female appointments.

5. Local Projections (LP) for Board Diversity Event Studies

To validate our previous results, we adopt a different process here by employing Jordà's (2005) Local Projection (LP) framework as an alternative to traditional event study methodologies. While conventional event studies have dominated the literature on market reactions to board appointments for decades, they impose restrictive assumptions that may not adequately capture the complex dynamics of market responses to female board appointments.

In fact, traditional event studies typically assume semi-strong market efficiency, where stock prices rapidly incorporate all publicly available information. Our LP approach relaxes this assumption, allowing for gradual information processing and investor learning, which is particularly relevant in emerging markets where informational frictions may be more pronounced.

The second advantage is flexibility in response dynamics. While traditional event studies often impose a predetermined structure on abnormal returns (e.g., constant mean or market model), our approach allows the data to reveal the temporal pattern of market responses without imposing ex-ante restrictions on the shape of the response function.

The third aspect is the robustness of estimation window choices. Traditional event studies necessitate specifying estimation windows for calculating expected returns, with results often sensitive to these choices. Our LP approach addresses this concern by directly modeling cumulative returns without requiring a separate estimation of expected returns.

The fourth is the explicit incorporation of market controls. Instead of constructing abnormal returns based on a market model estimated over a pre-event window, we directly control market returns in our regression framework, allowing for time-varying relationships between firm and market returns.

Finally, statistical inference is transparent. Our approach offers clear statistical inference at each horizon, accompanied by standard errors and confidence intervals that reflect the uncertainty in estimating the event effect across different time frames—a feature often obscured in traditional cumulative abnormal return analyses.

This methodological innovation is particularly well-suited for studying female board appointments in Saudi Arabia for several reasons. As female board representation is a relatively recent phenomenon in Saudi Arabia, market participants may lack historical reference points for evaluating its implications. This could lead to gradual information processing, which our LP approach is designed to capture. Moreover, the Saudi market has undergone significant regulatory changes, creating a dynamic environment where market reactions may evolve as investors update their beliefs about the implications of diversity initiatives. Finally, the cultural significance of female leadership in a traditionally conservative business environment may trigger complex investor responses that unfold over time rather than materializing instantaneously.

5.1. Model Specification and Estimation Procedure

The core innovation of our approach lies in the direct estimation of impulse response functions at each forecast horizon without imposing the recursive structure inherent in traditional event study methodologies. For each horizon

h, we estimate:

Where: represents the cumulative stock return from t−1 to t+h. is the binary female board appointment indicator. are lags of the first difference of the dependent variable. are the lagged market returns that control broader market movements. captures the horizon-specific effect of the appointment on cumulative returns while reflects the sensitivity to market performance.

For each horizon h from 0 to 20 trading days, we calculate the cumulative stock return from day t−1 to day t+h for each observation. Then, we estimate the horizon-specific regression using ordinary least squares (OLS). We extract the coefficient and its standard error, constructing 95% confidence intervals. Finally, we compile these estimates to trace the dynamic response path of stock returns following female board appointments. This procedure generates a sequence of horizon-specific treatment effects that collectively form the impulse response function, providing a comprehensive picture of how markets process and react to female board appointments over time.

This specification offers several advantages over traditional approaches. First, by estimating separate regressions for each horizon, we allow the effect of female board appointments to vary flexibly across different time frames rather than imposing a constant effect or a predetermined decay structure. Secondly, the LP method is more robust in modeling misspecification than the cumulative abnormal return (CAR) approach because errors in specifying short-horizon dynamics do not contaminate longer-horizon estimates. Finally, our framework explicitly controls for lagged market returns, addressing concerns that traditional abnormal return calculations may inadequately adjust for market-wide movements in emerging markets with distinct risk characteristics.

5.2. Local Projections Empirical Results

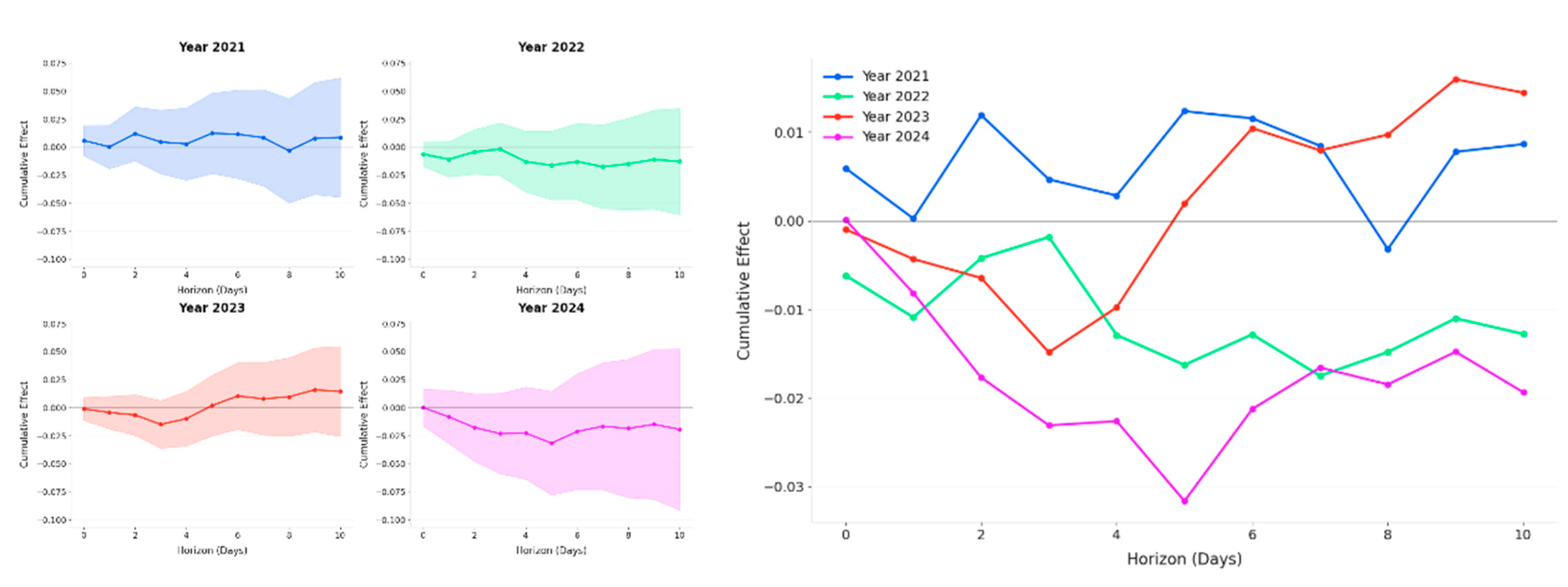

By adopting Jordà's (2005) Local Projection methodology, our analysis of female board appointments in Saudi Arabian firms reveals a nuanced pattern of market reactions. As illustrated in

Figure 8, we trace the dynamic effects of these appointments on stock returns over ten-day and twenty-day horizons.

The empirical evidence suggests that the announcement of female board appointments is associated with a modest negative stock price reaction that gradually intensifies over time. Specifically, as presented in

Table 7, we observe an immediate post-announcement effect of approximately −0.20% (day 0), which deepens to −1.87% by the tenth trading day. This pattern is consistent with an initial market skepticism that compounds rather than dissipates in the short term. Notably, the effect becomes marginally significant (p < 0.1) only at the 10-day horizon, suggesting that the market's full response materializes gradually rather than instantaneously. This pattern aligns with models of limited attention and information processing constraints (Hirshleifer & Teoh, 2003; Cohen & Frazzini, 2008), suggesting that markets may require time to fully process the implications of complex governance changes, particularly in novel institutional contexts.

The negative market reaction documented here contrasts with much of the literature from developed markets, where female board appointments often generate positive or neutral responses (Adams & Ferreira, 2009; Post & Byron, 2015; Campbell & Mínguez-Vera, 2008; Gregory et al., 2013). Our results align more closely with studies suggesting that the benefits of board diversity may be context-dependent (Ahern & Dittmar, 2012).

Several interpretations warrant consideration. First, the negative reaction may reflect investor uncertainty about the impact of gender diversity on firm performance in a traditionally male-dominated business environment. Second, it could indicate concerns about potential disruptions to established board dynamics or decision-making processes. Third, the reaction might stem from investors' perceptions that these appointments are primarily compliance-driven responses to regulatory pressures rather than strategic governance decisions.

The temporal dimension of our findings, with effects strengthening rather than attenuating over time, is particularly noteworthy. This pattern suggests that market participants may be engaging in a process of collective reassessment, potentially influenced by peer reactions or the gradual incorporation of information beyond the initial announcement. The absence of a rapid price correction indicates that the market's initial skepticism is not immediately countered by offsetting positive information.

These results highlight the potential short-term costs that firms may incur when increasing board diversity in contexts where such changes represent significant departures from established norms. Corporate leaders should recognize that while the long-term benefits of diversity may eventually materialize, firms may face adverse market reactions in the immediate aftermath of such appointments.

5.3. Dynamic Evolution of Market Perceptions

To capture the dynamic evolution of market perceptions regarding the new female board appointments, we conduct our investigation again, this time, year by year. The graphical representation of cumulative market reactions to female board appointments in Saudi Arabia from 2021 to 2024 in

Figure 9 reveals a nuanced and evolving pattern of investor responses. These findings provide valuable insights into how market perceptions have shifted during a critical period of corporate governance reform in the Kingdom.

In 2021, we observed a predominantly positive market reaction across all horizons, with cumulative effects reaching approximately +0.86% by the tenth day following appointment announcements. This initial positive response suggests that investors initially viewed female board appointments as potentially value-enhancing, possibly reflecting optimism about the implementation of Vision 2030 reforms and the anticipated benefits of increased board diversity. However, the wide confidence intervals indicate considerable uncertainty in these estimates, suggesting heterogeneous market reactions during this early phase of reform implementation.

A marked shift occurs in 2022, where the cumulative effect turns negative across all horizons, reaching approximately −1.28% by day ten. This reversal may reflect a reassessment by investors as the market accumulated more information about the practical implications of these governance changes. The narrower confidence intervals relative to 2021 suggest more consistent market reactions, potentially indicating a convergence of investor expectations regarding the impact of female board appointments.

By 2023, we observe a moderation in the market response, with the cumulative effect returning to a more positive position of approximately +1.44% by day ten. This represents the strongest positive reaction observed across our study period and may indicate an emerging market recognition of potential value creation through board diversity. The relatively narrow confidence intervals further suggest a more uniform market assessment during this period.

However, the negative trend intensifies again in 2024, with the cumulative effect reaching approximately −1.94% by the tenth day. The most pronounced negative reaction observed across all years occurs on day 5, with a decrease of over 3% and wider confidence intervals. This strengthening negative response may reflect growing investor skepticism regarding the immediate performance benefits of gender diversity initiatives or concerns about disruption to established governance practices.

This temporal evolution, presented in

Table 8, reveals a fascinating learning process in the Saudi market. The trajectory from initial optimism (2021) to pronounced skepticism (2022-2024) and eventual recalibration (2023) suggests that investor perceptions have undergone significant adjustments as the market has gained experience with female board representation. This pattern aligns with an adaptive expectations framework, where market participants continuously update their assessments based on accumulated evidence and experience.

Several factors may explain this evolutionary pattern. First, the initial positive reaction might reflect market enthusiasm about Saudi Arabia's modernization agenda, with female board appointments viewed as a signal of progressive governance practices that could attract international investment. The subsequent negative reaction could represent a "reality check" phase, where investors reassessed their expectations against early performance outcomes. The moderation might indicate a maturation in market understanding, where appointments are evaluated more on their specific merits rather than as general signals about firm governance.

These findings contribute to the broader literature on market reactions to board diversity initiatives by highlighting the dynamic nature of investor responses in an emerging market context undergoing significant institutional transformation. Unlike studies in developed markets that often find stable reaction patterns, our results emphasize how market perceptions can evolve substantially over relatively short periods in rapidly changing institutional environments.

For Saudi Arabia, these results suggest that the market's assessment of gender diversity initiatives is still evolving. The moderation observed in 2023 may indicate that as female board representation becomes more normalized, investor reactions will increasingly depend on appointees' specific qualifications and contributions rather than on gender alone. This highlights the importance of emphasizing the director’s qualifications and strategic fit in appointment announcements to shape market perceptions positively.

6. Quantile Regression Analysis Check

Building on our analysis with the local projections method, which provided valuable insights into the dynamic response of stock returns to market signals and event-related shocks, we now extend our investigation by employing a quantile regression framework. While local projections offer a robust approach for capturing average dynamic effects, quantile regression enables us to explore the heterogeneous effects across the entire distribution of stock returns. This new analysis is essential as it clarifies the impact of market conditions and event-specific interactions at various quantile levels. It enhances our understanding of non-linear and asymmetrical responses in financial markets. It provides complementary information that enriches the primary local projections analysis. It goes beyond merely confirming or refuting the average effect to offer a nuanced view. Discovering significant heterogeneity via quantile regression adds depth and context, leading to more robust and credible overall conclusions about the effect of women board appointments on the Saudi stock market.

We began by estimating the following equation to capture the different impacts at various performance levels:

Event represents the woman's appointment on the board; Anticipation signifies the period “before” the appointment (5 days), Adjustment denotes the period “after” the appointment (5 days), and MKT represents the market return.

Next, to investigate the evidence of the moderating role of market conditions on the relationship between our key determinant variables and stock returns, as well as to capture any interaction effects, we adopt the following specification:

By examining the effects before, during, and after appointment events, we gain valuable insights into market efficiency and investor sentiment about board diversity.

6.1. The Primary Equation Results

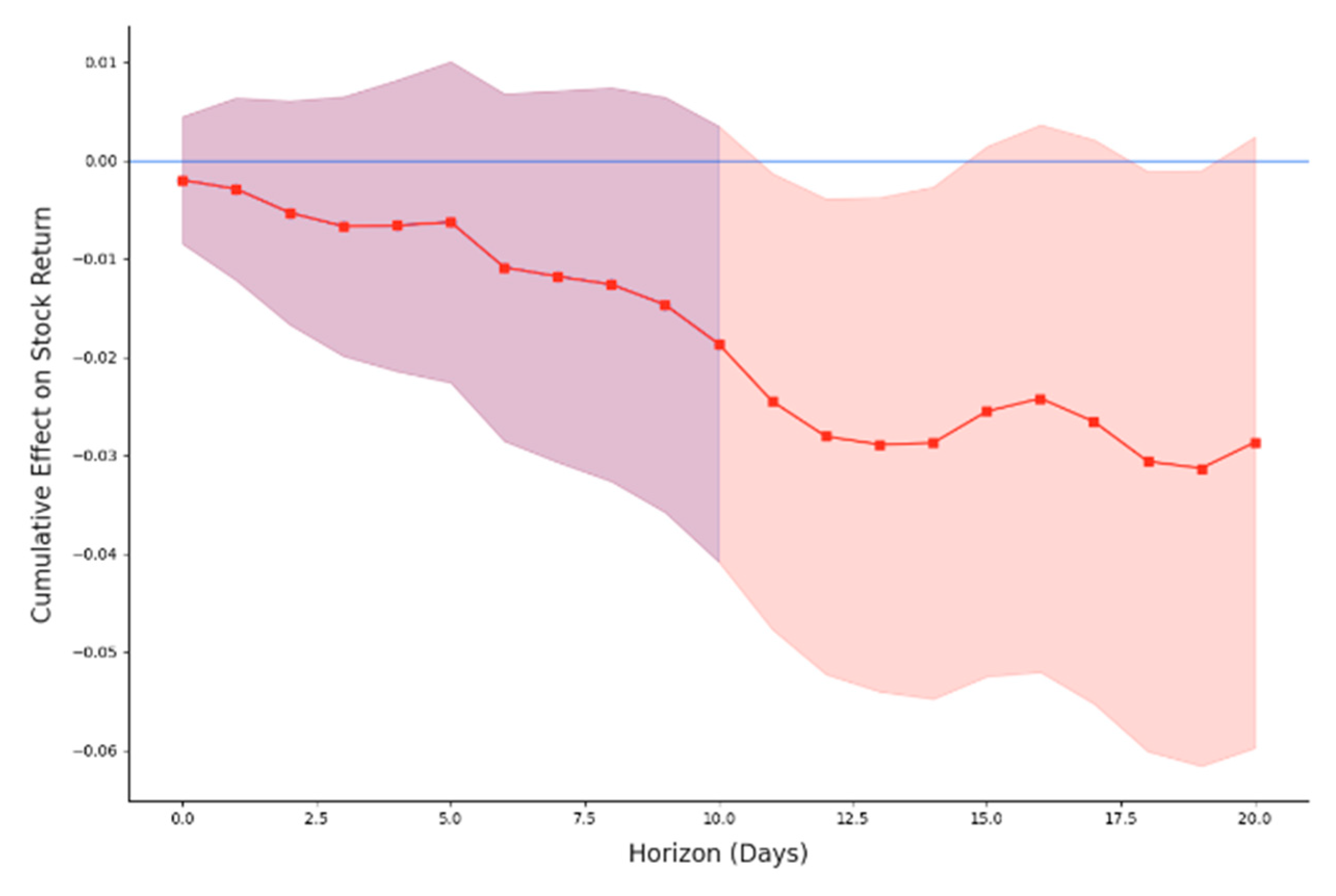

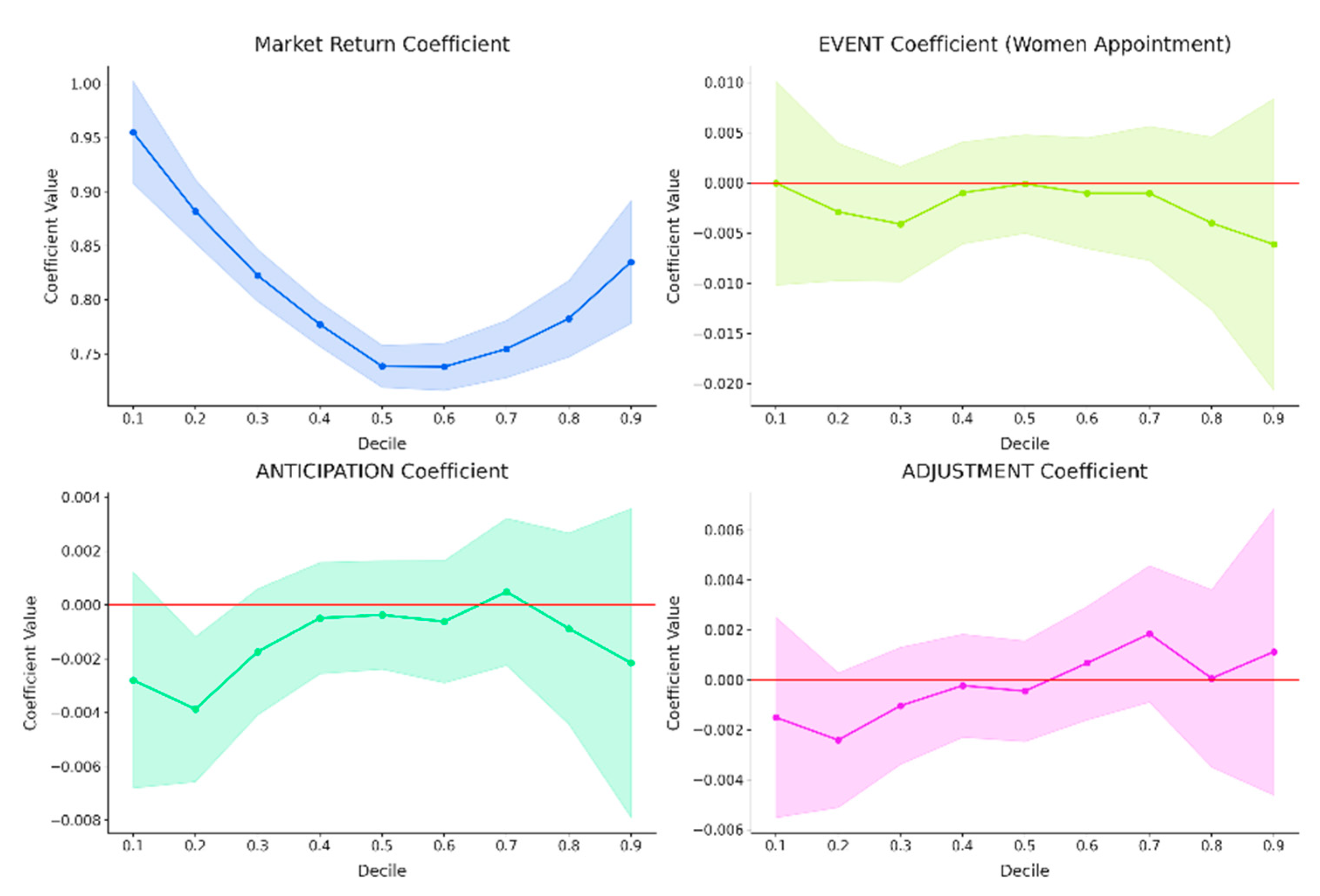

The quantile regression analysis shown in

Figure 10 and

Table 9 reveals nuanced patterns in how stock returns respond to women board appointments across various segments of the return distribution.

The anticipation variable, which captures market reactions in the periods leading up to women board appointments, shows a predominantly negative association with stock returns. This relationship is especially pronounced at the 0.2 quantile, where it reaches statistical significance. The negative coefficients indicate that markets may anticipate these governance changes and incorporate this information into pricing decisions prior to formal announcements.

This finding aligns with semi-strong market efficiency theories, indicating that information about potential board appointments may leak into markets through informal channels or be anticipated based on corporate governance trends. The more substantial effect at lower quantiles suggests that poorly performing stocks may be more sensitive to anticipated governance changes, possibly reflecting investor expectations that underperforming firms are more likely to alter board composition as a remedial strategy.

The event variable, which represents the immediate impact of women board appointments, consistently exhibits negative coefficients across all quantiles of the return distribution. While these effects do not reach statistical significance at conventional levels for most quantiles, the persistent negative direction warrants attention. The magnitude of these negative coefficients appears more pronounced and statistically significant at higher quantiles (0.8 - 0.9), suggesting that high-performing stocks may experience stronger immediate reactions to women's board appointments. This pattern could reflect market uncertainty regarding how these appointments might affect already successful firms or possibly indicate short-term adjustment costs associated with board transitions that investors temporarily price into returns.

The adjustment variable, which captures market reactions in periods following women board appointments, reveals an intriguing transition from negative coefficients at lower quantiles to positive coefficients at higher quantiles. Although statistically significant only for the second and seventh quantiles, this directional shift suggests a differential market response based on the firm's position in the return distribution. For underperforming stocks (lower quantiles), the continued negative effect may reflect investor skepticism about whether board diversity alone can address fundamental performance issues. Conversely, for outperforming stocks (higher quantiles), the positive coefficients indicate that markets may gradually recognize the potential benefits of diverse leadership in already successful firms, leading to favorable post-appointment adjustments in valuation.

The Market Return variable demonstrates a strong, statistically significant positive relationship with stock returns across all quantiles, confirming the dominant influence of broader market movements on individual stock performance. The effect is particularly pronounced at the lowest quantile (0.1), underscoring that poorly performing stocks remain highly sensitive to overall market conditions despite firm-specific governance changes.

These findings enhance our understanding of how markets process information regarding board diversity. The varying effects across different quantiles indicate that the impact of women's board appointments is not uniform but dependent on the firm's performance profile. The shift from negative to positive coefficients in the post-appointment period for higher-performing firms suggests potential long-term benefits that markets may gradually incorporate into valuations.

Future research may investigate whether these patterns persist over more extended time frames and whether they differ across various industry sectors or market conditions. Additionally, examining how these effects interact with other governance mechanisms could yield further insights into the complex relationship between board diversity and firm performance.

6.2. Interaction Effects

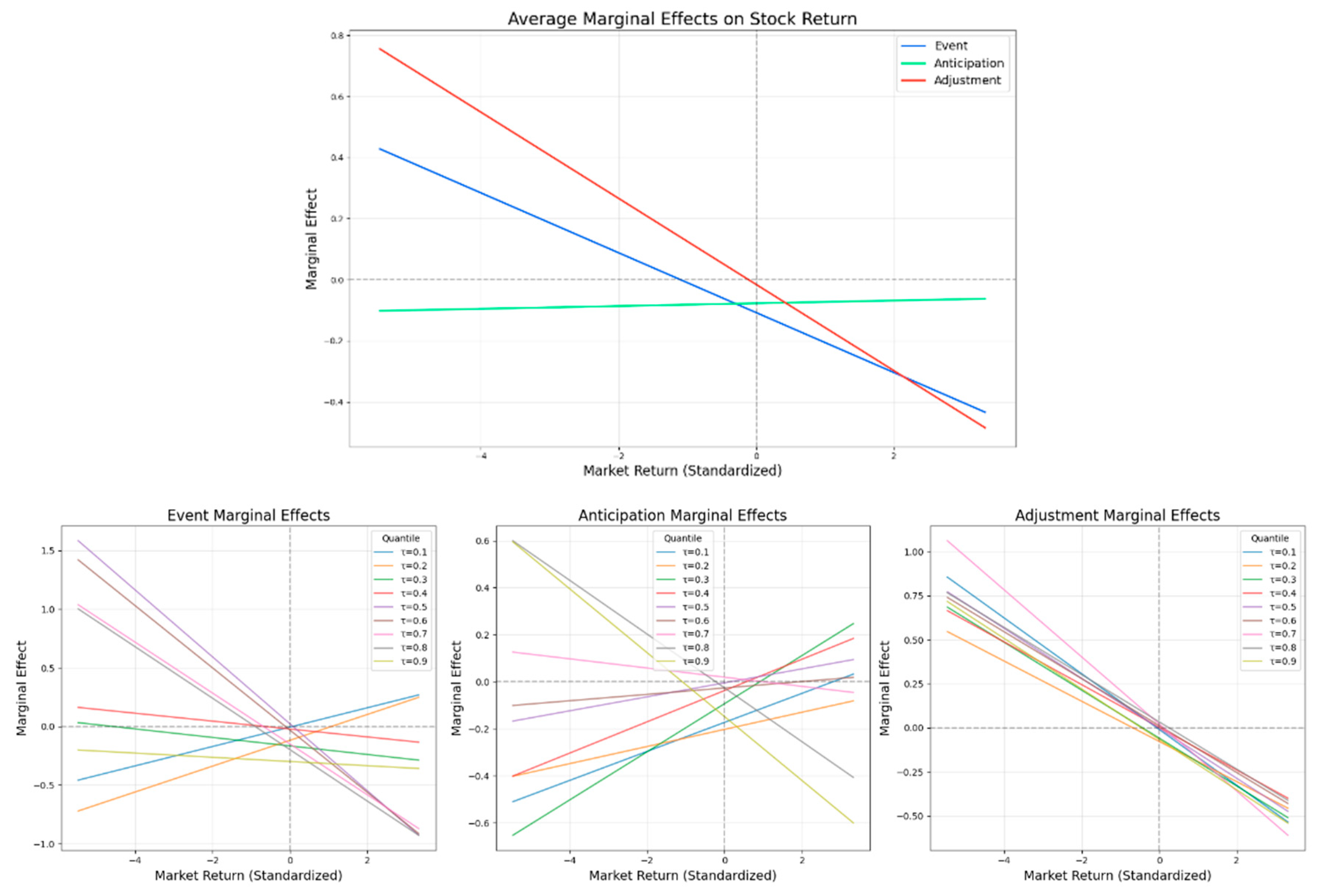

Our investigation clarifies how market conditions interact with the three phases surrounding women’s board appointments in Saudi Arabian companies. The results reveal that market dynamics significantly moderate the impact of these phases on stock returns, as shown in

Table 10. Notably, the interaction between the post-appointment adjustment period and market returns is particularly robust. The statistically significant negative coefficients for the Adjustment × Market Return interaction across various quantiles indicate that during periods of strong market performance, the post-appointment adjustment period exerts an increasingly negative effect on stock returns. This suggests that, despite the positive signaling associated with appointing women to boards, an adjustment cost or a correction effect may become more pronounced when markets perform well.

In contrast, the interaction effects associated with the event —the actual appointment of women on boards— and the anticipation phase before the appointment show more nuanced patterns. At lower return distribution quantiles, the marginal effect of the appointment event is slightly positive, potentially reflecting an initial boost in investor sentiment. However, as we move to higher quantiles, the effect turns negative, implying that for stocks already experiencing strong returns, the appointment event may be associated with subsequent performance corrections or rebalancing effects. Similarly, the anticipation phase exhibits modest or flat effects in the lower and median quantiles, but there is a more pronounced negative interaction in the upper quantiles. This suggests that heightened expectations before the appointment are challenging to sustain and might lead to an overvaluation that is subsequently corrected.

As presented in

Figure 11, our findings demonstrate the substantial heterogeneity in the marginal effects of event, anticipation, and adjustment phases, particularly as they interact with market returns.

In examining the event phase, we observe a pronounced negative marginal effect that intensifies with increasing market returns. This suggests that during periods of strong market performance, the appointment of women to corporate boards is associated with more substantial downward adjustments in stock returns. This finding challenges the conventional wisdom that favorable market conditions uniformly amplify positive news effects, indicating a more nuanced market response to board diversity initiatives instead.

The anticipation effects present an equally intriguing pattern. Our results show that anticipatory market behavior exhibits a consistently negative marginal effect that becomes more pronounced as market returns strengthen. This systematic relationship implies that market participants may be pricing in expected changes in corporate governance structures more aggressively during bullish periods, perhaps reflecting heightened sensitivity to potential organizational changes during times of market optimism.

Perhaps most notably, the adjustment phase shows a similar pattern of increasing negative marginal effects under stronger market conditions. This finding indicates that post-event market corrections are more significant when overall market returns are higher, suggesting a possible overcorrection mechanism in the price discovery process. The consistency of this pattern across various market return quantiles strengthens the robustness of this relationship.

These findings contribute to our understanding of how market conditions moderate the impact of corporate governance changes on firm value. The systematic variation in marginal effects across market states suggests that the timing of board appointments may have significant implications for their market reception. Moreover, the consistent pattern across event, anticipation, and adjustment phases indicates a structured market response mechanism that systematically varies with broader market conditions.

The results suggest that firms may benefit from considering market conditions when timing significant board changes, as the market's response appears to be conditionally dependent on the broader market environment. This insight could be especially valuable for firms seeking to optimize the market reception of their diversity initiatives in corporate leadership.

6.3. Discussion and Interpretation

Our quantile regression analysis of women's board appointments in Saudi Arabian companies reveals a complex interplay between corporate governance changes and market dynamics. The most striking finding is the consistently significant negative interaction between the post-appointment adjustment period and market returns across multiple quantiles of the return distribution. This robust pattern suggests that the market's response to female board appointments in Saudi Arabia is contextually dependent on broader market conditions.

The negative coefficient of the Adjustment × Market Return interaction indicates that stocks experience a more pronounced negative adjustment during bullish market periods following women's board appointments. This could be interpreted through several theoretical lenses. First, it may reflect a correction mechanism where initial positive sentiment or overvaluation during appointment announcements is subsequently tempered, particularly in favorable market conditions where valuations might already be stretched. Second, it could indicate that the market requires time to accurately price the governance implications of these appointments, with the adjustment process being more pronounced when market-wide returns are positive.

The differential effects across quantiles further enrich our understanding of this phenomenon. The interaction effect is strongest in the middle quantiles (0.3-0.7), suggesting that companies with moderate returns experience the most significant post-appointment adjustments. This non-uniform impact across the return distribution highlights the heterogeneous nature of market responses to female board appointments, potentially reflecting differences in investor composition, corporate characteristics, or industry-specific factors.

Interestingly, the Event and Anticipation interactions show less consistent patterns. The Event × Market Return interaction transitions from positive in lower quantiles to negative in higher quantiles, suggesting that the immediate impact of women's appointments varies considerably across the return distribution. Similarly, the Anticipation × Market Return interaction exhibits a gradual shift from positive to negative as we move from lower to higher quantiles. These patterns may reflect varying degrees of market efficiency in incorporating information about anticipated appointments, with different segments of the market potentially reacting with different speeds or magnitudes.

6.4. Implications

Relying on the Quantile-On-Quantile analysis, our findings contribute to several theoretical domains. First, they extend the literature on board diversity by demonstrating that market reactions to female board appointments are not uniform but rather contingent on market conditions and a company's position within the return distribution. This challenges simplistic narratives about diversity's impact on firm performance and suggests a more nuanced relationship mediated by contextual factors.

Second, our results speak to theories of market efficiency. The significant adjustment effects post-appointment indicate that markets may not immediately and fully incorporate the implications of governance changes, particularly in the context of novel or culturally significant shifts like women joining boards in Saudi Arabia. This supports the view that market efficiency may be bounded by cognitive limitations, information asymmetries, or cultural factors that influence how investors process and react to corporate governance changes.

Third, the quantile regression approach reveals distributional heterogeneity that traditional mean-based methods would mask. This methodological insight underscores the importance of considering the entire distribution of returns when examining market responses to corporate events, particularly in emerging markets undergoing significant social and governance transitions.

Furthermore, our findings suggest that the timing of female board appointments relative to market conditions may influence short-term market reactions for corporate leaders and board members in Saudi Arabia. Companies might benefit from strategic communication around these appointments, particularly during bullish market periods when the adjustment effect appears strongest. Additionally, setting realistic expectations about potential short-term market adjustments while emphasizing long-term governance benefits could help manage investor perceptions.

For investors, our results highlight the importance of considering the interaction between corporate governance changes and market conditions when evaluating Saudi Arabian stocks. The significant adjustment effects suggest opportunities for more sophisticated trading strategies that account for these predictable patterns following female board appointments.

For policymakers in Saudi Arabia and similar emerging markets, our findings underscore the complex market dynamics surrounding governance reforms. While promoting board diversity remains important, policymakers should recognize that market reactions may be nuanced and context-dependent. Supporting companies through these transitions with clear regulatory frameworks and educational initiatives could help stabilize market responses and facilitate smoother integration of women into corporate leadership roles.

In conclusion, our study reveals that the market impact of appointing women to corporate boards in Saudi Arabia is significantly moderated by market conditions, with the most pronounced effects occurring in the post-appointment adjustment period. These findings contribute to a more nuanced understanding of how markets process significant corporate governance changes in evolving regulatory and cultural environments, highlighting the importance of contextual factors in shaping market responses to board diversity initiatives.

7. Overall Findings Summary and Discussion

Our analysis reveals compelling insights into the market dynamics surrounding female board appointments in Saudi Arabia's corporate landscape. The findings demonstrate that market reactions to gender diversity initiatives are more nuanced and complex than previously understood, particularly in emerging markets undergoing significant social and economic transformation. Through our comprehensive analysis, we find that the appointment of female directors triggers a gradual yet persistent negative market response, with cumulative abnormal returns declining by approximately 2.27% over the event window. This reaction pattern challenges conventional assumptions about immediate market efficiency and suggests a more complex information absorption and value reassessment process.

The temporal evolution of market responses presents a particularly fascinating narrative. Initial market reactions in 2021 displayed cautious optimism, possibly reflecting the broader enthusiasm for Saudi Arabia's Vision 2030 reforms. However, this optimism gradually shifted toward skepticism, especially during periods of strong market performance. This temporal variation suggests that investors' assessment of female board appointments is not static but rather evolves with market conditions and accumulating experience. The more pronounced negative reactions during bullish market periods indicate that investors may view gender diversity initiatives as potentially disrupting established corporate governance mechanisms when firms are performing well.

Our quantile-on-quantile regression analysis reveals significant distributional heterogeneity in market responses, with effects varying substantially across different segments of the return distribution. This finding suggests that the market's interpretation of female board appointments is contingent on both firm-specific characteristics and broader market conditions. Particularly noteworthy is the amplification of negative reactions in the upper quantiles of the return distribution, indicating that high-performing firms face greater market scrutiny when appointing female directors.

The gradual intensification of negative market reactions, becoming marginally significant by the tenth trading day, aligns with theories of limited attention and information processing constraints. This pattern suggests that markets require time to fully process and incorporate the implications of significant governance changes, especially in contexts where such changes represent substantial departures from traditional business practices. Pre-announcement effects indicate information leakage and anticipatory trading behavior, highlighting the importance of considering the broader information environment surrounding board appointments.

These findings contribute significantly to the corporate governance literature by extending our understanding beyond developed markets. The results challenge the universality of findings from Western contexts and emphasize the importance of institutional and cultural factors in shaping market responses to corporate governance reforms. Moreover, combining event studies with local projections and quantile regression analysis, our methodological approach provides a more comprehensive framework for analyzing market reactions to corporate events.

From a practical perspective, our findings have important implications for corporate leaders and policymakers. The observed market reactions suggest that companies must carefully consider the timing and communication of female board appointments, particularly during periods of strong market performance. For policymakers, the results highlight the importance of supporting gender diversity initiatives with complementary policies that address market concerns and facilitate the integration of women into corporate leadership roles.

The study also reveals several areas for future research. Further investigation into the specific mechanisms driving market reactions, including the role of institutional investors, analyst coverage, and media attention, could provide additional insights. Moreover, longitudinal studies examining the long-term performance implications of female board appointments in emerging markets would help validate or challenge the market's initial skepticism. Qualitative research exploring how investors interpret and respond to these appointments could illuminate the mechanisms underlying the patterns we observed. Finally, comparative studies across different cultural contexts could help identify which aspects of our findings are specific to Saudi Arabia versus generalizable to other emerging markets undergoing similar governance transitions.

These insights are particularly relevant as Saudi Arabia continues its journey of economic diversification and social transformation. While the immediate market reaction to female board appointments appears negative, this should not necessarily be interpreted as rejecting gender diversity initiatives. Rather, it reflects the complex market adjustment process to significant corporate governance changes in a traditionally conservative business environment. As more women assume board positions and the market accumulates experience with diverse leadership structures, these reactions may evolve, potentially leading to more nuanced and positive assessments of gender diversity's contribution to corporate value.

8. Conclusion

This study provides compelling evidence of the complex market dynamics surrounding female board appointments in Saudi Arabia's evolving corporate landscape. Our findings reveal a nuanced pattern of market reactions that unfolds gradually over time, characterized by an initial period of cautious optimism followed by a phase of heightened skepticism. We uncovered significant temporal and distributional heterogeneity in market responses through our multi-methodological approach, which incorporates event studies, local projections, and quantile-on-quantile regression analysis.

The negative market reactions we observed, particularly their intensification over time, suggest that investors in the Saudi market may have reservations about the immediate impact of gender diversity initiatives on corporate performance. This response pattern likely reflects Saudi Arabia's unique institutional context, where traditional business practices meet progressive corporate governance reforms. Our analysis demonstrates that these market reactions are not uniform across the return distribution, with stronger effects manifesting during periods of robust market performance.

Our research makes several important contributions to the corporate governance literature. First, it extends our understanding of the effects of board diversity beyond developed markets, providing insights from an emerging market context that is undergoing significant social and economic transformation. Second, our methodological approach, which combines traditional event studies with more sophisticated econometric techniques, offers a more comprehensive framework for analyzing market responses to changes in corporate governance. Finally, our findings underscore the importance of considering both temporal dynamics and market conditions when implementing board diversity initiatives.

These results hold significant implications for policymakers and corporate leaders in Saudi Arabia and other similar emerging markets. Although the short-term market response may be negative, the gradual nature of the adjustment indicates that careful timing and communication of female board appointments could help manage market perceptions. Future research could effectively examine how specific directors’ characteristics, industry contexts, and institutional factors might influence these market reactions, especially in environments undergoing rapid governance reforms.

The findings highlight the complexity of implementing corporate governance changes in traditional business environments and suggest that the full impact of board diversity initiatives may take time to materialize in market valuations. As Saudi Arabia continues its economic and social transformation journey, these insights offer valuable guidance for managing the integration of women into corporate leadership roles while maintaining market confidence.

Author Contributions

Conceptualization, E.A; methodology, E.A. and N.B.M.; software, E.A.; validation, E.A., N.B.M. and I.C.; formal analysis, E.A.; investigation, E.A., N.B.M. and I.C.; resources, E.A.; data curation E.A., N.B.M. and I.C.; writing—original draft preparation, E.A., N.B.M. and I.C.; writing—review and editing, E.A., N.B.M. and I.C.; visualization, E.A.; supervision, E.A., N.B.M. and I.C. All authors have read and agreed to the published version of the manuscript.

Funding

This research was supported and funded by the Deanship of Scientific Research at Imam Mohammad Ibn Saud Islamic University (IMSIU) (Grant number IMSIU-DDRSP2504).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

All variables are sourced from the Saudi Exchange Market “Tadawul”.

Conflicts of Interest

The authors declare no conflicts of interest. The funders had no role in the design of the study; in the collection, analyses, or interpretation of data; in the writing of the manuscript; or in the decision to publish the results.

References

- Adams, R. B., & Ferreira, D. (2009). Women in the boardroom and their impact on governance and performance. Journal of Financial Economics, 94(2), 291-309.

- Adams, R. B., Gray, S., & Nowland, J. (2011). Does gender matter in the boardroom? Evidence from the market reaction to mandatory new director announcements. Evidence from the Market Reaction to Mandatory New Director Announcements (November 2, 2011).

- Adams, R. B., deHaan, J., Terjesen, S., & vanEes, H. (2015), Board Diversity: Moving the Field Forward. Corporate Governance, 23(2), 77–82.

- Ahern, K. R., & Dittmar, A. K. (2012). The changing of the boards: The impact on firm valuation of mandated female board representation. The quarterly journal of economics, 127(1), 137-197.

- Al-Matari, E. M., & Alosaimi, M. H. (2022). The role of women on board of directors and firm performance: Evidence from Saudi Arabia financial market. Corporate Governance and Organizational Behavior Review, 6(3), 44-55.

- Al-Matari, Y. A., Al-Swidi, A. K., & Fadzil, F. H. (2012). corporate governance and performance of Saudi Arabia listed companies. British Journal of Arts and Social Sciences, 9(1), 1-30.

- Ararat, M., Aksu, M., & Tansel Cetin, A. (2015). How board diversity affects firm performance in emerging markets: Evidence on channels in controlled firms. Corporate Governance: An International Review, 23(2), 83-103.

- Bayly, N., Breunig, R., & Wokker, C. (2024). Female board representation and corporate performance: a review and new estimates for Australia 1. Economic Record, 100(330), 386-417.

- Bennouri, M., Chtioui, T., Nagati, H., & Nekhili, M. (2018). Female board directorship and firm performance: what really matters?. Journal of Banking & Finance, 88, 267-291.

- Boehmer, E., Masumeci, J., & Poulsen, A. B. (1991). Event-study methodology under conditions of event-induced variance. Journal of financial economics, 30(2), 253-272.

- Braegelmann, K. A., & Ujah, N. U. (2020). Gender matters: market perception of future performance. Managerial Finance, 46(10), 1247-1262.

- Brown, S. J., & Warner, J. B. (1985). Using daily stock returns: The case of event studies. Journal of financial economics, 14(1), 3-31.

- Campbell, K., & Mínguez-Vera, A. (2008). Gender diversity in the boardroom and firm financial performance. Journal of business ethics, 83, 435-451.

- Campbell, K., & Mínguez-Vera, A. (2010). Female board appointments and firm valuation: short and long-term effects. Journal of Management and Governance, 14, 37-59.

- Carter, D. A., D'Souza, F., Simkins, B. J., & Simpson, W. G. (2010). The Gender and Ethnic Diversity of US Boards and Board Committees and Firm Financial Performance. Corporate Governance: An International Review, 18(5), 396-414.

- Carter, D. A., Simkins, B. J., & Simpson, W. G. (2003). Corporate governance, board diversity, and firm value. The Financial Review, 38(1), 33-53.

- Chaabouni, I., Ben Mbarek, N., & Ayadi, E. (2025). Do ESG Risk Scores and Board Attributes Impact Corporate Performance? Evidence from Saudi-Listed Companies. Journal of Risk and Financial Management, 18(2), 83.

- Cohen, L., & Frazzini, A. (2008). Economic links and predictable returns. The Journal of Finance, 63(4), 1977-2011.

- Cook, A., & Glass, C. (2011). Leadership change and shareholder value: How markets react to the appointments of women. Human Resource Management, 50(4), 501-519.

- Ding, D. K., & Charoenwong, C. (2013). Stock market reaction when listed companies in Singapore appoint female directors. International Journal of Management, 30(1), 285.

- Dobbin, F., & Jung, J. (2010). Corporate board gender diversity and stock performance: The competence gap or institutional investor bias. NCL Rev., 89, 809.

- Dobbin, F., Jung, J., Galia, F., & Zenou, E. (2011). Board diversity and corporate performance: Filling in the gaps: Corporate board gender diversity and stock performance: The competence gap or institutional investor bias. North Carolina Law Review, 89(3), 809-839.

- Eagly, A. H., & Karau, S. J. (2002). Role congruity theory of prejudice toward female leaders. Psychological Review, 109(3), 573–598.

- Erhardt, N. L., Werbel, J. D., & Shrader, C. B. (2003). Board of director diversity and firm financial performance. Corporate Governance: An International Review, 11(2), 102-111.

- Fama, E. F. (1970). Efficient capital markets. Journal of finance, 25(2), 383-417.

- Friedman, H. L. (2020). Investor preference for director characteristics: Portfolio choice with gender bias. The Accounting Review, 95(5), 117-147.

- Gregory, A., Jeanes, E., Tharyan, R., & Tonks, I. (2013). Does the stock market gender stereotype corporate boards? Evidence from the market's reaction to directors' trades. British Journal of Management, 24(2), 174-190.

- Gupta, V. K., Han, S., Mortal, S. C., Silveri, S. D., & Turban, D. B. (2018). Do women CEOs face greater threat of shareholder activism compared to male CEOs? A role congruity perspective. Journal of Applied Psychology, 103(2), 228.

- Hamdan, A. (2005). Women and education in Saudi Arabia: Challenges and achievements. International Education Journal, 6(1), 42–64.

- Hillman, A. J., Shropshire, C., & Cannella Jr, A. A. (2007). Organizational predictors of women on corporate boards. Academy of management journal, 50(4), 941-952.

- Hirshleifer, D., & Teoh, S. H. (2003). Limited attention, information disclosure, and financial reporting. Journal of accounting and economics, 36(1-3), 337-386.

- Huang, W. (2024). Female board representation and firm value: International evidence. Finance Research Letters, 68, 105998.

- Hvidt, M. (2013). Economic diversification in GCC countries: Past record and future trends. Research Paper, Kuwait Program on Development, Governance and Globalisation in the Gulf States.

- Jensen, M. C., & Meckling, W. H. (1976). Theory of the firm: Managerial behavior, agency costs, and ownership structure. Journal of Financial Economics, 3(4), 305-360.

- Jordà, Ò. (2005). Estimation and inference of impulse responses by local projections. American Economic Review, 95(1), 161-182.

- Kahneman, D., & Tversky, A. (2013). Prospect theory: An analysis of decision under risk. In Handbook of the fundamentals of financial decision making: Part I (pp. 99-127).

- Kakabadse, N. K., Figueira, C., Nicolopoulou, K., Hong Yang, J., Kakabadse, A. P., & Özbilgin, M. F. (2015). Gender diversity and board performance: Women's experiences and perspectives. Human Resource Management, 54(2), 265-281.

- Kang, E., Ding, D. K., & Charoenwong, C. (2010). Investor reaction to women directors. Journal of Business Research, 63(8), 888-894.

- Kirsch, A. (2018). The gender composition of corporate boards: A review and research agenda. The Leadership Quarterly, 29(2), 346-364.

- Konrad, A. M., Kramer, V., & Erkut, S. (2008). Critical mass:: The impact of three or more women on corporate boards. Organizational dynamics, 37(2), 145-164.

- Lee, P. M., & James, E. H. (2007). She'-e-os: gender effects and investor reactions to the announcements of top executive appointments. Strategic Management Journal, 28(3), 227-241.

- Liu, Y., Wei, Z., & Xie, F. (2014). Do women directors improve corporate performance in China? Journal of Corporate Finance, 28, 169–184.

- Lucey, B. M., & Carron, B. (2011). The effect of gender on stock price reaction to the appointment of directors: The case of the FTSE 100. Applied Economics Letters, 18(13), 1225-1229.

- MacKinlay, A. C. (1997). Event studies in economics and finance. Journal of Economic Literature, 35(1), 13-39.

- Miller, D.L. (2023). An Introductory Guide to Event Study Models. Journal of Economic Perspectives 37 (2): 203–30.

- Miller, T., & del Carmen Triana, M. (2009). Demographic diversity in the boardroom: Mediators of the board diversity–firm performance relationship. Journal of Management studies, 46(5), 755-786.

- Mumu, J. R., Saona, P., Haque, M. S., & Azad, M. A. K. (2022). Gender diversity in corporate governance: A bibliometric analysis and research agenda. Gender in Management: An International Journal, 37(3), 328-343.

- Pfeffer, J., & Salancik, G. (2015). External control of organizations—Resource dependence perspective. In Organizational behavior 2 (pp. 355-370). Routledge.

- Post, C., & Byron, K. (2015). Women on boards and firm financial performance: A meta-analysis. Academy of Management Journal, 58(5), 1546-1571.