Submitted:

22 April 2025

Posted:

23 April 2025

You are already at the latest version

Abstract

Keywords:

1. Introduction

- The Price-to-Earnings (P/E) ratio

- The expected earnings growth rate g

- The discount rate r, typically derived from the Capital Asset Pricing Model (CAPM).

2. Theoretical Foundation

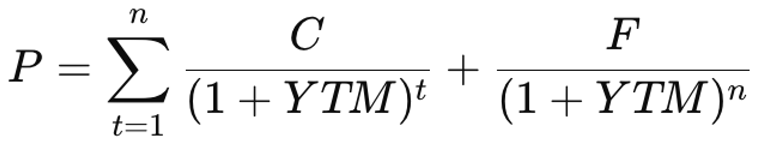

2.1. Yield to Maturity (YTM) for Bonds

- PPP: Bond price

- CCC: Coupon payment

- FFF: Face value at maturity

- n: Years to maturity

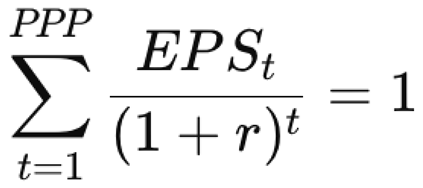

2.2. Potential Payback Period (PPP) for Stocks

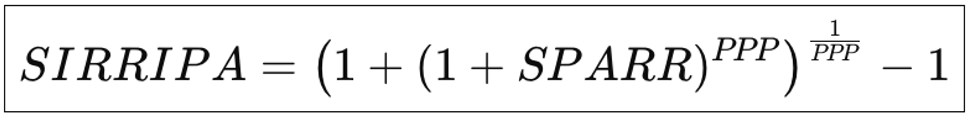

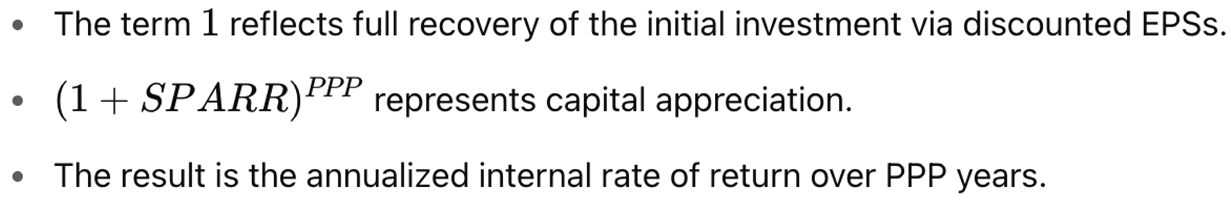

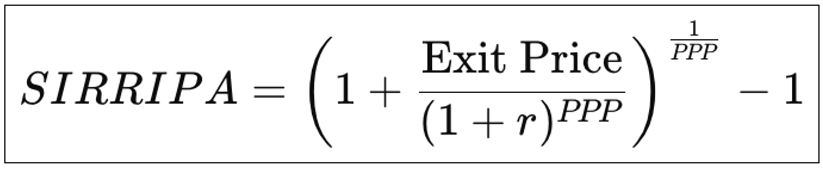

3. Derivation of the Total SIRRIPA

3.1. SIRRIPA Using SPARR

3.2. SIRRIPA Using Discounted Exit Price

4. Robustness and Realism of the Exit Price in SIRRIPA

4.1. Growth Decline from g to r

- No company sustains high growth indefinitely.

- Market saturation, competition, and scalability limits eventually slow growth.

- A linear trajectory is both realistic and mathematically consistent with the PPP model.

4.2. Exit P/E Equals PPP

5. Earnings Per Share vs. Coupons: A Theoretical Reconciliation

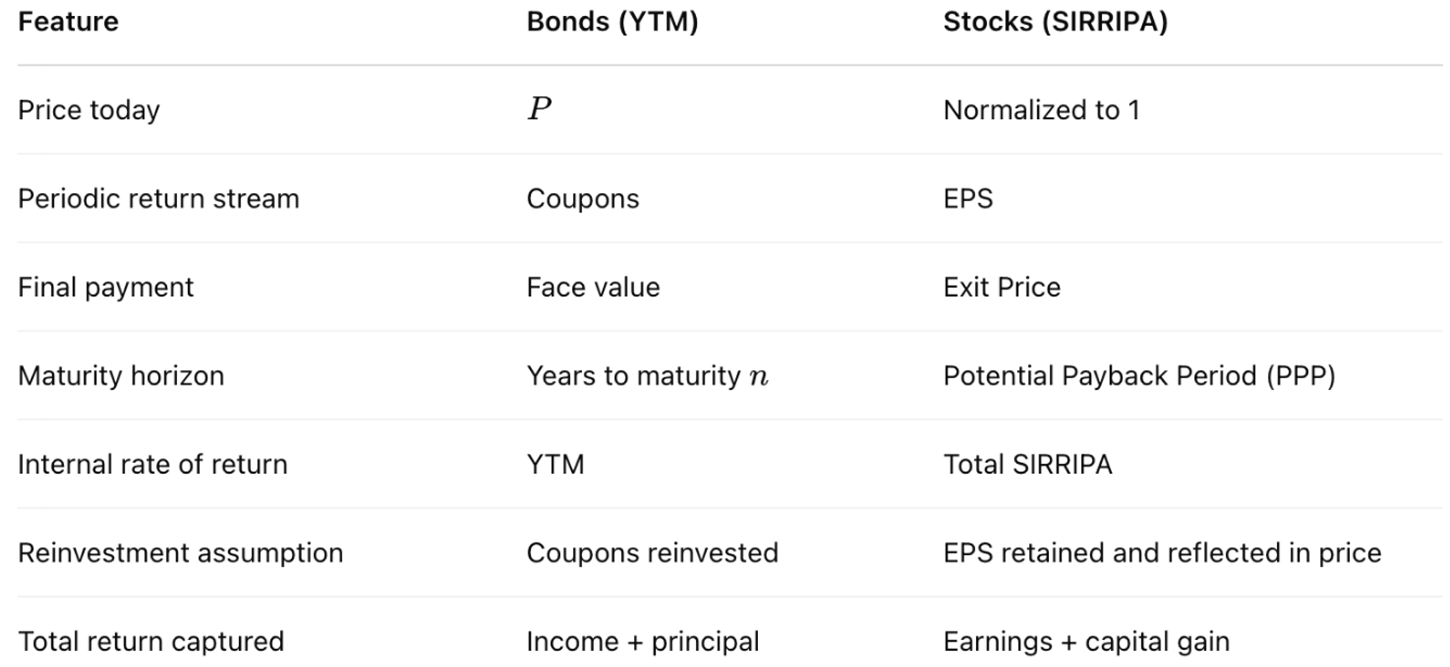

6. Structural Comparison: SIRRIPA vs. YTM

7. Case Study: Applying SIRRIPA to NVIDIA Stock

7.1. Data as of April 17, 2025

- -

- Stock Price: $101.49

- -

- P/E Ratio: 34.52

- -

- Expected Earnings Growth Rate (g): 40%

- -

- Risk-Free Rate (rf): 4.33% (10-year U.S. Treasury yield)

- -

- Expected Market Risk Premium (rm): 3.00%

- -

- Beta (β): 1.96

7.2. CAPM-Based Discount Rate

7.3. PPP-Derived Metrics

- -

- PPP (calculated from the P/E ratio, growth rate, and discount rate) = 13.68 years

- -

- SIRR (representing the compound return from earnings alone, based on the Doubling Formula) = 5.20%

- -

- SPARR (derived from the projected exit price at the end of the PPP period, discounted back to present) = 6.09%

- -

- SIRRIPA (total return metric, incorporating both discounted future earnings and capital appreciation) = 8.99%

- -

- SRP (Stock Risk Premium) = SIRRIPA – Risk-Free Rate = 8.99% – 4.33% = 4.66%.

7.4. Interpretation

- -

- The market may be undervaluing NVIDIA’s future earning power.

- -

- The stock still offers attractive long-term value when measured against its risk profile.

8. Cross-Asset Applications

- It enables direct comparisons between stock and bond returns on a unified, annualized basis.

- It supports efficient capital allocation by revealing risk-adjusted returns across asset classes.

- It enriches portfolio construction strategies by placing equities and fixed income on the same valuation scale.

9. Conclusion

References

- Bodie, Z., Kane, A., & Marcus, A. J. (2013). Investments (10th ed.). McGraw-Hill. The book is a comprehensive coverage of investment theory, useful for readers to contrast traditional valuation methods with the PPP-derived SIRR.

- Damodaran, A. (2002). Investment Valuation: Tools and Techniques for Determining the Value of Any Asset. Wiley Finance. The book provides insights on valuation techniques for various asset classes, offering context for why traditional methods fall short in capturing long-term earning power.

- Fama, E. F., & French, K. R. (1993). Common Risk Factors in the Returns on Stocks and Bonds. Journal of Financial Economics, 33 (1), 3-56. The article examines the risk factors influencing returns in stocks and bonds, relevant for understanding the importance of risk-adjusted metrics in investment evaluation. [CrossRef]

- Graham, B., & Dodd, D. (1934). Security Analysis. McGraw-Hill. The book represents the classic text on value investing that underscores the importance of intrinsic value, a concept integral to the PPP-derived SIRR’s focus on earning power.

- Kobiyh, M., El Amri, A., Oulfarsi, S., & Hilmi, Y. (2023). Behavioral finance and the imperative to rethink market efficiency. Financial Markets, Institutions and Risks, Volume 7, Issue 4. [CrossRef]

- Modigliani, F., & Miller, M. H. (1958). The Cost of Capital, Corporation Finance, and the Theory of Investment. The American Economic Review, 48(3), 261-297. The article represents a foundational work in financial theory, highlighting the impactof capital costs on corporate finance decisions, relevant to the discussion of discount rates in PPP and SIRR.

- Sam, R. (1984). "Le PER, un instrument mal adapté à la gestion mondiale des portefeuilles. Comment remédier à ses lacunes". Revue Analyse Financière publiée par la Société Française des Analystes Financiers (SFAF), 2ème trimestre 1984. The article critiques the P/E ratio’s effectiveness in global portfolio management and advocates for the adoption of the "Délai de Recouvrement (DR)" or "Payback.

- Period (PP)" as a more robust and adaptable evaluation tool. This article is part of a set of three articles written by Rainsy Sam in the 1980s that laid the foundation for the Potential Payback Period (PPP).

- Sam, R. (1985). Le Délai de Recouvrement (DR). Revue Analyse Financière, 3ème trimestre 1985. The article, which refines the concept of the DR (or PP), is part of a set of three articles written by Rainsy Sam in the 1980s that laid the foundation for the Potential Payback Period (PPP).

- Sam, R. (1988). Le DR confronté à la réalité des marchés financiers. Revue Analyse Financière, 4ème trimestre 1988. The article, which demonstrates the first applications of the DR (or PP) to portfolio management, is part of a set of three articles written by Rainsy Sam in the 1980s that laid the foundation for the Potential Payback Period(PPP).

- Sam, R. (2024). Stock Evaluation: Discovering the Potential Payback Period (PPP) as a Dynamic P/E Ratio. The website is a specialized platform dedicated to financial analysis, focusing on the Potential Payback Period (PPP) and its innovative application in deriving the Stock Internal Rate of Return (SIRR). It serves as both an educational and practical resource for investors, academics, and finance professionals interested in modern stock and bond valuation methodologies.

- Sam, R. (2025). "Le Potential Payback Period (PPP) : Une Généralisation Utile du Price Earnings Ratio (PER) Pour l’Evaluation des Actions". Revue Française d’Economie et de Gestion, "Volume 1 : Numéro 2" pp 621-632. Février 2025.

- Sam, R. (2025). "Le Potential Payback Period (PPP) : La Septième Révolution Financière". Revue Française d’Économie et de Gestion, "Volume 6 : Numéro 2" pp : 594- 620. Mars 2025.

- Sam, R. (2025). "Anatomy of a Looming Bear Market: How to Assess the Impact of Donald Trump’s Chaotic Measures on Wall Street". Revue Française d’Économie et de Gestion, "Volume 6 : Numéro 3" pp : 550- 560. Mars 2025.Sam, R. (2025). "Comparing Global Stock Markets Using Risk-Premiums Derived from the Potential Payback Period (PPP)". Revue Française d’Économie et de Gestion, "Volume 6 : Numéro 3" pp : 541- 549. Mars 2025.

- Sam, R. (2025). "Analyse Financière: Le Potential Payback Period (PPP), une alternative au Price Earnings Ratio pour évaluer les entreprises temporairement déficitaires – Etude de cas : Intel Corp.". Revue Française d’Économie et de Gestion, "Volume 6 : Numéro 3" pp : 561- 576. Mars 2025.

- Sharpe, W. F. (1964). Capital Asset Prices: A Theory of Market Equilibrium under Conditions of Risk. The Journal of Finance, 19(3), 425-442. The article introduces the Capital Asset Pricing Model (CAPM), which informs the risk adjustments in the PPP-derived SIRR. [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).