Introduction

Green hydrogen is increasingly recognized as a cornerstone of global decarbonization efforts, with the potential to mitigate up to 80 gigatons of CO₂ emissions by mid-century while supporting energy demand in sectors that are difficult to electrify, such as heavy industry, aviation, and long-duration storage (Hydrogen Council & McKinsey, 2021). Forecasts indicate that the global hydrogen market could exceed 660 million metric tons annually by 2050, driven by ambitious policy initiatives and the expansion of renewable energy systems. However, this momentum brings considerable uncertainties, including volatile cost projections, substantial infrastructure requirements, and the challenge of equitable deployment across diverse geopolitical contexts. While industrialized nations such as China, Germany, and Japan are advancing rapidly in hydrogen development, countries in the Global South face systemic barriers to aligning hydrogen deployment with broader goals of socio-economic growth and climate equity (NewClimate Institute, 2023). Despite a growing body of techno-economic research, very few studies integrate machine learning, stochastic simulation, and high-resolution spatial resource mapping to forecast hydrogen production costs under future policy and infrastructure uncertainty. Even fewer do so comparatively across countries with highly divergent grid systems, project scales, and development priorities. This study addresses that gap by linking three modeling domains—deterministic finance, Monte Carlo simulation, and machine learning—in a two-country analysis of Costa Rica and the United Kingdom.

The UK, for instance, considers hydrogen as a versatile tool to realize its decarbonization agenda, with aspirations of attaining up to 10 GW of low-carbon hydrogen production capacity by 2030 and up to 460 TWh demand by 2050, supported by mechanisms like the Hydrogen Business Model and the Low Carbon Hydrogen Standard (Royal Academy of Engineering, 2022). Costa Rica, by contrast, leverages nearly 100% renewable electricity and focuses on hydrogen deployment in transportation and agriculture, with cost estimates between $3.4–5.1/kg depending on the power source (Stamm et al., 2024). These contrasting national contexts—policy-driven industrial scaling versus sustainability-centered pilot deployment—offer an ideal platform to explore how technology performance, cost trajectories, and policy frameworks interact under different constraints.

Recent developments highlight Costa Rica’s emerging role in global green hydrogen investment. In April 2025, a €25 million initiative supported by the Mitigation Action Facility and GIZ was approved to finance hydrogen infrastructure, regulatory reform, and industrial pilots (GIZ-MAF, 2025). Simultaneously, the UK Embassy in San José announced strategic partnerships positioning Costa Rica as a regional hub for UK-led renewable energy and infrastructure projects (UK Embassy San José, 2024). This study provides timely spatial and economic modeling that can inform such initiatives by identifying viable production zones, technology trade-offs, and investment conditions.

The issues which are related to the technical, policy and economic feasibility of implementing hydrogen systems have been discussed in several theories. Deloitte (2023) and Taghizadeh-Hesary et al. (2022) also apply LCOH and NPV to analyze the costs of hydrogen production depending on the conditions, the impact of changing CAPEX, electricity prices, and financing options. Similarly, research in the field of machine learning is useful for proving the effectiveness in the field of forecasting and operations. For example, Mukelabai et al. (2024) use ML for boosting the performance forecasts and the component model for renewable hydrogen systems, also, Ukwuoma et al. (2024) explicate the advantage and use of the hybrid ensemble models for biomass-based hydrogen production to advance the prediction and explicability. These contributions show the capabilities of using ML to increase the key system parameters, whereby the system is better suited to complement variable renewable sources and decrease the LCOH through the fine-tuning of the system parameters. However, there is a lack of comparable research on ML-based models of projecting LCOH and NPV in countries with different resource potential and the level of infrastructure development. However, most of the hydrogeographical datasets for hydrogen economics are limited and confined to certain regions thus restricting the applicability of the existing stylized frameworks. For instance, some models of solar irradiance have been developed and applied in specific areas such as the case in India but none have been implemented in larger production of hydrogen to tackle the problem of intermittency (Sareen et al., 2024). Yet most of these models remain isolated by country, scale, or method, limiting their generalizability to different deployment environments.

Machine learning remarkably improves various green hydrogen production processes, especially those involving Solid Oxide Electrolysis Cells (SOECs). Decision trees, gradient boosting algorithms like XGBoost, Random forest and deep neural network (DNN) are used to forecast KPIs such as hydrogen production rates, current density and Ohmic resistance. Surprisingly, the XGBoost model has been proved to be accurate with the R² values greater than 0.95 for hydrogen production rates along with other important outputs. GA is then incorporated to improve input features so that higher hydrogen yields coupled with lower energy demands can be achieved. Moreover, the enhancement of machine learning algorithms increases cost-effectiveness since it optimizes parameters that define the Levelized Cost of Hydrogen (LCOH). This makes it possible to control factors like temperature, voltage, and the rate of gas flow that are very important when dealing with renewable energy sources like solar and wind power as indicated by Yang et al. (2025).These contributions illustrate the role of ML in individual systems, but do not compare its accuracy or policy relevance across nations with fundamentally different grid economics and infrastructure maturity.

The potential for renewable power generation, particularly wind, solar, and hydropower in Latin America provides a favorable factor for green hydrogen production. Chile, Argentina, and Uruguay are some of the countries most likely to assume the role of exporters because those countries provide cheap clean power to produce hydrogen through electrolysis. However, they face a number of challenges such as limited infrastructure, high costs of production, and fragmented regulatory frameworks that inhibit green hydrogen development in these countries. In this regard, specialists recommend increasing the level of cooperation with foreign partners, increasing investments in infrastructure and establishing effective certification systems that would help the market to develop (Torma et al., 2024). Furthermore, the established hydrogen policies within the region must embrace social equity and fairness on environmental impacts so that the generated development impacts will be accessible and support a just transition (Dorn, 2022). In the view of Gischler et al. (2023) regional cooperation, and the public–private sector partnership will be critical for the region in achieving sustainable and socially responsible green hydrogen development to enhance its chance of emerging as a global player in this innovative and important sector.

This paper introduces a unified, multi-scale modeling framework that links spatial resource mapping, deterministic techno-economic forecasting, Monte Carlo uncertainty simulation, and machine learning–accelerated cost prediction to compare green hydrogen development in Costa Rica (3 MW pilot) and the United Kingdom (50 MW commercial). High-resolution wind and solar maps first inform region-specific electricity-price adjustments; a deterministic LCOH and NPV model—augmented with 1,000-draw Monte Carlo simulations of tariffs, degradation rates, and policy incentives—then projects cost and cash-flow trajectories through 2050. Latin Hypercube sampling is used to train Random Forest, XGBoost, and LightGBM regressors, enabling millisecond-scale cost forecasting, benchmarking of error reductions, and identification of key drivers through SHAP analysis. CAPEX × electricity-price sensitivity surfaces are constructed, the predictive uplift of machine learning surrogates over naïve baselines is quantified, and areas of convergence and divergence between deterministic, stochastic, and data-driven approaches are mapped. This integrated framework addresses three core questions: (1) which techno-economic and regional factors dominate LCOH and NPV outcomes; (2) how much predictive improvement machine learning surrogates provide; and (3) what combined lessons emerge for policy and investment across these contrasting markets

By answering these questions, the study positions green hydrogen not only as a climate mitigation tool, but also as a pathway for

equitable, economically resilient energy transitions. The remainder of the paper is organized as follows: Section 2 reviews relevant literature;

Section 3 details the methodological framework;

Section 4 presents LCOH and NPV findings;

Section 5 introduces machine learning models and sensitivity testing; and

Section 6 offers a comparative discussion, identifies limitations, and outlines future directions.

Literature Review

2.1. The Role of Green Hydrogen in Global Decarbonization

Green hydrogen is pivotal for decarbonizing hard-to-electrify sectors like heavy industry, transport, and flexible power generation. In Thailand, it could meet 12.2% of total energy demand by 2050 through investments in electrolysers and renewables (Pradhan et al., 2024). Globally, demand is projected to increase fifteenfold, with the European Union alone needing around 1,300 GW of electrolyser capacity (Tarvydas, 2022). Green hydrogen also supports long-term energy storage and stabilizes grids dependent on intermittent renewables.

Deployment still faces steep production costs and infrastructure gaps. Concerns over the climate efficacy of blue hydrogen underscore the importance of rigorous life-cycle assessment and performance standards. As a result, international frameworks such as ISO 19870 and independent verification schemes are gaining traction (Tatarenko et al., 2024). Public acceptance is equally critical: studies show that trust-building communication is more effective than consultation alone (Buchner et al., 2025).

Although the global project pipeline—especially in China—is expanding, many low-emission initiatives remain unrealized. Large-scale impact will require synchronized advances in policy, infrastructure, and demand, particularly across Latin America (IEA, 2024a). Advanced economies are already moving: the EU’s hydrogen premium auctions, the U.S. Inflation Reduction Act, and national strategies in the UK, Australia, and Argentina collectively narrow the cost gap with fossil fuels (Bird & Bird LLP et al., 2024). While the UK emphasizes industrial clusters, Costa Rica is piloting decentralized models tuned to local renewable strengths.

High-resolution spatial mapping of solar and wind resources has emerged as a foundational step in regional hydrogen planning, enabling more accurate identification of cost-effective electrolysis zones and system design optimization (Tatarewicz et al., 2023). These geospatial insights are critical for tailoring hydrogen strategies to localized renewable strengths and infrastructure gaps, particularly in contexts like Costa Rica and the UK where spatial heterogeneity plays a pivotal role.

Taken together, these trends highlight a pressing need for robust, comparative techno-economic evidence to guide investment across heterogeneous national contexts—precisely the gap addressed by the present study.

2.2. Overview of Electrolysis Technologies (PEM, Alkaline, SOEC)

Green-hydrogen economics hinges on four main electrolysis routes, each balancing efficiency, capital cost, and grid flexibility. Alkaline electrolysis (AEC) is the work-horse option—60–80 % efficient at 65–100 °C and the lowest CAPEX (≈ US $1,080–1,296 kW⁻¹) but slow to track variable renewables (El-Shafie 2023). Proton-exchange-membrane (PEM) stacks deliver 99.999 %-pure H₂ and rapid ramping, ideal for wind- or hydro-linked systems, yet rely on scarce Ir/Pt catalysts that push CAPEX to $2,009–2,506 kW⁻¹.Solid-oxide electrolysis (SOEC) operates at 700–1,000 °C, exploiting waste-heat streams to hit up to 97.6 % (HHV) and just 2.5–3.5 kWh Nm⁻³ electricity use, yet thermal-cycling degradation still curbs commercial rollout (Norman et al. 2024). Off-grid trials of PEM in Europe and Australia—including unitised regenerative fuel cells—underscore their field readiness for flexible renewables (Borm & Harrison 2021).

2.3. Techno-Economic Landscape of Green Hydrogen

Green hydrogen production is shaped by a complex interplay between electrolyzer technologies, renewable energy sources, and regional techno-economic conditions. This section synthesizes findings from global case studies to highlight the feasibility of different hydrogen production pathways and their sensitivity to contextual variables.

High-efficiency technologies like solid oxide electrolysis (SOEC) offer energy efficiencies approaching 97.6%, but their deployment is constrained by high capital costs and vulnerability to thermal cycling. These systems are most viable in centralized, industrial contexts with steady electricity inputs, such as South Korea, where scaling SOEC systems from 20 kW to 2 MW reduced LCOH to $5.87/kg (Bui et al., 2023). In contrast, proton exchange membrane (PEM) and alkaline electrolysis (AEC) are more modular and cost-accessible. PEM systems are particularly advantageous in variable-grid environments, with studies reporting LCOH values as low as $2.94/kg and capital costs around $600/kW (Naqvi et al., 2024).

Cost evaluations reveal substantial variability depending on energy inputs and deployment scale. In Brazil, a 100 MW hybrid system using wind and solar achieved LCOH of $5.29/kg (AEC) and $5.92/kg (PEM), with AEC outperforming PEM in financial returns—reaching an IRR near 29% under sub-$7/kg pricing conditions (Pinheiro et al., 2025). Similarly, in Finland, flexible PEM systems switching between hydrogen generation and grid electricity exports achieved LCOH values between $0.65 and $2.16/kg depending on market dynamics, highlighting the role of operational flexibility (Javanshir et al., 2024). In Colombia, PEM and AEC electrolysis powered by renewables showed LCOH values ranging from $7.02–$9.69/kg, with CAPEX and capacity factor as key cost drivers; offshore wind was considered economically unfeasible due to low load factors (Velasquez-Jaramillo et al., 2024).

Solar-driven systems often face higher costs. In Australia, a PEM setup reported an LCOH of $6.36/kg, with 80% of total cost attributable to CAPEX—making outcomes highly dependent on subsidies and financial structuring (Rezaei et al., 2024). Meanwhile, a Spanish study found that electricity prices accounted for over 70% of LCOH ($3.47–$4.43/kg), and that public grants exceeding 30% significantly improved economic returns (Matute et al., 2023b). A Europe-wide review also underscored the importance of scaling, finding average green hydrogen costs at $5.02/kg and best-case values near $2.50/kg, with each 1% increase in system capacity reducing LCOH by 0.20% (Weißensteiner, 2025).

Hybrid and off-grid configurations show both promise and complexity. AEC systems in Brazil used for public transport showed LCOH of $25–56/MWh and NPV of $21.8 million due to co-product sales like oxygen and surplus electricity (Alcantara et al., 2025). In South Africa, solar-powered systems produced hydrogen at $2.12/kg, but storage costs reached 918 ZAR/kg, limiting off-grid competitiveness (Lebepe et al., 2025). Likewise, in Chile, hydrogen export to Europe cost $3.37–$4.77/kg, while storage in isolated systems could add $0.25/kg (Aldren et al., 2025). In Indonesia, LCOH varied dramatically—from $0.48/kg in Ambon to $82/kg in Kupang—due to renewable resource disparities and infrastructure gaps. A 20% component cost increase could raise LCOH by 30%, stressing the importance of resilient design and regional adaptation (Prasetyo et al., 2025).

Notably, a sensitivity framework developed by Baral & Šebo (2024) demonstrated that hybrid systems incorporating solar, wind, and Organic Rankine Cycle (ORC) technology could achieve an LCOH of $3.1/kg, with projections as low as $1.46/kg by 2050. The study identified CAPEX and capacity factor as the most impactful variables, while operating expenditures (OPEX) had minimal effect. These insights reinforce the critical role of Monte Carlo simulations in capturing cost uncertainties and performance variability.

These findings validate the importance of aligning technology choices with local conditions and justify the need for flexible, machine learning–augmented modeling frameworks—such as the one developed in this study—to improve cost prediction, reduce risk, and inform policy under diverse scenarios.

2.4. Comparative Context: UK and Costa Rica

2.4.1. Renewable Energy Profiles of the UK and Costa Rica

Costa Rica generates approximately 99% of its electricity from renewable sources—primarily hydroelectric (74%), followed by geothermal (13%), wind (11%), and solar (1%). This energy mix ensures a stable, year-round supply from flexible and dispatchable resources. From 2016 to 2021, renewable integration increased significantly, raising the country's energy self-sufficiency to 54%. Such conditions position Costa Rica favorably for green hydrogen production, particularly through off-peak hydro and wind utilization, although regional grid balancing and demand-matching remain key challenges (IRENA, 2024).

In contrast, the United Kingdom achieved 50.5% renewable electricity generation in Q3 2024, driven largely by wind (especially offshore and in Scotland), along with solar and biomass. The UK's decarbonizing grid—supported by expanded interconnector capacity and declining fossil-based generation—offers considerable promise for hydrogen production from renewable surpluses. Nonetheless, scaling hydrogen output will depend on reinforcing offshore wind infrastructure, enhancing storage capacity, and deploying more agile grid management systems (DESNZ, 2024a).

2.5. National Hydrogen Strategies and Targets

Costa Rica’s 2023 National Green Hydrogen Strategy outlines an ambitious roadmap targeting hydrogen demand of 18–20 kilotonnes annually by 2030 and 420 kilotonnes by 2050. To meet these goals, the country plans to install 0.2–1 GW of electrolysis capacity, with projected Levelized Cost of Hydrogen (LCOH) as low as $1.24/kg—particularly from wind-based systems. The strategy emphasizes domestic consumption due to currently high electricity prices and limited infrastructure for large-scale export. Implementation is bolstered by public–private partnerships, including ventures like Ad Astra Rocket and Cavendish S.A., alongside support from international donors such as GIZ and the IADB. However, political instability introduces risks to funding continuity and long-term planning (Stamm et al., 2024). A notable pilot, the Ad Astra Hydrogen Transportation Ecosystem, integrates wind and solar resources with PEM electrolyzers to demonstrate hydrogen-powered mobility and business models such as leasing and off-take agreements in the Guanacaste region (Ad Astra, 2024).

The United Kingdom’s Hydrogen Strategy, initially launched in 2021 and revised in 2024, sets a production target of 10 GW of low-carbon hydrogen capacity by 2030, aiming for up to 64 TWh of annual output. This is to be achieved through a balanced portfolio of green and blue hydrogen projects. The UK approach includes financial mechanisms such as the Net Zero Hydrogen Fund and policy frameworks like the Low Carbon Hydrogen Standard, targeting deployment in sectors such as transport, industrial heating, and power generation. Regional initiatives, including Scotland’s Orkney BIG HIT project, contribute to early-stage deployment and public acceptance. The hydrogen economy is projected to deliver up to £7 billion in gross value added (GVA) and create approximately 64,000 jobs by 2030, though policy coordination, storage, and distribution infrastructure remain persistent challenges (DESNZ, 2024b; UK Government, 2021).

2.6. Modeling and Simulation in Green Hydrogen Project Analysis

The evolution of green hydrogen production hinges increasingly on advanced modeling, simulation, and artificial intelligence (AI) tools. These computational approaches enhance system optimization, cost-efficiency, and performance forecasting, particularly for projects integrating renewable energy sources. In the context of this study's goals—forecasting LCOH and NPV in Costa Rica and the UK under uncertain scenarios—modeling tools such as CFD, thermodynamic simulations, and machine learning are pivotal.

Computational Fluid Dynamics (CFD) has emerged as a highly accurate method for simulating electrolyzer performance, with prediction accuracies nearing 95% for flow distributions and polarization curves (Shash et al., 2025).

Machine learning (ML) techniques are increasingly applied to estimate key performance indicators such as the (LCOH) and (NPV) across diverse hydrogen production scenarios. Tree-based algorithms—including Random Forests and Gradient Boosting—have demonstrated superior predictive accuracy compared to traditional regression models, particularly in handling complex techno-economic datasets. Moreover, these models contribute to optimizing operational parameters in real-time, supporting more efficient energy management and decision-making throughout the hydrogen value chain (Allal et al., 2025).

In parallel, high-fidelity simulation models are used to enhance the technical and economic viability of hydrogen systems. Recent studies show that replacing detailed electrolyzer models with reduced-order modeling techniques—such as neural networks and curve-fitting—can significantly reduce computational effort while maintaining accuracy (Criollo et al., 2024). These methods are validated through real-time simulations and experimental setups, supporting precise calculation of energy demands and cost per kilogram of hydrogen. In the microgrid case study presented, the levelized cost of hydrogen reached approximately $10.81/kg with a production energy requirement of 64 kWh/kg, demonstrating close alignment with international benchmarks.

Collectively, these AI- and simulation-driven strategies represent a transformative shift in hydrogen infrastructure design, offering scalable solutions to enhance efficiency, sustainability, and investment precision (Motiramani et al., 2025).

2.7. Machine Learning and Regression-Based Forecasting in Hydrogen Economics

ML has become a central component of green hydrogen cost modeling, particularly through the use of ensemble and regression techniques. IRENA (2021) established foundational drivers of the Levelized Cost of Hydrogen (LCOH), including capital expenditure (CAPEX), electricity price, efficiency, and deployment scale, which have since informed data-driven modeling efforts. Recent literature has explored a range of algorithms to enhance forecasting precision and support policy planning. For example, Kabir et al. (2023) applied K-Nearest Neighbors and Random Forest to hydrogen production modeling, achieving strong predictive accuracy and identifying critical variables such as temperature and voltage. Similarly, Kim et al. (2022) used Classification and Regression Trees (CART®) to model nuclear-powered hydrogen systems, revealing key cost determinants and producing LCOH estimates around $2.77/kg.

Additional contributions include Bassey and Ibegbulam (2023), who emphasized robust data preprocessing and advocated for transparent, explainable AI models in hydrogen forecasting. Devasahayam (2023) explored hybrid energy systems, suggesting that ML can optimize production when aligned with regional grid dynamics. Kwon et al. (2024) implemented a deep neural network with 71 inputs to predict hydrogen demand (R² = 0.9936), aiding investment decisions. Allal et al. (2025) confirmed that Random Forest effectively identifies cost driver hierarchies for infrastructure planning, while Alhussan et al. (2023) introduced a hybrid model combining Al-Biruni Earth Radius and Particle Swarm Optimization with Recurrent Neural Networks for solar hydrogen forecasting.

Despite recent advances, important gaps persist. Comparative benchmarking studies evaluating multiple machine learning algorithms within a unified techno-economic framework remain notably scarce. While individual algorithms have been tested on isolated datasets, there is limited literature comparing them head-to-head under consistent modeling conditions, especially for hydrogen cost forecasting. This lack of standardized benchmarking limits the generalizability of findings and constrains evidence-based model selection in hydrogen planning. By filling this gap, our study provides one of the few integrated benchmarks of ensemble tree-based models—Random Forest, XGBoost, and LightGBM—using a synthetic, region-tailored techno-economic dataset for green-hydrogen cost forecasting. Unlike prior work, our dataset explicitly encodes local renewable potential, policy incentives, and CAPEX learning curves, enabling country-specific scenario analysis across both developed and emerging markets.

Systematic reviews find that head-to-head benchmarking of multiple machine-learning algorithms within a single, end-to-end techno-economic framework is still rare, and the regional datasets that do exist are often coarse or internally inconsistent—particularly in data-scarce areas—making broad model generalisation difficult.

3. Methodology

3.1. Spatial Resource Assessment

This study conducts a spatial analysis of wind and solar energy resources in Costa Rica and the United Kingdom by leveraging geospatial raster datasets and administrative boundary shapefiles. Python (v3.11) was used as the primary analytical platform, employing libraries such as rasterio, geopandas, shapely, and numpy. For each country, high-resolution raster layers representing wind speed or global horizontal irradiance (GHI) were clipped using province- or country-specific polygons to isolate regional resource characteristics.

3.1.1. Zonal Statistics Extraction

To assess solar and wind potential, raster datasets were spatially masked and clipped. The threshold for identifying high-performance zones is set as the 90th percentile value of the dataset (

Eq. 1):

T90: The 90th percentile threshold of the data values.

X: The vector of valid raster values (e.g., wind speed or solar irradiance) for a given region.

Raster cells with values equal to or exceeding this threshold are defined as part of the top 10% high-performance zone (

Eq. 2):

3.2. Offshore Potential Mapping

To delineate offshore resource zones, a 20 km buffer was generated around each administrative unit (province or national region). The offshore area is defined as the difference between the buffered and the original landmass geometries (

Eq. 3):

Aoffshore: The resulting offshore area geometry.

Aregion: The original land-based administrative area.

Buffer(Aregion,20km): Geometric expansion by 20 kilometers.

These areas were rasterized and used to isolate marine wind or solar data for offshore analysis.

3.3. Wind Power Density Estimation

Wind energy potential was quantified by converting wind speed into wind power density using the kinetic energy formula (

Eq. 4):

This equation reflects the theoretical amount of kinetic energy available per square meter and assumes ideal conditions with no turbine losses.

3.4. Solar Irradiance Analysis

Solar resource potential was assessed using GHI datasets. High-performance solar zones were identified by calculating the 90th percentile of GHI values for each region (

Eq. 5):

Pixels meeting or exceeding this threshold were classified as part of the

top 10% solar performance zone (

Eq. 6):

3.6. Hydrogen LCOH Modeling

LCOH was estimated dynamically for the UK and Costa Rica from 2025 to 2050, using 5-year intervals and region-specific renewable resource data. The model integrates time-dependent electrolyzer degradation, regional electricity costs, policy incentives, and fundamental financial modeling principles. LCOH is calculated annually for each electrolyzer technology (PEM, Alkaline, SOEC) using the following formulation (

Eq. 7):

Where:

CAPEXadj :Total system capital expenditure adjusted for policy subsidies

CRF=: Capital Recovery Factor, where r is the discount rate and n is the plant lifetime

-

PH2 = Annual hydrogen production [kg/year]

Celec,t,r=Et⋅Pelec,r :Electricity cost per kg H₂, where Et is the electricity consumption [kWh/kg] at time t, and Pelec,r is the electricity price in region r.

Cwater = Water cost per kg H₂

COPEX = Fixed OPEX per kg H₂

Electricity consumption per kg H₂ increases over time due to electrolyzer stack degradation. The degraded voltage and the resulting adjusted energy consumption are calculated as (

Eq. 8):

Where:

V0 is the initial voltage,

ΔV is the voltage degradation rate in mV per 1000 hours (i.e, mV/kh)

Ht is cumulative operating hours at time t.

Vt=Degraded voltage at the time t.

E0=Initial specific energy use (kWh/kg)

Et= Adjusted specific energy use of time t as voltage degrades

Annual profit is computed as the difference between hydrogen and oxygen revenue and the production cost at each year t (

Eq. 9):

The

Net Present Value (NPV) is then calculated by discounting the annual profits over the project period from 2025 to 2050 (

Eq. 10):

Country-specific economic assumptions—including cost structures, renewable availability, and investment mechanisms—are documented in Supplementary Table 1 for the UK and Supplementary Table 2 for Costa Rica. The model's technical fidelity is supported by degradation-adjusted efficiency projections for each electrolyzer type, as detailed in Supplementary Table 3.

3.7. Regional Adjustments for Costa Rica and the UK

To reflect spatial variability in renewable energy potential, the LCOH models for both the United Kingdom and Costa Rica apply dynamic electricity cost adjustments based on normalized renewable resource scores. Each region’s Renewable Potential Score is computed by combining Global Horizontal Irradiance (GHI) and the average of onshore and offshore wind speeds

(Eq. 11):

This score is then normalized against the best-performing region to generate an

Adjustment Factor, reflecting relative resource quality

(Eq. 12):

The baseline electricity price in each region is then scaled accordingly

(Eq. 13):

These adjustment factors are applied consistently across all projection years (2025–2050) and across all electrolyzer technologies, ensuring geographic variability is directly embedded into hydrogen cost projections. Full regional renewable input data are provided in Supplementary Table 4.

3.8. Economic Calculations

The economic viability of hydrogen production in Costa Rica and the United Kingdom is assessed using two complementary indicators: LCOH and NPV. The LCOH represents the discounted cost to produce 1 kilogram of hydrogen, considering electrolyzer degradation, regionalized electricity prices linked to renewable resource availability, and investment incentives. In parallel, the NPV captures the present value of annual cash flows over a 20-year operational life, accounting for interactions between hydrogen production costs, stochastic price variations, and market mechanisms such as carbon credits and oxygen co-product revenues. Both metrics are evaluated for PEM, alkaline, and SOEC technologies across five-year intervals from 2025 to 2050. Key economic parameters and assumptions underpinning the NPV calculations are summarized in Table 2 for the United Kingdom and Table 3 for Costa Rica, including wholesale hydrogen price ranges, capital expenditure grants, electricity tariff distributions, operational subsidies, and fiscal incentives. This structured approach ensures that regional differences in cost drivers and support mechanisms are transparently incorporated into the comparative techno-economic analysis.

3.8.1. Net-present-value formulation

For each year t:

with

QH2 – annual hydrogen output.

PH2 – wholesale H₂ price draw; PO2P_{\text O_2}PO2 – O₂ credit.

Et – electricity consumption (rises with stack degradation).

Pe – electricity price draw.

Discount rate r: 6 % (UK) and 5 % (CR).

CAPEX is annuitized with the country-specific grant (UK & CR: 15 %).

A 1 000-iteration Monte-Carlo varies PH2, Pe, O₂ and CO₂ credits, and plant load-factor (±5 %).

Table 2.

Key Quantitative Data for UK Hydrogen Production, Pricing, and Financial Modeling.

Table 2.

Key Quantitative Data for UK Hydrogen Production, Pricing, and Financial Modeling.

| Data type |

Value / distribution in MC run |

Reference |

| Wholesale H₂ price 2025 – 2050 |

3.0 – 4.8 US $ kg⁻¹ (≙ £112→£71 MWh⁻¹) |

UK Hydrogen Strategy (2021a) |

| CfD / HPBM strike premium |

Triangular 5–7 US $ kg⁻¹ (mode = 6) |

DESNZ HPBM IA (2023) |

| Oxygen-gas credit |

Log-normal μ = 2.51 US $ kg⁻¹, σ = ±20 % |

GasWorld price index (2023) |

| Carbon credit (UK-ETS) |

Log-normal μ = 0.50 US $ kg⁻¹, σ = ±25 % |

UK-ETS Authority (2024) |

| Electricity tariff draw |

0.0516 – 0.0774 US $ kWh⁻¹ (4–6 p/kWh) |

UK Hydrogen Strategy (2021a) |

| Installed CAPEX 2025 |

PEM/Alk 1 500 US $ kW⁻¹; SOEC 1 900 US $ kW⁻¹ |

Lichner (2024); IEA (2024b) |

| CAPEX grant (Net-Zero Hydrogen Fund + GIGA) |

15 % of EPC |

DESNZ NZHF guidance (2024c) |

| Plant size & utilisation |

50 MW; 6 000 h y⁻¹ (±5 %) |

Frontier HAR-1 data pack (2024) |

| Discount rate (real) |

6 % |

HM Treasury Green Book (2022) |

| Monte-Carlo runs |

1 000 |

Custom Simulation |

Table 3.

Key Quantitative Data for Costa Rica Hydrogen Production, Pricing, and Financial Modeling.

Table 3.

Key Quantitative Data for Costa Rica Hydrogen Production, Pricing, and Financial Modeling.

| Category |

Variable |

Value / distribution in MC run |

Reference |

| Fiscal incentives |

Adjusted CAPEX grant |

15 % write-down |

MINAE (2025) |

| Revenue |

H₂ wholesale price |

3.0 – 4.0 US $ kg⁻¹ |

MINAE (2022) |

| Revenue |

O₂ credit (log-normal) |

μ = 2.51 US $ kg⁻¹, σ = 20 % |

Ad Astra, 2018 |

| Revenue |

CO₂ credit (log-normal) |

μ = 0.30 US $ kg⁻¹, σ = 30 % |

ICAO (2024) |

| Electricity |

Tariff draw |

0.04 – 0.06 US $ kWh⁻¹ |

ICE (2022) |

| Electricity |

OPEX electricity share |

70 % of OPEX |

Assumption |

| Electricity |

Base price in deterministic LCOH |

0.15 US $ kWh⁻¹ |

Assumption |

| OPEX |

OPEX subsidy |

10 % reduction |

MINAE (2025) |

| Technical |

Plant size |

3 MWₑ; 300 kg H₂ d⁻¹ |

Ad Astra, 2018 |

| Technical |

Full-load hours |

4 000 h yr⁻¹ ± 5 % |

Ad Astra, 2018 |

| Finance |

Discount rate |

5 % real |

Assumption |

| Finance |

Plant life |

20 years |

Assumption |

| Simulation |

Monte-Carlo draws |

1 000 iterations |

Custom |

3.9. Simulation-Augmented Machine Learning Framework for LCOH Forecasting

The simulation–machine learning hybrid framework was developed to efficiently simulate thousands of plausible techno-economic futures without excessive computational burden. It couples the deterministic LCOH models with supervised tree-based surrogates (Random Forest, XGBoost, and LightGBM). The workflow consists of three sequential stages: (i) synthetic data generation via Latin Hypercube Sampling (LHS), (ii) high-fidelity LCOH estimation using physics-based models, and (iii) surrogate training and validation.

3.9.1. Synthetic Data Generation

For Costa Rica, a four-dimensional Latin Hypercube Sample (LHS) comprising N=300N = 300N=300 strata was generated. Key uncertain inputs included subsidy-adjusted CAPEX, wholesale electricity price, fixed OPEX, and system capacity factor. For the United Kingdom, a six-dimensional LHS with N=500N = 500N=500 strata was created to reflect a wider policy and technical variability, adding degradation rate and a subsidy-flag dimension.

Each sample was evaluated using the respective deterministic LCOH model, which dynamically adjusts specific energy consumption Espec(t) over the 20-year project horizon based on technology-specific voltage degradation. Full parameter ranges, central values, and code implementations are detailed in Supplementary Table 5.

Annual LCOH was computed for each sample based on: (

Eq. 15):

Where:

CAPEXadj: Capital expenditure per kilowatt, adjusted for subsidy incentives.

CRF: Capital recovery factor, calculated as with discount rate rrr and project lifetime n.

mH2: Annual hydrogen output (kg), based on system size, efficiency, and capacity factor.

OPEX: Fixed operating costs (USD/kg).

pe: Electricity price (USD/kWh).

Espec(t): Specific energy use per kg H₂, defined as a function of 0, ΔV, and cumulative degradation time

3.9.2. Model Architecture and Training

The datasets were split 80/20 into training and test sets, with all features standardized via z-scoring. A five-fold grid search optimized Random Forest hyperparameters, while XGBoost and LightGBM used standard defaults suited for tabular regression. Model accuracy was assessed using cross-validated CV-MSE, MAE, RMSE, and R², with performance uplift measured against a naïve mean-prediction baseline (ΔMAE). The best-performing Random Forest models were serialized and analyzed using SHAP (SHapley Additive exPlanations) to interpret feature contributions on the test set. Summary and dependence plots for each technology and country highlighted electricity price, CAPEX, and capacity factor as key drivers, enhancing transparency and trust in the surrogate models.

4. Sensitivity Analysis for Green Hydrogen Economic Models

Building upon the techno-economic formulations outlined in

Section 3.6–3.8, a grid-based sensitivity analysis was performed to assess how the Levelized Cost of Hydrogen (LCOH) and Net Present Value (NPV) respond to variations in capital expenditure (CAPEX) and electricity price. Deterministic simulations were conducted for three electrolyzer technologies—PEM, Alkaline, and SOEC—each characterized by specific voltage profiles and degradation rates

(see Supplementary Table 3).

Simulations were performed separately for the United Kingdom and Costa Rica, using region-specific ranges for CAPEX and electricity prices based on projected 2025 conditions (detailed in Supplementary Table 1 and Table 2). At each grid point, LCOH was calculated by annualizing CAPEX over a 20-year project life and summing fixed operational costs, water consumption, and electricity expenses adjusted for efficiency degradation. NPV was computed as the discounted sum of annual net cash flows, considering revenues from hydrogen and oxygen sales and all relevant costs.

This framework enables a structured and comparative evaluation of green hydrogen economic viability across different technological and regional contexts, while detailed modeling assumptions and data sources are provided in the Supplementary Information.

5. Results

5.1. Wind and Solar Energy Potential in Costa Rica

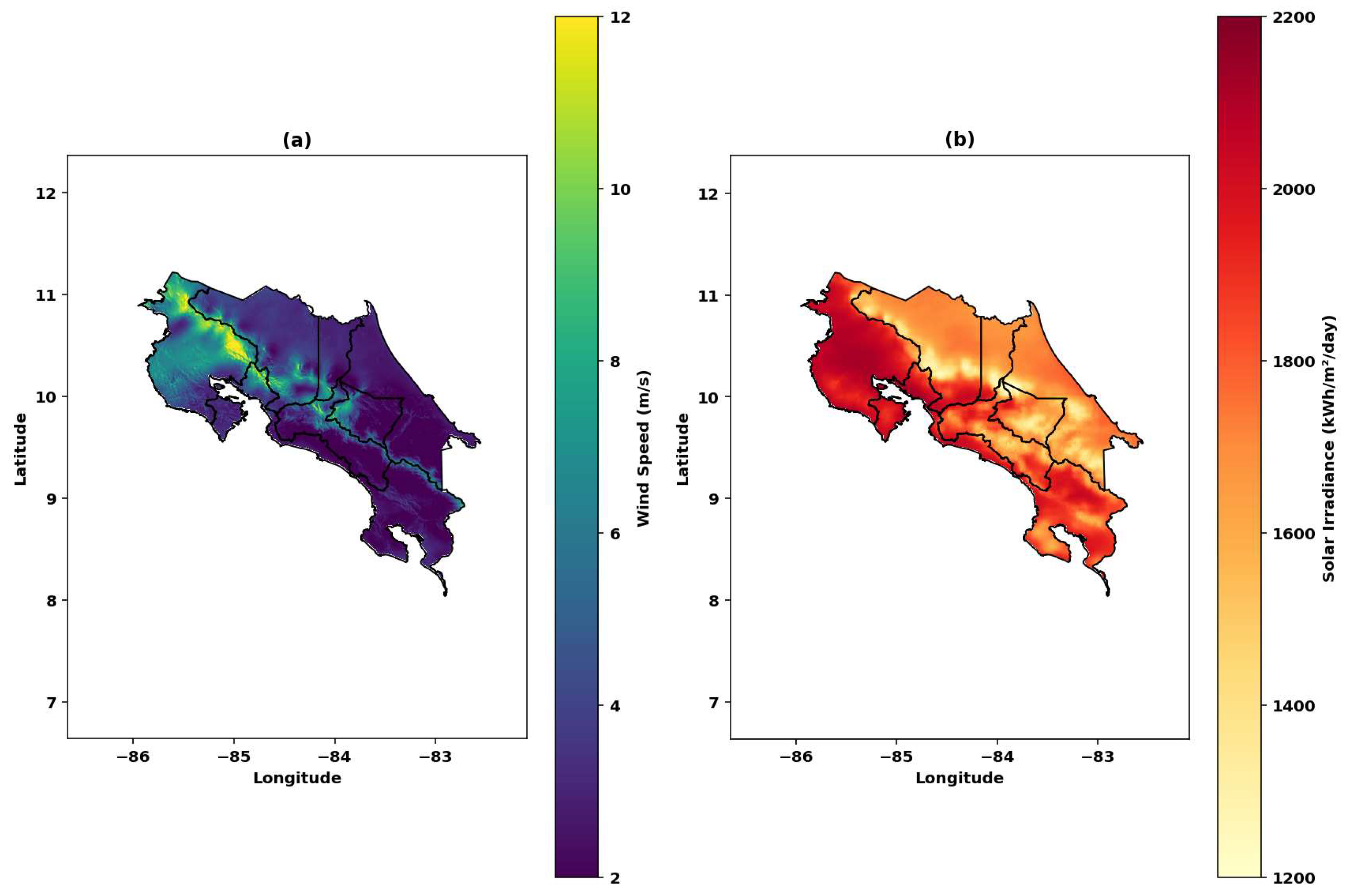

A spatial analysis of Costa Rica’s wind and solar resources reveals substantial regional variation, underscoring the country's strong potential for renewable energy generation. As illustrated in

Figure 1, Guanacaste emerges as the most promising region for both wind and solar energy. The mean onshore wind speed in Guanacaste is 6.59 m/s, with peaks reaching 19.17 m/s; its top 10% wind zones average 11.21 m/s. By contrast, Limón records the lowest wind speeds, with a mean of 2.40 m/s, indicating limited wind energy potential. Offshore wind speeds are relatively uniform across coastal provinces, averaging 4.57 m/s.

For solar energy, Guanacaste again leads with the highest mean Global Horizontal Irradiance (GHI) at 2005.27 kWh/m²/day, and the top 10% of its solar zones reach 2113.09 kWh/m²/day. Puntarenas follows with a mean GHI of 1885.08 kWh/m²/day, while Cartago and San José display lower solar potential, at 1612.32 and 1747.36 kWh/m²/day, respectively.

Figure 1.

Wind and Solar Maps of Costa Rica.

Figure 1.

Wind and Solar Maps of Costa Rica.

Caption: This figure illustrates the spatial distribution of wind speed (panel a) and solar irradiance (GHI) (panel b) across Costa Rica. Panel (a) shows wind speeds ranging from 2–12 m/s, with Guanacaste exhibiting the strongest values. Panel (b) presents solar irradiance from 1200–2200 kWh/m²/day, again with Guanacaste recording the highest GHI. Both maps include provincial boundaries to support geographical context and aid in identifying priority areas for renewable energy development.

In summary, Guanacaste clearly stands out as the leading region for both wind and solar deployment, positioning it as a focal point for renewable energy investment in Costa Rica.

5.2. Solar and Wind Energy Potential Across the United Kingdom and Northern Ireland

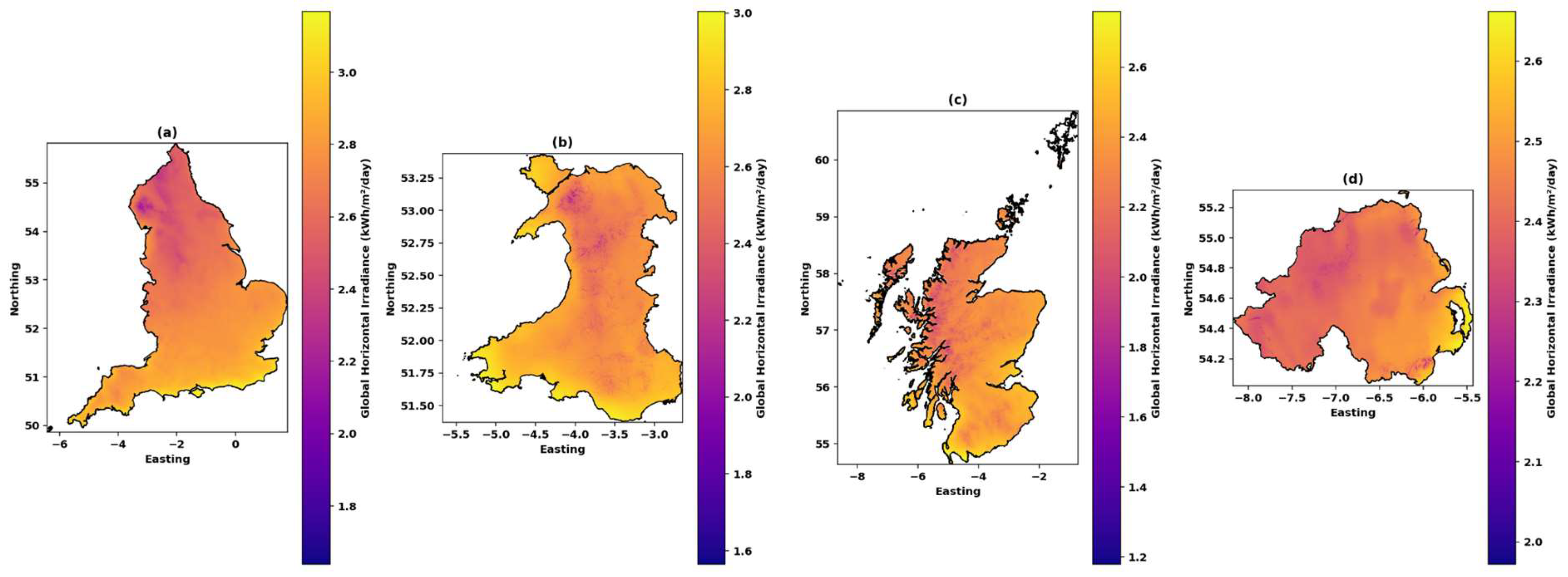

The solar irradiance (GHI) values across the four regions of the United Kingdom show regional variations in solar potential.

Figure 2displays the solar potential in England, Wales, Scotland, and Northern Ireland. In England (

Figure 2a), the mean GHI is 2.73 kWh/m²/day, with the highest recorded value of 3.17 kWh/m²/day and the lowest at 1.64 kWh/m²/day. The top 10% of solar zones in England have a threshold of 2.91 kWh/m²/day, with a mean of 2.98 kWh/m²/day. In Wales (

Figure 2b), the mean GHI is slightly lower at 2.67 kWh/m²/day, with values ranging from 1.57 kWh/m²/day to 3.00 kWh/m²/day. The top 10% solar zones in Wales have a threshold of 2.83 kWh/m²/day and a mean of 2.89 kWh/m²/day. Scotland (

Figure 2c) shows a mean GHI of 2.35 kWh/m²/day, with the minimum at 1.18 kWh/m²/day and the maximum at 2.76 kWh/m²/day. The top 10% solar zones in Scotland have a threshold of 2.50 kWh/m²/day and a mean of 2.56 kWh/m²/day. Finally, Northern Ireland (

Figure 2d) has a mean GHI of 2.44 kWh/m²/day, ranging from 1.97 kWh/m²/day to 2.66 kWh/m²/day, with the top 10% solar zones having a threshold of 2.50 kWh/m²/day and a mean of 2.56 kWh/m²/day.

Caption:This figure displays the Global Horizontal Irradiance (GHI) for four regions of the United Kingdom: England, Wales, Scotland, and Northern Ireland. Each region’s solar potential is shown in a separate subplot, labeled (a) for England, (b) for Wales, (c) for Scotland, and (d) for Northern Ireland, with individual colorbars representing the average daily solar irradiance (kWh/m²/day). The plasma colormap is used to visualize varying levels of solar energy intensity, with brighter regions indicating higher irradiance levels. These maps provide valuable insights for assessing the regional solar potential essential for renewable energy planning.

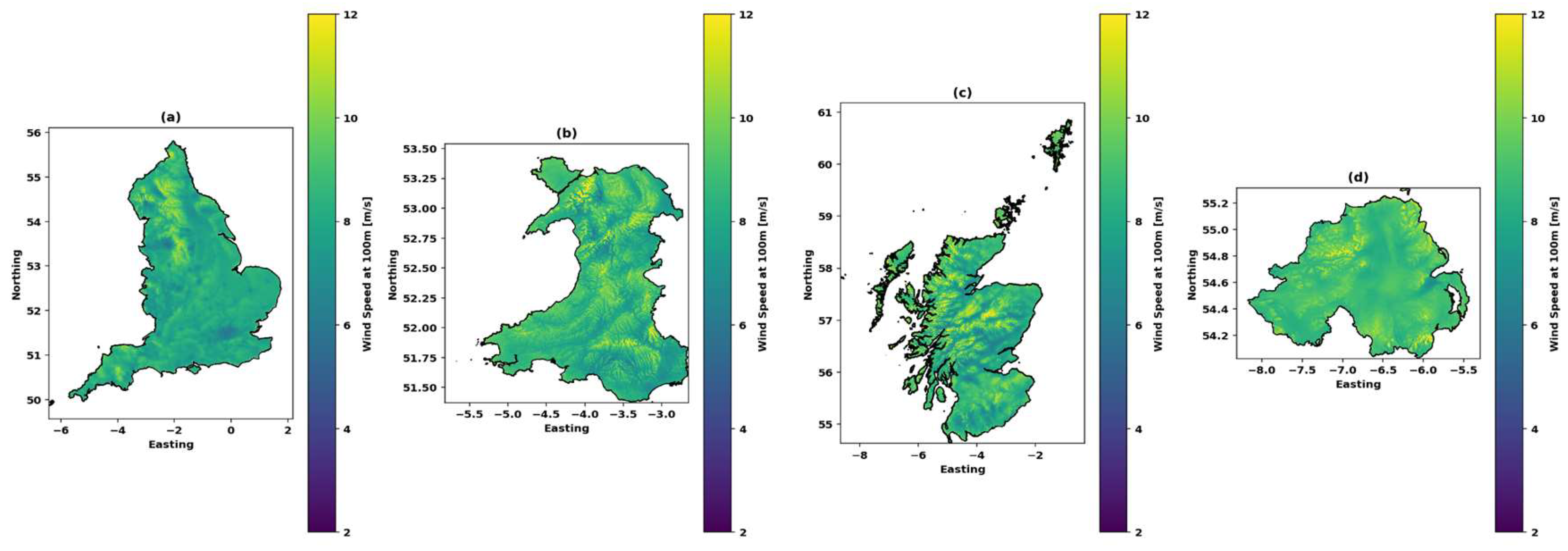

In terms of wind speed at 100m height,

Figure 3 illustrates the wind potential for the same four regions. For England (

Figure 3a), the average wind power density is 456.21 W/m², with a maximum value of 2725.38 W/m² and a minimum of 55.03 W/m². The top 10% wind zones in England have a threshold of 612.94 W/m², with a mean of 655.79 W/m². Wales (

Figure 3b) shows onshore wind speeds with a mean of 8.57 m/s and a maximum of 16.32 m/s. The offshore wind speed in Wales is slightly higher, with a mean of 9.20 m/s and a maximum of 13.72 m/s. The top 10% wind zones in Wales have a threshold of 9.90 m/s and a mean of 10.23 m/s. In Scotland (

Figure 3c), the onshore wind speed has a mean of 8.66 m/s, with a maximum of 18.78 m/s. Offshore wind speeds in Scotland are higher, with a mean of 9.92 m/s and a maximum of 16.45 m/s, and the top 10% wind zones show a threshold of 10.21 m/s and a mean of 11.20 m/s. For Northern Ireland (

Figure 3d), the onshore wind speed is 9.00 m/s on average, with a maximum of 16.45 m/s, while offshore wind speeds have a mean of 9.33 m/s and a maximum of 17.20 m/s. The top 10% wind zones in Northern Ireland show a threshold of 9.78 m/s and a mean of 10.34 m/s.

Caption:Figure 3 presents the wind speed data at 100 meters height across England, Wales, Scotland, and Northern Ireland. Each subplot, labeled (a) for England, (b) for Wales, (c) for Scotland, and (d) for Northern Ireland, shows the wind speed distribution with individual colorbars. The viridis colormap is used to visualize wind speed variations, where brighter areas indicate stronger wind speeds. These maps are essential for evaluating the feasibility of onshore wind energy generation, highlighting regions with higher wind potential.

These results indicate significant variability in both solar and wind potential across the regions. The data highlights that offshore areas (such as those in Wales, Scotland, and Northern Ireland) tend to have stronger wind speeds, which could be ideal for offshore wind energy projects. Similarly, the solar potential across all regions varies slightly, with England and Wales showing the highest solar irradiance values.

5.3. LCOH Estimations for Costa Rica and the United Kingdom

The hydrogen production cost projections reveal clear contrasts between Costa Rica and the United Kingdom, driven by differences in renewable energy availability, electricity market structures, and technology learning curves. These trends are visualized in

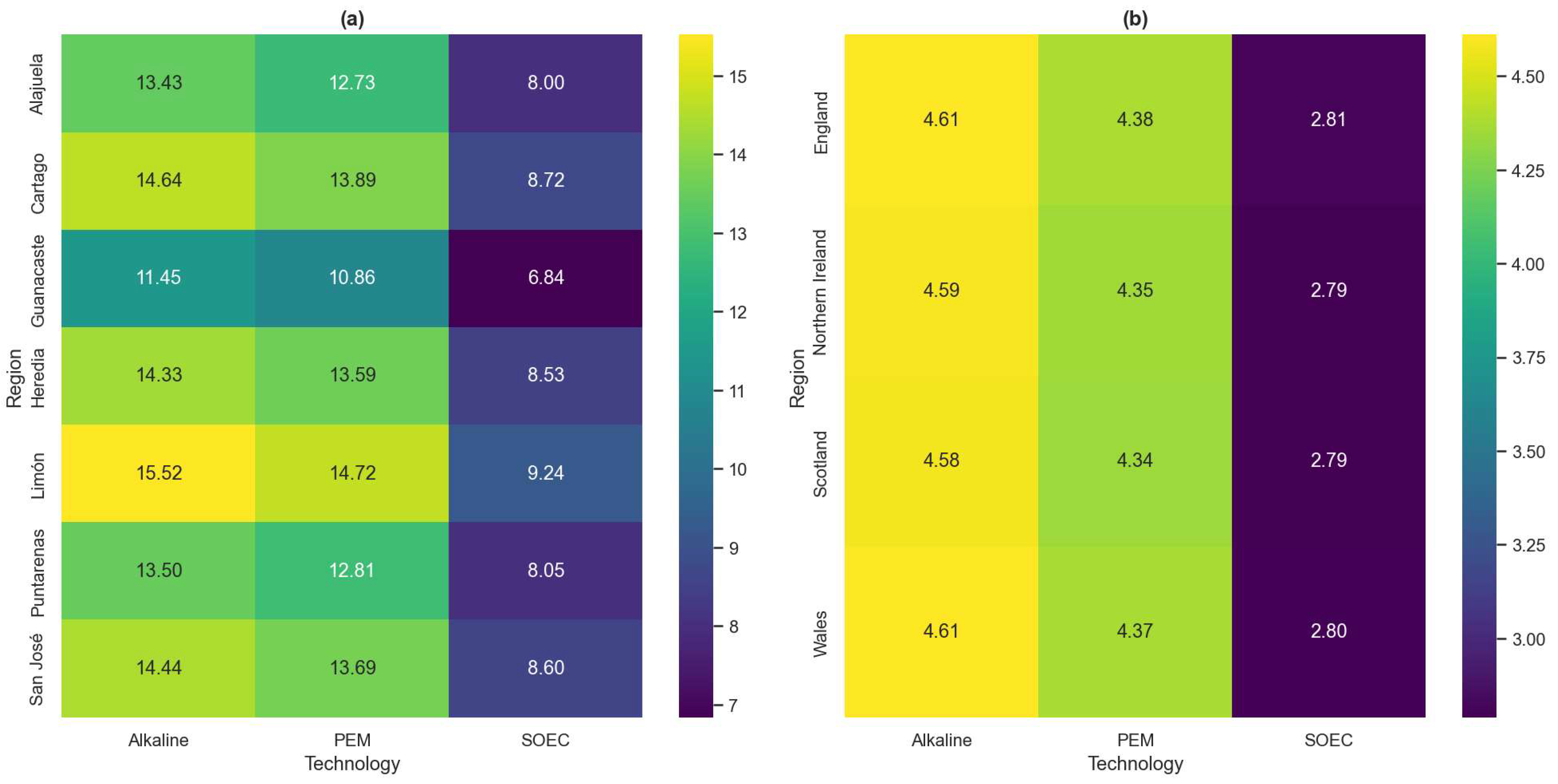

Figure 4, which maps the regional variations in Levelized Cost of Hydrogen (LCOH) for the year 2030 across both countries.

In Costa Rica, the lowest LCOH in 2025 is achieved in Guanacaste using SOEC technology at approximately 8.81 $/kg, benefitting from the region’s favorable combination of wind and solar resources. PEM electrolyzers in Guanacaste show a 2025 LCOH of around 13.95 $/kg, gradually declining to 10.57 $/kg by 2050 as capital and operational costs fall due to learning effects. In contrast, regions with less optimal renewable profiles, such as San José and Cartago, consistently report higher LCOH values across all technologies, underlining the central role of renewable quality in hydrogen competitiveness.

In the United Kingdom, starting LCOH values are significantly lower than in Costa Rica, primarily due to lower modeled electricity prices and aggressive CAPEX reduction assumptions. In 2025, the LCOH for PEM electrolysis in England is estimated at 4.68 $/kg, decreasing steadily to 3.34 $/kg by 2050. SOEC emerges as the most cost-effective technology option across the UK regions, reaching an LCOH of 2.07 $/kg by 2050. Although regional variations within the UK exist—driven mainly by wind resource differences between Scotland, Wales, and England—the disparities are relatively modest compared to those observed in Costa Rica.

Figure 4.

LCOH Comparison for Costa Rica and the United Kingdom.

Figure 4.

LCOH Comparison for Costa Rica and the United Kingdom.

Caption: Heatmap visualization of the Levelized Cost of Hydrogen (LCOH) across regions in (a) Costa Rica and (b) the United Kingdom for the year 2030, across three electrolyzer technologies (PEM, Alkaline, SOEC). Darker shades indicate lower LCOH ($/kg H₂), while lighter tones represent higher production costs, following a Viridis color scale. Spatial disparities are shaped by renewable resource availability, electricity pricing, and infrastructure factors, providing a comparative basis for investment strategies and policy formulation in the green hydrogen sector.

Overall, Costa Rica’s LCOH trajectory remains higher across the modeling horizon, even though it benefits from excellent renewable resources, due to inherently higher industrial electricity tariffs. Conversely, the UK benefits from lower baseline electricity prices and substantial offshore wind deployment, facilitating faster convergence to internationally competitive LCOH targets by mid-century. These results emphasize the critical interplay between regional resource availability, technology selection, and policy support in shaping the emerging hydrogen economy.

5.4. NPV Comparison for Hydrogen Production in Costa Rica and the United Kingdom

The harmonized 1,000-draw Monte Carlo analysis over a 20-year project horizon reveals pronounced regional contrasts in the investment feasibility of green hydrogen production, as visualized in

Figure 5. In Costa Rica, based on a 3 MW plant (approximately 300 kg H₂ per day), only Solid Oxide Electrolysis Cell (SOEC) technology achieves consistently positive returns, posting a mean Net Present Value (NPV) of approximately +3 million USD, with a P10–P90 confidence interval ranging from +2 million to +4 million USD. Proton Exchange Membrane (PEM) technology remains balanced at the break-even line, with a mean NPV near 0 million USD and variability between –1 million and +1 million USD, while Alkaline electrolysis also remains around the break-even point, averaging near 0 million USD, with variability between –1 million and +1 million USD. These modest NPVs are largely attributable to the pilot-scale deployment, the modest impact of Costa Rica’s 15% CAPEX grant, and the relatively narrow margin realizable even under the country's favourable industrial electricity tariffs (0.04–0.06 USD/kWh).

Conversely, the United Kingdom’s 50 MW green-hydrogen projects (approximately 30 tonnes H₂ per day) demonstrate substantially higher investment returns across all technologies. SOEC again leads, achieving a mean NPV of around +895 million USD (P10–P90: +784 million to +1.01 billion USD), while PEM and Alkaline configurations also deliver strong profitability, with mean NPVs of +767 million USD and +741 million USD, respectively. Notably, even the lower bounds of the UK NPV distributions remain above +630 million USD, highlighting robust resilience to market variability. These superior outcomes are primarily driven by the Hydrogen Production Business Model (HPBM) strike-price top-up (mode at 6 USD/kg, triangular distribution 5–7 USD/kg) combined with revenue inflows from the UK Emissions Trading Scheme (UK-ETS) carbon credits (~0.5 USD/kg), which together offset higher wholesale electricity costs (0.0516–0.0774 USD/kWh).

Figure 5.

Net Present Value (NPV) Comparison between Costa Rica and the United Kingdom.

Figure 5.

Net Present Value (NPV) Comparison between Costa Rica and the United Kingdom.

Caption: This figure presents a comparative bar plot of Net Present Value (NPV) outcomes for hydrogen production in Costa Rica (a) and the United Kingdom (b) using a harmonized Monte Carlo simulation framework. Each subplot shows the mean NPV (in million USD, 20-year real terms) for three electrolyzer technologies—PEM, Alkaline, and SOEC. Color intensity encodes the relative NPV magnitude within each country, mapped through the Viridis colormap. The dual-panel format highlights national differences in economic feasibility across technology options, with dedicated colorbars facilitating scale interpretation.

Overall, the findings depicted underline the pivotal role of both policy design and scale effects in shaping the economic viability of hydrogen investments. While Costa Rica’s renewable-rich environment and incentive structures support modest profitability at smaller scales—especially via high-efficiency SOEC pathways—the United Kingdom’s combination of market support mechanisms and large-scale plant deployment unlocks order-of-magnitude higher NPVs across all electrolyzer technologies. This comparative analysis highlights that market architecture, subsidy frameworks, and project size are decisive levers in the emerging global hydrogen economy.

5.5. Machine Learning Model Performance Comparison

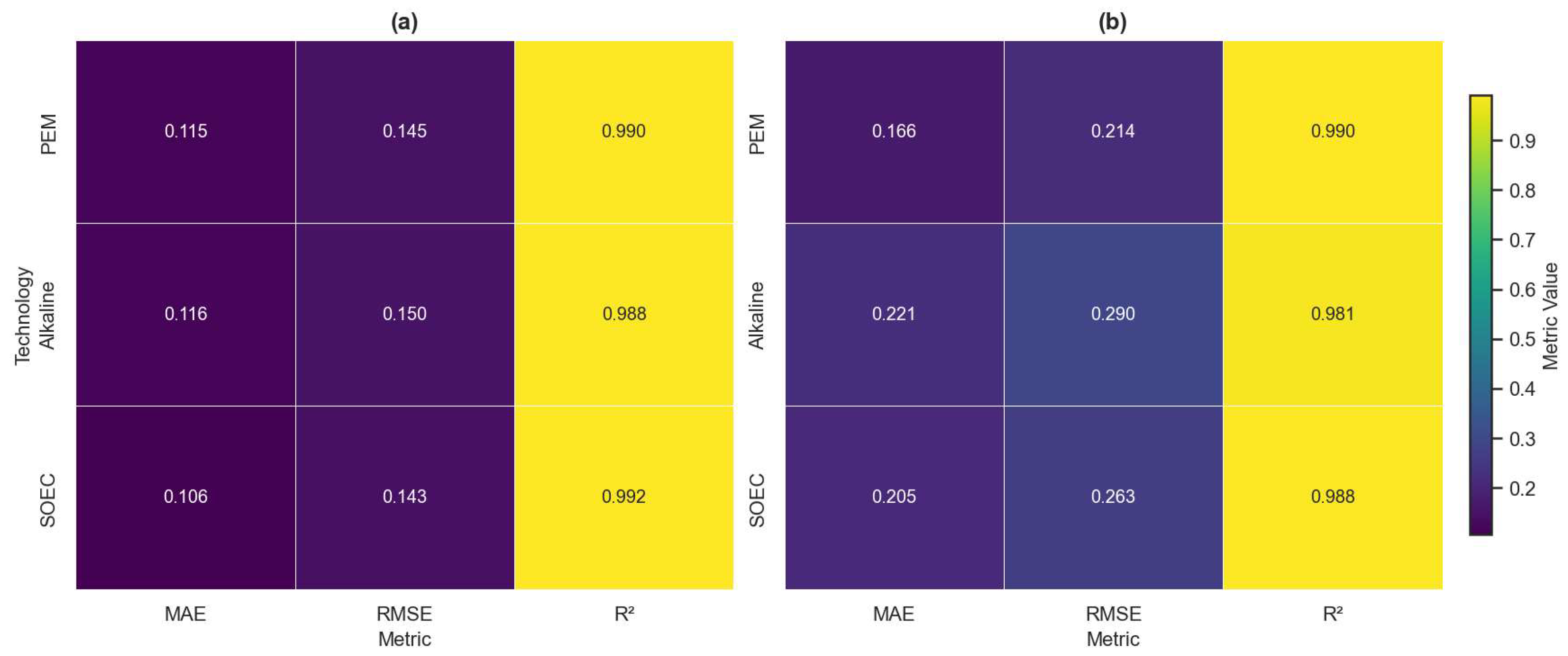

To assess the predictive capacity of machine learning models in estimating the Levelized Cost of Hydrogen (LCOH) for Costa Rica and the United Kingdom, three core metrics were evaluated: Mean Absolute Error (MAE), Root Mean Squared Error (RMSE), and the Coefficient of Determination (R²). As shown in

Figure 6, these metrics were compared across three electrolyzer technologies—PEM, Alkaline, and SOEC—highlighting both national and technological differences in model performance.

In Costa Rica, LightGBM consistently outperformed other models across all electrolyzer types. For PEM systems, it achieved a MAE of 0.115, RMSE of 0.145, and an R² of 0.990. Alkaline electrolyzers yielded a MAE of 0.116, RMSE of 0.150, and an R² of 0.988, while SOEC predictions reached a MAE of 0.106, RMSE of 0.143, and an R² of 0.992. These results confirm LightGBM’s superior generalization performance despite the country’s smaller, pilot-scale datasets. SHAP analysis further revealed that electricity price, CAPEX, and capacity factor were the most influential predictors of LCOH, enhancing the transparency and trustworthiness of the surrogate modeling framework.

Similarly, in the United Kingdom, LightGBM delivered the strongest predictive performance across all technologies. For PEM, it achieved a MAE of 0.166, RMSE of 0.214, and an R² of 0.990. Alkaline electrolyzers recorded a MAE of 0.221, RMSE of 0.290, and an R² of 0.981, while SOEC systems yielded a MAE of 0.205, RMSE of 0.263, and an R² of 0.988. These results reflect high model generalization enabled by large-scale, policy-supported datasets and more stable operational conditions. SHAP-based analysis confirmed the dominant influence of electricity price, CAPEX, and capacity factor, reinforcing the model’s interpretability and relevance for decision-making in well-developed hydrogen markets.

Figure 6.

Machine Learning Error Metrics Comparison for Costa Rica and the United Kingdom.

Figure 6.

Machine Learning Error Metrics Comparison for Costa Rica and the United Kingdom.

Caption: This figure presents the performance of the best machine learning models in predicting the Levelized Cost of Hydrogen (LCOH) for Costa Rica and the United Kingdom, across three electrolyzer technologies: PEM, Alkaline, and SOEC. Each heatmap displays three evaluation metrics—Mean Absolute Error (MAE), Root Mean Squared Error (RMSE), and Coefficient of Determination (R²)—with values annotated in each cell. Color intensities, based on the Viridis colormap, indicate relative metric magnitudes, using a consistent scale across both subplots. A shared vertical colorbar reflects the value gradient, enabling direct visual comparison between countries and technologies.

Overall, these findings affirm that ensemble learning methods—particularly LightGBM—are highly effective for capturing the complex techno-economic dynamics of green hydrogen production across diverse regional contexts.

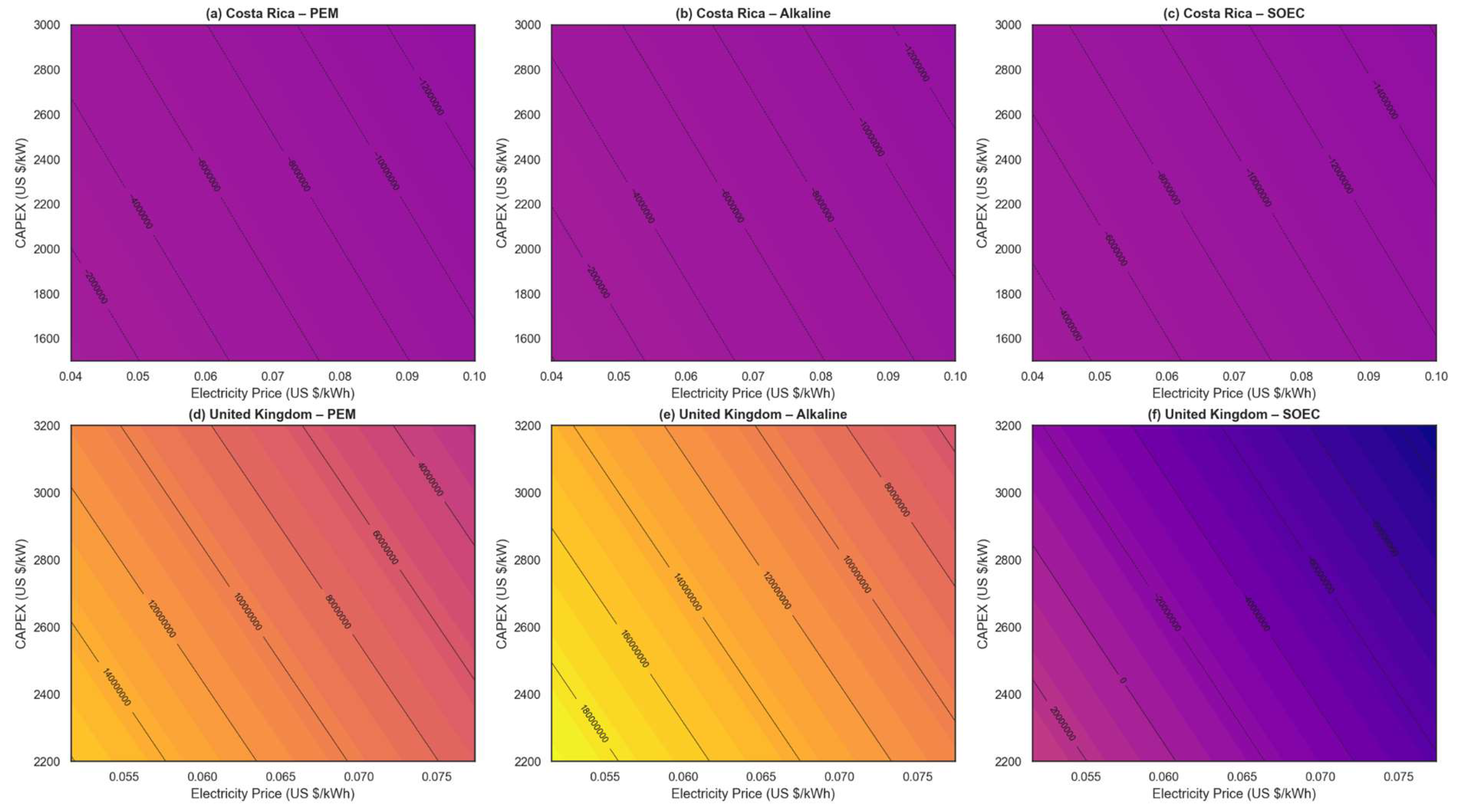

5.6. Sensitivity Analysis of Hydrogen Economics in Costa Rica and the United Kingdom

To quantify how project economics react to simultaneous shifts in capital cost and power-purchase tariff, two-dimensional sensitivity surfaces were generated for Levelized Cost of Hydrogen (LCOH) and Net Present Value (NPV). Each surface was computed separately for the three electrolyzer technologies—PEM, Alkaline, and SOEC—using consistent degradation parameters and operational assumptions established in

Section 3.6 to 3.8.

In Costa Rica, the analysis models a 3 MW installation operating at 4,000 full-load hours annually (capacity factor ≈ 0.456) under a 5% real discount rate (CRF = 0.0802). Despite favorable electricity prices and CAPEX reductions through a 15% free-trade-zone grant, the small project scale constrains profitability. The sensitivity surfaces reveal that while PEM and Alkaline electrolyzers can achieve positive NPVs under ideal cost conditions, SOEC systems remain challenged by their higher energy consumption and capital requirements. These dynamics emphasize that at smaller scales, even aggressive cost and efficiency improvements may not fully overcome investment barriers without targeted incentives.

Conversely, the United Kingdom scenario models a 50 MW plant operating 6,000 full-load hours annually (capacity factor ≈ 0.685) with a 6% discount rate (CRF = 0.0872). Here, a combination of larger project scale, power-price support mechanisms, and layered revenue streams—including Hydrogen Production Business Model (HPBM) strike-price top-ups, oxygen credits, and carbon credit revenues—significantly enhances financial viability. Both PEM and Alkaline technologies exhibit strong profitability across broad portions of the cost-space, while SOEC configurations, although less robust, still maintain positive returns under favorable conditions.

These trends are visualized in

Figure 7, which illustrates NPV sensitivity surfaces for Costa Rica and the United Kingdom across variations in subsidy-adjusted CAPEX and electricity price. Full supporting parameters and selected output values are summarized in

Supplementary Table 6.

Caption:

Figure 7 presents a comparative sensitivity analysis of Net Present Value (NPV) outcomes for green hydrogen projects in Costa Rica and the United Kingdom, across variations in subsidy-adjusted CAPEX and electricity price. Panels (a)–(c) display the sensitivity surfaces for Costa Rica, while panels (d)–(f) correspond to the United Kingdom. Each subplot shows contour maps colored by NPV magnitude (in real 2025 USD), with overlaid contour lines denoting regions of equal NPV for clearer visualization. Results are organized by electrolyzer technology—PEM, Alkaline, and SOEC—illustrating how economic feasibility responds to key cost drivers in different national contexts. This analysis highlights the critical interplay between CAPEX, energy pricing, and technology choice in shaping hydrogen investment viability.

Taken together, the comparative sensitivity analysis highlights that while Costa Rica’s renewable energy advantages are notable, achieving profitable hydrogen production at small scale requires additional financial instruments or scale-up strategies. In contrast, the UK's strong policy-driven revenue stacking and larger project sizes create more resilient investment landscapes, allowing green hydrogen projects to remain bankable even under moderately adverse cost scenarios.

6. Discussion

This comparative modeling study of green hydrogen development in Costa Rica and the United Kingdom highlights how national conditions, project scales, and policy frameworks shape the techno-economic viability of hydrogen production. While both nations are advancing hydrogen strategies, their pathways diverge significantly due to differing subsidy structures, resource endowments, and market mechanisms. Costa Rica relies on abundant, low-cost renewables, yet small-scale deployments (3 MW) face financial challenges even under optimistic assumptions, as evidenced by sensitivity analyses and Monte Carlo NPV projections—a trend also observed in previous techno-economic assessments highlighting the high LCOH of small-scale systems (Henry et al., 2023). In contrast, the United Kingdom leverages structured subsidy stacking—through the Hydrogen Production Business Model (HPBM), Net Zero Hydrogen Fund, and UK-ETS carbon credits—to enable large-scale (50 MW) projects with robust NPVs exceeding +800 million USD across all technologies, even under cost variability.

These findings align with Costa Rica’s Estrategia Nacional de Hidrógeno Verde 2022–2050 (MINAE, 2022), emphasizing decentralized production and renewable integration, yet reveal critical needs for scale-appropriate incentive mechanisms. In the United Kingdom, aggressive offshore wind deployment and public-private financing partnerships—such as the Net Zero Hydrogen Fund initiative (Department for Business, Energy & Industrial Strategy, 2021) and subsequent updates (DESNZ, 2024b)—are pivotal, supporting scalable hydrogen projects despite higher baseline infrastructure costs. This contrast highlights how policy-driven market design, project scale, and technology choice—particularly the dominance of SOEC configurations observed in both national contexts—will critically shape the future competitiveness of green hydrogen economies.

Machine learning techniques—particularly ensemble models such as Random Forest, XGBoost, and LightGBM—significantly enhanced both the accuracy and efficiency of hydrogen cost modeling in Costa Rica and the United Kingdom. As described in

Section 3.9, ML served as a surrogate modeling approach to simulate complex, uncertain scenarios beyond the reach of traditional deterministic methods. LightGBM consistently delivered the best results across both countries, achieving an

R² of 0.990 and a MAE of 0.166 for PEM systems in the UK, and an

R² of 0.992 with a MAE of 0.106 in Costa Rica despite the smaller dataset.

All models significantly outperformed a naïve-mean baseline (Costa Rica baseline MAE 1.585; UK baseline MAE 1.606), confirming the robustness of simulation-augmented machine learning over heuristic or purely deterministic estimates. Feature importance rankings—reinforced through SHAP analysis—consistently identified electricity price, CAPEX, and capacity factor as the dominant drivers of LCOH variability. Additionally, Monte Carlo simulations for Net Present Value (NPV) provided probabilistic financial viability insights, revealing how project scale, subsidy stacking, and market price dynamics interact under uncertainty.

These results reinforce the essential role of hybrid simulation–machine learning approaches not only for accurate forecasting but also for guiding technology design, risk-informed investment, and policy development in green hydrogen systems. This conclusion is supported by Chen et al. (2023), who emphasize the importance of machine learning in uncovering policy-relevant dynamics within complex energy systems, and aligns with recent findings by Shash et al. (2025), who demonstrated that integrating computational fluid dynamics (CFD), thermodynamic models, and AI optimization has enabled predictive accuracies exceeding 95% and operational cost reductions of up to 24%. Collectively, these insights highlight that ML-augmented frameworks are becoming indispensable for advancing the scalability, efficiency, and economic competitiveness of green hydrogen infrastructure.

This study builds upon the foundational work of Navarro Jiménez and Zheng (2024), who applied Monte Carlo simulations to evaluate spatial and techno-economic variability of hydrogen production costs within Costa Rica. While offering valuable insights for a single-country context, that research was limited in geographic scope and deterministic modeling approaches. The present analysis advances the framework by adopting a comparative, cross-national perspective encompassing both an emerging market (Costa Rica) and a developed market (United Kingdom). In addition, it integrates machine learning–based forecasting and model explainability techniques, substantially expanding the analytic depth and policy relevance. By doing so, the study offers enhanced guidance for investors, policymakers, and infrastructure planners operating across heterogeneous and uncertain market environments.

Moreover, this study aligns with broader systemic concerns raised by Jayachandran et al. (2024), who identified persistent barriers to green hydrogen deployment—such as electrolyzer efficiency constraints, safety issues in storage, and infrastructure immaturity—which manifest differently across national contexts. In Costa Rica, limited grid infrastructure and a reliance on decentralized systems create logistical and financial barriers to centralized hydrogen production, necessitating the development of modular, cost-effective systems tailored to localized demand. These constraints also impact the scalability and integration of hydrogen projects, particularly in remote or underdeveloped regions. In contrast, the United Kingdom must contend with the complexity and expense of deploying large-scale offshore infrastructure, which demands substantial upfront capital and sophisticated regulatory coordination. This infrastructure intensity contributes to heightened cost sensitivity, as demonstrated by our two-dimensional CAPEX and electricity price sensitivity surfaces, where UK projects exhibited sharper LCOH and NPV fluctuations compared to Costa Rican deployments.

These challenges emphasize the need to combine advanced modeling methods, such as simulation-enhanced machine learning, with strategic infrastructure development to translate hydrogen’s theoretical promise into real-world deployment. The U.S. National Clean Hydrogen Strategy and Roadmap (DOE, 2023) reinforces this view, advocating for co-located Regional Hydrogen Hubs and dedicating over $9.5 billion to reduce delivery costs and accelerate infrastructure growth. Similarly, Mullanu et al. (2024) demonstrate that AI and machine learning can strengthen system-wide management, from optimizing supply and demand to improving flow coordination, highlighting the essential role of integrating digital and physical infrastructure—a concept also reflected in the hybrid modeling framework of this study.

Further perspective is offered by the spatial modeling work of Müller et al. (2023), who employed a GIS-based least-cost optimization framework to assess hydrogen viability in Kenya. Their findings underscore the critical value of geospatial planning—particularly in low- and middle-income countries (LMICs)—to align hydrogen production, transport, and end-use zones in a cost-efficient manner. This principle directly supports Costa Rica’s decentralized hydrogen vision, where spatially distributed hubs could enhance system efficiency, reduce transmission costs, and accommodate the country’s mountainous terrain and fragmented grid infrastructure.

Beyond national strategies, Costa Rica and the United Kingdom also present complementary opportunities for bilateral cooperation. Costa Rica’s strength in decentralized renewable generation and environmental stewardship, paired with the United Kingdom’s advanced financial instruments and regulatory experience, creates a promising foundation for collaborative ventures. Potential areas include joint pilot projects, knowledge sharing in electrolyzer deployment strategies, and the co-development of machine learning–based forecasting and optimization tools. Additional opportunities may lie in offshore wind collaboration, particularly in Costa Rica’s Guanacaste region, where strong coastal wind resources could support hybrid hydrogen production models. Leveraging the United Kingdom’s offshore infrastructure expertise could accelerate the development of integrated wind–hydrogen hubs in decentralized contexts, promoting technology transfer and capacity building. Such cooperation could be supported by institutions like GIZ, the Inter-American Development Bank (IADB), or the UK Infrastructure Bank, fostering inclusive innovation, blended finance mechanisms, and knowledge diffusion across contrasting development contexts.

Expanding beyond bilateral models, this study also highlights several priority areas for advancing global hydrogen research and strategic planning, closely aligned with the observed Costa Rica–United Kingdom dynamics. Chief among these is the creation of open-access, interoperable datasets to support transparent and reproducible hydrogen cost modeling—mirroring the data-driven approach applied in this analysis. The scarcity of standardized, high-quality datasets remains a major bottleneck for cross-national comparability and model validation. Additionally, integrating demand-side forecasting to capture regional market variability, particularly critical for decentralized contexts like Costa Rica, is essential for effective project planning.

Systematic benchmarking of machine learning models across diverse geographic and economic contexts also emerges as a crucial step, ensuring that predictive insights developed here are transferable and scalable. A notable example of forward-looking national strategy is Colombia’s national hydrogen roadmap (Rodríguez-Fontalvo et al., 2024), which targets a production capacity of 9 Mt/a by 2050—exceeding projected domestic demand and aiming to secure 1.2% of the global market share through an estimated $244 billion investment. Like Costa Rica, Colombia leverages tropical renewable abundance to position itself as a competitive green hydrogen exporter. In contrast, the United Kingdom emphasizes offshore energy integration, carbon pricing mechanisms, and blended public–private finance models to drive scalability. These contrasting national trajectories echo the central insight of this study: that strategies for hydrogen deployment must be context-specific, tailored to each country’s economic structure, technological capabilities, and institutional frameworks, much like the differentiated approaches of Costa Rica and the United Kingdom highlighted throughout this analysis.

Overall, this study demonstrates the value of an integrated techno-economic and machine learning–augmented framework for advancing hydrogen strategies in both emerging and industrialized economies. By combining deterministic modeling, spatial resource analysis, Monte Carlo simulations, and data-driven forecasting, the research offers a transferable and scalable methodology for evaluating project viability, guiding policy formulation, and accelerating green hydrogen deployment across diverse global contexts.

7. Conclusion

This study developed an integrated techno-economic and machine learning–augmented framework to assess the viability of green hydrogen production across diverse national contexts, using Costa Rica and the United Kingdom as representative case studies. By combining spatial renewable resource analysis, deterministic cost modeling, Monte Carlo simulations, and ensemble machine learning algorithms, the research captures the complex, region-specific cost dynamics shaping hydrogen deployment.

The findings highlight how national conditions—such as renewable resource quality, electricity pricing, policy incentives, and project scale—critically influence green hydrogen feasibility. Costa Rica’s decentralized, renewables-rich environment contrasts with the United Kingdom’s centralized, policy-driven offshore wind strategy, emphasizing the importance of tailored deployment pathways. Machine learning–augmented forecasting, particularly with LightGBM, proved essential for enhancing predictive accuracy, uncovering key cost drivers, and informing risk-based investment and policy decisions.

The analysis also identifies opportunities for bilateral cooperation, leveraging Costa Rica’s renewable strengths and the United Kingdom’s advanced financial and regulatory frameworks. Joint initiatives, including pilot projects and the co-development of machine learning–based decision-support tools through platforms like GIZ, the IADB, and the UK Infrastructure Bank, could accelerate scalable hydrogen adoption.

Future research should prioritize the creation of open-access, interoperable techno-economic datasets; the systematic benchmarking of machine learning models across diverse settings; and the integration of dynamic demand-side modeling. These steps will be crucial for improving the transferability, transparency, and practical application of hydrogen deployment strategies.

Ultimately, this study provides a scalable, adaptable methodology to support green hydrogen planning globally, contributing to a more equitable and sustainable low-carbon energy transition.

Ethics Statement

This study did not involve any research on human subjects, human data, human tissue, or animals. Therefore, no ethical approval was required.

Conflict of Interest Declaration

The author confirms that no conflicts of interest are associated with the publication of this manuscript.

Funding Declaration

This study did not receive any particular funding from government, corporate, or charitable sources.

Declaration of Generative AI and AI-assisted Technologies in the Writing Process

During the preparation of this work, the author(s) used ChatGPT in order to improve grammar and readability.

Author Contributions

Andrea Navarro Jiménez developed the research idea, designed the study, gathered and analyzed the data, and prepared the manuscript.

Data Availability Statement

The dataset supporting the findings of this study is publicly available via Mendeley Data at: NAVARRO, ANDREA (2025), “Comparative Modeling of Green Hydrogen Development in Costa Rica and the UK: A Machine Learning-Driven Policy and Investment Forecasting Approach”, Mendeley Data, V1, doi: 10.17632/hw4g4xnd32.1. Not yet published

References

- Ad Astra Rocket Company. (2018). Green hydrogen pilot plant feasibility study (Phase 3). Unpublished internal report.

- Ad Astra. (2024). Costa Rica Hydrogen Transportation Ecosystem – Case Study Update. Retrieved from https://www.adastrarocket.com/cr/.

- Alcantara, M. L., Santana, J. C. C., Nascimento, C. A. O., & Ribeiro, C. O. (2025). Application of levelized and environmental cost accounting techniques to demonstrate the feasibility of green hydrogen-powered buses in Brazil. Hydrogen, 6(1), 10. [CrossRef]

- Aldren, C., Shah, N., & Hawkes, A. (2025). Quantifying key economic uncertainties in the cost of trading green hydrogen. Cell Reports Sustainability, 2, 100342. [CrossRef]

- Alhussan, A. A., El-Kenawy, E. M., Saeed, M. A., Ibrahim, A., & Abdelhamid, A. A. (2023). Green hydrogen production ensemble forecasting based on hybrid dynamic optimization algorithm. Frontiers in Energy Research, 11, 1221006. [CrossRef]

- Allal, Z., Noura, H. N., Salman, O., Vernier, F., & Chahine, K. (2025). A review on machine learning applications in hydrogen energy systems. International Journal of Thermofluids, 26, 101119. [CrossRef]

- Baral, S., & Šebo, J. (2024). Techno-economic assessment of green hydrogen production integrated with hybrid and organic Rankine cycle (ORC) systems. Heliyon, 10(2), e25742. [CrossRef]

- Bassey, K. E., & Ibegbulam, C. (2023). Machine learning for green hydrogen production. Computer Science & IT Research Journal, 4(3), 368–385. [CrossRef]

- Bird & Bird LLP, Allende & Brea, & Various Contributors. (2024). International Green Hydrogen Report 2024. Retrieved from https://allende.com/en/.

- BLP Legal. (2024, November 18). Costa Rica: A strategic destination for green hydrogen development. Retrieved from https://blplegal.com/.

- Borm, O., & Harrison, S. B. (2021). Reliable off-grid power supply utilizing green hydrogen. Clean Energy, 5(3), 441–446. [CrossRef]

- Buchner, J., Menrad, K., & Decker, T. (2025). Public acceptance of green hydrogen production in Germany. Renewable and Sustainable Energy Reviews, 208, 115057. [CrossRef]

- Bui, T., Lee, D., Ahn, K. Y., & Kim, Y. S. (2023). Techno-economic analysis of high-power solid oxide electrolysis cell system. Energy Conversion and Management, 286, 116704. [CrossRef]

- Chen, W., Zou, W., Zhong, K., & Aliyeva, A. (2023). Machine learning assessment under the development of green technology innovation: A perspective of energy transition. Renewable Energy, 214, 65–73. [CrossRef]

- Clean Hydrogen Joint Undertaking. (2023). Strategic Research and Innovation Agenda (SRIA) 2021–2027 Update 2023. Brussels, Belgium. Retrieved from https://www.clean-hydrogen.europa.eu/system/files/2023-03/SRIA_2023_update.pdf.

- Criollo, A., Minchala-Avila, L.I., Benavides, D., Ochoa-Correa, D., Tostado-Véliz, M., Meteab, W.K., & Jurado, F. (2024). Green Hydrogen Production—Fidelity in Simulation Models for Technical–Economic Analysis. Applied Sciences, 14(22), 10720. [CrossRef]

- Devasahayam, S. (2023). Deep learning models in Python for predicting hydrogen production: A comparative study. Energy, 280, 128088. [CrossRef]

- Department for Business and Trade (DBT). (2024). UK Infrastructure Bank: Financial support for hydrogen projects. Retrieved from https://www.gov.uk/government/publications/uk-infrastructure-bank-hydrogen-investment.

- Department for Business, Energy & Industrial Strategy. (2021a). UK Hydrogen Strategy. GOV.UK. Retrieved from https://www.gov.uk/government/publications/uk-hydrogen-strategy.

- Department for Business, Energy & Industrial Strategy. (2021b). Hydrogen production costs 2021 (Annex: Cost breakdowns and sensitivities). UK Government. Retrieved from https://www.gov.uk/government/publications/hydrogen-production-costs-2021.

- Department for Energy Security and Net Zero. (2022). Contracts for Difference Allocation Round 4: Results. UK Government. Retrieved from https://www.gov.uk/government/publications/contracts-for-difference-cfd-allocation-round-4-results.

- Department for Energy Security and Net Zero. (2023). Hydrogen Production Business Model: Impact Assessment (IA No. 11854). GOV.UK. Retrieved from https://www.gov.uk/government/publications/hydrogen-production-business-model-impact-assessment.

- Department for Energy Security and Net Zero. (2024a). Energy Trends December 2024 – Statistical release. UK Government. Retrieved from https://www.gov.uk/government/collections/energy-trends.

- Department for Energy Security and Net Zero. (2024b). Economic impact assessment for the hydrogen sector to 2030. UK Government. Retrieved from https://www.gov.uk/government/publications/economic-impactassessment-for-the-hydrogen-sector-to-2030.

- Department for Energy Security and Net Zero. (2024c). Net Zero Hydrogen Fund guidance. GOV.UK. Retrieved from https://www.gov.uk/government/publications/net-zero-hydrogen-fund.

- Deloitte. (2023). Green hydrogen: Energizing the path to net zero. Deloitte Economics Institute. https://www.deloitte.com/global/en/issues/climate/green-hydrogen.html.

- Dorn, F. M. (2022). Green colonialism in Latin America? Towards a new research agenda for the global energy transition. European Review of Latin American and Caribbean Studies, 114, 137–146. [CrossRef]