1. Introduction

About 90% of global goods trade is conducted by shipping, to facilitate the movement of goods and resources, and to support cross-national supply chains and global economic integration. However, shipping is also one of the major sources of global greenhouse gas emissions. According to the International Maritime Organization (IMO), shipping accounts for about 2-3% of global greenhouse gas emissions. Clarksons Research also had an estimate that shipping’s global Greenhouse Gas (GHG) emissions will increase to 1,046 million tonnes of CO2 in 2024 [

1], and are categorised as Scope 1 emissions, which are the most difficult to eliminate [

2]. Without mitigation measures, shipping emissions will increase to 130% of 2008 levels by 2050 [

3]. Failure to accelerate decarbonization could lead to higher costs, regulatory penalties and a loss of competitiveness as markets increasingly prioritize sustainability [

4].

Promoting decarbonization has become an imperative globally, and the consensus of the world economic development [

5], and decarbonization of maritime shipping has become important targets for the government, port companies and shipping operators [

6]. Some agencies have pledged to achieve “net zero” emissions by midcentury or thereabouts, and the IMO has set intermediate targets for emissions and zero emission fuels [

7]. EU “Fit for 55” has created a legal obligation to reduce EU emissions by at least 55% by 2030 (as compared to 1990 levels) and will introduce the FuelEU Maritime Regulation as of 1 January 2025 that may be complex to implement [

4].

By 2050, to align with efforts to limit global warming [

8], 35,000 existing ships must be retrofitted to zero-emission ones [

9], and retrofit involves the adoption of low-carbon technologies such as upgrading the power system, installing environmental protection equipment, etc. It is possible for ships to make investments to upgrade existing ships with new green technologies [

10], but it would be a costly expenditure for carriers, resulting in low retrofit rate for ships [

6,

11,

12], and the lack of motivation for carriers to adopt green technologies contributes to the exacerbation of carbon emissions. From a long-term perspective, encouraging carriers to invest in green technologies is not only in line with sustainable development goals but also brings competitive advantages and better economic benefits.

Carriers not only compete on price, but also on service, including reliability, on-time delivery, and safety [

13], and faster transportation service enables the product to be supplied with higher quality [

14]. Carrier service is becoming increasingly critical to a larger number and wider variety of shippers [

15], and is becoming increasingly intense [

13]. As customer demands from shippers for green services continue to rise, carriers are enhancing their competitiveness through diversified service offerings, and the competition are deemed to be the significant factor that impact the investment in reduced carbon emissions. In addition, more and more shippers prefer green transportation service, and a growing body of research suggests that consumers are green aware [

16,

17]. Furthermore, shippers are increasingly prioritizing sustainability by aligning shipping supply chains with green objectives and partnering with carriers that demonstrate environmental responsibility. This growing demand for low-carbon logistics solutions is also driving competition among shipping companies to provide more sustainable services.

To decarbonize, government subsidies have become one of the main approaches to encouraging the extensive use of low-emission technologies [

18,

19,

20], and have proven effective in reducing costs for ocean carriers [

21,

22]. With governmental subsidies, shipping carriers face reduced cost pressures, enabling them to invest in green technologies. This not only benefits individual carriers but is also crucial for global efforts to combat climate change. But in response to price-and-service competition between carriers and shippers’ green awareness, whether government subsidies can help reduce carbon emission, is an intriguing topic that merits exploration.

Some studies, such as Wang and Zhu [

23] analyzed the development of the maritime supply chain considering the competition among different carriers with aims to reduce emission. Liu and Wang [

13] constructed models to investigate incentives of alliance and values considering service competition, but neither of them took into account the significant impact that subsidies can have. Lu et al. [

14] and Yi et al. [

24] highlighted price competition between shipping carriers in freight transportation, but they did not consider service competition among shipping carriers. Motivated by this, we want to fill this gap by addressing the following specific research questions:

(1) Should governments provide subsidies to competitive carriers in terms of price and service to support their green technology investment?

(2) Is the government subsidy beneficial to decarbonization in the price-and-service competitive environment?

(3) How do competition intensities and environmental awareness impact prices, profits, carbon emission reductions and the total social welfare?

To answer above questions, we construct game-theoretic models to clarify the interactions among port, government, carriers and shippers of the shipping supply chain, in which carriers are competitive in price and service and shippers are environmentally conscious. A comprehensive framework is formulated under three strategies, i.e., FP, GP and HP. One carrier is subsidized in Scenario FP and GP, while both are provided subsidies in Scenario HP. Optimal solutions for each partner under all scenarios are derived, followed by numerical analysis to verify the optimal results for different partners.

Contributions of our paper lie in the following aspects, which significantly distinguish it from the extant literature. (1) We consider the government subsidy policy, carriers’ price and service competition, and shippers’ environmental awareness in the model simultaneously; (2) The effectiveness of subsidies to mitigate carbon emission with carriers’ price and service competition is verified through models constructed. And carriers are encouraged to make the transition to promote environmental sustainability; (3) We also shed light on the impact of shippers’ environmental awareness, price and service competition intensity on carbon emission, profits, prices and social welfare; (4) Our research broadens the research thread in the topic, and can provide policy guidelines for decision-makers, such as governments and carriers.

The remainder of the paper is organized as follows.

Section 2 reviews the literature.

Section 3 describes the problem, constructs the model in detail, and analyzes equilibrium solutions, followed by the numerical analysis provided in

Section 4.

Section 5 concludes the research work. Proofs are provided in the Appendix.

2. Literature Review

Our paper broadly intersects with three significant domains of study as follows: government subsidies on ports and carriers, carbon emission control in shipping supply chains and competition in price and service among ocean carriers.

2.1. Government Subsidies on Ports and Carriers

The existing literature primarily focuses on the role of government subsidies in ports, shipping companies, and carriers within inland waterway transportation and maritime supply chains [

25,

26,

27,

28]. Jasmi and Fernando [

29] investigated the relationship between drivers such as carriers, green initiative and regulation of the maritime green supply chain management. Zhuge et al. [

30] formulated subsidy design models to reduce vessel speed. Song et al. [

31] constructed a Nash game to analyze the impact of government subsidies on shipping companies. Results indicated that government subsidies can improve supply chain profits.

A dynamic game model of a three-echelon maritime supply chain with government subsidies was presented to abate carbon emission in Huang et al. [

21]. Findings show that government subsidies can improve greenness with carbon abatement technology. Chen et al. [

32] established a bi-level decision-making model considering providing subsidies to ports with the achievement of carbon neutrality. Peng et al. [

33] discussed two subsidy strategies widely adopted for ports. They found that two subsidy strategies can achieve the same effects on the application of shore power. Zhen et al. [

34] used the Stackelberg game methodology to investigate optimal subsidies on the installation of shore power on ports to reduce carbon emission. Li et al. [

35] considered government subsidy strategies on ports to reduce carbon emission. The findings indicated that the increase in subsidies can decrease unit investment cost.

Luo et al. [

6] considered government subsidy policy to promote shore power usage with aims to reduce carbon emission. They found that subsidy policy is effective in the short term. Hu et al. [

36] and Wang et al. [

37] designed different subsidy schemes for carriers and revealed the benefits with subsidies from the shipping company. Wang et al. [

19] designed subsidy schemes for shipping companies to coordinate inland river ports. Results demonstrated that implementation of the coordination through subsidies are applicable and valid. Zhong et al. [

38] analyzed the effectiveness of shore power systems in reducing emissions, and investigated the impact of incentive policies on sustainable port development. Different from above literature, our study simultaneously considers government subsidies, carrier competition, green-conscious shippers, and carbon emission reduction, and the impact of government subsidies on carbon emission reduction under such competitive environment remains underexplored.

2.2. Carbon Emission Control in Shipping Supply Chains

Ports and shipping companies are the main implementing entities to mitigate carbon emission. Technical low-carbon technologies such as shore power [

38,

39,

40,

41,

42], electric propulsion (EP) system [

43,

44], blockchain technologies [

22,

45,

46], carbon tax and cap-and-trade [

23,

47,

48] are often adopted to decrease carbon emission by ports and carriers. Yang et al. [

49], Jiao and Wang [

40] established game models considering the adoption of shore power and low sulfur fuel oil in the ports aiming to meet low-carbon strategies. Taking Shekou Container Terminal as example, Wan et al. [

50] analyzed the impact of three different emission reduction strategies. They found shore power system has the highest emission reduction effect. Livaniou and Papadopoulos [

51] explored the potential of LNG in replacing conventional marine fuels, namely heavy fuel oil and marine diesel oil to mitigate emission in shipping. Artificial intelligence and automation for shoreside operations were evaluated by Tsolakis et al. [

52] to investigate the environmental impact at ports.

Wang et al. [

18] proposed a trilevel programming model to address government subsidies on the adoption of liquefied natural gas to implement green maritime transportation. Fan et al. [

53] investigated the effect of Sulphur emission on ports and employed models to evaluate the effect. Analysis showed that emission control policies implemented were effective and further ensure ships’ compliance. Liu et al. [

54] explored the impact of carbon tax policy and knowledge sharing on carbon emission reduction technology of a shipping supply chain with market uncertainty. Kong et al. [

55] constructed models of the maritime supply chain to abate carbon emission with the system dynamic method. Results proved that using shore power can be beneficial for reducing emissions. Wang et al. [

37] made a bibliometric analysis of carbon emission reduction in ports. Zhuge et al. [

30] investigated the design of ECA policies to mitigate carbon dioxide emissions in global shipping. They found that proposed ECA policies can help reduce carbon emission. Wang [

56] and Luo et al. [

6] found government incentives can promote shore power usage to meet carbon emission goals, and make shipping service more green-conscious. In summary, it can be seen that carbon emission mitigation of a shipping supply chain is broadly explored in extant literature. However, the impact of government subsidies on carbon emission reduction, particularly under carriers' price-and-service competition and green-conscious shippers, remains insufficiently studied.

2.3. Competition in Price and Service Between Ocean Carriers

Competitive shipping companies want to maximize profits and pursue bigger market share, leading to fiercer price and service competition between carriers. Gelareh et al. [

57] addressed the competition between one liner shipping company and one incumbent in a hub-and-spoke network. Wang et al. [

58] proposed three game theoretical models to explain the competitive behaviors between two liner container shipping carriers. Lee and Song [

59] conducted a literature review on competition among maritime logistics operators for better responding to challenges. Liu and Wang [

13] investigated the competition between two carriers in a one-to-two shipping service chain. Song et al. [

60] considered service competition between two liner companies and built game models to depict liner alliances. Results indicated that liner companies may achieve a win-win outcome with a low-price level.

On the basis of competition between carriers, Wang and Zhu [

23] constructed models to pursue optimal solutions with different power structures considering the impact of carbon tax policy. Wang et al. [

22] explored the blockchain investment strategies in a competitive game model and they found competition intensity would affect price of shipping companies. Wang et al. [

61] constructed a game theory framework in which two types of shipping alliances compete in capacity. The findings demonstrated that in competitive market, mixed-alliance structure is beneficial to the increase of social welfare and consumer surplus. Despite these advancements, research on carbon emission mitigation with government subsidies in a competitive environment involving green-conscious shippers remains limited.

To date, relevant studies is not sufficiently rich, and our study wants to fill in this gap and attempt to explore the impact of governmental subsidies on carbon emission reduction in a price and service competitive environment with eco-conscious shippers. Our paper also enriches theoretical researches related to the government’ green subsidy policies. In addition, it is also beneficial to policymakers and carriers to have a better understanding of how governmental subsidies impact carbon emission reduction in competitive environment and green conscious shippers.

3. The Model

3.1. Problem Description

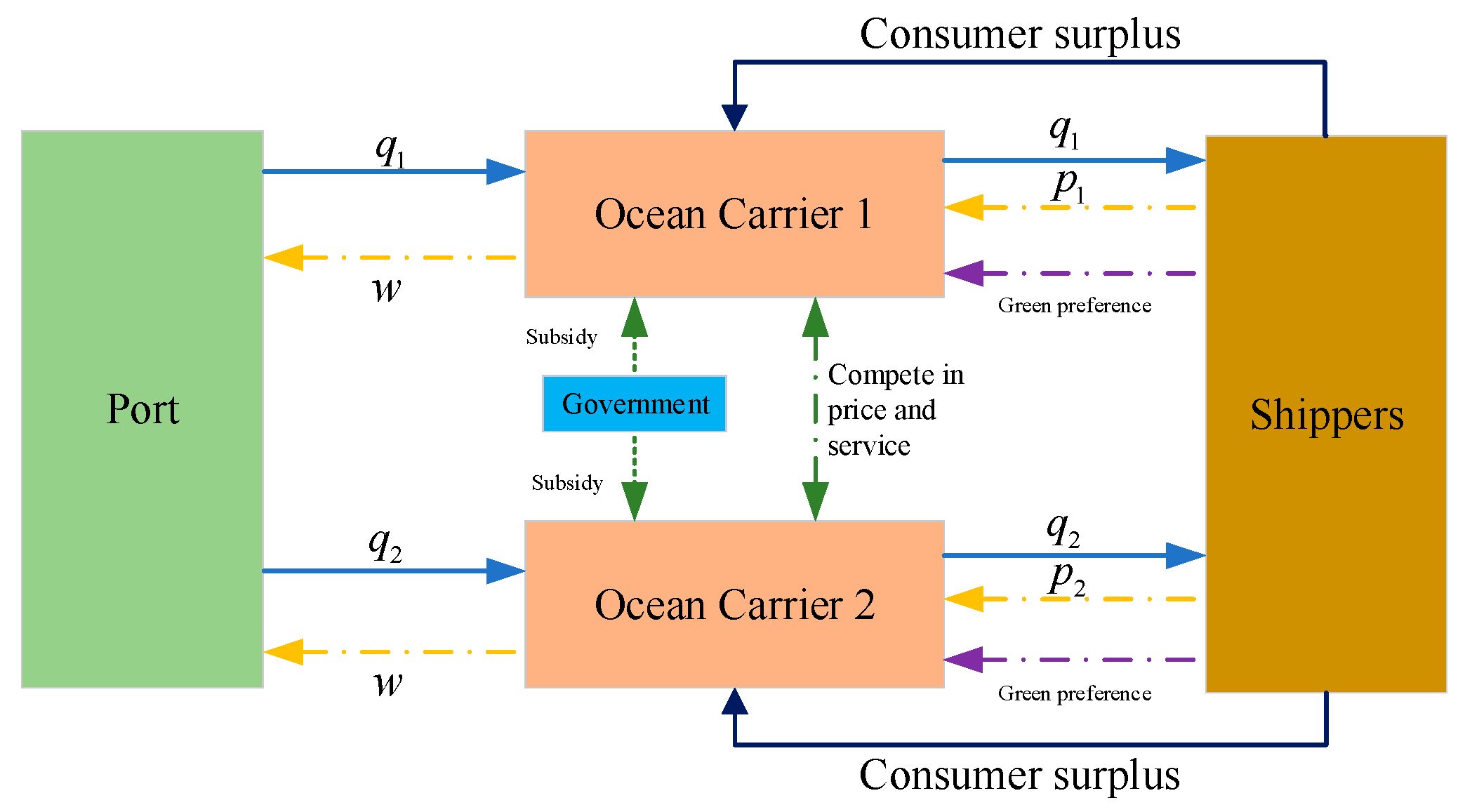

Consider a shipping supply chain consisting of shippers, two competitive carriers, a port and the government (see

Figure 1). As the service provider, the port is committed to providing better cargo tracking and more efficient transshipment [

4]. For simplicity, the port’ operational costs are assumed to be zero. As receivers of cargoes, shippers are environmentally sensitive and are heterogeneous in green transportation preference. Carriers take responsibilities for moving goods from the origin to the destination, ensuring safety and timeliness during transit. Additionally, they offer customer services, such as providing updates on transportation status, resolving any issues that arise during transit, and maintaining communication with clients. Both carriers compete in price and service to expand consumer markets. The government acts as the Stackelberg leader, and strategically provides subsidies to carriers. As the follower, carriers invest in green technologies with subsidies. All partners pursue profit maximization and maximal social welfare.

In the basic model, the sequence is as follows: first, the government decides to subsidize carriers and sets the subsidy ratio; second, carriers make decisions to invest in green technologies in price-and-service competition.

According to [

45,

62,

63,

64], we suppose demand functions are represented as follows:

Where, is the potential market share, is the freight price of carriers, is the demand, is carbon emission reduction, measures the service level provided by carriers, () represents green preference from shippers, () is the intensity of competition between carriers. The service level intensity of carriers, represented by (), varies, and is differentiated by services they provide. and elaborate price and service effects, thereby increasing the significance of maintaining competitive pricing and service offerings.

The total investment cost to decarbonize for carriers is

, with the government covering a ratio of

, which is common in relevant literature [

23,

35]. For convenience, all notations are listed in

Table 1.

3.2. Analysis Scenario

Three different scenarios are elaborated in our paper, namely FP, GP and HP. Only carrier 1 accepts subsidies and use green technologies to reduce carbon emission in Scenario FP. In Scenario GP, carrier 2 is subsidized to invest in green technology adoption. Both carriers invest in carbon emission abatement strategies with subsidies from the government in Scenario HP.

- (1)

Scenario FP

In this situation, only Carrier 1 is subsidized to reduce carbon emission, and the government provides

to Carrier1. Profits for different partners and social welfare are denoted as Equations (3) to (8).

Equations (3), (4) and (5) are profits for Carrier 1, Carrier 2 and the port, which are determined by freight prices, port service price, demands. In addition, the investment that Carrier 1 makes is inclusive in Equation (3). Equation (7) is the subsidy provided by the government. Equation (6) represents the consumer surplus, and social welfare, as defined in Equation (8), is the sum of the profits of carriers and the port, the consumer surplus, and the subsidy provided by the government. Carriers and the port seek to maximize their profits, while the government’s objective is to maximize social welfare.

Taking first-order derivatives of

on

,

and

, we can get optimal results such as

,

,

,

,

and

. Let

and

, thus,

,

,

,

and

can be obtained. Following

Table 2 shows optimal results under Scenario FP.

- (2)

Scenario GP

In this scenario, Carrier 2 invests in decreasing carbon emission with subsidies from the government, and the government shares

of the total investment

. Profits for carriers and ports, and social welfare are expressed as Equations (9) to (14).

Similarly, Equations (9), (10) and (11) are profits of Carrier 1, Carrier 2 and the port, respectively. The port and carriers are profit maximizers. Equation (12) is the subsidy provided by the government. Equation (12) and (14) provide consumer surplus and social welfare in Scenario GP, and the government’s goal is the maximization of social welfare.

By solving first-order derivatives of

on

,

and

, we can get

,

,

,

,

and

. Let

and

, we can get

,

,

, and

.

Table 3 below shows optimal results obtained.

- (3)

Scenario HP

In this scenario, both carriers make investments in carbon emission abatement with subsidies from the government, and the total investment cost for carriers to reduce carbon emission is

. Profits and social welfare are expressed as Equations (15) to (20).

Equations (15), (16) and (17) are profits for both carriers, and the port. Equation (19) is the total subsidy provided by the government. Equation (18) and (20) represent consumer surplus and social welfare, respectively. Carriers and the port seek to maximize their profits, and the government is to maximize social welfare.

Taking first-order derivatives of

on

,

and

, and let

,

,

and

, we can obtain following optimal results, as shown in

Table 4.

3.3. Equilibrium Analysis

Proposition 1.

If , then is a negative concave function of , and .

See Appendix.

Proposition 2.

If , then is negative jointly concave on , and .

See Appendix.

Proposition 3.

If , then is negative jointly concave on , , and .

See Appendix.

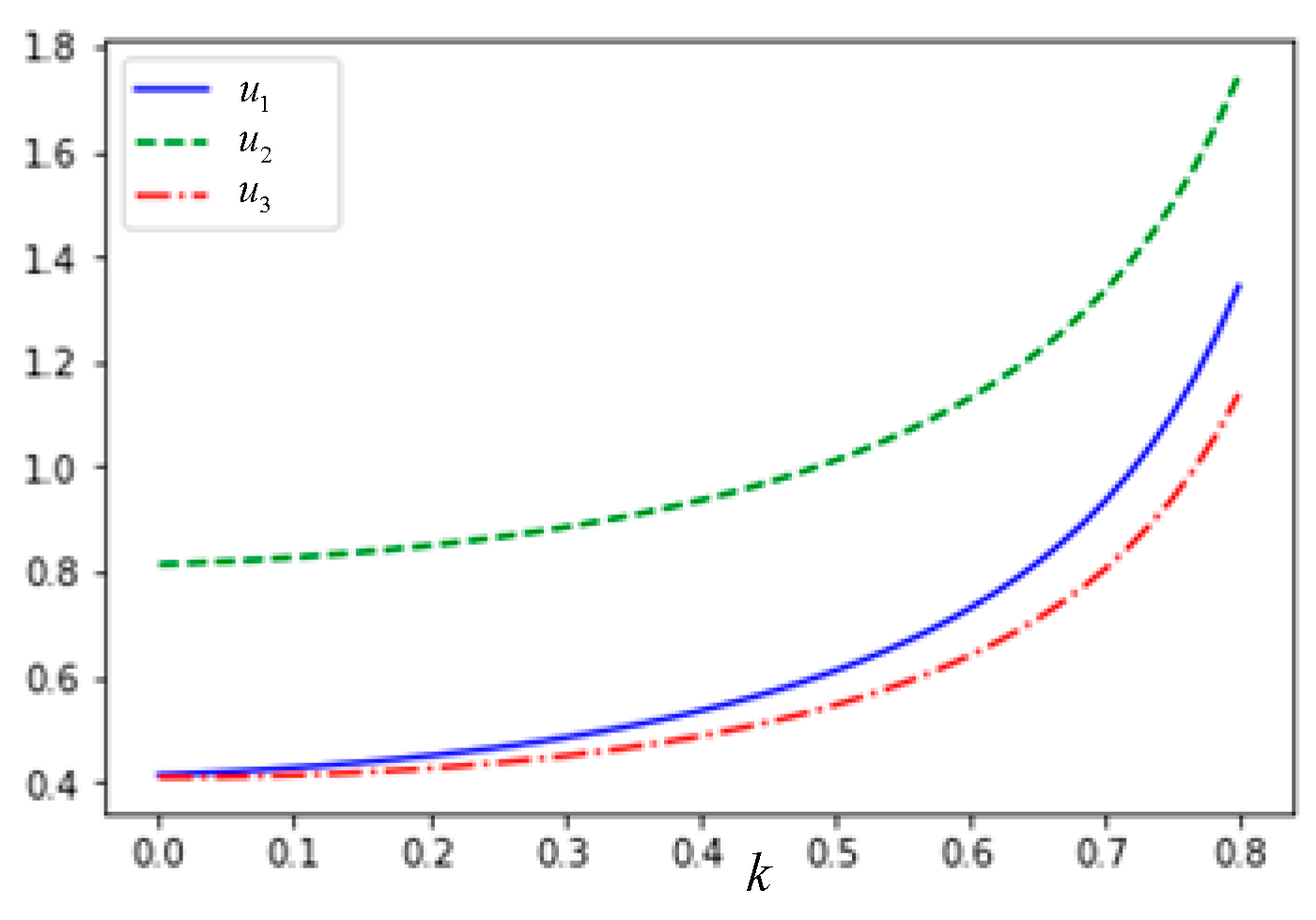

Figure 2 indicates that carriers should adopt FP strategy when price competition intensity increase, for subsidy coefficient is much higher, in this way can carriers get more profits, and we can derive that

.

Lemma 1. [Impact of price competition intensity on prices, carbon emission, profits and social welfare]

(1) increases in , and satisfy ,

;

(2) decreases in , and ;

(3) varies in , and , ;

(4) increases in , and when is lower than 0.588, ; when

belongs to [0.588,0.704],

; when is higher than 0.704, .

The intensity of competition can help increase freight price and social welfare, and help decrease profits in most circumstances, when too much operational costs are used to reduce carbon emission to meet shippers’ green preference. However, without subsidies and carriers’ unwillingness to use cleaner fuels, this will result in the harmful effect of increased carbon emissions.

Lemma 2. [Impact of subsidy coefficient on prices, carbon emission, profits and social welfare]

(1) decreases in ,and ,

;

(2) decreases in , and ;

(3) decreases in , and , ;

(4) decreases in , when is lower than 2.14,

; when , .

It is obvious that freight prices under different scenarios can be lowered down with subsidies, and the adoption of less-carbon fuel can be beneficial to the environmental sustainability, leading to the abatement in carbon emission. Furthermore, subsidies can offset operational costs, which can lead to a decrease in profits and social welfare.

Lemma 3. [Impact of service level on prices, carbon emission, profits and social welfare]

(1) increases in , and ,

;

(2) decreases in , and ;

(3) increases in , and , ;

(4) increases in , and .

Lemma 3 indicates that with high-quality service level can lead to higher operational costs, prompting carriers to increase freight prices. Meanwhile, customer satisfaction and loyalty can be improved with high-quality service levels, and attract high-end customers to pay more for faster and more reliable transportation, which boost the increase in profits and social welfare. Additionally, the increase in service level always generates higher speeds and more consumption in fuel, results in the increased carbon emissions.

4. Numerical Analysis

Based on the above theoretical analysis, next, numerical simulation analysis will be conducted to verify all propositions and lemmas. According to extant literature [

66,

67], the relevant parameter assumptions are set as follows, a=20,

,

,

,

,

.

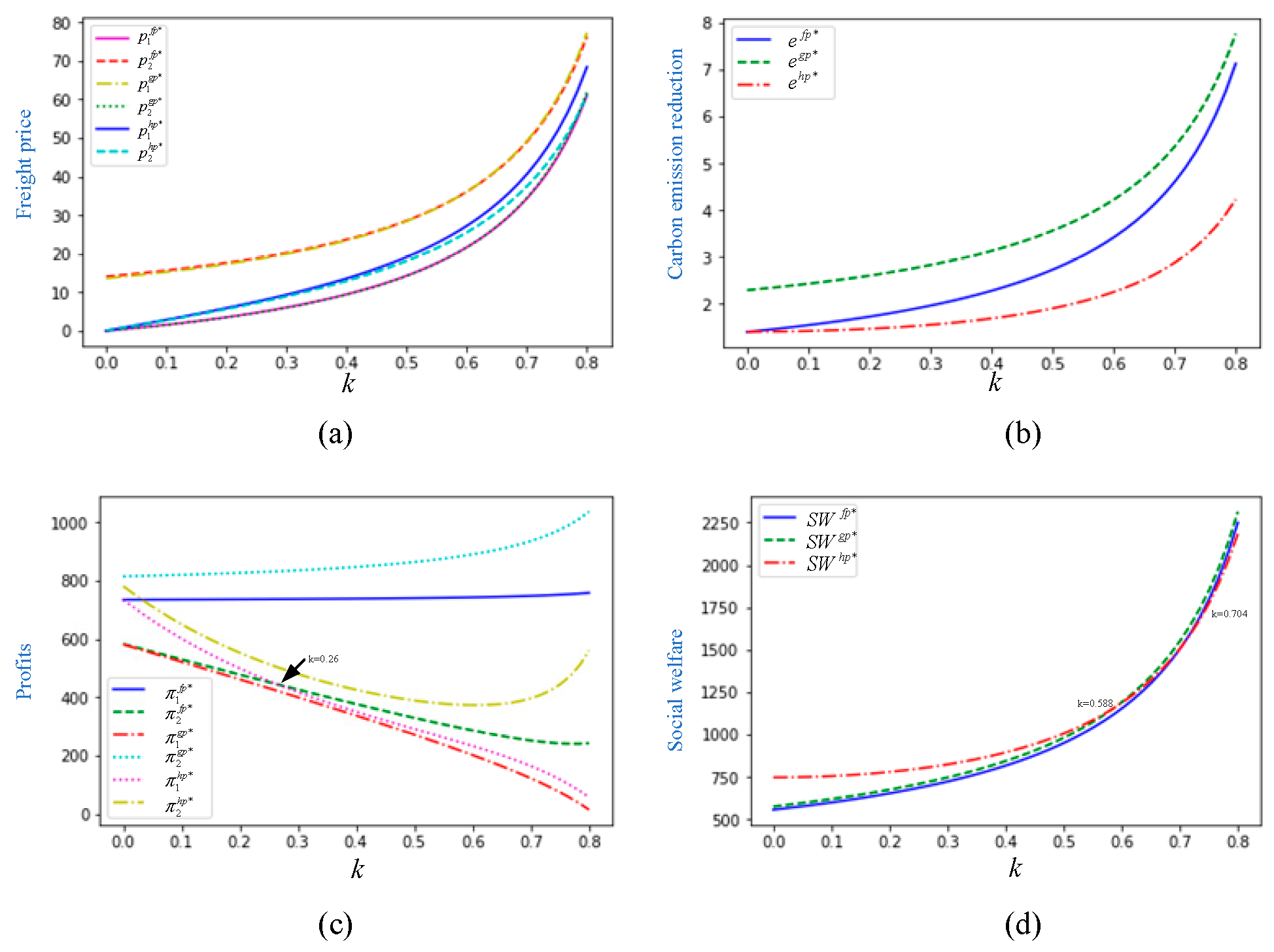

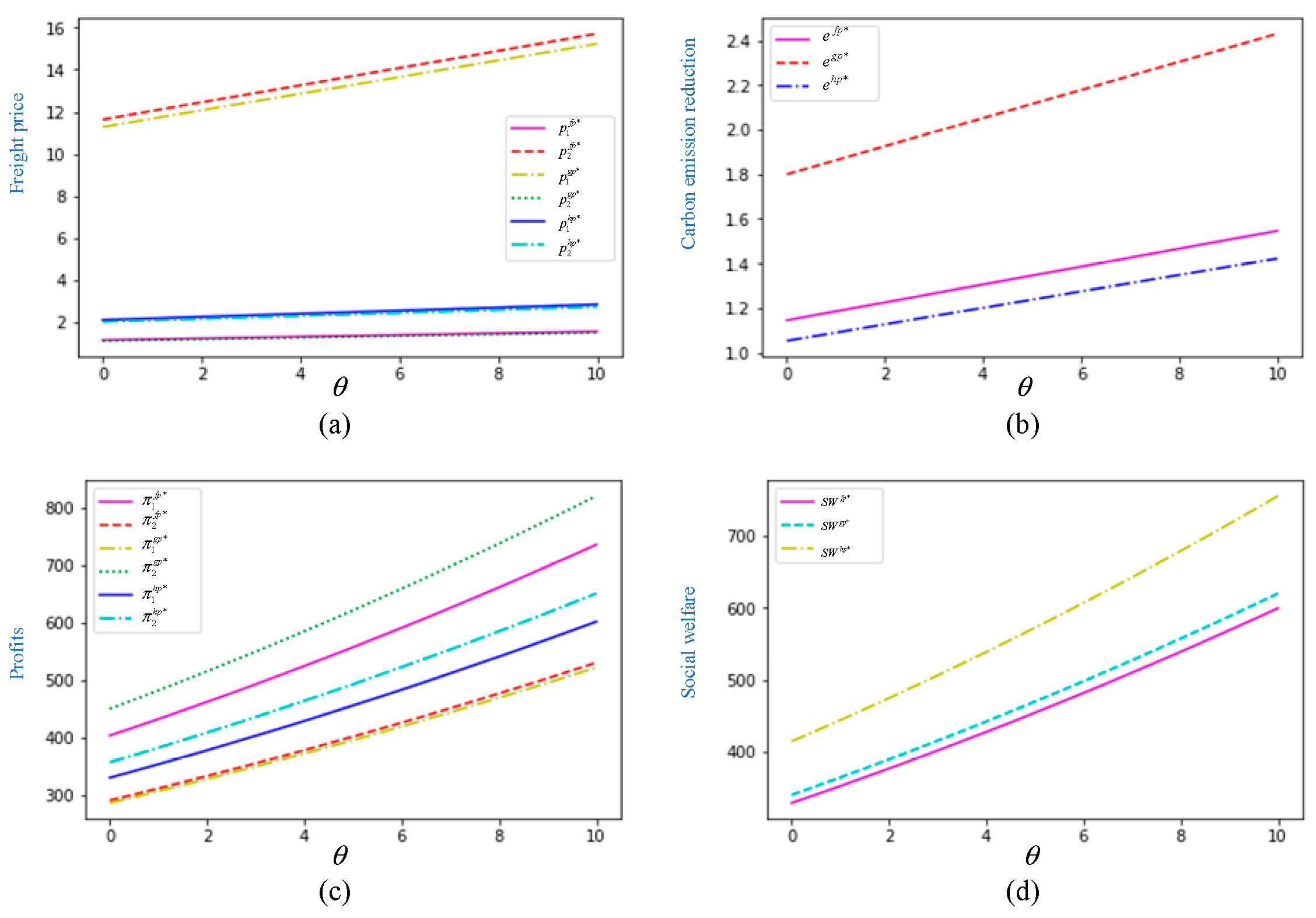

As

Figure 3(a) shows, with

and

, the increase of competition intensity can help increase freight prices, while carriers also aim to provide better transportation service. This is because carbon emission abatement necessitates increased investments in cleaner fuels, and carriers must raise prices to offset the additional operational costs. Despite these cost pressures, higher investments in cleaner fuels consistently lead to greater carbon emission reductions, as depicted in

Figure 3(b). Therefore, government subsidies should be increased to encourage the adoption of cleaner energy sources in transportation.

In a competitive market, carriers may need to enhance service quality or provide additional value-added services, such as faster delivery and improved customer service. However, these efforts often result in reduced profit margins, as illustrated in

Figure 3(c). Notably, in Scenario GP, subsidized carrier 2 can achieve positive profits due to market demand stimulation driven by service improvements. In contrast, the profit curve for carrier 1 in Scenario FP remains stable despite competition. This stability is likely attributable to a shift in competitive dynamics from price-based competition to service differentiation, such as speed, reliability, and customer service enhancements. Additionally, growing consumer awareness of environmental issues has intensified competition, prompting carriers to adopt greener technologies, such as carbon-neutral shipping, to appeal to environmentally conscious customers. This shift contributes to reduced carbon emissions and other environmental benefits, thereby enhancing overall social welfare, as depicted in

Figure 3(d).

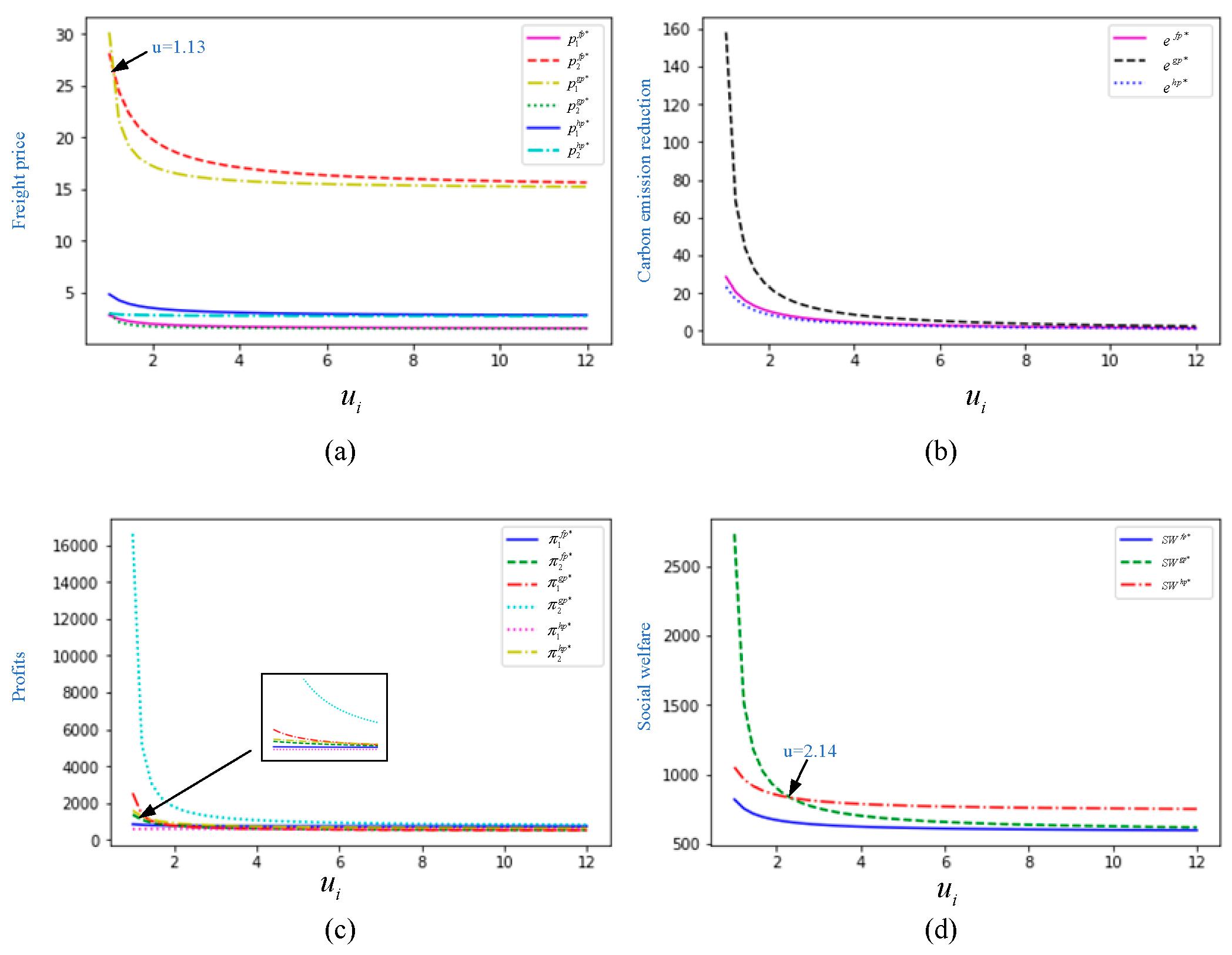

When

is set 0.1, it is obvious that freight price will be lowered with the increase of subsidy coefficient, as

Figure 4(a) shows. When subsidy coefficient is less than value 2, freight price drops sharply for carrier 1 in Scenario GP and carrier 2 in Scenario FP, and change smoothly thereafter. This is because high operational costs are offset by subsidies. And similar changes happen to carbon emission reduction, as illustrated in

Figure 4(b). At first, in GP scenario, carbon emission decreases sharply when

is less than value 2.14, while others show a relatively smooth trend. This is because carriers use cleaner energies with subsidies from the government, which is beneficial for carbon emission reduction, aligning with the reality. While all profit and social welfare curves under different scenarios also decline with the increase of subsidy coefficient, this is because fierce competition between carriers forces them to enhance service level and increase investments in carbon emission abatement.

With the increase of service level, from

Figure 5, we can see that all curves of prices, profits, social welfare and carbon emission arise, which aligns with Lemma 3. In a highly competitive market, offering high-quality service can help reduce the risk of delays, damage, or loss of goods during transportation. Such higher operational costs enable shippers to pay higher fees for these services with strong willingness. With high-quality service level, carriers tend to use higher speeds, or run without being fully loaded, leading to exacerbated carbon emissions. Meanwhile, high-quality service helps attract more customers and increase cargo volume. In addition, value-added services such as expedited shipping, special handling, or customized solutions also help increasing overall revenue and social welfare.

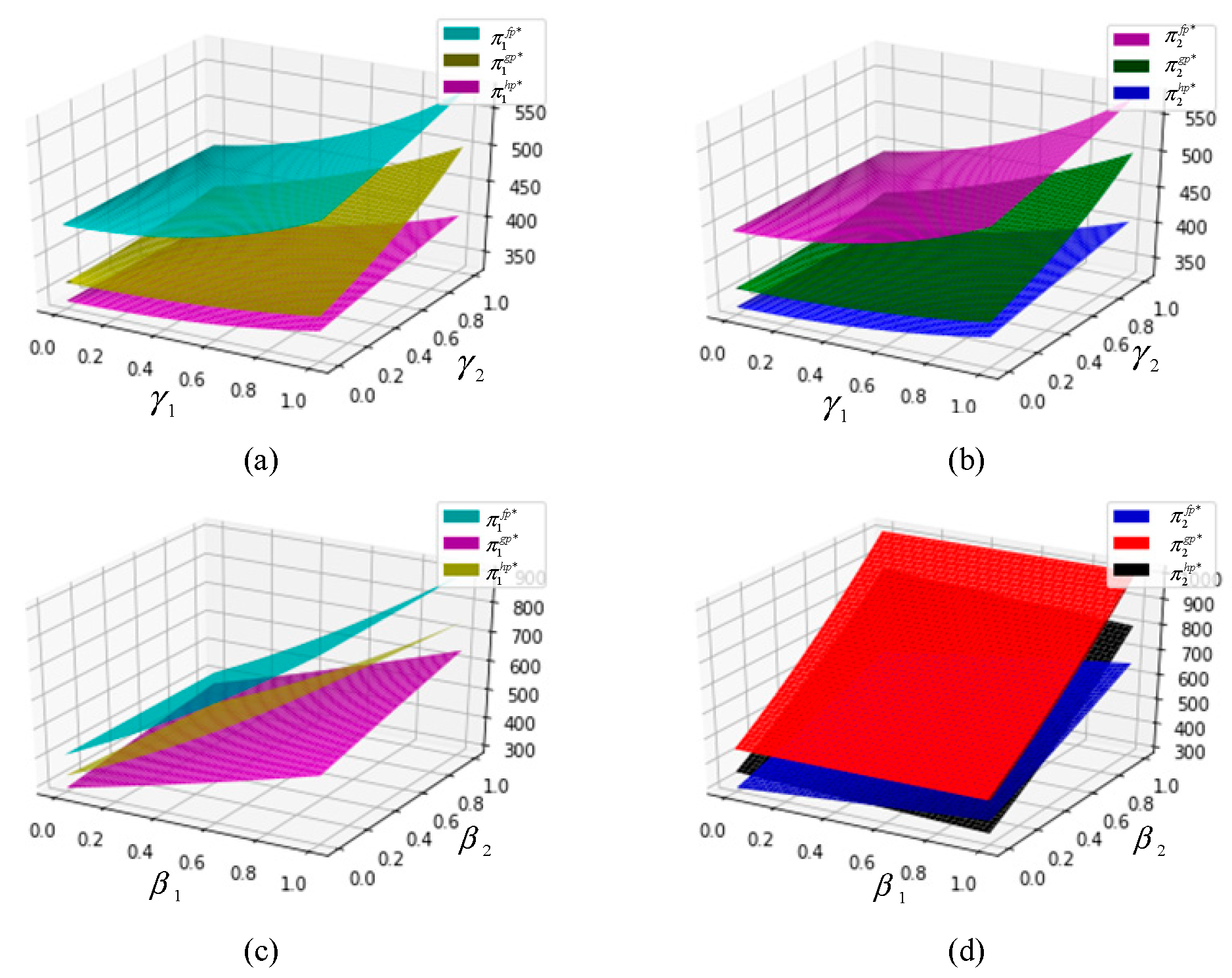

As

Figure 6(a) and (b) shows, profits for both carriers in different scenarios all increase with the increase of green preference from shippers. This is because, on one hand, carriers make investments in cleaner technologies adoption, reducing operational costs, ultimately boosting profitability. On the other hand, shippers’ green preferences indirectly push carriers to access policy-driven benefits, such as government subsidies. And green transport services can help carriers attract environmentally- conscious shippers and earn more profits. Service intensity also can help increase carriers’ profits, as presented in

Figure 6(c) and (d). High-quality services enhance carriers’ reputation and brand value, making it a preferred choice for shippers. Furthermore, service competition often incentivizes carriers to improve operational efficiencies, contributing to increased profitability.

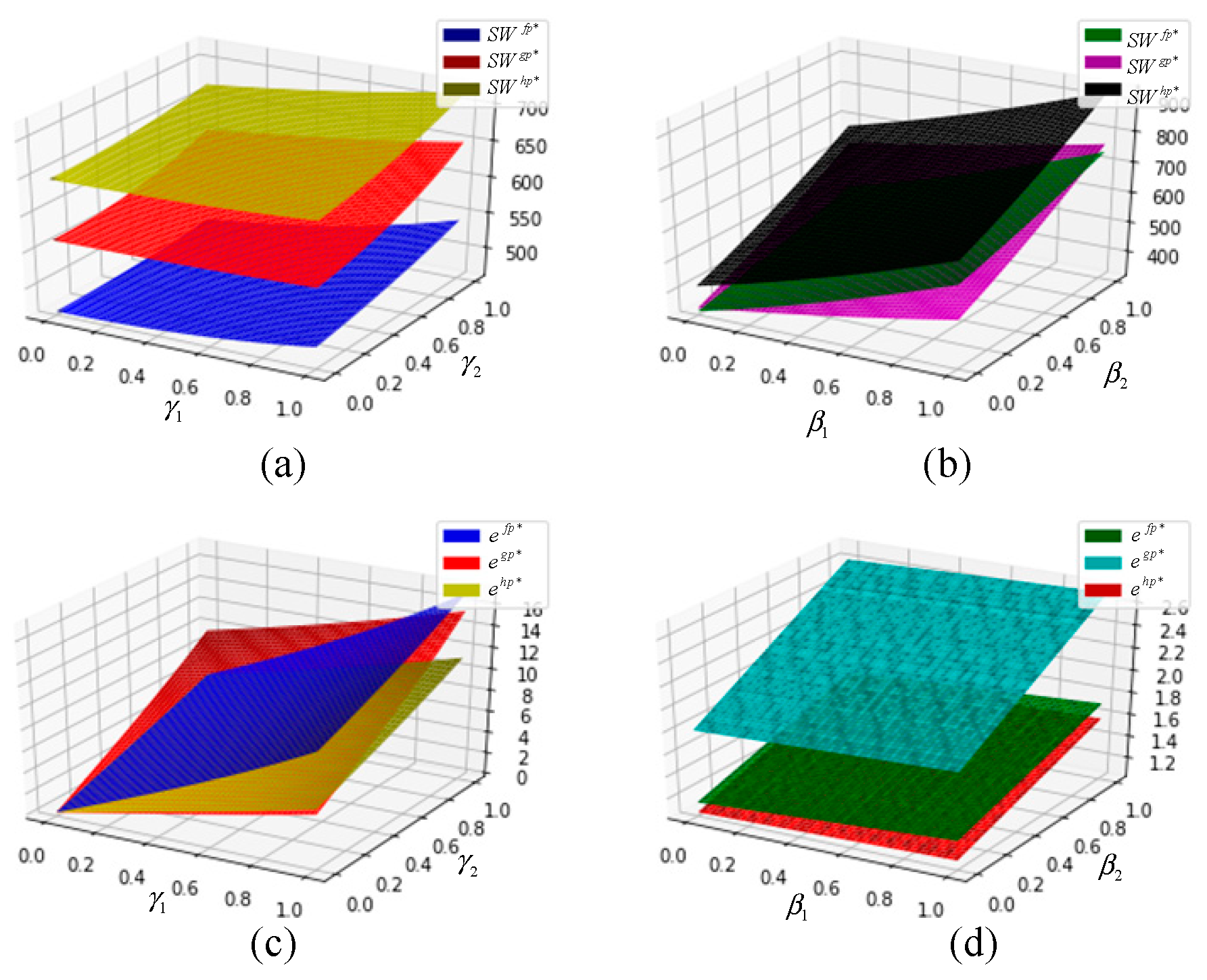

Figure7(a) and (c) show the impact of green preference on social welfare and carbon emission reduction. When environmental awareness and increase, and also increase. This is because shippers usually opt for more energy-efficient or environmentally friendly transport modes, and if subsidy policies are not properly designed, they might lead to inefficiencies or unintended consequences that increase emissions. Furthermore, encouraging carriers to investing in green technologies, which in turn might create more social benefits.

As service level intensifies, it can lead to both an increase in carbon emissions and social welfare, as displayed in

Figure 7(b) and (d). When carriers improve service levels, it often means more frequent trips, longer routes, or higher speeds, which increases fuel consumption and therefore carbon emissions. Furthermore, an improvement in the service level of carriers usually means faster and more reliable transportation, thus enhancing shippers’ satisfaction and utility, and overall social welfare.

5. Conclusion and Discussion

5.1. Main Findings and Managerial Implications

Shipping activities are a major source of greenhouse gas emissions, making it essential to tackle the issue of carbon emission for shipping companies. IMO sets regulations like the International Convention for the Prevention of Pollution from Ships (MARPOL), which aims to reduce shipping’s pollution emissions and mitigate the environmental impact. These regulations affect the economic behavior of shipping companies, often leading them to invest in cleaner technologies or fuel. However, high operational costs hinder shipping carriers from investment in green technologies, while government subsidies can help overcome these cost barriers. But in a price-and-service competitive environment, whether governmental subsidies can aid in carbon emission mitigation is a topic less commonly addressed in extant literature. Inspired by this, our paper considers a shipping supply chain consisting of a port, the government, two competitive carriers and shippers. Game-theoretic models are developed to depict shipping carriers’ green technology adoption decisions and the design of government policies. Ultimately, optimal results are derived and testified through numerical analysis. The principal conclusions are drawn as below.

Firstly, we uncover that governmental subsidies play a substantial role in carbon emission abatement across all scenarios within a price-and-service competitive environment, particularly when shippers exhibit strong green awareness. These subsidies provide carriers with the financial incentives necessary to adopt greener technologies and practices, contributing to significant reductions in carbon emissions. However, the study also reveals that government subsidies have a negative impact on freight prices, profits, and social welfare, regardless of the specific scenario in which carriers operate. While subsidies can promote environmental sustainability, they may also distort market dynamics by increasing carriers’ operational costs. This can lead to higher freight prices and reduced profitability. Additionally, these distortions may limit the overall economic benefits to social welfare, highlighting the need for carefully designed policy interventions. Future research could explore how subsidy schemes can be optimized to mitigate these negative effects while still achieving desired environmental outcomes.

Secondly, a higher service quality level enhances prices, profits, carbon emissions, and social welfare under different scenarios. However, in a highly price-competitive market, this can lead to increased carbon emissions due to the greater resource consumption associated with providing higher-quality services. This finding offers valuable managerial insights for decision-makers, including governments and shipping companies, in formulating effective environmental protection policies. Specifically, it emphasizes the need to balance service quality improvements with strategies aimed at reducing carbon emissions. Policymakers should consider regulatory frameworks that encourage both higher service standards and sustainable practices, ensuring that quality enhancements do not come at the expense of environmental goals.

Thirdly, price competition between carriers is detrimental to carbon emission reduction and may result in a decline in profits under certain scenarios. However, it has a positive influence on freight prices and social welfare. Our study demonstrates that price competition complicates carriers’ decisions to adopt green technologies, as the pressure to reduce costs may limit the resources available for sustainability investments. This highlights the need for policymakers to design balanced policies that encourage green technology adoption while maintaining competitive market dynamics. Furthermore, the findings suggest that governments should consider integrating incentives for environmental practices within competitive frameworks to ensure that carbon emission reduction is not sacrificed for short-term economic gains.

Lastly, increased shippers’ green preferences and intensified service competition jointly improve profits and social welfare, but lead to an increase in carbon emissions under all scenarios. This finding suggests that while carriers are incentivized to enhance service quality to meet consumers' environmental demands, such efforts often involve higher resource consumption, contributing to greater carbon emissions. In a competitive market, carriers are committed to delivering high-quality services to satisfy consumers' preferences, particularly in terms of sustainability. However, this focus on service excellence, while beneficial for social welfare and profits, may create unintended environmental consequences. Thus, policymakers need to carefully design regulatory frameworks that support green innovation without undermining service quality improvements. Balancing environmental goals with competitive market dynamics is essential to ensure that sustainability is integrated into the business model without causing negative trade-offs.

In summary, our findings can assist carriers in formulating subsidy policies that support carbon emission reduction efforts with shippers’ low-carbon preferences when carriers are competitive in price and service. And our paper can enrich the theoretical research by incorporating government subsidies, green environmental consciousness, carriers’ price and service competition within a shipping supply chain.

5.2. Future Research

This article focuses on the effect of governmental subsidies on carbon emission reduction with carriers’ competition and shippers’ green environmental conscious, and inevitably has some limitations that warrant further exploration. First, future research can extend the discussion by examining the impact of government subsidies on ports and forwarders to reduce carbon emission with carriers’ price and service competition and shippers’ green preference of a shipping supply chain. Second, in a price-and-service competitive environment, governments may adopt alternative regulatory measures, such as carbon emission taxes or carbon quotas, to incentivize environmental sustainability.

Author Contributions

Conceptualization, L.Y.(Lijuan Yang); methodology, L.Y.(Lijuan Yang); software, Y.C.(Youyuan Chen); validation, D.C.(Duanyu Chen); formal analysis, L.Y.(Lijuan Yang); writing—original draft preparation, L.Y.(Lijuan Yang); writing—review and editing, D.C.(Duanyu Chen); supervision, Z.Z.(Zhifeng Zhang). All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by GUAT Special Research Project on the Strategic Development of Distinctive Interdisciplinary Fields (TS2024211) and Key Project of Guangxi Natural Science Foundation (2024GXNSFDA010061).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data are available from the authors upon reasonable request.

Conflicts of Interest

The authors declare no conflicts of interest.

Appendix

Proof of Proposition 1

The Hessian matrix is as below:

Since,

If , then the Hessian matrix is negative jointly concave on , and if . Thus, Proposition 1 is proven.

Proof of Proposition 2

The Hessian matrix is as follows:

Since,

When it satisfies , then it is known that the Hessian matrix is negative jointly concave on , and . Proposition 2 is proven.

Proof of Proposition 3

The Hessian matrix is,

Since,

If , then the Hessian matrix is negative jointly concave on , and . Proposition 3 is proven.

Proof of lemma 1.

With the results in

Table 2, 3 and 4, through mathematical calculation, we can derive:

; ; ; ; ;

; ; ;

; ; ; ;

;

; ; when ;

; ; when ;

; ; when ;

Proof of lemma 2.

; ; ; ; ;

; ; ;

; ; ; ; ;

;

; ; when ;

; ; when ;

Proof of lemma 3.

; ; ; ; ; ; ; ;

; ; ; ; ;

; ; ;

References

- https://www.clarksons.com/home/news-and-insights/2024/green-technology-alternative-fuel-uptake/.

- Liu, P.; Xu, Y.; Xie, X.; Turkmen, S.; Fan, S.; Ghassemi, H.; He, G. Achieving the global net-zero maritime shipping goal: The urgencies, challenges, regulatory measures and strategic solutions. Ocean Coast Manage 2024, 256, 107301. [Google Scholar] [CrossRef]

- Faber, J.; Hanayama, S.; Zhang, S.; Pereda, P.; Comer, B.; Hauerhof, E.; van der Loeff, W.S.; Smith, T.; Zhang, Y.; Kosaka, H.; et al. Fourth IMO Greenhouse Gas Study 2020. International Maritime Organization. 2021.

- Review for Maritime Report. https://unctad.org/publication/review-maritime-transport-2024. 2024.

- Zhang, G.; Xu, J.; Zhang, Z.; Chen, W. Optimal decision-making and coordination of the shipping logistics service supply chain cooperation mode under the carbon quota and trading mechanism. Ocean Coast Manage 2024, 255, 107240. [Google Scholar] [CrossRef]

- Luo, C.; Zhou, Y.; Mu, M.; Zhang, Q.; Cao, Z. Subsidy, tax or green awareness: Government policy selection for promoting initial shore power usage and sustaining long-run use. J Clean Prod. 2024, 442, 140946. [Google Scholar]

- Black, S.; Parry, I.; Singh, S.; Vernon-Lin, N. Destination Net Zero: The Urgent Need for a Global Carbon Tax on Aviation and Shipping. 2024.

- Gualandi, Rebecca. IMO adopts more ambitious GHG targets for global shipping sector. Carbon Pulse, 2023. https://carbon-pulse.com/211324/.

- Smith, T.; Baresic, D.; Fahnestock, J.; Galbraith, C.; Velandia Perico, C.; Rojon, I.; Shaw, A. A strategy for the transition to zero-emission shipping. An Analysis of Transition Pathways, Scenarios, and Levers for Change. 2021. https://globalmaritimeforum.org/report/a-strategy-for-the-transition-to-zero-emission-shipping/.

- Patricksson, Ø.S.; Fagerholt, K.; Rakke, J.G. The fleet renewal problem with regional emission limitations: Case study from Roll-on/Roll-off shipping. Transp Res Part C Emerg Technol. 2015, 56, 346–358. [Google Scholar]

- Yu, J.; Voß, S.; Tang, G. Strategy development for retrofitting ships for implementing shore side electricity. Transp Res D Transp Environ. 2019, 74, 201–213. [Google Scholar]

- ICS Maritime Barometer Report 2023-2024. https://www.ics-shipping.org/resource/ics-maritime-barometer-report-2023-2024-2/.

- Liu, J.; Wang, J. Carrier alliance incentive analysis and coordination in a maritime transport chain based on service competition. Transp Res E Logist Transp Rev. 2019, 128, 333–355. [Google Scholar]

- Lu, T.; Chen, Y.J.; Fransoo, J.C.; Lee, C.Y. Shipping to heterogeneous customers with competing carriers. Manuf Serv Oper Manag. 2020, 22, 850–867. [Google Scholar]

- Hall, P.; Wager, W. Service quality in bulk chemical transportation: An Empirical investigation of Shipper perceptions. Logistics and Transportation Review, 1996, 32, 231–246. [Google Scholar]

- Wang, Y.; Hou, G. A duopoly game with heterogeneous green supply chains in optimal price and market stability with consumer green preference. J Clean Prod. 2020, 255, 120161. [Google Scholar]

- Tao, F.; Zhou, Y.; Bian, J.; Lai, K.K. Optimal channel structure for a green supply chain with consumer green-awareness demand. Ann Oper Res 2023, 324, 601–628. [Google Scholar]

- Wang, S.; Qi, J.; Laporte, G. Governmental subsidy plan modeling and optimization for liquefied natural gas as fuel for maritime transportation. Transport Res B-Meth 2022, 155, 304–321. [Google Scholar]

- Wang, M.; Tan, Z.; Du, Y. Coordinating inland river ports through optimal subsidies from the container shipping carrier. Transp Res E Logist Transp Rev. 2024, 189, 103671. [Google Scholar]

- He, L.; Wang, H.; Liu, F. Emission abatement in low-carbon supply chains with government subsidy and information asymmetry. Int J Prod Res 2024, 1–29. [Google Scholar]

- Huang, X.; Liu, G.; Zheng, P. Dynamic analysis of a low-carbon maritime supply chain considering government policies and social preferences. Ocean Coast Manage 2023, 239, 106564. [Google Scholar]

- Wang, H.; Wang, C.; Li, M.; Xie, Y. Blockchain technology investment strategy for shipping companies under competition. Ocean Coast Manage 2023, 243, 106696. [Google Scholar]

- Wang, J.; Zhu, W. Analyzing the development of competition and cooperation among ocean carriers considering the impact of carbon tax policy. Transp Res E Logist Transp Rev. 2023, 175, 103157. [Google Scholar]

- Yi, T.; Meiping, W.; Shaorui, Z. Pricing and contract preference in maritime supply chains with downstream competition impact of risk-aversion and contract unobservability. Ocean Coast Manag. 2023, 242, 106691. [Google Scholar]

- Lai, X.; Tao, Y.; Wang, F.; Zou, Z. Sustainability investment in maritime supply chain with risk behavior and information sharing. Int J Prod Econ. 2019, 218, 16–29. [Google Scholar]

- Li, D.; Qu, Y.; Ma, Y. Study on the impact of subsidies for overlapping hinterland shippers on port competition. Transp Res Part A Policy Pract. 2020, 135, 24–37. [Google Scholar]

- Gong, X.; Li, Z.C. Determination of subsidy and emission control coverage under competition and cooperation of China-Europe Railway Express and liner shipping. Transport Policy 2022, 125, 323–335. [Google Scholar]

- Huang, X.; Zheng, P.; Liu, G. Non-cooperative and Nash-bargaining game of a two-parallel maritime supply chain considering government subsidy and forwarder's CSR strategy: A dynamic perspective. Chaos. Soliton. Fract. 2024, 178, 114300. [Google Scholar]

- Jasmi, M.F.; Fernando, Y. Drivers of maritime green supply chain management. Sustain. Cities. Soc. 2018, 43, 366–383. [Google Scholar]

- Zhuge, D.; Wang, S.; Zhen, L.; Laporte, G. Subsidy design in a vessel speed reduction incentive program under government policies. Nav Res Log 2021, 68, 344–358. [Google Scholar]

- Song, Z.; Tang, W.; Zhao, R.; Zhang, G. Implications of government subsidies on shipping companies’ shore power usage strategies in port. Transp Res E Logist Transp Rev. 2022, 165, 102840. [Google Scholar]

- Chen, Z.; Zhang, Z.; Bian, Z.; Dai, L.; Hu, H. Subsidy policy optimization of multimodal transport on emission reduction considering carrier pricing game and shipping resilience: A case study of Shanghai port. Ocean Coast Manag. 2023, 243, 106760. [Google Scholar]

- Peng, Y.T.; Wang, Y.; Li, Z.C.; Sheng, D. Subsidy policy selection for shore power promotion: Subsidizing facility investment or price of shore power? Transport Policy 2023, 140, 128–147. [Google Scholar]

- Zhen, L.; Yuan, Y.; Zhuge, D.; Psaraftis, H.N.; Wang, S. Subsidy strategy design for shore power utilization and promotion. Marit Policy Manag. 2024, 51, 1606–1638. [Google Scholar]

- Li, Z.; Wang, L.; Wang, G.; Xin, X.; Chen, K.; Zhang, T. Investment and subsidy strategy for low-carbon port operation with blockchain adoption. Ocean Coast Manag. 2024, 248, 106966. [Google Scholar]

- Hu, Q.; Gu, W.; Wang, S. Optimal subsidy scheme design for promoting intermodal freight transport. Transp Res E Logist Transp Rev. 2022, 157, 102561. [Google Scholar]

- Wang, J.; Li, H.; Yang, Z.; Ge, Y.E. Shore power for reduction of shipping emission in port: A bibliometric analysis. Transp Res E Logist Transp Rev. 2024, 188, 103639. [Google Scholar]

- Zhong, Z.; Jin, H.; Sun, Y.; Zhou, Y. Two incentive policies for green shore power system considering multiple objectives. Comput Ind Eng 2024, 194, 110338. [Google Scholar]

- Tseng, P.H.; Pilcher, N. A study of the potential of shore power for the port of Kaohsiung, Taiwan: to introduce or not to introduce? Res Transp Bus Manag 2015, 17, 83–91. [Google Scholar]

- Jiao, Y.; Wang, C. Shore power vs low sulfur fuel oil: pricing strategies of carriers and port in a transport chain. Int J Low-Carbon Tec 2021, 16, 715–724. [Google Scholar]

- Hoang, A.T.; Tran, V.D.; Dong, V.H.; Le, A.T. An experimental analysis on physical properties and spray characteristics of an ultrasound-assisted emulsion of ultra-low-sulphur diesel and Jatropha-based biodiesel. J Mar Eng Technol 2022, 21, 73–81. [Google Scholar]

- Hoang, A.T.; Foley, A.M.; Nižetić, S.; Huang, Z.; Ong, H.C.; Ölçer, A.I.; Nguyen, X.P. Energy-related approach for reduction of CO2 emissions: A critical strategy on the port-to-ship pathway. J Clean Prod. 2022, 355, 131772. [Google Scholar]

- Bui, T.M.; Dinh, T.Q.; Marco, J.; Watts, C. An energy management strategy for DC hybrid electric propulsion system of marine vessels. In2018 5th International Conference on Control, Decision and Information Technologies (CoDIT), 2018.

- Gašparović, G.; Klarin, B. Techno-economical analysis of replacing Diesel propulsion with hybrid electric-wind propulsion on ferries in the Adriatic. In2016 International Multidisciplinary Conference on Computer and Energy Science (SpliTech), 2016.

- Li, J.; Wang, H.; Shi, V.; Sun, Q. Manufacturer's choice of online selling format in a dual-channel supply chain with green products. Eur. J. Oper. Res. 2024, 318, 131–142. [Google Scholar]

- Surucu-Balci, E.; Iris, Ç.; Balci, G. Digital information in maritime supply chains with blockchain and cloud platforms: Supply chain capabilities, barriers, and research opportunities. Technol. Forecast. Soc. 2024, 198, 122978. [Google Scholar]

- Cui, H.; Notteboom, T. Modelling emission control taxes in port areas and port privatization levels in port competition and co-operation sub-games. Transp Res D Transp Environ. 2017, 56, 110–128. [Google Scholar]

- Wang, X.; Zhang, S. The interplay between subsidy and regulation under competition. IEEE Trans Syst Man Cybern Syst. 2022, 53, 1038–1050. [Google Scholar]

- Yang, L.; Cai, Y.; Wei, Y.; Huang, S. Choice of technology for emission control in port areas: A supply chain perspective. J Clean Prod. 2019, 240, 118105. [Google Scholar] [CrossRef]

- Wan, Z.; Zhang, T.; Sha, M.; Guo, W.; Jin, Y.; Guo, J.; Liu, Y. Evaluation of emission reduction strategies for berthing containerships: A case study of the Shekou Container Terminal. J Clean Prod. 2021, 299, 126820. [Google Scholar] [CrossRef]

- Livaniou, S.; Papadopoulos, G.A. Liquefied Natural Gas (LNG) as a Transitional Choice Replacing Marine Conventional Fuels (Heavy Fuel Oil/Marine Diesel Oil), towards the Era of Decarbonisation. Sustainability 2022, 14, 16364. [Google Scholar] [CrossRef]

- Tsolakis, N.; Zissis, D.; Papaefthimiou, S.; Korfiatis, N. Towards AI driven environmental sustainability: an application of automated logistics in container port terminals. Int J Prod Res. 2022, 60, 4508–4528. [Google Scholar] [CrossRef]

- Fan, L.; Yu, Y.; Yin, J. Impact of Sulphur Emission Control Areas on port state control’s inspection outcome. Marit Policy Manag. 2023, 50, 908–923. [Google Scholar] [CrossRef]

- Liu, J.; Xu, H.; Lyu, Y. Emission reduction technologies for shipping supply chains under carbon tax with knowledge sharing. Ocean Coast Manag. 2023, 246, 106869. [Google Scholar] [CrossRef]

- Kong, Y.; Liu, J.; Chen, J. Exploring the carbon abatement measures in maritime supply chain: a scenario-based system dynamics approach. Int J Prod Res. 2023, 61, 6131–6152. [Google Scholar] [CrossRef]

- Wang, Q. Charting a greener course: China’s recent legal strategies in shore power promotion for achieving maritime emission targets. Mar. Policy. 2024, 170, 106386. [Google Scholar] [CrossRef]

- Gelareh, S.; Nickel, S.; Pisinger, D. Liner shipping hub network design in a competitive environment. Transp Res E Logist Transp Rev. 2010, 46, 991–1004. [Google Scholar] [CrossRef]

- Wang, H.; Meng, Q.; Zhang, X. Game-theoretical models for competition analysis in a new emerging liner container shipping market. Transport. Res. B-Meth. 2014, 70, 201–227. [Google Scholar] [CrossRef]

- Lee, E.S.; Song, D.W. Competition and co-operation in maritime logistics operations. InHandbook of ocean container transport logistics: Making global supply chains effective. 2014.

- Song, Z.; Tang, W.; Zhao, R. Liner alliances with heterogeneous price level and service competition: Partial vs. full. Omega 2021, 103, 102414. [Google Scholar] [CrossRef]

- Wang, J.; Xu, S.; Wu, L.; Wu, S.; Liu, Y. Multidimensional container shipping alliance decisions among competitors: Impact of capacity constraints and market competition. Transp Res E Logist Transp Rev. 2024, 190, 103694. [Google Scholar] [CrossRef]

- Tsay, A.A.; Agrawal, N. Channel dynamics under price and service competition. Manuf Serv Oper Manag. 2000, 2, 372–391. [Google Scholar] [CrossRef]

- Gao, J.; Xiao, Z.; Wei, H.; Zhou, G. Dual-channel green supply chain management with eco-label policy: A perspective of two types of green products. Comput. Ind. Eng. 2020, 146, 106613. [Google Scholar] [CrossRef]

- Zhang, C.; Liu, Y.; Han, G. Two-stage pricing strategies of a dual-channel supply chain considering public green preference. Comput Ind Eng. 2021, 151, 106988. [Google Scholar] [CrossRef]

- Zhou, H.; Liu, M.; Tan, Y. Long-term emission reduction strategy in a three-echelon supply chain considering government intervention and Consumers’ low-carbon preferences. Comput Ind Eng. 2023, 186, 109697. [Google Scholar] [CrossRef]

- Zhou, X.; Gao, C.; Zhang, D. Product service supply chain network competition: An equilibrium with multiple tiers and members. Int J Prod Res 2024, 62, 7324–7341. [Google Scholar] [CrossRef]

- Che, C.; Chen, Y.; Zhang, X.; Zhang, Z. The Impact of Different Government Subsidy Methods on Low-Carbon Emission Reduction Strategies in Dual-Channel Supply Chain. Complexity 2021, 2021, 6668243. [Google Scholar] [CrossRef]

- Li, M.; Luan, J.; Li, X.; Jia, P. An Analysis of the Impact of Government Subsidies on Emission Reduction Technology Investment Strategies in Low-Carbon Port Operations. Systems 2024, 12, 134. [Google Scholar] [CrossRef]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).