1. Introduction

The global unmanned aerial vehicle (UAV) industry, commonly known as drones, is experiencing exponential growth and is widely considered a transformative technology. Market forecasts project the global drone market to reach

$43.1 billion by 2028, with a compound annual growth rate (CAGR) of 13.9% from 2023 to 2028 (McKinsey analysis; Teal Group, 2022/2023). This growth is driven by diverse applications spanning agriculture, logistics, disaster relief, and more [

1,

2,

3,

7,

9,

10,

14]. Despite this promising global outlook, Thailand’s domestic UAV industry faces unique supply chain challenges that hinder its ability to fully capitalize on this growth and establish itself as a competitive player in the regional market.

While specific data on the Thai drone market size is limited, data from the Digital Government Development Agency (DGA) indicates that out of a total of 138,833 registered drones, more than 92%, are imported from foreign countries. This reliance on imports highlights a critical trade imbalance. [

16] To address this, the Thai government has set a goal of increasing the contribution of digital technology to its GDP to 30% by 2030, and the UAV industry is seen as a key sector in achieving this target.

This reliance is further compounded by several factors that impact local production costs. One key challenge is the import tax structure, where UAV components face higher tax rates (10-20%) compared to fully assembled drones. This policy creates a disincentive for domestic assembly and component manufacturing, placing Thai entrepreneurs at a disadvantage. Furthermore, the limited development of local component manufacturing capabilities necessitates the import of crucial parts such as batteries, motors, and airframe structures, further increasing production costs. The Board of Investment of Thailand (BOI) offers tax exemptions to assembly factories located in government-promoted investment zones; however, these factories must relocate their production bases to these specified areas to receive the tax exemption.

To achieve these objectives, this research employs a mixed-methods approach. We begin with secondary data analysis of industry statistics from sources such as the Office of Economic and Social Affairs, the Department of Internal Trade, and the Department of Foreign Trade. This is complemented by in-depth interviews with selected representatives from three key groups within the supply chain: the upstream (importers of foreign-made components, component manufacturers), midstream (importers of complete drones, domestic drone assemblers), and downstream (drone distributors, service providers) segments. The subsequent sections of this paper are organized as follows:

Section 2 presents the methodology employed in this study.

Section 3 provides an overview of the UAV supply chain.

Section 4 presents the findings of our supply chain analysis,

Section 5 discusses the impact of current challenges, and Section 6 concludes with policy recommendations aimed at promoting the Thai UAV industry.

2. Materials and Methods

This study employs a mixed-method approach, combining secondary data analysis and in-depth qualitative interviews to examine the supply chain dynamics of Thailand’s unmanned aerial vehicle (UAV) industry.

First, secondary data will be collected from reputable sources, including the Office of Economic and Social Affairs, the Department of Internal Trade, and the Department of Foreign Trade. These data will provide an overview of the UAV supply chain, covering upstream (component manufacturing and imports), midstream (UAV assembly and imports), and downstream (distribution and service provision) sectors. The analysis will identify key industry trends, regulatory frameworks, and market dynamics.

Next, in-depth interviews will be conducted with key stakeholders across the UAV supply chain. These stakeholders will be categorized into three groups: Upstream – Component manufacturers and importers of foreign-made UAV parts. Midstream – Domestic UAV assemblers and importers of complete UAV systems. Downstream – UAV distributors and service providers.

The interviews will explore, Business operations and market positioning., Challenges and regulatory constraints affecting industry growth., Strategic recommendations for policy development and industry advancement.

By integrating quantitative insights from secondary data with qualitative perspectives from industry experts, this study aims to provide a comprehensive understanding of Thailand’s UAV supply chain and offer actionable recommendations for fostering industry growth.

3. Results

The researchers employed a combination of field surveys, interviews, and observations to collect primary data, supplemented by secondary data from research documents, publicly available statistics, and relevant articles.

The study presents its findings in two main sections:

Production Status and Supply Chain Structure of the UAV Industry – This section examines the production landscape and supply chain dynamics within the UAV industry, providing insights into its current conditions and structural components.

Comparative Model for Assessing Key Environmental Factors – This section introduces a comparative model designed to evaluate the current state of critical environmental factors from multiple perspectives. The model aims to identify potential opportunities and challenges, offering a foundation for strategic development within the industry.

3.1. Supply Chain in the UAV Industry in Thailand

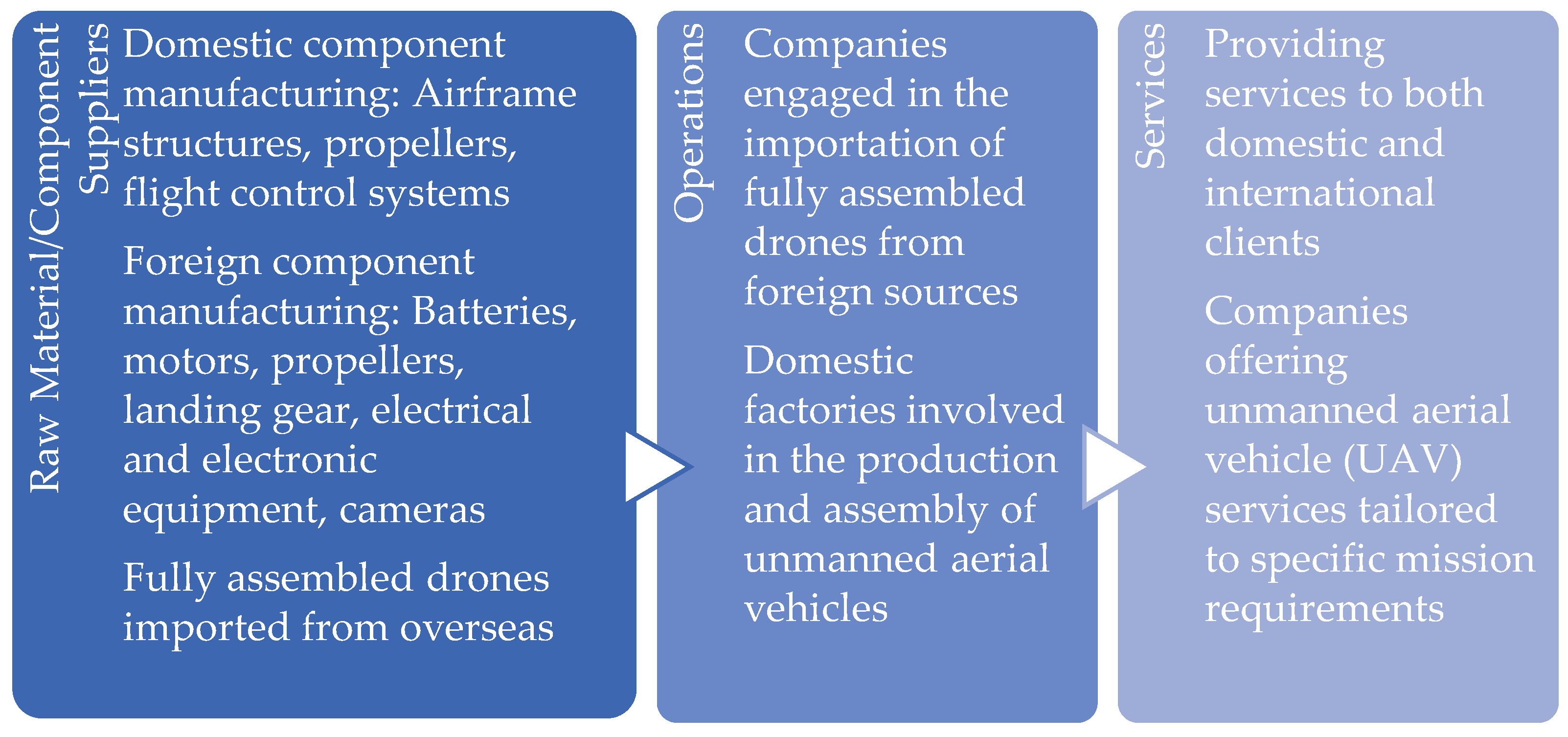

3.1.1. Raw Material and Component Suppliers

Group 1: Foreign UAV Manufacturers and Assemblers Foreign UAV manufacturers and assemblers have a significant impact on Thailand’s domestic supply chain due to their lower production costs compared to local manufacturers. Additionally, they benefit from government incentives, such as tax exemptions, when supplying products domestically. These advantages contribute to their strong competitive position by significantly reducing cost structures.

Group 2: Foreign UAV Component Manufacturers This group consists of companies that produce key UAV components, including lithium-ion batteries, motor sets with propellers, airframe structures, and cameras. Components manufactured abroad are generally more accessible and cost-effective than domestic production, particularly considering the challenges associated with sourcing raw materials and technical expertise locally. Consequently, importing these components into Thailand often results in significant cost savings.

Group 3: Domestic UAV Component Manufacturers Domestic UAV component manufacturers represent a relatively small segment of the industry and primarily focus on producing simpler components, such as airframe structures for fixed-wing, vertical take-off and landing (VTOL), and multirotor drones. However, their production costs tend to be higher due to the reliance on imported raw materials.

3.1.2. Operations

The UAV supply chain in Thailand consists of assembly factories and distribution agents.

Assembly Factories: Companies that import components for domestic assembly are subject to import taxes ranging from 10% to 20% of the component’s price, which represents a significant cost. However, tax exemptions are available for companies that establish assembly facilities in government-designated investment zones. To qualify for these benefits, manufacturers must relocate their production bases to these specified areas.

Distribution Agents: This group consists of companies that import fully assembled UAVs for domestic distribution. These businesses dominate the Thai market, accounting for approximately 92% of the total market share.

3.1.3. Services

The UAV supply chain also includes distribution companies and service providers specializing in UAV applications.

Distributors: These companies supply UAVs directly to customers for use in various applications.

Service Providers: This sector offers specialized UAV-related services, including aerial photography, surveying and mapping, and progress monitoring for construction projects. The service segment has emerged as a major revenue-generating industry and is experiencing significant growth in Thailand.

Figure 1.

Supply Chain in the UAV Industry in Thailand.

Figure 1.

Supply Chain in the UAV Industry in Thailand.

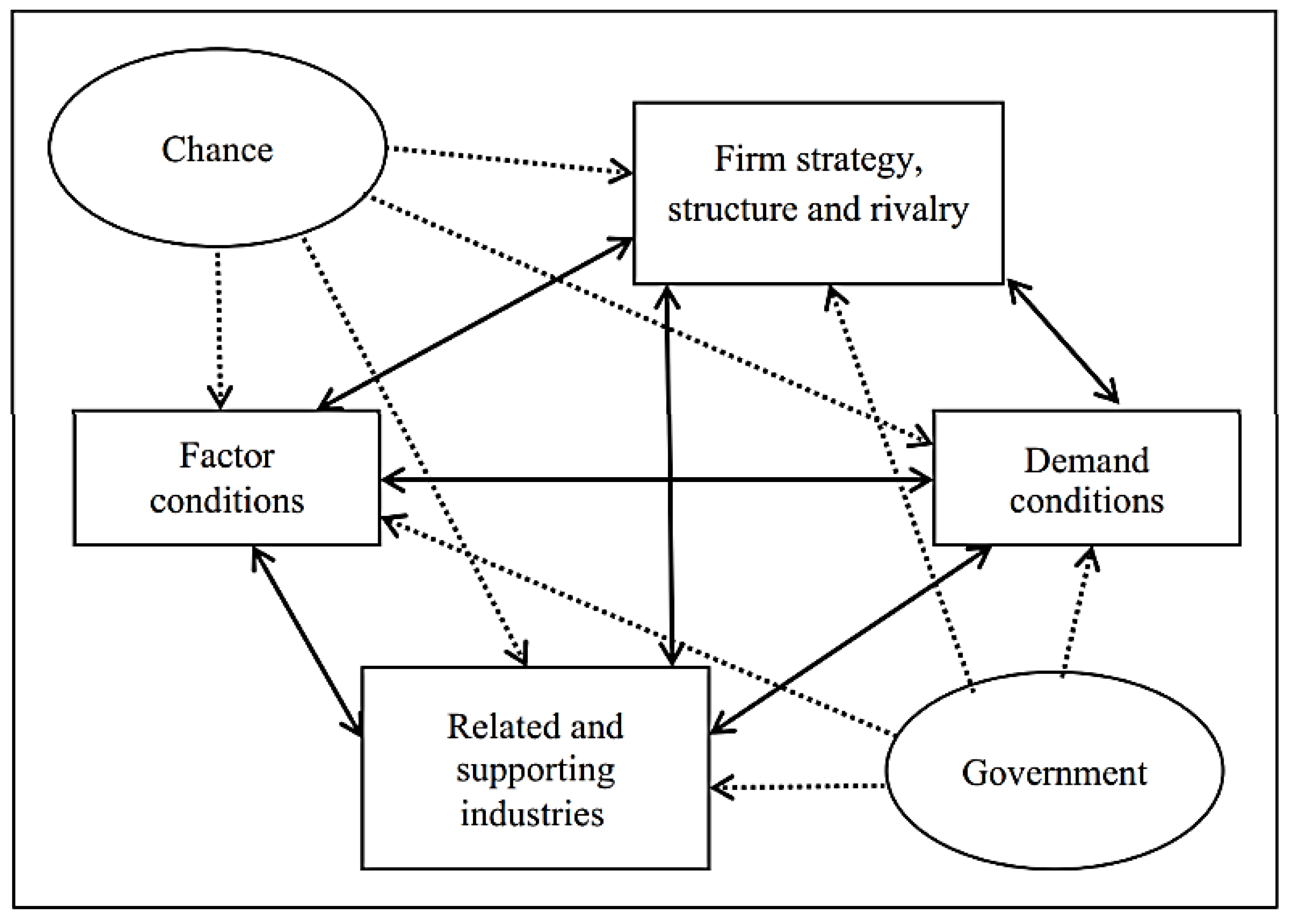

3.2. The Competitive Advantage of Nations, Diamond Model

Based on the analysis using Porter’s diamond model, in

Figure 2, it is an analysis of the interconnection of various related factors and serves as a measure of the readiness and potential of the driverless aerospace industry cluster [

4,

5,

8,

15]. This analysis is intended to be used for the development and improvement of operational strategies for various activities.

4. Discussion

The research highlights both the promising growth potential and the significant challenges facing the UAV industry in Thailand. While the global UAV market is experiencing rapid expansion, Thailand’s domestic sector struggles with a critical reliance on imports, particularly of fully assembled drones. The Digital Government Development Agency (DGA) data indicates that over 92% of registered drones in Thailand are imported, revealing a substantial trade imbalance. This reliance on imports is further exacerbated by the structure of import tax policies.

A key issue identified is the higher tax rates imposed on imported UAV components (10-20%) compared to fully assembled drones. This disincentives domestic assembly and component manufacturing, placing Thai entrepreneurs at a competitive disadvantage. Coupled with the limited development of local component manufacturing capabilities, this policy creates a significant barrier to entry and growth for domestic businesses. Although the Board of Investment of Thailand (BOI) offers tax exemptions, these are contingent upon relocating production bases to specific investment zones, which may not be feasible or desirable for all manufacturers.

The study utilizes Porter’s Diamond model to assess the competitive environment, highlighting the interconnection of factors influencing the driverless aerospace industry cluster. This analysis serves as a foundation for developing operational strategies and improving activities within the sector.

The service segment of the UAV industry, including aerial photography, surveying, and construction monitoring, is emerging as a major revenue-generating area and experiencing significant growth. However, even this segment is likely dependent on imported drones and components, further underscoring the need to strengthen domestic production capabilities.

5. Conclusions

In conclusion, this research reveals that while the Thai UAV industry possesses steady growth potential, it is currently hampered by a significant trade imbalance, unfavorable import tax policies, and limited local component manufacturing. The study underscores the need for strategic interventions to foster a more competitive domestic sector. To unlock the industry’s potential and enable Thailand to become a significant player in the global UAV market, the following actions are recommended:

Policy Review: The government should review investment promotion regulations and import/export taxes to reduce production costs for local entrepreneurs, specifically addressing the disparity between taxes on complete UAVs and components.

Investment in Infrastructure: Increased investment in high-quality testing and certification infrastructure is crucial to build consumer confidence in Thai-made UAV systems.

International Networks: Accelerating the establishment of international networks among entrepreneurs can expand market access for Thai UAV products.

Further research into the specifics of production cost structures is essential for developing targeted strategies to improve the competitiveness of Thai UAV manufacturers. By implementing these recommendations, Thailand can drive innovation, economic growth, and technological advancement within the UAV sector.

Acknowledgments

This work was supported by Suranaree University of Technology (SUT), Thailand Science Research and Innovation (TSRI), and National Science, Research and Innovation Fund (NSRF).

References

- Abderahman Rejeb, Alireza Abdollahi, Karim Rejeb, Horst Treiblmaier, Drones in agriculture: A review and bibliometric analysis, Computers and Electronics in Agriculture, Volume 198, (2022).

- Giordan, D., Adams, M.S., Aicardi, I. et al. The use of unmanned aerial vehicles (UAVs) for engineering geology applications. Bull Eng Geol Environ 79, 3437–3481 (2020).

- Janet Mayowa Nwaogu, Yang Yang, Albert P.C. Chan, Hung-lin Chi, Application of drones in the architecture, engineering, and construction (AEC) industry, Automation in Construction, Volume 150, (2023).

- Lee, B.; Park, S.-K. A Study on the Competitiveness for the Diffusion of Smart Technology of Construction Industry in the Era of 4th Industrial Revolution. Sustainability 2022, 14, 8348. [CrossRef]

- Lehene, C.F.; Jaradat, M.; Nistor, R.L. An Interdisciplinary and Multilevel Analysis of Local Economy Determinants and Their Impact on Firm Performance—Considering Porter’s Diamond Model, Clusters, and Industry. Systems 2024, 12, 82. [CrossRef]

- McKinsey analysis; Teal Group, 2022/2023 World Civil Unmanned Aerial Systems Market Profile & Forecast (2023).

- Michiel Jan van Veelen, Giulia Roveri, Anna Voegele, Tomas Dal Cappello, Michela Masè, Marika Falla, Ivo Beat Regli, Abraham Mejia-Aguilar, Sebastian Mayrgündter, Giacomo Strapazzon, Drones reduce the treatment-free interval in search and rescue operations with telemedical support – A randomized controlled trial, The American Journal of Emergency Medicine, Volume 66, (2023).

- Mihaela Herciu, Measuring International Competitiveness of Romania by Using Porter’s Diamond and Revealed Comparative Advantage, Procedia Economics and Finance, Volume 6, 273-279(2023).

- Nipun D. Nath, Chih-Shen Cheng, Amir H. Behzadan, Drone mapping of damage information in GPS-Denied disaster sites, Advanced Engineering Informatics, Volume 51, (2022).

- Petra Urbanová, Mikoláš Jurda, Tomáš Vojtíšek, Jan Krajsa, Using drone-mounted cameras for on-site body documentation: 3D mapping and active survey, Forensic Science International, Volume 281, Pages 52-62(2017).

- Porter, M. E. The competitive advantage of nations. The Free Press. A Division of Macmillan Incorporation, (1990).

- Saikong, W.; Phumma, P.; Tantrairatn, S.; Sumpavakup, C. A Comparative Study on Battery Modelling via Specific Hybrid Pulse Power Characterization Testing for Unmanned Aerial Vehicles in Real Flight Conditions. World Electr. Veh. J. 2025, 16, 55. [CrossRef]

- Tsai, Pei-Hsuan & Jou-Chen, Jou-Chen & Yang, Ho-Chin, Using Porter’s Diamond Model to Assess the Competitiveness of Taiwan’s Solar Photovoltaic Industry, (2021).

- Vipul Garg, Suman Niranjan, Victor Prybutok, Terrance Pohlen, David Gligor, Drones in last-mile delivery: A systematic review on Efficiency, Accessibility, and Sustainability, Transportation Research Part D: Transport and Environment, Volume 123, (2023).

- Zhang, C.; Xu, K.; Zhang, X.; Han, D.; He, Y. An Evaluation of the Rural Tourism Industry’s Competitiveness in the Yangtze River Economic Belt Based on the “Diamond Model”—Exampled by Wenjiang District, Huangpi District, and Jiangning District. Reg. Sci. Environ. Econ. 2025, 2, 5. [CrossRef]

- Digital Government Development Agency (Public Organization), https://data.go.th/dataset/dataset_11_94, last accessed 2023/10/4.

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).