Submitted:

09 May 2023

Posted:

10 May 2023

You are already at the latest version

Abstract

Keywords:

1. Introduction

2. Methods and Materials

2.1. Methods

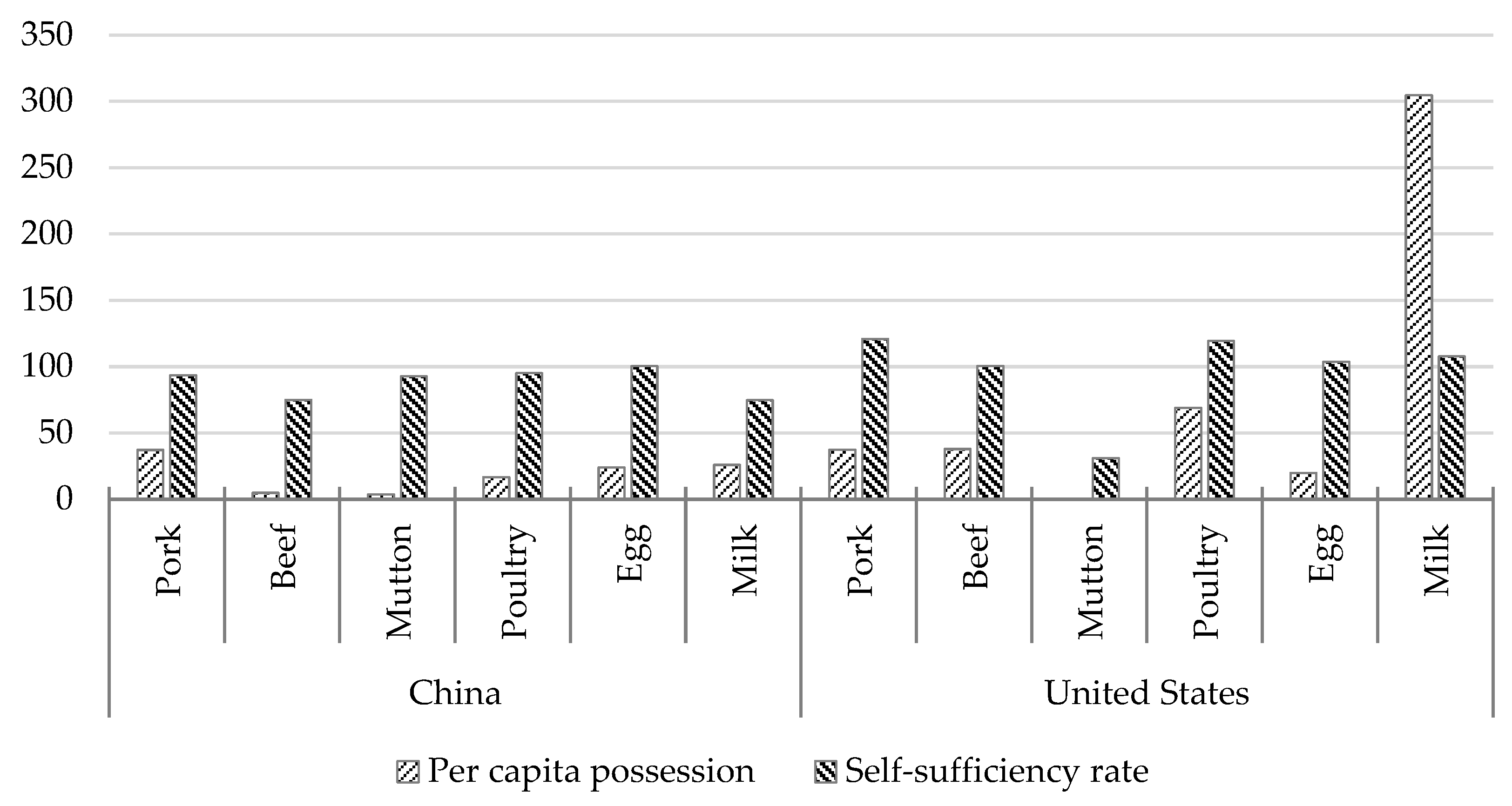

2.1.1. Supply security

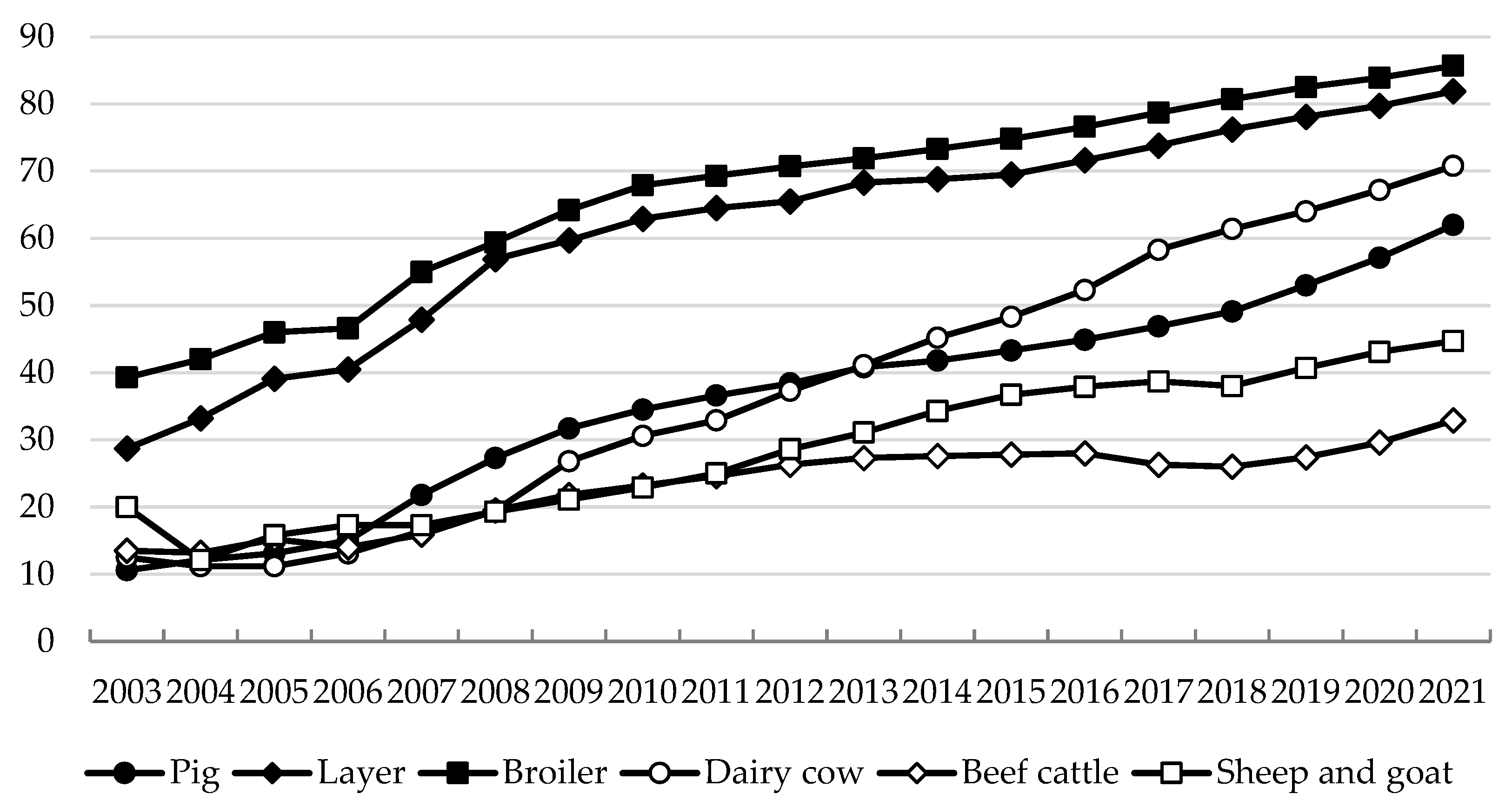

2.1.2. Science and technology equipment

2.1.3. Operation system

2.1.4. Industrial resilience

2.1.5. Competitiveness

2.2. Materials

3. Results and Discussion

3.1. Results

3.2. Discussion

4. Issues and challenges of China’s livestock powerhouse construction

4.1. Supply security capacity needs to be strengthened

4.2. Scientific and technological support needs to be improved

| Country | Pig | Beef cattle | Sheep and goat | Broiler | Layeryield | Milk yield | ||||

|---|---|---|---|---|---|---|---|---|---|---|

| Slaughterrate | Carcassweight | Slaughterrate | Carcassweight | Slaughterrate | Carcassweight | Slaughterrate | Carcassweight | |||

| Australia | 212.97 | 78.74 | 27.10 | 291.88 | 37.87 | 24.69 | 608.94 | 1.92 | 16.01 | 6400.40 |

| Brazil | 124.70 | 82.29 | 12.34 | 351.92 | 30.09 | 14.46 | 400.96 | 2.43 | 12.30 | 2280.70 |

| Canada | 166.99 | 102.63 | 30.01 | 417.46 | 94.06 | 22.99 | 439.12 | 1.89 | 17.72 | 9646.70 |

| China | 133.56 | 88.27 | 77.98 | 148.19 | 110.99 | 14.49 | 252.04 | 1.55 | 10.69 | 3026.90 |

| France | 180.15 | 94.53 | 25.73 | 319.48 | 57.87 | 18.14 | 305.50 | 1.89 | - | 7458.90 |

| Germany | 218.31 | 95.83 | 29.60 | 330.61 | 99.05 | 20.41 | - | - | 19.70 | 8481.40 |

| India | 103.64 | 35.00 | 21.08 | 103.00 | 34.88 | 10.59 | 328.87 | 1.34 | 11.98 | 1880.20 |

| Japan | 181.24 | 78.29 | 26.82 | 450.00 | 30.31 | 26.20 | 261.72 | 2.88 | 18.30 | 8939.20 |

| New Zealand | 254.74 | 70.89 | 46.27 | 159.81 | 87.20 | 20.24 | 458.88 | 1.91 | 15.96 | 4555.30 |

| Korea | 163.89 | 76.54 | 24.18 | 321.24 | 39.24 | 15.45 | 583.80 | 0.94 | 10.09 | 10374.30 |

| Russia | 179.23 | 92.90 | 43.43 | 213.75 | 55.13 | 18.04 | 484.88 | 1.89 | 16.70 | 5016.70 |

| United States | 174.06 | 97.32 | 36.64 | 370.59 | 38.08 | 24.92 | 597.13 | 2.43 | 17.08 | 10869.00 |

| Type | 2010 | 2015 | 2020 | 2021 | Average annual growth rate (%) | |

|---|---|---|---|---|---|---|

| Pig (CNY/head) |

Total output | 1341.01 | 1827.19 | 4146.29 | 2586.49 | 6.15 |

| Total Cost | 1250.20 | 1835.35 | 2913.65 | 2709.18 | 7.28 | |

| Feed cost | 696.90 | 870.08 | 960.55 | 1112.67 | 4.35 | |

| Labor Cost | 238.98 | 510.82 | 537.99 | 512.82 | 7.19 | |

| Beef cattle (CNY/head) |

Total output | 6014.92 | 10663.30 | 16713.20 | 17498.70 | 10.19 |

| Total Cost | 4983.38 | 8550.67 | 12641.30 | 13799.30 | 9.70 | |

| Feed cost | 1291.16 | 1709.56 | 2526.98 | 2965.52 | 7.85 | |

| Labor cost | 440.66 | 1010.52 | 1147.56 | 1175.52 | 9.33 | |

| Sheep and goat (CNY/head) |

Total output | 775.41 | 936.08 | 1573.63 | 1614.86 | 6.90 |

| Total Cost | 639.67 | 1002.11 | 1367.84 | 1418.25 | 7.51 | |

| Feed cost | 164.02 | 201.87 | 241.94 | 270.24 | 4.64 | |

| Labor cost | 196.27 | 422.32 | 495.04 | 530.60 | 9.46 | |

| Broiler (CNY/hundred) |

Total output | 2489.48 | 2627.07 | 2753.70 | 3061.84 | 1.90 |

| Total Cost | 2219.53 | 2700.31 | 2902.79 | 3164.02 | 3.28 | |

| Feed cost | 1615.85 | 1911.85 | 1916.43 | 2194.70 | 2.82 | |

| Labor cost | 179.80 | 354.20 | 414.16 | 409.20 | 7.76 | |

| Layer (CNY/hundred) |

Total output | 13772.50 | 15617.00 | 13980.70 | 17955.40 | 2.44 |

| Total Cost | 12871.90 | 14643.80 | 15865.10 | 17655.80 | 2.91 | |

| Feed cost | 9558.24 | 10082.83 | 10732.30 | 12412.90 | 2.40 | |

| Labor cost | 731.92 | 1599.62 | 1855.82 | 1802.76 | 8.54 | |

| Dairy cattle (CNY/head) |

Total output | 16361.70 | 21337.70 | 24609.60 | 26217.30 | 4.38 |

| Total Cost | 12190.90 | 16331.20 | 17300.20 | 18462.00 | 3.85 | |

| Feed cost | 8516.76 | 10165.34 | 10258.62 | 11327.12 | 2.63 | |

| Labor Cost | 1651.84 | 3695.35 | 4200.20 | 4186.45 | 8.82 | |

4.3. Modern operation system needed to be sound

| Enterprise | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|

| Muyuan Foods Co., Ltd. | 1101 | 1025 | 1812 | 4026 | 6120 |

| Wens Foodstuff Group Co., Ltd. | 2230 | 1852 | 955 | 1322 | 1791 |

| New Hope Group | 255 | 355 | 829 | 998 | 1461 |

| Zhengbang Group | 554 | 578 | 955 | 1493 | 845 |

| Aonong Group | 42 | 66 | 135 | 325 | 519 |

| Da Bei Nong Group | 168 | 164 | 185 | 431 | 443 |

| Tech-bank Food Co., Ltd. | 217 | 244 | 308 | 428 | 442 |

| COFCO Joycome Foods Limited | 255 | 199 | 205 | 343 | 410 |

| Tangrenshen Group Co., Ltd. | 68 | 84 | 102 | 154 | 216 |

| Tecon Biology Co., Ltd. | 65 | 84 | 135 | 160 | 203 |

| Total | 4955 | 4651 | 5621 | 9680 | 12450 |

| National | 69382 | 54419 | 52704 | 67128 | 69995 |

| Percentage of | 7.14 | 8.55 | 10.67 | 14.42 | 17.79 |

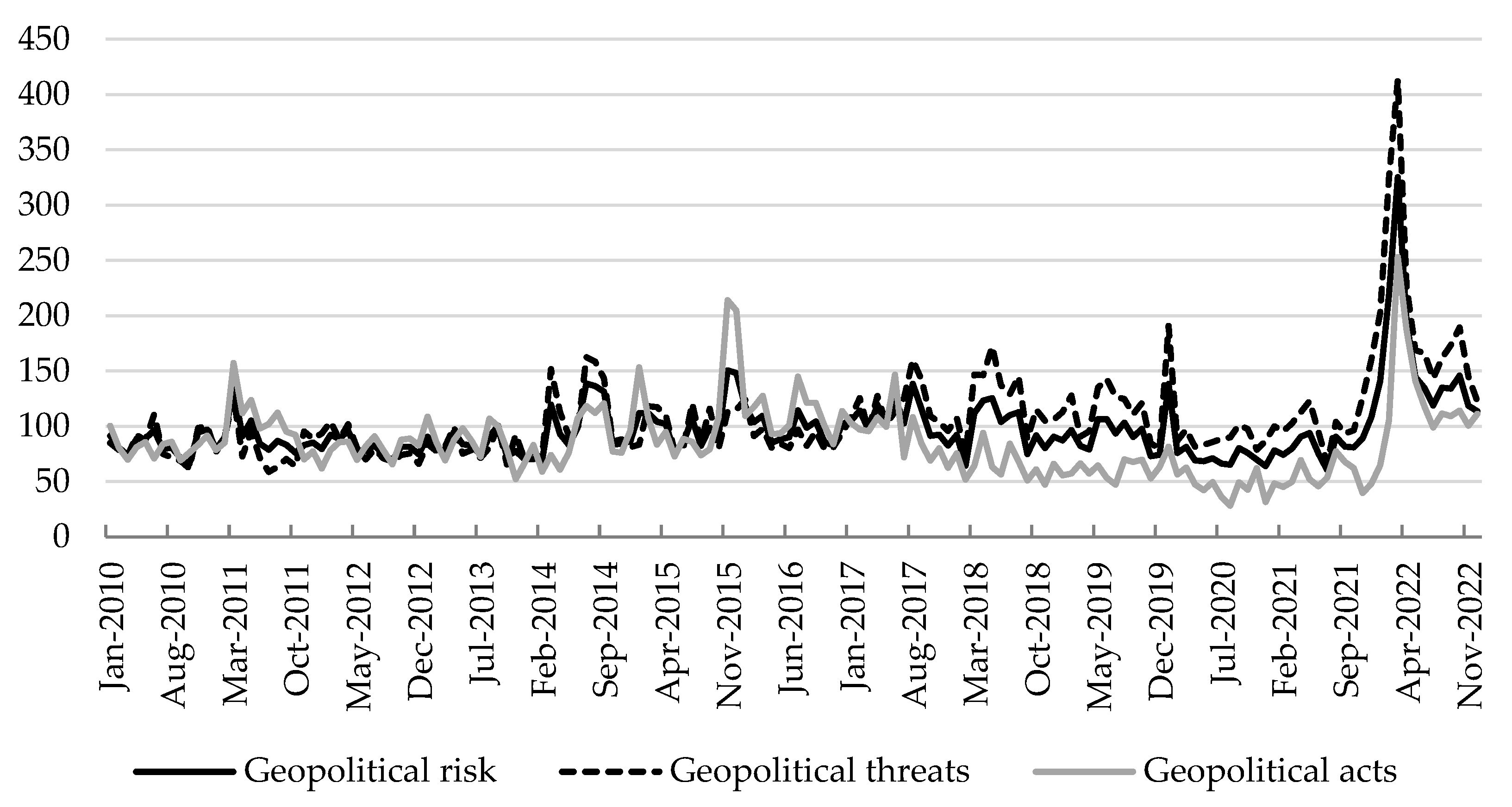

4.4. The industry chain and supply chain were not highly resilient

| Year | China | United States | ||||||

|---|---|---|---|---|---|---|---|---|

| New outbreaks | Cases | Killed and disposed | Deaths | New outbreaks | Cases | Killed and disposed | Deaths | |

| 2010 | 20434 | 496.56 | 18.36 | 70.08 | 53 | 0.07 | 0.13 | 0.00 |

| 2011 | 30466 | 417.93 | 31.35 | 43.56 | 40 | 0.03 | 1.55 | 0.00 |

| 2012 | 24107 | 269.08 | 184.50 | 32.05 | 50 | 0.09 | 0.02 | 0.00 |

| 2013 | 24884 | 267.04 | 61.17 | 33.27 | 55 | 0.68 | 1.06 | 0.00 |

| 2014 | 22640 | 265.21 | 217.17 | 22.54 | 454 | 0.07 | 11.65 | 0.01 |

| 2015 | 27142 | 293.35 | 62.34 | 34.97 | 253 | 2.53 | 1607.14 | 5.92 |

| 2016 | 23266 | 281.64 | 100.21 | 48.78 | 25 | 0.07 | 23.67 | 0.10 |

| 2017 | 8381 | 100.82 | 77.23 | 28.96 | 25 | 0.06 | 19.59 | 0.07 |

| 2018 | 8560 | 85.91 | 63.65 | 20.52 | 35 | 0.06 | 22.19 | 0.02 |

| 2019 | 3946 | 31.84 | 20.27 | 5.30 | 52 | 0.09 | 171.46 | 0.02 |

| 2020 | 124 | 0.90 | 1.76 | 0.87 | 245 | 0.09 | 33.95 | 2.22 |

| 2021 | 120 | 0.59 | 0.43 | 0.58 | 82 | 0.04 | 0.04 | 0.03 |

| 2022 | 18 | 0.03 | 0.06 | 0.03 | 994 | 0.02 | 5691.43 | 144.44 |

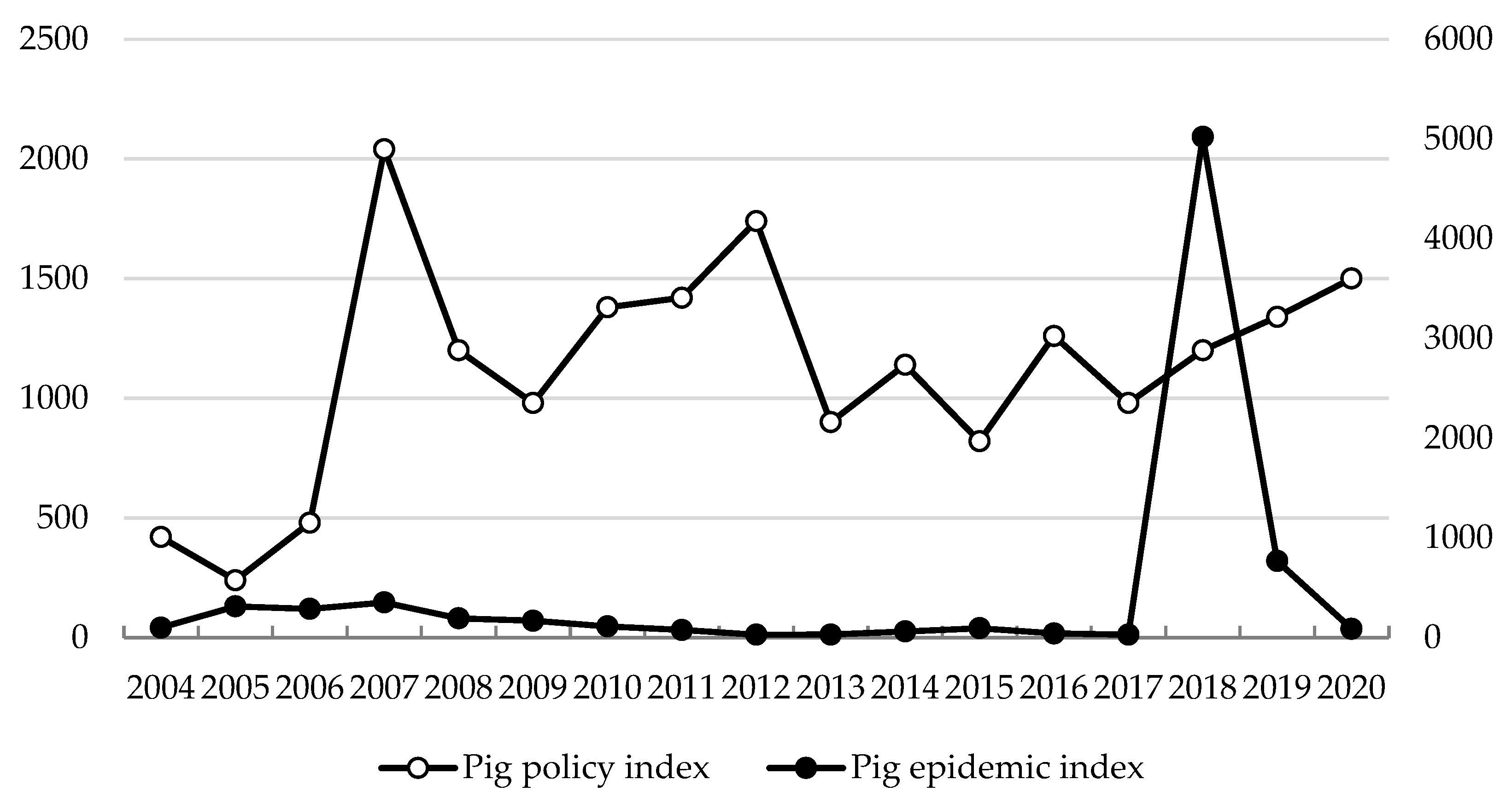

4.5. International trade risks were increasing

4.6. Policy support system needed to be improved

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Data Availability Statement

Conflicts of Interest

References

- Wang, X. Q.; Li, D. F. . Study on the international environment and competitiveness of pig production. Chinese Rural Econ. 1998, 8, 48–55. [Google Scholar]

- Tang, L.; Wang, M. L.; Shi, Z. Z. International comparison of total factor productivity of Chinese meat sheep from the perspective of competitive advantage. Issu. Agric. Econ. 2019, 10, 74–88. [Google Scholar]

- Chinese Academy of Agricultural Sciences. China agricultural sector development report 2020. Beijing: China Agricultural Science and Technology Press 2020.

- Yu, M. Comparative advantages and international competitiveness of China’s livestock industry under the WTO framework. Econ. Rev. J. 2002, 3, 31–32. [Google Scholar]

- Xia, X. P.; Li, B. L. Analysis on the international competitiveness of China sheep and goat meat products. J. Int. Trade 2009, 8, 38–44. [Google Scholar]

- Cui, Y.; Mu, Y. Y.; Li, B. L. China’s mutton trade and factors analysis on its international competition power. Issu. Agric. Econ. 2009, 30, 94–99. [Google Scholar]

- Zhang, R. R.; Shen, X. M.; Wang, J. M. Analysis of the international competitiveness of China’s Chicken industry. Chinese Rural Econ. 2010, 7, 28–38+46. [Google Scholar]

- Liao, Y.; Zhou, F. M. An empirical study on the international competitiveness of pork products in China. Int. Econ. Trade Res. 2011, 27, 25–33. [Google Scholar]

- Gao, H. X.; Wang, M. L.; Shi, Z. Z. International competitiveness of China’s pig industry. J. Northwest A&F Univ. (Soc. Sci. Ed.) 2020, 20, 145–152. [Google Scholar]

- Cui, X.; Guo, L. J.; Li, F. Z. Grey correlation analysis of factors influencing for animal husbandry competitiveness in China. Guizhou Agric. Sci. 2015, 43, 124–128. [Google Scholar]

- Chen, H. P.; Zhang, Y. R.; Huang, B. K. An empirical study on factors affecting herbivorous animal husbandry competitiveness based on co-integration analysis: taking Gansu province as a case. J. Agric. Sci. Technol. 2016, 18, 192–199. [Google Scholar]

- Ma, X. P.; Wang, M. L. Competitiveness of China’s layer industry and its international comparison: based on perspective of industrial development. Agric. Econ. Manag. 2021, 6, 94–106. [Google Scholar]

- Liu, C. Y.; Wang, J. M.; Wang, Z. L.; Pei, L.; Xin, X. F. Research on the evaluation of international competitiveness of china’s hog industrycomparative analysis based on the perspective of trade and industrial development. Chinese J. Agric. Resour. Reg. Plan. 2022, 43, 29–39. [Google Scholar]

- Zhang, Z. H.; Ji, Y. F.; He, Z. J. Evolution in the spatio-temporal pattern on animal husbandry green development competitiveness in China. J. Agric. Sci. Technol. 2022, 24, 12–23. [Google Scholar]

- Zhang, W. B. International competitiveness of China’s dairy industry: an analysis based on RCA and diamond model. Issu. Agric. Econ. 2005, 11, 38–42. [Google Scholar]

- Yin, Z. Y.; Wang, K.; Felipe, I. de. International competitiveness and influencing factors analysis of Chinese pig breeding industry: based on the industrial chain perspective and the diamond model. J. Hunan Agric. Univ. (Soc. Sci. Ed.) 2016, 17, 26–33. [Google Scholar]

- Wang, B. B.; Xiao, H. F. Regional analysis on structure and competitiveness of China’s animal husbandry: based on shift-share analysis space model. Chinese J. Agric. Resour. Reg. Plan., 2021, 42, 142–148. [Google Scholar]

- Xu, S.; Yan, F. Z. A comparative analysis of pork’s international competitiveness in China. Res. Agric. Mod. 2011, 32, 518–522. [Google Scholar]

- Zhang, Z.; Qiao, J. An empirical analysis on international competitiveness of China’s pork products. J. Int. Trade 2011, 7, 39–48. [Google Scholar]

- Xie, J. W.; Du, H. M. Empirical analysis on the lnfluencing factors for the international competitiveness of live pias in Hunan. Econ. Geogr. 2012, 32, 140–144. [Google Scholar]

- Yu, F. W.; Huang, X.; Wang, G. L. High-quality development of animal husbandry: theoretical lnterpretation and realization path. China Rural Econ. 2021, 4, 85–99. [Google Scholar]

- Wang, M. L.; Li, P. C.; Ma, X. P. The influence of scale structure adiustment on the hich-guality development of animal husbandry and its path optimization: an analysis from the perspective of pig breeding scale. China Rural Econ. 2022, 3, 12–35. [Google Scholar]

- Hu, H.; Jiang, G. H.; Ge, Y. High-auality development of chinese pig breeding industry: realistic needs connotation features and path selection. Issu. Agric. Econ. 2022, 12, 32–44. [Google Scholar]

- Wang, J. N.; Xu, Z. C.; Yang, J. Scale development model of animal husbandry in China: from an environmental preservation point of view. Issu. Agric. Econ. 2012, 8, 13–18. [Google Scholar]

- Chen, W. S.; Guan, L.; Huang, R. L.; Zhang, M. J.; Liu, H. N.; Hu, Y. L.; Yin, Y. L. Sustainable development of animal husbandry in China. Bull. Chinese Acad. Sci. 2019, 34, 135–144. [Google Scholar]

- Xiong, X. Z.; Yang, C.; Ma, X. P. Situation of China’s animal husbandry development and high-quality development strategy selection. J. Agric. Sci. Technol. 2022, 24, 1–10. [Google Scholar]

- Wang, M. L. China’s livestock industry development:achievements, experiences and future trends. Issu. Agric. Econ. 2018, 8, 60–70. [Google Scholar]

- Li, Y. The wind is strong broad prospects: review and prospect of animal husbandry machinery market. Contemp. Agric. Mach. 2022, 2, 30–31. [Google Scholar]

- Zhang, H. G. Animal husbandry machinery: will it rebound after the big fall. Agric. Mach. Mark. 2022, 6, 18–21. [Google Scholar]

- Hu, X. D.; Wang, M. L. The causes and enlightenments of U.S. hog production and price fluctuation. Issu. Agric. Econ. 2013, 9, 98–109+112. [Google Scholar]

- Hu, X. D.; Shi, Z. Z.; Zhang, H. C. China’s hog market regulation and control policy: historical evolution and future choices. Issu. Agric. Econ. 2022, 4, 4–14. [Google Scholar]

- Shi, Z. Z.; Hu, X. D. Epidemic shock, policy regulation, and China’s hog market price volatility. Res. Agric. Mod. 2023, 44, 130–141. [Google Scholar]

- Shi, Z. Z.; Hu, X. D. Analysis of supply and demand and its policy effects in China’s hog market. J. Huazhong Agric. Univ. (Soc. Sci. Ed.) 2022, 4, 104–115. [Google Scholar]

| Indicators | Unit | Calculation method | |

|---|---|---|---|

| Supply security | Global share | % | Domestic livestock production/Global livestock production |

| Per capita possession | kg | Livestock production/Total population | |

| Self-sufficiency rate | % | Livestock domestic production/(Domestic production + Net imports) | |

| Scientific and technological support | Slaughter rate | % | Slaughter/Inventory |

| Carcass weight (yield) | kg/head | Livestock production/Slaughter (livestock production/Inventory) | |

| Agricultural labor productivity | USD/person | Value added in agriculture/Employment in agriculture | |

| Industrial resilience | Comparative benefits | - | Producer price of livestock products/Producer price of feed grain |

| Resource carrying capacity | Head/ha | Livestock inventory/Agricultural land | |

| Feed grain self-sufficiency rate | % | Domestic production of feed grain/(Domestic production + Net imports) | |

| International trade | International market share | % | Domestic exports of livestock products/World exports of livestock products |

| Trade competitiveness index | - | (Exports of livestock products - Imports of livestock products)/(Exports of livestock products + Imports of livestock products) | |

| Revealed comparative advantage index | - | (Domestic exports of livestock products/World exports of livestock products)/(Domestic exports of agricultural products/World exports of agricultural products) | |

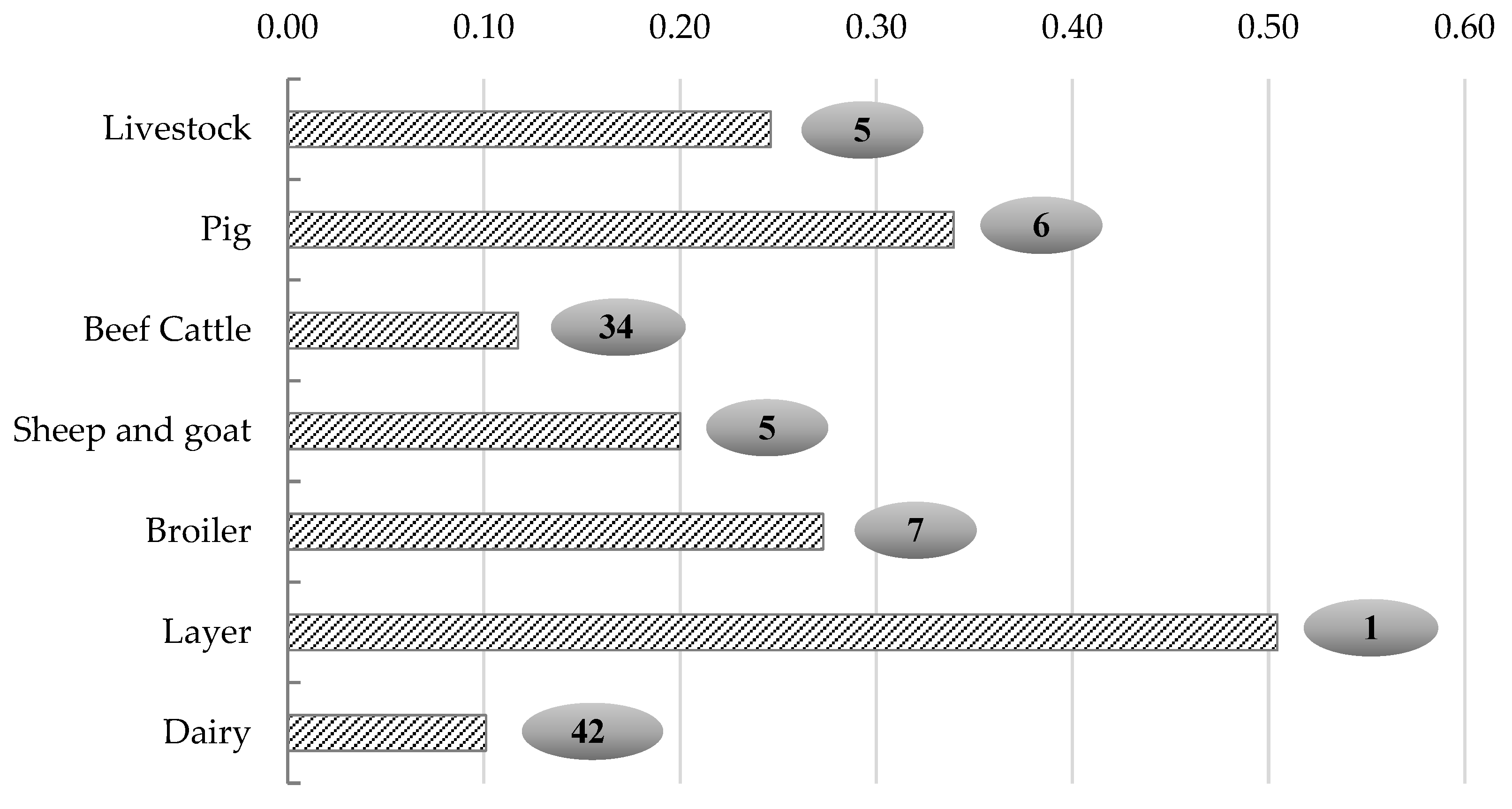

| Livestock | Pig | Beef cattle | Sheep and goat | Broiler | Layer | Dairy | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Country | Index | Country | Index | Country | Index | Country | Index | Country | Index | Country | Index | Country | Index |

| United States | 0.4521 | Spain | 0.6049 | United States | 0.4727 | New Zealand | 0.7489 | Brazil | 0.6646 | China | 0.5045 | New Zealand | 0.7619 |

| Brazil | 0.3556 | United States | 0.4431 | Brazil | 0.4703 | Australia | 0.5163 | United States | 0.5592 | United States | 0.4680 | United States | 0.3678 |

| New Zealand | 0.3439 | Netherlands | 0.4175 | Uruguay | 0.4320 | Ethiopia | 0.2048 | Poland | 0.4271 | Turkey | 0.4088 | India | 0.3210 |

| Netherlands | 0.2635 | Germany | 0.3964 | Australia | 0.4031 | Uruguay | 0.2002 | Hungary | 0.3137 | Panama | 0.2841 | Netherlands | 0.2938 |

| China | 0.2462 | Canada | 0.3430 | New Zealand | 0.3694 | China | 0.2002 | Belarus | 0.2998 | Malaysia | 0.2720 | Ireland | 0.2926 |

| Belarus | 0.2438 | China | 0.3396 | Paraguay | 0.3136 | Kenya | 0.1689 | Netherlands | 0.2983 | Belarus | 0.2479 | Belarus | 0.2901 |

| Poland | 0.2338 | Belgium | 0.3331 | Ireland | 0.3096 | North Macedonia | 0.1686 | China | 0.2730 | Germany | 0.2475 | Germany | 0.2653 |

| Argentina | 0.2138 | Brazil | 0.2758 | Argentina | 0.3011 | Pakistan | 0.1633 | Brunei | 0.2678 | Japan | 0.2412 | Luxembourg | 0.2356 |

| Australia | 0.2075 | Austria | 0.2463 | Nicaragua | 0.2764 | India | 0.1495 | Turkey | 0.2647 | India | 0.2239 | France | 0.2342 |

| India | 0.1969 | Ireland | 0.2202 | Canada | 0.2341 | Moldova | 0.1429 | Ukraine | 0.2575 | Portugal | 0.2164 | Argentina | 0.2223 |

| Germany | 0.1863 | Hungary | 0.2143 | Brunei | 0.2139 | Spain | 0.1398 | Argentina | 0.2551 | Ukraine | 0.1929 | Uruguay | 0.2119 |

| Canada | 0.1855 | Italy | 0.2087 | Netherlands | 0.2057 | Kazakhstan | 0.1377 | Thailand | 0.2439 | Brazil | 0.1833 | Belgium | 0.2102 |

| Turkey | 0.1855 | Chile | 0.1921 | Poland | 0.2047 | Greece | 0.1373 | Chile | 0.2236 | Brunei | 0.1832 | Poland | 0.2008 |

| Hungary | 0.1769 | France | 0.1913 | Belarus | 0.2028 | Kyrgyzstan | 0.1361 | Australia | 0.2057 | Argentina | 0.1829 | Australia | 0.1931 |

| Ukraine | 0.1690 | Russia | 0.1866 | Mexico | 0.1890 | Serbia | 0.1344 | New Zealand | 0.1901 | Morocco | 0.1825 | Czech Republic | 0.1855 |

| Spain | 0.1667 | Poland | 0.1851 | India | 0.1798 | Myanmar | 0.1290 | Russia | 0.1857 | Fiji | 0.1774 | Turkey | 0.1805 |

| France | 0.1608 | Belarus | 0.1591 | Pakistan | 0.1769 | Armenia | 0.1290 | Slovenia | 0.1852 | Thailand | 0.1744 | Kyrgyzstan | 0.1699 |

| Uruguay | 0.1602 | Korea | 0.1562 | Namibia | 0.1660 | Georgia | 0.1278 | France | 0.1612 | Pakistan | 0.1627 | Saudi Arabia | 0.1659 |

| Ireland | 0.1562 | Thailand | 0.1465 | Bolivia | 0.1535 | Argentina | 0.1182 | India | 0.1554 | Barbados | 0.1616 | Austria | 0.1649 |

| Paraguay | 0.1521 | Fiji | 0.1389 | South Africa | 0.1530 | South Africa | 0.1181 | Israel | 0.1516 | Bosnia and Herzegovina | 0.1512 | Slovenia | 0.1633 |

| Country | Livestock | Pig | Beef cattle | Sheep and goat | Broiler | Layer | Dairy |

|---|---|---|---|---|---|---|---|

| Australia | 0.2075 | 0.0863 | 0.4031 | 0.5163 | 0.2057 | 0.1118 | 0.1931 |

| Brazil | 0.3556 | 0.2758 | 0.4703 | 0.0339 | 0.6646 | 0.1833 | 0.1199 |

| Germany | 0.1863 | 0.3964 | 0.1264 | 0.0480 | - | 0.2475 | 0.2653 |

| Russia | 0.1443 | 0.1866 | 0.0837 | 0.0575 | 0.1857 | 0.1271 | 0.1206 |

| France | 0.1608 | 0.1913 | 0.1455 | 0.0926 | 0.1612 | - | 0.2342 |

| Korea | 0.0957 | 0.1562 | 0.0651 | 0.0198 | 0.0870 | 0.1152 | 0.0786 |

| Canada | 0.1855 | 0.3430 | 0.2341 | 0.0402 | 0.1387 | 0.1484 | 0.1302 |

| United States | 0.4521 | 0.4431 | 0.4727 | 0.0368 | 0.5592 | 0.4680 | 0.3678 |

| Japan | 0.1022 | 0.0714 | 0.0974 | 0.0210 | 0.0834 | 0.2412 | 0.0906 |

| New Zealand | 0.3439 | 0.0589 | 0.3694 | 0.7489 | 0.1901 | 0.1461 | 0.7619 |

| India | 0.1969 | 0.0964 | 0.1798 | 0.1495 | 0.1554 | 0.2239 | 0.3210 |

| China | 0.2462 | 0.3396 | 0.1174 | 0.2002 | 0.2730 | 0.5045 | 0.1011 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).