1. Introduction

Currently, artificial intelligence (AI), machine learning (ML), and process digitization are fundamental elements of daily life. This trend began in the 1990s with the global expansion of the Internet [

1] and notably intensified during the COVID-19 pandemic [

2]. Simultaneously, the increase in the use of online credit has generated large volumes of data [

3], leading the financial industry to the imperative need to develop advanced technological tools for risk prediction and effective uncertainty management [

4], that include exogenous variables in the process [

5,

6]. Presently, scoring models and machine learning techniques are common for risk prediction, applying innovations based on exhaustive data analysis, Data-Driven Innovation (DDI) [

7], and the BIG DATA concept [

8,

9].

In the context of rising demand, credit risk levels show a significant increase [

10,

11]. Despite the growing integration of Data-Driven Insights (DDI) and ML in the financial sector, substantial challenges persist, leaving numerous applications unexplored [

12,

13,

14,

15]. The application of ML techniques during unpredictable events, such as the 2008 housing crisis [

2,

16], the COVID-19 pandemic [

17], and the impacts of climate change [

18], have exposed critical limitations in risk assessment methodologies and revealed considerable uncertainties in their outputs [

2,

19,

20,

21]. These challenges underscore the need to examine the influence of external factors (EF) on the accuracy and robustness of ML models in credit risk evaluation [

7,

22], particularly concerning the inclusion of sequential or time-series data, which are commonly encountered in credit risk scenarios [

23]. Moreover, these issues emphasize the need to ensure explainability in ML-driven predictions [

24], both to facilitate informed decision-making by stakeholders and to maintain transparency for all parties involved [

25].

The main objective of this article is to address the integration of variables sensitive to external risk factors into machine learning models for credit risk assessment, a critical yet insufficiently explored topic in the academic context. Peru, as a case study, represents a particularly relevant scenario: it was the country with the highest COVID-19 death rate per 100,000 inhabitants during the pandemic [

26], it faced the periodic and devastating effects of the El Niño phenomenon [

18], and it experienced intense social unrest following the attempted coup in December 2022 [

27]. These events have directly impacted the microcredit market by targeting small businesses, a sector highly vulnerable to risk volatility [

18].

Although related economic analyses exist, a significant gap persists in academic research on the impact of EF on credit risk assessment, particularly within the Peruvian context. This study aims to address this gap by, offering valuable insights into its potential applicability and extrapolation to other emerging economies [

18]. To this end, EF-related variables are integrated into credit risk models through causality and stationarity tests [

28]. These variables are derived from public time series data and combined with proprietary data from a financial institution, referred to in this study as the ’financial model’ (FMOD). This innovative strategy not only enhances the predictive power of ML models but also establishes a replicable methodology for integrating diverse EF indicators into future risk prediction studies.

The FMOD dataset plays a pivotal role in this study. It incorporates a unique variable that identifies loans supported by government intervention during periods influenced by EF, such as climate change, social unrest, and the COVID-19 pandemic. This variable allows for the detection and detailed analysis of the potential biases introduced by mitigation programs designed to address economic disruptions. By explicitly accounting for these interventions, the FMOD dataset provides a nuanced understanding of how state-led programs shape credit risk dynamics and borrower behavior under varying external conditions.

Moreover, the FMOD dataset includes monthly updated records of delinquency days, enabling granular analysis across distinct periods. This temporal precision facilitates an in-depth exploration of the interplay between EF and default patterns, thus enhancing the methodological rigor of credit risk assessment. By integrating time-series data with real-world financial indicators, the FMOD dataset offers a robust and replicable framework for evaluating the influence of EF and government programs on financial stability and credit behavior in emerging markets.

Finally, this study evaluated the impact of EF on the predictive accuracy and explainability of ML models. Particular attention is paid to identifying the most influential factors when incorporating external variables into predictive frameworks. By addressing these challenges, this research not only fills a critical gap in the existing literature but also advances the understanding of EF’s effects on credit risk in emerging economies. This contributes actionable insights for policymakers and financial institutions aiming to enhance resilience in volatile economic environments.

2. Related WORK

This article aligns its focus with the research questions outlined in

Table 1, centering on the interplay between external factors and credit risk assessment. Particular emphasis is placed on the importance of explainability in ML-driven models, as understanding how EF impacts credit risk is critical for decision-making and actionable insights.

Credit risk, an inherent component of financial activities, emerges when there is delinquency in fulfilling credit obligations, because of the inability or lack of intention to pay [

29]. This study, focuses on the former, as it is strongly influenced by demographic variables such as economic activity and household income [

29], which can be significantly affected by external factors [

11]. Ensuring the explainability of these relationships is critical for building trust and providing actionable insights for policymakers, financial institutions, and affected stakeholders.

The external factors considered in this study include:

COVID-19 Pandemic: This global crisis posed an unprecedented challenge to financial stability, leading to increased credit risk and non-compliance with financial obligations [

30]. Its economic impacts, propagated through supply chains, disrupted payment systems and affected household finances [

31,

32].

Climatic Factors: Climate-related events such as droughts, floods, and landslides introduce significant risks to financial stability, increasing default rates and credit risk [

18]. Additionally, extreme weather events increase the cost of essential goods, forcing households to prioritize basic needs over loan repayments.

Social Unrest: Episodes of civil unrest negatively impact financial markets and increase household indebtedness, particularly among low-income groups, exacerbating delinquency risks [

30,

33].

To explore these relationships, a study focusing on Peru from January 2020 to September 2023 was conducted. The analysis was based on a comprehensive dataset comprising over 8.2 million records, as summarized in

Table 2. This dataset integrates diverse EF, such as COVID-19 positive cases and deaths, road blockages, and temperature anomalies, along with financial delinquency and credit activity data, ensuring a multifaceted approach to understanding credit risk dynamics under external influences.

The datasets were selected based on their ability to capture the intensity and variability of EF during the study period.

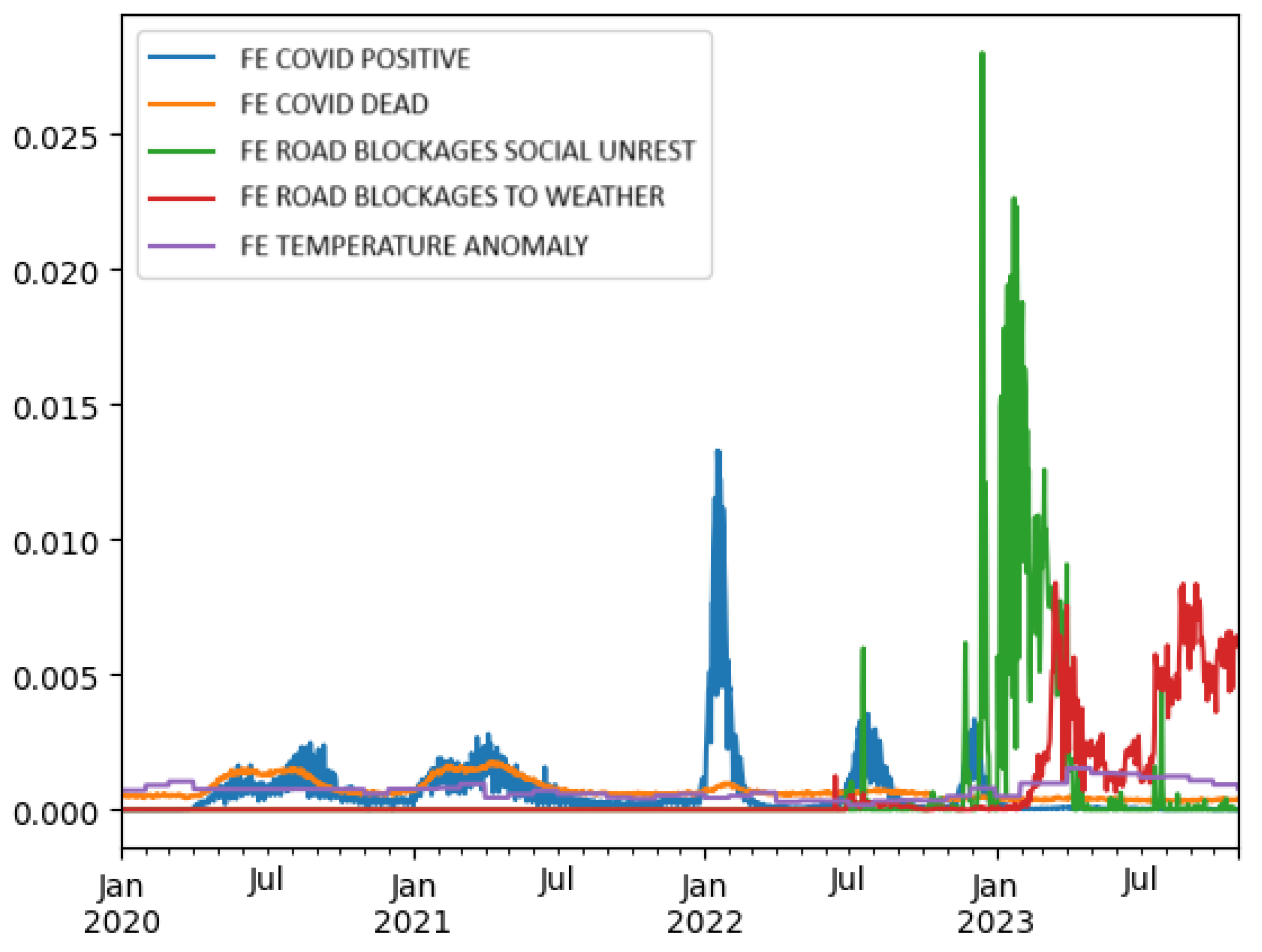

Figure 1 illustrates normalized time series, providing a uniform representation of the external events.

Figure 1 illustrates the trends of various external factors, including COVID-19 cases (positive and dead), social unrest, road blockages due to social unrest and weather, and temperature anomalies. Peaks in certain factors, such as COVID-19 cases and social unrest, were clearly visible during specific periods, indicating their significant occurrence and potential impact on other events or systems.

The analysis prioritizes the explainability of the results, ensuring that insights derived from machine learning models are interpretable and actionable. By integrating datasets on COVID-19 cases and deaths, climatic factors such as temperature anomalies and road blockages, and social unrest metrics, this study aimed to understand how EF influences delinquency behavior and credit risk.

This approach not only evaluates the predictive accuracy of machine learning models but also examines their capacity to provide transparent explanations for the relationships uncovered, ensuring their practical relevance for decision-making in volatile and complex environments.

3. The Proposed Model

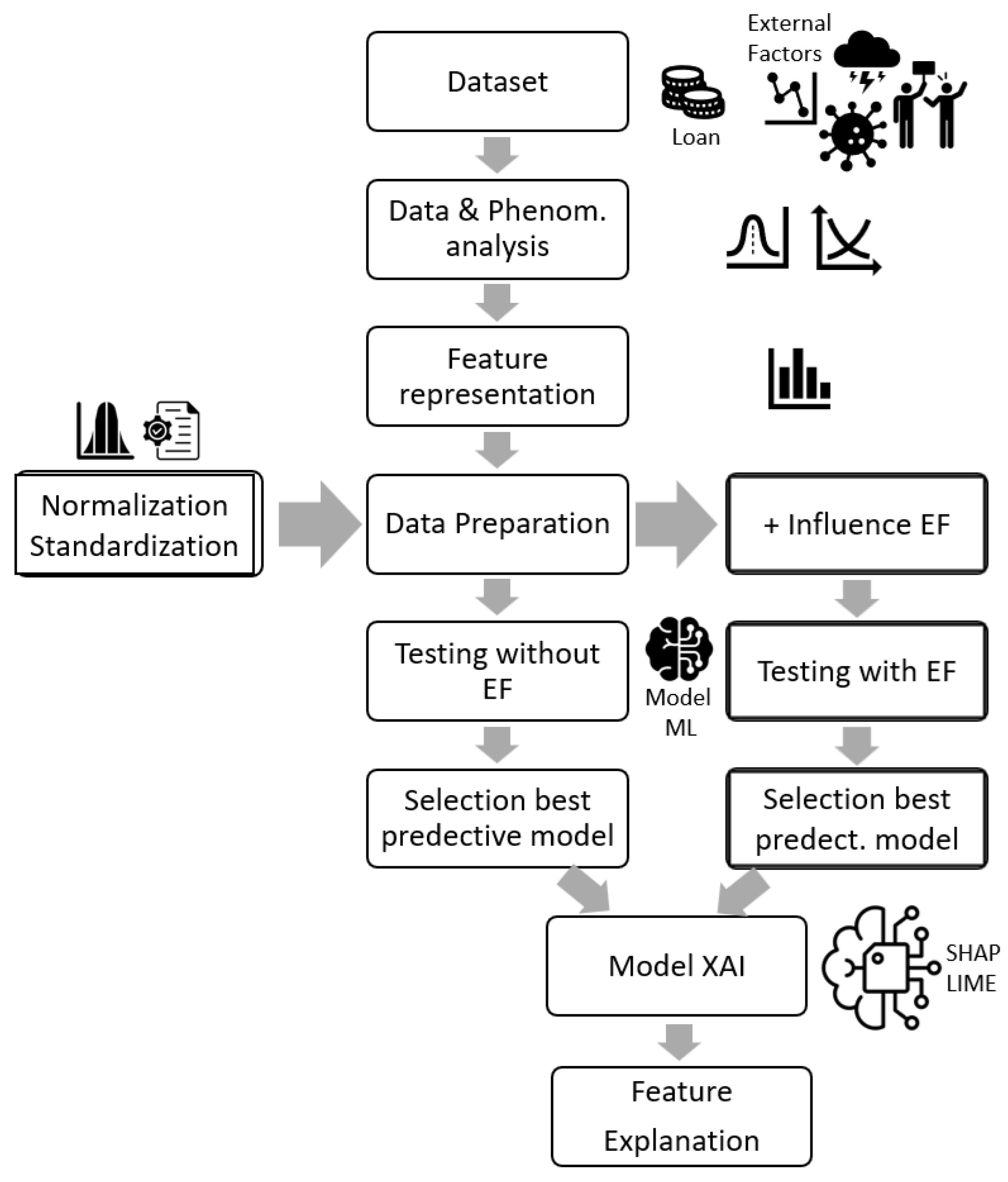

To evaluate the influence of EF on credit risk, we propose an adapted version of the

Cross-Industry Standard Process for Data Mining (CRISP-DM). This approach was designed to systematically incorporate EF into ML workflows, ensuring both practical applicability and theoretical rigor, as illustrated in

Figure 2. This model has been successfully applied in previous studies to analyze EF during crises [

34,

35].

Figure 2 illustrates a modified CRISP-DM (Cross-Industry Standard Process for Data Mining) framework tailored for analyzing external factors (EF). It outlines the sequential steps, including dataset analysis, feature representation, data preparation (with normalization standardization), testing with and without external factors, selecting predictive models, and applying explainable AI (XAI) tools such as SHAP and LIME for feature explanation.

3.1. Workflow Description

- 1.

Dataset Definition and Feature Selection: The process begins by determining the relevant datasets and conducting a comprehensive analysis of the phenomena to be evaluated (EF in this study). Feature selection was guided by established methodologies [

36], identifying attributes with high relevance to credit risk prediction, including both internal (e.g., loan characteristics) and external (e.g., EF) variables. The selected features were refined using feature importance techniques, such as Recursive Feature Elimination (RFE) and Mutual Information (MI), ensuring that only the most significant predictors were retained.

- 2.

Data Preparation: Preprocessing involved standardizing and normalizing the dataset (using sum normalization) to homogenize the data scales. Additionally, missing data were handled using multiple imputation techniques to maintain dataset integrity [

36].

- 3.

-

Integration of External Factors: To evaluate the impact of EF on credit risk prediction, additional variables corresponding to EF (e.g., COVID-19, temperature anomalies, social unrest) were incorporated into the dataset. These variables were derived from time-series analyses and causal relationships, validated through statistical methods such as the Dickey-Fuller test and the Granger causality test [

37].

The

Dickey-Fuller test was employed to verify the stationarity of the time series data, ensuring that relationships between variables were not spurious and that the models yielded reliable results [

37]. The stationarity of time series is critical, particularly when external factors such as COVID-19 cases, mortality rates, and roadblocks caused by weather events influence the temporal dynamics. The test is described mathematically as:

where:

: First difference in time series ().

: A constant.

: A trend term.

: Lagged value of the time series.

: Coefficients of lagged differences.

: The error term.

p: The number of lags.

Following the confirmation of stationarity, the

Granger causality test was applied to evaluate the causal influence of these external factors on economic activities. The test, widely used in econometric studies, is defined as:

where:

: Lagged values of series .

, , and : The coefficients.

: The error term.

Lag variables were calculated to capture delayed effects, with lag periods tailored to each EF (e.g., quarterly for temperature anomalies, monthly for social unrest and COVID-19). These statistical methods ensured rigorous validation of the causal relationship between EF and economic activities that influence credit defaults.

- 4.

ML Model Training and Hyperparameter Tuning: Advanced ML models (e.g., CNN, XGB, XNN, and EBM) were trained on datasets both with and without EF to assess their predictive contributions. Hyperparameter tuning was conducted using grid search and Bayesian optimization to enhance the model performance. To address the class imbalance in the dataset, techniques such as

Synthetic Minority Oversampling Technique (SMOTE) [

38] and class-weighted loss functions were employed [

39,

40].

- 5.

Evaluation and Explainability (XAI): Models were evaluated using metrics such as

Accuracy (ACC) and

Area Under the Curve (AUC) across multiple folds (10-fold cross-validation). To enhance interpretability, post-hoc explainability techniques such as

SHapley Additive Explanations (SHAP) and

Local Interpretable Model-Agnostic Explanations (LIME) were applied [

41] . These methods highlight the most influential features in predicting credit delinquency both before and after incorporating EF [

25].

- 6.

Comparison of Scenarios: The workflow was executed in parallel for scenarios excluding EF and those incorporating EF. This allowed for a direct comparison of the model performance and the added value of EF inclusion.

3.2. Key Enhancements in the Current Study

The integration of explainability methods (SHAP and LIME) provides actionable insights for decision-makers in financial institutions.

Comprehensive feature selection processes ensuring only the most predictive attributes were retained.

Rigorous hyperparameter optimization to maximize model performance and robustness.

By employing this adapted CRISP-DM workflow, this study contributes a systematic and replicable methodology for evaluating EF in credit risk contexts, particularly during crises.

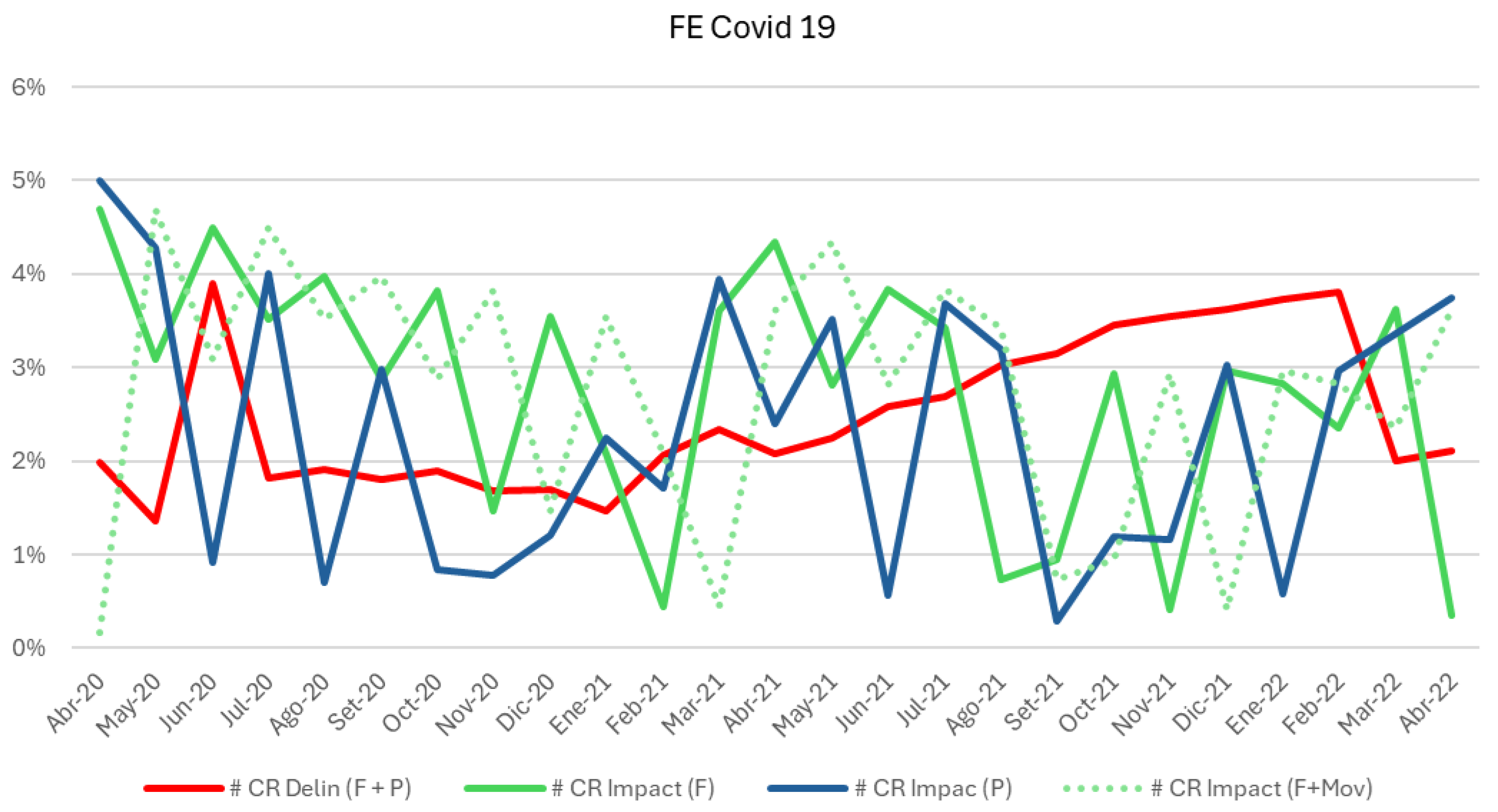

Figure 3 depicts the impact of COVID-19 on economic activities by comparing delinquency rates with the economic impacts over time. The graph highlights fluctuations in economic impact trends, particularly during pandemic peaks, and distinguishes patterns between financial and personal impacts (F+P) and movement-related impacts (CR Impact F+Mov).

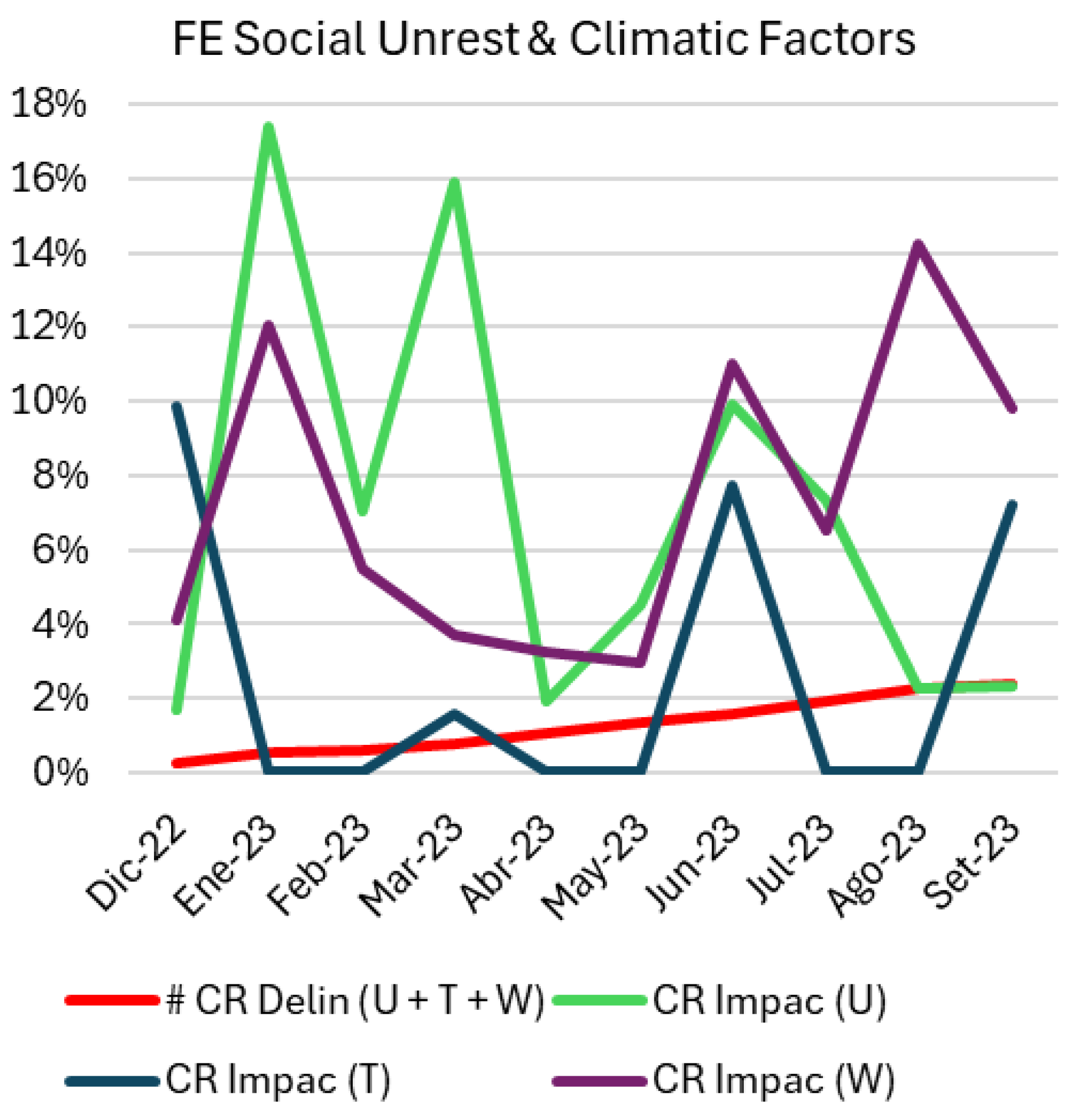

Figure 4 illustrates the impact of social unrest and climatic factors on economic activity from December 2022 to September 2023. It compares delinquency rates with the economic impact of social unrest, weather, and temperature anomalies, and shows significant spikes during periods of intensified external disruptions.

4. Research Strategy

The evaluation period for this study was defined based on the behavior of the monthly classification variables, starting from the onset of the impact of EF until stabilization, as shown in

Figure 3 and

Figure 4. Stabilization was defined as the point at which the slope of the curve representing the proportion of bad payers (red line) began to level off.

Evaluation Periods

-

COVID-19: The evaluation period spans March 2020 to January 2022. Loans disbursed until October 2021 were included to account for a 60-day grace period before delinquencies appeared, ensuring unbiased results (

Figure 3).

During the analysis of the COVID-19 external factors, it was identified that the trends in the number of positive cases and deaths often showed opposing behaviors. To address this, an additional experiment was conducted in which the death curve was shifted from one period to the right, referred to as the COVID MOV. This adjustment considered the estimated incubation period of the disease and the time to potential fatality, typically ranging from 2 to 3 weeks. By aligning the death data with this temporal delay, this analysis aimed to capture the causal relationship between disease progression and its impact on credit delinquency rates. This methodological adjustment is illustrated in

Figure 3 (green dotted line).

Social Unrest and Climate Factors: Data from December 2022 to September 2023 were analyzed, with loans disbursed up to June 2023 considered under the same grace period logic (

Figure 4).

Data Preprocessing

Machine Learning Models We implemented the following models to evaluate the binary classification tasks, prioritizing interpretability and predictive performance:

Each model was trained and validated using a 10-fold cross-validation split (60% training, 20% validation, 20% testing) [

50]. Hyperparameter tuning was conducted using grid search and Bayesian optimization to ensure optimal performance across all configurations.

Explainability with XAI To address concerns about interpretability, SHAP and LIME were applied to identify the most influential features in predicting credit delinquency both before and after incorporating EF. Models such as XNN and EBM provided native interpretability, complementing these post-hoc methods.

Statistical Evaluation The impact of EF on model performance was assessed using

Student’s t-test (Equation

3), applied to metrics such as ACC and Area AUC from the cross-validation folds, with a significance level of

[

51].

where:

: Mean of metrics from ten folds.

: Hypothetical mean under the null scenario.

s: Standard deviation of metrics.

n: Number of folds ().

Economic Activity Relevance

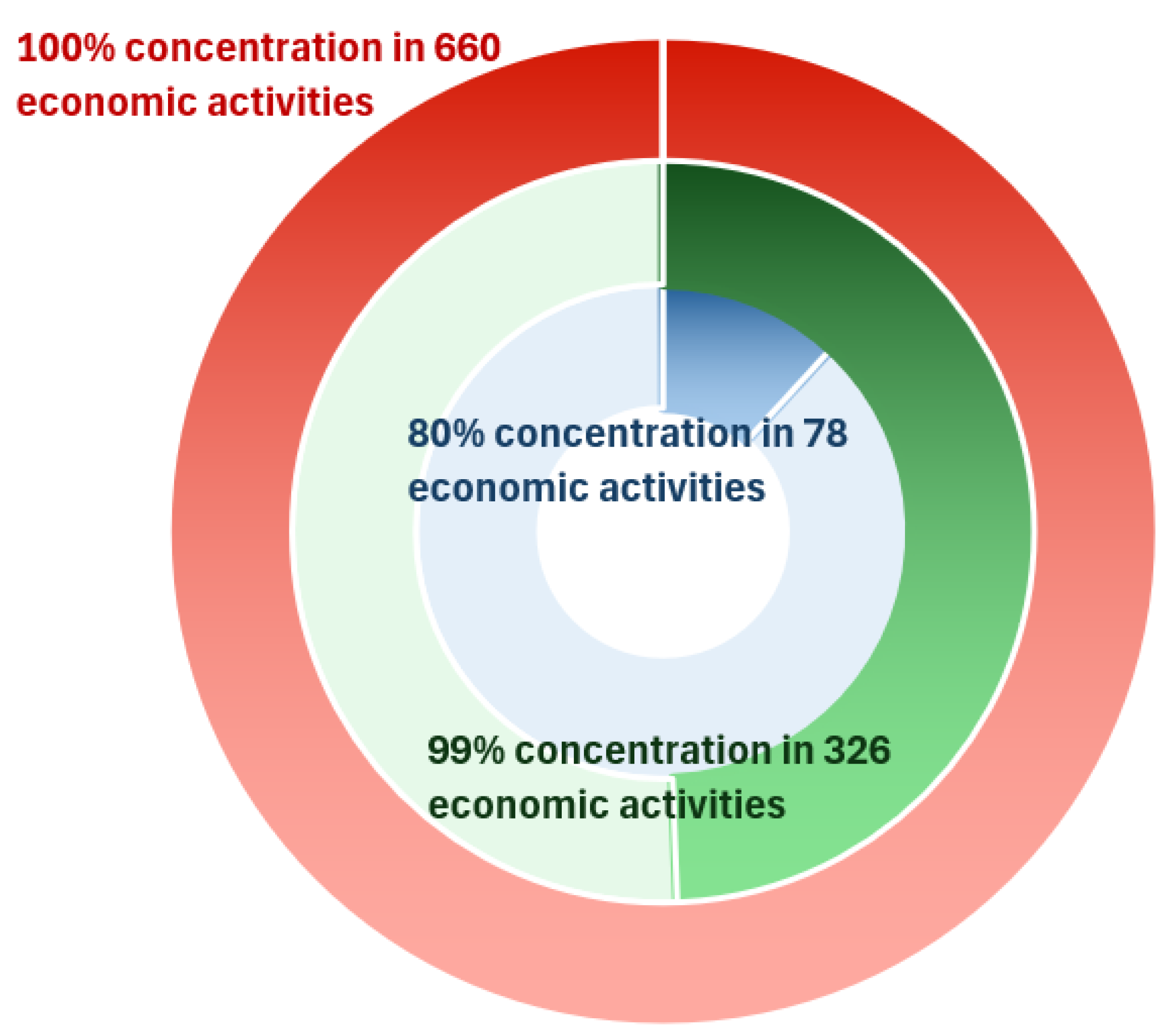

The dataset, comprising 367,000 loans (see

Table 2), was analyzed based on its concentration across economic activities. This analysis is particularly relevant, as the impact of EF on these activities amplifies exposure to credit risk. The distribution of loans is as follows:

80% Concentration: 80% of the loans are concentrated in 78 economic activities.

99% Concentration: 99% of the loans are concentrated in 326 economic activities.

100% Concentration: 100% of the loans are distributed across 660 economic activities.

Figure 5 illustrates these groupings, highlighting the increased dispersion and noise as the number of activities increases. To ensure a comprehensive analysis, the results were further examined by including and excluding loans affected by government-backed programs, thereby isolating the potential biases introduced by such interventions.

Research Limitations and Biases

While this study provides valuable insights into the influence of EF on credit delinquency predictions, several limitations and potential biases must be considered:

Context-Specific Findings: The analysis is based on data from the Peruvian context, which may limit the generalizability to other regions with different economic, social, and environmental dynamics. Future research should incorporate external validation by using datasets from diverse geographical areas to evaluate the transferability of the proposed methodology.

Training Data Bias: Dataset imbalances and underreporting of delinquency during government interventions may introduce biases. Although SMOTE has been used to address class imbalances, residual biases related to data collection practices or policy impacts may persist.

Model Transparency: While explainability techniques such as SHAP, LIME, and interpretable models (e.g., XNN, EBM) have been employed, the use of black-box models like CNN and XGB remains a challenge. This lack of inherent transparency could hinder their applicability to financial institutions, where explainability is crucial for regulatory compliance and stakeholder trust.

Temporal Assumptions: The assumption that loans disbursed near the evaluation cutoff reflect the grace period impacts may not fully account for the delayed delinquency effects, particularly for loans with extended repayment terms.

Data Quality and Noise: External factor measurements and institutional datasets may contain noise or inaccuracies that could affect model performance, despite preprocessing steps such as normalization and standardization. Future work should explore advanced noise-reduction techniques.

Researcher Influence: Prior domain knowledge and experience can introduce subtle biases in model selection, FE, or preprocessing decisions. To mitigate this, the study adhered to best practices such as k-fold cross-validation, rigorous statistical testing, and methodological transparency.

Despite these limitations, the methodological rigor applied in this study, including robust preprocessing, comprehensive statistical validation, and integration of explainable models, provides a solid foundation for future research. The findings highlight the need for further exploration of EF impacts in broader contexts, paving the way for more robust, interpretable, and generalizable credit risk assessment frameworks.

5. Experiment

To assess the influence of EF on economic activity delinquency, the Dickey-Fuller stationarity test was applied (see Equation

1) to the normalized time series of daily frequency. These series represent the days of delinquency associated with the analyzed economic activities. The data used for this analysis cover the period from January 2016 to September 2023 (see

Table 2). The analysis was performed for both periods influenced by EF and those without EF [

37].

The results indicate that during periods without EF influence, between 90% and 91% of economic activities exhibited non-stationary delinquency, while 7% and 6% showed stationarity. Additionally, 3% of the activities fell into the "indeterminate" category, where stationarity could not be conclusively determined. In periods with EF influence, the proportion of non-stationary activities decreased to 75% and 85%, whereas stationary activities increased to 22% and 6%. The "indeterminate" category also showed slight variations, with 2% and 9% of the activities falling into this group.

The "indeterminate" classification, though a minority, highlights cases where the delinquency patterns are less predictable or fall outside the thresholds for stationarity detection. This suggests that EF may not only influence stationarity directly, but may also introduce complexity in delinquency patterns, making it harder to classify definitively.

These findings are summarized in

Table 3, which provides a detailed breakdown of the stationarity classifications across the different periods of evaluation. The results underscore the dynamic impact of external factors on the stationarity of delinquency days in economic activities, reinforcing the need to account for these factors in economic analyses and credit risk prediction models.

To evaluate the seasonal impact of EF on the default behavior of economic activities, the Granger causality test (see Equation

2) was applied to the time series representing the days of default for each economic activity, in conjunction with the time series of each EF. For simplicity, a binary value of 1 was assigned when the p-value was less than 0.05, indicating statistically significant causality, and 0 otherwise. This binary classification was performed on a monthly basis to effectively capture temporal variations.

The results of this causality analysis were subsequently integrated into the credit dataset and associated with the corresponding economic activity and period under analysis. Additionally, a global binary classification variable was calculated and appended to the dataset to identify the payment quality of credit holders (good or bad payers) based on monthly delinquency data. This enriched dataset provided the foundation for applying algorithm (1) to the established datasets (see

Figure 5) to compute the ACC and AUC metrics for the evaluated machine learning models. These models were assessed across the scenarios listed in

Table 4. Based on the values obtained, the differences between the scenarios that include FE and SFE scenarios were calculated, as shown in

Table 5.

|

Algorithm 1:Dataset Evaluation using ML Algorithms |

EVALUATE

1. Remove the collinear variables (correlation > 90%) 2. Split data: 60% train, 20% validation, 20% test 3. Apply class balancing (SMOTE) 4. Select model: LDA, QDA, Perceptron, MLP, Ridge, RF, XGB, KNN, DL, CNN, XNN, FFN (Standar & Sparse & Local Penalty Regularization), EBM. 5. Train using k-fold cross-validation

6. Compute & store: , , ,

return Mean & for validation & test sets

EVALUATE_ALL_MODELS

1. Iterate over models & feature sets 2. Evaluate on data: 1.D100, 2.D99, 3.D80

return DataFrame with results

EVALUATE_XAI_BEST_MODELS

1. Evaluate SHAP 2. Evaluate LIME return DataFrame with SHAP & LIME results

FEATURES_EXPLANATION

|

The performance metrics (

ACC and

AUC) derived from the application of machine learning models for binary classification of good and bad payers, evaluated across datasets stratified by relevance to established scenarios, are presented in Tables A1, A2, A3, A4, A5, A6, A7, and A8 in the

Appendix A. These tables provide a detailed comparative analysis of the scenarios with and without the inclusion of EF related to COVID-19, social unrest, and climate change.

Additionally, Tables A9, A10, A11, and A12 in the

Appendix A identify the machine learning models that achieved statistically significant improvements in their classification metrics when the EFs were incorporated. These tables delineate the conditions under which specific models demonstrate enhanced predictive capabilities, providing critical insights into the sensitivity and adaptability of various machine learning approaches to external factors.

The comprehensive dataset from these experiments forms a robust foundation for addressing the research questions that underpin this study. Given the extensive volume of information presented, the subsequent discussion focuses on the most significant results, with direct references to the relevant tables to highlight critical findings and their implications for predictive modeling under diverse scenarios.

5.1. RQ1: How Did the COVID-19 Pandemic, Through Factors Such as Positive Cases and Mortality Rates, Influence Credit Defaults in Different Economic Activities?

The experimental analysis, considering both the COVID (direct pandemic variables) and COVID MOV (shifted mortality rates) scenarios, underscores the pivotal role of mortality in shaping credit default patterns. These findings can be summarized into three core observations:

-

Time-Lagged Impact of Mortality vs. Positive Cases

Incorporating a one-period shift in mortality data (COVID MOV) yielded appreciable gains in the model performance (e.g., ACC, AUC) relative to the unshifted setting. This indicates that severe outcomes of the disease, rather than raw infection counts, exert a more substantial and delayed influence on repayment capacity. Consequently, pandemic-driven economic setbacks—particularly staff shortages, mandated closures, and consumer caution—became more pronounced and detectable when aligned with actual fatality data rather than infection surges alone.

-

Influence by Dataset Concentrations (1.D100, 2.D99, 3.D80)

The dataset is partitioned into three concentrations: 1.D100, 2.D99, and 3.D80, reflecting progressively narrower subsets of economic activity:

- -

1.D100 (all economic activities): Broader heterogeneity in default patterns. While mortality data still indicated a heightened risk in face-to-face sectors, the variability was higher across diverse industries.

- -

2.D99 (top 99% of loans): The focus on major segments showed mid-level delinquency spikes tied to mortality. Excluding marginal activities reduced the noise and sharpened the observed mortality effect.

- -

3.D80 (top 80% of loans): Further narrowing accentuated the impact of mortality on default. High-contact activities form a sizeable share; therefore, time-lagged mortality (COVID MOV) led to the strongest gains in AUC and ACC.

While each partition benefited from COVID-related variables, 3.D80 displayed the most robust improvement of 2.D99 retained significant, though moderate, gains, and 1.D100 exhibited a broader variance.

-

Role of Government-Backed Interventions

Under scenarios including government-backed credit (WGB_CR), the pandemic’s immediate effect on defaults was partially offset by such guarantees. However, once these supports were omitted (WOGB_CR), the default rates in the hardest-hit segments (particularly in the 3.D80) increased more sharply, highlighting the essential cushioning effect of policy interventions. Additionally, the synergy between shifted mortality data (COVID MOV) and the presence or absence of government guarantees revealed a narrow window in which policy measures can substantially alleviate—or conversely intensify—delinquency outcomes.

Models with Superior Performance and Statistical Significance.

Based on the experiments and their statistical validations:

CNN consistently achieved top-tier ACC and AUC across 1.D100, 2.D99, and 3.D80, with notable improvements when mortality the data lagged (COVID MOV).

XGB also displayed robust gains in predictive accuracy, especially in 3.D80, which frequently reached statistical significance when external factors were considered.

XNN and

EBM—though less frequently surpassing

CNN or

XGB—demonstrated scenario-specific improvements with external factors. Post-hoc explainability analyses (SHAP, LIME) consistently identify mortality as a primary driver within these interpretable architectures. Furthermore, while the relative importance of certain predictors shifts under the influence of external factors, the variables that remain critical pertain to debt management, income streams, and borrowers’ historical financial behavior (see

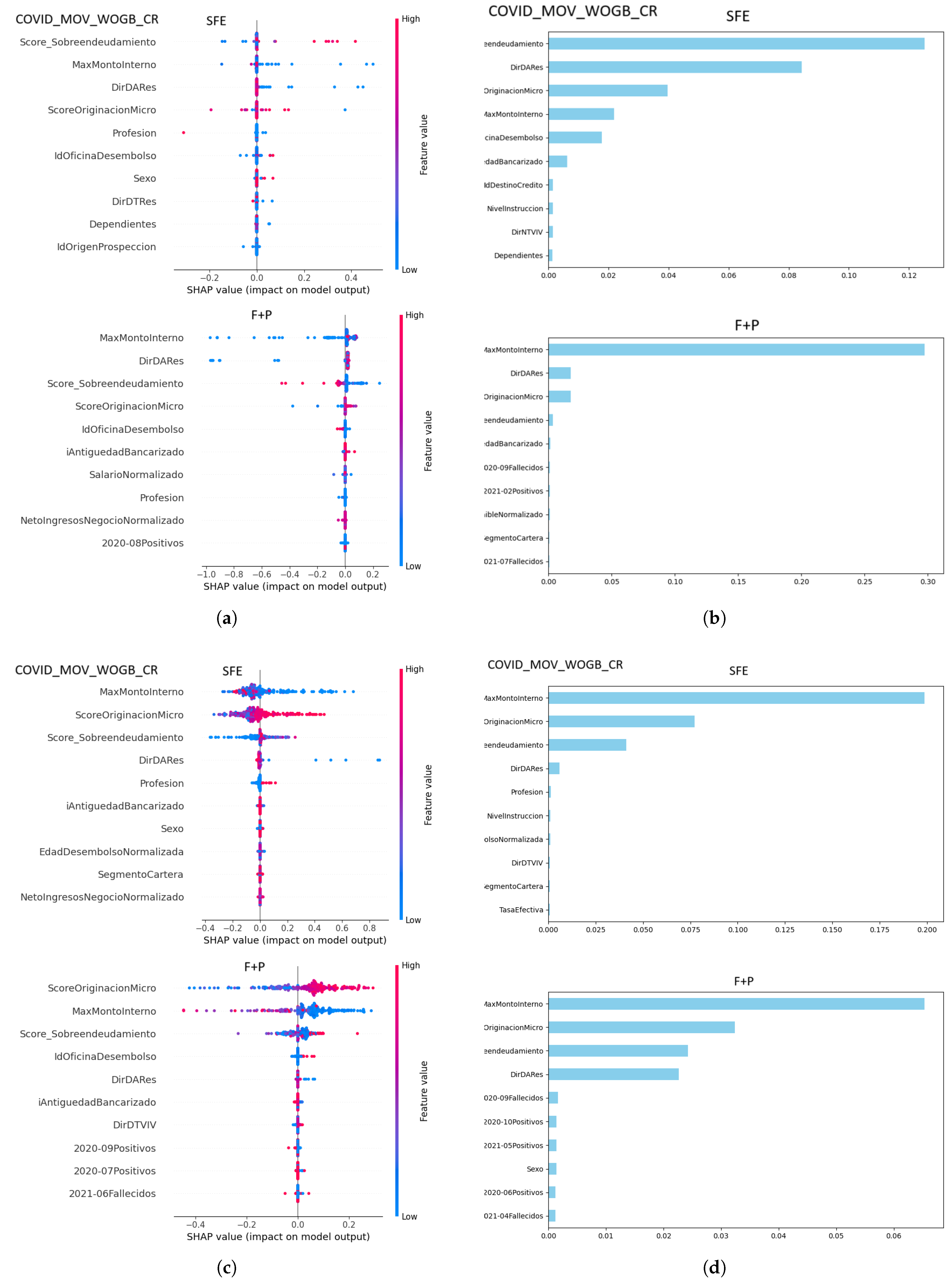

Figure 6).

Figure 6 (

a) presents the top 10 features driving the prediction differences between the SFE and F+P scenarios using LIME for the XNN model. In the SFE scenario, sendudamiento, DirDARes, and OrganizacionMicro were the most influential, with sendudamiento having the greatest impact. In contrast, the F+P scenario was dominated by MaxMontoInterno, followed by DirDARes and OrganizacionMicro, highlighting distinct variations in feature importance across scenarios.

Figure 6 (

b) illustrates the SHAP analysis of the CNN model. It compares the top 10 influential features for two scenarios: SFE (possibly "standard feature evaluation") and F+P (potentially representing an alternate configuration or scenario). The SHAP values highlight the impact of each feature on the model outputs, with red representing high feature values and blue representing low feature values.

Figure 6 (

c) illustrates the SHAP analysis of the CNN model. It compares the top 10 influential features for two scenarios: SFE (possibly "standard feature evaluation") and F+P (potentially representing an alternate configuration or scenario). The SHAP values highlight the impact of each feature on the model outputs, with red representing high feature values and blue representing low feature values.

Figure 6 (

d) highlights the top 10 contributing characteristics for the SFE (Standalone Financial Entities) and F+P (Combined Financial and Personal) scenarios using LIME CNN analysis. In the SFE scenario, features like "Monto Interno" and "Origen Ingreso Micro" are most influential, while the F+P scenario includes similar features along with COVID-19-related factors, emphasizing their significance in personal impact contexts.

In summary, evidence from both COVID and COVID MOV experiments confirm that:

Mortality rates, especially when time-shifted, exert a stronger predictive influence on default than raw case counts, most notably in the 3.D80, where high-contact activity predominated.

Government-backed credits play a decisive buffering role in mitigating pandemic-driven defaults.

CNN and XGB consistently ranked as top-performing models across data partitions, with XNN and EBM achieving noteworthy gains under specific EF scenarios.

From a methodological standpoint, incorporating lag-adjusted mortality data (COVID MOV) significantly enhanced the accuracy and robustness of the model. Strategically, these findings advocate nuanced, time-sensitive interventions targeting the most susceptible segments (particularly high-contact activities in the 3.D80), while reinforcing the protective effect of government guarantees on systemic credit risk.

5.2. RQ2: To What Extent do Climate Change Indicators, Such as Temperature Anomalies and Road Blockages Due to Weather, Impact Credit Delinquency Patterns?

The AUC and ACC results in Tables A5–A6 (government-backed credits, WGB_CR) and Tables A7–A8 (no government guarantees, WOGB_CR), along with their corresponding significance matrices (Tables A11–A12), clarify the influence of climate-related factors (T, W) on credit delinquency:

- 1.

-

Government-Backed Credits (WGB_CR): Moderate but Consistent Improvements

When climate indicators (e.g., temperature anomalies and road blockages) are incorporated into datasets with government-backed loans, we observe statistically significant gains (Y) for models such as xgb, cnn, and rf.

XGB stands out for achieving significance in virtually all scenarios (T, T+W, U+T+W), highlighting its strong adaptability to climate-driven variation.

CNN benefits from the enriched data, with ACC improvements reaching 2–3% in some cases, especially when temperature anomalies or road blockages are combined with other factors.

Even simpler models such as a ridge, consistently register significant gains across combinations (T+W), suggesting that climate variables, albeit moderate in their overall contribution, reliably enhance predictive capacity when government guarantees partly shield borrowers from severe financial shocks.

- 2.

-

Without Government-Backed Credits (WOGB_CR): More Pronounced Effects

In datasets excluding government guarantees, climate factors exhibit higher impact and variability, as demonstrated by the “Y” entries in Table A12:

XGB attains significance across all relevance groups, reinforcing its robustness when borrowers receive no policy safeguards.

CNN and XNN displayed larger swings in ACC and AUC, potentially yielding double-digit gains in particular scenarios (T, T+W). However, this comes with greater sensitivity to how the data are structured and which external factors are combined, reflecting the heightened vulnerability of borrowers in the absence of state intervention.

Classical methods (lda, ridge) also showed repeated significant gains (Y), although generally without the dramatic improvements observed in more flexible (tree-based or deep) architectures. Their steadiness hints at a baseline advantage in capturing incremental signals from climate variables even in high-risk, non-guaranteed contexts.

Consequently, the effect of weather disruptions and temperature extremes on delinquency appears more pronounced when policy protection is removed, exposing certain borrower segments to a higher default risk.

Overall Extent of Climate Influence. These findings point to a moderate yet significant relationship between climate anomalies (temperature, road blockages) and default patterns:

-

Magnitude of Effect:

Although less dramatic than pandemic-driven variables (e.g., mortality rates), climate factors yield AUC gains of up to 1–3% and ACC improvements of up to 30% for certain neural networks.

-

Context Dependence:

The presence of government-backed guarantees (WGB_CR) mitigates some risk exposure, leading to steadier but still statistically significant gains. Absent such guarantees (WOGB_CR), climate effects intensify, which is reflected in broader performance variability and heightened delinquency predictions among vulnerable borrowers.

-

Model Variability:

XGB remains consistently robust (significant in all tested scenarios), where as neural network models such as

cnn and

xnn can realize sizable gains or exhibit performance swings in both

WGB_CR and

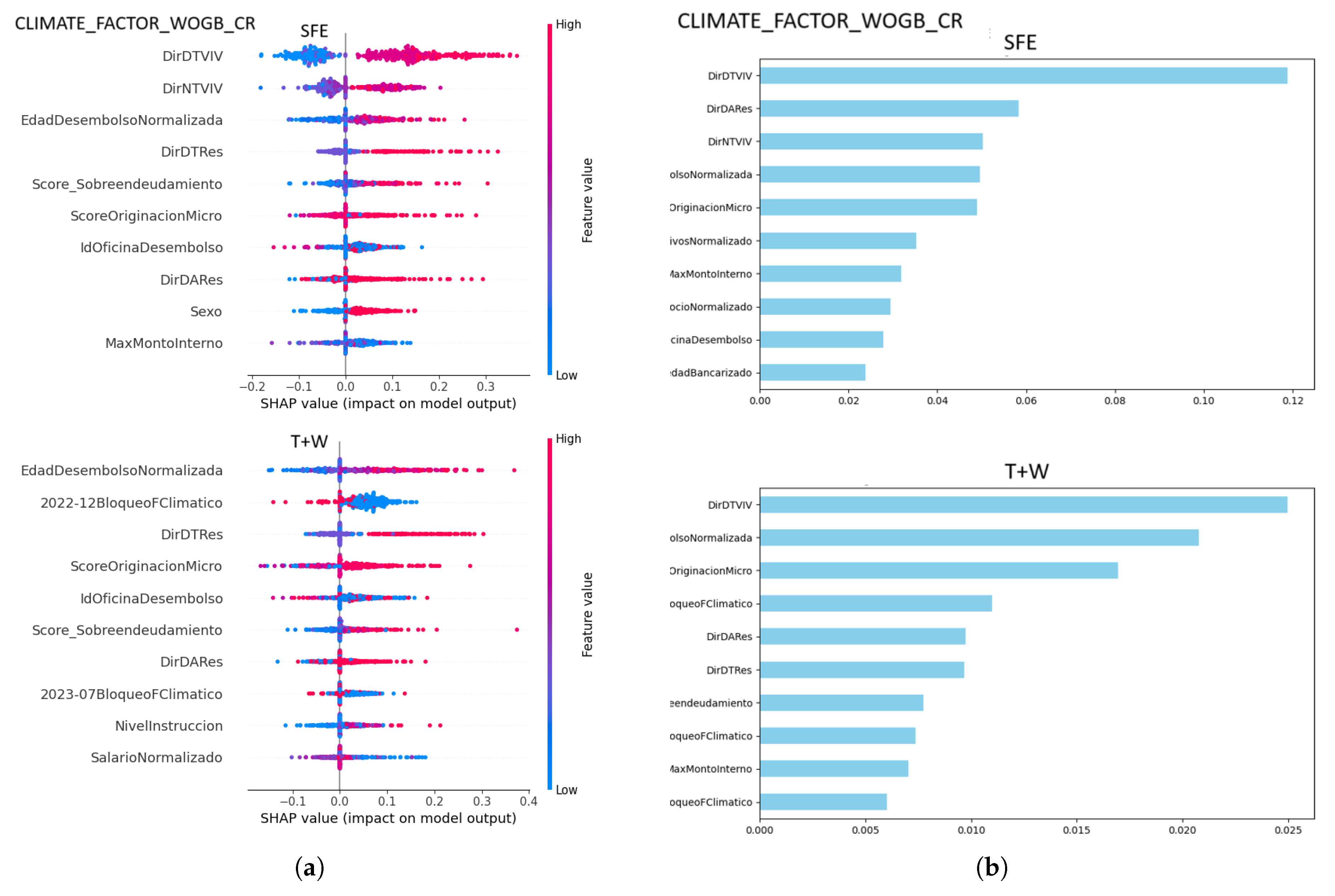

WOGB_CR environments. Through the application of the SHAP and LIME interpretability techniques, it becomes evident that incorporating FE into the dataset highlights the critical importance of factors related to debt management and demographic characteristics in determining model performance (see

Figure 7).

In summary, temperature anomalies and road blockages due to the weather exert a clear and statistically validated influence on credit delinquency. This influence is amplified when no policy interventions exist, implying a greater vulnerability to climate-driven shocks. Consequently, incorporating climate factors proves beneficial for model accuracy (AUC, ACC) and underscores the role of exogenous environmental conditions in credit risk assessment.

Figure 7 (

a) illustrates the SHAP analysis for an XGB (Extreme Gradient Boosting) model, showcasing the top 10 impactful features for two scenarios: SFE and T+W. The SHAP plots demonstrate how each feature influences the model output, with the same red and blue color coding for high and low feature values, respectively.

Figure 7 (

b) showcases LIME feature importance analysis for SFE and T+W scenarios in the

CLIMATE_FACTOR_WOGB_CR dataset. In both scenarios, DirDTIVIV emerges as the most influential feature, with dSexoNormalizado also playing a significant role in the T+W scenario, highlighting the varying feature contributions across the two contexts.

5.3. RQ3: What Is the Relationship Between Credit Delinquency and Social Unrest, Considering Disruptions to Economic Activities and Societal Stability?

Focusing on the U scenario (i.e., social unrest) and the corresponding U-SFE comparisons in our significance tables, we observe that the inclusion of social unrest data yields statistically significant improvements in certain models’ predictive performance. While the broader dataset also includes climate factors (temperature anomalies and road blockages), the findings below emphasize how unrest-specific variables influence credit delinquency patterns:

-

Disruptions to Economic Activities

Social unrest frequently coincides with logistical bottlenecks, reduced consumer foot traffic, and heightened uncertainty, all of which contribute to delayed or missed loan payments. Models like

xgb and

cnn, when enriched with

U data, exhibit

Y (significance) in metrics such as

AUC and

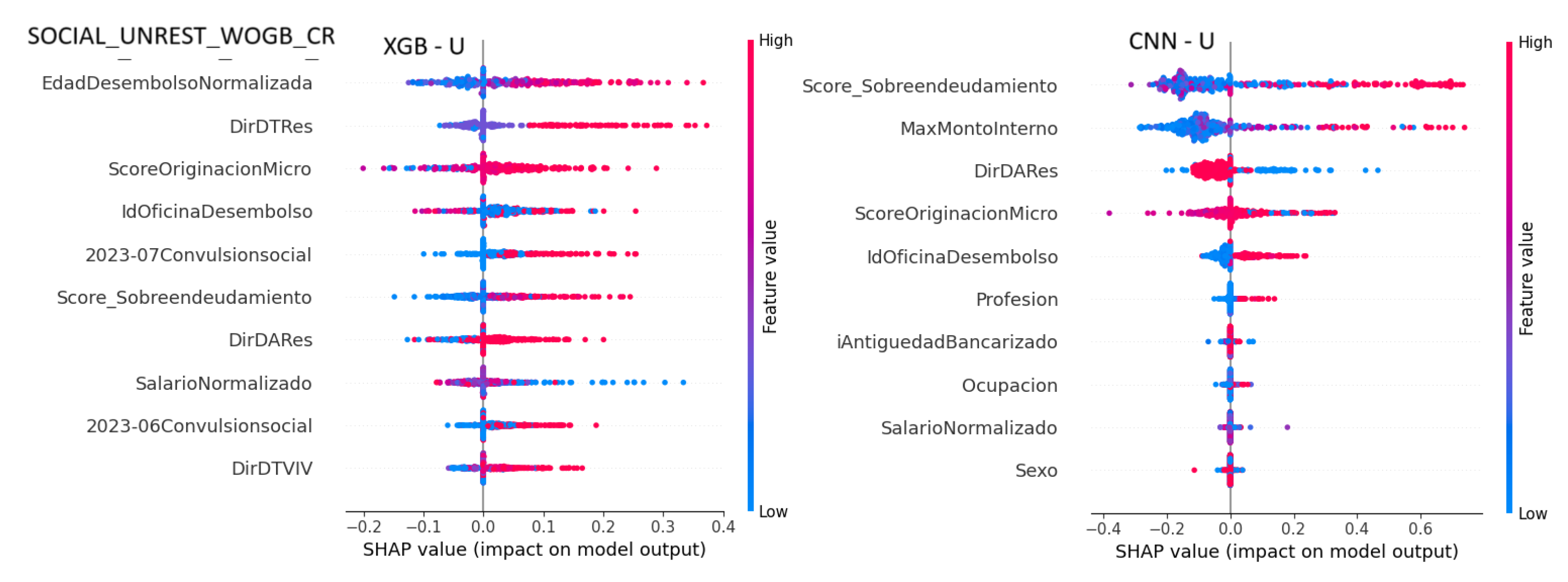

ACC, indicating that unrest-related disruptions provide a measurable signal for anticipating spikes in delinquency. By leveraging SHAP and LIME interpretability techniques, it becomes evident that the integration of EF into the dataset underscores the pivotal role of demographic characteristics and debt management variables in shaping the predictive performance of the model (see

Figure 8)

Figure 8 presents the SHAP feature importance analysis for the XGB and CNN models under the "U scenarios" in the

SOCIAL_UNREST_WOGB_CR dataset. The top 10 influential features are shown for each model, with

Score_Sobreendeudamiento and MaxMontoInterno being particularly significant in both, highlighting their impact on the model predictions.

-

Societal Stability and Default Risk

Heightened social tensions (e.g., mass protests and road blockages for political reasons) lead to non-linear effects in local economies. Our experimental results suggest that these effects are most pronounced for borrowers who rely on face-to-face transactions or local commerce—business segments that are easily disrupted by unrest events. Neural network models (cnn, xnn) demonstrate particular sensitivity to these phenomena, showing moderate-to-large gains in predictive accuracy once social-unrest (U) features are added.

-

Partial Overlap with Climate Factors

Although climate factors (T, W) are separated from social unrest (U) to answer this research question, real-world events are commonly intertwined (e.g., protests triggered by economic losses after extreme weather). Accordingly, even while focusing on scenario U, some borrowers’ behavior may reflect not only political or social disruptions, but also climatic complications present in the data. This partial overlap underscores the complexity of isolating social factors from environmental influences; however, it does not diminish the measurable improvements derived from adding U data.

Summary of Social Unrest Effects.

The inclusion of U features (i.e., indicators of social unrest) consistently enhances the predictive power of leading models, such as xgb and cnn, by capturing default risks tied associated with market disruptions and broader societal instability. Although some classical approaches (lda, ridge) post more moderate improvements, they additionally report statistically significant gains in select cases, affirming that social unrest signals can refine credit scoring across diverse modeling techniques. Critically, these findings suggest that default peaks may align with pronounced unrest events, intensifying delinquency among vulnerable sectors and underscoring the value of integrating sociopolitical variables in credit risk assessment.

5.4. RQ4: How Do the Combined Effects of External Factors (COVID-19, Climate Change, and Social Unrest) Contribute to Variations in Credit Delinquency, and What Are the Most Influential Factors?

Drawing on the findings for each individual EF and their integrated scenarios (e.g., U+T+W for social unrest plus climate variables, and COVID data combined with these), the following synthesis emerges:

- 1.

-

Layered Crises Magnify Delinquency Risks

When COVID-19 indicators (especially mortality), climate anomalies (temperature, road blockages), and social unrest (disruptions to economic activities) coincide, models show statistically significant boosts in predictive accuracy. Tables A11–A12 reveal a higher density of “Y” entries in multi-factor scenarios (e.g., U+T+W), signifying that layered crises intensify default likelihood. This effect is particularly pronounced among borrowers without government-backed guarantees (WOGB_CR), where combined stresses (pandemic plus climate plus social unrest) lead to marked performance gains or variability in cnn, xnn, and xgb models.

- 2.

-

Relative Influence of External Factors

COVID-19 Mortality: Remains the single strongest predictor overall, particularly when temporally aligned (COVID MOV). Mortality exerts a time-lagged but deeper impact on credit risk, overshadowing mere infection counts once severe outcomes translate into workforce disruptions, income loss, and economic contraction.

Climate Variables (Temperature, Road Blockages): Yield moderate but consistent improvements in AUC and ACC, with amplified effects under WOGB_CR. Borrowers lacking state-backed credit demonstrate greater vulnerability to weather-driven shocks, leading to notable delinquency surges in combined scenarios.

Social Unrest (U): Exerts a strong influence on default, especially in synergy with other EF. Disruptions to commerce and labor flows create immediate liquidity pressure, pushing up delinquency rates. Government-backed credit (WGB_CR) partially mitigates this effect but does not eliminate it, as shown by the consistent Y significance in multi-factor contexts (U+T+W).

- 3.

-

Crucial Role of Government-Backed Credits and Model Adaptability

Policy Buffering (WGB_CR): Borrowers with government-supported loans typically fare better against layered crises; nonetheless, combined EF scenarios still exhibit statistically significant default spikes, underscoring that even robust policy interventions cannot fully neutralize multi-layered disruptions.

Model Differentiation: Tree-based (xgb, rf) and deep learning (cnn) methods exhibit the greatest adaptability to multi-factor shocks. XGB was the most versatile across all combined scenarios, consistently achieving significance (Y). Classical models (lda, ridge) show moderate yet steady improvements, while xnn and mlp can yield scenario-specific surges or dips, indicating to heightened sensitivity to data composition.

Overall Conclusions on Combined EFs and Key Drivers.

Layered External Factors (COVID + Climate + Social Unrest) generate compounding disruptions that models detect as higher delinquency risk, most evident where no government-backed safety net exists.

Mortality (COVID MOV) stands out as the most dominant single predictor, but climate anomalies and social unrest further amplify default volatility.

Government-Backed Credits modulate these risks, lowering overall default exposure but not eliminating the statistically significant contributions of multi-factor crises.

Model Adaptability rests foremost with xgb, cnn, and certain classical methods (ridge) that frequently achieve statistically significant gains in multi-factor experiments, however, SHAP and LIME analyses reveal persistent, critical roles for EFs even in policy-supported scenarios..

Interpretable Key Features: Beyond the EF variables, debt management and income stability remain central. Post-hoc methods confirm that combining external factors with fundamental financial attributes yields the most robust and interpretable risk predictions (see

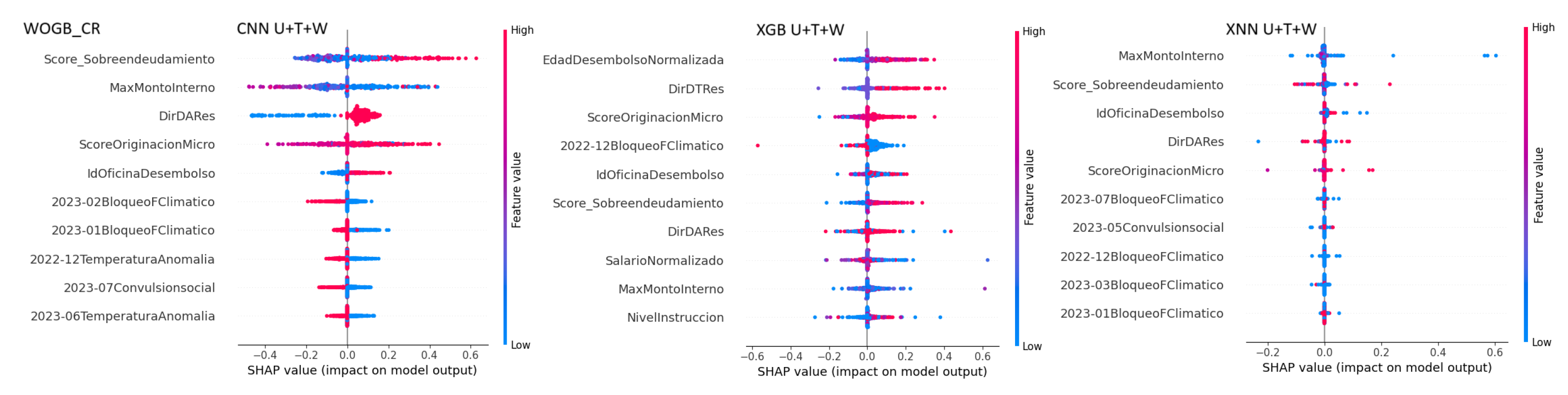

Figure 9).

Hence, the combined impact of pandemic severity (COVID-19), climatic disruptions, and social unrest heightens credit delinquency more sharply than any single factor alone, with COVID-19 mortality ranking as the most influential overall driver. This synergy of layered crises underscores the need for integrative risk frameworks and targeted policy interventions to buffer at-risk borrowers in complex and volatile environments.

Figure 9 the top 10 features influencing the outputs of CNN, XGB, and XNN models under the U+T+W scenario using SHAP analysis. Key features like MaxMontoInterno,

Score_Sobreendeudamiento, and DirDARes consistently emerge across models, with variations in ranking and impact. CNN highlights

Score_Sobreendeudamiento as the most significant, XGB emphasizes EdadDesembolsoNormalizada, and XNN prioritizes MaxMontoInterno, showcasing distinct yet overlapping patterns in feature importance.

6. Challenges Presented in the Research

Although this study demonstrates the usefulness of integrating COVID-19, climate, and social unrest factors into credit risk modeling, several methodological and contextual hurdles have emerged throughout the research:

Heterogeneous Data Quality and Availability: Collecting, cleaning, and synchronizing EF datasets (e.g., mortality rates, road blockages, protest events) poses significant difficulties. Public sources often lack uniform reporting standards or experience latency in updates, leading to potential gaps or inconsistencies that must be carefully handled.

Temporal Alignment of External Factors: The strongest effects of COVID-19 mortality, for example, manifested only after a certain incubation or lag period (COVID MOV). Identifying and adjusting these temporal misalignments requires a combination of domain insights (epidemiological time lags) and statistical tests (Granger causality, Dickey-Fuller). Errors in lag determination can under- or over-estimate the actual influence of EFs.

Variability in Government-Backed Scenarios: Comparing WGB_CR (loans with guarantees) with WOGB_CR (loans without guarantees) introduced notable distributional differences, particularly in periods where policy interventions were rapidly evolving. Striking a balance between model generalization and scenario-specific evaluation proved to be challenging.

Overfitting Concerns with Multi-Factor Models: While incorporating multiple EFs (mortality, climate, and social unrest) improved predictive power, it also increased the risk of overfitting—especially for neural networks with more parameters. Regularization techniques and hyperparameter tuning only partially mitigated these risks, underscoring the need for robust validation practices.

Explainability vs. Model Complexity: Post-hoc methods (SHAP, LIME) enhanced interpretability but did not fully address black-box concerns inherent to deep or ensemble models.

Despite these challenges, our approach to data preprocessing, lag alignment, and scenario-based evaluation underscores the adaptability of machine learning techniques to volatile external factors, while indicating areas that require further methodological refinements.

7. Discussion

The findings establish that exogenous risk variables—spanning health crises (COVID-19), climate anomalies (temperature, road blockages), and social unrest—exert substantial, statistically significant influences on credit delinquency patterns. By applying a comprehensive methodology that includes stationarity tests, Granger causality, scenario partitioning (WGB_CR vs. WOGB_CR), and post-hoc interpretability (SHAP, LIME), this study bridges analytical rigor with practical insights. Several implications emerge:

Synergistic Effects of Multi-Factor Crises: Whereas single-factor analyses might overlook partial economic shocks, layered crises (e.g., COVID MOV, temperature anomalies, and social unrest) reveal magnified default probabilities. This underscores the need for multi-dimensional risk assessments, particularly in emergent economies subject to concurrent disruptions.

Importance of Lagged Data Alignment: Adjusting mortality data to reflect delayed economic disruptions (incubation and fatality progressions) significantly boosted model performance (COVID MOV). Such temporal alignments may be relevant for climate variables that exhibit seasonal lags or accumulation effects, reinforcing the concept that accurate forecasting hinges on domain-aware data transformations.

Policy Implications: The WGB_CR vs. WOGB_CR comparison highlights how government-backed loans temper default surges in crisis periods, but does not eliminate the statistical significance of external shocks. Policymakers may consider targeted interventions—like extended grace periods or subsidized credit lines—for sectors most exposed to combined crises (e.g., high-contact industries and small agriculture).

Model Adaptability and Interpretability: Although tree-based ensembles (xgb, rf) and deep networks (cnn) have been proven to capture non-linear EF interactions, domain stakeholders require transparency regarding decisions. Post-hoc interpretability methods confirm that variables tied to mortality, unrest, and road blockages shape the largest jumps in predicted delinquency—particularly when borrowers lack policy safeguards. However, reconciling the model complexity with actionable explanations remains an open area for future research.

Generality and Transferability: While study focuses on Peruvian credit data, the underlying methodology—lag alignment, scenario partitioning, and post-hoc interpretability—is extensible to other regions experiencing parallel shocks (e.g., infectious outbreaks, natural disasters, and socio-political unrest). External validation with diverse datasets would further confirm the model’s cross-cultural robustness, paving the way for broader and globally relevant policy insights.

In conclusion, the combined approach of scenario-based partitioning, advanced ML models, and post-hoc interpretability provides a novel, pragmatic framework for capturing how multiple exogenous factors converge to affect credit risk. Future investigations may refine temporal modeling (e.g., dynamic lag structures) or explore domain-specific features (e.g., crop yields in climate-sensitive zones), fueling more holistic, explainable, and regionally transferable credit-risk assessment pipelines.

8. Conclusion and Future Research

This study has demonstrated that credit risk estimation improves notably when EF such as COVID-19 severity, climate anomalies (temperature, weather-induced road blockages), and social unrest are systematically integrated into machine learning workflows. The empirical results, validated through stationarity testing, Granger causality, and post-hoc explainability (SHAP, LIME), confirm that incorporating EF yields statistically significant gains in both AUC and ACC across various model architectures (e.g., CNN, XGB, XNN, and EBM). Moreover, our findings provide three key insights:

Mortality as a Dominant Driver: COVID-19 mortality, when time-lagged (COVID MOV) to reflect disease progression, consistently emerged as the single most influential predictor of delinquency. This underscores the importance of aligning external health-related data with economic indicators to capture lagged effects accurately.

Combined Crises Amplify Default Risks: When climatic (temperature, road blockages) and social unrest factors co-occur alongside, default likelihoods rise substantially. This effect is especially pronounced in scenarios without government-backed credit guarantees (WOGB_CR), indicating that policy interventions play a crucial buffering role but cannot fully negate multi-factor shocks.

Modeling with Explainability: Tree-based models (XGB, RF) and deep neural networks (CNN) adapt effectively to EF-enriched scenarios, while interpretable architectures (EBM, XNN) confirm the prominence of exogenous variables in driving default spikes. Post-hoc techniques (SHAP, LIME) further reinforce that demographic and debt-management variables remain central predictors once EF data are introduced.

Collectively, these results provide a comprehensive, scenario-driven perspective on how exogenous disruptions—health crises, climate-related events, and civil unrest—affect credit defaults. By combining domain-specific transformations (time-lagged data alignment), rigorous experimentation (multiple partitions of economic activities), and explainability frameworks, this study offers a replicable methodology for other emerging markets in which layered external shocks are increasingly common.

While the proposed approach has yielded promising insights, several areas warrant further investigation:

Dynamic Temporal Modeling: This study used fixed lag structures (e.g., one-month shift for mortality data). Future research could employ adaptive or non-linear lag models to capture evolving relationships between EF and delinquency, especially for slowly manifesting phenomena such as climate change or protracted social unrest.

Cross-Regional Validation: Although Peru presents a compelling case due to high COVID-19 mortality, repeated climate disturbances, and social unrest, additional studies in different geographic contexts would help to generalize these findings. Multi-country datasets can verify whether similar EF patterns drive credit defaults elsewhere.

In-depth Policy Impact Analysis: The presence or absence of government-backed credits (WGB_CR vs. WOGB_CR) significantly influenced model performance. Future work might focus on evaluating which types of policy measures (e.g., moratoria, subsidized interest rates, and targeted liquidity injections) are most effective at mitigating EF-induced default risks.

Enhanced Interpretability Techniques: While post-hoc methods (SHAP, LIME) shed light on EF relevance, exploring inherently interpretable deep learning paradigms or leveraging causal modeling could yield more transparent decision rules—particularly crucial for regulatory compliance and stakeholder trust in financial institutions.

Longer-Horizon Forecasts and Continuous Risk Indicators: This research focused on monthly binary classification (good vs. bad payer). Developing continuous risk scores or multi-horizon forecasts could provide more granular guidance for early intervention strategies and dynamic credit re-scoring in unstable economic climates.

With global financial systems increasingly exposed to convergent exogenous shocks— health crises, climate extremes, and sociopolitical unrest—this study underscores the value of robust, explainable, and domain-aware machine learning tools. By integrating multiple EF into credit risk models and systematically quantifying their effects, researchers and practitioners can enhance both predictive performance and interpretability, ultimately fostering more resilient and inclusive lending ecosystems.

Author Contributions

Conceptualization, Noriega, J. and Herrera, J.; methodology, Noriega, J.; validation, Noriega, J., Rivera, L. and Herrera, J.; formal analysis, Noriega, J., , Castañeda, J. and Herrera, J.; investigation, Noriega, J.; resources, Noriega, J.; writing—original draft preparation, Noriega, J.; writing—review and editing, Noriega, J., Rivera, L., , Castañeda, J. and Herrera, J.; visualization, Noriega, J., Castañeda, J.; supervision, Herrera, J.; project administration, Noriega, J. All authors have read and agreed to the published version of the manuscript..

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflicts of interest.

Appendix A. Additional Tables

Table A1.

Average AUC & ACC across 10 folds of ML models with COVID EF WGB_CR, by evaluated scenario and relevance groups.

Table A1.

Average AUC & ACC across 10 folds of ML models with COVID EF WGB_CR, by evaluated scenario and relevance groups.

| |

AUC (%) |

ACC (%) |

|

SCENARIOS |

RESULTS |

SCENARIOS |

RESULTS |

|

SFE |

P |

F+P |

F |

P-SFE |

F+P-SFE |

F-SFE |

SFE |

P |

F+P |

F |

P-SFE |

F+P-SFE |

F-SFE |

| WGB_CR |

|

| 1.D100 |

|

| cnn |

72.82 |

73.63 |

74.09 |

74.09 |

0.82 |

1.28 |

1.27 |

67.49 |

70.07 |

70.18 |

70.14 |

2.58 |

2.69 |

2.65 |

| ebm |

81.13 |

81.23 |

81.42 |

81.26 |

0.10 |

0.29 |

0.13 |

74.84 |

74.94 |

75.05 |

74.93 |

0.09 |

0.20 |

0.08 |

| ffn |

72.30 |

72.56 |

72.39 |

73.38 |

0.26 |

0.10 |

1.08 |

66.74 |

65.24 |

66.15 |

66.14 |

- 1.50 |

- 0.59 |

- 0.60 |

| ffnlp |

72.11 |

72.35 |

72.41 |

72.72 |

0.25 |

0.30 |

0.61 |

66.28 |

67.55 |

65.64 |

65.19 |

1.27 |

- 0.64 |

- 1.09 |

| ffnsp |

72.31 |

72.31 |

71.42 |

72.77 |

0.00 |

- 0.89 |

0.47 |

66.40 |

66.45 |

64.67 |

65.59 |

0.05 |

- 1.73 |

- 0.81 |

| knn |

67.21 |

66.92 |

66.93 |

66.93 |

- 0.29 |

- 0.28 |

- 0.28 |

63.23 |

63.00 |

62.97 |

62.98 |

- 0.22 |

- 0.26 |

- 0.24 |

| lda |

67.23 |

68.01 |

68.54 |

68.25 |

0.78 |

1.31 |

1.02 |

63.09 |

63.74 |

64.09 |

63.77 |

0.65 |

1.00 |

0.67 |

| mlp |

69.30 |

70.83 |

71.17 |

70.47 |

1.53 |

1.87 |

1.17 |

60.82 |

63.26 |

63.58 |

62.87 |

2.44 |

2.76 |

2.06 |

| percep |

57.96 |

58.44 |

59.88 |

59.46 |

0.48 |

1.92 |

1.50 |

44.58 |

57.99 |

56.37 |

49.31 |

13.41 |

11.78 |

4.73 |

| qda |

67.44 |

66.98 |

65.81 |

67.17 |

- 0.46 |

- 1.63 |

- 0.27 |

52.50 |

54.01 |

54.13 |

53.72 |

1.52 |

1.64 |

1.22 |

| rf |

81.74 |

81.51 |

81.21 |

81.46 |

- 0.23 |

- 0.53 |

- 0.29 |

75.51 |

75.44 |

75.22 |

75.48 |

- 0.07 |

- 0.29 |

- 0.03 |

| ridge |

66.94 |

67.55 |

68.05 |

67.81 |

0.62 |

1.12 |

0.87 |

62.93 |

63.39 |

63.70 |

63.43 |

0.46 |

0.77 |

0.50 |

| xgb |

80.76 |

81.00 |

81.10 |

81.07 |

0.23 |

0.33 |

0.30 |

74.77 |

74.98 |

75.03 |

74.98 |

0.21 |

0.26 |

0.22 |

| xnn |

50.14 |

50.38 |

50.10 |

50.37 |

0.24 |

- 0.05 |

0.22 |

53.42 |

57.99 |

62.76 |

54.22 |

4.57 |

9.34 |

0.80 |

| 2.D99 |

|

| cnn |

72.75 |

73.60 |

74.27 |

73.57 |

0.86 |

1.52 |

0.83 |

67.04 |

70.03 |

70.42 |

69.97 |

2.98 |

3.37 |

2.93 |

| ebm |

81.04 |

81.24 |

81.37 |

81.24 |

0.19 |

0.33 |

0.20 |

74.77 |

74.93 |

75.04 |

74.94 |

0.16 |

0.28 |

0.18 |

| ffn |

72.69 |

72.38 |

71.50 |

71.55 |

- 0.31 |

- 1.20 |

- 1.14 |

66.07 |

65.94 |

65.86 |

65.75 |

- 0.14 |

- 0.21 |

- 0.32 |

| ffnlp |

71.71 |

72.81 |

72.16 |

72.45 |

1.09 |

0.44 |

0.74 |

65.27 |

66.83 |

66.28 |

65.94 |

1.56 |

1.02 |

0.67 |

| ffnsp |

72.58 |

73.11 |

72.58 |

72.99 |

0.53 |

- 0.00 |

0.41 |

63.93 |

65.34 |

66.81 |

66.17 |

1.41 |

2.87 |

2.24 |

| knn |

67.10 |

66.88 |

66.88 |

66.88 |

- 0.22 |

- 0.21 |

- 0.21 |

63.24 |

63.02 |

63.02 |

63.04 |

- 0.23 |

- 0.22 |

- 0.21 |

| lda |

67.17 |

67.92 |

68.46 |

68.19 |

0.75 |

1.29 |

1.02 |

63.07 |

63.68 |

64.04 |

63.78 |

0.60 |

0.96 |

0.70 |

| mlp |

69.79 |

68.93 |

69.62 |

68.70 |

- 0.86 |

- 0.16 |

- 1.08 |

63.83 |

64.12 |

59.76 |

64.96 |

0.29 |

- 4.07 |

1.13 |

| percep |

55.09 |

57.67 |

54.19 |

56.99 |

2.58 |

- 0.90 |

1.90 |

55.48 |

58.56 |

53.93 |

50.60 |

3.07 |

- 1.55 |

- 4.88 |

| qda |

67.32 |

66.90 |

65.74 |

67.08 |

- 0.42 |

- 1.58 |

- 0.23 |

52.41 |

53.98 |

54.02 |

53.63 |

1.57 |

1.62 |

1.22 |

| rf |

81.68 |

81.33 |

81.02 |

81.30 |

- 0.35 |

- 0.66 |

- 0.38 |

75.63 |

75.32 |

75.09 |

75.38 |

- 0.31 |

- 0.54 |

- 0.24 |

| ridge |

66.85 |

67.47 |

67.97 |

67.74 |

0.62 |

1.12 |

0.89 |

62.94 |

63.39 |

63.68 |

63.49 |

0.45 |

0.73 |

0.55 |

| xgb |

80.72 |

80.96 |

80.97 |

80.95 |

0.24 |

0.25 |

0.24 |

74.81 |

74.97 |

74.89 |

74.86 |

0.16 |

0.08 |

0.04 |

| xnn |

50.47 |

50.25 |

50.48 |

50.59 |

- 0.23 |

0.00 |

0.11 |

57.50 |

53.55 |

59.22 |

54.37 |

- 3.95 |

1.71 |

- 3.14 |

| 3.D80 |

|

| cnn |

72.68 |

73.18 |

73.79 |

73.50 |

0.50 |

1.11 |

0.82 |

66.38 |

70.28 |

70.65 |

70.44 |

3.90 |

4.26 |

4.06 |

| ebm |

80.73 |

81.03 |

81.16 |

81.05 |

0.29 |

0.43 |

0.31 |

74.92 |

75.16 |

75.29 |

75.19 |

0.24 |

0.37 |

0.27 |

| ffn |

71.76 |

72.16 |

72.38 |

72.83 |

0.41 |

0.62 |

1.07 |

63.24 |

66.92 |

66.19 |

67.18 |

3.68 |

2.95 |

3.94 |

| ffnlp |

71.14 |

72.00 |

71.66 |

71.97 |

0.86 |

0.51 |

0.83 |

65.73 |

66.90 |

66.45 |

65.44 |

1.16 |

0.72 |

- 0.29 |

| ffnsp |

70.87 |

72.03 |

72.29 |

72.13 |

1.15 |

1.42 |

1.25 |

64.07 |

65.62 |

66.69 |

65.65 |

1.54 |

2.61 |

1.58 |

| knn |

66.57 |

66.57 |

66.57 |

66.57 |

- 0.01 |

0.00 |

0.00 |

62.98 |

62.95 |

62.95 |

62.96 |

- 0.02 |

- 0.03 |

- 0.01 |

| lda |

67.33 |

67.90 |

68.29 |

68.07 |

0.57 |

0.96 |

0.74 |

63.45 |

63.88 |

64.20 |

64.02 |

0.43 |

0.75 |

0.57 |

| mlp |

67.96 |

68.85 |

68.61 |

69.92 |

0.89 |

0.66 |

1.96 |

58.09 |

63.16 |

62.43 |

60.73 |

5.07 |

4.34 |

2.64 |

| percep |

57.44 |

55.39 |

59.27 |

56.66 |

- 2.05 |

1.83 |

- 0.78 |

52.88 |

57.22 |

50.16 |

56.66 |

4.35 |

- 2.71 |

3.78 |

| qda |

67.69 |

66.51 |

64.11 |

66.30 |

- 1.18 |

- 3.58 |

- 1.39 |

52.76 |

54.28 |

52.68 |

53.73 |

1.52 |

- 0.08 |

0.97 |

| rf |

81.18 |

81.03 |

80.68 |

80.96 |

- 0.15 |

- 0.51 |

- 0.22 |

75.47 |

75.57 |

75.26 |

75.52 |

0.11 |

- 0.20 |

0.05 |

| ridge |

66.67 |

67.23 |

67.59 |

67.40 |

0.56 |

0.92 |

0.73 |

63.06 |

63.35 |

63.73 |

63.55 |

0.29 |

0.67 |

0.49 |

| xgb |

80.20 |

80.75 |

80.76 |

80.69 |

0.54 |

0.56 |

0.49 |

74.74 |

75.13 |

75.15 |

75.14 |

0.39 |

0.41 |

0.39 |

| xnn |

50.35 |

50.07 |

49.89 |

50.03 |

- 0.28 |

- 0.47 |

- 0.33 |

63.26 |

63.80 |

60.07 |

53.46 |

0.54 |

- 3.19 |

- 9.80 |

Table A2.

Average AUC & ACC across 10 folds of ML models with COVID EF WOGB_CR, by evaluated scenario and relevance groups.

Table A2.

Average AUC & ACC across 10 folds of ML models with COVID EF WOGB_CR, by evaluated scenario and relevance groups.

| |

AUC (%) |

ACC (%) |

|

SCENARIOS |

RESULTS |

SCENARIOS |

RESULTS |

|

SFE |

P |

F+P |

F |

P-SFE |

F+P-SFE |

F-SFE |

SFE |

P |

F+P |

F |

P-SFE |

F+P-SFE |

F-SFE |

| WOGB_CR |

|

| 1.D100 |

|

| cnn |

72.92 |

74.10 |

74.17 |

74.28 |

1.18 |

1.25 |

1.35 |

67.53 |

72.93 |

72.67 |

73.11 |

5.41 |

5.15 |

5.58 |

| ebm |

81.38 |

81.29 |

81.45 |

81.31 |

- 0.09 |

0.07 |

- 0.07 |

76.54 |

76.41 |

76.51 |

76.48 |

- 0.13 |

- 0.03 |

- 0.06 |

| ffn |

72.71 |

72.60 |

73.34 |

72.89 |

- 0.11 |

0.63 |

0.18 |

67.46 |

67.29 |

67.49 |

68.33 |

- 0.17 |

0.03 |

0.88 |

| ffnlp |

72.16 |

72.32 |

71.68 |

73.16 |

0.15 |

- 0.49 |

1.00 |

66.86 |

66.56 |

63.51 |

66.75 |

- 0.30 |

- 3.35 |

- 0.11 |

| ffnsp |

72.48 |

73.44 |

73.75 |

73.36 |

0.96 |

1.27 |

0.88 |

65.18 |

68.26 |

67.02 |

69.48 |

3.09 |

1.84 |

4.30 |

| knn |

66.21 |

65.98 |

65.98 |

65.99 |

- 0.23 |

- 0.23 |

- 0.22 |

63.19 |

62.84 |

62.82 |

62.84 |

- 0.35 |

- 0.36 |

- 0.35 |

| lda |

66.08 |

66.68 |

67.16 |

66.89 |

0.60 |

1.08 |

0.81 |

63.18 |

63.64 |

63.93 |

63.65 |

0.46 |

0.75 |

0.47 |

| mlp |

70.92 |

70.07 |

71.03 |

68.89 |

- 0.85 |

0.11 |

- 2.03 |

60.20 |

67.96 |

63.45 |

62.29 |

7.76 |

3.25 |

2.09 |

| percep |

55.94 |

54.88 |

57.04 |

55.72 |

- 1.06 |

1.10 |

- 0.22 |

54.77 |

59.56 |

50.92 |

57.58 |

4.78 |

- 3.85 |

2.81 |

| qda |

66.82 |

65.97 |

64.75 |

66.18 |

- 0.84 |

- 2.07 |

- 0.64 |

50.72 |

52.66 |

52.59 |

52.06 |

1.94 |

1.86 |

1.33 |

| rf |

79.53 |

79.09 |

78.75 |

78.99 |

- 0.44 |

- 0.78 |

- 0.53 |

75.34 |

75.34 |

75.17 |

75.21 |

0.01 |

- 0.16 |

- 0.13 |

| ridge |

65.95 |

66.44 |

66.89 |

66.66 |

0.50 |

0.94 |

0.71 |

63.14 |

63.44 |

63.77 |

63.54 |

0.30 |

0.63 |

0.40 |

| xgb |

80.43 |

80.60 |

80.64 |

80.68 |

0.17 |

0.21 |

0.25 |

76.00 |

76.16 |

76.13 |

76.24 |

0.16 |

0.13 |

0.24 |

| xnn |

50.14 |

50.71 |

50.15 |

50.19 |

0.56 |

0.00 |

0.05 |

62.48 |

66.64 |

62.37 |

54.50 |

4.17 |

- 0.10 |

- 7.98 |

| 2.D99 |

|

| cnn |

73.04 |

73.95 |

74.16 |

74.28 |

0.91 |

1.12 |

1.24 |

68.52 |

72.56 |

72.93 |

72.91 |

4.03 |

4.40 |

4.38 |

| ebm |

81.23 |

81.31 |

81.44 |

81.33 |

0.08 |

0.22 |

0.10 |

76.31 |

76.39 |

76.49 |

76.48 |

0.07 |

0.18 |

0.17 |

| ffn |

72.50 |

72.95 |

72.44 |

73.37 |

0.46 |

- 0.05 |

0.87 |

64.38 |

65.93 |

64.91 |

68.10 |

1.54 |

0.53 |

3.72 |

| ffnlp |

72.72 |

72.92 |

73.36 |

72.79 |

0.20 |

0.64 |

0.07 |

68.01 |

65.29 |

69.55 |

70.48 |

- 2.72 |

1.54 |

2.47 |

| ffnsp |

73.19 |

73.12 |

72.32 |

73.13 |

- 0.07 |

- 0.87 |

- 0.06 |

67.88 |

61.75 |

68.83 |

65.88 |

- 6.13 |

0.95 |

- 2.00 |

| knn |

65.94 |

66.00 |

66.00 |

66.00 |

0.06 |

0.06 |

0.06 |

62.92 |

62.58 |

62.58 |

62.59 |

- 0.35 |

- 0.34 |

- 0.33 |

| lda |

66.00 |

66.67 |

67.15 |

66.90 |

0.67 |

1.15 |

0.90 |

63.15 |

63.63 |

64.00 |

63.67 |

0.48 |

0.85 |

0.52 |

| mlp |

68.79 |

70.06 |

70.21 |

70.58 |

1.27 |

1.42 |

1.79 |

70.57 |

64.20 |

64.24 |

68.64 |

- 6.37 |

- 6.33 |

- 1.93 |

| percep |

55.28 |

56.66 |

55.64 |

56.59 |

1.37 |

0.36 |

1.31 |

54.45 |

56.49 |

49.80 |

55.10 |

2.04 |

- 4.65 |

0.65 |

| qda |

66.72 |

65.95 |

64.69 |

66.12 |

- 0.77 |

- 2.03 |

- 0.60 |

50.57 |

52.65 |

52.77 |

52.16 |

2.08 |

2.20 |

1.60 |

| rf |

79.41 |

78.96 |

78.60 |

78.91 |

- 0.46 |

- 0.81 |

- 0.51 |

75.31 |

75.19 |

74.90 |

75.24 |

- 0.13 |

- 0.41 |

- 0.07 |

| ridge |

65.85 |

66.42 |

66.87 |

66.65 |

0.57 |

1.02 |

0.80 |

63.13 |

63.45 |

63.82 |

63.58 |

0.32 |

0.69 |

0.45 |

| xgb |

80.35 |

80.66 |

80.65 |

80.61 |

0.32 |

0.30 |

0.26 |

76.13 |

76.28 |

76.21 |

76.25 |

0.15 |

0.08 |

0.12 |

| xnn |

50.08 |

50.74 |

50.00 |

49.90 |

0.67 |

- 0.08 |

- 0.18 |

62.22 |

65.34 |

70.29 |

66.02 |

3.12 |

8.07 |

3.80 |

| 3.D80 |

|

| cnn |

73.29 |

73.32 |

73.58 |

73.05 |

0.03 |

0.29 |

- 0.24 |

68.07 |

72.86 |

73.28 |

72.64 |

4.78 |

5.20 |

4.56 |

| ebm |

80.75 |

81.05 |

81.13 |

81.02 |

0.30 |

0.37 |

0.27 |

76.37 |

76.72 |

76.74 |

76.69 |

0.35 |

0.37 |

0.32 |

| ffn |

71.19 |

73.05 |

72.68 |

73.08 |

1.86 |

1.49 |

1.88 |

63.49 |

66.53 |

66.51 |

68.70 |

3.04 |

3.02 |

5.22 |

| ffnlp |

72.25 |

72.57 |

71.92 |

73.00 |

0.32 |

- 0.33 |

0.74 |

64.39 |

64.96 |

64.64 |

62.94 |

0.57 |

0.25 |

- 1.45 |

| ffnsp |

71.72 |

73.07 |

72.27 |

72.45 |

1.35 |

0.55 |

0.72 |

68.29 |

64.39 |

64.76 |

65.33 |

- 3.90 |

- 3.53 |

- 2.96 |

| knn |

65.37 |

65.36 |

65.36 |

65.37 |

- 0.01 |

- 0.01 |

- 0.00 |

62.54 |

62.52 |

62.51 |

62.53 |

- 0.02 |

- 0.03 |

- 0.00 |

| lda |

65.85 |

66.35 |

66.70 |

66.52 |

0.50 |

0.85 |

0.67 |

63.27 |

63.64 |

63.93 |

63.75 |

0.37 |

0.65 |

0.48 |

| mlp |

69.10 |

71.07 |

69.19 |

70.08 |

1.96 |

0.09 |

0.97 |

62.97 |

59.38 |

52.32 |

60.10 |

- 3.59 |

- 10.65 |

- 2.87 |

| percep |

55.71 |

56.80 |

57.86 |

55.39 |

1.09 |

2.16 |

- 0.31 |

51.81 |

55.32 |

52.05 |

50.98 |

3.51 |

0.24 |

- 0.83 |

| qda |

66.65 |

65.29 |

63.02 |

65.30 |

- 1.36 |

- 3.63 |

- 1.35 |

50.91 |

53.12 |

50.75 |

52.15 |

2.21 |

- 0.16 |

1.25 |

| rf |

78.71 |

78.53 |

78.12 |

78.56 |

- 0.18 |

- 0.59 |

- 0.15 |

75.29 |

75.54 |

75.39 |

75.65 |

0.25 |

0.10 |

0.36 |

| ridge |

65.48 |

65.97 |

66.26 |

66.13 |

0.48 |

0.78 |

0.65 |

63.14 |

63.37 |

63.65 |

63.58 |

0.23 |

0.51 |

0.43 |

| xgb |

79.57 |

80.16 |

80.16 |

80.20 |

0.59 |

0.59 |

0.63 |

75.92 |

76.45 |

76.44 |

76.45 |

0.54 |

0.52 |

0.54 |

| xnn |

50.76 |

50.57 |

49.89 |

49.89 |

- 0.19 |

- 0.87 |

- 0.86 |

56.71 |

55.79 |

71.19 |

66.89 |

- 0.92 |

14.48 |

10.18 |

Table A3.

Average AUC & ACC across 10 folds of ML models with COVID MOV EF WGB_CR, by evaluated scenario and relevance groups.

Table A3.

Average AUC & ACC across 10 folds of ML models with COVID MOV EF WGB_CR, by evaluated scenario and relevance groups.

| |

AUC (%) |

ACC (%) |

|

SCENARIOS |

RESULTS |

SCENARIOS |

RESULTS |

|

SFE |

P |

F+P |

F |

P-SFE |

F+P-SFE |

F-SFE |

SFE |

P |

F+P |

F |

P-SFE |

F+P-SFE |

F-SFE |

| WGB_CR |

|

| 1.D100 |

|

| cnn |

72.63 |

73.34 |

74.25 |

74.04 |

0.71 |

1.61 |

1.41 |

66.85 |

69.80 |

70.36 |

69.98 |

2.95 |

3.51 |

3.13 |

| ebm |

81.13 |

81.23 |

81.40 |

81.27 |

0.10 |

0.28 |

0.14 |

74.84 |

74.94 |

74.93 |

74.95 |

0.09 |

0.09 |

0.10 |

| ffn |

71.73 |

72.79 |

73.11 |

73.02 |

1.05 |

1.37 |

1.28 |

64.01 |

67.56 |

65.13 |

65.75 |

3.55 |

1.12 |

1.73 |

| ffnlp |

71.58 |

71.96 |

72.83 |

72.17 |

0.38 |

1.25 |

0.58 |

64.96 |

65.44 |

65.43 |

66.57 |

0.48 |

0.47 |

1.61 |

| ffnsp |

72.35 |

72.17 |

73.07 |

72.46 |

- 0.18 |

0.72 |

0.10 |