1. Introduction

Rice is a cornerstone of global food security, serving as a staple for more than half of the world's population. Its significance is particularly pronounced in Asia, where it is a dietary mainstay. The global rice market, valued at

$293.8 billion in 2021, is projected to grow to

$356 billion by 2030, reflecting a steady Compound Annual Growth Rate (CAGR) of 2.6% [

1]. This growth underscores the indispensable role of rice in global food systems, with per capita annual consumption averaging 67.5 kg in 2022. Key industry players, such as MGP Components and Rice Bran Technologies, are capitalizing on this demand to innovate and develop value-added rice products.

Despite robust production, challenges persist. The 2022/23 agricultural year saw global rice production estimated at 503.3 million tons, yet an 8.7-million-tonne deficit was forecasted due to surging demand and production setbacks in major rice-producing nations like China and Pakistan. Geopolitical disruptions, such as the Russia-Ukraine conflict, have further stressed rice supplies, positioning it as a critical alternative to wheat and corn. This imbalance is particularly impactful in economically vulnerable regions such as Bangladesh and Vietnam, highlighting the urgent need for strategies that address supply chain resilience and food security [

2].

The Role of Sensory Perception in the Global Aromatic Rice Industry

Sensory attributes—taste, aroma, texture, and appearance—are pivotal in shaping consumer preferences and driving market demand for premium rice varieties like Jasmine, Basmati, and Phka Rumduol. These characteristics elevate aromatic rice as both a cultural symbol and an economic asset for producing countries [

3]. Sensory excellence not only enhances consumer satisfaction but also adds substantial market value, reinforcing competitiveness in the global arena.

The World’s Best Rice Award, initiated in 2009 by The Rice Trader (TRT), exemplifies the emphasis on sensory quality. This annual competition rigorously evaluates entries on taste, aroma, and texture, enabling nations like Thailand, Vietnam, and the U.S. to showcase their finest aromatic rice varieties. Such platforms underscore the economic and cultural importance of sensory attributes in reinforcing global consumer loyalty and market reputation [

4].

Country of Origin and Consumer Behavior

Country of Origin (COO) significantly influences consumer preferences, particularly in Asian markets where rice consumption is both culturally ingrained and economically critical [

5,

6,

7]. Thai Jasmine rice, celebrated for its unparalleled aroma and grain quality, sets a global standard for premium rice. Similarly, Vietnamese and Cambodian rice are gaining recognition for their quality and competitive pricing, while Chinese aromatic rice, such as black rice, appeals to health-conscious consumers for its nutritional benefits.

Empirical studies reveal that COO impacts purchasing decisions through perceptions of quality, safety, and authenticity [

8]. In China, rising awareness of food safety and quality certifications has shifted preferences toward branded and certified rice, often at a premium [

9,

10]. Conversely, Thai consumers prioritize sensory attributes, such as aroma and texture, alongside a preference for locally sourced rice, reflecting cultural pride and trust in domestic production [

11,

12].

Interplay of Sensory and Cultural Factors

Sensory attributes and COO interact with socio-economic and cultural dynamics to shape consumer behavior. For example, Chinese consumers, with rising incomes and health awareness, demonstrate a preference for certified and branded rice, valuing quality and safety [

13]. A, Thai consumers, rooted in strong ethnocentric tendencies, exhibit a preference for locally produced rice, emphasizing sensory excellence over certifications. This divergence highlights the need for tailored marketing strategies that align with the unique priorities of each market segment [

13].

Certification systems, such as Thailand's Geographical Indications (GI), enhance consumer trust and product authenticity. Similarly, certifications in Vietnam and Cambodia bolster the regional competitiveness of their fragrant rice varieties. These elements influence willingness to pay (WTP) and consumer acceptance, showcasing the interplay of sensory, economic, and cultural factors in driving rice consumption behavior.

Implications and Contributions

This research explores consumer preferences in China and Thailand, providing actionable insights for producers, policymakers, and marketers. By analyzing the interplay between sensory perceptions and COO, this study identifies opportunities to enhance the competitiveness of fragrant rice in key markets. The findings stress the importance of addressing cultural and sensory priorities, such as certification in China and sensory excellence in Thailand, to optimize product positioning and consumer engagement.

This study ultimately contributes to a broader understanding of global rice consumption trends, offering a framework for examining the factors that drive consumer behavior in diverse cultural contexts. By leveraging these insights, stakeholders can align production and marketing strategies to meet the evolving demands of the global rice market.

2. Materials and Methods

2.1. Data and Study Area

This study investigates consumer preferences for fragrant rice in China and Thailand, with a specific focus on the factors that influence purchasing decisions. The research was conducted in two phases, ensuring a rigorous data collection process and thorough analysis aligned with the study's objectives. The geographical focus included Guangzhou, China and Bangkok, Thailand, two prominent urban centers representing significant rice consumer markets in their respective regions.

Data Types and Data Sources

Phase 1: Pre-testing and Questionnaire Development

The initial phase involved collecting preliminary data through field trials and interviews with both consumers and distributors. The primary goal was to identify critical attributes influencing consumer decisions about rice purchases, such as price, rice quality, consumer knowledge, and perceptions of Chinese and Thai rice. These findings informed the creation of a structured questionnaire, which was collaboratively designed by researchers and professors South China Agricultural University, China, and Kasetsart University, Thailand.

Pre-testing Strategy and Study Areas

Pre-testing was conducted with 30 participants from each study location: Kasetsart University in Bangkok, Thailand, and South China Agricultural University in Guangzhou, China. These locations were chosen for their strategic importance to the rice industry:

Bangkok, Thailand: Known for its rich culinary diversity, Bangkok is a global culinary hub where international and traditional Thai cuisines coexist. This makes it a prime setting for exploring consumer preferences, including both domestically produced and imported rice. The city's cultural and economic influence provides a nuanced understanding of Thai consumer behavior.

Guangzhou, China: As a major economic center in southern China, Guangzhou is pivotal in the rice trade, particularly as a distribution hub for imported rice varieties, including Thai fragrant rice. This position makes it ideal for investigating cross-cultural perceptions and preferences, especially in relation to imported products.

Questionnaire Refinement

The pre-testing phase offered valuable feedback on several aspects of the questionnaire, including clarity of attribute descriptions, cultural relevance, and overall question design. Revisions were made to ensure that the questionnaire accurately captured the nuances of consumer preferences in both contexts. This iterative refinement process enhanced the methodological rigor and cultural adaptability of the study.

Phase 2: Main Data Collection

The second phase of this study focused on a comprehensive examination of consumer preferences through sensory evaluation trials and face-to-face interviews conducted in Guangzhou, China, and Bangkok, Thailand, while incorporating additional insights from Vietnam and Cambodia. This holistic approach aimed to capture a nuanced understanding of preferences for aromatic rice varieties across four culturally distinct countries. The study emphasized critical sensory attributes such as aroma, texture, flavor, and appearance, which are widely recognized as pivotal determinants of consumer satisfaction and willingness to pay [

14].

Sensory Evaluation and Questionnaire Design

The final questionnaire was meticulously crafted to encompass a broad spectrum of factors influencing consumer preferences. These factors included rice consumption behavior, sensory evaluations, quality attributes, and purchasing decisions, which were further contextualized by social, economic, and environmental considerations [

3].

Sensory evaluation trials involved blind testing of representative aromatic rice varieties sourced from China, Thailand, Vietnam, and Cambodia. This methodological approach ensured that assessments of sensory attributes remained unbiased and were conducted under standardized conditions [

15]. Blind testing was particularly instrumental in isolating the intrinsic sensory qualities of each rice variety, enabling robust comparisons across regions.

Integration of Secondary Data

To complement the primary sensory data, secondary data were gathered from government bodies, academic literature, and industry reports. These additional resources offered crucial insights into:

Rice standards and certifications adopted across the four countries.

Market trends and their implications for aromatic rice.

The role of sensory attributes in shaping consumer perceptions and market positioning.

By integrating these diverse datasets, the study constructed a comparative framework to evaluate the competitiveness of aromatic rice varieties, both regionally and globally [

16].

Data Collection Method

Primary data were collected through an experimental survey approach, targeting a total of 1,330 respondents (665 from each country). The sample was selected using an accidental sampling method, and the sample size was determined based on the following formula [

17]:

with:

= Sample size

= Number of attributes

= Total Number of attribute levels

The result was a sample of 665 respondents per country, ensuring a robust dataset for analysis of consumer preferences for fragrant rice, including organic and conventional varieties.

2.2. Theoretical Models

This section presents an advanced theoretical framework for examining how sensory perception, country of origin (COO), and ethnocentrism shape consumer behavior in the rice markets of China and Thailand. Drawing upon seminal models from consumer economics, we integrate the Random Utility Model (RUM), Lancaster's Characteristics Theory, and Ethnocentrism Theory, while accounting for heterogeneity in preferences using advanced econometric techniques, particularly the Mixed Logit Model.

The theoretical underpinnings of this study stem from the Random Utility Model (RUM), which posits that consumer decisions are driven by their attempt to maximize utility under constraints [

18]. In the context of rice purchasing behavior in China and Thailand, consumers derive utility not merely from the product as a whole, but from the specific attributes associated with the rice, such as aroma, texture, and country of origin. These attributes are essential in shaping their purchasing decisions, particularly in culturally distinct markets.

In this study, utility

for consumer

choosing rice option

in a given choice set can be decomposed as:

where

represents the observable utility based on the characteristics of the rice, and

is a stochastic error term reflecting unobserved factors. The systematic component

is a linear function of the rice’s attributes:

The Mixed Logit Model is employed to estimate this utility function, allowing for variation in consumer preferences by accommodating unobserved heterogeneity in coefficients. This framework effectively captures the interaction between sensory perceptions and ethnocentric tendencies with COO effects, which are critical in cross-cultural studies of rice markets.

Lancaster’s (1966) Characteristics Theory posits that utility is derived from a product’s attributes rather than the product itself [

19]. This theory aligns with sensory marketing concepts, emphasizing the role of sensory attributes—such as aroma, flavor, and texture—in driving consumer preferences for aromatic rice.

In this study, sensory attributes such as aroma and texture are modeled as key determinants of utility. For example, aromatic rice varieties like Jasmine and Basmati hold cultural significance in China and Thailand, where sensory experiences are integral to consumer satisfaction. Southern Chinese consumers, for instance, highly value aroma due to cultural preferences for fragrant rice varieties, while Thai consumers often prioritize texture, such as softness, for meal satisfaction [

20]. The sensory utility component is expressed as:

In this framework, it is hypothesized that Chinese consumers will assign a higher weight (β1) to aroma, whereas Thai consumers will place greater emphasis on texture (β2). These cultural differences provide nuanced insights into sensory-driven preferences in both countries.

The Country of Origin (COO) Effect suggests that consumers often use the origin of a product as a proxy for quality and safety [

21]. This phenomenon is particularly strong in food markets where food safety concerns are prevalent. In China, recurring food safety scandals have heightened consumers’ reliance on domestic products, perceived as safer or more reliable compared to imports [

22]. The COO effect can be particularly pronounced among ethnocentric consumers who prioritize products that symbolize national pride or self-reliance [

23]. The Consumer Ethnocentrism construct, measured by the CETSCALE, interacts with the COO effect to further influence consumer preferences. Ethnocentric consumers prefer domestic products, even if imports are perceived to be of higher quality or offer better value. The interaction term

in the utility function captures the additional utility that ethnocentric consumers derive from consuming domestic rice:

It is hypothesized that Chinese consumers exhibit stronger ethnocentric tendencies, driven by sociopolitical and cultural factors, resulting in a marked preference for domestic rice. Thai consumers, while valuing domestic products, may demonstrate relatively lower ethnocentric bias and greater openness to imports.

The Mixed Logit Model is employed to account for heterogeneity in consumer preferences across individuals. Unlike the standard logit model, which assumes homogeneous preferences, the mixed logit model allows coefficients to vary across individuals, reflecting diverse consumer attitudes towards sensory attributes and COO. This is particularly relevant in cross-cultural studies where heterogeneity in taste and preferences can be substantial.

The mixed logit model assumes that individual-specific preferences are distributed across the population, allowing for a richer interpretation of consumer behavior. The choice probability for consumer

i selecting rice product

j from a choice set

C is given by:

This model captures the complex interactions between sensory perceptions, ethnocentrism, and COO, providing robust insights into the drivers of consumer preferences in the rice markets of China and Thailand.

2.3. Choice Sets Design

The selection of fragrant rice as the principal product for this investigation is motivated by its prominence as a dietary fundamental in both China and Thailand, wherein contemporary consumer behavior indicates a notable transition towards premium rice offerings. Fragrant rice, distinguished for its exceptional sensory properties, has increasingly garnered preference due to its superior aroma, texture, and aesthetic appeal. These sensory dimensions have been recognized as fundamental factors affecting consumer Willingness to Pay (WTP) for premium rice strains [

24,

25]. Within this framework, the present study seeks to examine consumer preferences regarding fragrant rice alongside their corresponding WTP, employing the Engel-Kollat-Blackwell (EKB) Model to systematically delineate consumer decision-making processes across organized stages [

26,

27,

28].

The design of the choice experiment in this research emphasizes sensory perception, which is critical in influencing consumer purchasing choices. Recent scholarly discourse posits that sensory elements such as aroma, softness, and grain integrity have been widely acknowledged as fundamental indicators of rice quality, directly impacting consumer preferences and behaviors [

24,

29]. These sensory properties were utilized as essential variables in the formation of the choice sets, thereby enabling the study to ascertain how consumers negotiate trade-offs among various quality dimensions when selecting their preferred rice product.

In addition to sensory properties, this investigation also integrates variables such as price, brand identifiers, traceability information, and certification status. Price was conceptualized as a continuous variable, quantified in the domestic currencies of the two sampled nations, China and Thailand, and categorized into low, medium, and high brackets to assess consumer sensitivity to price variations [

30,

31]. Notably, traceability—the capacity to monitor a product throughout its supply chain—was operationalized as a binary variable (Yes or No) to evaluate its influence on consumer trust and safety apprehensions [

32,

33]. Certification labels issued by governmental authorities or independent organizations were incorporated to furnish consumers with assurances regarding food safety and quality, further shaping their decision-making processes [

34,

35].

This design not only facilitates a comprehensive analysis of how sensory attributes interact with other product characteristics but also underscores the intricacies of consumer decision-making within cross-national contexts [

36]. Considering both sensory quality and supplementary factors such as price and traceability, the choice sets developed in this study offer an extensive understanding of the elements that impact consumer preferences for fragrant rice.

In recent years, the use of Country of Origin (COO) labeling has gained significant traction in the global food market, serving as a key determinant in consumer decision-making. COO labels provide vital information about where a product was grown, processed, and packaged, allowing consumers to differentiate between domestic and imported products [

7,

37]. In the rice industry, COO labels play a critical role, as they not only indicate the geographic origin of the rice but also signal its quality and safety. Consumers often associate rice from certain countries with higher standards of production and superior sensory attributes, such as aroma and texture, which can influence their willingness to pay a premium for products from these regions [

7].

The significance of COO lies in its ability to act as an extrinsic quality cue. Studies have shown that COO information can enhance consumer trust, particularly in cases where the origin country has a positive reputation for food safety and high agricultural standards. This trust, in turn, increases the consumer's Willingness to Pay (WTP) for rice from countries perceived as high-quality producers [

38,

39]. For example, consumers may prefer rice from countries like Thailand or Japan, which are known for their premium rice varieties, over rice from less well-known rice-producing regions.

2.4. Experiment Design

The experiment design for this study aimed to systematically evaluate consumer preferences for fragrant rice by incorporating key attributes and their respective levels. Initially, a full factorial design was considered, identifying five essential attributes influencing consumer choices: price, country of origin (COO), aroma, certification, and grain texture. Among these attributes, three had two levels, while two had three levels, resulting in a total of (3×3×2×2×2) = 72 possible combinations of choice sets.

Optimizing Choice Sets for Practicality

Due to the impracticality of presenting all 72 combinations to each respondent—given the potential for fatigue, reduced data quality, and higher costs—the study adopted a D-efficient design using STATA 17. This approach reduced the choice sets to 24 statistically optimized sets while maintaining the rigor and reliability of the results [

40]. By employing this method, the design minimized cognitive load on respondents, ensuring ease of response while preserving the integrity of the data [

41,

42].

To streamline further, the 24 choice sets were divided into six versions of the questionnaire, each containing four choice sets. This subdivision mitigated the risks of fatigue and complexity for respondents while reducing survey administration costs. Each respondent was randomly assigned to one version, balancing the distribution of responses across all sets.

Choice Set Structure

Each choice set presented three options to respondents:

Option A: A combination of identified rice attributes at varying levels.

Option B: Another combination of attributes differing from Option A.

Option C (Opt-out Option): Allowed respondents to abstain if neither Option A nor Option B met their preferences.

This structure reflects real-world decision-making scenarios, where consumers often have the flexibility to choose or abstain based on personal preferences.

Incorporating Sensory and Economic Attributes

Key sensory attributes, such as sweetness, aromatic quality, softness, and grain integrity, were central to the study, along with non-sensory attributes like price, COO, and certification status.

Table 1 and

Table 2 detail the characteristics and levels used in the choice sets.

Implications of Design

This carefully structured design allows for robust analysis of consumer preferences, particularly the trade-offs they make between sensory and economic attributes. For example, the inclusion of price as a continuous variable enables analysis of price sensitivity across different levels. Similarly, COO, certification, and sensory factors—such as aroma and grain texture—provide insights into how consumers value premium rice attributes.

By employing D-efficiency and optimizing the choice sets, the design ensures that respondents are neither overwhelmed nor fatigued, thus maintaining high-quality data collection that is representative of real-world purchasing behaviors.

3. Results

This section may be divided by subheadings. It should provide a concise and precise description of the experimental results, their interpretation, as well as the experimental conclusions that can be drawn.

3.1. Partcipants Demographics

The study involved 1,330 participants, evenly distributed between Guangzhou, China, and Bangkok, Thailand, to ensure a balanced and representative sample. Key socioeconomic factors, including gender, age, education, marital status, and household size, were analyzed to understand consumer preferences for fragrant rice.

The gender distribution was nearly balanced, with a slightly higher proportion of female participants in both regions. The majority of participants were within the age range of 26–45 years, underscoring their role as primary decision-makers in household purchasing. Educational attainment showed notable differences, with a higher percentage of participants in Guangzhou achieving bachelor’s degrees or higher compared to Bangkok. In terms of marital status, most participants in Guangzhou were married, while Bangkok had a greater proportion of single individuals. Household sizes differed slightly between the two regions, with Guangzhou having smaller households on average, which may influence purchasing priorities.

Table 3.

Socioeconomic Characteristics of Participants.

Table 3.

Socioeconomic Characteristics of Participants.

List |

Chinese consumers |

Thai consumers |

Total/

Average |

Percentage |

Total/

Average |

Percentage |

| Number of samples |

665 |

100 |

665 |

100 |

| Problems with taste or smell |

|

|

|

|

| do not have |

665 |

100 |

665 |

100 |

| have |

0 |

0 |

0 |

0 |

| Sex |

|

|

|

|

| man |

218 |

32.8 |

171 |

25.7 |

| female |

447 |

67.2 |

494 |

74.3 |

| Age |

|

|

|

|

| 16-25 years |

11 |

1.7 |

22 |

3.3 |

| 26-35 years |

144 |

21.7 |

173 |

26.0 |

| 36-45 years |

441 |

66.3 |

377 |

56.7 |

| 46-55 years |

68 |

10.2 |

84 |

12.6 |

| above 55 years old |

1 |

0.2 |

9 |

1.4 |

| Education level |

|

|

|

|

| Junior high school or less |

65 |

9.8 |

76 |

11.4 |

| High school or equivalent |

163 |

24.5 |

139 |

20.9 |

| college or vocational education |

176 |

26.5 |

92 |

13.8 |

| Bachelor's degree |

210 |

31.6 |

273 |

41.1 |

| Master's degree or higher |

51 |

7.7 |

85 |

12.8 |

| Marital status |

|

|

|

|

| single |

166 |

25 |

352 |

52.9 |

| married |

499 |

75 |

313 |

47.1 |

| Number of family members |

|

|

|

|

| 1-2 people |

343 |

51.6 |

157 |

23.6 |

| 3-4 people |

205 |

30.8 |

297 |

44.7 |

| 5-6 people |

93 |

14.0 |

175 |

26.3 |

| 7 or more people |

24 |

3.6 |

36 |

5.4 |

These characteristics provide a comprehensive understanding of the demographics influencing rice preferences and purchasing behaviors, serving as a foundation for further analysis. This detailed information is summarized in the following table.

In

Table 4, Household income and professional background significantly influence consumer behavior, especially in the context of premium rice markets [

43,

44,

45], local standards in Guangzhou, China [

46,

47,

48], and Bangkok, Thailand [

49,

50]. In Guangzhou, the majority (51.4%) reported monthly household incomes between 8,001–12,000 RMB, while 34.7% earned over 12,000 RMB. By contrast, Bangkok respondents displayed more income diversity, with 44.4% in the 8,001–12,000 RMB bracket, 34.9% earning 4,001–8,000 RMB, and 10.2% earning over 12,000 RMB. This income distribution highlights varied purchasing power and willingness to pay for high-quality rice products [

45,

51,

52]

Table 4.

Socioeconomic Characteristics of Participants.

Table 4.

Socioeconomic Characteristics of Participants.

List |

Chinese consumers

|

Thai consumers

|

|

Total/ Average

|

Percentage

|

Total/

Average |

Percentage

|

| Number of samples |

665 |

100 |

665 |

100 |

| Occupation |

|

|

|

|

| Government officer |

49 |

7. 4 |

143 |

21.5 |

| State enterprise |

46 |

6.9 |

103 |

15.5 |

| Company employee |

256 |

38. 5 |

87 |

13.1 |

| Personal business |

145 |

21.8 |

125 |

18.8 |

| Freelance |

81 |

12. 2 |

84 |

12.6 |

| Housewife |

22 |

3.3 |

30 |

4.5 |

| Students |

5 |

0. 8 |

56 |

8.4 |

| Retire |

61 |

9. 2 |

37 |

5.6 |

| Other |

0 |

0 |

0 |

0 |

| Total household income per month |

|

|

|

|

| Less than 4,000 RMB |

5 |

0. 8 |

70 |

10.5 |

| 4,001 – 8,000 RMB |

87 |

13. 1 |

232 |

34.9 |

| 8,001 – 12,000 RMB _ |

342 |

51. 4 |

295 |

44.4 |

| More than 12, 000 RMB |

231 |

34. 7 |

68 |

10.2 |

Household size also varied between the two regions, with Guangzhou averaging 3.5 members per household and Bangkok slightly smaller at 3.1. Larger households tend to prioritize bulk purchases, whereas smaller households may focus more on quality attributes, such as certifications and sensory excellence.

Professional backgrounds further contextualize economic conditions. In Guangzhou, company employees comprised the largest group (38.5%), followed by personal business owners (21.8%) and retirees (9.2%). Conversely, Bangkok respondents included a higher proportion of government officers (21.5%) and state enterprise employees (15.5%), alongside business owners (18.8%). These occupational variations reflect distinct economic structures and purchasing behaviors in the two regions

3.2. Sensory Perception Analysis

Sensory attributes, including taste, fragrance, softness, and completeness, play a critical role in shaping consumer preferences for fragrant rice.

Table 5 presents a comparative analysis of the impact of these attributes on WTP across the two markets.

Table 5 reports the analysis of sensory attributes underscores their pivotal role in shaping consumer preferences, particularly in the context of fragrant rice. Among Chinese consumers, taste emerged as the most influential sensory attribute, as indicated by its co-efficient (β = 0.8008, p < 0.001) [

53,

54]. This highlights the importance of flavor in driving purchase decisions, aligning with cultural values where culinary satisfaction is deeply intertwined with the quality and flavor of staple foods. Fragrance (β = 0.6277, p < 0.001) and grain completeness (β = 0.8168, p < 0.001) [

55,

56], were also highly rated, reflecting the traditional emphasis on aromatic and visually appealing rice varieties. These findings are consistent with Lancaster’s Characteristics Theory, which postulates that utility is de-rived not from the product itself but from its specific attributes.

In contrast, Thai consumers displayed distinct preferences, with softness being the most valued sensory attribute (β = 0.9836, p < 0.001) [

57,

58]. This aligns with the cultural preference for rice that complements Thai cuisine, where softness enhances the dining experience. Interestingly, fragrance had a negative coefficient (β = -1.1772, p < 0.001) [

59,

60], suggesting that the role of aroma in influencing Thai consumer preferences is secondary compared to texture. This divergence emphasizes the necessity for tailored marketing strategies that address the sensory priorities unique to each consumer base.

The relationship between sensory perceptions and willingness to pay (WTP) further elucidates these dynamics [

61,

62]. "Through an examination of the coefficient of the interaction term variable divided by the price variable coefficient, it is evident that changes in sensory attributes lead to incremental changes in WTP. For example, a one-unit increase in the perceived value of taste for Chinese consumers correlates with a higher willingness to pay, a trend that holds statistical validity as verified using the Delta Method technique [

63]. This method provides a robust framework for ensuring the reliability of findings by statistically assessing the incremental impact of sensory attributes on WTP.

The interplay between sensory perceptions and WTP underscores the strategic implications for product positioning in international markets. For Chinese consumers, enhancing the sensory profile of rice through superior taste and fragrance, alongside grain completeness, can significantly elevate perceived value [

56]. Conversely, in Thailand, emphasizing textural qualities while cautiously addressing aromatic aspects can cater to local preferences more effectively [

64].

These insights reveal the nuanced role of sensory perceptions in consumer decision-making. By integrating econometric models, such as the Random Utility Model (RUM), and applying techniques like the Delta Method, the analysis provides a statistically rigorous understanding of how sensory attributes contribute to consumer preferences and economic behavior. This approach not only affirms the theoretical underpinnings of Lancaster’s framework but also offers practical guidance for optimizing product design and marketing strategies to meet culturally specific consumer demands.

Ultimately, the findings underscore the critical importance of aligning sensory attributes with consumer expectations, ensuring that product offerings resonate with the sensory priorities of diverse consumer segments in the global rice market.

3.3. Country of Origin (COO) Analysis

The analysis of the country-of-origin (COO) effects on consumer preferences reveals significant insights into how the origin of fragrant rice influences purchasing decisions among Chinese and Thai consumers shows in

Table 6. The findings demonstrate that COO significantly affects consumer evaluations, with the impact varying between these two national groups due to cultural and contextual differences.

For Chinese consumers, rice originating from Thailand holds the highest coefficient (β = 2.2779, p < 0.001), underscoring Thailand’s strong reputation for producing high-quality fragrant rice, such as jasmine rice. The results suggest that Chinese consumers place substantial value on the premium quality associated with Thai rice, aligning with prior research that emphasizes the importance of COO as a heuristic cue for quality in food products [

21,

65]. Cambodian and Vietnamese rice also score positively (β = 1.4164, p < 0.001; β = 1.1936, p < 0.001), reflecting a favorable perception of rice from these neighboring Southeast Asian countries. Chinese rice, while positively evaluated (β = 1.1788, p < 0.001), receives a relatively lower coefficient compared to imported varieties, which may indicate that domestic rice, although familiar, is perceived as less distinctive in sensory or quality terms.

Similarly, Thai consumers exhibit the highest preference for Thai rice (β = 2.2779, p < 0.001), affirming strong ethnocentric tendencies and the cultural importance of local rice varieties in Thailand [

65]. Unlike Chinese consumers, Thai respondents assign relatively lower coefficients to imported rice. Cambodian rice (β = 1.4164, p < 0.001) is positively evaluated, reflecting geographic proximity and historical trade relationships that may contribute to familiarity and trust. Vietnamese rice (β = 1.1936, p < 0.001) is also favored, albeit to a lesser extent. However, the findings suggest that Thai consumers maintain a strong preference for domestically produced rice, aligning with the concept of consumer ethnocentrism, which posits that individuals prioritize local goods due to national pride and perceived economic benefits [

23].

The standard deviation analysis further highlights variations in consumer perceptions within each COO category. Among Chinese consumers, the large standard deviation for Thai rice (SD = 7.545965, p < 0.001) indicates greater heterogeneity in perceptions, possibly driven by differing levels of exposure to or awareness of Thai rice brands. Conversely, Thai consumers exhibit a negative standard deviation for Thai rice (SD = -1.815996, p < 0.001), suggesting a more uniform and favorable perception among respondents. This consistency may reflect the ingrained cultural and culinary significance of locally produced rice in Thailand.

The COO effect is deeply rooted in both the symbolic and functional values that consumers associate with the product's origin. Symbolically, COO acts as a marker of authenticity and cultural heritage, as seen in the premium positioning of Thai rice in the Chinese market. Functionally, COO serves as a cue for quality and safety, especially in food markets where consumers rely on extrinsic attributes to mitigate perceived risks. This is particularly relevant in China, where food safety concerns have heightened the reliance on COO as a determinant of trust.

The findings also align with Lancaster's Characteristics Theory (1966), which posits that consumers derive utility from the attributes of a product rather than the product itself [

19]. COO serves as an extrinsic attribute that shapes consumer perceptions of intrinsic qualities, such as aroma, texture, and grain integrity [

39]. Thai rice’s dominant position in both Chinese and Thai markets exemplifies how COO enhances the perceived value of these intrinsic attributes, thereby influencing consumer preferences and willingness to pay [

46,

66].

Moreover, the significant standard deviation values suggest that COO influences are not uniform across all consumers but are moderated by individual factors such as cultural familiarity, prior experience, and socioeconomic status. The Delta Method could further quantify the incremental changes in willingness to pay (WTP) associated with variations in COO, providing a robust statistical framework for examining these interactions.

In conclusion, the COO effect significantly shapes consumer preferences for fragrant rice in both China and Thailand, highlighting the interplay between sensory perceptions and cultural values. For Chinese consumers, the preference for Thai rice underscores its premium positioning and the importance of quality cues in shaping purchase decisions. For Thai consumers, the strong preference for domestic rice reflects ethnocentric values and the cultural importance of rice as a staple food. These insights underscore the need for targeted marketing strategies that leverage COO to enhance brand equity and consumer trust in cross-national markets.

3.4. Willingness to Pay Analysis

The data in

Table 7 provide a comprehensive analysis of the willingness to pay (WTP) for various attributes of fragrant rice among Chinese and Thai consumers. The findings illustrate distinct consumer preferences influenced by cultural and economic contexts, underscoring the importance of sensory and extrinsic factors in purchasing decisions.

For Chinese consumers, sensory attributes are significant determinants of WTP. Enhanced taste commands the highest premium among sensory characteristics, with Chinese consumers willing to pay 49.73 RMB per bag [

54,

67]. Similarly, fragrance is highly valued, with a WTP of 38.98 RMB per bag [

54,

68], reflecting a preference for aromatic and flavorful rice varieties. Grain completeness and quality standard seals are also crucial, with premiums of 50.73 RMB and 50.82 RMB per bag, respectively [

55,

69], indicating strong consumer trust in certified quality and visual appeal. Texture, while important, carries a lower premium of 27.22 RMB per bag, suggesting that softness is a secondary consideration compared to taste and fragrance.

The country of origin (COO) significantly impacts Chinese consumer preferences. Vietnamese rice garners a premium of 73.21 RMB [

55], and Cambodian rice is valued slightly higher at 87.97 RMB per bag. Notably, Thai fragrant rice commands the highest premium of 141.48 RMB per bag (insert citation), demonstrating its strong reputation for quality in the Chinese market. These preferences highlight the critical role of COO as an extrinsic quality cue in shaping purchasing behavior.

For Thai consumers, the valuation of fragrant rice attributes differs significantly. The highest premium is assigned to Thai fragrant rice at 73.61 RMB per bag [

70,

71]—substantially lower than the corresponding valuation by Chinese consumers. Among sensory attributes, softness is a priority for Thai consumers, with a WTP of 9.59 RMB per bag [

72]. However, fragrance exhibits a negative coefficient (-11.48 RMB), indicating that aroma is not a key driver of preference [

73], aligning with cultural preferences for texture and mouthfeel over aromatic qualities. Grain completeness and quality standard seals hold modest premiums of 3.94 RMB and 6.25 RMB per bag, respectively [

65,

74], highlighting a more conservative approach to premium attributes.

The influence of COO on Thai consumer behavior reflects regional preferences and trust in local production. Cambodian rice is valued at 29.40 RMB per bag, followed by Vietnamese rice at 17.55 RMB. Chinese rice, however, is valued the least, at 6.17 RMB per bag, emphasizing a strong preference for regionally or locally sourced rice varieties over imports.

Key Findings and Implications

The analysis reveals notable disparities in WTP across consumer groups. Chinese consumers exhibit a markedly higher WTP for almost all attributes compared to Thai consumers, with an average premium disparity of approximately 111.05 RMB versus 16.20 RMB per 5 kg bag. This indicates that Chinese consumers place a greater emphasis on premium attributes such as origin, certification, and sensory excellence. Conversely, Thai consumers demonstrate more conservative spending behavior, influenced by cultural priorities and economic factors, with affordability and texture being the dominant considerations [

75].

These findings have significant implications for the fragrant rice industry. In Chinese markets, strategies should focus on premium positioning, leveraging sensory attributes such as taste and fragrance alongside COO branding, particularly for Thai rice, to maximize consumer appeal [

72,

76]. Emphasizing certifications and quality seals can further enhance consumer trust and justify higher price points [

77]. For the Thai market, marketing efforts should prioritize affordability and texture optimization, aligning with local consumer preferences [

78,

79]. While certifications can add value, their impact may be secondary to price considerations in this context [

80,

81,

82]

4. Discussion

This research provides an in-depth examination of the influence of sensory perceptions, country of origin (COO), and consumer preferences for fragrant rice in China and Thailand. By integrating choice experiments and willingness to pay (WTP) analyses, the study identifies key behavioral differences driven by sensory, economic, and cultural factors [

45,

83], offering critical insights for producers, marketers, and policymakers.

The findings underscore that sensory attributes are central to shaping consumer preferences. For Chinese consumers, attributes such as taste and fragrance emerge as pivotal, with higher WTP values of 49.73 RMB and 38.98 RMB, respectively [

46,

54,

84]. Conversely, Thai consumers prioritize texture, with a WTP of 9.59 RMB, while fragrance is negatively valued (-11.48 RMB) [

45], reflecting differing cultural priorities. These preferences highlight the importance of aligning product characteristics with market-specific sensory expectations [

85,

86].

Country of origin plays a decisive role in influencing purchasing decisions, with Thai fragrant rice commanding the highest WTP premiums in both markets, at 141.48 RMB for Chinese consumers and 73.61 RMB for Thai consumers [

87]. This indicates a strong perception of quality associated with Thai rice globally. Cambodian and Vietnamese rice varieties also demonstrate competitiveness in both markets, although their valuation is comparatively lower [

88,

89]. The prominence of COO reflects its role as an extrinsic quality cue, shaping trust and perceived product authenticity [

90].

Economic and cultural contexts further amplify these differences. Rising incomes and heightened health awareness among Chinese consumers drive their preference for premium attributes, including certifications (50.82 RMB) [

91,

92]. In contrast, Thai consumers exhibit price sensitivity, with affordability and texture as dominant factors influencing their decisions [

93]. Despite this, certification still holds moderate value in Thailand (6.25 RMB) [

94], suggesting untapped potential for increasing consumer education and awareness of its significance [

45].

Implications for stakeholders emphasize the necessity for tailored marketing strategies. For Chinese markets, a premium approach highlighting sensory excellence, COO branding, and robust certification is essential. Meanwhile, for Thailand, strategies should focus on affordability, emphasizing texture, and leveraging certifications to build trust and justify higher pricing.

Future research should explore evolving consumer preferences across different demographic and regional contexts, particularly in response to socio-economic shifts and technological advancements in agriculture. Understanding the interplay between branding, certification, and sensory quality in broader markets can provide actionable strategies for enhancing competitiveness.

This study significantly contributes to the understanding of consumer behavior in the rice market, offering a framework for aligning production and marketing strategies with diverse global demands. It highlights the critical interplay of sensory attributes, COO, and certifications in shaping purchasing decisions, ultimately reinforcing the importance of cultural and economic considerations in developing competitive rice products.

5. Conclusions

This investigation presents a thorough examination of the sensory characteristics and country-of-origin influences that shape consumer inclinations towards aromatic rice in China and Thailand. Employing rigorous methodological strategies, including choice experiments and structural equation modeling, the inquiry elucidates essential insights into the cultural and economic determinants that impact rice procurement decisions.

The results emphasize the crucial significance of sensory characteristics—fragrance, texture, and grain caliber—as vital determinants of consumer inclinations. For Chinese consumers, the predilection for superior-quality rice accentuates the significance of certifications and brand credibility in a marketplace characterized by increasing income levels and heightened awareness of food safety. Conversely, Thai consumers display pronounced ethnocentric inclinations, preferring domestically produced rice while prioritizing cost-effectiveness and sensory excellence, particularly in texture.

The investigation underscores the imperative of customizing marketing strategies to cater to culturally specific inclinations. In Chinese markets, accentuating sensory characteristics, in conjunction with certifications and robust country-of-origin branding, can amplify competitiveness. In Thai markets, concentrating on affordability and the texture of rice is congruent with consumer priorities.

These revelations yield significant implications for policymakers, producers, and marketers in optimizing the positioning of fragrant rice within global markets. By capitalizing on sensory characteristics and country-of-origin perceptions, stakeholders can augment the value proposition of premium rice varieties, thereby enhancing international competitiveness and addressing the shifting demands of diverse consumer segments.

This research contributes to the expanding corpus of literature on cross-cultural consumer behavior and furnishes actionable strategies to align production, marketing, and policy frameworks with dynamic global market trends. Future inquiries should investigate the intersection of technology, branding, and sensory innovation in sustaining the competitiveness of fragrant rice within a rapidly globalizing food economy.

Author Contributions

Conceptualization, T.S; methodology, T.S., A.B. and B.J.; software, T.S., A.B. and F.K.; validation, T.S., A.B. and B.J.; formal analysis, T.S. and S.S.; investigation, T.S.; resources, T.S., S.S. and A.B.; data curation, T.S., S.S. and A.B.; writing—original draft preparation, T.S. and S.S.; writing—review and editing, B.J.; visualization, T.S., A.B. and S.S.; supervision, T.S. and B.J.; project administration, T.S.; funding acquisition, T.S., A.B. and S.S. All authors have read and agreed to the published version of the manuscript.

Funding

“This research was funded by National Research Council of Thailand (NRCT), number RDG6220009” coordinated through Knowledge Network Institute of Thailand , Office of Project Coordination, Agricultural Policy Research

Data Availability Statement

The study's original contributions are detailed in the article; for further inquiries, please contact the corresponding author.

Acknowledgments

The authors thank the people whose comments helped to improve this article.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Data screening

During this phase, all questionnaires utilized in the study underwent a thorough screening process to identify any missing data prior to commencing the analysis. Although this step may seem straightforward, it played a crucial role in facilitating the data analysis process. Descriptive statistical analysis was conducted for each questionnaire item to validate accuracy. Responses yielding values outside the expected range were compared with the original questionnaires to enhance precision.

Appendix B

Table A1 displays the total number and percentage of missing values, indicating that variance across all variables within the male and female groups was equal.

Table A1.

Missing Data of the Variables.

Table A1.

Missing Data of the Variables.

| Variables |

Symbol |

Missing value China |

Missing value Thailand |

| Brand Attachment |

BA |

2 |

1 |

| Brand Switching |

BS |

3 |

- |

| Brand Trust |

BT |

- |

1 |

| Nutrition property label |

COO |

4 |

3 |

| Consumer Satisfaction |

CS |

2 |

- |

| Decision Making |

DM |

- |

2 |

| Product Certificate |

PC |

2 |

- |

| Product Price |

PP |

3 |

- |

| Rice used for testing |

R |

- |

- |

| Sensory Branding |

SB |

- |

- |

| Sensory Experience |

SE |

- |

- |

| Sensory Perception |

SP |

- |

- |

| The Senses |

TS |

3 |

2 |

| Total |

|

19 out of 21,633 data points

|

11 out of 21,633 data points

|

| Percentage |

|

0.08% |

0.05% |

Missing data constitutes a prevalent and paramount concern in data analysis, as it can significantly impact the validity and dependability of research findings [

95,

96]. The occurrence of missing data can result in biased parameter estimations, diminished statistical power, and obstacles in generalizing the conclusions. To alleviate these repercussions, it is imperative to evaluate the pattern of missing data to ascertain whether it transpires randomly (Missing Completely at Random, MCAR) or adheres to a systematic pattern (Missing at Random, MAR, or Missing Not at Random, MNAR) [

97].

In this investigation, the dataset underwent a meticulous assessment to ascertain the magnitude and nature of missing data [

98]. propose that missing data levels below 10% are generally manageable and unlikely to undermine the analysis significantly. The dataset in this inquiry exhibited a missing data rate of 0.04%, which is considerably beneath the acceptable threshold. This minimal percentage was regarded as statistically non-significant, alleviating concerns regarding the potential distortion of the study's conclusions.

Given that the missing data was ascertained to occur randomly (MCAR), statistical imputation methodologies were utilized to mitigate the issue. Randomly missing values were substituted using statistical techniques that ensure minimal bias and uphold the integrity of the dataset [

99]. endorse such methodologies, emphasizing their effectiveness in preserving consistency and mitigating the risk of introducing systematic errors during the imputation procedure. These techniques ensure that the missing data does not disproportionately influence the parameter estimations or the overall validity of the study.

By addressing missing data through these rigorous methodologies, this investigation enhances the dependability of its results and upholds adherence to established best practices in statistical analysis. This approach bolsters the robustness of subsequent analyses and fortifies the credibility of the research findings.

Appendix C

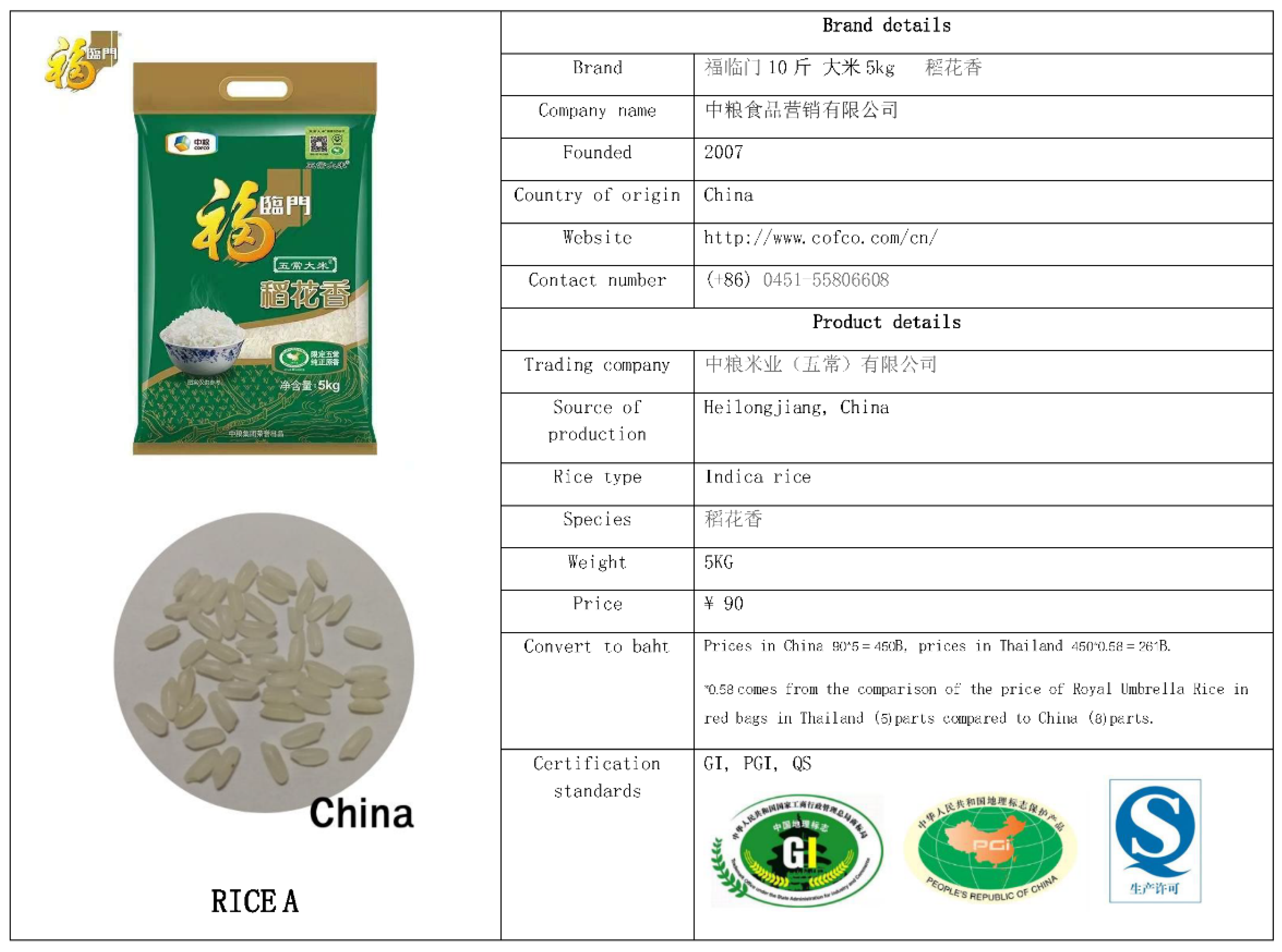

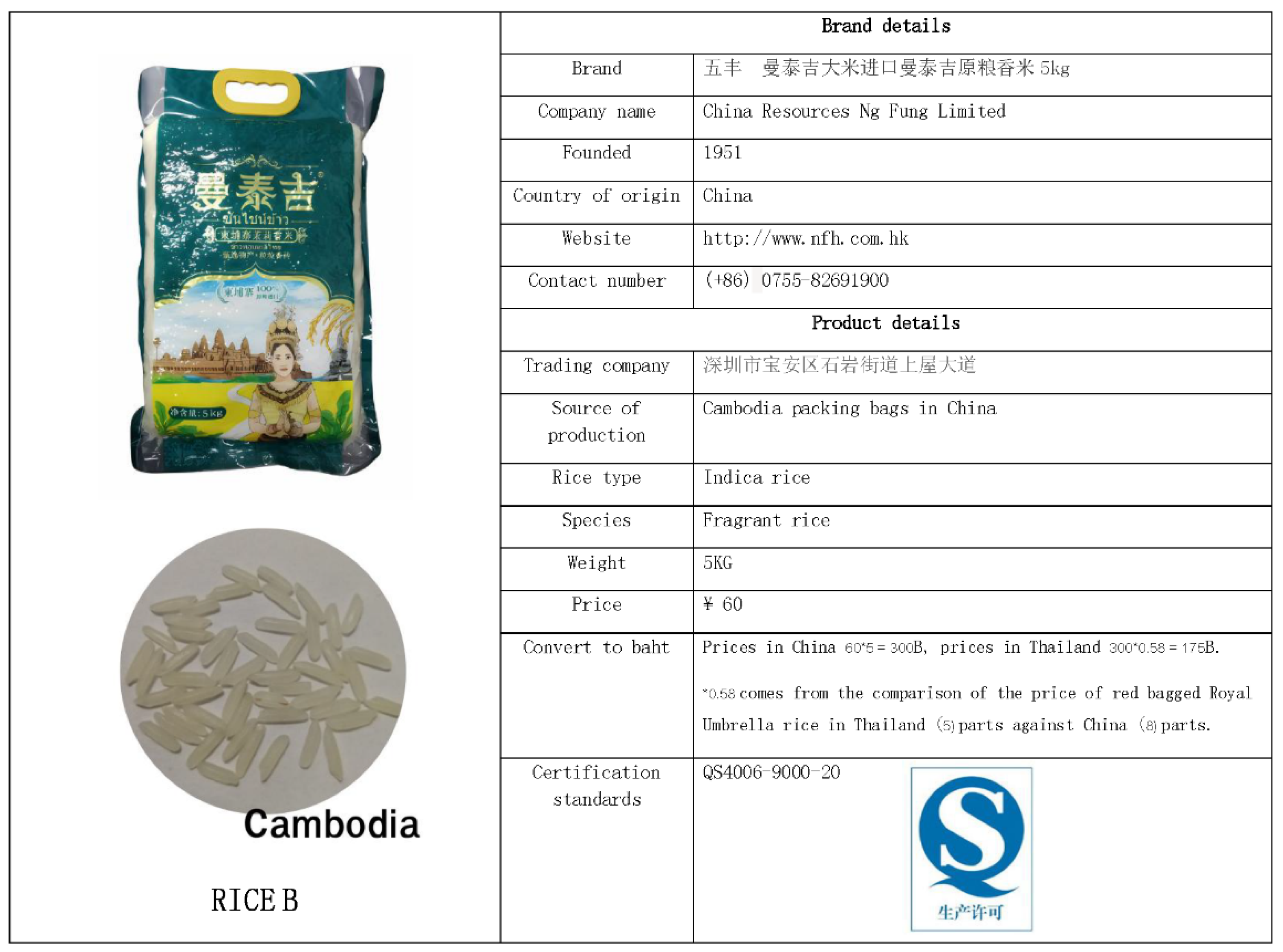

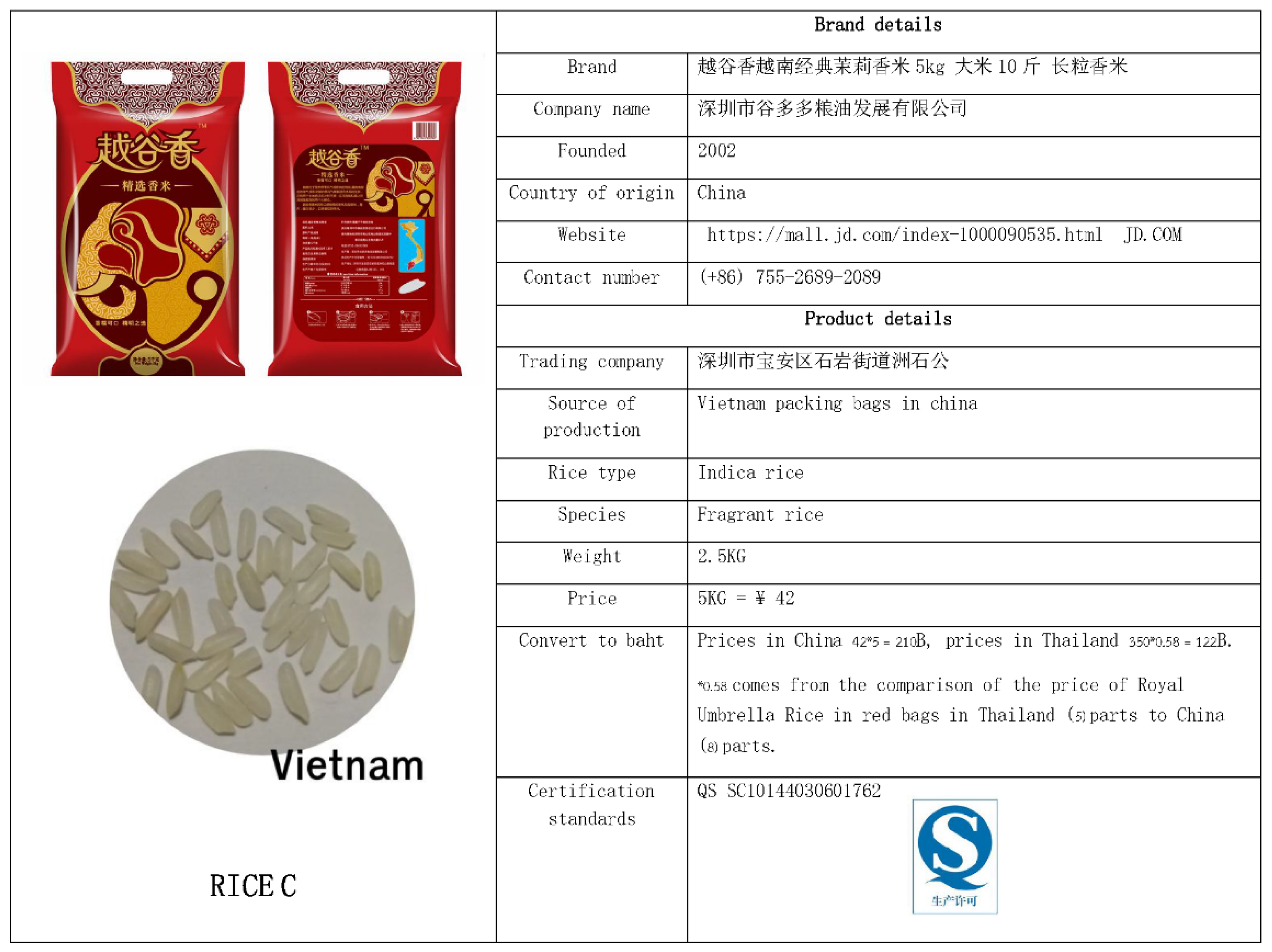

Detailed figure of rice used in the experiment with explanations

Figure A1.

Details of the rice from China used in the experiment.

Figure A1.

Details of the rice from China used in the experiment.

Figure A2.

Details of the rice from Cambodia used in the experiment.

Figure A2.

Details of the rice from Cambodia used in the experiment.

Figure A3.

Details of the rice from Vietnam used in the experiment.

Figure A3.

Details of the rice from Vietnam used in the experiment.

Figure A4.

Details of the rice from Thailand used in the experiment.

Figure A4.

Details of the rice from Thailand used in the experiment.

References

- Industry ARC. Global Rice Market: Trends and Forecast (2021-2030). Industry Analysis Report. Available online: https://www.industryarc.com/Research/Rice-Market-Research-509581 (accessed on 23 October 2024).

- Bin Rahman, M.; Zhang, Q. Rice and Global Food Security: Challenges and Prospects. Agric. Policy Rev. 2023.

- Mohanty, S. Trends in Global Rice Consumption and Trade. Rice Today 2013, 12, 30–34.

- The Rice Trader (TRT). World’s Best Rice Award: A Celebration of Quality. Available online: www.thericetrader.com (accessed on 12 October 2024).

- Walley, K.; Cheng, L.; Liu, T. Antecedent Factors Impacting Country of Origin (COO): An Investigation into Food Provenance in China. TMJ 2019, 7, 752. [CrossRef]

- Dobrenova, F.V.; Grabner-Kräuter, S.; Terlutter, R. Country-of-Origin (COO) Effects in the Promotion of Functional Ingredients and Functional Foods. Eur. Manag. J. 2015, 33, 314–321. [CrossRef]

- Chiciudean, D.; Funar, S.; Chiciudean, G. Study Regarding the Influence of Country of Origin (COO) over the Consumer Decision-Making Process in Buying Food. Bull. Univ. Agric. Sci. Vet. Med. Cluj-Napoca Hortic. 2013, 70, 13–20.

- Chen, S.; Wright, M.; Gao, H.; Liu, H.; Mather, D. The Effects of Brand Origin and Country-of-Manufacture on Consumers’ Institutional Perceptions and Purchase Decision-Making. Int. Mark. Rev. 2020, 37, 205–219. [CrossRef]

- Wang, J.; Tao, J.; Chu, M. Behind the Label: Chinese Consumers’ Trust in Food Certification and the Effect of Perceived Quality on Purchase Intention. Food Control 2020, 108, 106825. [CrossRef]

- Zader, A. Grain as Commodity: The Making of Chinese Consumer-Citizens through the Northeast Rice Network. 2011.

- Somsong, P.; McNally, R.C.; Hsieh, C.-M. Consumers’ Perceptions towards Thai Rice: A Cross-Cultural Comparison between Easterners and Westerners. Br. Food J. 2019, 121, 1349–1362. [CrossRef]

- Meullenet, J.-F.; Griffin, V.K.; Carson, K.; Davis, G.; Davis, S.; Gross, J.; Hankins, J.A., et al. Rice External Preference Mapping for Asian Consumers Living in the United States. J. Sens. Stud. 2001, 16, 41–55. [CrossRef]

- Boonkong, A.; Jiang, B.; Kassoh, F.S.; Srisukwatanachai, T. Chinese and Thai Consumers’ Willingness to Pay for Quality Rice Attributes: A Discrete Choice Experiment Method. Front. Sustain. Food Syst. 2023, 7, 1270331. [CrossRef]

- Tran, D.V.; Quality Attributes of Aromatic Rice: Global Trends and Consumer Preferences. Food Chem. 2020, 312, 126123.

- Gupta, R.; Garg, S. Role of Sensory Evaluation in Rice Marketing: A Global Perspective. J. Food Sci. 2019, 84, 1000–1012. [CrossRef]

- Bin Rahman, M.; Zhang, Q. Rice and Global Food Security: Challenges and Prospects. Agric. Policy Rev. 2023, 10, 20–30.

- Hair, J.F.; Black, W.C.; Babin, B.J.; Anderson, R.E.; Tatham, R.L. Multivariate Data Analysis, 6th ed.; Pearson International Edition: New Jersey, NJ, USA, 2006.

- McFadden, D. Conditional Logit Analysis of Qualitative Choice Behavior. In Frontiers in Econometrics; Zarembka, P., Ed.; Academic Press: New York, NY, USA, 1974; pp. 105–142.

- Lancaster, K.J. A New Approach to Consumer Theory. J. Polit. Econ. 1966, 74, 132–157. [CrossRef]

- Wang, Q., et al. Consumer Preferences for Rice Attributes: Evidence from China and Thailand. Food Policy 2015, 55, 17–25. [CrossRef]

- Bilkey, W.J.; Nes, E. Country-of-Origin Effects on Product Evaluations. J. Int. Bus. Stud. 1982, 13, 89–100. [CrossRef]

- Wu, L., et al. The Role of Food Safety in Consumer Decision-Making: A Comparative Study Between China and Thailand. Agric. Econ. Rev. 2017, 28, 205–215.

- Shimp, T.A.; Sharma, S. Consumer Ethnocentrism: Construction and Validation of the CETSCALE. J. Mark. Res. 1987, 24, 280–289. [CrossRef]

- Lee, S.-J.; Lee, K.-G. Understanding Consumer Preferences for Rice Wines Using Sensory Data. J. Sci. Food Agric. 2008, 88, 813–819. [CrossRef]

- Lu, L.; Hu, Z.; Fang, C.; Hu, X. Characteristic Flavor Compounds and Functional Components of Fragrant Rice with Different Flavor Types. Foods 2023, 12, 2185. [CrossRef]

- Meullenet, J.-F.; Griffin, V.K.; Carson, K.; Davis, G.; Davis, S.; Gross, J.; Hankins, J.A., et al. Rice External Preference Mapping for Asian Consumers Living in the United States. J. Sens. Stud. 2001, 16, 73–85. [CrossRef]

- Bidarti, A.; Laila, H.; Yulius, Y. Structure of Rice Demand and Consumer Lexicographic Preferences in Indonesia. Russ. J. Agric. Socio-Econ. Sci. 2019, 12, 4–11. [CrossRef]

- Bairagi, S.; Demont, M.; Custodio, M.C.; Ynion, J. What Drives Consumer Demand for Rice Fragrance? Evidence from South and Southeast Asia. Br. Food J. 2020, 122, 441–457. [CrossRef]

- Tomlins, K.I.; Manful, J.T.; Gayin, J.; Kudjawu, B.; Tamakloe, I. Study of Sensory Evaluation, Consumer Acceptability, Affordability and Market Price of Rice. J. Sci. Food Agric. 2007, 87, 1564–1575. [CrossRef]

- Simha, S. Study of Sensory Marketing Strategies in Retailing Business. Asia Pac. Magn. Rec. Conf. 2020, 1–7.

- Iannario, M.; Manisera, M.; Piccolo, D.; Zuccolotto, P. Sensory Analysis in the Food Industry as a Tool for Marketing Decisions. Adv. Data Anal. Classif. 2012, 6, 249–263. [CrossRef]

- Haleem, A.; Khan, S.; Khan, M.I. Traceability Implementation in Food Supply Chain: A Grey-DEMATEL Approach. Inf. Process. Agric. 2019, 6, 335–348. [CrossRef]

- Liu, Y.; Gao, H. Traceability Management for Food Safety along the Supply Chain Collaboration of Agricultural Products. Agric. For. Fish. 2018, 7, 38–43. [CrossRef]

- Truong, V.A.; Lang, B.; Conroy, D.M. When Food Governance Matters to Consumer Food Choice: Consumer Perception of and Preference for Food Quality Certifications. Appetite 2022, 168, 105688. [CrossRef]

- Prinsloo, N.; Van der Merwe, D.; Bosman, M.J.C.; Erasmus, A.C. A Critical Review of the Significance of Food Labelling during Consumer Decision Making. Tydskr. Gesinsek. Verbr. Wetenskappe 2012, 40, 58–65.

- Symmank, C. Extrinsic and Intrinsic Food Product Attributes in Consumer and Sensory Research: Literature Review and Quantification of the Findings. J. Int. Consum. Stud. 2019, 42, 201–212. [CrossRef]

- Holdershaw, J.; Konopka, R. The Effect of Visibility of Country of Origin Labelling on Consumers’ Fresh Meat Preferences. Asia Pac. J. Mark. Logist. 2023, 35, 84–102. [CrossRef]

- Jang, J.A.; Oh, J.; Na, Y.; Yeo, G.E.; Cho, M.S. Emotions Evoked by Colors and Health Functionality Information of Colored Rice: A Cross-Cultural Study. Foods 2021, 10, 231. [CrossRef]

- Herz, M. Do You Know COO? An Explorative Perspective on Consumers’ Country-of-Origin Knowledge. In Advances in Consumer Research; Springer: Berlin, Germany, 2015; pp. 101–117. [CrossRef]

- Flynn, T.N.; Bilger, M.; Malhotra, C.; Finkelstein, E.A. Are Efficient Designs Used in Discrete Choice Experiments Too Difficult for Some Respondents? A Case Study Eliciting Preferences for End-of-Life Care. PharmacoEconomics 2016, 34, 663–672. [CrossRef]

- Rouder, J.; Saucier, O.; Kinder, R.; Jans, M. What to Do With All Those Open-Ended Responses? Data Visualization Techniques for Survey Researchers. Survey Practice 2021, 14. [CrossRef]

- Azeem, M.W. Introducing an Efficient Alternative Technique to Optional Quantitative Randomized Response Models. Methods 2023, 57, 123–132. [CrossRef]

- Eze, E.; Lemchi, J.I.; Ohajianya, D.; Eze, C.; Ehirim, N.C.; Effiong, J.; Korie, O.; Ben-Chendo, G.; Njoku, G. Consumer Influence on Retail Prices of Rice in Imo State of Nigeria. Nig. Agric. J. 2014, 45, 21–32.

- Naseem, A.; Mhlanga, S.; Diagne, A.; Adegbola, P.Y.; Midingoyi, G.S. Economic Analysis of Consumer Choices Based on Rice Attributes in the Food Markets of West Africa—the Case of Benin. Food Sec. 2013, 5, 637–648. [CrossRef]

- Anang, B.T.; Adjetey, S.N.A.; Abiriwe, S.A. Consumer Preferences for Rice Quality Characteristics and the Effects on Price in the Tamale Metropolis, Northern Region, Ghana. Int. J. AgriSci. 2011, 3, 223–230.

- Bunyasiri, I.; Sirisupluxana, P. Consumer’s Behavior and Rice Attributes for Thai HomMali Rice in Sichuan Province of China. J. Bus. Res. Mark. Rev. 2018, 12, 113–125. [CrossRef]

- Zader, A. Grain as Commodity: The Making of Chinese Consumer-Citizens through the Northeast Rice Network. Unpubl. Work 2011, 10, 45–56.

- Nie, W.; Abler, D.G.; Zhu, L.; Li, T.; Lin, G. Consumer Preferences and Welfare Evaluation under Current Food Inspection Measures in China: Evidence from Real Experiment Choice of Rice Labels. Sustainability 2018, 10, 14003. [CrossRef]

- Bairagi, S.; Demont, M.; Custodio, M.C.; Ynion, J. What Drives Consumer Demand for Rice Fragrance? Evidence from South and Southeast Asia. Br. Food J. 2020, 122, 147–159. [CrossRef]

- Cavite, H.J.M.; Mankeb, P.; Suwanmaneepong, S. Community Enterprise Consumers’ Intention to Purchase Organic Rice in Thailand: The Moderating Role of Product Traceability Knowledge. Br. Food J. 2021, 123, 2383–2398. [CrossRef]

- Sari, Y.N.; Rasmikayati, E.; Saefudin, B.R.; Karyani, T.; Wiyono, S. Willingness To Pay Konsumen Beras Organik Dan Faktor-Faktor Yang Berkaitan Dengan Kesediaan Konsumen Untuk Membayar Lebih. Forum Agribisnis 2020, 10, 46–57. [CrossRef]

- Obih, U.; Baiyegunhi, L.S. Willingness to Pay and Preference for Imported Rice Brands in Nigeria: Do Price–Quality Differentials Explain Consumers’ Inertia? S. Afr. J. Econ. Manag. Sci. 2017, 20, 1–11. [CrossRef]

- Wang, O.; Gellynck, X.; Verbeke, W. Chinese Consumers and European Beer: Associations between Attribute Importance, Socio-Demographics, and Consumption. Appetite 2017, 108, 416–425. [CrossRef]

- Liu, C.; Dong, J.; Wang, J.; Yin, X.; Li, Q. A Comprehensive Sensory Evaluation of Beers from the Chinese Market. J. Inst. Brew. 2012, 118, 136–142. [CrossRef]

- Wang, Z.; Wang, Z.; Li, J.; Zheng, S.; Moritaka, M.; Fukuda, S. Factors Affecting Chinese Consumer Awareness and Acceptance of Japanese Rice. J. Fac. Agric. Kyushu Univ. 2013, 58, 303–310. [CrossRef]

- Zader, A. Grain as Commodity: The Making of Chinese Consumer-Citizens through the Northeast Rice Network. Unpubl. Work 2011, 10, 45–56.

- Wangcharoen, W.; Ngarmsak, T.; Wilkinson, B.H.P. Suitability of Using Herbs as Functional Ingredients in Thai Commercial Snacks. Kasetsart J. Nat. Sci. 2002, 36, 376–381.

- Jantathai, S.; Sungsri-in, M.; Mukprasirt, A.; Duerrschmid, K. Sensory Expectations and Perceptions of Austrian and Thai Consumers: A Case Study with Six Colored Thai Desserts. Food Res. Int. 2014, 64, 195–202. [CrossRef]

- Lapsongphon, N.; Yongsawatdigul, J.; Cadwallader, K.R. Identification and Characterization of the Aroma-Impact Components of Thai Fish Sauce. J. Agric. Food Chem. 2015, 63, 3766–3776. [CrossRef]

- Rotsatchakul, P.; Chaiseri, S.; Cadwallader, K.R. Identification of Characteristic Aroma Components of Thai Fried Chili Paste. J. Agric. Food Chem. 2008, 56, 1415–1422. [CrossRef]

- Gabrielyan, G.; McCluskey, J.J.; Marsh, T.L.; Ross, C.F. Willingness to Pay for Sensory Attributes in Beer. Agric. Resour. Econ. Rev. 2014, 43, 125–139. [CrossRef]

- Mahadevia, P.J.; Shah, S.; Mannix, S.; Brewster-Jordan, J.; Kleinman, L.; Liebman, C.; O’Dowd, L. Willingness to Pay for Sensory Attributes of Intranasal Corticosteroids among Patients with Allergic Rhinitis. J. Manag. Care Pharm. 2006, 12, 143–151. [CrossRef]

- Wang, H.; He, J.; Kim, Y.; Kamata, T. Willingness-to-Pay for Water Quality Improvements in Chinese Rivers: An Empirical Test on the Ordering Effects of Multiple-Bounded Discrete Choices. J. Environ. Manag. 2013, 131, 257–267. [CrossRef]

- Pongkijvorasin, S.; McGreevy, S.R. Loving Local Beans? The Challenge of Valorizing Local Food in the Thai Highlands. Environ. Dev. Sustain. 2021, 23, 1865–1883. [CrossRef]

- Nitiwanakul, W. A Comparative Study of Customer Perceived Value as a Driver for Fine Dining Restaurant Selection: A Case of Thai Consumers and Expatriates. AU J. Manag. 2014, 12, 45–58.

- Yu, X.; Yu, X.; Yan, B.; Gao, Z. Can Willingness-to-Pay Values Be Manipulated? Evidence from an Organic Food Experiment in China. Agric. Econ. 2014, 45, 579–589. [CrossRef]

- Shi, J. A Study of Influence of Personal Factors on Consumer Behavior in Luxury Goods in China. Unpublished Work, 2012.

- Wu, L.; Wang, H.; Zhu, D.; Hu, W.; Wang, S. Chinese Consumers’ Willingness to Pay for Pork Traceability Information—the Case of Wuxi. Agric. Econ. 2016, 47, 71–79. [CrossRef]

- Leesawatwong, M.; Jamjod, S.; Rerkasem, B.; Pinjai, S. Determinants of a Premium-Priced, Special-Quality Rice. Int. Rice Res. Notes 2011, 36, 23–30.

- Prathepha, P.; Srisa-ard, K. Population Differentiation of Thai Fragrant Rice Variety Revealed by SSR Marker Analysis. Genomics Genet. 2014, 7, 171–180. [CrossRef]

- Pinson, S.R.M. Inheritance of Aroma in Six Rice Cultivars. Crop Sci. 1994, 34, 1153–1157. [CrossRef]

- Lapsongphon, N.; Yongsawatdigul, J.; Cadwallader, K.R. Identification and Characterization of the Aroma-Impact Components of Thai Fish Sauce. J. Agric. Food Chem. 2015, 63, 2386–2394. [CrossRef]

- Sansenya, S.; Hua, Y.; Chumanee, S. The Correlation between 2-Acetyl-1-Pyrroline Content, Biological Compounds and Molecular Characterization to the Aroma Intensities of Thai Local Rice. J. Oleo Sci. 2018, 67, 739–747. [CrossRef]

- Suwannaporn, P.; Linnemann, A.R. Consumer Preferences and Buying Criteria in Rice: A Study to Identify Market Strategy for Thailand Jasmine Rice Export. J. Food Prod. Mark. 2008, 14, 33–53. [CrossRef]

- Isvilanonda, S.; Kongrith, W. Thai Household’s Rice Consumption and Its Demand Elasticity. Asean Econ. Bull. 2008, 25, 281–295. [CrossRef]

- Golestan Hashemi, F.S.; Rafii, M.Y.; Ismail, M.; Mohamed, M.T.M.; Rahim, H.A.; Latif, M.A.; Aslani, F. Opportunities of Marker-Assisted Selection for Rice Fragrance through Marker-Trait Association Analysis of Microsatellites and Gene-Based Markers. Plant Biol. 2015, 17, 883–896. [CrossRef]

- Alhabeeb, M.J. Consumer Product Quality and the Optimal Choice: A Perfect Information Frontier Approach. Acad. Mark. Stud. J. 2000, 4, 57–68.

- Somsong, P.; McNally, R.C.; Hsieh, C.-M. Consumers’ Perceptions towards Thai Rice: A Cross-Cultural Comparison between Easterners and Westerners. Br. Food J. 2019, 121, 2964–2977. [CrossRef]

- Simsiri, S.; Sahachaisaeree, N. Factors Affecting Buyers’ Perceptions in Accordance with Marketing Strategy: A Case of Vernacular Thai Product. Procedia Soc. Behav. Sci. 2010, 5, 280–290. [CrossRef]

- Wang, H.; Moustier, P. The Benefits of Geographical Indication Certification through Farmer Organizations on Low-Income Farmers: The Case of Hoa Vang Sticky Rice in Vietnam. Cah. Agric. 2021, 30, 19. [CrossRef]

- Mameno, K.; Kubo, T.; Ujiie, K.; Shoji, Y. Flagship Species and Certification Types Affect Consumer Preferences for Wildlife-Friendly Rice Labels. Ecol. Econ. 2023, 200, 107691. [CrossRef]

- Yumkella, K.K.; Unnevehr, L.J.; Garcia, P. Noncompetitive Pricing and Exchange Rate Pass-through in Selected U.S. and Thai Rice Markets. J. Agric. Appl. Econ. 1994, 26, 227–242. [CrossRef]

- Aoki, K.; Akai, K.; Ujiie, K. A Choice Experiment to Compare Preferences for Rice in Thailand and Japan: The Impact of Origin, Sustainability, and Taste. Food Qual. Prefer. 2017, 56, 92–102. [CrossRef]

- Li, X.; Liu, Y.; Zhu, X.; Walley, K.; Wang, S.; Li, Y. Chinese Customers’ Sensory Evaluation between Chinese Wine and Foreign Wine. Unpublished Work, 2017.

- Agbas, N.; Ceballos, R. On the Conjoint Analysis of Consumer’s Preferences on Quality Attributes of Rice. Adv. Appl. Stat. 2019, 58, 45–56. [CrossRef]

- Meullenet, J.-F.; Griffin, V.K.; Carson, K.; Davis, G.; Davis, S.; Gross, J.; Hankins, J.A.; et al. Rice External Preference Mapping for Asian Consumers Living in the United States. J. Sens. Stud. 2001, 16, 69–87. [CrossRef]

- Nitiwanakul, W. A Comparative Study of Customer Perceived Value as a Driver for Fine Dining Restaurant Selection: A Case of Thai Consumers and Expatriates. AU J. Manag. 2014, 2, 35–45.

- Unnevehr, L.J. Consumer Demand for Rice Grain Quality and Returns to Research for Quality Improvement in Southeast Asia. Am. J. Agric. Econ. 1986, 68, 634–638. [CrossRef]

- Hang, C.C.; Suzuki, N.; 鈴木伸彦. Characteristics of the Rice Marketing System in Cambodia. J. Fac. Agric. Kyushu Univ. 2005, 50, 115–121. [CrossRef]

- Insch, G.S. The Impact of Country-of-Origin Effects on Industrial Buyers’ Perceptions of Product Quality. Manag. Int. Rev. 2003, 43, 391–412.

- Hu, Y.L.; Yan, R.; Zhang, J.Y.; Ye, L.; Xiang, L.; Cui, J.; Tang, Y.; et al. The Preference for Front-of-Pack Labeling and Its Association with the Understanding of Nutrition Facts Panel among Residents Aged 18 to 70: Results of a Survey in 6 Provinces of China. Unpublished Work, 2022. [CrossRef]

- SI, Z. Investigation and Analysis of Consumptive Request for Chinese Premium Teas. J. Zhejiang A & F Univ. 2013, 25, 89–97.

- Thanasuta, K. Thai Consumers’ Purchase Decisions and Private Label Brands. Int. J. Emerg. Mark. 2015, 10, 41–55. [CrossRef]

- Holzapfel, S.; Wollni, M. Is GlobalGAP Certification of Small-Scale Farmers Sustainable? Evidence from Thailand. J. Dev. Stud. 2014, 50, 999–1013. [CrossRef]

- Hair JF, Black WC, Babin BJ, Anderson RE. Multivariate Data Analysis. 7th ed. Pearson, 2017.

- Tabachnick, B. G., & Fidell, L. S. Using Multivariate Statistics. Pearson Education, 2007. Available online: https://hisp.htmi.ch/pluginfile.php/77114/mod_resource/content/0/Using%20Multivariate%20Statistics%20%28Tabachnick%20and%20Fidell%29.pdf (accessed on 1 October 2023).

- Pallant J. SPSS survival manual: A step-by-step guide to data analysis using IBM SPSS. 7th ed. Taylor & Francis, 2020.

- Hair JF, Hult GTM, Ringle CM, Sarstedt M. A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM). SAGE Publications, 2014.

- Schafer JL, Graham JW. Missing data: Our view of the state of the art. Psychol Methods. 2002, 7(2):147–77. [CrossRef]

Table 1.

Alternative sets of characteristics of rice set 1 (selected according to actual needs).

Table 1.

Alternative sets of characteristics of rice set 1 (selected according to actual needs).

| Characteristics |

Level |

| Rice A |

Choose, not choose (based on actual preferences) |

| Rice B |

Choose, not choose (based on actual preferences) |

| Rice C |

Choose, not choose (based on actual preferences) |

| Rice D |

Choose, not choose (based on actual preferences) |

| Price (RMB/ 5 kg) |

30, 60 (SQ), 90, 120 |

Table 2.

Alternative sets of characteristics of rice set 2.

Table 2.

Alternative sets of characteristics of rice set 2.

| Characteristics |

Level |

| Sweet |

Very sweet, little sweet (SQ) |

| Aromatic |

Very fragrant, little fragrant (SQ) |

| Softness |

Very soft, less soft (SQ) |

| Graininess |

Very complete, less complete (SQ) |

| Country of origin |

Thailand, China, Cambodia, Vietnam, Not specified (SQ) |

| Certification |

Yes, No (SQ) |

| Price (RMB/ 5 kg) |

30, 60 (SQ), 90, 120 |

Table 5.

Influence of sensory attributes on WTP for Chinese and Thai consumers.

Table 5.

Influence of sensory attributes on WTP for Chinese and Thai consumers.

Variable |

Chinese consumers |

Thai consumers |

| Coefficient |

Std. Error |

z |

P>|z| |

Coefficient |

Std. Error |

z |

P>|z| |

| Taste |

.8008 |

.0720 |

11.12 |

0.000 |

.1569946 |

.1471817 |

1.07 |

0.286 |

| Fragrance |

.6277 |

.0621 |

10.10 |

0.000 |

-1.177224 |

.1636899 |

-7.19 |

0.000 |

| Softness |

.4384 |

.0617 |

7.10 |

0.000 |

.9835731 |

.1430975 |

6.87 |

0.000 |

| Completeness |

.8168 |

.0635 |

12.85 |

0.000 |

.4039755 |

.1370604 |

2.95 |

0.003 |

| Standard deviation |

|

|

|

|

|

|

|

|

| Taste |

.7095 |

.1136 |

6.24 |

0.000 |

-.3323462 |

.3722423 |

-0.89 |

0.372 |

| Fragrance |

.0581 |

.1110 |

0.52 |

0.601 |

.1350497 |

.4472435 |

0.30 |

0.763 |

| Softness |

.0931 |

.1454 |

0.64 |

0.522 |

-.3478726 |

.3856231 |

-0.90 |

0.367 |

| Completeness |

-.3548 |

.1490 |

-2.38 |

0.017 |

-.0105127 |

.1770447 |

-0.06 |

0.953 |

Table 6.

Coefficients and significance of COO effects.

Table 6.

Coefficients and significance of COO effects.

Variable |

Chinese consumers |

Thai consumers |

| Coefficient |

Std. Error |

z |

P>|z| |

Coefficient |

Std. Error |

z |

P>|z| |

| COO - China |

1.1788 |

.2189 |

5.38 |

0.000 |

1.1788 |

.2189 |

5.38 |

0.000 |

| COO - Cambodia |

1.4164 |

.2124 |

6.67 |

0.000 |

1.4164 |

.2124 |

6.67 |

0.000 |

| COO - Vietnam |

1.1936 |

.2166 |

5.51 |

0.000 |

1.1936 |

.2166 |

5.51 |

0.000 |

| COO - Thailand |

2.2779 |

.2056 |

11.08 |

0.000 |

2.2779 |

.2056 |

11.08 |

0.000 |

| Standard deviation |

|

|

|

|

|

|

|

|

| COO - China |

.6335767 |

.476723 |

1.33 |

0.184 |

1.66425 |

.3036383 |

5.48 |

0.000 |

| COO - Cambodia |

3.014759 |

.4237541 |

7.11 |

0.000 |

.8157004 |

.2685153 |

3.04 |

0.002 |

| COO - Vietnam |

1.799721 |

.4285062 |

4.20 |

0.000 |

.0533708 |

.2031896 |

0.26 |

0.793 |

| COO - Thailand |

7.545965 |

.4831092 |

15.62 |

0.000 |

-1.815996 |

.2604622 |

-6.97 |

0.000 |

Table 7.

Comparative WTP values for attributes across consumer groups.

Table 7.

Comparative WTP values for attributes across consumer groups.

| Attributes (variables) |

Willingness to pay

Chinese consumers |

Willingness to pay

Thai consumers |

| Taste |

49. 73 |

1.53 |

| Fragrance |

38.9 8 |

-11.48 |

| Softness |

27. 22 |

9.59 |

| Completeness |

50. 73 |

3.94 |

| Quality standard seal |

50. 82 |

6.25 |

| Country of origin - China |

73. 21 |

6.17 |

| Country of origin - Cambodia |

87. 97 |

29.40 |

| Country of origin - Vietnam |

74 .13 |

17.55 |

| Country of origin - Thailand |

141.48 |

73.61 |

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).