1. Introduction

FinTech or financial technology is driven by a number of emerging technologies. These are a range of new business models, new technology applications, and new products and services that have a significant impact on the financial market and financial service delivery [

1]. FinTech industry has experienced significant growth in recent years, transforming the global financial services landscape. FinTech companies have revolutionized traditional practices in banking, payments, lending, and investments by leveraging cutting-edge technologies and innovative business models [

2]. Examples of activities in FinTech range from digital payment instruments, FinTech lending (i.e., peer-to-peer lending [P2P lending] and crowdfunding), Open Banking, cryptocurrency, to robo-advising. The adoption of FinTech services has also moved at a steady and upward pace [

3]. According to the EY Global FinTech Adoption Index the rate has increased from 16% in 2015, to 33% in 2017, and to 64% in 2019. There is awareness among 96% of consumers that at least one alternative FinTech service is available [

4].

Among the most noteworthy innovations, the introduction of Open Banking, driven by the Payment Services Directive 2 (PSD2), further enhanced by PSD3 [

5] and the Payment Services Regulation, PRS [

6], have had a significant impact on the banking market. It has facilitated the entry of third-party providers (TPPs) into the financial ecosystem, promoting more open and competitive access to customers’ banking data, thus fostering the development of new digital services [

7]. In essence, Open Banking can be defined as a model where banking data is shared with third parties through Application Programming Interfaces (APIs). APIs should not merely be seen as technical interfaces but rather as key enablers for creating innovative and engaging Customer Experiences (CX). Through APIs, organizations can share business processes, data, and services with partners, as well as internal and external developers, creating new opportunities for collaboration and innovation. The launch of interactive API platforms allows banks to design customer-centric solutions capable of meeting the needs of an increasingly demanding and connected digital consumer [

8].

Open Banking therefore represents an innovative model, but it presents certain challenges, mainly related to its digital nature. While it promotes the sharing of data and financial services through online platforms, banks still require a physical presence in order to maintain direct interaction with customers. This aspect is not addressed by Open Banking, which focuses more on digital services. As a result, the closure of bank branches could be seen as a side effect of this standard. In the period between 2003 and 2020, there was a reduction in the number of branches — most sharply for the Netherlands, Lithuania and the United Kingdom — with a decline of more than 40% [

9]. According to a recent report on regional economies by the Bank of Italy [

10], the efficiency improvement process in the banking sector has led to a significant reduction in bank branches and ATMs in Italy. Between 2015 and 2022, the number of bank branches decreased by 30.7%, and by the end of 2022, 39.9% of Italian municipalities had no bank branches, compared to 28.4% at the end of 2015. The COVID-19 pandemic has further driven many people to prefer open banking-based services over traditional branches, triggering a domino effect that has led to the closure of numerous physical locations.

The growing phenomenon of bank branch closures, driven by rising operational costs and the difficulty of meeting key performance indicators (KPIs), which has had significant consequences, particularly in peripheral areas. In these regions, limited access to essential banking services has eroded customer trust, pushing them to seek alternatives and negatively impacting the banks themselves. This scenario has forced banks to innovate their processes and services to remain competitive, with a particular focus on redefining the CX, an increasingly crucial aspect for retaining customers in a highly competitive market. In a recent study [

11], Artificial Intelligence (AI) is shown to be transforming the financial investment sector by redefining strategies and operational processes. Specifically, the "phygital" standard, combining physical and digital experiences, and omnichannel strategies are reshaping customer relationships. AI facilitates the integration of human interaction with advanced digital services, such as automated data analysis and personalized offerings. This hybrid standard enhances CX by enabling seamless interactions across multiple channels, improving both operational efficiency and customer satisfaction. The "phygital" model thus maximizes the benefits of both environments.

In the financial sector, particularly in the dynamic context of FinTech, optimizing the CX is a crucial element in enhancing the customer journey, making it not only more seamless but also inherently satisfying. Living a positive CX can promote the creation of an emotional tie between a firm’s brand and its customers which in turn enhance customer loyalty [

12]. A recent article published in 2022 highlights several key research challenges in the context of banking innovation. One of these challenges involves the development of techniques and models to create fully functional and highly humanized self-service branches. The goal is to develop high-tech branches that, while not staffed, can ensure an excellent CX, offering personalized and intuitive services [

13]. Moreover, "phygital" initiatives are currently being carried out independently by individual banks. However, the fragmented and non-standardized standard does not support the growth of the third-party market or encourage competition. This disadvantages citizens, who have access to a limited range of options, resulting in a reduced CX.

The objective of this work is to build upon the concept of Open Banking and extend it to bank branches, giving rise to a new standard known as Open Branching (OB). Specifically, OB aims to transform the bank branch into a technologically advanced space, where all services traditionally offered in person can also be accessed digitally. This model allows for the delivery of a wide range of digital services via APIs, while ensuring a user interface (UI) and experience that align with those of traditional branches. Moreover, OB represents an opportunity for banks to redesign their physical presence among competitors, adapting to a context where the demand for digital services is constantly growing. This standard enables banks to maintain human interaction in branches while offering the efficiency and flexibility typical of digital channels. OB can be seen not only as an extension of Open Banking but also as an evolution of the banking sector toward greater innovation and flexibility, always keeping the CX at the forefront.

As part of the MilanoHub program [

14], in collaboration with the Bank of Italy and other major Italian banks, we have developed and standardized a taxonomy of key products and services for branch-customer interactions, defining a coding of use cases that represents a sort of standard service model offered to customers who physically access the branch. To validate the standard, we present a case study in which OB is implemented through the branch operator, an agent who acts as a human intermediary between the customer and branch services. Through the implementation of WoX Edge, a virtual operator with human-like characteristics, the customer can interact and receive responses in line with service standards. Finally, by integrating WoX Edge with the metaverse [

15], the customer will be able to access virtual branch services from anywhere, simply by using a headset.

The rest of the paper is structured as follows.

Section 2 provides an in-depth analysis of the state of the art, examining the topic of financial technologies and Open Banking and highlighting its limitations.

Section 3 illustrates the new standard of Open Branching. In

Section 4 we present a case study based on the new standard. In

Section 5 we discuss the main results. Finally,

Section 6 provides the conclusions and sketches the future works.

2. Related Works

According to Shueffel [

16], FinTech can be identified as a new financial industry that integrates technology to optimize financial operations. Financial technology has long been at the center of debates in the financial, policy, regulatory and academic sectors. In particular, the banking industry is undergoing rapid and widespread changes driven by technological advances and increasing customer expectations for personalized and real-time banking experiences [

17]. In this context, FinTech is distinguished by its highly dynamic and innovative nature, taking full advantage of new information and communication technologies. At the same time, CX emerges as a complex and multidimensional concept [

18]. CX reflects customers’ perceptions of how well interactions with a company meet their needs [

19]. Understanding the CX and its evolution over time is critical for companies. Today, customers interact with companies through multiple touchpoints on various channels and media, and their experiences tend to be more social. These changes require companies to integrate multiple business functions and even external partners in creating and delivering positive CX [

20].

A study conducted by PwC [

21] shows that 73% of consumers consider CX a crucial factor in their purchasing decisions. However, many banks struggle to meet customer expectations, often due to outdated systems and a lack of integration across channels. Open banking, supported by PSD2 and further enhanced by PSD3, has significantly transformed the banking landscape, fostering greater competition and innovation [

5]. As McKinsey [

22] points out, PSD2 has enabled new non-bank payment service providers (PSPs) to access customer banking data, promoting innovative payment solutions and improving compliance of traditional banks. In summary, the evolution of Open Banking through PSD2 and PSD3, represents a significant shift toward a more competitive and innovative financial landscape, with the potential to improve the CX and expand access to financial services.

Despite the potential benefits of digital transformation in banking, many institutions still face limitations that hinder the improvement of the CX. One of the main problems is the digital divide: a portion of the population remains underserved, mainly due to lack of access to technology or lack of digital literacy [

23]. In addition, over-reliance on automated systems and AI-based solutions can create a sense of disconnect between customers and their banks, leading to a perceived "dehumanization" of service [

24]. To improve CX and foster customer loyalty, especially in the FinTech context, it is essential to consider their needs and expectations [

18]. Although technology offers quick and efficient solutions, customers still value human interactions, especially when it comes to complex financial decisions. This suggests that a purely digital standard may not be sufficient to meet all customer needs. As a result, FinTech companies should ensure that they maintain effective communication channels and take a proactive approach to problem solving.

Research indicates that the closure of bank branches has a particularly negative impact on vulnerable groups, such as the elderly and low-income people, who often struggle to adopt digital alternatives [

25]. Indeed, progressive branch closures and increased use of digital channels risk widening the digital divide, leaving a significant portion of the population behind. While younger generations tend to adapt more quickly to new technologies, older or less tech-savvy populations still prefer face-to-face interactions. For this reason, the physical presence of banks remains critical to ensuring inclusive access to financial services [

26].

The authors in [

13] propose the concept of open branching as an innovative and inclusive solution to address the challenges of digital transformation in the banking sector. This approach integrates advanced technologies such as AI, the IoT, and Natural Language Processing (NLP) to create humanized self-service branches and deliver high-quality banking experiences. Furthermore, they suggest developing use cases that can be delivered in a multichannel mode, both in branches and through the metaverse, via a set of APIs called "Open Branching". Finally, the authors emphasize the need for new payment schemes to enable offline digital money exchange, ensuring privacy, anonymity, and solving the double-spending problem in a sustainable and energy-efficient manner.

2.1. Motivations

In the current context, there are significant limitations in addressing the challenges related to digital transformation in the banking sector, particularly with regard to the definition and implementation of standards for "phygital" branches. Although Open Banking, supported by PSD2 and enhanced by PSD3, has had a profound impact on transforming the banking landscape by improving competition and stimulating innovation, current research does not adequately explore the integration of physical and digital channels. This integration is crucial for ensuring equitable and inclusive access to financial services, especially in a context where the closure of bank branches — particularly in peripheral areas — is becoming an increasingly widespread phenomenon.

Branch closures are typically attributed to factors such as rising operational costs and the difficulty of meeting performance targets. However, the lack of standardization for "phygital" branches and the limited experimentation with effective models for integrating physical and digital channels leave significant gaps in the research. Furthermore, much of the existing literature fails to adequately address the complexity of CX, which must be redefined to better align with the needs of a rapidly evolving market. Despite technological advances, banks continue to struggle in meeting customer expectations, often due to outdated systems and a lack of integration across different channels. In this context, the transition to "phygital" branch models presents a crucial challenge that could help bridge the digital divide. This transition would enable the integration of advanced technologies, such as AI, IoT, and NLP, to create more humanized self-service branches. However, the current literature still does not offer concrete, standardized solutions for these initiatives. This limitation prevents banks from fully capitalizing on the potential of effective integration between physical and digital channels, negatively impacting the inclusivity and accessibility of banking services—particularly for the more vulnerable segments of the population.

3. Open Branching

In the evolving landscape of banking, the traditional dichotomy between physical and virtual branches no longer reflects the complexity of customer needs and technological advancements. Our vision includes a fluid model for bank branches, where the distinction between physical and virtual experiences is not binary but exists along a continuum. The fluid branch vision allows branches to adopt varying degrees of physical and virtual engagement, represented as points on a slider or trackbar, depending on customer preferences, operational needs, and technological capabilities. Our vision is supported by various experiences already implemented by several banks worldwide, which can be categorized into the following classification.

Traditional Branches (100% Physical): Conventional bank branches offer face-to-face interaction with customers. They rely on human advisors and physical documentation, with minimal technological integration. Most legacy banking institutions still operate traditional branches as their default format, such as Wells Fargo in the U.S. and CaixaBank in Spain.

-

Hybrid Branches ("Phygital"): These branches blend physical and digital experiences. Customers can interact with staff while also utilizing self-service kiosks, interactive screens, or augmented reality tools for services like financial planning or account management. Examples of banks that have adopted a Hybrid approach include:

- −

BNP Paribas has implemented phygital branches that integrate augmented reality (AR) to support customer investment planning [

27].

- −

Deutsche Bank offers branches with video conferencing zones and digital tools to support both in-person and remote experiences [

28].

-

Self-Service Digital Branches: Focused on automation, these branches provide interactive teller machines (ITMs), advanced ATMs, and digital kiosks for transactions and support. They reduce human involvement while maintaining a physical presence. Among the Self-Service Digital Branches, we find:

- −

BBVA’s "intelligent branches" use ITMs and kiosks for fully automated customer service [

29].

- −

UniCredit in Italy has deployed advanced ATMs for complex transactions such as loan management [

30].

- −

ICICI Bank in India operates "Digital Lite" branches that function almost entirely through self-service kiosks [

31].

-

Paperless Branches: In this configuration, physical branches operate without paper, relying entirely on digital tools like electronic contracts and biometric authentication. These branches streamline processes but still maintain a physical footprint. Examples of paperless branches include:

- −

ING Direct pioneered fully paperless operations, allowing customers to complete all processes electronically [

32].

- −

CaixaBank operates "Store" branches that eliminate paper through digital signatures and document storage [

33].

-

Virtualized Physical Branches: Here, physical spaces are complemented by remote interactions through video consultations or virtual reality (VR). These branches serve customers who visit in person but leverage virtual tools to enhance the experience. Some examples of virtualized physical branches are:

- −

Intesa Sanpaolo in Italy has introduced virtualized interactions in physical branches via video banking solutions [

34].

- −

HSBC uses VR in select branches to help customers explore investment products [

35].

-

Virtual Branches (100% Digital): Entirely online, these branches eliminate physical spaces and offer banking services through video calls, AI-powered chatbots, and immersive virtual reality platforms. Customers can access services from anywhere without visiting a physical location. Examples of fully virtual banks are:

- −

Bank of America operates a fully virtual branch through its AI assistant, Erica [

36].

- −

DBS Bank in Singapore provides remote consultations using virtual reality [

37].

- −

Intesa Sanpaolo has launched digital branches for remote banking services [

38].

The fluidity of branch experiences can be visualized as a slider, ranging from fully physical (traditional branches) to fully virtual (virtual branches). Intermediate points on this slider represent the various configurations of physical and virtual engagement, as shown in the following

Figure 1.

Despite the promise of fluid branches, a major obstacle remains: there is currently no technological standard to support the seamless integration of physical and virtual elements. The lack of such a standard means that the implementation of use cases for each branch type is left to individual banks, leading to fragmented solutions. This fragmentation hinders the emergence of a competitive ecosystem of trusted third-party providers (TTPs) — similar to the role played in open banking under the PSD2 framework. Such an ecosystem would foster competition, drive innovation, and enable the delivery of user-centric banking products with high-quality user experiences.

To address this gap, we propose the OB standard, which can be viewed as an evolution of Open Banking designed to transform bank branches into technologically advanced spaces. This new model aims to make traditional services accessible in digital format through the use of APIs, allowing for the provision of a wide range of digital services while maintaining a user interface and experience consistent with those of physical branches. OB offers banks an opportunity to rethink their territorial presence in response to the growing demand for digital services, without compromising human interaction.

The OB standard seeks to create highly humanized self-service branches that provide a personalized and high-quality banking experience. This model not only aims to bridge the digital divide and counter the dehumanization of services caused by excessive automation but also focuses on developing use cases in a multichannel format. This enables interactions both in-branch and in the metaverse, fostering a more inclusive and interactive banking environment. Ultimately, OB represents a significant step toward a more innovative and inclusive banking sector, positioning CX at the heart of operations and ensuring equitable and personalized access to financial services for all demographics. OB has been specifically designed for the European market, given the region’s relevance due to its extensive customer protection regulations.

The opportunity provided by MilanoHub allowed us to develop a standard service model for customers who physically access the branch. This model is based on the interoperability between the branch and new technological players, who will provide standardized services. The service model, referred to as OB, is designed to serve as the "phygital" equivalent of the branch, in much the same way digital services function within Open Banking.

Table 1 presents the use cases alongside a compliance perimeter map, outlining the general and supervisory regulations to which these cases must adhere, ensuring that the providing bank remains compliant with current regulatory standards.

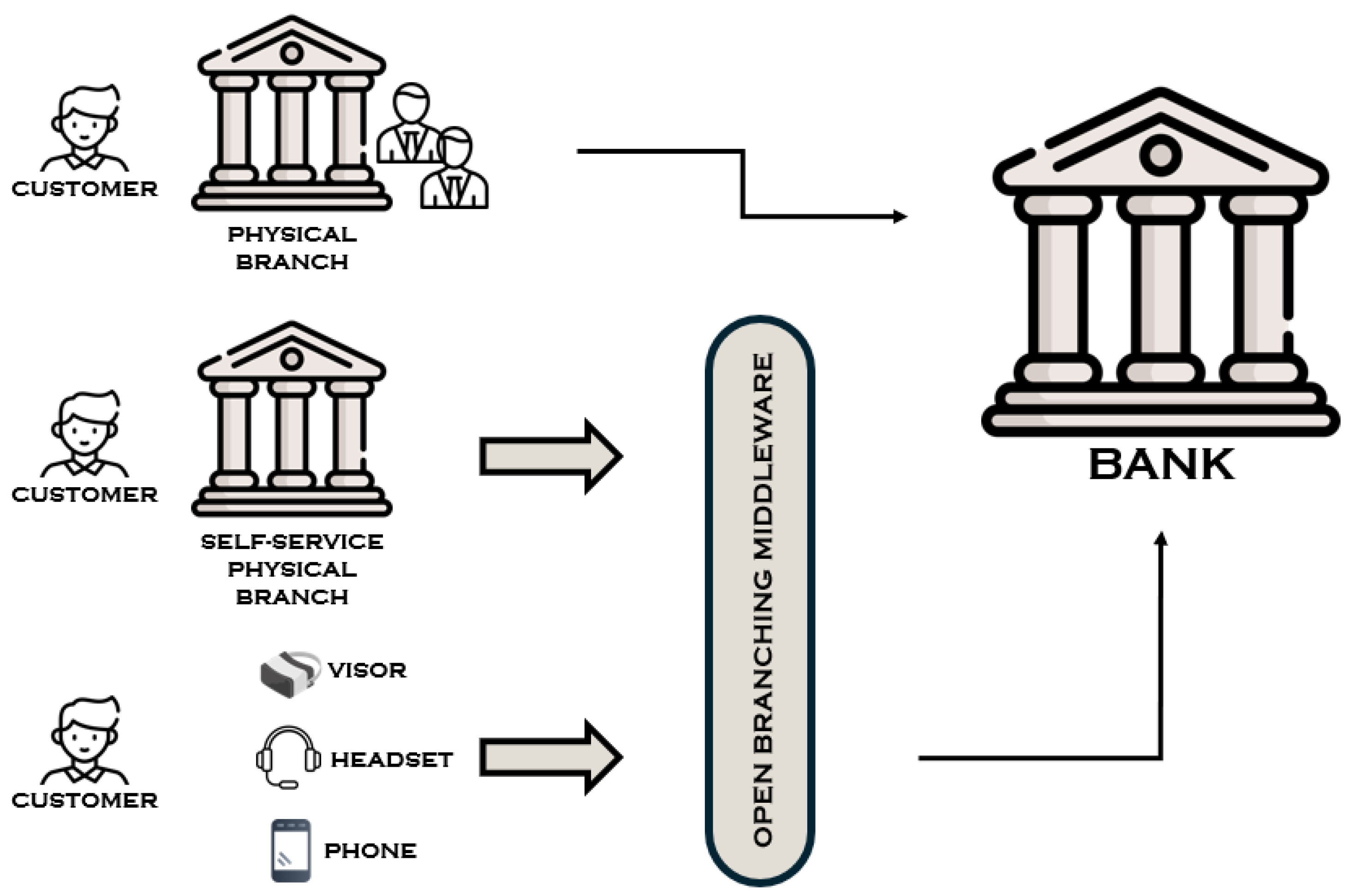

Three types of bank branches are illustrated in

Figure 2: a traditional physical bank branch, a self-service branch and a remote branch. OB is designed to be branch-fluid, adapting to different branch configurations with varying levels of physical presence. For example, a traditional branch can be 100% physical, a self-service branch 50%, while a fully remote branch can operate with 0% physical presence.

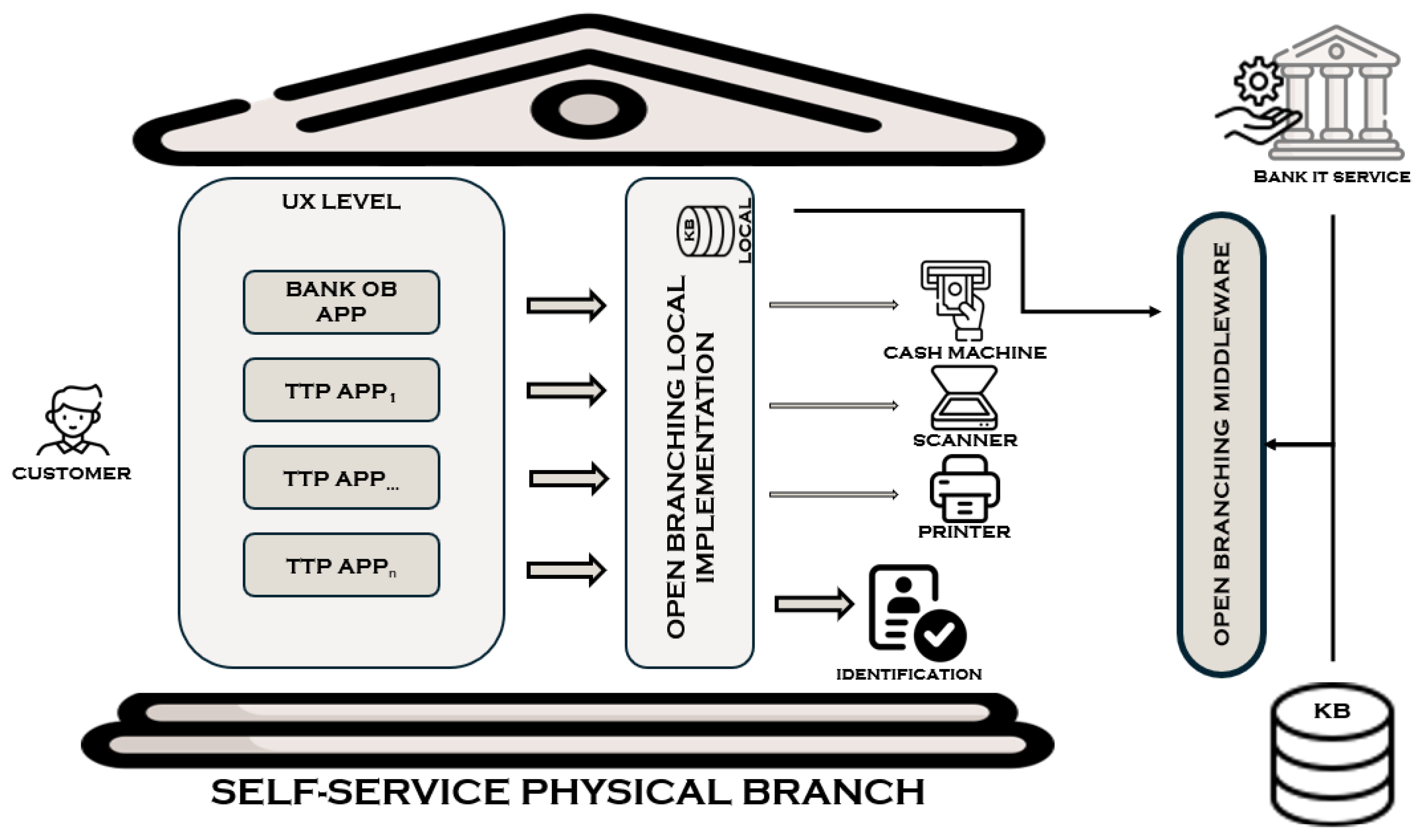

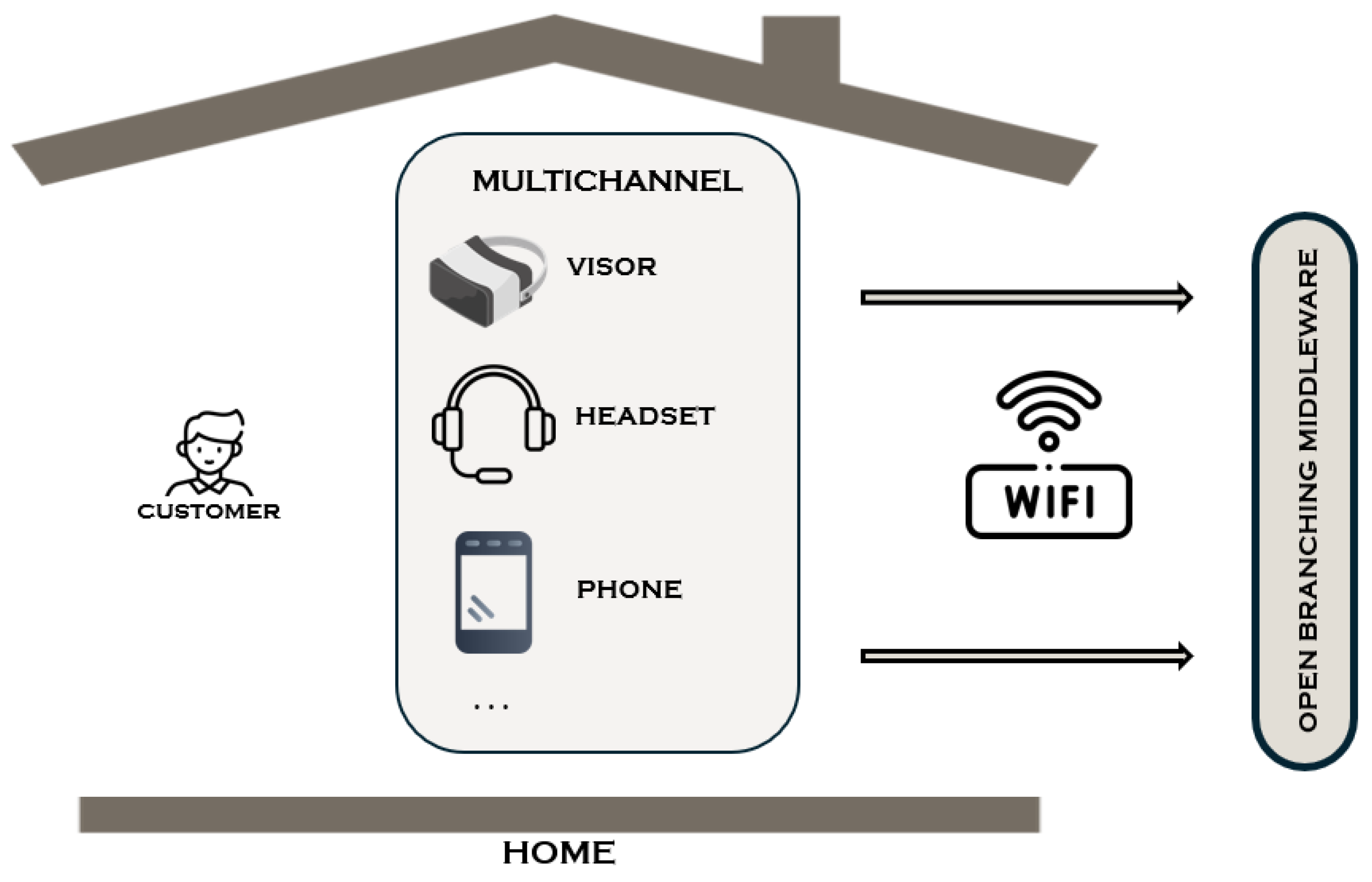

Figure 3 and

Figure 4 elaborate on the self-service branch and the remote branch, respectively. The self-service branch is characterized by the absence of physical operators, with customers interacting independently with digital tools to identify themselves and perform all necessary operations. In the case of the remote branch, customers can access banking services from the comfort of home, using viewers and headsets, connecting to a Wi-Fi network, thus using a multichannel format.

4. Case Study

To validate our standard, we developed a case study focused on the implementation of the concept of OB, which allows for both physical interactions in branches, through increased digitalization, and digital interactions in the metaverse, creating a more inclusive and interactive banking environment. As part of a series of initiatives aimed at promoting innovation in the banking sector, Bank of Italy launched the MilanoHub program. In this framework, the Engineering Team of Vidyasoft Srl [

39] — a young Italian fintech company established as a spin-off of the University of Salento — participated with an experimental project called "WoX Edge: a customer-centric and inclusive smart speaker for the branch of the future" winner of the Call for proposal 2021 "MilanoHub” [

40], was the protagonist of an intense phase of ideation and design of the architectural model and the implementation of some use cases to foster a subsequent application experimentation to support the relationship between banks and customers in the digital era.

WoX Edge is the result of research originating from WoX [

41,

42,

43,

44,

45,

46,

47,

48,

49], a model-driven IoT middleware developed by Vidyasoft co-founders, as an outcome of extensive research activity in the IoT domain.

With the introduction of WoX Edge, a virtual assistant designed to emulate human interactions, customers can communicate effortlessly and receive responses that meet established service standards. In parallel, we have developed the metaverse [

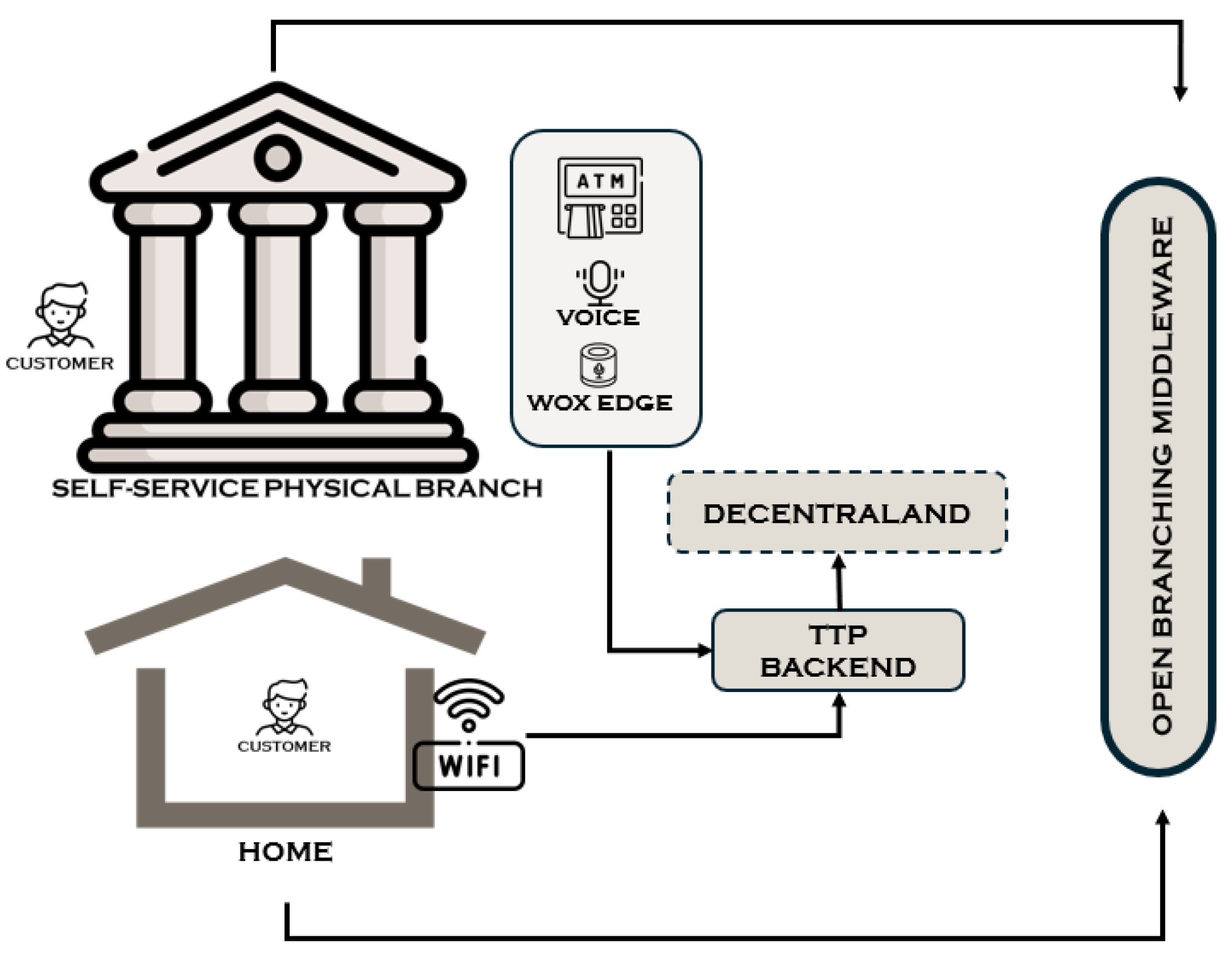

50] as an additional channel, providing a multichannel experience. By integrating WoX Edge into the metaverse, customers will have the ability to access virtual branch services from anywhere, simply by using headphones and a headset. In this way, WoX Edge and the metaverse function as two distinct yet complementary channels, offering greater flexibility in accessing banking services.The use cases, developed in the contest of the Bank of Italy’s Milan Hub pathway, constitute a standard service model dedicated to customers who physically visit the branch. This model is based on the interoperability between branches and new technological players, who will provide standardized services. The system, called OB, has been designed as the "phygital" equivalent for bank branches, similarly to how digital services operate in Open Banking.

The implementation of OB within the case study followed three key steps:

Implementation of the branch operator: The first step involves the introduction of a human operator who acts as an intermediary between the customer and branch services. This operator ensures a personalized interaction, supporting the customer in a traditional manner.

Integration of the virtual assistant (WoX Edge): The second step involves the virtual assistant WoX Edge, which interacts with customers autonomously, responding to their requests while maintaining service standards and improving operational efficiency.

Activation of the metaverse channel: The final step involves integrating the metaverse, allowing customers to access the virtual branch from anywhere via a headset, expanding the possibilities for interacting with banking services.

WoX Edge is not only a voice assistant that facilitates banking operations but also a key element in promoting financial inclusivity through a new CX model. By recognizing the identity of the customer and analyzing their past financial habits, the application not only enhances the security of transactions but also identifies unusual or non-compliant operations with the customer’s profile, thus ensuring compliance with consumer protection regulations and preventing fraud.

To achieve these objectives, we outlined the following key points in the case study implementation:

Integration of WoX Edge into the metaverse: Designing and implementing the voice assistant within the virtual context.

Intuitive interaction via UI: Users interact with the assistant through a simple interface, utilizing the keyboard.

Access to banking services in the metaverse: WoX Edge ensure an innovative and seamless experience in accessing banking services.

Rigorous testing: Comprehensive tests are conducted to verify the proper functioning of the assistant and the entire virtual banking system.

4.1. Architectural Details

For the integration of the WoX Edge service, in the form of a chatbot, into the metaverse, the logical architecture was evaluated. The logical architecture involves the customer, within the metaverse, communicating with the chatbot via APIs, continuing or ending the conversation as needed. The technologies chosen for development include "Postman" for API testing, "Decentraland" as the development platform, "TypeScript" as the programming language, and "Visual Studio Code" as the development environment. Specific libraries for "Decentraland", such as "decentraland-ecs" [

51] and "@dcl/ui-scene-utils" [

52], were also utilized, while "Metamask" was selected to manage access to the metaverse. Finally, the physical architecture (

Figure 5) outlines the communication between the customer and the WoX Edge assistant; using a REST API and sending POST HTTP requests, the customer communicates with the WoX Edge assistant.

4.2. Knowledge Base

In detail, the use cases have been organized into various sheets of a Knowledge Base modelled in an Excel file, which is then imported into the Intent Matching tool. This Knowledge Base consists of six distinct sheets:

Login: Includes use cases accessible only after authentication.

Operations: Gathers use cases related to card transactions at an informational level.

Accounts: Comprises all questions related to current accounts.

Insurance: Includes use cases concerning insurance products offered by banks.

Cards: Collects use cases related to information on costs and card activations.

Loans, Mortgages, Leasing: Includes informational use cases for these three product categories.

Each sheet is structured with the following columns:

Topic: Related to the macro-category of use cases.

Question: Includes training phrases that will be submitted to the NLP engine to manage and understand user input.

Answer: Provides a unique response for the questions indicated in the previous column.

Context: A technical variable to set a dialogue context based on the specific request of the customer.

In total, the Knowledge Base includes 244 use cases, 399 intents, and 2965 training phrases. Unfortunately, it cannot be shared because it contains sensitive information about the Italian bank Vidyasoft collaborated with to implement OB.

4.3. The Hardware Component of WoX Edge

The hardware component of WoX Edge consists of a device equipped with a microphone, speakers, limited computational capacity (based on Raspberry PI [

53]), and Bluetooth Low Energy (BLE) and Ethernet (ETH) connectivity. It includes a software module developed in Python (version 3.*), which handles audio pre and post processing and interfaces with the backend system.

Figure 6 shows an image of the device, created by Vidyasoft.

4.4. Backend WoX Edge

The second key component of the WoX Edge system is the backend software, developed according to the OB standard. This standard defines a set of APIs that expose use cases for interactions with the physical branch. The backend is implemented using the Java Spring Boot framework, ensuring interconnection between the voice assistant, the branch backend, and cloud services.

The main software components include:

Speech-to-text: An AI-based engine for transcribing speech into text format from .wav audio files. Initially Google’s cloud service was used, but during the course of the project an on-premise version based on Python technology was tested.

NLP: An AI engine that enables it to understand the user’s request, received in text form from the previous form, regardless of the wording of the sentence.

Text-to-speech: A speech synthesis module that converts a text string containing the answer to be provided to the user into a .wav audio file. Again, Google’s cloud service was complemented by an on-premise solution based on Microsoft’s text-to-speech, which yielded satisfactory results.

Backend for implementing the OB standard: Developed in Java Enterprise Edition and Spring Boot.

API design tools: Swagger.

DBMS: MySQL.

Hardware: Customization of the Raspberry PI prototyping board.

4.5. System Operation

The input/output channel of WoX Edge consists of a voice assistant that can not only interact with the user through natural language, but also communicate and synchronize with other UI present in an automated branch, such as tablets, ATMs, document and card scanners, etc. This process makes it possible to find the best match and, consequently, to determine the user’s intent. The system currently in use is Google DialogFlow, which employs two matching algorithms to identify the best intent: rule-based grammar matching and matching based on machine learning algorithms. Dialogflow runs both algorithms simultaneously and selects the best result. Because AI systems are not deterministic, they can make mistakes. In such cases, when the confidence score assigned to the personalized intents is low, the system resorts to a default intent called "fallback intent", which provides a default sentence in which the user is asked to repeat what he or she said.

The AI engine developed allows for comprehensive context management through appropriate configuration of training sentences. Once the system captures the user’s initial sentence, the context enables the identification and setting of the dialogue topic, ensuring that the conversational flow between the user and the system is highly accurate in determining the intents related to the requests. This happens because, once the context is identified, the number of training sentences to compare is significantly reduced. Most of the training sentences are associated with a specific context, so the system identifies the relevant context of the conversation once a match with the training sentences is found. The Knowledge Base of WoX Edge is fully configured with the different dialogue contexts.

4.6. Test

With the introduction of WoX Edge, a virtual operator with human-like characteristics, customers can interact and receive responses in line with traditional service standards. Furthermore, the integration of WoX Edge into the metaverse allows customers to access virtual branch services from any location, simply by wearing a headset and earphones, making the experience even more flexible and accessible.

To create a new scene within Decentraland, after setting up the initial environment, it was needed to use the command "dcl init" and select the "Scene" option. This command generates a basic directory structure, which includes essential files for the development of the case study. Three directories of particular importance are "src", which contains the source code written in Typescript to define the application’s logic; "models", used to store 3D models of objects (

Figure 7 shows the model of the used voice assistant in the Metaverse); and "images", used to archive images. For creating a 3D virtual assistant (NPC — Non-player character —), the 3D model is loaded from the "models" directory, and then the actions corresponding to clicking either the "YES" or "NO" button are defined. Specifically, once the "YES" button is selected, the UI is generated. The 2D UI enables interaction between the user and the assistant. Finally, to enable the voice assistant, the REST API is used to send POST requests, allowing the user to send questions and receive responses from the chatbot interactively.

Summarizing the various steps necessary for our case study:

An NPC object is added to the scene to represent the 3D virtual assistant and facilitate the initial interaction with the user.

Actions are defined based on whether the user chooses to use the chatbot service or not.

When the user agrees to use the service, a 2D UI is created, which will be used to input and send their requests and questions.

After the user submits a question through the text input, the doPost function is called to handle an HTTP POST request using a REST API. This allows the user to receive the chatbot’s response and interact with it.

After starting the initial environment of the metaverse, the user successfully enters the virtual world, managing to interact smoothly with the surrounding environment. Here, they can view the 3D model of the assistant and interact with it through simple clicks.

As seen earlier, two situations can occur:

Interaction with NPC, click on the "NO" button.

Interaction with NPC, click on the "YES" button.

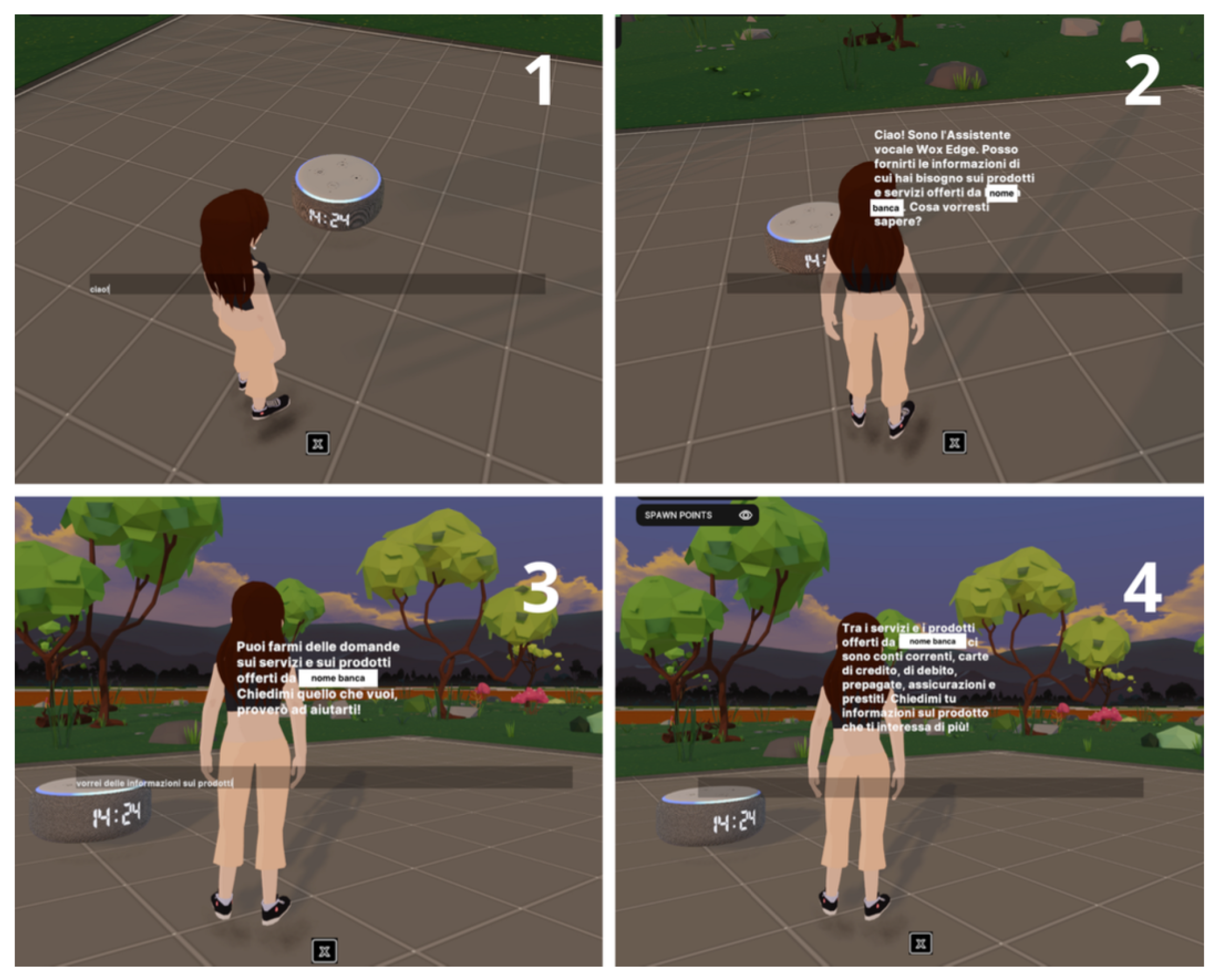

Figure 8 illustrates the interaction with the NPC and the buttons, focusing on the case of clicking the "NO" button. Upon approaching the assistant and clicking (1), the correct activation of the NPC from the console can be observed, followed by the initiation of the dialogue within the virtual world (2). Once the "NO" button is clicked (3), the closing dialogue window is correctly displayed (4). It is important to mention that the prototype is in Italian, as it was created for Italian customers, as highlighted in the context of the previously mentioned project. In particular, in

Figure 8, an interaction with the Wox Edge voice assistant is shown, where it greets the user and asks if they wish to use the chatbot. In this case, the response is negative, and the voice assistant invites the user to return whenever they wish.

In

Figure 9 focuses on the case of clicking the "YES" button. Upon approaching the assistant and clicking, the correct activation of the NPC from the console is observed, followed by the initiation of the dialogue within the virtual world (1). Once the "YES" button is clicked (2), the dialogue window is correctly displayed (3), along with the activation of the UI, allowing the user to interact with the chatbot (4). In this case, the Wox Edge voice assistant, after greeting the user, asks if they wish to use the Chatbot assistant. Upon receiving an affirmative response, it provides the text input to begin the communication.

Subsequently, an additional test is conducted, as illustrated in

Figure 10, focused on the interaction with the chatbot. Once the UI is displayed, the user enters a series of questions to the assistant in the text input field and submits them by pressing the "Enter" button. Once submitted, the questions are logged in the console, and the response is displayed both in the console and in the virtual world. In this case, the Wox Edge voice assistant introduces itself and asks if it can provide information on various products and services. It clarifies that users can ask questions about the offered services and products and encourages them to inquire about anything they need help with. The assistant specifies that among the available products and services are current accounts, credit cards, debit cards, insurance, and loans, and that users can request more information about these products to learn more.

5. Discussion

In this study, we developed the concept of OB, which represents an evolution of Open Banking, based on the findings of the work under review [

13] and expanding upon them. The term OB refers to a technologically advanced branch, where services traditionally offered in-person are also made accessible digitally. By utilizing APIs, this innovation allows for the provision of a full range of digital services while maintaining the interface and experience of a physical branch. The introduction of this new standard, supported by the validation of a central institution such as the Bank of Italy, represents a significant step toward the standardization and digitalization of banking services. However, it raises significant critical issues for the banking industry. It is essential to demonstrate in which cases and why banks should promote the mandatory adoption of OB as a standard. While the model appears to offer effective solutions to branch closures, particularly in remote areas, there is a lack of well-developed digital infrastructure and standardized processes that could assist all banks in transitioning to the new model in a fair and inclusive way. This is particularly relevant for small banks, which often rely on third-party providers for their technological systems [

54]. Such dependency often leads to limited control over essential digital tools and delays in the adoption of innovative banking solutions.

A central point of consideration is to determine when OB is actually beneficial. While it fits well in digitized environments where customers are technologically up-to-date, it may be less effective in environments with less digitally literate customers. To make OB a practical reality, increased investment in user and bank staff training would be beneficial, as well as economic and regulatory incentives to encourage adoption, particularly by smaller banks, which, as noted, are most affected by the closure of traditional branches. The use cases developed during the research demonstrate how the OB standard can be implemented in a multichannel mode, providing a seamless banking experience, both physical and virtual, and supporting the transition to a more inclusive financial ecosystem. In this context, developers and institutions could play a key role. For example, developers could create intuitive UIs, simplifying access to services for less experienced customers. Institutions, on the other hand, could facilitate the adoption of OB through regulations that financially support small banks in the transition.

At the regulatory level, significant challenges arise both in Italy and globally. Regulatory fragmentation among different countries could hinder the development of the OB standard, emphasizing the need for greater harmonization to address disparities among banks. The development of the case study was helpful in demonstrating the feasibility of the standard, which was validated by the Bank of Italy. However, a single case study is insufficient to draw definitive conclusions. For this reason, further experiments involving a larger number of users should be conducted to validate the results on a broader scale. Furthermore, the case study was developed using technologies available in 2021, such as Google DialogFlow. Although these solutions are still in use, they have been surpassed by more advanced AI tools, such as Large Language Models (LLMs). However, this does not represent a limitation for the presented research, as the OB standard is independent of the technology used to implement it. Looking ahead to experiments with real users, it will still be necessary to update the technology stack to meet user expectations in terms of response flexibility and dialogue richness, as well as to collect data based on state of the art technologies.

In particular, future research could focus on the implementation of new technologies and the integration of advanced digital services, including those based on the metaverse, to analyze their impact and opportunities in the banking context. Additionally, the development of new services, such as cryptocurrency money conversion and advanced user support tools, is expected. Among the difficulties identified in this case study are financial issues and a lack of specific expertise. Moreover, internal resistance within banks poses another obstacle. Many institutions may fear losing their direct relationship with customers or may be concerned about the initial implementation costs. Therefore, although OB proves to be an effective tool for addressing the challenges of the banking sector, it remains of paramount importance among future challenges to develop a series of new case studies that address the critical issues that have emerged and explore potential solutions.

6. Conclusions

This study introduces a new standard, which won the 2021 "MilanoHub" Call for Proposals and was validated by a major institution, the Bank of Italy. The standard was implemented in a case study conducted by a fintech startup in collaboration with an Italian bank. Our research builds on the recommendations of the authors in [

13], highlighting how the use of AI, IoT, and NLP, combined with the integration of APIs, can create a physical-digital banking environment that meets the needs of an increasingly digitally oriented clientele, without compromising the quality of human interaction. OB is not merely a natural extension of Open Banking, but rather an evolution of the traditional bank branch model, adapted to the contemporary context of increasing digitalization and the gradual reduction of physical branches. Specifically, the development of highly humanized self-service branches, supported by virtual operators and accessible through the metaverse, overcomes the limitations caused by branch closures, ensuring continuity of services in areas no longer served by traditional branches.

To validate the OB standard, a taxonomy was developed to classify major products and services related to customer-branch interaction. This led to the creation of a standardized use case coding system, which serves as a reference model for the services offered in physical branches. The OB standard is based on interoperability between branches and new technological providers, capable of delivering standardized services, positioning itself as the "phygital" equivalent of the branch.

Key outcomes include:

Improved CX: Through interactive virtual spaces, customers can access personalized and innovative banking services.

Unlimited access to banking services: Customers can manage accounts in real time and receive personalized assistance without time or location limitations.

Integration between bank and customer in the metaverse: Enables contact with the bank within advanced digital environments.

Thus, this work is intended to be useful for various stakeholders in the financial and technology sectors:

Banks and financial institutions (public and private): To better understand how to integrate traditional banking services with advanced technologies. This could help improve CX, attract new generations of digital users, and increase the efficiency of services.

Fintech startups and technology companies: To identify opportunities to develop new solutions and tools that meet the needs of an increasingly digital banking market.

Researchers: To explore the effects and implications of these technologies within the financial sector.

Customers and end users: To experience an innovative and flexible digital banking system, allowing continuous access to services without geographical or time limitations.

Finally, future developments include the following opportunities offered by OB:

Diversification of payment methods: OB could lead to the development of new payment methods.

Adoption of digital currencies: The possibility of using digital currencies for transactions in both the virtual and physical worlds.

Funding

This research received no external funding.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data produced by this study are available on request from the corresponding author due to industrial secret of the involved commercial bank.

Acknowledgments

The authors thank the Bank of Italy team guided by Dr. Antonia Ferraris Di Celle for the valuable support in the project development. We also thank eng. Angelo Iannielli for developing the Knowledge base of the WoX Edge prototype.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Li, B.; Xu, Z. Insights into financial technology (FinTech): a bibliometric and visual study. Financial innovation 2021, 7, 1–28. [CrossRef]

- Iyelolu, T.V.; Agu, E.E.; Idemudia, C.; Ijomah, T.I. Legal innovations in FinTech: Advancing financial services through regulatory reform. Finance & Accounting Research Journal 2024, 6, 1310–1319.

- Agarwal, S.; Zhang, J. FinTech, lending and payment innovation: A review. Asia-Pacific Journal of Financial Studies 2020, 49, 353–367. [CrossRef]

- EY-GLOBALFINTECH. Global FinTech Adoption Index 2019. https://assets.ey.com/content/dam/ey-sites/ey-com/en_gl/topics/banking-and-capital-markets/ey-global-fintech-adoption-index.pdf, 2019.

- Europea, C. Direttiva del Consiglio Europeo. https://eur-lex.europa.eu/resource.html?uri=cellar:e09b163c-1687-11ee-806b-01aa75ed71a1.0009.02/DOC_1&format=PDF, 2023.

- Europea, C. Regolamento del Parlamento Europeo e del Consiglio. https://eur-lex.europa.eu/resource.html?uri=cellar:04cc5bd5-196f-11ee-806b-01aa75ed71a1.0010.02/DOC_1&format=PDF, 2023.

- Gounari, M.; Stergiopoulos, G.; Pipyros, K.; Gritzalis, D. Harmonizing open banking in the European Union: an analysis of PSD2 compliance and interrelation with cybersecurity frameworks and standards. International Cybersecurity Law Review 2024, 5, 79–120. [CrossRef]

- Premchand, A.; Choudhry, A. Open banking & APIs for transformation in banking. In Proceedings of the 2018 international conference on communication, computing and internet of things (IC3IoT). IEEE, 2018, pp. 25–29.

- Murinde, V.; Rizopoulos, E.; Zachariadis, M. The impact of the FinTech revolution on the future of banking: Opportunities and risks. International review of financial analysis 2022, 81, 102103. [CrossRef]

- Fiore, V. Trasformazione digitale nel settore bancario: strategie innovative per un nuovo presidio territoriale. https://www.ilsole24ore.com/art/trasformazione-digitale-settore-bancario-strategie-innovative-un-nuovo-presidio-territoriale-AFbRduuB, 2023.

- Bucci, P. L’intelligenza artificiale conquista l’industria dei servizi finanziari. Dalla valutazione dei rischi alla personalizzazione della relazione con il cliente, banche e assicurazioni abbracciano l’AI per migliorare l’efficienza operativa e l’intercanalità. https://www.datamanager.it/2024/06/finance-lai-ridefinisce-gli-investimenti/, 2024.

- Gentile, C.; Spiller, N.; Noci, G. How to sustain the customer experience:: An overview of experience components that co-create value with the customer. European management journal 2007, 25, 395–410. [CrossRef]

- Vergallo, R.; Mainetti, L. The role of technology in improving the Customer Experience in the banking sector: A systematic mapping study. IEEE Access 2022, 10, 118024–118042. [CrossRef]

- Banca d’Italia. https://www.bancaditalia.it/?dotcache=refresh.

- Vidyasoft. WoX Edge. https://www.vidyasoft.it/prodotti.

- Schueffel, P. Taming the beast: A scientific definition of fintech. Journal of Innovation Management 2016, 4, 32–54. [CrossRef]

- Komulainen, H.; Makkonen, H. Customer experience in omni-channel banking services. Journal of Financial Services Marketing 2018, 23, 190–199. [CrossRef]

- Barbu, C.M.; Florea, D.L.; Dabija, D.C.; Barbu, M.C.R. Customer experience in fintech. Journal of Theoretical and Applied Electronic Commerce Research 2021, 16, 1415–1433. [CrossRef]

- Balmaceda Castro, I.; Rusu, C.; Aciar, S. Customer eXperience in e-learning: a systematic mapping study. In Proceedings of the International Conference on Human-Computer Interaction. Springer, 2020, pp. 158–170.

- Lemon, K.N.; Verhoef, P.C. Understanding customer experience throughout the customer journey. Journal of marketing 2016, 80, 69–96. [CrossRef]

- PwC. Experience is everything: Here’s how to get it right. https://www.pwc.de/de/consulting/pwc-consumer-intelligence-series-customer-experience.pdf, 2019.

- Mckinsey. PSD2: Taking advantage of open-banking disruption. https://www.mckinsey.com/industries/financial-services/our-insights/psd2-taking-advantage-of-open-banking-disruption, 2018.

- PwC. The future of financial services. https://www.pwc.co.uk/assets/pdf/2020-vision-future-of-financial-services.pdf, 2020.

- Kumar, K.N.; Balaramachandran, P.R. Robotic process automation-a study of the impact on customer experience in retail banking industry. Journal of Internet Banking and Commerce 2018, 23, 1–27.

- Stefanelli, V.; Manta, F. Digital Financial Services and Open Banking Innovation: Are Banks Becoming ‘invisible’? Global Business Review 2023, p. 09721509231151491. [CrossRef]

- Cho, S.; Lee, Z.; Hwang, S.; Kim, J. Determinants of bank closures: what ensures sustainable profitability in mobile banking? Electronics 2023, 12, 1196. [CrossRef]

- BNP PARIBAS. https://www.bnpparibascardif.com/en/article/-/article/smart-phygital-transforming-store-into-experience, 2018.

- DEUTSCHE BANK. https://investor-relations.db.com/files/documents/annual-reports/2023/Human-Capital-Report-2022.pdf, 2022.

- BBVA. https://shareholdersandinvestors.bbva.com/wp-content/uploads/2022/03/Annual-Report-2021.pdf, 2021.

- UniCredit. https://www.unicredit.it/it/privati/servizi-digitali/tutti-i-servizi/self-service.html, 2022.

- ICICI. https://www.icicibank.com/sme/digital-lite, 2023.

- ING RESEARCH. https://www.ing.com/Investors/Financial-performance/Quarterly-results/2020.htm, 2020.

- CAIXABANK. https://www.caixabank.com/en/shareholders-investors/economic-financial-information/annual-half-year-statements.html, 2022.

- INTESA SANPAOLO. https://group.intesasanpaolo.com/en/newsroom/press-releases/2024/11/at-salone-dei-pagamenti—intesa-sanpaolo-and-mastercard-togethe#, 2022.

- HSBC. https://www.privatebanking.hsbc.com/wih/investments-Insights/other-investment-insights/the-metaverse-how-the-next-big-wave-in-technology-is-attracting-long-term-investments/, 2023.

- BANK of America. https://promotions.bankofamerica.com/digitalbanking/mobilebanking/erica, 2021.

- DBS BANK. https://www.dbs.com/metaverse/index.html, 2023.

- INTESA SANPAOLO. https://group.intesasanpaolo.com/en/newsroom/press-releases/2023/06/intesa-sanpaolo-presents-isybank–the-group-s-new-digital-bank, 2023.

- Vidyasoft. https://www.vidyasoft.it.

- d’Italia, B. Banca d’Italia. https://www.bancaditalia.it/media/notizia/fintech-milano-hub-call-for-proposals-2021-elenco-progetti-ammessi/?com.dotmarketing.htmlpage.language=102.

- Caione, A.; Fiore, A.; Mainetti, L.; Manco, L.; Vergallo, R. WoX: model-driven development of web of things applications. In Managing the Web of Things; Elsevier, 2017; pp. 357–387.

- Mainetti, L.; Manco, L.; Patrono, L.; Vergallo, R. A Cloud Architecture for Managing IoT-aware Applications According to Knowledge Processing Rules. Journal of Communications Software and Systems 2016, 12, 45–52. [CrossRef]

- Fiore, A.; Caione, A.; Mainetti, L.; Manco, L.; Vergallo, R. Top-down delivery of iot-based applications for seniors behavior change capturing exploiting a model-driven approach. Journal of Communications Software and Systems 2018, 14, 60–67.

- Mainetti, L.; Manco, L.; Patrono, L.; Sergi, I.; Vergallo, R. Web of topics: An iot-aware model-driven designing approach. In Proceedings of the 2015 IEEE 2nd World Forum on Internet of Things (WF-IoT). IEEE, 2015, pp. 46–51.

- Caione, A.; Fiore, A.; Mainetti, L.; Manco, L.; Vergallo, R. Rapid prototyping Internet of Things solutions through a model-driven approach: A case study in AAL. In Proceedings of the 2017 2nd International Multidisciplinary Conference on Computer and Energy Science (SpliTech). IEEE, 2017, pp. 1–6.

- Mainetti, L.; Panarese, P.; Vergallo, R. WoX+: A meta-model-driven approach to mine user habits and provide continuous authentication in the smart city. Sensors 2022, 22, 6980. [CrossRef]

- Panarese, P.; Meraglia, E.; Vergallo, R.; Mainetti, L. Enhancing Voice Assistants: A Proactive Approach. In Proceedings of the 2021 6th International Conference on Smart and Sustainable Technologies (SpliTech). IEEE, 2021, pp. 1–4.

- Mainetti, L.; Manco, L.; Patrono, L.; Secco, A.; Sergi, I.; Vergallo, R. An ambient assisted living system for elderly assistance applications. In Proceedings of the 2016 IEEE 27th annual international symposium on personal, indoor, and mobile radio communications (PIMRC). IEEE, 2016, pp. 1–6.

- Caione, A.; Fiore, A.; Mainetti, L.; Manco, L.; Vergallo, R. Exploiting an IoT local middleware for the orchestration of mobile device sensors to detect outdoor and indoor user positioning. In Proceedings of the 2017 25th International Conference on Software, Telecommunications and Computer Networks (SoftCOM). IEEE, 2017, pp. 1–5.

- Nüesch, R.; Alt, R.; Puschmann, T. Hybrid customer interaction. Business & Information Systems Engineering 2015, 57, 73–78.

- decentraland-ecs. https://github.com/decentraland/decentraland-ecs-utils, 2021.

- @dcl/ui-scene-utils. https://github.com/decentraland/decentraland-ui-utils, 2021.

- Raspberry PI. https://www.raspberrypi.com.

- d’Italia, B. Banca d’Italia. https://www.bancaditalia.it/pubblicazioni/mercati-infrastrutture-e-sistemi-di-pagamento/approfondimenti/2024-047/N.47-MISP.pdf, 2024.

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).