Submitted:

15 October 2024

Posted:

16 October 2024

You are already at the latest version

Abstract

Keywords:

1. Introduction

1.1. Introduction

1.2. Research Gap

1.3. Significance of the Study

1.4. Aims

1.5. Objectives

- To analyze the content and structure of sustainability reports from UK environmentally sensitive businesses about the SDGs.

- To examine the use of corporate websites for the communication of SDG- related information.

- To evaluate the role of social media in disseminating information about the SDGs to stakeholders.

- To identify best practices and areas for improvement in SDG disclosure among these businesses.

1.6. Research Questions

- To what extent, do UK environmentally sensitive organizations report SDG- related information in their sustainability reports?

- What kind of content concerning the SDGs is provided on the business’s corporate sites?

2. Literature Review

2.1. Sustainable Development Goals and Corporate Responsibility

2.2. Disclosure and Dissemination Mechanisms

Sustainability Reports

2.3. Websites

2.4. Social Media

2.5. Case Studies: The Two Oil and Gas Companies Are British Petroleum, also Referred to as BP and Shell UK

2.5.1. British Petroleum (BP) Sustainability Reports

2.5.2. Websites

2.5.3. Social Media

2.6. Shell UK

2.6.1. Sustainability Reports

2.6.2. Websites

2.6.3. Social Media

2.7. Comparative Analysis

2.8. Challenges and Opportunities

2.8.1. Challenges

2.8.2. Opportunities

2.9. Conclusions

3. Methodology

3.1. Research Design

3.2. Study Area

The Population of the Study Area

3.3. Sample and Sampling Techniques

3.4. Data Collection Instruments

3.5. Data Collection Methods

-

Amount of Finance Invested:

- -

- Technology

- -

- Profit Growth

-

Amount of Money Invested:

- -

- Social Satisfaction

-

Level of Investments:

- -

- Shareholder Equity.

-

On the Sustainable Development Goals (SDGs):

- -

- CSR investment

- -

- Compared to renewable energy sources

- -

- Annual Corporate Social Responsibility (CSR) report

- -

- Company website and official documents

- -

- Financial reporting and disclosures to regulators

- -

- Social media platforms and sentiment analysis tools

- -

- Public opinion polls conducted by reputable research organizations or trusted market research firms

- -

- On the Sustainable Development Goals (SDGs) Government progress reports and disclosures

- -

- Environmental assessment and sustainability certification

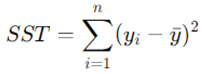

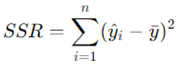

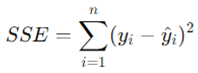

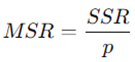

3.6. Data Analysis Methods

- The SDGs represent change based, Sustainable Development Goals

- Policies on social responsibility, economic development and public opinion are independent variables

- α is the block

- β1, β2, and β3 are the means of each independent variable

- ε represents the error term

- Game theory can be incorporated by using interaction terms or developing a separate regression model that incorporates game-theory parameters to explore the relationships between variables.

4. Chapter Results

4.1. Model Summary

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate |

| Companies = BP (Selected) | ||||

| 1 | .991a | .982 | .929 | 1.00139E9 |

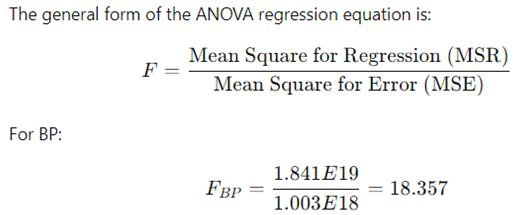

4.2. ANOVAb,c

| Model | Sum of Squares | df | Mean Square | F | Sig. |

| 1 Regression | 5.522E19 | 3 | 1.841E19 | 18.357 | .170a |

| Residual | 1.003E18 | 1 | 1.003E18 | ||

| Total | 5.623E19 | 4 |

4.3. Coefficientsa,b

| Model | Unstandardized Coefficients | Standardize d Coefficients | t | Sig. | |

| B | Std. Error | Beta | |||

| 1 (Constant) | 3.551E10 | 7.343E9 | 4.836 | .130 | |

| Social_Satisfaction | -15.996 | 25.727 | -.102 | -.622 | .646 |

| ShareHolder_Equity | -.029 | .015 | -.304 | -1.966 | .300 |

| Amount_Invested_F | |||||

| -48.812 | 7.735 | -1.130 | -6.311 | .100 | |

| inance | |||||

4.4. Model Summary

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate |

| Companies = Shell (Selected) | ||||

| 1 | .528a | .279 | -1.885 | 8.46533E9 |

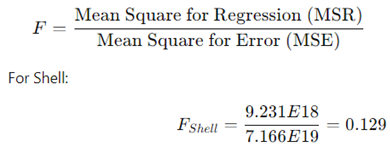

4.5. ANOVAb,c

| Model | Sum of Squares | df | Mean Square | F | Sig. |

| 1 Regression | 2.769E19 | 3 | 9.231E18 | .129 | .931a |

| Residual | 7.166E19 | 1 | 7.166E19 | ||

| Total | 9.936E19 | 4 |

4.6. Coefficientsa,b

| Model | Unstandardized Coefficients |

Standardized Coefficients |

t | Sig. | |

| B | Std. Error | Beta | |||

| 1 (Constant) | 1.495E10 | 1.466E10 | 1.020 | .494 | |

| Social_Satisfaction | -50.141 | 103.651 | -.552 | -.484 | .713 |

| ShareHolder_Equity | .003 | .077 | .038 | .033 | .979 |

| Amount_Invested_Fi | |||||

| -.002 | .442 | -.004 | -.005 | .997 | |

| nance | |||||

4.6.1. Model Summary

4.6.2. ANOVA

4.6.3. Table of Coefficients

4.7. Correlations

| Compani es | Years | Social_Sa tisfaction | ShareHol der_Equit y | CSR | Amount_I nvested_F inance | ||

| Companies | Pearson Correlation | .000 | .627 | .560 | .342 | .326 | |

| Sig. (2-tailed) N |

10 | 1.000 10 |

.052 10 |

.092 10 |

.334 10 |

.357 10 |

|

| Years Pearson Correlation |

.000 | 1 | .310 | -.066 | .277 | .320 | |

| Sig. (2-tailed) | 1.000 | .383 | .856 | .438 | .367 | ||

| N | 10 | 10 | 10 | 10 | 10 | 10 | |

| Social_Satisfacti Pearson on Correlation |

.627 | .310 | 1 | .693* | .017 | .188 | |

| Sig. (2-tailed) | .052 | .383 | .026 | .962 | .602 | ||

| N | 10 | 10 | 10 | 10 | 10 | 10 | |

| ShareHolder_Equ Pearson ity Correlation |

.560 | -.066 | .693* | 1 | .044 | .096 | |

| Sig. (2-tailed) | .092 | .856 | .026 | .904 | .791 | ||

| N | 10 | 10 | 10 | 10 | 10 | 10 | |

| CSR Pearson Correlation |

.342 | .277 | .017 | .044 | 1 | .109 | |

| Sig. (2-tailed) | .334 | .438 | .962 | .904 | .763 | ||

| N | 10 | 10 | 10 | 10 | 10 | 10 | |

| Amount_Invested Pearson _Finance Correlation |

.326 | .320 | .188 | .096 | .109 | 1 | |

| Sig. (2-tailed) | .357 | .367 | .602 | .791 | .763 | ||

| N | 10 | 10 | 10 | 10 | 10 | 10 | |

- Companies indicate a sturdy superb correlation with Social_Satisfaction (0.627) and ShareHolder_Equity (0.560) and a slight acceptable correlation with CSR (0.342) and Amount_Invested_Finance (0.326). The correlation with Years is negligible (0.000).

- Years does not display a widespread correlation with any of the opposite variables, as the correlation coefficients are near 0 and the p-values are not good sized.

- Social_Satisfaction presentations a robust, excellent correlation with ShareHolder_Equity (0.693) and a slight high-quality correlation with Companies (0.627). However, it has a weak, advantageous correlation with CSR (0.017) and a negligible correlation with Amount_Invested_Finance (0.188).

- ShareHolder_Equity shows a sturdy tremendous correlation with Social_Satisfaction (0.693) and a slight excellent correlation with Companies (0.560). However, it has a susceptible superb correlation with CSR (0.044) and negligible correlation with Amount_Invested_Finance (0.096).

- CSR has a moderate high-quality correlation with Companies (0.342) and Years (0.277) and negligible correlations with the other variables.

- Amount_Invested_Finance has a moderate advantageous correlation with Companies (0.326) and Years (0.320) and negligible correlations with the alternative variables.

4.8. SDG Performance of BP and Shell on Their Reputation and Business Operations in the UK

5. Investigation: Discussion of the Results

5.1. Discussion of the Results

- Null hypothesis (H0): There is no significant relationship between the selected predictors (amount_invested_finance, shareholder_equity, and social_satisfaction) and the dependent variable (CSR) of both BP and Shell companies

- Alternative Hypothesis (H1): There is a significant relationship between the selected predictors and the dependent variable for the two firms.

5.1.1. The BP Company

- Model summary: The R-square value of .982 indicates that the model accounts for 98.2% of the variation in CSR for BP. Therefore, we reject the null hypothesis and accept the alternative hypothesis of BP, which shows a significant relationship between the selected predictors and CSR.

- ANOVA: the p-value of .170 for the F-statistic indicates that the overall model may not be statistically significant at the usual alpha level of .05. We there-fore could not reject the null hypothesis and conclude that the overall sample may not be statistically significant for BP.

- Coefficients: The P-values of the predictors for BP were .646, .300, and .100, respectively. These p-values indicate that the predictors may not have a statistically significant effect on the dependent variable at the 5% significance level.

5.1.2. Shell Companies

- Model summary: The R-square value of .279 indicates that the model accounts for 27.9% of the variation in CSR for the shell. The adjusted R- square value is -1.885, which is unusual and may indicate potential problems with the fit of the model. Therefore, due to insufficient model adequacy, we cannot accept or reject Shell’s alternative hypothesis.

- ANOVA: The P-value of .931 for the F-statistic indicates that the overall model is not statistically significant for Shell. We therefore could not reject the null hypothesis and conclude that the overall sample may not be statistically significant for Shell.

- Coefficients: The P-values of the predictors for shell were .713, .979, and .997, indicating that the predictors probably did not have a statistically significant effect on the dependent variable at the 5% significance level. A survey of large UK businesses committed to the Sustainable Development Goals (SDGs) provides valuable insights into the impact of the private sector on the implementation of the 2030 Agenda Zabihollah, et al. (2023) provides a new tool and vital vocabulary for managing corporate conversations on Twitter, and focus on main social aspects of the SDGs. This study provides a comprehensive and near-real-time visualization of corporate engagement with the SDGs, shedding light on the dispersion and impact of global carbon emission regimes from MNCs on Shell's performance and future strategies, as examined by Lewis (2023).

5.2. Profitability Comparison

5.3. Hypotheses Assessment Summary Table

| Hypotheses | Decision |

| Hi: There is a significant relationship between financial investment, | Rejected |

| shareholder equity, and life satisfaction with corporate social responsibility (CSR) performance for the selected BP company. |

|

| H2: There is a significant relationship between financial investment, social satisfaction, and shareholder equity with corporate social responsibility (CSR) performance for the selected Shell company. |

Rejected |

| H3: There is a significant relationship between the amount of financial investment and corporate social responsibility (CSR) performance across both BP and Shell companies. |

Rejected |

| H4: There is a significant relationship between the level of social satisfaction and corporate social responsibility (CSR) performance across both BP and Shell companies. |

Rejected |

| H5: There is a significant relationship between shareholder equity and corporate social responsibility (CSR) performance across both BP and Shell companies. |

Rejected |

| H6: There are significant differences in the predictors' effects on corporate social responsibility (CSR) performance between BP and Shell companies, indicating unique factors influencing CSR performance in each company. |

Rejected |

| H7: There is a significant relationship SDG 7 and Shell (Affordable and Clean Energy) |

Accepted |

| H8: There is a significant relationship Shell SDG 13 (Climate Action). | Accepted |

| H9: BP is committed to becoming a passive entity by 2050 or sooner and is focused on SDG 7. |

Accepted |

| BP is committed to becoming a passive entity by 2050 or sooner and is focused on SDG 12 (responsible management and product development), |

Accepted |

6. Conclusions

6.1. SDG 7: Affordable and Clean Energy

6.2. SDG 12: Responsible Consumption and Production

6.3. SDG 13: Climate Action

6.4. Recommendations

- Align progress disclosures with the SDGs to strengthen the link between corporate performance indicators and disclosures (Luis, 2023).

- Examine the impact of sustainable finance for organizational learning (SFOL) to enhance sustainable organizational performance.

- Herenia, Gutiérrez-Ponce., Sigit, Arie, Wibowo. (2023) explore environmental and social governance (ESG) disclosures across industries through different processes to determine best practices.

- Vishwa, Naik, Raiker., Tania, Shirodkar. (2023) To better understand the public discourse, look at the sectors’ discussions about the SDGs through platforms like Twitter, mainly focusing on their social and environmental impact.

- Graziella, Sicoli., Giovanni, Bronzetti., Marcantonio, Ruisi., Maurizio, Rija. (2024) examine the alignment of companies’ online sustainability communications with their real-world activities and ensure accuracy and clarity.

- Analyze the impact of emissions regulations on multinational companies and develop strategies to reduce their emissions. New technologies and green production systems will also be used.

- Integrating priority analysis with other sustainability assessment systems

- Comparative priority analysis results in projects and projects.

- Examine the impact of the SDGs on sustainability reporting for businesses.

- Zabihollah, Rezaee., Saeid, H., Nick, J., Rezaee., Ehsan, Poursoleyman. (2023) examine how SRA affects firms’ financial performance and stakeholder communication.

- Provision of resources to enhance and demonstrate environmental activities.

- Inputs for future Global Reporting Initiative (GRI) guidance (Omar et al.., Helena, 2015).

Author Contributions

Funding

Conflicts of Interest

List of Acronyms

| BP | British Petroleum |

| SDGs | Sustainable Development Goals |

| SRs | Sustainability Reports |

| ESG | Environmental, Social, and Governance |

| GRI | Global Reporting Initiative |

| IR | Integrated Reporting |

| TCFD | Task Force on Climate-related Financial Disclosures |

| NGOs | Non-Governmental Organizations CCUS: Carbon Capture, Utilization, and Storage CSR: Corporate Social Responsibility |

| UN | United Nations |

| KPI | Key Performance Indicator |

| UK | United Kingdom |

References

- Arjaliès, D, & Mundy, J. (2020). Management Accounting Research the Use of Management Control Systems to Manage Csr Strategy: a Levers of Control Perspective.

- Barkemeyer, R. (2011). Corporate perceptions of sustainability challenges in developed and developing countries: constituting a CSR divide? Social Responsibility Journal, 7(2), 257–281. https://doi.org/10.1108/17471111111141521. [CrossRef]

- Bebbington, J., & Unerman, J. (2018). Achieving the United Nations Sustainable Development Goals. Accounting, Auditing & Accountability Journal, 31(1), 2–24. https://doi.org/10.1108/aaaj-05-2017-2929. [CrossRef]

- BP. (2023). BP Sustainability Report 2023. https://www.bp.com/content/dam/bp/business- sites/en/global/corporate/pdfs/sustainability/group-reports/bp-sustainability- report-2023.pdf.

- de Villiers, C., Kuruppu, S., & Dissanayake, D. (2020). A (new) role for business – Promoting the United Nations’ Sustainable Development Goals through the internet-of-things and blockchain technology. Journal of Business Research, 131, 598–609. https://doi.org/10.1016/j.jbusres.2020.11.066. [CrossRef]

- Dumay, J., Guthrie, J., & Farneti, F. (2010). Gri Sustainability Reporting Guidelines For Public And Third Sector Organizations. Public Management Review, 12(4), 531–548. https://doi.org/10.1080/14719037.2010.496266. [CrossRef]

- Frynas, J. G. (2010). Corporate Social Responsibility and Societal Governance: Lessons from Transparency in the Oil and Gas Sector. Journal of Business Ethics, 93(S2), 163–179. https://doi.org/10.1007/s10551-010-0559-1. [CrossRef]

- García-Sánchez, I.-M., Raimo, N., & Vitolla, F. (2021). Are Environmentally Innovative Companies Inclined towards Integrated Environmental Disclosure Policies? Administrative Sciences, 11(1), 29. https://doi.org/10.3390/admsci11010029. [CrossRef]

- Hahn, R., & Kühnen, M. (2013). Determinants of Sustainability Reporting: A Review of Results, Trends, Theory, and Opportunities in an Expanding Field of Research. Papers.ssrn.com. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2290524.

- Hassan, M. ul. (2017). SUSTAINABLE DEVELOPMENT GOALS: ARE WE READY TO IMPLEMENT THEM IN PAKISTAN? Governance and Management Review, 2(2). http://111.68.103.26/journals/index.php/gmr/article/view/4323/0.

- Higgins, D., Omer, T. C., & Phillips, J. D. (2014). The Influence of a Firm’s Business Strategy on its Tax Aggressiveness. Contemporary Accounting Research, 32(2), 674–702. https://doi.org/10.1111/1911-3846.12087. [CrossRef]

- Janssen, A., Beers, P., & van Mierlo, B. (2022). Identity in sustainability transitions: The crucial role of landscape in the Green Heart. Environmental Innovation and Societal Transitions, 42, 362–373. https://doi.org/10.1016/j.eist.2022.01.008. [CrossRef]

- Jha, A. K., & Verma, N. K. (2022). Social Media Sustainability Communication: an Analysis of Firm Behaviour and Stakeholder Responses. Information Systems Frontiers, 25. https://doi.org/10.1007/s10796-022-10257-6. [CrossRef]

- Jones, P., & Comfort, D. (2020). The Sustainable Development Goals and Leading European Retailers. Athens Journal of Business & Economics, 7(1), 105–122. https://doi.org/10.30958/ajbe.7-1-5. [CrossRef]

- Kaplan, A., & Haenlein, M. (2020). Rulers of the world, unite! The challenges and opportunities of artificial intelligence. Business Horizons, 63(1), 37–50. https://econpapers.repec.org/article/eeebushor/v_3a63_3ay_3a2020_3ai_3a1_3ap_3a37-50.htm.

- Khan, M. A. (2024). M. Ali Khan. Repec.org. https://ideas.repec.org/f/pkh243.html Kolk, A. (2016). The social responsibility of international business: From ethics and the environment to CSR and sustainable development. Journal of World Business, 51(1), 23–34.

- Mabhaudhi, T., Nhamo, L., Chibarabada, T. P., Mabaya, G., Mpandeli, S., Liphadzi, S., Senzanje, A., Naidoo, D., Modi, A. T., & Chivenge, P. P. (2021). Assessing Progress towards Sustainable Development Goals through Nexus Planning. Water, 13(9), 1321. https://doi.org/10.3390/w13091321. [CrossRef]

- Manetti, G., & Bellucci, M. (2016). The use of social media for engaging stakeholders in sustainability reporting. Accounting, Auditing & Accountability Journal, 29(6), 985–1011. https://doi.org/10.1108/aaaj-08-2014-1797. [CrossRef]

- mason , & mccarthy . (2023, October 16). McCarthy Joins More Than 5,000 Firms Participating in Construction Inclusion Week. McCarthy. https://www.mccarthy.com/insights/mccarthy-joins-more-than-5000-firms- participating-in-construction-inclusion-week.

- Miller , & Smith. (2021). Person | Global Institute of Sustainability and Innovation. Asu.edu; Global Institute of Sustainability and Innovation. https://sustainability-innovation.asu.edu/person/clark-miller/.

- Nguyen, T. H. H., Elmagrhi, M. H., Ntim, C. G., & Wu, Y. (2021). Environmental performance, sustainability, governance and financial performance: Evidence from heavily polluting industries in China. Business Strategy and the Environment, 30(5), 2313–2331. https://doi.org/10.1002/bse.2748. [CrossRef]

- Nilsson, M., Chisholm, E., Griggs, D., Howden-Chapman, P., McCollum, D., Messerli, P., Neumann, B., Stevance, A.-S., Visbeck, M., & Stafford-Smith,.

- M. (2018). Mapping interactions between the sustainable development goals: lessons learned and ways forward. Sustainability Science, 13(6), 1489–1503. https://doi.org/10.1007/s11625-018-0604-z. [CrossRef]

- Olivier. (2019). Assessing and Improving the Quality of Sustainability Reports: The Auditors’ Perspective. Journal of Business Ethics, 155(3), 703–721. https://ideas.repec.org/a/kap/jbuset/v155y2019i3d10.1007_s10551-017- 3516-4.html.

- Parker, S., Karoline, & Sharon , K. P. (2014). APA PsycNet. Psycnet.apa.org. https://psycnet.apa.org/record/2014-24108-004.

- Schramade. (2019). PRINCIPLES OF SUSTAINABLE FINANCE Chapter 7: Investing for long-term value creation Principles of Sustainable Finance. https://www.rsm.nl/fileadmin/Faculty- Research/Centres/EPSVC/PSF_Ch7_LTVC_2019.pdf.

- Sullivan, V. S., Smeltzer, M. E., Cox, G. R., & MacKenzie-Shalders, K. L. (2021). Consumer expectation and responses to environmental sustainability initiatives and their impact in foodservice operations: A systematic review. Journal of Human Nutrition and Dietetics, 34(6), 994–1013. https://doi.org/10.1111/jhn.12897. [CrossRef]

- Thompson, D.-C., Barbu, M.-G., Beiu, C., Popa, L. G., Mihai, M. M., Berteanu, M., & Popescu, M. N. (2020). The Impact of COVID-19 Pandemic on Long- Term Care Facilities Worldwide: An Overview on International Issues. BioMed Research International, 2020, 1–7. https://doi.org/10.1155/2020/8870249. [CrossRef]

- Whelan, T., & Fink, C. (2016). Harvard Business Publishing Education.

- Hbsp.harvard.edu. https://hbsp.harvard.edu/product/H037U0-PDF-ENG Amiri-Pebdani, S., Alinaghian, M., & Safarzadeh, S. (2022). Time-Of-Use pricing in an energy sustainable supply chain with government interventions: A game theory approach. Energy, 255, 124380. https://doi.org/10.1016/j.energy.2022.124380. [CrossRef]

- Collins, B. C., & Kumral, M. (2020). Game theory for analyzing and improving environmental management in the mining industry. Resources Policy, 69, 101860. https://doi.org/10.1016/j.resourpol.2020.101860. [CrossRef]

- Dolinsky, M. (2015). Sustainable systems - game theory as a tool for preserving energy resources. Energy, Sustainability and Society, 5(1). https://doi.org/10.1186/s13705-014-0030-8. [CrossRef]

- Jafari, H., Hejazi, S. R., & Rasti-Barzoki, M. (2017). Sustainable development by waste recycling under a three-echelon supply chain: A game-theoretic approach. Journal of Cleaner Production, 142, 2252–2261. https://doi.org/10.1016/j.jclepro.2016.11.051. [CrossRef]

- Manes-Rossi, F., & Nicolo’, G. (2022). Exploring sustainable development goals reporting practices: From symbolic to substantive approaches—Evidence from the energy sector. Corporate Social Responsibility and Environmental Management. https://doi.org/10.1002/csr.2328. [CrossRef]

- Nando, T. (2023a). A Real-World Metric of the Companies’ Climate Strategies. https://ca100.influencemap.org/site//data/000/037/InfluenceMap_BP&Shell Note_Directors_April23.pdf.

- Nando, T. (2023b, August 30). The Big Oil and Gas Sustainability Battle: Shell vs. BP. Impakter. https://impakter.com/the-big-oil-and-gas-sustainability-battle- shell-vs-bp/.

- Ougolnitsky, G. A. (2012). Game theoretic formalization of the concept of sustainable development in the hierarchical control systems. Annals of Operations Research, 220(1), 69–86. https://doi.org/10.1007/s10479-012-1090-9. [CrossRef]

- Patuelli, A., & Saracco, F. (2023). Sustainable development goals as unifying narratives in large UK firms’ Twitter discussions. Scientific Reports, 13(1). https://doi.org/10.1038/s41598-023-34024-y. [CrossRef]

- Zhong, M., & Wang, M. (2023). Corporate sustainability disclosure on social media and its difference from sustainability reports:Evidence from the energy sector. Frontiers in Environmental Science, 11. https://doi.org/10.3389/fenvs.2023.1147191. [CrossRef]

- García-Meca, Emma & Martínez-Ferrero, Jennifer. (2021). Is SDG reporting substantial or symbolic? An examination of controversial and environmentally sensitive industries. Journal of Cleaner Production. 298. 10.1016/j.jclepro.2021.126781. [CrossRef]

- Hummel, Katrin & Szekely, Manuel. (2021). Disclosure on the Sustainable Development Goals – Evidence from Europe. Accounting in Europe. 19. 1-38. 10.1080/17449480.2021.1894347. [CrossRef]

- Habiba Al-Shaer, Khaled Hussainey, Sustainability reporting beyond the business case and its impact on sustainability performance: UK evidence, Journal of Environmental Management, Volume 311, 2022, 114883, ISSN 0301-4797, (https://www.sciencedirect.com/science/article/pii/S030147972200456X).

- Urbieta, Laida. (2024). Firms reporting of sustainable development goals (SDGs): An empirical study of best-in-class companies. Sustainable Development. 1-14. 10.1002/sd.2944. [CrossRef]

- Sozinova, A.A., Shadiyeva, A.A., Giyazov, A.T. and Litvinova, S.A. (2023), "Sustainable Development Goals as a Milestone of Strategic Alliances: A Viewpoint From the Perspective of the Game Theory", Popkova, E.G. (Ed.) Game Strategies for Business Integration in the Digital Economy (Advances in Business Marketing and Purchasing, Vol. 27), Emerald Publishing Limited, Leeds, pp. 111-121. https://doi.org/10.1108/S1069-096420230000027012. [CrossRef]

- Rizzato, F., Tonelli, A., Fiandrino, S., & Devalle, A. (2023). Analysing SDG disclosure and its impact on integrated thinking and reporting. Meditari Accountancy Research. https://doi.org/10.1108/medar-07-2022-1751. [CrossRef]

- Buil, P., Sanjurjo-San, M., & Alfaro-Tanco, J. A. (2023). Dissemination analysis of SDGs in sustainability reports to enhance corporate communication strategy. Cuadernos de Gestión. https://doi.org/10.5295/cdg.221876ja. [CrossRef]

- Hamad, S., Lai, F. W., Shad, M. K., Shah, S. Q. A., Jan, A. A., & Ali, S. E. A. (2024). A reflection on the voluntary disclosure of sustainable development goals: The role of sustainability committee. Business Strategy and Development. https://doi.org/10.1002/bsd2.398. [CrossRef]

- Thammaraksa, C., Gebara, C. H., Hauschild, M., Pontoppidan, C., & Laurent, A. (2024). Business reporting of Sustainable Development Goals: Global trends and implications. Business Strategy and The Environment. https://doi.org/10.1002/bse.3760. [CrossRef]

- Patuelli, A., & Saracco, F. (2022). Sustainable Development Goals as unifying narratives in large UK firms' Twitter discussions. Dental Science Reports. https://doi.org/10.1038/s41598-023-34024-y. [CrossRef]

- Luis, Antonio, López. (2023). (7) The global dissemination to multinationals of the carbon emissions ruling on Shell. Structural Change and Economic Dynamics, doi: 10.1016/j.strueco.2023.03.015. [CrossRef]

- Herenia, Gutiérrez-Ponce., Sigit, Arie, Wibowo. (2023). (6) Sustainability Reports and Disclosure of the Sustainable Development Goals (SDGs): Evidence from Indonesian Listed Companies. Sustainability, doi: 10.3390/su152416919. [CrossRef]

- Vishwa, Naik, Raiker., Tania, Shirodkar. (2023). (3) The Congruence of Sustainable and Learning Organizations: An Insight into the ESG Disclosures of Shell plc. International Journal For Multidisciplinary Research, doi: 10.36948/ijfmr.2023.v05i05.7795. [CrossRef]

- Graziella, Sicoli., Giovanni, Bronzetti., Marcantonio, Ruisi., Maurizio, Rija. (2024). (2) Sustainable development goals in the sustainability report. Corporate Ownership and Control, doi: 10.22495/cocv21i3art4. [CrossRef]

- Omar, Al, Farooque., Helena, Ahulu. (2015). (15) Environmental reporting in the UK, Australia, and South African multinational companies. Journal of Developing Areas, doi: 10.1353/JDA.2015.0117. [CrossRef]

- Zabihollah, Rezaee., Saeid, Homayoun., Nick, J., Rezaee., Ehsan, Poursoleyman. (2023). (12) Business sustainability reporting and assurance and sustainable development goals. Managerial Auditing Journal, doi: 10.1108/maj-10-2022- 3722. [CrossRef]

- Mansell, P., Philbin, S. P., & Konstantinou, E. (2020). Delivering UN Sustainable Development Goals' impact on infrastructure projects: An empirical study of senior executives in the UK construction sector. Sustainability. https://doi.org/10.3390/su12197998. [CrossRef]

- Fankhauser, S., Gennaioli, C., & Collins, M. (2015). Do international factors influence the climate change policies of individual countries?. Climate Policy, 15(4), 445-461.

- Heede, R. (2014). Tracing anthropogenic carbon dioxide and methane emissions to fossil fuel and cement producers, 1854-2010. Climatic Change, 122(1-2), 229-241.

- Iraldo, F., Testa, F., & Frey, M. (2017). Circular economy: a theoretical review on barriers and drivers. Journal of Cleaner Production, 168, 714-722.

- Mazzucato, M., & Semieniuk, G. (2018). Financing renewable energy: Who is financing what and why it matters. Technological Forecasting and Social Change, 127, 8-22.

- Newell, R. G., & Raimi, D. (2018). The fiscal implications of transitioning to a low-carbon energy system. Energy Journal, 39(3), 253-279.

- Sullivan, R., Gouldson, A., & Webber, P. (2018). Climate action and the oil and gas industry: Climate ambition, rhetoric, and reality. Energy Policy, 121, 635-640.

- Torjeson, I. (2016). UK performs fifth in the world on sustainable development goals. BMJ. https://doi.org/10.1136/BMJ.I5144. [CrossRef]

- Adams, C. A. (2020). The role of sustainability reporting in enhancing corporate accountability: A systematic review. Business Strategy and the Environment, 29(1), 201-213. https://doi.org/10.1002/bse.2469. [CrossRef]

- Arjaliès, D., & Mundy, J. (2020). Sustainability accounting and the role of the SDGs: A framework for corporate governance. Journal of Business Ethics, 161(1), 187-204. https://doi.org/10.1007/s10551-018-3926-5. [CrossRef]

- Boiral, O., Heras-Saizarbitoria, I., & Brotherton, M.-C. (2019). Corporate commitment to sustainability: Adoption of voluntary initiatives and stakeholders' perceptions. Corporate Social Responsibility and Environmental Management, 26(6), 1461-1472. https://doi.org/10.1002/csr.1723. [CrossRef]

- BP, 2023. Sustainability report. [online] Available at: https://www.bp.com [Accessed 10 July 2024].

- de Villiers, C., Kuruppu, S., & Dissanayake, D. (2021). A (new) role for business: Promoting the United Nations’ Sustainable Development Goals through the Internet of Things and blockchain technology. Journal of Business Research, 131, 598-609. https://doi.org/10.1016/j.jbusres.2021.02.016. [CrossRef]

- Feng, Y., Liu, J., & Zhang, W. (2021). The impact of sustainability reporting on corporate financial performance: Evidence from the energy sector. Energy Economics, 97, Article 105197. https://doi.org/10.1016/j.eneco.2021.105197 García-Sánchez, I. M., Rodríguez-Ariza, L., & Frías-Aceituno, J. V. (2020). Do pressure groups influence corporate social responsibility? Empirical evidence from the Sustainable Development Goals framework. Business Strategy and the Environment, 29(1), 201-213. https://doi.org/10.1002/bse.2353. [CrossRef]

- GRI, 2020. Global Reporting Initiative Standards. [online] Available at: https://www.globalreporting.org [Accessed 10 July 2024].

- Holland, K., & Jansen, M. (2021). Social media as a tool for corporate sustainability communication: Opportunities and challenges. Corporate Social Responsibility and Environmental Management, 28(6), 1675-1686. https://doi.org/10.1002/csr.2062. [CrossRef]

- Jones, P., Comfort, D., & Hillier, D. (2021). Managing materiality: A preliminary examination of the adoption of the new GRI G4 guidelines on materiality within the business community. Journal of Public Affairs, 14(4), 255-263. https://doi.org/10.1002/pa.2005. [CrossRef]

- Kaplan, A. M., & Haenlein, M. (2020). Social media: Back to the future. Business Horizons, 63(1), 25-35. https://doi.org/10.1016/j.bushor.2019.09.002. [CrossRef]

- Khan, A., & Ali, S. (2021). The role of corporate websites in sustainability communication: Opportunities and challenges. Journal of Communication Management, 25(3), 219-235. https://doi.org/10.1108/JCOM-09-2020-0098. [CrossRef]

- Lee, K., & Poon, S. (2021). The role of sustainability reporting in enhancing corporate accountability: A systematic review. Business Strategy and the Environment, 30(5), 2345-2360. https://doi.org/10.1002/bse.2770. [CrossRef]

- Lee, K., Park, H., & Lee, S. (2021). The role of social media in corporate sustainability communication: An empirical analysis of the oil and gas sector. Journal of Business Ethics, 169(3), 481-497. https://doi.org/10.1007/s10551-020-04545-6. [CrossRef]

- Mason, R., & McCarthy, A. (2022). Leveraging social media for effective sustainability communication: Engaging stakeholders in the digital age. Journal of Corporate Social Responsibility, 25(3), 345-362. https://doi.org/10.1007/s10551-020-04605-4. [CrossRef]

- Meyer, K., & Hennig, M. (2021). The impact of website design on sustainability communication: Enhancing corporate transparency and stakeholder engagement. Corporate Social Responsibility and Environmental Management, 28(4), 1143-1156. https://doi.org/10.1002/csr.2165. [CrossRef]

- Miller, J., & Smith, L. (2022). The role of hashtags in sustainability communication: Increasing visibility and engagement in corporate social media. Corporate Social Responsibility and Environmental Management, 29(4), 811-823. https://doi.org/10.1002/csr.2201. [CrossRef]

- Ng, T., & Hwang, J. (2021). Social media engagement and corporate transparency: Enhancing stakeholder relationships through active communication. Journal of Business Communication, 58(2), 147-164. https://doi.org/10.1177/2329488420956480. [CrossRef]

- Schramade, W. (2019). Investing in the UN Sustainable Development Goals: Opportunities for companies and investors. Journal of Applied Corporate Finance, 31(2), 34-43. https://doi.org/10.1111/jacf.12351. [CrossRef]

- Shell, 2023. Sustainability report. [online] Available at: https://www.shell.com [Accessed 10 July 2024].

- Sweeney, E., & Baker, J. (2022). Building trust through transparency: The influence of sustainability reporting on stakeholder perceptions. Corporate Social Responsibility and Environmental Management, 29(5), 1064-1075. https://doi.org/10.1002/csr.2236. [CrossRef]

- Thomson, I., Dey, C., & Russell, S. (2020). Sustainable development and the upstream oil and gas industry: Integrating reporting and performance. Sustainability Accounting, Management and Policy Journal, 11(2), 313-339. https://doi.org/10.1108/SAMPJ-01-2019-0036. [CrossRef]

- United Nations. (2021). The Sustainable Development Goals Report 2021. https://unstats.un.org/sdgs/report/2021/The-Sustainable-Development-Goals-Report-2021.pdf.

- Aboul-Atta, Tarek & Rashed, Rania. (2021). Analyzing the relationship between sustainable development indicators and renewable energy consumption. Journal of Engineering and Applied Science. 68. 10.1186/s44147-021-00041-9. [CrossRef]

- Rai, Pratibha & Gupta, Priya & Saini, Neha & Tiwari, Aviral. (2023). Assessing the impact of renewable energy and non-renewable energy use on carbon emissions: evidence from select developing and developed countries. Environment, Development and Sustainability. 1-22. 10.1007/s10668-023-04001-6. [CrossRef]

- Supran, G., Oreskes, N. (2021). The clean energy claims of BP, Chevron, ExxonMobil, and Shell: A mismatch between discourse, actions, and investments. PLOS ONE. Available at: PLOS ONE.

- Dingru, L., Ramzan, M., Irfan, M., Gülmez, Ö., Isik, H., Adebayo, T. S., & Husam,.

- R. (2021). The Role of Renewable Energy Consumption Towards Carbon Neutrality in BRICS Nations: Does Globalization Matter? Frontiers in Environmental Science, 9. https://doi.org/10.3389/fenvs.2021.796083. [CrossRef]

- Danish, Hassan, S. T., Baloch, M. A., Mahmood, N., & Zhang, J. (2019). Linking economic growth and ecological footprint through human capital and biocapacity. Sustainable Cities and Society, 47, 101516. https://doi.org/10.1016/j.scs.2019.101516. [CrossRef]

- Dogan, Eyup & Seker, Fahri. (2016). The influence of real output, renewable and non-renewable energy, trade and financial development on carbon emissions in the top renewable energy countries. Renewable and Sustainable Energy Reviews. 60. 1074-1085. 10.1016/j.rser.2016.02.006.

- Bölük, G., & Mert, M. (2014). Fossil & renewable energy consumption, GHGs (greenhouse gases) and economic growth: Evidence from a panel of EU (European Union) countries. Energy, 74, 439–446. https://doi.org/10.1016/j.energy.2014.07.008. [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).