Submitted:

29 February 2024

Posted:

01 March 2024

You are already at the latest version

Abstract

Keywords:

1. Introduction

2. Literature Review

3. Empirical Analysis

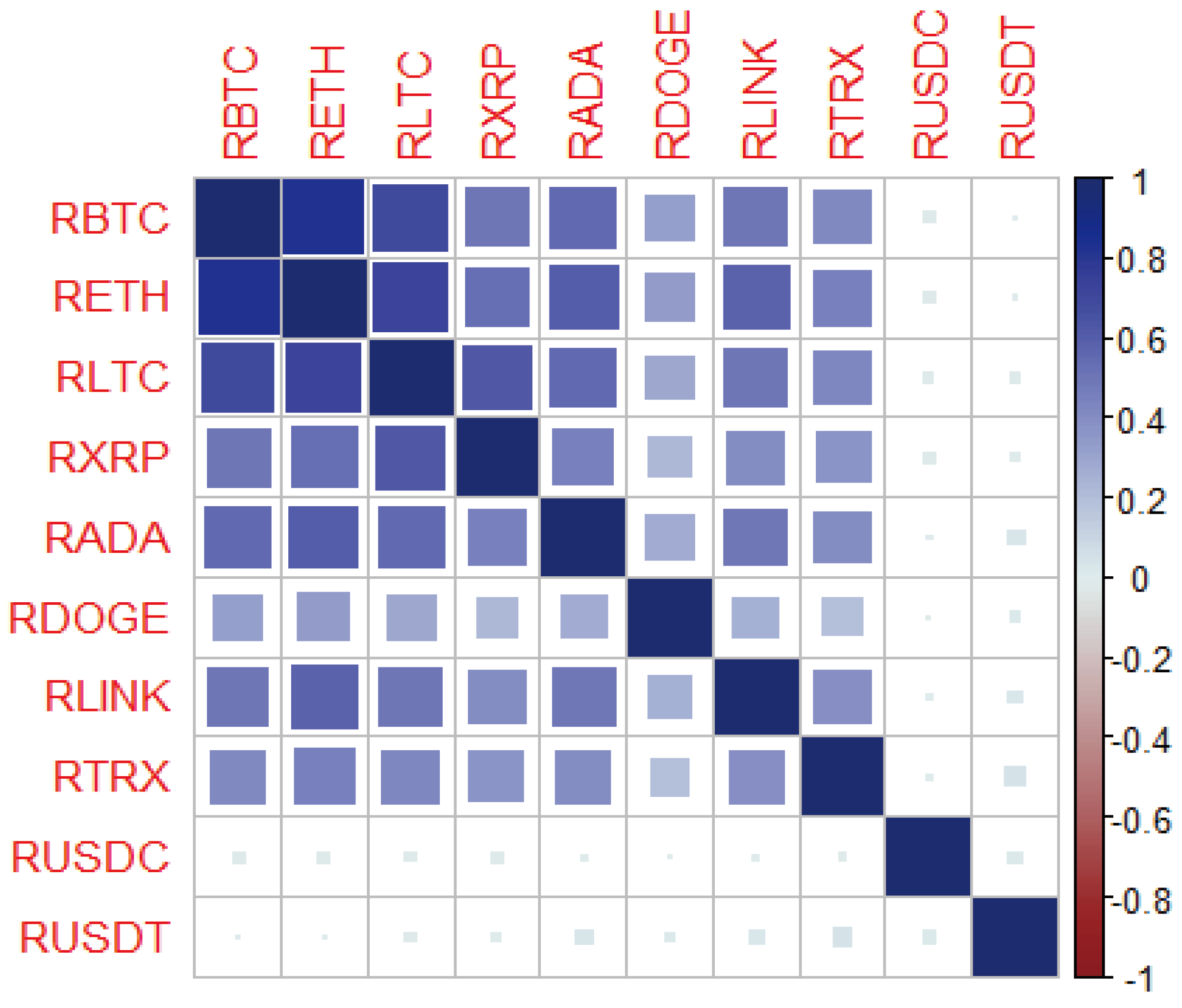

3.1. Data and Methodology

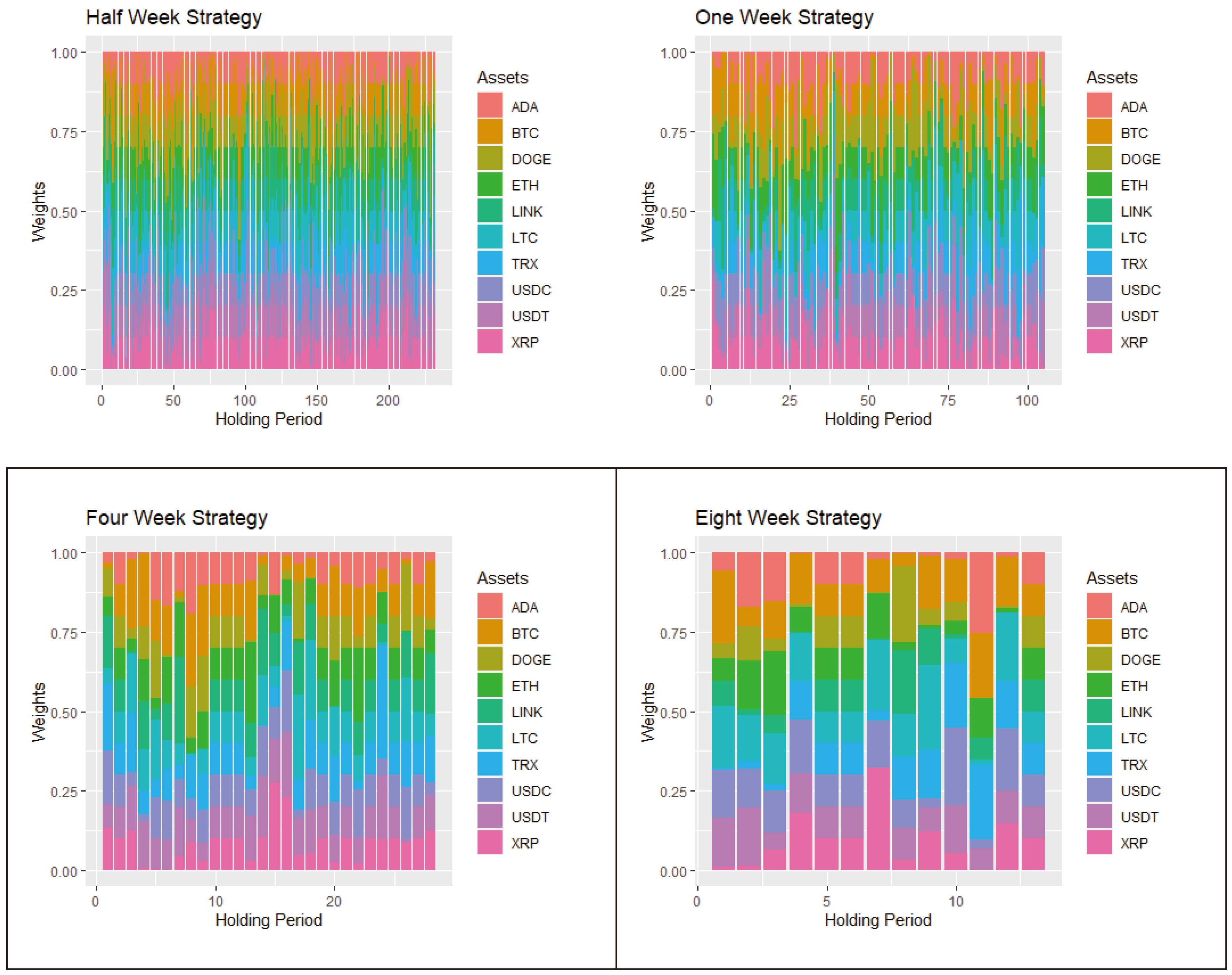

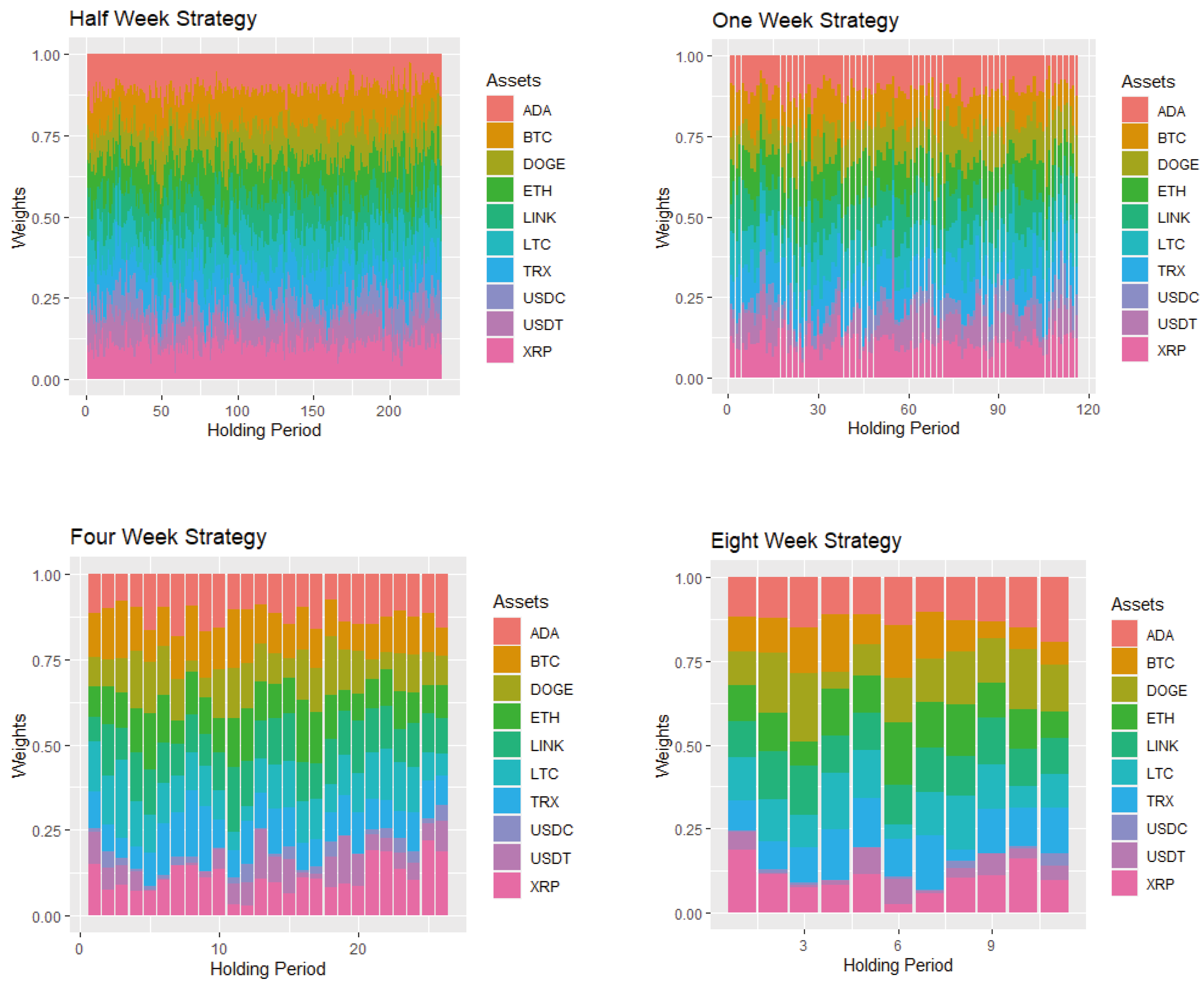

3.2. Sharpe-Maximization Methodology Portfolio

3.3. Kurtosis Minimization Methodology Portfolio

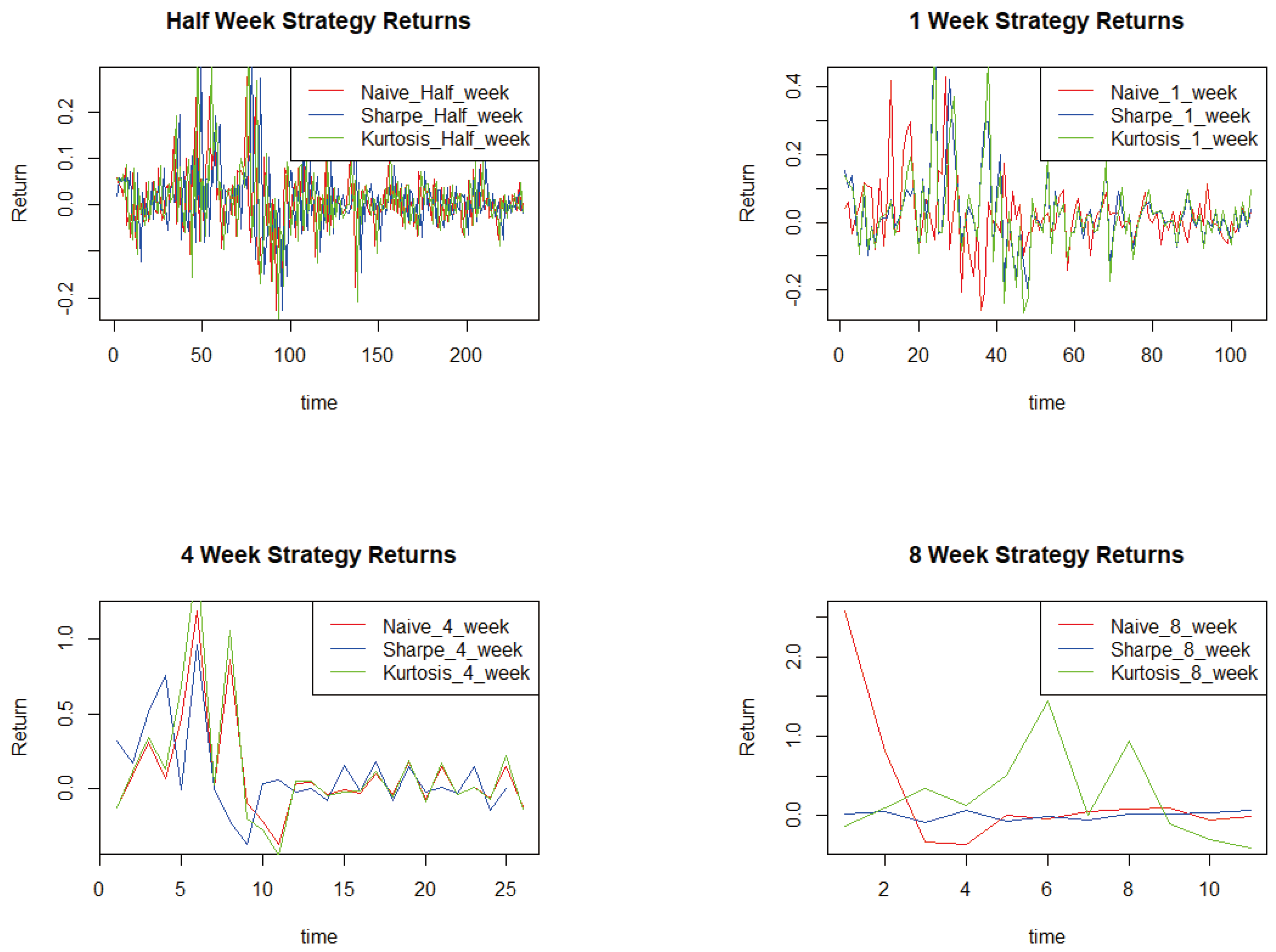

4. Results and Discussion

5. Conclusion:

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Adrianus, R. and Soekarno, S. (2018). Determinants of momentum strategy and return in short time horizon: case in indonesian stock market. International Journal of Trade and Global Markets, 11(1), 1. [CrossRef]

- Akyildirim, E., Goncu, A., & Sensoy, A. (2021). Prediction of cryptocurrency returns using machine learning. 827 Annals of Operations Research, 297(1–2), 3–36. [CrossRef]

- Alipour, P. and Charandabi, S. (2023). Analyzing the interaction between tweet sentiments and price volatility of cryptocurrencies. European Journal of Business Management and Research, 8(2), 211-215. [CrossRef]

- Antonakakis, N., Chatziantoniou, I., & Gabauer, D. (2019). Cryptocurrency market contagion: market uncertainty, market complexity, and dynamic portfolios. Journal of International Financial Markets Institutions and Money, 61, 37-51. [CrossRef]

- Araujo, F., Fernandes, L., Silva, J., Sobrinho, K., & Tabak, B. (2023). Assessment the predictability in the price dynamics for the top 10 cryptocurrencies: the impacts of russia–ukraine war. Fractals, 31(05). [CrossRef]

- Bagus, P. and Horra, L. (2021). An ethical defense of cryptocurrencies. Business Ethics the Environment & Responsibility, 30(3), 423-431. [CrossRef]

- Ballis, A. and Verousis, T. (2022). Behavioural finance and cryptocurrencies. Review of Behavioral Finance, 14(4), 545-562. [CrossRef]

- Choi, S. and Feinberg, R. (2022). Linking consumer innovativeness to the cryptocurrency intention: moderating effect of the lohas (lifestyle of health and sustainability) lifestyle. Journal of Engineering Research and Sciences, 1(12), 1-8. [CrossRef]

- Conlon, T., Corbet, S., & McGee, R. (2020). Are cryptocurrencies a safe haven for equity markets? an international perspective from the covid-19 pandemic. Research in International Business and Finance, 54, 101248. [CrossRef]

- Dabbous, A., Sayegh, M., & Barakat, K. (2022). Understanding the adoption of cryptocurrencies for financial transactions within a high-risk context. The Journal of Risk Finance, 23(4), 349-367. [CrossRef]

- DeMiguel, V., Garlappi, L., & Uppal, R. (2011). Optimal versus naive diversification: how inefficient is the 1/n portfolio strategy? 644-664. [CrossRef]

- ElBahrawy, A., Alessandretti, L., Kandler, A., Pastor-Satorras, R., & Baronchelli, A. (2017). Evolutionary dynamics of the cryptocurrency market. Royal Society Open Science, 4(11), 170623. [CrossRef]

- Eom, C., Park, J., Kim, Y., & Kaizoji, T. (2015). Effects of the market factor on portfolio diversification: the case of market crashes. Investment Analysts Journal, 44(1), 71-83. [CrossRef]

- Green, J., Manski, S., Hansen, T. & Broatch, J. (2023). Descriptive statistics, Editor(s): Robert J Tierney, Fazal Rizvi, Kadriye Ercikan, International Encyclopedia of Education (Fourth Edition), Elsevier, 2023, Pages 723-733, ISBN 9780128186299. [CrossRef]

- Gupta, N., Mitra, P., & Banerjee, D. (2022). Cryptocurrencies and traditional assets: decoding the analogy from emerging economies with crypto usage. Investment Management and Financial Innovations, 20(1), 1-13. [CrossRef]

- Hanif, W., Ko, H., Pham, L., & Kang, S. (2023). Dynamic connectedness and network in the high moments of cryptocurrency, stock, and commodity markets. Financial Innovation, 9(1). [CrossRef]

- Inci, A. and Lagasse, R. (2019). Cryptocurrencies: applications and investment opportunities. Journal of Capital Markets Studies, 3(2), 98-112. [CrossRef]

- Jana, S. (2024). Can cryptocurrencies provide better diversification benefits? evidence from the indian stock market. Journal of Interdisciplinary Economics. [CrossRef]

- Ji, Q., Bouri, E., Lau, C., & Roubaud, D. (2019). Dynamic connectedness and integration in cryptocurrency markets. International Review of Financial Analysis, 63, 257-272. [CrossRef]

- Khan, S. (2022). The legality of cryptocurrency from an islamic perspective: a research note. Journal of Islamic Accounting and Business Research, 14(2), 289-294. [CrossRef]

- Kozlovskyi, S., Petrunenko, I., Mazur, H., Butenko, V., & Ivanyuta, N. (2022). Assessing the probability of bankruptcy when investing in cryptocurrency. Investment Management and Financial Innovations, 19(3), 312-321. [CrossRef]

- Krishna, S. (2023). Cryptocurrency adoption and its influence on traditional financial markets. Interantional Journal of Scientific Research in Engineering and Management, 07(11), 1-11. [CrossRef]

- Letho, L., Chelwa, G., & Alhassan, A. (2022). Cryptocurrencies and portfolio diversification in an emerging market. China Finance Review International, 12(1), 20-50. [CrossRef]

- LIU, Y., Tsyvinski, A., & Wu, X. (2022). Common risk factors in cryptocurrency. The Journal of Finance, 77(2), 1133-1177. [CrossRef]

- Lorenzo, L. and Arroyo, J. (2023). Online risk-based portfolio allocation on subsets of crypto assets applying a prototype-based clustering algorithm. Financial Innovation, 9(1). [CrossRef]

- Ma, Y., Ahmad, F., Liu, M., & Wang, Z. (2020). Portfolio optimization in the era of digital financialization using cryptocurrencies. Technological Forecasting and Social Change, 161, 120265. [CrossRef]

- McMorrow, J. and Esfahani, M. (2021). An exploration into people’s perception and intention on using cryptocurrencies. Holistica – Journal of Business and Public Administration, 12(2), 109-144. [CrossRef]

- Mungo, L., Bartolucci, S., & Alessandretti, L. (2023). Crypocurrency co-investment network: token returns reflect investment patterns. [CrossRef]

- Nasir, N. and Wahab, H. (2022). Analysing time-scales currency exposure using maximal overlap discrete wavelet transform (modwt) for malaysian industrial., 426-439. [CrossRef]

- Petukhina, A., Reule, R., & Härdle, W. (2020). Rise of the machines? intraday high-frequency trading patterns of cryptocurrencies. European Journal of Finance, 27(1-2), 8-30. [CrossRef]

- Plerou, V., Gopikrishnan, P., Rosenow, B., Amaral, L., Guhr, T., & Stanley, H. (2002). Random matrix approach to cross correlations in financial data. Physical Review E, 65(6). [CrossRef]

- Rajharia, P. (2023). Cryptocurrency adoption and its implications: a literature review. E3s Web of Conferences, 456, 03002. [CrossRef]

- Razak, M. (2023). The dynamic role of the japanese property sector reits in mixed-assets portfolio. Journal of Property Investment & Finance, 41(2), 208-238. [CrossRef]

- Scagliarini, T., Pappalardo, G., Biondo, A., Pluchino, A., Rapisarda, A., & Stramaglia, S. (2022). Pairwise and high-order dependencies in the cryptocurrency trading network. Scientific Reports, 12(1). [CrossRef]

- Schellinger, B. (2020). Optimization of special cryptocurrency portfolios. The Journal of Risk Finance, 21(2), 127-157. [CrossRef]

- Shahzad, M. (2024). Cryptocurrency awareness, acceptance, and adoption: the role of trust as a cornerstone. Humanities and Social Sciences Communications, 11(1). [CrossRef]

- Siegel, A. and Woodgate, A. (2007). Performance of portfolios optimized with estimation error. Management Science, 53(6), 1005-1015. [CrossRef]

- Silva, I. R. R. d., Hadad, E., & Oliveira, P. P. B. d. (2022). Cryptocurrencies trading algorithms: a review. Journal of Forecasting, 41(8), 1661-1668. [CrossRef]

- Subramoney, S., Chinhamu, K., & Chifurira, R. (2023). Var estimation using extreme value mixture models for cryptocurrencies. [CrossRef]

- Sukumaran, A., Gupta, R., & Jithendranathan, T. (2015). Looking at new markets for international diversification: frontier markets. International Journal of Managerial Finance, 11(1), 97-116. [CrossRef]

- Sukumaran, S., Bee, T., & Wasiuzzaman, S. (2022). Cryptocurrency as an investment: the malaysian context. Risks, 10(4), 86. [CrossRef]

- Susilo, D., Wahyudi, S., Pangestuti, I., Nugroho, B., & Robiyanto, R. (2020). Cryptocurrencies: hedging opportunities from domestic perspectives in southeast asia emerging markets. Sage Open, 10(4), 215824402097160. [CrossRef]

- Symitsi, E. and Chalvatzis, K. (2019). The economic value of bitcoin: a portfolio analysis of currencies, gold, oil and stocks. Research in International Business and Finance, 48, 97-110. [CrossRef]

- Tola, V., Lillo, F., Gallegati, M., & Mantegna, R. (2008). Cluster analysis for portfolio optimization. Journal of Economic Dynamics and Control, 32(1), 235-258. [CrossRef]

- Trimborn, S., Li, M., & Härdle, W. (2019). Investing with cryptocurrencies—a liquidity constrained investment approach*. Journal of Financial Econometrics, 18(2), 280-306. [CrossRef]

- Tzouvanas, P., Kizys, R., & Tsend-Ayush, B. (2020). Momentum trading in cryptocurrencies: short-term returns and diversification benefits. Economics Letters, 191, 108728. [CrossRef]

- Wang, Y. (2024). Do cryptocurrency investors in the uk need more protection? Journal of Financial Regulation and Compliance. [CrossRef]

- Waspada, I., Salim, D., & Krisnawati, A. (2022). Horizon of cryptocurrency before vs during covid-19. [CrossRef]

- Yousaf, I. and Ali, S. (2020). Discovering interlinkages between major cryptocurrencies using high-frequency data: new evidence from covid-19 pandemic. Financial Innovation, 6(1). [CrossRef]

- Zaretta, B. and Pangestuti, I. R. D. (2023). A methodological point of view in a systematic review of the documentation of the effect of volatility on cryptocurrency investment. International Conference on Research and Development (ICORAD), 2(1), 7-23. [CrossRef]

- Zema, S., Fagiolo, G., Squartini, T., & Garlaschelli, D. (2021). Mesoscopic structure of the stock market and portfolio optimization. [CrossRef]

- Zhang, M. (2024). Relationships among return and liquidity of cryptocurrencies. Financial Innovation, 10(1). [CrossRef]

- Zhang, Y., Chan, S., Chu, J., & Sulieman, H. (2020). On the market efficiency and liquidity of high-frequency cryptocurrencies in a bull and bear market. Journal of Risk and Financial Management, 13(1), 8. [CrossRef]

- Zhao, H. and Zhang, L. (2021). Financial literacy or investment experience: which is more influential in cryptocurrency investment? The International Journal of Bank Marketing, 39(7), 1208-1226. [CrossRef]

| Descriptive statistics | Bitcoin | Cardano | Chainlink | Dogecoin | Ethereum | Litecoin | Ripple | Tron | Tether | USD coin |

|---|---|---|---|---|---|---|---|---|---|---|

| Minimum | -8.00% | -25.31% | -36.04% | -31.73% | -14.77% | -45.17% | -54.32% | -18.97% | -3.99% | -30.34% |

| Maximum | 11.84% | 29.44% | 20.52% | 37.84% | 7.37% | 13.29% | 24.44% | 26.68% | 5.84% | 30.74% |

| Range | 19.84% | 54.75% | 56.56% | 69.57% | 22.14% | 58.46% | 78.76% | 45.65% | 9.83% | 61.08% |

| Mean | 0.01% | 0.01% | 0.00% | 0.02% | 0.01% | 0.00% | 0.01% | 0.01% | 0.00% | 0.00% |

| Median | 0.01% | 0.00% | 0.00% | 0.00% | 0.01% | 0.01% | 0.02% | 0.00% | 0.00% | 0.00% |

| Satndard Deviation | 0.71% | 1.27% | 1.40% | 1.94% | 0.92% | 1.14% | 1.37% | 1.19% | 0.19% | 0.45% |

| Coefficient of Variation | 114.18 | 159.26 | 607.00 | 116.96 | 114.76 | 654.10 | 257.33 | 186.45 | 23808.26 | -22843.35 |

| Skewness | -0.17 | -3.09 | -1.34 | 0.87 | -0.65 | -4.54 | -3.09 | -0.04 | 0.67 | 0.41 |

| Kurtosis | 21.30 | 36.47 | 48.47 | 56.89 | 18.29 | 167.47 | 166.85 | 39.43 | 173.69 | 2185.35 |

| Jarque Bera Test (p-value) | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Rebalancing Frequency | Naive Portfolio | Sharpe-maximization methodology | Kurtosis-minimization methodology |

|---|---|---|---|

| Half-week | 426.82% | 384.55% | 491.45% |

| One-week | 429.18% | 859.18% | 531.03% |

| Four-week | 345.30% | 187.16% | 379.40% |

| Eight-week | 301.01% | 332.03% | 335.79% |

| Rebalancing Frequency | Naive portfolio | Sharpe-maximization methodology | Kurtosis-minimization methodology |

|---|---|---|---|

| Half-week | 83.89% | 99.80% | 116.43% |

| One-week | 107.67% | 169.57% | 124.34% |

| Four-week | 92.53% | 58.83% | 98.87% |

| Eight-week | 83.89% | 86.96% | 90.72% |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).