1. Introduction

Understanding how behavioral or cognitive biases affect economic decisions and outcomes is central in modern economics because traditional models based on the assumption that agents are fully rational struggle to explain a wide range of economic phenomena. For instance, the recurrent occurrence of bubbles and crashes in financial markets poses a challenge to classical models with agents who have unbiased beliefs and always make rational decisions. To overcome these limitations, researchers have been seeking alternative explanations to better understand various abnormal economic phenomena, especially employing experimental and psychological approaches. Some of the groundbreaking work that spawned this relatively new field includes, not limited to, Kahneman and Tversky [

1], who introduced prospect theory to explain decision-making under risk; Thaler [

2], who developed the concept of mental accounting to describe how people categorize economic outcomes; Fehr and Schmidt [

3], who provided evidence for fairness and reciprocity in economic interactions; and Loewenstein et al. [

4], who emphasized the role of emotions in risk perception and decision-making. Additional recent studies that investigate how cognitive biases affect economic and financial decisions include Exler et al. [

5] and Sharma et al. [

6].

While many different types of cognitive biases have been explored in this growing literature, one that has recently attracted particular interest in psychology is unrealistic optimism. According to the formal definition provided by Weinstein [

7], unrealistic optimism means that people tend to erroneously believe that negative outcomes are less likely to occur to themselves than to others. In other words, unrealistic optimism indicates the tendency that people typically perceive themselves as less vulnerable to misfortune while believing others as more prone to bad luck.

Specifically, Weinstein [

7] shows that individuals perceive their own chance of developing lung cancer as significantly lower than the true average likelihood of being diagnosed with that disease. Weinstein [

8] extends this study and shows that this phenomenon is ubiquitous regardless of which type of disease is considered, including diabetes, heart attack, drug addiction, and insomnia. Moreover, Burger and Palmer [

9] find that while individuals tend to lose their optimism about the likelihood of a specific negative event after experiencing that event, those people typically do not change their perceived vulnerablity to other negative events. In addition, a recent study by Gassen et al. [

10] shows that people continue to exhibit this type of cognitive bias, using the survey data on the risk perceptions of individuals on the likelihood of being infected by COVID-19. However, as argued by Coelho [

11], the potential impact of unrealistic optimism on economic and business outcomes has been largely ignored by economic researchers, practitioners in corporate sectors, and policymakers, despite the prevalence of unrealistic optimism among individuals in various situations, as seen above. In a related critique, Rizzo and Whitman [

12] emphasize the broader challenges that behavioral economics faces in incorporating context-dependent cognitive biases like unrealistic optimism into policy-making, due to persistent knowledge limitations regarding individual preferences and situational heterogeneity.

This paper sheds new light on the potential economic consequences of unrealistic optimism by examining how this type of optimistic beliefs influences individual decision-making and market dynamics. Specifically, we develop an economic model to show that when people hold unrealistic optimism, the economy is more likely to enter into recessions earlier and face underinvestment rather than experiencing bubbles and overinvestment. This result challenges conventional wisdom because optimism or overconfidence is generally considered a behavioral bias that generates economic booms, excessive risk taking, and overinvestments. In particular, Malmendier and Tate [

13], Gervais et al. [

14], Hirshleifer et al. [

15], and Lee et al. [

16] empirically show that overconfident corporate managers often overestimate the profitability of new projects and thereby invest more aggressively in new investment opportunities. Malmendier et al. [

17] explores this issue further by analyzing how managerial overconfidence varies across different hierarchical levels within firms. Moreover, Harrison and Kreps [

18] and Scheinkman and Xiong [

19] develop theoretical models to show that asset markets tend to experience speculative bubbles when investors have time-varying heterogeneous beliefs on assets because assets are usually owned by those investors with the most optimistic view at any given point in time. Our paper, however, shows that the conceptually opposite outcomes may occur by particularly examining unrealistic optimism, a form of optimism intensively studied in psychology but largely overlooked in economics.

Our model consists of producers and consumers. Producers produce output goods to maximize their profits, taking the output price and production costs as given. Initially, each consumer values one unit of the output as 1 in terms of the consumption goods. However, in the future, an aggregate shock may hit all existing consumers. Upon the arrival of the shock, each consumer will assign a value of less than 1 to one unit of the output. That is, the aggregate shock can be categorized as a preference shock, while another interpretation is possible. However, each consumer is assumed to hold unrealistic optimism in this model. Specifically, as briefly mentioned above, every consumer incorrectly believes that the aggregate shock will hit all other consumers, but not herself. In other words, each consumer considers that she will not be the victim of the adverse event unlike all other consumers. For instance, if we interpret the aggregate shock as income shocks, we can say that consumers incorrectly believe that all other consumers will experience a wage cut if a crisis hits the economy, but such a bad event would not occur to themselves.

In the benchmark economy, in which each consumer correctly believes that nobody, including herself, can avoid the aggregate shock, the output price stays at 1 today but will drop in the future exactly when the aggregate shock occurs. In this case, every consumer makes zero profits at every date. However, when consumers hold unrealistic optimism, the output price falls today even before the aggregate shock actually hits the economy.

To see the underlying mechanism behind this outcome, note that when consumers exhibit unrealistic optimism, each of them wrongly believes that she can make arbitrage profits in the future if she waits until the aggregate shock occurs, instead of purchasing output goods today. Thus, if the output price does not fall today, the output goods market cannot clear today because all consumers with unrealistic optimism would choose to buy the goods in the future in this case. Therefore, the output price must fall immediately to clear the market. Further, once the output price plummets, producers will lose incentives to produce output goods to some extent, leading to underinvestment. Through this mechanism, unrealistic optimism can trigger early recessions and underinvestment even before the aggregate shock occurs rather than causing expansions or bubbles.

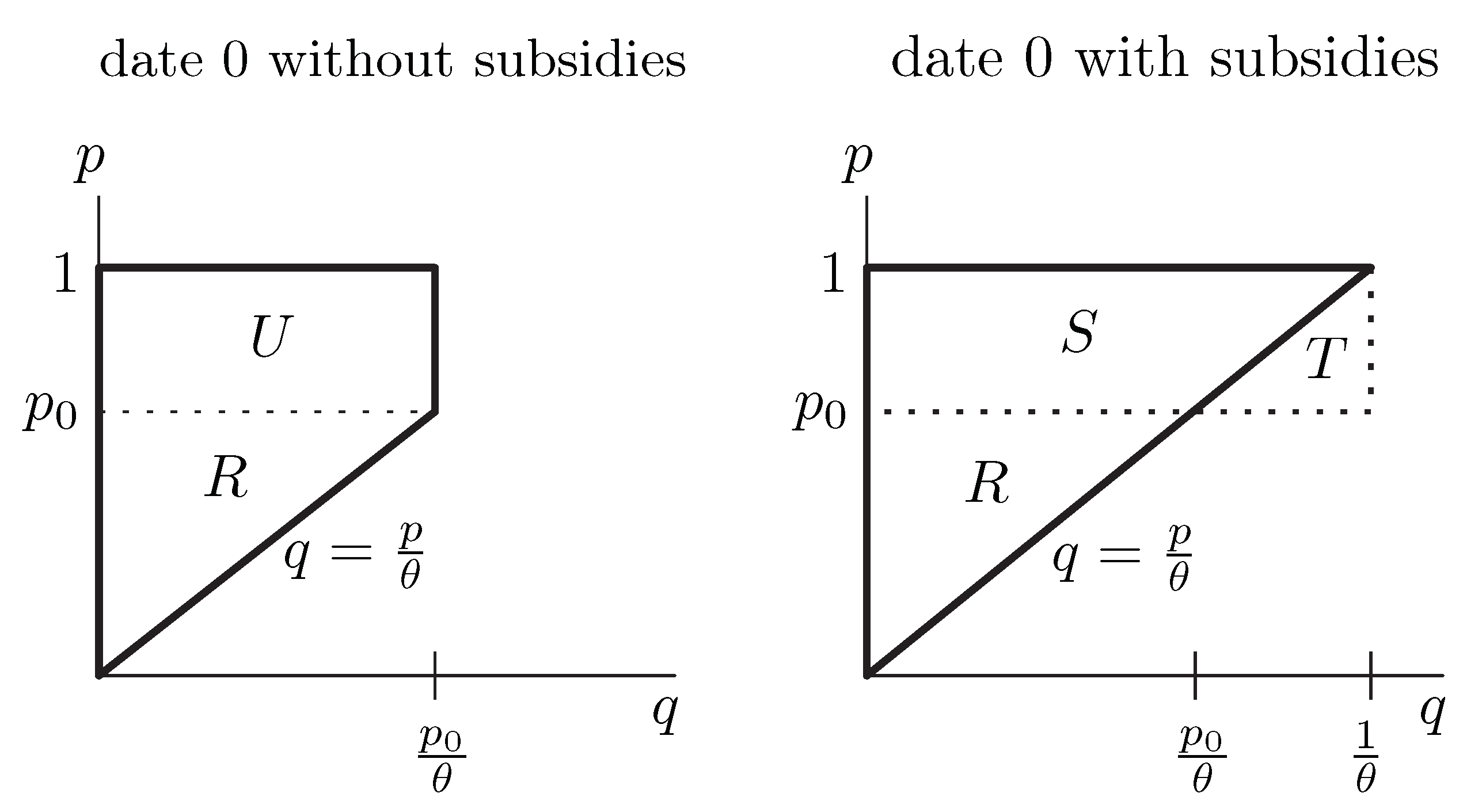

Our paper also investigates whether the government can effectively prevent or mitigate economic crises arising from the aforementioned mechanism driven by unrealistic optimism. It is well known that when all agents have the correct beliefs about the impact of the aggregate shock in a canonical setting, the government cannot enhance welfare or may even hurt welfare by providing subsidies to consumers or directly purchasing the output goods. However, when the economy experiences recessions due to the unrealistic optimism of agents, there is room for the government to intervene in the market and improve welfare of the economy. Specifically, suppose that the government provides subsidies to all consumers, who intend to purchase the output goods today, in order to lift the output price to 1. Then the utility level of some consumers, who would otherwise purchase the goods in the future in the case without subsidies, increases because they can buy the output goods, which they value as 1, at a price lower than 1 due to the subsidies. Thus, this increment in their utility offsets the amount of money paid by taxpayers. But when the output price increases, producers produce more outputs, eventually leading to the welfare improvement. This argument can be used to support the effectiveness of a number of government intervention policies implemented during the 2008 financial crisis and 2020 COVID-19 crisis, such as stimulus packages and direct financial aid to consumers and businesses.

Despite the positive effects of government subsidies, the government must be able to choose the right timing for intervention. We show that if the government intervenes in the market after the aggregate shock hits the economy, the government subsidies would make no difference or would be less effective, compared to the case where the government takes the action preemptively. Specifically, suppose the government provides subsidies right after the occurrence of the aggregate shock. Then, at that date, consumers can still buy the output goods by spending the same amount of money as before due to the subsidies. As such, at the beginning, consumers with unrealistic optimism will again falsely expect to exploit the arbitrage opportunity unless the output price remains at a low level as before. As a result, the output price will still stay at the low level in the first period, which means that the government has failed to prevent the early occurrence of the recession. In this regard, we see that the government can improve welfare to the maximum capacity only when it chooses the right timing for intervention.

The rest of the paper is organized as follows. In

Section 2, we provide the literature review. In

Section 3, we develop the model and discuss the main results of the model. In

Section 4, we discuss the welfare implications of government intervention. In

Section 5, we extend the model into a dynamic setup. In

Section 6, we discuss the limitations and the directions for future research. In

Section 7, we conclude.

2. Related Literature

Understanding the causes and consequences of economic fluctuations has been a central focus in economic research. Traditional macroeconomic theories mainly attribute economic fluctuations to various factors, including productivity shocks, liquidity constraints, and financial frictions. For instance, Kydland and Prescott [

20] show that time lags in production and investment decisions, driven by exogenous technology shocks, can generate persistent and empirically plausible aggregate fluctuations in output. Kiyotaki and Moore [

21] demonstrate how credit constraints can amplify and propagate shocks, leading to prolonged recessions. Bernanke et al. [

22] highlight the role of financial accelerator mechanisms, where deteriorating balance sheets exacerbate downturns by tightening borrowing conditions. Brunnermeier and Sannikov [

23] extend these insights by incorporating liquidity constraints and fire sales into macroeconomic models, showing how financial instability can lead to severe economic contractions. Furthermore, Guerrieri and Lorenzoni [

24] show that credit market frictions can exacerbate economic downturns by limiting firms’ access to external financing, leading to constrained investment and prolonged recessions.

Another strand of the economics literature attempts to explain economic fluctuations using information-based mechanisms. For instance, Veldkamp [

25] studies why financial markets tend to exhibit sudden crashes and slow recoveries by developing information-based models. More specifically, Veldkamp [

25] shows that during economic booms, public information about economic conditions is more abundantly produced and so, prices and economic activities adjust more rapidly during booms, which can potentially trigger a sudden crash when the economic conditions start to make a downturn. In addition, Ordonez [

26] incorporates financial frictions and agency costs into the model by Veldkamp [

25] to show that this asymmetric phenomenon generally occurs because monitoring costs for lenders are more likely to increase during recessions and crisis periods, hindering the lenders from identifying the best timing for re-entering the market, compared to the boom periods. Ordonez [

26] further shows that such an asymmetric outcome would be more likely to occur in countries with poor financial systems.

While these traditional approaches have substantially enhanced our understanding of the mechanism behind economic fluctuations, whether these theories are supported by data is inconclusive. Specifically, Altug [

27] finds that the model by Kydland and Prescott [

20] struggles to account for observed aggregate fluctuations, particularly regarding the persistence and volatility of output. Gali [

28] also presents empirical evidence suggesting that technology shocks alone cannot explain observed business cycle patterns. Regarding the model with financial frictions, while Christiano [

29] provide evidence supporting the idea that financial frictions play a crucial role in explaining the depth and persistence of recessions, Boehl and Strobel [

30] show that the ability of these models to explain the macroeconomic dynamics of the real economy is limited. Also, the mechanisms proposed by Veldkamp [

25] and Ordonez [

26] are theoretically compelling, measuring the precise role of informational frictions in market crashes and recoveries remains challenging due to the lack of detailed micro-level data. In addition, Shiller [

31] also argues that severe fluctuations in stock prices are hard to justify from the rational forecasts of firms’ future cash flows.

Due to the shortcomings of these conventional macroeconomic models, researchers have started exploring alternative theories to explain economic booms and crises. Among those recent approaches, the approach incorporating insights from behavioral psychology has gained significant attention. For example, Shiller [

31] shows that an excessive volatility of stocks is hard to justify from rational forecasts of future cash flows of firms, suggesting that psychological factors, such as overreaction to market news, must be considered to account for large fluctuations in asset prices. Thaler [

2] shows how individuals systematically deviate from rational decision-making, which in turn leads to bubbles and crashes, providing a cornerstone for the later development of behavioral economics models. Banerjee [

32] shows how herd behavior can arise when individuals make decisions based on the observed actions of the crowd rather than on their own private information, which can potentially lead to bubbles and crashes in financial markets. Bordalo et al. [

33] explore the role of diagnostic expectations, a belief formation mechanism based on the representativeness heuristic proposed by Kahneman and Tversky [

34], in shaping boom-and-bust cycles in the economy.

In addition, Kaizoji and Sornette [

35] propose a mechanism in which optimism drives asset bubbles that eventually collapse, triggering recessions. Bianchi et al. [

36] explore how belief distortions, driven by subjective expectations about economic fundamentals, amplify macroeconomic fluctuations and business cycle dynamics. Song [

37] incorporates investor sentiment into a dynamic capital mobility model to unravel the role of investtor sentiment in causing market crashes. Relatedly, researchers have also analyzed the role of pessimistic biases such as ambiguity aversion in driving significant discounts in asset prices, a phenomenon commonly called the equity premium puzzle; see, for instance, Gilboa and Schmeidler [

38], Hansen and Sargent [

39], and Epstein and Schneider [

40], and Ju and Miao [

41], and Bao et al. [

42].

Despite the growing interest in psychology-based explanations, few studies have examined the role of unrealistic optimism in macroeconomic outcomes, although this specific type of optimism has been extensively studied in the psychology literature, as mentioned above. To the best of our knowledge, our paper is the first to incorporate unrealistic optimism into an economic framework and sheds new insights into the economic role of this type of behavioral bias. Specifically, our paper demonstrates that unrealistic optimism can accelerate recessions, while previous papers typically link optimism to speculative bubbles or explain market crashes as correction of preceding booms driven by optimism. This unique feature of our paper underscores the need for further empirical research to differentiate between optimism-driven booms and optimism-induced downturns. By highlighting this mechanism, our study contributes to the literature on behavioral macroeconomics and provides new insights for government policy design as well.

3. Model and Main Results

In this section, we develop a simple model with unrealistic optimism and examine how such a cognitive bias influences output prices and production decisions.

3.1. Simple Model with Unrealistic Optimism

Consider a simple model with a representative producer and a continuum of infinitely many consumers who are prone to a certain type of cognitive bias, which will be described later. There are only two dates indexed by . All agents are risk neutral and discount future consumptions at a rate normalized to 0.

At each date t, the producer can produce units of the output at costs of by taking the output price as given, where represents the marginal cost per unit of output. Although the main results of this paper continue to hold with a more general form of the cost function, we adopt this quadratic cost function for simplicity. Let be the output price at date t. Then the producer decides to produce at each date t. Here, although we interpret the output goods as the real goods for convenience, the main implications of the model can be certainly applied to a setup where investors trade financial assets such as stocks or bonds instead of real goods.

We now consider the behavior of consumers. Each consumer is initially endowed with a certain unit of the consumption goods, which is normalized to 1. For simplicity, we assume that consumption goods are perfectly storable. As such, in this model, each risk-neutral consumer only needs to decide when to buy the output goods between date 0 and date 1. Although we can relax the assumption that consumption goods are perfectly storable, considering such a more general setup would not yield any additional important implications.

At date 0, all consumers value one unit of the outputs as 1 in terms of the consumption goods. At date 1, an aggregate preference shock will hit the economy with a probability . Upon the arrival of the shock, each consumer will value one unit of the outputs as . Here, we can interpret this preference shock in many different ways. For example, if we regard the producer as an input supplier and the consumers as the producers of the final goods, we can interpret the preference shock as a productivity shock to those final goods producers. Or, if we alternatively assume that consumers receive an exogenous amount of income at every date, we may say that the amount of income at date 1 will drop with a certain probability.

Before introducing the unrealistic optimism held by consumers, we first consider the canonical case where all consumers have correct beliefs about the potential impact of the aggregate shock. In this benchmark economy, due to market competition, the price of the output goods at date

t, denoted by

, will be equal to

That is, in equilibrium, the output price is determined in a way that all consumers earn zero profits at each date. For the latter purpose, we refer to the state where the aggregate shock does not occur as the good state and the other state as the bad state.

Regarding the production and consumption decisions, suppose that all agents expect that the output price will be given in the above way. Then, at date 0, (i) the producer produces units of the output, (ii) any consumer who wishes to buy the outputs at date 0 can buy one unit of the output, (iii) the total measure of consumers who buy the outputs at date 0 is equal to , and (iv) the other consumers decide to consume at date 1. At date 1, if the aggregate shock occurs, (i) the producer produces units of the output, (ii) any consumer who wishes to buy the outputs at date 0 can buy units of the output, (iii) the total measure of consumers who buy the outputs is , and (iv) the other consumers consume their own endowment. If the aggregate shock does not occur at date 1, the economic outcomes remain the same as in date 0.

Now, we assume that each consumer is susceptible to a certain type of cognitive bias. Specifically, we assume that each consumer incorrectly believes that the aggregate shock will hit all other consumers, but not herself. But the truth is that the aggregate shock will actually hit all existing consumers, including herself, and each consumer will eventually learn this fact once the shock indeed occurs at date 1. For instance, if we interpret the aggregate shock as an income shock, we can say that consumers believe that all other consumers will face a wage cut when the economy enters a recession, while believing such a bad shock would not hit themselves. In the psychology literature, this form of optimism, which states that people tend to underestimate the chances of negative outcomes occurring to themselves compared to others, is widely called unrealistic optimism, optimism bias, or comparative optimism; see, for instance, Weinstein [

8], Weinstein and Klein [

43], Hoorens et al. [

44], Jefferson et al. [

45], and Gassen et al. [

10].

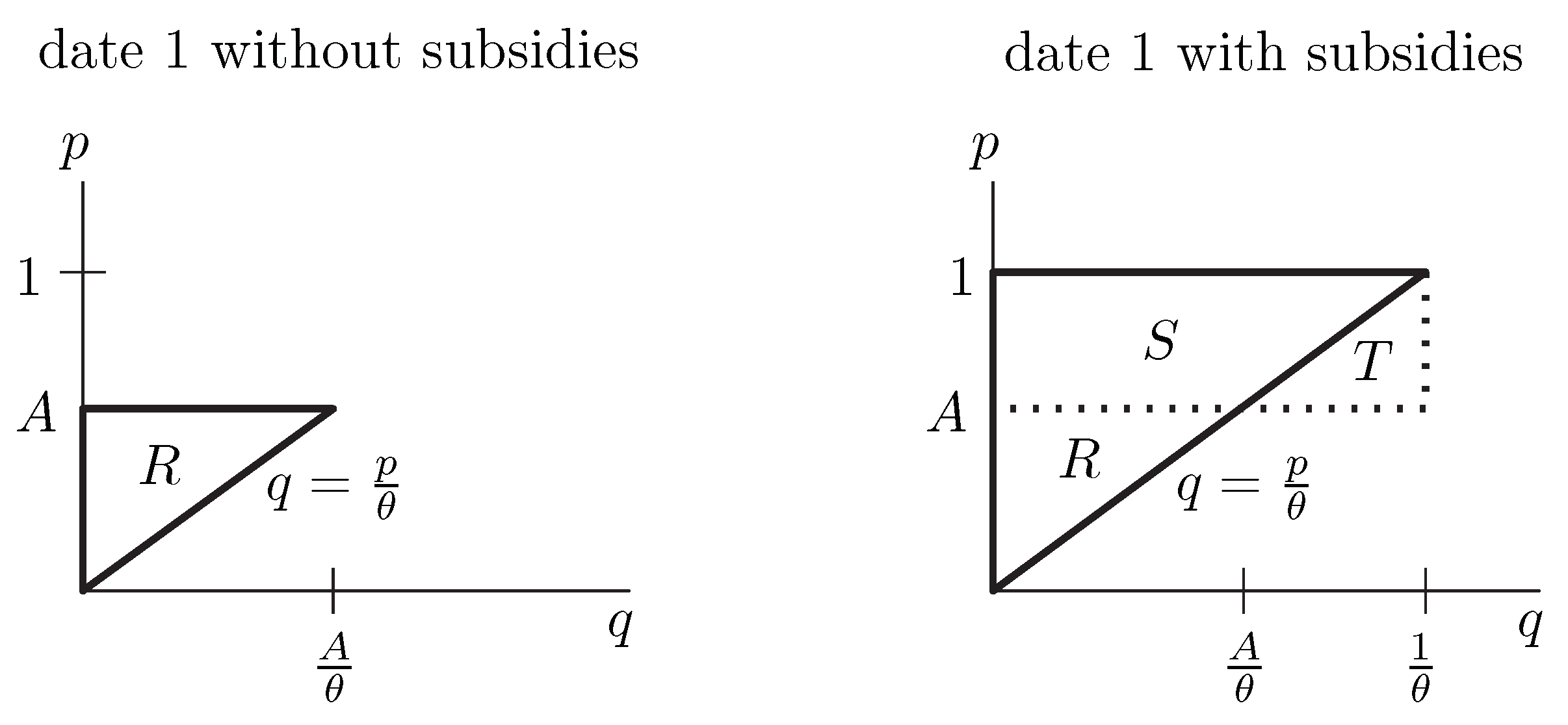

Using this model, we show that the unrealistic optimism can cause an earlier market collapse and underinvestment. To this aim, first recall that every consumer believes the aggregate shock to hit all other consumers, but not herself. As such, every consumer expects that the output price will drop to A at date 1 if the aggregate shock actually occurs, because she believes that the shock will at least hit all other consumers. But then, from the date-0 perspective, each consumer believes that she can make positive profits equal to in expectation if she purchases the output goods at date 1 rather than at date 0. Hence, for the output market to clear at date 0, the output price must drop to some extent at date 0 so that each consumer would be indifferent between purchasing the outputs at date 0 or date 1. For clarification, note that no consumers can actually earn positive profits in the end because the truth is that the aggregate shock will actually hit all consumers as mentioned above.

Accordingly, in the presence of unrealistic optimism, the output price at date 0 is determined so as to satisfy the following indifference condition:

which implies

The left-hand side of (

2) indicates the immediate profits that each consumer can earn if she buys the output goods at date 0. The right-hand side denotes the present value of the profits that each consumer expects to earn if she buys the output goods at date 1, as discussed above. Then, since these two terms must be equal to each other for the output market at date 0 to clear, the output price at that date is given by the expression in (

3). This result implies that the output price will be more depressed due to the unrealistic optimism if the aggregate shock is more likely to occur or the magnitude of the shock, measured by

, is larger, both of which are intuitive.

In addition, the above result also implies that the unrealistic optimism causes underinvestment. Specifically, since the output price falls below 1 at date 0, which is the intrinsic value of the output, the producer decides to produce only units of the output rather than as in the case without the unrealistic optimism.

These results sharply contrast with our common intuition because optimism is generally viewed as a cognitive bias that leads to bubbles in financial markets or overinvestment in the production side. For instance, Harrison and Kreps [

18] and Scheinkman and Xiong [

19] show that when investors have heterogeneous beliefs and short selling is not allowed, markets exhibit bubbles not only because assets are priced by those investors who have the most optimistic view on given assets but also because those investors can resell their assets when their own valuation drops relative to the valuation of other investors. Also, Malmendier and Tate [

13], Gervais et al. [

14], and Hirshleifer et al. [

15] provide empirical evidence that overconfident managers tend to overvalue their investment projects and thus invest more aggressively in new projects than other managers without overconfidence, especially when firms have abundant internal capital.

The type of optimism considered in this paper is different from the types of optimism considered in the above papers. In our paper, each consumer correctly estimates the impact of the aggregate shock on all other consumers but incorrectly estimates the impact of the aggregate shock on herself. When agents have this type of optimism, our model shows that markets can rather experience an early downturn and firms underinvest in new projects. In this regard, our paper sheds new light on the true sources of economic recessions and investment distortions through the lens of behavioral bias.

5. Extensions

In this section, we extend the above model into a dynamic setup with infinite horizons to show the main result of our model continues to hold in a more general setting. Specifically, we incorporate the unrealistic optimism into the neoclassical investment model developed by Hayashi [

46].

To begin, consider a firm that produces stochastic outputs over time, where the output level is determined by the investment decisions of the firm. Specifically, the time-

t output level, denoted by

, evolves according to

where

is the investment rate at time

t,

is a constant volatility, and

is a standard Brownian motion. To choose the investment level of

at time

t, the firm has to spend

as the convex adjustment costs, where

is a constant that measures the size of investment costs. At each point in time, the firm makes the investment decisions to maximize the present value of its future profits. We assume that all agents are risk neutral and discount future consumptions at a constant risk-free rate of

r.

Initially, the firm can sell one unit of the outputs at the normalized price of 1. But an aggregate preference shock may hit the firm’s consumers in the future. Specifically, the preference shock will arrive at a Poisson rate of . Upon the arrival of the shock, all consumers will value one unit of the outputs as . In this regard, we can also interpret the preference shock to consumers as the profitability shock to the firm. We call the periods with the high profitability the normal times and the periods with the low profitability the bad times. Also, as in the previous model, each consumer can buy at most one unit of the outputs throughout her life due to some budget constraints.

If consumers have correct beliefs about the impacts of the aggregate shock, the price of the output will stay at 1 during the normal times and will fall right after the aggregate shock hits the economy. However, as in the above simple model, we assume that consumers incorrectly believe that the aggregate shock will hurt only other consumers, but not herself. In this case, we will show that the output price will not stay at 1 during the normal times. Specifically, let P denote the per-unit output price during the normal times. We will later verify that the output price should be a constant during the normal times due to the stationary structure of the model.

To pin down the output price during the normal times, we consider two strategies regarding when to buy the product. The first strategy is that a consumer buys the product just today. The second possible strategy is that a consumer waits until the aggregate shock hits the economy. Under the strategy, the consumer will immediately earn

as profits, while under the second strategy, she expects to earn

in terms of the time-

t present value value. Then, for the output market to clear at each point in time, each consumer must be indifferent between those two strategies, which implies

This result first means that the output price lies between

A and 1 as expected. From this expression, we can also see that the output price falls more due to the unrealistic optimism when the discount rate is lower, the aggregate shock is more likely to occur, and the magnitude of the shock is larger. All these results are intuitive.

For clarification, in the above argument, we have used the fact that consumers do not have any incentives to buy the product

after the aggregate shock hits the economy because of discounting. Further, we can actually consider other more general strategies in addition to the above-mentioned two strategies. Specifically, let

denote the arrival time of the aggregate shock. Then consider a consumer who aims to buy the product at time

, where

is any specific date. That is, this consumer will buy the product at time

T if the aggregate shock has not occurred until then, but will buy the product right after the aggregate shock hits the economy if that event happens before time

T. Under this strategy, the consumer expects to earn the profits of

by definition. Then we see that the amount of these profits does not depend on the specific time

T if the output price

P is given by (

5). In fact, this argument can be further extended to the case where the target purchasing time

T is a random stopping time that is independent of the arrival time of the aggregate shock. Therefore, we confirm that

P expressed in (

5) is indeed an equilibrium price.

We now calculate the present value of the firm. We first pin down the firm value during the bad times. During this period, the firm value denoted by

satisfies the following Hamilton-Jacobi-Bellman equation:

The left-hand side is the required return. The first term on the right-hand side is the amount of cash flows produced by the firm, the second term is the adjustment costs, and the remaining terms represent the changes in the firm value due to the growth and fluctuations in the output level. We conjecture that

is equal to

for some constant

, which is called Tobin’s Q. Then, using the first-order condition that

, we see that

must satisfy

Hence, we find that Tobin’s Q and the optimal investment level during the bad times are respectively given by

where we have excluded the other possible choice for

and

to ensure that the growth rate

should not exceed

r in the risk-neutral measure. We also impose the parameter condition that

to ensure that the investment rate is positive.

During the normal times, the firm value denoted by

satisfies the following differential equation:

We again conjecture that

for some constant

q. Then, proceeding similarly as above, we find that Tobin’s Q and the optimal investment level during the normal times are respectively given by

From this result, we clearly see that the optimistic bias causes underinvestment rather than overinvestment because the socially optimal level of investment is equal to

We have therefore characterized a dynamic model with infinite horizons, in which consumers display unrealistic optimism. This model shows that even if the aggregate shock is expected to hit the economy in the far future, the output price must drop to some extent immediately today. This result therefore confirms that recessions or market crashes can be precipitated by unrealistic optimism.

6. Limitations and Future Research

While this study provides novel insights into the economic implications of unrealistic optimism, several limitations warrant further investigation. First, the model assumes that all consumers exhibit identical degrees of unrealistic optimism. In reality, cognitive biases vary across individuals, as shown in Rabin [

47] and Berthet [

48], and thus, incorporating heterogeneous beliefs could yield richer dynamics and more nuanced policy implications. In this regard, future research could explore how varying levels of optimism among consumers affect aggregate economic outcomes.

Second, our model considers a simplified setting in which the economy consists of a single representative producer and consumers who face an exogenous aggregate shock. Extending the framework to a multi-sector economy or incorporating endogenous belief formation could enhance our understanding of how unrealistic optimism interacts with broader economic forces, including labor markets, financial intermediation, and global trade. In particular, Agranov et al. [

49] provide experimental evidence that individuals’ cognitive levels and beliefs are shaped endogenously by their environment and strategic context, suggesting that belief formation is a dynamic process rather than a fixed trait. Incorporating such mechanisms into macroeconomic models could yield more realistic predictions about behavior under uncertainty.

Third, while the model emphasizes the role of government intervention in mitigating the adverse effects of premature recessions, the analysis does not account for potential distortions arising from policy implementation. Investigating how different forms of intervention, such as monetary policy or regulatory measures rather than fiscal subsidies, affect the inefficiencies stemming from unrealistic optimism would be a valuable avenue for future research. Relatedly, Krokida et al. [

50] examine the interactions between monetary policy and herd behavior in stock markets.

Finally, empirical validation remains an essential step in furthering this line of inquiry. Developing robust empirical methodologies to distinguish the effects of unrealistic optimism from those of traditional pessimism would significantly contribute to our understanding of behavioral biases in macroeconomic settings. A recent approach adopted by Liu et al. [

51], who examine how distinct aspects of behavioral biases, such as bounded rationality, myopic behavior, prospect-biased behavior, optimism, and pessimism, differently affect decision-making, could be useful for this task. In addition, future studies could also leverage survey data or experimental methods to identify the prevalence and economic consequences of unrealistic optimism in different contexts.