Submitted:

14 July 2023

Posted:

18 July 2023

You are already at the latest version

Abstract

Keywords:

1. Introduction

The Idea of Using Hydrogen Fuel Cells

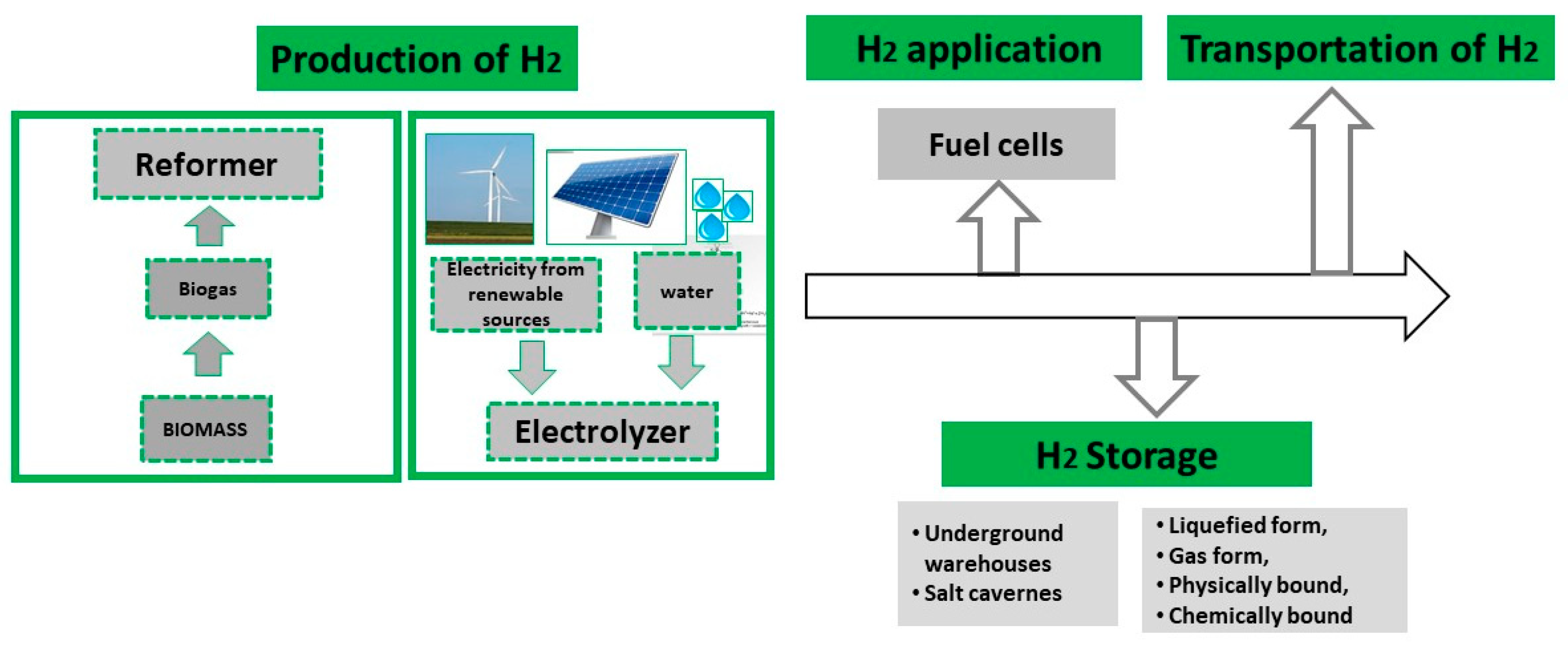

RES - Electrolyser - Fuel Cells: Green Energy Storage

- 1st generation electrolysers, used in the years 1800-1950, were used for the production of ammonia, they were alkaline electrolysers (usually KOH) working at atmospheric pressure, the separator was asbestos, later the electrolysis process was used for the production of chlorine, where hydrogen became new by-product;

- 2nd generation electrolysers, used in the years 1950-1980, were based on polymers showing special transport properties - proton exchange, this solution allowed the use of water instead of alkali, which made it possible to reduce the system, reduce its size, achieve higher efficiency and power density. The leading companies were General Electric, later Hamilton Sundstrand (USA) and Siemens and ABB (Germany);

- 3rd generation electrolysers, used in the years 1980-2010, are characterized by higher efficiency, durability over 50,000 hours. hours at lower investment costs, are mostly used for hydrogen production;

- 4th generation electrolysers, developed in the years 2010-2020, are an important element in the process of decarbonisation of many industry sectors, not only in the energy sector, the constantly increasing capacity of electrolyzer stacks allows for lower capital expenditures (CAPEX), which increases the importance of electrolysis ditch the energy policy agenda and green hydrogen specific objectives;

- 5th generation electrolyzers, after 2020 to 2050, the period most likely to be the electrolyser capacity from the MW scale to the GW scale, which will be achieved through lower costs (< 200 USD/kW) and increase in lifetime (>50,000 hours). These assumptions will require greater production capacity and rapid, ground-breaking development of research on materials for electrolysers.

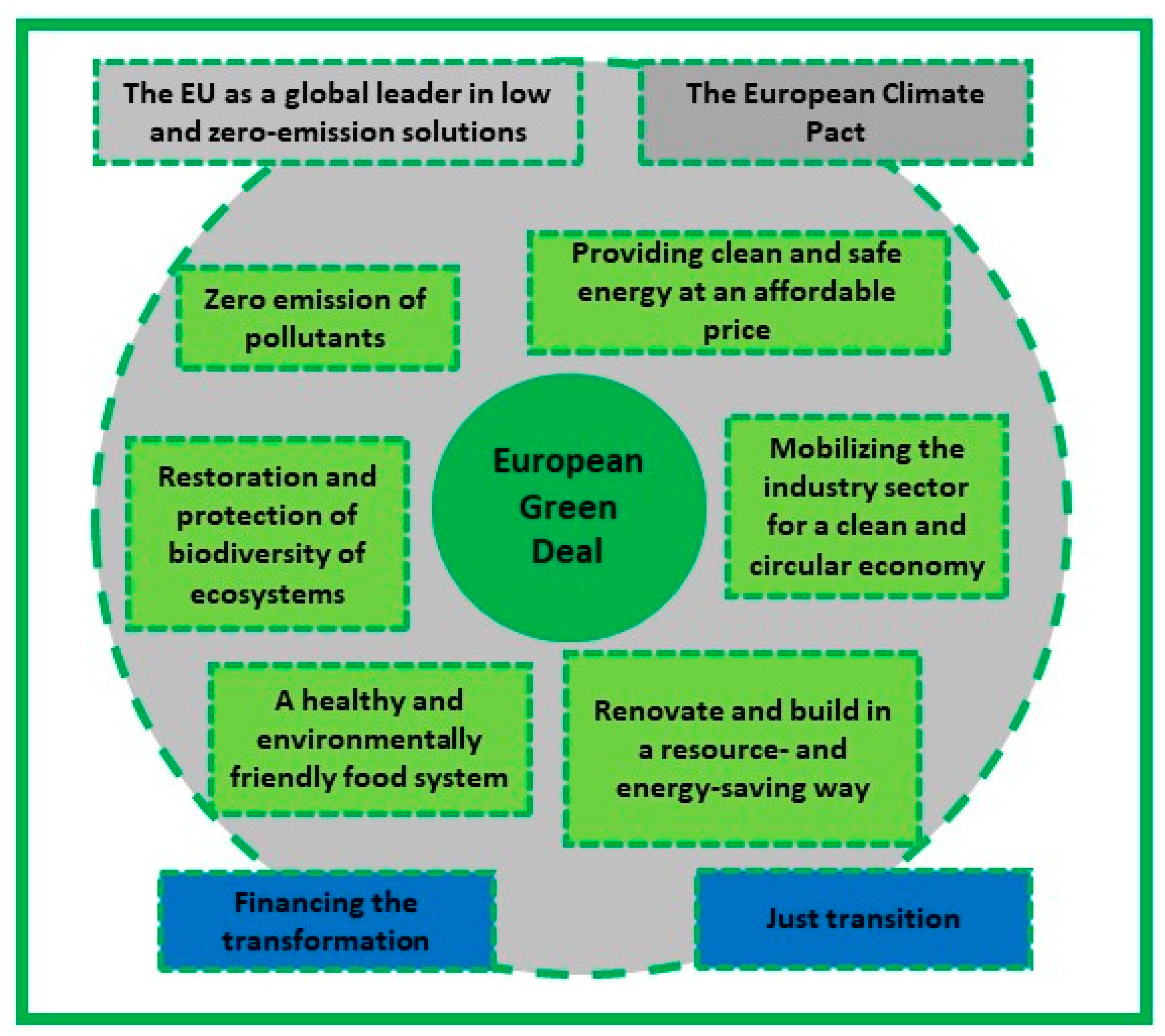

2. Development of the Hydrogen Value Chain Based on Applicable Legal Acts

- Europe without pollution - pollution of air, water and solution to the problem of industrial pollution;

- Transitioning to a circular economy - adopting a new Circular Economy Action Plan by March 2020;

- “Farm to Fork” program - targets for reducing chemical pesticides (50% by 2030), fertilizers and increasing the area of organic crops;

- Green Common Agricultural Policy - high environmental and climate ambitions under the reform of the Common Agricultural Policy;

- JUST Transition mechanism - financial support for regional energy transformation plans;

- Financing transformation - funds for green innovations and public investments;

- Clean, Affordable and Secure Energy - Assessment of Member States’ ambitions as part of their National Energy and Climate Plans;

- Achieving climate neutrality - a proposal for the first climate act that records the goal of climate neutrality by 2050;

- Sustainable transport and the adoption of a strategy for sustainable and smart mobility, as well as the review of the Alternative Fuels Infrastructure Directive and the TEN-T Regulation [23];

- Protecting Europe’s natural capital - a proposal for an EU biodiversity strategy to 2030.

- Phase I covers the period from 2020 to 2024 and its goal is to install electrolysers powered by renewable energy with a capacity of at least 6 GW and a production capacity of 1 million tons of renewable hydrogen. In this phase, it is planned to increase the production of electrolyzers and build them at demand centers such as steel mills or refineries. A refueling station for buses equipped with fuel cells is to be developed. The years envisaged for this stage will also be the time of creating the hydrogen market, stimulating its liquidity and planning benefits for hydrogen investments. The steps taken are centralized and provide for the stationary use of energy to produce hydrogen. Activities in this phase, such as the expansion of CO2 capture infrastructure, the construction of electrolysers and the creation of a lead market financing plan, will give impetus to economic development.

- Phase II covers the period from 2025 to 2030 - in these years, the strategic goal is to install electrolysers powered by renewable energy with a capacity of at least 40 GW and at the same time produce 10 million tons of renewable hydrogen in the European Union. Compared to the first phase, which lasted 4 years, this is an almost seven-fold increase, which gives an idea of the dynamics of activities related to the development of the hydrogen economy in this phase. The use of hydrogen will be possible even for more energy-intensive sectors of the economy, such as steel production or heat supply to buildings. At this stage, it is planned to increase price competitiveness. A more distributed system of local hydrogen clusters and so-called hydrogen valleys will start decentralized production based on local demand. The possibility of using the existing network of gas pipelines as a means of transporting hydrogen will be considered. Obtaining hydrogen from fossil fuels with CO2 capture will continue to be modernized, which will further reduce greenhouse gas emissions. This phase will play an important role in stabilizing the RES-based electricity system, performing supporting and buffering functions.

- Phase III is the period from 2030 to 2050. This is the last phase in which technologies are expected to mature and expand to other sectors of the economy. We are also talking about a large increase in energy consumed from renewable sources, as its 25% share will be used to produce renewable hydrogen [26]. The entire investment plan for the European Union, spread over 30 years, is estimated at EUR 180-470 billion, which consists of: construction of electrolysers, construction and connection of new renewable energy sources, modernization of installations for capturing and storing carbon dioxide, refueling stations, infrastructure. Further funds in the amount of EUR 850-1000 million are to be spent on the creation of 400 hydrogen refueling stations [27,28].

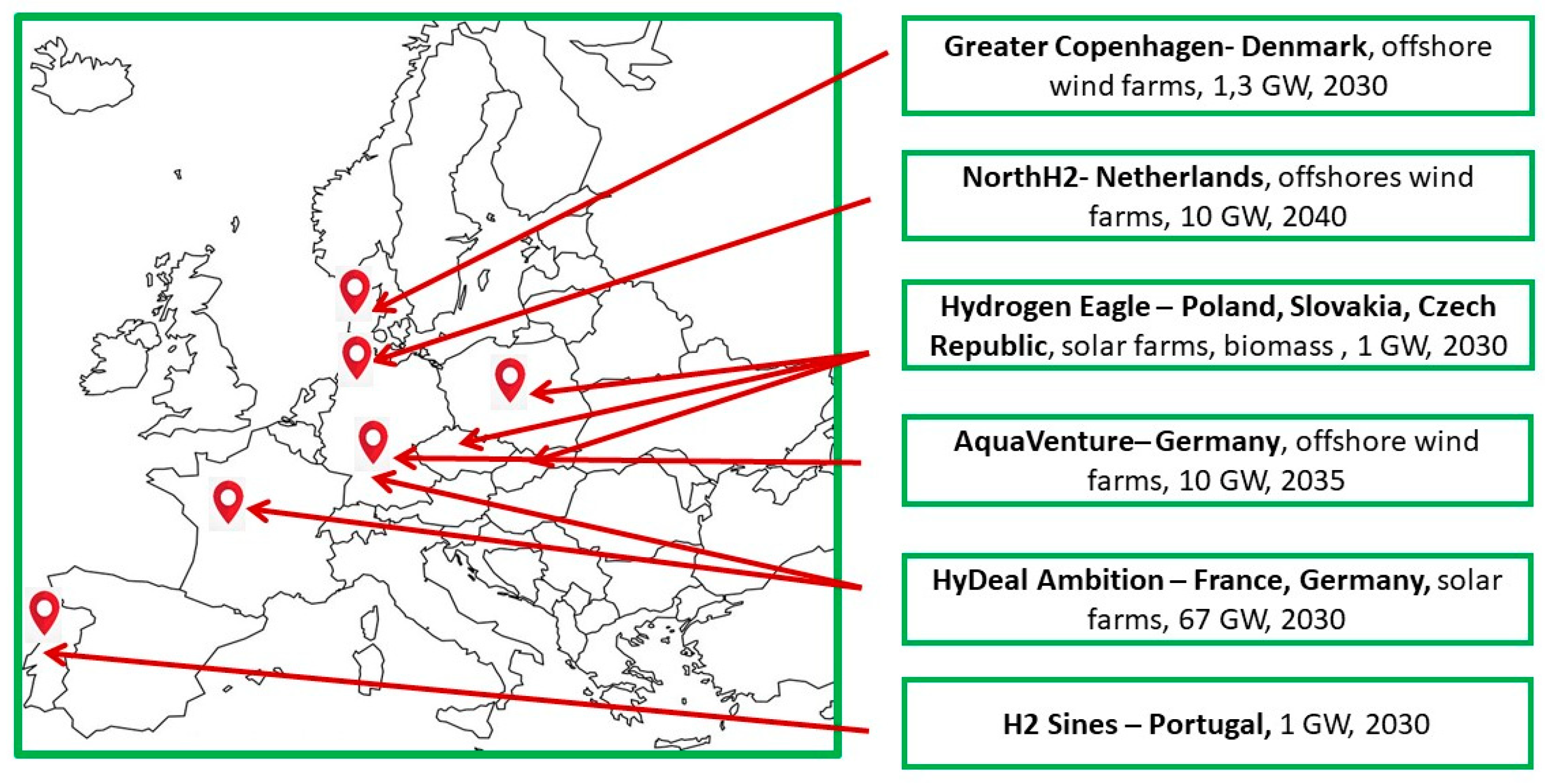

3. Potential and Prospects for the Development of the Hydrogen Market - Good Practices in European Countries

4. Development and Initiatives in the Field Of Hydrogen Technologies in Poland - Road Map in Poland

- flagship project related to electromobility in Polish transport,

- Polish Nuclear Energy Programme,

- the project Strategic Electromobility Development Program.

- Objective 1 - “implementation of hydrogen technologies in the energy sector”;

- Objective 2 – “use of hydrogen as an alternative fuel in transport”;

- Objective 3 - “supporting the decarbonisation of industry”;

- Objective 4 - “production of hydrogen in new installations”;

- Objective 5 – “efficient and safe hydrogen transmission”;

- Objective 6 – “creating a stable regulatory environment”.

Development of Hydrogen Technology Infrastructure and the Hydrogen Value Chain in Poland - Hydrogen Valleys

- scale of the project – in addition to the planned demonstration projects, stakeholders must plan at least two large, multi-million (EUR) investments as part of the valley operation. Typically, a valley consists of multiple sub-projects that make up a larger project portfolio. It is assumed that the hydrogen valley should have investment outlays of at least EUR 20 million. The European average is EUR 100 million,

- geographically defined area – hydrogen ecosystems must cover a given area or region. It can be a local hydrogen hub and its hinterland, or a region in a given country, or a cross-border region – e.g., a transport corridor along a major waterway,

- coverage of the hydrogen value chain - i.e., activities planned in the valley from hydrogen production using energy from renewable sources, through storage and distribution to its use - off-take in the region,

- the possibility of using hydrogen in several sectors of the economy - the use of regionally produced hydrogen in projects in transport, industry and energy, applying the principle: one source - many applications in various sectors. It is assumed that hydrogen should be used in at least two sectors of the economy,

- activities of stakeholders in a given hydrogen valley are carried out according to a given feasibility study, which guarantees that the activities have a real chance of launching the project and obtaining financing from EU, national and regional funds.

- Type 1 - small hydrogen valley, specialized mainly in the transport sector, for which hydrogen in the region is produced from RES in electrolysers with a capacity of up to 10 MW, stored and distributed for purposes such as public transport and hydrogen refueling stations, CAPEX, i.e., capital expenditures account for (production capacity) is approx. EUR 20 million.

- Type 2 - medium hydrogen valley, focused on decarbonisation of energy-intensive industry, a type that is currently being implemented in Poland. The projects in these valleys are located around entities called anchors, i.e., large corporations and their needs, activities within these valleys primarily integrate two sectors: industry and transport. Hydrogen is produced in electrolysers with a capacity of up to 10-300 MW, and the capital expenditure (CAPEX) is around EUR 100 million.

- Type 3 - a large hydrogen valley characterized by very good conditions for the production of energy and hydrogen from RES, with the use of large-scale hydrogen production for the needs of the region and for export - see: Australia (contract to Japan), Arab countries - long-term contracts, with the use of 250-1000 MW of electrolyzer capacity, CAPEX of approx. EUR 500 million and more.

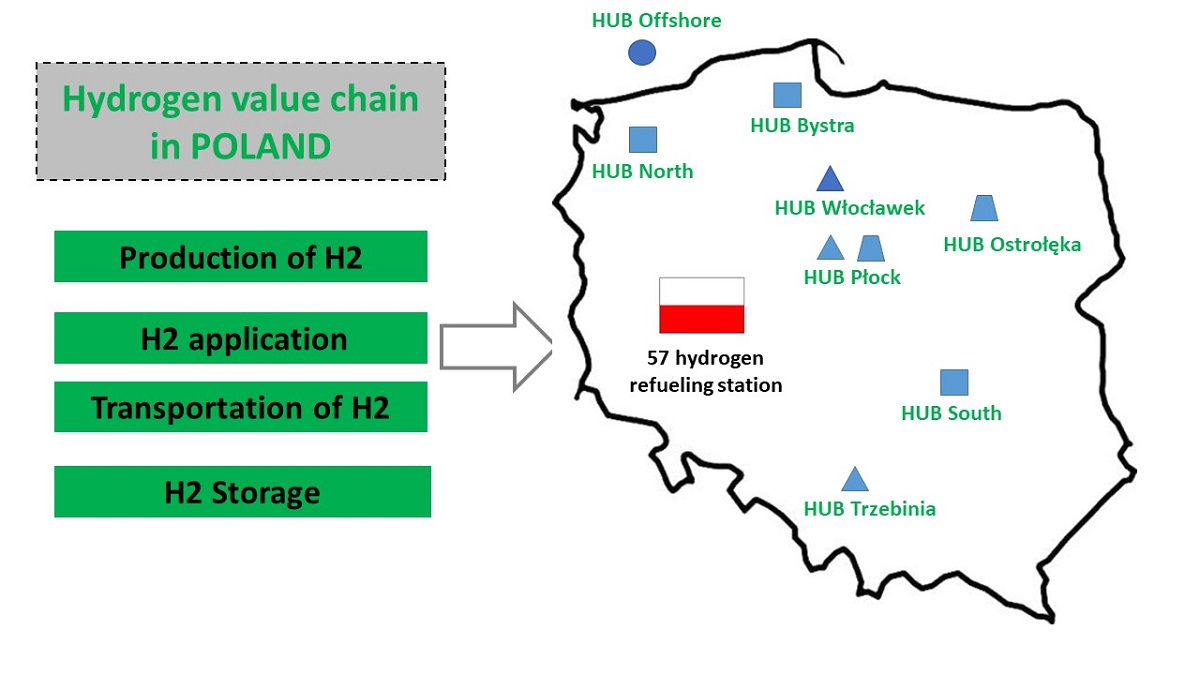

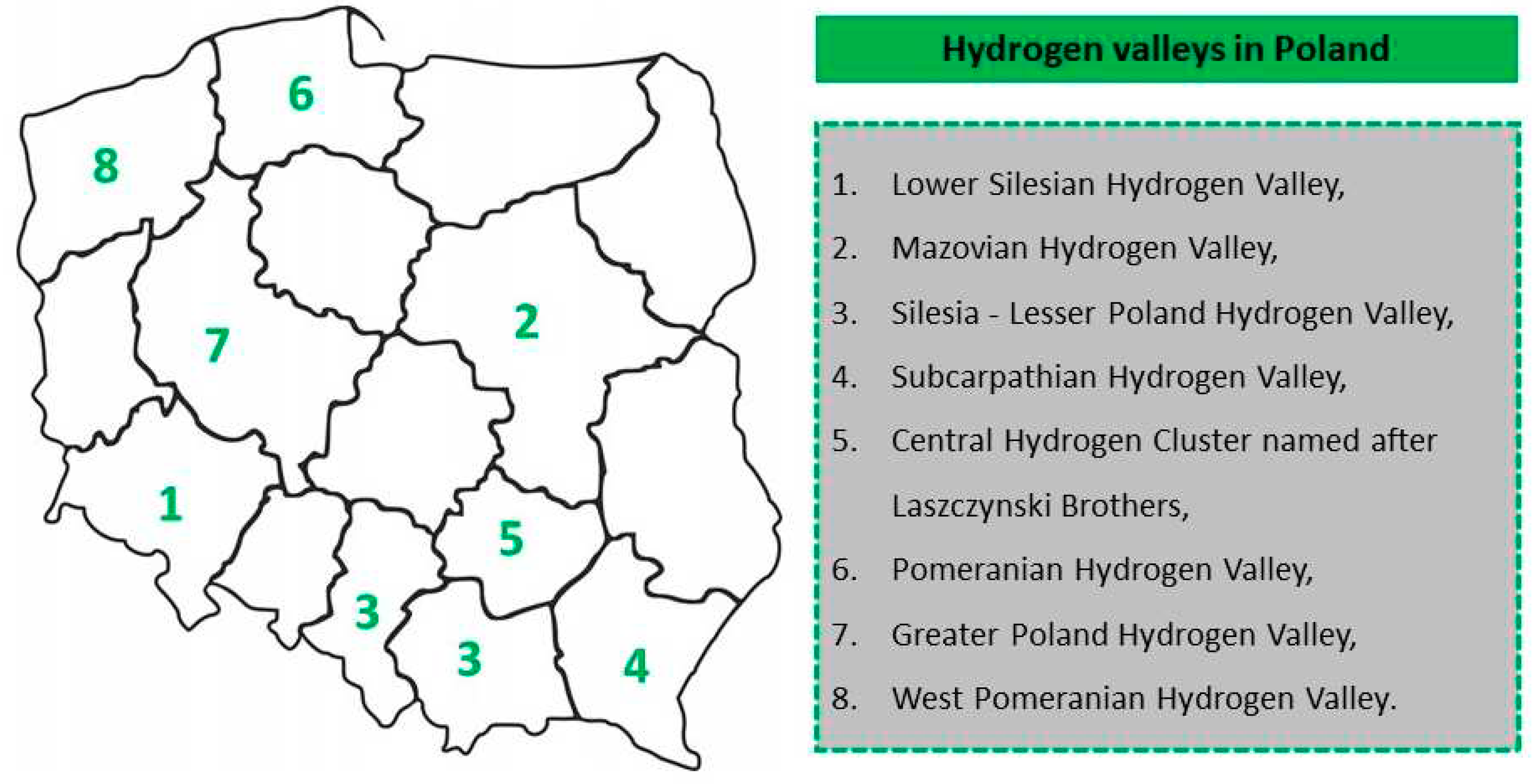

Hydrogen Valleys in Poland

- Lower Silesian Hydrogen Valley,

- Mazovian Hydrogen Valley,

- Silesia - Lesser Poland Hydrogen Valley,

- Subcarpathian Hydrogen Valley,

- Central Hydrogen Cluster named after Laszczynski Brothers,

- Pomeranian Hydrogen Valley,

- Greater Poland Hydrogen Valley,

- West Pomeranian Hydrogen Valley.

- a proposal for a new wording of the regulations regarding the area of clean transport, which are mandatory for cities with more than 100,000 inhabitants. They show an average annual exceedance of nitrogen dioxide (NO2) pollution. Modification of the catalog of vehicles authorized to enter the zone was also included. In addition, it has been possible for municipal authorities to assign separate exemptions related to vehicle traffic,

- reducing the amount and frequency of collecting fees related to EIPA numbers in order to significantly accelerate the expansion of the vehicle charging network,

- changing the management board’s obligations regarding the installation and use of charging points in buildings to the designated power level and shortening the period for examining applications,

- introduction of the concept of an electrically assisted bicycle, which ensures the development and assistance for the most diverse electric vehicles, improvement of definitions related to the use of hydrogen in transport.

Analysis of Hydrogen Production and Storage Possibilities in Polish Conditions

- Azoty Group – 42% market share (producing approx. 420,000 tonnes/year, significant part of the hydrogen is sold on the market - covering approx. 85% of domestic sales),

- LOTOS Group - 14% market share (producing approx. 145,000 tonnes/year, used for own purposes),

- PKN Orlen - 14% share (producing approx. 145,000 tonnes/year, used for own purposes),

- Jastrzebska Spolka Weglowa - 7% share (producing approx. 75 thousand tonnes per year),

- others: 23%.

5. Summary

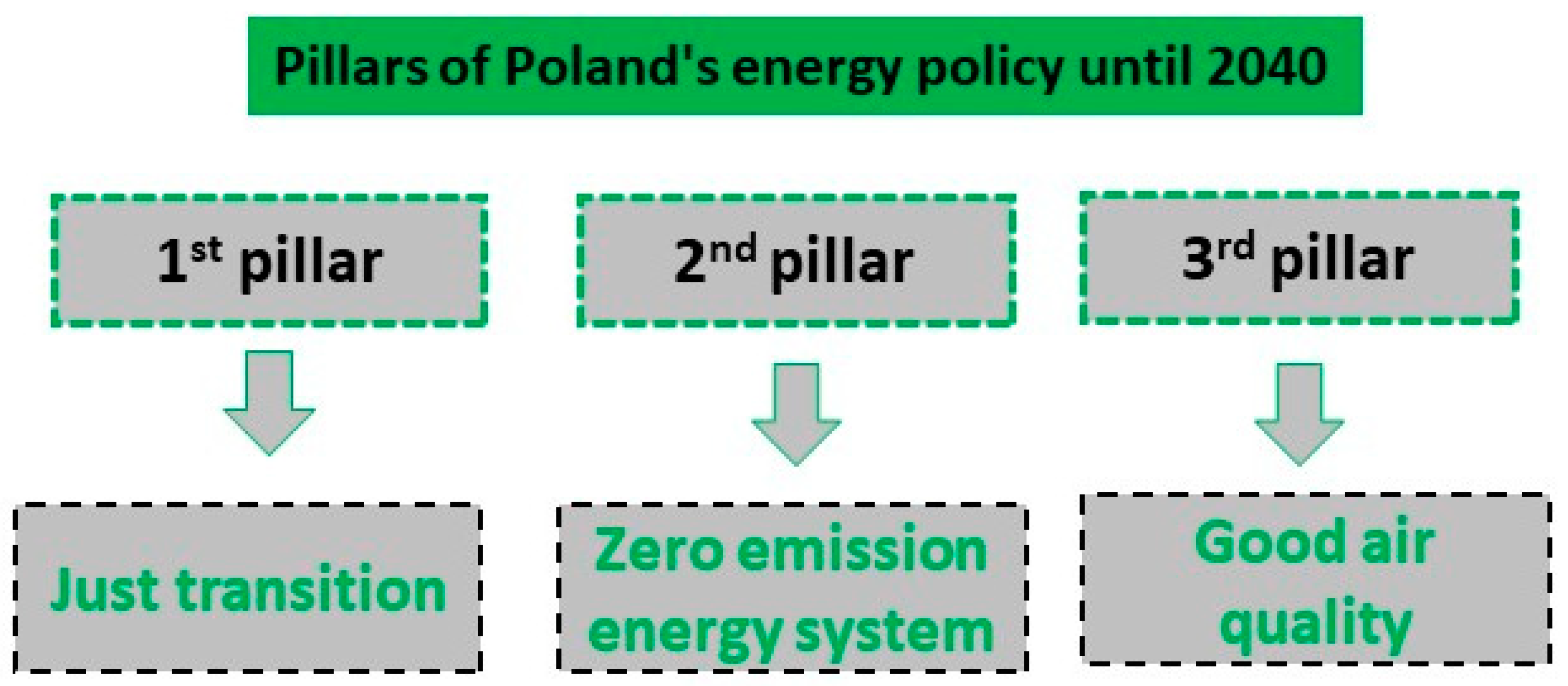

- implementation of the objectives and assumptions of the Polish Hydrogen Strategy and supporting documents; including in particular the Energy Policy of Poland PEP2040 based on a just transformation, a zero-emission energy system and the pursuit of good air quality;

- development of hydrogen technologies in the three main sectors where hydrogen is used - transport, energy and industry;

- striving for economic growth by creating jobs and investments in the creation of the hydrogen value chain, including the construction of new electrolysers,

- development of hydrogen technologies in the field of initiatives in the form of clusters and hydrogen valleys;

- activities of hydrogen valley stakeholders, Polish leaders in the energy industry, taking into account long-term plans supported by programs subsidizing activities related to hydrogen technologies;

- international cooperation between Poland, Slovakia and the Czech Republic under the project: HydrogenEagle; whose main assumption is the production of green hydrogen using biomass and solar farms in electrolyzers with a capacity of 1 GW;

- activities related to gathering specialized staff in the field of hydrogen technologies by creating didactic courses, organizing training and post-graduate studies;

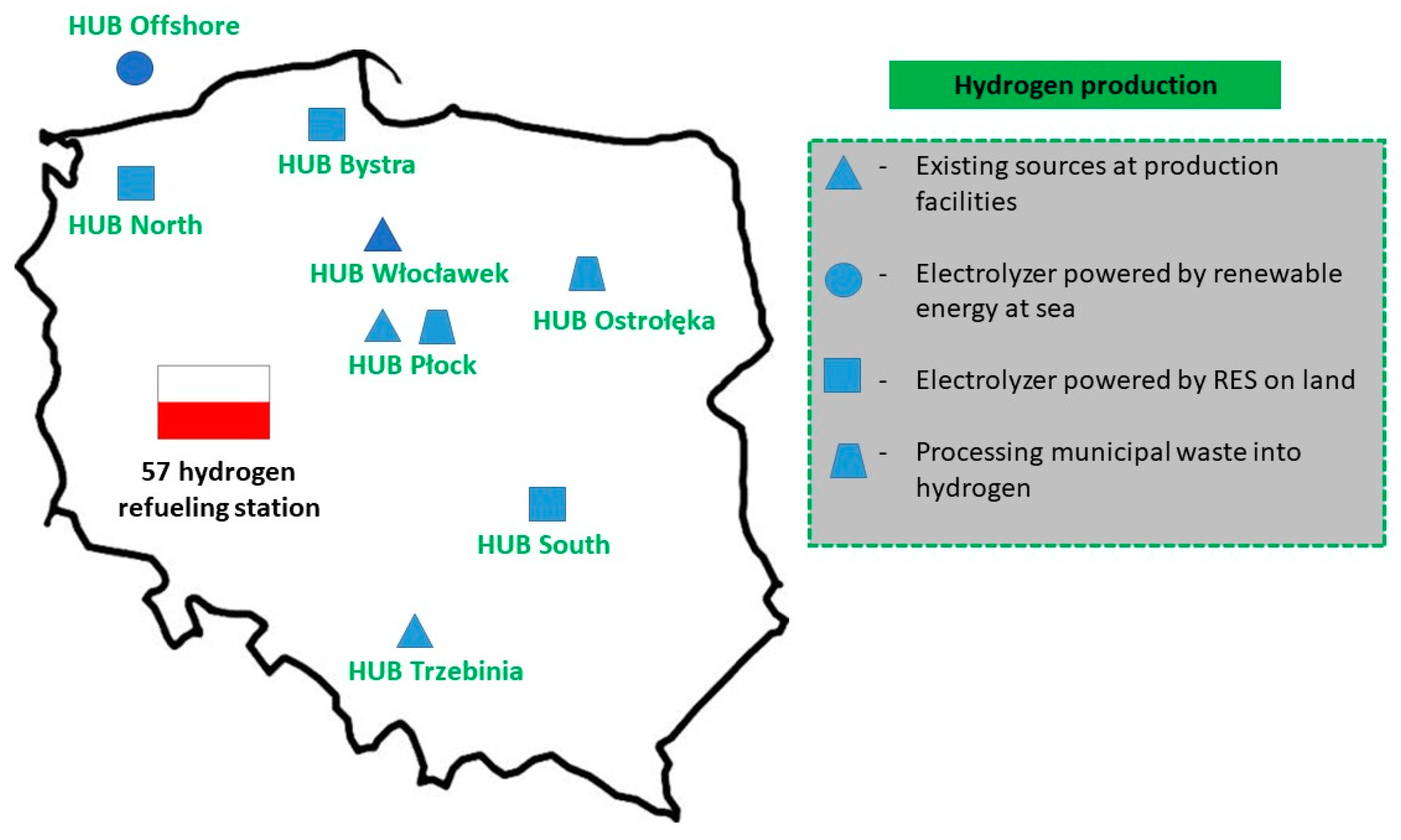

- plans to create 57 hydrogen refueling stations in Poland, obtained in hubs from four sources;

- Poland is ranked fifth in the global ranking of hydrogen producers and third in hydrogen production in Europe;

- implementation of projects based on the production of hydrogen from biomethane and the processing of municipal waste; which is also tantamount to taking recycling activities.

Author Contributions

Funding

Conflicts of Interest

References

- Włodarczyk R., The Use of Fuel Cell Technology as Electricity and Heat Generators in Residential Buildings, Instal, 22-28 (6), 2021. [CrossRef]

- Włodarczyk R., Kacprzak A., Magazynowanie energii w postaci wodoru w warunkach polskich - potencjał i wyzwania (w:) Nowoczesne technologie konwersji i magazynowania energii, Politechnika Częstochowska, 2019, 138-165, ISBN 978-83-7193-721-7 (in polisch).

- EUR-Lex - 52020DC0301 - EN - EUR-Lex (europa.eu) (access on July 2023).

- Wlodarczyk R., Research on the functional properties of materials used for PEMFC fuel cell interconnectors, Publisher Czestochowa University of Technology, Czestochowa, 2011.

- Herman A., Chaudhuri T., Spagnol P., International Journal of Hydrogen Energy 2005, 30, 1297-12302.

- Ball M., Wietschel M., International Journal of Hydrogen Energy, 2009, 34, 615-627.

- https://www.dw.com/pl/jak-słońce-zamienia-wodę-morską-w-wodór-szansa dla Portugalii/ (accessed on June 2023).

- https://www.gramwzielone.pl/energia-sloneczna/20532/energia-z-farmy-pv-i-magazynu-energii-za-0145-usdkwh (accessed on June 2023).

- www.doe.gov – (accessed on July 2023).

- Mustain W.E., Chetenet M., Page M., Kim Y.S., Royal Society of Chemistry, 13, 2020, 2805-2838.

- Fan L. Tu Z., Chan S.W., Energy Reports 7, 2021, 8421-8446.

- IRENA (2020), Green Hydrogen Cost Reduction: Scaling up Electrolysers to Meet the 1.5⁰C Climate Goal, International Renewable Energy Agency, Abu Dhabi.

- Kumar S.S., Himabindu V., Materials Science for Energy Technologies, 2(3) 2019, 442-454.

- Report preaprde for the 2nd Hydrogen Energy Ministerial Meeting in Tokyo, Japan, Hydrogen: A renewable energy perspective, IRENA, September 2019.

- Reksten A.H., Thomassen M.S., Moller-Holst S., Sundseth K., International Journal of Hydrogen Energy, 47, 2022, 38106-38113.

- Komunikat dotyczący pakietu Fit for 55 - Ministerstwo Klimatu i Środowiska - Portal Gov.pl (www.gov.pl) (accessed on July 2023).

- Unijna strategia wodorowa (osw.waw.pl) (accessed on July 2023).

- M. Sobolewski, Europejski Zielony Ład: w stronę neutralności klimatycznej, Wydawnictwo Sejmowe dla Biura Analiz Sejmowych, Warszawa 2020, s. 2. (in polisch).

- M. Ciechanowska, Strategia w zakresie wodoru na rzecz Europy neutralnej dla klimatu, Nafta-Gaz 2020, nr 12, s. 95.

- Microsoft Word - PL 366 -7.doc (europa.eu) (accessed on July 2023).

- DECYZJA RADY (UE) 2016/ 590 - z dnia 11 kwietnia 2016 r. - w sprawie podpisania, w imieniu Unii Europejskiej, porozumienia paryskiego przyjętego w ramach Ramowej konwencji Narodów Zjednoczonych w sprawie zmian klimatu (europa.eu) (accessed on July 2023).

- Józefiak, “Europejski Zielony Ład” jako nowa unijna strategia w zakresie ochrony klimatu, [w:] U. Kurczewska (red.), Jaka przyszłość Unii Europejskiej? : wyzwania, problemy, szanse, Oficyna Wydawnicza SGH, Warszawa 2020, s. 81 eur-lex.europa.eu (accessed on July 2023).

- eur-lex.europa.eu/legal-content/PL/TXT/HTML/?uri=CELEX:52021PC0559 (accessed on July 2023).

- A hydrogen strategy for a climate-neutral Europe, Komunikat Komisji do Europejskiego Parlamentu, Bruksela 07.08.2020, Teksty przyjęte - Europejska strategia w zakresie wodoru - Środa, 19 maja 2021 r. (europa.eu) (accessed on July 2023).

- Buttler A., Spliethoff H., Renewable and Sustainable Energy Reviews, 82, 2018, 2440-2454.

- Zore U. K., Yedire S. G., Pandi N., Manickam S., Sonawane S., Ultrasonic Sonochemistry 73, 2021, 105536.

- Refueling Protocols for Medium and Heavy-Duty Vehicles (europa.eu) (accessed on July 2023).

- Fuel Cells Bulletin, Volume 2020, Issue 2, February 2020, Page 12.

- WWF_Polska_11_listopada.pdf (accessed on July 2023) (in polisch).

- EGHAC - The European Green Hydrogen Acceleration Center (accessed on July 2023).

- Plan rozwoju w zakresie zaspokojenia obecnego i przyszłego zapotrzebowania na energię elektryczną na lata 2021-2030 , Polskie Sieci Elektroenergetyczne, Warszwa 2020, in polisch.

- Strategia UE na rzecz integracji sektora energetycznego – Stowarzyszenie Energii Odnawialnej (seo.org.pl) (accessed on July 2023).

- H2 subsidies | The Netherlands grants €800m for over 1GW of green hydrogen projects for heavy industry | Hydrogen news and intelligence (hydrogeninsight.com) (accessed on July 2023).

- Global Hydrogen Review, Clean Energy Ministerial Advancing Clean Energy Together, International Energy Agency, www.iea.org,.

- Puertollano green hydrogen plant - Iberdrola (accessed on July 2023).

- Focus on hydrogen: a role for hydrogen in italy’s clean energy strategy, Italian Association for Hydrogen and Fuel Cells (H2IT), 2018.

- Recent developments in the French hydrogen sector: the draft hydrogen ordinance | Herbert Smith Freehills | Global law firm (accessed on July 2023).

- Ørsted takes final investment decision on first renewable hydrogen project (orsted.com) (accessed on July 2023).

- ORLEN Group to launch international hydrogen program | PKN ORLEN (accessed on July 2023).

- https://www.gov.pl/web/fundusze-regiony/informacje-o-strategii-na-rzecz-odpowiedzialnego-rozwoju (accessed on June 2023).

- Polska Strategia Wodorowa do roku 2030 z perspektywą do roku 2040, Ministerstwo Klimatu i Środowiska, Warszawa 2021.

- Prawo wodorowe- środowisko regulacyjne wspierające rozwój gospodarki wodorowej, Global Compact Network Poland, Know-How Hub- Centrum Transferu Wiedzy (in polisch).

- Plan na rzecz Odpowiedzialnego Rozwoju - Ministerstwo Funduszy i Polityki Regionalnej - Portal Gov.pl (www.gov.pl) (accessed on July 2023).

- Polityka Energetyczna Polski do 2040 roku (PEP 2040) (in Polish), https://www.gov.pl/documents/33372/436746/PEP2040_projekt_v12_2018-11-23.pdf/ee3374f4-10c3-5ad8-1843-f58dae119936 (accessed on June 2023).

- Krajowy plan na rzecz energii i klimatu https://bip.mos.gov.pl/index.php?id=5608 (accessed on June 2023).

- Energy policy: general principles | Fact Sheets on the European Union | European Parliament (europa.eu) (accessed on July 2023).

- EU’s Clean Hydrogen Partnership launches €195m research call | ICIS (accessed on July 2023).

- Roland Berger: An update on Hydrogen Valleys | Roland Berger (accessed on July 2023).

- DOLINY WODOROWE - Agencja Rozwoju Przemysłu S.A. (arp.pl) (accessed on July 2023).

- https://www.orlen.pl/pl/zrownowazony-rozwoj/projekty-transformacyjne/wodor/Naklady-inwestycyjne (accessed on July 2023).

- „Clean Cities – hydrogen mobility in Poland (Phase I)” nr projektu: INEA/CEF/TRAN/M2019/2359474 (orlen.pl) (accessed on July 2023).

- https://www.orlen.pl/pl/zrownowazony-rozwoj/projekty-transformacyjne/wodor/aktualnosci-o-wodorze/pkn-orlen-zbuduje-w-polskich-miastach-stacje-tankowania-wodoru (accessed on July 2023).

- COP24 - Ministerstwo Klimatu i Środowiska - Portal Gov.pl (www.gov.pl) (accessed on July 2023).

- PURE H2 – Instalacja Oczyszczania Wodoru i Infrastruktura do Tankowania - Grupa LOTOS S.A. (accessed on July 2023).

- Vision & Mission | Hydrogen Europe (accessed on July 2023).

- PGNiG rozpoczęło projekt ELIZA; chce rozwijać technologię wodorową | FXMAG (accessed on July 2023).

- Hydrogen Roadmap Europe, L uxembourg: Publications Office of the European Union, 2019, Hydrogen%20Roadmap%20Europe_Report.pdf (europa.eu) (accessed on July 2023).

- https://www.osw.waw.pl/pl/publikacje/analizy/2020-06-16/niemiecka-strategia-wodorowa-zielony-wodor-w-centrum-uwagi (accessed on June 2023).

| Country | Production/ton | Electrolysis capacity/GW | Planned expenditures in billion Euro |

|---|---|---|---|

| Netherlands | 75 thousand | 3-4 | 0.5 |

| Germany | 10 million | 7-8 | 9 |

| Sweden | 5 million | 4-6 | thousand |

| Spain | 500 thousand | 4 | 8.9 |

| France | No data | 6.5 | 2 |

| Portugal | 170 thousand | 1 | thousand |

| Poland | 165 thousand | 1.7 | 3.7 |

| Valley | Headquarters | Concept | Stakeholders | Specializations | Achievements |

|---|---|---|---|---|---|

| Lower Silesian Hydrogen Valley | Wroclaw | management of hydrogen hubs. | KGHM, ZAK Kedzierzyn-Kozle, ARP S.A. Toyota, Z-Klaster, Wroclaw University of Science and Technology, University of Wroclaw, UMWD, Linde, Total. |

green ammonia, green heat, green copper and metallurgy, green river transport, hydrogen storage, RES, biogas, water pipelines. | two applications in the consortium for Clean Hydrogen Partnership, first show at DDW in Europe - Hydrogen Week in Brussels, green H2 production: 720 t/y |

| Mazovian Hydrogen Valley | Plock | integration to the needs of a large concern. | PKN Orlen, ARP S.A., BGK Toyota, KAPE, AGH, Siemens Energy, Warsaw University of Technology, Energy Institute University of Warsaw |

petrochemicals, synthetic fuels, production of green hydrogen, biogas, HRS, hydrogen logistics, energy storage, green chemistry. | petrochemicals, synthetic fuels, production of green hydrogen, biogas, HRS, hydrogen logistics, energy storage, green chemistry. |

| Silesia - Lesser Poland Hydrogen Valley | Katowice | energy transformation of Silesia and Lesser Poland based on FSI | Orlen South, Polenergia, ARP S.A., JSW Innovation, Azoty Group, The Silesian Technical University, AGH, KOMAG, IPTE, Katowicka SSE, GZM, Columbus. |

green glycol, energy transformation of Silesia, hydrogen production, hydrogen storage, green steel, zero-emission public transport, CCUS. | commissioning of the installation for the production of green glycol, H2Poland portal |

| Subcarpathian Hydrogen Valley | Rzeszow | integration around the university and the aviation valley | Rzeszów University of Technology, Podkarpackie Marshal’s Office, Pole-nergia, city of Sanok, ARP S.A., entities from the aviation valley, Autosan, ML System. | hydrogen buses, aviation, hydrogen in the energy sector, green heat, hydrogen-strings. | application for Project Development Assistance |

| Central Hydrogen Cluster named after Laszczynski Brothers | Kielce | integration around the project of decarbonisation of raw materials mines | Industrial Group Industria, ARP S.A., city of Kielce, commune of Chęciny, Świętokrzyska University of Technology, Colum-bus, ML System, AIUT, Azoty Group. | hydrogen production, hydrogen dump trucks, hydrogen storage, RES, green public transport | feasibility study, transition to the implementation phase |

| Pomeranian Hydrogen Valley | Gdansk | integration around local government initiatives, decarbonisation of the port of Gdynia, concept “Shore H2 Valley”. | Pomeranian Marshal’s Office, Cluster of Hydrogen Technologies, City of Gdynia, PKP Energetyka, Port of Gdynia, Sescom, Gdańsk University of Technology. | zero-emission public transport, hydrogen production, offshore, port decarbonisation, hydrogen storage, production of electrolysers, HRS. | completed mapping of the region’s potential in PDA format |

| Greater Poland Hydrogen Valley | Poznan | integration around local government initiatives and the needs of a large corporation. | Wielkopolska Marshal’s Office, ZE PAK, Solaris, Adam Mickiewicz University, Poznań University of Technology, ARR Konin, city of Piła, Wielkopolska Council of Thirty | hydrogen production, hydrogen storage, HRS, hydrogen buses, RES. | mapping the needs of the region, h2wielkopolska.pl portal |

| West Pomeranian Hydrogen Valley | Szczecin | integration around a large chemical concern, the “Shore H2 Valley” concept. | West Pomeranian University, Azoty Group, ARP S.A., Enea, Port Police, Maritime University of Technology, NFOŚ, ZUT, Koszalin University of Technology. | green ammonia, low-emission sea transport, low-emission river transport, ammonia collection infrastructure, hydrogen production, offshore. | over 30 entities interested in the development of the hydrogen valley |

| Hydrogen value chain | Activity area | Stakeholder |

|---|---|---|

| Production | separation of hydrogen from coke oven gas | Jastrzębska Społka Weglowa (JSW) |

| use of electrolysers to produce H2 from renewable energy sources | Lotos, Polish Power Grids (PSE) | |

| sale of electrolysers powered by PV | Sescom | |

| scaling own production of “grey” hydrogen for sale | Azoty Group | |

| production and use of “green” hydrogen; cogeneration converted to hydrogen combustion | Polenergia | |

| distribution of electrolysers | RB Consulting | |

| the use of electrolysers with electricity from biomass | Pątnów Adamów Konin Power Plant Complex (ZE PAK) | |

| the use of electrolyzers cooperating with renewable energy sources | Orlen | |

| production of SNG (synthetic natural gas): hydrogen from electrolysis with electricity from RES, carbon dioxide from emission installations | Tauron Wytwarzanie | |

| separation of hydrogen from coke oven gas | Walbrzych Plants Coke “Victoria” | |

| methane steam reforming | Steelproduct | |

| Storage | injection of hydrogen into distribution and transmission networks; underground storage | PGNiG |

| Stako from the Worthington Industries Group | tanks | |

| Application | vehicle charging stations | Lotos, PKN ORLEN, PGNiG |

| use of hydrogen in locomotives | PKP Cargo | |

| hydrogen locomotive prototype | H. Cegielski | |

| development of fuel cell models | EC Grupa (Energocontrol Sp. z o.o.) | |

| hydrogen emergency power system | APS Energia with the Gdańsk University of Technology | |

| hydrogen bus production | Solaris | |

| combustion of hydrogen in cogeneration turbines | Polenergia (z Siemens) | |

| Transmission in gas networks | hydrogen blending in gas pipelines | PGNiG |

| Apparatus and devices | gas meters | Intergas |

| pressure tanks | cGAS controls | |

| hydrogen sensors | Emag Serwis | |

| cryostatic devices | Frankoterm |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).