Submitted:

09 January 2026

Posted:

09 January 2026

You are already at the latest version

Abstract

Keywords:

1. Introduction

- Assessment of available resources: Estimating reserves of oil, gas, or minerals needed for energy production;

- Identification of vulnerabilities: Detecting critical points in infrastructure (e.g., power grids, gas pipelines) that could cause major disruptions;

- Crisis scenarios: Analyzing the impact of potential external shocks, such as embargoes, natural disasters, or cyberattacks on energy systems.

- Efficiency and sustainability: Enables the adoption of strategies to reduce energy losses and optimize costs;

- Integration of energy sources: Analyses help plan the energy mix, combining traditional sources (oil, gas, nuclear) with renewable sources (solar, wind, hydro) to reduce dependence on a single resource;

- Demand and supply management: Energy consumption forecasts allow for production adjustments and help prevent shortages or overproduction.

- Autonomy and resilience: Energy communities (e.g., solar energy cooperatives or local microgrids) can use analytics to efficiently manage their energy production and storage;

- Reducing vulnerability: A better understanding of energy systems enables communities to minimize the impact of price fluctuations or supply chain disruptions;

- Participation in energy decision-making: Analytics provide concrete data that support informed decisions regarding local investments and policies.

- Energy policies: Governments can develop energy security strategies, including strategic oil/gas reserves, safe nuclear infrastructure, and resilient power grids;

- Reducing external dependence: Analyzing energy systems helps identify opportunities for domestic production and diversification of sources;

- Energy transition: Enables states to plan the shift to cleaner energy sources without compromising supply stability.

- Environmental impact assessment: Analyses allow the measurement of the effects of energy production and consumption on the environment and public health;

- Technological risk mitigation: Especially in the nuclear or mining sectors, energy system analysis helps prevent accidents and implement safety measures;

- Long-term sustainability: It helps balance supply and demand, prevents resource depletion, and promotes a sustainable energy mix.

- Ensuring the energy security of communities and nations;

- Optimizing resources and infrastructure;

- Transitioning toward more sustainable and resilient energy.

2. State of Art

- Dependence on imports – many countries rely heavily on imported oil and gas, making them vulnerable to price volatility and supply disruptions;

- Domestic production – nations with domestic reserves focus on exploration, extraction, and refining capacity to ensure self-sufficiency;

- Strategic reserves – countries maintain strategic petroleum reserves to buffer against crises or supply shocks;

- Challenges – aging infrastructure, limited refining capacity, and geopolitical tensions can threaten energy security.

- Global market volatility – oil and gas markets are highly sensitive to geopolitical events, such as conflicts in the Middle East or sanctions on key producers;

- Energy transition pressures – international efforts to reduce fossil fuel dependence push countries to diversify into renewables, impacting long-term investment in oil and gas;

- Collaboration – international pipelines, LNG trade, and multilateral agreements (e.g., OPEC) affect supply stability<

- Energy diversification – nuclear energy provides a stable, low-carbon base load to complement intermittent renewables;

- Safety and regulation – strong regulatory frameworks are needed to manage risks of accidents, radioactive waste, and plant security;

- Development – some nations are expanding nuclear capacity to ensure long-term energy security.

- Technological cooperation – international agencies (like the IAEA) provide guidance for safety, regulation, and nuclear technology transfer;

- Global risks – nuclear proliferation and accidents are major concerns for international energy security;

- Supply of uranium – uranium markets are concentrated; geopolitical factors can influence availability.

- Resource exploration – countries rich in minerals like lithium, cobalt, and rare earths focus on domestic mining to support energy and technology sectors;

- Environmental management – mining activities must balance resource extraction with environmental sustainability and community well-being;

- Industrial policy – governments may incentivize local processing to reduce dependence on foreign supply chains.

- Global supply chains – critical minerals are often concentrated in a few countries (e.g., lithium in South America, cobalt in the DRC), creating vulnerability;

- Trade tensions – export restrictions or trade disputes can disrupt access to key resources for energy storage and technology<

- Grid reliability – countries invest in transmission and distribution infrastructure to reduce outages and integrate renewable energy sources;

- Decentralization – microgrids and distributed energy systems enhance community-level energy security;

- Energy mix – combining fossil fuels, nuclear, and renewables reduces dependence on a single energy source.

- Interconnected grids – cross-border electricity trading (e.g., in Europe) helps balance supply and demand;

- Cybersecurity threats – modern grids face risks from cyberattacks, affecting community access to electricity<

- Integration of energy sources – modeling systems combining oil, gas, nuclear, renewables, and storage for resilient planning;

- Risk assessment – evaluating geopolitical, environmental, and technical risks affecting national and community energy security;

- Transition to low-carbon energy – countries are increasingly analyzing systems to meet climate goals without compromising security;

- Digitalization and smart grids – advanced monitoring and predictive tools enhance reliability and responsiveness;

- Community-focused strategies – decentralized energy generation, local storage, and efficiency measures strengthen local resilience.

- Strengthening domestic production and strategic reserves for fossil fuels;

- Expanding safe nuclear capacity with proper oversight;

- Developing mining and critical mineral industries responsibly;

- Building resilient and flexible electricity grids;

- Considering international dependencies and risks in policy planning.

3. Smart Energy Power Analysis

3.1. The Concept of Smart Energy Power

- Hard power: economic and coercive pressure, infrastructural strength, ownership and control of strategic energy resources, strategic investments – the goal is to maximize influence in a strategic Energy Sector, relying exclusively on threat, sanction, coercion, or domination;

- Soft power: strong international relations, international cooperation, robust energy diplomacy, permissive energy policies, promotion of green technologies, environmental standards, and sustainable energy policies that attract partners through mutual benefits – the goal is to maximize influence in a strategic energy sector without relying solely on coercion or domination. (Figure 1) [5,6,7,8,9]

- EU and the energy transition: The EU uses hard power through sanctions against Russia for gas, but also soft power by promoting green energy and providing funds for the energy transition in partner countries;

- China and the Belt and Road Initiative: A combination of hard power (investments in energy infrastructure and control of resources) and soft power (technology transfer, “win-win” projects);

- Romania: Can use soft power by promoting renewable energy and know-how in hydro and wind, and hard power through strategic participation in regional energy networks (e.g., interconnections with Hungary, Bulgaria, Moldova, or Greece).

3.2. Hard Power Analysis

- The National Oil System – exploration, extraction, transportation, storage, refining, and distribution of oil and petroleum products;

- The National Gas System – exploration, extraction, transportation, storage, and distribution of natural gas;

- The National Nuclear System – extraction and processing of uranium ore, nuclear fuel manufacturing, heavy water production, and electricity generation;

- The National Mining System – extraction, transportation, storage, and distribution of coal (hard coal and lignite), and electricity generation;

- The National Power System – generation, transmission, distribution, and supply of electricity to consumers (household, industrial, and critical).

3.2.1. The National Oil System

- Upstream: oil and gas exploration and production: 193 on-shore and offshore commercial oil and gas fields; exploration in the perimeter of Neptune Deep and Han Asparuh – Black Sea: ~ 7000 production wells;1000 facilities; 13 000 km. of pipeline;

- Downstream Oil: Petrobrazi refinery (annual capacity of 4,5 million tons of oil); 110 oil and condensate storage depots; 13 gasoline storage depots; 8 fuel storage depots (Jilava, Brazi, Ișalnița, Timișoara, Deva, Bacău, Cluj, Arad); 403 Petrom fuel stations; 151 OMV gas stations;

- Downstream Gas: natural gas (production, processing, marketing, supply) which covers about 40% of the demand for natural gas in Romania; electricity (production and supply): Brazi power plant – 860 MW.

- 9 offshore drilling rigs: Atlas, Fortuna, Jupiter, Orizont, Prometeu, Saturn, Uranus, Deep Driller, Alpha;

- 10 multifunctional ships: King, Queen, Vega, Antares, Alcor, Orion, Centaurus, Unicorn, Perseus, Phoenix;

- 2 heavy barge cranes: Neptune, Granite;

- 2 marine ships: Bigfoot 1, Bigfoot 2.

- Domestic Oil Subsystem: 1 173 km. pipelines (6,2 million tons / year transport capacity); 120 000 m3 storage capacity; 47 pumping stations: Urziceni, Grindu, Cartojani, Potlogi, Videle, Poieni, Izvoru, Icoana, Lact, Ghercești, Siliștea, Boldești, Gura Vitioaiei, Păcureți, Predealul Sărari, Surani, Urlați, Băicoi, Mislea, Recea, Moreni, Teiș, Ochiuri, Saru, Oarja, Poiana Lacului, Otești, Orlești, Mădulari, Vârteju, Iancu Jianu, Bărbătești, Țicleni, Naidăș, Satchinez, Bodrog, Turnu, Petreu, Oprineșești, Lascăr, Ghelința, Cerdac, Lucăcești, Comănești;

- Import Oil Subsystem: 971 km. pipelines (12,5 million tons / year transport capacity); 79 500 m3 storage capacity; 7 pumping stations: Constanța Sud, Mircea Vodă, Bărăganu, Dragoș Vodă, Călăreți, Mavrodin, Mărtinești;

- Gasoline / Liquid Ethane Subsystem: 28 km. pipelines (0,073 million tons / year transport capacity); 250 m3 storage capacity; 3 gasoline pumping stations: Călacea, Abrămuți, Turburea;

- Oil / Gasoline Railway Subsystem: 13 oil and condensate loading ramps; 2 gasoline loading ramps; 13 locomotives. 55 railway wagons; 12,7 railway infrastructure; 69 oil and gasoline boilers.

- 3 oil storage deposits, petroleum products and petrochemicals: North Platform Section – 290 000 m3 for heavy fuel and VGO; Port Platform Section – 105 000 m3 for petroleum products and chemical liquids; South Platform Section – 965 000 m3 for crude oil, petrol, diesel and fuel;

- Tanks with capacities ranging from 1 000 m3 to 55 000 m3, of metal construction, cylindrical, installed vertically – aboveground, equipped with protective belts, with fixed or floating roofs, and with fire-fighting systems. Some of the tanks are equipped with automatic measuring systems, such as radar, for the level and temperature of the stored product;

- Loading/unloading capacities for petroleum and liquid chemical products, consisting of ramps and internal railways with a total length of approximately 30 km, equipped with loading/unloading facilities;

- Loading installations for products into tank trucks;

- Pipelines for the loading/unloading to/from ships of crude oil, petroleum products, petrochemicals, liquid chemicals, and oils, with diameters ranging from 100 mm. to 1000 mm.;

- Pump houses capable of achieving flow rates between 300 m3/h and 2 500 m3/h.;

- Weighing for tank trucks and railway tank cars;

- Computerized metering installations located in the immediate vicinity of the diesel, gasoline, and crude oil loading/unloading docks;

- Laboratories equipped with equipment for performing specific physicochemical analyses;

- Installations on the loading quay for products from barges (crude oil, diesel, gasoline, fuel oil) and for bunkering ships with light and heavy fuel in all oil berths.

- Petromidia Refinery (5 million tons per year): Petromidia is strategically located on the shore of the Black Sea in Năvodari, 20 km north of the Port of Constanța; Logistical Advantages: Own marine terminal; Facilities at Midia Port: berths 1–4 for crude oil and products, and berths 9 (A, B, and C) for petroleum product exports; Own railway logistics system; Access to the Danube–Black Sea Canal; The marine terminal is the refinery’s most important logistical asset. It is located 8.6 km offshore and can accommodate vessels of up to 160 000 TDW; Through this terminal and the entire logistics system developed by the company in the region, Romania has the potential to become an energy hub—a regional platform connecting natural resources from Asia with European demand for raw material processing and petroleum product supply;

- Vega Refinery;

- Petrochemical Division: PP (polypropylene) installation; LDPE (low density polyethylene) installation; HDPE (high density polyethylene) installation; the only marine terminal on the Black Sea; cryogenic tank (10,000 tons);

- Rompetrol Downstream: 922 fuel distribution points; 8 fuel depots: Petromidia Năvodari, Arad, Craiova, Mogoșoaia, Șimleul Silvaniei, Vatra Dornei, Zărnești;

- Rompetrol Gas: 210 LPG stations; 8 000 cylinder distribution points; 3 bottling stations (Năvodari, Arad, Bacău); 3 LPG / propane / butane deposits: Mogoșoaia, Pantelimon, Dumbrava.

- Petrotel Lukoil Refinery;

- 310 fuel distribution stations;

- 7 fuel depots: Lukoil Ploiești, Râmnicu Vâlcea, Brașov, Cluj, Arad, Oil Terminal Constanța, Oil Terminal Galați.

- Romania is one of the few oil producers in the European Union;

- Domestic production mainly comes from onshore fields (Muntenia, Moldova, Transylvania) and offshore fields in the Black Sea (less than for gas);

- Main producer: OMV Petrom;

- Long-term trend: gradual decline in production due to the maturity of the fields.

- Romania imports crude oil, primarily for refineries;

- Frequent sources (in recent years): Kazakhstan, Azerbaijan, and other countries in the Black Sea region and the Middle East;

- After 2022, dependence on Russian oil was significantly reduced, in line with EU policies.

- Port of Constanța – a key point for crude oil imports by sea, through the company Oil Terminal Constanța;

- Pipelines and rail transport for supplying refineries, via Conpet, which is the transport operator in Romania;

- Major refineries: Petromidia (operated by Rompetrol Rafinare – KMG International) – the largest in Romania and a pillar of the refining industry; Vega Ploiești (operated by Rompetrol Rafinare – KMG International); Petrobrazi (operated by OMV Petrom); Petrotel Lukoil (operated by Lukoil).

- Approximately 30–40% of the oil demand is met through domestic production, while the remainder comes from imports (values may vary annually).

- Romania maintains strategic oil reserves and has diversified sources, which reduces the major risk of disruption;

- Oil remains important for transportation, the petrochemical industry, and less so for electricity generation.

- National Agency for Mineral Resources - which owns the hydrocarbon resource;

- On-shore / off-shore prospecting operators - prospecting the hydrocarbon resource;

- Exploration - development - on-shore / off-shore exploitation operators - who explore, develop and exploit the hydrocarbon resource;

- Transmission operators - which transport oil and petroleum products through pipelines to distribution operators;

- Warehousing operators - which store oil and petroleum products for strategic purposes;

- Refining operators - who refine oil and turn it into petroleum products;

- Distribution operators - which distribute through pipelines or other means, oil and petroleum products to supply operators;

3.2.2. National Gas System

- On-shore exploration: 8 perimeters of exploration - development - exploitation (3 projects: Transylvanian Central Basin, Moldova and Muntenia);

- Offshore exploration: perimeter EX Trident - Black Sea;

- Natural gas production: 2 production branches: Mediaș and Târgu Mureș; 140 commercial deposits; ~ 3,240 probes; manifolds, gas heaters, impurity separators, compressors, drying stations, gas measuring panels;

- Electricity production: Iernut Thermal Power Plant – 600 MW;

- Natural gas trading;

- Technological transport: freight transport; passenger transportation; specific technological transport and maintenance;Well operations (intervention, repairs and production tests);

- Natural gas storage (Depogaz Ploiești): 6 warehouses: Bilciurești, Sărmășel, Urziceni, Ghercești, Bălăceanca, Cetatea de Baltă.

- Upstream: oil and gas exploration and production: 193 on-shore and offshore commercial oil and gas fields; exploration in the perimeter of Neptune Deep - Black Sea: ~ 7000 production wells; ~ 1000 facilities; ~ 13,000 km of pipeline;

- Downstream Oil: Petrobrazi refinery (annual capacity of 4.5 million tons of oil); 110 oil and condensate storage depots; 13 gasoline storage depots; 8 fuel storage depots (Jilava, Brazi, Ișalnița, Timișoara, Deva, Bacău, Cluj, Arad); 403 Petrom fuel stations; 151 OMV gas stations;

- Downstream Gas: natural gas (production, processing, marketing, supply) which covers about 40% of the demand for natural gas in Romania; electricity (production and supply): Brazi power plant - 860 MW.

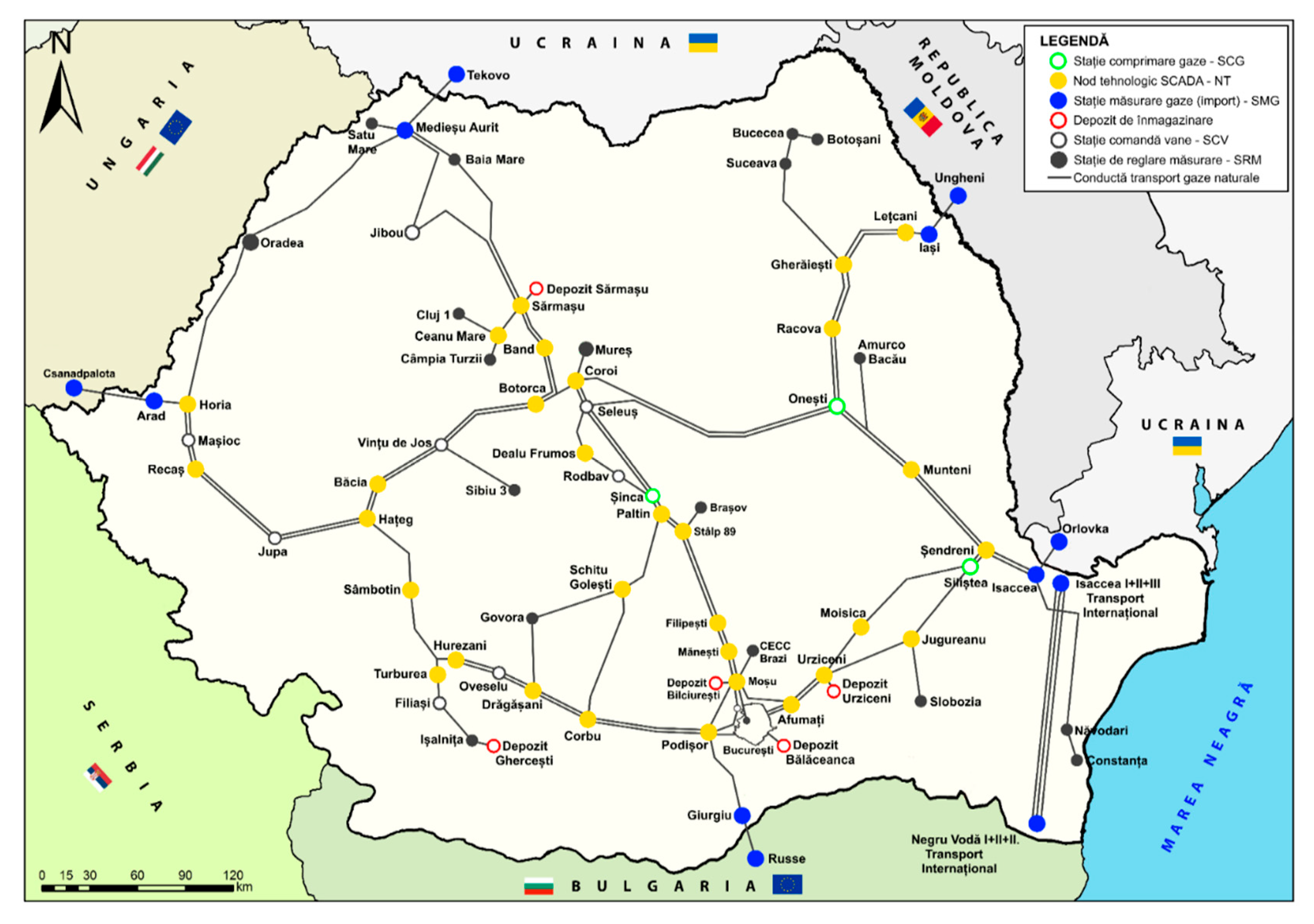

- 13 430 km. of pipes;

- 5 compression stations;

- 58 control stations valves and / or technological nodes;

- 1 038 cathodic protection stations;

- 902 gas odor stations;

- 11 interconnections with other transport systems: Arad - Csanadpalota (Hungary); Iasi - Ungheni (Republic of Moldova); Giurgiu - Ruse (Bulgaria); Negru Vodă 1 - Kardam (Bulgaria); Negru Vodă 2 - Kardam (Bulgaria); Negru Vodă 3 - Kardam (Bulgaria); Medieșu Aurit (import) - Tekovo (Ukraine); Isaccea (import) - Orlovka (Ukraine); Isaccea 1 - Orlovka (Ukraine); Isaccea 2 - Orlovka (Ukraine); Isaccea 3 - Orlovka (Ukraine);

- 7 connections to storage facilities: Sărmaș - Romgaz; Bălăceanca - Romgaz; Butimanu - Romgaz; Balta Fortress - Romgaz; Ghercești - Romgaz; Urziceni - Romgaz; Târgu Mureș – Depomureș;

- 131 interconnections with production facilities: 77 - Romgaz; 36 - OMV Petrom; 13 - Amronco; 1 - Raffles Energy; 1 - Lotus Petrol; 1 - Stratum Energy; 1 - Hunt Oil Company; 1 - Serinus Energy;

- 926 interconnections with distribution systems: 894 - physical exit points; 32 - number of distribution system operators;

- 225 interconnections with direct consumers: 15 physical output points - direct consumers (gas power plants); 19 physical output points - direct consumers (industrial combined); 167 physical exit points - direct consumers (commercial consumers); 24 physical exit points - direct consumers (residential consumers);

- 85 interconnections between production facilities and distribution systems: 85 physical entry / exit points - direct natural gas delivery.

- The Black Sea – offshore fields, the most well-known being Neptun Deep and Domino. The exploitation of these resources is under development and could cover a substantial part of domestic consumption in the coming years;

- Onshore fields – mainly in the Transylvania and Banat regions, operated by companies such as Romgaz and Petrom. These already provide a significant portion of domestic production;

- Romania produces approximately 11–12 billion m3 of natural gas annually (2024 data), covering around 80% of domestic consumption.

- Gas Transport: The national transmission network is operated by Transgaz and includes approximately 13 000 km of pipelines. It enables the distribution of both domestic and imported gas to all regions of the country;

- Underground Gas Storage: Romania has several underground storage facilities capable of storing over 3 billion m3, ensuring supply security during periods of high demand. Examples: Sărmășel, Bilciurești, Ghercești.

- Increasing domestic production, including through the exploitation of the Black Sea;

- Diversifying imports to reduce dependence on a single source;

- Modernizing infrastructure, including the construction of new pipelines and interconnections with neighboring countries;

- Strategic storage for critical periods.

- Exploiting natural gas from the Black Sea depends on large investments and environmental legislation;

- Domestic demand increases slightly each year, especially in the context of the transition to cleaner energy;

- Romania's integration into the European gas market offers opportunities, but also pressures related to price and competitiveness.

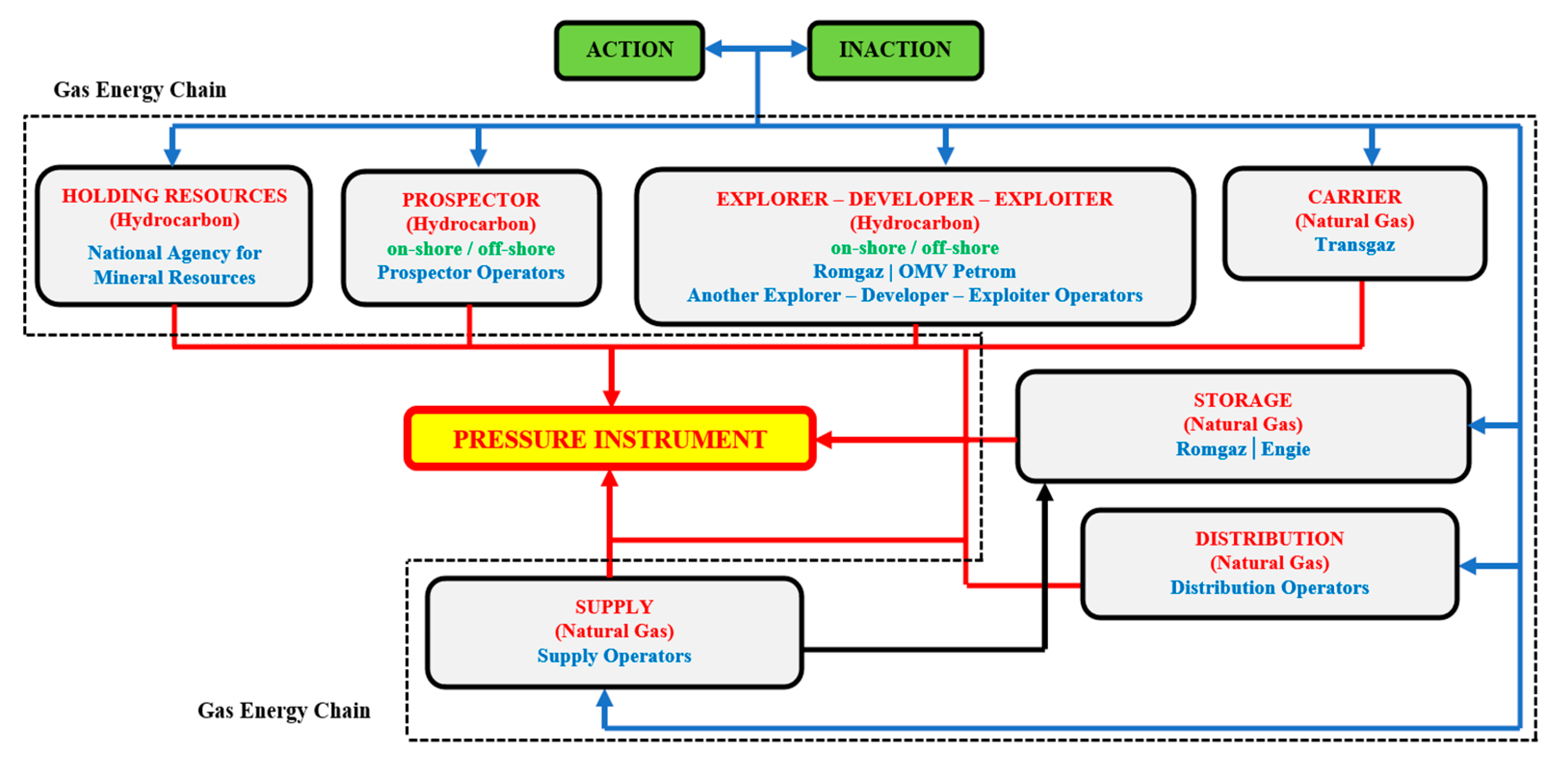

- National Agency for Mineral Resources - which owns the hydrocarbon resource;

- On-shore / off-shore prospecting operators - prospecting the hydrocarbon resource;

- Exploration – Development - on-shore / off-shore exploitation operators - who explore, develop and exploit the hydrocarbon resource;

- Transmission operators - which transport natural gas through pipelines to distribution operators;

- Storage operators – which store natural gas for strategic purposes;

- Distribution operators – which distribute through pipelines or other means, natural gas to supply operators;

- Supply operators – which supply natural gas to consumers through pipelines or other means.

3.2.3. Nuclear Power System

- Suceava Branch (uranium ore production);

- Feldioara branch (processing, refining);

- Oravița Sector (conservation, closure, greening);

- Steel Sector (conservation, closure, greening).

- Uranium Crucea Mining (Suceava County);

- Uranium Botușana Mining (Suceava County).

- Processing Plant - R Plant: uranium ore is processed by a hydrometallurgical process, following which the technical concentrate of sodium diuranate - Na2U2O7 is obtained;

- Uranium Concentrate Technical Refining Plant - Plant E: the process continues with the production of uranium oxide (stable intermediate product) and the sinterable uranium dioxide powder - UO2 (raw material for the manufacture of nuclear fuel needed for CANDU type nuclear power plants).

- Pitesti Nuclear Fuel Factory branch (nuclear fuel manufacturing);

- Cernavoda Nuclear Power Plant branch (operation of units 1 and 2).

- Pills Section - manufacture of UO 2 tablets using uranium dioxide powder as raw material;

- Assembly Section - manufacture of: zircaloy components for the beam; fuel elements; CANDU 6 type fuel bundles.

- Nuclear Unit 1: fuel: natural uranium - UO2; moderator and coolant: heavy water (deuterium oxide) - D2O;

- Nuclear Unit 2: fuel: natural uranium - UO2; moderator and coolant: heavy water (deuterium oxide) - D2O.

- Romania’s state nuclear operator Nuclearelectrica has sourced natural uranium concentrates from Kazakhstan’s Kazatomprom, the world’s largest uranium producer, under open tender contracts. These deliveries supply Romania’s nuclear fuel cycle, including processing at Feldioara;

- Discussions are underway for a longer-term 10-year uranium supply contract between Nuclearelectrica and Kazatomprom to ensure stable deliveries into the future.

- The Feldioara Uranium Concentrate Processing Plant, owned by a subsidiary of Nuclearelectrica, has recently become operational and even won international contracts to process uranium into UO2 fuel for other countries (e.g., Argentina);

- Nuclearelectrica’s integrated cycle aims to process imported uranium concentrates into nuclear fuel at the plant in Pitești, enhancing fuel security and adding value domestically.

- Large tracts of land in Feldioara (Brașov) have been concessioned to Nuclearelectrica to restart uranium extraction and processing activities as part of national energy security planning;

- The strategy emphasizes reducing reliance on imports and supporting an integrated nuclear fuel supply chain, potentially including exploration and mining of domestic uranium resources.

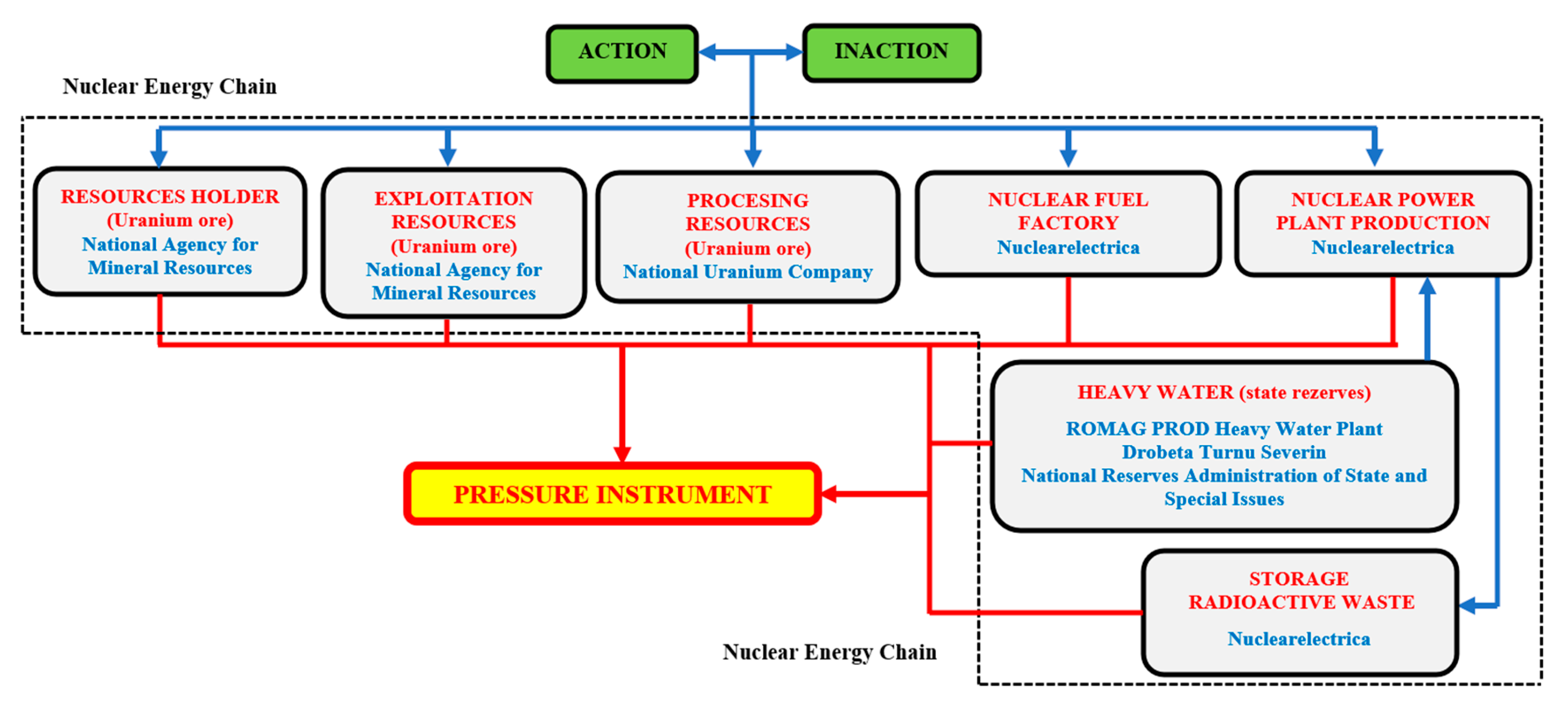

- National Agency for Mineral Resources – which holds the uranium ore resource;

- National Uranium Company – which exploits and processes the uranium ore resource;

- Nuclearelectrica – which produces the nuclear fuel necessary for the production of electricity and stores radioactive waste in conditions of safety and environmental protection;

- Center for Heavy Water Management and National Administration of State Reserves and Special Issues - which hold heavy water as a strategic state reserve.

3.2.4. Mining Power System

- Jiu Valley Mining Basin (coal - top coal): Lonea Mining; Livezeni Mining; Vulcan Mining; Lupeni Mining;

- Oltenia Mining Basin (lignite - lower coal): Roșia - Rovinari Mining; Jilț Mining; Motru Mining.

- Coal extraction: Lonea Mining Branch; Livezeni Mining Branch; Vulcan Mining Branch; Lupeni Mining Branch; Prestserv Petroșani branch;

- Coal-based electricity generation: Paroșeni Power Plant Branch.

- Mining Directorate: Roșia - Rovinari Mining; Jilț Mining; Motru Mining;

- Energy Department: Rovinari Power Plant Branch; Turceni Power Plant Branch; Ișalnița Power Plant Branch; Craiova Power Plant Branch II.

- main activity: exploitation and extraction of lignite;

- location: Gorj and Mehedinți counties;

- year of production: 1957;

- capabilities: 118 high-capacity mining machinery; over 220 km. conveyor belt capable of ensuring a production of 25/30 million tons of lignite / year distributed in 12 surface mining perimeters (10 mining units in the Rovinari, Motru, Jilț and Mehedinți basins);

- total coal extracted: 1.5 billion tons;

- estimated resources: for the next 40 years (95.4% Gorj and 4.6% Mehedinti).

- Ișalnița Power Plant: 630 MW (2 blocks of 315 MW) – operation on condensed lignite;

- Rovinari Power Plant: 990 MW (3 blocks of 330 MW) – operation on condensed lignite;

- Turceni Power Plant: 1320 MW (4 blocks of 330 MW) – operation on condensed lignite;

- Craiova II Power Plant: 300 MW (2 blocks of 150 MW) – operation on lignite in cogeneration.

- Romania produces coal domestically, but production has been declining overall in recent years. In 2023 and early 2025 data show net coal output falling compared with previous periods – for example, production in the first half of 2025 was about 902,400 tonnes of oil equivalent (toe), down roughly 2.9 % year-on-year;

- Projections from Romania’s National Commission for Strategy and Forecast (CNSP) anticipate continued decline in coal production through 2027 (to around 1.432 million toe by 2027).

- Romania does import some coal, but import volumes have also been decreasing significantly. For example, January–June 2025 imports dropped about 60.7% compared to the prior year;

- This reduction reflects both lower domestic demand and EU sanctions: coal imports from Russia have been banned since August 2022 under EU sanctions;

- Projected imports continue falling – expected to drop to roughly 79,000 toe by 2027.

- Coal has historically been a significant fuel for electricity and heat generation. However, coal consumption is declining as Romania transitions toward other energy sources (gas, nuclear, renewables);

- The trend in Europe overall is toward decreasing coal use – Romania’s production and consumption reflect that broader pattern.

- Romania is in a transition away from coal toward cleaner energy, with investment in gas, solar, wind, and nuclear. This shift is driving down the need for coal production and imports;

- However, Romania has also sought to delay the closure of coal-fired plants beyond planned phase-out dates (around 2026) to ensure energy security while new capacities are built.

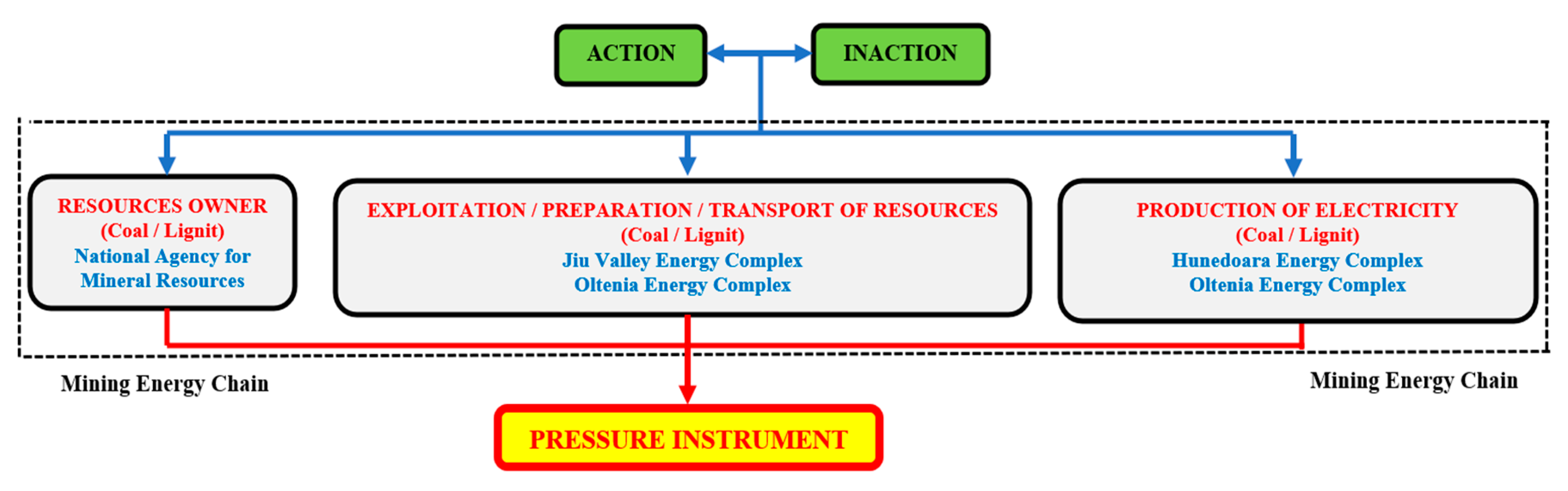

- National Agency for Mineral Resources – which owns the coal resource (coal and lignite);

- Jiu Valley Energy Complex – which exploits, prepares, transports and produces electricity based on coal;

- Oltenia Energy Complex – which exploits, prepares, transports and produces lignite-based electricity.

3.2.5. National Power System

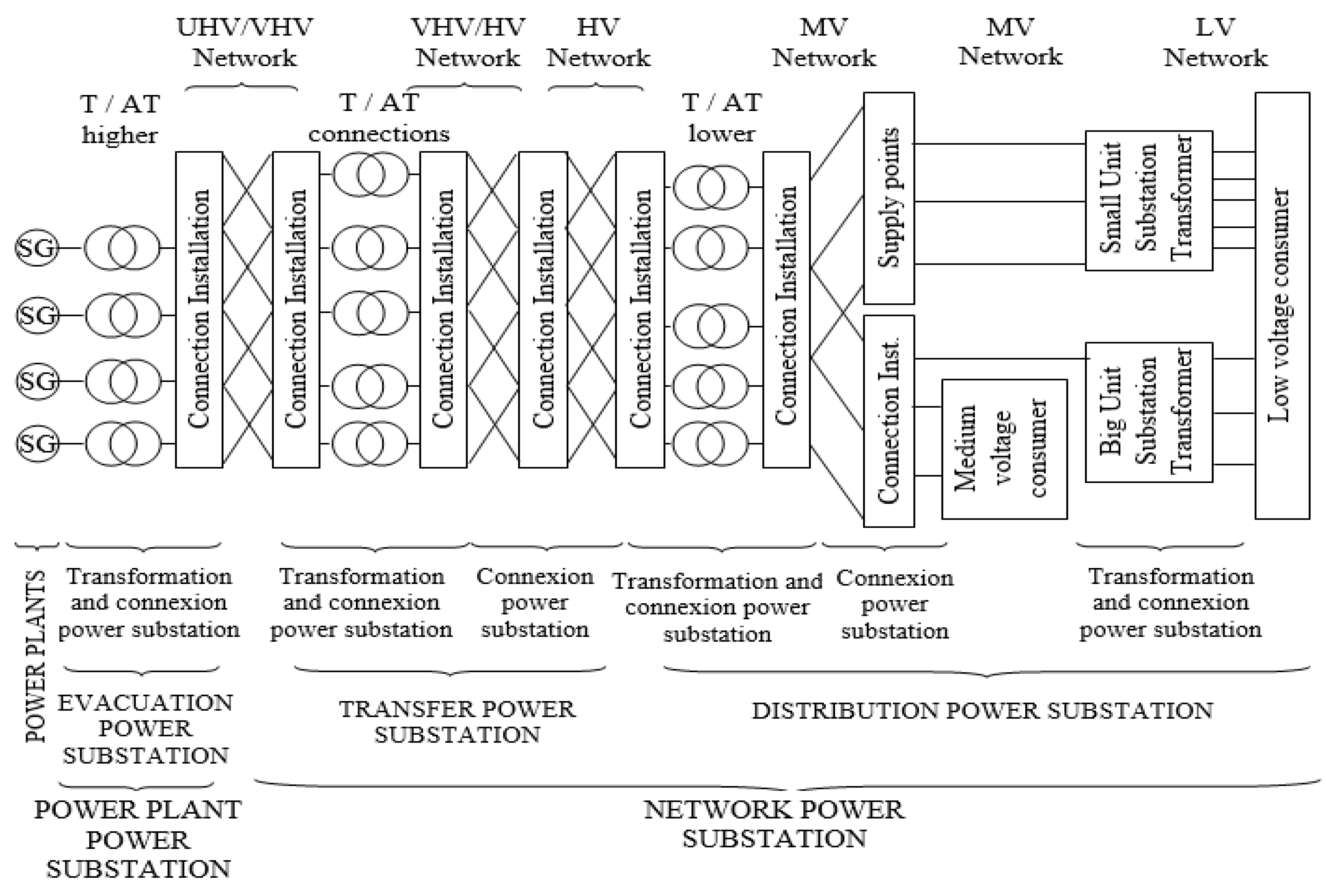

- power generators – hydrogenerators, thermogenerators, atomogenerators, wind generators, photovoltaic installations, etc.), which produce electricity and are located in power plants;

- power transformers (power autotransformers) – which transform voltage and are in power stations;

- transport power grid – which transport electricity;

- distribution power grid – that distributes electricity.

- safety (security) in the supply of consumers (the level of safety is predetermined at the request of the consumer according to its technical characteristics);

- electricity quality (the evaluation of the quality of electricity is done through the values of the quality indices, which must be within the limits set by regulations and / or requested by consumers);

- the economy (to operate in economic conditions);

- external requirements (environment and other external factors).

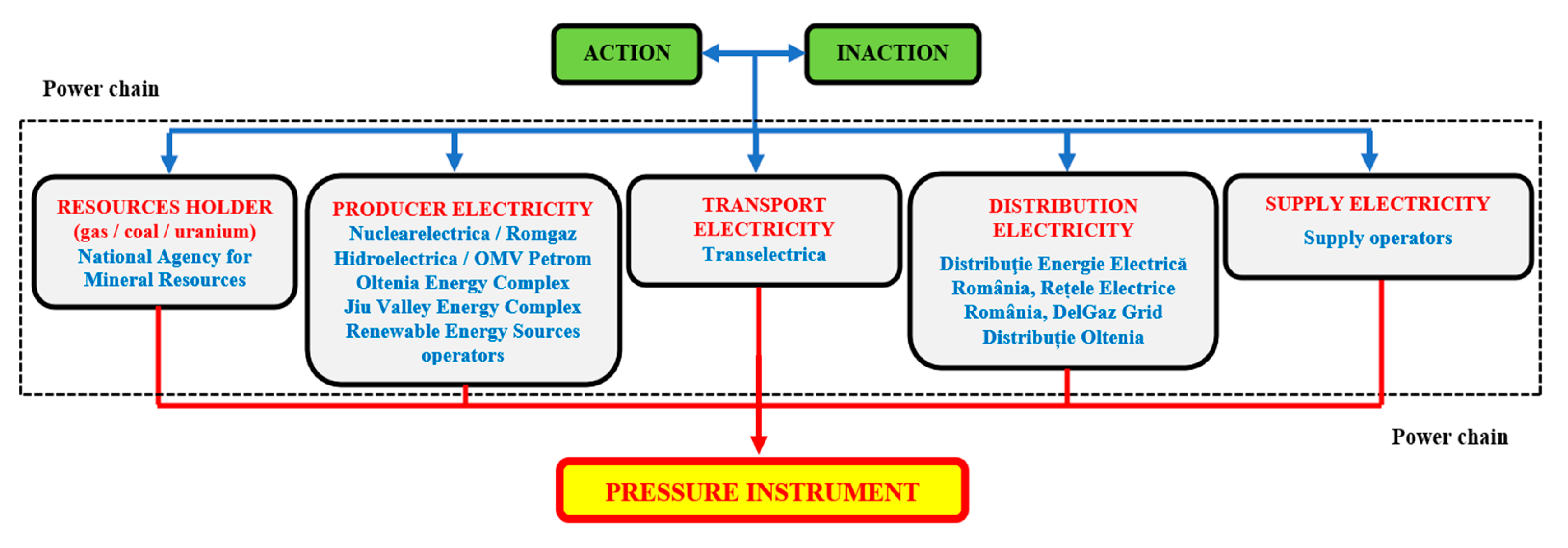

- Electricity generation: Hidroelectrica; Nuclearelectrica; Romgaz; OMV Petrom; Oltenia Energy Complex; Jiu Valley Energy Complex; Renewable Energy Sources (RES) Power Plants;

- Electricity transport: Transelectrica;

- Electricity distribution: distribution operators;

- Electricity supply: supply operators.

- Elements for power generation;

- Power substations;

- Power networks (grid);

- Power consumers.

- transmission and system operator of the National Power System, by (Figure 10):

- 81 power substations (220 kV, 400 kV and 750 kV): 400/220/110 kV Bucharest South; 400/110 kV Domnești; 400/220/110 kV Iernut; 400/220/110 kV Sibiu South; 400/110 kV Dârste; 400/110 kV Brașov; 400/220/110 kV Gutinaș; 400/220/110 kV Suceava; 400/110 kV Bacău South; 400/110 kV Roman North; 400 kV Isaccea (Republic of Moldova); 400 kV Stupina (Bulgaria); 400 kV Rahman (Bulgaria); 400/220/110 kV Lacu Sărat; 400 kV Cernavoda; 400/110 kV Medgidia South; 400/110 kV Constanța North; 400/110 kV Tariverde; 400/110 kV Tulcea West; 400/110 kV Smârdan; 400 kV Ţânţăreni (Bulgaria); 400 kV Porțile de Fier (Serbia); 400/220/110 kV Urecheşti; 400/220 kV Slatina; 400/110 kV Drăgăneşti-Olt; 400/220/110 kV Brazi West; 400/220/110 kV Bradu; 400/110 kV Gura Ialomiței; 400/110 kV Pelican; 400/220/110 kV Arad (Hungary); 400 kV Nădab (Hungary); 400/220/110 kV Mintia; 400/220 kV Roșiori (Ukraine); 400 kV Gădălin; 400/110 kV Cluj East; 400/110 kV Oradea Sud; 220/110 kV Fundeni; 220/110 kV Gheorgheni; 220/110 kV Fântânele; 220/110 kV Ungheni; 220/110 kV Alba Iulia; 220/110 kV Munteni; 220/110 kV Iași (FAI); 220/110 kV Dumbrava; 220/110 kV Stejaru; 220/110 kV Filești; 220/110 kV Bărboși; 220/110 kV Focșani West; 220/110 kV Stâlpu; 220/110 kV Teleajen; 220/110 kV Mostiștea; 220/110 kV Turnu Măgurele; 220/110 kV Ghizdaru; 220/110 kV Târgoviște; 220/110 kV Pitești Sud; 220/110 kV Arefu; 220/110 kV Stupărei; 220/110 kV Târgu-Jiu North; 220/110 kV Sărdăneşti; 220/110 kV Turnu Severin; 220/110 kV Cetate; 220/110 kV Calafat; 220/110 kV Gradient; 220/110 kV Craiova North; 220/110 kV Râureni; 220/110 kV Resita (Serbia); 220/110 kV Calea Aradului; 220/110 kV Săcălaz; 220/110 kV Timişoara; 220/110 kV Iaz; 220/110 kV Pestiș; 220/110 kV Hăşdat; 220/110 kV Baru Mare; 220/110 kV Paroşeni; 220/110 kV Câmpia Turzii; 220/110 kV Cluj Floresti; 220/110 kV Tihău; 220/110 kV Sălaj; 220/110 kV Baia Mare 3; 220/110 kV Vetiș;

- 8 931,6 km. overhead power lines (OHL): 400 kV Bucharest South – Domnești; 400 kV Bucharest South – Gura Ialomiței; 400 kV Bucharest South – Pelicanu; 400 kV Bucharest South – Slatina; 400 kV Domnești – Brazi Vest; 220 kV Bucharest South – Fundeni; 220 kV Bucharest South – Ghizdaru; 220 kV Bucharest South – Mostiștea; 220 kV Fundeni – Brazi West; 400 kV Iernut – Gădălin; 400 kV Iernut – Sibiu South; 400 kV Sibiu South – Mintia; 400 kV Sibiu South – Țânțăreni; 400 kV Sibiu South – Brașov; 400 kV Brașov – Bradu; 400 kV Brașov – Dârste; 400 kV Brașov – Gutinaș; 400 kV Dârste – Brazi West; 220 kV Gheorgheni – CHE Stejaru; 220 kV Gheorgheni – Fântânele; 220 kV Fântânele – Ungheni; 220 kV Ungheni – Iernut; 220 kV Iernut – Baia Mare 3; 220 kV Iernut – Câmpia Turzii; 220 kV South Sibiu – CHE Lotru; 220 kV Alba Iulia – Mintia; 220 kV Alba Iulia – CHE Șugag; 220 kV Alba Iulia – CHE Gâlceag; 220 kV Alba Iulia – Cluj Floresti; 400 kV Gutinaș – Brașov; 400 kV Gutinaș – Bacău South; 400 kV Bacău South – Roman North; 400 kV Roman North – Suceava; 220 kV Gutinaș – Dumbrava; 220 kV Gutinaș – CTE Borzești; 220 kV Gutinaș – Munteni; 220 kV Gutinaș – Iași (FAI); 220 kV Iași (FAI) – Munteni; 220 kV Iași (FAI) – Suceava; 220 kV Dumbrava – CHE Stejaru; 220 kV CHE Stejaru – Gheorgheni; 400 kV Rahman – Dobrudja (Bulgaria); 400 kV Stupina – Varna (Bulgaria); 400 kV Isaccea – Vulcănești (Republic of Moldova); 750 kV Isaccea – Southern Ukraine (Ukraine) - decommissioned line; 400 kV Smârdan – Gutinaș; 400 kV Smârdan – Lacu Sărat; 400 kV Smârdan – Isaccea; 400 kV Lacu Sărat – Gura Ialomiței; 400 kV Lacu Sărat – Isaccea; 400 kV Isaccea – Tulcea West; 400 kV Isaccea – Rahman; 400 kV Isaccea – Stupina; 400 kV Tulcea West – Tariverde; 400 kV Tariverde – Constanța North; 400 kV Constanța North – Cernavoda; 400 kV Cernavoda – Medgidia South; 400 kV Cernavoda – Pelicanu; 400 kV Cernavoda – Gura Ialomiței; 400 kV Lacu Sărat – CTE Brăila; 220 kV Focșani West – Gutinaș; 220 kV Focșani West – Bărboși; 220 kV Bărboși – Filești; 220 kV Lacu Sărat – CTE Brăila; 400 kV Brazi West – Dârste; 400 kV Brazi West – CTE Petrom Brazi; 400 kV Brazi West – Domnești; 400 kV Bradu – Brașov; 400 kV Bradu – Țânțăreni; 400 kV Gura Ialomiței – Lacu Sărac; 400 kV Gura Ialomiței – Cernavoda; 400 kV Gura Ialomiței – Bucharest South; 400 kV Pelicanu – Cernavoda; 400 kV Pelicanu – Bucharest South; 220 kV Teleajen – Brazi West; 220 kV Teleajen – Stâlpu; 220 kV Mostiștea – Bucharest South; 220 kV Turnu Măgurele – Ghizdaru; 220 kV Turnu Măgurele – Craiova North; 220 kV Ghizdaru – Bucharest South; 220 kV Târgoviște – Brazi West; 220 kV Târgoviște – Bradu; 220 kV Pitești South – Bradu; 220 kV Arefu – CHE Vidraru; 220 kV Arefu – Râureni; 220 kV Bradu – Stupărei; 400 kV Porțile de Fier – Djerdap (Serbia); 400 kV Țânțăreni – Kosloduy (Bulgaria); 400 kV Urechești – Porțile de Fier; 400 kV Urechești – Domnești; 400 kV Urechești – Țânțăreni; 400 kV Urechești – CTE Rovinari; 400 kV Porțile de Fier – Slatina; 400 kV Țânțăreni – Bradu; 400 kV Țânțăreni – Slatina; 400 kV Țânțăreni – CTE Turceni; 400 kV Slatina – Bucharest South; 400 kV Slatina – Drăgănești Olt; 220 kV Urechești – Târgu Jiu North; 220 kV Urechești – Sărdănești; 220 kV Sărdănești – Craiova North; 220 kV Craiova North – Slatina; 220 kV Craiova Nord – Turnu Măgurele; 220 kV CTE Ișalnița – Grădiște; 220 kV Grădiște – Slatina; 220 kV Porțile de Fier – Resița; 220 kV Porțile de Fier – Turnu Severin; 220 kV Porțile de Fier – Cetate; 220 kV Cetate – Calafat; 220 kV Râureni – Arefu; 220 kV Râureni – Stupărei; 220 kV Stupărei – Bradu; 220 kV Craiova North – CTE Ișalnița; 220 kV CHE Lotru – Sibiu South; 400 kV Nădab – Bekecsaba (Hungary); 400 kV Arad – Sandorfalva (Hungary); 400 kV Resita – Pancevo (Serbia); 400 kV Nădab – Arad; 400 kV Arad – Mintia; 400 kV Mintia – Sibiu South; 220 kV Arad – Calea Aradului; 220 kV Arad – Timișoara; 220 kV Calea Aradului – Săcălaz; 220 kV Săcălaz – Timișoara; 220 kV Timișoara – Mintia; 220 kV Timișoara – Reșița; 220 kV Resita – Iaz; 220 kV Resita – Porțile de Fier; 220 kV Mintia – Pestiș; 220 kV Mintia – Hășdat; 220 kV Mintia – Alba Iulia; 220 kV Hășdat – Pestiș; 220 kV Hășdat – CHE Retezat; 220 kV Hășdat – Baru Mare; 220 kV Baru Mare – Paroșeni; 220 kV Paroșeni – Târgu Jiu North; 400 kV Roșiori – Mukacevo (Ukraine); 400 kV Roșiori – Oradea South; 400 kV Roșiori – Gădălin; 400 kV Gădălin – Cluj East; 400 kV Gădălin – Iernut; 220 kV Roșiori – Vetiș; 220 kV Roșiori – Baia Mare 3; 220 kV Baia Mare 3 – Tihău; 220 kV Baia Mare 3 – Iernut; 220 kV Tihău – Sălaj; 220 kV Tihău – Cluj Floresti; 220 kV Cluj Floresti – CHE Mărișelu; 220 kV Cluj Floresti – Turzii Plain; 220 kV Cluj Floresti – Alba Iulia; 220 kV Câmpia Turzii – Iernut;

- 218 transformation units totaling 37 794 MVA;

- dispatching infrastructure (EMS / SCADA - Energy Management / Surveillance-Control and Data Acquisition System) which is carried out within the Operational Unit - National Energy Dispatcher (DEN) and the 5 Territorial Dispatchers (DET);

- capacity allocation on interconnection power lines;

- green certificates;

- balancing market operator – OPE: balancing market platform;

- commercial operator of the electricity market - OPCOM: trading platforms and green certificate trading platform;

- wholesale electricity market operator - OMEPA: metering system;

- telecommunications and IT operator – TELETRANS: fiber optics, digital telecom system.

- Nuclear power: Cernavodă Nuclear Power Plant is a key low-carbon source; Nuclear generation increased modestly in recent reports;

- Thermal (coal and gas): Historically significant but declining, especially coal due to EU phase-out pressures; Gas and coal plants still contribute a major share of production;

- Hydropower: Important renewable source, but production has dropped due to lower water flows;

- Wind and Solar: Solar generation has seen strong growth, particularly from small and prosumer installations; Wind output has been more volatile but still part of the mix;

- In 2025, total available electricity was reported at ~57.2 TWh, up slightly versus the previous year;

- Hydro and wind output declined, while nuclear and solar grew (solar up ~35%).

- Imports have increased significantly in 2025 due to falling domestic production (especially hydro), with imports rising 40–67% in various reporting periods;

- Exports also continue, as Romania trades power with neighbors depending on price and system balance.

- Romanian electricity consumption in 2022 included ~13.5 TWh for households and ~36.7 TWh for businesses;

- In 2025, consumption remained robust with slight shifts: population demand up, but industrial use generally flat or slightly down in some reports.

- Lower hydro and wind output;

- Balancing grid demand with international markets

- Renewables & Transition: Solar power has been one of the fastest-growing segments, while the country works to reduce coal dependency and align with EU climate goals;

- Grid Integration: Romania actively participates in EU energy markets, trading electricity based on real-time supply and demand across borders.

- National Agency for Mineral Resources - which owns energy resources (oil, natural gas, coal, uranium ore);

- Jiu Valley Energy Complex - which produces coal-based electricity;

- Oltenia Energy Complex - which produces electricity based on lignite;

- Nuclearelectrica - which produces uranium-based electricity;

- Hidroelectrica - which produces water-based electricity;

- Romgaz / OMV Petrom - which produces electricity based on natural gas;

- Distribuţie Energie Electrică România, Rețele Electrice România, DelGaz Grid și Distribuție Oltenia and Supply operators – which distributes and supplies electricity to consumers.

3.3. Soft Power Analysis

3.3.1. The National Oil System – International Relations

- Romania has one of Europe’s oldest oil industries, dating back to the mid-19th century;

- The Ploiești oil fields were particularly significant. By World War I and II, Romania was a major oil exporter to Germany and the Allies;

- During World War II, Romanian oil was crucial to the Axis powers, making it a strategic target for Allied bombing campaigns.

- Under communist rule, Romania’s oil industry was nationalized and became a tool for state-led economic planning;

- Oil exports were directed mainly to Soviet bloc countries, though Romania maintained some trade with Western Europe, especially in the 1970s–1980s;

- Oil revenues funded industrialization, but Romania’s reliance on foreign technology and equipment led to strategic vulnerabilities.

- Romania transitioned to a market economy, privatizing parts of its oil sector (e.g., Petrom in the 1990s, later acquired by OMV, Austria’s energy giant, in 2004);

- Modern Romania is integrated into European energy markets, with pipelines connecting it to Central and Eastern Europe;

- Romania is also a participant in European Union energy policy, which includes: diversification of supply, energy security measures and reducing dependence on Russian oil and gas

- EU Member State: Romania exports oil and refined products to EU countries, and is involved in strategic projects like Nabucco and other pipeline initiatives;

- Energy security: Romania is viewed as a potential alternative route for oil and gas to reduce dependency on Russian energy.

- Historically complex: Romania depended on Russian imports of oil products, but political tensions and EU policies have limited direct cooperation;

- Romania’s oil infrastructure (refineries and ports) makes it strategically important in the Black Sea region.

- Romania has partnered with the U.S. and NATO on energy security and protecting pipelines;

- Romanian oil has sometimes been part of strategic petroleum reserves discussions in NATO.

- Romania produces around 0.1–0.2% of global oil (modest but regionally significant);

- It trades with neighboring countries (Hungary, Bulgaria, Serbia) and exports refined products globally.

- Location: Near the Black Sea, serving as a hub for oil transit between East and West;

- Refining capacity: Ploiești and other refineries supply Central and Southeastern Europe;

- Energy security: Romania’s domestic production reduces EU reliance on imports and provides leverage in international energy diplomacy.

3.3.2. The National Gas System – International Relations

- Domestic production: Romania is one of the largest natural gas producers in the EU, mainly from the Transylvanian Basin and the Black Sea offshore fields;

- Consumption vs. production: Romania produces enough gas to meet a significant portion of domestic demand, but still imports gas during peak consumption periods;

- Infrastructure: Includes a network of pipelines, storage facilities, and interconnections with neighboring countries like Hungary, Bulgaria, and Ukraine.

- Domestic: Romgaz and OMV Petrom are the largest producers; Transgaz manages the national transmission system;

- International: Russia has historically been a major supplier through pipelines like Trans-Balkan and TurkStream; EU countries (Hungary, Bulgaria, Austria) interact with Romania via gas interconnections; The U.S. and other LNG suppliers influence diversification strategies.

- Diversification hub: Its infrastructure could serve as a transit corridor for gas from the Black Sea, Azerbaijan, or LNG imports;

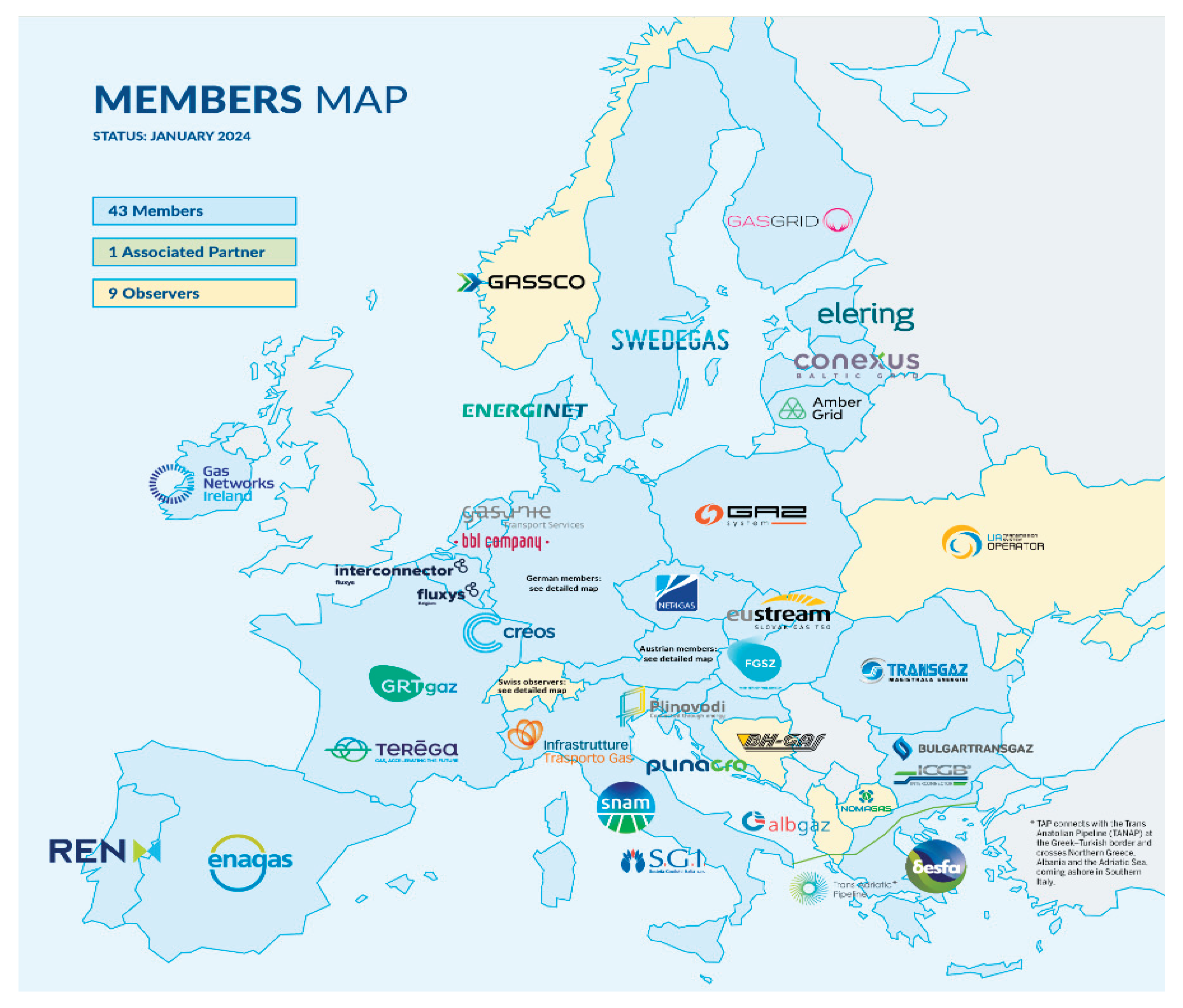

- Integration with EU energy markets: Romania is part of the European Network of Transmission System Operators for Gas (ENTSO-G), which coordinates cross-border gas flows;

- Storage capacity: Romania has significant underground storage (e.g., in Sărmășel and Bilciurești) to stabilize regional supply.

- Romania participates in the EU internal gas market;

- Cross-border gas trading is facilitated via market coupling mechanisms;

- System operation follows EU standards for reliability, transparency, and sustainability.

- Hungary, by gas pipeline: Arad – Csanadpalota;

- Republic of Moldova, by gas pipeline: Iasi – Ungheni;

- Bulgaria, by gas pipeline: Giurgiu – Ruse, Negru Vodă – Kardam 1, 2, 3;

- Ukraine, by gas pipeline: Medieșu Aurit – Tekovo, Isaccea – Orlovka 1, 2, 3.

- Security of supply;

- Gas network stability during peak demand or outages;

- Regional energy solidarity.

- Russia–EU relations: Romania’s gas system has historically depended on Russian gas, but recent geopolitical tensions push Romania toward diversification;

- Black Sea gas: The discovery of offshore reserves (Neptun Deep) could enhance Romania’s energy independence and export potential, shifting regional dynamics;

- Transit potential: Romania could act as a gateway for gas from Azerbaijan (via the Southern Gas Corridor) or LNG imports into Central and Southeastern Europe.

- EU directives: Compliance with the Third Energy Package, promoting competition and network unbundling;

- Interconnection projects: BRUA Pipeline (Bulgaria-Romania-Hungary-Austria), enhancing access to Central Europe; Romania-Hungary interconnector, facilitating gas flows between the two countries;

- Regional alliances: Collaboration with Black Sea countries to develop offshore resources.

- Modernization of infrastructure to meet EU standards;

- Political and regulatory uncertainty affecting foreign investment;

- Geopolitical pressures from Russia and energy market volatility.

- Export potential from Black Sea gas;

- Becoming a regional hub for diversified gas supply;

- Increasing renewable and hydrogen integration in line with EU Green Deal policies.

3.3.3. The National Nuclear System – International Relations

- Cernavodă Nuclear Power Plants: Only operational nuclear facility in Romania; Uses CANDU 6 reactors (Canadian Deuterium Uranium technology) – heavy water reactors; Current status: 2 reactors operational, 2 more planned or under consideration; Accounts for roughly 20% of Romania’s electricity;

- Nuclear Fuel Cycle: Romania has limited domestic uranium resources, but most fuel is imported; Heavy-water technology allows for on-site refueling without needing enriched uranium;

- Regulatory Bodies: National Commission for Nuclear Activities Control: nuclear safety, licensing; Romanian Atomic Forum: Industry promotion and international cooperation.

- International Treaties & Agreements: Non-Proliferation Treaty (NPT) – Romania is a non-nuclear-weapon state under the NPT; IAEA Safeguards – Romania adheres to inspections and reporting; Convention on Nuclear Safety – Ensures adherence to international nuclear safety standards; EURATOM Treaty – As an EU member, Romania participates in EU nuclear cooperation and regulation frameworks;

- Cooperation with Other Countries: Canada: CANDU reactor technology; ongoing collaboration for maintenance, upgrades, and fuel supply; France & USA: Technical support, safety upgrades, potential partnerships in future reactor development; Russia: Historically for reactor parts and fuel but reduced due to geopolitical concerns; European Union: Funding and regulatory oversight for nuclear safety and expansion projects.

- Nuclear Energy & EU Strategy: EU encourages member states to diversify energy sources while reducing carbon emissions; Romania’s nuclear expansion is aligned with EU climate and energy security goals, including reducing reliance on fossil fuels.

- Energy Security: Nuclear energy reduces Romania’s dependence on imported natural gas, particularly from Russia; Expanding nuclear capacity is seen as a strategic move for energy independence;

- Regional Influence: Romania’s nuclear program, though not militarized, increases its strategic value in Eastern Europe; Potential collaboration with neighbors (Bulgaria, Hungary) on grid integration and energy trade;

- Non-Proliferation Role: Romania supports international non-proliferation norms; Heavy water reactors raise some proliferation concerns globally (plutonium potential), but Romania remains under strict IAEA supervision.

- Cernavodă Units 3 & 4; Planned expansion could double nuclear output; Involves international partners (Canada, EU, potential US investment);

- Green Energy Transition: Nuclear power is central to Romania’s decarbonization strategy; Balancing nuclear with wind, solar, and hydro energy is key;

- International Partnerships: Further cooperation with NATO and EU in nuclear safety and emergency preparedness; Potential research in small modular reactors (SMRs) as part of innovation and export potential.

3.3.4. The National Mining System – International Relations

- Industrial backbone: Coal mining has been central to Romania’s industrial development, especially during the 19th and 20th centuries. The Jiu Valley in Transylvania and Oltenia regions were the main coal-producing areas;

- Social and political significance: Coal miners played a key role in Romania’s economy and politics, notably during the communist era. The mines were heavily state-subsidized, making Romania largely self-sufficient in energy production;

- Post-communist transition: After 1989, many coal mines became economically unviable due to inefficiency and competition from imported coal. Romania began privatization and restructuring, impacting international trade relations.

- Exports: Historically, Romania exported coal to neighboring countries (Hungary, Bulgaria, and former Yugoslav states) and some Western European markets;

- Imports: Modern Romania imports high-quality coal and coking coal for steel production from countries like Russia, Poland, and Australia;

- EU integration: Romania’s membership in the European Union (since 2007) affected coal trade: EU regulations on emissions, energy efficiency, and competition required Romania to adapt its mining sector.

- EU climate policies: Romania is part of the EU’s Green Deal, which promotes phasing out coal by 2030–2040; This has geopolitical implications because reducing coal reliance shifts Romania toward imports of gas or renewables, affecting relationships with energy exporters (e.g., Russia);

- Regional cooperation: Romania participates in Central and Eastern European energy networks, sharing technology, expertise, and sometimes coal supplies;

- Foreign investment: International companies (from Germany, Austria, and China) have been involved in modernizing Romanian mining equipment or energy infrastructure, linking Romania to global supply chains.

- Energy security: Coal was once a pillar of Romanian energy independence. Reducing coal dependence increases Romania’s reliance on natural gas, which has international security implications, particularly with Russia;

- Environmental diplomacy: Romania must balance EU pressure to cut coal usage with domestic economic interests in mining regions, sometimes causing friction in EU-level negotiations;

- Strategic positioning: Romania’s coal resources, while shrinking in global importance, remain part of its transition narrative, helping secure EU funding for clean energy and infrastructure projects.

- Economic viability: Most coal mines are not profitable without EU subsidies. International investors and EU funds support retraining workers and transitioning mines to renewable energy projects;

- Cross-border projects: Romania participates in energy grid integration projects with Hungary, Bulgaria, and Ukraine, partially motivated by the decline in domestic coal use;

- Research collaboration: Romanian universities and mining institutes collaborate internationally on cleaner mining technologies and carbon capture initiatives.

3.3.5. The National Power System – International Relations

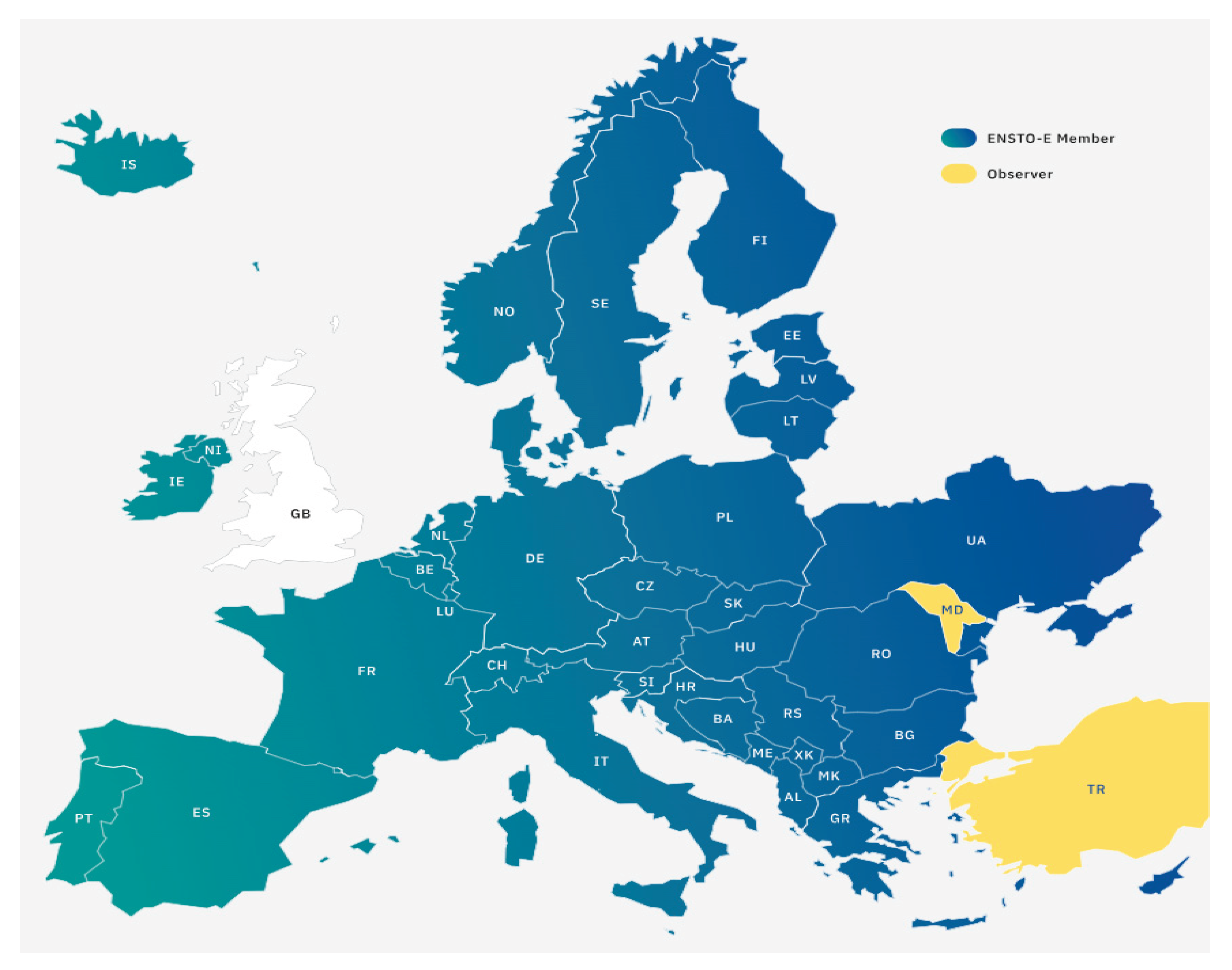

- Romania participates in the EU internal electricity market;

- Cross-border electricity trading is facilitated via market coupling mechanisms;

- System operation follows EU standards for reliability, transparency, and sustainability.

- Hungary, by 400 kV OHL: Nadab – Bekescsaba and Arad – Sandorfalva OHL;

- Bulgaria, by 400 kV OHL: Țânțăreni – Kosloduy, Rahman – Dobrudja and Stupina – Varna;

- Serbia, by 400 kV OHL: Resita – Pancevo 2 and Porțile de Fier – Djerdap;

- Ukraine, by 400 kV OHL: Roșiori – Mukacevo and Isaccea – Southern Ukraine (cancelled);

- Republic of Moldova, by 400 kV OHL: Isaccea – Vulcanesti.

- Security of supply;

- Grid stability during peak demand or outages;

- Regional energy solidarity.

- A diversified energy mix (hydro, nuclear, fossil fuels, renewables);

- Domestic electricity generation capacity;

- Reduced dependency on external electricity imports.

- Canada;

- EU institutions;

- International Atomic Energy Agency (IAEA).

- EU climate and energy targets;

- Cross-border renewable integration;

- Participation in regional balancing and ancillary services markets.

- The Energy Community;

- Regional electricity market integration initiatives in Southeast Europe;

- EU-funded infrastructure projects (PCI – Projects of Common Interest).

- Grid modernization to accommodate renewables;

- Managing cross-border congestion;

- Aligning national policies with evolving EU regulations.

4. Diplomacy and Energy Policy – An Integral Part of the Security of Energy Communities

- Ensuring access to resources – negotiating contracts for the import or export of natural gas, oil, nuclear energy, or renewable sources;

- Energy market stability – cooperation between states to prevent energy crises and avoid extreme price fluctuations;

- Geopolitical influence – energy becomes a tool of power in international relations, affecting alliances and the strategic position of states.

- Diversification of energy sources – to reduce dependence on a single supplier or type of resource;

- Promotion of renewable and efficient energy – to reduce vulnerabilities and environmental impact;

- Strategic infrastructure planning – transport, storage, and distribution networks designed to withstand economic or political shocks.

- International agreements – such as energy cooperation treaties, which provide both stability and predictability for investments;

- Response to energy crises – coordination between states to prevent shortages or manage emergency situations;

- Regional integration – energy communities like those in the EU or ASEAN optimize their resources through diplomatic cooperation and joint strategies.

- Geopolitical tensions – conflicts between states can affect energy supply;

- Dependence on external resources – vulnerability to price fluctuations or embargoes;

- Energy transition – the shift to renewable sources requires investment and international coordination.

5. Development and Implementation of the Energy Security Strategy at Community, National and Regional Level

- Strict legislation and regulations on energy safety and security;

- Establishment of strategic funds for investments and emergency situations;

- Education and awareness programs on energy efficiency;

- Research and innovation for sustainable and resilient technologies.

6. Conclusions

- Community Solar, Energy Clubs & Prosumers: Energy communities are enabling local production, use, and trading of electricity – reducing dependence on large utilities and grid congestion. Households with solar panels, batteries, and EVs can exchange energy within the community; Cooperative models (e.g., in the UK & Spain) let residents link consumption with local renewables and benefit from lower prices and reduced bills (~10–30% reported);

- Peer-to-Peer (P2P) Trading: Academic and industry research highlights blockchain and P2P platforms to support transparent, decentralized energy transactions among community members (prosumers and consumers).

- AI, IoT & Predictive Energy Management: The integration of AI and IoT enables real-time monitoring, predictive load balancing, and dynamic energy sharing to optimize local grids;

- Smart Meters & Grid Automation: Smart meters and analytics let consumers track usage and support efficient energy distribution – key foundations for SECs.;

- Blockchain & Digital Platforms: Blockchain-based energy management systems are being tested to eliminate intermediaries, enhance scalability, and tailor community solutions.

- Microgrid Expansion: Community microgrids that combine local renewables, storage, and control systems are spreading – especially in the U.S., Europe, and island contexts – boosting resilience and sustainability;

- Interconnected Multi-Site Systems: Trends show a shift from isolated microgrids to connected local energy networks managing multiple sites or clusters for broader energy reliability.

- Growing Market Size: The SEC and broader smart community markets are projected to grow rapidly over the next decade (e.g., revenue rising significantly by 2032);

- EU & National Policies Supporting Energy Communities: European policies (e.g., Spain’s RD-Law and EU renewable community frameworks) are accelerating adoption by enabling shared self-consumption and broader distribution areas;

- Grid Integration Challenges & Opportunities: Energy community growth prompts changes in market design, regulation, and grid architecture to fully integrate localized energy resources.

- Energy Access & Equity: Community projects are making renewable energy more accessible to vulnerable and low-income households, reducing energy poverty;

- Local Sustainability: SECs lower carbon emissions and enhance local energy resilience, especially in regions with extreme weather or grid vulnerabilities.

- Decentralization - Prosumer-driven energy generation & local trading;

- Digitalization – AI, IoT, blockchain improve energy management;

- Resilience – Microgrids strengthen local energy security;

- Policy support – Regulatory frameworks enable SEC growth;

- Market expansion – Smart energy community solutions growing fast.

References

- Popescu, C.; Panait, M.; Palazzo, M.; Siano, A. Energy Transition in European Union—Challenges and Opportunities. In Energy Transition. Industrial Ecology; Khan, S.A.R., Panait, M., Guillen, Puime, Raimi, F.L., Eds.; Springer: Singapore, 2022. [Google Scholar]

- Daniel Fîță, Sorin Mihai Radu, Marcela Draghilă, Antonia Obreja, Ioan Sima, Cristian Sigheartău, Alin Cruceru, Alexandru Radu, Geopolitics, International Relations, Security Studies (in romanian: Geopolitică, Relații internaționale, Studii de securitate), Risoprint Cluj Napoca Publishing House. 2025; ISBN 978-973-53-3386-7.

- Glover, J.D.; Overbye, T.; Sarma, M.S. Power System Analysis and Design, 6th ed.; John Wiley and Sons: Hoboken, NJ, USA, 2017. [Google Scholar]

- Wen, B.; Wang, J.; Guo, Y. Big Data Analytics for Smart Grid: A Review. Renew. Sustain. Energy Rev. 2018, 91, 720–733. [Google Scholar]

- Daniel Fîță, Alin Cruceru, Gabriela Popescu, Marcela Draghilă, Asami Lișu, Alexandru Radu, Smart Power – Analysis of Soft and Hard Power in International Relations (in romanian: Smart Power – Analiza Soft și Hard în Relațiile Internaționale), Risoprint Cluj Napoca Publishing House. 2025; ISBN 978-973-53-3461-1.

- Budka, K.C.; Deshpande, J.G.; Thottan, M. Communication Networks for Smart Grids; Springer: London, UK, 2014. [Google Scholar]

- Farhangi, H. A Road Map to Integration: Perspectives on Smart Grid Development. IEEE Power Energy Mag. 2014, 12, 52–66. [Google Scholar] [CrossRef]

- Daniel Fîță, Olga Bucovețchi, Gabriel Bujor Băbuț, Alin Cruceru, Alexandru Radu, Marcela Drăghilă, Asami Lișu, Resilience – The New Vector of Global Power. Geopolitics, Hard & Soft Power, and the Dynamics of International Relations (in romanian: Reziliența – Noul vector al puterii mondiale. Geopolitica, Hard & Soft Power și dinamica Relațiilor Internaționale), Risoprint Cluj Napoca Publishing House. 2025; ISBN 978-973-53-3480-2.

- Bórawski, P.; Holden, L.; Bełdycka-Bórawska, A. Perspectives of Photovoltaic Energy Market Development in the European Union. Energy 2023, 270, 126804. [Google Scholar] [CrossRef]

- Petrilean, D.C.; Fîță, N.D.; Vasilescu, G.D.; Ilieva-Obretenova, M.; Tataru, D.; Cruceru, E.A.; Mateiu, C.I.; Nicola, A.; Darabont, D.-C.; Cazac, A.-M.; Bejinariu, C. Sustainability Management Through the Assessment of Instability and Insecurity Risk Scenarios in Romania’s Energy Critical Infrastructures. Sustainability 2025, 17, 2932. [Google Scholar] [CrossRef]

- Rîurean, S.; Fîță, N.D.; Pasculescu, D.; Slușariuc, R. Securing Photovoltaic Systems as Critical Infrastructure: A Multi-Layered Assessment of Risk, Safety, and Cybersecurity. Sustainability 2025, 17, 4397. [Google Scholar] [CrossRef]

- Beňa, L.; Nowak, M.; Kusiński, M. Analysis of the Impact of Micro Photovoltaic Installations on the Voltage in the Low Voltage Distribution Network. Int. J. Power Syst. Eng. 2021, 12, 89–101. [Google Scholar]

- Fita, N.D.; Utu, I.; Marcu, M.D.; Pasculescu, D.; Mila, I.O.; Popescu, F.G.; Lazar, T.; Schiopu, A.M.; Muresan-Grecu, F.; Cruceru, E.A. Global Energy Crisis and the Risk of Blackout: Interdisciplinary Analysis and Perspectives on Energy Infrastructure and Security. Energies 2025, 18, 4244. [Google Scholar] [CrossRef]

- Pasculescu, D.; Riurean, S.; Obretenova, M.I.; Lazar, T.; Tatar, A.M.; Fita, N.D. Intelligent Modeling of PV – BESS Microgrids for Enhanced Stability, Cyber–Physical Resilience and Blackout Prevention. Energies 2025, 19, no. 1:148. [Google Scholar] [CrossRef]

- OMV Petrom Company. 2026. Available online: https://www.omvpetrom.com/en (accessed on 4 January 2026).

- Petroleum Services Group Company. 2026. Available online: https://www.gspoffshore.com/ (accessed on 4 January 2026).

- Conpet Company. 2026. Available online: https://www.conpet.ro/ (accessed on 4 January 2026).

- Oil Terminal Company. 2026. Available online: https://oil-terminal.com/en/ (accessed on 4 January 2026).

- Rompetrol Rafinare Company. 2026. Available online: https://rompetrol-rafinare.kmginternational.com/en/homepage (accessed on 4 January 2026).

- Lukoil Company. 2026. Available online: https://lukoil.ro/ro (accessed on 4 January 2026).

- Romgaz Company. 2026. Available online: https://www.romgaz.ro/en (accessed on 4 January 2026).

- Transgaz Company. 2026. Available online: https://www.transgaz.ro/ro (accessed on 4 January 2026).

- National Uranium Company. in romanian: Compania Natională a Uraniului. 2026. Available online: https://www.cnu.ro/ (accessed on 4 January 2026).

- Nuclearelectrica Company. 2026. Available online: https://nuclearelectrica.ro/cne/ (accessed on 4 January 2026).

- Autonomous Administration for Nuclear Activities (in romanian: Regia Autonomă a Activităților Nucleare). 2026. Available online: http://www.raan.ro/ (accessed on 4 January 2026).

- National Heavy Water Management Center Centrul National de Management al Apei Grele. 2026. Available online: https://www.cnmag.ro/ (accessed on 4 January 2026).

- Jiu Valley Energy Complex Complexul Energetic Valea Jiului. 2026. Available online: https://www.cevj.ro/ (accessed on 4 January 2026).

- Oltenia Energy Complex (in romanian: Complexul Energetic Oltenia). 2026. Available online: http://ceoltenia.ro/ro/ (accessed on 4 January 2026).

- Transelectrica Company. 2026. Available online: https://www.transelectrica.ro/ (accessed on 4 January 2026).

- The European Network of Transmission System Operators for Gas – ENTSO-G. 2026. Available online: https://www.entsog.eu/ (accessed on 4 January 2026).

- The European Network of Transmission System Operators for Electricity – ENTSO-E. 2026. Available online: https://www.entsoe.eu/ (accessed on 4 January 2026).

- Bórawski, P.; Holden, L.; Bełdycka-Bórawska, A. Perspectives of Photovoltaic Energy Market Development in the European Union. Energy 2023, 270, 126804. [Google Scholar] [CrossRef]

- Beňa, L.; Nowak, M.; Kusiński, M. Analysis of the Impact of Micro Photovoltaic Installations on the Voltage in the Low Voltage Distribution Network. Int. J. Power Syst. Eng. 2021, 12, 89–101. [Google Scholar]

- Fuentes, S.; Villafafila-Robles, R.; Lerner, E. Composed Index for the Evaluation of the Energy Security of Power Systems: Application to the Case of Argentina. Energies 2020, 13, 3998. [Google Scholar] [CrossRef]

- Motakatla, V.R.; Liu, W.; Hao, J.; Padullaparti, H.V.; Kumar, U.; Choi, S.L.; Mendoza, I. Integrated Transmission and Distribution Co-Simulation Platform for Demonstration of Bulk Grid Services Using Distributed Energy Resources. Energies 2024, 17, 3215. [Google Scholar] [CrossRef]

- Nguyen, H. Newton-Raphson Method in Complex Form for Power System Load Flow Analysis. IEEE Trans. Power Syst. 2000, 15, 123–131. [Google Scholar] [CrossRef]

- Ulbig, A.; Borsche, T.S.; Andersson, G. Impact of Low Rotational Inertia on Power System Stability and Operation. IFAC Proc. Vol. 2014(47), 7290–7297. [CrossRef]

- Li, H.; Vittal, V. Co-Simulation for Power System Dynamic Analysis. In Proceedings of the IEEE PES General Meeting, San Diego, CA, USA, 22–26 July 2012; pp. 1–8. [Google Scholar]

- Siozinys, V.; Siozinys, M.; Rimkus, A.; Dapkute, A. Virtual Power Plant as a Tool for Cost-Reflective Network Charging and Energy Management. Elektron. Elektrotechnika 2023, 29, 35–42. [Google Scholar]

- Motter, A.E.; Lai, Y.C. Cascade-Based Attacks on Complex Networks. Phys. Rev. E 2002, 66, 065102(R). [Google Scholar] [CrossRef] [PubMed]

- Zhou, K.; Yang, S. Digital Twin Framework and Its Application to Power Grid. CSEE J. Power Energy Syst. 2019, 5, 156–163. [Google Scholar]

- Sioshansi, F.P. Smart Grid: Integrating Renewable, Distributed and Efficient Energy; Elsevier: Waltham, MA, USA, 2012. [Google Scholar]

| Nr. Crt. |

STEPS | RESOURCE TYPE | OPERATOR |

|---|---|---|---|

| 1. | Resource Management | hydrocarbon | National Agency for Mineral Resources |

| 2. | Prospect onshore | hydrocarbon | Prospecting Operators |

| 3. | Exploration – Development – Exploitation onshore | hydrocarbon | OMV Petrom |

| Other Exploration Operators – Development – Operation | |||

| Exploration – Development – Exploitation offshore | OMV Petrom | ||

| Other Exploration Operators – Development – Operation | |||

| 4. | Transport | oil | CONPET |

| 5. | Storage | oil | OMV Petrom |

| OIL Terminal | |||

| CONPET | |||

| fuel | OMV Petrom | ||

| Lukoil | |||

| Rompetrol Refine | |||

| 6. | Refinement | oil | OMV Petrom (Petrobrazi) |

| Rompetrol Rafine (Petromidia, Vega) | |||

| Lukoil (Petrotel Lukoil) | |||

| other Refining Operators | |||

| 7. | Distribution | fuel | OMV |

| Petrom | |||

| Rompetrol Rafine | |||

| Lukoil | |||

| other operators |

| Nr. Crt. |

STEPS | RESOURCE TYPE | OPERATOR |

|---|---|---|---|

| 1. | Resource Management | hydrocarbon | National Agency for Mineral Resources |

| 2. | Prospect onshore | hydrocarbon | Prospecting Operators |

| 3. | Exploration – Development – Exploitation onshore | hydrocarbon | Romgaz |

| OMV Petrom | |||

| Other Exploration Operators – Development – Operation | |||

| Exploration – Development – Exploitation offshore | OMV Petrom | ||

| Romgaz | |||

| Other Exploration Operators – Development – Operation | |||

| 4. | Transport | natural gases | Transgaz |

| 5. | Storage | natural gases | Romgaz - Depogaz Ploiești |

| Engie - Depomureș | |||

| 6. | Distribution | natural gases | Distribution Operators |

| 7. | Supply | natural gases | Supply Operators |

| Nr. Crt. |

STEPS | RESOURCE TYPE | OPERATOR | SUBOPERATOR |

|---|---|---|---|---|

| 1. | Resource Management | uranium ore | National Agency for Mineral Resources | |

| 2. | Exploitation | uranium ore | National Uranium Company | Uranium Mining Crucea |

| Uranium Mining Botusana | ||||

| 3. | Processing / Refining | uranium ore | National Uranium Company | Feldioara Plant |

| 4. | Manufacture of Nuclear Fuel | nuclear fuel bundles | Nuclearelectrica | Pitesti Nuclear Fuel Factory |

| 5. | Electricity Production | natural uranium | Nuclearelectrica | Cernavoda Nuclear Power Plant |

| heavy water | National Center for Heavy Water Management CNMAG (state reserves: heavy water) |

ROMAG PROD Heavy Water Plant Drobeta Turnu Severin | ||

| National Administration of State Reserves and Special Issues - Ministry of Internal Affairs (state reserves: heavy water) | ||||

| 6. | Storage | radioactive waste | Nuclearelectrica | Cernavoda Nuclear Power Plant |

| Nr. Crt. |

STEPS | RESOURCE TYPE | OPERATOR | SUBOPERATOR |

|---|---|---|---|---|

| 1. | Resource Management | coal coal / lignite |

National Agency for Mineral Resources | |

| 2. | Exploitation Preparation Transport |

coal | Jiu Valley Energy Complex | Lonea Mining, Livezeni Mining, Vulcan Mining, Lupeni Mining |

| lignite | Oltenia Energy Complex | Roșia – Rovinari Mining, Jilț Mining, Motru Mining |

||

| 3. | Electricity generation | coal | Jiu Valley Energy Complex | Paroșeni Power Plant |

| lignite | Oltenia Energy Complex | Rovinari Power Plant, Turceni Power Plant, Ișalnița Power Plant, Craiova II Power Plant | ||

| THE COUNTRY | CONNECTION TYPE (Overhead Power Line) |

VOLTAGE LEVEL |

|---|---|---|

| Ukraine | Roșiori – Mukacevo | 400 kV – connection to the EU |

| Isaccea – Southern Ukraine | 400 kV (750 kV gauge) – decommissioned line | |

| Hungary | Nadab – Bekescsaba | 400 kV – connections to the EU |

| Arad – Sandorfalva | ||

| Serbia | Resita – Pancevo 2 | 400 kV – connections to the EU |

| Iron Gates – Djerdap | ||

| Bulgaria | Țânțăreni – Kosloduy | 400 kV – connections to the EU |

| Rahman – Dobrudja | ||

| Stupina – Varna | 400 kV (750 kV gauge) – connection to the EU | |

| Republic Of Moldova | Isaccea – Vulcanesti | 400 kV |

| No. | Fuel type | Power [MW] |

Name of Power Plant |

|---|---|---|---|

| a) | Water operators | 6 762 | Hidroelectrica |

| b) | Nuclear operators | 1 413 | Nuclearelectrica |

| c) | Coal operators | 6 240 | Jiu Valley Energy Complex, Oltenia Energy Complex |

| d) | Hydrocarbon operators | 5 787 | OMV Petrom, Romgaz |

| e) | Aeolian operators | 3 027 | Renewable Energy Sources operators |

| f) | Biomass operators | 130 | |

| g) | Photovoltaic operators | 1 348 | |

| TOTAL | 24 738 |

| Nr. Crt. |

STEPS | RESOURCE TYPE | OPERATOR | SUBOPERATOR |

|---|---|---|---|---|

| 1. | Resource Management | oil | National Agency for Mineral Resources | |

| natural gases | ||||

| uranium ore | ||||

| coal | ||||

| 2. | Production | natural gases | Romgaz SA / OMV Petrom SA | |

| coal: lignite | Oltenia Energy Complex | |||

| coal: coal | Jiu Valley Energy Complex | |||

| uranium ore | Nuclearelectrica | |||

| the water | Hidroelectrica | |||

| 3. | Transport | electricity | Transelectrica | |

| 4. | Distribution | electricity | Distribuţie Energie Electrică România | |

| Rețele Electrice România | ||||

| DelGaz Grid | ||||

| Distribuție Oltenia | ||||

| 5. | Supply | electricity | Supply operators | |

| Level | Sector | Main objectives | Strategic Measures / Instruments | Examples / Comments |

|---|---|---|---|---|

| Community | Oil | Ensuring local supply, reducing dependence on imports | Local fuel stocks; Partnerships with local distributors; Promotion of alternative transport and energy efficiency. |

Community fuel stations, local car-sharing programs |

| Gas | Continuity of supply, consumer safety | Network monitoring systems; Emergency plans in case of shortages; Community awareness for responsible consumption. |

Community Gas Information and Alert Centers | |

| Nuclear | Education and information, public safety | Information campaigns; Emergency drills and training. |

Public training in the event of nuclear incidents | |

| Mining | Occupational safety and environmental protection | Strict safety regulations; Environmental and pollution monitoring. |

Local Environmental and Safety Inspectorates | |

| Electricitity | Continuity of supply, reduction of consumption | Backup systems (generators); Energy efficiency program; Loss detection. |

Community Microgrids, Smart Public Lighting | |

| National | Oil | Supply security, price stability | National strategic stocks; Diversification of sources; Regulations and import/export taxes. |

Strategic oil reserves, international agreements |

| Gas | Reducing external dependency, ensuring supply continuity | Development of transport and storage infrastructure; Long-term contracts with various suppliers; Alternative sources (LNG). |

LNG Terminals, Regional Interconnections |

|

| Nuclear | Energy independence, power plant safety | Development of own nuclear capabilities; Strict safety regulations; Nuclear waste management. |

Nuclear Power Plant, National Agency for Nuclear Safety | |

| Mining | Supply of strategic resources | Sustainable resource exploitation; Strict regulation and export control. |

Coal resources, critical ores |

|

| Electricitity | Continuity of supply, system flexibility | National Energy and Smart Grid Plan; Storage and Renewable Capacities; Regional Interconnections. |

Smart grids, backup power plants |

|

| Regional | Oil | Cross-Border energy stability and security | Regional strategic infrastructure; Cooperation agreements; Monitoring of regional; markets |

Oil corridors, regional hubs |

| Gas | Common security, vulnerability reduction | Interconnections between countries; Regional LNG infrastructure; Crisis response plans. |

European gas networks, common storage |

|

| Nuclear | Regional standardization and safety | Standardization of nuclear regulations; Cooperation in case of incidents; Joint research projects. |

International Atomic Energy Agency (IAEA) | |

| Mining | Ensuring access to critical resources | Joint projects for mining and recycling; Supply chain security policies. |

European strategic resources, ore recycling |

|

| Electricitity | Regional grid stability and energy transition | Regional energy markets; Interconnected grids and shared storage; Regional green energy projects. |

European networks, HVDC interconnections, joint offshore wind farms |

| Level | Sector | Strategic Directions | Concrete actions |

|---|---|---|---|

| Community | Oil | Reducing dependence on fuels | Promotion of public and alternative transportation (bicycles, electric vehicles); Local fuel storage for critical situations. |

| Gas | Increasing consumption efficiency | Thermal insulation of buildings; Local programs for responsible consumption. |

|

| Nuclear | Information and Safety | Community education regarding nuclear power plants; Local evacuation plans and emergency drills. |

|

| Mining | Sustainable exploitation | Monitoring environmental impact; Material recycling projects. |

|

| Electricitity | Responsible consumption and resilience | Installation of solar panels on public buildings; Local microgrids for continuity. |

|

| National | Oil | Diversification of sources | Conclusion of international agreements for supply; Development of domestic refineries. |

| Gas | Supply Security | Development of gas infrastructure (pipelines, LNG terminals); National strategic reserves. |

|

| Nuclear | Development and modernization of capacities | Modernization of existing power plants; Investments in nuclear research and safe fuel. |

|

| Mining | Ensuring Strategic Resources | Controlled exploitation of critical resources; Strict environmental regulations. |

|

| Electricitity | Sustainability and Reliability | Development of smart grids; Investments in renewable energy and hydropower. |

|

| Regional | Oil | Interstate cooperation | Creating common reserves; Regional oil crisis plans. |

| Gas | Interconnectivity and Diversification | Development of gas corridors between countries; Regional partnerships for LNG. |

|

| Nuclear | Safety and Standardization | Regional agreements on nuclear safety; Exchange of best practices and monitoring. |

|

| Mining | Sustainable development | Cooperation for the responsible exploitation of resources; Standardization regarding environment and safety. |

|

| Electricitity | Interconnection and Stability | Creation of regional energy markets; Common backup and support systems in case of shortages. |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2026 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).