1. Introduction

The integration of Environmental, Social, and Governance (ESG) criteria into commercial real estate (CRE) practices has evolved from a niche concern to a foundational aspect of sustainable development and investment strategy. Amid growing climate risks, investor activism, and shifting workforce expectations, the office building sector has emerged as a critical testing ground for ESG application (Beeferman, 2020; Rees & Briône, 2024). The office environment—where millions of employees spend a substantial portion of their daily lives—not only shapes environmental outcomes through energy use and emissions but also exerts profound influence on health, productivity, equity, and organizational identity (Kropman et al., 2023; McGrath & Worzala, 2024).

Green certification systems such as LEED, BREEAM, WELL, and NABERS now dominate sustainable building discourse, offering measurable frameworks to improve energy performance, water use, indoor environmental quality, and occupant well-being. Yet, mounting evidence questions whether these systems consistently deliver on their promises. Studies have revealed substantial performance gaps between certified buildings and actual post-occupancy outcomes, particularly in energy consumption and user satisfaction (Scofield et al., 2021; Leite Ribeiro et al., 2025). Moreover, these frameworks often fail to account for contextual variables such as local climate, building typology, and user behavior—factors that are increasingly crucial in a post-pandemic, hybrid-work era (Licina & Yildirim, 2021; Wan et al., 2022).

Simultaneously, attention to the social sustainability of office environments has intensified. Mental health, employee well-being, and inclusive workplace cultures are now recognized as critical components of corporate performance and risk management (Kelloway et al., 2023; Sadick & Kamardeen, 2020). Evidence from workplace design studies demonstrates that natural light, biophilic elements, acoustic control, and thermal comfort significantly influence cognitive performance, stress levels, and organizational outcomes (Gritzka et al., 2020; Jensen & van der Voordt, 2020). However, these design principles are often inconsistently applied, and robust, longitudinal evaluations of their efficacy remain limited.

Against this backdrop, the digitalization of office environments—via Internet of Things (IoT), smart sensors, and AI-enabled infrastructure—offers new opportunities for real-time ESG monitoring and adaptive workplace design (Zhang et al., 2022; Blazevic & Riehle, 2024). Smart office systems promise to optimize energy use, monitor employee health, and enhance space utilization. Yet, they also raise ethical and operational challenges around data privacy, user acceptance, and system interoperability (Mamoojee, 2023; Nappi & Ribeiro, 2020).

At the governance level, ESG reporting frameworks remain fragmented, with substantial variation in disclosure standards, workforce representation, and the treatment of Scope 3 emissions (Tsairi & Martens, 2024; Nováková, 2024). Despite widespread adoption of corporate sustainability rhetoric, meaningful stakeholder engagement and board-level accountability for ESG outcomes remain elusive (Rees & Briône, 2024). Nonetheless, emerging evidence indicates that ESG-aligned strategies—ranging from spatial equity and ethical finance to inclusive design—can generate both reputational and financial returns, particularly in premium office markets (Valero, 2025; Liu et al., 2025).

2. Methodology

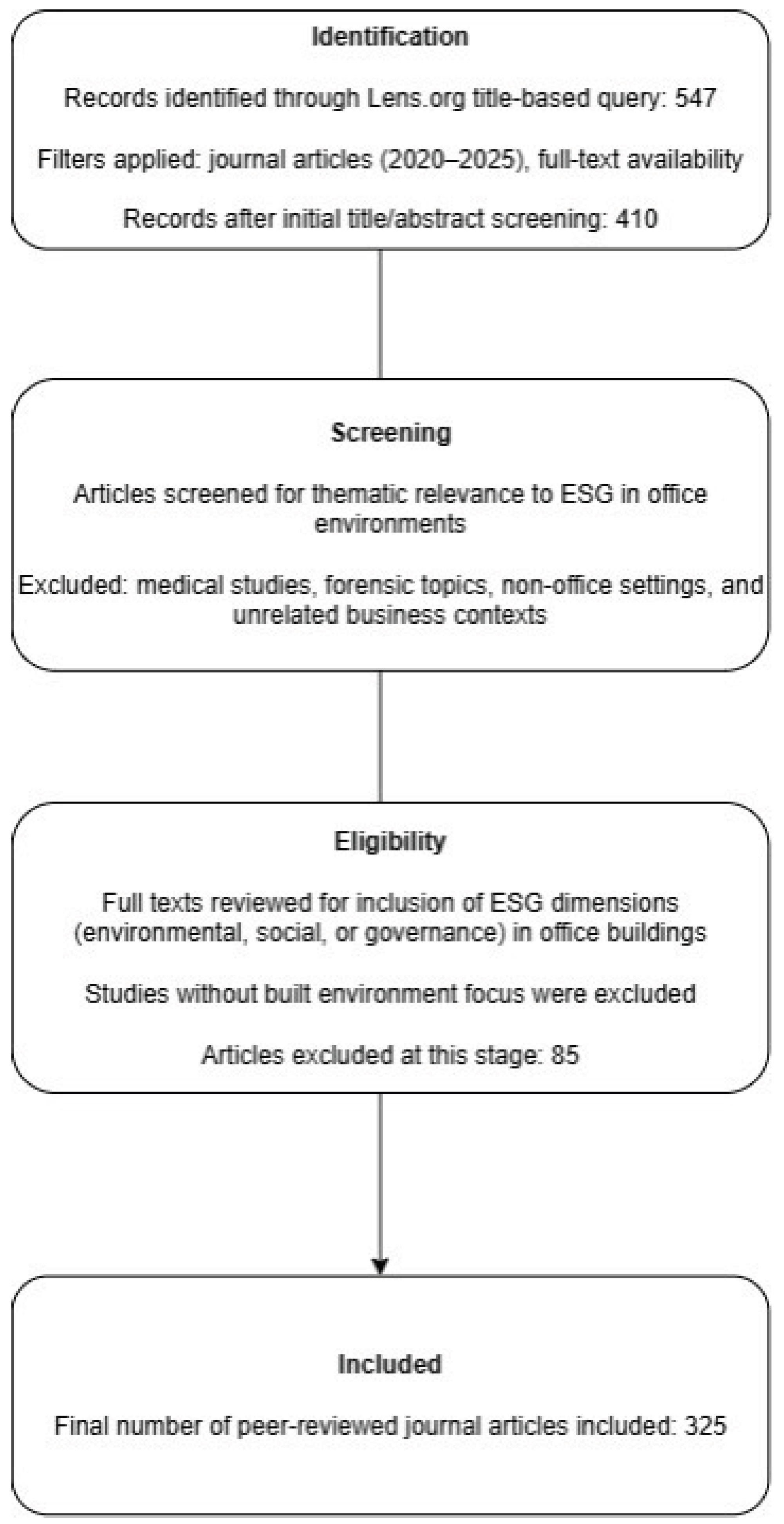

This study followed the PRISMA 2020 guidelines to conduct a systematic literature review of peer-reviewed journal articles examining ESG practices in office environments. The dataset was retrieved from Lens.org using a title-based search query targeting ESG and office-related concepts. Articles were screened for relevance through two rounds, resulting in a final dataset of 325 articles published between 2020 and 2025. Articles were included if they discussed environmental sustainability, social equity, or governance frameworks within office buildings. Exclusions were made for medical, forensic, or irrelevant business contexts.

Figure 1.

PRISMA 2020 flowchart illustrating the selection process for peer-reviewed journal articles on ESG practices in office environments (2020–2025), retrieved from Lens.org. A total of 547 records were identified, with 325 meeting full inclusion criteria after two screening stages.

Figure 1.

PRISMA 2020 flowchart illustrating the selection process for peer-reviewed journal articles on ESG practices in office environments (2020–2025), retrieved from Lens.org. A total of 547 records were identified, with 325 meeting full inclusion criteria after two screening stages.

Flowchart showing article selection using PRISMA 2020 methodology. Begins with 547 records identified from Lens.org. After screening and eligibility review, 325 articles included in final analysis, with exclusions due to topic irrelevance or lack of ESG/office focus.

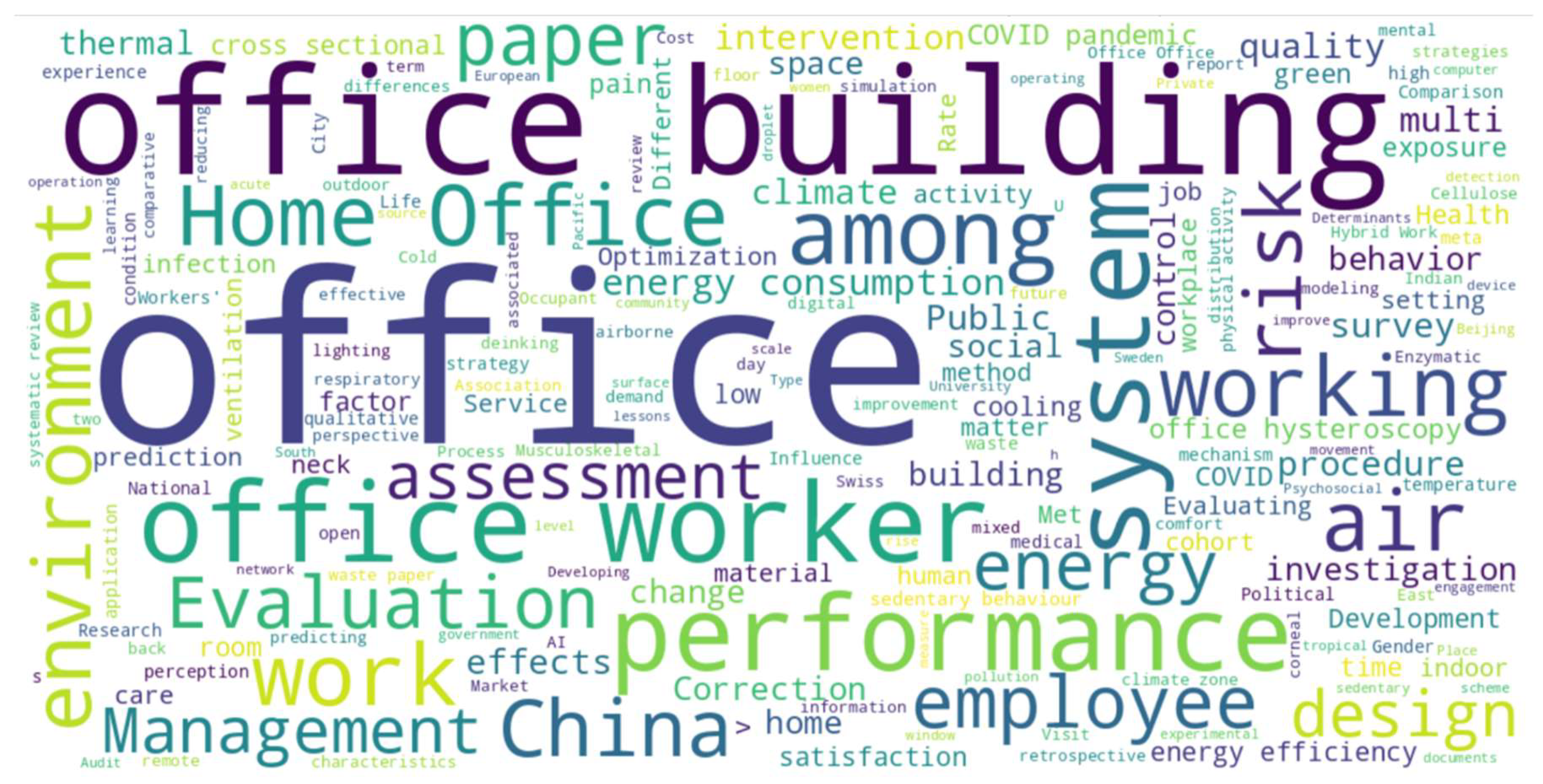

To identify major conceptual trends, a thematic analysis was conducted using lexical patterns derived from article titles. A word cloud visualization was generated to capture the frequency and prominence of terms appearing across the dataset. Keywords such as “building,” “performance,” “energy,” “employee,” “system,” “green,” and “governance” emerged as central themes. These insights guided the development of five thematic clusters presented in the literature review: (1) green certification and environmental performance, (2) social sustainability and employee wellbeing, (3) ESG governance and reporting, (4) digital ESG monitoring, and (5) financial implications of ESG in office investments.

Figure 2.

Word cloud of lexical patterns found in titles of ESG + office-related articles (2020–2025). Prominent terms include “office,” “building,” “worker,” “performance,” “energy,” “system,” and “design,” reflecting major conceptual trends across the literature.

Figure 2.

Word cloud of lexical patterns found in titles of ESG + office-related articles (2020–2025). Prominent terms include “office,” “building,” “worker,” “performance,” “energy,” “system,” and “design,” reflecting major conceptual trends across the literature.

Word cloud visualization highlighting frequent terms in ESG-office literature titles from 2020–2025. Words like “office,” “building,” “worker,” “performance,” “system,” and “energy” are most prominent, indicating key research themes in the field.

3. Thematic Analysis Literature Review

Green Certifications and Environmental Performance in Office Buildings

Green building certifications such as LEED, BREEAM, WELL, and NABERS have emerged as central tools in promoting sustainability within commercial real estate, particularly office buildings. These systems not only set benchmarks for energy performance but increasingly prioritize human well-being and post-occupancy outcomes. Across diverse empirical and conceptual studies, scholars have interrogated both the efficacy and limitations of certification systems, revealing a complex interplay between environmental metrics, organizational strategy, and actual building performance.

Several studies emphasize the shift toward occupant-centric sustainability, with WELL certification leading this reorientation. Grzegorzewska and Kirschke (2021), examining six WELL-certified office buildings in Poland, illustrate how design criteria related to thermal comfort, ventilation, daylight access, and active lifestyle infrastructure enhance both employee satisfaction and productivity. Their work supports the claim that green certifications are increasingly perceived as organizational value drivers, providing not just environmental gains but also strategic advantages in talent retention and branding.

Yet, the effectiveness of such certifications in achieving intended environmental outcomes remains contested. Leite Ribeiro et al. (2025) critically assess the heterogeneous energy performance of LEED-certified buildings, pointing to a disjunction between certification levels and actual energy use. Specifically, buildings in warmer climates—due to over-reliance on ASHRAE 90.1 standards—may suffer from thermal inefficiencies, highlighting the limitations of one-size-fits-all certification frameworks. Their call for contextual adaptations and robust post-occupancy evaluation (POE) resonates with Scofield et al. (2021), whose analysis of 4,400 U.S. office buildings reveals that only LEED Gold-certified buildings reliably outperform their non-certified counterparts. Notably, the disconnect between LEED scoring mechanisms and real-world energy savings—with negligible correlation (R2 < 1%)—raises critical questions about the predictive validity of such frameworks.

In contrast, Gui and Gou (2020) present NABERS as a more performance-sensitive system, capable of differentiating outcomes across energy, emissions, water use, and indoor environmental quality (IEQ). Their dataset of 2,657 office buildings in Australia demonstrates strong empirical relationships between higher certification levels and tangible improvements in both resource efficiency and occupant comfort. Their proposed Built Environment Efficiency (BEE) metric innovatively integrates IEQ with energy/emissions data, offering a composite performance tool that addresses the decoupling problem often seen in LEED and BREEAM assessments.

Beyond building metrics, green certifications are increasingly implicated in workplace culture and employee behavior. Parida et al. (2021) introduce a behavioral dimension to green building literature through Green Human Resource Management (GHRM). Their study finds that GHRM practices catalyze employees’ green behaviors, enhance organizational identification, and improve work satisfaction—mediated by social identity theory. Such findings advance the argument that green buildings must be accompanied by institutional practices to unlock their full organizational potential.

A methodological response to certification critiques is provided by Šuman et al. (2020), who combine certification schemes with cost-benefit analysis (CBA) to guide early-stage renovation decisions. Their four-step framework integrates environmental and economic performance, using BREEAM’s refurbishment criteria to evaluate renovation scenarios. The case study from Slovenia shows that additional sustainability upgrades improve both certification outcomes and economic feasibility, particularly when multi-project benefits such as increased property value are monetized.

The post-certification performance gap remains a pervasive concern. Afroz et al. (2020) review post-occupancy monitoring across major certification systems and highlight the lack of standardized protocols for data collection, submetering, and user feedback. They argue that without robust data infrastructures, certification becomes an episodic event rather than a sustained performance commitment. Similarly, Licina and Yildirim (2021), through a rare cohort-based longitudinal design, find that WELL-certified offices yielded only marginal improvements in satisfaction and productivity compared to BREEAM or conventional buildings. Noise and visual comfort remained persistent issues, and SBS symptoms were not consistently reduced, suggesting diminishing marginal benefits of higher-tier certifications absent contextual tailoring.

From an economic standpoint, green certifications continue to yield rental premiums despite performance gaps. Li et al. (2021) document a 19.5% average rental premium for LEED-certified buildings in China, with effects reaching up to 25.5% in cities like Shanghai. These premiums, they argue, are partly due to early adoption advantages in an emerging market and the strong signaling value of certification to environmentally conscious tenants. This study extends the hedonic pricing literature beyond Western contexts, highlighting that market-based incentives remain powerful drivers of green building uptake.

Finally, Wan et al. (2022) tackle the retrofit challenge in inefficient Chinese office buildings. Using a simulation-based lifecycle model, they identify optimal combinations of envelope, HVAC, and lighting upgrades that offer up to 13% energy savings with 7–8 year payback periods. Their findings point to the importance of cost-effective technical planning tailored to local conditions, reinforcing calls for regionalized, data-informed certification adaptations.

Social Sustainability and Employee Wellbeing in Workspaces

A foundational contribution by Kropman et al. (2023), building on Bergefurt et al. (2022), systematically maps physical workspace elements to ten mental health indicators, categorizing outcomes into pathogenic (e.g., stress, burnout) and salutogenic (e.g., well-being, productivity) domains. Their analysis of 133 studies demonstrates strong and consistent evidence that elements such as daylight, office layout, and thermal comfort are robust predictors of psychological outcomes, including stress reduction and enhanced concentration. By framing office design within levels of sufficiency—“insufficient,” “sufficient,” and “optimal”—the study offers a pragmatic schema for integrating mental health considerations into workplace planning. Yet, it also calls attention to underexamined dimensions such as mood, engagement, and burnout, suggesting that the current evidence base remains fragmented.

This aligns with findings from Sadick and Kamardeen (2020), who underscore the role of nature exposure in office design. Their systematic review reveals that both indoor (e.g., plants, window views) and outdoor (e.g., gardens, terraces) nature integration contribute distinct yet complementary psychological benefits. While indoor features enhance subjective motivation and perceived well-being, outdoor exposure fosters cognitive restoration and stress mitigation—outcomes vital to resilience and productivity. These insights bolster the strategic case for biophilic design as a cross-cutting intervention linking social, environmental, and economic goals of sustainability frameworks.

Further advancing this multidimensional perspective, Jensen and van der Voordt (2020) synthesize evidence from corporate real estate and facilities management literature to construct a conceptual model of healthy workplaces. Their framework integrates physical, organizational, and personal factors, affirming that health-related outcomes are shaped not solely by environment but through interaction with organizational structure and job design. However, the authors critique the prevailing literature for its vague operationalization of “well-being,” calling for theory-grounded and interdisciplinary empirical studies to substantiate causal pathways between workspace and health.

The organizational perspective is elaborated by Kelloway, Dimoff, and Gilbert (2023), who argue that mental health exists along a continuum from flourishing to clinical disorder. Their review identifies leadership, autonomy, and social support as protective resources that buffer against occupational stressors, reinforcing the necessity of holistic, multi-level interventions. Importantly, they advocate for managerial training in mental health literacy, workplace accommodations, and early intervention strategies, demonstrating that mental health initiatives can yield both humanistic and productivity-related returns.

Parallel to this organizational approach, Gritzka et al. (2020) review ten nature-based interventions (NBIs) and affirm their utility in promoting psychological detachment and attention restoration, drawing on Attention Restoration Theory (ART) and Stress Reduction Theory (SRT). While NBIs such as green exercise and nature savoring show consistent benefits for mental health, their review is tempered by methodological limitations, including small sample sizes and limited experimental control. The study calls for theory-integrated and methodologically robust designs to elevate NBIs from promising practices to evidence-based policy interventions.

From a corporate strategy lens, Wu et al. (2021) identify eight categories of best practices for workplace mental health, culminating in the development of the Carolyn C. Mattingly Award framework. Their synthesis transcends conventional Employee Assistance Programs (EAPs), advocating instead for comprehensive, stigma-free cultures of support that embed mental health in leadership, policy, and operational domains. This shift toward systemic, culture-level interventions underscores a growing recognition that ad hoc wellness offerings are insufficient for lasting change.

Similarly, Van der Voordt and Jensen (2023) examine the value proposition of healthy workplaces, reviewing 45 academic and industry sources. While physical improvements (e.g., ergonomic furniture, biophilia, high IEQ) are positively associated with satisfaction and performance, evidence on economic cost-benefit analysis remains sparse. The review highlights the disconnect between perceived and measured productivity gains, calling for integrative evaluative frameworks that capture health, financial, and societal outcomes in tandem.

Productivity is further addressed by de Oliveira et al. (2023), who critically review 38 empirical studies linking mental health to work output. Their findings confirm a consistent association between poor mental health (especially anxiety and depression) and productivity losses via absenteeism and presenteeism. However, they critique the dominance of cross-sectional designs and reliance on self-report data, emphasizing the need for longitudinal studies and consideration of endogeneity and heterogeneity in modeling the mental health–productivity nexus.

Technological change is also emerging as a double-edged determinant of mental health. Johnson et al. (2020) argue that automation and flexible work reshape psychological experiences in contradictory ways—simultaneously enabling autonomy and work-life balance while inducing stress, social isolation, and job insecurity. Their analysis calls for mental health-aware job design and participatory technology development, especially as hybrid work becomes normalized in post-pandemic contexts.

Indeed, the COVID-19 pandemic has served as a catalyst for reimagining workplace strategies. Tagliaro (2024), synthesizing outcomes from the III Transdisciplinary

Workplace Research (TWR) Conference, argues that the future of work must align corporate real estate (CRE) with human-centered, inclusive, and resilient practices. This transdisciplinary agenda encompasses salutogenic design, digital infrastructure, and psychosocial considerations, reinforcing the call for multi-scalar frameworks that integrate physical, digital, and organizational environments.

Finally, the psychological burden of workplace bullying is highlighted by Conway et al. (2021), who compile robust meta-analytic and longitudinal evidence linking bullying to depression, anxiety, and PTSD. The authors emphasize theoretical models such as the transactional theory of stress and coping and self-determination theory, and urge for more clinical, multi-wave studies. Their work confirms that social sustainability is undermined not only by design failure but also by toxic relational dynamics, thus requiring multi-level prevention and policy interventions.

ESG Reporting and Governance Practices in Office Real Estate

Beeferman (2020) provides a foundational analysis of investor-driven change in ESG governance, particularly emphasizing the shift from conventional financial metrics to a more inclusive view of human capital management. Highlighting actors such as CalPERS and BlackRock, the study illustrates how investor coalitions are advancing disclosure on workforce practices—including diversity, compensation, and engagement—as material indicators of long-term value. The emergence of initiatives like the Human Capital Management Coalition (HCMC) and the Workforce Disclosure Initiative (WDI) reflects growing demands for standardized and transparent reporting. Yet, Beeferman identifies enduring obstacles such as inconsistent regulatory standards and conceptual ambiguity. The study underscores the need for aligning financial materiality with ethical imperatives, effectively reframing labor governance as central to sustainable investment strategy.

Ryle et al. (2023) expand this discussion by exploring how non-disclosure agreements (NDAs) in sexual harassment cases challenge ESG credibility. Through legal and policy analysis, they argue that NDAs undermine transparency and perpetuate toxic workplace cultures, thus constituting a governance failure with material reputational risks. Their critique is bolstered by the introduction of the “Weinstein Tax,” which disincentivizes NDAs by eliminating tax deductibility. The authors propose governance reforms including independent audits, transparency mandates, and the elimination of forced arbitration, emphasizing that corporate silence on misconduct is incompatible with emerging ESG norms.

Tsairi and Martens (2024) present a critical gap in current ESG and CSR frameworks: the underreporting of employee mobility impacts, including commuting and travel. Their review of 29 reporting frameworks reveals that while some acknowledge Scope 3 GHG emissions, few consider broader social equity or safety implications. The findings illuminate the disconnect between employers’ control over mobility patterns and their minimal accountability in ESG disclosures. The authors argue for expanded ESG metrics that integrate environmental and social dimensions of mobility, positioning travel-related impacts as a systemic governance issue. Their call for a paradigm shift suggests that employer responsibility must extend to equitable, safe, and low-emission mobility practices.

Complementing this, Nováková (2024) analyzes ESG disclosures in the Czech construction sector within the evolving EU Corporate Sustainability Reporting Directive (CSRD) framework. Her findings demonstrate high surface-level awareness—evidenced by ISO certifications—but widespread gaps in structured reporting, especially concerning Scope 3 emissions and climate risk disclosures. Notably, foreign-owned firms exhibit more comprehensive alignment with international standards, suggesting that transnational governance mechanisms may drive upward harmonization in ESG reporting. Nováková’s study highlights the persistent structural challenges in implementing ESG frameworks, particularly in emerging markets.

Rees and Briône (2024) offer a robust empirical examination of how UK FTSE 350 firms have responded to board-level workforce engagement requirements under the revised UK Corporate Governance Code. Through an extensive mixed-methods dataset, they find that most companies have adopted minimal compliance strategies, such as appointing designated non-executive directors (NEDs), with limited evidence of substantive employee voice. The study critiques the “comply or explain” approach as largely symbolic, noting that only worker-director models yielded tangible influence. Their findings call for a pluralist reconceptualization of corporate purpose, one that views labor as co-investors in firm value and supports mandatory governance reforms to institutionalize democratic participation in corporate boards.

Helfaya, Muthuthantrige, and Xu (2024) further reinforce the importance of governance structures by empirically linking corporate sustainability governance initiatives (CSGIs) to improved labor rights outcomes in Indian listed companies. Utilizing a panel regression across 1,212 firm-years, the study finds that board-level CSR engagement, CSR committees, and board diversity positively correlate with reduced violations of child labor, forced labor, and freedom of association. Grounded in multi-theoretical frameworks (legitimacy, stakeholder, agency, and resource dependency theories), the research confirms that well-governed firms not only disclose more, but also do more in practice. This study uniquely contributes to the underexplored Global South context, aligning firm behavior with UN SDGs 3, 5, 8, and 10.

As ESG priorities increasingly influence organizational attractiveness, Takimoto and Srisuphaolarn (2021) investigate the role of ESG factors in shaping Generation Z’s workplace preferences in Thailand. Although financial stability remains paramount, the study shows that social and governance dimensions—such as fairness, transparency, and freedom of expression—are becoming salient to younger talent. This indicates a critical reorientation of employer branding, wherein ESG is not merely an investor concern, but also a talent acquisition tool. Their findings suggest a convergence between sustainability strategy and human resource management in the post-pandemic labor market.

This connection is echoed by Adanlawo and Chaka (2024), who explore public expectations for CSR communication in Nigeria. Their survey-based study emphasizes that stakeholders expect firms to prioritize internal stakeholders, especially employees, in CSR messaging before targeting external audiences. Preferences also vary by gender and domain, revealing that context-sensitive communication—across workplace, governance, community, and environment—is crucial for reputational legitimacy. The findings affirm that effective ESG implementation must be dialogical and audience-specific, particularly in emerging economies.

Sarıgül et al. (2023) bring an organizational behavior lens to the ESG discourse, showing how governance structures shape workplace culture and peer dynamics. Positive peer relationships—enabled by inclusive governance—foster job satisfaction, creativity, and cooperation. Drawing on behavioral economics, the study emphasizes that peer influence mechanisms (e.g., social norms, motivational spillovers) play a tangible role in productivity, linking organizational culture with governance-enabled performance outcomes. This underscores that ESG governance is not merely top-down; it also manifests in horizontal, interpersonal dynamics that affect workplace efficacy.

Lastly, De Castañeda Altuna, Appel-Meulenbroek, and Azasu (2025) integrate spatial and organizational governance in hybrid work contexts. Their in-depth interviews with CRE professionals reveal that effective office layout strategies must align with organizational structure, particularly under hybrid work models. The study identifies five strategic alignment functions—task facilitation, communication, adaptability, hierarchy expression, and behavior monitoring—demonstrating that governance and spatial design co-evolve. This insight offers practical value for post-pandemic corporate real estate (CRE) management, reinforcing that spatial governance is a critical but often overlooked dimension of ESG implementation.

Smart Offices and Digital ESG Monitoring

Rousta (2023) sets the theoretical foundation by proposing a holistic model for transitioning traditional workplaces into sustainable smart offices. Her doctoral work emphasizes the integration of energy-efficient technologies, sensor adaptability, and digital infrastructure within participatory design processes. Beyond technical upgrades, Rousta highlights the centrality of behavioral alignment and stakeholder engagement in achieving organizational efficiency and occupant well-being. The study’s emphasis on a human-centered digital transition establishes a critical baseline for understanding how technology mediates ESG outcomes in real estate.

Expanding the practical implementation of such frameworks, Gatea et al. (2024) present a sensor-integrated smart office system using the ESP32 microcontroller. The research emphasizes real-time environmental control, security, and energy efficiency through a modular system of RFID, ultrasonic, and climate sensors. The use of decentralized edge-computing via ESP32 and visualization through Blynk exemplifies the growing trend toward scalable, low-cost smart infrastructure, particularly relevant for dynamic office environments with variable occupancy and climate conditions.

The success of smart office transitions depends not only on technology but on organizational readiness and strategic alignment. Mamoojee (2023) applies the Technology–Organization–Environment (TOE) framework to identify key drivers (efficiency, occupant satisfaction), inhibitors (interoperability, skill gaps), and success factors (management support, user-centered design) in IoT deployment. The study underscores the necessity of aligning stakeholder needs with technical capabilities to overcome persistent barriers in commercial real estate (CRE) innovation.

Similarly, Kalyanam (2022) offers a comprehensive survey of IoT applications in office ecosystems, from predictive maintenance to automated workflows. Drawing on diverse case studies, the study highlights the role of embedded connectivity in fostering real-time responsiveness and operational intelligence. However, the analysis also brings attention to data governance challenges, including security vulnerabilities and integration costs—issues that remain underexplored in ESG reporting despite their implications for system sustainability and user trust.

Blazevic and Riehle (2024) further advance this conversation by introducing a domain-specific IoT architecture for Smart Collaboration Spaces (SCS), based on the edge–fog–cloud continuum. Validated through implementation in a university campus, the study integrates LoRaWAN sensor networks to optimize collaboration environments through real-time air quality and occupancy monitoring. The emphasis on

GDPR-compliant, open-source systems speaks to the increasing need for privacy-preserving, adaptable smart office solutions that align with European data protection norms.

While energy efficiency and automation are central to smart office development, a parallel literature emphasizes the occupant health benefits of IoT-enabled workspaces. Zhang et al. (2022) provide a systematic survey outlining how AI and IoT integration can support physical and mental well-being via responsive systems that adapt lighting, air quality, and ergonomics. Their proposed five-level architecture and “3A” framework (acquisition, analysis, application) form a blueprint for context-aware, personalized interventions that target sedentary behavior, stress, and indoor environmental quality (IEQ). This research reframes the smart office as a co-created wellness ecosystem, underscoring the need for interdisciplinary collaboration between engineering, behavioral science, and design.

Complementing this, Nappi and Ribeiro (2020) analyze the dual purpose of IoT in productivity and health monitoring. Their review highlights the potential for IoT to optimize spatial layouts and enhance social behavior tracking, but also draws attention to employee resistance stemming from privacy concerns. The study reveals that transparency and anonymization are critical to sustaining user engagement, and that ethical design principles must be integrated into smart office infrastructure to balance data utility with autonomy.

A growing number of studies now bridge theory with implementation through functional prototypes and applied systems engineering. Lee et al. (2022) introduce a smart lighting system using a leader–follower mechanism and PIR sensors, capable of adjusting LED brightness based on real-time occupancy detection. This system demonstrated substantial energy savings (up to 84%) while maintaining high user satisfaction, showing how non-invasive, cost-effective IoT applications can yield measurable gains in both sustainability and comfort.

Uppal et al. (2021) extend the IoT utility into predictive maintenance, combining cloud computing and machine learning (ML) to forecast device faults and reduce environmental disruption. Their recommender system, integrated with smart sensors and mobile alerts, exemplifies how health-promoting digital infrastructure can be seamlessly embedded into office operations. This study aligns predictive analytics with ESG goals, particularly in reducing downtime, extending device life, and supporting safe, uninterrupted work environments.

In a similar health-oriented vein, Maiti et al. (2023) propose a privacy-preserving infrared desk sensor to monitor movement breaks and mitigate sedentary behavior. By using Dynamic Time Warping (DTW) to classify postures non-invasively, the sensor supports real-time eHealth interventions without compromising anonymity. This represents an important evolution in workplace health technology—offering minimalist, ethical solutions for behavior monitoring that can be scaled across diverse office environments.

Financial Impacts of ESG Integration in Office Investments

A growing body of literature emphasizes that office real estate is not merely a physical asset but a strategic enabler of workforce equity and organizational performance. McGrath and Worzala (2024) argue persuasively that real estate planning—via site location, accessibility, and affordability—plays a pivotal role in shaping human capital outcomes. Their work, grounded in regulatory frameworks like the EU’s CSRD Article 29b, links spatial inequality with labor market disparities, suggesting that exclusionary real estate practices (e.g., employment redlining, transit deserts) erode firm productivity and social equity. By contrast, inclusive spatial strategies support wage equality, work-life balance, and workforce diversity, positioning office design as a lever for realizing the full potential of the “S” in ESG.

Similarly, Yadav and Yadav (2025) extend this discussion by examining the strategic alignment of workforce finance with ESG values. Their review highlights emerging practices such as ESG-linked pensions and carbon-neutral payroll systems, which not only signal corporate commitment to sustainability but also enhance employee retention and investor confidence. However, they identify challenges in cost, regulation, and standardization, calling for policy innovation and digital finance tools to bridge ethical intent with financial practice.

A consistent theme across the literature is that physical upgrades to building infrastructure are yielding both ESG and financial returns. Sharma (2024) provides a comparative valuation analysis across Europe and India, illustrating that energy-efficient retrofits and modernizations increase asset value and tenant satisfaction while supporting broader sustainability mandates. The study highlights the pivotal role of REITs in financing such upgrades and notes that regional variations in regulatory support significantly shape outcomes. These insights affirm that ESG-aligned capital improvements serve as both asset resilience strategies and drivers of competitive differentiation in a shifting investment landscape.

Ifediora and Igwenagu (2024) further corroborate this value linkage through a PCA-based analysis of ESG determinants in residential and commercial valuation. Their results show that community engagement, energy efficiency, and green certifications are consistently linked to positive valuation impacts. The strength of their statistical approach—validated through KMO and Bartlett’s tests—adds robustness to the argument that ESG is no longer a peripheral concern but a central pillar in valuation frameworks, especially for investors seeking long-term stability and regulatory alignment.

Tenant preferences are also evolving in line with ESG commitments, influencing occupancy patterns and rent premiums. Liu et al. (2025) and Liu et al. (2024) use lease data and Refinitiv ESG scores to examine tenant selection of BREEAM-certified office spaces in London. Their studies find that publicly listed companies—particularly those with strong governance scores—are more likely to choose certified properties and, in some cases, pay a premium. Notably, this trend is sectorally concentrated in office real estate, with retail and industrial markets showing muted ESG effects. These findings suggest that ESG leasing strategies are becoming a key tool for office landlords in attracting institutional tenants and aligning with corporate governance values.

Valero (2025) adds further granularity through a multi-criteria decision analysis of Class A office buildings in Madrid. ESG-certified buildings consistently outperform non-certified peers in valuation, occupancy speed, and rental income, underscoring the market premium associated with sustainability-linked credentials. Valero’s integration of climate risk and financial metrics reflects a growing academic and professional consensus: certifications are not just environmental proxies, but strategic assets in real estate portfolio management.

The integration of ESG into corporate real estate management (CREM) is increasingly seen as a strategic priority rather than a compliance exercise. Riratanaphong and Pewklieng (2025) offer an applied framework aligning 16 CREM dimensions—from site planning to innovation—with ESG goals. Through comparative case studies in Bangkok, they show that operational sustainability practices often yield synergistic benefits across environmental, social, and governance domains. Their model highlights the importance of flexible, context-sensitive strategies tailored to local constraints (e.g., asset age, ownership) and suggests that CREM is uniquely positioned to drive ESG value internally and externally.

However, the adoption of sustainability into valuation practices remains uneven. Hossain et al. (2023) report that UK commercial property valuers, while increasingly aware of RICS sustainability guidance, still face challenges in embedding broader ESG metrics—such as waste, water, and resilience—into appraisal models. Barriers include data scarcity, lack of training, and weak market comparables. This disconnect highlights a persistent gap between ESG rhetoric and valuation practice, suggesting the need for capacity-building and methodological innovation within the valuation profession.

The post-pandemic context has introduced profound volatility into office markets, further amplifying the need for ESG-aligned asset resilience. Dessalines (2023) documents the structural shift toward hybrid work in U.S. cities, with persistent office underutilization, widespread defaults, and a bifurcation between premium Class A assets and declining Class B/C properties. In this context, ESG-aligned retrofitting and “flight to quality” repositioning are not just risk mitigation strategies but existential imperatives. However, adaptive reuse remains constrained by high conversion costs and physical limitations, underlining the importance of anticipatory ESG planning in CRE asset management.

4. Discussion

This review reveals a rapidly evolving landscape in which ESG (Environmental, Social, and Governance) integration in office real estate is no longer a peripheral trend but a structural transformation reshaping architectural design, corporate strategy, governance frameworks, and valuation practices. Across the five thematic domains, a unifying insight emerges: ESG is a multi-scalar, interdisciplinary agenda whose success depends on dynamic interaction between built environments, organizational culture, stakeholder behavior, and regulatory frameworks.

Green certification systems have emerged as dominant tools for signaling environmental performance and organizational values. Yet, their operational effectiveness remains contested. Studies such as those by Leite Ribeiro et al. (2025) and Scofield et al. (2021) highlight the persistent disjunction between design-stage aspirations and post-occupancy realities. Despite the marketing appeal and rental premiums associated with LEED and BREEAM certifications (Li et al., 2021; Valero, 2025), empirical analyses suggest limited correlation between certification level and energy efficiency. Conversely, performance-based systems like NABERS (Gui & Gou, 2020) offer a more reliable predictor of environmental outcomes, calling into question the adequacy of point-based certification schemes. Furthermore, behavioral and organizational dimensions—such as GHRM practices (Parida et al., 2021)—are increasingly recognized as essential mediators of building performance, expanding the definition of sustainability beyond physical infrastructure.

The integration of social sustainability and employee wellbeing reveals equally important shifts. Empirical studies (e.g., Kropman et al., 2023; Sadick & Kamardeen, 2020) confirm that workspace design has measurable psychological effects on employees, particularly when biophilic elements, daylight, and thermal comfort are optimized. However, the literature continues to rely heavily on self-reported cross-sectional data, as noted by de Oliveira et al. (2023), limiting causal inference. Moreover, while workplace mental health is now a well-established concern (Kelloway et al., 2023; Wu et al., 2021), gaps persist in interdisciplinary integration between environmental design, organizational psychology, and public health. Particularly under-researched are the interactive effects of technological change, hybrid work, and psychosocial stressors (Johnson et al., 2020; Tagliaro, 2024), which require more granular, longitudinal research.

On the governance front, the ESG reporting ecosystem is marked by a tension between growing investor demand for transparency and weak regulatory harmonization. While initiatives such as the WDI and HCMC (Beeferman, 2020) indicate progress, empirical studies (e.g., Rees & Briône, 2024; Nováková, 2024) show that many firms adopt minimal compliance strategies or provide only superficial disclosures. Significantly, the social dimension of ESG—especially labor practices, harassment governance, and workforce engagement—remains inconsistently reported and poorly standardized, despite its centrality to sustainable firm value (Ryle et al., 2023; Helfaya et al., 2024). The emerging emphasis on employee mobility (Tsairi & Martens, 2024) and internal stakeholder communication (Adanlawo & Chaka, 2024) signals a needed expansion of governance scopes to better capture the lived realities of workplace sustainability.

A growing literature on smart offices and digital ESG monitoring reflects the sector’s pivot toward technologically mediated sustainability. Studies on IoT-based office systems (Gatea et al., 2024; Mamoojee, 2023) demonstrate real-time responsiveness, environmental efficiency, and behavioral adaptability. Yet, this transition is not without challenges. Privacy concerns (Nappi & Ribeiro, 2020), system interoperability, and data governance remain critical barriers to adoption, particularly in contexts where digital literacy and infrastructure vary widely. Moreover, the literature’s emphasis on technical architecture (e.g., Blazevic & Riehle, 2024; Zhang et al., 2022) needs to be matched with attention to human–machine interaction, ethical design, and long-term user engagement. Overall, smart office environments offer a compelling case for embedding ESG into daily operational systems, but their success hinges on stakeholder trust and cross-functional alignment.

Finally, the financial impacts of ESG integration are increasingly evident but unevenly distributed. Multiple studies (e.g., Liu et al., 2025; Sharma, 2024) affirm the value-added effects of ESG-compliant buildings—whether through tenant preferences, enhanced rental income, or risk-adjusted returns. However, this benefit is mediated by sectoral context, regulatory incentives, and organizational maturity. While Class A buildings and public firms demonstrate ESG alignment (Valero, 2025; Liu et al., 2024), adoption among smaller, older, or privately held assets remains limited. Furthermore, valuation practices lag behind market dynamics, as noted by Hossain et al. (2023), suggesting a disconnect between theory and appraisal practice. The ongoing post-pandemic reconfiguration of workspaces (Dessalines, 2023) only intensifies this challenge, requiring adaptive reuse strategies, flexible valuation models, and scenario-based risk analysis.

5. Conclusion

This literature review has systematically examined the integration of ESG principles into the design, management, and valuation of office real estate across five interrelated thematic domains: green certifications, social sustainability, governance and reporting, smart office technologies, and financial impacts. Together, the reviewed studies offer compelling evidence that ESG is not merely an aspirational framework but a concrete and transformative force reshaping the office property sector. Certifications like LEED, WELL, and NABERS serve as operational anchors for environmental performance and human well-being, while workplace design and digital infrastructures increasingly mediate employee health, engagement, and productivity. Simultaneously, governance practices and investor expectations are pushing organizations toward greater transparency, equity, and data accountability. Importantly, ESG-aligned investments are demonstrating measurable financial returns—particularly in high-quality office assets—though valuation practices and market adoption remain uneven.

Despite these advances, several critical gaps persist. First, a persistent disconnect between certification ratings and actual building performance points to the need for enhanced post-occupancy evaluation mechanisms and adaptive, context-sensitive sustainability standards. Second, while social and psychological dimensions of workspace design are now widely acknowledged, the literature remains fragmented, under-theorized, and methodologically constrained. Future research must adopt more interdisciplinary, longitudinal, and mixed-method approaches to evaluate causal relationships between environmental interventions and mental health outcomes. Third, ESG governance remains constrained by inconsistent reporting standards, limited employee voice, and an overemphasis on environmental over social metrics. New regulatory frameworks and stakeholder engagement models will be essential to close this implementation gap.

In the realm of smart offices, the promise of responsive, health-promoting, and energy-efficient workplaces is substantial—but the ethical, infrastructural, and organizational barriers to adoption require deeper exploration. As digitalization accelerates, future studies must interrogate not only the technological affordances of smart systems but also their social acceptability, governance implications, and impact on workplace equity.

Finally, there is a pressing need to realign valuation models and investment strategies with ESG performance indicators. As hybrid work models, climate imperatives, and generational workforce shifts redefine office demand, real estate research must move toward integrated models that assess ESG not as an externality, but as a core determinant of asset resilience, corporate reputation, and long-term value creation.

In conclusion, ESG integration in office real estate is both a mirror and a mechanism of broader societal change. As organizations navigate a post-pandemic world marked by environmental urgency, mental health crises, and technological disruption, ESG offers a unifying yet flexible framework for advancing sustainable, inclusive, and adaptive workplaces. Future research should aim not only to evaluate ESG outcomes but to co-produce knowledge with practitioners, regulators, and users—ensuring that the next generation of office spaces serves both planetary and human well-being.