Submitted:

02 January 2026

Posted:

04 January 2026

Read the latest preprint version here

Abstract

Keywords:

1. Introduction

1.1. The Challenge of Financial Time Series Analysis

1.2. Visibility Graphs: Philosophy and Geometric Intuition

1.3. Physical and Economic Foundations of Energy Markets

1.4. Research Objectives and Contributions

1.5. Organization of the Paper

2. Methodology

2.1. Data Description and Characteristics

2.2. Preprocessing Pipeline: Rationale and Implementation

2.2.1. Stage 1: Logarithmic Transformation

- Gas: (raw prices to )

- Power: (raw prices to )

2.2.2. Stage 2: LOESS Detrending

- Gas: mean , standard deviation

- Power: mean , standard deviation

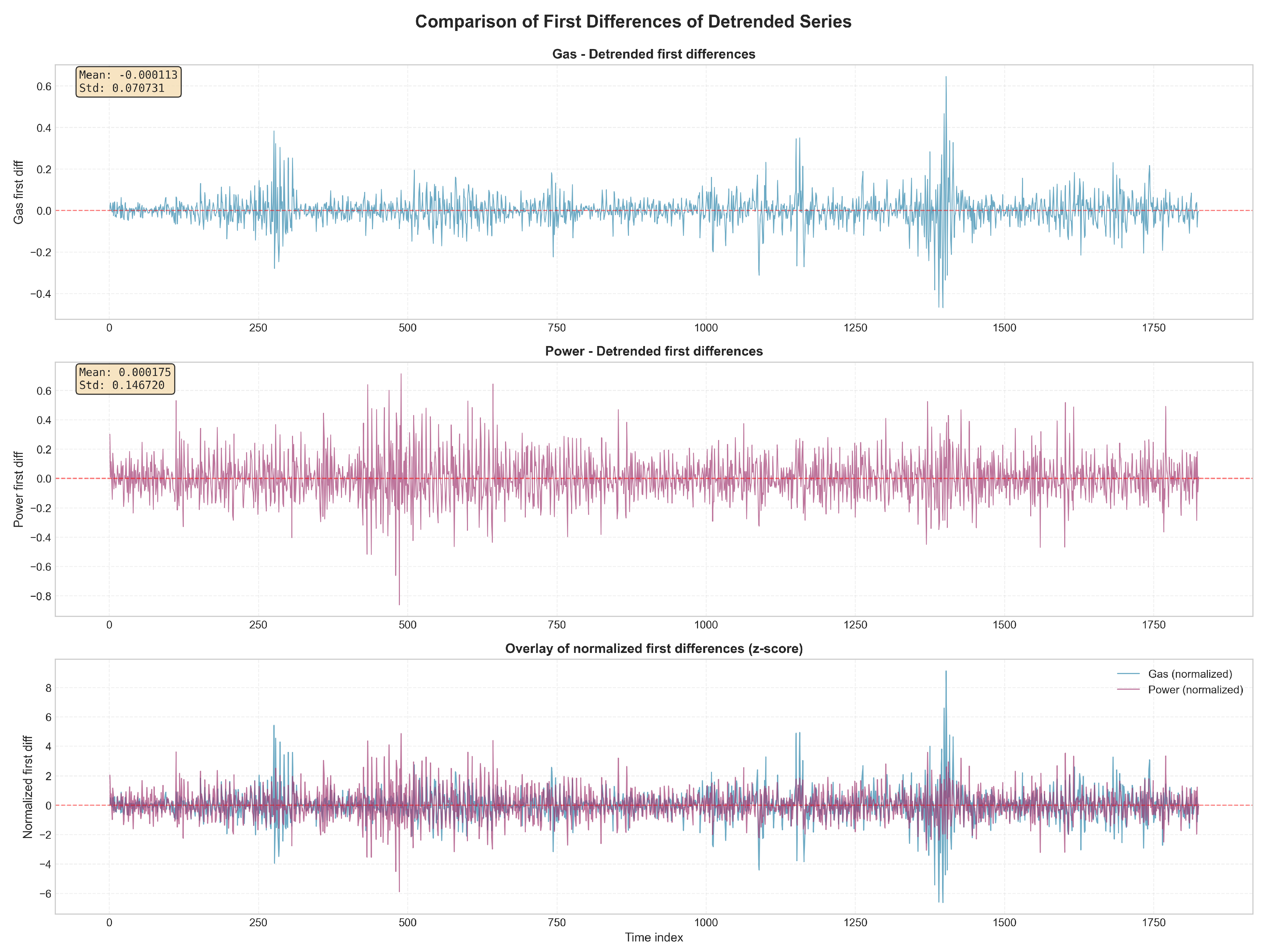

2.2.3. Stage 3: First Differencing

- Gas: mean , standard deviation

- Power: mean , standard deviation

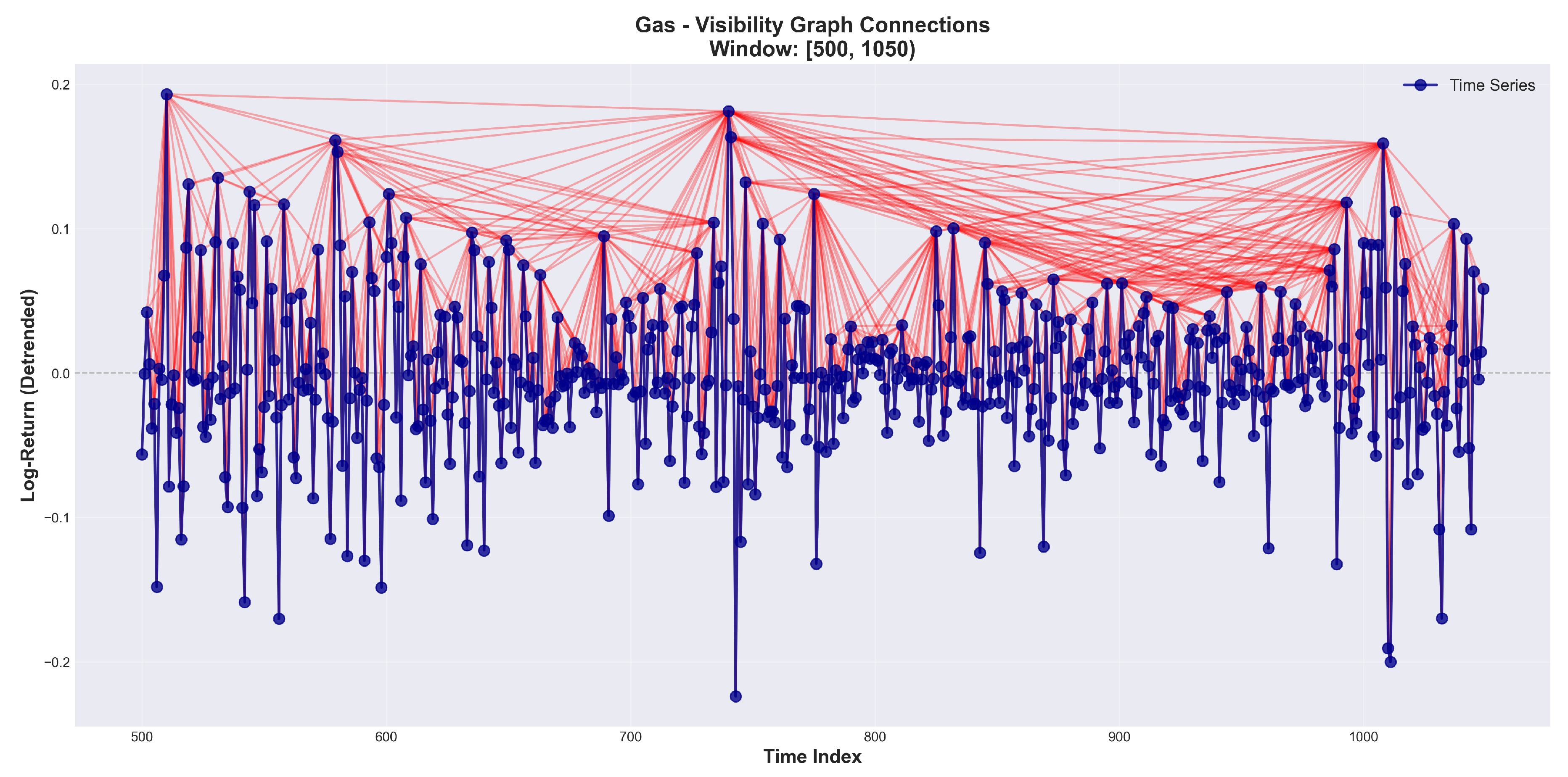

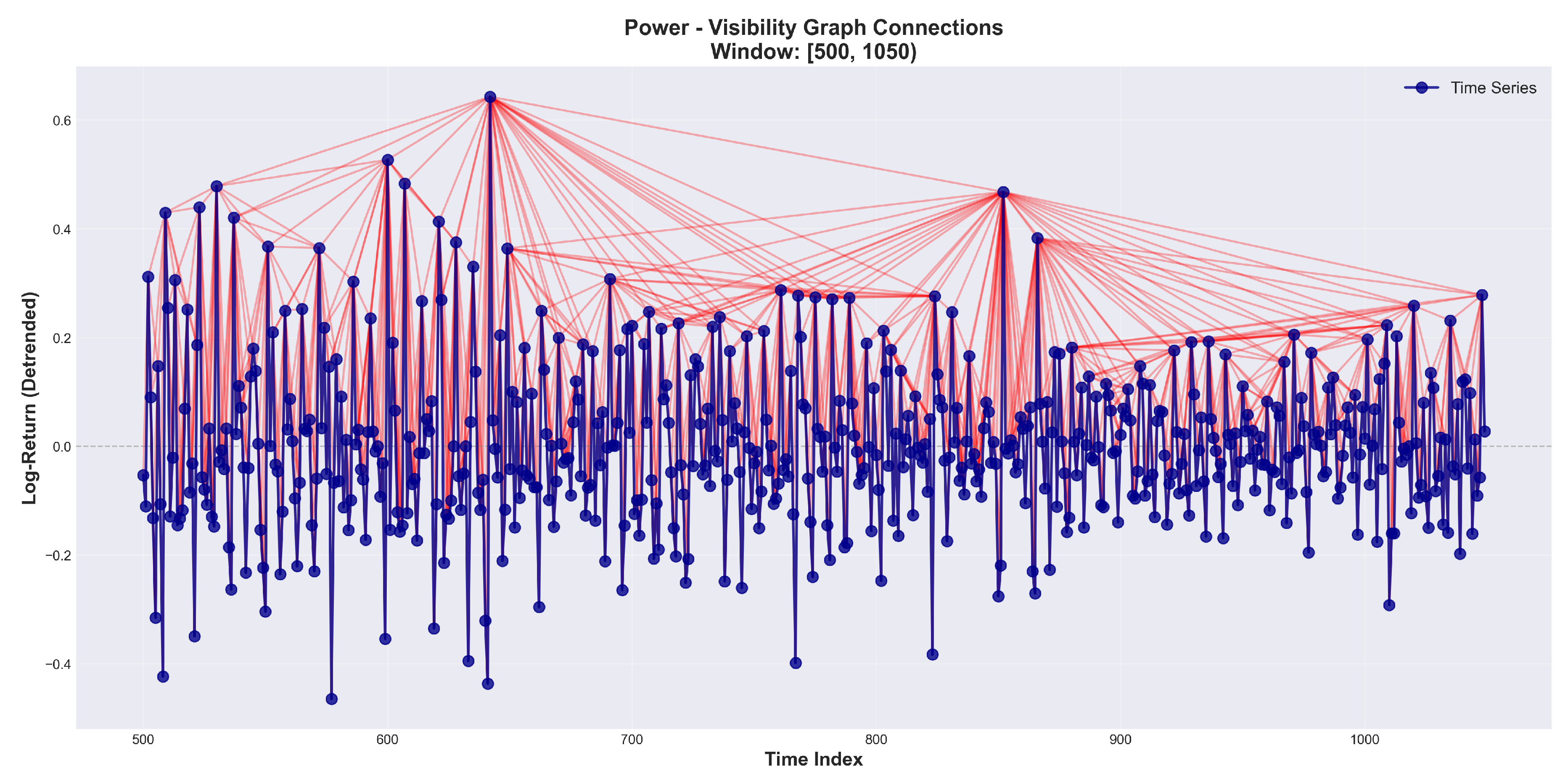

2.3. Visibility Graph Construction: Algorithm and Implementation

2.3.1. Algorithmic Procedure

- V denotes the set of vertices (nodes) of the graph

- E denotes the set of edges (connections between nodes)

- is the number of nodes (equal to the number of differenced time series observations)

- is the number of edges

- 1.

- Node initialization: Create graph with 1,825 nodes where node i corresponds to data point .

- 2.

-

Edge determination: For each pair with :

- (a)

- Visibility test: Check if all intermediate points k () satisfy:

- (b)

- Edge addition: If all intermediate points satisfy the condition, add edge to E.

- 3.

- Graph output: Return undirected visibility graph .

2.3.2. Network Metrics

- Number of nodes (N) and edges (M): Basic size measures.

- Density: Fraction of existing edges:

- Degree distribution: Probability that a node has degree k.

- Clustering coefficient: Tendency to form tightly connected groups:where is edges among neighbors of node i, its degree.

- Average path length: Mean shortest path distance, where denotes the length of the shortest path between nodes i and j. A path is a sequence of nodes connected by edges; the shortest path (or geodesic path) is the path with the minimum number of edges connecting two nodes. In our context, measures how many intermediate visibility connections are needed to link two time points, indicating the efficiency of information propagation through the temporal network:

- Diameter: Maximum shortest path length .

- Assortativity: Pearson correlation of degrees at edge ends, where denotes the average degree of all nodes in the network:

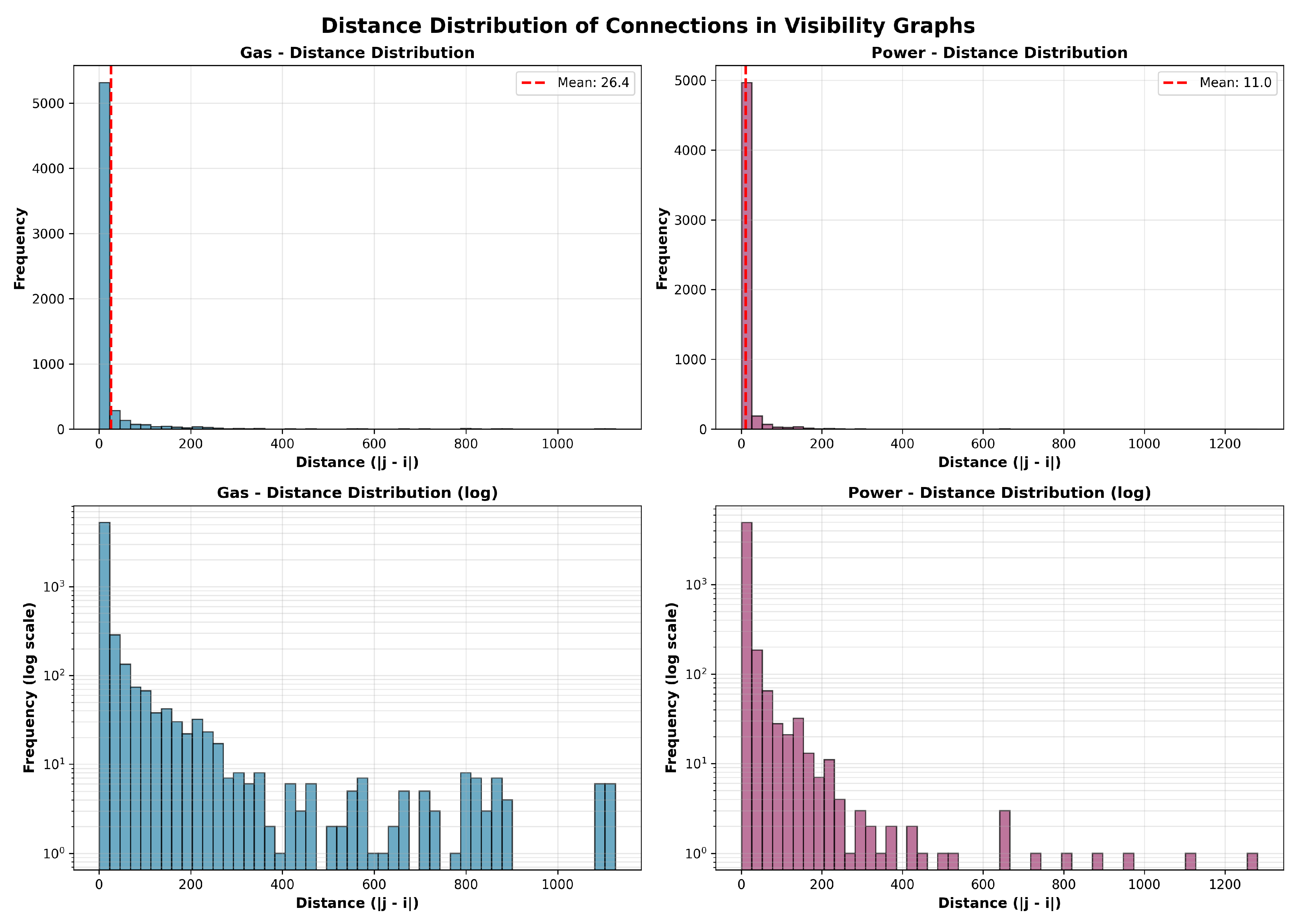

2.3.3. Edge Distance Distribution

3. Results

3.1. Preprocessing Effects

3.2. Overview of Visibility Graph Topological Properties

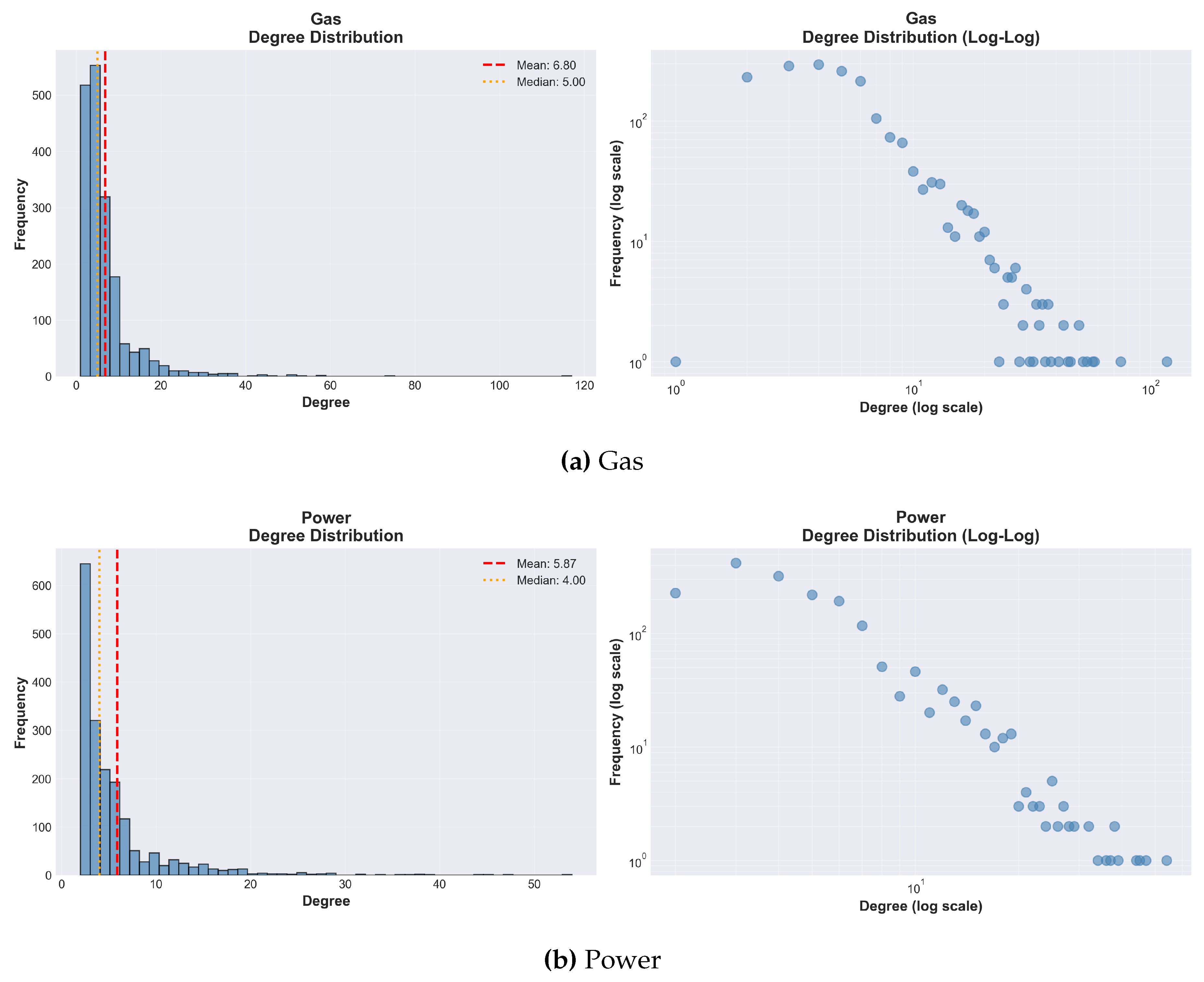

3.3. Connectivity and Density

3.4. Degree Distribution

3.5. Clustering Coefficients

3.6. Assortativity

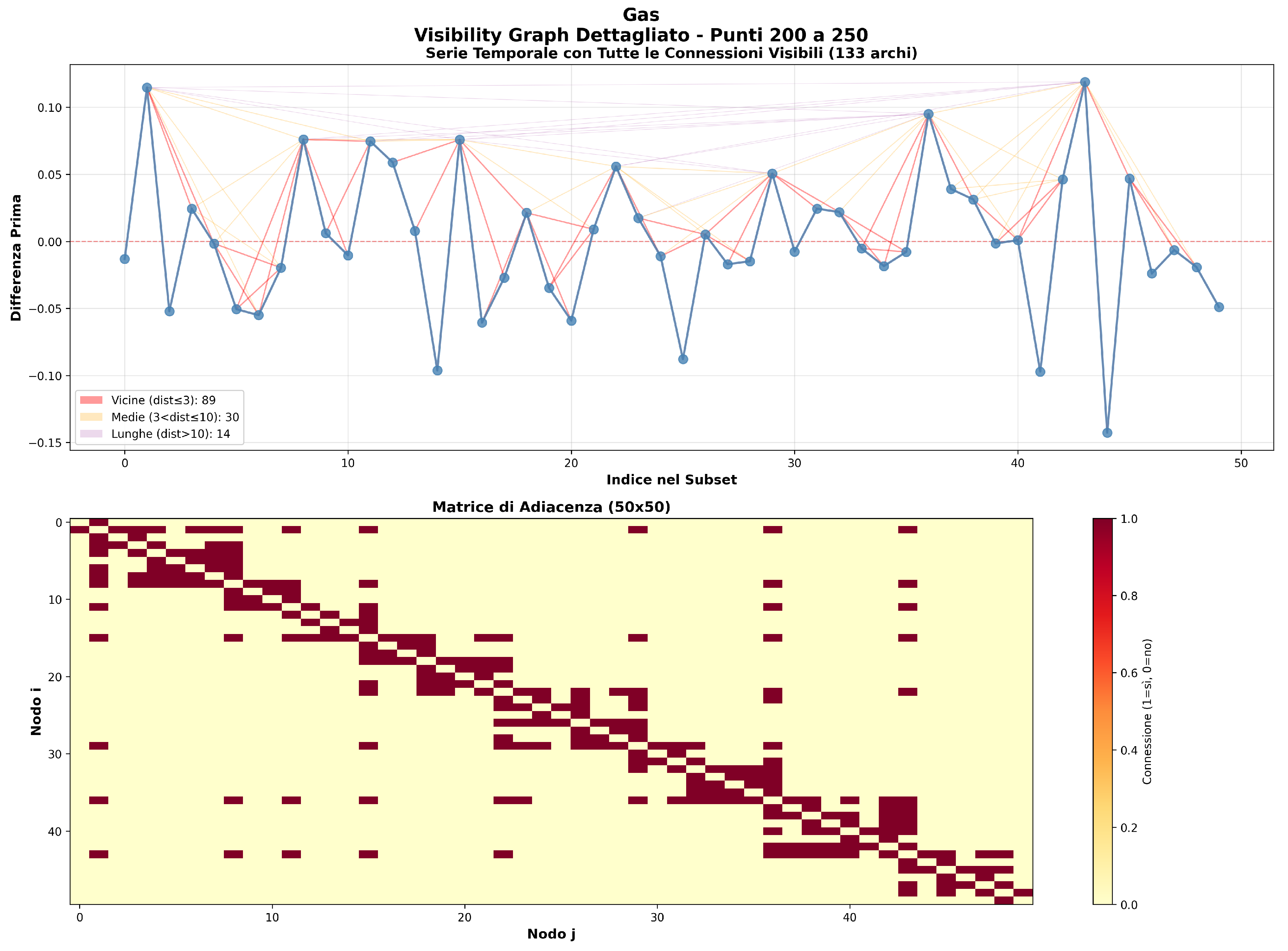

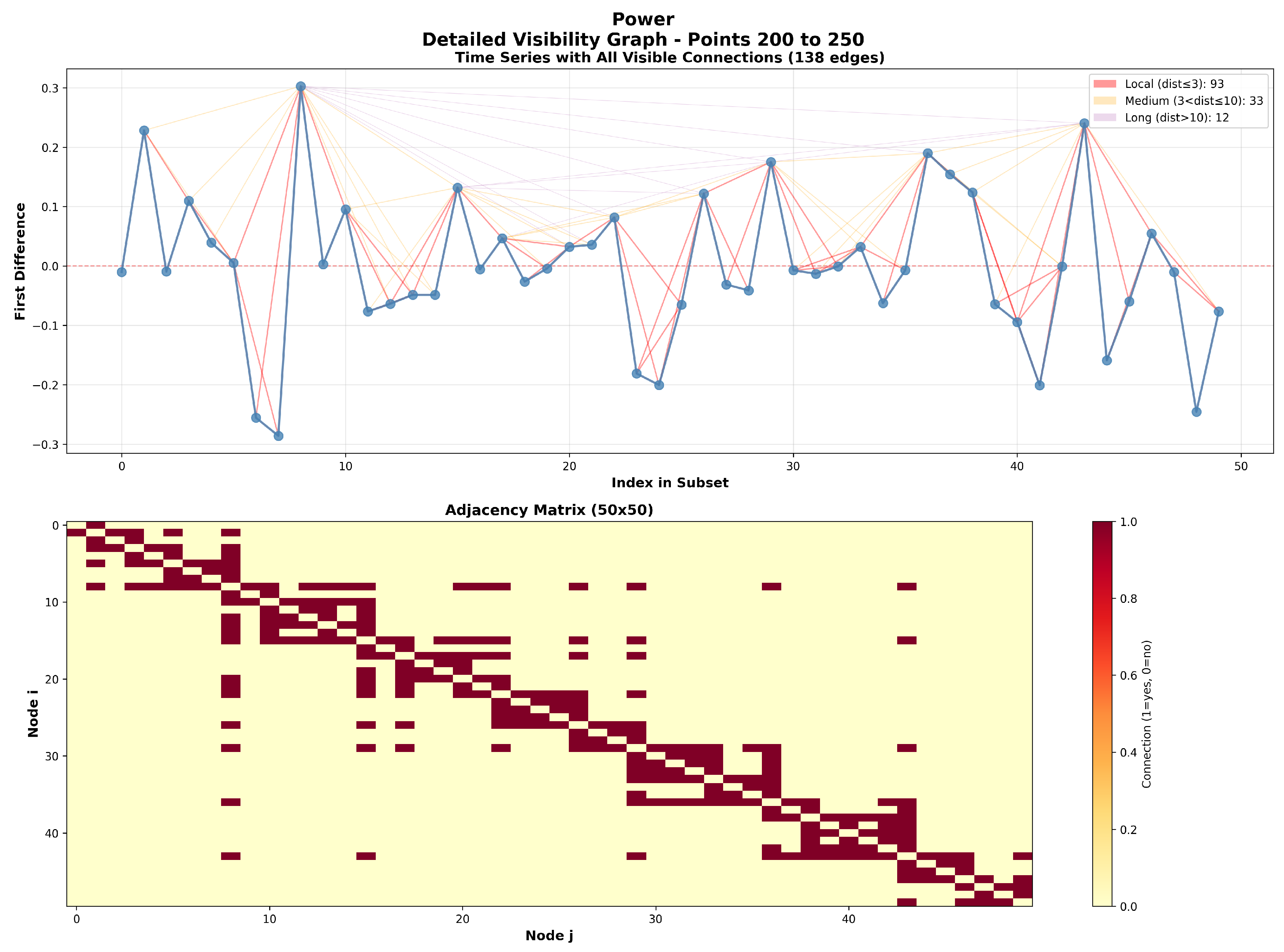

3.7. Temporal Structure of Connections: The Key Differentiator

3.7.1. Short-Range Connections

3.7.2. Long-Range Connections: The Dramatic Contrast

3.8. Local Visibility Structure

4. Correlation Analysis Between Gas and Power Time Series

4.1. Methodology for Correlation Analysis

- 1.

- Pearson correlation coefficient (r): Linear association between daily returns

- 2.

- Spearman rank correlation (): Non-parametric measure based on rank order, robust to outliers

- 3.

- Kendall’s tau (): Non-parametric measure based on concordant/discordant pairs

- Cross-correlation analysis: Computing return correlation as function of time lag

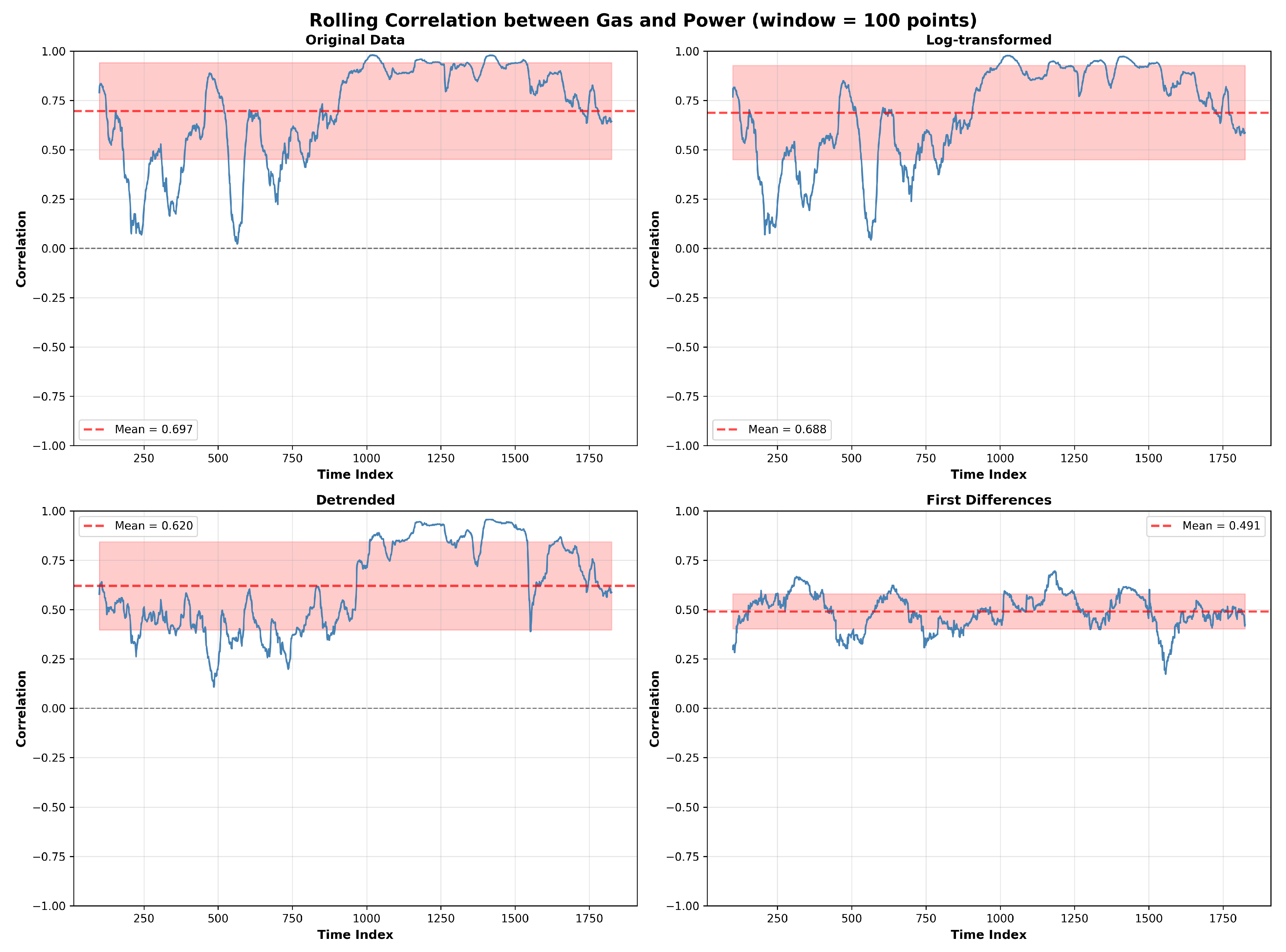

- Rolling correlation: Using 100-day windows to track temporal evolution

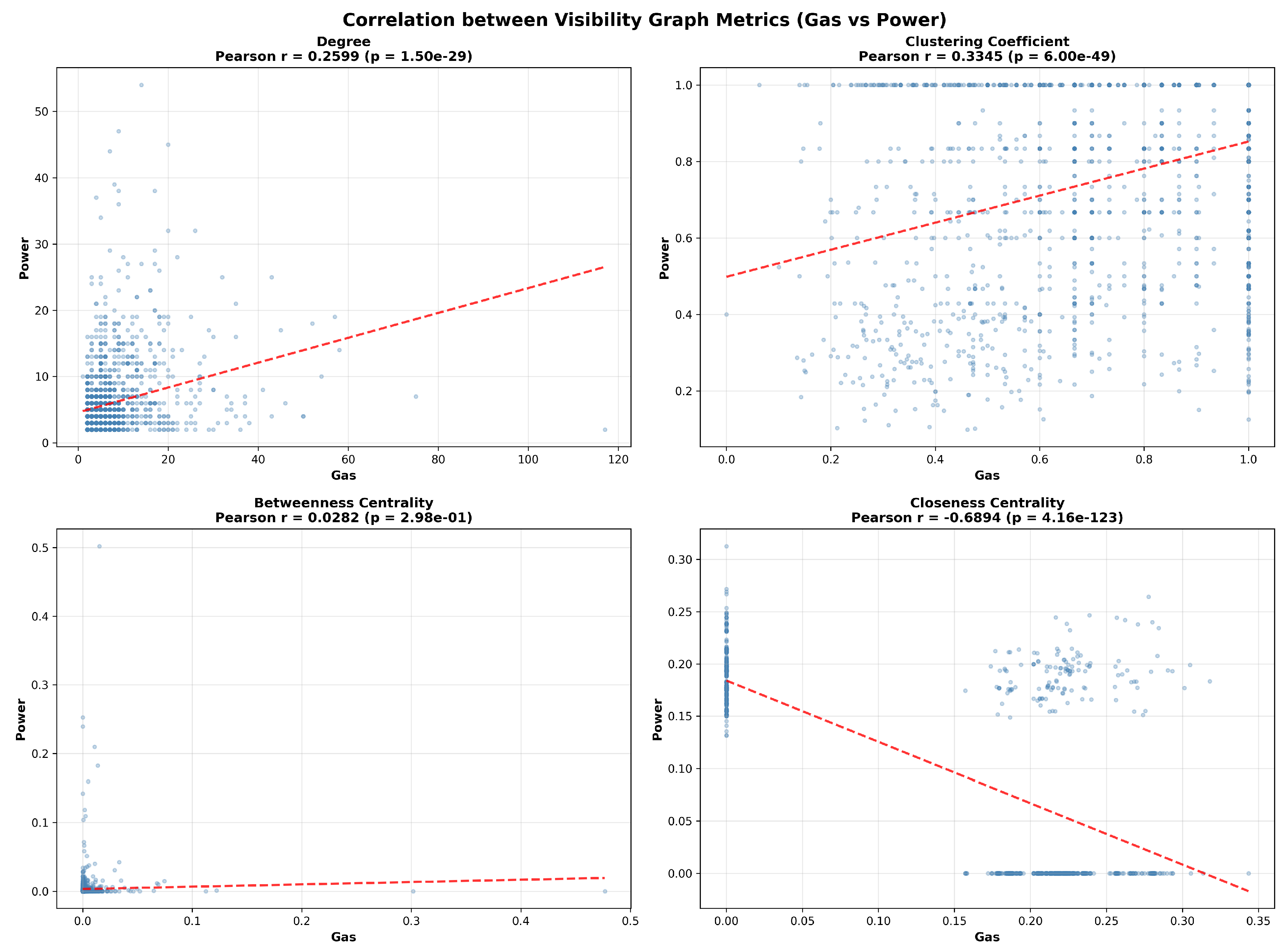

- Graph metric correlations: Correlating node-level properties between gas and power visibility graphs

- Structural similarity: Measuring edge overlap using Jaccard similarity coefficient

4.2. Log-Return Correlation Analysis

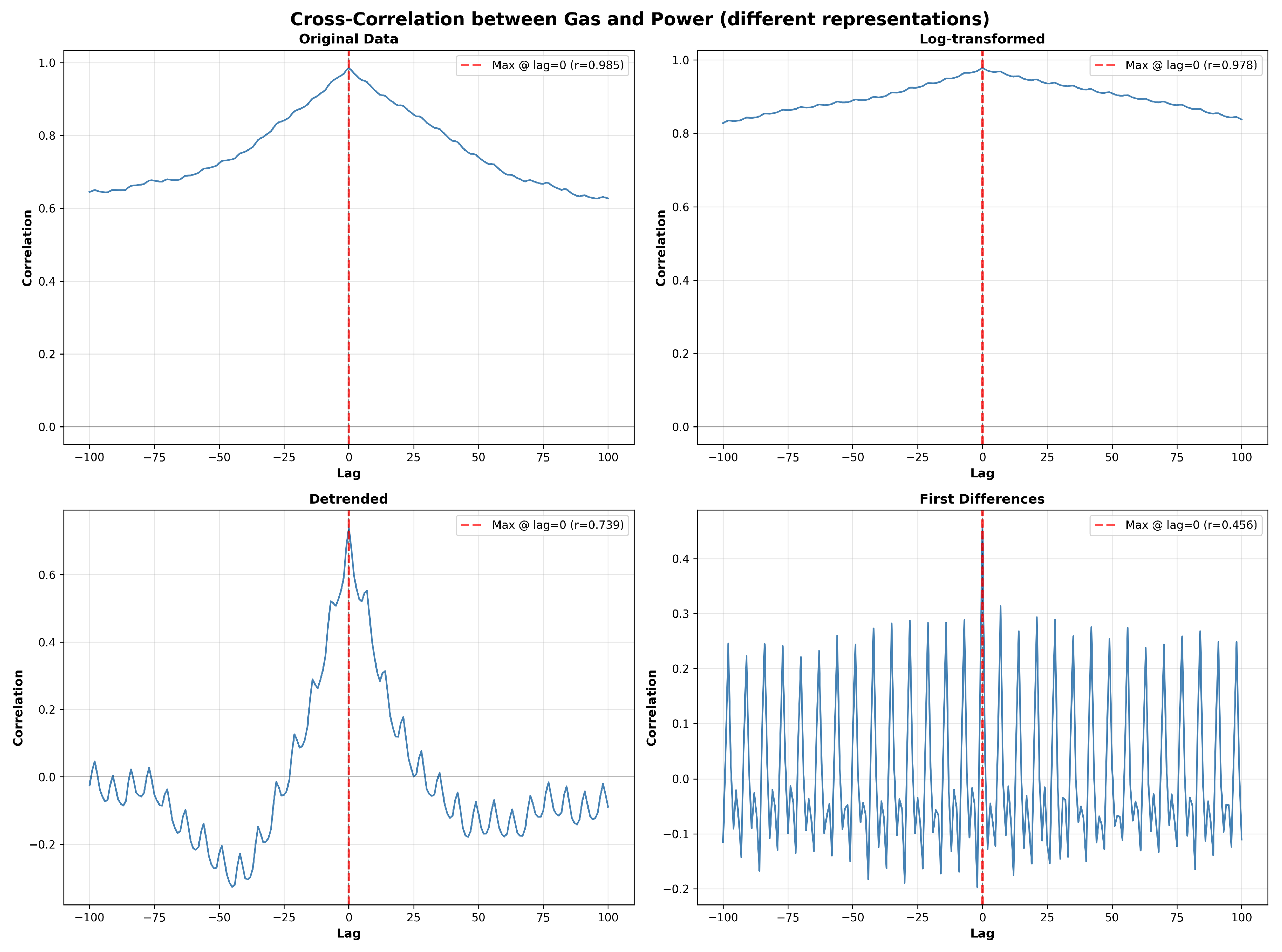

4.3. Cross-Correlation and Temporal Lead-Lag Analysis

4.4. Rolling Correlation: Time-Varying Relationships

4.5. Correlation of Visibility Graph Metrics

4.6. Structural Similarity: Edge Overlap Between Visibility Graphs

- Jaccard similarity: (40.4%)

- Common edges: 3,325 edges shared by both graphs

- Total union: 8,231 distinct edges across both graphs

- Gas-unique edges: 2,877 edges (46.4% of gas edges)

- Power-unique edges: 2,029 edges (37.9% of power edges)

4.7. Synthesis: Log-Return Correlation Structure

5. Discussion

5.1. Physical and Economic Interpretation of Topological Differences

5.1.1. Gas Markets: Persistent Extremes and Long Memory

5.1.2. Power Markets: High Volatility with Rapid Mean Reversion

5.2. Shared Topological Properties: Universal Market Features

5.3. Practical Implications for Market Participants

5.3.1. Risk Management

5.3.2. Price Forecasting

5.3.3. Portfolio Construction

5.4. Methodological Considerations and Robustness

5.5. Limitations and Future Directions

5.5.1. Data Limitations

5.5.2. Model Limitations

5.5.3. Generalizability and Scope

6. Conclusions

6.1. Summary of Principal Findings

6.1.1. Differential Connectivity and Temporal Reach

6.1.2. Heavy-Tailed Degree Distributions and Hub Nodes

6.1.3. Universal Small-World Architecture

6.1.4. Paradox of Volatility Versus Structure

6.2. Broader Methodological and Scientific Impact

6.3. Final Remarks

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Mandelbrot, B. The variation of certain speculative prices. Journal of Business 1963, 36, 394–419. [Google Scholar] [CrossRef]

- Cont, R. Empirical properties of asset returns: stylized facts and statistical issues. Quantitative Finance 2001, 1, 223–236. [Google Scholar] [CrossRef]

- Tsay, R.S. Analysis of Financial Time Series, 2nd ed.; Wiley: Hoboken, NJ, USA, 2005. [Google Scholar]

- Mari, C. Stochastic NPV based vs stochastic LCOE based power portfolio selection under uncertainty. Energies 2020, 13, 3607. [Google Scholar] [CrossRef]

- Newman, M.E.J. The structure and function of complex networks. SIAM Review 2003, 45, 167–256. [Google Scholar] [CrossRef]

- Boccaletti, S.; Latora, V.; Moreno, Y.; Chavez, M.; Hwang, D.-U. Complex networks: Structure and dynamics. Physics Reports 2006, 424, 175–308. [Google Scholar] [CrossRef]

- Zou, Y.; Donner, R.V.; Marwan, N.; Donges, J.F.; Kurths, J. Complex network approaches to nonlinear time series analysis. Physics Reports 2019, 787, 1–97. [Google Scholar] [CrossRef]

- Lacasa, L.; Luque, B.; Ballesteros, F.; Luque, J.; Nuño, J.C. From time series to complex networks: The visibility graph. Proceedings of the National Academy of Sciences 2008, 105, 4972–4975. [Google Scholar] [CrossRef]

- Luque, B.; Lacasa, L.; Ballesteros, F.; Luque, J. Horizontal visibility graphs: Exact results for random time series. Physical Review E 2009, 80, 046103. [Google Scholar] [CrossRef]

- Lacasa, L.; Luque, B.; Luque, J.; Nuño, J.C. The visibility graph: A new method for estimating the Hurst exponent of fractional Brownian motion. Europhysics Letters 2009, 86, 30001. [Google Scholar] [CrossRef]

- Luque, B.; Lacasa, L.; Ballesteros, F.J.; Robledo, A. Analytical properties of horizontal visibility graphs in the Feigenbaum scenario. Chaos 2012, 22, 013109. [Google Scholar] [CrossRef]

- Wang, N.; Li, D.; Wang, Q. Visibility graph analysis on quarterly macroeconomic series of China based on complex network theory. Physica A: Statistical Mechanics and its Applications 2012, 391, 6543–6555. [Google Scholar] [CrossRef]

- Stosic, D.; Stosic, D.; Ludermir, T.B.; Stosic, T. Nonextensive triplets in cryptocurrency exchanges. Physica A: Statistical Mechanics and its Applications 2018, 505, 1069–1074. [Google Scholar] [CrossRef]

- Yang, Y.H.; Liu, Y.L.; Shao, Y.H. Visibility graph analysis of crude oil futures markets: Insights from the COVID-19 pandemic and Russia-Ukraine conflict. Fluctuation and Noise Letters 2025, 24, 2550021. [Google Scholar] [CrossRef]

- Mari, C.; Baldassari, C. Optimization of mixture models on time series networks encoded by visibility graphs: an analysis of the US electricity market. Computational Management Science 2023. [Google Scholar] [CrossRef]

- Ravetti, M.G.; Carpi, L.C.; Gonçalves, B.A.; Frery, A.C.; Rosso, O.A. Distinguishing noise from chaos: Objective versus subjective criteria using horizontal visibility graph. PLoS ONE 2014, 9, e108004. [Google Scholar] [CrossRef]

- Zhang, J.; Small, M. Complex network from pseudoperiodic time series: Topology versus dynamics. Physical Review Letters 2006, 96, 238701. [Google Scholar] [CrossRef]

- Weron, R. Modeling and Forecasting Electricity Loads and Prices: A Statistical Approach; Wiley Finance Series: Hoboken, NJ, USA; Wiley, 2006. [Google Scholar]

- Huisman, R.; Huurman, C.; Mahieu, R. Hourly electricity prices in day-ahead markets. Energy Economics 2007, 29, 240–248. [Google Scholar] [CrossRef]

- Mari, C.; De Sanctis, A. Modeling spikes in electricity markets using excitable dynamics. Physica A: Statistical Mechanics and its Applications 2007, 384, 547–560. [Google Scholar] [CrossRef]

- Mari, C.; Lucheroni, C. Internal hedging of intermittent renewable power generation and optimal portfolio selection. Annals of Operations Research 2019. [Google Scholar] [CrossRef]

- Cleveland, W.S. Robust locally weighted regression and smoothing scatterplots. Journal of the American Statistical Association 1979, 74, 829–836. [Google Scholar] [CrossRef]

- Cleveland, W.S.; Devlin, S.J. Locally weighted regression: An approach to regression analysis by local fitting. Journal of the American Statistical Association 1988, 83, 596–610. [Google Scholar] [CrossRef]

- Lan, X.; Mo, H.; Chen, S.; Liu, Q.; Deng, Y. Fast transformation from time series to visibility graphs. Chaos 2015, 25, 083105. [Google Scholar] [CrossRef] [PubMed]

- Watts, D.J.; Strogatz, S.H. Collective dynamics of ‘small-world’ networks. Nature 1998, 393, 440–442. [Google Scholar] [CrossRef]

- Zarepour, M.; Perotti, J.I.; Tong, H.; Billoni, O.V.; Chialvo, D.R.; Cannas, S.A. Universal and nonuniversal neural dynamics on small world connectomes: A finite-size scaling analysis. Physical Review E 2019, 5, 052138. [Google Scholar] [CrossRef]

- Majdandzic, A.; Braunstein, L.A.; Curme, C.; Vodenska, I.; Levy-Carciente, S.; Stanley, H.E.; Havlin, S. Multiple tipping points and optimal repairing in interacting networks. Nature Communications 2016, 7, 10850. [Google Scholar] [CrossRef] [PubMed]

- Mari, C.; Mari, E. Gaussian clustering and jump-diffusion models of electricity prices: a deep-learning analysis. Decisions in Economics and Finance 2021. [Google Scholar] [CrossRef]

- Mari, C.; Baldassari, C. Ensemble methods for jump-diffusion models of power prices. Energies 2021, 14, 4404. [Google Scholar] [CrossRef]

- Zhou, T.-T.; Jin, N.-D.; Gao, Z.-K.; Luo, Y.-B. Limited penetrable visibility graph for establishing complex network from time series. Acta Physica Sinica 2012, 61, 030506. [Google Scholar] [CrossRef]

- Ribeiro, H.V.; Zunino, L.; Mendes, R.S.; Lenzi, E.K. Complexity-entropy causality plane: A useful approach for distinguishing songs. Physica A: Statistical Mechanics and its Applications 2012, 391, 2421–2428. [Google Scholar] [CrossRef]

| Metric | Gas | Power |

|---|---|---|

| Number of nodes | 1,825 | 1,825 |

| Number of edges | 6,202 | 5,354 |

| Density | 0.003726 | 0.003217 |

| Average degree | 6.80 | 5.87 |

| Maximum degree | 117 | 54 |

| Clustering coefficient | 0.762 | 0.767 |

| Diameter | 9 | 10 |

| Average path length | 4.59 | 5.36 |

| Assortativity | 0.175 | 0.171 |

| Connected | Yes | Yes |

| Distance Category | Gas | Power |

|---|---|---|

| Distance = 1 (adjacent points) | 29.41% | 34.07% |

| Distance = 2 | 14.90% | 17.99% |

| Distance = 3–4 | 16.98% | 18.45% |

| Average distance | 26.39 | 10.96 |

| Correlation Measure | Coefficient | p-value | Interpretation |

|---|---|---|---|

| Pearson r | 0.456 | Moderate positive linear correlation | |

| Spearman | 0.482 | Moderate positive rank correlation | |

| Kendall | 0.335 | Moderate concordance | |

| 0.208 | — | 21% shared variance |

| Metric | Value | Interpretation |

|---|---|---|

| Optimal Lag | 0 days | No lead-lag relationship |

| Maximum Correlation | 0.456 | Same-day synchronization |

| Correlation at Lag ±1 | 0.085, 0.091 | Negligible adjacent-day correlation |

| Correlation at Lag ±5 | 0.023, 0.019 | No weekly predictability |

| Statistic | Value | Interpretation |

|---|---|---|

| Mean Correlation | 0.491 | Average relationship strength |

| Standard Deviation | 0.089 | Moderate temporal variability |

| Minimum Correlation | 0.173 | Weakest coupling episode |

| Maximum Correlation | 0.696 | Strongest coupling episode |

| Range | 0.523 | Substantial regime variation |

| Graph Metric | Pearson r | p-value | Interpretation |

|---|---|---|---|

| Degree | 0.260 | Weak-moderate positive | |

| Clustering Coefficient | 0.335 | Moderate positive | |

| Betweenness Centrality | 0.024 | 0.376 | Not significant |

| Closeness Centrality | -0.719 | Strong negative |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2026 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).