Executive Summary

This paper offers a strategic examination for corporate executives and policy architects on harnessing business sustainability to achieve a market edge, using International Business Machines Corporation (IBM) as a central exemplar. The principal finding is that sustainability, when deliberately woven into the fabric of a corporation's strategy, transitions from a mandatory expense to a powerful catalyst for enduring value and organizational fortitude. IBM's methodology, enacted via its Impact Framework and the Sustainability Accelerator, yields quantifiable outcomes, such as a 68.5% decrease in operational greenhouse gas emissions since 2010, sourcing more than 70% of electricity from renewable sources, and diverting 94.2% of non-hazardous waste from landfills. These ecological initiatives produce direct corporate advantages, including considerable operational savings from energy conservation, fresh income channels from sustainability-centric software and advisory services, and improved risk control.

Essential takeaways for industry leaders encompass:

Strategic Integration: Sustainability requires incorporation into fundamental operations and oversight mechanisms, moving beyond a marginal or auxiliary role.

Tech and its Dual Nature: While digital tools, including artificial intelligence, are vital for enhancing efficiency, the substantial energy consumption of these technologies and the data centers that support them demands deliberate management.

The Supply Chain: The most formidable obstacles, including indirect Scope 3 emissions and material shortages, are predominantly located within extensive, international supplier networks.

The analysis asserts that for technology enterprises to completely harness the strategic capacity of sustainability, it must be entrenched within foundational business models, strategic frameworks, innovation cycles, and oversight systems. IBM, an established frontrunner in computing infrastructure, enterprise software, and professional services, has committed to rigorous sustainability targets, showing advancement in domains like lowering emissions, adopting clean energy, managing waste, and generating social benefit. By evaluating IBM's strategic orientation, execution programs, performance data, and commercial results, this study delivers actionable insights for executives, regulators, and academics aiming to embed sustainability within technology-focused entities.

This document organized into nine segments: Firstly will proceed by establishing a theoretical background, before presenting an analytical framework and a detailed case study of IBM. It will then analyse the business value, challenges, and external pressures, concluding with strategic recommendations. This comprehensive assessment affirms that an anticipatory and thoroughly integrated sustainability strategy is now an indispensable element of contemporary corporate stewardship and sustained competitive vitality within the technology industry.

1. Introduction

Sustainability refered to the ability of human societies to persist beyond an extended timeframes, upholding ecological equilibrium and preserving natural resources for subsequent populations (Elkington, 1997). In the corporate sphere, it entails an enterprise's intentional stewardship of its outcomes within environmental, societal, and economic spheres. This method obliges corporations to lessen detrimental ecological and community effects while concurrently generating durable financial worth for various interested parties, such as workers, clients, shareholders, and the general public (World Economic Forum, 2023).

As a significant catalyst for worldwide economic progress, the technology industry has experienced swift expansion propelled by developments in artificial intelligence (AI), distributed computing services, and interconnected device networks. These advancements have revolutionized company processes, deepened client interactions, and reformed models for providing services (Bharadwaj and Soni, 2017). Nonetheless, this accelerated progression has simultaneously aggravated environmental and societal issues. The creation, utilization, and discarding of digital apparatuses hasten the exhaustion of resources and escalate volumes of electronic refuse, whereas the power demands of data storage facilities amplify emissions of climate-warming gases (GeSI, 2015). Furthermore, the industry contends with problems like disparities in digital access, worries over information confidentiality, and employment hazards in international supplier networks.

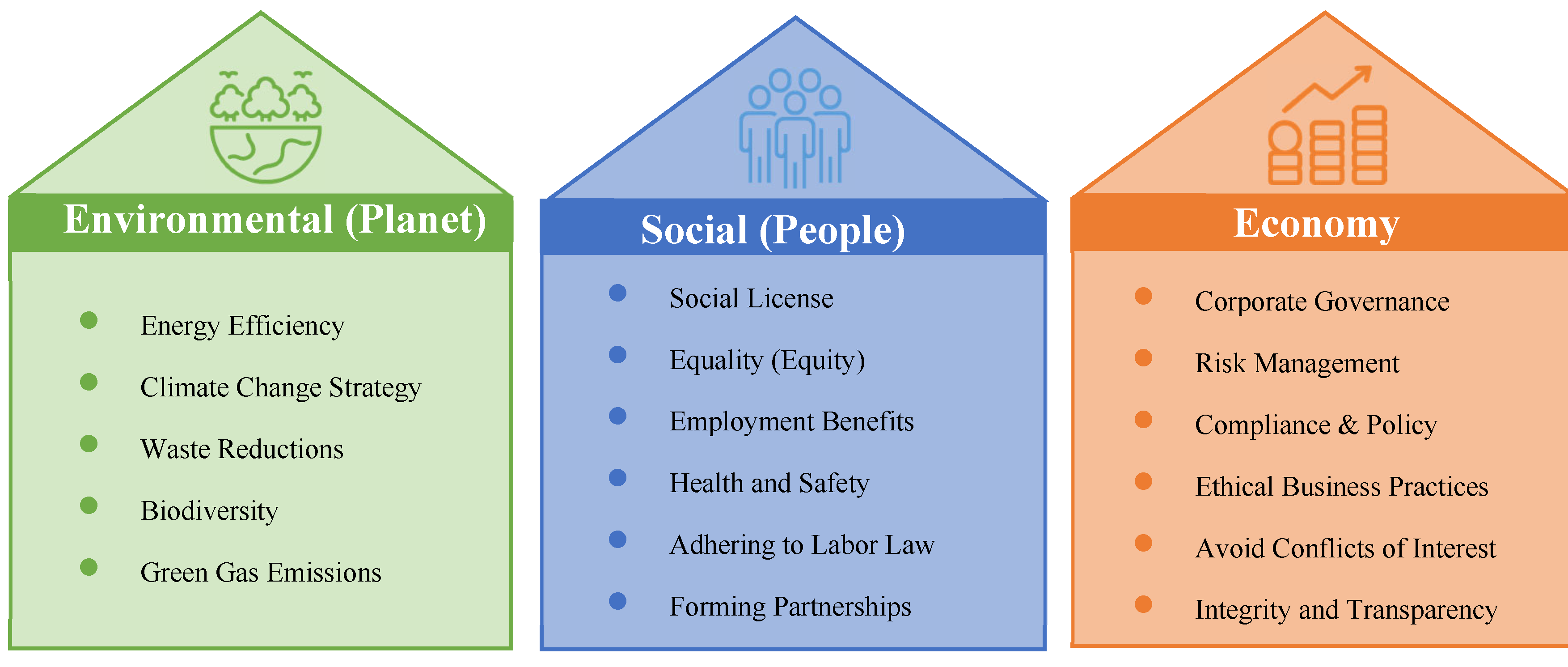

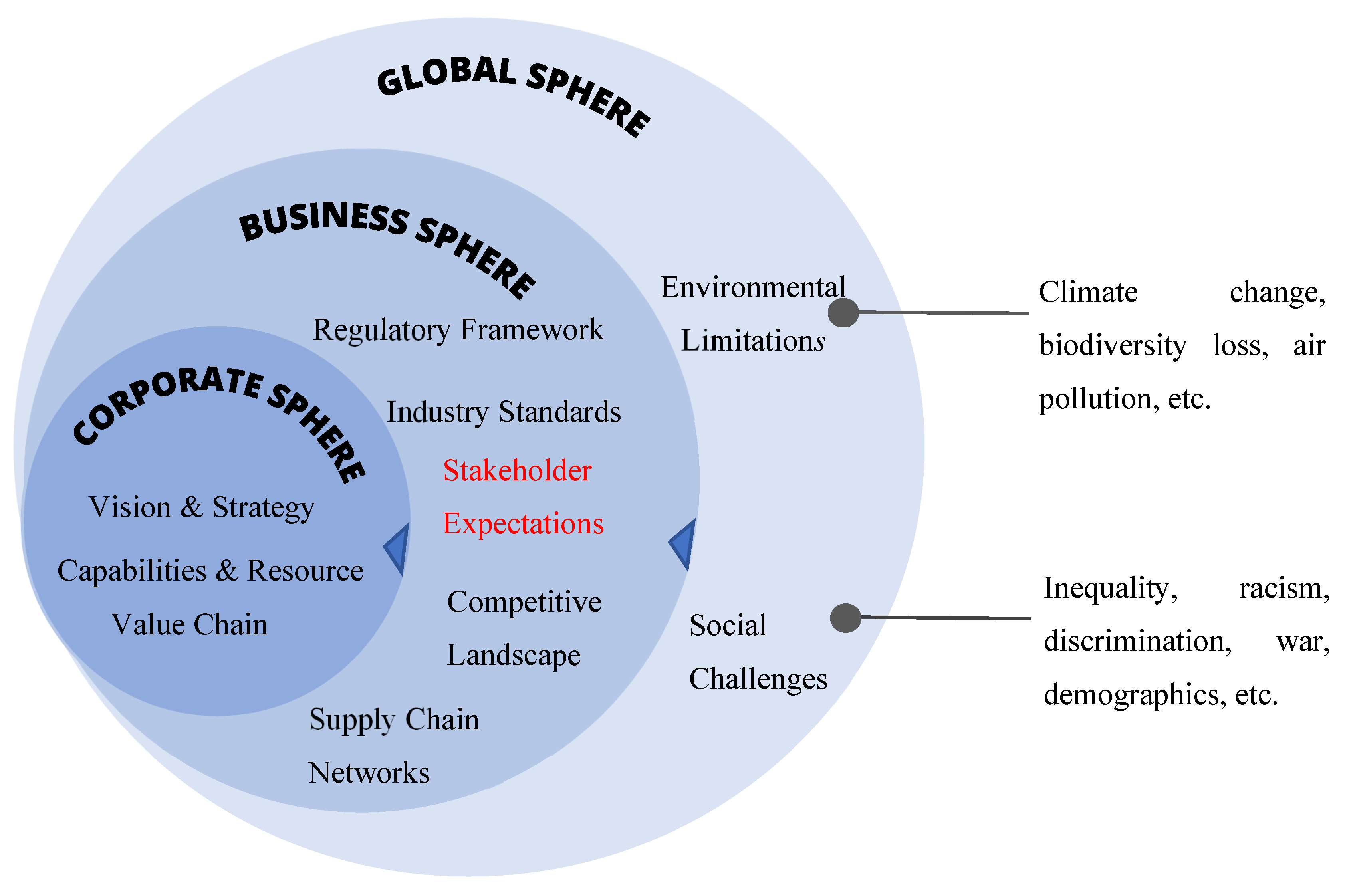

Figure 1.

The Three Pillars of Corporate Sustainability (Author’s own illustration).

Figure 1.

The Three Pillars of Corporate Sustainability (Author’s own illustration).

Within this context, the present study scrutinizes the assimilation of sustainability tenets into operational methodologies inside the technology field. It appraises principal obstacles and developing possibilities connected to diminishing ecological footprints, bettering societal accountability and oversight, and boosting enduring financial rivalry.

The objective is to furnish an all-encompassing comprehension of how technology corporations can harmonize strategic choices with the doctrines of tripartite performance evaluation. For technology businesses aiming to curtail ecological footprints and reinforce communal duty, sustainability has ascended to a position of strategic importance (Kiron et al., 2012). Crucial concentration domains encompass power conservation, diminution of electronic scrap, and expanded employment of replenishable power origins (EPA, 2019). Supervisory agencies, financiers, consumers, and other involved parties progressively anticipate that organizations will exhibit quantifiable advancement (Porter and Kramer, 2006). Reacting to this, companies are embracing power-saving technologies, integrating reprocessable substances, and establishing retrieval and reprocessing schemes (IEA, 2023).

The rewards of these endeavors comprise decreased operational expenditures, elevated brand standing, strengthened adherence to regulations, and more robust confidence from stakeholders (Epstein and Buhovac, 2014). Observational studies corroborate these results. For example, investigations by the Natural Resources Defense Council (NRDC, 2014) revealed that power-efficient data hubs can slash electrical use by as much as half, while analyses from the Ellen MacArthur Foundation (2019) indicated that circular economic frameworks can meaningfully lessen electronic waste in the technology sector. In spite of these gains, enterprises encounter difficulties like substantial upfront capital outlays, modernizations of infrastructure, and the necessity to modify commercial frameworks and supplier channels (Hart and Milstein, 2003).

Mounting universal anticipations concerning corporate answerability have additionally swayed the incorporation of sustainability. Interested groups now insist on increased openness, especially in sectors with pronounced effects like technology (OECD, 2022). As a result, disclosure structures such as the Global Reporting Initiative (GRI), the Sustainability Accounting Standards Board (SASB), and the European Union’s Corporate Sustainability Reporting Directive (CSRD) mandate more stringent revelation of sustainability execution. This organizational compulsion prompts firms to ingrain sustainability throughout product life cycles, functional endeavors, and supplier network administration.

Concurrently, sustainability is ever more associated with corporate ingenuity. Even though innovations like distributed computing and AI use considerable energy, they equally possess the capacity to enhance power productivity, improve resource application, and allow anticipatory upkeep across various sectors (Accenture, 2023). New digital instruments such as virtual replicas, ledger-based tracking mechanisms, and sophisticated data examination foster more clear and sustainable practices in supply networks. These progressions emphasize the twofold dilemma confronting technology companies: minimizing the ecological consequences linked with digitization while employing innovation to progress sustainability on a large scale.

2. Background

This segment lays the conceptual groundwork and contextual significance for the research undertaken. It commences by articulating a definition for corporate sustainability and tracking its progression within the field of business management. Subsequently, it explores the unique position of the technology industry, which concurrently aggravates worldwide sustainability issues and furnishes inventive remedies. Broadly characterized, corporate sustainability entails the assimilation of environmental, social, and governance (ESG) standards into a company’s strategic formulation, daily operations, and decisional protocols. Instead of being handled as an incidental or charitable endeavor, it has emerged as a pivotal factor for an organization's endurance and sustained market viability (Dyllick and Muff, 2016). This viewpoint is echoed by IBM (2023a), which observes that forward-thinking businesses acknowledge the perils and prospects linked with embracing conscientious commercial conduct. This twofold outlook positions sustainability as a moral imperative and a tactical resource.

The intellectual foundation of corporate sustainability originates from the triple bottom line concept, which prompts firms to gauge success not solely by monetary results but also by societal and ecological consequences (Elkington, 1997). This three-fold paradigm, usually illustrated as three mutually reliant columns, signifies a comprehensive realignment of commercial endeavors towards generating mutual benefit and satisfying current necessities without endangering the potential of later generations to fulfill theirs (WCED, 1987). It stresses the interdependence of financial achievement, communal welfare, and environmental soundness.

Strategically, the conception of sustainability has undergone substantial transformation. Originally construed as a limited activity centered on risk reduction and meeting regulatory standards, it is now viewed as a conduit for generating value, achieving market distinction, and fostering organizational ingenuity. Incorporated into corporate planning, sustainability projects can bolster brand image, boost operational productivity, lessen vulnerability to regulatory and ecological threats, and facilitate entry to funding from investors who emphasize ESG criteria (Eccles, Ioannou and Serafeim, 2014). Moreover, sustainability holds a crucial function in managing human resources. Studies show that the workforce progressively favors employers that display substantive dedication to ethical conduct, inclusiveness, and environmental guardianship (Kiron et al., 2017). For the investment community, clear sustainability disclosure indicates sound extended risk oversight and administration, whereas for purchasers, it conveys dependability, honesty, and principled corporate behavior.

2.1. Sustainability in the Technology Sector

The technology industry holds a pivotal and contradictory position in the international sustainability milieu. It functions as an engine for digital change while simultaneously constituting a major user of power, raw materials, and natural assets. As reported by the International Energy Agency (IEA, 2023), the worldwide information and communications technology (ICT) field accounts for an estimated 2% to 4% of global greenhouse gas (GHG) releases, a share predicted to rise alongside escalating data usage, artificial intelligence (AI), and cloud-based services.

This contradictory stance highlights the sector's dual identity as an originator of sustainability problems and a prospective wellspring of creative answers. The ecological impact of the technology trade is shaped by three interrelated elements.

(1) Primarily, operations demanding intensive energy substantially add to emissions. Data storage facilities, cloud systems, and networking frameworks need uninterrupted and dependable electrical supply, frequently surpassing the energy consumption of whole industrial sectors or national economies (IEA, 2023). (2) Secondly, discarded electronics have become an urgent worldwide predicament. The manufacturing, use, and discard of digital gadgets produce large amounts of electronic refuse, which approximated 53 million metric tons in 2023 (Global E-waste Monitor, 2023). Inadequate handling of this refuse can lead to contamination, leakage of poisonous materials, and forfeiture of reusable substances.

(3) Thirdly, the supplier networks of the technology industry bear considerable ecological and societal ramifications. The mining of minerals like cobalt, lithium, and rare earth elements is regularly connected to ecosystem damage, water pollution, and grave human rights violations, including verified instances of juvenile labor in small-scale mining areas (Amnesty International, 2021). These components demonstrate that sustainability dilemmas in the technology field are complex, involving power usage, management of hardware life cycles, and international supplier chain methods. Concurrently, technology firms hold a distinctive capability to formulate remedies that alleviate these effects via energy-frugal processing, incorporation of renewable power, circular-economy design doctrines, and sophisticated digital instruments for ecological surveillance and resource enhancement (World Economic Forum, 2023).

In spite of these hurdles, the technology sector possesses a significant chance to propel economy-wide carbon reduction and advocate sustainability across numerous industries. Employing digital breakthroughs such as artificial intelligence (AI), the Internet of Things (IoT), and extensive data analysis, these companies supply indispensable instruments for intelligent energy grids, resource refinement, and sustainable city and industrial frameworks (World Economic Forum, 2023). This dual function outlines the sector's tactical environment, compelling companies to concurrently diminish their personal ecological impact and broaden technological answers that permit other industries to accomplish their sustainability goals.

Consequently, the sustainability agenda within the technology sector has progressed from a compliance-focused methodology to one concentrating on strategic metamorphosis. Prominent companies, including IBM, Microsoft, and Google, have pledged to bold carbon-neutral objectives, heightened the use of renewable power, and initiated circular-economy projects, illustrating how sustainability can be ingrained into essential business strategy while also producing a competitive edge (IEA, 2023).

3. Analytical Framework

To effectively examine the intricate relationship between business strategy and sustainability, a systematic conceptual approach is necessary. This study utilizes the Triple Bottom Line (TBL) model as its principal analytical instrument. Originating from Elkington's (1997) work, the TBL framework broadens a corporation's evaluative scope beyond mere financial profitability to incorporate its social and environmental outcomes, frequently termed the "people" and "planet" bottom lines. The model contends that enduring corporate prosperity and credibility hinge on harmonizing and amalgamating results across three mutually dependent areas: economic, environmental, and social.

This model is especially suitable for appraising IBM's approach, as it transcends a confined monetary viewpoint to assess how the enterprise generates worth for a wide array of stakeholders whilst overseeing its effects on communities and the natural world. The examination is organized to investigate how IBM's projects and results correspond with each TBL pillar:

1. Environmental Performance: This area appraises the corporation's influence on natural ecosystems. It involves the development and execution of policies aimed at diminishing adverse effects (e.g., greenhouse gas emissions, refuse, water consumption) and augmenting beneficial ones (e.g., preservation, uptake of renewable energy). Scrutiny centers on strategic objectives, functional projects, and crucial performance metrics associated with ecological guardianship (Epstein and Buhovac, 2014).

2. Social Performance: This area judges the corporation's connections with individuals and communities. It encompasses employment standards, human rights, diversity and inclusion, product accountability, community involvement, and wider societal influence. Scrutiny centers on how societal fairness and ethical deliberations are ingrained in corporate oversight, supplier network administration, and innovation procedures (Dyllick and Muff, 2016).

3. Economic Performance: This area inspects conventional fiscal well-being and the more extensive financial worth produced via sustainable methods. It proceeds past simple profit to analyze how ecological and communal projects aid in expense reduction, income creation, risk alleviation, brand capital, and lasting investor worth. This directly links sustainability to competitive superiority and organizational durability (Porter and Kramer, 2011). The model is implemented dynamically, acknowledging that the three areas are not isolated but engage in a perpetual cycle of interaction.

For example, capital allocated to environmental productivity (environmental) may yield considerable expense reductions (economic), which could subsequently be funneled into worker training initiatives (social). This unified outlook permits a comprehensive assessment of IBM’s sustainability strategy as an integrated propellant of value generation.

Figure 2 highlights that a sustainability strategy defines the organisation’s overarching objectives, prioritising initiatives such as carbon neutrality, circular product design, and responsible innovation (UN Global Compact, 2022).

These strategic goals are operationalised through programmes that drive measurable sustainability performance. By collecting data on emissions reductions, resource efficiency, ethical sourcing, and social outcomes, firms generate evidence to guide managerial decision-makers and assess whether strategic objectives are being met (IEA, 2023). This iterative process ensures that sustainability is integrated into the organisation’s overall value creation framework, rather than functioning as a secondary or isolated activity.

Furthermore,

Figure 2 above demonstrates that business value outcomes function both as the consequence of effective sustainability integration and as a driver for ongoing enhancement. When organisations achieve tangible benefits, including reduced operational costs, improved brand reputation, stronger customer loyalty, enhanced competitive positioning, or increased investor confidence, these outcomes reinforce the rationale for expanding sustainability initiatives (World Economic Forum, 2023).

4. IBM’s Case Study

The case study presents a detailed examination of International Business Machines Corporation’s (IBM) approach to sustainability. As a global leader in computing, cloud infrastructure, and artificial intelligence, IBM operates at the convergence of technological innovation and the increasing demand for environmentally and socially responsible business practices. The case study investigates the company’s overarching strategic framework, key environmental initiatives, performance outcomes, and the ways in which IBM utilises technological capabilities to advance its sustainability objectives. Following the analytical framework outlined in

Section 3, the discussion focuses on strategic orientation, performance indicators, and the foundational investments underpinning IBM’s long-term sustainability ambitions.

IBM's all-encompassing sustainability plan is founded upon its Impact Framework, which is organized around three linked foundational elements: ecological stewardship, social fairness, and principled conduct (IBM, 2023a). This structure embodies the corporation's dedication to producing lasting worth for both its internal workforce and external interested parties. IBM (2023a) expresses its guiding principle as utilizing information, sophisticated analysis, and technological tools to tackle an organization's fundamental purpose with a forward-thinking, extended-horizon perspective. This methodology demonstrates the reciprocal strengthening connection between technological progress and sustainability, underlining the cooperative advantages that bolster operational toughness, market edge, and improved corporate authenticity (Porter and Kramer, 2011; World Economic Forum, 2023).

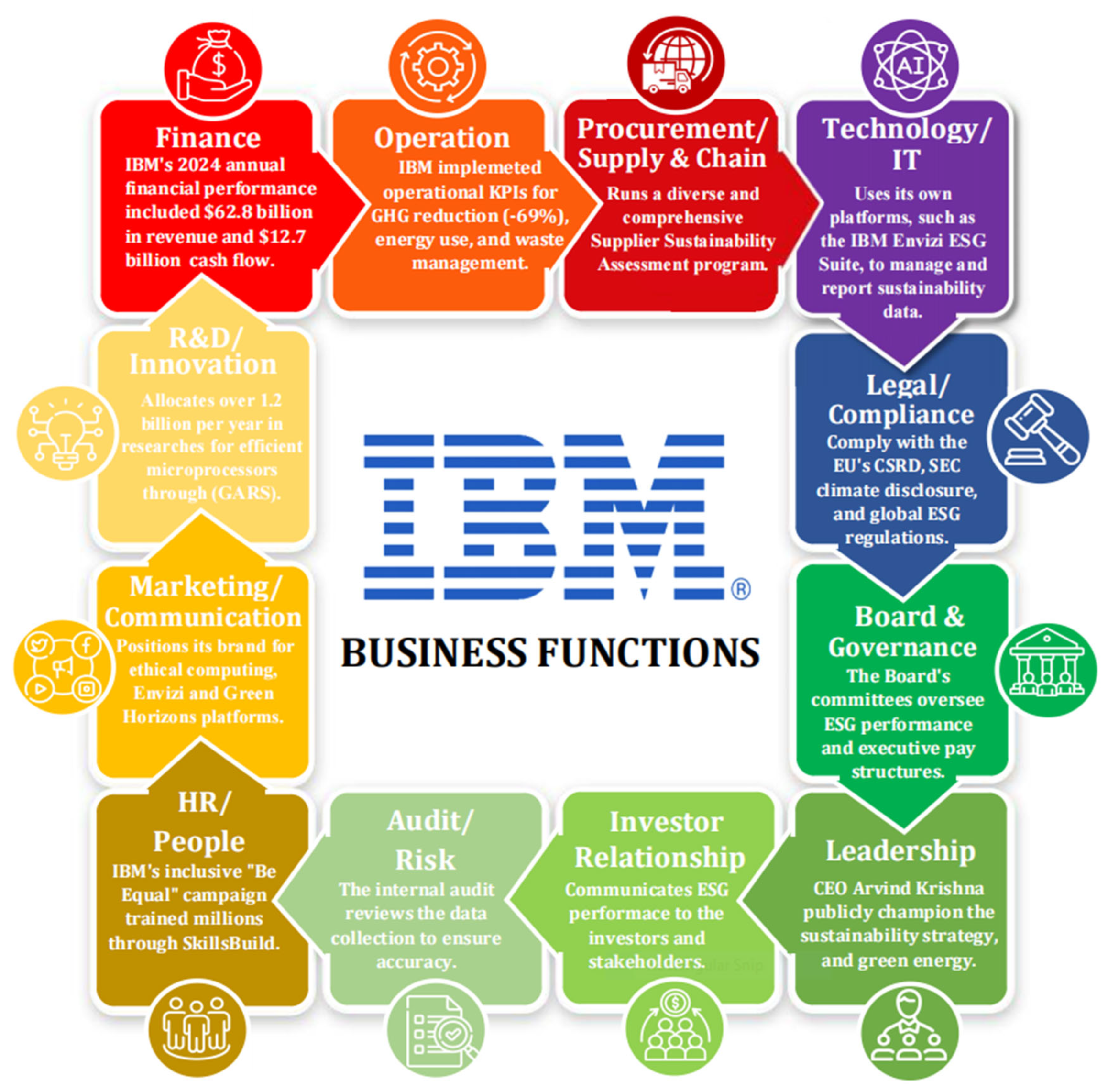

To operationalize its broad Impact Framework, IBM directly incorporates sustainability into its core functional activities and oversight mechanisms. The firm utilizes an intentionally decentralized arrangement where sustainability obligations are allocated across its main operational sectors, representing a contemporary viewpoint that sustainability ought to be a shared duty ingrained in the strategic aims of every significant department, as opposed to being restricted to one specialized group (Eccles, Ioannou and Serafeim, 2014). This structure is secured by hierarchical supervision from the Board of Directors, which links managerial monitoring and remuneration directly to ESG results—a method demonstrated to powerfully synchronize leadership objectives with sustainability aims (Amel-Zadeh and Serafeim, 2018).

The functional integration of sustainability is evident across IBM's value chain. The Research & Development division, for instance, channels substantial investment into "Green by Design" projects, such as the development of more efficient semiconductors (IBM, 2023). These innovations are then leveraged by the Information and Technology function, which utilises its own platforms, like the IBM Envizi ESG Suite, to manage and report sustainability data. This creates a synergistic cycle where IBM's products are used to advance its own and its clients' ESG targets, exemplifying the principle of corporate "green innovation" (Schiederig et al., 2012). On the operational front, the Procurement and Supply Chain team administers a comprehensive Supplier Sustainability Assessment program.

This aligns with the growing corporate focus on managing environmental and social performance across the entire supply chain (Seuring & Müller, 2008). Concurrently, the Operations unit enforces key performance indicators for reducing greenhouse gases and managing waste, ensuring internal accountability. Supporting this, Human Resource Management cultivate the necessary culture and skills, while Marketing and Communication builds the IBM brand around its sustainability platforms, enhancing its ethical reputation (Kotler & Lee, 2005).

Figure 3.

IBM’s Business Functions Driving Sustainability (Author’s own illustration based on IBM report).

Figure 3.

IBM’s Business Functions Driving Sustainability (Author’s own illustration based on IBM report).

Critical support functions underpin this structure at IBM. The Finance department monitors investments, supporting the $62.8 billion revenue generated in 2024 through robust operating cash flow and strategic activities, including major acquisitions like HashiCorp. Legal and Compliance navigates the complex landscape of global ESG regulations, such as the EU's Corporate Sustainability Reporting Directive (CSRD), SEC disclosure rules. The Audit function provides assurance by reviewing data collection processes, a critical step for credible reporting (Simnett et al., 2009). Meanwhile, Investor Relations communicates ESG performance to the market, as effective sustainability communication is increasingly linked to stakeholder confidence and financial value (Greening et al., 2020).

In summary, this functional analysis reveals that the efficacy of IBM's strategy stems from its decentralized nature. By assigning tailored sustainability mandates to each business unit, IBM has created a system where ESG objectives are advanced in concert with core business performance, a hallmark of integrated strategy (Porter & Kramer, 2011).

4.1. Environmental Strategy

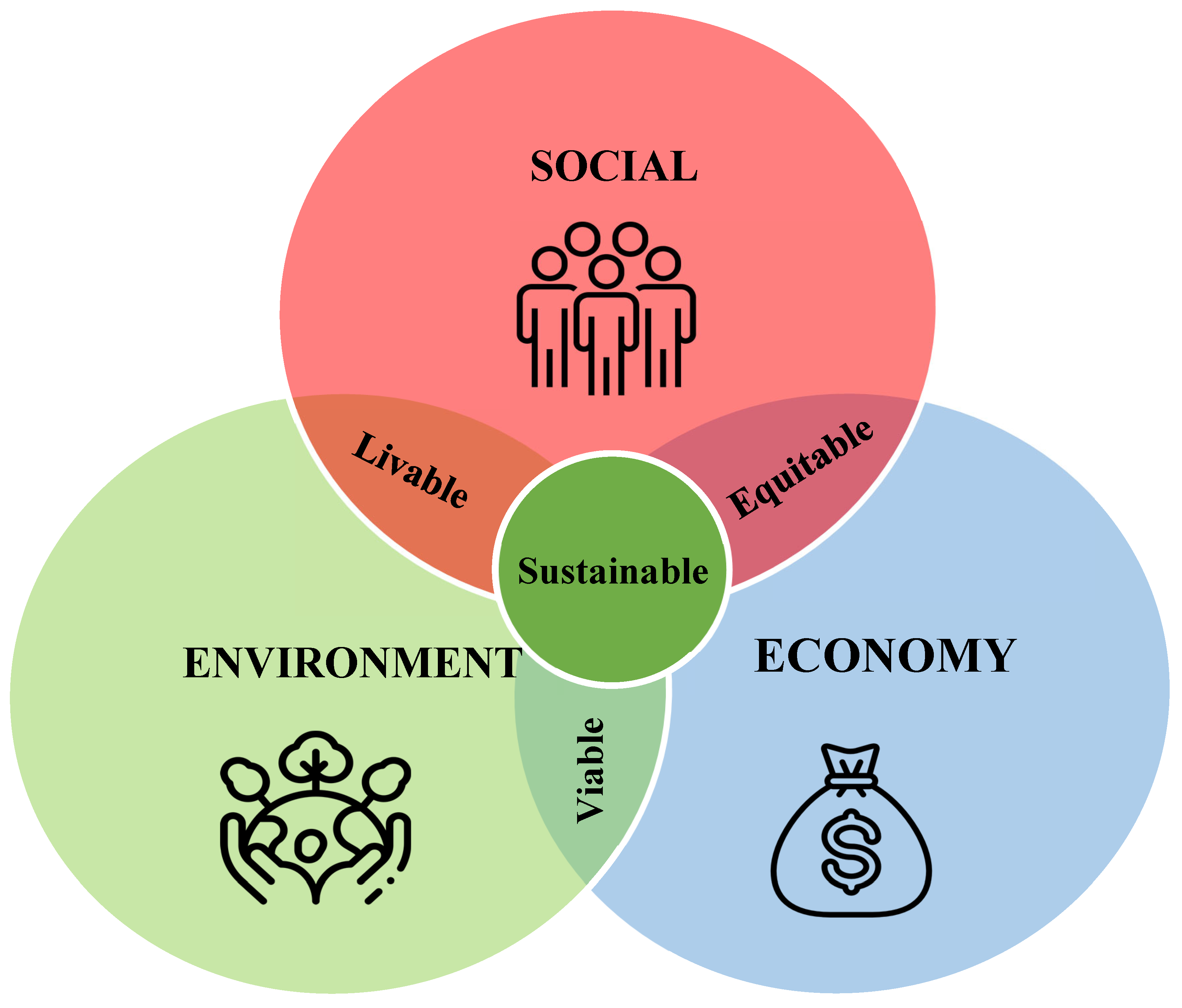

Within the environmental domain, IBM’s sustainability strategy centres on reducing climate impact, conserving natural resources, and supporting clients in pursuing analogous commitments (IBM, 2023). A key mechanism for implementing these objectives is IBM’s supplier sustainability assessment programme, which utilises a weighted evaluation model incorporating environmental sustainability, social responsibility, governance and ethics, business continuity, and innovation. Environmental sustainability receives the highest weighting, followed by social, governance, and continuity components, while innovation functions as a supplementary criterion (IBM, 2024).

Scholarly research notes that IBM conducts quarterly reviews alongside an annual comprehensive assessment of supplier performance. Suppliers falling below the 70% threshold are issued targeted improvement plans, and continued underperformance may result in contract termination (Eccles et al., 2014; Dyllick and Muff, 2016). This stringent evaluation framework ensures compliance with international sustainability standards and enables IBM to effectively manage climate, regulatory, and reputational risks across its global supply chain. By embedding sustainability into procurement and operational processes, IBM demonstrates that environmental stewardship can be integrated into core business practices while simultaneously reducing long-term risk exposure.

Beyond supplier assessments, IBM’s social and governance initiatives encompass ethical sourcing requirements, a longstanding supplier diversity programme, and capacity-building initiatives for supplier organisations. In 2023, more than 95% of IBM’s suppliers reported implementing environmental management systems aligned with ISO 14001 standards (IBM, 2023). In the same year, IBM allocated over $2 billion in procurement expenditure to minority-, women-, and veteran-owned businesses. Academic discourse on responsible innovation also highlights IBM’s contributions to ethical artificial intelligence, noting its systematic integration of fairness, transparency, and accountability principles into technological development (Jobin et al., 2019).

As depicted in the Pie chart in

Figure 4, the supplier assessment programme applies a weighted scoring system that integrates these multiple dimensions to drive consistent and measurable sustainability performance. IBM encounters several significant hurdles in implementing sustainability across its operations and supply chain. To address these risks, the company operates a comprehensive supplier sustainability assessment programme.

Within this programme, environmental sustainability is assigned the highest weighting at 30%, subdivided into carbon footprint reduction initiatives (10%), energy efficiency programmes (5%), waste management and recycling systems (5%), and sustainable material sourcing (10%). Social responsibility accounts for 25% of the assessment, comprising labour practices and human rights compliance (15%) and diversity and inclusion initiatives (10%). Governance and ethics also represent 25%, encompassing anti-corruption policies (10%) and data privacy and security standards (15%). Business continuity contributes 15%, including risk management systems (10%) and supply chain resilience (5%), while innovation and collaboration account for 5%, exemplified by joint sustainability innovation projects with partners such as Lumen that facilitate the development of scalable AI solutions (IBM, 2021).

IBM conducts quarterly reviews of supplier performance, complemented by an annual comprehensive assessment. Suppliers scoring below the 70% threshold are provided with targeted improvement plans, and those with persistent underperformance may face contract termination. This structured framework ensures that IBM’s supply chain aligns with international sustainability objectives while mitigating risks associated with climate change, regulatory compliance, and reputational exposure.

Overall, the programme demonstrates IBM’s commitment to environmental stewardship, social responsibility, and ethical business practices, reinforcing its position as a leader in sustainable technology procurement (Eccles et al., 2014; Dyllick and Muff, 2016).

4.2. Sustainable and Efficient IT

Sustainable and energy-efficient information technology represents a core component of IBM’s overarching sustainability strategy. By investing strategically in hybrid-cloud architectures, green IT infrastructure, and responsible computing practices, IBM aims to separate technological innovation from environmental impact. Solutions such as Green Horizons and IBM Envizi equip organisations with advanced tools to monitor emissions, optimise resource utilisation, and meet ESG reporting obligations through AI-driven analytics and data insights (IBM, 2024). Scholarly research frequently identifies IBM as a leading exemplar of how a global technology firm can operationalise sustainability by embedding environmental stewardship, social inclusion, and ethical governance into both strategic and operational processes (Eccles et al., 2014; Dyllick and Muff, 2016). By integrating sustainability into its organisational framework, IBM illustrates that a multidimensional approach can simultaneously generate societal value and strengthen long-term economic performance, competitiveness, and resilience.

4.3. Key Initiatives and Performance Metrics

IBM implements its strategic sustainability pillars through well-defined initiatives underpinned by comprehensive measurement and reporting systems. The following subsections detail the company’s key programmes alongside their associated performance metrics, spanning both environmental and digital domains (IBM, 2023).

4.3.1. Greenhouse-Gas Reductions and Renewable Energy

IBM’s strategy for reducing greenhouse gas (GHG) emissions represents one of the most advanced and transparent frameworks in the global technology sector. The company’s performance reflects disciplined execution of its commitments:

Performance Metrics: By 2023, IBM had reduced its operational Scope 1 and 2 GHG emissions by 68.5% relative to 2010 levels, surpassing its interim target of 65% by 2025. In the same year, 70.6% of IBM’s global electricity consumption was sourced from renewable energy, progressing toward the 2030 goal of 90% (IBM, 2023; ESG Voices, 2024).

Key Initiatives: This success is underpinned by a multi-faceted approach. IBM implemented over 675 energy-conservation projects across 130 facilities worldwide, which avoided 95,000 megawatt-hours (MWh) of energy consumption and 33,000 metric tonnes of CO₂ equivalent (mtCO₂e) emissions in 2023 alone. Initiatives include high-efficiency cooling systems, advanced lighting solutions, and AI-driven facility management. The company also participates in renewable-energy consortia to expand clean-energy markets and leverages its consulting services to assist clients in adopting decarbonisation strategies, thereby amplifying its impact.

4.3.2. Waste Management and the Circular Economy

Waste management and circular-economy practices constitute a central component of IBM’s environmental strategy, reflecting a commitment to responsible material use throughout the product lifecycle. IBM places a strong emphasis on waste reduction at the source through sustainable product design, environmentally conscious procurement, and enhanced material efficiency. By incorporating recyclability criteria into hardware and packaging design, the company reduces its reliance on virgin raw materials and limits the volume of waste requiring processing (IBM, 2023). The company’s global waste-management framework prioritises segregation, responsible disposal, and the diversion of materials from landfills, ensuring that operational waste streams, including manufacturing residues and everyday office waste, are managed in accordance with both international standards and local regulations (Global E-waste Monitor, 2023).

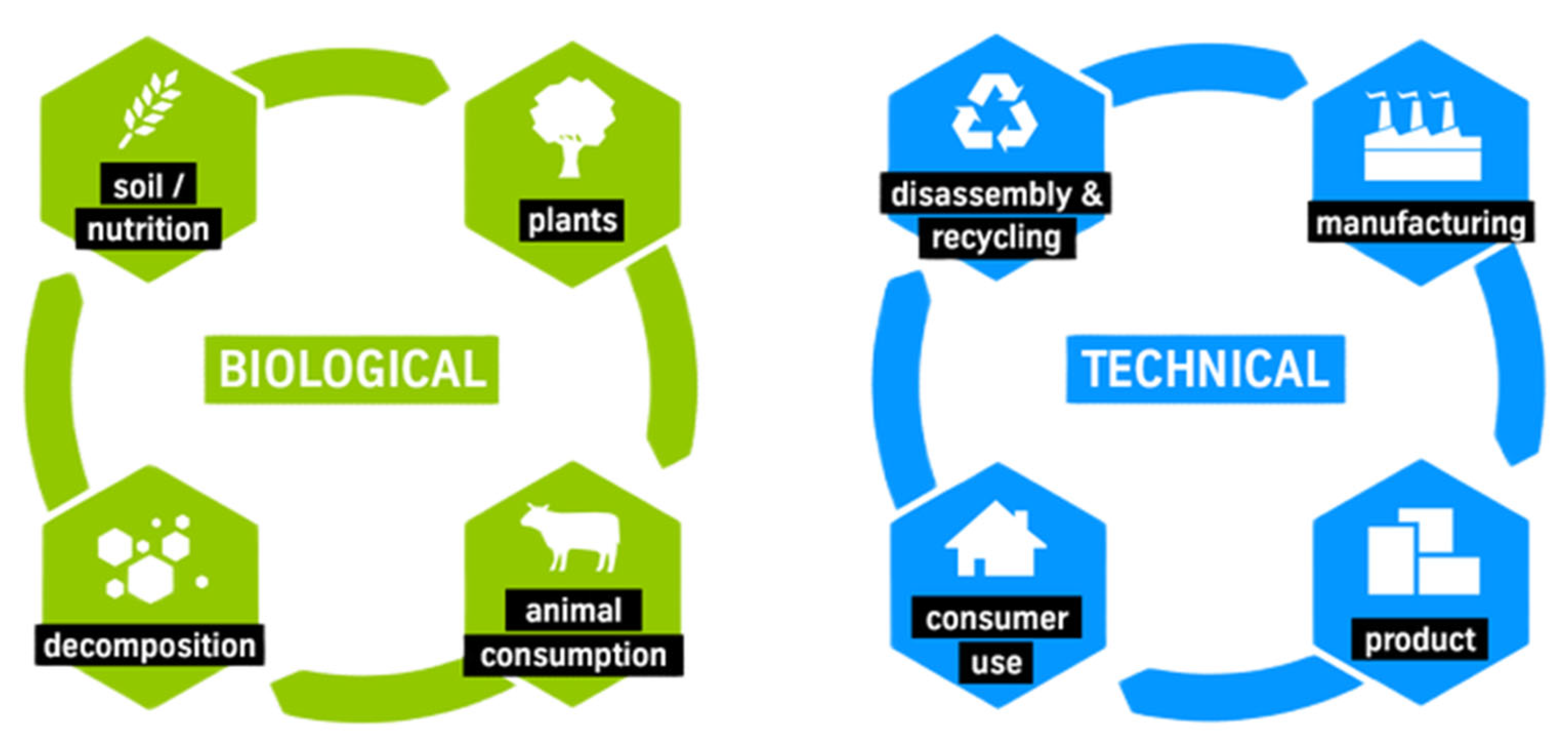

Figure 5.

Circular Economy Upcycling Concept (Author’s own illustration).

Figure 5.

Circular Economy Upcycling Concept (Author’s own illustration).

Building on these foundational practices, IBM actively promotes circular-economy principles within its technology ecosystem by advancing reuse, refurbishment, remanufacturing, and closed-loop recycling. End-of-life equipment is systematically collected, disassembled, and processed so that valuable components and materials can be reintegrated into the production cycle, thereby reducing environmental impact and supporting sustainable resource management (Ellen MacArthur Foundation, 2019).

Performance Metrics: In 2023, IBM achieved a 94.2% diversion rate for non-hazardous waste from landfills and incineration, exceeding its 2025 target of 90%. Additionally, non-essential single-use plastics were eliminated from 58 of IBM’s 60 corporate cafeterias (IBM, 2023).

Key Initiatives: The cornerstone of these efforts is IBM’s Global Asset Recovery Services (GARS), which refurbishes and redeploys IT equipment. In 2023, GARS processed more than 26,000 metric tonnes of IT equipment and parts, reusing 96% of the materials. IBM also applies a Design for Environment (DfE) philosophy, emphasising material efficiency, recyclability, and modular product design. The company utilises its Envizi platform to monitor waste streams in real time, ensuring operational efficiency and regulatory compliance.

4.3.3. Digital-Sustainability Solutions

IBM leverages its technological expertise to develop digital solutions that enable organisations to manage and enhance their own ESG performance, effectively integrating sustainability into core business offerings.

Key Initiatives and Impact: A flagship offering is the IBM Envizi ESG Suite, a software platform that automates the collection and analysis of sustainability data from thousands of sources. The platform enables clients to monitor energy consumption, emissions, water usage, and waste generation, while facilitating reporting in compliance with frameworks such as the Global Reporting Initiative (GRI) and Task Force on Climate-related Financial Disclosures (TCFD) (IBM, 2024).

4.3.4. Investment in AI and IT for Sustainability

IBM strategically allocates resources to research and development (R&D) to ensure that its core technologies function as engines for sustainability innovation.

Key Initiatives: The company invests significantly in AI-enabled sustainability research. IBM Research has developed AI algorithms to improve solar and wind power forecasting and implemented blockchain solutions to enhance supply-chain transparency. According to a 2024 IBM report, 88% of business leaders plan to increase investment in IT for sustainability, positioning IBM to meet this demand through offerings such as AI-powered climate modelling and carbon-intelligence services (IBM, 2024).

∙ Financial Commitment: IBM supports these initiatives with substantial financial investment. In 2023, over US$1.2 billion of the company’s R&D budget was allocated to sustainability-related technologies (ESG Voices, 2024). This investment philosophy reflects the concept of “responsible computing,” which emphasises the development of technology systems that minimise energy consumption and are designed and deployed ethically. By integrating AI and IT innovation into its sustainability strategy, IBM demonstrates how technological advancement can enhance data accuracy, operational efficiency, and stakeholder accountability while contributing to broader sustainability objectives.

IBM’s substantial investment in sustainability-focused research and development, shows how principles of responsible computing are embedded within its broader corporate strategy. This level of commitment supports the creation of technologies that prioritise ethical design, reduced energy consumption, and long-term environmental stewardship.

5. IBM’s Analysis

This analysis is organized around four core value-creation domains: operational efficiency, revenue expansion, risk reduction, and the strengthening of intangible assets. Aligning with the third dimension of the analytical framework, it demonstrates how IBM’s sustainability strategy functions as a driver of financial performance, competitive advantage, and organizational resilience, rather than a mere cost center. The analysis evaluates the tangible commercial benefits derived from IBM’s approach and examines some intrinsic constraints and dilemmas that frame its accomplishments.

5.1. Expense Reduction and Operational Effectiveness

IBM's sustainability plan has yielded considerable financial savings. During 2023, its 675 energy-preservation ventures resulted in an approximated US$11 million in yearly expense prevention (IBM, 2023a). Attaining a 94.2% waste redirection rate decreases costs for refuse processing and elimination, whereas the GARS initiative diminishes ecological consequences and establishes auxiliary income channels. Together, these endeavors offer compelling proof that a circular economic framework is both ecologically sound and financially beneficial (Eccles, Ioannou and Serafeim, 2014).

5.2. Income Expansion and Market Distinction

Sustainability has developed into a stimulant for income expansion and a crucial element of market differentiation. Systems like the Envizi ESG Suite respond to the escalating need for ESG information oversight, furnishing a notable income source (IBM, 2024a). Investigations from the IBM Institute for Business Value propose that entities merging sustainability with digital modernization realize as much as 19% greater income growth compared to less developed counterparts (IBM IBV, 2023). IBM's robust ESG execution additionally functions as a persuasive market differentiator affecting purchasing choices among corporate customers (Eccles, Ioannou and Serafeim, 2014).

5.3. Risk Oversight and Extended Durability

IBM's sustainability strategy functions as an all-inclusive risk oversight structure. By procuring 70.6% of its electricity from renewable origins, IBM lessens susceptibility to instability in fossil fuel markets and prospective carbon taxation (IBM, 2023a). Its Supplier Code of Conduct and Diversity Initiative mitigate risks related to supplier concentration and reputation. Supervision of ESG strategy at the board level guarantees that risk detection and alleviation are integrated within high-level decisional frameworks, protecting operational continuity (Dyllick and Muff, 2016).

5.4. Stakeholder Confidence and Brand Capital

IBM's sustainability outcomes boost intangible resources like stakeholder confidence and brand worth. Accomplishing significant benchmarks ahead of timetable and obtaining external accolades (e.g., CDP’s “A List”) fortifies its trustworthiness as a principled industry leader (IBM, 2024b). This trustworthiness affects investor communications and improves worker involvement, as personnel progressively favor employers possessing solid ESG qualifications (Kiron et al., 2017). This confidence converts into client allegiance, as customers search for collaborators capable of aiding their personal ESG aspirations.

5.5. Constraints and Strategic Dilemmas

A complete appraisal must also recognize the intrinsic constraints and unresolved strategic dilemmas that define the forefront of corporate sustainability at IBM. Three key issues are outlined below.

The Unresolved Issue of Scope 3 Discharges: Notwithstanding model advancement on operational discharges, IBM's most substantial ecological effect resides in its supplier network. Scope 3 discharges make up the bulk of its carbon imprint. Although the supplier appraisal program controls risk, authentic leadership necessitates advancing past evaluation to proactive cooperation in decarbonizing the worldwide supply chain.

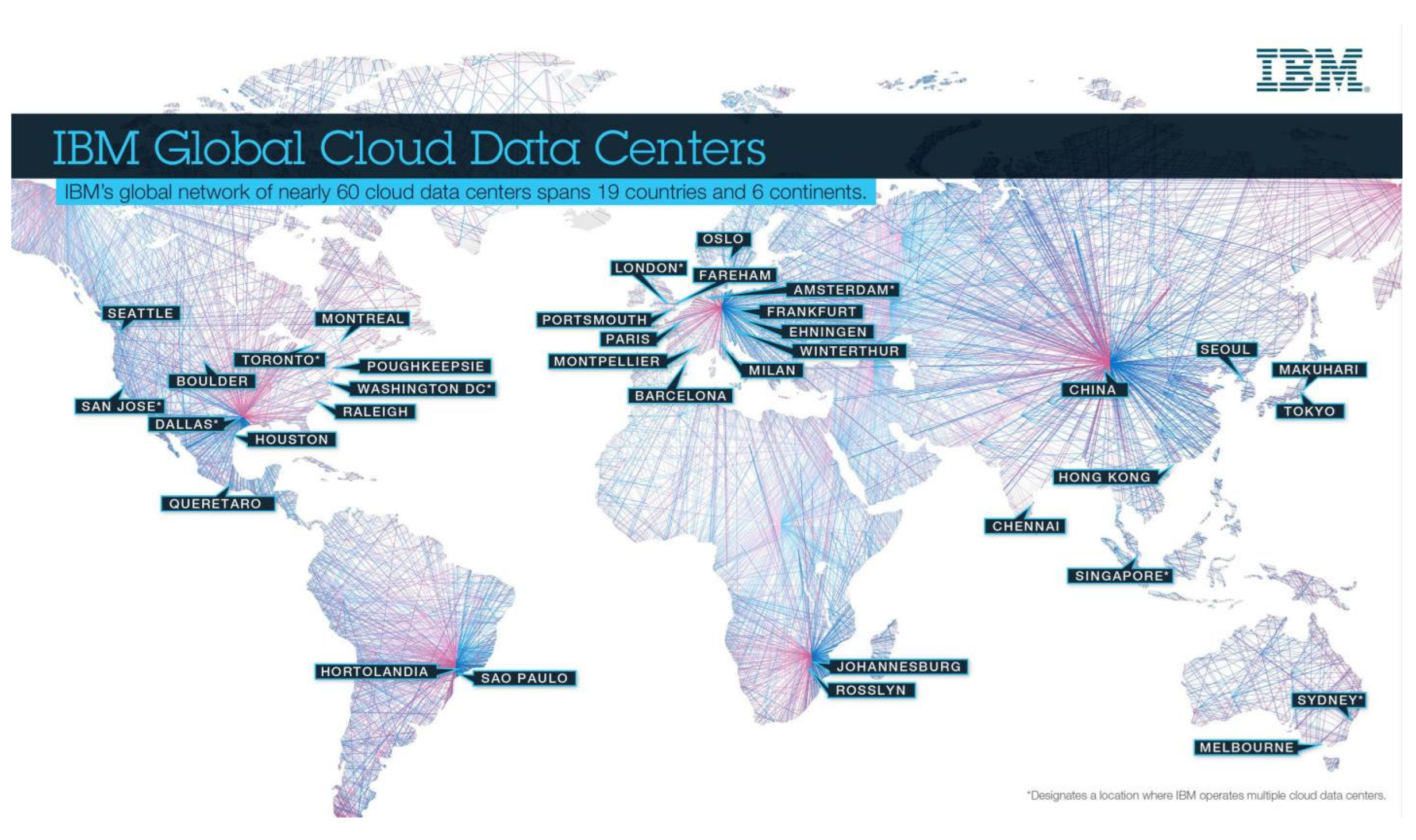

The Digital-Technology Contradiction: IBM's core business is entangled in a central industry paradox: its foundational technologies, particularly data centers, are highly energy-intensive. While its Sustainability Accelerator supports broad climate action, IBM advocates for a diverse energy mix to facilitate "orderly adaptation" rather than committing to a strict phase-out of fossil fuels. Crucially, the growth of AI and cloud services which are the key drivers of IBM's revenue directly increases its operational energy demands. Therefore, IBM must continually demonstrate that the environmental benefits enabled by its solutions outweigh the growing footprint of its own digital infrastructure.

The Circularity Shortfall in Hardware: Whereas operational waste redirection is elevated, the definitive examination for a hardware producer is product conception and end-of-life administration. IBM's methodology has not yet completely adopted modular design, extensive repairability, and product-as-a-service paradigms that would optimize resource preservation, denoting a chance for more profound business model invention.

These constraints position IBM’s achievements within the broader context of sustainability, highlighting that its progress, while advanced, remains ongoing. The following Section further examine the external and internal pressures that make these issues difficult to resolve.

Figure 6.

IBM's Global Network of Cloud Data Centers (Source: International Data Corporation).

Figure 6.

IBM's Global Network of Cloud Data Centers (Source: International Data Corporation).

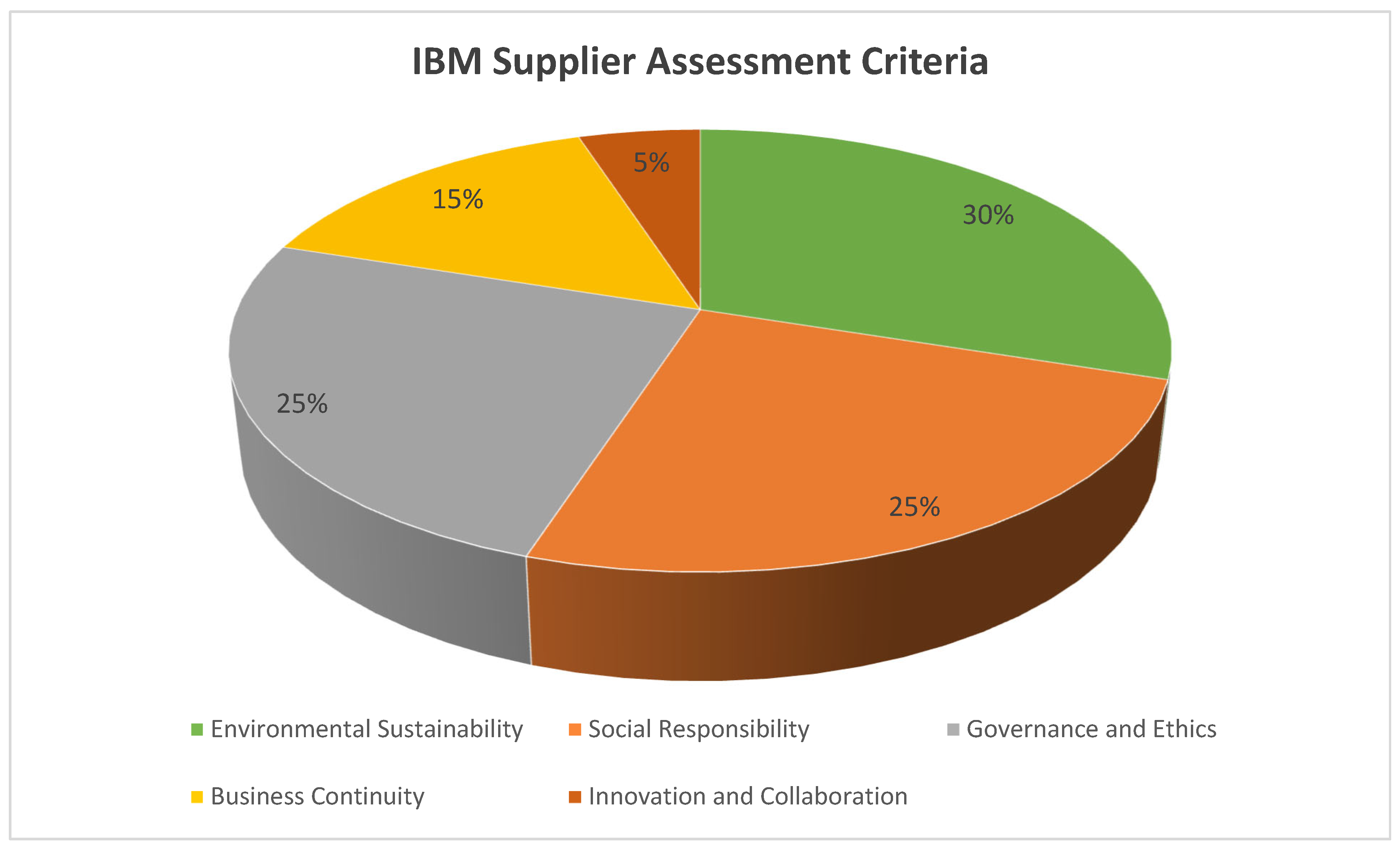

6. Key External Pressures on IBM

The constraints and dilemmas outlined in

Section 5.5 are intensified by a multifaceted and swiftly changing international landscape. In addition to its internal strategic difficulties, IBM confronts considerable external pressures stemming from market rivalry, international political dynamics, trade disruptions, regulatory demands, and the tangible effects of climate change. Notwithstanding the notable advancements made in its sustainability endeavors, IBM functions within a worldwide context that is exceptionally intricate and in constant flux. The wider setting encompasses intense competitive forces from well-established technology corporations alongside emerging digital competitors, intertwined with overarching global concerns like climate transformation, exhaustion of resources, and geopolitical unpredictability (World Economic Forum, 2023; IEA, 2023).

Figure 7.

Spheres of Influence: Business Sustainability Perspective Model (Author’s own illustration).

Figure 7.

Spheres of Influence: Business Sustainability Perspective Model (Author’s own illustration).

At the same time, the company faces increasing regulatory scrutiny and shifting expectations from stakeholders who demand higher levels of transparency, ethical behaviour, and verifiable environmental and social outcomes. These conditions require IBM to continually refine and adapt its sustainability strategy in ways that balance operational efficiency, regulatory compliance, and technological innovation. This adaptive approach is essential for maintaining organisational resilience and long term competitiveness within an unpredictable global landscape (Porter and Kramer, 2006; GeSI, 2015). This analysis examines the external pressures faced by IBM as well as the wider technology sector. These pressures can be grouped into operational, physical, regulatory, and reputational categories, each of which is strongly interconnected (Porter and Kramer, 2006; GeSI, 2015).

Challenges such as supply chain disruptions, variability in energy availability, and non compliance with emerging environmental standards can influence operational performance while simultaneously affecting the company’s social licence to operate and its long term competitive position (IEA, 2023; World Economic Forum, 2023). Anticipating and effectively managing these pressures is essential for IBM to continue generating business value from sustainability initiatives and to preserve organisational resilience, stakeholder confidence, and strategic flexibility.

6.1. Intense Competitions

IBM operates within a global environment characterised by complex and increasingly intense competitive pressures. The company navigates what can be understood as a dual-front competitive landscape. On one front, IBM faces significant competition from established technology giants such as Microsoft, Amazon and Google, which dominate key strategic domains including cloud computing, artificial intelligence, cybersecurity and enterprise software (McKinsey, 2023). These firms possess extensive financial resources, strong brand recognition and highly integrated digital ecosystems, enabling them to scale new technologies rapidly and respond efficiently to evolving customer requirements. This places IBM under ongoing pressure to differentiate its offerings, preserve enterprise customer loyalty and maintain relevance across highly competitive digital markets.

On the second front, IBM competes with a growing number of smaller, agile start-ups and digital disruptors. These firms often specialise in niche technological areas or innovative business models, drawing on fast-paced innovation cycles, flexible organisational structures and highly focused product portfolios (Smith, 2022). Their ability to experiment, iterate and commercialise solutions quickly allows them to address specific client needs with greater agility than many incumbent firms. As a result, IBM must accelerate its internal innovation processes, strengthen research and development pipelines and pursue strategic partnerships and acquisitions to ensure sustained competitiveness.

The simultaneous pressure exerted by dominant industry leaders and emerging disruptors requires IBM to continuously evolve its technological portfolio, enhance product differentiation and maintain long-term investment in innovative capabilities. If the company does not respond effectively to these dynamics, it risks losing market share and weakening its strategic position. Competitive intensity therefore remains a central external pressure shaping IBM’s global strategy and influencing its long-term innovation trajectory (IBM, 2023).

6.2. Geopolitical Instability

As a multinational enterprise operating in more than 170 countries, IBM is significantly exposed to geopolitical instability and the challenges of an increasingly unpredictable global environment. Developments such as trade tensions, sanctions, diplomatic disputes, regional conflicts and shifting political alliances directly shape IBM’s operational conditions and strategic room for manoeuvre (OECD, 2023).

These dynamics contribute to regulatory uncertainty, disrupt global supply chains and heighten operational risks for firms engaged in cross-border technological activities. Trade restrictions, tariffs and export controls represent particularly influential sources of risk. Heightened geopolitical tensions often lead governments to introduce tighter regulations on technology transfers, impose data localisation requirements or limit market access for foreign technology companies (World Bank, 2024). Such actions can restrict IBM’s ability to provide services, collaborate with international partners or expand into strategic growth markets. These constraints are especially consequential in areas such as semiconductor production and chip manufacturing, where geopolitical decisions can generate financial uncertainty and complicate long-term strategic planning.

Geopolitical instability also undermines supply-chain reliability. Regional conflicts, political disruptions and diplomatic shifts can delay access to essential hardware components, create logistical constraints and increase production costs. For technology firms that depend on complex, globally distributed supply networks, such disruptions can affect delivery timelines, elevate operational costs and weaken customer satisfaction (KPMG, 2023). Political instability frequently leads to rapid and unanticipated regulatory changes. Governments undergoing turbulence may revise or introduce new rules related to cybersecurity, data protection, labour standards or sustainability reporting.

These developments increase compliance obligations and require continuous adjustments to governance structures and operational processes (IBM, 2023). Overall, geopolitical instability represents a substantial external pressure shaping IBM’s risk management priorities and global competitive positioning. The company’s ability to anticipate, respond to and mitigate these geopolitical risks is critical for maintaining operational resilience and sustaining long-term strategic advantage in an increasingly volatile international landscape.

6.3. Regulatory Scrutiny

The regulatory pressures facing the global technology industry have become increasingly stringent and wide-ranging, forming a significant external challenge for IBM. Governments and international institutions continue to introduce comprehensive frameworks governing data privacy, antitrust enforcement, cybersecurity, environmental reporting and the ethical use of artificial intelligence (European Commission, 2023). For a multinational enterprise, navigating this expanding regulatory environment requires substantial financial resources, advanced compliance capabilities and strong governance mechanisms.

Data-protection regulations, particularly the General Data Protection Regulation (GDPR), impose demanding obligations related to data collection, user consent and cross-border data transfers. Meeting these requirements necessitates secure digital infrastructures, sophisticated internal controls and ongoing compliance monitoring to prevent financial penalties and reputational damage (ICO, 2024). At the same time, antitrust authorities have intensified scrutiny of large technology firms. Regulators increasingly examine whether mergers, acquisitions or strategic alliances limit market competition or hinder the growth of smaller innovators (FTC, 2024).

Such oversight can slow IBM’s acquisition processes, restrict certain forms of collaboration and influence its strategic expansion decisions. Environmental regulation presents another important layer of compliance. Many jurisdictions now mandate detailed sustainability disclosures, carbon accounting and verified environmental performance throughout corporate supply chains. For IBM, producing reliable ESG information is essential not only to satisfy regulatory requirements but also to maintain the confidence of investors and stakeholders who rely on transparent reporting (IBM, 2023).

Additionally, the rapid development of artificial intelligence has prompted the introduction of new policy frameworks addressing algorithmic fairness, transparency, bias mitigation and responsible deployment. IBM must ensure that its AI systems adhere to emerging global standards, including the provisions of the EU AI Act and national guidelines that govern ethical AI practices (European Parliament, 2024). Collectively, these regulatory developments have become a central factor shaping IBM’s strategic choices, operational configurations and long-term investment priorities. Effective compliance is now fundamental to sustaining organisational legitimacy and securing a competitive position within the global technology sector.

6.4. Stakeholder Expectations

IBM operates in an environment increasingly defined by the expectations of diverse stakeholders, who demand greater transparency, ethical responsibility, and demonstrable progress in sustainability and governance. These expectations arise from investors, customers, employees, and civil-society organisations, all of whom collectively influence IBM’s strategic priorities and corporate agenda (PwC, 2023). Investors, particularly those employing ESG-integrated strategies, expect IBM to provide credible evidence of progress toward critical sustainability goals, including carbon reduction, responsible sourcing, and efficient resource management. Data-driven and transparent reporting is essential for assessing long-term value creation, risk management, and corporate resilience (BlackRock, 2023).

Customers, including enterprise clients and public-sector entities, expect IBM’s technological solutions to uphold high standards in security, privacy, ethical AI, and environmental responsibility. These expectations directly influence procurement decisions and require IBM to integrate sustainability and ethical principles into product development and service delivery (IBM, 2024). Employees also exert significant influence, as the modern technology workforce increasingly seeks purpose-driven employment and prioritises organisations with strong ethical, inclusive, and environmentally responsible practices. Effectively addressing these expectations strengthens IBM’s ability to attract, motivate, and retain top talent, while fostering a cohesive and values-aligned organisational culture (Deloitte, 2023).

Civil-society organisations and the wider public further intensify scrutiny, holding IBM accountable for the social and environmental impacts of its technologies. This pressure shapes the company’s disclosure practices, community engagement initiatives, and public commitments. Collectively, stakeholder expectations constitute a powerful external force, compelling IBM to embed sustainability, ethics, and transparency within its operational and strategic frameworks. Meeting these demands enhances organisational legitimacy and contributes to sustainable competitive advantage in the global technology sector.

6.5. Climate Change and Energy Consumption

The technology sector represents a notable source of global greenhouse gas emissions, with data centres contributing significantly to overall energy consumption. The International Energy Agency (IEA, 2023) estimates that data centres consume approximately 1% of global electricity, highlighting the high energy intensity of digital services. This reliance on substantial energy inputs exposes technology firms, including IBM, to both physical and financial risks associated with climate change. Extreme weather events and prolonged droughts have already caused disruptions to critical supply chains, particularly in Taiwan’s semiconductor manufacturing sector, which plays a central role in global technology production.

Figure 8.

Electricity Consumption of Major Tech Giants (Data Source: Electrical Power Research Institute).

Figure 8.

Electricity Consumption of Major Tech Giants (Data Source: Electrical Power Research Institute).

IBM consumes roughly 2,400 GWh of electricity each year, placing the company at the centre of a twofold challenge. The growing need for artificial intelligence and cloud computing is driving up its already substantial energy use, while climate-driven disruptions threaten the reliability and resilience of the infrastructure and supply chains that underpin these operations. Although IBM has committed to achieving net-zero greenhouse gas emissions by 2030, its legacy operations remain energy-intensive, creating a tension between the pursuit of technological growth and the imperative to minimise environmental impact (IBM, 2023).

6.6. Resource Scarcity

As outlined in point (3) in

Section 2.1, the technology sector’s dependence on critical minerals represents a core structural vulnerability. For IBM, this industry-wide exposure becomes especially pronounced in the development of its most advanced hardware systems. Cutting-edge semiconductor technologies, including the company’s 2 nm nodes, and components used in quantum computing platforms require precise quantities of minerals such as niobium and neodymium, alongside growing demands for lithium and cobalt. These inputs are indispensable to the fabrication of modern computer chips, including superconducting qubits integrated into IBM’s quantum processors, as well as batteries and other specialised electronics. Any restriction in the availability of these minerals can therefore disrupt IBM’s manufacturing timelines, increase procurement expenses, and slow the pace of technological progress (IEA, 2023).

Figure 9.

Child Labor in DRC’s Cobalt Mines (Stocksphoto).

Figure 9.

Child Labor in DRC’s Cobalt Mines (Stocksphoto).

IBM’s pursuit of next-generation technologies, such as 2 nm semiconductor nodes, further heightens its exposure to supply constraints. The precise requirements of advanced chip fabrication demand not only consistent availability of materials but also exceptional purity and quality, making the supply chain for these minerals particularly sensitive. The concentration of critical resources globally amplifies the associated risks. For instance, roughly 70% of global cobalt production occurs in the Democratic Republic of the Congo (DRC), where mining has been linked to child labour, forced labour, and unsafe working conditions (Amnesty International, 2021).

This geographic concentration exposes IBM to geopolitical risks, including trade restrictions, political instability, and export controls, as well as reputational risks tied to ethical sourcing and corporate responsibility. In addition to mineral constraints, semiconductor manufacturing places heavy demands on other key resources, particularly ultra-pure water, which is required in large volumes during wafer fabrication. In drought-prone regions, this creates competition among industrial, agricultural, and residential users, increasing supply chain vulnerability. Together, these factors highlight IBM’s exposure to material scarcity, cost fluctuations, ethical scrutiny, and regulatory pressures, underscoring the need for strategic responses such as supplier diversification, sustainable sourcing, and technological innovations focused on material efficiency and recycling.

In addition, escalating global competition for critical minerals is creating greater uncertainty and volatility across supply chains, presenting strategic challenges for IBM. Governments worldwide are introducing policies to strengthen control over essential mineral resources, including the United States’ industrial incentives under the Inflation Reduction Act (U.S. Department of Energy, 2023) and the European Union’s Critical Raw Materials Act (European Commission, 2023). These developments place growing pressure on manufacturers to ensure responsible sourcing, diversify away from single-region suppliers, and invest in alternative materials.

As regulatory frameworks tighten and demand continues to rise faster than supply, procurement costs are expected to increase (IEA, 2023). For IBM, adapting to this landscape will require more rigorous supplier oversight, enhanced compliance procedures, and sustained investment in R&D focused on material substitution, resource-efficient fabrication, and circular-economy strategies that recover valuable minerals from end-of-life electronics (Ellen MacArthur Foundation, 2021). Collectively, these trends illustrate how resource scarcity is shifting from an operational challenge to a strategic issue that affects IBM’s innovation capacity and long-term competitiveness.

6.7. Population Growth and E-Waste

The expansion of the global population, which now surpasses 8 billion, intensifies the demand for digital devices and services (United Nations, 2024). This escalating demand exacerbates pressure on raw material supplies and accelerates the generation of electronic waste. According to the Global E-waste Monitor (2023), the world produced approximately 53 million metric tonnes of e-waste in 2023, presenting substantial environmental and public health challenges. As a prominent manufacturer of servers, mainframes, and other hardware systems, IBM is a notable contributor to this expanding waste stream. The environmental consequences of this e-waste are severe and complex. When electronic products are disposed of, they are frequently landfilled or informally recycled in developing countries using primitive methods, such as open-air burning, to recover valuable metals.

These processes emit toxic substances—including lead, mercury, and brominated flame retardants—into the environment, leading to the contamination of air, water, and soil (Forti et al., 2023). This contamination not only imposes direct health risks on local populations, including neurological damage and respiratory diseases, but also creates a persistent ecological burden. Moreover, the inefficient reclamation of rare earth elements and precious metals from e-waste perpetuates a cycle of resource depletion by necessitating further mining, a cycle that the circular economy model aims to disrupt.

In addition to energy use and waste, the manufacturing processes for digital infrastructure, particularly semiconductor fabrication, rely on hazardous chemicals and persistent pollutants. If not managed under stringent environmental standards, these substances can significantly threaten local water and soil quality. While IBM has established various sustainability initiatives, its approach to end-of-life product management has not yet attained the degree of circularity demonstrated by industry leaders. For instance, companies like Medtronic utilise modular product designs and extensive take-back programmes to enhance resource recovery (Medtronic, 2023).

To substantively address its environmental footprint, IBM must embed circular principles from the initial design phase through to end-of-life management. This requires a strategic evolution beyond incremental recycling targets towards the adoption of transformative product-as-a-service models for its hardware systems. By retaining ownership of servers and mainframes and leasing computational power, IBM would establish a direct economic incentive to design for exceptional durability, ease of repair, and complete component recoverability.

6.8. Biodiversity Loss

Biodiversity loss represents a critical environmental risk within IBM’s upstream supply chain, largely arising from the extraction of raw materials used in electronic components. The mining of key minerals such as cobalt, copper, and rare earth elements has been linked to substantial ecological damage, including deforestation, soil erosion, habitat degradation, and contamination of terrestrial and aquatic ecosystems (Amnesty International, 2021; IEA, 2023). These effects extend beyond isolated sites, disrupting wider ecological networks, threatening endangered species, and accelerating the depletion of natural capital that local communities rely upon.

Given IBM’s dependence on global mineral supply chains, where environmental oversight is often limited, these biodiversity impacts are both significant and structurally embedded in its sourcing practices. Biodiversity pressures also arise from IBM’s operational activities, extending beyond its supply chain. While the use of virgin paper in packaging contributes to deforestation, a more immediate impact originates from semiconductor fabrication. The historical and potential ongoing use of persistent pollutants, such as per- and polyfluoroalkyl substances (PFAS), in these manufacturing processes presents a direct threat to local soil and water quality if emissions are not rigorously managed (EPA, 2022).

These persistent pollutants can accumulate in ecosystems, threatening aquatic species and entering food chains. Collectively, these factors illustrate the complex and multi-layered nature of IBM’s biodiversity footprint, encompassing both upstream sourcing and operational impacts. Compared with sectors such as construction and forestry, where certified frameworks like FSC and PEFC are standard practice, IBM has yet to adopt equivalent biodiversity-focused procurement policies. While progress has been made in areas such as waste reduction and renewable energy, initiatives specifically addressing biodiversity conservation, ecosystem restoration, and circular supply chains remain limited. This shortfall exposes IBM to reputational, regulatory, and operational risks, particularly as global reporting standards increasingly require disclosure of nature-related impacts and dependencies (TNFD, 2023).

Strengthening biodiversity governance is therefore essential for the company to achieve a truly integrated and holistic sustainability strategy. When ecosystems are degraded by mining or pollution, their natural ability to withstand and recover from climate change effects is significantly weakened. This diminished resilience leaves regions more susceptible to severe droughts, floods, and storms (IPCC, 2022).

Such climate-related disruptions can directly interrupt the flow of essential materials for IBM, causing shortages, unpredictable costs, and delays in production. At the same time, the erosion of natural resources like fertile soil and clean water compromises the economic stability and food sources of nearby populations, which can lead to social tension and instability in key sourcing locations (World Bank, 2021). Therefore, the loss of biodiversity acts as a force that intensifies other dangers, creating deep connections between environmental health, climate risks, and community well-being across IBM's operations.

7. Implementation Challenges

Beyond operational pressures, IBM encounters a range of strategic and implementation challenges that complicate the integration of sustainability into its long-term digital transformation agenda. These challenges stem from inherent tensions in digital growth, the evolving demands for reliable data and measurement systems, and the financial investments required to scale sustainability initiatives. Together, they highlight the difficulty of reconciling rapid technological advancement with sustained environmental and social objectives. A key strategic tension for IBM is the digital-technology paradox. While digitalisation can drive significant sustainability benefits through innovations such as smart-grid optimisation, AI-enabled resource management, and advanced environmental monitoring, it simultaneously contributes to rising energy consumption and increasing electronic waste. The expansion of IBM’s cloud-computing infrastructure, AI capabilities, and 60 global data-centers that spans 19 countries and 6 continents amplifies this tension.

As demand for digital services grows, efficiency gains achieved through improved hardware or software may be offset by the overall increase in operational scale, resulting in a net rise in environmental impact (IEA, 2023). Addressing this paradox requires continued innovation in green information technology. Strategies include deploying high-efficiency servers, implementing advanced cooling and heat-recovery systems, and investing strategically in renewable energy to decarbonise data-centre operations. Moreover, IBM must ensure that the environmental benefits delivered by its digital solutions outweigh the impacts of its operational growth. Achieving this balance demands strong alignment between sustainability objectives, technological development, and business strategy, ensuring that digital transformation functions as a net positive contributor to environmental progress rather than inadvertently exacerbating ecological pressures.

7.1. Data and Measurement Gaps

Despite IBM’s recognition as a leader in ESG data management through platforms such as the Envizi ESG Suite, data immaturity remains a critical challenge across the technology sector. Internal research by IBM indicates that around 65% of IT and sustainability leaders view limitations in measurement and analytics as significant barriers to achieving meaningful ESG progress (IBM, 2024). For both IBM and its clients, integrating real-time operational data with sustainability performance indicators is technically and organisationally complex. This often results in datasets that are inconsistent, incomplete, or insufficiently standardised, particularly in relation to Scope 3 emissions, which constitute the largest portion of IBM’s overall carbon footprint and depend heavily on supplier reporting, industry averages, and variable disclosure practices. The lack of robust, harmonised, and sector-wide data frameworks constrains IBM’s ability to accurately quantify environmental impacts, perform predictive risk assessments, and transparently demonstrate progress toward decarbonisation goals (CDP, 2023; GRI, 2022). As a result, a persistent implementation gap emerges, where corporate sustainability ambitions exceed the organisation’s capacity to effectively measure, manage, and operationalise them. Addressing this gap requires strengthened data governance, improved supplier data quality, and the development of sector-wide reporting standards, which are essential for sustaining IBM’s long-term ESG performance.

7.2. Financing Green programs

Securing long-term financing for sustainable development remains a significant strategic challenge for IBM. While the company allocates roughly 6 billion dollars annually to research and development, transitioning to environmentally sustainable technologies often demands additional capital with long-term horizons and uncertain short-term financial returns (IBM, 2023). Investor short-termism exacerbates this challenge, as many shareholders prioritise quarterly performance metrics over the long-term value generated through environmental and social initiatives.

As one industry expert observes, “tech firms struggle to monetise sustainability; AI ethics, for example, does not directly boost revenue” (Deloitte, 2023). Financial planning is further complicated by regulatory uncertainty. In the United States, the lack of a uniform national carbon-pricing mechanism reduces incentives for low-carbon investments and complicates the forecasting of future compliance costs. IBM’s internal assessments indicate that a considerable share of sustainability-related technology expenditures are treated as one-off investments rather than being embedded in recurring operational budgets (IBM, 2024). This highlights the difficulty of institutionalising sustainability financing and the limitations in scaling initiatives, maintaining continuity, and achieving long-term strategic impact.

Addressing these financial constraints effectively requires integrating sustainability-related expenditures into core operational budgets, establishing predictable funding mechanisms, and aligning investor expectations with long-term environmental objectives. Through consistent and strategically guided financial commitments, IBM can ensure that its sustainability initiatives deliver measurable, enduring value to both the company and its stakeholders (Eccles et al., 2014; Krueger, Sautner and Starks, 2020). Innovative financing mechanisms, including green bonds, sustainability-linked loans, and impact investment partnerships, offer additional avenues to bridge the gap between short-term capital needs and long-term sustainability objectives. These instruments can provide dedicated funding for low-carbon technologies, circular economy programs, and social-impact initiatives, while attracting investors with ESG-focused mandates.

Such approaches not only enhance financial flexibility but also reinforce IBM’s reputation as a responsible, forward-looking enterprise committed to measurable environmental and social outcomes. Simultaneously, collaborating with government agencies, industry consortia, and philanthropic organisations can expand access to co-funding opportunities, grants, and incentives that offset upfront investment costs. Strategic partnerships can accelerate the adoption of sustainable innovations across IBM’s supply chain and client networks, generating shared value that extends beyond immediate financial returns. By combining external financing avenues with internal capital planning, IBM can embed sustainability as a core strategic priority, ensuring that long-term environmental and social goals are both achievable and financially sustainable.

8. Discussion

This study integrates insights from the IBM case study to extract broader lessons and strategic implications for the global technology sector. By analysing both IBM’s achievements and the challenges it has faced, the research highlights the key factors that facilitate effective sustainability integration. It also outlines a forward-looking framework for technology companies aiming to align financial performance with environmental stewardship and social responsibility.

8.1. Key Success Factors

IBM’s sustainability performance demonstrates several replicable success factors that strengthen its credibility and effectiveness as a leading technology firm. Under the leadership of CEO Arvind Krishna, who advocates that technological innovation must serve as a central driver of sustainability progress, positioning IBM to integrate climate responsibility into both its strategic direction and operational practices. The IBM Impact Framework, encompassing environment, equity, and ethics, ensures that sustainability considerations are integrated into corporate governance, innovation, and decision-making processes. Board-level oversight and executive accountability provide the clarity and resources required to achieve measurable progress.

Another significant success factor is data-driven monitoring and transparency. IBM employs advanced platforms, such as the Envizi ESG Suite, to track energy consumption, emissions, and waste across its global operations, enabling evidence-based decision-making and continuous improvement. Transparent reporting in line with frameworks such as GRI, TCFD, and SBTi enhances stakeholder trust, strengthens credibility, and mitigates the risk of greenwashing. IBM also leverages its technological expertise to support sustainability objectives. This dual-value approach transforms sustainability from a cost center into a driver of competitive advantage and innovation. Finally, the company’s ambitious and time-bound targets, including achieving net-zero emissions by 2030 and sourcing 90% of electricity from renewables, anchor its strategy. Interim achievements, such as a 68.5% reduction in greenhouse gas emissions, demonstrate disciplined execution, reinforce organizational focus, and maintain momentum toward long-term objectives.

8.2. Implications for Tech Firms

The IBM case offers a strategic blueprint with important lessons for tech firms worldwide. A primary insight is the need to embed sustainability throughout the entire value chain. Environmental and social considerations should extend beyond corporate headquarters, incorporating eco-design, circular economy principles, and responsible sourcing into product development, manufacturing, service delivery, and end-of-life management. This approach also requires assessing supplier relationships and partnerships through a rigorous ESG lens to ensure alignment with corporate sustainability objectives. Another key takeaway is the importance of developing strong sustainability capabilities and robust ESG data infrastructure is critical for setting credible targets, monitoring performance, and meeting regulatory obligations.

Technology companies, with their expertise in data and analytics, are well positioned to build and leverage these capabilities. In addition, firms must clearly quantify and communicate the business value of sustainability initiatives. Demonstrating links between environmental and social programs and measurable outcomes—such as cost savings, revenue growth, risk mitigation, and enhanced brand reputation—is essential to securing executive support and long-term investment. IBM’s experience shows that articulating financial and strategic returns transforms sustainability from symbolic commitment into actionable strategy.

Fostering collaborative innovation is also crucial. Addressing complex sustainability challenges requires partnerships that span industries, consortia, and open innovation models. By collaborating to standardize metrics, develop shared infrastructure—such as renewable-energy projects or e-waste recycling facilities—and pool expertise, technology companies can amplify collective impact and accelerate progress toward common sustainability goals.

Additionally, sustainability should be fully integrated into corporate governance and decision-making structures. Establishing dedicated ESG committees, linking executive compensation to sustainability performance, and embedding environmental and social criteria into strategic planning ensures that sustainability is a central component of long-term corporate strategy. Institutionalising these practices strengthens accountability, supports consistent resource allocation, and signals commitment to investors, employees, and customers.

Finally, risk management and scenario planning should incorporate sustainability-related uncertainties. Climate risks, regulatory changes, resource constraints, and evolving stakeholder expectations can significantly affect operations and financial performance. Technology firms benefit from forward-looking risk frameworks that include ESG factors, enabling proactive mitigation and resilience-building. IBM’s approach demonstrates that integrating sustainability into strategic planning not only safeguards operational continuity but also creates opportunities for innovation, market differentiation, and value creation in a rapidly evolving business environment.

8.3. Recommendations for Practice

Based on IBM’s analysis, five actionable recommendations can formulated to guide technology-sector and business firms in enhancing sustainability performance and gain strategic advantage. (1) First, integrate sustainability into core business operations and governance structures. ESG metrics should be incorporated into executive performance evaluations, risk-management processes, and product development life-cycles. Sustainability should also be a regular agenda item for board-level committees and white-collar discussions to ensure oversight, accountability, and continuous strategic alignment.

(2) Second, invest in unified data and analytics platforms. Companies should prioritise integrated systems that consolidate sustainability data from across operations and the supply chain. Maintaining a single source of truth enables accurate reporting, identifies operational inefficiencies, and informs strategic decision-making.

(3) Third, adopt a comprehensive value-chain perspective. Firms should map Scope 3 emissions and assess broader environmental impacts throughout the supply chain. Implementing stringent supplier codes of conduct and collaborating with partners to build capacity through training, resources, and technical support helps ensure alignment with shared sustainability objectives.