1. Introduction

The rapid increase of Buy Now, Pay Later (BNPL) services between 2018 and 2025 has dramatically altered the world of global consumer finance by enabling users to buy things now and pay later using interest-free instalments. With an accelerating pace of digital commerce and maturing fintech infrastructures, BNPL use has rapidly expanded across both developed and developing countries [

1,

2]. Younger generations are taking advantage of BNPL due to its flexibility and accessibility compared to traditional forms of credit [

3].

Behavioural finance suggests that BNPL minimises the “pain of payment” for consumers by changing the way they view their payments in terms of smaller instalments, which results in less cognitive resistance to spending [

4,

5]. While BNPL has helped democratise the ability of people to make purchases, the rate at which BNPL has grown has led to a large amount of academic, ethical, and regulatory scrutiny of BNPL. Behavioural nudges used in BNPL marketing strategies, including: instalment framing, urgency cues and loss aversion appeals, are being identified as behavioural nudges that can lead to consumers making impulsive purchases [

6,

7].

Post-purchase regret is defined as a consumer’s feelings of remorse after making an impulse purchase based upon comparisons between what was purchased and what could have been bought instead [

8]. Regret affects consumers’ future purchasing behaviours, loyalty and ultimately affects their overall financial health. Although there is a large body of research examining impulse buying and regret in the area of consumer behaviour, very little research has examined the constructs of impulse buying and regret in the context of BNPL.

Three gaps define the current state of academic literature.

First, BNPL serves as a payment service as well as a persuasive marketing platform designed to change how consumers perceive prices and diminish their subjective financial risks. Very few studies have explored how BNPLs’ marketing tactics transform into impulse purchases and consumers’ emotional reactions to those purchases.

Second, most of the existing BNPL research has focused on identifying factors that contribute to the adoption of BNPL, understanding consumers’ perceptions of financial risk associated with BNPL, and exploring regulatory issues [

9,

10]. There has been very little attention paid to the psychological consequences of BNPL use.

Third, although previous studies have demonstrated links between digital payment tools, such as mobile wallets and e-banking apps, and impulsive consumption [

11], the combination of BNPL characteristics - including delayed payment salience and algorithmic nudging - is relatively new to the theory of impulsive behaviour.

Recent studies indicate several possible areas of concern: Impulsivity may be a mediator of risky debt [

12]; Compulsive BNPL behaviour due to materialism [

13]; Mindfulness as a protective factor [

14]; Social comparison as a moderating variable in BNPL-related well-being [

15]. However, among the studies that explore these emerging concerns, the direct and validated measurement of post-purchase regret is missing. Researchers have relied on proxy measures, including financial distress, decreased well-being or dissatisfaction, thus leaving an important emotional outcome of BNPL use unexplored.

Therefore, this study performs a systematic and integrated examination of BNPL research between 2018 and 2025 to describe the development of theories, methods, and evidence regarding the relationship between BNPL use, impulsive buying, and post-purchase regret. Utilising PRISMA 2020 guidelines [

16] and the CASP appraisal [

17], this study identifies the conceptual gaps, provides an overview of the current knowledge, and establishes a framework for future research. The purpose of this study is to integrate a fragmented body of research related to BNPL use, to identify the role of regret within BNPL-related behavioural outcomes.

Furthermore, to provide information for scholars, policymakers and practitioners who seek to develop innovations in BNPL that are consistent with consumer protection and overall financial well-being.

2. Methodology

To guarantee that this study was carried out rigorously and transparently, it was planned and reported as per the PRISMA 2020 protocol [

16,

18]. Database searches were performed from 1 January 2010 to 31 December 2025 to cover all existing scholarships on BNPL. The methodological design of the study follows the same format of four linked stages: (i) identifying relevant studies via a structured database search, (ii) assessing the relevance of studies through the use of formal inclusion and exclusion criteria, (iii) extracting and systematically synthesizing data, and (iv) critically appraising the quality of each of the studies that were included in the review, a process consistent with best practice for conducting rigorous literature reviews in business and consumer research [

19]. Through combining these components of the review process, the review provides an appropriate balance between providing broad coverage of topics and a level of detail within its analyses that produces a substantial body of evidence at the intersection of BNPL adoption, impulsive buying, and post-purchase regret.

2.1. Search Strategy

This review utilised Scopus as its primary database, due to its broad scope of high-quality journals across fields of study, including Business, Marketing, Psychology and Behavioural Finance. This selection is supported by several systematic reviews in Consumer Behaviour that have used Scopus in recent years [

20,

21], thereby providing both quality and breadth of relevant data.

A search strategy was applied between the dates of January 1st, 2010, and December 31st, 2025. To capture the fundamental constructs of interest, a Boolean search query was created to apply to the title, abstract and keyword fields of each potential record:

(“Buy Now Pay Later” or “BNPL”) AND (“impulsive buying” or “impulse buying” or “impulsive purchase” or “impulse purchase”) AND (“post-purchase regret” or “consumer regret” or “purchase regret”) AND (“behavioural finance” or “consumer behaviour” or “digital payment”)

Only peer-reviewed journal articles written in the English language, along with review-type papers, were retained within this analysis. All conference papers, book chapters and grey literature were excluded from the study. Search results were exported into both CSV and BibTex format to assist in the screening process and reference management, while adhering to the established guidelines for transparency regarding search strategies [

18].

2.2. Eligibility Criteria

Appropriate inclusion and exclusion criteria were utilised to narrow down the sample size of the identified studies. The search time frame included peer-reviewed articles from January 1st, 2010, to December 31st, 2025. Only those articles that have a publication date of January 1st, 2018, through December 31st, 2025, are eligible for inclusion in this review because this time frame corresponds with increased globalisation and proliferation of BNPL services [

1,

2].

Articles were included if they (i) explicitly examined BNPL in relation to impulsive buying and/or post-purchase regret, (ii) reported empirical or conceptual contributions within the domains of consumer behaviour, behavioural finance, or marketing, and (iii) were peer-reviewed and written in English. Publications were excluded if they were outside the subject scope (e.g., engineering, medicine), not peer-reviewed, not in English, or did not provide sufficient data for synthesis. Only full-text articles with adequate empirical or conceptual contributions were retained for analysis, in line with best practice for systematic literature reviews [

16,

19].

The applied criteria are summarised in

Table 1, which illustrates how boundaries were set to enhance methodological rigour, comparability, and transparency.

2.3. Screening and PRISMA Flow

A total of 15,605 results were generated by the first search of databases through Scopus, which spanned the time frame of 2010 – 2025. The use of the temporal filter limited the results to those studies published during the time frame of 2018-2025. This narrowed the pool down to 6,200 results. A duplicate check was completed to remove any duplicate studies that had been included within the previous search results. Since there were duplicates present within the results, this was done both automatically and manually. As such, 1,050 duplicate records were removed from the results, and 5,150 unique studies remained to be reviewed for potential inclusion in the review. Screening of the titles and abstracts of the remaining studies resulted in the exclusion of 4,500 studies that clearly did not pertain to the specific topic of interest to the review.

Following the elimination of these studies, the 650 remaining full-text articles were reviewed for eligibility for inclusion in the review. A total of 640 studies were eliminated based on the criteria listed below. These studies were classified into four categories. Four hundred studies were out of scope, 120 studies that were either conference papers or were non-peer reviewed, 80 studies lacked sufficient data or conceptual measures to support their inclusion in the review, and finally, 40 studies were found to be residual duplicates. Therefore, after the application of all of the criteria mentioned above, 10 studies were ultimately selected for inclusion in the review. The studies included in this review directly investigated the relationship between BNPL adoption and the incidence of impulsive buying and/or post-purchase regret.

Figure 1 provides a representation of the systematic review selection process in the form of a PRISMA 2020 Flow Diagram. It presents the typical procedures for the screening of studies in addition to enhancing the methodology’s transparency and reproducibility [

16,

22].

2.4. Data Extraction and Synthesis

Systematic data extraction was conducted using a defined approach, based on the research questions and objectives of the current study. Two researchers independently used a structured coding tool to extract the following study attributes: Author(s), Year of Publication, Country/Context, Sample Characteristics, Theoretical Framework, Method Design, Measurement Constructs, Analytical Methods, Key Findings, and Stated Limitations. These are consistent with the guidelines for conducting systematic literature reviews [

19].

To enhance reliability, the data were reviewed independently by two researchers, and any discrepancies between them were discussed and resolved, as is standard best practice for systematic reviews [

16].

All of the extracted data were compiled into an evidence matrix table (

Table 2), from which the themes were synthesised via thematic synthesis. Inductive clustering of the evidence revealed three recurring thematic domains: (i) Psychological Mechanisms (Impulsivity, Self-Control, Religiosity), (ii) Structural Determinants (Demographics, Financial Literacy), and (iii) Ethical/Regulatory Dimensions (Responsible Consumption, Transparency, Sustainability). Thematic Synthesis was able to provide both the interpretative depth and the comparative descriptive analysis that allows for an interpretation of the evidence base, similar to previous studies [

21,

23].

2.5. Quality Appraisal

For assessing the robustness of the included studies, the ten-point CASP (Critical Appraisal Skills Programme) Checklist (version 2020) has been utilised. CASP is commonly used to appraise the methodological quality of reviews within health care, psychology and social sciences [

17]. The ten-point checklist has been applied to each of the included studies. It includes criteria such as clarity of aims, appropriateness of methodology, suitability of design, recruitment strategy, data collection procedures, analytical rigour, ethical considerations, clarity of findings, and overall contribution.

The CASP Checklist was chosen as the sole appraisal instrument, as the studies included in this review were primarily cross-sectional surveys with some conceptual integration. While both the AXIS tool for cross-sectional studies [

29] and the Mixed Methods Appraisal Tool (MMAT) [

30] could have potentially been applied to evaluate these studies, they were not designed to allow for consistent and comparable appraisals of all studies.

Two independent reviewers appraised the studies to increase reliability. A consensus was achieved on nine of the ten studies, with the remaining disagreement being resolved through discussion. Therefore, a 90 per cent agreement level was achieved by the reviewers, and a Cohen’s Kappa Coefficient of 0.81, indicating a high degree of agreement between reviewers [

31]. The results of the CASP appraisal of the ten studies are reported in detail in the

Table 3 Results Section and provide a comparative assessment of each of the ten studies included in this review.

2.6. Risk of Bias Assessment

The review of study-level bias and review-level bias focused upon assessing the sampling methodologies utilised in all included studies; the type of data collected; and a systematic assessment of the quality of the studies themselves, utilising the CASP Checklist. The majority of studies presented in this review used cross-sectional self-report surveys based on either students or convenience samples from digitally engaged countries, including Indonesia, India, Australia and Poland. As a result, both sampling techniques create an increased risk of selection bias and, therefore, limit the generalizability of the findings to larger populations of financially aware young adults who are active users of digital channels to purchase products. Also, due to the reliance on self-administered questionnaires, there are concerns related to common-method variance and social-desirability bias when assessing financially and morally sensitive constructs, such as debt, compulsive spending, and financial stress. While many of the studies presented herein indicated they used valid measures and/or advanced analytical techniques, only a few studies provided evidence that they directly addressed these biases with procedural remedies (e.g., temporal separation; anonymity assurances) or statistical diagnostics (e.g., Harman’s single factor test; marker variables).

Given that the review only considered sources listed in Scopus, which includes high-quality journals across many disciplines, the decision only to consider Scopus may have also created a database bias in that studies identified in other potential databases (i.e., Web of Science, PsycINFO, specialised finance/psychology databases) would be omitted. Furthermore, restricting the search to only peer-reviewed, English-language articles may have created language and publication bias in excluding practitioner reports, regulatory documents, and non-English academic literature addressing BNPL-related impulsivity and regret. Since the area of BNPL is still developing and has only been studied since 2018-2025, it is reasonable to assume that there are early-stage or null-result studies that remain unreported. These structural biases do not negate the findings of this review; however, they do indicate that caution should be taken when interpreting the findings and suggest that future reviews should include searches of multiple databases, languages and publication formats in order to provide a more comprehensive evidence base.

2.7. Transparency and Replicability

Throughout the review process, the detailed search strategy, PRISMA 2020 documentation and screening log [

16] were thoroughly recorded in accordance with best-practice recommendations for systematic reviews. Although the protocol was defined before the start of the study (internally) rather than formally registered on platforms that support methodological accountability, such as the Open Science Framework (OSF) or PROSPERO [

32], all Boolean searches (TITLE-ABS-KEY), database parameters and time frames (2010–2025) were fully documented. This level of documentation facilitates replication and aligns with established guidance for the transparent reporting of results in evidence syntheses [

19].

A Full PRISMA 2020 Checklist Is Provided In Appendix A, and The Extracted Dataset (CSV And BibTeX Formats) Can Be Made Available Upon Request. This Review Ensures Methodological Transparency, Enhances Replicability, and Strengthens The Credibility of Its Findings For Both Academic and Policy Audiences Through Adherence To PRISMA and CASP Standards.

3. Results

3.1. Descriptive Overview

There are 10 studies that have been published since 2018 to date, which met the inclusion criteria for this review and were therefore analysed within it. The field of study is relatively new and reflects the emerging area of scholarly inquiry into BNPL’s relationship to impulsive buying and post-purchase regret.

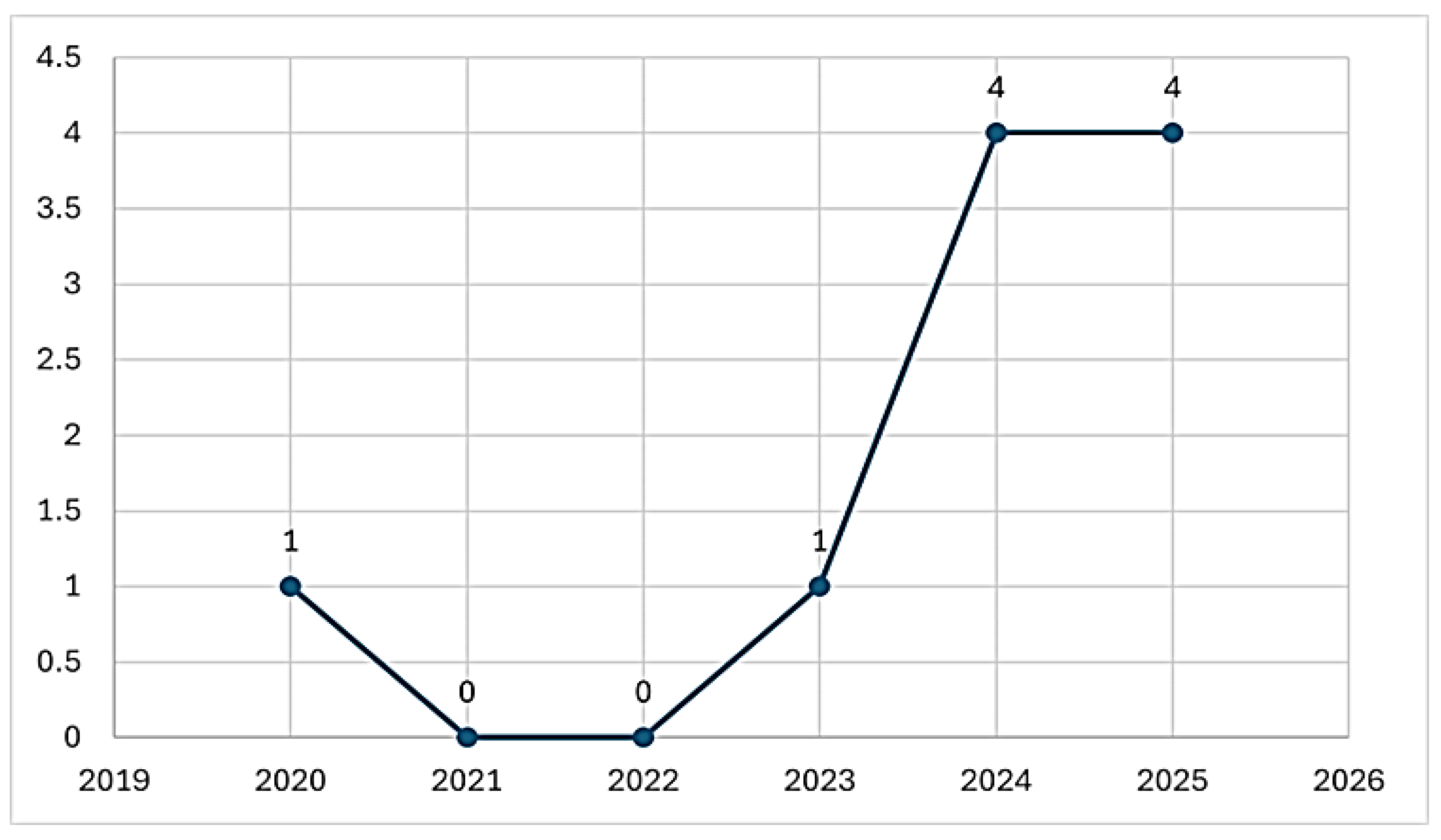

Figure 2 illustrates the temporal distribution of the reviewed studies. Studies published prior to 2020 were limited to two, as only one was published in 2020 and another in 2023. There were no relevant studies published in 2021 or 2022. These time gaps reflect the early stages of BNPL scholarship and likely the interruptions experienced by researchers worldwide due to the COVID-19 pandemic [

33].

The number of studies published has increased sharply in 2024 and 2025, as four studies were published in each year. The rapid growth demonstrates the increasing use of BNPL around the world and the developing understanding among scholars of its behavioural and psychological implications [

1,

2]. The increase also highlights the relevance of this review to provide a comprehensive analysis of an emerging and highly diverse field of study.

3.2. Publication Outlets

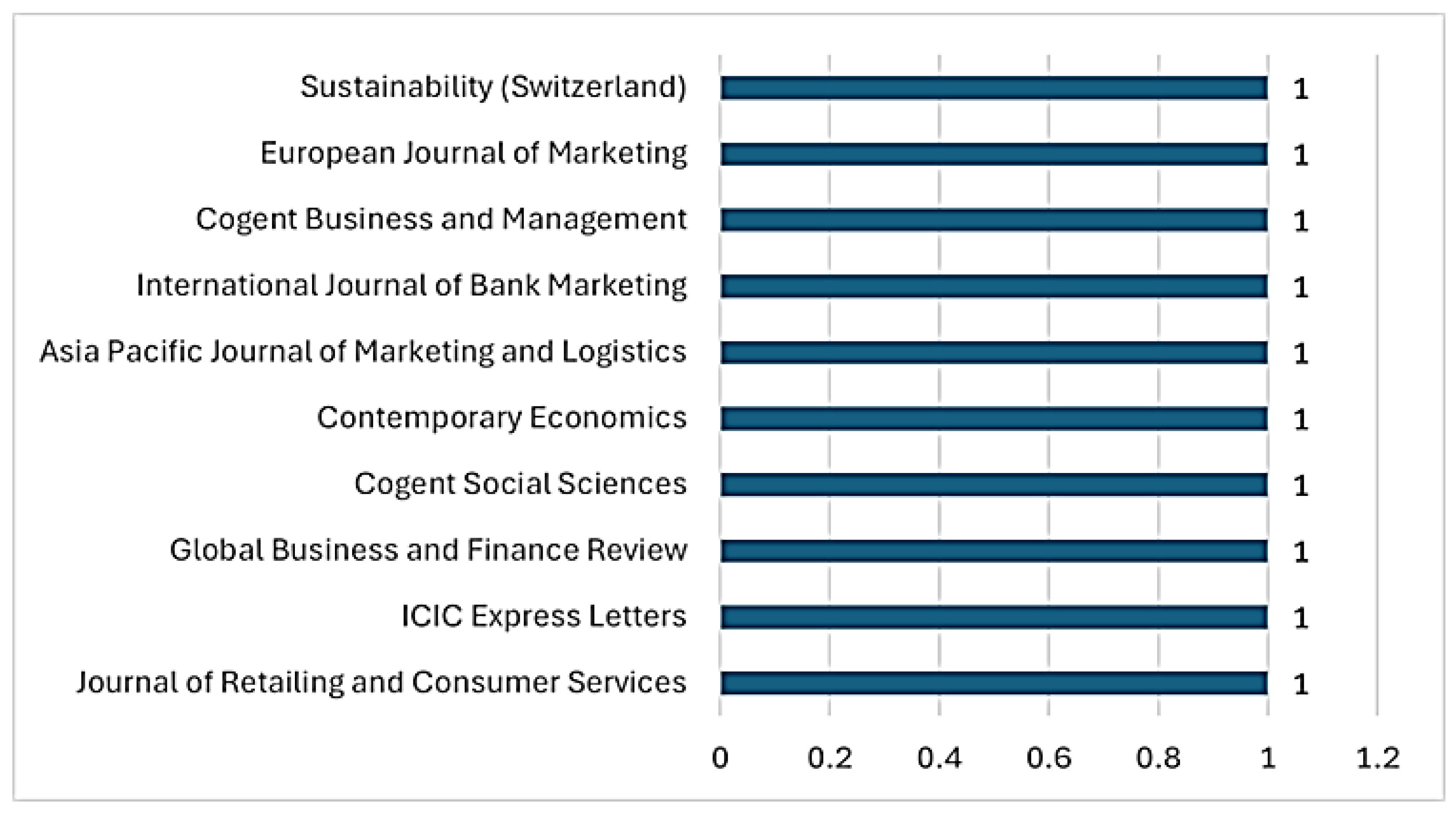

A wide range of journals were used as publication sources for this review of literature (see

Figure 3), indicating that all studies reviewed appeared in separate journals. The use of several different journals represents a number of other disciplines, such as, but not limited to, consumer research, marketing, finance, and sustainability. Examples of these are: the Journal of Retailing and Consumer Services, the Asia Pacific Journal of Marketing and Logistics, the International Journal of Bank Marketing, the European Journal of Marketing, and Sustainability (Switzerland).

The diversity of journals suggests that the BNPL research area is in its exploratory stage and therefore has no one journal which dominates the discussion around it, as is typical of emerging and developing areas of research [

19]. The diversity of disciplines represented by the journals also suggests that BNPL is relevant to many different places, including consumer behaviour, marketing strategies, financial well-being, and sustainable consumption [

21].

It should be noted that many of the journals listed represent high-level journals, suggesting that the BNPL research area is gaining increasing levels of academic legitimacy within those top tier academic domains, which is consistent with Podsakoff et al. [

34] that demonstrated that publication in leading journals is often seen as a sign of the maturity and acceptance of a new or emerging area of academic research.

3.3. Characteristics of Included Studies

The ten studies in this systematic review are summarised in

Table 2 in terms of the authors, geographic locations, conceptual models, methodologies used, and conclusions drawn. The majority of research studies were located in Asia, especially India and Indonesia, where there has been significant growth in both fintech adoption and Buy Now, Pay Later (BNPL) usage. Studies were also conducted in more developed countries like Australia, New Zealand, Germany and Poland, which allow researchers to make comparisons between developing and more developed financial systems.

Methodologically, the majority of studies surveyed customers using cross-sectional survey designs that analysed customer responses with Partial Least Squares Structural Equation Modelling (PLS-SEM) analysis. PLS-SEM is currently the dominant methodology in BNPL behavioural research [

35,

36]. However, alternative methods, including some form of mixed-methods research and exploratory modelling (for example, DEMATEL and regression-based frameworks), were employed but very infrequently. The dominance of PLS-SEM research demonstrates the heavy reliance on self-reporting from customers in BNPL research and the potential for future research to explore the value of longitudinal or experimental study designs.

Theoretically, Impulsive Buying Theory (IBT), Cognitive Dissonance Theory (CDT), and Behavioural Finance were the three primary theories applied in BNPL research. The additional theoretical frameworks applied include Materialism, Self Control/Mindfulness, and Social Comparison Theory [

37]. These theoretical perspectives identify many of the psychological and behavioural factors that influence BNPL usage.

There was no commonality in terms of how the studies examined post-purchase regret as an element of the constructs modelled in the studies In addition to examining impulsive behaviour, financial awareness, and well-being, all of the studies in the review addressed post-purchase consequences that are closely related to regret, such as economic stress, compulsive buying, and reduced well-being, rather than regret itself as a directly operationalised construct. Regret, although it may be the most critical post-purchase consequence of BNPL, has been significantly underexamined [

8]. Therefore, the review identifies a gap in the existing literature regarding the relationship between BNPL usage and regret and provides the opportunity to examine BNPL usage in the broader behavioural and ethical context.

3.4. Quality Appraisal

The CASP assessment (

Table 3) revealed that most studies demonstrated high methodological rigour, particularly in terms of clearly stated aims, valid measures, and the use of advanced analytical techniques. Studies employing structural equation modelling (PLS-SEM) and exploratory causal methods (e.g., DEMATEL) scored highest on analytical robustness [

17].

Nevertheless, several common limitations were observed. First, a substantial number of studies relied on student-based or convenience samples, which restricts generalisability to broader consumer populations [

38]. Second, the heavy reliance on cross-sectional survey designs limits the ability to draw causal inferences regarding BNPL use, impulsivity, and post-purchase regret [

39]. Third, although impulsivity and financial well-being were frequently measured, the absence of direct operationalisation of post-purchase regret was a recurrent gap, leaving one of the most critical consumer outcomes underexplored [

8].

Despite these limitations, the overall quality of the included studies was judged to be medium-to-high to high, ensuring that the synthesis rests on a solid empirical and conceptual foundation.

Table 3 presents a comparative overview of the CASP evaluation, demonstrating the strengths and weaknesses of each study.

3.5. Thematic Synthesis

These ten studies provided a basis for synthesising the primary themes that represent how BNPL use relates to impulse buying and regret. Three major themes that are representative of how BNPL influences impulse buying and subsequent regret-related outcomes can be derived from the data.

3.5.1. Theme 1: BNPL Enables Impulsivity

BNPL was found to enable impulse buying in nearly every study examined. The means by which BNPL enabled impulse buying were through instalment plans, providing a sense of urgency, and creating a false perception of affordability. By removing the saliency of payment immediately after purchase, these mechanisms reduce cognitive barriers to impulsive decision making and create a predisposition toward purchasing based on emotions rather than planned actions, particularly with younger and less financially sophisticated individuals [

5,

40].

3.5.2. Theme 2: Post-Purchase Regret and Financial Stress

Post-purchase regret was infrequently assessed directly within the context of the studies reviewed here; however, indirect indicators of post-purchase regret were evident in the forms of increased financial stress, compulsive buying, dissatisfaction, and decreased overall well-being. Therefore, it appears that when BNPL encourages impulse buying, it also leads to regret-related consequences, thereby supporting the theoretical relationships between instant gratification and long-term cognitive dissonance [

8]. None of the ten studies examined in this review directly measured regret. All studies examined here indirectly measured regret using proxy measures of stress, dissatisfaction, and/or overall well-being.

3.5.3. Theme 3: Moderators and Protective Factors

A number of the studies reviewed here indicated various contextual moderator variables that influenced the outcome of BNPL use. These include financial awareness, religiosity, mindfulness, and cultural values. These moderating variables have been found to moderate impulsivity and mitigate adverse economic outcomes associated with BNPL use, providing avenues for consumer education, ethical marketing practices, and regulatory intervention [

41,

42]. Furthermore, these moderator variables illustrate that the effect of BNPL use is not consistent across all users but varies based on psychological and sociocultural contexts.

3.6. Summary of Findings

The existing body of evidence for BNPL, impulsive purchasing behaviour and post-purchase regret is still developing; however, it has experienced a considerable increase in interest by researchers since 2023.

There is consistent evidence of BNPL contributing to impulsive consumption via instalment framing, urgency cues and perceived affordability. Although there is limited empirical evidence that directly addresses post-purchase regret, most studies have addressed this topic through indirect means, including constructs such as financial stress, decreased well-being, and compulsive purchasing behaviour [

8].

A significant gap exists within the extant literature regarding post-purchase regret, as it is likely the most salient behavioural and emotional outcome of BNPL usage. In order to address this void, future research should utilise longitudinal, experimental, and cross-cultural methodologies to develop a more comprehensive understanding of the mechanisms associated with post-purchase regret. Furthermore, the inclusion of additional theoretical frameworks that are multidisciplinary in nature (i.e., encompassing both behavioural and ethical/financial domains) will be crucial to provide a more holistic understanding of the consumer and social implications of BNPL [

39].

4. Discussion

Triangulating thematic synthesis (descriptive trends), quality appraisal, and ten studies from peer-reviewed literature published between 2018 and 2025 provides empirical evidence that while research on BNPL related to impulsive buying and post-purchase regret is expanding quickly, it remains largely in its early stages of development.

4.1. Theoretical Positioning

Placed at the intersection of Consumer Psychology and Behavioural Finance, the Review has extended previous theory to show BNPL purchasing is both financially based and psychologically influenced through Digital Nudges and Cognitive Biases. Although Impulsive Buying Theory explained the affective nature of BNPL Purchasing, Cognitive Dissonance Theory explained why regret and negative post-purchase emotions arise from repayment commitments. The Review therefore placed BNPL into the distinct consumption environment, which increases the emotional conflict between consumers’ cognitive control and the Instalment Framing and Affordability Illusions used to influence their purchasing decisions. In establishing this theoretical placement, the Review established an enhanced analytical basis for examining regret as a significant yet unrecognised consumer outcome.

4.2. Evolution of Research Activity

The time pattern clearly shows how new the research trend is here. The first studies appeared sporadically between 2020 and 2022, followed by substantial growth in 2024 and 2025, which reflects both the rapid diffusion of BNPL services in retail markets and the growing interest of academics and regulators in their implications [

28,

43]. Reports like the UK Woolard Review [

44], the OECD [

1], and the BIS [

2] are a significant contribution to this surge of interest and, therefore, create an environment that can attract more scholarly work. This surge indicates the timeliness of integrating the evidence into a coherent body and signals that the theoretical and methodological foundation of the area remains underdeveloped in this area of rapid expansion [

2,

21].

4.3. Interdisciplinary but Fragmented Landscape

The reviewed research was published across a wide variety of academic journals in several disciplines, including marketing, finance, psychology, and multidisciplinary fields, as an illustration of how BNPL is relevant to multiple disciplines but also as a reflection of a fractured body of knowledge without a single discipline or field being identified as the primary discipline. Fragmentation of similar sorts has been reported in digital finance areas such as mobile payment systems [

21,

45], which indicates that BNPL research will require more integration of theory and more cohesiveness in research agendas. This review provides one of the first steps toward reducing the dispersion mentioned above and combining evidence from all of these different areas so that a unifying body of BNPL research can emerge [

46].

4.4. Theoretical Insights

There are three major intellectual currents. First, these mechanisms in BNPL, like instalment framing, urgency cues and affordability illusions, serve as behavioural nudge that reduce the psychological barrier for consumption, therefore extending Impulsive Buying Theory (IBT) as well as indicating how digital payment systems increase impulsivity [

7,

47,

48].

Second, the indirect indicators of the post-purchase regret, are aligned with Cognitive Dissonance Theory (CDT) as they have been indicated an adverse effect from the conflict between short-term satisfaction from using the product and repayment obligation [

49,

50]; however, post-purchase regret has seldom been assessed in the studies or operationalized as a valid construct, which is a serious conceptual gap.

Third, some variables moderate the behavior of users, like financial awareness, religiosity and mindfulness, which suggest the possibility of integrating behavioral finance and consumer ethics perspectives on this topic and expanding the current theoretical frameworks with cultural and psychological buffers [

41,

42,

51,

52].

4.4.1. Why Post-Purchase Regret Has Not Been Directly Measured in BNPL Research

Although the potential impact of post-purchase regret in consumer decision-making is theoretically essential, none of the ten studies in this review directly operationalised post-purchase regret as a validated construct. Instead, researchers relied on proxy indicators, such as financial stress, compulsive buying behaviour, and reduced well-being, to infer regret-related experiences. This absence of direct measurement indicates a significant methodological and conceptual gap between BNPL research and the broader literature on post-purchase regret. First, most studies have been focused on the adoption of BNPL, with few examining the drivers of adoption (e.g., perceived risk, indebtedness, materialism, convenience), and none have examined the emotional responses consumers experience subsequent to purchasing using BNPL. Second, the instruments used by researchers to measure BNPL have not included valid measures of regret; therefore, researchers are forced to use proxy variables for regret, such as financial stress, compulsive buying behaviour, or reduced well-being. Third, the fact that many studies of BNPL have employed cross-sectional designs and have relied upon students as subjects limits the ability of these studies to capture regret, since regret typically develops over time, only after the consumer has completed their payment cycle. Fourth, because the growth of BNPL was so rapid (2020-2025), research on BNPL has tended to focus almost exclusively on the issues related to the adoption of BNPL (and the risks associated with it) and has paid little attention to the psychological aftermath of purchasing using BNPL, making it empirically underdeveloped.

Therefore, the absence of measures of regret does not indicate that regret is irrelevant to the study of BNPL but instead represents a significant methodological blind spot. Future studies of BNPL should include valid measures of regret, employ longitudinal or experimental designs, and conceptualise regret as an independent emotional response, as opposed to being a derivative of dissatisfaction or financial strain. Addressing this research gap will be necessary to build a complete understanding of the psychological implications of BNPL.

4.4.2. Methodological Synthesis Across Included Studies

The synthesis identifies some consistent patterns across methods used in the 10 studies reviewed, including strengths and weaknesses of the extant literature. The studies are primarily based upon a quantitative cross-sectional survey design, and seven of those studies utilised PLS-SEM as their primary analysis tool. Although the high level of similarity among the methods used can provide a comparable way to test models and measure latent constructs, the dominant usage of the same analytical technique limits causal inference. It makes it challenging to capture psychological phenomena that evolve, such as post-purchase regret.

Only one of the studies employed a causal modelling methodology (DEMATEL) or a mixed-methods approach (vignettes), and these represent exceptions to the predominantly correlational nature of the existing body of research.

The sampling frame is similar in breadth to the methodologies used to collect data, and a majority of the studies sampled students or used convenience samples comprised of digitally active youth in India, Indonesia, Australia, and Poland. Utilising student or convenience samples maximises internal validity of the results; however, it limits the generalizability of the findings to other youth outside of digitally active youth, particularly due to differences in culture, economics and regulations related to BNPL in different markets around the world.

In addition, the widespread use of self-administered online questionnaires may create an increased risk of social desirability bias and standard method variance (CMV). Furthermore, while CMV is often addressed statistically and/or procedurally in many studies, none of the studies reviewed by this synthesis did so.

The measurement of various constructs (impulsive buying, financial stress, materialism, and consumerism) was consistent in its use of validated scales. No study, however, used validated measurements of post-purchase regret. Instead, each study inferred regret through constructs that occur after the decision to buy, i.e., reduced well-being, compulsive buying behaviour, or subjective indicators of financial distress.

The omission of validated regret measurements represents a methodological gap in BNPL research design. Specifically, because impulse purchases and emotional responses to those purchases typically occur at different points in time, the cross-sectional survey design is incapable of capturing the timing of when these two events occurred.

Collectively, the synthesis of the above-described studies indicates that although there is substantial analytical sophistication in the BNPL field, the methodological approach of the studies reviewed is narrow. Therefore, future studies would be enhanced by employing longitudinal designs, experimental designs, and mixed-methods designs, expanding sample frames to include a broader range of youth than those who are digitally engaged, and utilising validated measures of regret to improve the understanding of the psychological effects of BNPL-driven impulsivity.

4.4.3. Proposed Conceptual Framework

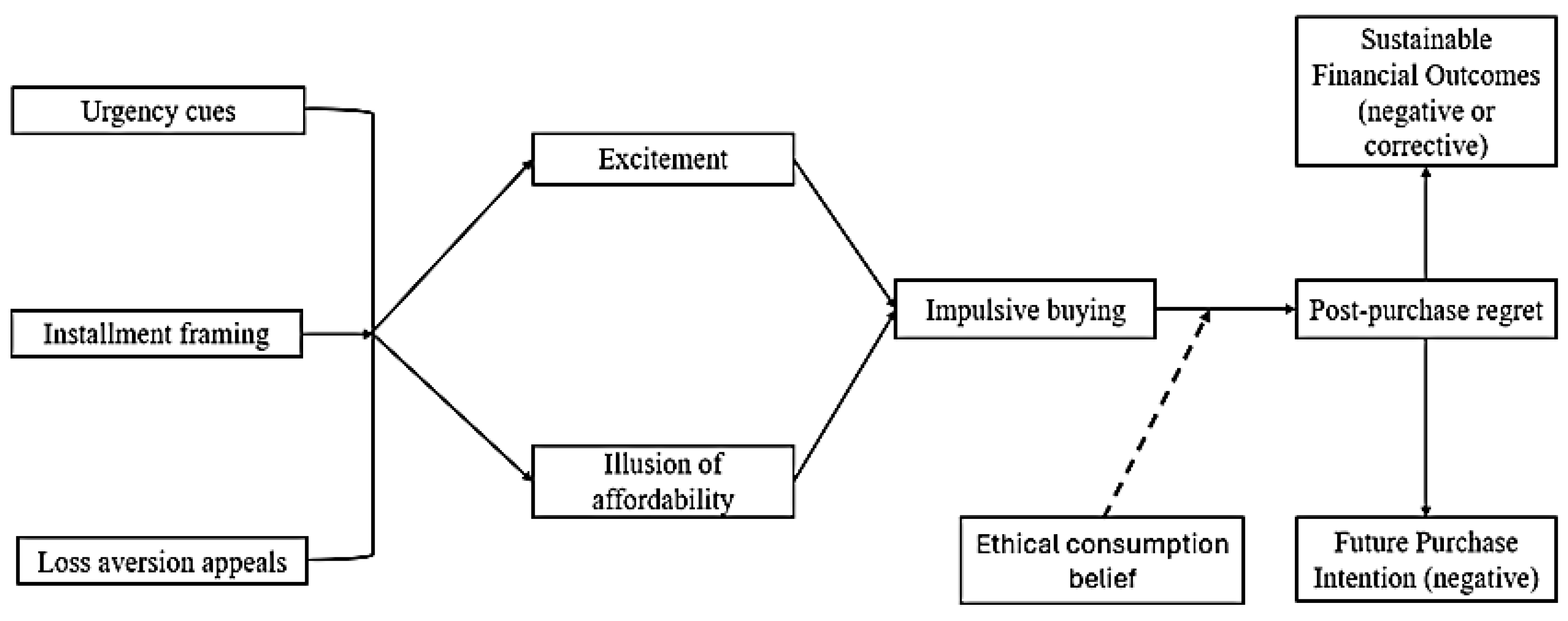

Building upon previously established theories of psychology and consumer behaviour, the proposed conceptual framework outlines how BNPL marketing strategies generate cognitive processing, emotional response, impulsive behaviour and ultimately post-purchase regret. The Affective Mechanism is based on the dual process model of decision-making [

53] that differentiates fast, emotionally-based decision-making from slow, rational decision-making. Cues used in BNPL marketing strategies, such as urgency messages, loss aversion appeals and so forth, elicit positive emotional responses, thereby decreasing the amount of time and energy available for consumers to evaluate options reflectively and increasing the likelihood that they will make an impulse purchase. The Cognitive Pathway is based on Festinger’s (1957) Cognitive Dissonance Theory. When consumers act in ways that do not match their values, they experience psychological discomfort, which leads to dissonance. BNPL marketing strategies utilise cues specific to BNPL marketing, such as instalment framing and affordability illusions that decrease consumers’ use of cognitive control, create distorted mental images of costs and risks associated with purchasing and subsequently lead to impulse purchases that are the precursors to dissonance-generated regret.

The moderating effect of Ethical Consumption Belief, as outlined in the framework, relates to the theory of Moral Self-Regulation and Value-Congruence [

54]. Consumers who believe in ethical consumption are more likely to evaluate their purchasing decisions through a moral lens. Therefore, they are more likely to experience greater levels of regret if their impulsively or unsustainably purchased products contradict their personal ethical values. On the other hand, those consumers with lower ethical orientations may be less likely to experience these emotions. Overall, the integration of these theories into the proposed conceptual framework provides support for the structure of the framework and provides insight into the manner in which BNPL marketing strategies can initiate both emotional and cognitive processes that influence consumers to make impulse purchases and experience post-purchase regret, while also influencing long-term behaviours such as future purchase intentions and sustainable financial well-being.

Figure 4.

Conceptual framework.

Figure 4.

Conceptual framework.

The new framework demonstrates how BNPL marketing strategies will elicit both cognitive and affective responses from consumers that together influence their purchasing behaviour and emotional experience in relation to their purchases. Urgency cues, instalment framing, and loss aversion appeals are associated with affective states (i.e., excitement) while the former two strategies influence cognitive states (e.g., illusions of affordability); these states can contribute to consumers experiencing reduced capacities for reflection when making purchasing decisions. Therefore, BNPL marketing strategies contribute to impulsive purchasing decisions, which may lead to post-purchase regret. The relationship between the marketing strategy and post-purchase regret is moderated by ethical consumption beliefs, i.e., whether the consumer’s regret is intensified or attenuated based upon the degree of correspondence between the consumer’s post-purchase regret and their moral standards. Finally, post-purchase regret affects both the consumer’s intention to make future purchases and long-term sustainable financial performance, influencing consumers’ overall economic well-being.

4.5. Methodological Strengths and Weaknesses

CASP Assessment shows the majority of research conducted has used strong statistical methods, especially by use of PLS-SEM or DEMATEL, with a validated scale [

36]. However, there are four significant limitations to the body of research as follows: (i) the large amount of cross sectional survey based research, which limits ability to infer causality [

55], (ii) the large number of student and convenience samples, which limit the generalizability of the results [

38], (iii) the limited geographical scope, primarily limited to Asian and European countries, and therefore may not be representative of the global variability of BNPL [

14,

56]; and (iv) the lack of direct measurement of regret in this body of research, with researchers using dissatisfaction, compulsive buying, or financial stress as proxies for regret [

57]. The reliance on self-reported surveys also increases the risk of common-method bias [

58]. These limitations represent the developmental stage of the research and indicate that the research is still developing towards establishing a standardised methodology.

4.6. Practical and Policy Implications

The results exemplify that BNPL has a dual-sided nature. The use of instalment framing and the impact of urgency cues will have the immediate effect of increasing short-term sales. However, it can also have the unintended consequence of damaging consumer trust by causing customers to experience regret-related outcomes [

57]. Therefore, for marketers who are interested in using BNPL responsibly, transparency is key. Marketing practices must be responsible and affordable, and campaigns need to be balanced between promotional efforts [

10]. For regulators, there is a need for regulations to identify behavioural biases like loss aversion and affordability illusion, and there is a need to promote financial literacy programs specifically for young consumers [

44,

59]. As for international guidelines and standards such as the UN Principles for Responsible Digital Lending and the OECD recommendations for consumer protection, these represent the appropriate frameworks to support the development of responsible regulations for BNPL [

1,

60].

Overall, the literature reflects BNPL as an enabler of digital consumption, but it is also a source of financial vulnerability. The current body of research has made significant contributions to the advancement of theoretical knowledge by relating impulsivity and regret. The body of research regarding BNPL is still relatively limited and conceptually and methodologically restricted. In order to advance the body of research regarding BNPL, there needs to be better theoretical integration of the disciplines of consumer behaviour, behavioural finance, and ethics, and there also needs to be greater methodological innovation with regard to longitudinal and experimental studies. It is also critical to extend the scope of study regarding the cultural and regulatory diversity of the contexts of BNPL to fully understand all of the behavioural and social consequences of BNPL. Therefore, this literature review provides an essential contribution to the consolidation of isolated pieces of research and the identification of the following steps for research, practice, and policy.

5. Limitations and Future Research Directions

Although this review’s methodology has been rigorously applied, the review is subject to some key limitations that need to be carefully considered. The first limitation is the fact that this review relied solely upon Scopus for database search, which, as an exhaustive database, may have omitted relevant studies indexed in databases such as Web of Science, PsycINFO or ABI/INFORM. Future systematic reviews could benefit from using multiple databases to increase the breadth of studies searched and thus decrease selection bias. The second limitation is the restriction of searching to only peer-reviewed publications written in English, which may represent a form of publication bias that favours formal, Western-centric academic publication at the expense of potentially valuable insight from grey literature, or those published in languages other than English. The third limitation relates to the fact that the synthesis was completed using a relatively small number of studies (n=10), which reflects the developing nature of BNPL research, and therefore, conclusions derived from this study should be interpreted cautiously. The fourth limitation is that all studies identified in this review used cross-sectional surveys as their design methodology, which restricts the ability to infer causality between variables and obscures how regret evolves. The fifth limitation is that the use of indirect measures of post-purchase regret also indicates that one of the most significant psychological consequences of BNPL consumption is still poorly researched.

Additionally, given the reliance upon self-report survey designs to collect data in this review, there are several reasons why potential standard method biases could exist. Future research should endeavour to incorporate procedural and statistical remedies (such as Harman’s Single-Factor Test or Marker Variables) to mitigate bias. Additionally, although CASP was applied uniformly throughout this review, it would be beneficial for future reviews to employ additional assessment tools (for example, AXIS or MMAT) to increase the robustness of quality assessments and provide greater comparability amongst them.

Ultimately, future research should expand its methodological and contextual scope to: (i) extend beyond English language, academic publications and to include grey literature from diverse international contexts; (ii) utilise longitudinal, experimental and/or mixed-method designs to improve causal inference; (iii) investigate cross-cultural contexts and underresearched regions including the Middle East, Africa and Latin America; (iv) measure post-purchase regret as a validated concept directly rather than indirectly; and (v) incorporate ethics, sustainability and consumer wellbeing into research on the long-term societal impacts of adopting BNPL. By addressing the limitations identified in this review, future research can progress towards a more comprehensive, interdisciplinary, and ethically grounded understanding of the role of BNPL in influencing consumer behaviour.

5.1. Future Research Directions

A better understanding of the methodology, conceptually and contextually, of BNPL and its relationship to impulse purchasing and post-purchase regret can be achieved through future research focusing on the gaps identified in this study. There are three specific avenues to pursue to advance BNPL research further.

Firstly, researchers need to employ broader methodologies than cross-sectional surveys and use both longitudinal and experimental designs to capture the temporal changes in an individual’s emotional responses. This is particularly relevant because post-purchase regret typically develops after the first payment cycle of a BNPL loan has been completed. Longitudinal studies will help to identify how the impulsive BNPL purchases develop into cognitive dissonance, stress or regret over time. Experimental studies employing manipulations of instalment framing, urgency cues or affordability illusions will help to strengthen the causal linkages between impulsive behaviour and BNPL environments.

Secondly, there is currently no evidence of validated measures of regret in the BNPL literature that researchers can apply to their studies. Therefore, the development of standardised instruments to measure regret in BNPL settings is required. Researchers should either utilise established regret scales and adapt them to measure regret in BNPL settings or develop new BNPL-specific measures of regret which can differentiate between immediate dissatisfaction, financial pressure and genuine post-purchase regret. The application of valid measures of regret will enable researchers to progress from using proxy measures of regret (e.g., decreased well-being and compulsive buying) and facilitate more accurate theoretical testing of the constructs of IBT and CDT in BNPL settings.

Thirdly, the current sampling strategies used by researchers are limited. Most current studies have focused on young, digitally active, and predominantly middle-class populations in SE Asia, India, Australia and certain regions in Europe. In order to understand the global variability in the psychological effects of BNPL, it is essential to include samples from diverse cross-cultural, socio-economic and underrepresented markets, including but not limited to the Middle East, Africa, and Latin America. These different marketplaces vary significantly in terms of financial education, religious values, government regulations protecting consumers, and debt culture; therefore, they are critical for understanding the variation in the psychological impacts of BNPL across cultures. Comparative cross-cultural studies could identify how cultural values, religiosity, financial knowledge, or social norms influence the level of impulsiveness and regret experienced by consumers.

Fourthly, researchers should consider incorporating a more integrated theoretical framework when conducting BNPL studies. The majority of existing studies rely on IBT, CDT or Behavioural Finance theory; however, integrating these theories with ethical consumption, mindfulness, or digital nudging frameworks could produce a more comprehensive understanding of how consumers process BNPL cues and modulate the emotional consequences of BNPL decisions. In addition, researchers could explore moderators such as self-control, financial awareness, and ethical consumption beliefs to explain why some consumers report significant levels of regret, whereas other consumers do not.

Lastly, industry and policy provide opportunities for BNPL research through an interdisciplinary approach. Future research should assess whether consumer protection regulations, transparency requirements, and responsible marketing policies and procedures reduce the levels of impulsiveness and regret reported by consumers. Furthermore, research examining how the algorithmic design of apps, user interfaces, AI-based nudges and repayment reminders affect consumers’ purchasing behaviours could create meaningful implications for policymakers and Fintech developers.

6. Implications

6.1. Theoretical Implications

The findings of this study provide an integrated theory for the use of BNPL through the combination of existing theories from consumer behaviour, psychology and finance. This review expands upon the impulse buying theory (IBT) regarding how BNPL digital payment formats, i.e., instalments and urgency cues, can be used as behavioural nudge mechanisms to increase impulse purchases [

43,

61]. Additionally, the findings support cognitive dissonance theory (CDT) in that consumers are likely to feel regretful or have “bad feelings” when their repayment responsibilities for the BNPL loan contradict the instant gratification they experience from making a purchase [

8,

15].

Finally, this study identifies moderators of BNPL use, including financial consciousness, mindfulness and religiosity, which will allow researchers to broaden the scope of explanations of behavioural finance [

14,

25]. These moderators provide a basis for further BNPL research to expand beyond simple usage/adoption models into a multidisciplinary framework that includes psychological, cultural and ethical influences on purchasing decisions [

56].

6.2. Managerial Implications

For the practitioner, BNPL is a two-edged sword. In terms of converting customers, BNPL will be effective at reducing the burden of payments and increasing sales growth for the retailer. However, if BNPL is based solely on impulse (and the consumer cannot repay), then this could lead to the development of dissatisfaction with the purchase, post-purchase regrets and/or financial distress. These issues could ultimately damage long-term loyalty and brand equity.

Retailers and Fintech providers should implement clear and transparent communications regarding repayment requirements and potential risks associated with BNPL, assess the affordability of BNPL to protect financially sensitive consumers, and create marketing promotions that focus on developing sustainable customer relationships rather than maximising short-term sales. The integration of accountability within the marketing of BNPL will enable companies to mitigate the negative consequences of BNPL, increase consumer confidence and allow them to differentiate their company in an ever-increasing competitive environment of digital finance.

6.3. Policy Implications

The results indicate that from a regulatory perspective, there is a need for behaviorally informed policy which addresses the cognitive biases influencing the adoption of BNPL with specific regard to its features (e.g., installment framing, urgency cues, loss aversion appeals) in addition to traditional disclosure based approaches which may fail to account for how consumers tend to underestimate or discount future cost(s).

Therefore, policymakers should enhance affordability checks on BNPL products and require BNPL providers to conduct transparent risk assessment(s). Policymakers should also implement requirements for BNPL providers to provide transparent and standardised formats for disclosures, to reduce information asymmetry and implement financial literacy programs directed towards the youth population, who are the primary demographic influenced by BNPL-induced impulse purchasing behaviours.

As such, by integrating behavioural science into existing consumer protection policy, policymakers will be able to find an appropriate level of regulation of financial innovation and responsibility, so that BNPL can contribute positively to financial inclusion and not negatively influence debt cycle(s), nor negatively affect consumers.

7. Conclusion

This review is an example of the first comprehensive synthesis of existing research regarding the relationship between the adoption of Buy Now, Pay Later (BNPL), impulse purchasing and post-purchase regret. Through the collection of evidence from ten empirical and conceptual studies conducted from 2018 to 2025, the study illustrates how the area of consumer behaviour, behavioural finance and ethics, is becoming increasingly fragmented due to the rapid growth in BNPL.

The results show that BNPL serves as a strong behavioural stimulus, reducing the perceived cost of paying and increasing the likelihood of making impulse purchases, especially by young and technology-oriented consumers. Although post-purchase regret has rarely been studied directly, many examples exist of indirect expressions of regret (i.e., financial stress, compulsive shopping, decreased well-being), and the study’s findings raise serious questions concerning consumer protection and regulatory oversight. The moderating effects of consciousness of one’s finances, religiosity and mindfulness provide insight into how individual and cultural factors can counteract some negative consequences of BNPL and provide a basis for further research on integrating theory.

Methodologically, there is still much to be done in terms of using longitudinal designs, non-student populations and valid measurement tools for studying regret in the context of BNPL, limiting both the ability to generalise and draw causal conclusions based on existing literature. Therefore, future research should employ longitudinal, experimental and cross-cultural methodologies, and develop reliable tools for measuring regret in the context of BNPL.

From a practical/academic policy standpoint, the findings of the study emphasise the importance of marketing responsibly and balancing short-term conversion rates with long-term building of trust between a business and its customers, as well as implementing behaviorally informed regulations that take into account the cognitive biases present in BNPL plans.

In conclusion, this study makes a significant contribution by identifying post-purchase regret as an essential but poorly understood consequence of adopting BNPL products, through the consolidation of scattered findings into a unified body of evidence, and by outlining a forward-thinking agenda for conducting additional research, practice and policy. In addition, the study identifies both the opportunities and risks associated with the growing use of BNPL and calls for interdisciplinary, cross-cultural and ethically focused research designed to protect the interests of consumers, while guiding the development of a sustainable global digital finance system.

Author Contributions

Conceptualization, Omar M. Nusir and Che Aniza Che Wel; methodology, Omar M. Nusir and Siti Ngayesah Ab Hamid; validation, Che Aniza Che Wel, Lamees Al-Zoubi and Ahmad Samed Al-Adwan; formal analysis, Omar M. Nusir; data curation, Omar M. Nusir and Siti Ngayesah Ab Hamid; writing—original draft preparation, Omar M. Nusir; writing—review and editing, Che Aniza Che Wel, Siti Ngayesah Ab Hamid, Lamees Al-Zoubi and Ahmad Samed Al-Adwan; visualization, Omar M. Nusir; supervision, Che Aniza Che Wel; project administration, Omar M. Nusir. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

No new data was created or analysed in this study. Data sharing does not apply to this article.

Acknowledgments

The authors would like to express their sincere appreciation to Assoc. Prof. Dr Che Aniza Che Wel and Dr Siti Ngayesah Ab Hamid for their invaluable supervision, continuous guidance, and constructive feedback throughout the development of this manuscript. Her academic insight and unwavering support were instrumental in shaping the quality and direction of this work. The authors also thank Universiti Kebangsaan Malaysia (UKM) for providing educational support during the research process.

Conflicts of Interest

The authors declare no conflict of interest.

Abbreviations

The following abbreviations are used in this manuscript:

| BNPL |

Buy Now, Pay Later |

| CASP |

Critical Appraisal Skills Programme |

| CDT |

Cognitive Dissonance Theory |

| CMV |

Standard Method Variance |

| IBT |

Impulsive Buying Theory |

| MMAT |

Mixed Methods Appraisal Tool |

| PLS-SEM |

Partial Least Squares Structural Equation Modelling |

References

- OECD Consumer Finance Risk Monitor; OECD Publishing, 2024; ISBN 978-92-64-31988-2.

- Giulio Cornelli; Leonardo Gambacorta; Livia Pancotto Buy Now, Pay Later: A Cross-Country Analysis. BIS Quarterly Review 2023.

- Buy Now, Pay Later Guide. Worldpay 2023.

- Bellary, S.; Bala, P.K.; Chakraborty, S. Exploring Cognitive-Behavioral Drivers Impacting Consumer Continuance Intention of Fitness Apps Using a Hybrid Approach of Text Mining, SEM, and ANN. Journal of Retailing and Consumer Services 2024, 81, 104045. [CrossRef]

- Prelec, D.; Loewenstein, G. The Red and the Black: Mental Accounting of Savings and Debt. Marketing Science 1998, 17, 4–28. [CrossRef]

- Bakar, R.M.; Fauziyah, N.; Rahmat, A. Do Consumers Perceive Impulsive Buying and Pain of Payment? E-Commerce Transactions Using Pay Later, E-Wallet, and Cash-On-Delivery. GADJAH MADA INT. J. BUS. 2025, 27, 31. [CrossRef]

- Rook, D.W.; Fisher, R.J. Normative Influences on Impulsive Buying Behavior. J CONSUM RES 1995, 22, 305. [CrossRef]

- Zeelenberg, M.; Pieters, R. A Theory of Regret Regulation 1.0. J Consum Psychol 2007, 17, 3–18. [CrossRef]

- Wang, Z. Economic Brief. 2025,.

- EBA Identifies Payment Fraud, Indebtedness and de-Risking as Key Issues Affecting Consumers in the EU. European Banking Authority 2025.

- Djamhari, S.I.; Mustika, M.D.; Sjabadhyni, B.; Ndaru, A.R.P. Impulsive Buying in the Digital Age: Investigating the Dynamics of Sales Promotion, FOMO, and Digital Payment Methods. Cogent Business & Management 2024, 11, 2419484. [CrossRef]

- Kumar, S.; Nayak, J.K. Understanding the Intricacies of Risky Indebtedness, Impulse Buying and Perceived Risk in Buy-Now-Pay-Later Adoption. APJML 2024, 36, 1697–1716. [CrossRef]

- Raj, V.A.; Jasrotia, S.S.; Rai, S.S. Intensifying Materialism through Buy-Now Pay-Later (BNPL): Examining the Dark Sides. IJBM 2024, 42, 94–112. [CrossRef]

- Schomburgk, L.; Hoffmann, A. How Mindfulness Reduces BNPL Usage and How That Relates to Overall Well-Being. EJM 2023, 57, 325–359. [CrossRef]

- Mappadang, A.; Hendryadi, H.; Yoewono, H.; Elizabeth, E.; Fitriawati, R. The God Locus of Financial Control, Impulsive Use of Buy-Now-Pay-Later Service, and Subjective Financial Well-Being among Accounting Students: The Role of Social Comparison Tendencies. Cogent Social Sciences 2025, 11, 2474192. [CrossRef]

- Page, M.J.; McKenzie, J.E.; Bossuyt, P.M.; Boutron, I.; Hoffmann, T.C.; Mulrow, C.D.; Shamseer, L.; Tetzlaff, J.M.; Akl, E.A.; Brennan, S.E.; et al. The PRISMA 2020 Statement: An Updated Guideline for Reporting Systematic Reviews. BMJ 2021, 372, n71. [CrossRef]

- CASP Checklists. Critical Appraisal Skills Programme 2020.

- Rethlefsen, M.L.; Kirtley, S.; Waffenschmidt, S.; Ayala, A.P.; Moher, D.; Page, M.J.; Koffel, J.B.; PRISMA-S Group; Blunt, H.; Brigham, T.; et al. PRISMA-S: An Extension to the PRISMA Statement for Reporting Literature Searches in Systematic Reviews. Syst Rev 2021, 10, 39. [CrossRef]

- Snyder, H. Literature Review as a Research Methodology: An Overview and Guidelines. Journal of Business Research 2019, 104, 333–339. [CrossRef]

- Mongeon, P.; Paul-Hus, A. The Journal Coverage of Web of Science and Scopus: A Comparative Analysis. Scientometrics 2016, 106, 213–228. [CrossRef]

- Donthu, N.; Kumar, S.; Mukherjee, D.; Pandey, N.; Lim, W.M. How to Conduct a Bibliometric Analysis: An Overview and Guidelines. Journal of Business Research 2021, 133, 285–296. [CrossRef]

- Moher, D.; Liberati, A.; Tetzlaff, J.; Altman, D.G.; The PRISMA Group Preferred Reporting Items for Systematic Reviews and Meta-Analyses: The PRISMA Statement. PLoS Med 2009, 6, e1000097. [CrossRef]

- Thomas, J.; Harden, A. Methods for the Thematic Synthesis of Qualitative Research in Systematic Reviews. BMC Med Res Methodol 2008, 8, 45. [CrossRef]

- Mukherjee, S. Factors Impeding Buy Now, Pay Later (BNPL) Adoption in India: A Mixed-Method Approach. Journal of Retailing and Consumer Services 2025, 87, 104402. [CrossRef]

- Fauzana, R.F.; Rubiyanti, N.R.; Kumalasari, A.D.K.; Pradana, M.P. Conspicuous Consumption and Consumeristic Behavior: The Moderating Effect of Financial Conciousness. Glob Bus Financ Rev 2025, 30, 34–50. [CrossRef]

- Surjandy, S.; Tannia, E.M.; Cahyadi, A.; Siswanto, G.K. The Analysis of Impulse Buying’s Factors Effect on Peer-to-Peer Lending Consumers to Financial Technology Awareness, Literacy, and Risk Factors. ICIC Express Letters 19, 301–308.

- Fook, L.A.; McNeill, L. Click to Buy: The Impact of Retail Credit on Over-Consumption in the Online Environment. Sustainability 2020, 12, 7322. [CrossRef]

- Waliszewski, K.; Solarz, M.; Kubiczek, J. Factors Influencing the Use of Buy Now Pay Later (BNPL) Payments. CE 2024, 18, 444–457. [CrossRef]

- Downes, M.J.; Brennan, M.L.; Williams, H.C.; Dean, R.S. Development of a Critical Appraisal Tool to Assess the Quality of Cross-Sectional Studies (AXIS). BMJ Open 2016, 6, e011458. [CrossRef]

- Hong, Q.N.; Fàbregues, S.; Bartlett, G.; Boardman, F.; Cargo, M.; Dagenais, P.; Gagnon, M.-P.; Griffiths, F.; Nicolau, B.; O’Cathain, A.; et al. The Mixed Methods Appraisal Tool (MMAT) Version 2018 for Information Professionals and Researchers. EFI 2018, 34, 285–291. [CrossRef]

- McHugh, M.L. Interrater Reliability: The Kappa Statistic. Biochem Med 2012, 22, 276–282. [CrossRef]

- Booth, A.; Clarke, M.; Dooley, G.; Ghersi, D.; Moher, D.; Petticrew, M.; Stewart, L. The Nuts and Bolts of PROSPERO: An International Prospective Register of Systematic Reviews. Syst Rev 2012, 1, 2. [CrossRef]

- Else, H. How a Torrent of COVID Science Changed Research Publishing — in Seven Charts. Nature 2020, 588, 553–553. [CrossRef]

- Podsakoff, P.M.; MacKenzie, S.B.; Bachrach, D.G.; Podsakoff, N.P. The Influence of Management Journals in the 1980s and 1990s. Strategic Management Journal 2005, 26, 473–488. [CrossRef]

- Hair, J.F.; Risher, J.J.; Sarstedt, M.; Ringle, C.M. When to Use and How to Report the Results of PLS-SEM. EBR 2019, 31, 2–24. [CrossRef]

- Hair, J.F.; Hult, G.T.M.; Ringle, C.M.; Sarstedt, M. A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM); Third edition.; SAGE Publications, Incorporated: Thousand Oaks, 2022; ISBN 978-1-5443-9640-8.

- Verplanken, B.; Sato, A. The Psychology of Impulse Buying: An Integrative Self-Regulation Approach. J Consum Policy 2011, 34, 197–210. [CrossRef]

- Henrich, J.; Heine, S.J.; Norenzayan, A. The Weirdest People in the World? Behav Brain Sci 2010, 33, 61–83. [CrossRef]

- Rindfleisch, A.; Malter, A.J.; Ganesan, S.; Moorman, C. Cross-Sectional versus Longitudinal Survey Research: Concepts, Findings, and Guidelines. Journal of Marketing Research 2008, 45, 261–279. [CrossRef]

- Shah, A.K.; Mullainathan, S.; Shafir, E. Some Consequences of Having Too Little. Science 2012, 338, 682–685. [CrossRef]

- Brown, K.W.; Ryan, R.M. The Benefits of Being Present: Mindfulness and Its Role in Psychological Well-Being. Journal of Personality and Social Psychology 2003, 84, 822–848. [CrossRef]

- Prawitz, A.D.; Garman, E.T.; Sorhaindo, B.; O’Neill, B.; Kim, J.; Drentea, P. InCharge Financial Distress/Financial Well-Being Scale 2017.

- Alkadi, R.S.; Abed, S.S. Consumer Acceptance of Fintech App Payment Services: A Systematic Literature Review and Future Research Agenda. JTAER 2023, 18, 1838–1860. [CrossRef]

- The Woolard Review: A Review of Change and Innovation in the Unsecured Credit Market. Financial Conduct Authority 2021.

- Gomber, P.; Kauffman, R.J.; Parker, C.; Weber, B.W. On the Fintech Revolution: Interpreting the Forces of Innovation, Disruption, and Transformation in Financial Services. Journal of Management Information Systems 2018, 35, 220–265. [CrossRef]

- Zetzsche, D.A.; Arner, D.W.; Buckley, R.P.; Weber, R.H. The Future of Data-Driven Finance and RegTech: Lessons from EU Big Bang II. SSRN Journal 2019. [CrossRef]

- Badgaiyan, A.J.; Verma, A. Does Urge to Buy Impulsively Differ from Impulsive Buying Behaviour? Assessing the Impact of Situational Factors. Journal of Retailing and Consumer Services 2015, 22, 145–157. [CrossRef]

- Sun, B.; Zhang, Y.; Zheng, L. Relationship between Time Pressure and Consumers’ Impulsive Buying—Role of Perceived Value and Emotions. Heliyon 2023, 9, e23185. [CrossRef]

- Festinger, L. A Theory of Cognitive Dissonance; Reissued by Stanford Univ. Press in 1962, renewed 1985 by author, [Nachdr.].; Stanford University Press: Stanford, Calif, 2001; ISBN 978-0-8047-0911-8.

- Sweeney, J.C.; Hausknecht, D.; Soutar, G.N. Cognitive Dissonance after Purchase: A Multidimensional Scale. Psychol. Mark. 2000, 17, 369–385.

- Sutikno, B.; Aji, H.M. Understanding Buy-Now-Pay-Later Adoption in the Muslim Market: Do Religious-Based Ethics Matter? SEAM 2024, 18, 102–124. [CrossRef]

- Worthington, E.L.; Wade, N.G.; Hight, T.L.; Ripley, J.S.; McCullough, M.E.; Berry, J.W.; Schmitt, M.M.; Berry, J.T.; Bursley, K.H.; O’Connor, L. The Religious Commitment Inventory--10: Development, Refinement, and Validation of a Brief Scale for Research and Counseling. Journal of Counseling Psychology 2003, 50, 84–96. [CrossRef]

- Kahneman, D. Thinking. Fast and Slow; Farrar, Straus and Giroux: New York, 2011;

- Shaw, D.; Shiu, E. An Assessment of Ethical Obligation and Self-identity in Ethical Consumer Decision-making: A Structural Equation Modelling Approach. Int J Consumer Studies 2002, 26, 286–293. [CrossRef]

- Podsakoff, P.M.; MacKenzie, S.B.; Podsakoff, N.P. Sources of Method Bias in Social Science Research and Recommendations on How to Control It. Annu. Rev. Psychol. 2012, 63, 539–569. [CrossRef]

- Relja, R.; Ward, P.; Cook, R.; Zhao, A.L. Credit Dom(Me)s, BNPL Switches and Debt Subs: Experiences of Pain and Pleasure. Journal of Business Research 2025, 194, 115380. [CrossRef]

- Keil, J.; Burg, V. “Buy Now, Pay Later” and Impulse Shopping. SSRN Journal 2023. [CrossRef]

- Jordan, P.J.; Troth, A.C. Common Method Bias in Applied Settings: The Dilemma of Researching in Organizations. Australian Journal of Management 2020, 45, 3–14. [CrossRef]

- Buy Now, Pay Later: Market Trends and Consumer Impacts. Consumer Financial Protection Bureau.

- Transforming Our World: The 2030 Agenda for Sustainable Development. United Nations 2015.

- Ngo, T.T.A.; Nguyen, H.L.T.; Nguyen, H.P.; Mai, H.T.A.; Mai, T.H.T.; Hoang, P.L. A Comprehensive Study on Factors Influencing Online Impulse Buying Behavior: Evidence from Shopee Video Platform. Heliyon 2024, 10, e35743. [CrossRef]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).