Submitted:

02 December 2025

Posted:

03 December 2025

You are already at the latest version

Abstract

Keywords:

Introduction

Statement of the Problem

Aim and Objectives of the Study

Research Hypotheses

Scope of the Study

Literature Review

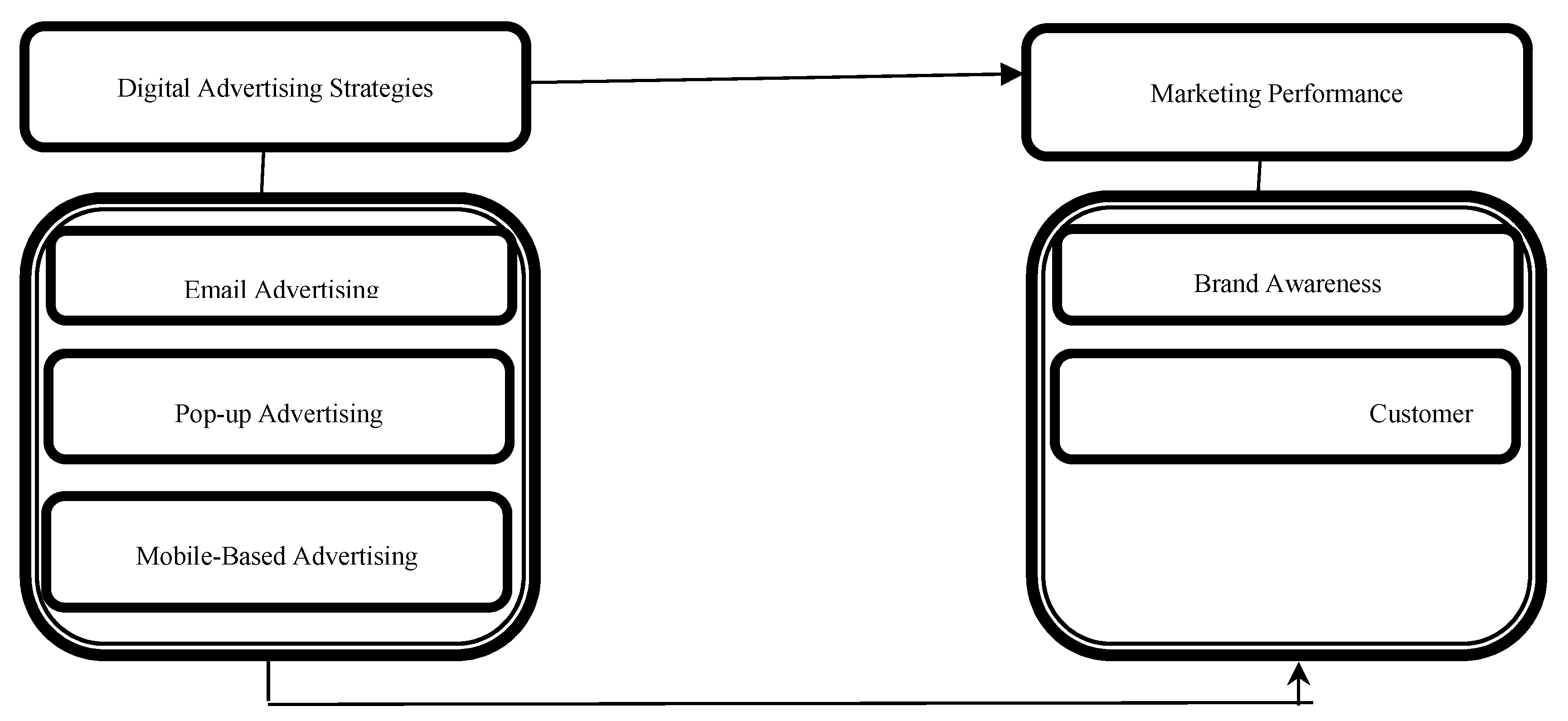

Conceptual Framework

Concept of Digital Advertising Strategies

Dimensions of Digital Advertising

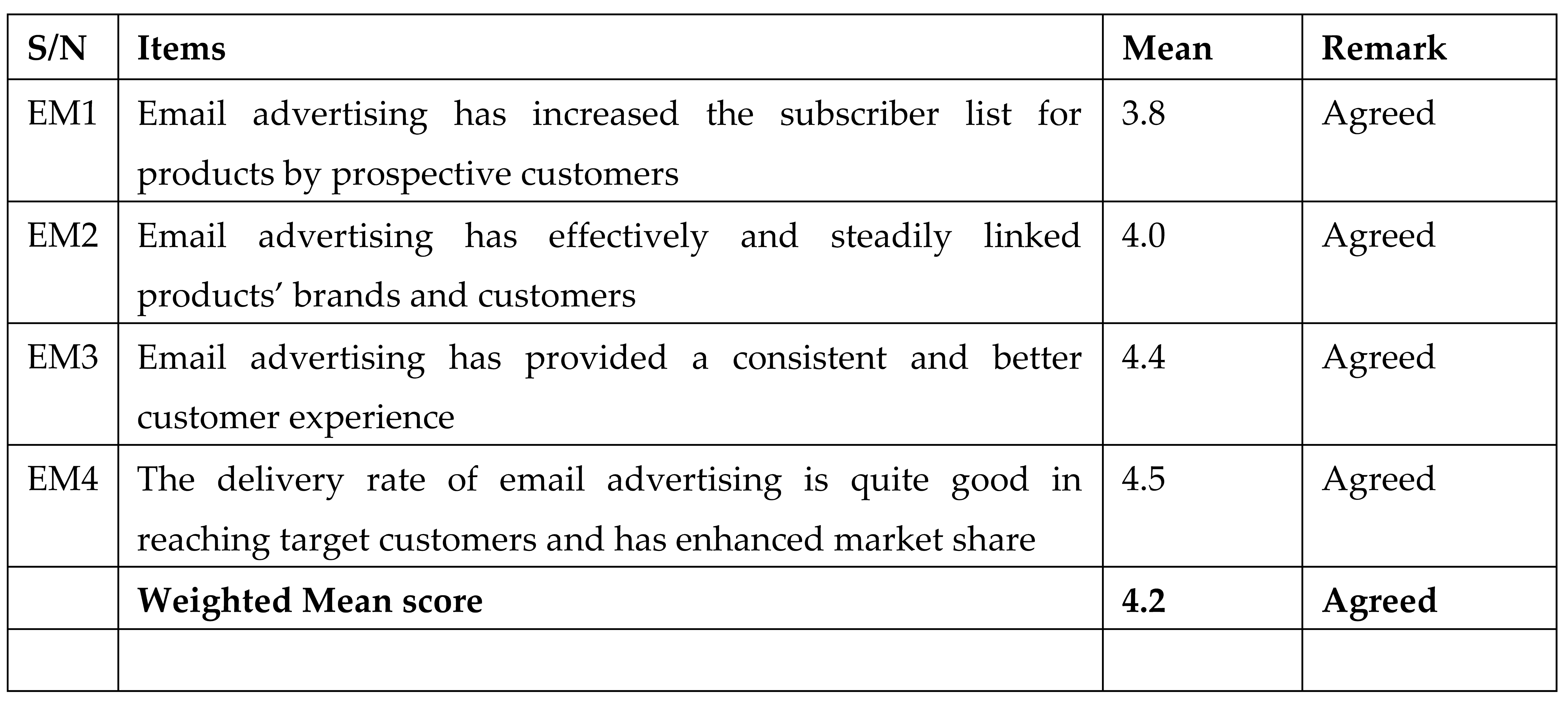

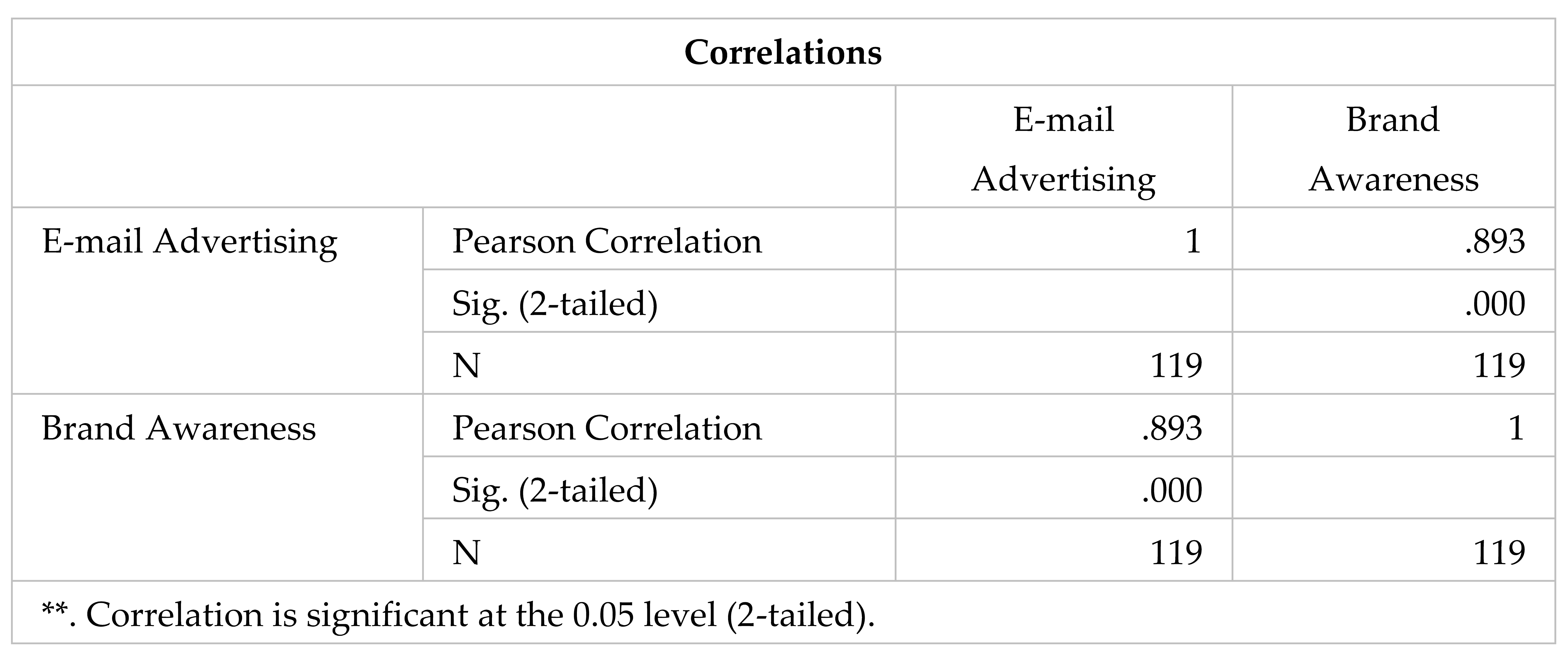

E-Mail Advertising

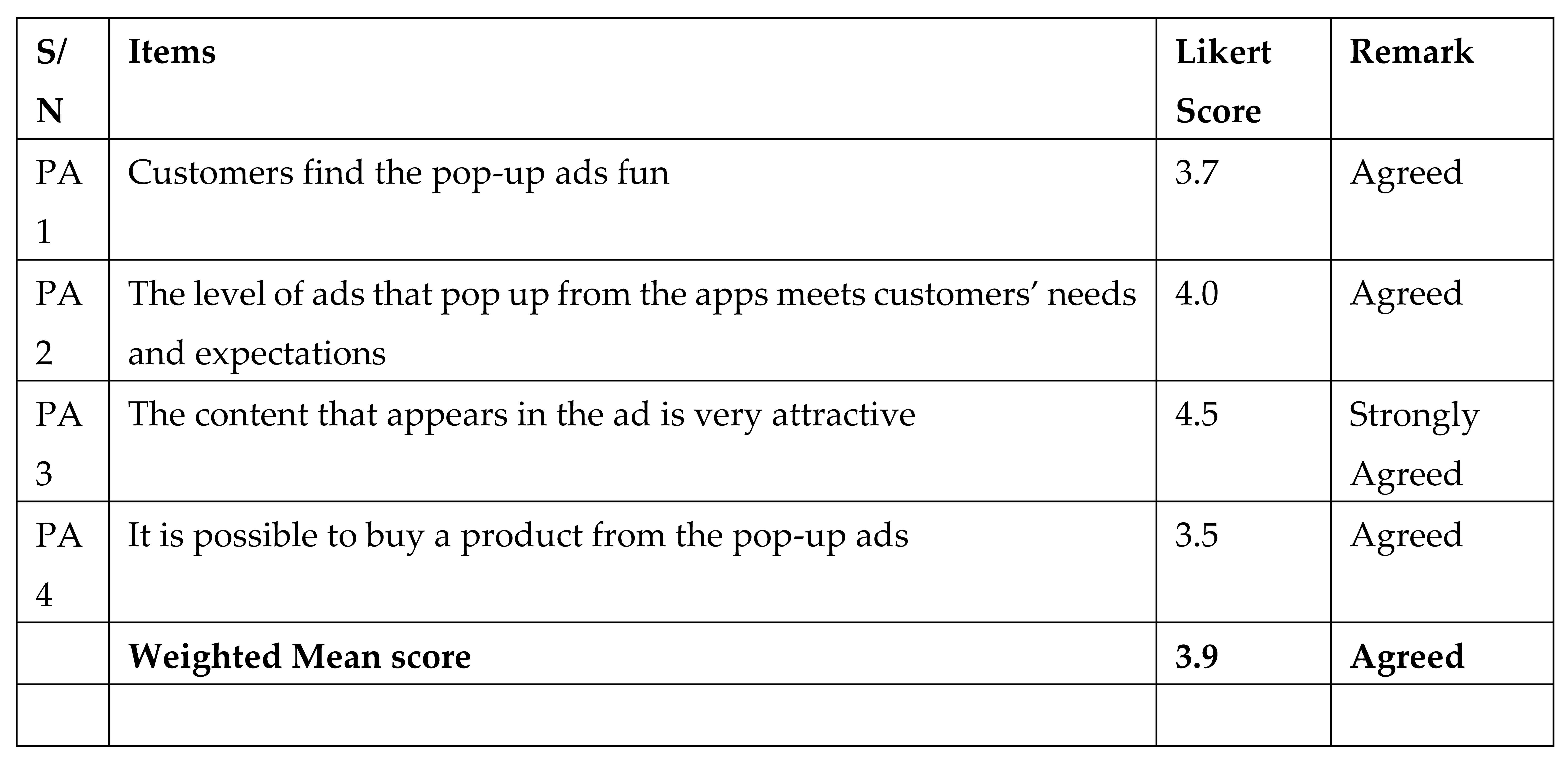

Pop-Up Advertising

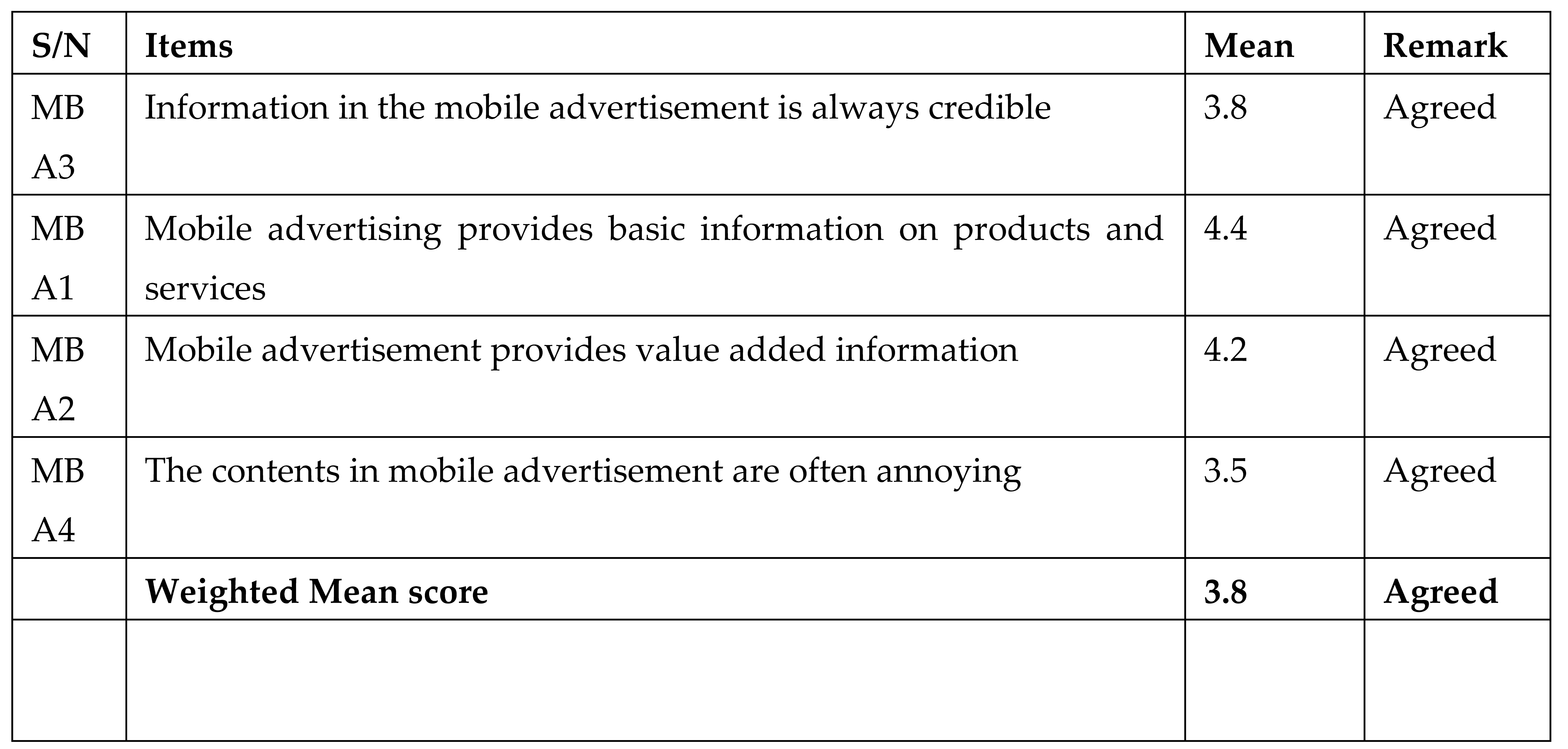

Mobile-Based Advertising

Marketing Performance

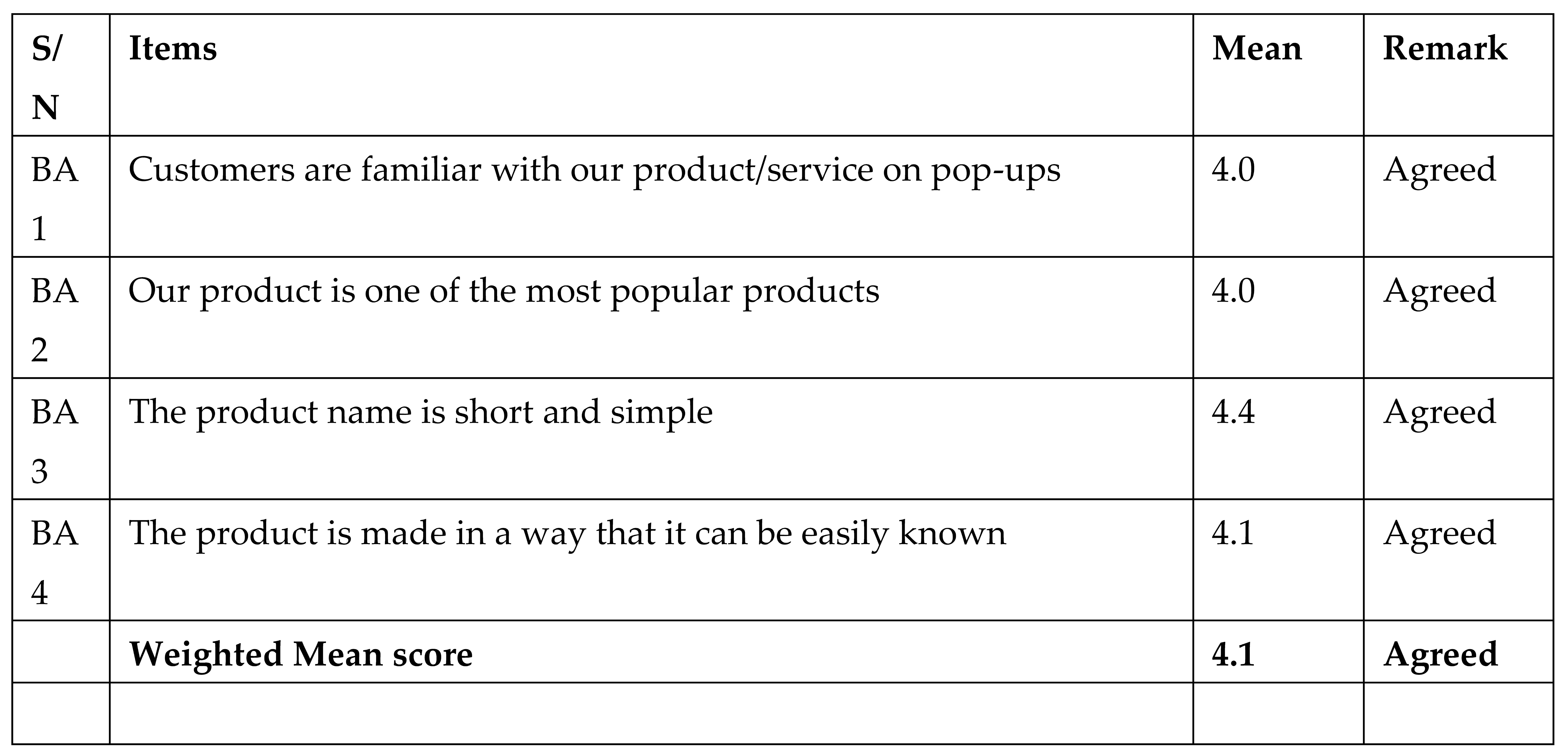

Brand Awareness

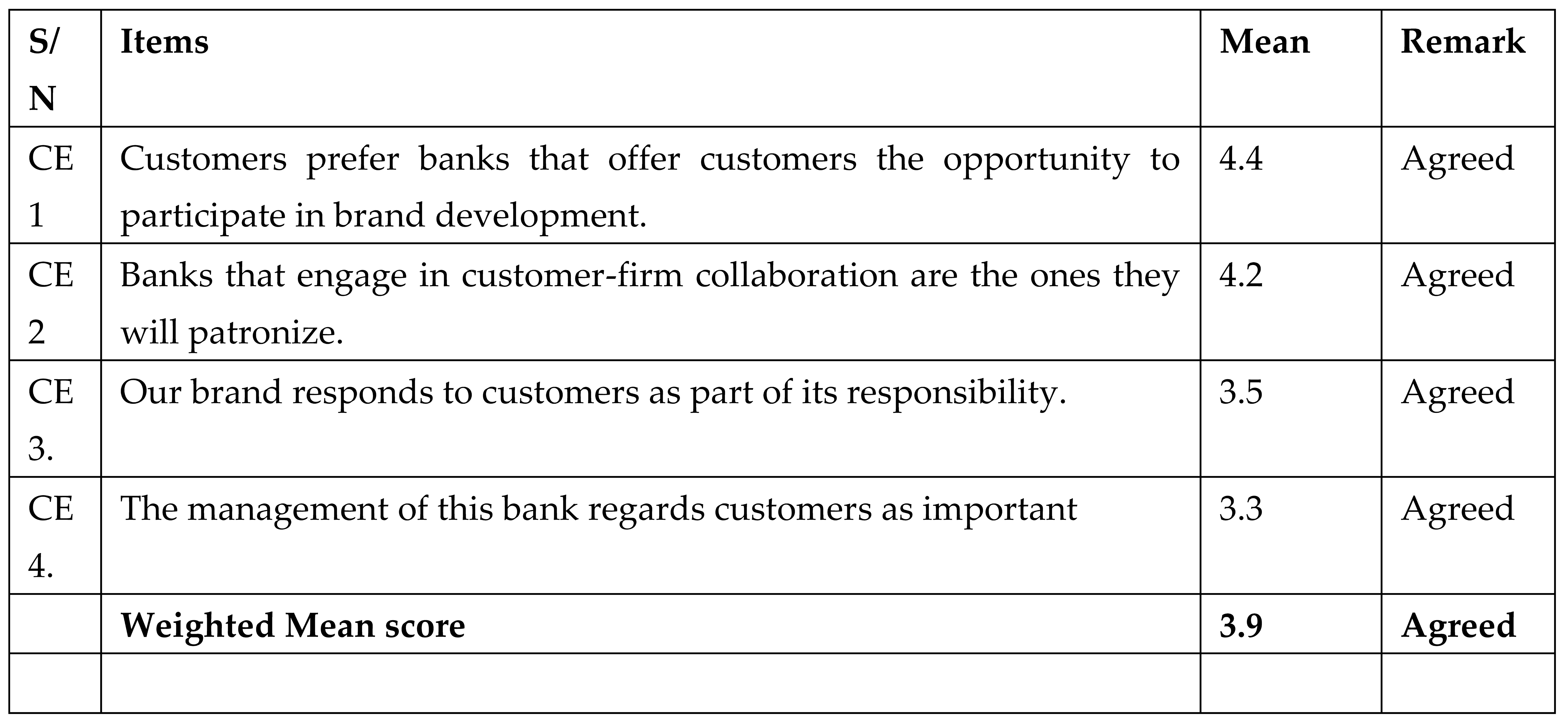

Customer Engagement

Digital Advertising Strategies and Marketing Performance

Theoretical Framework

Empirical Review

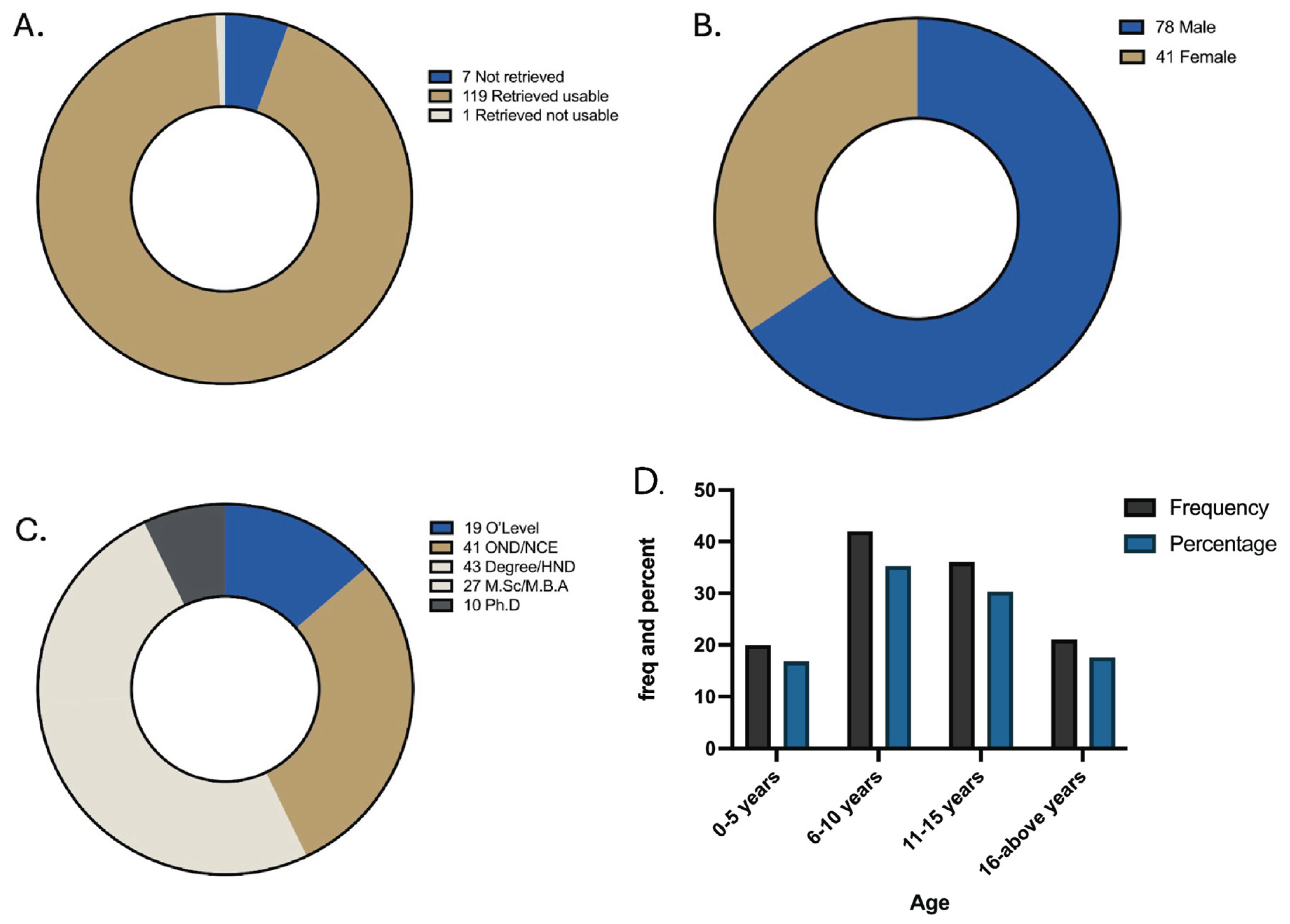

Methodology

Results and Discussion

Data Presentation

Univariate Analysis of Digital Advertising Strategies and Marketing Performance

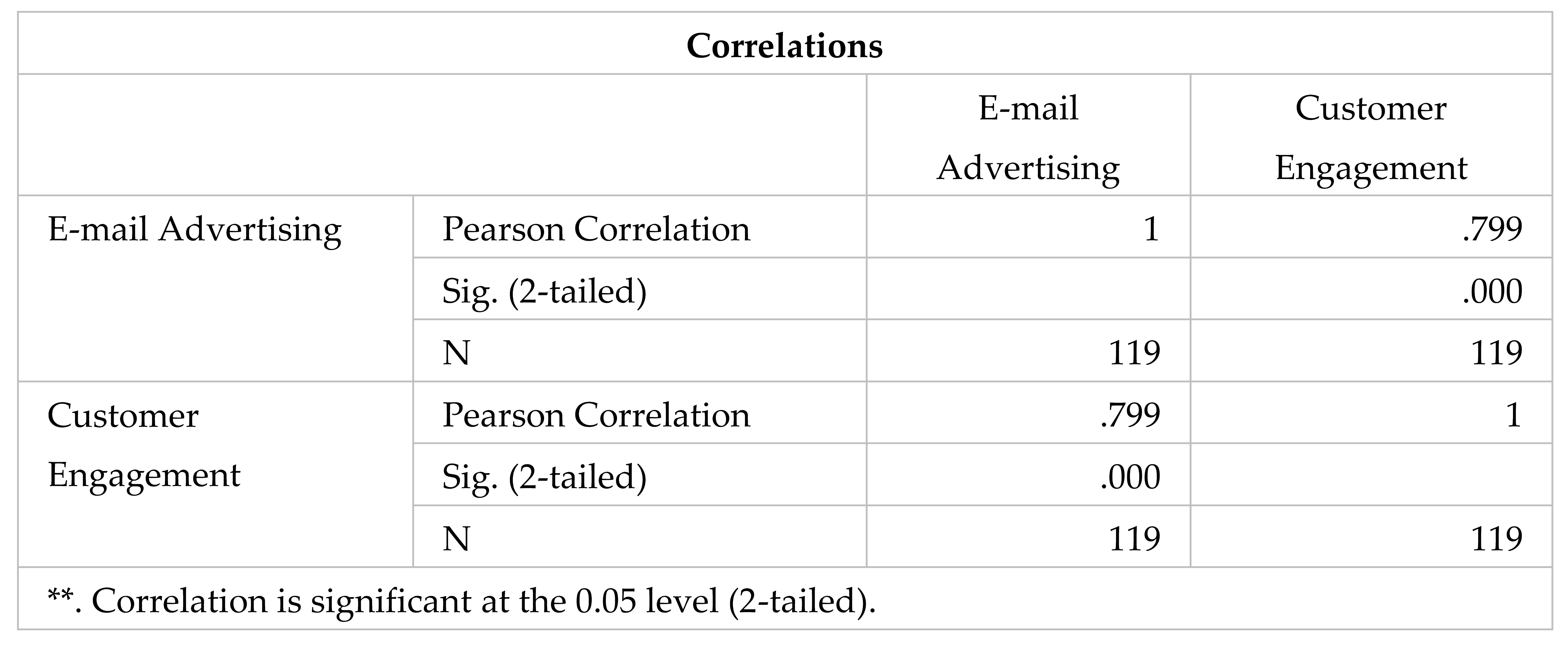

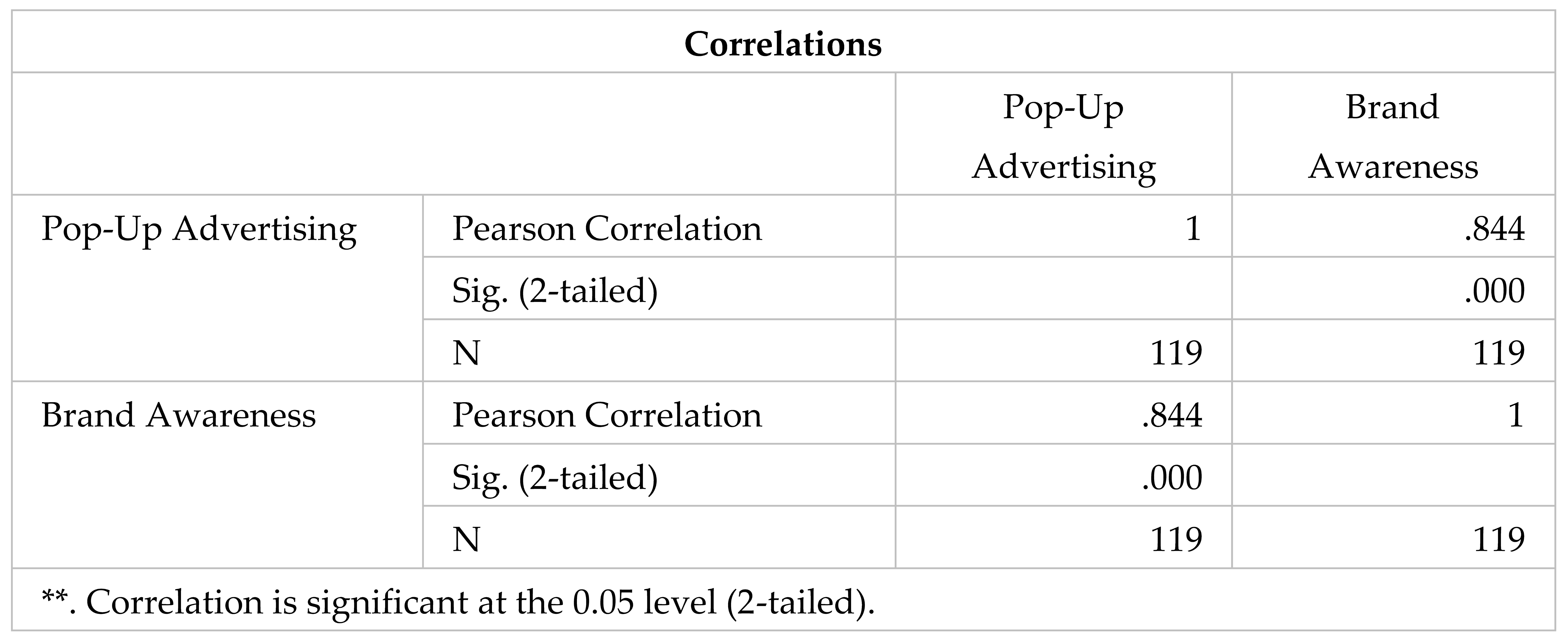

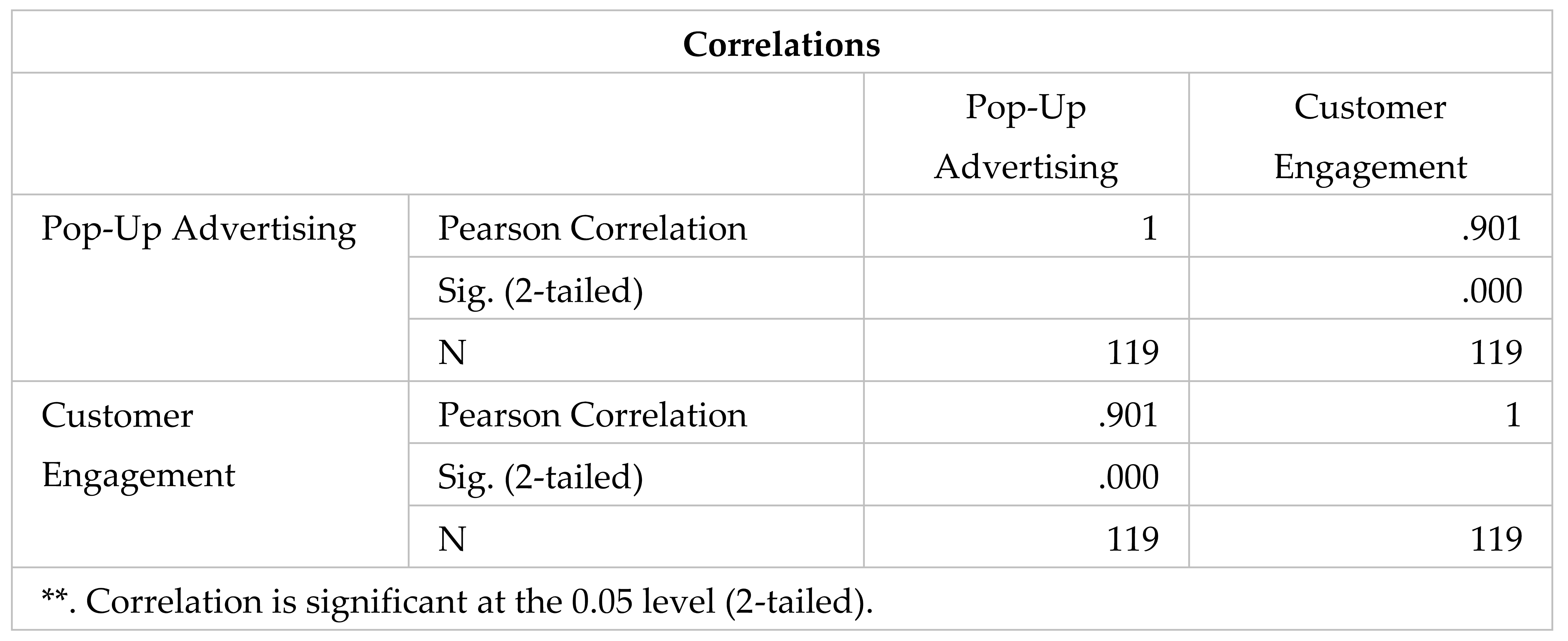

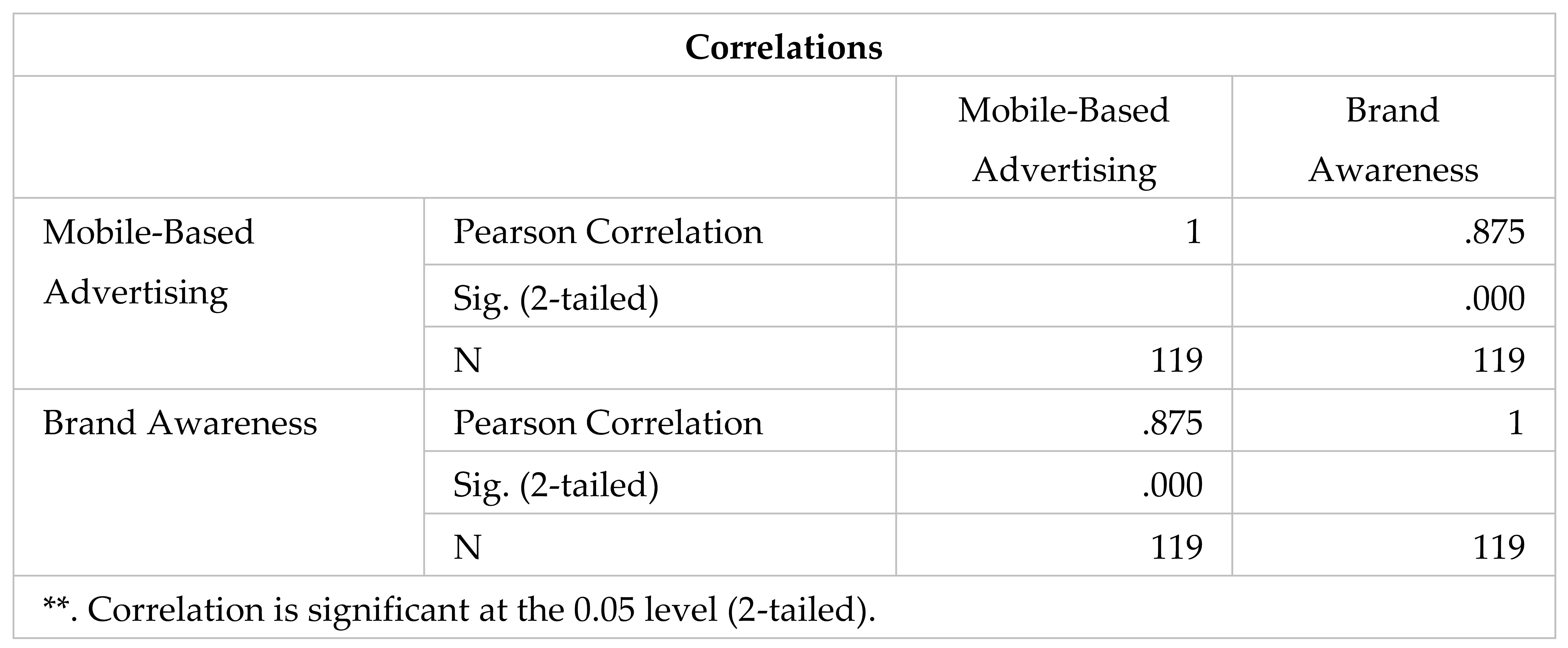

Bivariate Analysis Using Pearson Product-Moment Correlation Coefficient

Discussion and Findings

Correlation Between e-Mail Advertising and Marketing Performance

Correlation Between Pop-Up Advertising and Marketing Performance

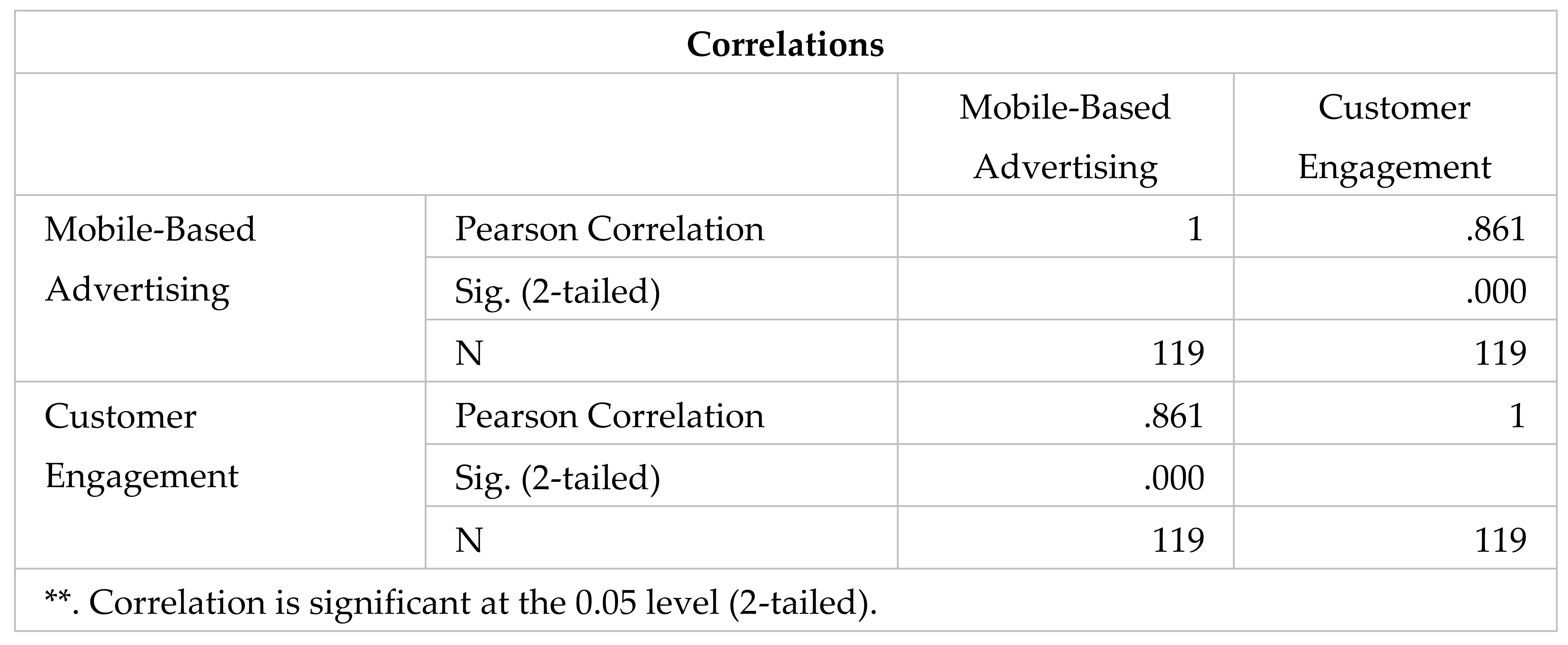

Correlation Between Mobile-Based Advertising and Marketing Performance

Conclusions

- To answer the 3rd and 4th research questions, the study concludes that a “strong and positive significant relationship” exists between pop-up advertising and the marketing performance (brand awareness and customer engagement) of deposit money banks in Rivers State.

- The results on the relationship between mobile-based advertising and marketing performance (brand awareness and customer engagement) indicated “strong and positive impact”.

Recommendations

- Banks should ensure that their E-trade channels command trust so that customers can transact business through them without being defrauded.

- It must be proven at all times by these deposit money banks that their social media channels are reliable; this must be guaranteed by providing customers with 24-hour access to information about their offerings.

- The electronic banking strategies adopted by banks must be continually evaluated and reviewed so that appropriate measures are put in place to deploy the most profitable digital advertising to help achieve the firm’s operational goals.

- The author also recommends that deposit money banks deliver tangible benefits to prospects and customers and improve performance by providing relevant content that helps solve the most challenging problems they face.

- It also recommends that deposit money banks create content that is creative, original, and appealing to engage consumers with the brand and spread positive word of mouth in the online community.

- The research recommends that banks should enhance their investment in new technologies to drive the development of online platforms.

- The study also recommends that deposit money banks should foster their email and social media marketing tools.

- Regarding social media marketing, the research recommends that banks leverage the seamless communication offered by various social networks to interact with their customers.

- The study also recommends that the regulator foster partnerships with established telecommunications firms and other players in the advertising sector to implement emerging e-mail marketing strategies. These partnerships will bring about enhanced production for both industry players

Conflicts of Interest

Data Availability

References

- Ozili, P.K. COVID-19 pandemic and economic crisis: The Nigerian experience and structural causes. J. Econ. Adm. Sci. 2020, 37, 401–418. [Google Scholar] [CrossRef]

- Alao, B.B.; Adewale, A.A.; Olanrewaju, K.M. Post-pandemic digital transformation and performance of Nigerian banks: Lessons from COVID-19 disruptions. J. Bank. Financ. Technol. 2023, 7, 145–160. [Google Scholar] [CrossRef]

- Nwokah, N.G.; Poi, E.L. Customers’ involvement and retention of deposit money banks in Port Harcourt. J. Mark. Consum. Res. 2016, 29, 53–66. [Google Scholar]

- Akins, J.T. The impact of digital advertising strategies on consumer purchasing behavior in the social media era. J. Digit. Mark. Commun. 2023, 5, 22–35. [Google Scholar] [CrossRef]

- Guo, J.; Zhang, W.; Xia, T. Impact of Shopping Website Design on Customer Satisfaction and Loyalty: The Mediating Role of Usability and the Moderating Role of Trust. Sustainability 2023, 15, 6347. [Google Scholar] [CrossRef]

- Eshiett, I.O. FinTech privacy security and customer engagement in Nigerian financial sector. Open Access Res. J. Sci. Technol. 2024, 12, 155–168. [Google Scholar] [CrossRef]

- Chan, K. Online Hedonic Consumers’ Privacy Concerns: A Systematic Review. Asia-Europe Institute, University of Malaya. 2018. Available online: https://aei.um.edu.my/online-hedonic-consumers-privacy-concerns-a-systematic-literature-review.

- Crawford University. Perceived Risk and Online Shopping Ineffectiveness in Nigeria. 2022. Available online: https://repository.crawforduniversity.edu.ng/bitstreams/577d36bb-eca0-48e8-b7fb-27d3a1d8a98a/download.

- Ihinmoyan, T. Effects of digital advertising on consumer buying behavior in Nestle Plc Nigeria Lagos. Int. J. Multidiscip. Curr. Educ. Res. (IJMCER) 2022, 4, 80–86. [Google Scholar]

- Njoku, I.; Ani, W. Barriers to the Adoption of E-Marketing in The Banking Sector in Nigeria. Int. J. Res. Innov. Soc. Sci. 2023, 7, 1455–1470. Available online: https://www.rsisinternational.org/journals/ijriss/Digital-Library/volume-7-issue-7/1455-1470.pdf. [CrossRef]

- Umoh, B.U.; Ofurum, U.D.; Soyingbe, O. The impact of bank fraud on economic stability and public trust in Nigeria’s financial system. Glob. Acad. J. Econ. Bus. 2024, 6, 187–195. [Google Scholar] [CrossRef]

- Zhou, Z. Digital Transformation of Advertising: Trends, Strategies, and Evolving User Preferences in Online Advertising. Highlights Business, Econ. Manag. 2023, 23, 1224–1229. [Google Scholar] [CrossRef]

- Kim, C.; Park, S.; Kwon, K.; Chang, W. How to select search keywords for online advertising depending on consumer involvement: An empirical investigation. Expert Syst. Appl. 2012, 39, 594–610. [Google Scholar] [CrossRef]

- Wuisan, D.S.; Handra, T. Maximizing Online Marketing Strategy with Digital Advertising. Startupreneur Bus. Digit. (SABDA Journal) 2023, 2, 22–30. [Google Scholar] [CrossRef]

- Aleisa, N.; Alamri, N.; Al-Habeeb, Z.; Maqsood, M.; AboAlsmh, H.M.; Alsedrah, I.T.; Afridi, Z. The impact of digital marketing on customer behaviours and enterprises. Acad. Strateg. Manag. J. 2023, 22, 1–16. [Google Scholar]

- Bettiga, D.; Noci, G. The influence of television content on advertisement: A neurophysiological study. Front. Psychol. 2024, 15, 1266906. [Google Scholar] [CrossRef]

- Oladejo, M.O.; Yinus, S.O.; Tajudeen, S.; Akintunde, H.A. Effect of electronic marketing practice on service satisfaction and legal framework in Nigeria banking sector. Int. J. Res. Innov. Soc. Sci. 2024, 8, 439–449. [Google Scholar] [CrossRef]

- Thomas, J.S.; Chen, C.; Iacobucci, D. Email Marketing as a Tool for Strategic Persuasion. J. Interact. Mark. 2022, 57, 377–392. [Google Scholar] [CrossRef]

- Ramadhani, N.; Prastowo, S.L.; Isrial, I. Digital Marketing, Relationship, and Customer Trust As Key of Brand Loyalty. Int. J. Business, Law, Educ. 2025, 6, 1166–1176. [Google Scholar] [CrossRef]

- EmailToolTester. Email Marketing ROI: Average Return on Email Marketing. 2024. Available online: https://www.emailtooltester.com/en/blog/email-marketing-roi/.

- Yetkin, O.; Basal, M. Brand Attitude Process of Pop-Up Ads Used in Digital Marketing. Open J. Soc. Sci. 2024, 12, 148–159. [Google Scholar] [CrossRef]

- Suryadi, N.; Barinta, D.D.; Fasieh, M.F.I.; Firdausiah, R.A.; Nurmasari, N.D. The effectiveness of pop-up advertising on millennial consumers’ purchase intentions. Rev. Gestao Tecnol. Manag. Technol. 2024, 24, 123–142. [Google Scholar] [CrossRef]

- Popupsmart. Popup Conversion Benchmark Report 2025: 10,000+ Campaigns Analyzed. 2025. Available online: https://popupsmart.com/blog/popup-conversion-benchmark-report.

- Vijayakumar, G.; Rahiman, H.U.; Nawaz, N.; Prasad, N.V.S. Perceived Intrusiveness and Digital Audience : An Empirical Approach. Indian J. Mark. 2024, 54, 51. [Google Scholar] [CrossRef]

- Aliarte, K.N.; Dulay, J.J.; Novilla, N.J.; Sario, Z.M.Z. Improving Marketing Personalization with AI How Self Congruency Influences Consumer Engagement. Int. J. Res. Innov. Soc. Sci. 2024, VIII, 537–549. [Google Scholar] [CrossRef]

- SQ Magazine. Mobile Marketing Statistics 2025: Ad Spend, Engagement & ROI. 20 March 2025. Available online: https://sqmagazine.co.uk/mobile-marketing-statistics/.

- Abdelkefi, M.I. Mobile advertising effectiveness: A digital marketing perspective on consumer attitudes. New Media Mass Commun. 2025, 107, 81–93. [Google Scholar] [CrossRef]

- Ahmad, M.; Rana, M.L.T.; Anjum, Z.U.Z. Fostering Consumer’ Acceptance of SMS-Based Mobile Advertising: A South Asian Perspective. Ann. Hum. Soc. Sci. 2023, 4, 638–651. [Google Scholar] [CrossRef]

- Mobydeen, W.H.O. The Impact of Digital Marketing Practices on the Organizational Performance in the Mobile Phone Companies in Jordan. Master’s Thesis, Near East University Institute of Graduate Studies Business Administration Programme, Nicosia, Cyprus, 2021. [Google Scholar]

- Kotler, P.; Keller, K.L. Marketing Manag ement, 15th ed.; Pearson Prentice Hall: hoboken, NJ, USA, 2016. [Google Scholar]

- Aaker, D. Aaker on Branding: 20 Prinsip Esensial Mengelola dan Mengembangkan Brand; Gramedia Pustaka Utama: Jakarta, Indonesia, 2015. [Google Scholar]

- Mathew, V.; Ali, R.T.M.; Thomas, S. Loyalty intentions: Does the effect of commitment, credibility and awareness vary across consumers with low and high involvement? J. Indian Bus. Res. 2014, 6, 213–230. [Google Scholar] [CrossRef]

- López-Rodríguez, C.E.; Sánchez-García, I. Measures of brand awareness: Bibliometric analysis and implications. TEM J. 2024, 13, 3056–3067. [Google Scholar] [CrossRef]

- Zhou, L.; Wang, H. Exploring the relationship between consumer brand knowledge and brand awareness in digital environments. J. Mark. Commun. 2023, 29, 512–526. [Google Scholar] [CrossRef]

- Keller, K.L.; Brexendorf, T.O. Measuring brand equity and brand value: A critical review and new framework. Int. J. Res. Mark. 2022, 39, 1–17. [Google Scholar] [CrossRef]

- Hollebeek, L.D.; Clark, M.K.; Macky, K. Digital brand engagement: A multi-dimensional conceptualization and research agenda. J. Bus. Res. 2021, 134, 275–285. [Google Scholar] [CrossRef]

- Pang, H.; Ruan, Y. Determining influences of information irrelevance, information overload and communication overload on WeChat discontinuance intention: The moderating role of exhaustion. J. Retail. Consum. Serv. 2023, 72, 103289. [Google Scholar] [CrossRef]

- Harmeling, C.M.; Moffett, J.W.; Arnold, M.J.; Carlson, B.D. Toward a theory of customer engagement marketing. J. Acad. Mark. Sci. 2016, 45, 312–335. [Google Scholar] [CrossRef]

- Hollebeek, L.D.; Srivastava, R.K.; Chen, T. S-D logic–informed customer engagement: Integrative framework, revised fundamental propositions, and application to CRM. J. Acad. Mark. Sci. 2016, 47, 161–185. [Google Scholar] [CrossRef]

- Hollebeek, L.D.; Macky, K. Digital Content Marketing’s Role in Fostering Consumer Engagement, Trust, and Value: Framework, Fundamental Propositions, and Implications. J. Interact. Mark. 2019, 45, 27–41. [Google Scholar] [CrossRef]

- Dessart, L.; Veloutsou, C.; Morgan-Thomas, A. Revisiting consumer engagement: A systematic review and future research directions. J. Bus. Res. 2023, 158, 113725. [Google Scholar] [CrossRef]

- eMarketer Editors. US Digital Ad Spending Will Surpass Traditional in 2019. 2019. Available online: https://www.emarketer.com/content/us-digital-ad-spending-will-surpass-traditional-in-2019.

- De Veirman, M.; Cauberghe, V.; Hudders, L. Marketing through Instagram influencers: The impact of number of followers and product divergence on brand attitude. Int. J. Advert. 2017, 36, 798–828. [Google Scholar] [CrossRef]

- Liaukonyte, J.; Thales, T.; Kenneth, C.W. Television advertising and online shopping. Mark. Sci. 2015, 34, 311–330. [Google Scholar] [CrossRef]

- Narayanan, S.; Kirthi, K. Measuring position effects in search advertising: A regression discontinuity approach. Mark. Sci. 2015, 34, 388–407. [Google Scholar] [CrossRef]

- Strycharz, J.; Van Noort, G.; Smith, E.; Helberger, N. Turning personalization off: Consumer protection against personalized ads online. Cyberpsychology J. Psychosoc. Res. Cyberspace 2019, 13, 33–41. [Google Scholar] [CrossRef]

- Van Dam, S.; Van Reijmersdal, E.A. Insights in adolescents’ persuasion knowledge, perceptions, and responses regarding online sponsored videos. Cyberpsychology J. Psychosoc. Res. Cyberspace 2019, 13, 42–62. [Google Scholar] [CrossRef]

- Rogers, E.M. Diffusion of Innovations, 6th ed.; Free Press: New York, NY, USA, 2020. [Google Scholar]

- Ruggiero, T.E. Uses and gratifications theory in the digital age: A review and future directions. Mass Commun. Soc. 2020, 23, 855–872. [Google Scholar]

- Sulaiman, O.; Ojochenemi, S.Y.; Sadiq, H. Effect of digital advertising on consumer buying behaviour in Lokoja Metropolis. KIU Interdiscip. J. Humanit. Soc. Sci. 2021, 2, 326–344. [Google Scholar] [CrossRef]

- Segev, S.; Wang, W.; Fernandes, J. The effects of ad-context congruency on responses to advertising in blogs: Exploring the role of issue involvement. Int. J. Advert. 2014, 33, 17–36. [Google Scholar] [CrossRef]

- Pasqualotti, L.; Baccino, T. Online advertisement: How are visual strategies affected by the distance and the animation of banners? Front. Psychol. 2014, 5, 211. [Google Scholar] [CrossRef]

- Sokolik, K.; Magee, R.G.; Ivory, J.D. Red-Hot and Ice-Cold Web Ads: The Influence of Web Ads’ Warm and Cool Colors on Click-Through Rates. J. Interact. Advert. 2014, 14, 31–37. [Google Scholar] [CrossRef]

- Wang, Z.; Lang, A. Effects of animation and motion in digital advertising on user attention and cognitive processing. J. Interact. Mark. 2022, 58, 45–58. [Google Scholar] [CrossRef]

- Jeshurun, S.B. A study on the effectiveness of email marketing. Shanlax Int. J. Manag. 2018, 6, 84–86. [Google Scholar]

- Reimers, V.; Chao, C.-W.; Gorman, S. Permission email marketing and its influence on online shopping. Asia Pac. J. Mark. Logist. 2016, 28, 308–322. [Google Scholar] [CrossRef]

- Lee, X.X.; Vo, X.X. Title of the article. Title of the Journal 2017, pages. [Google Scholar]

- Shahzad, K.; Khan, S.; Ahmed, M. Impact of mobile advertising on consumers’ attitude. Ilkogr. Online 2021, 20, 860–868. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).