3.1. Pendle Architecture: Dividing a Yielding Asset into PT and YT

Modern decentralized finance of a derivative instrument (DeFi) is an existing financial cryptocurrency system that offers a large number of tools for making a profit: staking, farming, lending, liquidity pool. However, there is a fundamental problem: the inability to directly trade future income. Traditionally, a user who places an asset in a staking or lending desk can only wait for profit or withdraw the asset early, losing future returns. This reduces capital efficiency, restricts access to liquidity, and makes it impossible to form a secondary market for income. The solution to this problem was offered by the Pendle protocol, which allows tokenizing the yield, i.e. turning it into a separate trading asset that can be sold, bought, transferred, or used in DeFi operations.

The first step of the protocol is to wrap the original yielding asset (e.g., stETH) in a special standardized token SY (Standardized Yield Token). The SY acts as a “wrapper” representing the full value of the asset along with the future yield. In the protocol, all assets are processed through SY, which allows for standardized interaction regardless of the source of income.

Further, SY is automatically divided into two components:

PT (Principal Token) - a token that represents the “body” of the asset, i.e. the amount that will be returned after the maturity date (expiry). PT does not generate income, but only guarantees the return of the asset.

YT (Yield Token) is a token that contains all future profits accrued until the expiry date. It is YT that allows you to make money on growing yields.

What is the relationship between

. The simplest understanding of function

is sum of

and

, but authors propose to reduce the Pendle model to a system of differential equations for formalization. This approach allows us to describe the dynamics of the cost of PT and YT tokens as functions of

time, which change under the influence of the yield rate and time discontation. The following system of differential equations is used purely as a conceptual token-engineering formalization of SY/PT/YT flows over time. It is not calibrated to empirical electricity price dynamics, and developing such stochastic models lies outside the scope of this paper. This is important because the interdependence of the components

SY, PT, YT can be considered as a constrained problem in the form of a balance equation:

The original SY asset grows by accumulating yield with an instant rate of . Instant yield rate — the rate of increase in the value of the SY income asset over time, which acts as an analogue of Annual Percentage Rate (APR).

The PT — token is the discounted value of the asset that approaches SY at maturity, with an effective discount rate of . The effective discount rate of is the rate of convergence of the value of PT to SY when approaching the maturity date.

The YT token reflects the difference between the current SY and PT value, and therefore decreases to zero over time.

with initial conditions

and marginal conditions at maturity

The producer-seller (user) can choose how to dispose of these tokens:

If a user sells YT, he or she actually gives up income but receives SY for it. This is equivalent to fixing the profit “here and now”.

If the user sells PT, he gives up the principal amount of the asset, but retains the right to all the income (YT) and receives liquidity in the form of a SY token that can be exchanged for ETH or another asset.

If he holds both PT and YT, he keeps the entire SY - a full yielding asset that can be “deployed” into the original asset (for example, stETH) after expiration.

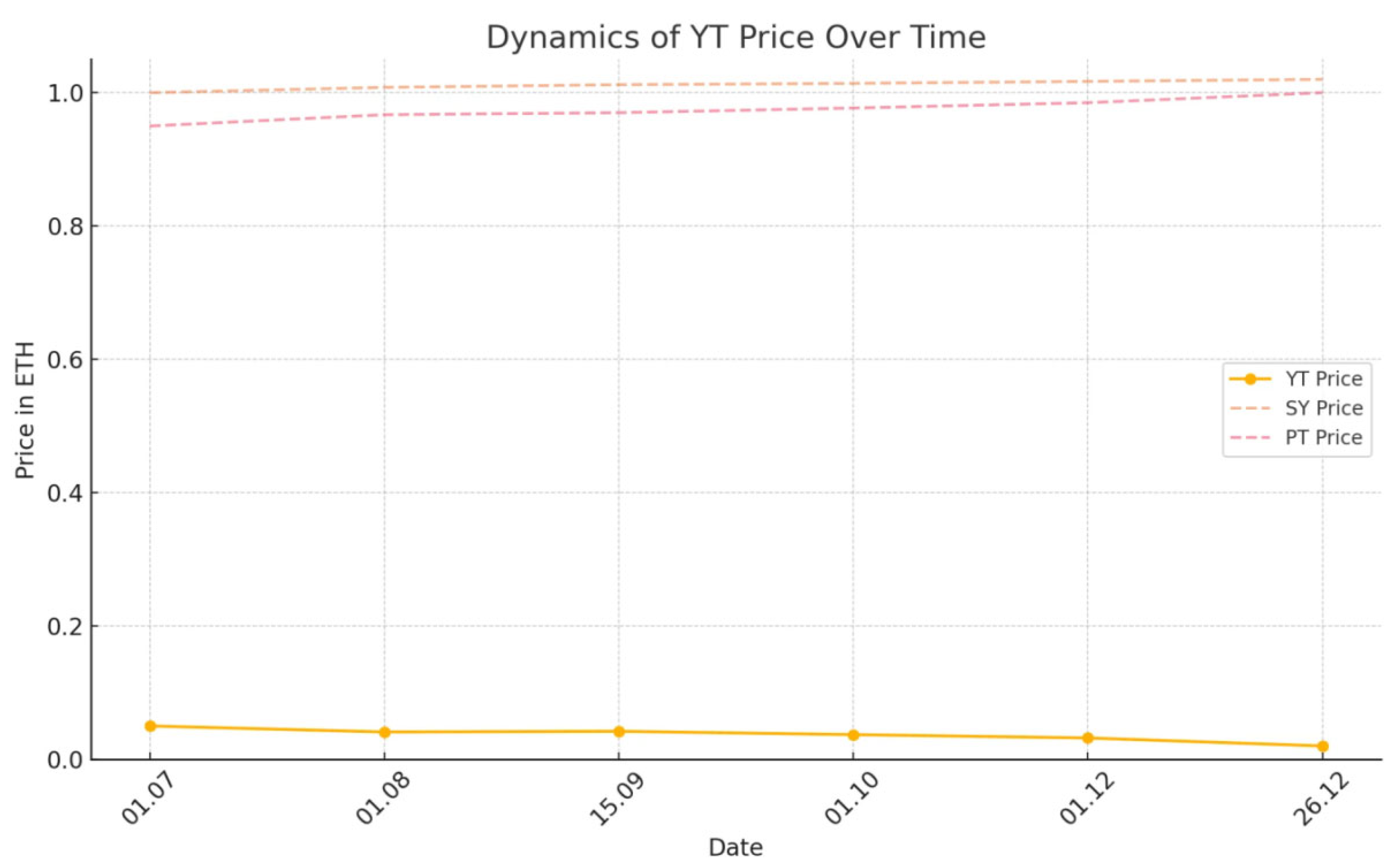

All trading between these tokens is realized through the SY/PT financial market, where the price of PT changes according to the time to expiry. The closer to the end of the electricity supply period, the more expensive PT becomes. Since , changes in the price of PT automatically affect the price of YT

Figure 1 shows how the value of the revenue token YT decreases over time: at the beginning of the period, SY = 1.00 ETH, PT = 0.95 ETH, so YT = 0.05 ETH. As the income accumulates, SY grows, but PT rises in price faster due to the decrease in the discount, so the difference (the price of YT) gradually disappears. Before expiry, YT is almost worthless and at maturity is equal to zero.

The Pendle protocol proved that the separation of the underlying asset (PT) and the future income (YT) creates a yield market. The principle is simple: if an asset generates income, it can be separated and tokenized. In ETH staking, Pendle allows you to choose whether to keep the principal or the income. This approach can be adapted to the electricity market, where the producer generates future cash flows. We propose to formalize supply obligations in the form of PT and YT tokens, which are adapted to the commodity nature of energy. This PT/YT mapping is architectural rather than a calibrated pricing model; it structures programmable short-term delivery rights and revenue claims without treating electricity as a conventional yield-bearing financial asset. In the revised model, we propose:

PT (Principal Token) - a token representing the right to receive a certain amount of electricity in a given time interval (for example, 1 PT = 1 kWh from 16:00 to 17:00), possibly linked to an EAC (Energy Attribute Certificate);

YT (Yield Token) - a token representing the producer-seller’s income from the sale of PTs, i.e. the future profit that will be received upon the fact of energy consumption.

When a producer tokenizes a future energy supply, it issues a pair of PT and YT:

PT is an obligation to the consumer-buyer, which is realized in the form of future electricity supply and the right for the consumer to receive electricity (kWh).

YT is the obligation to the producer-seller to receive the corresponding monetary revenue (UAH) generated from delivering that same amount of electricity in the specified time slot.

The producer can retain YT (ensuring future profits) either by selling it at a discount, attracting liquidity in advance, or by selling it to other market participants.

This creates the preconditions for a secondary market for energy performance obligations, where:

consumers can freely transfer or sell their PTs, which allows for flexible planning and load balancing;

investors invest in YT to receive a predictable income from the transaction;

producers get new tools for liquidity and risk management;

the system as a whole becomes open, transparent, and programmable.

Thus, energy contracts turn into liquid tokenized assets, where each kilowatt of electricity becomes part of a decentralized commodity and financial market.

3.2. Decentralization of the Purchase and Sale of Electricity

In classical centralized or decentralized exchanges, trading is carried out through a bilateral order book (Bid/Ask), where each order contains only the price and volume. This approach is effective for fungible assets such as tokens, stocks, currencies, but is limited for electricity, as it is physical in nature, consumed in real time, and not fungible between different time intervals. The energy available from 14:00 to 15:00 is not equivalent to the energy available from 20:00 to 21:00, and its price is constantly changing under the influence of supply, demand, peak loads, and local conditions. In the classic order book model, there is no possibility to specify a time slot, which leads to inaccurate matching of orders, reduced trading efficiency, and makes it impossible to create a full-fledged market for short-term electricity supply contracts.

To solve this problem, a modified model of the exchange cup is needed, where each order fixes not only the volume and price, but also a specific time interval for delivery. This will ensure an accurate match between suppliers and consumers, balance supply and demand in real time, and create a flexible pricing mechanism. In a decentralized architecture, this logic is implemented at the level of smart contracts that automatically process orders based on time, volume, and price, eliminating the limitations of traditional exchange models and creating the basis for a scalable, transparent, and efficient electricity market.

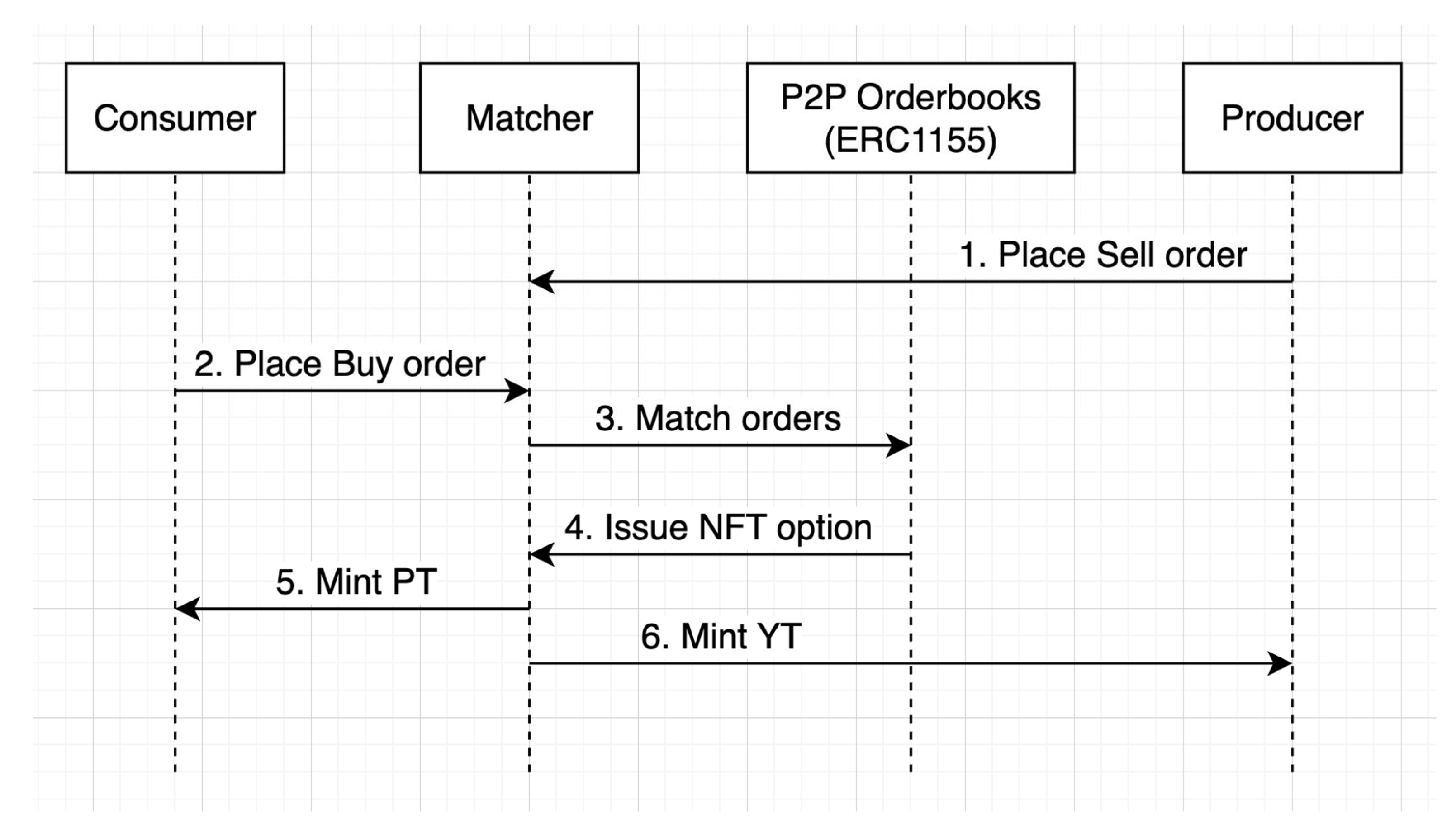

In the extended architecture of the tokenized energy market, the main element is a glass of orders in the form of tokens, implemented through two separate smart contracts of the ERC1155 standard [

9]:

Each order for purchase or sale in this system is represented as a unique ERC1155 token, the tokenId of which encodes the parameters of a particular trading position, including the time slot of delivery (for example, 13:00-14:00) and the desired price per 1 kWh.

tokenId = (uint256(timestamp) << 128) | uint128(price)

timestamp - the unix timestamp of the start of delivery. For example, Tue, 22 Jul 2025 19:00:00 will be encoded in 1753210800, which means delivery from 19:00 to 20:00

price - the desired price in kopecks (for example, 102 for 1.02 UAH/kWh).

<< - bit shift to the left

| - logical OR

uint256()/uint128() - conversion of variable types.

The number of ERC1155 tokens on a participant’s balance sheet under a certain tokenId reflects the amount of energy that the participant is willing to buy or sell under specific contract conditions - for example, 1 kWh in a certain time slot at a fixed price. Thus, each token in the system represents a specific trading position. The key element of the system is the Matcher contract (or Gateway), a coordinating smart contract that has the authority to change the state of both ERC1155 glasses and is responsible for all clearing and transaction logic. The Matcher scans the available tokens in both cups, identifies the orders that match the parameters (price and time), and automatically performs the match. In case of a successful match, the Matcher burns the order tokens, records the transaction, deposits funds, and issues an NFT option along with a pair of financial tokens - PT (right to consume) and YT (right to producer income). Here’s an example of an extended glass:

Bid Book (energy sale):

(13:00-14:00, 1.05 UAH) - Producer1: 40, Producer2: 24, Producer3: 50

(13:00-14:00, 1.04 UAH) - Producer1: 50, Manufacturer2: 55

(13:00-14:00, 1.03 UAH) - Producer1: 40, Manufacturer2: 20

(12:00-13:00, 1.05 UAH) - Producer1: 40, Manufacturer2: 24, Manufacturer3: 50

(12:00-13:00, 1.04 UAH) - Producer1: 50, Manufacturer2: 55

(12:00-13:00, 1.03 UAH) - Producer1: 40, Producer2: 20

Ask Book (energy purchase):

(13:00-14:00, 1.02 UAH) - Consumer1: 20

(13:00-14:00, 1.01 UAH) - Consumer1: 20, Consumer2: 70

(13:00-14:00, 1.00 UAH) - Consumer1: 20, Consumer2: 70

(12:00-13:00, 1.02 UAH) - Consumer1: 20

(12:00-13:00, 1.01 UAH) - Consumer1: 20, Consumer2: 70

(12:00-13:00, 1.00 UAH) - Consumer1: 20, Consumer2: 70

Market analysis:

Example of a transaction:

Producer1 wants to sell 15 kWh of energy in the 12:00-13:00 slot at a price of 1.02 UAH/kWh.

The Matcher sees that there is a matching request from Consumer1 for 20 kWh at this price in Ask Book. The matcher contract conducts a match:

-

An NFT option is created in which the:

- ◯

Producer: Producer1

- ◯

Buyer: Consumer1

- ◯

Time: 12:00-13:00

- ◯

Volume: 15 kWh

- ◯

Price: 1.02 UAH/kWh

Consumer1’s bid in the Ask Book is reduced from 20 to 5 kWh.

-

Matcher issues:

Consumer1 transfers 15.3 UAH to the contract YT - this is the payment for energy.

3.3. Examples of the Creation and Implementation of PT, YT, and IndexYT

The PT token (Principal Token) is a digital representation of the consumer’s right to receive a certain amount of energy in a specific time slot. Each PT token is an ERC20-compliant asset representing the consumer’s right to receive a certain amount of electricity in a specific time slot. Technically, the PT does not contain all the data about the interval, price, or supplier, but refers to the corresponding NFT option, which contains the full terms of delivery:

The consumer’s balance in PT tokens directly indicates how many kilowatt-hours of energy the consumer is entitled to consume in accordance with the associated NFT option. Thus, PT is an easily tradable legal instrument that delegates the entire logic of a contractual obligation to the option level.

For example, if balanceOf(<consumer address>) returns a value of 20, it means that the consumer is entitled to receive 20 kWh of energy in the time slot specified in the PT contract.

Owning a PT gives the user the right to receive the corresponding amount of electricity from a specific supplier, which is fixed in the NFT option and in the specified time slot. The fact of fulfillment of the obligation is confirmed by the distribution system operator.

Since PT is a transferable asset, it can be freely used for further circulation. In particular, the token holder can sell it directly to another person on the over-the-counter (OTC) market or place it in the Ask exchange cup as an offer for sale, indicating the desired price per kilowatt-hour and the corresponding delivery time slot. This opens up the possibility for speculative or investment use of PT. Even if the user does not plan to consume electricity personally, they can sell their PT tokens on the secondary market.

In addition to the basic function of representing the right to consume electricity, PT is a programmable token that allows for flexible configuration of its behavior in accordance with the policies of the power system. In particular, PT can be used to set restrictions on transmission (rebalancing) or sales, which are activated depending on the state of the grid or the distribution system operator’s policy.

These restrictions are implemented through the oracle, a trusted data source that provides the smart contract with up-to-date information on the technical state of the grid (e.g., energy shortage or surplus, critical load in the region, etc.) or other policy parameters. Based on this data, the PT token can automatically prohibit or authorize such actions:

transfer of the token to another consumer (i.e., load rebalancing between locations)

sale of PT on the secondary market;

dividing the token into small parts (if necessary, to limit microtrading).

Thus, PT is not only a legal but also a technically controlled element in the energy infrastructure. It ensures compliance with regulations and balance in the grid without centralized manual intervention, using automated rules and adaptive logic for access to consumption rights.

PT token life cycle.

1. Creation (Mint)

A PT is created after successful matching of an application in the decentralized electricity market, when a consumer agrees to purchase energy in a certain slot.

-

At the time of the transaction, the Matcher:

- ◯

Issues an NFT option, which fixes the seller’s obligations;

- ◯

issues a PT to the consumer in the amount corresponding to the ordered amount of kWh.

2. Ownership

After creation, the PT token becomes the property of the consumer and is stored in his wallet. The PT is a digital representation of the right to receive a certain amount of electricity in a specific time slot, which must be delivered by the supplier specified in the NFT option.

The user can flexibly manage his right to receive electricity: store it until delivery, transfer it or rebalance it among other consumers depending on the need and policies of the electricity distribution operator, and sell it on the secondary market, fixing the value at the current price.

3. [Utilization.

When the time slot specified in the PT arrives (startTime ≤ now < endTime), the token becomes active and enters the use phase. This does not necessarily mean physical consumption of electricity in real time.

The PT is not a direct mechanism for physical delivery, but rather a tool for accounting for the capacity of energy obligations to be fulfilled by the producer specified in the option. After the end of the slot (now ≥ endTime), the distribution system or an external operator verifies the fact of delivery (or lack thereof).

Electricity Yield Token

The Yield Token (YT) is an ERC-20 token that reflects the producer’s right to receive payment for the electricity supplied. It is generated simultaneously with the creation of the PT when the Matcher contract compares the Bid and Ask, it issues the consumer PT (the right to receive electricity) and the producer an equivalent amount of YT, which preserves the liquidity paid by the buyer.

YT is created so that the producer has flexibility in choosing a financial strategy. He can either wait until the delivery and receive full payment or redeem YT at a discount to get instant liquidity.

Buyback at a discount

The original Pendle model created the YT token for assets that gradually accumulate income in real time, such as rebase tokens like stETH, whose balance automatically increases in users’ wallets. In Pendle’s model, YT serves as a dynamic representation of a variable yield that grows every second, depending on how much income is still left to be earned.

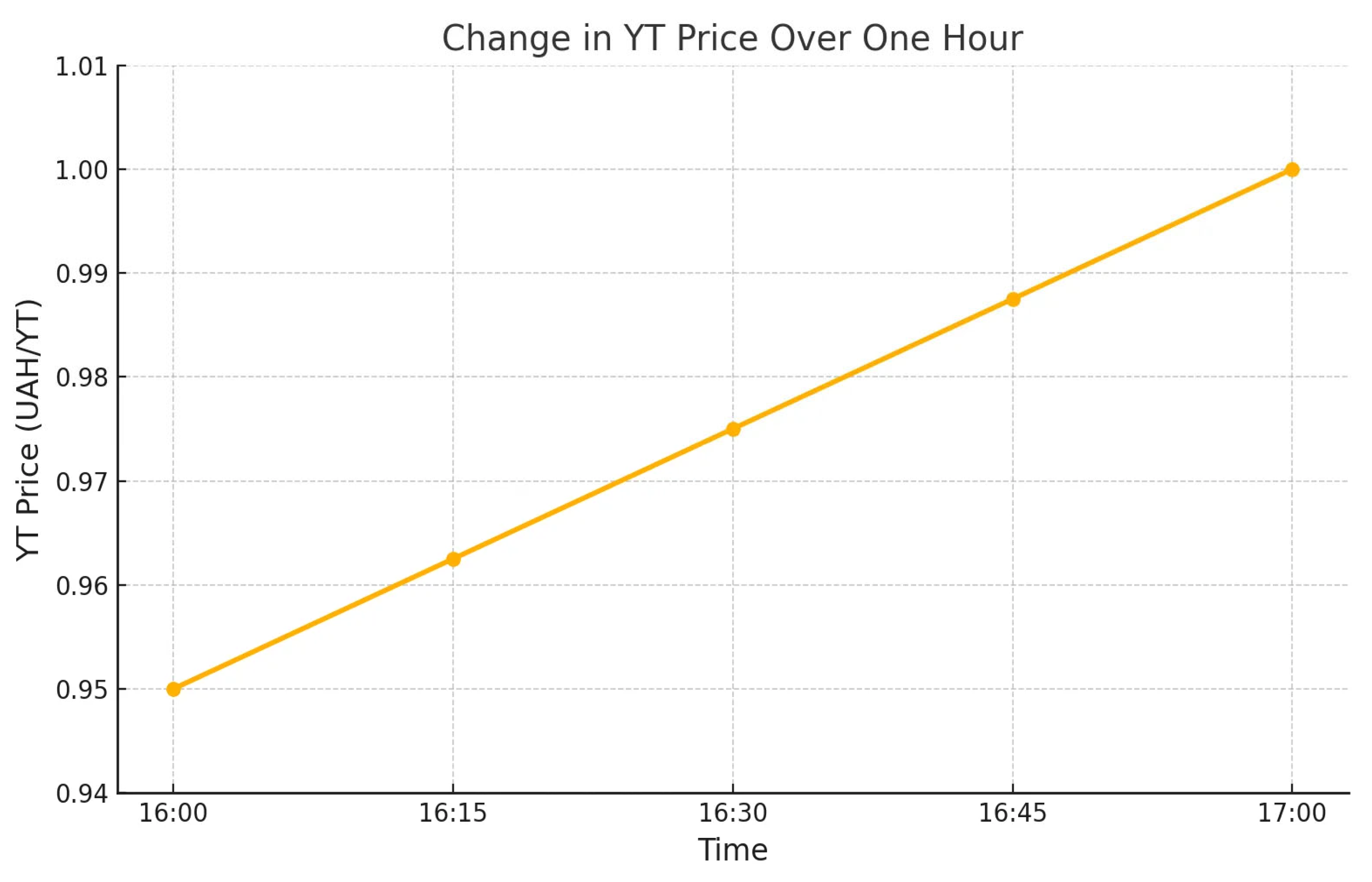

A simplified alternative is offered - the discount redeem mechanism, which sets a time-varying redemption price for YT. The price of YT increases linearly from a certain initial value (for example, 95% of the face value) to the full 100% of the value at the end of the slot. This approach maintains a simple logic for producers, allows them to capture a discounted profit immediately after the transaction, and does not require a complex curve or constant revaluation of tokens as in the Pendle protocol.

The price depends on the discount

and the time frame from the beginning of the slot

and the end of the slot

Thus, at the start of the slot, YT is allowed to be exchanged for liquidity at a discount of

(e.g.,

α = 0.95), since

, and as the period approaches the end (

), the discount disappears and the price approaches the face value (

Figure 2), i.e.,

Example 1: One producer holding YT until the end of the period

The producer sells 100 kWh for the slot 16:00-17:00 for 1.20 UAH/kWh and receives 120 YT = 100 kWh *** 1.2 UAH /** kWh and holds it until the end of the slot, expecting full payment.

Input data:

Slot start: t₀ = 16:00

End of the slot: tₑ = 17:00

Early discount: α = 0.95, which means a 5% discount

Initial liquidity: x = 120 UAH

Quantity of YT: y = 120 YT

The price of YT changes over time in the slot from 16:00 to 17:00. This is shown on the graph.

The producer did not sell 120 YT during the entire slot, holding them until 17:00, when the discount disappeared and each token became worth 1.20 UAH. As a result, he redeemed all the tokens and received UAH 120 from the funds reserved in the contract, fulfilling the obligation to supply 100 kWh in the 16:00-17:00 slot. There was no trading on the secondary market, so the discount remained only theoretical and did not affect the producer’s final income. This is an example of direct supply, when the producer receives full payment without intermediate transactions.

Example 2: A producer sells YT, but some tokens are not redeemed by the end of the period

| Time |

Participant |

Action |

Number of YT |

Price(UAH/YT)

|

Amount (UAH) |

Comment |

| 16:00 |

The product |

Buys UAH from YT |

120 |

0.95 |

+114.00 |

Received UAH immediately |

| 16:00 |

Trader1 |

Buys YT |

40 |

0.95 |

-38.00 |

The price is fixed |

| 16:15 |

Trader2 |

Buys YT |

60 |

0.9625 |

-57.75 |

According to |

| 17:00 |

Trader1 |

Buys UAH from YT |

40 |

1.00 |

+40.00 |

Profit +2 UAH |

| 17:00 |

Trader2 |

Buys UAH from YT |

60 |

1.00 |

+60.00 |

Profit +2.25 UAH |

| 17:00 |

- |

Excess funds |

- |

- |

1.75 UAH |

The balance was formed |

IndexYT

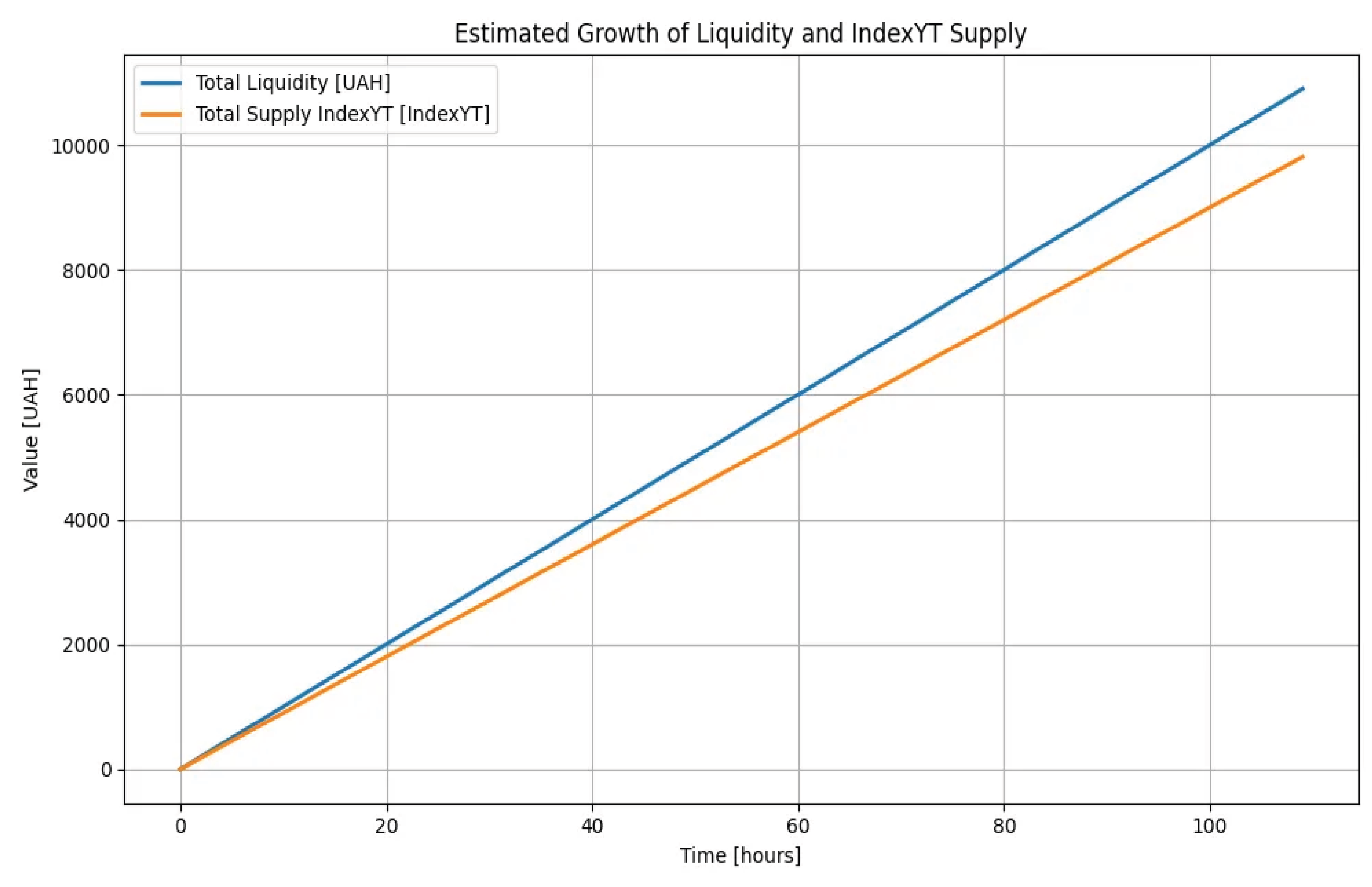

The Yield Token (YT) is a token that gives the electricity producer the right to receive payment for the delivery in a certain time slot. Its main feature is a limited lifecycle and low liquidity until maturity, when it can be converted into full value. This limits the use of YT in DeFi. To solve this problem, we propose the IndexYT token, which accumulates YT from different slots in a single pool. The user transfers YT to the IndexYT contract, where they are stored until the end of the period. After maturity, the IndexYT contract buys back liquidity and forms a reserve that ensures all IndexYT tokens in circulation. At the beginning of the period, YT is traded at a discount

, as the revenue has not yet been realized. This gives the producer the opportunity to immediately sell YT at a discount and receive liquidity. The IndexYT issuance formula is proposed:

The IndexYT token issuance formula is a balanced compromise between the electricity producer and the financial system.

On the one hand, the producer receives better terms than if he immediately redeemed YT at a discount - instead of , he receives a secured and liquid token whose value is YT * (1 − ), which is usually more profitable. This incentivizes the producer to transfer YT to IndexYT and thereby receive a liquid asset before the actual delivery of energy. On the other hand, the system ensures that YT is redeemed in full at face value after the delivery period is over. Until then, YT tokens are stored in the IndexYT contract, which gradually accumulates liquidity. When the period ends, the contract redeems the liquidity from YT at 100% of its value, and the proceeds replenish the IndexYT reserve. This allows the IndexYT token issuance to remain balanced and the token itself to have liquid coverage.

Thanks to the issuance formula, where each IndexYT token is issued at a discount , the total supply of IndexYT grows slower than the amount of liquidity entering the contract. This means that for every unit of liquidity, less than one unit of token is issued, which creates an excess of value in the system. Over time, this ensures the growth of the internal price of one IndexYT token and turns it into an investment asset that accumulates the profitability of many YTs and becomes an attractive investment tool.

When withdrawing liquidity or exiting the investment, the owner burns N IndexYT tokens and receives a share of the total pool:

This mechanism guarantees a transparent and fair distribution of liquidity (

Figure 3), and IndexYT becomes a liquid, diversified, and attractive derivative instrument for investors.

Figure 3.

Graphical representation of the YT price for the period from 16:00 to 17:00.

Figure 3.

Graphical representation of the YT price for the period from 16:00 to 17:00.

Figure 4.

Graphical display of liquidity (UAH) and the total amount of IndexYT.

Figure 4.

Graphical display of liquidity (UAH) and the total amount of IndexYT.