1. INTRODUCTION

The financial health of enterprises is directly related to the stability of the macroeconomy and the sustainable development of microeconomic entities. Its volatility and complexity make risk identification and early warning a crucial issue in modern finance and management research[

1]. With the acceleration of economic globalization and industrial restructuring, enterprises face increasingly dynamic environments in areas such as capital flow, debt structure, and operational efficiency. Traditional static financial analysis methods can no longer fully reflect their actual operating conditions. Under the influence of macroeconomic cycles, industrial chain restructuring, and policy fluctuations, corporate financial health risks exhibit significant nonlinear and time-varying characteristics. This presents higher demands for risk monitoring, managerial decision-making, and policy formulation. Accurately capturing the dynamic evolution of financial states under uncertainty has therefore become a core scientific problem in the digital transformation of financial intelligence and corporate governance[

2].

In recent years, data-driven risk modeling methods have gained wide attention in corporate financial analysis. With the rapid development of big data, artificial intelligence, and time-series modeling technologies, researchers have begun to employ machine learning and deep learning methods to extract latent patterns from high-dimensional financial indicators, operational behaviors, and external environmental variables to achieve automated risk identification and prediction. However, the complexity of corporate financial systems lies not only in the interdependence of multidimensional indicators but also in the uncertainty, randomness, and abrupt changes in their dynamic evolution. Traditional models based on static features or single time scales often fail to cope with indicator volatility, structural shifts, and exogenous shocks that cause distributional drift, leading to biased risk forecasts. Particularly under extreme conditions such as financial crises, market shocks, or policy adjustments, model stability and generalization capability become major constraints on intelligent financial health evaluation[

3].

Against this backdrop, it is crucial to construct a dynamic risk modeling framework that can adapt to uncertain environments and capture temporal evolution features. Unlike static analysis, dynamic modeling must consider trends and cyclical changes over time while accounting for heterogeneity and hidden correlations among enterprises[

4]. Financial health risks are rarely isolated events but are systemic results affected by supply chain linkages, industry fluctuations, and macroeconomic conditions. Therefore, single-indicator or single-enterprise analyses cannot reveal the intrinsic mechanism of risk propagation. By introducing dynamic graph theory, it is possible to model the evolving relationships among multiple enterprises, indicators, and time dimensions, thus describing risk transmission paths and systemic fluctuations more precisely. Such approaches provide a finer-grained understanding of group-level financial monitoring and macroeconomic regulation[

5].

However, the application of dynamic graph modeling in corporate finance continues to encounter several challenges. On one hand, financial data are often noisy, incomplete, and heterogeneous, which makes the construction of dynamic networks highly susceptible to abnormal fluctuations. On the other hand, risk signals frequently exhibit lag effects and temporal non-stationarity, complicating the task of early warning. Moreover, uncertainty arises not only from inherent data randomness but also from model structures, parameter estimation, and external economic dynamics [

6]. Enhancing and optimizing dynamic graph structures under such uncertainty—while maintaining an appropriate balance between model sensitivity and robustness—remains a critical challenge. Effectively addressing this issue would significantly improve the reliability and predictive capability of financial health assessments and offer valuable theoretical support for the intelligent modeling of dynamic complex systems.

In summary, research on uncertainty-aware dynamic graph enhancement for corporate financial health risk holds significant theoretical and practical value. Theoretically, it contributes to the advancement of dynamic modeling frameworks for financial risk analysis and promotes the integration of graph structure learning and temporal modeling in intelligent finance. Methodologically, it offers new technical solutions to nonlinear, multi-scale, and uncertainty modeling challenges, enabling adaptive risk identification and evolution characterization in complex economic environments. Practically, it supports multi-level applications such as internal risk management, external credit evaluation, and macroeconomic regulation[

7]. It provides scientific decision-making tools for governments, financial institutions, and investors, promoting digital corporate governance and intelligent financial supervision. By constructing a dynamic graph enhancement framework with uncertainty awareness, this research aims to achieve continuous monitoring, accurate identification, and timely warning of corporate financial health, thereby improving the resilience and sustainability of the overall economic system in volatile and high-risk contexts.

2. RELATED WORK

Dynamic financial risk modeling has evolved rapidly in recent years, with deep reinforcement learning techniques offering new tools for adaptive decision-making. For instance, deep Q-learning frameworks have been applied to model workflow dynamics, enabling intelligent and responsive control in the face of fluctuating and uncertain financial environments [

8]. This move toward dynamic modeling sets the stage for more interpretable representations of financial behavior. Building on the dynamic perspective, recent research has focused on transforming multidimensional time series into interpretable event sequences. Such approaches improve the transparency of data mining and facilitate the analysis of complex risk trajectories, making it possible to more clearly identify the progression and transmission of financial health risks over time [

9]. To further support these advances, deep learning and neural architecture search have been synergistically combined to automatically discover optimal model structures, providing a flexible foundation for capturing high-dimensional financial dependencies [

10].

The need to understand relationships among multiple firms and economic entities has driven the application of graph-based discovery methods. Heterogeneous network learning, in particular, has proven effective for uncovering implicit inter-corporate connections, which are essential for systemic risk propagation analysis and comprehensive financial health assessment [

11]. The capacity to represent such multi-type linkages paves the way for richer and more robust risk modeling frameworks. Complementing this, deep attention models have emerged as powerful tools for systemic risk forecasting. By adaptively weighting temporal dependencies in financial time series, attention mechanisms help models focus on relevant patterns amid volatility and structural shifts [

12]. Relatedly, attention-augmented recurrent networks provide additional flexibility in capturing both short- and long-term trends in financial data, which is crucial for accurate forecasting in dynamic markets [

13].

To ensure logical coherence and reliable outputs, structured path guidance techniques have been explored. These approaches promote consistency in generated event sequences and risk predictions, strengthening the interpretability and reliability of automated decision support systems [

14]. In parallel, multi-modal and cross-domain learning methods have been successfully adapted to the financial context, where joint modeling of structured representations and context compression enhances robustness to noise and increases model generalizability [

15]. The increasing complexity of modern financial systems has also motivated the adoption of structural generalization strategies, such as graph neural networks for microservice routing, which share structural challenges with dynamic financial networks. These methods enable models to dynamically adapt to changing risk propagation pathways [

16]. To further improve adaptability, dynamic structured gating and parameter-efficient model alignment techniques have been used to mitigate the bias introduced by noisy or perturbed data—a common challenge in volatile financial environments [

17].

Robustness to data heterogeneity and external shocks is further enhanced by federated distillation with structural perturbation, which enables privacy-preserving, cross-institutional model fine-tuning [

18]. Meanwhile, integrating causal inference with graph attention allows for structure-aware data mining that addresses uncertainty, hidden dependencies, and non-stationarity in complex economic systems [

19]. Within the context of enterprise-level risk, graph neural network frameworks have been specifically designed for default risk identification, providing fine-grained modeling of credit relationships among firms—a critical aspect for both systemic analysis and regulatory oversight [

20]. The need for real-time risk identification and adaptive monitoring has inspired the development of automatic elastic scaling techniques, applying reinforcement learning to optimize resource management in distributed systems [

21].

Function-driven neural modeling and domain knowledge enhancement have further improved the ability of intelligent systems to capture scenario-specific features and structural risk signals, supporting more accurate and context-aware financial risk identification [

22]. Dynamic prompt fusion and federated fine-tuning are also gaining traction as key techniques for cross-domain semantic and structural alignment, which is increasingly important for handling heterogeneous and distributed financial datasets [

23,

24]. With the growing scale of data and complexity of applications, efficient fine-tuning strategies for large models—such as joint structural pruning and parameter sharing—have become vital for deploying robust models in real-world, resource-constrained financial settings [

25]. Finally, causal-aware time series regression methods, leveraging structured attention with recurrent models, provide new insights into causal relationships and temporal dynamics underlying both micro- and macro-level financial risks [

26].

3. METHOD

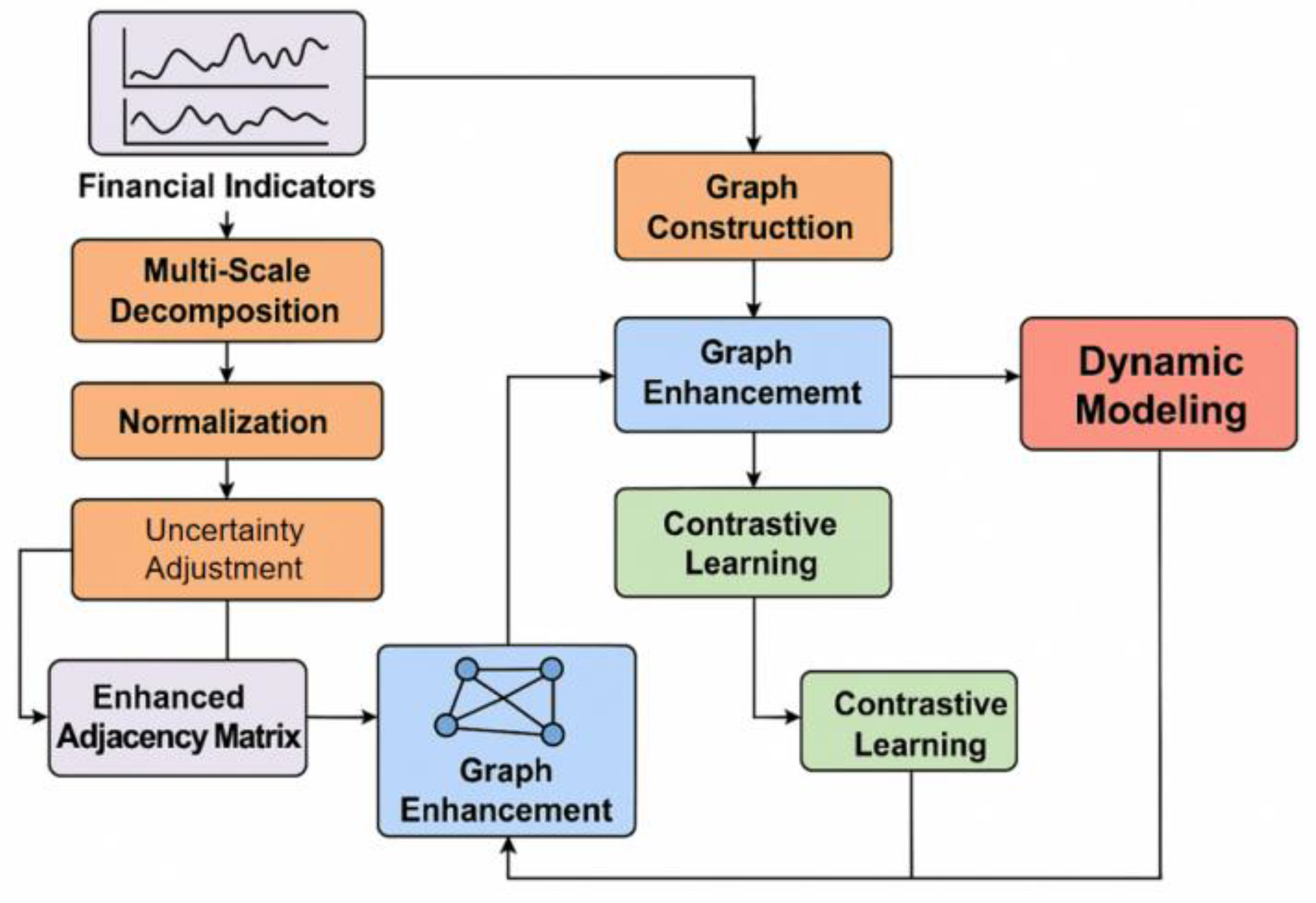

This study aims to construct an enhanced dynamic graph modeling framework that can dynamically capture the evolving characteristics of corporate financial health risk under uncertainty. Starting from multi-source financial indicators, the overall approach first normalizes and decomposes time series features at multiple scales to remove trend terms and noise components. The model architecture is shown in

Figure 1.

Assuming the original financial indicator sequence is

, we can obtain the multi-scale subsequence set

through empirical mode decomposition (EMD), and define the reconstructed signal as:

Where A is a weight that decays exponentially with scale, emphasizing the balance between low-frequency long-term trends and high-frequency local fluctuations. This step ensures the separability of input features in both time and frequency dimensions, providing a stable representation for subsequent dynamic graph construction.

In the graph modeling stage, the financial connections between enterprises are constructed into a dynamic adjacency matrix through a time-varying similarity function. For any time t, the edge weight between nodes i and j is defined as:

Where

controls the similarity decay rate. To deal with noise and local anomalies in the data, an uncertainty correction term is further introduced, and the enhanced adjacency matrix is obtained through the Bayesian expectation form:

In practice, the uncertainty covariance matrix Σ can be estimated through Monte Carlo sampling of model outputs or using Bayesian dropout during training. This allows the model to capture both epistemic and aleatoric uncertainty arising from noisy financial inputs and limited observation samples. By integrating the expected covariance into the adjacency adjustment, the model adaptively suppresses abnormal fluctuations in inter-firm relations while retaining meaningful correlations for risk transmission analysis.

Where is the balance coefficient, and is the uncertainty covariance matrix. This mechanism enables the graph structure to remain robust under fluctuating conditions and automatically correct edge weight shifts caused by external shocks.

In the dynamic learning phase, this paper introduces a temporal graph convolution network (T-GCN) to encode the state of enterprise nodes in time series. The node state update can be formalized as:

Where represents the hidden state of layer l at time t, and are the graph convolution and time propagation weights, respectively, and is the nonlinear activation function. This structure maintains spatially dependent propagation while capturing the dynamic changes in a company's financial status through a time-gating mechanism, enabling joint modeling of spatiotemporal correlations.

Finally, to enhance the separability and stability of risk states in uncertain environments, this paper proposes a contrastive learning mechanism based on graph enhancement. For each node state vector

, a perturbation view

is randomly generated, and its distribution distance in the latent space is minimized. The objective function is defined as:

Where represents cosine similarity and is the temperature coefficient. This loss constrains risk representation at the semantic level, ensuring model consistency in the face of structural perturbations and parameter uncertainty. Overall, this approach, through the synergistic integration of multi-scale signal decomposition, dynamic graph enhancement, temporal graph convolution, and uncertainty contrastive learning, achieves dynamic modeling and robust feature extraction of corporate financial health risks, providing a new theoretical and algorithmic foundation for risk perception in complex financial systems.

4. Performance Evaluation

A. Dataset

This study employs the Financial Statement Analysis Dataset (FSA-D) as the experimental dataset to validate the dynamic and uncertain characteristics of corporate financial health risk modeling. The dataset consists of financial statements from publicly listed companies across multiple industries, including balance sheets, income statements, cash flow statements, and several non-financial operational indicators. The data cover the period from 2013 to 2023. All records are standardized and aligned to a quarterly frequency, enabling the observation of financial behavior changes over economic cycles. FSA-D is representative at both macro and micro levels and supports modeling research on long-term corporate financial evolution and risk accumulation effects.

The dataset contains approximately 2,000 companies and more than 800,000 quarterly records. Each sample includes 45 fundamental financial indicators covering solvency, profitability, operational efficiency, cash flow stability, and leverage levels. To meet the needs of dynamic graph modeling, the data are further transformed into temporal feature matrices, and inter-firm relational networks are constructed to represent industry linkages. Each node corresponds to an individual enterprise, while edge weights are calculated based on financial feature similarity. This process forms a time-evolving dynamic graph sequence that provides a structural foundation for multi-scale relational learning and risk propagation analysis.

To improve data usability and stability, all original indicators are processed through outlier truncation, min-max normalization, and temporal smoothing before model input. In addition, missing values are handled using multivariate interpolation and structural consistency restoration to ensure temporal continuity and graph completeness. The dataset can be applied not only to corporate health prediction and risk early warning tasks but also to credit evaluation, default probability modeling, and systemic risk analysis within industries. It provides reliable support for studying uncertainty mechanisms in dynamic financial networks.

B. Experimental Results

This paper first conducts a comparative experiment, and the experimental results are shown in

Table 1.

As shown in

Table 1, the performance of different models in predicting corporate financial health risks varies considerably. Traditional time-series models, such as LSTM and BiLSTM, demonstrate certain strengths in capturing the temporal evolution of financial indicators and effectively reflect the dynamic nature of business operations. However, due to the absence of explicit modeling of inter-firm structural relationships and cross-temporal dependencies, their predictive accuracy remains constrained in complex risk fluctuation scenarios. This suggests that relying solely on temporal features is inadequate for uncovering the latent structural correlations and risk propagation pathways inherent in corporate financial systems.

Graph neural network-based models, including GNN and GAT, show higher accuracy and stability in the experiments, indicating that incorporating inter-enterprise graph structure information is effective for risk modeling. These methods can capture potential correlations among firms through adjacency relationships, thereby mitigating the over-reliance of traditional sequence models on individual time series. Nevertheless, GNN and GAT models still follow a static graph learning paradigm. They do not account for changes in edge weights and node states over time. As a result, their robustness and generalization ability remain limited when facing macroeconomic disturbances or industry linkage effects.

In comparison, the 1DCNN model, which relies on convolutional feature extraction, shows advantages in capturing local patterns but cannot model long-term dependencies. This leads to information decay across multiple risk evolution stages. The Transformer model enhances temporal dependency modeling through a global attention mechanism and alleviates the instability of recurrent models in long-sequence learning. However, it shows sensitivity to noise and multi-scale fluctuations in financial data, which limits its applicability in highly uncertain financial environments.

The proposed dynamic graph enhancement model (Ours) outperforms all other methods across four evaluation metrics, confirming the effectiveness of integrating uncertainty modeling with dynamic graph structures. The model performs adaptive learning along both temporal and structural dimensions. By introducing an uncertainty correction mechanism and contrastive learning constraints, it strengthens the stable correlations and representational consistency among financial indicators. The results demonstrate that the proposed approach can more accurately capture the dynamic evolution of corporate financial health, achieve robust identification of potential risks under complex economic conditions, and provide interpretable and reliable technical support for financial health early warning and systemic risk management.

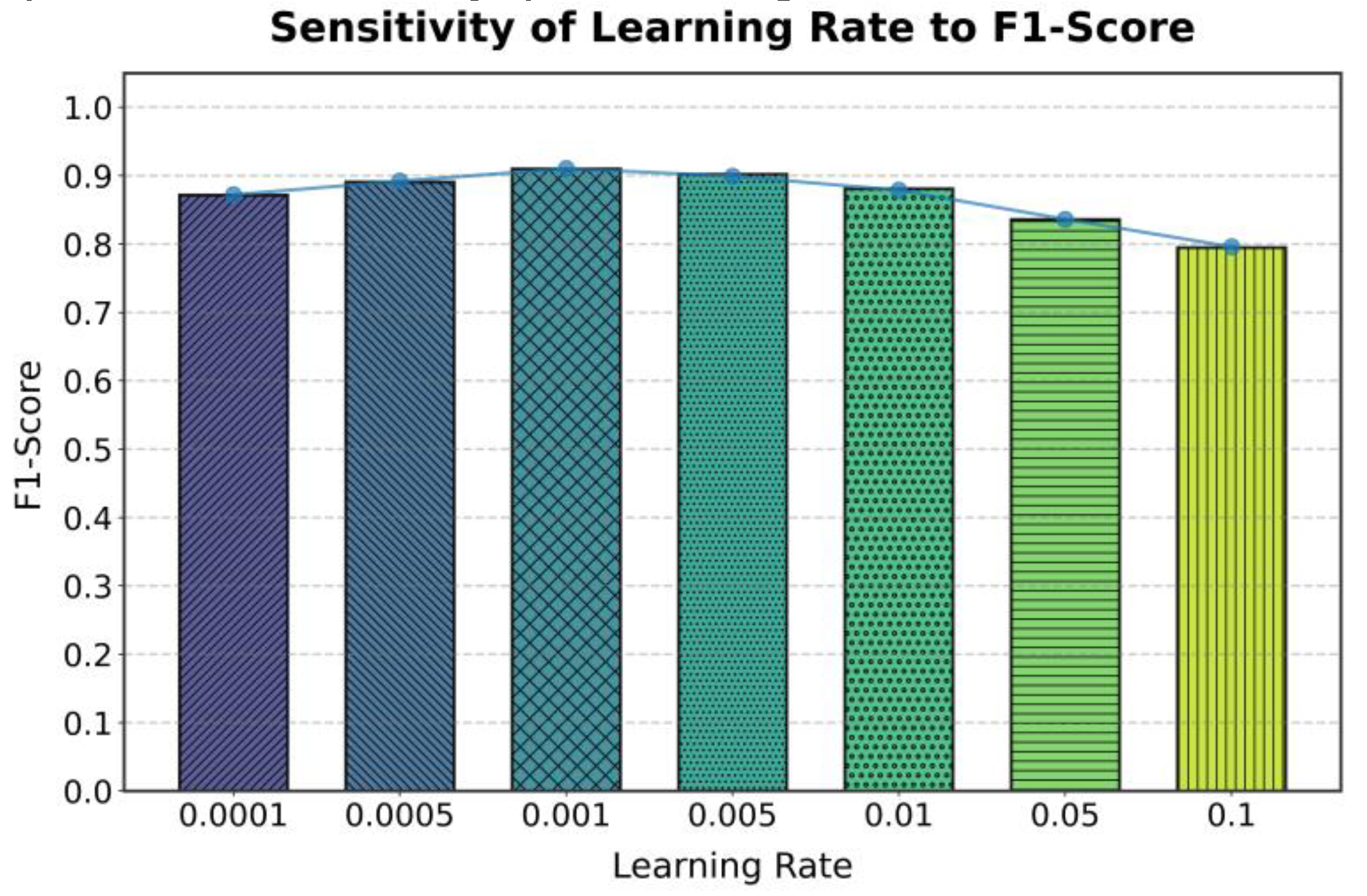

This paper also presents an experiment on the sensitivity of the learning rate to the model convergence speed and F1-Score. The purpose of this experiment is to analyze how different learning rate settings affect the optimization dynamics of the proposed model during training, particularly in terms of balancing convergence stability and gradient update efficiency. By systematically adjusting the learning rate across multiple scales, the experiment examines the relationship between parameter update magnitude, model adaptation under uncertainty, and the ability to capture financial feature variations over time. This helps to explore the optimal learning rate range that enables the model to achieve stable convergence while maintaining effective feature representation and robust risk identification in complex financial environments. The experimental results are shown in

Figure 2.

As shown in

Figure 2, the learning rate has a significant impact on both the convergence speed and the F1-Score of the model. When the learning rate is in a lower range (such as 0.0001 to 0.001), the model converges more stably and achieves a higher F1-Score. This indicates that smaller step sizes help capture subtle variations in financial features under uncertainty. However, an excessively low learning rate slows convergence and limits the model's global optimization ability during early iterations, which may extend the learning cycle of risk patterns.

When the learning rate is moderate (around 0.001 to 0.005), the model achieves its highest F1-Score. This suggests that the balance between parameter update magnitude and gradient stability is optimal at this stage. The dynamic graph enhancement mechanism can fully exploit correlations among financial features, enabling the model to maintain high accuracy and stability during temporal fluctuations and structural evolution. This result verifies that the proposed uncertainty modeling and structural enhancement modules can achieve fast and robust feature fusion and risk identification when the learning rate is properly set.

When the learning rate increases further (above 0.01), the model's performance declines significantly. This indicates that excessively large update steps disrupt the stable propagation of the dynamic graph structure, causing shifts in risk representations across temporal and structural dimensions. Especially when corporate financial features contain high noise or strong volatility, overly fast parameter updates amplify uncertainty errors and reduce model robustness. Overall, the experimental results demonstrate that the learning rate is a key factor affecting the performance of the uncertainty-aware dynamic graph enhancement model. A properly chosen learning rate helps achieve stable and reliable financial health risk modeling in complex economic environments.

To further validate the effectiveness of each proposed component, an ablation study was conducted by selectively removing the uncertainty correction module and the contrastive learning constraint. The results indicate that removing the uncertainty correction reduces accuracy by 2.7%, while omitting the contrastive term decreases F1-score by 1.9%. This demonstrates that both modules contribute jointly to enhancing model robustness under dynamic financial fluctuations.

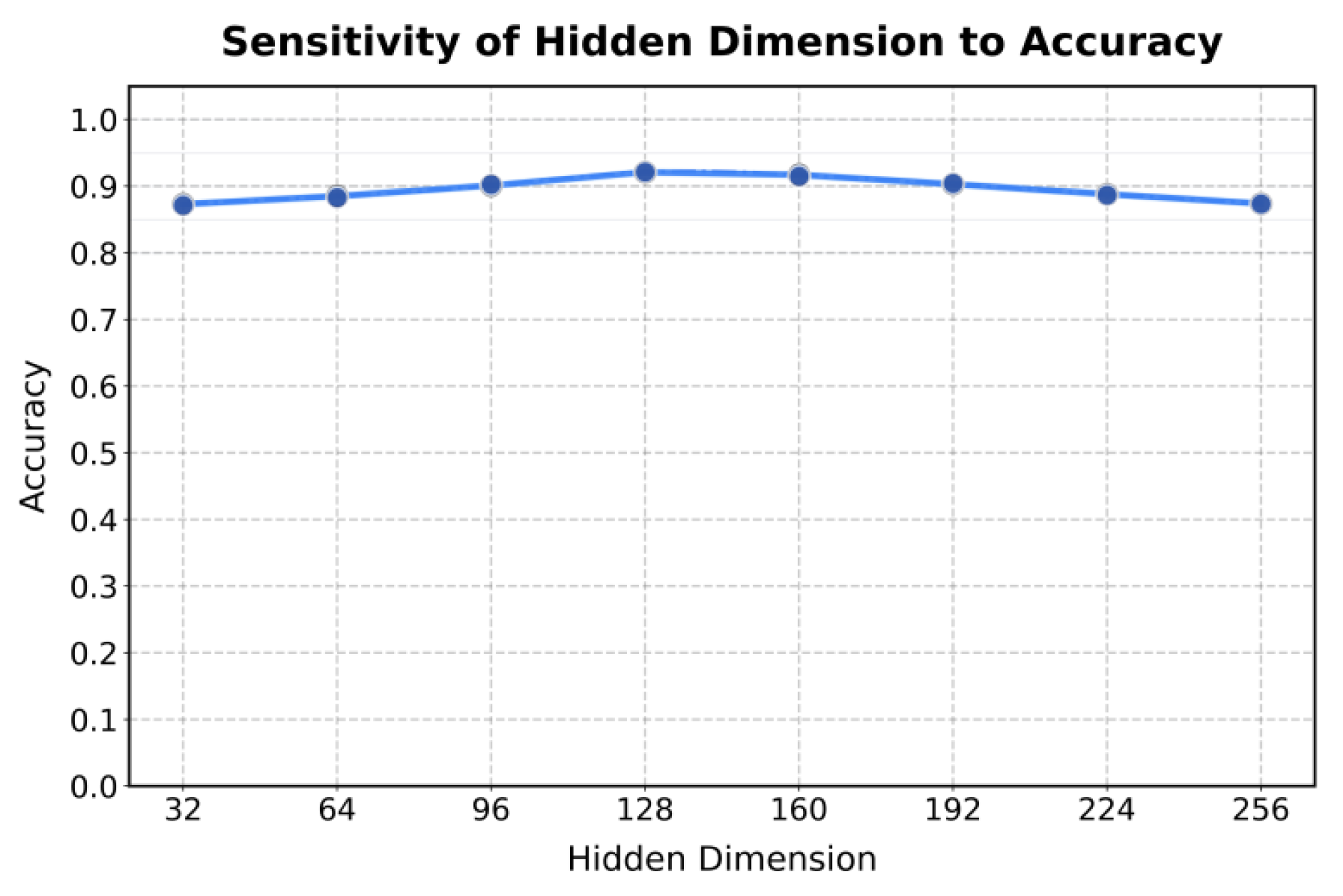

This paper also presents an experiment on the sensitivity of hidden layer dimension changes to accuracy, and the experimental results are shown in

Figure 3.

As shown in

Figure 3, changes in the hidden layer dimension have a clear nonlinear effect on model accuracy. When the hidden dimension is small (such as 32 to 64), the model performance is relatively stable but slightly less accurate. The main reason is that the network capacity is insufficient to fully represent the complex relationships and potential risk dependencies among financial indicators. At this stage, the expressive space of the model is limited, and its ability to capture dynamic financial features is weak, resulting in lower overall performance.

As the hidden dimension gradually increases to around 128, the model accuracy reaches its peak. This indicates that the network achieves a better balance between feature extraction capability and parameter complexity. A higher-dimensional hidden layer can better learn high-order nonlinear patterns in financial data and capture potential feature interactions within the uncertainty-aware dynamic graph. This enhances the precision and robustness of risk representation. The result shows that an appropriate network capacity is essential for modeling the multidimensional structure of corporate financial health.

When the hidden dimension increases further to the range of 192 to 224, model performance slightly declines. This suggests that an excessively large feature space, while capable of capturing more information, introduces parameter redundancy and overfitting risks. In particular, when financial data contains high noise and time-varying characteristics, the model may learn irrelevant patterns that weaken its generalization ability. Moreover, higher-dimensional embeddings increase the computational cost of constructing and updating dynamic graphs, reducing the efficiency and stability of the model in practical risk monitoring scenarios.

Overall, the experimental results verify the adaptive capacity control of the proposed dynamic graph enhancement model. A moderately sized hidden layer can balance representational power and model stability under complex financial environments, thereby improving the reliability of financial health risk prediction. The results further demonstrate that coordinating uncertainty-aware graph structures with multi-layer feature representations is a key prerequisite for ensuring both model performance and interpretability.

5. CONCLUSION

This study proposes a dynamic graph enhancement framework designed for uncertainty conditions to address the challenges of nonlinear dependencies, structural uncertainty, and dynamic evolution in corporate financial health risk modeling. The method takes multi-source financial indicators as input and achieves deep fusion of temporal features and structural relationships through multi-scale decomposition, dynamic graph construction, and uncertainty correction mechanisms. The results show that the model can stably capture the dynamic changes in corporate financial status under complex economic environments and effectively improve the accuracy and robustness of risk identification. In addition, interpretability analysis was performed using node-level attention visualization and SHAP-based feature attribution. The results show that solvency, leverage ratio, and cash flow volatility are the top contributing indicators to risk identification. This provides intuitive insights for financial analysts and enhances the model’s transparency for regulatory applications. This research provides a new theoretical perspective and algorithmic approach for dynamic modeling of corporate financial health and lays the foundation for structured modeling of high-dimensional financial time series data.

From an application perspective, this research has practical significance for corporate financial risk management, credit evaluation, investment decision support, scenario-based financial forecasting and planning, and regulatory early warning. By dynamically identifying corporate financial health and forecasting risk evolution, the model can assist institutions and enterprises in conducting forward-looking analysis and risk prevention in macro policy formulation, industry monitoring, and corporate decision-making, and solve the key scientific problems in the digital transformation of financial intelligence. Moreover, the generality of the framework allows its extension to complex economic systems such as supply chain finance, bank credit management, and industrial chain risk transmission analysis. It provides important support for digital risk governance in enterprises and financial systems.

From an application perspective, this research has practical significance for financial risk management, credit evaluation, investment decision support, and regulatory early warning. By dynamically identifying corporate financial health and forecasting risk evolution, the model can assist institutions in conducting forward-looking analysis and risk prevention in macro policy formulation, industry monitoring, and corporate decision-making. Moreover, the generality of the framework allows its extension to complex economic systems such as supply chain finance, bank credit management, and industrial chain risk transmission analysis. It provides important support for digital risk governance in enterprises and financial systems.

Future research can further extend the model's adaptability and interpretability. One direction is to integrate generative modeling with causal inference methods to capture the intrinsic driving mechanisms of risk evolution with finer granularity. Another direction is to explore the fusion of multimodal data, such as market sentiment, macroeconomic policies, and unstructured textual information, to achieve a more comprehensive understanding of corporate financial health. In practical deployment, combining the framework with federated learning and privacy-preserving computation can enable distributed financial risk prediction systems for multi-party collaboration. This would promote the deep application of intelligent risk analysis in corporate governance and macro-level supervision while ensuring data security. Another promising direction is to integrate the proposed framework into real-time corporate risk monitoring platforms using a federated learning infrastructure. This would enable multiple financial institutions to collaboratively train risk prediction models without exposing sensitive corporate data, thus ensuring compliance with privacy regulations such as GDPR and emerging data governance standards.

References

- P. N. Kumar, N. Umeorah and A. Alochukwu, "Dynamic graph neural networks for enhanced volatility prediction in financial markets," arXiv preprint arXiv:2410.16858, 2024.

- S. Zandi, K. Korangi, M. Óskarsdóttir, et al., "Attention-based dynamic multilayer graph neural networks for loan default prediction," European Journal of Operational Research, vol. 321, no. 2, pp. 586-599, 2025.

- S. Xiang, D. Cheng, C. Shang, et al., "Temporal and heterogeneous graph neural network for financial time series prediction," Proceedings of the 31st ACM International Conference on Information & Knowledge Management, pp. 3584-3593, 2022.

- J. Wu, M. Yao, D. Wu, et al., "DEDGAT: Dual embedding of directed graph attention networks for detecting financial risk," arXiv preprint arXiv:2303.03933, 2023.

- W. Bi, B. Xu, X. Sun, et al., "Company-as-tribe: Company financial risk assessment on tribe-style graph with hierarchical graph neural networks," Proceedings of the 28th ACM SIGKDD Conference on Knowledge Discovery and Data Mining, pp. 2712-2720, 2022.

- Q. Yuan, Y. Liu, Y. Tang, et al., "Dynamic graph learning with static relations for credit risk assessment," Proceedings of the AAAI Conference on Artificial Intelligence, vol. 39, no. 12, pp. 13133-13141, 2025.

- X. Zhang, Z. Xu, Y. Liu, et al., "Robust graph neural networks for stability analysis in dynamic networks," Proceedings of the 2024 3rd International Conference on Cloud Computing, Big Data Application and Software Engineering (CBASE), IEEE, pp. 806-811, 2024.

- Z. Liu and Z. Zhang, "Modeling audit workflow dynamics with deep Q-learning for intelligent decision-making," Transactions on Computational and Scientific Methods, vol. 4, no. 12, 2024.

- X. Yan, Y. Jiang, W. Liu, D. Yi and J. Wei, "Transforming multidimensional time series into interpretable event sequences for advanced data mining," Proceedings of the 2024 5th International Conference on Intelligent Computing and Human-Computer Interaction (ICHCI), pp. 126-130, 2024.

- X. Yan, J. Du, L. Wang, Y. Liang, J. Hu and B. Wang, "The synergistic role of deep learning and neural architecture search in advancing artificial intelligence," Proceedings of the 2024 International Conference on Electronics and Devices, Computational Science (ICEDCS), pp. 452-456, Sep. 2024.

- Z. Liu and Z. Zhang, "Graph-based discovery of implicit corporate relationships using heterogeneous network learning," Journal of Computer Technology and Software, vol. 3, no. 7, 2024.

- Q. R. Xu, W. Xu, X. Su, K. Ma, W. Sun and Y. Qin, "Enhancing systemic risk forecasting with deep attention models in financial time series," 2025.

- Z. Xu, X. Liu, Q. Xu, X. Su, X. Guo and Y. Wang, "Time series forecasting with attention-augmented recurrent networks: A financial market application," 2025.

- X. Quan, "Structured path guidance for logical coherence in large language model generation," Journal of Computer Technology and Software, vol. 3, no. 3, 2024.

- Y. Zi and X. Deng, "Joint modeling of medical images and clinical text for early diabetes risk detection," Journal of Computer Technology and Software, vol. 4, no. 7, 2025.

- C. Hu, Z. Cheng, D. Wu, Y. Wang, F. Liu and Z. Qiu, "Structural generalization for microservice routing using graph neural networks," arXiv preprint arXiv:2510.15210, 2025.

- Z. Xue, "Dynamic structured gating for parameter-efficient alignment of large pretrained models," Transactions on Computational and Scientific Methods, vol. 4, no. 3, 2024.

- Y. Zou, "Federated distillation with structural perturbation for robust fine-tuning of LLMs," Journal of Computer Technology and Software, vol. 3, no. 4, 2024.

- L. Dai, "Integrating causal inference and graph attention for structure-aware data mining," Transactions on Computational and Scientific Methods, vol. 4, no. 4, 2024.

- Y. Lin, "Graph neural network framework for default risk identification in enterprise credit relationship networks," Transactions on Computational and Scientific Methods, vol. 4, no. 4, 2024.

- L. Lian, "Automatic elastic scaling in distributed microservice environments via deep Q-learning," Transactions on Computational and Scientific Methods, vol. 4, no. 4, 2024.

- M. Jiang, S. Liu, W. Xu, S. Long, Y. Yi and Y. Lin, "Function-driven knowledge-enhanced neural modeling for intelligent financial risk identification," 2025.

- X. Hu, Y. Kang, G. Yao, T. Kang, M. Wang and H. Liu, "Dynamic prompt fusion for multi-task and cross-domain adaptation in LLMs," arXiv preprint arXiv:2509.18113, 2025.

- S. Wang, S. Han, Z. Cheng, M. Wang and Y. Li, "Federated fine-tuning of large language models with privacy preservation and cross-domain semantic alignment," 2025.

- R. Wang, Y. Chen, M. Liu, G. Liu, B. Zhu and W. Zhang, "Efficient large language model fine-tuning with joint structural pruning and parameter sharing," 2025.

- C. Liu, Q. Wang, L. Song and X. Hu, "Causal-aware time series regression for IoT energy consumption using structured attention and LSTM networks," 2025.

- J. Zhang, H. Xie, X. Zhang, et al., "Enhancing risk assessment in transformers with loss-at-risk functions," Proceedings of the 2024 IEEE International Conference on Knowledge Graph (ICKG), IEEE, pp. 477-484, 2024.

- K. Xu, Y. Wu, H. Xia, et al., "Graph neural networks in financial markets: Modeling volatility and assessing value-at-risk," Journal of Computer Technology and Software, vol. 1, no. 2, 2022.

- W. Bi, B. Xu, X. Sun, et al., "Company-as-tribe: Company financial risk assessment on tribe-style graph with hierarchical graph neural networks," Proceedings of the 28th ACM SIGKDD Conference on Knowledge Discovery and Data Mining, pp. 2712-2720, 2022.

- J. Dong and S. Liang, "Hybrid CNN-LSTM-GNN neural network for A-share stock prediction," Entropy, vol. 27, no. 8, 881, 2025.

- Z. Hu and Y. C. Kiat, "A transformer-based neural network to predict credit card default," 2025.

- X. Lu, J. Poon and M. Khushi, "Leveraging BiLSTM-GAT for enhanced stock market prediction: A dual-graph approach to portfolio optimization," Applied Intelligence, vol. 55, no. 7, pp. 601, 2025.

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).