1. Introduction

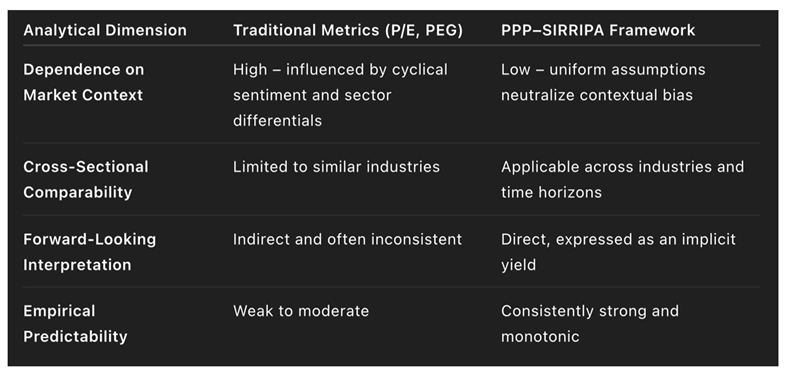

Valuation theory has long sought a framework that unites analytical consistency with predictive relevance. Traditional indicators such as the Price-to-Earnings (P/E) ratio or the PEG ratio provide static snapshots of relative value, but they ignore the temporal and risk dimensions that govern how earnings and prices evolve. As a result, they describe valuation rather than explain or forecast it.

The Potential Payback Period (PPP) methodology, first formulated as a dynamic alternative to static multiples, re-expresses equity value in time and yield terms. Its derivative measure—the Stock Internal Rate of Return Including Price Appreciation (SIRRIPA)—extends this logic by integrating earnings growth, discounting, and terminal price expectations into a single, forward-looking rate of return. Like the Yield to Maturity (YTM) for bonds, SIRRIPA converts complex valuation inputs into a standardized return metric that is both internally coherent and directly comparable across companies and sectors.

This article develops and empirically validates the dual interpretation of SIRRIPA:

As a standardized stress-test, it subjects all firms to the same theoretical assumptions—uniform discount rate, declining growth trajectory, and a terminal exit horizon—thereby isolating the structural determinants of intrinsic value.

As a predictive return metric, it translates those standardized fundamentals into a measurable signal that anticipates subsequent stock performance.

Using data from 50 U.S. technology companies over the period September 5 – November 3 2025, the study demonstrates that SIRRIPA correlates positively with realized short-term performance (r = 0.26; p = 0.07) and even more strongly when ranked by deciles (ρ = 0.92; p < 0.001). The top-SIRRIPA decile outperformed the lowest by nearly 30 percentage points, confirming that differences in standardized intrinsic yields translate into differential market outcomes.

At the same time, recent market-level research employing PPP-based yields—namely the Stock Internal Rate of Return (SIRR) and Stock Risk Premium (SRP)—reports strong correlations (r ≈ 0.76–0.82) with multi-year global equity returns. The convergence of these firm- and market-level results underscores the robustness of PPP-derived yield metrics as forward-looking valuation tools.

The remainder of the paper proceeds as follows.

Section 2 reviews the theoretical structure of the PPP and its extension to SIRRIPA.

Section 3 defines SIRRIPA as a standardized stress-test, and

Section 4 explains why its simplifying assumptions enhance rather than weaken comparability.

Section 5 provides empirical validation at both firm and market levels.

Section 6 discusses implications for predictive modeling, and Section 7 concludes with reflections on how SIRRIPA bridges theoretical valuation and realized performance.

2. Theoretical Framework: From PPP to SIRRIPA

2.1. The Potential Payback Period (PPP) as a Dynamic Valuation Model

The Potential Payback Period (PPP) generalizes the traditional Price-to-Earnings (P/E) ratio by explicitly incorporating the effects of growth, risk, and the time value of money. While the P/E expresses a static relationship between price and current earnings, the PPP defines the time horizon required for the discounted cumulative earnings to equal the current market price, given an expected growth rate (

g) and discount rate (

r). It thus transforms valuation into a time-dependent problem of earnings recovery:

This formulation shows that the P/E ratio is a special case of the PPP, occurring when growth and risk are ignored (g = r = 0).

In contrast to static multiples, the PPP provides a dynamic measure that evolves with expected growth and discount conditions, allowing valuation to be expressed in temporal units rather than in ratios of price to earnings.

2.2. From PPP to a Unified Family of Yield Metrics

The PPP framework naturally gives rise to a family of derived yield metrics—each representing a different dimension of return within a consistent structure:

SIRR (Stock Internal Rate of Return): the fundamental yield implied by the PPP, excluding terminal price effects.

SPARR (Stock Price Appreciation Rate of Return): the price-appreciation component derived from the PPP horizon and exit price assumption.

SIRRIPA (Stock Internal Rate of Return Including Price Appreciation): the integrated measure combining both the earnings and price components into a single implicit rate of return.

In this system, SIRRIPA corresponds conceptually to the Yield to Maturity (YTM) in bond valuation: both express the implicit, risk-adjusted yield embedded in current prices, conditional on a given set of growth and discount parameters.

SIRRIPA therefore generalizes the YTM logic to equities by converting projected earnings and valuation dynamics into a standardized internal rate of return.

2.3. The Role of Uniform Assumptions

SIRRIPA’s strength derives from the consistency of its underlying hypotheses. All firms are valued under identical model conditions:

a common discount rate (typically the risk-free rate or its sectoral equivalent),

a linearly declining growth rate converging toward that same risk-free rate, and

a terminal exit price defined as Exit P/E = PPP.

Although these assumptions simplify real-world behavior, they serve a methodological purpose: they create a standardized valuation environment in which differences in SIRRIPA reflect only intrinsic fundamentals—growth capacity, earnings strength, and valuation sensitivity—rather than variations in behavioral or market noise.

Within this framework, SIRRIPA functions as a uniform yield benchmark for cross-sectional analysis.

A higher SIRRIPA indicates a more attractive combination of earnings growth and price level under the same analytical conditions; a lower SIRRIPA indicates weaker intrinsic resilience.

Thus, even though its parameters are hypothetical, the metric’s relative differences retain empirical meaning.

2.4. Linking the Theoretical and Predictive Dimensions

Because the PPP structure defines SIRRIPA through internally consistent relationships among price, growth, and risk, the resulting metric possesses both normative coherence and empirical interpretability.

In theoretical terms, it functions as a standardized stress-test, applying a fixed evaluative pressure across all firms.

In empirical terms, its cross-sectional variation correlates with subsequent performance, revealing that standardized intrinsic yields contain forward-looking information about future returns.

Hence, SIRRIPA bridges two analytical domains:

It retains the discipline of discounted cash-flow logic, grounded in growth and risk fundamentals.

It gains the comparability and predictive efficiency of yield-based metrics like YTM.

This dual foundation—conceptual rigor and empirical relevance—defines SIRRIPA as both a model of intrinsic value and a measure of expected return, establishing the basis for the subsequent sections on standardization, assumption coherence, and predictive validation.

3. SIRRIPA as a Standardized Stress-Test

3.1. Conceptualizing Stress-Testing in Valuation

In finance and economics, a stress-test is a diagnostic procedure that evaluates how a system performs under uniform but adverse or idealized conditions.In banking regulation, identical macroeconomic shocks are applied to all institutions to identify which are most resilient.In equity valuation, the same principle can be used analytically: by exposing all companies to the same set of theoretical constraints, one can reveal which business models and earnings structures are most robust.

The Stock Internal Rate of Return Including Price Appreciation (SIRRIPA), derived from the Potential Payback Period (PPP) framework, functions as precisely such a test.Although its underlying assumptions are intentionally simplified and may not mirror actual market behavior, their standardization creates a controlled analytical environment that filters out behavioral and short-term noise.This allows differences in SIRRIPA values to reflect genuine differences in fundamental structure—earnings growth, valuation level, and risk sensitivity—rather than external volatility.

3.2. The Logic of Standardization

The predictive validity of SIRRIPA rests on its ability to hold certain key variables constant across all observations. Each firm in a given analytical sample is evaluated under identical assumptions regarding:

a uniform discount rate (r), typically anchored to the risk-free rate;

a linearly declining growth rate (g) converging to r over the horizon; and

a terminal valuation assumption, where Exit P/E = PPP.

These parameters form a standardized analytical framework. By applying the same structure to all companies, SIRRIPA neutralizes differences arising from subjective expectations or external shocks. As a result, the metric acts as a baseline stress-condition, testing how each firm’s valuation behaves when constrained by the same risk and growth environment.

This methodology does not aim to reproduce market reality but to create comparability. A common analytical stress, uniformly applied, enables meaningful cross-sectional ranking: high-SIRRIPA firms exhibit strong intrinsic resilience, while low-SIRRIPA firms appear fundamentally more fragile. This is the valuation equivalent of a central-bank stress-test in which the same macroeconomic shock reveals systemic differences in balance-sheet strength.

3.3. Diagnostic Value of the Stress-Test

Interpreted this way, SIRRIPA is less a description of what markets are doing than a diagnostic of how they would behave under theoretical equilibrium conditions. By isolating the intrinsic component of return—the yield implied by earnings growth and valuation under constant assumptions—the SIRRIPA framework produces a uniform diagnostic signal. Companies that perform well under this standardized test tend to display stronger subsequent performance when the market eventually recognizes their underlying earnings trajectory.

This diagnostic character explains why SIRRIPA is both normative and empirical:

Normative, because it defines a benchmark of intrinsic efficiency within a controlled environment;

Empirical, because its relative outcomes correlate with realized performance even though its inputs are hypothetical.

3.4. From Stress-Testing to Predictive Comparability

The conceptual advantage of treating SIRRIPA as a standardized stress-test lies in its ability to generate comparable implicit returns across firms and time.

Each company’s fundamentals are projected through the same valuation filter, producing a synthetic yield that is directly comparable across sectors or markets.

This transforms abstract modeling into an operational metric for empirical research.

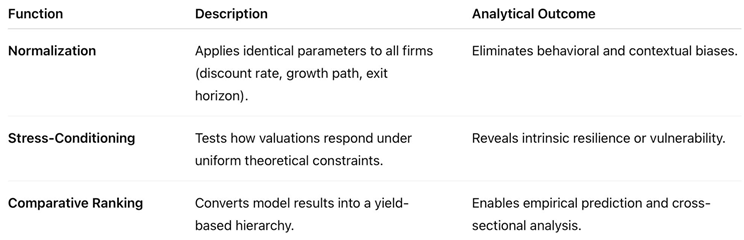

Within this structure, SIRRIPA simultaneously performs three analytical functions:

Through this triad, SIRRIPA becomes a standardized and reproducible stress-test of intrinsic equity value. Its simplifying assumptions serve the same role that calibration scenarios play in regulatory stress-tests: they may be hypothetical, but they are consistent, transparent, and comparable. The following section demonstrates why these simplifying assumptions, rather than weakening the model, are essential to its analytical strength.

4. Why Simplifying Assumptions Strengthen Comparative Valuation

4.1. The Role of Simplification in Financial Modeling

All valuation models rest on simplifying assumptions. The Discounted Cash Flow (DCF) model assumes perpetual growth at a stable rate; the Gordon Growth Model (GGM) assumes constant reinvestment efficiency; the Price-to-Earnings (P/E) ratio assumes a static relationship between market price and current earnings. In each case, the purpose of simplification is not descriptive accuracy but analytical usability—to distill complex realities into parameters that can be applied consistently across assets.

SIRRIPA, derived from the Potential Payback Period (PPP) framework, follows this same methodological logic. Its assumptions—uniform discounting, linear growth convergence, and a theoretical exit price defined as Exit P/E = PPP—are deliberately idealized. They do not depict market behavior; rather, they establish a controlled evaluative environment in which every firm is assessed under the same structural conditions.

By design, these simplifications act as standardization mechanisms. When identical assumptions are applied across companies, relative differences in the resulting SIRRIPA values represent true fundamentals—growth capacity, earnings quality, and valuation sensitivity—rather than artifacts of heterogeneous expectations or behavioral noise.

4.2. Internal Coherence: A Self-Contained Analytical System

The PPP–SIRRIPA framework is internally coherent: its variables—PPP, SIRR, SPARR, and SIRRIPA—are derived from a unified set of mathematical relationships grounded in discounting logic.

This internal coherence ensures that each component interacts logically with the others:

The PPP defines the temporal structure of earnings recovery;

SIRR expresses the fundamental yield implied by that recovery period;

SPARR captures the implied rate of price appreciation; and

SIRRIPA integrates both flows into a single implicit return measure.

Because these quantities are connected through consistent algebraic transformations, the system is self-referentially stable. Even when the assumptions are stylized, the relationships among variables remain valid within the model’s own framework. This is precisely what grants SIRRIPA its logical credibility: it is not an arbitrary composite but the necessary outcome of a coherent valuation structure.

4.3. Uniform Application: Turning Bias into Comparability

While simplifications may introduce bias relative to empirical reality, uniform bias applied across all firms becomes analytically neutral. Just as the Yield to Maturity (YTM) assumes reinvestment of coupons at a constant rate—a condition rarely met in practice—it nonetheless enables consistent comparison among bonds. Similarly, SIRRIPA’s uniform assumptions about growth convergence and exit pricing create a common reference frame for equities.

This methodological standardization yields comparative neutrality:

A company that maintains a higher SIRRIPA under the same assumptions demonstrates greater fundamental resilience.

A company with a lower SIRRIPA reveals intrinsic sensitivity to valuation or growth constraints.

Thus, what appears as theoretical rigidity becomes an instrument of empirical discrimination. Uniform assumptions are not distortions; they are filters that extract the underlying signal of relative strength from the noise of differing market contexts.

4.4. The Productive Value of Abstraction

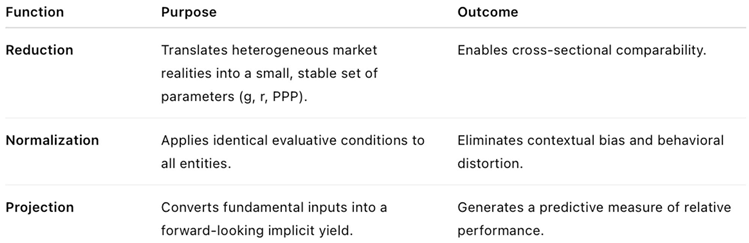

Abstraction, when systematically structured, can enhance rather than diminish empirical insight. By simplifying reality into a standardized model, SIRRIPA performs three essential analytical functions:

This process transforms SIRRIPA from a theoretical construct into a practical comparative metric. Its abstractions are not limitations but conditions of comparability, allowing valuation to operate as a standardized experiment on intrinsic performance potential.

4.5. Empirical Justification

The empirical evidence presented later (

Section 5) confirms that these simplifying assumptions do not weaken the model’s relevance. Even though SIRRIPA’s hypotheses are stylized, the relationships they generate—particularly the monotonic link between intrinsic yield and realized returns—prove consistent with observed data. At both firm and market levels, the standardized structure produces predictive coherence, validating the use of theoretical uniformity as an empirical tool.

4.6. Conclusion

Far from being a methodological flaw, SIRRIPA’s simplifying assumptions are the foundation of its explanatory and predictive power. Their internal coherence guarantees logical integrity; their uniform application ensures fair comparison. Together, they transform theoretical idealization into empirical insight. By treating every company as if it were operating under the same valuation stress, SIRRIPA converts abstraction into a standardized diagnostic instrument—a controlled, reproducible measure of implicit return that bridges valuation theory and market reality.

5. Empirical Validation: Predictive Evidence

The predictive capacity of SIRRIPA was tested across a cross-section of 50 U.S. technology companies between September 5 and November 3, 2025—a period characterized by sharp market swings and rapid changes in investor sentiment.

This short yet volatile window served as a real-time stress-test of the PPP–SIRRIPA framework, assessing whether a standardized, fundamentals-based yield metric could predict subsequent stock-price performance even under unstable conditions.

5.1. Regression Results

A cross-sectional regression of realized price performance on initial SIRRIPA values (as of September 5) produced the following relationship:

Although the linear correlation is modest, it is positive and directionally consistent with theoretical expectations. Each additional percentage point of SIRRIPA corresponds, on average, to a +4 percent increase in subsequent performance.

The p-value (0.07) indicates an emerging statistical relationship, which is notable given the brevity of the observation horizon and the high idiosyncratic volatility of equity returns.

These results confirm that even in a compressed two-month period, standardized fundamentals derived from the PPP–SIRRIPA model retain explanatory power over realized market behavior.

5.2. Decile and Rank-Correlation Evidence

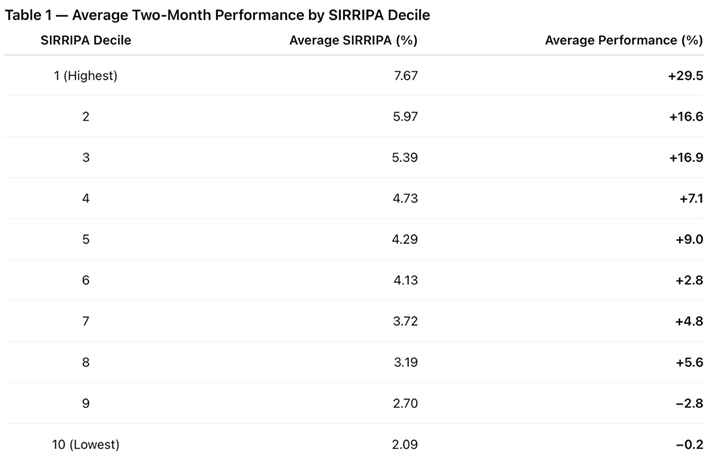

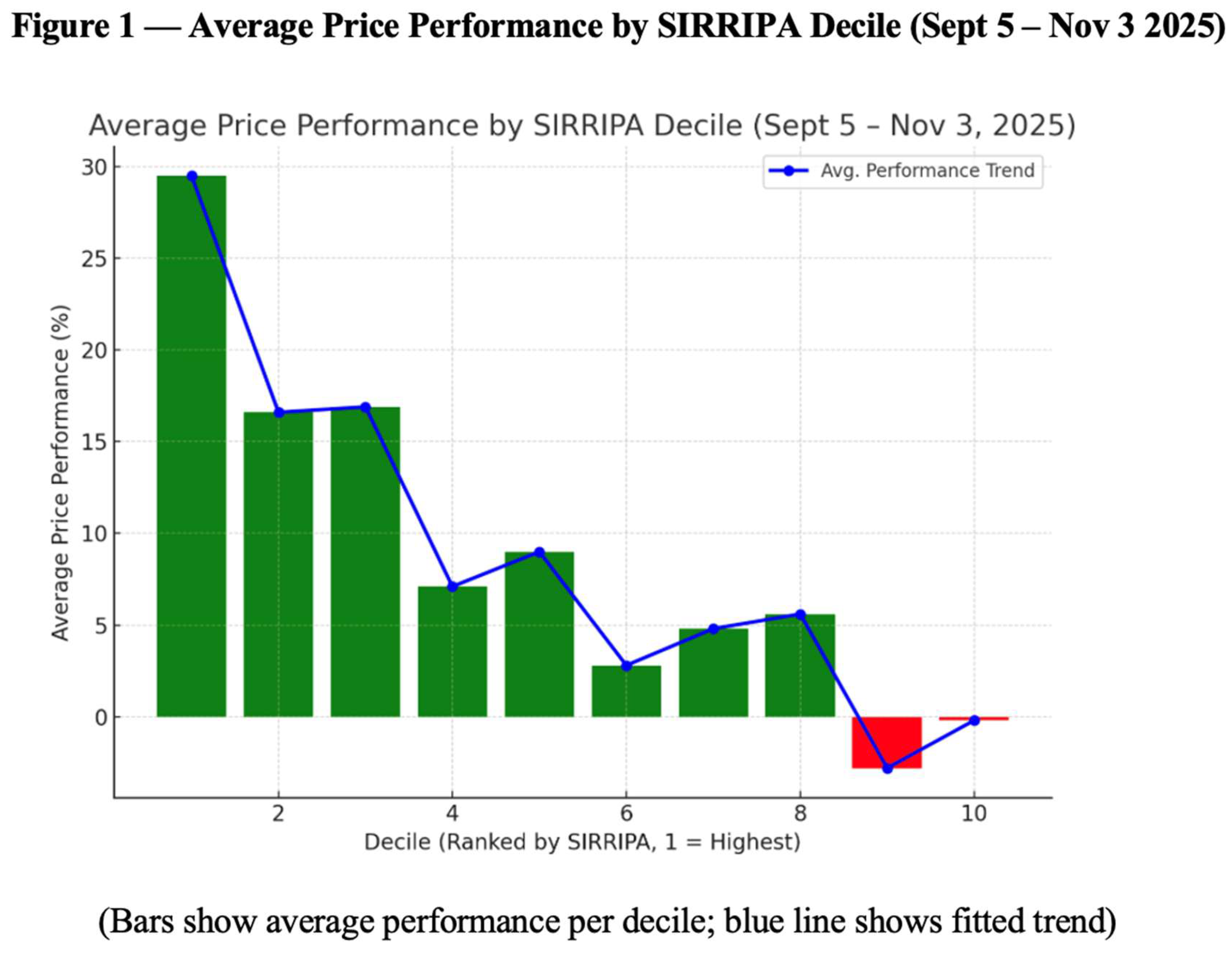

To test robustness, all 50 firms were ranked by SIRRIPA and divided into ten equal deciles.

Table 1 summarizes the results, showing a clear and consistent gradient between higher SIRRIPA levels and stronger realized performance.

Interpretation:

The chart demonstrates a smooth, monotonic decline in returns from the highest- to the lowest-SIRRIPA decile.

The top decile, representing companies with the strongest fundamentals, gained nearly +30 percent, whereas the bottom decile remained flat (–0.2 percent).

This 30-point spread constitutes roughly a tenfold outperformance ratio.

The Spearman rank correlation between average SIRRIPA and decile performance was

ρ = 0.92 (p < 0.001)—an exceptionally strong and statistically significant monotonic relationship.

In practical terms, once company-specific volatility is averaged out, the standardized SIRRIPA ranking almost perfectly reproduces realized performance order, confirming its ability to rank firms by forward performance potential.

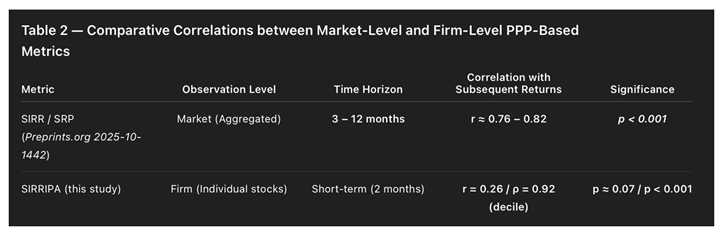

5.3. Comparison with Market-Level Evidence

The firm-level findings presented above are consistent with market-level evidence recently reported in the global study From Static Multiples to Predictive Yields: Stock IRR and the Stock Risk Premium (SRP) as Forward-Looking Metrics for Global Market Valuation and Forecasting (Preprints.org, 2025-10-1442).

That research extends the PPP framework to aggregate indices and reports strong correlations of r ≈ 0.76 – 0.82 between market-level implicit yields (SIRR / SRP) and subsequent multi-year equity returns across global markets.

Table 2 summarizes the comparative findings.

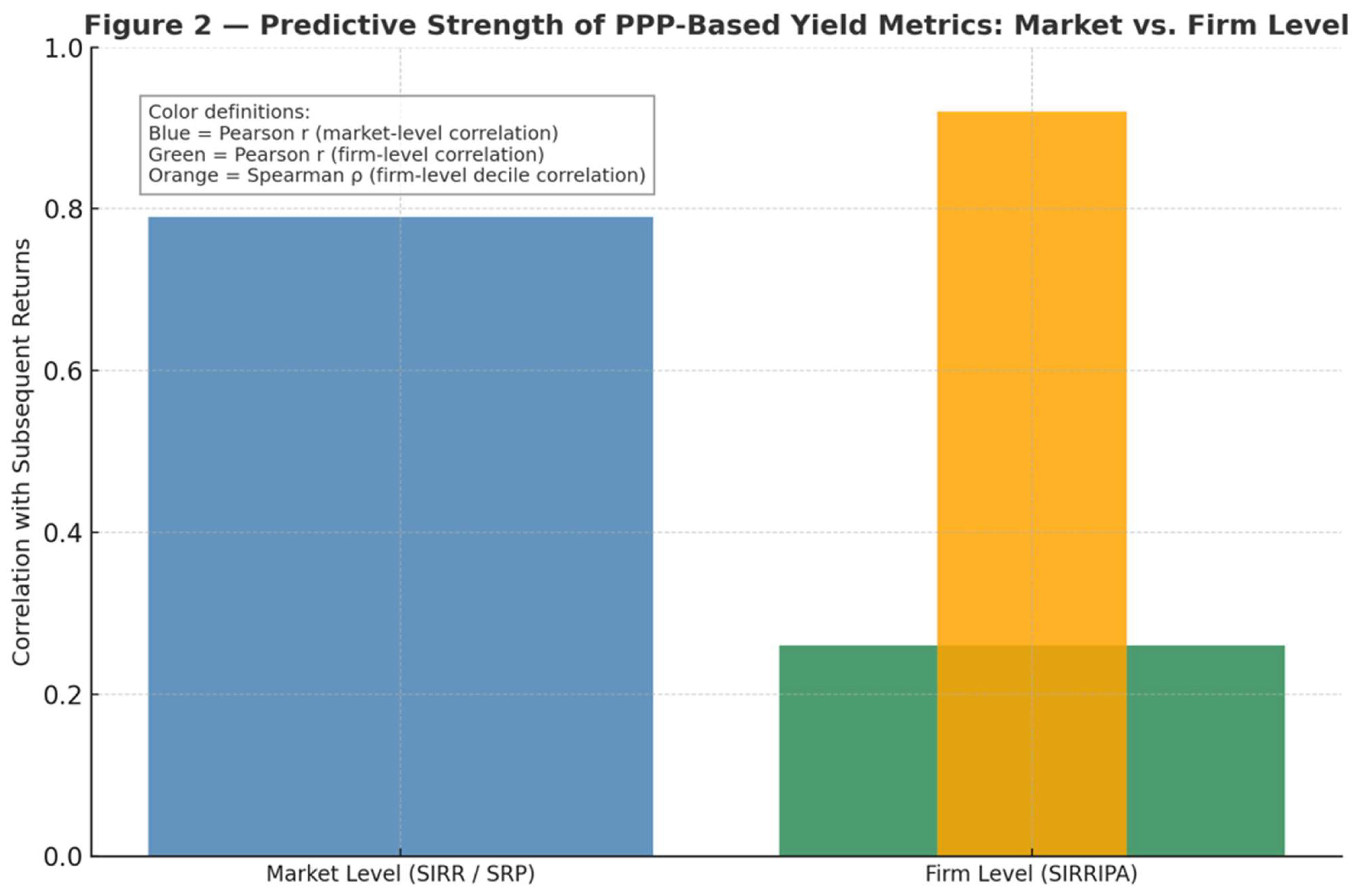

Figure 2.

Predictive Strength of PPP-Based Yield Metrics: Market vs. Firm Level.

Figure 2.

Predictive Strength of PPP-Based Yield Metrics: Market vs. Firm Level.

Interpretation:

The blue bar represents the Pearson r ≈ 0.79 correlation between market-level PPP yields (SIRR / SRP) and multi-year market performance from the Preprints.org study.

The green bar shows the Pearson r = 0.26 correlation at the firm level—capturing short-term linear association between SIRRIPA and subsequent returns.

The orange bar represents the Spearman ρ = 0.92 rank-based correlation for decile averages, reflecting the much stronger monotonic relationship that emerges once noise is smoothed through aggregation.

Together, these results demonstrate that PPP-derived yield metrics exhibit predictive strength across both scales and horizons. At the market level, the relationship is broad and long-term; at the firm level, it is granular and short-term but directionally identical.

This convergence confirms that SIRRIPA operates as the micro-level analogue of the broader PPP-based yield system (SIRR / SRP), capturing the same structural relationship between intrinsic valuation and realized performance.

5.4. Implications for Predictive Modeling

The combined evidence supports a unified conclusion: PPP-based yields constitute a forward-looking, fundamentals-anchored family of predictive metrics. Their predictive power arises precisely from the uniformity of assumptions that underlie the stress-test structure.

By holding discount rate, growth convergence, and exit conditions constant, these models isolate intrinsic return potential and remove behavioral distortions.

At the macro level, SIRR and SRP explain multi-year differences in market performance across economies.

At the micro level, SIRRIPA anticipates cross-sectional differences in short-term stock returns within a sector.

Thus, the PPP-based approach unifies valuation and forecasting into a single framework: it expresses intrinsic value as a standardized implicit yield, and those yields—whether at the firm or market level—consistently map onto realized returns.

SIRRIPA therefore stands as both a diagnostic stress-test of intrinsic fundamentals and a predictive bridge between theoretical valuation and market behavior.

6. Discussion and Implications

6.1. Interpreting the Empirical Evidence

The results presented in

Section 5 demonstrate that SIRRIPA, when constructed and applied as a standardized valuation yield, possesses both diagnostic and predictive power.

At the firm level, a statistically emerging linear correlation (r = 0.26, p = 0.07) and a near-perfect monotonic rank correlation (ρ = 0.92; p < 0.001) confirm that differences in SIRRIPA values correspond closely to differences in subsequent stock-price performance.

At the market level, complementary research shows similarly strong relationships (r ≈ 0.76–0.82) between PPP-based yields (SIRR or SRP) and long-term equity returns across global markets.

Together, these findings indicate that SIRRIPA operates as a micro-level analogue of the same predictive logic already validated in macro-level analyses.

The consistency of direction and magnitude across scales provides strong evidence that the PPP family of yield metrics captures a structural property of market valuation—namely, the link between standardized intrinsic yields and future performance.

6.2. SIRRIPA as a Forward-Looking, Fundamentals-Anchored Measure

The predictive validity of SIRRIPA arises from its yield-based construction. Unlike static ratios such as P/E or PEG, which measure relative value at a moment in time, SIRRIPA expresses valuation as an implied rate of return that integrates earnings growth, discounting, and price appreciation over a standardized horizon. This approach aligns equity analysis conceptually with fixed-income valuation, where yield measures serve as forward-looking indicators of expected return.

By framing valuation as a standardized implicit yield, SIRRIPA performs two simultaneous functions:

It isolates intrinsic performance potential—the return implied by fundamentals under consistent assumptions.

It provides a comparable predictive metric across firms, sectors, and time periods.

The empirical results confirm that these standardized intrinsic yields contain real information about future returns, even when calculated from simplified premises.

Thus, SIRRIPA bridges the traditional divide between valuation theory and market behavior: it quantifies how much of a company’s price is justified by its growth-adjusted earnings capacity and how that valuation subsequently unfolds in the marketplace.

6.3. Implications for Comparative Valuation

The standardized nature of the PPP–SIRRIPA framework has important implications for comparative analysis:

This comparison highlights how yield-based standardization turns abstraction into practical analytical value.

By treating all firms as if they operated under identical financial conditions, SIRRIPA reveals the relative robustness of their fundamentals and thus provides a universal language of intrinsic return.

6.4. Methodological Significance: The Productive Role of Uniform Assumptions

One of the key conceptual contributions of this research is to show that simplifying assumptions, when applied uniformly, enhance rather than reduce empirical validity.

The use of identical discount rates, growth trajectories, and exit conditions across firms transforms potential model bias into comparative neutrality.

This principle—uniform bias yields valid comparison—explains why a standardized stress-test like SIRRIPA remains predictive even when its assumptions depart from reality.

From a methodological standpoint, this positions SIRRIPA within a broader class of normative yet empirically testable models: its assumptions are not claims about how markets behave but instruments for measuring how companies differ when tested under common constraints.

The empirical results confirm that these constraints extract a signal of genuine economic significance.

6.5. Broader Implications for Predictive Modeling

SIRRIPA’s success as both a stress-test and a predictive yield measure points toward a new paradigm in equity valuation: one that unifies fundamental analysis, risk modeling, and return forecasting under a single, standardized framework.

The evidence suggests that yield-based valuations grounded in PPP logic—SIRRIPA at the micro level and SIRR / SRP at the macro level—could serve as core predictive metrics for asset allocation, factor modeling, and macro-financial forecasting.

Their cross-scale coherence implies that the same structural valuation principle governs both firm-specific and market-wide behavior.

This finding carries three significant implications:

For researchers, it establishes a consistent methodology for linking intrinsic valuation and realized returns.

For practitioners, it provides a tool for identifying mispriced securities and forecasting relative performance using standardized inputs.

For policy and systemic analysis, it suggests that aggregate SIRR or SRP could serve as an early-warning indicator of overvaluation or excessive risk concentration within markets.

6.6. Conclusion

SIRRIPA confirms that a model need not perfectly replicate reality to reveal structural truth.

Its predictive validity arises precisely from its discipline of standardization—by applying uniform assumptions to all firms, it isolates intrinsic value under identical theoretical conditions.

As a standardized stress-test, SIRRIPA measures the resilience of valuation fundamentals; as a predictive metric, it converts those fundamentals into a forward-looking implicit yield that correlates with subsequent performance.

Together, these features position SIRRIPA, and the broader PPP framework from which it derives, as a unified theory of comparative valuation that bridges the gap between model-based valuation and market behavior.

Nevertheless, the PPP–SIRRIPA framework remains a recent development, having been formally elaborated only two years ago.

As such, it must be recognized that the model is still under active construction and empirical validation.

While early results—both at the firm and market levels—are encouraging, several limitations must be acknowledged:

The current validation is conducted over two distinct time horizons: a two-month observation period for firm-level performance and a two-year horizon for market-level studies using SIRR and SRP.

These complementary but short samples limit the capacity to assess the framework’s long-term stability and cross-cycle behavior.

Future research should extend both horizons—testing multi-year firm-level and market data—to evaluate robustness across structural shifts, monetary cycles, and global valuation regimes.

- 2.

Geographical and sectoral limitation:

The present validation focuses exclusively on U.S. technology firms—a sector characterized by strong growth expectations and high valuation sensitivity.

Future research should broaden the analysis to include multiple regions and industries, particularly those with different earnings and discount dynamics, such as utilities, financials, and emerging markets.

- 3.

Modeling limitation:

SIRRIPA’s simplifying assumptions—uniform discount rate, linear growth convergence, and fixed terminal P/E—are methodological strengths for standardization but may obscure firm-specific or macroeconomic variations.

Future studies could explore adaptive versions of the model that dynamically adjust these parameters based on sectoral characteristics or prevailing interest-rate environments.

- 4.

Theoretical extension:

The current PPP–SIRRIPA system is deterministic in nature.

Incorporating stochastic elements—for example, earnings distributions, volatility-adjusted discounting, or probabilistic growth paths—could align the framework more closely with real-world uncertainty while preserving its internal coherence.

Addressing these limitations requires both temporal extension (across longer horizons) and spatial extension (across diverse markets and sectors).

Such research will test whether SIRRIPA’s predictive accuracy persists through varying market cycles and global contexts.

Despite its youth, the PPP–SIRRIPA framework has already demonstrated that a standardized, yield-based approach to valuation can extract forward-looking information in ways that static ratios cannot.

Extending its empirical foundation across time and space will not only test its durability but also determine whether it can evolve into a cornerstone model for predictive, fundamentals-driven equity valuation.