Submitted:

31 October 2025

Posted:

03 November 2025

You are already at the latest version

Abstract

Keywords:

1. Introduction

2. Materials and Methods

2.1. Sample and Study Area Description

2.2. Experimental Design and Control Group

2.3. Measurement Methods and Quality Control

2.4. Data Processing and Model Equations

2.5. Statistical Analysis and Validation

3. Results and Discussion

3.1. State-dependent effects of sentiment, volume, and momentum

3.2. Model fit and regime classification accuracy

3.3. Return dynamics within states

3.4. Robustness checks and comparison with prior work

4. Conclusion

References

- Maurya, P. K.; Bansal, R.; Mishra, A. K. Investor sentiment and its implication on global financial markets: a systematic review of literature. In Qualitative Research in Financial Markets; 2025. [Google Scholar]

- Yang, J.; Li, Y.; Harper, D.; Clarke, I.; Li, J. Macro Financial Prediction of Cross Border Real Estate Returns Using XGBoost LSTM Models. Journal of Artificial Intelligence and Information 2025, 2, 113–118. [Google Scholar]

- Maharana, S. Energy Market Shocks: Effect of Oil Price Volatility on Supply Chain. In Supply Chain Disruptions and Impact on Global Inflation; IGI Global Scientific Publishing, 2025; pp. 59–84. [Google Scholar]

- Zhu, W.; Yang, J. Causal Assessment of Cross-Border Project Risk Governance and Financial Compliance: A Hierarchical Panel and Survival Analysis Approach Based on H Company's Overseas Projects. 2025. [Google Scholar] [CrossRef]

- Marcus, A.; Malen, J.; Ellis, S. The promise and pitfalls of venture capital as an asset class for clean energy investment: Research questions for organization and natural environment scholars. Organization & Environment 2013, 26(1), 31–60. [Google Scholar]

- Wang, J.; Xiao, Y. Research on Credit Risk Forecasting and Stress Testing for Consumer Finance Portfolios Based on Macroeconomic Scenarios. 2025. [Google Scholar] [CrossRef]

- Oprea, A. The use of principal component analysis (pca) in building yield curve scenarios and identifying relative-value trading opportunities on the romanian government bond market. Journal of Risk and Financial Management 2022, 15(6), 247. [Google Scholar] [CrossRef]

- Manjunatha, B.; Karthik, R.; Kiran, N. R.; Naik, A. P.; Damodhara, G. N.; Gunashekhar, H.; Mahendra, K. R. Theoretical Foundations and Application of Hidden Markov Models. Journal of Scientific Research and Reports 2024, 30(8), 837–849. [Google Scholar] [CrossRef]

- Lommers, K.; Harzli, O. E.; Kim, J. Confronting machine learning with financial research. arXiv preprint 2021, arXiv:2103.00366. [Google Scholar] [CrossRef]

- Abdollahi, H. Market volatility and new evidence from media sentiment: An AI-driven approach. 2024. [Google Scholar]

- Xiao, X.; Li, A.; Kchouri, B.; Shan, S. Tracing the dynamic impact of energy transitions on equity market volatility in an era of financial turbulence. Energy Economics 2024, 133, 107443. [Google Scholar] [CrossRef]

- Liu, Z. Stock volatility prediction using LightGBM based algorithm. In 2022 International Conference on Big Data, Information and Computer Network (BDICN); January, IEEE, 2022; pp. 283–286. [Google Scholar]

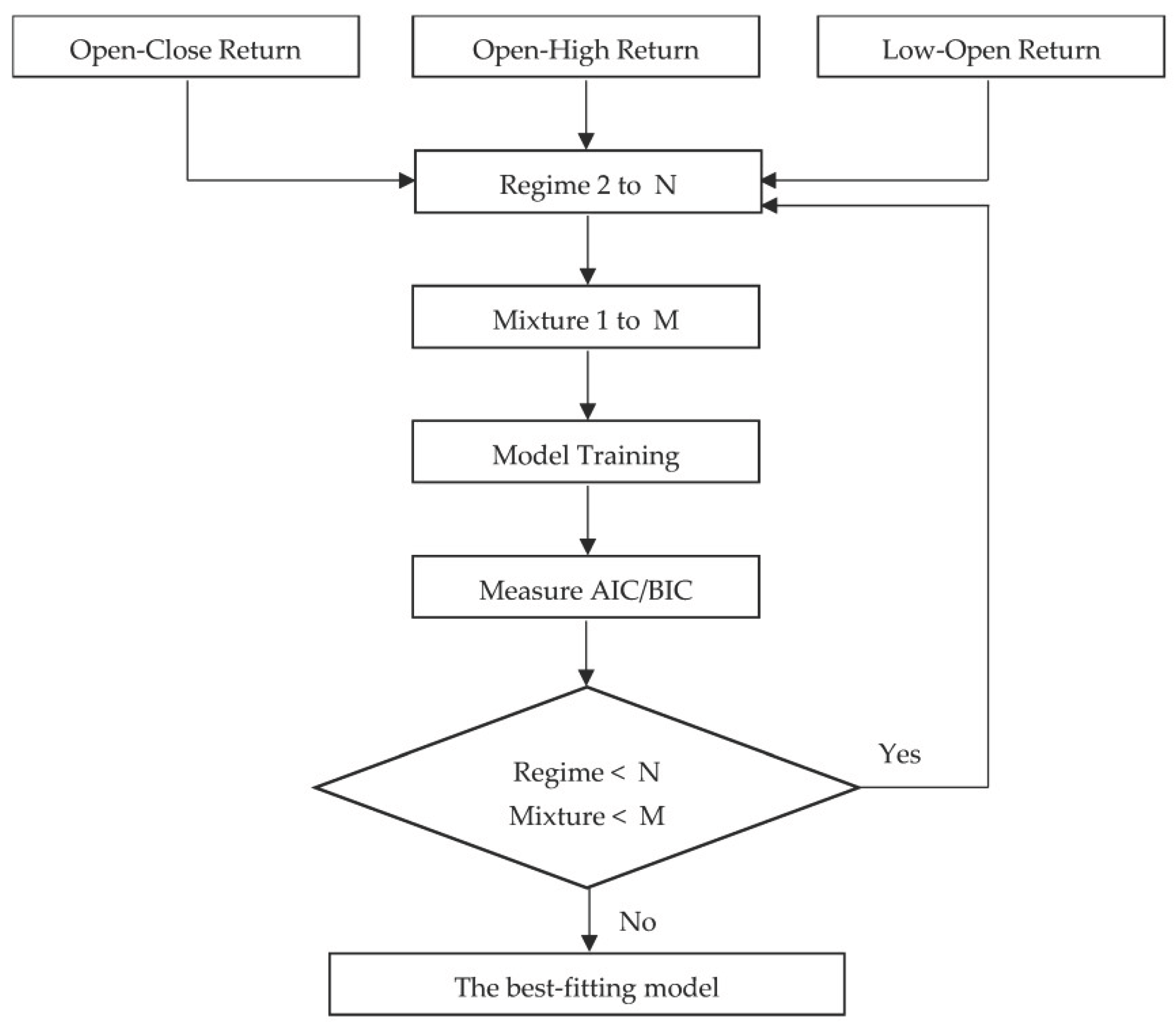

- Li, S. Momentum, volume and investor sentiment study for us technology sector stocks—A hidden markov model based principal component analysis. PLoS One 2025, 20(9), e0331658. [Google Scholar]

- Wu, C.; Zhu, J.; Yao, Y. Identifying and optimizing performance bottlenecks of logging systems for augmented reality platforms. 2025. [Google Scholar] [CrossRef]

- Oprea, A. The use of principal component analysis (pca) in building yield curve scenarios and identifying relative-value trading opportunities on the romanian government bond market. Journal of Risk and Financial Management 2022, 15(6), 247. [Google Scholar] [CrossRef]

- Wang, J.; Xiao, Y. Assessing the Spillover Effects of Marketing Promotions on Credit Risk in Consumer Finance: An Empirical Study Based on AB Testing and Causal Inference. 2025. [Google Scholar] [CrossRef]

- Yuan, M.; Wang, B.; Su, S.; Qin, W. Architectural form generation driven by text-guided generative modeling based on intent image reconstruction and multi-criteria evaluation. In Authorea Preprints; 2025. [Google Scholar]

- Hu, W. Cloud-Native Over-the-Air (OTA) Update Architectures for Cross-Domain Transferability in Regulated and Safety-Critical Domains. In 2025 6th International Conference on Information Science, Parallel and Distributed Systems; September, 2025. [Google Scholar]

- Bazzi, M.; Blasques, F.; Koopman, S. J.; Lucas, A. Time-varying transition probabilities for Markov regime switching models. Journal of Time Series Analysis 2017, 38(3), 458–478. [Google Scholar] [CrossRef]

- Zhu, W.; Yao, Y.; Yang, J. Real-Time Risk Control Effects of Digital Compliance Dashboards: An Empirical Study Across Multiple Enterprises Using Process Mining, Anomaly Detection, and Interrupt Time Series. 2025. [Google Scholar] [CrossRef]

- Fang, J.; Hao, W.; Wongchoti, U. Time-series momentum in individual stocks: is it there and where to look? Applied Economics 2022, 54(18), 2048–2066. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).