Abstract. The volatility of global energy markets, particularly electricity prices, plays a crucial role in influencing international economic activities. With the ongoing global energy transition and the push for low-carbon development, predicting electricity prices has become increasingly important for policymakers and market participants. This paper explores the forecasting capabilities of the ARIMA and LSTM models in analyzing electricity prices in the United States, drawing from data spanning 2001 to 2024.ARIMA, a traditional time series model, is valued for its simplicity and effectiveness in capturing linear trends, while LSTM, a deep learning-based model, excels at handling long-term dependencies in complex datasets. This study reveals that while both models offer valuable insights, each exhibits limitations. ARIMA struggles with non-linear patterns and volatility, whereas LSTM tends to underestimate extreme price values. The findings highlight the potential of hybrid models that combine traditional and machine learning approaches to enhance forecasting accuracy in the increasingly dynamic energy market. This research provides essential guidance for improving decision-making processes in the context of the global shift towards clean energy.

1. Introduction

The volatility of the global energy market has always been a crucial factor influencing international economic activities. In the context of accelerating global energy transformation and low-carbon development, the impact of electricity price fluctuations on the global economic system has become increasingly prominent. As a vital component of the international economy, changes in electricity prices not only affect the economic structures of energy-producing and consuming countries but also exert significant influence on the functioning of major economies worldwide through commodity markets, financial markets, and global supply chains.

Electricity price fluctuations are closely tied to various factors, including the global economic cycle, financial market fluctuations, exchange rate variations, monetary policies, international trade relations, and geopolitical events. Since 2000, electricity prices have experienced several notable fluctuations, influenced by factors such as economic crises and shifts in energy demand.

Simultaneously, the global energy landscape is undergoing profound changes due to the pursuit of low-carbon development goals. The rapid growth of renewable energy sources and improvements in energy efficiency are gradually reducing reliance on fossil fuels, thereby impacting traditional energy markets. Many economies worldwide have set ambitious carbon neutrality targets under the Paris Agreement framework, driving investment growth in clean energy while introducing significant uncertainty in the fossil fuel market, further exacerbating electricity price volatility.

The advent of Generative AI is set to revolutionize the way we predict electricity prices. These AI algorithms have the ability to generate data that is similar to the data they are trained on, enabling them to predict future trends based on past patterns. They can simulate various scenarios and outcomes, offering a more comprehensive understanding of potential electricity price fluctuations. Generative AI has the potential to manage the complexity and unpredictability of the global energy market. Unlike traditional models, generative AI can learn and adapt to new information, making it more efficient and accurate in predicting future electricity prices. As a result, these models can aid in better understanding the risk and uncertainty associated with electricity price volatility.

In this context, accurately predicting electricity prices has become an urgent challenge for policymakers and participants in financial markets. Traditional forecasting methods have typically relied on the analysis of macroeconomic indicators and supply-demand fundamentals. However, as data scales expand and market environments become increasingly complex, the limitations of traditional methods are becoming more apparent. This paper delves into the performance of the ARIMA model and LSTM model for forecasting electricity prices, evaluates its applicability in energy market analysis, and presents new analytical approaches and tools to address the complexities of the electricity market in the era of low-carbon development.

2. Literature Review

In the electricity market, accurate forecasting of electricity price is of great significance to the operation of power system and the decision-making of market participants. In recent years, many scholars have adopted different methods to forecast short-term electricity price. This paper summarizes some short-term electricity price forecasting methods based on time series and machine learning model.

In terms of time series model, Traditional time series models, such as ARIMA and its variants, are widely used in electricity price forecasting because of their simplicity and effectiveness. Pan Yurong and Jia Chaoyong made short-term electricity price forecast based on seasonal ARIMA model, showing good forecasting accuracy [

1]. Zhang Yihong et al. also adopted the autoregressive integral moving average model to forecast the day-ahead electricity price [

2]. In addition, ARIMA-GARCH combined with wave model and ARIMAX model combined with wavelet transform also show the potential to improve the prediction accuracy [

3,

4].

In terms of machine learning model, In recent years, the application of deep learning technology in electricity price forecasting has gradually increased. Guo Xueli et al. proposed a method based on improved VMD, PSO and CNN-LSTM, which showed high prediction accuracy and generalization ability [

5]. Zhu Xiaojing and Xue Ruimeng used wavelet transform and Bi-LSTM-TCN model to forecast short-term electricity price, which further improved the forecasting effect of the model [

6].

In terms of mixed model, The mixed model combining multiple methods shows advantages in improving the prediction accuracy and stability. In addition, the model using a combination of various algorithms, such as the combined model of LSTM and XGBoost and the LSTM method of variational modal decomposition and Adam optimization, also proved its effectiveness in electricity price forecasting [

7,

8].

To sum up, both traditional time series analysis methods, modern machine learning techniques, or mixed models formed by combining these methods have shown their respective advantages and potentials in short-term electricity price forecasting. Future research can further explore the adaptability and robustness of these models under different market conditions, and how to combine various models and algorithms more effectively to improve the accuracy of forecasting.

3. Data and Model Analysis

3.1. Data Introduction

This comprehensive dataset offers a detailed look at the United States electricity market, providing valuable insights into prices, sales, and revenue across various states, sectors, and years. With data spanning from 2001 onwards to 2024, this dataset is a powerful tool for analyzing the complex dynamics of the US electricity market and understanding how it has evolved over time.

This file contains monthly data on electricity prices, sales, and revenue in the United States, disaggregated by state and sector (residential, commercial, industrial, and other) from 2001 onwards. The dataset includes variables such as the average price per kilowatt-hour (kWh), total revenue, total sales, and the number of customers (where available). This granular data allows for in-depth analysis of the US electricity market, enabling users to compare trends across states, sectors, and time periods, and to investigate the relationships between prices, sales, and revenue.

3.2. Model Introduction of ARIMA

In the realm of time series forecasting, this paper employs the ARIMA (AutoRegressive Integrated Moving Average) model to predict electricity prices in the United States. The ARIMA model is a popular statistical approach for analyzing and forecasting time series data, particularly when the data exhibit patterns over time. It combines three key components: autoregression (AR), differencing (I), and moving averages (MA), allowing it to capture both the temporal dependencies and trends present in the data.

The autoregressive component utilizes past values of the series to predict future values, while the integrated part involves differencing the series to achieve stationarity—an essential requirement for effective modeling. The moving average component addresses the noise in the data by considering past forecast errors. Together, these components enable the ARIMA model to adapt to various patterns in the electricity price series.

The model selection process involves determining the optimal parameters for the AR and MA components, often achieved through techniques like the Akaike Information Criterion (AIC) or Bayesian Information Criterion (BIC). After fitting the ARIMA model to the electricity price data, the model forecasts future prices by leveraging the identified patterns.

In this paper, we detail the performance of the ARIMA model in predicting U.S. electricity prices over the coming days. By comparing the forecasted values with actual prices, we evaluate the model’s accuracy and effectiveness. Additionally, we discuss the strengths of the ARIMA model in handling time series data, including its interpretability and ease of use, alongside its limitations, such as the requirement for stationarity and sensitivity to outliers. The results provide valuable insights into future trends in U.S. electricity prices and offer essential data support for stakeholders in the energy market when making informed investment decisions.

3.3. Model Introduction of LSTM

In the aspect of model selection, this paper uses the LSTM (long-term and short-term memory network) model to predict the time series of electricity prices in the United States. The LSTM model is a special recurrent neural network (RNN) that can effectively capture long-term dependencies in time series by introducing a Memory Cell. Traditional RNNs are prone to issues like gradient vanishing or gradient explosion when processing long series data, making it difficult for the model to retain earlier information. LSTM addresses these challenges through the mechanisms of the "forget gate," "input gate," and "output gate" within its internal structure, enabling it to perform well when handling long-term dependent data.

Based on the trained LSTM model, this paper forecasts electricity prices in the U.S. over the next few days. By comparing the predicted values with actual data, this paper evaluates the model’s prediction accuracy in detail and discusses the advantages and limitations of the LSTM model in dealing with the complex fluctuations of electricity prices. Moreover, the forecasting results presented in this paper not only provide valuable insights into the future trends of U.S. electricity prices but also offer data support for market participants when making energy-related investment decisions.

4. ARIMA Model Analysis

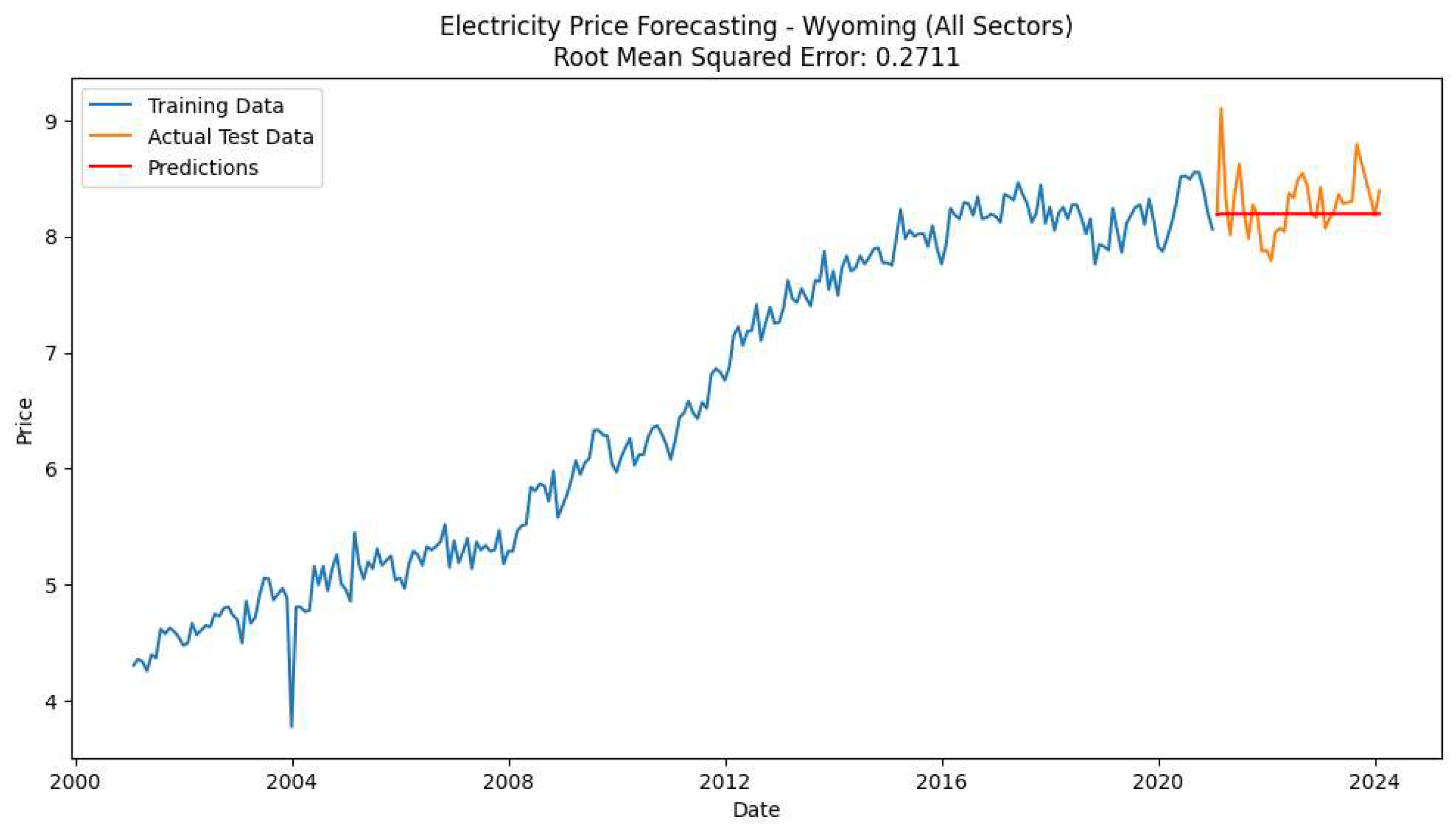

This paper extracts the data from 2001 to 2024, resamples the electricity price data on a monthly basis, and generates a time series of monthly average electricity prices. Furthermore,

Figure 1 illustrates this time series to show the long-term trend and fluctuations of electricity prices in the United States during this time period.

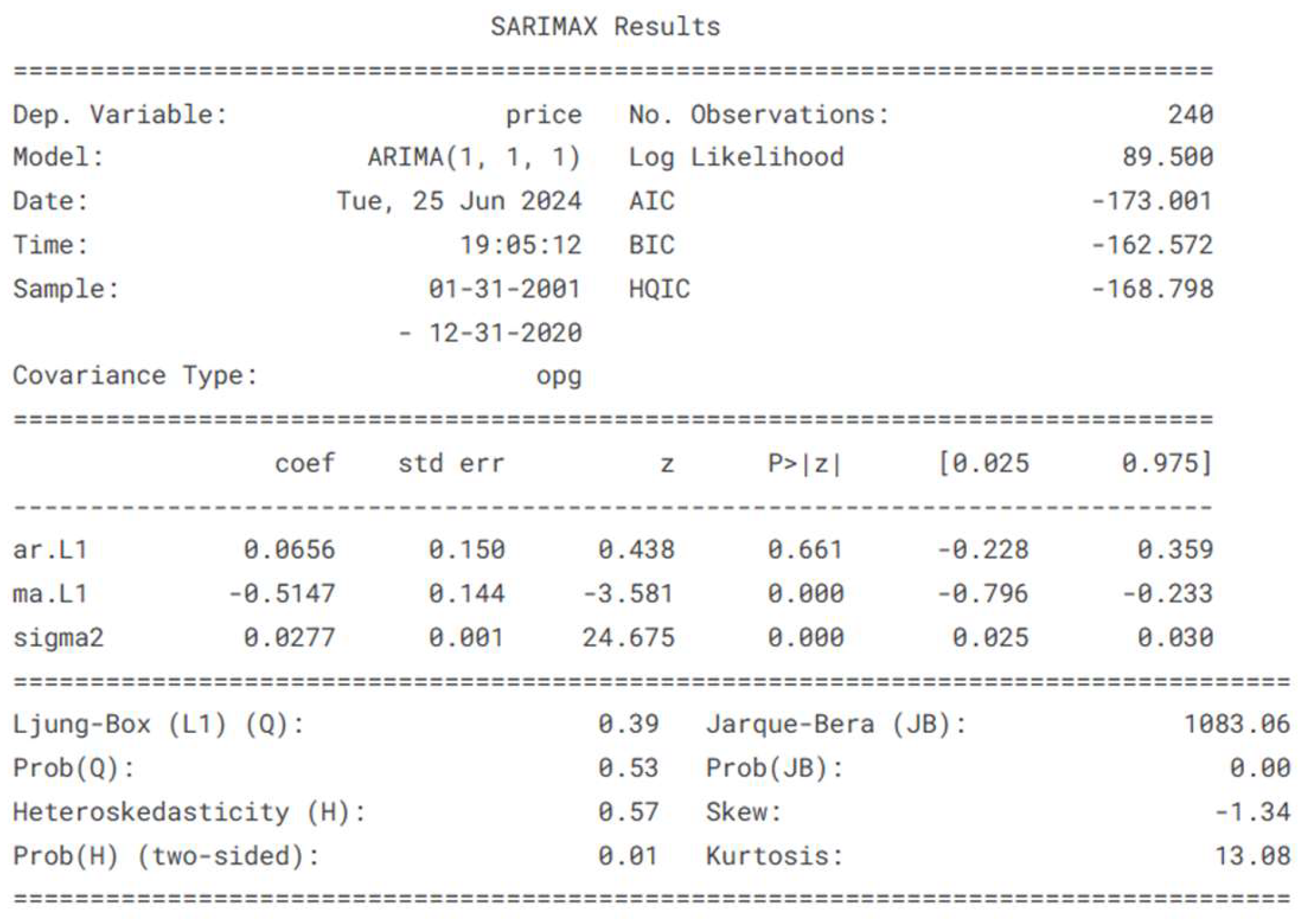

The SARIMAX model results indicate that the ARIMA(1, 1, 1) model was applied to predict electricity prices, utilizing a dataset of 240 observations from January 2001 to December 2020. The model produced an Akaike Information Criterion (AIC) of -173.001, suggesting a relatively good fit.

Figure 2.

ARIMA Model Results.

Figure 2.

ARIMA Model Results.

Among the coefficients, the moving average component (MA(1)) was statistically significant with a coefficient of -0.5147 and a p-value of 0.000, indicating its strong influence on the model. In contrast, the autoregressive component (AR(1)) was not statistically significant, with a p-value of 0.661. The variance estimate (σ²) was significant, reinforcing the model’s ability to capture fluctuations in electricity prices.

Diagnostic tests showed no autocorrelation in the residuals, as indicated by the Ljung-Box Q statistic. However, the model exhibited non-normality and heteroskedasticity, as evidenced by the Jarque-Bera and heteroskedasticity tests. These findings suggest that while the model captures key dynamics in electricity prices, further refinements may be necessary to address the issues of non-normality and heteroskedasticity.

5. LSTM Model Analysis

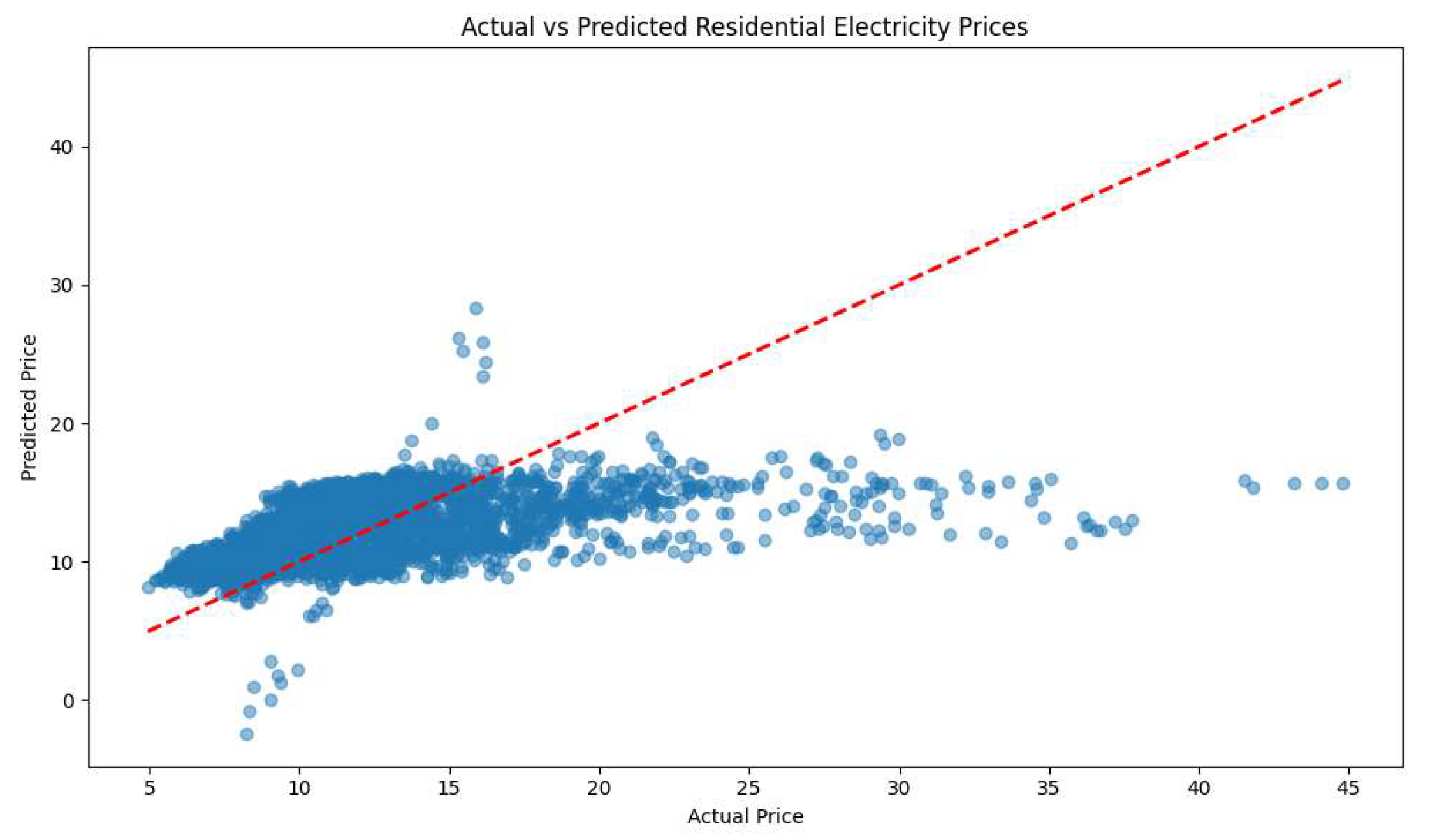

In this experiment, the LSTM model is used to predict the residential electricity price in the United States. The results show that the model shows a significant underestimation tendency in the high price range, especially when the actual price exceeds 15, the predicted value is mostly below 20. For the lower price range (between 5 and 15), the prediction of the model is concentrated, but there are still some deviations from the ideal 45-degree reference line. This shows that the model has errors in the overall forecast, especially in the case of higher prices, and fails to accurately capture the changing trend of actual prices.

Figure 3.

LSTM Model Predicted results.

Figure 3.

LSTM Model Predicted results.

This phenomenon may be due to the under-fitting of the model, especially in the high price range, LSTM failed to identify the complex patterns in the data. In addition, the uneven distribution of training data may be another reason, especially in the higher price range, the number of data samples may be insufficient, which leads to the poor generalization ability of the model. In addition, the lack of feature selection or data preprocessing may further limit the model’s ability to capture key patterns.

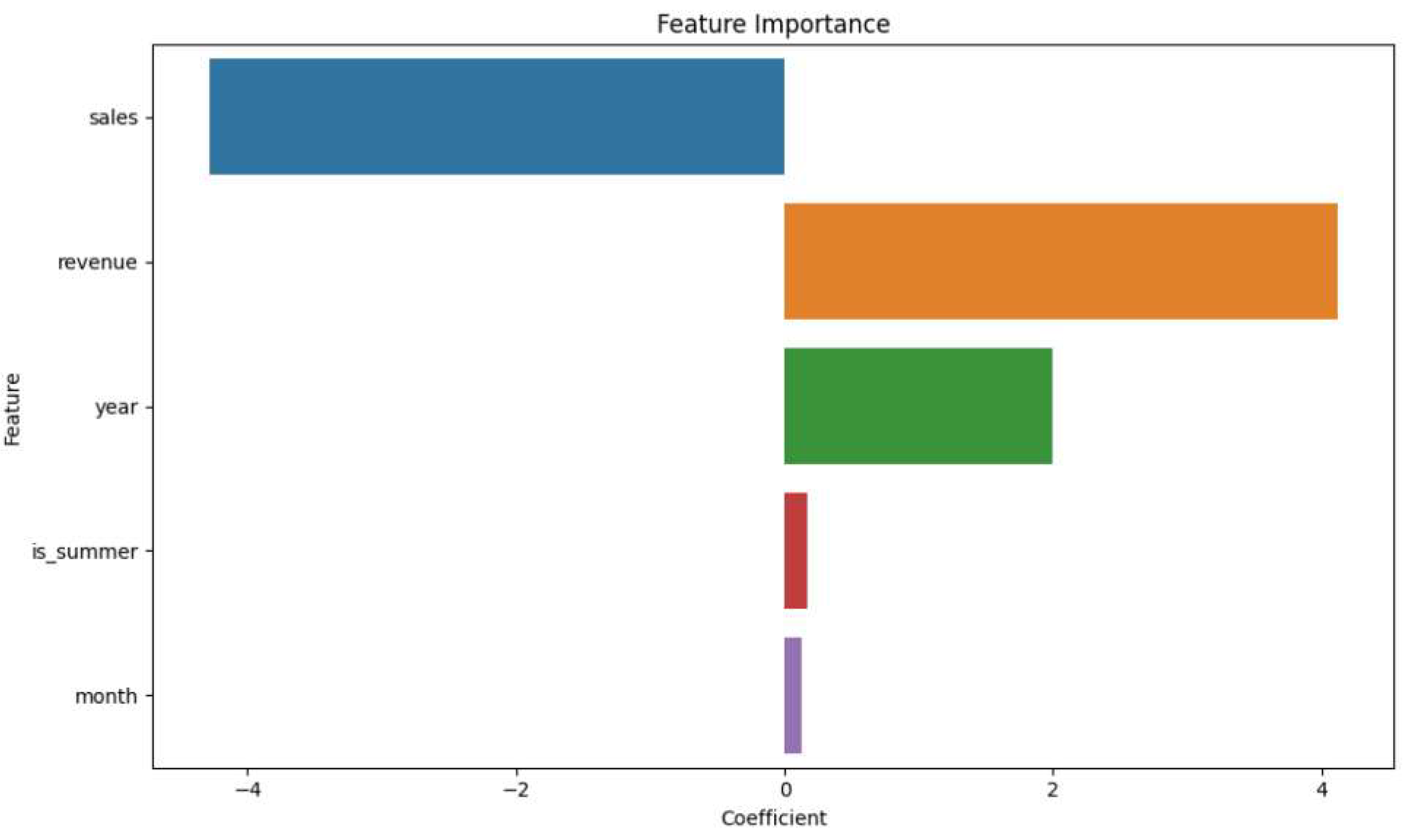

Figure 4 shows the importance of each feature in the model for forecasting electricity price, that is, the regression coefficient of each feature. The Sales feature has a significant negative coefficient, indicating that the sales volume has a strong negative impact on the electricity price. With the increase of sales volume, the predicted electricity price decreases, which may reflect economies of scale or other market factors related to sales volume.

Revenue feature shows a positive coefficient, indicating that the higher the income, the higher the electricity price. This may indicate that the increase of income is related to the change of market demand, which in turn affects the price.The Year feature also has a positive impact, which means that with the increase of the year, the electricity price shows an upward trend. This may be due to inflation, policy changes or rising energy costs year by year.The characteristics of Is_summer and Month have little influence on the price, and the coefficient is close to zero, indicating that seasonal changes and months have no significant effect on the forecasted electricity price.

It can be seen from the characteristic importance diagram that sales volume and income play a key role in the forecast of electricity price. The increase in sales leads to the decline in prices, while the increase in income pushes the price up. The characteristics of year show that the price of electricity increases gradually with time, while seasonal factors and months have little influence on the price.

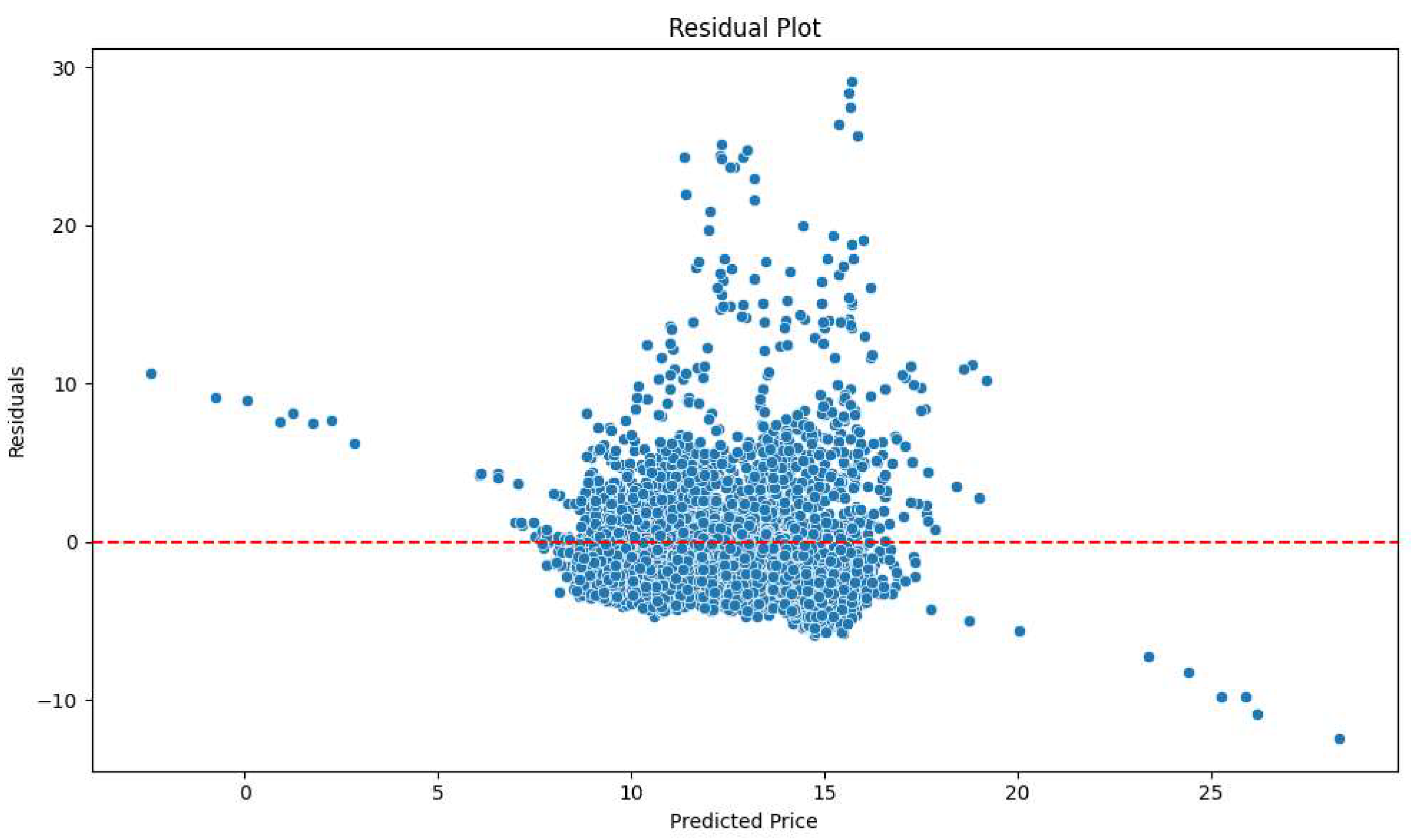

Figure 5 shows the residual distribution of the power price predicted by the model. Most of the residuals are concentrated in the range of 10 to 15, and are symmetrically distributed around the 0-line, which shows that the prediction of the model in this price range is more accurate and the error is smaller. In the range of higher forecast price, the fluctuation of residual is obviously increased. Especially when the predicted price exceeds 20, the error of the model becomes more significant, which shows that the positive residual increases, which means that the model underestimates the high price. In the area where the predicted price is close to 0, the residual error shows obvious negative deviation, which means that the model predicts the lower price on the high side.

The residual diagram reveals that the model performs well in the middle price range (10 to 15), but there are obvious errors in the areas with low predicted value and high predicted value. For the prediction of high price, the model underestimates the actual price, while for the prediction of low price, the model overestimates the actual price.

6. Conclusions

The research conducted in this paper highlights the significant complexities and volatility associated with electricity price forecasting, accentuated by the ongoing shifts towards low-carbon development and the increasing penetration of renewable energy sources. The analysis of various forecasting models, including the traditional ARIMA model and the more contemporary LSTM model, underscores the evolving landscape of energy market analysis.

The ARIMA model, with its emphasis on autoregression, moving averages, and differencing, has demonstrated a commendable ability to capture and predict trends in electricity prices based on historical data. However, its limitations are evident in scenarios where market conditions are highly volatile or when the data exhibit non-linear characteristics. The necessity for stationarity and its sensitivity to outliers can restrict the ARIMA model’s applicability under dynamic market conditions, as seen in the statistical challenges of non-normality and heteroskedasticity revealed in the model diagnostics.

On the other hand, the LSTM model, designed to overcome the shortcomings of traditional RNNs by effectively managing long-term dependencies, shows promise in handling the complex patterns observed in electricity prices. Nonetheless, this model’s tendency to underestimate high price ranges indicates potential issues with underfitting and the challenge of managing disparate data distributions. The need for extensive data preprocessing and feature selection to enhance the model’s performance is evident, as is the necessity for a robust training dataset that adequately represents all price levels.

Both models’ analyses reveal critical insights into the necessity for hybrid approaches that combine the strengths of traditional time series analysis with advanced machine learning techniques. By leveraging the simplicity and interpretability of models like ARIMA with the robust data handling and pattern recognition capabilities of LSTM, forecasters can potentially achieve more accurate and generalizable results.

Future research should focus on refining these models through the integration of additional predictive variables and alternative machine learning algorithms that can adapt to the fast-evolving energy markets. Exploring the synergies between different model architectures may also yield substantial improvements in forecasting accuracy.

In conclusion, while significant strides have been made in electricity price forecasting, the journey towards developing a universally robust predictive model continues. The transition to low-carbon economies, the fluctuating nature of global energy markets, and technological advancements in data analysis and model training are set to play pivotal roles in shaping future research directions in this vital field.

7. Future Research Direction

In addition to the ARIMA and LSTM models, Generative Adversarial Networks (GANs) and scenario generation strategies can also be used to improve electricity price forecasting.

In the field of artificial intelligence, GANs have emerged as a promising tool for data generation, particularly in situations where data scarcity can limit the applicability of existing models. GANs consist of two competing neural networks - a generator and a discriminator - that work in tandem to produce data that mimic the distribution of the original dataset. The generator creates synthetic data points, and the discriminator evaluates these points based on their similarity to the real data. Through this adversarial process, the generator improves its ability to produce realistic data.

This concept can be extended to the realm of energy price forecasting by using GANs to generate synthetic energy market price data. The generated data can be used to augment the existing dataset, thereby enhancing the robustness and predictive ability of the forecasting model. This approach is especially useful in situations where historical price data may not adequately capture future market dynamics due to significant changes in influencing factors such as renewable energy penetration, policy changes, or technological advancements.

In addition to GANs, scenario generation strategies can also be employed to improve electricity price prediction. By using generative AI algorithms to create different market scenarios, we can analyze their impact on energy price volatility and financial risk. These scenarios could encompass a wide array of factors, such as varying levels of renewable energy penetration, changes in energy policy, or fluctuations in fossil fuel prices. By analyzing the effect of these scenarios on electricity prices, we can gain a more comprehensive understanding of potential price fluctuations and develop more robust risk management strategies.

Moreover, a risk assessment model can be developed based on generative models to simulate price trends under different market conditions. By evaluating the impacts of these price trends on financial risk management, stakeholders can make more informed decisions regarding their investments in the energy market.

Furthermore, the integration of time series generation models, such as LSTM or Transformer, can aid in generating more accurate energy price forecasts. By considering the influence of external variables and using these models to generate time series data, we can capture more complex patterns in the data and enhance the forecasting model’s accuracy.

In conclusion, while ARIMA and LSTM models offer valuable insights into electricity price forecasting, the integration of advanced techniques such as GANs, scenario generation strategies, and time series generation models can provide a more comprehensive and robust approach to predicting future energy prices. The adoption of these methods could potentially revolutionize electricity price forecasting, offering a more accurate and versatile tool to navigate the complexities of the global energy market.

References

- Pan Yurong, Jia Chaoyong. Short-term electricity price forecast based on seasonal ARIMA model [J]. Journal of baicheng normal University, 2018,32(12):18-24.

- Zhang yihong, Zhu Guorong, Cai yongzi, et al. day-ahead electricity price forecasting based on autoregressive integral moving average model [J]. automation technology and application, 2020,39(01):125-129+139.

- Liu Yan, Xing Wei, Ding Lequn, et al. Spot electricity price forecast based on ARIMA-GARCH model [J]. Energy Technology and Economy, 2012,24(02):59-63.

- Dang Yazheng, Xu Tengfei, Gao Yan. Short-term load forecasting based on Haar wavelet and ARIMAX model [J]. Journal of Shanghai University of Technology, 2019,41(01):64-70.

- Guo Xueli, Hua Dapeng, Bao Pengyu, et al. A short-term electricity price forecasting method based on improved VMD-PSO-CNN-LSTM [J]. Journal of Electric Power Science and Technology, 2024,39(02):35-43.

- Zhu Xiaojing, Xue Ruimeng. Bi-LSTM-TCN short-term electricity price forecast based on wavelet transform [J]. advanced technology of electrical engineering and energy, 2023,42(12):60-68.

- Hong Zheng, Liu Liqun. Electricity price forecasting based on the combined model of LSTM and XGBoost [J]. Journal of Taiyuan University of Science and Technology, 2023,44(02):131-136.

- Ma Liying, Wei Yunbing. An LSTM electricity price forecasting method based on variational modal decomposition and Adam optimization [J]. Intelligent Computer and Application, 2022,12(12):142-146+152.

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).