Submitted:

21 October 2025

Posted:

22 October 2025

You are already at the latest version

Abstract

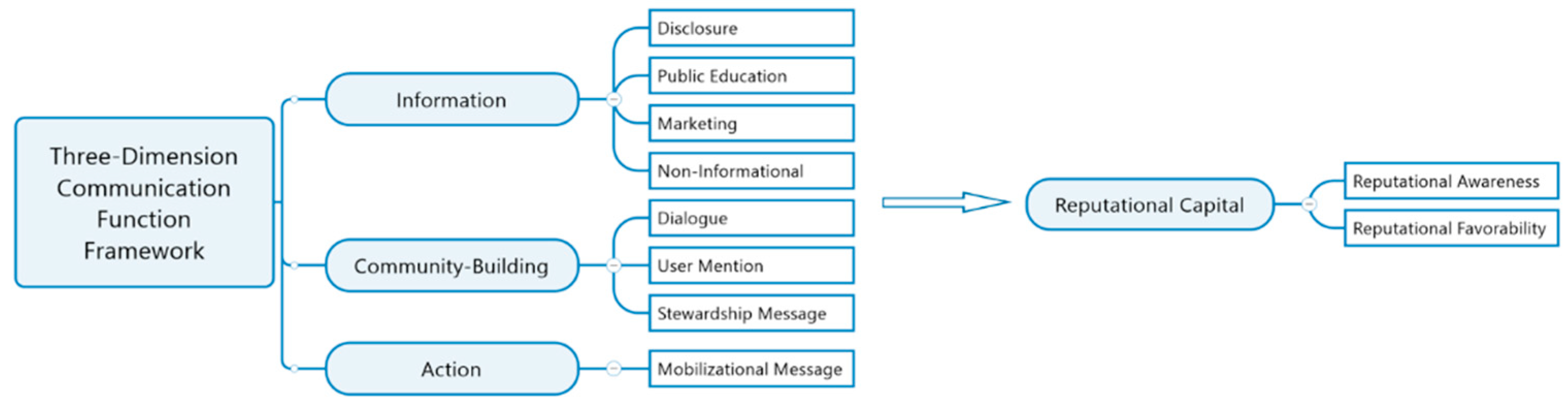

Analyzing 2,309,573 tweets by S&P 500 firms along with 2,498,767 public replies, we examine how firms’ ESG communication tactics on social media influence the micro-level accumulation of reputational capital. Leveraging prior communication literature, we categorize firms’ ESG messages based on three primary communication functions: Information, Community-Building, and Action. Information-based tactics unidirectionally disseminate knowledge but do not directly engage stakeholders; Community-building tactics foster engagement and relationship-building; Action-based tactics seek to mobilize stakeholders to take direct action. Our results indicate that information-focused ESG messages drive reputational awareness, whereas community-building tactics influence reputational favorability. Additional analyses reveal different audience response patterns between ESG-specific and general corporate messaging as well as between B2C and B2B firms. This study provides evidence of new, non-reporting-based ESG communication tactics and illustrates how firms accumulate reputational capital on a micro, message-by-message, day-to-day level. Our findings offer insights into the strategic use of ESG communication to enhance corporate reputation.

Keywords:

1. Introduction

2. ESG Communication and Corporate Reputation

2.1. ESG and Reputational Capital

2.1.1. Two Dimensions of Reputational Capital: Reputational Awareness and Favorability

2.2. ESG Communication on Social Media to Gain Reputational Capital

3. Method

3.1. Sample and Data

3.2. Dependent Variables: Reputational Awareness and Favorability

3.3. Independent Variables: Communicative Tactics

3.4. Control Variables

4. Results

4.1. Descriptive Analyses

4.1.1. Control Variables

4.1.2. Dependent Variables

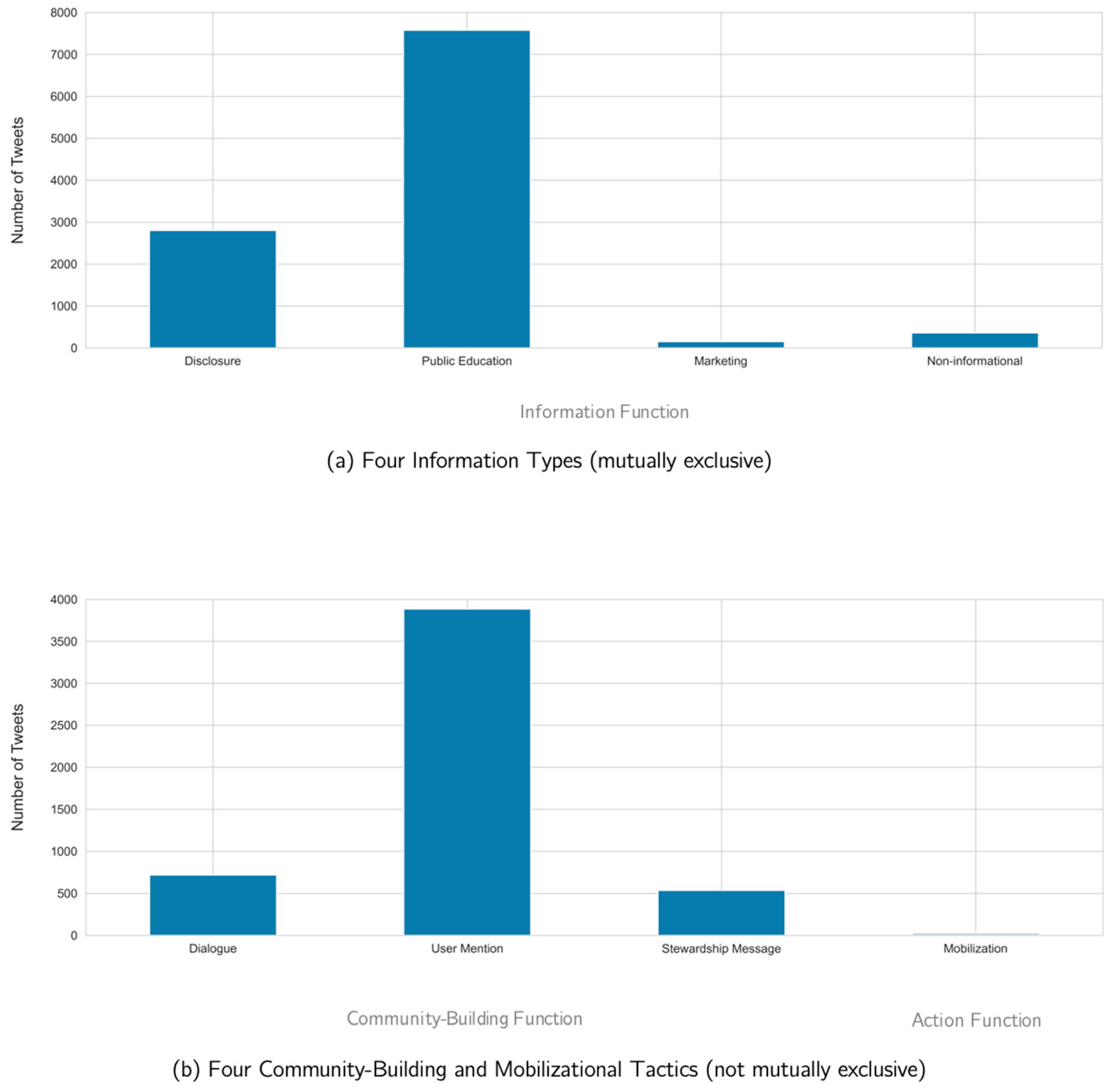

4.1.3. RQ1: Eight Communicative Tactics

#deliveringsmiles

#deliveringsmiles

4.2. Tests of RQ2

4.3. RQ3: Testing Interactions with Disclosure

4.4. Additional Analyses

4.4.1. Generalizability to All S&P 500 Tweets

4.4.2. B2C vs. B2B Firms

4.5. Robustness Tests

5. Discussion and Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A. Variable Definitions

| Variable | Description |

|

Dependent Variables REPUTATIONAL AWARENESS Retweet Count |

The number of retweets each firm tweet received |

|

REPUTATIONAL FAVORABILITY Positive Replies |

The number of positive replies each firm tweet received |

|

Independent Variables INFORMATION |

Tweet coded as containing a disclosure, public education, or marketing tactic (0,1) |

| Disclosure | Tweet discloses information on firm’s ESG activities (0,1) |

| Public Education | Tweet contains information intended to educate public on ESG-related issue (0,1) |

| Marketing | Tweet contains information marketing the company’s products or services (0,1) |

| Non-Informational | Tweet conveys no information (0,1) |

| COMMUNITY-BUILDING | Tweet contains dialogue and/or mobilization tactic (0,1) |

| Dialogue | Tweet contains a dialogic tactic – asking a question, responding to public query, engaging in tweetchat (0,1) |

| User Mention | Tweet contains a mention of another user (0,1) |

| Stewardship Message | Tweet conveys a message thanking or congratulating another Twitter user (0,1) |

| ACTION | |

| Mobilizational Message | Tweet contains a mobilizational tactic – asking audience members to, for instance, vote or retweet message (0,1) |

|

Control Variables ACCOUNT-LEVEL Followers |

Number of followers of the firm’s Twitter account |

| Time on Twitter | Number of days firm has managed Twitter account (as of 1/1/2020) |

| Prior Statuses Count | Cumulative number of tweets sent by firm’s Twitter account (as of 1/1/2020) |

|

FIRM-LEVEL Size |

Logged Total Assets (Compustat) |

| Sales | Logged sales (Compustat) |

| ESG Risk | Morningstar Sustainalytics’ [66] overall ESG risk score, determined by assessing a company's exposure to material ESG risks and its effectiveness in managing them. |

| 1 | This is closely in line with Fombrun and Van Riel’s [67] preferred definition: “A corporate reputation is a collective representation of a firm’s past actions and results that describes the firm’s ability to deliver valued outcomes to multiple stakeholders. It gauges a firm’s relative standing both internally with employees and externally with its stakeholders…” (p. 10). The authors also provide an exhaustive review of alternative definitions. |

| 2 | The accounting and management literature have long established precedent for using non-monetary proxies to measure intangible constructs like reputation. For example, Raithel and Schwaiger [68] demonstrate that nonfinancial aspects such as product quality, workplace environment, and social responsibility contribute to measuring reputation. Similarly, survey-based rankings such as the Fortune Most Admired Companies index have been extensively used in reputation research [69]. Media sentiment [70,71] has also been used to proxy for corporate reputation. |

| 3 | Retweets have been used to capture a variety of different concepts in the literature, with some research focusing on how retweets reflect qualities of the message, such as its pass-along value [33] or validity [35], and others focusing on the outcomes of retweeting, particularly how retweets increase the dissemination [36] or diffusion of the message to a wider audience [20]. While both are valid uses of retweets, the latter is a more “direct” measure and is in line with our use of the retweet measure. At their core, retweets serve to boost dissemination by “expanding the number of people who receive a given message” ([20], p. 363). and are thus tightly linked to the notion of awareness. |

| 4 | The coding of the replies is important for another reason: like retweets, replies are linked to specific firm tweets, allowing the analyses to remain consistently focused on individual firm messages. Social media thus afford a unique opportunity for message-level analyses that examine the flow of both the awareness and favorability dimensions of CSR-driven reputational capital. This point is worth expanding on. It is only possible to develop and “see” reputational change by linking specific organizational actions to specific audience reactions. By focusing on the message level of analyses, we can generate insights into how specific individual messages engender specific reputational responses from members of the public. |

| 5 | This approach follows established accounting research on the measurement of intangible assets, where constructs like reputation are often captured using observable stakeholder responses (e.g., [2,35]). In this view, social media metrics act as empirical proxies for stakeholder perceptions that contribute to the development of reputational capital. |

| 6 | |

| 7 | Two co-authors hand-coded all hashtags that were employed in 100 or more firm tweets and identified 133 relevant hashtags considered to focus on CSR, sustainability, and ESG topics, such as #ESG, which was used in 3,105 tweets, and #Sustainability, which was used in 2,686 tweets. Our main sample comprises the 10,851 firm tweets that employed one or more of the 133 CSR/sustainability/ESG-focused hashtags. |

| 8 | Our sentiment analysis process involved three human coders classifying 1,000 randomly selected replies as negative, neutral, or positive using a standardized coding scheme. Of these coded tweets, 71% achieved complete agreement across all three coders, 30% had two of three coders agree, and less than 1% showed complete disagreement. Each tweet’s final classification was determined by a majority vote weighted by coder confidence based on past performance. While positive replies are relatively infrequent (6.9% of tweets receive at least one positive reply), this aligns with previous findings on sentiment distribution in corporate social media communications (e.g., [5]) and suggests that achieving positive stakeholder sentiment represents a meaningful distinction between communication tactics. |

| 9 | To verify that our metrics capture genuine public engagement rather than merely organizational networking, we conducted a systematic analysis of the accounts interacting with firms’ ESG messages. Examining a random sample of 100 tweets that received retweets or replies, we classified users as either personal or organizational based on profile descriptions, images, and posting patterns. This analysis revealed that 88% of accounts engaging with ESG messages were personal/individual accounts, while only 12% were organizational or official accounts. This predominance of individual engagement supports our interpretation of these interactions as meaningful indicators of stakeholder awareness and favorability rather than artifacts of business-to-business networking or automated engagement. |

| 10 | Our inductive insights were developed by also looking at the 42 ESG-focused Twitter accounts of the 200 largest firms in the Fortune 500 index in 2014. We identified ESG-focused accounts via a qualitative assessment of each of the 200 firms’ Twitter accounts. The account purpose is generally clearly stated in each account’s profile. For example, for GE’s ESG account, @gehealthy, the profile description is “Healthymagination is GE’s innovation catalyst for solving major global health challenges, advancing brain health, enabling healthy cities and more.” Typically, these specialized “CSR/sustainability/ESG” accounts supplement a “general” company account, such as (in GE’s case) @generalelectric. |

| 11 | This third-party ESG performance metric provides an independent assessment of each firm’s exposure to material ESG risks and its effectiveness in managing them. By controlling for this measure of actual ESG performance, we can better isolate the effects of communication tactics from underlying ESG activities. |

| 12 | Public education and disclosure constitute two distinct one-way informational tactics. Anything that is informational but reports on the firm’s ESG activities is classified as Disclosure; Public Education messages, in contrast, contain information (including facts, educational material, inspirational messages, etc.) on ESG-related topics that does not relate to the firm’s activities. Public education tactics seem to be a new way of building a positive reputation; similar to related findings that audiences may be built on social media by adopting a niche “expertise” role [72], focused public education efforts may help foster a large network of positively affected followers, thereby enhancing both the awareness and favorability dimensions of reputation. |

| 13 | The above tweet is an example of a message that contains two tactics: Disclosure, by reporting on the company’s charitable partnerships, and User Mention. As noted earlier, while the informational tactics (disclosure, public education, and marketing) are mutually exclusive, none of the community-building or action-oriented tactics are – multiple such tactics could occur in any one message. |

| 14 | Our independent variables’ variance inflation factors (VIFs) in these tests remain well below conventional thresholds (all under 3.5, compared to common cutoffs of 5 or 10), indicating that multicollinearity does not substantially affect our parameter estimates or statistical inferences. |

| 15 | Based on a review of SIC codes and revenue streams as in Srinivasan et al. [73], we classify 15% of the firms in our sample as B2C firms, 60.5% as B2B firms, and the remainder as a mix. |

References

- Lunawat, R. The Role of Information in Building Reputation in an Investment/Trust Fund. Eur. Account. Rev. 2013, 22, 513–532. [Google Scholar] [CrossRef]

- Lev, B.; Gu, F. The End of Accounting and the Path Forward for Investors and Managers; John Wiley & Sons, Inc.: Hoboken, NJ, 2016. [Google Scholar]

- Ivanov, A.; Sharman, R. Impact of User-Generated Internet Content on Hospital Reputational Dynamics. J. Manag. Inf. Syst. 2018, 35, 1277–1300. [Google Scholar] [CrossRef]

- Lodhia, S.; Stone, G. Integrated Reporting in an Internet and Social Media Communication Environment: Conceptual Insights. Aust. Account. Rev. 2017, 27, 17–33. [Google Scholar] [CrossRef]

- She, C.; Michelon, G. Managing Stakeholder Perceptions: Organized Hypocrisy in CSR Disclosures on Facebook. Crit. Perspect. Account. 2019, 61, 54–76. [Google Scholar] [CrossRef]

- Tang, Q.; Gu, B.; Whinston, A.B. Content Contribution for Revenue Sharing and Reputation in Social Media: A Dynamic Structural Model. J. Manag. Inf. Syst. 2012, 29, 41–76. [Google Scholar] [CrossRef]

- Castelló, I.; Etter, M.; Årup Nielsen, F. Strategies of Legitimacy through Social Media: The Networked Strategy. J. Manag. Stud. 2016, 53, 402–432. [Google Scholar] [CrossRef]

- Unerman, J.; Bennett, M. Increased Stakeholder Dialogue and the Internet: Towards Greater Corporate Accountability or Reinforcing Capitalist Hegemony? Accounting, Organ. Soc. 2004, 29, 685–707. [Google Scholar] [CrossRef]

- Lovejoy, K.; Saxton, G.D. Information, Community, and Action: How Nonprofit Organizations Use Social Media. J. Comput. Commun. 2012, 17, 337–353. [Google Scholar] [CrossRef]

- Bellucci, M.; Manetti, G. Facebook as a Tool for Supporting Dialogic Accounting? Evidence from Large Philanthropic Foundations in the United States. Accounting, Audit. Account. J. 2017, 30, 874–905. [Google Scholar] [CrossRef]

- King, K.K.; Wang, B.; Escobari, D.; Oraby, T. Dynamic Effects of Falsehoods and Corrections on Social Media: A Theoretical Modeling and Empirical Evidence. J. Manag. Inf. Syst. 2021, 38, 989–1010. [Google Scholar] [CrossRef]

- Michelon, G.; Rodrigue, M.; Trevisan, E. The Marketization of a Social Movement: Activists, Shareholders and CSR Disclosure. Accounting, Organ. Soc. 2020, 80, 101074. [Google Scholar] [CrossRef]

- Jiang, L.; Gu, Y.; Dai, J. Environmental, Social, and Governance Taxonomy Simplification: A Hybrid Text Mining Approach. J. Emerg. Technol. Account. 2023, 20, 305–325. [Google Scholar] [CrossRef]

- Bebbington, J.; Larrinaga, C.; Moneva, J.M. Legitimating Reputation/the Reputation of Legitimacy Theory. Accounting, Audit. Account. J. 2008, 21, 371–374. [Google Scholar] [CrossRef]

- Go, A.; Bhayani, R.; Huang, L. Twitter Sentiment Classification Using Distant Supervision. CS224N Proj. Report, Stanford 2009, 1–12.

- Wang, Y.Y.; Wang, T.; Yoon, K. A Methodology for the Sport Industry to Capture Public Perceptions and Responses in the Time of {COVID}-19. J. Emerg. Technol. Account. 2021, 18, 205–211. [Google Scholar] [CrossRef]

- Wang, Y.; Wang, T. Python Code and Illustrative Crisis Management Data from Twitter. J. Inf. Syst. 2022, 36, 211–217. [Google Scholar] [CrossRef]

- Lange, D.; Lee, P.; Dai, Y. Organizational Reputation: A Review. J. Manage. 2011, 37, 153–184. [Google Scholar] [CrossRef]

- Rindova, V.P.; Williamson, I.O.; Petkova, A.P.; Sever, J.M. Being Good or Being Known: An Empirical Examination of the Dimensions, Antecedents, and Consequences of Organizational Reputation. Acad. Manag. J. 2005, 48, 1033–1049. [Google Scholar] [CrossRef]

- Saxton, G.D.; Gomez, L.; Ngoh, Z.; Lin, Y.-P.; Dietrich, S. Do CSR Messages Resonate? Examining Public Reactions to Firms’ CSR Efforts on Social Media. J. Bus. Ethics 2019, 155, 359–377. [Google Scholar]

- Moser, D. V; Martin, P.R. A Broader Perspective on Corporate Social Responsibility Research in Accounting. Account. Rev. 2012, 87, 797–806. [Google Scholar] [CrossRef]

- Tsang, A.; Frost, T.; Cao, H. Environmental, Social, and Governance (ESG) Disclosure: A Literature Review. Br. Account. Rev. 2023, 55, 101149. [Google Scholar] [CrossRef]

- Patten, D.M. Seeking Legitimacy. Sustain. Accounting, Manag. Policy J. 2019, 11, 1009–1021. [Google Scholar] [CrossRef]

- Aguinis, H.; Glavas, A. What We Know and Don’t Know about Corporate Social Responsibility: A Review and Research Agenda. J. Manage. 2012, 38, 932–968. [Google Scholar] [CrossRef]

- Gödker, K.; Mertins, L. CSR Disclosure and Investor Behavior: A Proposed Framework and Research Agenda. Behav. Res. Account. 2018, 30, 37–53. [Google Scholar] [CrossRef]

- Bouten, L.; Hoozée, S. On the Interplay between Environmental Reporting and Management Accounting Change. Manag. Account. Res. 2013, 24, 333–348. [Google Scholar] [CrossRef]

- Fombrun, C.; Van Riel, C. The Reputational Landscape. Corp. Reput. Rev. 1998, 1, 5–13. [Google Scholar] [CrossRef]

- Cen, L.; Chen, F.; Hou, Y.; Richardson, G.D. Strategic Disclosures of Litigation Loss Contingencies When Customer-Supplier Relationships Are at Risk. Account. Rev. 2018, 93, 137–159. [Google Scholar] [CrossRef]

- Cook, J.; Kowalewski, Z.T.; Minnis, M.; Sutherland, A.; Zehms, K.M. Auditors Are Known by the Company They Keep. J. Account. Econ. 2020, 70, 101314. [Google Scholar] [CrossRef]

- Bigus, J.; Hua, K.P.M.; Raithel, S. Definitions and Measures of Corporate Reputation in Accounting and Management: Commonalities, Differences, and Future Research. Account. Bus. Res. 2024, 54, 304–336. [Google Scholar] [CrossRef]

- Fraustino, J.; Connolly-Ahern, C. Corporate Associations Written on the Wall: Publics’ Responses to Fortune 500 Ability and Social Responsibility Facebook Posts. J. Public Relations Res. 2015, 27, 452–474. [Google Scholar] [CrossRef]

- Gómez-Vásquez, L. Me Gusta o Te Sigo : Análisis de La Comunicación de Prácticas de Responsabilidad Social Corporativa a Través de Los Medios Sociales. Corresp. Análisis 2013, 3, 89–109. [Google Scholar] [CrossRef]

- Lee, K.; Oh, W.-Y.; Kim, N. Social Media for Socially Responsible Firms: Analysis of Fortune 500’s Twitter Profiles and Their CSR/CSIR Ratings. J. Bus. Ethics 2013, 118, 791–806. [Google Scholar] [CrossRef]

- Barnett, M.L.; Jermier, J.M.; Lafferty, B.A. Corporate Reputation: The Definitional Landscape. Corp. Reput. Rev. 2006, 9, 26–38. [Google Scholar] [CrossRef]

- Cade, N.L. Corporate Social Media: How Two-Way Disclosure Channels Influence Investors. Accounting, Organ. Soc. 2018, 68, 63–79. [Google Scholar] [CrossRef]

- Blankespoor, E.; Miller, G.S.; White, H.D. The Role of Dissemination in Market Liquidity: Evidence from Firms’ Use of Twitter. Account. Rev. 2014, 89, 79–112. [Google Scholar] [CrossRef]

- Rowbottom, N.; Lymer, A. Exploring the Use of Online Corporate Reporting Information. J. Emerg. Technol. Account. 2009, 6, 27–44. [Google Scholar] [CrossRef]

- King, B.G. A Social Movement Perspective of Stakeholder Collective Action and Influence. Bus. Soc. 2007, 47, 21–49. [Google Scholar] [CrossRef]

- Vasi, I.B.; Walker, E.T.; Johnson, J.S.; Tan, H.F. ``No Fracking Way!’’ Documentary Film, Discursive Opportunity, and Local Opposition against Hydraulic Fracturing in the United States, 2010 to 2013. Am. Sociol. Rev. 2015, 80, 934–959. [Google Scholar] [CrossRef]

- Saxton, G.D.; Waters, R.D. What Do Stakeholders `like’ on Facebook? Examining Public Reactions to Nonprofit Organizations’ Informational, Promotional, and Community-Building Messages. J. Public Relations Res. 2014, 26, 280–299. [Google Scholar] [CrossRef]

- Trinkle, B.S.; Crossler, R.E.; Bélanger, F. Voluntary Disclosures via Social Media and the Role of Comments. J. Inf. Syst. 2015, 29, 101–121. [Google Scholar] [CrossRef]

- Kane, G.C.; Alavi, M.; Labianca, G.J.; Borgatti, S. What’s Different about Social Media Networks? A Framework and Research Agenda. MIS Q. 2014, 38, 274–304. [Google Scholar]

- Bellucci, M.; Simoni, L.; Acuti, D.; Manetti, G. Stakeholder Engagement and Dialogic Accounting. Accounting, Audit. Account. J. 2019, 32, 1467–1499. [Google Scholar] [CrossRef]

- Colleoni, E. CSR Communication Strategies for Organizational Legitimacy in Social Media. Corp. Commun. An Int. J. 2013, 18, 228–248. [Google Scholar] [CrossRef]

- Merkl-Davies, D.M.; Brennan, N. A Theoretical Framework of External Accounting Communication: Research Perspectives, Traditions, and Theories. Accounting, Audit. Account. J. 2017, 30, 433–469. [Google Scholar] [CrossRef]

- Cho, C.H.; Laine, M.; Roberts, R.W.; Rodrigue, M. Organized Hypocrisy, Organizational Façades, and Sustainability Reporting. Accounting, Organ. Soc. 2015, 40, 78–94. [Google Scholar] [CrossRef]

- Malik, A.; Heyman-Schrum, C.; Johri, A. Use of Twitter across Educational Settings: A Review of the Literature. Int. J. Educ. Technol. High. Educ. 2019, 16, 1–22. [Google Scholar] [CrossRef]

- Hull, K.; Dodd, J.E. Faculty Use of Twitter in Higher Education Teaching. J. Appl. Res. High. Educ. 2017, 9, 91–104. [Google Scholar] [CrossRef]

- Read, W.; Robertson, N.; McQuilken, L.; Ferdous, A.S. Consumer Engagement on {T}witter: Perceptions of the Brand Matter. Eur. J. Mark. 2019, 53, 1905–1933. [Google Scholar] [CrossRef]

- Gómez-Carrasco, P.; Guillamón-Saorín, E.; García Osma, B. Stakeholders versus Firm Communication in Social Media: The Case of Twitter and Corporate Social Responsibility Information. Eur. Account. Rev. 2021, 30, 31–62. [Google Scholar] [CrossRef]

- Lei, L. (Gillian); Li, Y.; Luo, Y. Social Media and Voluntary Nonfinancial Disclosure: Evidence from Twitter Presence and Corporate Political Disclosure. J. Inf. Syst. 2018, 33, 99–128. [CrossRef]

- Waters, R.D. Redefining Stewardship: Examining How Fortune 100 Organizations Use Stewardship with Virtual Stakeholders. Public Relat. Rev. 2011, 37, 129–136. [Google Scholar] [CrossRef]

- Zhou, M.; Lei, L.; Wang, J.; Fan, W.; Wang, A.G. Social Media Adoption and Corporate Disclosure. J. Inf. Syst. 2015, 29, 23–50. [Google Scholar] [CrossRef]

- González-Bailón, S.; Paltoglou, G. Signals of Public Opinion in Online Communication: A Comparison of Methods and Data Sources. Ann. Am. Acad. Pol. Soc. Sci. 2015, 659, 95–107. [Google Scholar] [CrossRef]

- Hopkins, D.; King, G. A Method of Automated Nonparametric Content Analysis for Social Science. Am. J. Pol. Sci. 2010, 54, 229–247. [Google Scholar] [CrossRef]

- Landis, J.; Koch, G. The Measurement of Observer Agreement for Categorical Data. Biometrics 1977, 33, 159–174. [Google Scholar] [CrossRef]

- Miles, M.B.; Huberman, A.M. Qualitative Data Analysis: A Sourcebook of New Methods; Sage: Beverly Hills, CA, 1984; ISBN 0803922744. [Google Scholar]

- Strauss, A.; Corbin, J. Basics of Qualitative Research; 2nd ed.; Sage: Thousands Oaks, CA, 1998.

- Bakshy, E.; Hofman, J.M.; Mason, W.A.; Watts, D.J. Everyone’s an Influencer: Quantifying Influence on Twitter. Proc. Fourth ACM Int. Conf. Web Search Data Min. 2011, NY, 65–74. [Google Scholar]

- Larcker, D.F.; Rusticus, T.O. On the Use of Instrumental Variables in Accounting Research. J. Account. Econ. 2010, 49, 186–205. [Google Scholar] [CrossRef]

- Du, S.; Yu, K. Do Corporate Social Responsibility Reports Convey Value Relevant Information? Evidence from Report Readability and Tone. J. Bus. Ethics 2020, online bef. [CrossRef]

- Schultz, F.; Castelló, I.; Morsing, M. The Construction of Corporate Social Responsibility in Network Societies: A Communication View. J. Bus. Ethics 2013, 115, 681–692. [Google Scholar] [CrossRef]

- KPMG International KPMG International Survey of Corporate Responsibility Reporting 2011; The Netherlands, 2011.

- Hillman, A.J.; Hitt, M.A. Corporate Political Strategy Formulation: A Model of Approach, Participation, and Strategy Decisions. Acad. Manag. Rev. 1999, 24, 825–842. [Google Scholar] [CrossRef]

- Brivot, M.; Gendron, Y.; Guénin, H. Reinventing Organizational Control: Meaning Contest Surrounding Reputational Risk Controllability in the Social Media Arena. Accounting, Audit. Account. J. 2017, 30, 795–820. [Google Scholar] [CrossRef]

- Morningstar Sustainalytics ESG Risk Ratings Methodology. Available online: https://connect.sustainalytics.com/esg-risk-ratings-methodology (accessed on 15 March 2025).

- Fombrun, C.; Van Riel, C. The Reputational Landscape. Corp. Reput. Rev. 1997, 1–16. [Google Scholar]

- Raithel, S.; Schwaiger, M. The Effects of Corporate Reputation Perceptions of the General Public on Shareholder Value. Strateg. Manag. J. 2015, 36, 945–956. [Google Scholar] [CrossRef]

- Saxton, T. The Effects of Partner and Relationship Characteristics on Alliance Outcomes. Acad. Manag. J. 1997, 40, 441–463. [Google Scholar] [CrossRef]

- Pollock, T.G.; Rindova, V.P. Media Legitimation Effects in the Market for Initial Public Offerings. Acad. Manag. J. 2003, 46, 631–642. [Google Scholar] [CrossRef]

- Wei, J.; Ouyang, Z.; Chen, H. Well Known or Well Liked? The Effects of Corporate Reputation on Firm Value at the Onset of a Corporate Crisis. Strateg. Manag. J. 2017, 38, 2103–2120. [Google Scholar] [CrossRef]

- Suddaby, R.; Saxton, G.D.; Gunz, S. Twittering Change: The Institutional Work of Domain Change in Accounting Expertise. Accounting, Organ. Soc. 2015, 45, 52–68. [Google Scholar] [CrossRef]

- Srinivasan, R.; Lilien, G.L.; Sridhar, S. Should Firms Spend More on Research and Development and Advertising during Recessions? J. Mark. 2011, 75, 49–65. [Google Scholar] [CrossRef]

| # of Tweets | |

| All tweets sent by S&P 500 firms 2020-2022 Less: Non-ESG Tweets Less: Missing control variable data Total ESG tweets |

2,309,573 (2,300,928) (36) 10,851 |

| Variable | Count | Mean | Std Dev | Min. | Max |

|

Dependent Variables REPUTATIONAL AWARENESS Retweet Count |

10,851 | 2.132 | 7.214 | 0 | 325 |

|

REPUTATIONAL FAVORABILITY Positive Replies |

10,851 | 0.069 | 0.462 | 0 | 20 |

|

Independent Variables INFORMATION |

10,851 | 0.967 | 0.179 | 0 | 1 |

| Disclosure | 10,851 | 0.257 | 0.437 | 0 | 1 |

| Public Education | 10,851 | 0.696 | 0.460 | 0 | 1 |

| Marketing | 10,851 | 0.014 | 0.116 | 0 | 1 |

| Non-Informational | 10,851 | 0.033 | 0.179 | 0 | 1 |

| COMMUNITY | 10,851 | 0.436 | 0.496 | 0 | 1 |

| Dialogue | 10,851 | 0.066 | 0.249 | 0 | 1 |

| User Mention | 10,851 | 0.357 | 0.479 | 0 | 1 |

| Stewardship Message | 10,851 | 0.049 | 0.216 | 0 | 1 |

| ACTION | |||||

| Mobilizational Message | 10,851 | 0.003 | 0.056 | 0 | 1 |

|

Control Variables ACCOUNT-LEVEL |

|||||

| Followers | 10,851 | 148.018 | 599.817 | 0.357 | 13,187.786 |

| Time on Twitter | 10,851 | 45.013 | 7.581 | 10.41 | 57.72 |

| Prior Statuses Count | 10,851 | 8.921 | 1.044 | 4.277 | 14.695 |

|

FIRM-LEVEL Assets |

10,851 | 10.127 | 1.136 | 6.862 | 14.705 |

| Sales | 10,851 | 9.511 | 1.014 | 6.253 | 13.23 |

| ESG Risk | 10,851 | 23.035 | 7.509 | 6.988 | 50.947 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) | (11) | (12) | (13) | (14) | (15) | (16) | (17) |

| (1) Retweet Count | 1 | ||||||||||||||||

| (2) Positive Replies | 0.18* | 1 | |||||||||||||||

| (3) Information | 0.00 | -0.01 | 1 | ||||||||||||||

| (4) Disclosure | 0.01 | 0.01 | 0.11* | 1 | |||||||||||||

| (5) Public Education | -0.01 | -0.01 | 0.28* | -0.89* | 1 | ||||||||||||

| (6) Marketing | 0.00 | -0.01 | 0.02* | -0.07* | -0.18* | 1 | |||||||||||

| (7) Community | -0.01 | 0.00 | -0.15* | 0.06* | -0.12* | 0.00 | 1 | ||||||||||

| (8) Dialogue | -0.05* | 0.00 | -0.34* | 0.05* | -0.18* | 0.00 | 0.30* | 1 | |||||||||

| (9) User Mention | 0.01 | 0.00 | 0.07* | 0.04* | -0.01 | 0.00 | 0.85* | -0.15* | 1 | ||||||||

| (10) Stewardship Message | 0.00 | 0.01 | -0.41* | 0.02* | -0.17* | -0.02 | 0.26* | 0.18* | 0.01 | 1 | |||||||

| (11) Mobilizational Message | 0.00 | 0.00 | -0.01 | 0.00 | -0.01 | -0.01 | 0.00 | 0.02 | 0.00 | 0.00 | 1 | ||||||

| (12) Followers | 0.18* | 0.08* | -0.27* | 0.00 | -0.10* | -0.02* | 0.07* | 0.29* | -0.07* | 0.08* | 0.03* | 1 | |||||

| (13) Time on Twitter | 0.08* | 0.03* | -0.06* | 0.05* | -0.07* | 0.00 | -0.08* | 0.05* | -0.10* | 0.02* | -0.01 | 0.15* | 1 | ||||

| (14) Prior Statuses Count | 0.06* | 0.07* | -0.19* | -0.07* | -0.01 | 0.00 | 0.06* | 0.22* | -0.04* | 0.07* | 0.01 | 0.31* | 0.30* | 1 | |||

| (15) Size | 0.12* | 0.06* | -0.12* | 0.02* | -0.07* | -0.01 | 0.05* | 0.20* | -0.04* | 0.05* | -0.01 | 0.27* | 0.04* | 0.20* | 1 | ||

| (16) Sales | 0.11* | 0.03* | -0.14* | 0.02 | -0.07* | -0.02 | 0.08* | 0.24* | -0.03* | 0.04* | 0.00 | 0.36* | -0.01 | 0.23* | 0.75* | 1 | |

| (17) ESG Risk | -0.03* | 0.00 | -0.06* | -0.01 | -0.02* | 0.02 | -0.04* | 0.04* | -0.07* | 0.06* | 0.00 | 0.00 | -0.04* | -0.15* | 0.16* | 0.12* | 1 |

| DV = Retweet Count | DV = Positive Replies | ||||

| (1) | (2) | (3) | (4) | ||

| INFORMATION | 0.79** | 0.60* | |||

| (0.10) | (0.28) | ||||

| Disclosure | 0.30** | 0.36 | |||

| (0.12) | (0.31) | ||||

| Public Education | 0.29* | 0.13 | |||

| (0.11) | (0.31) | ||||

| Marketing | 0.34* | -0.19 | |||

| (0.17) | (0.60) | ||||

| COMMUNITY-BUILDING | -0.06* | 0.10 | |||

| (0.03) | (0.10) | ||||

| Dialogue | -0.95** | -1.17** | |||

| (0.09) | (0.28) | ||||

| User Mention | 0.06+ | 0.22* | |||

| (0.03) | (0.10) | ||||

| Stewardship Message | 0.10 | 0.39+ | |||

| (0.08) | (0.21) | ||||

| ACTION | |||||

| Mobilizational Message | -0.30 | -0.16 | -0.64 | -0.59 | |

| (0.27) | (0.29) | (1.06) | (1.05) | ||

| ACCOUNT-LEVEL CONTROLS | |||||

| Followers | 0.001** | 0.001** | 0.001** | 0.001** | |

| (0.001) | (0.001) | (0.001) | (0.001) | ||

| Time on Twitter | 0.01** | 0.01** | 0.01 | 0.01 | |

| (0.001) | (0.001) | (0.01) | (0.01) | ||

| Prior Statuses Count | -0.02 | -0.10** | 0.29** | 0.31** | |

| (0.02) | (0.02) | (0.06) | (0.06) | ||

| FIRM-LEVEL CONTROLS | |||||

| Size | 0.35** | 0.28** | 0.75** | 0.70** | |

| (0.02) | (0.02) | (0.08) | (0.08) | ||

| Sales | -0.07** | -0.07* | -0.71** | -0.63** | |

| (0.03) | (0.03) | (0.10) | (0.10) | ||

| ESG Risk | -0.02** | -0.03** | -0.01 | -0.01 | |

| (0.00) | (0.00) | (0.01) | (0.01) | ||

| _cons | -3.15** | -0.28 | -5.58** | -6.74** | |

| (0.31) | (0.35) | (1.06) | (1.09) | ||

| Industry Fixed Effects | YES | YES | YES | YES | |

| N | 10,851 | 10,851 | 10,851 | 10,851 | |

| Model Sig. (χ2) | 1052.89** | 822.70** | 196.19** | 237.08** | |

| Log likelihood | -19388.79 | -19430.89 | -2356.57 | -2339.00 | |

| DV = Retweet Count | DV = Positive Replies | ||||

| (1) | (2) | (3) | (4) | ||

| INFORMATION | |||||

| Disclosure | 0.87** | 0.42** | 0.71* | 0.34 | |

| (0.11) | (0.12) | (0.32) | (0.37) | ||

| Public Education | 0.83** | 0.40** | 0.53+ | 0.19 | |

| (0.10) | (0.11) | (0.29) | (0.35) | ||

| Marketing | 0.93** | 0.55** | 0.15 | -0.13 | |

| (0.15) | (0.15) | (0.59) | (0.62) | ||

| COMMUNITY-BUILDING | -0.001 | 0.09 | |||

| (0.03) | (0.12) | ||||

| Dialogue | -1.48** | -0.87** | |||

| (0.11) | (0.33) | ||||

| User Mention | 0.10** | 0.17 | |||

| (0.03) | (0.12) | ||||

| Stewardship Message | 0.19* | 0.16 | |||

| (0.09) | (0.29) | ||||

| ACTION | |||||

| Mobilizational Message | -0.93* | -0.86* | -20.43 | -21.33** | |

| (0.41) | (0.40) | (25575.98) | (1.14) | ||

| INTERACTIONS | |||||

| Disclosure × Community | -0.20** | 0.00 | |||

| (0.06) | (0.21) | ||||

| Disclosure × Dialogue | 0.06 | -0.87 | |||

| (0.17) | (0.58) | ||||

| Disclosure × User Mention | -0.05 | 0.16 | |||

| (0.06) | (0.21) | ||||

| Disclosure × Stewardship Message | -0.42** | 0.57 | |||

| (0.15) | (0.43) | ||||

| Disclosure × Mobilizational Message | 1.50** | 1.39* | 20.64 | 21.77 | |

| (0.57) | (0.57) | (25575.98) | (28.05) | ||

| Account-level Controls | YES | YES | YES | YES | |

| Firm-level Controls | YES | YES | YES | YES | |

| Industry Fixed Effects | YES | YES | YES | YES | |

| N | 10,851 | 10,851 | 10,851 | 10,851 | |

| Model Sig. (χ2) | 1073.14** | 1393.31** | 199.55** | 114.14** | |

| Log likelihood | -19378.19 | -19185.17 | -2353.93 | -2335.56 | |

| DV = Retweet Count | DV = Positive Replies | |||

| (1) | (2) | (3) | (4) | |

| INFORMATION | 1.54** | 0.03** | ||

| (0.01) | (0.01) | |||

| Disclosure | 0.44** | -0.05** | ||

| (0.01) | (0.01) | |||

| Public Education | 0.35** | -0.39** | ||

| (0.01) | (0.01) | |||

| Marketing | 0.30** | -0.07** | ||

| (0.01) | (0.02) | |||

| COMMUNITY-BUILDING | -1.78** | -1.36** | ||

| (0.01) | (0.01) | |||

| Dialogue | -4.52** | -2.22** | ||

| (0.01) | (0.01) | |||

| User mention | 0.13** | -0.21** | ||

| (0.01) | (0.01) | |||

| Stewardship Message | -0.18** | 0.14** | ||

| (0.01) | (0.01) | |||

| ACTION | ||||

| Mobilizational Message | 1.01** | 0.24** | 0.87** | 0.59** |

| (0.04) | (0.03) | (0.06) | (0.05) | |

| ACCOUNT-LEVEL CONTROLS | ||||

| Followers | 0.00** | 0.00** | 0.00** | 0.00** |

| (0.00) | (0.00) | (0.00) | (0.00) | |

| Time on Twitter | 0.02** | 0.02** | -0.00 | -0.00* |

| (0.00) | (0.00) | (0.00) | (0.00) | |

| Prior Statuses Count | -0.50** | -0.01** | 0.01** | 0.15** |

| (0.00) | (0.00) | (0.00) | (0.00) | |

| FIRM-LEVEL CONTROLS | ||||

| Size | -0.01 | 0.20** | 0.20** | 0.25** |

| (0.00) | (0.00) | (0.01) | (0.01) | |

| Sales | 0.09** | 0.10** | -0.23** | -0.23** |

| (0.00) | (0.00) | (0.01) | (0.01) | |

| ESG Risk | -0.01** | 0.00** | -0.01** | -0.01** |

| (0.00) | (0.00) | (0.00) | (0.00) | |

| _cons | 3.86** | -1.91** | 1.87** | 0.65** |

| (0.04) | (0.03) | (0.06) | (0.06) | |

| Industry Fixed Effects | YES | YES | YES | YES |

| N | 2,309,171 | 2,309,171 | 2,309,171 | 2,309,171 |

| Model Sig. (χ2) | 305368.36 | 610936.38 | 38186.50 | 60633.92 |

| Log likelihood | -1.58e+06** | -1.41e+06** | -5.70e+05** | -5.60e+05** |

| DV = Retweet Count | DV = Positive Replies | ||||||||

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | ||

| B2C | B2B | B2C | B2B | B2C | B2B | B2C | B2B | ||

| INFORMATION | 1.63** | 0.18 | 1.64** | -0.21 | |||||

| (0.26) | (0.11) | (0.57) | (0.34) | ||||||

| Disclosure | 0.38 | 0.02 | -0.36 | -0.14 | |||||

| (0.30) | (0.12) | (0.79) | (0.37) | ||||||

| Public Education | 0.38 | 0.05 | -0.57 | -0.22 | |||||

| (0.30) | (0.12) | (0.79) | (0.36) | ||||||

| Marketing | 0.63 | 0.28+ | -14.85 | -0.34 | |||||

| (0.50) | (0.17) | (2689.55) | (0.63) | ||||||

| COMMUNITY-BUILDING | -0.15+ | -0.10** | 0.27 | 0.14 | |||||

| (0.08) | (0.03) | (0.24) | (0.12) | ||||||

| Dialogue | -3.40** | -1.33** | -2.71** | -0.73* | |||||

| (0.41) | (0.11) | (0.77) | (0.34) | ||||||

| User Mention | 0.05 | 0.04 | 0.60* | 0.24+ | |||||

| (0.07) | (0.03) | (0.24) | (0.12) | ||||||

| Stewardship Message | -0.09 | -0.02 | -0.60 | 0.42 | |||||

| (0.17) | (0.09) | (0.54) | (0.26) | ||||||

| ACTION | |||||||||

| Mobilizational Message | -1.59* | -0.15 | -1.30* | -0.20 | -14.94 | 0.06 | -14.90 | 0.04 | |

| (0.68) | (0.35) | (0.66) | (0.35) | (1638.06) | (1.10) | (2492.35) | (1.10) | ||

| Account-level Controls | YES | YES | YES | YES | YES | YES | YES | YES | |

| Firm-level Controls | YES | YES | YES | YES | YES | YES | YES | YES | |

| Industry Fixed Effects | YES | YES | YES | YES | YES | YES | YES | YES | |

| N | 1,632 | 6,551 | 1,632 | 6,551 | 1,632 | 6,551 | 1,632 | 6,551 | |

| Model Sig. (χ2) | 269.51** | 1105.38** | 385.31** | 1260.47** | 989.96** | 60.65** | 1512.37** | 73.23** | |

| Log likelihood | -2579.51 | -12047.41 | -2508.40 | -11948.46 | -392.92 | -1505.14 | -378.04 | -1499.33 | |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).