1. Introductions

Governments worldwide rely on taxation as a primary source of revenue to finance public services and foster development. However, developing countries like Ethiopia often grapple with weak tax administration, large informal sectors, and pervasive tax evasion, constraining revenue mobilization (Jerene, 2016; Kassahun, 2016). In response, technological interventions have been introduced to streamline collection, enhance transparency, and curb revenue leakages.

One such intervention in Ethiopia is the mandatory deployment of Cash Register Machines (CRMs). Since 2009, the government has promoted CRMs to accurately record transactions, issue receipts, and create an auditable trail, thereby reducing opportunities for tax fraud (Mesele, 2019). Theoretically, CRMs should improve the efficiency of Value Added Tax (VAT) and Turnover Tax (TOT) collection by automating record-keeping and facilitating monitoring.

However, the practical efficacy of CRMs in the Ethiopian context remains underexplored. Challenges such as high installation and maintenance costs, frequent machine failures, power interruptions, inadequate user training, and low taxpayer awareness have been reported (Alem, Azeb & Bezaye, 2014; Dagnachew, 2018). These factors potentially undermine the anticipated gains in tax collection efficiency.

This study focuses on the Addis Ketema Sub-City Tax Office to empirically investigate the efficiency of CRMs. It moves beyond a simple pre-post automation comparison to analyze the specific factors influencing CRM effectiveness. The study is guided by three research questions:

What are the key challenges associated with CRM utilization?

What is the relationship between CRM-related factors and tax collection efficiency?

What is the effect of these factors on tax collection efficiency?

By addressing these questions, the study provides actionable insights for policymakers and tax authorities to optimize CRM implementation, thereby strengthening Ethiopia's domestic revenue mobilization efforts.

2. Literature Review

2.1. Theoretical Framework

The study is anchored in two main theories. The Optimal Tax Theory emphasizes designing tax systems to minimize distortions and administrative costs (Anware, 2014). CRMs align with this theory by potentially lowering the cost of enforcement and reducing compliance-related market distortions. The Ability-to-Pay Theory posits that taxes should be levied according to an individual's economic capacity (Richardson, 2008). Effective CRM implementation ensures that the recorded turnover accurately reflects a business's ability to pay, thereby enhancing vertical and horizontal equity.

2.2. Factors Affecting Tax Collection Efficiency

2.2.1. Tax Authority Capacity

Effective tax administration requires a well-equipped tax authority capable of efficiently collecting revenues. This includes investment in professional personnel, up-to-date technology, and adequate infrastructure to streamline tax procedures. Improving revenue performance involves minimizing collection costs through administrative simplification, efficiency measurement, and elimination of factors contributing to sub-optimal revenue (Misrak, 2014). Consequently, the tax authority must be capacitated with both advanced technologies and a competent workforce to meet these objectives.

2.2.2. Awareness of Taxpayers

Taxpayer awareness, defined as knowledge coupled with responsive action, plays a critical role in ensuring timely tax payments (Dana & Atin, 2014). Understanding the contribution of taxes to national development and the negative consequences of delayed payments motivates compliance. Awareness also encompasses knowledge of tax rules, payment obligations, and legal enforcement mechanisms (Manik & Asri in Rahayu, 2010, as cited by Dana & Atin, 2014).

2.2.3. Compliance

Compliance refers to the willingness of taxpayers to adhere to tax laws both in spirit and letter. It can be voluntary driven by trust and cooperation—or enforced through audits and penalties in environments of distrust (Misrak, 2014). Compliance facilitation, including measures that simplify obligations, enhances voluntary collections, while enforcement strategies ensure adherence. Understanding taxpayer behavior, including factors influencing attitudes toward compliance, is critical for promoting tax compliance and mitigating noncompliance, which negatively affects revenue, labor markets, and state stability (Ahmed & Kedir, 2015; Nelson, 2015).

2.2.4. Cash Register Machines

Cash register machines, traditionally electrical devices, record sales transactions with visible transaction amounts for both consumers and sales staff. Regulation No. 139/2007 specifies mandatory features, including non-convertible accumulating totals, tamper-proof design, automatic daily sales reports, discount and refund recording, TCP/IP support, mobile compatibility, safety mechanisms, and automatic receipt printing (The New Encyclopedia, 1768). Technological advancements have replaced mechanical registers with electronic point-of-sale systems, enabling faster transaction processing, inventory management, and credit verification.

2.2.5. Challenges of Cash Register Machines

Despite regulatory frameworks, challenges persist in implementing cash register machines effectively. Dagnachew (2018) identifies issues such as inequitable revenue administration, inadequate utilization of machines due to weak accountability, power interruptions, software failures, and customer resistance. Notably, among 31,000 users, only 3,500 machines are connected to the ERCA server, highlighting significant gaps in compliance and technological integration.

2.3. The Role of Technology in Tax Collection

Globally, the adoption of Electronic Fiscal Devices (EFDs), including CRMs, has been a cornerstone of tax modernisation. Studies from Tanzania (Saidi, 2015) and Kenya (Lumumba, 2010) found that EFDs significantly increased tax revenue, reduced operational costs, and improved compliance by creating a reliable transaction trail.

In the Ethiopian context, empirical evidence is emerging but mixed. Kassahun (2016) found that audit follow-up, tax evasion, and administration costs significantly impacted VAT income in Hawassa City, while taxpayer awareness did not. Conversely, Mesele (2019) in Wolaita Sodo Town reported a positive effect of CRMs on tax revenue. Commonalities across studies highlight challenges such as inadequate training, machine failures, and taxpayer resistance (Alem, Azeb & Bezaye, 2014; Zinath, 2013). This study builds on this nascent literature by providing a comprehensive analysis of the predictors of CRM efficiency in a major sub-city of Addis Ababa.

2.4. Conceptual Framework

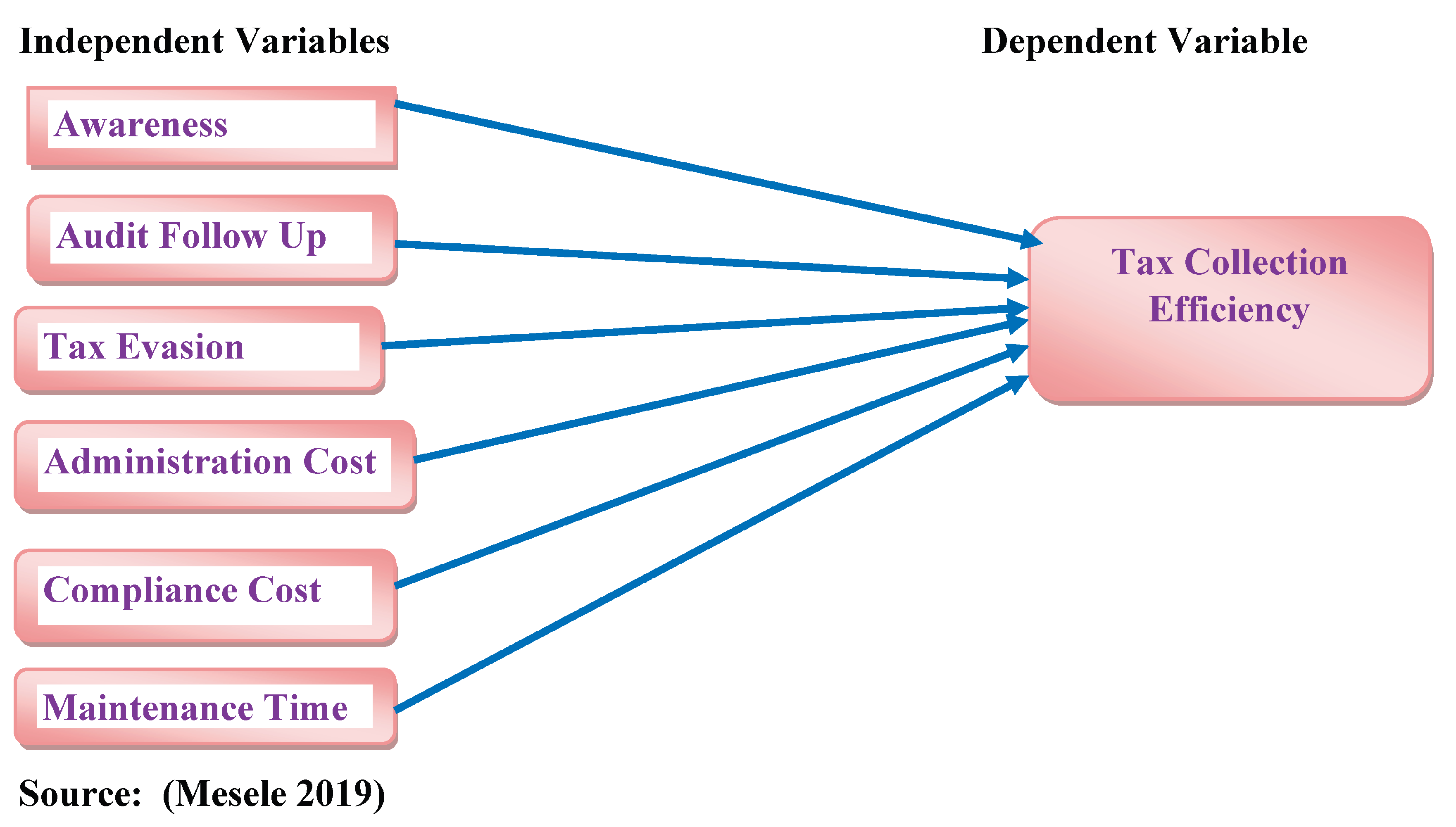

The conceptual framework of the study is draw based on the relationship between efficiency of cash register machine and tax collection. Therefore, the conceptual framework of the study shows the relationship between independent variables and the dependent variable.

Figure 2.1.

Conceptual Framework of the Study. Source: (Mesele 2019).

Figure 2.1.

Conceptual Framework of the Study. Source: (Mesele 2019).

2.5. Research Hypothesis

Based on the objectives of the study and conceptual framework the following hypothesis were formulated:

H1: Awareness of tax payers about cash register machine has significant effect on tax Collection Efficiency

H2: Audit follows up has significant effect on tax Collection Efficiency

H3: Tax Evasion has significant effect on tax Collection Efficiency

H4: Maintenance time has significant effect on tax Collection Efficiency

H5: Administration Cost has significant effect on tax Collection Efficiency

H6: Compliance cost has significant effect on tax Collection Efficiency

3. Methodology

3.1. Research Design and Approach

An explanatory sequential mixed-methods design was employed. This approach allowed for the collection and analysis of quantitative data first, followed by qualitative data to explain and elaborate on the quantitative findings.

3.2. Population and Sampling

The target population was 2,780 CRM users (taxpayers) in Addis Ketema Sub-City, categorized into service, merchandise, and manufacturing sectors. Using Yamane's (1967) formula with a 5% margin of error, a sample size of 350 was determined. A combination of stratified and purposive sampling was used to select the taxpayers. Furthermore, six tax experts (senior experts, auditors) were purposively selected for interviews.

According to Addis Ketema Sub- City Tax Office the total population of tax registered organizations is 2780.

n = = 350 sample tax payers were selected as follow;

Where

n = sample size

N = population size

e = sample error at 5%

Table 1.

Population and Sample Size of the Respondents.

Table 1.

Population and Sample Size of the Respondents.

| No |

Types of business activities |

Number of population |

Sample size |

| 1 |

Manufacturing |

701 |

88 |

| 2 |

Merchandize |

887 |

112 |

| 3 |

Service |

1192 |

150 |

| Total |

|

2780 |

350 |

3.3. Data Collection and Analysis

Primary data were collected through structured questionnaires (using a 5-point Likert scale) and semi-structured interviews. The questionnaire measured six independent variables Knowledge and Awareness (KA), Tax Audit Follow-Up (TAFU), Tax Evasion (TE), Maintenance Time (MT), Administration Cost (AC), Compliance Cost (CC) and the dependent variable, Tax Collection (TC).

3.4. Model Specification

To measure the efficiency of cash register machine in tax Collection: The Case of Addis Ketema Sub- City Tax Office. The researcher used the following model. The independent variables and the dependent variable tax collection measured in the following ways. The regression model was specified as:

Where:

TCE = Tax Collection Efficiency

AK= Awareness and Knowledge

AFU= Audit Follow-up

TE= Tax-Evasion

CC= Cost of Compliance

CA= Cost of Administration

MT= maintenance-time.

ß0 = Constant or intercept term

ß1, ß2… ß6 = Parameter estimate associated with the influence of the independent variables on the dependent variable e = Error term i.e. other variables not included in the model

3.5. Data Analysis Methods

Quantitative data were analyzed using SPSS version 28, employing descriptive statistics, Pearson correlation, and multiple regression analysis. Qualitative data from interviews were analyzed thematically to triangulate and enrich the quantitative results.

3.6. Reliability and Validity

A pilot test ensured the instrument's validity. Reliability was confirmed using Cronbach's Alpha, with all constructs scoring above 0.80, indicating excellent internal consistency.

Table 2.

Reliability Test of Measurement Items.

Table 2.

Reliability Test of Measurement Items.

| Variables |

Cronbach alpha value |

Decision |

| Knowledge and Awareness |

0.800 |

Reliable |

| Tax Audit Follow Up |

0.889 |

Reliable |

| Tax Evasion |

0.822 |

Reliable |

| Maintenance Time |

0.823 |

Reliable |

| Administration Cost |

0.837 |

Reliable |

| Compliance Cost |

0.843 |

Reliable |

| Tax Collection |

0.874 |

Reliable |

| Composite Reliability |

0.841 |

Reliable |

3.7. Ethical Considerations

The researcher explained the research study, stating it was academic and voluntary, with participants having the freedom to withdraw at any time. They signed an informed consent form, ensuring their privacy was protected.

4. Results

In this study, 350 questionnaires were distributed to participants, and 347 were returned, resulting in a 99% response rate, with only three questionnaires (1%) not returned. All returned questionnaires were valid and included in the data analysis. According to Mugenda and Mugenda (2003), response rates of 50% are considered sufficient, 60% good, and rates above 70% exceptional. Therefore, the 99% response rate achieved in this study is exceptionally high, ensuring robust and reliable data for analysis.

4.1. Descriptive Statistics Results

Table 3 above shows the descriptive statistics (mean and standard deviation) summarized the respondents' perceptions. Compliance Cost (M=3.31) and Tax Audit Follow-Up (M=3.23) had the highest mean scores, indicating they are the most influential factors. Tax Collection had a mean of 2.97, suggesting a moderate level of perceived efficiency.

4.2. Correlation Analysis Results

Table 4 above presented the Pearson correlation analysis that revealed that all six independent variables had a statistically significant positive relationship with tax collection (p < 0.01). Tax Audit Follow-Up exhibited the strongest correlation (r = 0.830), followed by Knowledge and Awareness (r = 0.641).

4.3. Regression Results

A multiple regression was run to predict tax collection from the six independent variables. The model was a good fit, F(6, 340) = 177.287, p < .000, and explained 75.8% of the variance in tax collection (R² = .758, Adjusted R² = .754). The Durbin-Watson statistic of 1.773 indicated no autocorrelation. Tests confirmed that assumptions of normality, linearity, and homoscedasticity were met, and VIF scores (all < 5) indicated no multicollinearity.

The findings of the study indicated that all predictors used in this study has a significant effect on tax collection with sig values of less than 1%. In addition, the findings of the study indicated that all predictors have positive effect on tax collection. Based on the analysis, the most important factors influencing tax collection are tax audit follow up and knowledge and awareness.

Table 5.

Regression Results.

Table 5.

Regression Results.

| Model |

Unstandardized Coefficients |

Standardized Coefficients |

t |

Sig. |

| B |

Std. Error |

Beta |

| 1 |

(Constant) |

.319 |

.096 |

|

3.341 |

0.001 |

| Knowledge and Awareness |

.246 |

.033 |

.257 |

7.472 |

0.000 |

| Tax Audit Follow-Up |

.611 |

.039 |

.684 |

15.481 |

0.000 |

| Tax-Evasion |

.179 |

.038 |

.209 |

4.747 |

0.000 |

| Maintenance Time |

.095 |

.037 |

.129 |

2.570 |

0.011 |

| Cost of Administration |

.107 |

.041 |

.105 |

2.635 |

0.009 |

| Cost of Compliance |

.176 |

.045 |

.220 |

3.955 |

0.000 |

4.4. Hypothesis Test Results 4.5. Interview Results

The research highlights the benefits of cash register machines in tax collection, including automated systems for thorough inspections, fair tax segmentation, simplified transaction management, reduced information gaps, efficient tax administration, improved stocktaking and sales audits, prompt reporting, and a positive impact on tax income collection. These machines also improve compliance by assisting businesses in the timely filing of tax returns and reducing tax evasion or fraud.

Table 6.

Summary of Hypothesis Testing Findings.

Table 6.

Summary of Hypothesis Testing Findings.

| No |

Hypothesis |

P-value |

Beta |

Test Result |

| 1 |

H1: Awareness of tax payers about cash register machine has significant effect on tax Collection Efficiency |

0.000 |

0.257 |

Accepted |

| 2 |

H2: Audit follows up has significant effect on tax Collection Efficiency |

0.000 |

0.684 |

Accepted |

| 3 |

H3: Tax Evasion has significant effect on tax Collection Efficiency |

0.000 |

0.209 |

Accepted |

| 4 |

H4: Maintenance time has significant effect on tax Collection Efficiency |

0.011 |

0.129 |

Accepted |

| 5 |

H5: Administration Cost has significant effect on tax Collection Efficiency |

0.009 |

0.105 |

Accepted |

| 6 |

H6: Compliance cost has significant effect on tax Collection Efficiency |

0.013 |

0.220 |

Accepted |

Taxpayers face significant maintenance costs due to the reliance on cash-registered machines, which can be unaffordable for traders. Inadequate maintenance service can lead to extended downtime, exposing traders to fraud or evasion risks. Correcting errors in cash register machines can be time-consuming and involve multiple processes. Tax collectors may stigmatize traders, impeding collaboration and compliance efforts. The time-consuming tax payment process can also be time-consuming. These issues highlight the need for changes in maintenance, support, and procedural aspects to improve tax collection efficiency and reduce trader burden.

Taxpayers face challenges such as refund settlement delays, dissatisfaction with the Tax Authority's service, and potential revisions to cash register machine rules. Tax collectors face power interruptions and technical issues with the tax office server. Although cash register machines reduce administrative costs but come with high compliance costs, they improve efficiency and accuracy in tax declaration and filing. They also reduce tax evasion and fraud, combating corruption within the taxation system. The complex influence of cash register machines on taxpayers and collectors extends from operational issues to increased efficiency and compliance.

5. Discussion

The study's findings confirm that cash register machine (CRM) efficiency is a multi-dimensional construct significantly influenced by administrative, technical, and behavioural factors. The positive and significant effect of tax audit follow-up underscores that technology alone is insufficient; it must be backed by a credible and systematic audit mechanism. The threat of detection acts as a powerful deterrent against tax evasion, a finding consistent with studies in Tanzania (Andrew et al., 2015) and Hawassa, Ethiopia (Kassahun, 2016).

The significance of knowledge and awareness highlights the critical role of taxpayer education. When taxpayers understand the purpose of CRMs, the tax laws, and the consequences of non-compliance, their willingness to use the machines correctly and comply increases. This aligns with the theoretical premise that voluntary compliance is bolstered by trust and understanding (Misrak, 2014).

The positive relationship between tax evasion and collection efficiency suggests that CRMs are perceived as effective tools for curbing fraud. However, the interview data revealed concerns that the current audit selection criteria are not robust enough to identify all evaders, indicating an area for improvement.

The challenges of maintenance time and costs (administration and compliance costs) were pronounced. Qualitative data revealed that delayed maintenance (often exceeding the stipulated 48-hour window) causes business disruptions and fosters frustration, potentially leading to non-use of the machines. While CRMs reduce long-term administrative costs for the authority, the initial and maintenance costs for taxpayers can be a burden, affecting their perception of the system's fairness and efficiency.

6. Conclusions and Recommendation

6.1. Conclusions

This study concludes that cash register machines hold substantial potential to enhance the efficiency of tax collection in the Addis Ketema Sub-City. The strong predictive power of the model demonstrates that CRM efficiency is primarily driven by robust audit systems, high levels of taxpayer awareness, and effective control of tax evasion. However, this potential is critically moderated by the reliability of technical support (maintenance) and the management of associated costs. Therefore, CRMs are not a standalone solution but a core component of an integrated tax administration system that requires parallel strengthening of human capital, administrative processes, and stakeholder engagement.

6.2. Recommendation

Based on the findings, the following recommendations are proposed:

❖ Enhance Taxpayer Awareness and Training: The tax office should launch sustained, multi-channel awareness campaigns using media, workshops, and printed materials. Training should focus on the benefits of CRMs, correct usage, and the legal ramifications of tampering or non-compliance.

❖ Strengthen Audit Systems and Transparency: The tax authority should invest in data analytics to make audit selection more risk-based and transparent. Communicating the audit criteria and process can improve taxpayer perception and the deterrent effect of audits.

❖ Enforce Maintenance Service-Level Agreements: The tax office must strictly monitor and enforce the maintenance contracts with CRM suppliers, ensuring adherence to the 48-hour repair rule as per Regulation 46/99. Penalties for non-compliance should be applied.

❖ Streamline Taxpayer Services: To address compliance cost and time concerns, the tax office should digitise and simplify tax return filing and payment processes. Opening more service windows and enhancing online services can reduce the time burden on traders.

❖ Improve Technical Infrastructure: Collaborate with relevant telecom and power providers to ensure stable connectivity and electricity, which are essential for the real-time data transmission of CRMs to the tax authority's servers.

6.3. Future Research Directions

Future research should investigate the 24.2% of variance in tax collection not explained by this model, potentially exploring factors like the role of tax morale, political will, and the influence of the informal sector. A longitudinal study tracking the same taxpayers over time could also provide deeper insights into the long-term impact of CRMs.

6.4. Practical Implication

The findings of this study offer valuable insights for policymakers, tax administrators, and business owners in Ethiopia and other developing economies. The strong positive relationship identified between audit follow-up and tax collection efficiency emphasises the need to strengthen audit mechanisms to enhance transparency and reduce tax evasion. Furthermore, the study underscores the pivotal role of taxpayer awareness in fostering voluntary compliance, suggesting that targeted educational initiatives such as community outreach programs, media campaigns, and market-based awareness efforts can effectively promote the adoption and proper use of Cash Register Machines (CRM).

Addressing challenges associated with CRM maintenance and infrastructure, the study recommends the establishment of responsive technical support systems and stricter enforcement of service-level agreements with CRM vendors. Finally, the predictive model developed provides a practical framework for tax authorities to employ data-driven decision-making, enabling more strategic resource allocation and performance monitoring to improve overall tax administration efficiency.

6.5. Contributions of the study

- ☞

F Theoretical Contributions: This study offers empirical validation and contextual application of optimal tax and ability-to-pay theories within a developing economy. It illustrates how technology, specifically Customer Relationship Management (CRM) systems, can operationalise these theories by minimising administrative costs and enhancing the accuracy of tax base assessments. It develops and tests a comprehensive conceptual model that integrates six critical predictors of CRM efficiency, offering a validated framework for future research on tax technology adoption.

- ☞

Methodological Contribution: The use of a sequential mixed-methods approach enriches the field by demonstrating how quantitative results can be effectively explained and contextualised through qualitative insights, providing a more holistic understanding of the phenomenon.

References

- Abdu, M., & Zemenu, T. (2015). The Impact of Electronic Tax Register Machines on VAT Compliance in Ethiopia, the Case of Bahir Dar City. Research Journal of Finance and Accounting, 6(13).

- Ahmed, A., & Kedir, S. (2015). Tax Compliance and its Determinant: the Case of Jimma Zone, Ethiopia. International Journal of Research in Social Sciences, 6(2), 7–21.

- Ainsworth, R. T. (2011). VAT Fraud and Technological solution. World Journal of VAT/GST Law.

- Alem, Z., Azeb, N., & Bezaye, A. (2014). Benefits and Challenges of Cash Register Machine in Arada Sub City. St. Mary's University.

- Andrew, Nancy, Charles, and George (2015). The effect of Electronic Fiscal Devices on VAT Collection in Tanzania. [Publisher information missing from thesis].

- Anware, M. (2014). Determinants of tax revenue performances in Ethiopia. Mini research paper, Jimma University. (Unpublished).

- Cobham, A. (2007). Tax evasion, tax avoidance and development finance. Queen Elisabeth House Working Paper No. 129, Oxford University.

- Creswell, J. W. (2014). Research Design: Qualitative, Quantitative, and Mixed Methods Approaches (4th ed.). Sage Publications.

- Daba, G. (2017). Factors Affecting Rental Income Tax Payers Compliance with Tax System: In Case of Hawassa City Administration, SNNRS, Ethiopia. Research Journal of Finance and Accounting, 8(9), 75–83.

- Dagnachew, T. (2018). Challenges and opportunities of adopting e-tax system in the case of ERCA (LTO) [Master's thesis, St. Mary's University].

- Dečman, M., & Klun, M. (2015). The Impact of Information Systems on Taxation: A Case of Users' Experience with an e-Recovery Information System. The Electronic Journal of e-Government, 13(2), 110-121.

- Fetters, M. D., & Freshwater, D. (2015). The integration challenge. Journal of Mixed Methods Research, 9(2), 115-117.

- George, D., & Mallery, P. (2013). Validity and Reliability Report. National Center for Analysis of Longitudinal Data in Education.

- Grant, C., & Osanloo, A. (2014). Understanding, Selecting, and Integrating a Theoretical Framework in Dissertation Research: Creating the Blueprint for 'House'. Administrative Issues Journal: Connecting Education, Practice and Research, 4(2), 12-22.

- IMF. (2017). Electrical Fiscal Device or cash register machine Impact of Tax payers and Compliance & Managerial Efficiency. International Monetary Fund.

- Jerene, W. (2016). Challenges of VAT collection performance. Journal of Ethiopian Tax Administration, 4(12).

- Jimenez, G., Sionnaigh, N. M., & Kamenov, A. (2013). Information Technology for Tax Administration. USAID's Leadership in Public Financial Management.

- Kagan, J. (2021, May 24). What Is Taxation? Investopedia. https://www.investopedia.com/.

- Kassahun, B. (2016). The Impact of Electronic Cash Register Machine on VAT Income: The Case of Hawassa City. International Journal of Research in Management, Science and Technology, 6(11), 40-48.

- Lumumba, O. M. (2010). Automation and customs tax administration in Kenya. [Publisher information missing from thesis].

- Mastewal, M. (2018). Determinants Of Tax Collection Efficiency: The Case of Ministry of Revenue Large Tax Payer's Branch Office [Master's thesis, Jimma University].

- McKim, C. (2017). The Value of Mixed Methods Research: A Mixed Methods Study. Journal of Mixed Methods Research, 11(2), 202-222.

- Mesele, M. (2019). Collection of Vat Using Cash Register Machines in Wolaita Sodo Town: Reflection of Challenging Factors. SSRG International Journal of Economics and Management Studies, 6(8).

- Misrak, T. (2014). Ethiopia Tax Accounting (2nd Edition). Woinshet Chanie.

- Nazrawit, T. M. (2022). The Effect of E-Tax System on Tax Revenue Collection: The Case of Ethiopian Ministry of Revenue Large Taxpayers Office [LTO] [Master's thesis, Addis Ababa University].

- Nelson, M. (2015). Determinants of Tax Compliance among Small and Medium Enterprises in Kenya: A Case of Nairobi County. Government Information Quarterly, 27(11), 87–93.

- Richardson, G. (2008). The relationship between culture and tax evasion across countries: Additional evidence and extensions. Journal of International Accounting, Auditing and Taxation.

- Saidi, S. (2015). An assessment of effectiveness of electronic fiscal devices (EFDS) in enhancing tax collection in Tanzania: the case study of TRA coast regional office. [Publisher information missing from thesis].

- Samuel, T. (2012). Value Added Tax in Ethiopia. Addis Ababa University Press.

- Yalemtesfa, T. (2011). The Impact of Electronic Tax Register on VAT: The Case of Addis Ababa city [Master's thesis, Addis Ababa University].

- Yamane, T. (1967). Statistics: An Introductory Analysis (2nd ed.). Harper and Row.

- Zinath, D. G. (2013). Assessment the Impact of Electronic Tax Register Machine on VAT Collection: The Case of Addis Ababa City Revenue and Customs Authority [Master's thesis, Addis Ababa University].

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).