3.1. Current State of Poultry Production and Farming Systems Worldwide

Animal production plays a crucial role in meeting the growing global demand for essential dietary protein of animal origin. According to the United Nations, the world’s population is projected to increase by nearly 2 billion over the next 30 years [

34]. An increase in population increases food demand and supply.

Poultry farming offers affordable, high-quality protein to consumers while creating income-generating opportunities throughout the value chain, thus contributing to both economic and social sustainability [

32]. One of the sector’s key strengths is its adaptability: production systems vary according to flock purpose, feed and nutrient requirements, production orientation, and housing type [

24]. Poultry can be easily integrated into diverse agricultural systems worldwide, especially within rural communities at subsistence and small-scale levels, thereby supporting sustainable livelihoods.

Over recent decades, the poultry industry has undergone substantial transformation to meet rising demand for affordable and safe meat and eggs. Between 1990 and 2020, poultry meat production grew at an average annual rate of 4–5% [

12]. outpacing the growth of pig meat (2–3% per year) and bovine meat (1–1.5% per year) [

36]. By 2022, poultry accounted for roughly 41% of global meat production, compared to about 15% in the 1980s -a shift driven by cost efficiency, short production cycles, and technological advancements [

22]. Global egg production also expanded significantly, reaching approximately 87 million tons in 2021 [

12]. Despite ongoing challenges, such as avian influenza outbreaks and rising feed costs, innovations in genetics, automation, and farm management continue to propel the sector’s growth [

37].

Given poultry’s importance as a source of high-quality protein and essential nutrients, its demand is expected to rise by 15% over the next decade, with global consumption projected to reach 91 million tons by 2032. Meeting this demand sustainably will require significant improvements in production efficiency for both eggs and chicken meat-maximizing output while minimizing input use.

Poultry farming remains one of the fastest-growing sectors within global animal agriculture, playing a critical role in meeting the protein demands of a growing population. According to recent projections by the FAO and OECD, global poultry meat production is expected to reach, with consumption projected to rise to 173 million tons by 2034. This growth is largely attributed to the efficiency of poultry production-marked by short reproductive cycles, low feed conversion rates, and high profitability. The leading producers remain the United States, China, Brazil, and India, with rising demand also driven by shifts in consumer preferences toward animal proteins with a lower environmental footprint [

10]. In the European Union, the poultry industry is shaped by strict legislative frameworks, such as Regulation (EC) No 1831/2003, which prohibits the use of antibiotic growth promoters, aligning production systems with higher standards of animal welfare and food safety [

8].

Technological progress, including advancements in genetics, feed formulation, and farming practices, is already enabling more efficient production. In parallel, ongoing research and development efforts-focused on optimizing feed composition, enhancing breeding programs, and improving farm management-continue to drive efficiency gains.

In any farming system, the scale of production is a determining factor, shaping the type and number of inputs required, their costs, and the potential revenue from product sales. Clear distinctions between subsistence, small-scale, and commercial operations are essential. As noted by the authors, a major challenge in agricultural development is the persistent failure to fully recognize the diversity of farming systems that will be responsible for feeding the global population in the coming decades, as well as the shortcomings of policies designed to support them [

20].

Recent trends in the sector reflect a growing emphasis on sustainability, biosecurity, and digital transformation. Advanced technologies, such as automated feeding, climate control, and precision health monitoring, are increasingly implemented across commercial operations. Simultaneously, interest in organic and small-scale poultry farming is rising, particularly within European markets. Climate change has also intensified the focus on heat-tolerant breeds and environmentally friendly feed additives. Scientific studies confirm that heat stress negatively impacts poultry growth, immune function, and gut health, underlining the need for adaptive strategies [

18,

2,

30].

3.2. Regional and Socioeconomic Disparities in Poultry Production Dynamics (with European Context)

Poultry production trends vary significantly across countries, reflecting differences in economic development, infrastructure, and market orientation. The most notable growth has occurred in lower-middle-income nations, where poultry meat production has consistently expanded at an average annual rate exceeding 8 % over the past two decades. In contrast, low-income countries, starting from a low production base, have seen much slower growth. Egg production mirrors these patterns.

In high-income countries, extensive or free-range poultry systems represent a minor share of overall production, though specialized segments-such as organic poultry and hobby flocks-have recently gained traction in niche markets. Meanwhile, in low- and middle-income countries, industrial systems are expanding and gaining market share, yet the majority of producers still rely on small-scale, extensive methods characterized by low biosecurity and narrow profit margins. A considerable number of independent small commercial producers still operate under semi-intensive conditions with limited access to inputs and markets.

In many developing economies, the expansion of poultry production has outpaced the development of slaughtering and processing infrastructure. As a result, live-bird markets remain crucial, even for large-scale operations, driven by consumer preferences, lack of adequate facilities, or tax policies that penalize formal abattoirs. This leads to “spent” hens from commercial layer units often entering rural informal markets.

Export-oriented countries tend to exhibit more advanced, vertically integrated poultry value chains with stronger risk-management systems. Regional disparities within countries also reflect local economic dynamics and proximity to inputs and markets-such as faster growth in eastern China, central-region concentration of broiler production in Thailand, or the westward shift of Brazil’s poultry sector following the movement of grain production.

In the European Union, the poultry industry operates under strict regulatory frameworks regarding animal welfare, environmental sustainability, and food safety. These policies encourage the development of vertically integrated production systems and certified value chains, while simultaneously stimulating consumer demand for poultry products from alternative systems, such as free-range and organic farming. For example, the European Commission’s portal outlines the structure and regulations of the EU poultry sector [

7].

Over the past decade, global poultry production and consumption have grown by nearly 4%, whereas the overall increase in European poultry consumption has been more modest. In Europe, most notable consumption trends are qualitative rather than quantitative, reflecting a shift toward greater chicken consumption at the expense of turkey, along with changing consumer preferences that favor meat cuts and, in particular, processed poultry products. The rapid expansion of this product category-often marketed without highlighting the origin of the raw material-has encouraged imports from emerging production regions that are highly competitive on the global market.

Animal welfare has become a key priority of EU agricultural policy. According to a study by the European Commission, rural development instruments of the Common Agricultural Policy (CAP) significantly contribute to improved animal welfare and reductions in antimicrobial use [

6].

At the same time, the growth of industrial-scale “megafarms”-housing tens of thousands of poultry-has raised environmental and ethical concerns. Investigative research published by

The Guardian revealed the presence of over 24,000 such large-scale farms across Europe, including in the UK, France, Germany, Italy, and Poland, and highlighted challenges related to pollution, waste management, and enforcement of EU welfare regulations [

33].

Civil society organizations and scientific institutions continue to call for stronger reform of poultry welfare legislation, particularly to address the limitations of current intensive systems and better reflect public demand for sustainable animal farming [

19].

Expansion of the poultry industry has been driven by both demand-side and supply-side factors. Key elements contributing to an outward shift in the demand curve include: rising income levels; increases in the prices of substitute meats, such as pork or beef; stronger consumer preference for poultry; and reductions in the cost of complementary poultry products. Influencing factors also encompass population growth, higher real per capita incomes, the income elasticity of demand, urbanization, and fluctuations in real prices. Moreover, in many nations, evolving consumer tastes and preferences have led to a shift from “inferior” foods toward those considered “superior.” The fastest income growth is occurring in regions such as Africa (4.2%), Asia (3.5%), and Latin America (2.3%), which also experience high population growth rates from 1.2% to 2.2% [

29]. As incomes rise, meat consumption generally increases, and the high expenditure elasticity of poultry highlights its leading role in diets across both developed and developing countries (

Table 1).

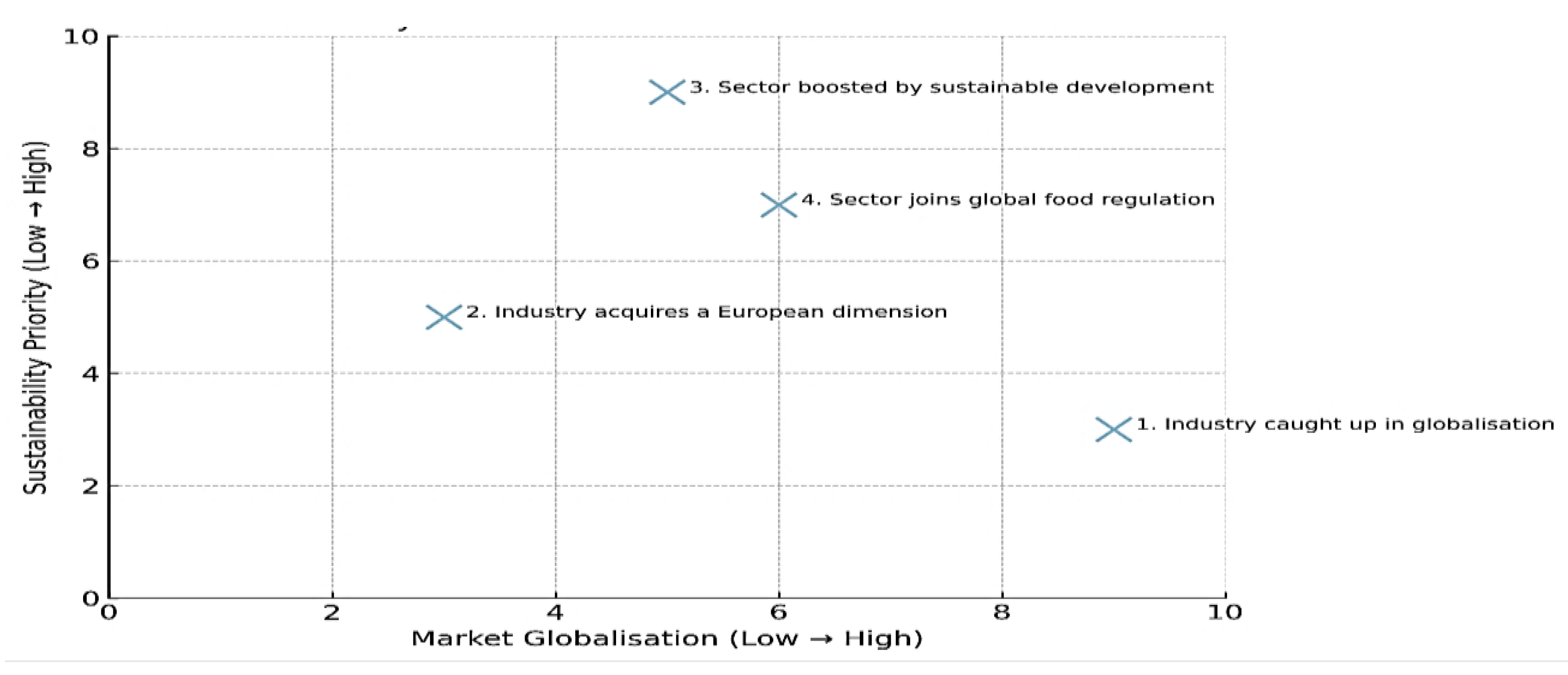

Researchers developed four prospective scenarios based on different assumptions about the three components (

Figure 1).

Two scenarios project a continuation of current trends:

- -

Scenario 1 – "The Poultry Industry in the Grip of Globalization" – envisions a future shaped by increasingly liberalized agricultural markets.

- -

Scenario 2 – "The Poultry Industry Gains a European Identity" – assumes a reorientation of EU policies prioritizing job creation and protection.

The remaining two scenarios describe more substantial shifts:

- -

Scenario 3 – "The Poultry Sector Driven by Sustainable Development" – places environmental considerations at the forefront, influencing the attitudes and choices of French and European consumers.

- -

Scenario 4 – "The Poultry Sector under Global Food Governance" – unfolds in a context of recurring food crises, prompting the establishment of worldwide regulations on food trade to safeguard both food security and natural resources.

The four prospective scenarios outlined above highlight the complex interplay of regional, socioeconomic, and global factors shaping the future of poultry production in Europe. Each scenario underscores distinct pathways, from the continuation of globalized market trends and sustainability-driven transformations to policy-driven European reorientation and responses to global food crises. These scenarios provide a framework for stakeholders to anticipate potential challenges and opportunities, guiding strategic decision-making to balance economic viability, environmental sustainability, and food security in the evolving poultry sector.

3.3. State of Poultry Farming in Moldova: Challenges and Pathways to Sustainability

Poultry farming is a cornerstone of Moldova’s livestock sector, significantly contributing to food security and rural employment. This article synthesizes data from national and international sources to evaluate the state of poultry farming in Moldova and propose strategies for its sustainable development.

Poultry production in Moldova, primarily focused on chickens for meat and eggs, involves both commercial farms and smallholder operations. Approximately 68% of rural households in lower-middle-income countries like Moldova engage in poultry farming, utilizing the nation’s 2.2 million hectares of arable land [

13]. In 2023, the poultry population was approximately 4.3 million birds, a 12% decline from 2020, with 65% managed by private households [

27]. The industrial sector lags behind European Union standards, limiting scalability.

Moldova produced about 600 million eggs and 38,000 tons of poultry meat in 2023, yet domestic demand for poultry meat reached 76,000 tons, requiring imports of 22,000 tons to address a 29% shortfall [

25]. Poultry meat constitutes a significant share of national meat output, and eggs are a dietary staple.

The sector benefits from short production cycles, enabling rapid market responses. Over the past decade, moderate growth has occurred through facility modernization, improved breeds, and better feeding practices [

12]. However, challenges include outdated infrastructure, high feed costs, and reliance on imported feed components like soybean meal. Fluctuating grain prices, biosecurity risks such as avian influenza, logistical constraints, and other factors further impede progress [

25]. Despite gaining EU export rights in 2023, low adoption of modern technologies and market volatility hinder competitiveness [

27].

To ensure sustainable development, Moldova can invest in modern equipment, such as automated feeding systems and climate-controlled housing, to enhance efficiency. Strengthening biosecurity through vaccination programs and robust protocols can mitigate disease risks. Expanding access to low-interest loans and subsidies will support infrastructure upgrades and quality input procurement. Training programs on best practices and market access, alongside leveraging EU export opportunities, can boost productivity and competitiveness [

13].

By addressing these challenges and leveraging its agricultural strengths, Moldova’s poultry sector can reduce import dependency, enhance food security, and contribute to long-term economic growth [

33].

There are 43 poultry farms and nearly 227,000 individual households raising up to six million birds in Moldova. Additionally, there are 24 poultry slaughterhouses in the republic, which annually supply almost 45,000 tons of meat, and 12 egg collection centers package nearly 253 million eggs each year [

1].

Most poultry farms in Moldova are backyard or semi-intensive systems, with only a small percentage employing modern intensive methods.

Table 2 summarizes the distribution of farm types based on size and production system.

3.4. Development Pathways

The Republic of Moldova's poultry industry currently produces approximately 54,000 tons of poultry meat annually across its specialized enterprises. However, domestic consumption significantly exceeds this output, reaching around 76,000 tons per year. This results in a shortfall of approximately 22,000 tons, or about 29% of the demand, which is met through imports.

According to the Ministry of Agriculture and Food Industry of the Republic of Moldova, the country's population of 2.682 million requires an estimated 85,000 tons of poultry meat annually to meet nutritional needs [

23].

In terms of per capita poultry meat production among Commonwealth of Independent States (CIS) countries, Moldova ranks near the bottom with 13.5 kg per person per year. For comparison, Belarus leads with 52.9 kg per capita, followed by Ukraine (27.8 kg), Kazakhstan (18.7 kg), Armenia (12.5 kg), Azerbaijan (9.6 kg), Uzbekistan (2.1 kg), and both Turkmenistan and Tajikistan (1.3 kg) [

21].

In a significant development for Moldova’s poultry sector, the European Union granted permission in 2023 for the export of processed poultry meat and table eggs to EU countries. This decision followed a February 2023 meeting of the Plants, Animals, Food, and Feed (PAFF) Committee, where EU member states supported the European Commission’s draft legislation to include Moldova as an authorized exporter of these products. In 2024, Moldova successfully initiated its first exports of chilled poultry meat to the EU, marking a milestone in its agricultural trade.

Ensuring the quality and safety of poultry products represents a key element in the sustainable development of the poultry sector in the Republic of Moldova. Quality assurance systems are designed to protect consumer health, improve competitiveness, and facilitate access to international markets, particularly the European Union.

The assurance of poultry product quality is based on a combination of international, European, and national legislative frameworks. At the international level, the Codex Alimentarius establishes fundamental guidelines for food hygiene and safety, while ISO 22000 provides requirements for food safety management systems [

9]. Within the European Union, poultry production is governed by Regulation (EC) No 852/2004 on the hygiene of foodstuffs and Regulation (EC) No 853/2004 laying down specific hygiene rules for food of animal origin.

In Moldova, the Law on Food Safety (No. 113/2012) and the Law on Veterinary and Sanitary Control (No. 221/2007) provide the legal foundation for food safety and animal health. These are harmonized progressively with EU acquis, in line with the EU–Moldova Association Agreement [

5].

Modern poultry farms are required to implement Hazard Analysis and Critical Control Points (HACCP), Good Manufacturing Practices (GMP), and Good Hygiene Practices (GHP) to minimize risks along the production chain. In Moldova, HACCP implementation has become mandatory for enterprises engaged in processing poultry products, supervised by the National Agency for Food Safety (ANSA).

Laboratory monitoring includes microbiological testing (e.g., Salmonella spp., Campylobacter spp.) and chemical residue analysis (antibiotics, heavy metals, mycotoxins) to ensure compliance with EU maximum residue limits (MRLs) [

17]. Increasingly, traceability systems and digital databases are introduced to strengthen transparency in the production chain.

To secure approval for exporting Class A eggs-the highest quality category-Moldova implemented a Salmonella control program for laying hen flocks. The program underwent evaluation by the European Commission, with compliance verified during an audit in April 2022. These efforts align with Moldova’s broader aspirations, including its application for EU membership in March 2022, and demonstrate progress in aligning with EU standards for food safety, veterinary, and phytosanitary policies [

16].

Table 3 presents the production volumes of key agricultural products across all categories of producers in Moldova from 2020 to 2023. The data encompass livestock farming (measured in live weight, thousand tons), cow's milk (thousand tons), and egg production (million pieces). The analysis below examines trends, fluctuations, and key insights derived from the data.

Total livestock production (in live weight) shows an overall upward trend from 147.5 thousand tonnes in 2021 to 170.3 thousand tonnes in 2023, despite a dip in 2021 compared to 2020 (159.2 thousand tonnes). The increase of 15.4% from 2021 to 2023 indicates growth in the livestock sector. The recovery in 2022 (160.5 thousand tonnes) and further growth in 2023 suggest improved production capacity or market demand, particularly in specific livestock categories.

Poultry production, a significant contributor to total livestock output, saw a decline from 60.6 thousand tonnes in 2020 to 53.3 thousand tonnes in 2021 (a 12.0% drop), followed by a recovery to 59.6 thousand tonnes in 2022 and further growth to 65.0 thousand tonnes in 2023 (a 22.0% increase from 2021). This growth aligns with Moldova’s recent authorization to export poultry meat to the EU, indicating potential market-driven expansion.

The

Figure 2 below presents the annual poultry production (in thousand tons, live weight) in Moldova from 2015 to 2024 [

28]. The data provide insights into the trends and fluctuations in the poultry sector, a key component of Moldova’s agricultural industry. The analysis examines production patterns, identifies key trends, and contextualizes the findings within the broader agricultural landscape.

Poultry production in Moldova increased from 62.7 thousand tonnes in 2015 to 70.5 thousand tonnes in 2024, reflecting a net growth of 12.5% over the decade. Despite fluctuations, the overall trajectory indicates a strengthening poultry sector. The highest production was recorded in 2016 (69.9 thousand tonnes), while the lowest was in 2021 (53.3 thousand tonnes). The recovery from 2021 to 2024 (a 32.3% increase) suggests resilience and potential market-driven expansion.

The significant increase in production from 2022 to 2024 corresponds with Moldova’s approval to export processed poultry meat to the EU, following the February 2023 decision by the Plants, Animals, Food, and Feed (PAFF) Committee. The first export of chilled poultry meat in 2024 likely incentivized producers to scale up operations.

The fluctuations between 2016 and 2021 suggest vulnerabilities in the poultry sector, potentially due to inconsistent investment, disease risks (e.g., avian influenza), or reliance on imports to meet domestic demand, which is estimated at 76 thousand tonnes annually [

21].

The recovery from the 2021 low point demonstrates the poultry sector’s adaptability, likely supported by improved biosecurity measures (e.g., Salmonella control programs for EU compliance) and government efforts to align with EU food safety standards.

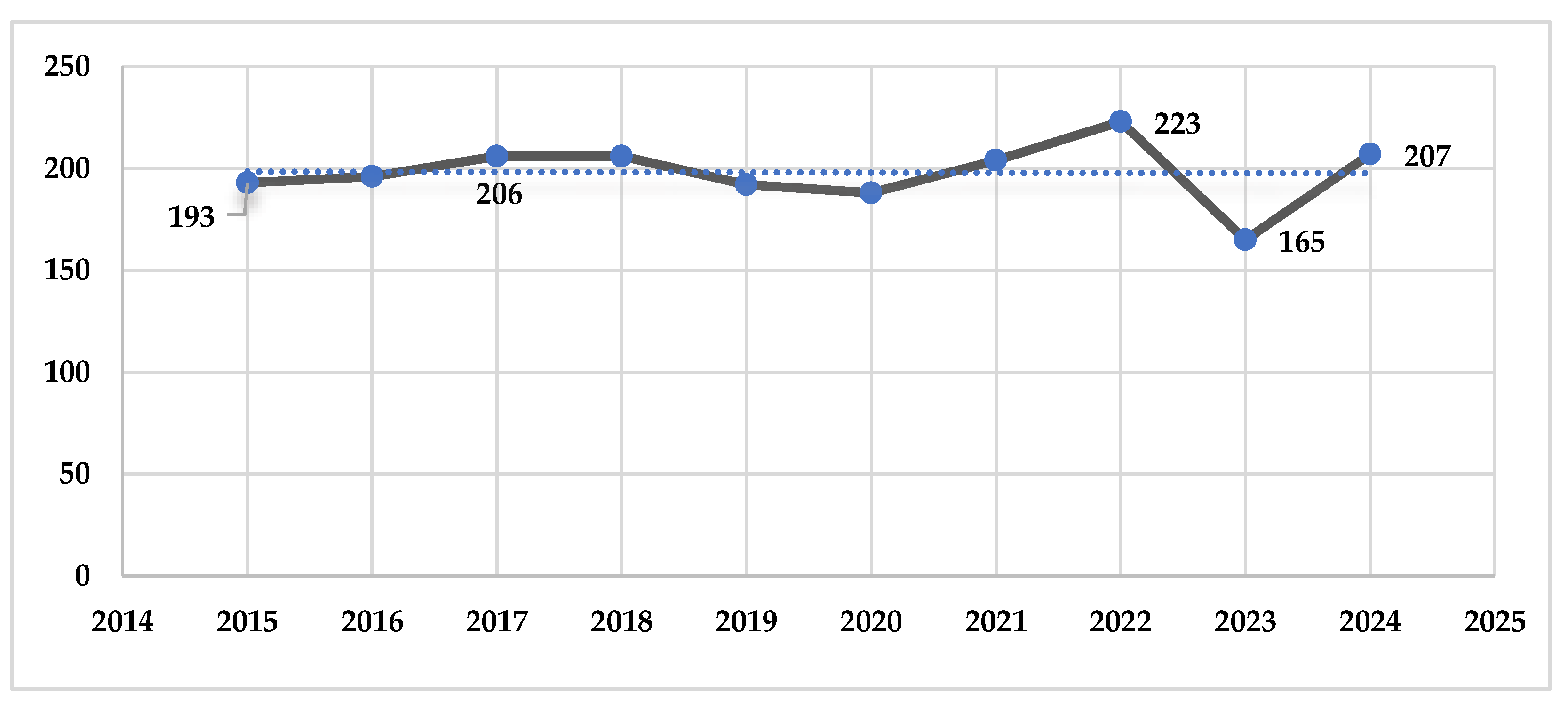

The average annual egg production per laying hen (in pieces) across Moldova from 2015 to 2024 reflect the productivity of the poultry sector, specifically in egg production, and provide insights into trends, fluctuations, and potential influencing factors such as farming practices, feed quality, and biosecurity measures (

Figure 3).

The average annual egg production per layer ranged from a low of 165 pieces in 2023 to a high of 223 pieces in 2022. Over the decade, there is no clear linear trend, with productivity showing periods of growth, stability, and decline. From 193 pieces per layer in 2015 to 207 pieces in 2024, there is a modest net increase of 7.3%. However, significant year-to-year fluctuations indicate variability in production efficiency. A recovery began in 2021 with 204 pieces per layer (an 8.5% increase from 2020), followed by a significant jump to 223 pieces in 2022 (a 9.3% increase from 2021). The 2022 peak, the highest in the decade, aligns with Moldova’s efforts to meet EU standards for egg exports (e.g., Salmonella control programs), suggesting improvements in biosecurity and farm management. Productivity rebounded to 207 pieces per layer in 2024, a 25.5% increase from 2023, returning to levels seen in 2017–2018. This recovery likely reflects improved conditions, such as stabilized feed supply, enhanced biosecurity, or increased investment following Moldova’s first egg exports to the EU in 2024 [

28].

The peak in 2022 and recovery in 2024 align with Moldova’s authorization to export Class A eggs to the EU, following the 2023 PAFF Committee decision and compliance with EU Salmonella control standards [

16]. Improved farm management to meet these standards likely boosted productivity in 2022 and 2024. To sustain and enhance productivity, Moldova’s poultry industry should focus on improving feed quality, adopting advanced breeding techniques, and strengthening biosecurity measures to meet both domestic demand and export opportunities.

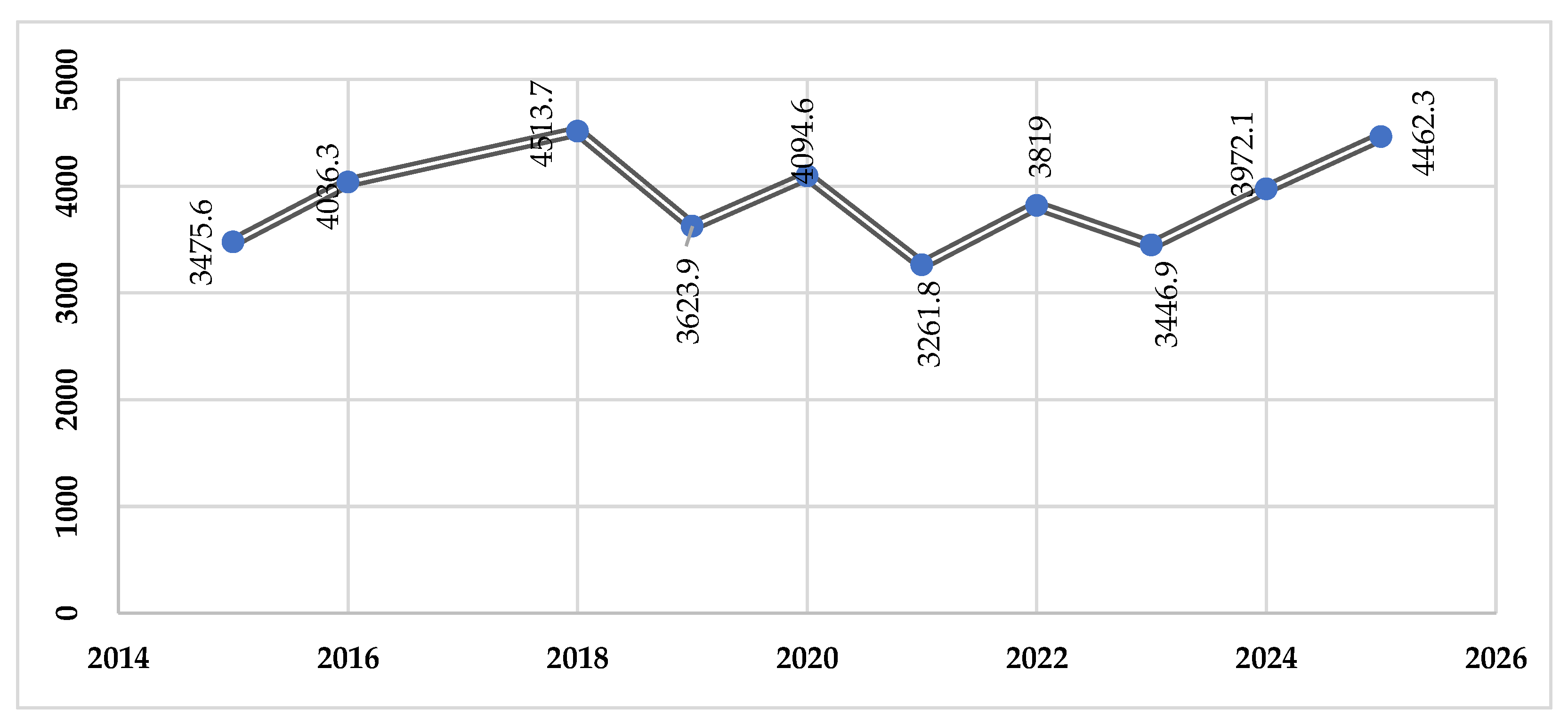

The

Figure 4 presents data on poultry consumption in Moldova, measured in thousand capita (likely referring to thousand kilograms or tonnes per capita, adjusted for population), from 2015 to 2025. The data provide insights into consumption trends, reflecting changes in dietary preferences, economic conditions, and market dynamics. The analysis examines patterns, fluctuations, and contextual factors influencing poultry consumption in Moldova over this period.

Poultry consumption in Moldova increased from 3475.6 thousand capita in 2015 to 4462.3 thousand capita in 2025, reflecting a net growth of approximately 28.4% over the decade. This upward trend suggests rising demand for poultry, likely driven by its affordability, nutritional value, and increasing consumer preference for white meat.

The highest consumption was recorded in 2018 (4513.7 thousand capita), while the lowest was in 2021 (3261.8 thousand capita). The recovery from 2021 to 2025 (a 36.8% increase) indicates a strong rebound in demand. Consumption rebounded to 3819.0 thousand capita in 2022, followed by a dip to 3446.9 in 2023 (a 9.8% decrease), before rising steadily to 3972.1 in 2024 and 4462.3 in 2025. The 29.5% increase from 2023 to 2025 aligns with increased poultry production (70.5 thousand tonnes in 2024) and Moldova’s entry into the EU export market for poultry meat in 2023, which may have stabilized supply and reduced prices.

With Moldova’s population estimated at approximately 2.682 million (Ministry of Agriculture and Food Industry, Republic of Moldova), the 2025 consumption of 4462.3 thousand capita translates to roughly 1.66 kg per person per year. This is significantly lower than the previously cited domestic demand of 76 thousand tonnes (approximately 28.3 kg per capita), suggesting the "thousand capita" unit may reflect a specific subset of consumption or a data scaling issue. Alternatively, the data may represent production rather than total consumption, requiring clarification. The projected 2025 consumption of 4462.3 thousand capita suggests growing consumer preference for poultry, possibly driven by its affordability compared to other meats (e.g., cattle production dropped to 7.1 thousand tonnes in 2023) and increasing awareness of its nutritional benefits. Strategic investments in production capacity, biosecurity, and market development are essential to sustain growth and reduce import dependency.

The analysis of the provided tables on livestock production, poultry production, poultry consumption, and egg production per layer, combined with contextual material, offers a comprehensive view of Moldova’s poultry sector from 2015 to 2025. The data reveal a sector characterized by growth potential, significant volatility, and emerging opportunities, particularly in the context of Moldova’s integration into the European Union (EU) market [

14].

Total livestock production increased from 147.5 thousand tonnes in 2021 to 170.3 thousand tonnes in 2023, with poultry and pigs driving growth.

Poultry meat production grew from 62.7 thousand tonnes in 2015 to 70.5 thousand tonnes in 2024, a 12.5% increase, despite a low of 53.3 thousand tonnes in 2021. The recovery from 2022 to 2024 aligns with Moldova’s authorization to export poultry meat to the EU in 2023, reflecting market-driven expansion and improved production capacity.

Moldova’s poultry sector demonstrates resilience and growth potential, particularly in poultry meat and egg production, supported by access to EU markets following the 2023 approval for exporting processed poultry meat and Class A eggs. The first exports of chilled poultry meat in 2024 and compliance with EU Salmonella control standards have driven improvements in production efficiency and biosecurity. However, the sector faces challenges: including production shortfalls, low per capita output compared to regional peers, and volatility due to economic disruptions, feed price fluctuations, and disease risks.

To sustain and accelerate growth, Moldova’s poultry sector should focus on enhancing production capacity through investments in modern farming technologies, high-yield poultry breeds, and feed optimization to boost both meat and egg production and reduce import dependency. Strengthening biosecurity by maintaining adherence to EU standards, such as Salmonella control programs, is critical to preserving export market access and improving productivity. Addressing volatility requires policies to stabilize feed costs, improve disease management, and support farmers during economic disruptions. Leveraging EU market access by expanding exports of poultry meat and eggs can drive economic growth, provided quality and safety standards are consistently met.