Submitted:

26 September 2025

Posted:

28 September 2025

You are already at the latest version

Abstract

Keywords:

Introduction

I. PEG vs. PPP—Foundations

- P/E: price-to-earnings ratio,

- g: earnings growth rate,

- r: discount rate (reflecting interest rate and risk).

- In absolute terms, it represents a robust annualized return.

- In relative terms, it is well above prevailing risk-free interest rates (~4%).

- Importantly, only a few stocks present PPP < 10 when r = 0, because this condition represents a strict optimization of the P/E–growth relationship.

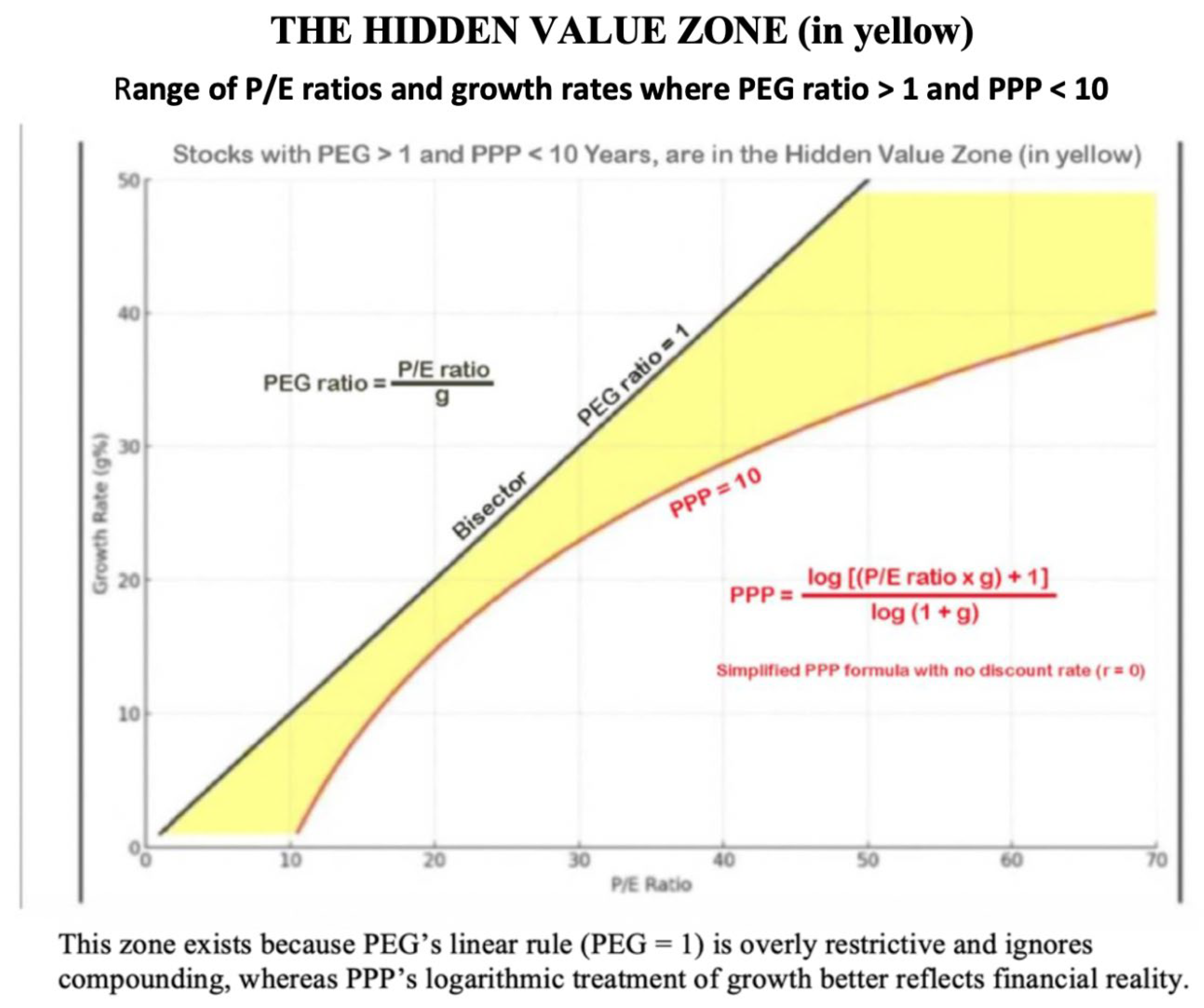

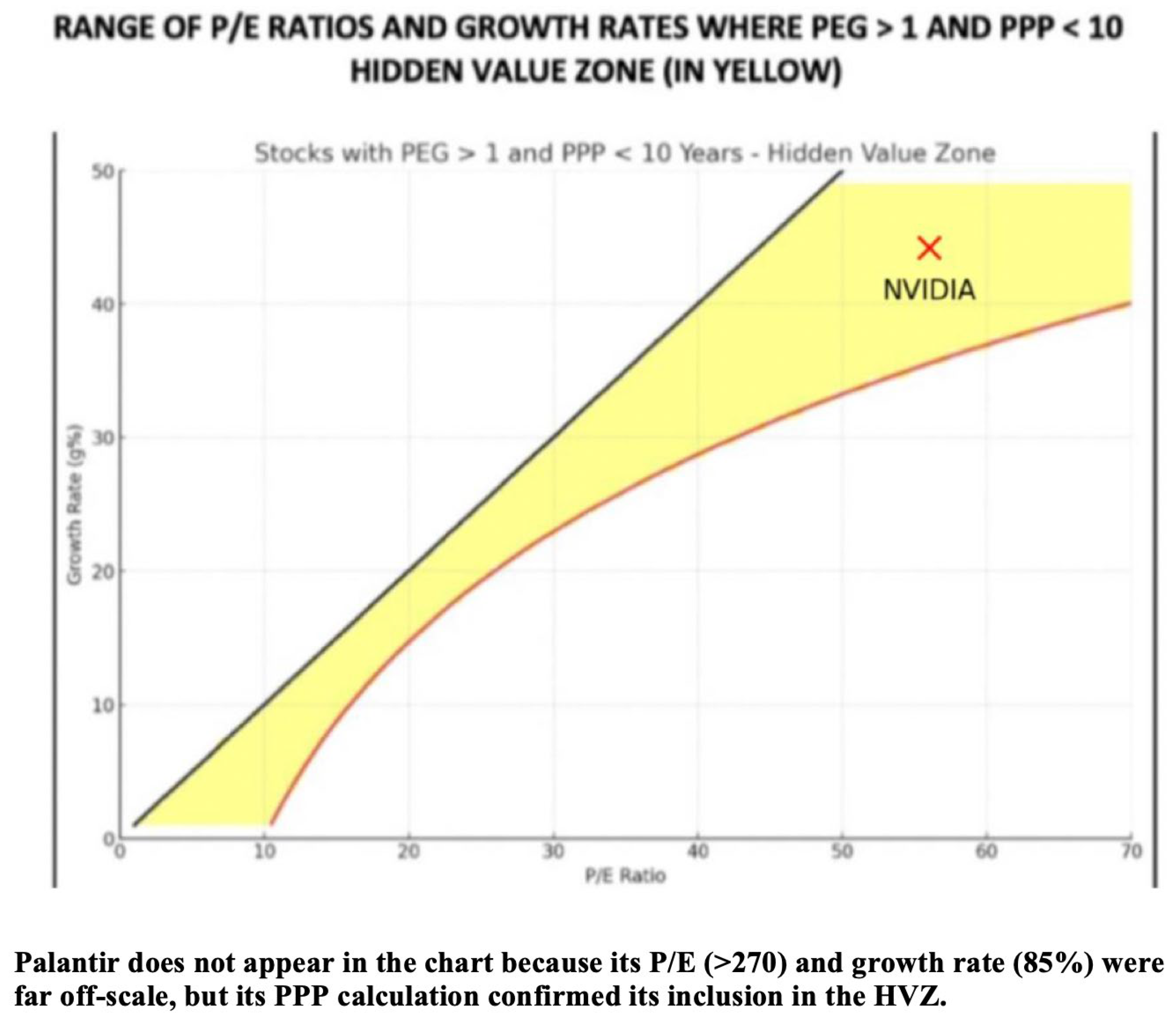

II. The HVZ—Graphical Definition

- Below the PEG = 1 line (i.e., PEG > 1), and

- Above the PPP = 10 curve (i.e., PPP < 10).

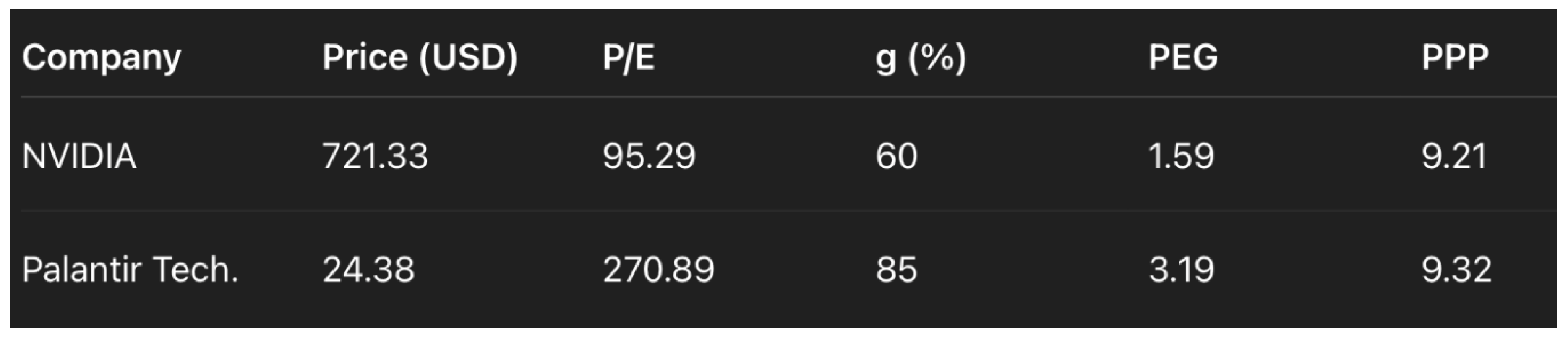

III. Initial Identification of HVZ Stocks (February 2024)

|

IV. Proof Through Performance (Feb 2024 – Sept 2025)

- Baseline (9 Feb 2024): USD 721.33

- Split adjustment (10-for-1, June 2024): USD 72.13

- Price (24 Sep 2025): USD 176.97

- Performance: +145%

- Baseline (9 Feb 2024): USD 24.38

- Price (24 Sep 2025): USD 179.56

- Performance: +636%

- Performance (same period): +21.93%

V. Literature Context

- Basu (1977). In one of the earliest empirical studies on the Price-to-Earnings ratio, Basu demonstrated that stocks with low P/E ratios tended to outperform those with high P/E ratios, challenging the efficient market hypothesis. While his work confirmed the usefulness of valuation multiples, it also underscored the limitations of P/E as a static measure. The PPP framework expands on this insight by generalizing P/E into a dynamic construct that incorporates growth, interest rates, and risk, thereby extending and overcoming the limitations of Basu’s static formulation. [1]

- Graham and Dodd (2008). Their seminal work on Security Analysis established the foundation for value investing by emphasizing intrinsic value, earnings power, and the margin of safety. The PPP aligns with this tradition by quantifying intrinsic value through the theoretical recovery of stock price from discounted future earnings. The HVZ can thus be understood as a contemporary extension of Graham and Dodd’s principles, adapted to account for compounding growth and modern capital market conditions. [2]

- Lynch (2000). Peter Lynch popularized the PEG ratio as a quick heuristic for incorporating growth into valuation, suggesting that a PEG of 1 represented fair value. However, the PEG ratio’s reliance on a linear formulation of the relationship between P/E and growth is overly simplistic. The PPP provides a more financially consistent logarithmic approach, and the HVZ specifically emerges from the divergence between PEG and PPP. In this sense, the HVZ highlights opportunities that the PEG ratio prematurely excludes but that remain attractive under PPP. [3]

VI. Discussion and Implications

- Methodological. The PEG ratio is based on a linear trade-off between valuation and earnings growth, whereas the PPP incorporates compounding effects through a logarithmic formulation and explicitly accounts for growth, interest rates, and risk.

- Conceptual. The PPP generalizes the traditional P/E ratio. In fact, the P/E ratio can be understood as a degenerate case of the PPP that arises when both growth (g) and the discount rate (r) are set to zero.

- Practical. When setting r = 0, the condition PPP < 10 corresponds to a Stock Internal Rate of Return (SIRR) exceeding 7.18 percent, which represents a demanding threshold that relatively few stocks are able to surpass. Those that do, while still being excluded under the PEG criterion, fall within the Hidden Value Zone.

- Empirical. NVIDIA and Palantir, both identified as HVZ stocks as of February 2024, subsequently recorded exceptional performances: NVIDIA appreciated by +145 percent and Palantir by +636 percent by September 2025, compared with a gain of only +21.93 percent for the S&P 500 index over the same period.

VII. Conclusion

References

- Basu, S. Investment performance of common stocks in relation to their price-earnings ratios: A test of the efficient market hypothesis. The Journal of Finance, 1977, 32, 663–682. [Google Scholar]

- Graham, B., & Dodd, D. (2008). Security Analysis: Sixth Edition. McGraw-Hill Education.

- Lynch, P. (2000). One Up on Wall Street: How to Use What You Already Know to Make Money in the Market. Simon & Schuster.

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).