Submitted:

03 May 2025

Posted:

06 May 2025

You are already at the latest version

Abstract

Keywords:

1. Introduction: Revisiting Traditional Valuation Metrics

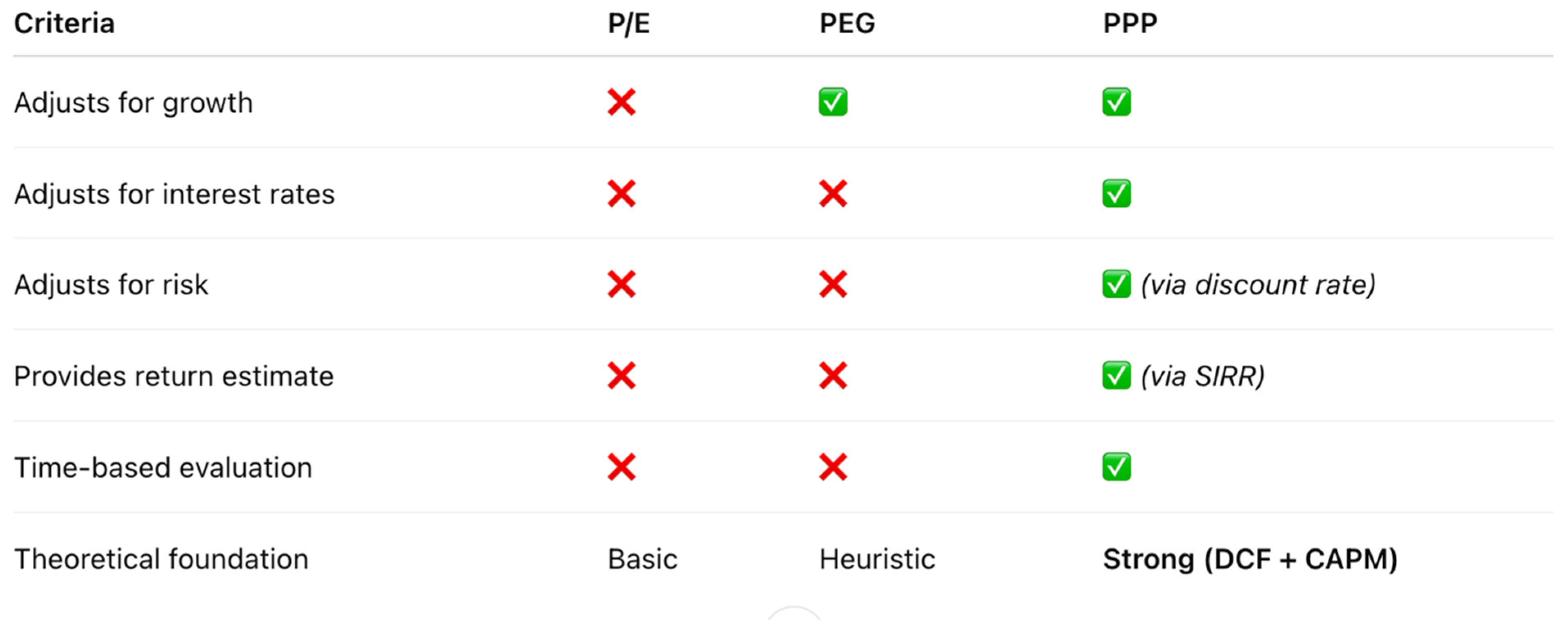

2. Understanding the Limitations of P/E and PEG

2.1. The P/E Ratio

- Zero earnings growth

- No discounting of future earnings

- Static and risk-free operating conditions.

2.2. The PEG Ratio

- Linear treatment of growth, ignoring compounding and the time value of money. This linear structure is an oversimplification of financial reality, where growth is exponential in nature and must be discounted over time.

- No consideration of interest rates or risk.

- Arbitrary “PEG = 1” threshold, with no theoretical foundation.

- Over-reliance on analyst projections for growth estimates.

3. The Potential Payback Period (PPP): A Dynamic Adjustment

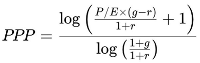

3.1. PPP Formula

- P/E is the price-to-earnings ratio

- g is the average earnings growth rate

- r is the discount rate, calculated as the risk-free rate plus a market risk premium adjusted for the stock’s specific risk, in accordance with the CAPM framework.

4. From PPP to SIRR: A New Return-Based Metric

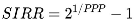

5. Case Study: Applied Materials vs. Broadcom

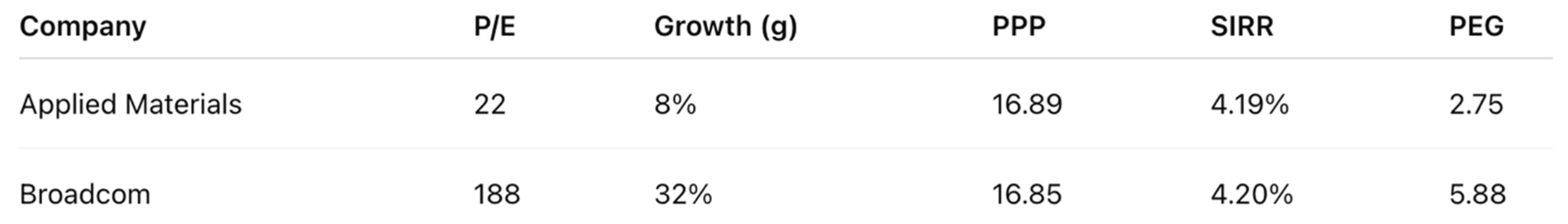

6. The Hidden Value Zone (HVZ): Where the PPP Reveals What PEG Misses

- The black line represents the traditional PEG = 1 boundary (i.e., P/E = g), often used as an arbitrary threshold to judge overvaluation. It is also the bisector of the graph, representing points where the P/E ratio is numerically equal to the earnings growth rate (g). Stocks below this line have a PEG ratio above 1 and are therefore considered overvalued according to the PEG approach.

- The red curve represents PPP = 10 years, assuming a 0% discount rate (r = 0), focusing purely on the relationship between price and compounded growth. As earnings growth accelerates, the PPP decreases, reducing the time needed to recover the investment through future discounted earnings.Stocks positioned above this curve have a PPP below 10 years and are therefore considered to offer attractive intrinsic value according to the PPP approach.

- The yellow shaded area between the two curves is the Hidden Value Zone (HVZ) — a region where high-growth stocks appear overvalued by PEG standards but are revealed as undervalued under the PPP framework. The HVZ essentially results from a clash between the linear logic of the PEG ratio and the logarithmic structure of the PPP formula, with the latter offering a more realistic representation of earnings growth and value recovery over time.

- NVIDIA: P/E = 69.31; growth rate = 57.38%; PPP = 8.18; PEG = 1.21.

- Alphabet: P/E = 23.85; growth rate = 21.91%; PPP = 9.23; PEG = 1.09.

- Amazon: P/E = 44.48; growth rate = 32.90%; PPP = 9.67; PEG = 1.35.

7. Application to Market Indices: The S&P 500

- P/E = 30

- g = 18%

- r = 4.62% (risk-free rate represented by the 10-year U.S. Treasury yield).

- PPP = 13.10 years

- SIRR = 5.43%

8. Comparing PPP to Traditional Metrics

9. Conclusion

- Incorporate growth, risk, and the time value of money

- Extend the traditional P/E and PEG ratios into dynamic metrics

- Offer investors a time-based and return-based framework

- Reveal valuation clarity for both individual stocks and broad indices.

References

- Bodie, Z. , Kane, A., & Marcus, A. J. (2013). Investments (10th ed.). McGraw-Hill. Comprehensive coverage of investment theory, useful for contrasting traditional valuation methods with the PPP-derived SIRR and SIRRIPA.

- Damodaran, A. (2002). Investment valuation: Tools and techniques for determining the value of any asset. Wiley Finance. Provides insights into valuation techniques for various asset classes, highlighting why traditional methods can fall short in capturing long-term earning power as reflected by PPP-derived SIRR and SIRRIPA.

- Fama, E. F. , & French, K. R. (1993). Common risk factors in the returns on stocks and bonds. Journal of Financial Economics, 33(1), 3–56. Examines risk factors influencing stock and bond returns, underscoring the importance of risk-adjusted metrics in investment evaluation such as PPP-derived SIRR and SIRRIPA.

- Graham, B. , & Dodd, D. (1934). Security analysis. McGraw-Hill. Classic work on value investing emphasizing intrinsic value, a concept central to the PPP-derived SIRR and SIRRIPA’s focus on earning power.

- Modigliani, F. , & Miller, M. H. (1958). The cost of capital, corporation finance, and the theory of investment. The American Economic Review, 48(3), 261–297. Foundational paper in financial theory, highlighting the role of capital costs in investment decisions, relevant to discount rate discussions in PPP, SIRR, and SIRRIPA.

- Sam, R. (1984). Le PER, un instrument mal adapté à la gestion mondiale des portefeuilles. Comment remédier à ses lacunes. Revue Analyse Financière, 2e trimestre 1984. Critiques the limitations of the P/E ratio for global portfolio management and proposes the DR (Payback Period) as a more robust evaluation tool, paving the way for PPP-derived metrics such as SIRR and SIRRIPA.

- Sam, R. (1985). Le Délai de Recouvrement (DR). Revue Analyse Financière, 3e trimestre 1985. Refines the DR concept (early form of the PPP), setting theoretical groundwork for dynamic valuation metrics like SIRR and SIRRIPA.

- Sam, R. (1988). Le DR confronté à la réalité des marchés financiers. Revue Analyse Financière, 4e trimestre 1988. Applies the DR concept in real-world financial markets, validating its relevance and laying further foundations for the PPP and its derivatives such as SIRR and SIRRIPA.

- Sam, R. (2024). Stock evaluation: Discovering the Potential Payback Period (PPP) as a dynamic P/E ratio. Dedicated platform focusing on the Potential Payback Period (PPP) and its innovative use in deriving both the Stock Internal Rate of Return (SIRR) and the Stock Internal Rate of Return Including Price Appreciation (SIRRIPA).

- Sam, R. (2025). Le Potential Payback Period (PPP): Une généralisation utile du Price Earnings Ratio (PER) pour l’évaluation des actions. Revue Française d’Économie et de Gestion, 1(2), 621–632. Explores how the PPP generalizes and extends the traditional P/E ratio by integrating earnings growth, interest rates, and risk, leading to evaluation metrics such as SIRR and SIRRIPA.

- Sam, R. (2025). Le Potential Payback Period (PPP): La septième révolution financière. Revue Française d’Économie et de Gestion, 6(2), 594–620. Positions the PPP as a major evolution in financial analysis, comparable to earlier pivotal innovations, and highlights the significance of metrics such as SIRR and SIRRIPA.

- Sam, R. (2025). Anatomy of a looming bear market: How to assess the impact of Donald Trump’s chaotic measures on Wall Street. Revue Française d’Économie et de Gestion, 6(3), 550–560. Analyzes potential bear market scenarios linked to political instability, applying PPP-derived methods, including SIRR and SIRRIPA, to assess market risks.

- Sam, R. (2025). Comparing global stock markets using risk-premiums derived from the Potential Payback Period (PPP). Revue Française d’Économie et de Gestion, 6(3), 541–549. Applies PPP-derived risk premiums and related return metrics such as SIRR and SIRRIPA to compare and rank different global stock markets.

- Sam, R. (2025). Analyse financière: Le Potential Payback Period (PPP), une alternative au Price Earnings Ratio pour évaluer les entreprises temporairement déficitaires – Étude de cas: Intel Corp. Revue Française d’Économie et de Gestion, 6(3), 561–576. Demonstrates how the PPP, through metrics such as SIRR and SIRRIPA, can be effectively applied to companies with temporary losses, where the traditional P/E ratio fails, using Intel Corp. as a case study.

- Sharpe, W. F. (1964). Capital asset prices: A theory of market equilibrium under conditions of risk. The Journal of Finance, 19(3), 425–442. Introduces the Capital Asset Pricing Model (CAPM), forming the basis for adjusting returns for risk, crucial for calculating PPP-derived SIRR and SIRRIPA.

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).