Submitted:

07 September 2025

Posted:

10 September 2025

You are already at the latest version

Abstract

Keywords:

1. Introduction

2. Global Ev Charging Infrastructure Status

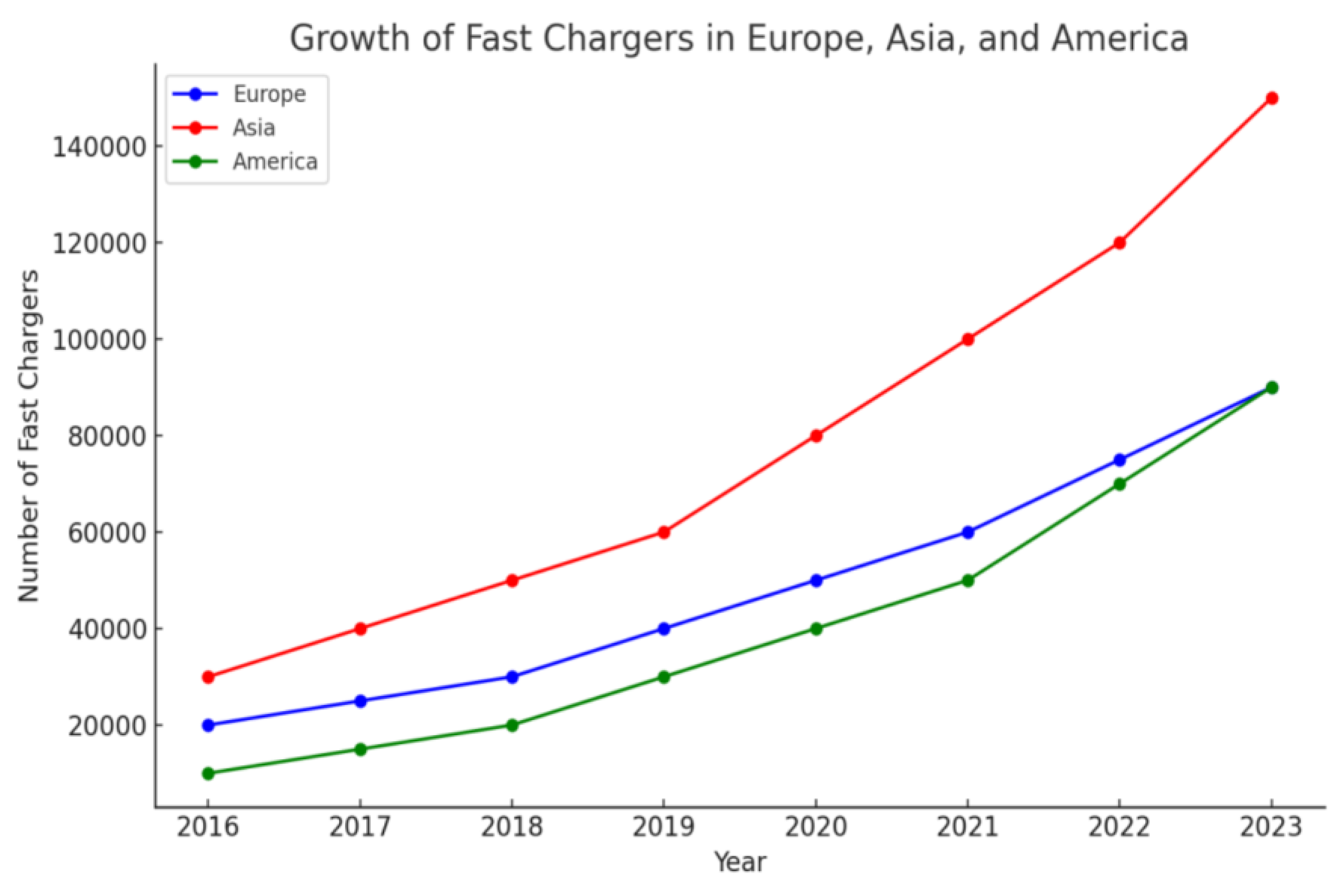

2.1. North America

2.2. Europe

2.3. Asia-Pacific

2.4. Other Regions

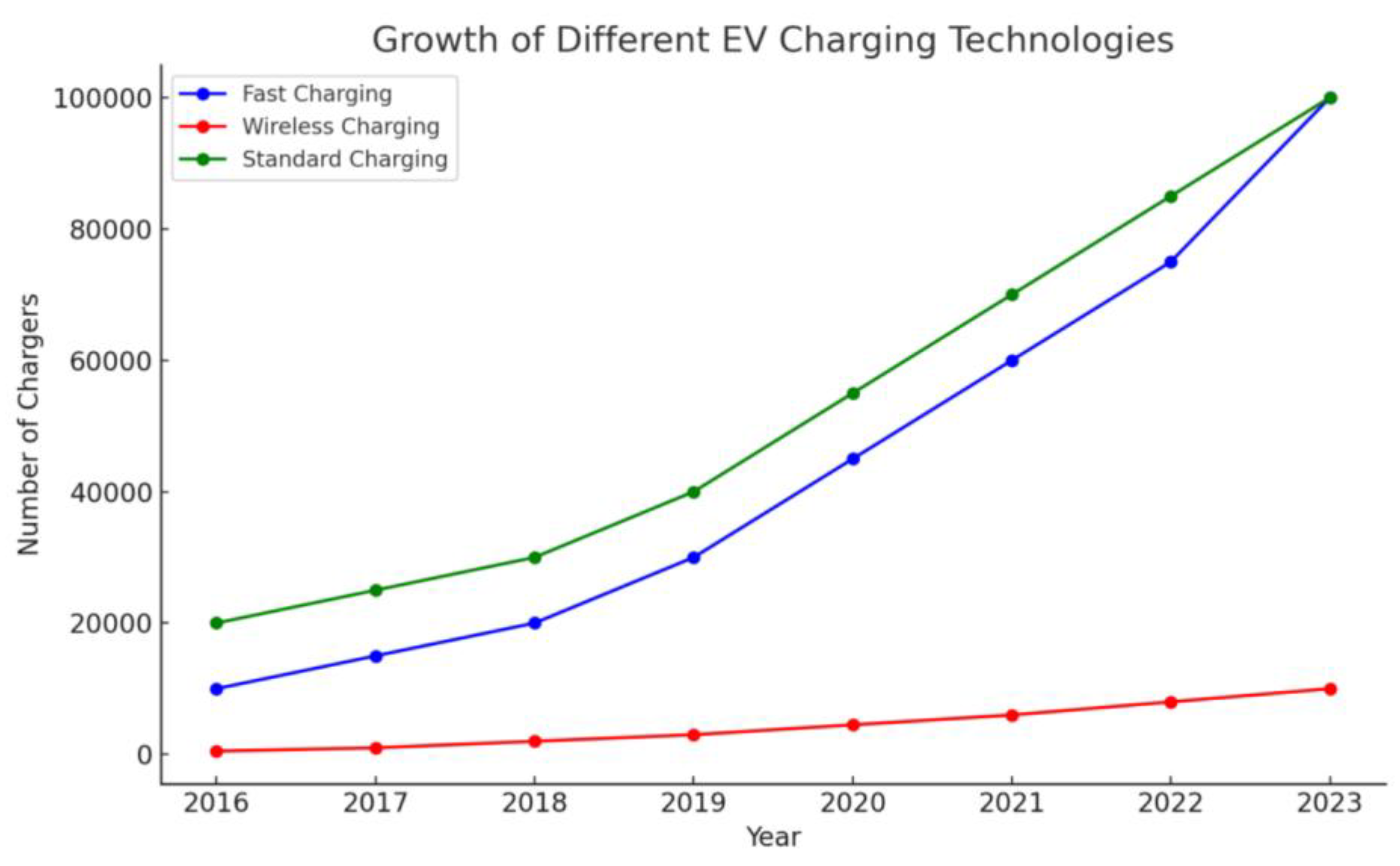

3. Advancements in Charging Technology

3.1. Fast Charging Technology

3.2. Wireless Charging Technology

3.3. Standardization and Interoperability

3.4. Smart Grids and Energy Management Systems

4. Challenges

4.1. High Infrastructure Construction Costs

4.2. Lack of Standardization

4.3. Grid Load Pressure

4.4. Utilization and Maintenance of Charging Stations

4.5. Policy Support and Market Incentives

4.6. User Acceptance and Behavior Change

5. Opportunities and Future Outlook

5.1. Development Opportunities

5.2. Future Outlook and Recommendations

References

- International Energy Agency. Global EV Outlook 2022. 2022. Available online: https://www.iea.org/reports/global- ev-outlook-2022.

- McKinsey & Company. Charging ahead: Electric-vehicle infrastructure demand. 2023. Available online: https://www.mckinsey.com/industries/automotive-and-assembly/our-insights/charging-ahead-electric-vehicle-infrastructure-demand.

- Tesla, Inc. Supercharger. 2023. Available online: https://www.tesla.com/supercharger.

- European Commission. The European Green Deal. 2019. Available online: https://ec.europa.eu/info/strategy/priorities-2019-2024/european-green-deal_en.

- European Commission. Directive 2014/94/EU on the deployment of alternative fuels infrastructure. 2021. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A32014L0094.

- China Electric Vehicle Charging Infrastructure Promotion Alliance. 2023 Annual Report. 2023. Available online: http://www.evcipa.org.cn/.

- Ministry of Economy, Trade and Industry, Japan. EV Infrastructure Development Strategy. 2023. Available online: https://www.meti.go.jp/english/.

- Ministry of Trade, Industry and Energy, South Korea. Electric Vehicle Charging Infrastructure Plan. 2023. Available online: https://english.motie.go.kr/.

- Latin American Energy Organization (OLADE). Electric Vehicle Charging Infrastructure in Latin America. 2023. Available online: http://www.olade.org/.

- African Union Commission. Electric Mobility Programme. 2023. Available online: https://au.int/en/.

- CharIN e.V. Fast Charging Standards and Technologies. 2023. Available online: https://www.charin.global/.

- SAE International. Wireless Power Transfer for Electric Vehicles. 2023. Available online: https://www.sae.org/standards/content/j2954_202101/.

- International Organization for Standardization. ISO 15118 Road vehicles — Vehicle to grid communication interface. 2023. Available online: https://www.iso.org/standard/55366.html.

- European Alternative Fuels Observatory. Interoperability of Charging Infrastructure. 2023. Available online: https://www.eafo.eu/.

- National Renewable Energy Laboratory (NREL). Electric Vehicle Charging Infrastructure Trends. 2023. Available online: https://www.nrel.gov/docs/fy23osti/76890.pdf.

- International Council on Clean Transportation (ICCT). Challenges of Electric Vehicle Infrastructure. 2023. Available online: https://theicct.org/publications/challenges-ev-infrastructure-2023.

- U.S. Department of Transportation. The Infrastructure Investment and Jobs Act. 2021. Available online: https://www.transportation.gov/.

- Tesla, Inc. Supercharger. 2023. Available online: https://www.tesla.com/supercharger.

- Statista. Number of electric vehicle charging stations in the United States from 2016 to 2022. 2023. Available online: https://www.statista.com/.

- U.S. Department of Energy. National Electric Vehicle Infrastructure (NEVI) Formula Program. 2023. Available online: https://www.energy.gov/.

- Lin, Y. Construction of Computer Network Security System in the Era of Big Data. Advances in Computer and Communication 2023, 4(3). [Google Scholar] [CrossRef]

- Yang, Y.; Guo, Z.; Gellman, A. J.; Kitchin, J. Modeling Ternary Alloy Segregation with Density Functional Theory and Machine Learning. 2022 AIChE Annual Meeting, November; AIChE, 2022. [Google Scholar]

- Yang, Y.; Liu, M.; Kitchin, J. R. Neural network embeddings based similarity search method for atomistic systems. Digital Discovery 2022, 1(5), 636–644. [Google Scholar] [CrossRef]

- Yang, Y.; Achar, S. K.; Kitchin, J. R. Evaluation of the degree of rate control via automatic differentiation. AIChE Journal 2022, 68(6), e17653. [Google Scholar] [CrossRef]

- Natural Resources Canada. Electric Vehicle Infrastructure. 2023. Available online: https://www.nrcan.gc.ca/.

- Natural Resources Canada. Electric Vehicle and Alternative Fuel Infrastructure Deployment Initiative. 2023. Available online: https://www.nrcan.gc.ca/.

- European Commission. The European Green Deal. 2019. Available online: https://ec.europa.eu/info/strategy/priorities-2019-2024/european-green-deal_en.

- German Federal Network Agency. Electric Vehicle Charging Infrastructure in Germany. 2023. Available online: https://www.bundesnetzagentur.de/.

- German Federal Network Agency. Annual Report 2022. 2023. Available online: https://www.bundesnetzagentur.de/.

- Netherlands Enterprise Agency. Public Charging Infrastructure. 2023. Available online: https://www.rvo.nl/.

- Lin, Y. Optimization and Use of Cloud Computing in Big Data Science. Computing, Performance and Communication Systems 2023, 7(1), 119–124. [Google Scholar] [CrossRef]

- Yang, J. Data-Driven Investment Strategies in International Real Estate Markets: A Predictive Analytics Approach. International Journal of Computer Science and Information Technology 2024, 3(1), 247–258. [Google Scholar] [CrossRef]

- Norwegian Ministry of Transport. National Transport Plan 2022-2033. 2023. Available online: https://www.regjeringen.no/en/dep/sd/id870/.

- Norwegian Electric Vehicle Association. Electric Vehicle Charging Infrastructure. 2023. Available online: https://elbil.no/english/.

- China Electric Vehicle Charging Infrastructure Promotion Alliance. 2023 Annual Report. 2023. Available online: http://www.evcipa.org.cn/.

- China Electric Vehicle Charging Infrastructure Promotion Alliance. 2022 Annual Report. 2023. Available online: http://www.evcipa.org.cn/.

- Yang, J. Comparative Analysis of the Impact of Advanced Information Technologies on the International Real Estate Market. Transactions on Economics, Business and Management Research 2024, 7, 102–108. [Google Scholar] [CrossRef]

- Yang, J. Application of Business Information Management in Cross-border Real Estate Project Management. International Journal of Social Sciences and Public Administration 2024, 3(2), 204–213. [Google Scholar] [CrossRef]

- Wang, C.; Yang, H.; Chen, Y.; Sun, L.; Zhou, Y.; Wang, H. Identification of Image-spam Based on SIFT Image Matching Algorithm. JOURNAL OF INFORMATION &COMPUTATIONAL SCIENCE 2010, 7(14), 3153–3160. [Google Scholar]

- Ministry of Industry and Information Technology, China. Electric Vehicle Charging Infrastructure Plan. 2023. Available online: http://www.miit.gov.cn/.

- Ministry of Economy, Trade and Industry, Japan. EV Infrastructure Development Strategy. 2023. Available online: https://www.meti.go.jp/english/.

- Ministry of Economy, Trade and Industry, Japan. Annual Report on Energy. 2023. Available online: https://www.meti.go.jp/english/.

- Ministry of Economy, Trade and Industry, Japan. EV Fast Charging Technology. 2023. Available online: https://www.meti.go.jp/english/.

- Lin, Y. Design of urban road fault detection system based on artificial neural network and deep learning. Frontiers in neuroscience 2024, 18, 1369832. [Google Scholar] [CrossRef] [PubMed]

- Yang, Y.; Jiménez-Negrón, O. A.; Kitchin, J. R. Machine-learning accelerated geometry optimization in molecular simulation. The Journal of Chemical Physics 2021, 154(23). [Google Scholar] [CrossRef]

- Ministry of Trade, Industry and Energy, South Korea. Electric Vehicle Charging Infrastructure Plan. 2023. Available online: https://english.motie.go.kr/.

- Department of Mineral Resources and Energy, South Africa. EV Charging Network Pilot Project. 2023. Available online: http://www.energy.gov.za/.

- Department of Mineral Resources and Energy; South Africa. Annual Report. 2023. Available online: http://www.energy.gov.za/.

- Brazilian Electric Mobility Association. Electric Vehicle Charging Infrastructure in Brazil. 2023. Available online: http://www.abve.org.br/.

- UAE Ministry of Energy and Infrastructure. Electric Vehicle Charging Infrastructure. 2023. Available online: https://www.moei.gov.ae/.

- UAE Ministry of Energy and Infrastructure. Annual Report. 2023. Available online: https://www.moei.gov.ae/.

- Saudi Ministry of Energy. National EV Charging Infrastructure Plan. 2023. Available online: https://www.energy.gov.sa/.

- International Energy Agency. Global EV Outlook 2022. 2022. Available online: https://www.iea.org/reports/global- ev-outlook-2022.

- McKinsey & Company. Charging ahead: Electric-vehicle infrastructure demand. 2023. Available online: https://www.mckinsey.com/industries/automotive-and-assembly/our-insights/charging-ahead-electric-vehicle-infrastructure-demand.

- Tesla, Inc. Supercharger. 2023. Available online: https://www.tesla.com/supercharger.

- Wireless Power Consortium. Wireless Charging Market Growth. 2023. Available online: https://www.wirelesspowerconsortium.com/.

- BMW Group. Wireless Charging for BMW 530e. 2023. Available online: https://www.bmw.com/.

- U.S. Department of Energy. Wireless Charging Pilot Program. 2021. Available online: https://www.energy.gov/.

- Chen, T.; Lian, J.; Sun, B. An Exploration of the Development of Computerized Data Mining Techniques and Their Application. International Journal of Computer Science and Information Technology 2024, 3(1), 206–212. [Google Scholar] [CrossRef]

- An, L.; Song, C.; Zhang, Q.; Wei, X. Methods for assessing spillover effects between concurrent green initiatives. MethodsX 2024, 12, 102672. [Google Scholar] [CrossRef] [PubMed]

- Shih, H. C.; Wei, X.; An, L.; Weeks, J.; Stow, D. Urban and Rural BMI Trajectories in Southeastern Ghana: A Space-Time Modeling Perspective on Spatial Autocorrelation. International Journal of Geospatial and Environmental Research 2024, 11(1), 3. [Google Scholar]

- International Organization for Standardization. ISO 15118 Road vehicles — Vehicle to grid communication interface. 2023. Available online: https://www.iso.org/standard/55366.html.

- International Energy Agency. Global EV Outlook 2022. 2022. Available online: https://www.iea.org/reports/global- ev-outlook-2022.

- International Energy Agency. Global EV Outlook 2022. 2022. Available online: https://www.iea.org/reports/global- ev-outlook-2022.

- Tesla, Inc. Powerwall and Powerpack. 2023. Available online: https://www.tesla.com/energy.

- National Renewable Energy Laboratory (NREL). Electric Vehicle Charging Infrastructure Trends. 2023. Available online: https://www.nrel.gov/docs/fy23osti/76890.pdf.

- Deloitte. Smart Charging Technology and its Impact. 2023. Available online: https://www.deloitte.com/.

- Tu, H.; Shi, Y.; Xu, M. Integrating conditional shape embedding with generative adversarial network-to assess raster format architectural sketch. In 2023 Annual Modeling and Simulation Conference (ANNSIM); IEEE, May 2023; pp. 560–571. [Google Scholar]

- Shi, Y.; Ma, C.; Wang, C.; Wu, T.; Jiang, X. Harmonizing Emotions: An AI-Driven Sound Therapy System Design for Enhancing Mental Health of Older Adults. In International Conference on Human-Computer Interaction; Springer Nature Switzerland: Cham, May 2024; pp. 439–455. [Google Scholar]

- International Energy Agency. Global EV Outlook 2022. 2022. Available online: https://www.iea.org/reports/global- ev-outlook-2022.

- International Organization for Standardization. ISO 15118 Road vehicles — Vehicle to grid communication interface. 2023. Available online: https://www.iso.org/standard/55366.html.

- International Electrotechnical Commission. EV Charging Standards. 2023. Available online: https://www.iec.ch/.

- Liu, M.; Li, Y. Numerical analysis and calculation of urban landscape spatial pattern. In 2nd International Conference on Intelligent Design and Innovative Technology (ICIDIT 2023); Atlantis Press, October 2023; pp. 113–119. [Google Scholar]

- Lin, Y. Discussion on the Development of Artificial Intelligence by Computer Information Technology.

- National Renewable Energy Laboratory (NREL). Electric Vehicle Charging Infrastructure Trends. 2023. Available online: https://www.nrel.gov/docs/fy23osti/76890.pdf.

- National Renewable Energy Laboratory (NREL). Electric Vehicle Charging Infrastructure Trends. 2023. Available online: https://www.nrel.gov/docs/fy23osti/76890.pdf.

- McKinsey & Company. Charging ahead: Electric-vehicle infrastructure demand. 2023. Available online: https://www.mckinsey.com/industries/automotive-and-assembly/our-insights/charging-ahead-electric-vehicle-infrastructure-demand.

- McKinsey & Company. Charging ahead: Electric-vehicle infrastructure demand. 2023. Available online: https://www.mckinsey.com/industries/automotive-and-assembly/our-insights/charging-ahead-electric-vehicle-infrastructure-demand.

- European Environment Agency. Electric Vehicle Charging Infrastructure. 2023. Available online: https://www.eea.europa.eu/.

- Xu, T. Comparative Analysis of Machine Learning Algorithms for Consumer Credit Risk Assessment. Transactions on Computer Science and Intelligent Systems Research 2024, 4, 60–67. [Google Scholar] [CrossRef]

- Wang, C.; Yang, H.; Chen, Y.; Sun, L.; Wang, H.; Zhou, Y. Identification of Image-spam Based on Perimetric Complexity Analysis and SIFT Image Matching Algorithm. JOURNAL OF INFORMATION &COMPUTATIONAL SCIENCE 2012, 9(4), 1073–1081. [Google Scholar]

- Soana, V.; Shi, Y.; Lin, T. A Mobile, Shape-Changing Architectural System: Robotically-Actuated Bending- Active Tensile Hybrid Modules.

- Zhong, Y.; Liu, Y.; Gao, E.; Wei, C.; Wang, Z.; Yan, C. Deep Learning Solutions for Pneumonia Detection: Performance Comparison of Custom and Transfer Learning Models. medRxiv 2024, 2024–06. [Google Scholar] [CrossRef]

- Lian, J.; Chen, T. Research on Complex Data Mining Analysis and Pattern Recognition Based on Deep Learning. Journal of Computing and Electronic Information Management 2024, 12(3), 37–41. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).