1. Introduction

Pillar 2 Requirements (P2R) represent a supervisory instrument within the Single Supervisory Mechanism (SSM) of the European Central Bank (ECB). This quantity is designed to address risks not fully captured under Pillar 1 capital requirements rules (P1R). While P2R is determined individually for each financial institution through the Supervisory Review and Evaluation Process (SREP), there is an obvious increase in interest about ways in which broader macroeconomic conditions act as factor in supervisory expectations and capital requirements. This becomes obvious during periods of macro-financial turbulence. During those periods, vulnerabilities of the whole economic system can result in a precautionary increase in capital buffers across the entire banking sector. Nevertheless, although mainstream literature has explored various factors influencing P2R decisions, in this paper we try to address the need for models that can be used in that context. To be specific, we are proposing a methodological approach that reliably uses big-picture economic aggregates as main predictors in the context of banking supervision.

The origin of the P2R can be traced back to the introduction of the Basel II Accord. The P2R serves as a central instrument within the supervisory mechanism, allowing regulators to increase capital requirements for individual banks signaling to pose higher risk. It follows a building block approach, where supervisory authorities add the P2R on top of the prescribed P1R, thereby forming the Total SREP Capital Requirement (TSCR). The overall idea is that this framework makes the supervisory process more adaptable, allowing it to account for all risks a bank faces, beyond just those covered by P1R.

The purpose of the P2R is twofold [

17]. First, it addresses deficiencies that render the P1R insufficient. Second, it covers additional risks not included in the P1R framework. From a normative perspective, when conducting the Internal Capital Adequacy Assessment Process (ICAAP), banks must incorporate the TSCR into their capital planning horizon [

18]. This implies that these capital requirements should be considered continuously and awareness about their impact should be consistent.

In our analysis, we try to examine how macroeconomic shocks affect supervisory capital requirements under the ECB’s SSM framework, with a dataset that covers the 2021–2025 period. It is noticeable that this time period is marked by the COVID recovery, energy price shocks, geopolitical tensions related to the situation in Ukraine, and an inflationary shock in the euro area.

We construct a dataset that represents the paired combination of country-level macroeconomic indicators with bank-level P2R observations. Further, by using Principal Component Analysis (PCA), we define the macroeconomic and financial environment represented with several variables into a small number of interpretable latent variables, which are then included in a Bayesian Vector Autoregression (BVAR) model. Hence, by doing so, we assess the dynamic and potentially nonlinear response of P2R to systemic macroeconomic shocks, while maintaining parsimony and empirical tractability.

P2R is a derivation of the SREP framework which analyses the following key areas: business model and strategy, internal governance and institution-wide controls, and capital adequacy. Within the capital adequacy area, main focus topics are credit and counterparty risk, market risk, operational risk, and interest rate risk arising from non-trading book activities. This means that P2R should be purely idiosyncratic and tailor-made for a particular bank. Our research design is settled in another way. Hence, we want to analyse whether there are any systemic factors which influence the assignment of the P2R.

Our analysis aims to contribute to the literature that deals with macroprudential research exploring how supervisory practices respond to common, rather than purely idiosyncratic, sources of financial stress.

The remainder of the paper is structured as follows.

Section 2 reviews the existing literature on Pillar 2 capital requirements and their interaction with macroeconomic factors, highlighting both supervisory practice and empirical findings.

Section 3 outlines the methodological framework, including the application of PCA to extract common macroeconomic shocks and the use of BVAR to trace their dynamic influence on P2R. Also, same section presents the dataset and key descriptive statistics, followed by

Section 4, which reports the main empirical results, including the interpretation of principal components and impulse response functions.

Section 5 provides a discussion of the findings in the context of recent macro-financial developments in the EU. Finally,

Section 6 concludes with policy implications and suggestions for potential extension of the research on this topic.

2. Literature Review

The P2R represents an additional capital buffer imposed by the ECB through SREP, and is determined at the level of the individual financial institution, in line with its individual risk profile. Despite its uniquely tailored application, recent mainstream literature finds the importance of both systemic factors and broader determinants in the process of P2R calibration crucial for efficient capital requirements setting framework.

In their work Alves et al. [

2] examine a panel of banks subject to ECB oversight between 2016 and 2021. They find that, over the longer term, structural elements such as credit risk, funding risk, and the quality of governance are primary drivers of P2R levels. In contrast, short-term influences are more closely linked to profitability and market risk. Also, their work offers evidence of proportionality in supervisory practices, suggesting that larger institutions or those with greater market access may be subject to differentiated capital requirements.

The Basel Committee on Banking Supervision (BCBS) emphasizes that Pillar 2 should account for risks not fully captured under Pillar 1, including external factors such as macroeconomic conditions and business cycle effects [

5]. This broader perspective underlines the relevance of systemic determinants in supervisory capital assessment.

The ECB, in its own supervisory reports, notes that P2R decisions are increasingly informed by macro-financial developments, for example, trends in interest rates, inflationary pressures, and geopolitical risks [

20]. These systemic dimensions are incorporated into the SREP framework through forward-looking analyses and stress testing.

Beyer and Dautović [

8] provide evidence that banks disclosing their P2R benefit from lower funding costs, particularly those with robust capital positions. This implies that P2R, beyond reflecting only pure supervisory judgment, also serves as a market signal. Therefore, the importance of systemic factors in its determination should never be under-diminished.

Nevertheless, the academic literature remains relatively limited in explicitly modeling macroeconomic variables as predictors of P2R. This gap should be considered given that macro-financial conditions can significantly shape banks’ risk exposures and capital adequacy. Understanding the mechanics of these broader forces on P2R is crucial for the estimation of the effectiveness of supervisory frameworks across the euro area.

2.1. Macroeconomic Indicators in Banking Supervision

As we mentioned, the P2R is formally determined at the individual bank level through the SREP framework, yet its calibration is clearly influenced by broader macroeconomic conditions. Even though supervisory assessments are presented at the individual bank level and anticipate systemic shocks, like inflation spikes, GDP downturns, housing bubbles, inevitably shape supervisory expectations and actions across the sector [

5,

19].

In this analysis, a macro-prudential perspective is adopted by extracting common macroeconomic factors at the EU level using PCA, and incorporating these as variables within a BVAR framework. This approach allows us to capture shared economic shocks. Examples of those shocks are monetary tightening, inflation surges, or construction downturns. Those are the shocks that can simultaneously affect the risk environment of multiple banks, even if idiosyncratic exposures differ [

4,

10].

The integration of macroeconomic indicators into supervisory practice has become increasingly central to the ECB’s approach. These indicators are now recognized as essential tools in assessing systemic risk, particularly within the EU’s banking system. GDP growth, for instance, is fundamental. This could be attributed to many reasons: it captures the business cycle and directly affects credit demand, asset quality, and default probabilities, etc. Periods of economic expansion may lead to risk underestimation, while downturns often reveal underlying vulnerabilities. We can find empirical analysis that support this view: Behn et al. [

6] find a negative correlation between GDP growth and non-performing loans, while Drehmann et al. [

15] identify GDP growth as a key variable in early warning models for banking crises. The ECB itself incorporates GDP growth into its stress testing and SREP methodologies [

19].

Inflation, measured through the Harmonised Index of Consumer Prices (HICP), is another critical macroeconomic variable utilized in the context of our analysis. It affects real interest rates, the monetary policy stance, and the valuation of financial assets. Persistent inflationary pressures can erode capital buffers and increase funding costs, especially for banks with fixed-income portfolios. Borio and Lowe [

10] argue that inflation, when combined with credit growth, is a strong predictor of financial instability.

We use euro yield curve spread, usually calculated as the difference between long-term and short-term interest rates. This variable represents measurement, or can serve as a proxy, for market expectations regarding future economic activity and monetary policy direction. A flattening or inverted yield curve is widely interpreted as a signal of recession risk and tightening credit conditions. Estrella and Mishkin [

16] demonstrate the predictive power of the yield curve for economic downturns, and the ECB incorporates yield spreads into its financial stability reviews [

19].

Trade balances, both in goods and services, are also relevant. Persistent trade deficits may indicate structural vulnerabilities and external imbalances, particularly in countries with high foreign debt. Such imbalances can influence sovereign risk and, by extension, the banking sector due to the sovereign-bank nexus. Kaminsky and Reinhart [

31] incorporate trade balances in their early warning systems for financial crises.

Financial inflows are a direct indication of investors’ confidence and financial openness. Nonetheless, sudden reversals of FDI can provoke capital flight and macro-financial stress, particularly in smaller or emerging EU economies. Alfaro et al. [

1] expose the relation between FDI volatility and financial fragility in host countries. Additionally, ECB includes FDI in its balance of payments and international investment position statistics.

For evaluating the evolution of the housing market, real estate market indicators are essential. To be specific, we control building permits and the price-to-income ratio. While building permits show construction activity and credit exposure to the real estate industry, elevated price-to-income ratios indicate overvaluation. Jordà et al. [

30] show that real estate booms are the most consistent predictors of banking crises. The ESRB uses these indicators to calibrate borrower-based measures such as loan-to-value (LTV) and debt-to-income (DTI) caps [

21].

Net turnover and production indexes offer insight into sectoral economic activity, especially in the building and industrial sectors. These measurements are useful for evaluating sectoral concentration and SME credit risk in bank loan portfolios. The ECB’s Bank Lending Survey (BLS) and the Survey on the Access to Finance of Enterprises (SAFE) use turnover and production expectations to assess credit demand and risk perceptions [

19].

In conclusion, many studies show that macroeconomic aggregates, such as GDP growth and inflation, are reliable predictors of financial instability and banking distress [

30,

31]. Moreover, regulatory institutions increasingly incorporate systemic indicators into supervisory models and stress testing exercises [

19,

21]. PCA provides a data-driven method to condense such indicators into latent factors, capturing the common variation that reflects systemic economic shifts [

36].

2.2. BVAR and PCA

We find that the BVAR model is a natural fit in the context of our analysis because it is suitable when dealing with short panels and significant parameter uncertainty. They have been widely used in macro-financial research and supervisory policy simulations [

23,

25]. Hence, by integrating PCA factors into the BVAR, we aim to trace the dynamic relationship between macroeconomic shocks and P2R levels, providing insight into the systemic component of capital requirement decisions.

The reasoning for using latent variables based on indicators represented by country-level macroeconomic aggregates is related to the institutional architecture of euro area banking supervision. The Single Supervisory Mechanism (SSM) is intended to bring about consistent supervisory outcomes across participating countries. On the other side, in practice, macroeconomic conditions aren’t uniform. Each member state faces its own business cycle, housing market trends, and fiscal policies [

27,

35]. Therefore, the PCA offers a compromise between the two.

That’s why the approach here uses country-level macroeconomic factors, trying to capture the impact of national macro-financial trends on P2R outcomes while staying within a unified regulatory framework. In recent mainstream literature on this topic, we can find conclusions that support our decision in this context. In that regard, Alves et al. [

2] suggest that even under centralized supervision, there’s a need for adaptation to country-level risks. Similar to this, ECB itself confirms a need for a certain degree of country focus perspective in this context [

20].

In reality, the ECB strives for a harmonized application of supervisory standards. Nevertheless, the level of judgment in setting P2R remains sensitive to national economic developments. For instance, a housing market boom in one member state may prompt higher capital requirements for banks with real estate exposures in that country. According to that, the supervision authority should react by increasing P2R, even if other member states experience no such pressures [

21,

30]. Therefore, the integration of macroeconomic signals on a national level into supervisory modeling under the SSM framework is highly important. In addition, in the case of the EU, it is crucial to condense all those national signals into constructs that allow the EU level metrics. PCA allows such complex measurement procedures, and even further, those measurements are suitable for further utilization in the context of the BVAR framework.

Modeling PCA factors as common macroeconomic shocks within a BVAR framework enables analysis of systemic macro-financial transmission mechanisms. In the same time, this approach allows maintaining a balance between parsimony and empirical tractability. Bank-level macroeconomic data tends to be sparse, noisy, and inconsistent across jurisdictions. Using a PCA framework to aggregate variables helps reduce idiosyncratic noise and highlight latent co-movements. This means efficiency in measuring something that is not directly measurable, but we can measure it indirectly. Also, this exercise incorporates nice technical feature into our analysis. By extracting PCA factors we ensure sufficient time-series depth for robust BVAR estimation [

3,

7,

40].

Employing PCs that are, conditionally speaking, global for the whole EU area, offers several analytical advantages over modeling each country separately. First, it simplifies the interpretation of results, as shocks are consistently defined across banks and jurisdictions. This allows comparison of how different banks react to shared macroeconomic shocks such as inflation spikes, GDP downturns, or yield curve flattening [

12,

33].

Second, it avoids the overfitting risk associated with estimating high-dimensional VARs or fully specified panel BVARs, which would require hierarchical modeling techniques to capture heterogeneous dynamics across banks and countries [

14,

34] and this would produce unnecessary complexity. On the other hand, our approach approximates this structure by estimating the systemic (macro) component and projecting its dynamic influence onto a supervisory outcome, or, to be precise, P2R, at the bank level.

This methodology is consistent with the nature of euro area banking supervision. This feature is centralized in structure but operates within decentralized macroeconomic environments. Treating macro factors as shocks makes it possible to identify how national economic conditions shape supervisory expectations under a common regulatory umbrella [

2,

20]. Nonetheless, we should notice that the relationship established here is necessarily indirect.

3. Materials and Methods

To condense a wide array of macro-financial indicators into a smaller set of latent factors, we apply PCA on standardized country-level macroeconomic data. Therefore, we were able to extract relevant influences that determine the broader setting for banking supervision. This method extracts components that capture the common variation across variables. This approach allows us to handle the dimensionality, but more importantly in our case is that we can resolve the potential issue of multicollinearity [

3,

40]. PCA scores are retained as drivers of the macro-financial environment in subsequent models.

The PCA is implemented using the

FactoMineR and

factoextra packages in

R [

28,

32], which provide both the component scores and contribution metrics for interpretation and visualization.

Initially, we use a standard VAR with P2R and the first three components. To be specific, in this case, the VAR model is estimated by

vars package [

37]. Nevertheless, this model does not provide satisfactory results due to small sample issues.

Hence, to address limitations of classical VAR (e.g., overfitting in small samples), we continue our analysis with BVAR, which uses priors to improve estimation efficiency [

25,

34].

The BVAR exercise is done by using the

BVAR package in

R [

38]. The extracted PCA factors serve as a reduced-form representation of unobserved macroeconomic shocks affecting P2R [

7,

14].

Let us be specific. We reduce dimensionality and uncover the latent structure in macroeconomic data. In the technical sense, we use

Principal Component Analysis to 13 standardized macro-financial variables across EU countries. These variables include GDP growth, inflation, fiscal balance, trade balance, production of the industrial sector, aggregate related to the construction production, housing market aggregate, and interest rate spreads. The data matrix

is first standardized such that each variable has zero mean and unit variance:

where

is the sample mean and

the standard deviation of variable

j.

As we mentioned, the PCA is implemented via the

FactoMineR package in

R [

28], which computes the eigenvectors of the covariance matrix of

and projects the standardized data onto a lower-dimensional space:

where

is the matrix of eigenvectors (loadings), and

contains the principal component scores. The first three components, which explain the larger portion of total variance, are kept and included in the final model as common macroeconomic factors. Visualization and diagnostic analysis are done by

factoextra package [

32], including scree plots and variable contribution graphs.

The extracted scores are then merged with bank-level panel data by country and year, resulting in a panel structure suitable for further econometric analysis. This allows the integration of systemic macroeconomic shocks into bank-level supervisory outcomes, specifically P2R, as part of a macro-prudential modeling framework.

After we extracted the first three principal components (denoted as , , and ) from the PCA and used them as exogenous macroeconomic factors in a BVAR framework. These components capture common macro-financial shocks across countries and are jointly modeled with P2R as endogenous variables.

The standard form of a VAR(

p) model is given by:

In the Bayesian framework, prior distributions are placed over the parameters

and

. A commonly used specification is the

Minnesota prior, which assumes that each variable follows a random walk process and shrinks coefficients of lags from other variables toward zero. This regularization mitigates overfitting, particularly in small samples or with many parameters [

25,

34].

Formally, the prior for each coefficient

is:

where

is the prior mean (often zero) and

is the prior variance, which decreases with the lag order and the distance from own-variable lags.

Posterior inference assumes combining the prior with the likelihood of the data:

Let us notice that

BVAR package in

R implements efficient sampling algorithms for posterior simulation and inference [

38]

Further, IRFs are derived from the posterior distribution of model parameters to trace the dynamic response of P2R to shocks in each PCA-derived factor over time. Strictly speaking, an IRF

describes the effect of a one-unit structural shock at time

t on the vector of endogenous variables

, holding all other shocks constant. In our analysis, or to be general, in a BVAR framework, these responses are computed from the posterior draws of coefficient matrices and the structural impact matrix

B such that:

where

are the moving average coefficients derived from the estimated BVAR. The IRFs are accompanied by 68% credible intervals in this case, which reflect the uncertainty surrounding parameter estimates and provide a probabilistic interpretation of the macro-financial transmission mechanisms influencing supervisory capital decisions.

3.1. Data Description

In our empirical analysis we rely on 471 observations organized in a panel dataset. Variables included in the panel represent supervisory and macro-financial indicators across several euro area banks over the period 2021–2025.Hence, our dataset integrates data on an individual bank level on one side, and macroeconomic variables sourced primarily from the IMF, on the other side [

29], European Central Bank [

20]. Also, we use some indicators produced by Eurostat.

The main variable of interest is P2R, and it reflects supervisory capital requirements at the individual bank level. Other variables include a diverse set of macro-financial indicators: real GDP growth, HICP inflation and index levels, government fiscal balance, euro yield curve spreads, net turnover, FDI inflows, construction and industrial production indices, the price-to-income ratio in real estate, and trade balance measures. These variables were selected based on their theoretical relevance and prior use in supervisory modeling frameworks [

9,

11,

39], and we use those to extract main factors that are included in the BVAR model.

Key economic activity indicators include GDP growth, which ranges from a slight contraction of -2% to a robust expansion of 13.6%, with an average growth rate around 2.7%. The fiscal stance, measured by the government balance, shows mostly negative values, indicating fiscal deficits up to 8%, with an average deficit of about 3.4%.

Inflation dynamic is measured by the Harmonised Index of Consumer Prices (HICP). This variable ranges from 104.8 to 125.8. The euro yield curve spread reflects market expectations and monetary conditions. The variation is modest for this one (between 0.28% and 0.75%).

Investment activity is tracked through foreign direct investment (FDI) inflows, and net business turnover values, both indicating substantial heterogeneity across observations. Further, construction and industry production indices fluctuate around the baseline 100, with construction output ranging from about 87 to 108 and industry output from 84 to 119, illustrating variable sectoral performance. The trade deficit shows wide dispersion, from a deep deficit of 72,000 to a surplus of 210,000.

We use the price-to-income ratio to measure housing market conditions. This variable has mean approximately 0.077, with a range between 0.055 and 0.094, indicating variations in affordability.

To conclude, our dataset encompasses a range of European countries and their key banking institutions, reflecting diverse financial landscapes across the region. By including major banking systems from Spain, Germany, Italy, France, Austria, and the Netherlands, we try to represent adequately these countries that we find important from the perspective of EU financial architecture. This assumes including multiple banks per country. We included some countries from Northern Europe such as Belgium and Ireland. We try to construct the dataset that reflects pan-European perspective of our analysis. Also, smaller EU member states like the Baltic states Estonia, Latvia, and Lithuania are represented, providing valuable insights into less frequently studied banking markets. Southern European countries such as Greece, Portugal, and Slovenia are also included, reflecting their roles in the broader European financial ecosystem.

4. Results

For our BVAR model, we’re keeping it simple with just the top three components from the PCA analysis. We picked these because they explain most of the action in the macro data, according to the eigenvalue stuff. Additionally, we can make economic interpretations for these three components. The first seems to represent general economic shape. The second is more about the real economy and construction sector, and the third hints at financial and trade-related pressures. We find sticking with these three is a good compromise. Keeps things easy to understand and avoids making the model too complicated or adding unnecessary information.

So, these components are solid in summing up our dataset and give us some good clues about how the selected macroeconomic aggregates affect capital requirement decisions, where our work sets P2R in focus. This way, we can model common economic shocks as a condensed construct that catches multiple macroeconomic variables simultaneously.

Dim.1 captures a broad macroeconomic cycle factor. It exhibits high loadings on

GDP growth (

), the

HICP Index (

),

Government Balance (

), and the

Price-to-Income Ratio (

). Basically, this means that the first component reflects general economic strength, cyclical fluctuations, and inflationary dynamics. The relevance of these variables is known in the macroprudential related literature, where real GDP growth is usually set as a leading indicator of banking crises and credit booms [

6,

15]. Inflation, particularly when combined with low real interest rates, can encourage risk-taking and contribute to asset price misalignments, putting upward pressure on capital needs [

10]. So, Dim.1 can be interpreted as a latent construct that stands for a general macro-financial driver of systemic risk relevant for supervisory calibration.

Dim.2 is driven almost entirely by two variables:

Building Permits and

Production in Industry, both with loadings near

. This dimension reflects real economy activity with a focus on the construction and industrial sectors. Building permits are widely used as anticipating indicators of housing market dynamics and are closely tied to bank exposures through mortgage lending and real estate related credit [

30]. Further, industrial production is a solid measurement for output and business cycle fluctuations, especially relevant for the sector of small and medium-sized enterprises (SMEs). These are the direct determinants in the calibration of macroprudential tools, such as loan-to-value (LTV) or debt-service-to-income (DSTI) limits, as emphasized by the European Systemic Risk Board [

21]. Therefore, Dim.2 likely reflects supervisory concerns related to credit concentration and cyclical risk in real asset markets.

Dim.3 exhibits strong loadings on the

Euro Yield Curve Spread (

),

Net Turnover (

), and the

Trade Deficit (

), pointing to financial and external sector pressures. The yield curve slope is a known predictor of economic downturns and tightening credit conditions, often used by central banks and supervisors to monitor financial stability risks [

16]. Net turnover reflects firm-level liquidity and business dynamics, which may indicate stress or resilience in the corporate sector. At the same time, significant and less significant vulnerabilities in the external balance can feed into sovereign and banking sector risks, especially through the bank-sovereign nexus as a main channel [

31]. Thus, Dim.3 can be seen as capturing externally driven macro-financial tensions with implications for banking system resilience.

Table 1.

Variable Contributions to Each Principal Component.

Table 1.

Variable Contributions to Each Principal Component.

| Variable |

Dim.1 |

Dim.2 |

Dim.3 |

| Building_Permits_ |

0.0822 |

0.9798 |

0.0449 |

| Enterprises_ |

-0.1763 |

-0.0074 |

0.0785 |

| Euro.Yield.Curve.Spread |

-0.5285 |

-0.1209 |

0.5778 |

| FDI_ |

0.0304 |

0.1236 |

0.0360 |

| GDP.growth |

-0.7973 |

-0.0285 |

0.3769 |

| GovBalance_ |

0.5800 |

-0.1716 |

-0.1998 |

| HICP.Index |

0.7320 |

-0.0935 |

-0.4351 |

| HICP.Rate |

0.1211 |

0.1681 |

-0.0433 |

| NetTurnover_ |

0.4866 |

0.0199 |

0.5965 |

| Price.to.income.ratio |

0.6297 |

-0.0701 |

0.4961 |

| Production_Construction_ |

-0.4803 |

0.0225 |

-0.1914 |

| Production_Industry_ |

0.0822 |

0.9798 |

0.0449 |

| Trade.deficit...goods.and.services |

0.6419 |

-0.0932 |

0.5549 |

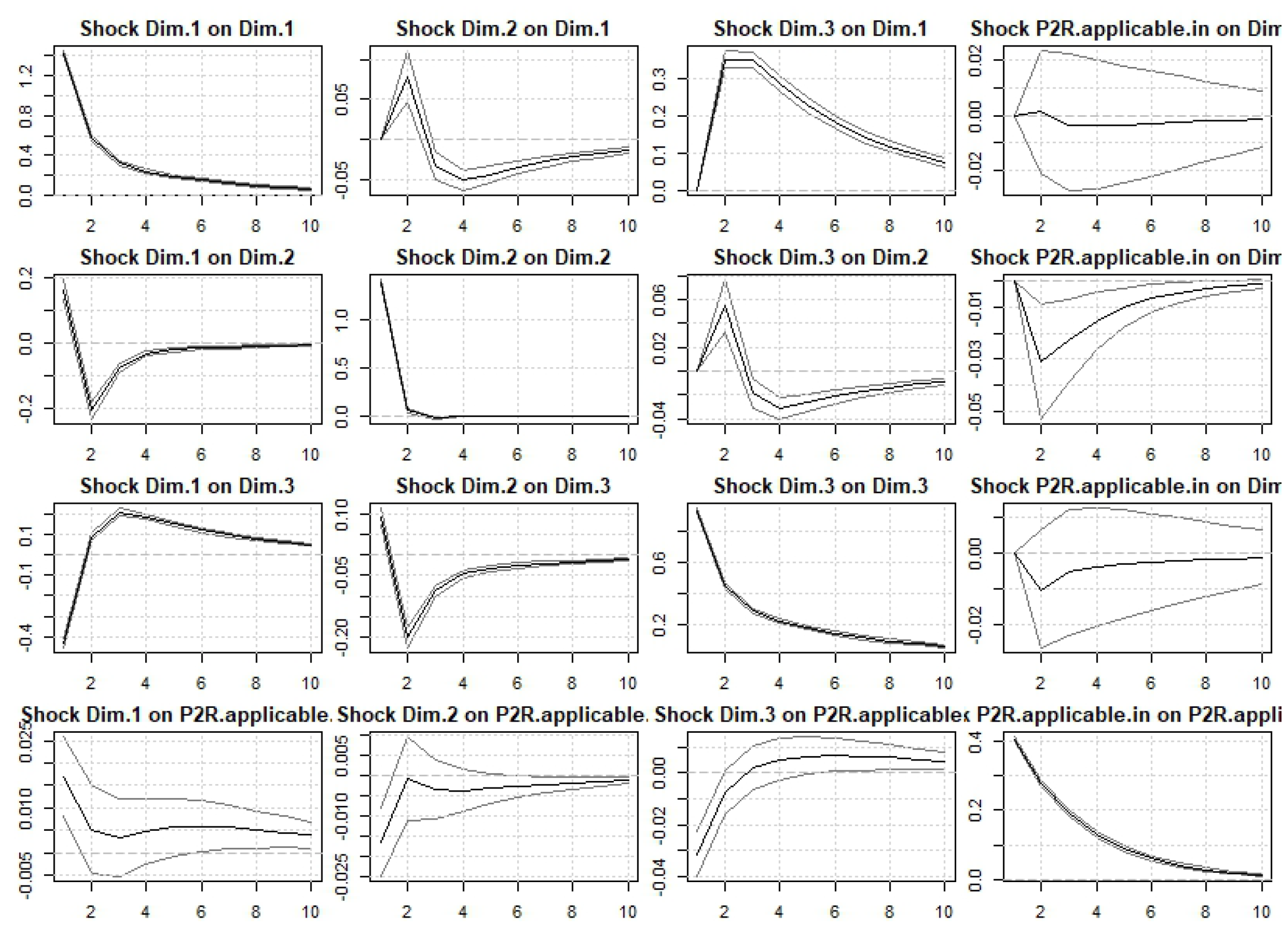

After extracting main three components, we continue with the BVAR model, which is specified with four variables: the first three principal components derived from the macroeconomic dataset (Dim.1–Dim.3) and the supervisory capital metric, P2R.applicable.in. The estimation includes one lag, because we have yearly, data and a balanced panel of 471 observations, as we mentioned in data section. This relatively simple and parsimonious setup allows us to have tractable inference. In addition, we are able to maintain the core macro-financial dynamics relevant for supervisory modeling.

The shrinkage hyperparameter , which drives the tightness of the prior around zero, was endogenously optimized and converged to a value of 0.299. This value indicates a moderate degree of shrinkage, allowing the data to influence posterior estimates without overfitting. The Gibbs sampling procedure was run for 10,000 iterations with a 50% burn-in period. An acceptance rate of 91.2% suggests satisfactory convergence of the Markov Chain Monte Carlo (MCMC) process.

The variance-covariance matrix of the residuals exposes limited correlation between P2R.applicable.in and the three PCA components. This implies that macroeconomic shocks captured by the principal components influence the supervisory capital buffer primarily through lagged, dynamic channels rather than through immediate simultaneity. Also, the posterior variance of P2R residuals is relatively low (0.166). Therefore, the model is sufficient in explaining the variation in our variable related to the supervision authority and is suitable for observing dynamic responses via impulse response functions.

Figure representing IRFs shows the dynamic between macro-financial shocks and P2R, according to the results of our final BVAR model.

The

first component (Dim.1), which represents broad macroeconomic and inflationary conditions that are loaded on GDP growth, inflation (HICP), and government balance, has blurred influence on P2R. A one-standard-deviation shock to Dim.1 leads to a positive, but in the short term not statistically significant, increase in P2R, peaking around the fourth period. This result, in case that it is statistically significant, would be consistent with the pro-cyclicality of capital buffers, whereby supervisors may adjust capital requirements upward during economic expansions to lean against rising credit risk or exuberant lending [

9,

39].

The

second component (Dim.2) captures real economy and, even more importantly, construction dynamics, with nearly exclusive loadings on building permits and industrial production. A positive shock to this extracted factor produces slight, mildly negative effect on P2R, potentially reflecting supervisory sensitivity to real estate sector overheating. However, this effect is not persistent, and this leaves a possibility that supervision authority already uses this quantity as input in its assessment process. This pattern is consistent with conclusion in existing literature. Jordà et al. [

30] highlight the predictive power of real estate booms, and real estate sector i general, for banking crises. Generally speaking, we should underline the relevance of construction-related indicators in calibrating borrower-based macroprudential tools [

21].

The

third component (Dim.3), reflects financial and external imbalances. This dimension includes the euro area yield curve spread, net turnover, and trade deficit. This component has negative and medium-term effect on P2R. This could reflect supervisors’ heightened caution under tightening financial conditions and widening external imbalances. Again, this is a scenario that aligns with mainstream literature, because when money is getting harder to borrow, and the gap between what certain national economy earns, on one side, and what that economy owes, on the other, should indicate the increase in perceived systemic risk. Flattening yield curves, for instance, are widely regarded as precursors to economic slowdowns [

16], while external deficits often signal vulnerabilities in open economies [

31].

Importantly,

reverse responses from P2R to the PCA-derived macro components are indisputable. This suggests that P2R adjustments are more reactive rather than causative, aligning with the supervisory literature that positions capital buffer decisions as responses to evolving macroeconomic risks rather than drivers of them . Hence, banks adjust their financial safety nets to match economic risks, not to cause them[

11].

Figure 1.

Impulse Response Functions from the BVAR Model Including Principal Components and Supervisory Capital Metric. The BVAR model is specified with four variables: the first three principal components (Dim.1–Dim.3) extracted from the macroeconomic dataset, and the supervisory capital metric (P2R.applicable.in).

Figure 1.

Impulse Response Functions from the BVAR Model Including Principal Components and Supervisory Capital Metric. The BVAR model is specified with four variables: the first three principal components (Dim.1–Dim.3) extracted from the macroeconomic dataset, and the supervisory capital metric (P2R.applicable.in).

5. Discussion

In our analysis, extracted components (Dim.1–Dim.3) reflect distinct yet mutually connected macro-financial dynamics that are highly relevant in the context of supervisory capital requirements, including P2R. During the 2021–2025 period, the EU economy faced a series of overlapping shocks, from the effects of the COVID-19 pandemic to the inflationary spike and energy crisis triggered by the war in Ukraine in 2022. The first component, representing the latent construct for macroeconomic and inflationary conditions, captures the pro-cyclical pressures that became especially intense during this time. With a spike in inflation, uneven GDP recovery, and expansive fiscal policies across the EU, supervisory authorities faced increased uncertainty in every aspect but especially in planning capital requirements. This latent construct represents the joint co-movements of prices and economic growth. Additionally, it reflects how these macroeconomic drivers could induce economic pressure, which then reflects as a shift in risk weights. Consequently, it initiates a readjustment of anticipative capital requirements that should work as buffers across the EU, especially in countries with flexible rules on discretionary P2R calibrations.

The other two latent constructs highlight external vulnerabilities and those specific to individual sectors that intensified in the same period, and these appear to put pressure on P2R in the short term. The construction and industrial sectors (captured in the second component) got hit hard by supply chain issues, volatile input prices, and the situation where it is harder to get loans. The real estate sector, which initially benefited from low interest rates, began to show signs of stress and struggles with new developments across the EU, prompting heightened supervisory focus on borrower-based tools and bank exposures to cyclical sectors. Interest rates, trade gaps that are dropping, and declining corporate turnover are related to the second component, indicating rising systemic risk, particularly in the countries relying on exports or with large external debt.

IRFs show that disruptions in the second and third latent components are related to short and medium-term fluctuations in overall economic risks, often forcing banks to make cautious adjustments to their capital reserves through P2R. This is reasonable, because economic shocks increase risks for a while, leading banks to set aside extra money for safety. Therefore, the sensitivity of P2R to shocks in the second dimension reflects how disruptions in the construction and industrial sectors, especially during the 2022–2023 energy and supply chain crises, heightened concerns over asset quality and credit concentration. This is consistent with findings from macroprudential literature highlighting the role of real estate cycles in amplifying banking sector risks [

13,

30], and the ESRB’s recommendations on borrower-based measures as first lines of defense against overheating credit markets [

21].

The third component’s association with, conditionally speaking, external imbalances and financial market disruptions maps closely to periods of heightened financial fragility, on one side, and tightening financial conditions, on the other. Previous work related to this topic has shown that inversions in the yield curve often announce downturns and are predictive of credit contractions [

16,

26]. When paired with eroding trade balances, these factors raise sovereign and banking sector risk simultaneously. This triggers the reactions of supervisory authority aimed at strengthening capital buffers. The BVAR results suggest that economic and financial disruptions impacting individual sectoral performance and global ties directly influence active determinants of the forward-looking capital requirements according to the ECB’s rules.

Using PC in BVAR framework is helpful for simplifying analysis and understanding macro-prudential risks, but it has its drawbacks. While PCA provides an efficient condensed measurement of joint co-movements of macroeconomic indicators, the extracted latent variables do not offer straightforward interpretability. Additionally, aggregation at the country level may have a problem related to the within-country heterogeneity across banks [

12,

24]. On the other hand, this approach is parsimony on one side, and relatively easy to use in practice. Finally, this methodological approach is relevant to the ECB’s broad banking regulations and BVAR is widely used by ECB.

Combining economic data hides key differences among banks in the same national economy. For example, two banks in one country might have very different general financial setups, risk levels, or ways of doing business. This aggregation can lead to an underestimation of the diversity in how banks respond to common macroeconomic shocks, potentially biasing inferences about the systemic effects of those shocks [

12,

24]. Further, our methodology builds latent constructs as linear combinations of multiple correlated macroeconomic variables. While useful for dimensionality reduction, these factors may lack straightforward economic interpretation. As a result, IRFs derived from BVAR models using PCA-based shocks may be difficult to map directly to intuitive economic narratives (e.g., “inflation shock” or “real estate bust”), complicating the policy relevance and communication of results [

22].

Future related work could further progress with work based on results from this paper by exploring how banking supervisory authorities might optimally balance these systemic influences with risk assessments on the individual bank level. For example, there is an obvious gap to investigate whether the ECB should develop a formalized “macro adjustment factor” for P2R, and critically, how such an adjustment would integrate with existing stress-testing frameworks and the broader supervisory review process. Even further, let us be more specific; a line of inquiry that reflects macro factors as represented in this analysis would directly inform the effectiveness of the ECB’s forward-looking supervisory methodology under the SREP, particularly in anticipating risks with complex structures, such as real estate market bubbles or yield curve inversions.

6. Conclusions

Our results show that while the first component, associated with GDP growth and inflation, has a relatively blurred influence on P2R in the short term, the second and third components exhibit clearer and more timely effects. This implies that shocks affecting unique sectors like construction and industry, along with financial and global trade imbalances, lead to changes in the capital requirements that will manifest themselves shortly afterwards or in the medium term, reflecting increased risks during economic stress.

Policy implication for ECB is obvious. To improve in this context, this authority could prioritize forward-looking economic analysis that utilizes models that capture the effect of broad set of macroeconomic variables in its supervisory process. As the ECB continues to enhance the transparency of the SREP and make this process more open to the general public, including broader economic conditions in this exercise, this institution can make capital planning stronger and better prevent crises. Moreover, our methodological approach illustrates the analytical advantage of combining techniques like PCA for the construction of latent variable models that exploit endogeneity and allow dynamic perception. In that sense, BVAR is an easy-to-use methodological approach that allows us to check how well banking rules work in turbulent economic situations. Future research could further enrich this perspective by incorporating bank-specific heterogeneity or extending the model to capture cross-border spillovers within the euro area’s banking union.

Further, our results suggest that the ECB in its P2R framework should integrate a macroeconomic component when determining final P2R figures for the banks under direct supervision. In other words, it should analyse current and projected variables for the industry production and building permits, which are part of the real estate market included in Dim.2. Alongside, second-level macro-variables of interest should be the yield curve with its current values and expected trend, either flattening or inverting, results in the corporate sector and how its overall profitability is developing, and how the trade deficit is progressing. Also, all of these variables could be considered country-by-country where the respective bank has its headquarters or it is the main country where its operations are active.

Author Contributions

“Conceptualization, M.L. and B.B.; methodology, B.B.; software, B.B.; validation, M.L., O.E. and D.T.; formal analysis, B.B.; investigation, M.L.; resources, D.T.; data curation, O.E.; writing—original draft preparation, M.L and B.B.; writing—review and editing, M.L., O.E. and D.T.; visualization, B.B., M.L., O.E. and D.T.; supervision, M.L., O.E. and D.T. All authors have read and agreed to the published version of the manuscript.”, please turn to the

CRediT taxonomy for the term explanation. Authorship must be limited to those who have contributed substantially to the work reported.

Acknowledgments

In this section you can acknowledge any support given which is not covered by the author contribution or funding sections. This may include administrative and technical support, or donations in kind (e.g., materials used for experiments). Where GenAI has been used for purposes such as generating text, data, or graphics, or for study design, data collection, analysis, or interpretation of data, please add “During the preparation of this manuscript/study, the author(s) used [tool name, version information] for the purposes of [description of use]. The authors have reviewed and edited the output and take full responsibility for the content of this publication.”

Conflicts of Interest

The authors declare no conflicts of interest. The views expressed in this article are solely those of the authors and do not necessarily reflect the official positions of their affiliated institutions.

Appendix A

Appendix A.1

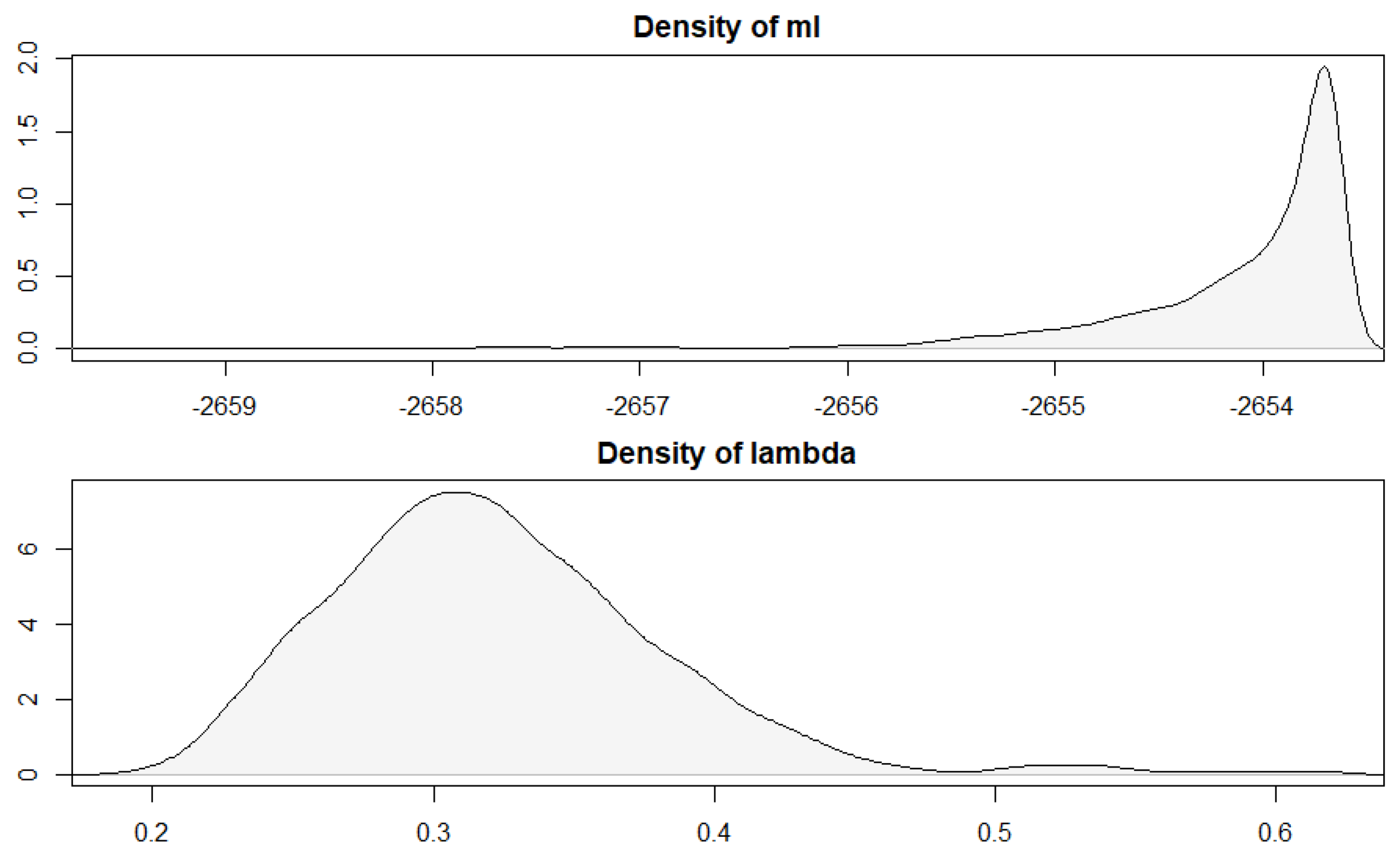

Figure A.1 shows the posterior density of the marginal likelihood (ml) and the shrinkage hyperparameter (). The marginal likelihood peaks sharply around , indicating stable model fit across iterations. The density of is unimodal and centered near , suggesting moderate shrinkage. These results confirm the reliability of the prior specification and support the robustness of the BVAR estimation.

Figure A1.

Posterior Densities of Marginal Likelihood and Shrinkage Parameter.

Figure A1.

Posterior Densities of Marginal Likelihood and Shrinkage Parameter.

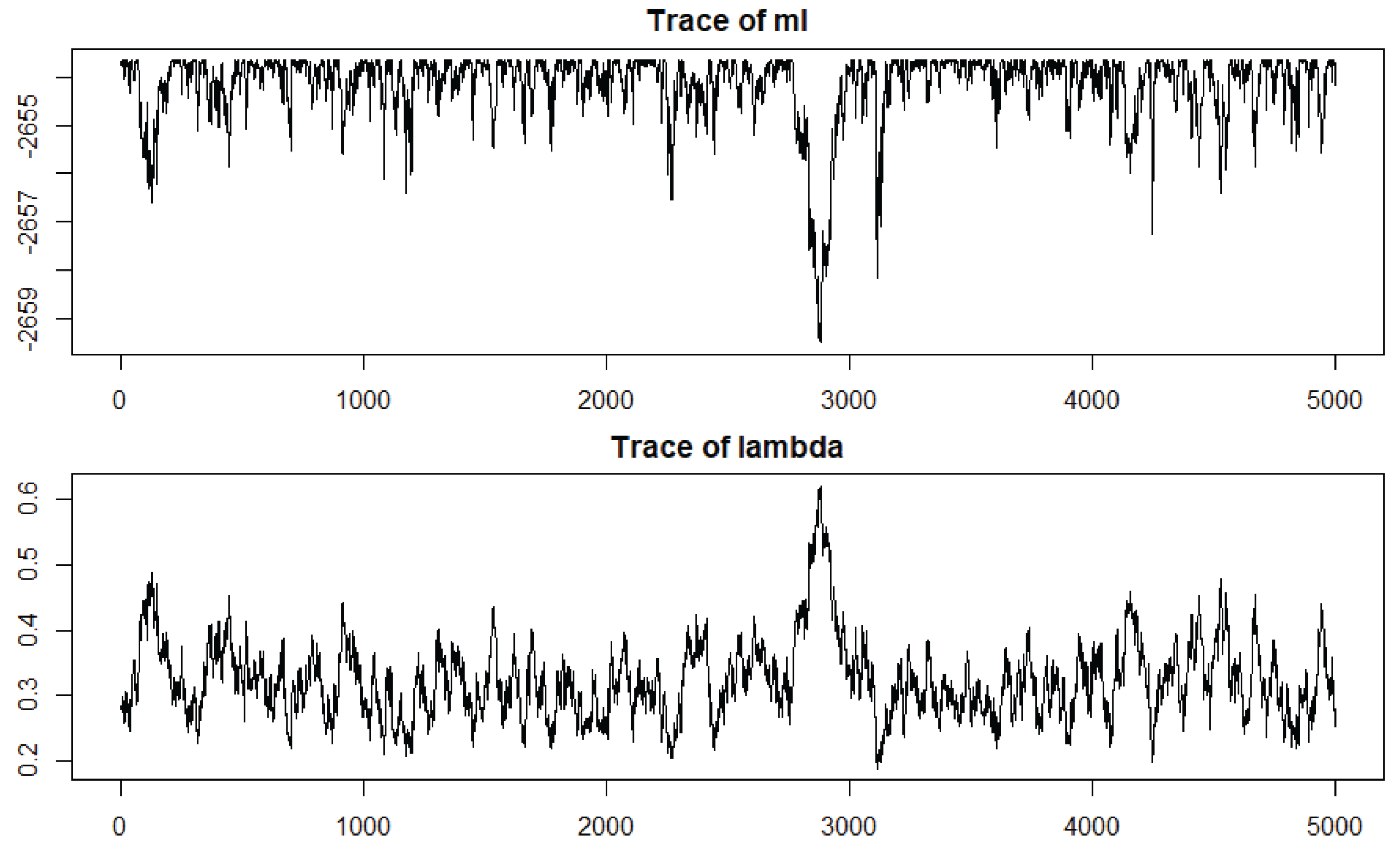

Figure A.2 shows the trace of similarly indicates stable mixing around a central value near 0.3. Although it shows more pronounced local fluctuations, particularly between iterations 2,500 and 3,500, the overall behavior suggests the chain has reached its stationary distribution.

These patterns support the validity of the posterior inference and imply that the BVAR estimation is not dominated by outliers or poor convergence.

Figure A2.

Plots for the marginal likelihood (ml) and the shrinkage hyperparameter () across the 5,000 retained MCMC draws after burn-in.

Figure A2.

Plots for the marginal likelihood (ml) and the shrinkage hyperparameter () across the 5,000 retained MCMC draws after burn-in.

References

- Alfaro, Laura, Areendam Chanda, Sebnem Kalemli-Ozcan, and Selin Sayek. 2004. Fdi and economic growth: The role of local financial markets. Journal of International Economics 64(1), 89–112. [CrossRef]

- Alves, Nuno, Alberto Citterio, and Carlos R. Marques. 2023. Pillar 2 requirements: Determinants and cross-country evidence. ECB Working Paper Series (2789).

- Bai, Jushan and Serena Ng. 2008. Forecasting economic time series using targeted predictors. Journal of Econometrics 146.

- Banbura, Marta, Domenico Giannone, and Lucrezia Reichlin. 2010. Large bayesian vector autoregressions. Journal of Applied Econometrics 25(1), 71–92.

- Basel Committee on Banking Supervision. 2023. Pillar 2 capital requirements: Review of practices and approaches. Technical report, Bank for International Settlements.

- Behn, Markus, Rainer Haselmann, and Paul Wachtel. 2016. Procyclical capital regulation and lending. Journal of Finance 71(2), 919–956.

- Bernanke, Ben S., Jean Boivin, and Piotr Eliasz. 2005. Measuring the effects of monetary policy: A factor-augmented vector autoregressive (favar) approach. Quarterly Journal of Economics 120(1), 387–422.

- Beyer, Andreas and Edin Dautović. 2023. Bank transparency and market efficiency. Working Paper Series 3031, ECB.

- Borio, Claudio and Philip Lowe. 2001, September. To provision or not to provision: Asset price cycles and prudential regulation. BIS Quarterly Review, 36–48.

- Borio, Claudio and Philip Lowe. 2002. Asset prices, financial and monetary stability: Exploring the nexus. Working Paper 114, Bank for International Settlements.

- Budnik, Klaas M. R. and Johannes Kleibl. 2019. Macroprudential regulation in the european union in 1995–2018: Introducing a new data set on policy actions of a macroprudential nature. Working Paper Series (2288).

- Canova, Fabio and Matteo Ciccarelli. 2007. Estimating multicountry var models. International Economic Review 48(4), 929–959.

- Crowe, Christopher, Giovanni Dell’Ariccia, Deniz Igan, and Pau Rabanal. 2013. How to deal with real estate booms: Lessons from country experiences. Journal of Financial Stability 9(3), 300–319. [CrossRef]

- Del Negro, Marco and Frank Schorfheide. 2004. Priors from general equilibrium models for vars. International Economic Review 45(2), 643–673.

- Drehmann, Mathias, Claudio Borio, and Kostas Tsatsaronis. 2011. Anchoring countercyclical capital buffers: The role of credit aggregates. Working Paper 355, Bank for International Settlements.

- Estrella, Arturo and Frederic S. Mishkin. 1998. Predicting u.s. recessions: Financial variables as leading indicators. Review of Economics and Statistics 80(1), 45–61.

- European Banking Authority. 2022. Guidelines on common procedures and methodologies for the supervisory review and evaluation process (srep) and supervisory stress testing. Technical report, European Banking Authority, Paris. This report outlines standardized procedures and methodologies for the supervisory review and evaluation process (SREP) and stress testing, enhancing consistency in banking supervision across the EU.

- European Central Bank. 2018. Guide to the internal capital adequacy assessment process (icaap). Technical report, European Central Bank, Frankfurt am Main. This guide provides a framework for banks to assess their internal capital adequacy, ensuring they maintain sufficient capital to cover all risks beyond just those under standard requirements.

- European Central Bank. 2024. Macroprudential bulletin. Report, European Central Bank. Forthcoming or unpublished as of August 6, 2025. Verify specific issue number or publication date on ECB website. Accessed August 6, 2025.

- European Central Bank. 2025. Supervisory priorities and assessment frameworks. Report, European Central Bank. Forthcoming or unpublished as of August 6, 2025. Verify specific report or working paper number on ECB banking supervision website. Accessed August 6, 2025.

- European Systemic Risk Board. 2023. Macroprudential measures in the EU: Institutions, settings and challenges. Technical report 579, Publications Office of the European Union.

- Fendoğlu, Selen. 2017. Credit cycles and capital flows: Effectiveness of the macroprudential policy framework in emerging markets. Journal of International Money and Finance 72, 88–106.

- Fratzscher, Marcel and Sandra Reiche. 2016. A global macro-financial model for forecasting macroeconomic and financial stress. Journal of Forecasting 35(2), 129–148.

- Gennaioli, Nicola, Andrei Shleifer, and Robert Vishny. 2014. Neglected risks: The psychology of financial crises. American Economic Review 104(5), 310–314.

- Giannone, Domenico, Michele Lenza, and Giorgio Primiceri. 2015. Prior selection for vector autoregressions. Review of Economics and Statistics 97(2), 436–451.

- Gilchrist, Simon and Egon Zakrajšek. 2002. Credit spreads and business cycle fluctuations. Finance and Economics Discussion Series (2002-21).

- Gomes, Sandra, Pierre Jacquinot, and Massimo Pisani. 2014. The eagle: A model for policy analysis of macroeconomic interdependence in the euro area. Economic Modelling 41, 324–340.

- Husson, François, Sébastien Lê, and Jérôme Pagès. 2008. FactoMineR: An R Package for Multivariate Analysis.

- International Monetary Fund. 2025. International financial statistics. Accessed July 2025.

- Jordà, Òscar, Moritz Schularick, and Alan M. Taylor. 2015. Leveraged bubbles. Journal of Monetary Economics 76, S1–S20.

- Kaminsky, Graciela L. and Carmen M. Reinhart. 1999. The twin crises: The causes of banking and balance-of-payments problems. American Economic Review 89(3), 473–500.

- Kassambara, Alboukadel and Fabian Mundt. 2017. factoextra: Extract and Visualize the Results of Multivariate Data Analyses. R package version 1.0.5.

- Koop, Gary. 2010. Forecasting with medium and large bayesian vars. Journal of Applied Econometrics 28(2), 177–203.

- Koop, Gary and Dimitris Korobilis. 2003. Bayesian multivariate time series methods for empirical macroeconomics. Foundations and Trends in Econometrics 3(4), 267–358.

- Lane, Philip R. 2020. The euro area outlook: Monetary policy in uncertain times. ECB Speech.

- Mingione, Marco. 2011. Forecasting with principal components analysis: An application to financial stability indices for jamaica. https://boj.org.jm/uploads/pdf/papers_pamphlets/papers_pamphlets_Forecasting_with_Principal_Components_Analysis__an_application_to_Financial_Stability_Indices_for_Jamaica.pdf. Accessed July 2025.

- Pfaff, Bernhard. 2008. VAR, SVAR and SVEC Models: Implementation Within R Package vars.

- Pflaum, Daniel. 2023. Bayesian Vector Autoregression (BVAR). R package version 1.0.2.

- Repullo, Rafael and Jesús Saurina. 2009. The procyclical effects of bank capital regulation. CEPR Discussion Paper No. 6862.

- Stock, James H. and Mark W. Watson. 2002. Forecasting using principal components from a large number of predictors. Journal of the American Statistical Association 97(460), 1167–1179.

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).