1. Introduction

Agriculture currently faces a dual challenge: maintaining productivity and ensuring sustainability in a context of profound climate, technological, and social transformations. It is no longer sufficient to evaluate agricultural performance based on strictly economic indicators, such as productivity per hectare or financial profitability. Growing regulatory, environmental, and market pressures require the agricultural sector to integrate elements such as biodiversity protection, soil conservation, efficient water resource management, and the reduction of pollutant emissions into its practices (FAO, 2022; Poore & Nemecek, 2018).

In this new context, accounting assumes a strategic role, ceasing to be merely a language of technical recording and becoming a critical instrument for representing the environmental and social dimensions of productive activity (Akpan & Oluwagbade, 2023).

However, the currently dominant accounting model, particularly in the agricultural sector, remains based on a limited view of economic value, focusing on monetary transactions and the measurement of fair market value. This regulatory framework, enshrined, for example, in NCRF 17 in Portugal and IAS 41 internationally, largely overlooks the positive and negative ecological externalities generated by agricultural activity (Silva, Rodrigues & Fonseca, 2021; Elad, 2004).

This limitation raises a fundamental question: can accounting remain neutral in the face of the growing challenges of environmental sustainability and ecological transition? Or, on the contrary, should it assume a transformative role, incorporating new metrics, data sources, and value criteria that more fairly and comprehensively reflect agriculture’s environmental contributions and impacts?

The development of so-called Agriculture 5.0, characterized by the integration of smart sensors, robotics, artificial intelligence, and big data analytics, represents an unprecedented opportunity to generate reliable, real-time environmental data, with the potential for integration into financial reporting systems (Duman et al., 2023). However, accounting standards have not yet kept pace with this progress, lacking frameworks for recognizing hybrid assets, auditable environmental metrics, and valuing the ecosystem services provided by sustainable agricultural practices (Schaltegger & Burritt, 2017; Natural Capital Coalition, 2016).

In this scenario, this article proposes reconfiguring the role of agricultural accounting based on a multidisciplinary theoretical framework that includes the Natural Capital Theory (Costanza et al., 1997), Critical and Environmental Accounting (Gray, Adams, & Owen, 2014), and Integrated Reporting Theory (IIRC, 2013). Through a critical analysis of NCRF 17 and a proposal of alternative measurement and reporting models, it is argued that agricultural accounting can and should evolve to reflect the ecological and social values of contemporary agricultural activity.

2. Literature Review

2.1. Theoretical Framework

This research is grounded in four complementary theoretical perspectives, which combine to provide a critical analysis of the current agricultural accounting model and inform proposals for normative and practical transformation: Agency Theory, Natural Capital Theory, Critical Environmental Accounting, and Integrated Reporting Theory. Each of these approaches highlights different limitations of traditional accounting, and together, they support the construction of a new paradigm oriented toward sustainability and technological innovation in the primary sector.

2.1.1. Agency Theory

Agency Theory (Jensen & Meckling, 1976) constitutes the foundation of the analysis, revealing the information asymmetries between internal decision-makers (managers) and external stakeholders. In the agricultural context, such asymmetries intensify when negative environmental impacts, such as soil degradation or excessive use of water resources, are not highlighted in financial reports, creating room for opportunistic behavior. The emergence of Agriculture 5.0, with sensors and digital tools capable of collecting environmental data in real-time, can mitigate this moral hazard; however, the absence of regulatory frameworks to integrate such data into formal accounting perpetuates informational opacity (Christ & Burritt, 2017; Duman et al., 2023).

2.1.2. Natural Capital Theory

Complementing the agency’s approach, the Natural Capital Theory (Costanza et al., 1997) emphasizes the need to incorporate ecosystem services into accounting, such as pollination, carbon sequestration, and water filtration, which, although not priced on the market, are crucial to the sustainability of agricultural holdings. The traditional accounting model, by focusing exclusively on exchange value, ignores these non-tradable benefits, compromising the usefulness of reporting for sustainable decision-making (de Groot et al., 2012). This omission is particularly critical when standards such as NCRF 17 and IAS 41 do not provide any mechanism for recognizing or valuing these environmental contributions (Jones & Solomon, 2013).

2.1.3. Critical and Environmental Accounting

The traditional accounting model thus has limitations that are exacerbated by the perspective of Critical and Environmental Accounting (Gray et al., 1996; Schaltegger & Burritt, 2010), which challenges the purported neutrality of conventional accounting. According to this approach, the emphasis on monetary quantification and the omission of socio-ecological impacts result in an incomplete and biased representation of organizational reality. In the agricultural sector, this criticism gains particular relevance, as regenerative or sustainable practices are not recognized as generating accounting value. In contrast, intensive and environmentally aggressive practices continue to be measured solely on economic criteria (Bebbington & Larrinaga, 2014). Thus, accounting ceases to be a tool for transparency and becomes a factor in legitimizing unsustainable models.

2.1.4. Integrated Reporting Theory

In response to these structural flaws, the Integrated Reporting Theory (IIRC, 2013) proposes a comprehensive approach that considers multiple capitals, financial, natural, human, social, intellectual, and manufactured, as components of organizational value. This logic provides a comprehensive view of performance, aligning with sustainability objectives and meeting the growing demand for transparency from investors. However, its practical application in the agricultural sector remains limited due to the lack of standardized methodologies, regulatory resistance, and the weak connection between digital information systems (Agriculture 5.0) and accounting reporting models (Adams, 2017). Given agriculture’s significant environmental footprint and growing regulatory pressure (Poore & Nemecek, 2018), the operationalization of multi-capital reporting has become an urgent necessity.

The literature has highlighted a critical gap between the ESG discourse adopted by many agricultural organizations and its effective translation into financial reports (Gerber et al., 2023; Almeida et al., 2024). Although digitalization brings new capabilities to measure environmental impacts, the data generated is rarely integrated into formal accounting, remaining out of the reach of auditors and investors (Scientific Horizons, 2023). This gap compromises the reliability of reporting, reduces comparability between organizations, and hinders access to sustainable financing. As Duman et al. (2023) suggest, accounting needs to evolve to incorporate the digital information flows generated by Agriculture 5.0, thereby transforming it into an instrument for ecological management and the creation of shared value.

2.2. Agricultural Accounting

The literature suggests a necessary transformation in agricultural accounting models, driven by factors such as the ecological transition, technological advances in Agriculture 5.0, and increasing pressure for greater environmental transparency (Ragazou et al., 2023). This section organizes the critical literature review around five fundamental axes: (i) regulatory limitations of agricultural accounting; (ii) the relevance of natural capital and ecosystem services; (iii) contributions of environmental and critical accounting; (iv) challenges and opportunities of digitalization; and (v) the integration of ESG reporting and new regulatory frameworks.

2.2.1. Regulatory Limitations of Agricultural Accounting

Current accounting standards, such as IAS 41 (internationally) and NCRF 17 (in Portugal), use fair value as the baseline criterion for measuring biological assets. Although technically coherent, this model reveals severe limitations in the context of sustainability. Valuation based on market prices overlooks significant environmental externalities, such as soil degradation, biodiversity loss, or, conversely, ecological regeneration and carbon sequestration (Elad, 2004; Silva, Rodrigues, & Fonseca, 2021).

Furthermore, IAS 41 has been criticized for discouraging sustainable practices, as ecological benefits are not translated into accounting value, harming farms that adopt regenerative or agroecological models (Argilés-Bosch et al., 2012). This gap between practice and reporting contributes to what Schaltegger and Burritt (2017) refer to as the “ecological blindness” of traditional financial accounting.

2.2.2. Natural Capital and Ecosystem Services

The concept of natural capital redefines how value should be understood in the agricultural context. Unlike conventional assets, natural resources, such as fertile soils, freshwater, biodiversity, or climate stability, are not readily tradable but are essential to the continuity of productive activity (Costanza et al., 1997).

Ecosystem services, such as pollination, natural pest control, the water cycle, and carbon sequestration (Müller & Sukhdev, 2018). These values, although not reflected in financial statements, have a direct impact on medium- and long-term economic sustainability. Ignoring them results in a structural undervaluation of sustainably managed biological assets.

In this context, initiatives such as the Natural Capital Protocol (Natural Capital Coalition, 2016) and the recommendations of the Task Force on Nature-related Financial Disclosures (TNFD, 2023) propose voluntary frameworks that can evolve into regulatory references, anticipating a new generation of environmental value-oriented accounting practices.

2.2.3. Environmental Accounting and Critical Perspectives

Environmental accounting emerges as a response to the limitations of classical financial accounting, proposing the explicit inclusion of environmental costs and benefits in financial statements (Schaltegger & Burritt, 2010). At the same time, critical accounting warns of the ideological nature of accounting neutrality, suggesting that the systematic exclusion of ecological externalities benefits dominant economic interests to the detriment of the common good (Gray et al., 1993; Bebbington, 2007).

In the specific case of agriculture, these criticisms gain traction because the relationship between production and the environment is direct and interdependent. Sustainable agricultural operations generate significant public value (environmental quality, healthy food, soil protection), but this value remains invisible if accounting systems only capture commercial productivity (Jones & Solomon, 2013).

2.2.4. Agriculture 5.0 and Digitalization

Agriculture 5.0 represents a revolution in the way data is generated, processed, and used in agricultural management. Technologies such as smart sensors, drones, automated irrigation systems, and artificial intelligence enable the collection of real-time environmental data, including humidity levels, gas emissions, and local biodiversity (Duman et al., 2023; Sukhdev et al., 2021).

Despite this progress, accounting remains technically unprepared to capitalize on this new type of information. The lack of guidelines on how to integrate sensor data, for example, in the calculation of fair value, reveals a regulatory gap that compromises the potential of these systems to improve financial reporting and their ecological relevance (Sustainable Transformation of Accounting in Agriculture, 2023).

Furthermore, questions arise about the reliability, auditability, and standardization of this data: can this data be independently validated? Is it comparable across farms? How can materiality and integrity be ensured when it is included in reports?

2.2.5. ESG, Sustainability, and Emerging Regulatory Pressures

The proliferation of Environmental, Social, and Governance (ESG) has been a voluntary response to growing stakeholder demand for more transparent and accountable information. However, many organizations still treat ESG as an appendix to financial reporting, without full integration with formal accounting systems (Cho et al., 2015; Laine et al., 2020).

The new European Directive on Corporate Sustainability Reporting (CSRD) promises to change this panorama, requiring companies, including those in the agri-food sector, to integrate materially relevant environmental metrics into their annual reports, such as water consumption, gas emissions, and impacts on biodiversity, with the same rigor required for financial accounting (EFRAG, 2023).

For agricultural accounting to keep pace with this trend, it will be necessary to develop technical and regulatory instruments that allow these indicators to be incorporated into asset measurement, explanatory notes, and strategic reporting, thus promoting a more sustainable and evidence-based governance model.

The scientific literature reveals growing dissatisfaction with current agricultural accounting models, which are considered incapable of capturing the ecological, technological, and social complexity of contemporary agriculture. The emergence of environmental accounting, natural capital theory, and digitalization in agriculture presents opportunities for accounting reform; however, their practical application still faces technical, cultural, and regulatory challenges.

This research follows a critical and proactive line of reflection on the role of accounting in the agricultural sector, in a context marked simultaneously by the ecological transition and the increasing digitalization of production processes. By combining theoretical foundations with normative and operational concerns, the study seeks to transcend the traditional limitations of economic measurement, proposing the integration of environmental and technological dimensions into the financial reporting of agricultural holdings. Twenty-first-century agriculture faces interdependent and increasingly complex challenges: on the one hand, the need to ensure productivity and food security; on the other, the urgency of aligning agricultural practices with the principles of ecological sustainability and digital innovation. This new context imposes additional demands on agricultural accounting systems, which are called upon to evolve toward more comprehensive, transparent, and transformative models.

Within this framework, the central objective of this study is to critically assess the adequacy of currently prevailing agricultural accounting practices, with a special focus on NCRF 17, in light of the challenges posed by environmental sustainability and technological digitalization.

The aim is to identify the conceptual and operational weaknesses of current measurement models and explore alternatives that enable the recognition of ecological externalities, ecosystem services, and hybrid assets in a controlled and comparable manner. To achieve this goal, the research proposes: (1) to analyze the limitations of NCRF 17 in measuring biological assets in sustainable contexts; (2) to explore the integration of environmental metrics, such as carbon sequestration or biodiversity preservation, into fair value criteria; (3) to evaluate the accounting treatment of hybrid assets that combine biological and technological capital, characteristic of Agriculture 5.0; (4) to investigate the potential of digital technologies as sources of accountable and auditable data with an impact on financial and ESG reporting; (5) propose reporting models that incorporate tangible environmental externalities and ecosystem services in the annexes to the financial statements or in complementary indicators; and, finally, (6) identify normative, institutional and cultural barriers that condition the adoption of environmentally responsible and technologically integrated accounting practices.

Based on these objectives, the study is structured around five fundamental research questions: (i) To what extent are current accounting systems, particularly NCRF 17, capable of reliably and transparently reflecting the environmental and social impacts of agricultural activity? (ii) What potential do Agriculture 5.0 technologies have for generating valuable data for measuring value and valuing sustainable practices in financial reporting? (iii) How can agricultural accounting incorporate, in a controllable and comparable manner, the value of ecosystem services generated by regenerative agricultural practices? (iv) What challenges and opportunities arise from the integration of hybrid, biological, and technological assets into farm accounting? (v) And, finally, what regulatory and institutional conditions are necessary for agricultural accounting to cease being complicit in environmental invisibility and become an active instrument of sustainability?

The formulation of these objectives and research questions is based on the identification of three critical gaps in the literature and contemporary accounting practice.

Firstly, there is a systematic disregard for environmental externalities in current normative models, which continue to exclusively prioritize market metrics (Elad, 2004; Gray et al., 2014).

Secondly, there is a lack of auditable and widely accepted methodologies for measuring natural capital and ecosystem services, which makes it difficult to include them in financial reports (Costanza et al., 1997; Natural Capital Coalition, 2016).

Thirdly, the gap between the technological advances of Agriculture 5.0 and the capacity of current accounting systems to integrate this data as relevant and validated evidence stands out (Duman et al., 2023).

Based on these assumptions, this research aims to contribute to the development of a new conceptual and operational framework that enables agricultural accounting to accurately and responsibly represent the ecological and digital complexity characterizing the sector, aligning with the principles of sustainability and innovation.

3. Methodology

This research adopts a qualitative, exploratory, and theoretical-conceptual approach, focusing on a critical analysis of accounting standards, scientific literature, and institutional frameworks on agricultural accounting, sustainability, and digitalization. The methodological strategy is based on developing normative proposals and alternative reporting models that address the environmental and technological challenges currently faced by the agricultural sector.

This is a conceptual investigation, framed within the domain of theoretical research with normative and propositional purposes (Ryan et al., 2002), aligned with the assumptions of critical and environmental accounting. It is based on the premise that accounting is not a neutral measurement technique, but rather an institutional construct with social, political, and ecological implications (Gray et al., 1996; Schaltegger & Burritt, 2017). Thus, by questioning the ability of current standards, particularly NCRF 17, to reflect the environmental impacts and positive contributions of sustainable agricultural holdings, the study adopts a critical stance, while simultaneously being oriented towards the development of practical and applicable solutions.

The methodology is developed in three interconnected phases.

First, a critical and in-depth documentary analysis of NCRF 17 – Agriculture was conducted, in conjunction with IAS 41 – Agriculture, as well as the main international guidelines on sustainability reporting, including the Natural Capital Protocol (NCC, 2016), GRI standards, EFRAG’s proposals within the scope of CSRD, and the models proposed by the TNFD. This analysis identified relevant gaps, particularly regarding the valuation of positive externalities, the recognition of hybrid assets, and the inclusion of environmental metrics in measurement and reporting models.

Secondly, a systematic review of the scientific literature was conducted, encompassing theoretical and empirical studies published in reputable journals such as Sustainability Accounting, Management and Policy Journal, European Accounting Review, Agricultural Economics, Science, and Nature Sustainability. The literature was analyzed based on five main themes: the limitations of traditional agricultural accounting models, natural capital theory, advances in environmental accounting, the impact of Agriculture 5.0, and emerging trends in ESG standardization.

Finally, based on the articulation between the normative analysis and the literature review, applicable models were developed, including: an ecological fair value proposal, adjusted by environmental metrics; a simplified ESG template for agricultural holdings; a structure for environmental explanatory notes to be integrated into the financial statements; and a comparative table between the traditional reporting and the reformulated proposal with ecological sensitivity.

To reinforce the practical applicability of the presented proposals, two exemplary cases of Portuguese farms that combine sustainable practices with technological innovation were used as inspiration for this research: Esporão, SA, and Herdade do Freixo. Esporão, located in the Alentejo region, is recognized for its organic viticulture, the use of sensors and drones, and the integration of ESG indicators in reports aligned with GRI standards. Herdade do Freixo, located in the municipality of Redondo, combines precision agriculture with underground architecture and certified environmental management. These cases, although not analyzed exhaustively empirically, serve as qualitative illustrations of a structural dysfunction between effective sustainable practices and the current accounting model, reinforcing the urgency of developing more sustainability-sensitive regulations.

Naturally, as this is conceptual research, it is not based on quantitative data or direct empirical observations. Although this delimitation is intentional, given the normative and propositional orientation of the study, it is recognized that future research may benefit from the application of complementary empirical methodologies. Among these, in-depth case studies with interviews with accountants and managers, comparative analyses between conventional and sustainable farms, and audit and materiality tests of the proposed environmental metrics stand out. Despite the limitations inherent to this type of approach, the adopted methodology allows us to combine theory, standards, and practice with a transformative objective. By contributing to the advancement of agricultural accounting as an autonomous field of research and stimulating normative and institutional debate on the limits of current measurement, the study provides a solid foundation for constructing new accounting frameworks aligned with the ecological and digital challenges of contemporary agriculture.

4. Results and Proposals

Based on normative analysis, literature, and illustrative evidence of good sustainable agricultural practices, this research presents a set of conceptual and operational proposals aimed at overcoming the main obstacles to environmental visibility in agricultural accounting. The results demonstrate that accounting, when reformulated based on environmental metrics, digital technologies, and a multi-capital logic, can evolve from a technical recording instrument into a proper system that supports ecological sustainability and organizational transparency.

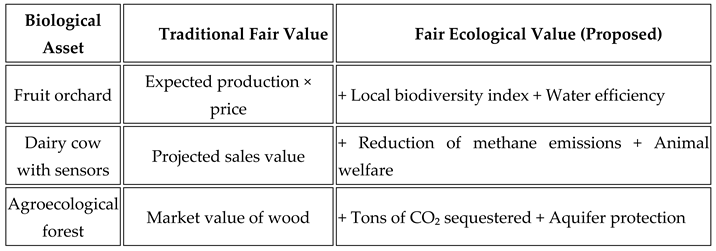

One of the main proposals developed in this study is the adoption of the Ecological Fair Value (EVF) model, which aims to overcome the limitations of the fair value model established in NCRF 17/IAS 41. The fair value of NCRF 17 continues to be based on observable market prices, disregarding the environmental, social, or technological attributes of biological assets. Therefore, a complementary measurement model is proposed that, while maintaining the market benchmark, integrates auditable quantitative environmental indicators.

Table 1 illustrates this approach, demonstrating the differences between the traditional fair value model and the (proposed) Ecological Fair Value model.

The proposed JVE model is not intended to replace the current fair value criterion, but rather to complement it with objective environmental data, which will be disclosed in explanatory notes to the financial statements or in integrated ESG reports.

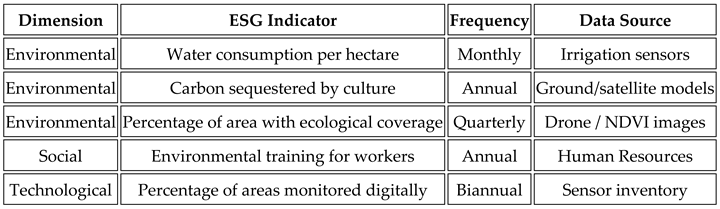

To operationalize these metrics and ensure their comparability, we also propose the adoption of a simplified ESG template adapted to the realities of agricultural holdings. This standardized indicator model enables the systematization of data collection through technologies associated with Agriculture 5.0, including IoT sensors, drones, and geographic information systems. The proposal is presented in

Table 2.

The suggested template can be used as an annex to financial reports or as a voluntary ESG reporting supplement, facilitating the integration of environmental practices into formal reporting systems and increasing audit control of the information provided.

At the same time, recognizing that regulatory models do not yet enable the direct measurement of positive externalities on the balance sheet, we suggest including an Environmental Explanatory Note in the financial statements to address this gap. This note, both qualitative and quantitative, would facilitate an appreciation of the ecological contributions of the practices adopted by agricultural holdings, even if they have no direct impact on accounting balances. An example of wording could be as follows: Note X – Ecological Externalities of Agricultural Activity: During the 2024 financial year, the farm adopted regenerative practices that resulted in: Estimated retention of 16 tons of CO₂; A 28% reduction in water consumption per hectare; Regeneration of 2 hectares of soil with permanent vegetation cover; Preservation of 3 endangered pollinator species. Although these contributions do not directly impact the financial statements, they are disclosed as part of the farm’s commitment to environmental transparency and sustainability, thereby ensuring its reputation for environmental and sustainable practices.

Another innovative proposal focuses on the integration of hybrid assets, that is, those resulting from the combination of biological elements with digital technologies. Traditional agricultural accounting does not adequately account for assets such as sensor-equipped cows, automated greenhouses, or artificial intelligence-controlled irrigation systems. Therefore, the proposal is to create an intermediate accounting category or associated subaccounts that distinguish the value of the biological asset from the value of the incorporated technological investment. For example, in the case of a dairy cow with sensors, the dairy cow could be considered the main asset; the market value of the cow could be considered a ( biological) sub-asset, namely, the monitoring sensors, smart feeding devices, and others.

This distinction would enable the partial capitalization of technological investments directly related to the productivity and environmental sustainability of living assets, promoting greater fairness and transparency in the accounting recognition of innovation.

The proposals presented in this study contribute to increasing environmental transparency in agricultural holdings’ financial reporting, recognizing data generated by Agriculture 5.0 as legitimate sources of accounting information, valuing sustainable practices currently invisible in the balance sheet, and anticipating emerging regulatory trends, such as those outlined in the CSRD and the new ESG reporting standards. These proposals are designed for progressive implementation and can be adopted voluntarily by agricultural entities, pending regulatory developments and the institutional legitimization of the new proposed measurement and reporting models.

5. Discussion

The results of this research highlight a structural mismatch between the challenges of sustainability in agriculture and current accounting models. In particular, NCRF 17 – Agriculture, by adopting fair value as the exclusive criterion for measuring biological assets, reproduces an economistic view of value, focused solely on market flows. This logic overlooks relevant environmental and social externalities, thereby compromising the ability of financial reporting to accurately represent the ecological and technological realities of contemporary agriculture (Elad, 2004; Gray, Adams, & Owen, 2014).

The logic of accounting neutrality, historically oriented toward objective and verifiable measurement, has been the target of increasing criticism from critical and environmental accounting. These authors highlight the effects of ecological invisibility resulting from practices that treat all biological assets indiscriminately, regardless of whether they are managed using sustainable or intensive methods. By omitting essential dimensions of value creation, such as ecosystem regeneration and climate change mitigation, financial reports become incomplete and unsuited to contemporary demands (Schaltegger & Burritt, 2010; Bebbington, 2007; Costanza et al., 1997; Jones & Solomon, 2013). The proposals presented in this study, such as fair ecological value, the environmental explanatory note, and the ESG template, emerge as mechanisms to overcome this apparent neutrality, repositioning agricultural accounting as an active instrument of sustainability.

In this context, Agriculture 5.0 offers unique opportunities. By incorporating sensors, drones, and artificial intelligence, this new approach generates a new generation of auditable environmental data, with significant potential to enhance the traceability and timeliness of accounting information (Duman et al., 2023). However, the lack of regulations that recognize such data as valid accounting inputs limits their formal integration into financial reporting. This regulatory gap prevents the valorization of the potential generated by technological innovations, thereby deepening the gap between agricultural practice and traditional accounting (Sukhdev et al., 2021; Sustainable Transformation of Accounting in Agriculture, 2023). Thus, the proposal to recognize hybrid assets that combine biological and technological capital represents an effort to update accounting models to the new productive reality, where value is co-created between nature and technology.

At the same time, it is essential to acknowledge that, although ESG reporting has proliferated in recent years, its integration into financial accounting remains limited. According to Cho et al. (2015), many of these reports operate in conjunction with the traditional accounting system, utilizing unaudited metrics based on often inconsistent voluntary frameworks. However, the regulatory landscape is undergoing rapid changes. The entry into force of the new European Corporate Sustainability Reporting Directive (CSRD), along with the European Sustainability Reporting Standards (ESRS) and the emerging Taskforce guidelines on Nature-related Financial Disclosures (TNFD, 2023), signals a turning point. These regulations require companies to integrate relevant, reliable, and controllable environmental and social information into their official reports. The proposals outlined in this study align with this regulatory evolution, anticipating regulatory requirements and offering models that can be tested and adjusted by primary sector organizations.

These transformations will inevitably have profound repercussions on the accounting profession. Most professionals still lack the necessary training to effectively deal with ecological metrics, non-financial data, or concepts such as natural capital and ecosystem services (Laine et al., 2020). This reality will require ongoing academic training, investment in environmental literacy, and the fostering of a professional culture more aligned with the principles of sustainability. Accounting thus ceases to be a mere system for recording past transactions and becomes a strategic language for anticipating, valuing, and planning sustainably.

At a theoretical level, the results of this research reinforce the need to broaden the concept of value used in accounting. As stated by Gray et al. (1996) and Schaltegger & Burritt (2017), accounting value cannot remain restricted to monetary flows: it must necessarily incorporate ecological and social dimensions, which are increasingly crucial for business continuity, organizational legitimacy, and access to sustainable financing. The ecological value accounting proposal presented in this study constitutes a step in this direction, preserving the technical integrity of the accounting system but reconfiguring the criteria and metrics underlying its measurement.

Despite the theoretical and normative contributions developed here, it is essential to acknowledge that this research is conceptual and does not involve direct empirical validation of the proposed models. Therefore, as a line of research, we suggest developing future studies that could apply these proposals to specific cases, test the feasibility of independent auditing of environmental metrics integrated into fair value, assess the perceptions of stakeholders, including accountants, farmers, and investors, regarding the usefulness and legitimacy of these approaches, and analyze their applicability in different geographic, legal, and institutional contexts. Such empirical research will consolidate the foundations laid in this work and contribute to a more robust and legitimate transformation of agricultural accounting toward sustainability.

6. Conclusion

This study highlighted that agricultural accounting, based primarily on NCRF 17 and IAS 41, remains insufficient to reflect the ecological, technological, and social complexity of contemporary agriculture. Measurement based solely on fair market value disregards positive environmental externalities, such as carbon sequestration or soil regeneration, and discourages sustainable agricultural practices. Although technically coherent, this model proves to be ethically limited and economically restrictive, particularly in contexts where the value of agricultural assets depends on their ecological responsibility and the environmental impact of the practices employed.

This conceptual and critical research proposed a set of accounting reform models designed to overcome these limitations. Among the most relevant contributions are the concept of Ecological Fair Value, which complements market value with controllable environmental metrics; a proposed ESG template adapted to agriculture, supported by data from emerging technologies such as sensors and drones; the introduction of an environmental explanatory note as a transitional mechanism for recognizing positive externalities; and the proposed accounting integration of hybrid assets, which combine biological and technological elements. These proposals aim not only to fill gaps in the current accounting model but also to anticipate international regulatory developments, particularly within the scope of the CSRD, ESRS, and TNFD, contributing to more transparent, practical, and sustainable agricultural accounting.

From a theoretical perspective, this study reinforces criticism of the supposed neutrality of financial accounting, arguing that the invisibility of environmental externalities constitutes an obstacle to sustainable decision-making. At the same time, it advocates expanding the concept of accountable value to include natural capital and ecosystem services, in order to reflect value creation in the agricultural sector more fully. Thus, it proposes that accounting assume a transformative role, moving beyond being merely a descriptive tool to become a strategic instrument supporting technological innovation and environmental sustainability.

On a practical level, the results of this study have direct implications for various target audiences. Accountants and auditors must prepare to deal with environmental metrics and non-financial data, requiring ongoing training and professional development. Agricultural companies, especially those that are more innovative and focused on sustainable practices, require reporting systems that are consistent with their operations and capable of capturing and communicating ecological value. Education and training institutions must review their curricula to incorporate topics related to environmental, digital, and critical accounting. Finally, legislators and regulatory bodies are called upon to review current measurement and reporting models to ensure they effectively meet the objectives of the green and digital transition.

Based on these conclusions, a progressive revision of NCRF 17 and IAS 41 is recommended to incorporate sustainability metrics and specific guidance for hybrid assets. It is also desirable that EFRAG or similar entities develop sector-specific application guides for agriculture within the scope of the CSRD, and that institutional support for pilot projects of ecological accounting in the primary sector be encouraged, based on the proposals presented here. The creation of specific national or regional technical standards for agricultural ESG reporting could facilitate the adaptation of family farms, rural SMEs, and cooperatives to the new requirements. To this end, it will be essential to promote interdisciplinary dialogue between accountants, agricultural engineers, ecologists, and economists, ensuring a pluralistic and robust construction of value measurement systems.

Finally, this research opens multiple avenues for future empirical and interdisciplinary studies. We suggest applying the proposed models to real-world case studies, analyzing stakeholder acceptability, investigating the economic impact of adopting environmental metrics on access to sustainable financing, and developing digital tools that automatically integrate environmental data into agricultural accounting systems, such as intelligent dashboards.

Agriculture is a sector that not only produces food but also shapes ecosystems, impacts the climate, and structures rural areas. Ignoring these impacts in financial accounting perpetuates an incomplete and, at times, unfair view of the actual value generated. Accounting, therefore, plays a central role in the transition to sustainable and resilient production models. This study aims to contribute to this transformation by presenting viable proposals that reconcile technical rigor, regulatory innovation, and environmental responsibility. More than a technical exercise, the agricultural accounting reform proposed in this paper represents a commitment to ecological justice, sustainable innovation, and intergenerational responsibility.

References

- Almeida, A., Dale, A., Hay, R., Everingham, Y., & Lockie, S. (2024). Environmental, Social, and Governance (ESG) in Agriculture: Trends and Gaps in Research. Australasian Journal of Environmental Management, 1–30. [CrossRef]

- Akpan, J. U., & Oluwagbade, O. I. (2023). Social and environmental responsibility in accounting: Beyond financial metrics. International Journal of Social Sciences and Management Research, 9(9), 163–188.

- Argilés, J. M., & Slof, E. J. (2001). New opportunities for farming accounting. European Accounting Review, 10(2), 361–383. [CrossRef]

- Argilés-Bosch, J. M., García-Blandón, J., Ravenda, D., & Monteiro, S. M. (2012). Harmonization effects of accounting standards on the economic value of biological assets. Agricultural Economics, 43(1), 43–55.

- Bebbington, J. (2007). Accounting for sustainable development performance. Accounting, Auditing & Accountability Journal, 20(5), 593–625. [CrossRef]

- Bebbington, J., Unerman, J., & O’Dwyer, B. (2014). Sustainability accounting and accountability. Routledge.

- Cho, C. H., Laine, M., Roberts, R. W., & Rodrigue, M. (2015). Organized hypocrisy, organizational facades, and sustainability reporting. Accounting, Organizations and Society, 40, 78–94. [CrossRef]

- Costanza, R., d’Arge, R., de Groot, R., Farber, S., Grasso, M., Hannon, B., … & van den Belt, M. (1997). The value of the world’s ecosystem services and natural capital. Nature, 387(6630), 253–260. [CrossRef]

- Duman, T., Zeybek, H., & Kara, M. (2023). Digital agriculture and accounting transformation. Journal of Agricultural Informatics, 14(1), 12–25.

- EFRAG. (2023). European Sustainability Reporting Standards (ESRS) Exposure Drafts. European Financial Reporting Advisory Group.

- Elad, C. (2004). Fair Value Accounting in the Agricultural Sector: Some Implications for International Accounting Harmonization. European Accounting Review, 13(4), 621–641. [CrossRef]

- FAO. (2022). The State of Food and Agriculture 2022: Leveraging automation in agriculture. Rome: Food and Agriculture Organization of the United Nations.

- Gerber, R., Smit, A., & Botha, M. (2023). An evaluation of environmental, social, and governance reporting in the agricultural sector. Business Strategy & Development, 7.

- Gray, R., Adams, C. A., & Owen, D. (2014). Accountability, social responsibility, and sustainability: Accounting for society and the environment. Pearson.

- Gray, R., Owen, D., & Adams, C. A. (1996). Accounting and accountability: Changes and challenges in corporate social and environmental reporting. Prentice Hall.

- IIRC. (2013). The International <IR> Framework. International Integrated Reporting Council.

- Jones, M. J., & Solomon, J. F. (2013). Problematizing accounting for biodiversity. Accounting, Auditing & Accountability Journal, 26(5), 668–687.

- Laine, M., Tregidga, H., & Milne, M. J. (2020). Resolving inconsistency in corporate sustainability reporting: The case for a stakeholder approach. Accounting, Auditing & Accountability Journal, 33(5), 1270–1299. [CrossRef]

- Natural Capital Coalition. (2016). Natural Capital Protocol.

- Poore, J., & Nemecek, T. (2018). Reducing the environmental impacts of food through producers and consumers. Science, 360(6392), 987–992. [CrossRef]

- Ragazou, K., Garefalakis, A., Zafeiriou, E., & Passas, I. (2022). Agriculture 5.0: A new strategic management mode for a cost-efficient and energy-smart agriculture sector. Energies, 15(9), 3113. [CrossRef]

- Ryan, B., Scapens, R. W., & Theobald, M. (2002). Research methods and methodology in finance and accounting. Thomson.

- Schaltegger, S., & Burritt, R. (2010). Sustainability accounting for companies: Catchphrase or decision support for business leaders? Journal of World Business, 45(4), 375–384. [CrossRef]

- Schaltegger, S., & Burritt, R. (2017). Contemporary environmental accounting: Issues, concepts and practice. Routledge.

- Scientific Horizons. (2023). Application of ESG practices in agriculture. Scientific Horizons, 11(3), 34–48.

- Silva, M., Rodrigues, L., & Fonseca, A. (2021). Environmental disclosure in agriculture: An assessment of accounting standards. Sustainability Accounting, Management and Policy Journal, 12(1), 121–143.

- Sukhdev, P., Whitaker, M., & Smith, S. (2021). Accounting for sustainability: Transparency, technology and transformation. Global Environmental Change, 68, 102278. [CrossRef]

- TNFD – Taskforce on Nature-related Financial Disclosures. (2023). Beta Framework.

Table 1.

Traditional fair value model vs. (Proposed) ecological fair value model.

Table 1.

Traditional fair value model vs. (Proposed) ecological fair value model.

Table 2.

ESG template proposal.

Table 2.

ESG template proposal.

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).