Submitted:

14 July 2025

Posted:

16 July 2025

You are already at the latest version

Abstract

Keywords:

1. Introduction

2. Materials and Methods

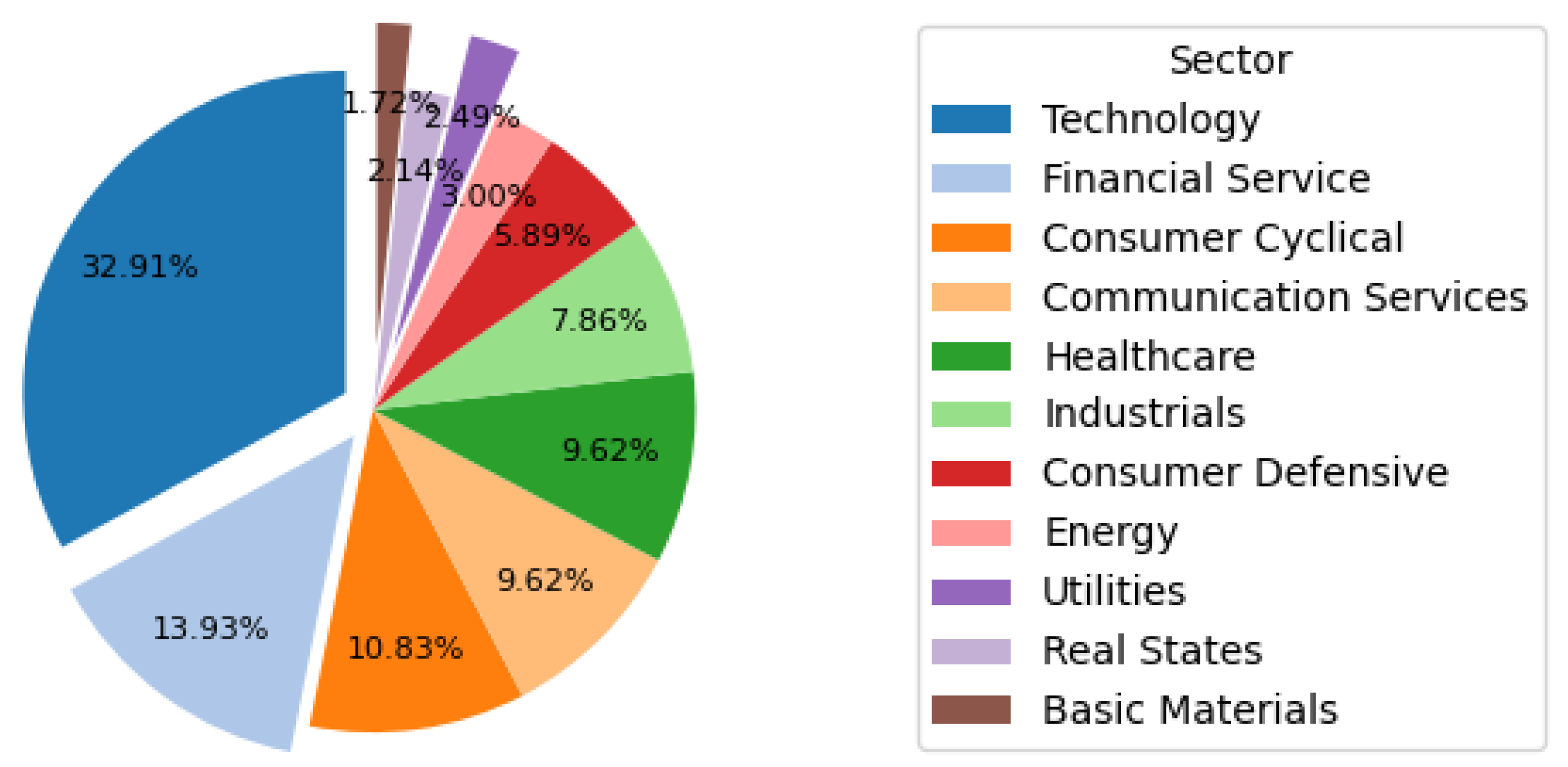

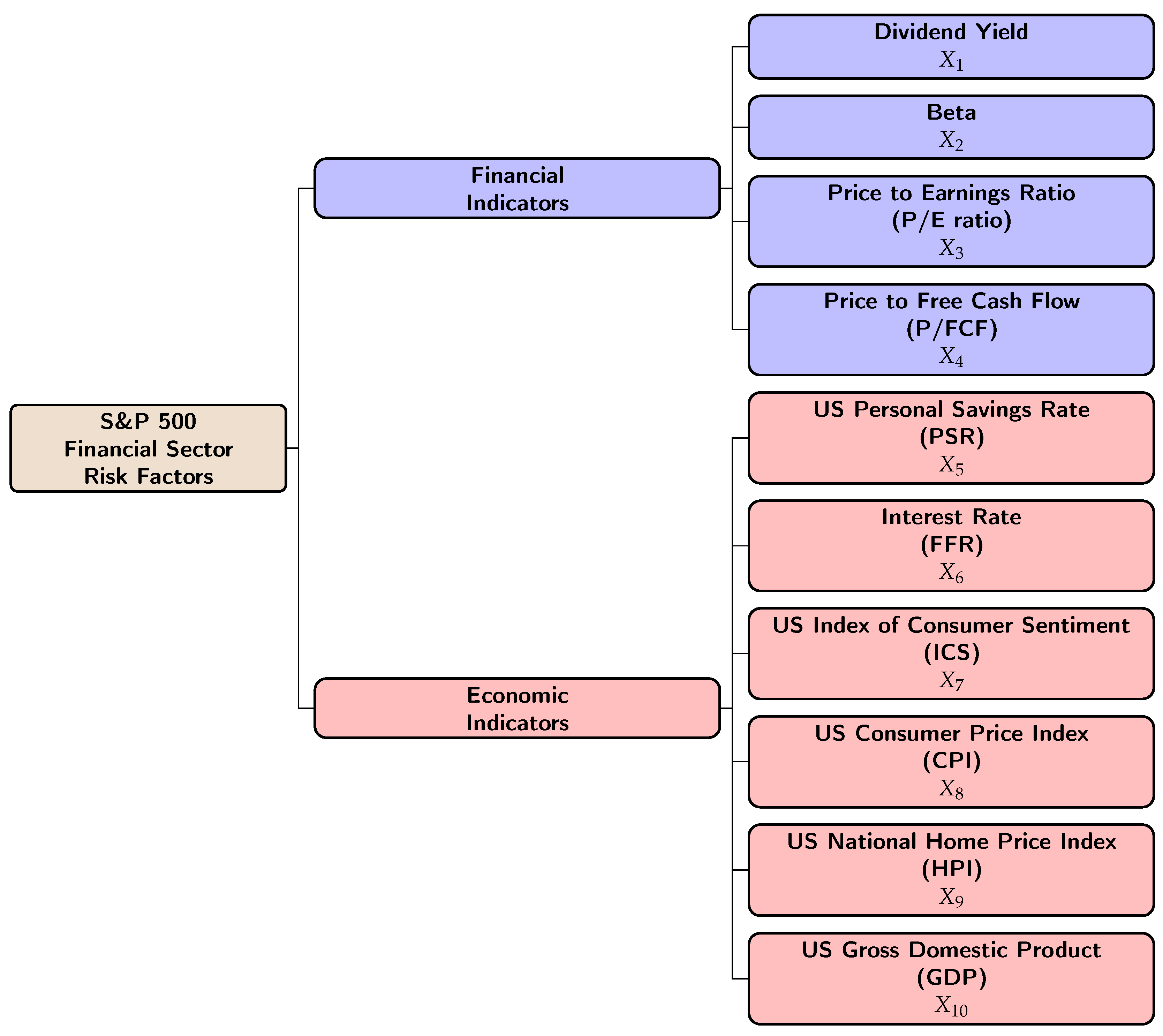

2.1. The Data

-

Dividend YieldDividend Yield gives the ratio of the earnings in dividend payout per year for the invested on a security which is expressed as a percentage of the annual return on the investment. A high dividend yield means that we are getting more income per investment. But it may not always be positive for the investor, i.e., it may happen due to a higher rate than the companies earning. The formula for calculating Dividend Yield can be written as,

-

BetaBeta is a statistical measure that is used by financial market practitioners to identify the volatility of returns relative to the market as a whole. This provides the risk of return of a particular stock in relation to the stocks of the entire market. Beta can be calculated by using the following expression,where is the return of the individual stock and is the return of the entire market.

-

Price to Earnings Ratio (P/E ratio)The price-to-earnings ratio is a ratio used to value a company that measures the current share price of a stock with respect to earnings per share (EPS). A high P/E ratio may provide an overvalued measure for the company’s stock. The P/E ratio doesn’t provide a value for the companies that have no earnings or that faces to a losing. This can be calculated as follows,

-

Price to Free Cash Flow Ratio (P/FCF)Price to Free Cash Flow is a ratio that indicates a company’s ability to continuously operate. A high value of P/FCF indicates that the company’s stock is overvalued. The formula for calculating P/FCF is as follows,

-

U.S. Personal Savings Rate (PSR)The personal savings rate in the United States is a measure of personal savings as a percentage of disposable personal income (DPI). This is calculated as the ratio of personal savings to the DPI. The personal savings are the same as the personal income minus personal outlays and personal taxes.

-

Interest Rate (FFR)The federal funds effective rate is the interest rate at which depository institutions trade federal funds, where balances held at Federal Reserve Banks with each other overnight. When a depository institution has surplus balances in its reserve account, it lends to other banks in greater need of balances. The rate that the borrowing institution pays to the lending institution is determined between two banks, where the weighted average rate for all of these types of negotiations is called the effective federal funds rate. This is essentially determined by the market but is influenced by the Federal Reserve through the open market operations to reach the federal funds rate target.

-

U.S. Index of Consumer Sentiment (ICS)The Index of Consumer Sentiment in the United States was developed by the University of Michigan by tracking consumer sentiment in the United States through surveys done on random samples of US households. The index takes into account the people’s feelings towards the current health of the economy and measures short and long-term expectations of personal finances and business conditions. Thus, consumer sentiment aids major spending and investments.

-

U.S. Consumer Price Index (CPI)The Consumer Price Index measures the average change over time in the prices paid by U.S. consumers for a market basket of consumer goods and services. The index is calculated for all items with less food and energy. The CPI can be calculated as follows,where is the consumer price index of the current period, is the cost of the market basket in the current period, and is the cost of the market basket in the base period.

-

U.S. National Home Price Index (HPI)The U.S. National Home Price Index measures the change in the value of the U.S. residential housing market by tracking the purchase prices of single-family homes. The index provides banks and mortgage lenders the recent data on sales prices, inventory levels, and the total number of homes sold. Investors in financial services and home construction can be more uptick when home sales data is rising.

-

U.S. Gross Domestic Product (GDP)The GDP of the United States is a featured measure of U.S. output, which indicates the market value of the goods and services produced by the labor and property that are located in the United States. GDP values were measured in trillions on a quarterly basis.

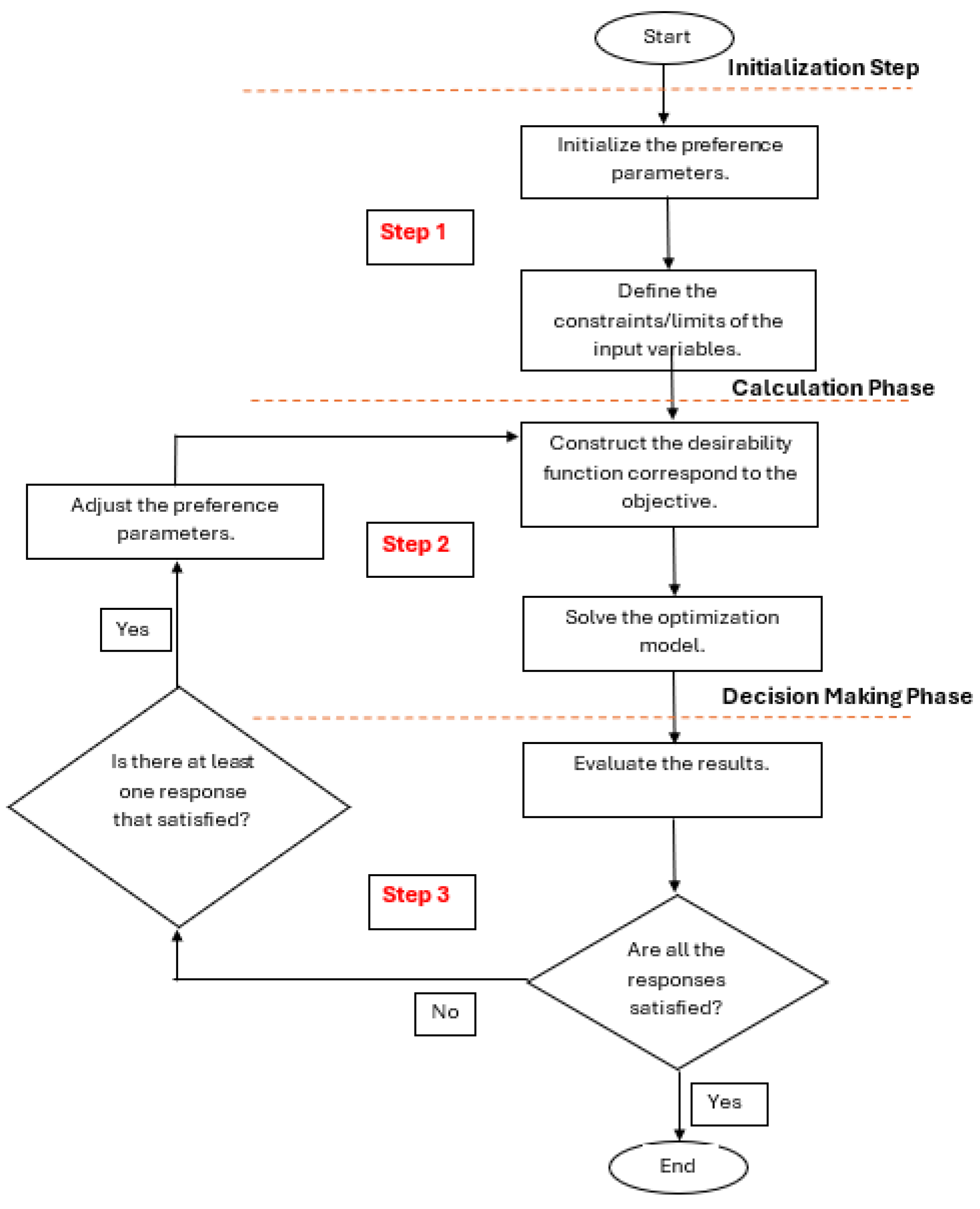

2.2. Analytical Approach For The Desirability Method

3. Results

3.1. Identifying the Values of the Indicators that Maximize the Weekly Closing Price (WCP) of the Financial Sector of 500

- Step 1.

- Build the analytical predictive model that predicts the response variable (WCP) with a high degree of accuracy [9].

- Step 2.

- Define the constraints/limits of the individual indicators and the response (WCP).

- Step 3.

- Identify the desirability function that optimizes the response (WCP) based on our objective (maximize).

- Step 4.

- Obtain the maximum value of the response (WCP) and the values of the nine indicators by executing the desirability method.

- Step 5.

- Validate the results of the optimization method.

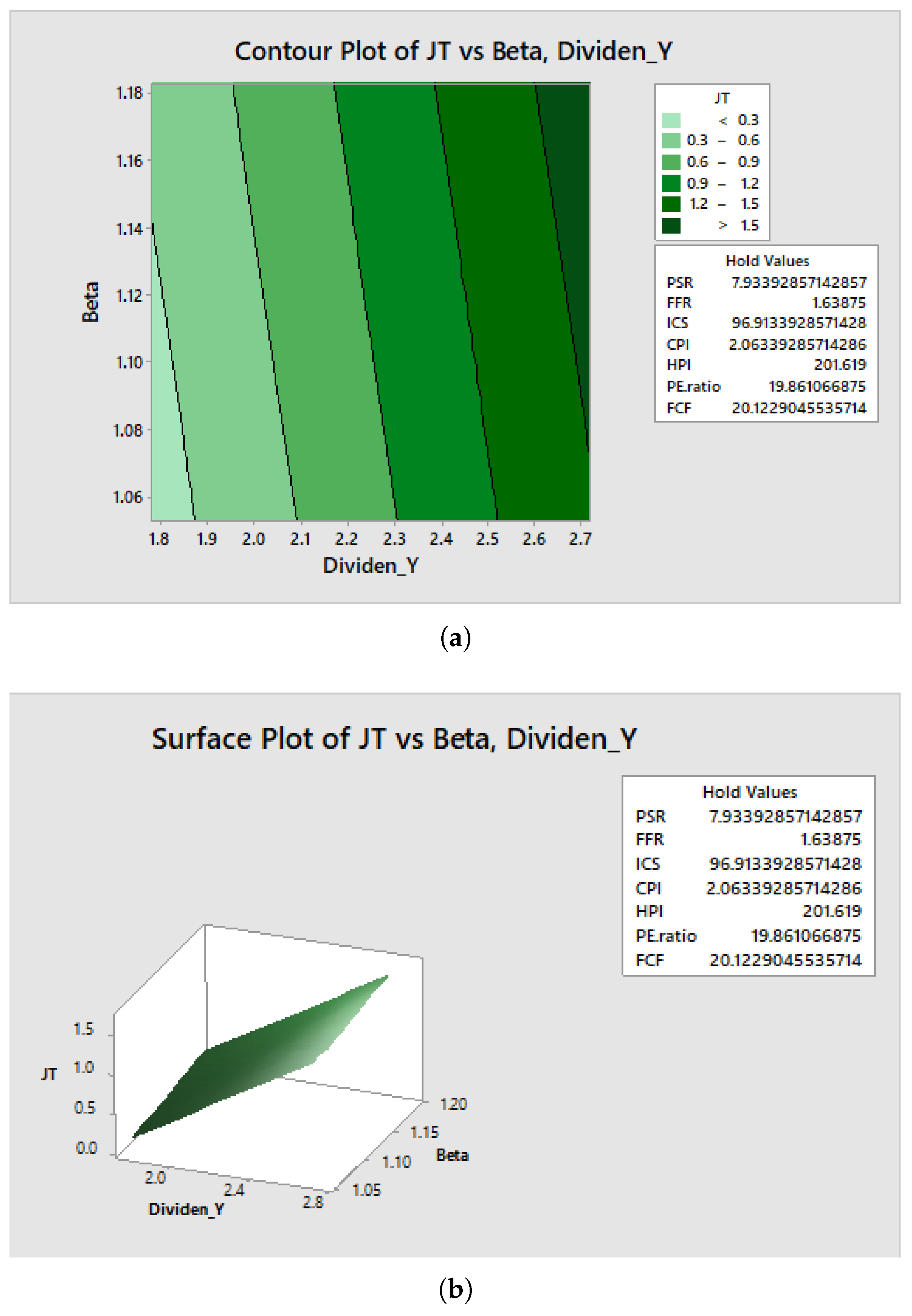

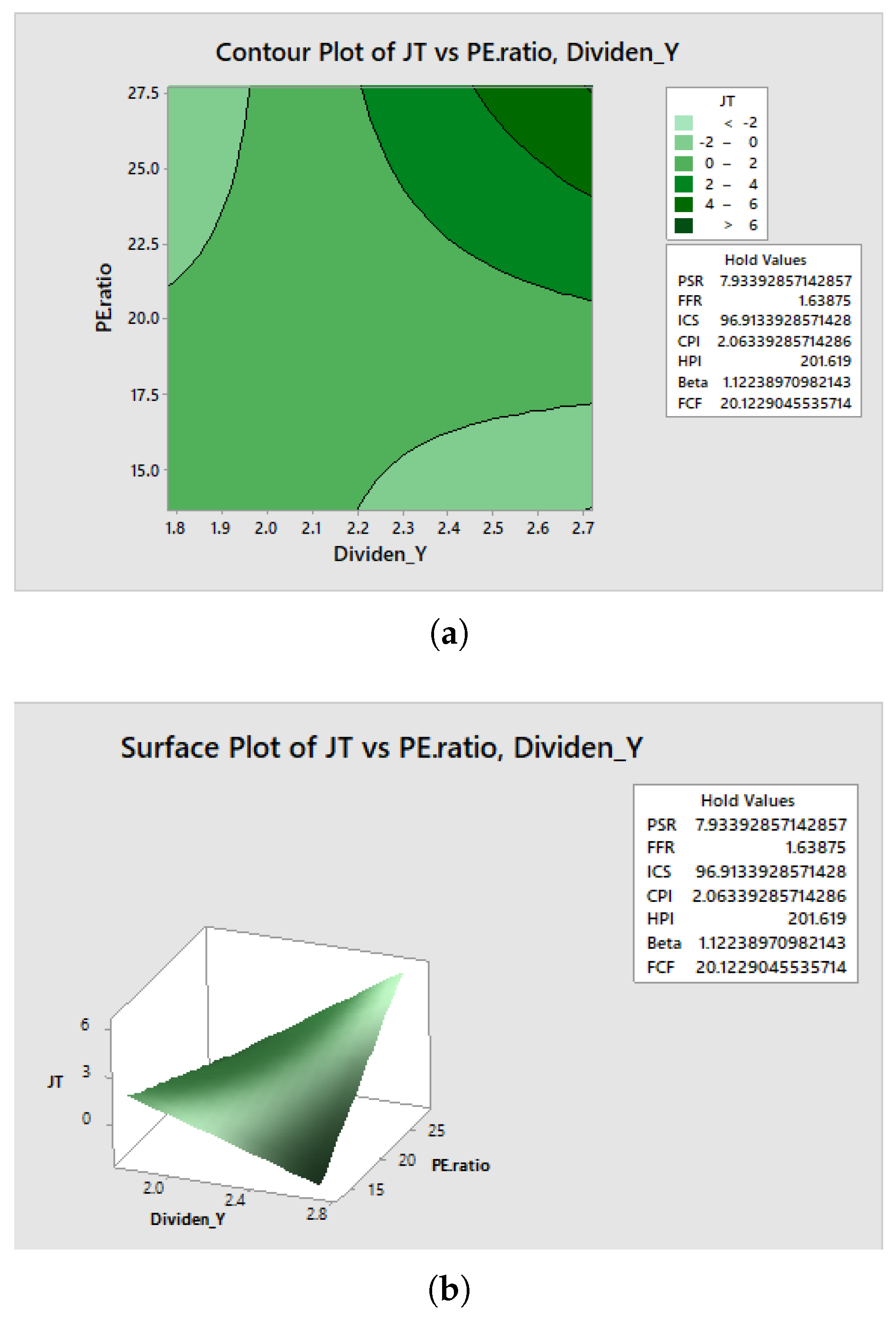

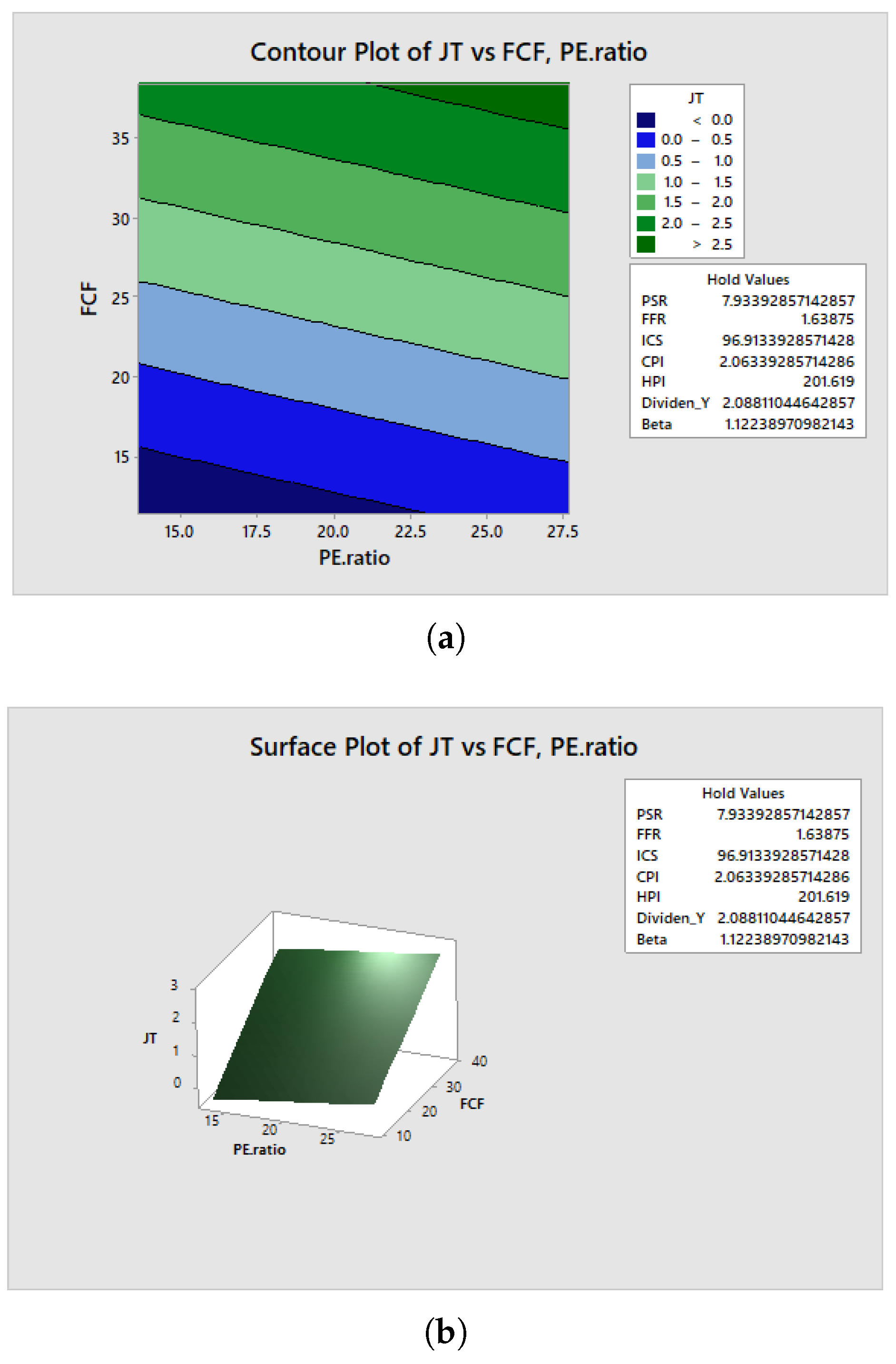

3.2. Graphical Visualization of Our Optimization Method

4. Discussion and Conclusions

- Dividend Yield : 2.2496

- Beta : 1.1178

- P/E ratio : 20.674

- Price to Free Cash Flow Ratio : 31.5997

- U.S. Personal Savings Rate (PSR) : 7.9

- Interest Rate(FER) : 1.54

- U.S. Index of Consumer Sentiment (ICS): 95.6

- U.S. Consumer Price Index (CPI) : 2.05

- U.S National Home Price Index (HPI): 201.081

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Abbreviations

| WCP | Weekly Closing Price |

References

- Yahoo finance/S&P 500 Financials (Sector) (SP500-40), 2024. https://finance.yahoo.com/quote.

- Lusardi, A.; Mitchell, O.S. The Economic Importance of Financial Literacy: Theory and Evidence. Journal of Economic Literature 2014, 52, 5–44. [CrossRef]

- Abu-Mostafa, Y.S.; Atiya, A.F. Introduction to financial forecasting. Applied Intelligence 1996, 6, 205–213.

- Zhong, X.; Enke, D. Forecasting daily stock market return using dimensionality reduction. Expert Systems with Applications 2017, 67, 126–139. [CrossRef]

- Iluppangama, M.; Abeywardana, D.; Tsokos, C.P. Systematic Comparison, Evaluation and Identification of Robust Model to Forecast the Closing Price of S&P 500 Financial Sector through Classical and AI-Based Approaches. Int J Bank Fin Ins Tech. 2024, 2, 1–16.

- Shah, D.; Isah, H.; Zulkernine, F. Stock Market Analysis: A Review and Taxonomy of Prediction Techniques. International Journal of Financial Studies 2019, 7. [CrossRef]

- Arévalo, R.; García, J.; Guijarro, F.; Peris, A. A dynamic trading rule based on filtered flag pattern recognition for stock market price forecasting. Expert Systems with Applications 2017, 81, 177–192. [CrossRef]

- Babu, M.S.; Geethanjali, D.N.; Satyanarayana, B.S. Clustering Approach to Stock Market Prediction 2011.

- Iluppangama, M.; Abeywardana, D.; Tsokos, C.P. A Real Data-Driven Analytical Model That Predicts Weekly Closing Price Of S&P 500 Financial Sector (under review).

- Beers, B. Economic Indicators That Move Financial Stocks, 2022. https://www.investopedia.com/ask/answers/031015/what-economic- indicators-are-important-investing-financial-services-sector.asp.

- Ross, S. What Economic Indicators Are Important to Consider When In- vesting in the Banking Sector, 2021. https://www.investopedia.com/ask/answ economic-indicators-are-important-consider-when-investing-banking-sector.asp.

- Frankel, M. 9 Essential Metrics All Smart Investors Should Know, 2018. https://www.fool.com/investing/2018/03/21/9-essential-metrics-all- smart-investors-should-kno.aspx.

- Thun, K. 6 Metrics To Measure Portfolio Performanc, 2022. https://seekingalpha.com/article/4500869-portfolio-performance-evaluation-metric.

- Harrington, J.E.C. The Desirability Function. Industrial Quality Control 1965, 21, 494–498.

- Derringer, G.; Suich, R. Simultaneous Optimization of Several Response Variables. Journal of Quality Technology 1980, 12, 214–219. [CrossRef]

- Abeywardana, D.; Iluppangama, M.; Tsokos, C.P. Papillary Thyroid Cancer, PTC: Identifying the Values of the Risk Factors that Will Minimize the Malignant Tumor Size Through Desirability Function Approach. European Journal of Applied Sciences 2024, 12, 220–231. [CrossRef]

- YCHARTS, 2024. https://ycharts.com/companies.

- FRED economic data; Economic Research Federal Reserve Bank of St. Louis,, 2024. https://fred.stlouisfed.org.

- U.S. Bureau of Labor Statistics, 2024. https://www.bls.gov.

- NIST/SEMATECH e-Handbook of Statistical Methods; 2012. https://doi.org/http://www.itl.nist.gov/div898/handbook/.

- Marinković, V. Some applications of a novel desirability function in simultaneous optimization of multiple responses. FME Transactions 2021.

- Jeong, I.J.; Kim, K.J. An interactive desirability function method to multiresponse optimization. European Journal of Operational Research 2009, 195, 412–426. [CrossRef]

- Nasuhar Abd Aziz1, Nurul Awanis, S.N.N. Modified Desirability Function For Optimization of Multiple Responses. JOURNAL OF MATHEMATICS AND COMPUTING SCIENCE 2018, 1, 39–54.

- Ali, M.; Sheha, A.; Tsokos, C.; Mamudu, L. Desirability function approach t o response surface optimization analysis of atmospheric carbon dioxide CO2 emission s in Africa. Glob. J. Sci. Front. Res.(GJSFR) H 2022, 22, 1–10.

- Frost, J. Statistics By Jim. https://statisticsbyjim.com/graphs/contour-plots/.

| Indicator | Minimum | Maximum |

| -1.82063 | 2.24255 | |

| 380.38007 | 511.88997 | |

| 1.78141 | 2.71797 | |

| 1.05292 | 1.18281 | |

| 13.6510 | 27.6971 | |

| 11.4375 | 38.4019 | |

| 6.3 | 9.5 | |

| 0.66 | 2.42 | |

| 89.8 | 101.4 | |

| 1.7 | 2.4 | |

| 187.316 | 214.846 |

| 2.24255 | 511.88997 | 2.24969 | 1.11786 | 20.674 | 31.5997 | 7.9 | 1.54 | 95.6 | 2.05 | 201.081 |

| SE of Fit | 95% CI | 95% PI | |||

| 0.9492 | 0.9398 | 0.99 | 0.263 | (499.859, 521.646) | (495.195, 524.504) |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).