Submitted:

27 June 2025

Posted:

30 June 2025

You are already at the latest version

Abstract

Keywords:

1. Introduction

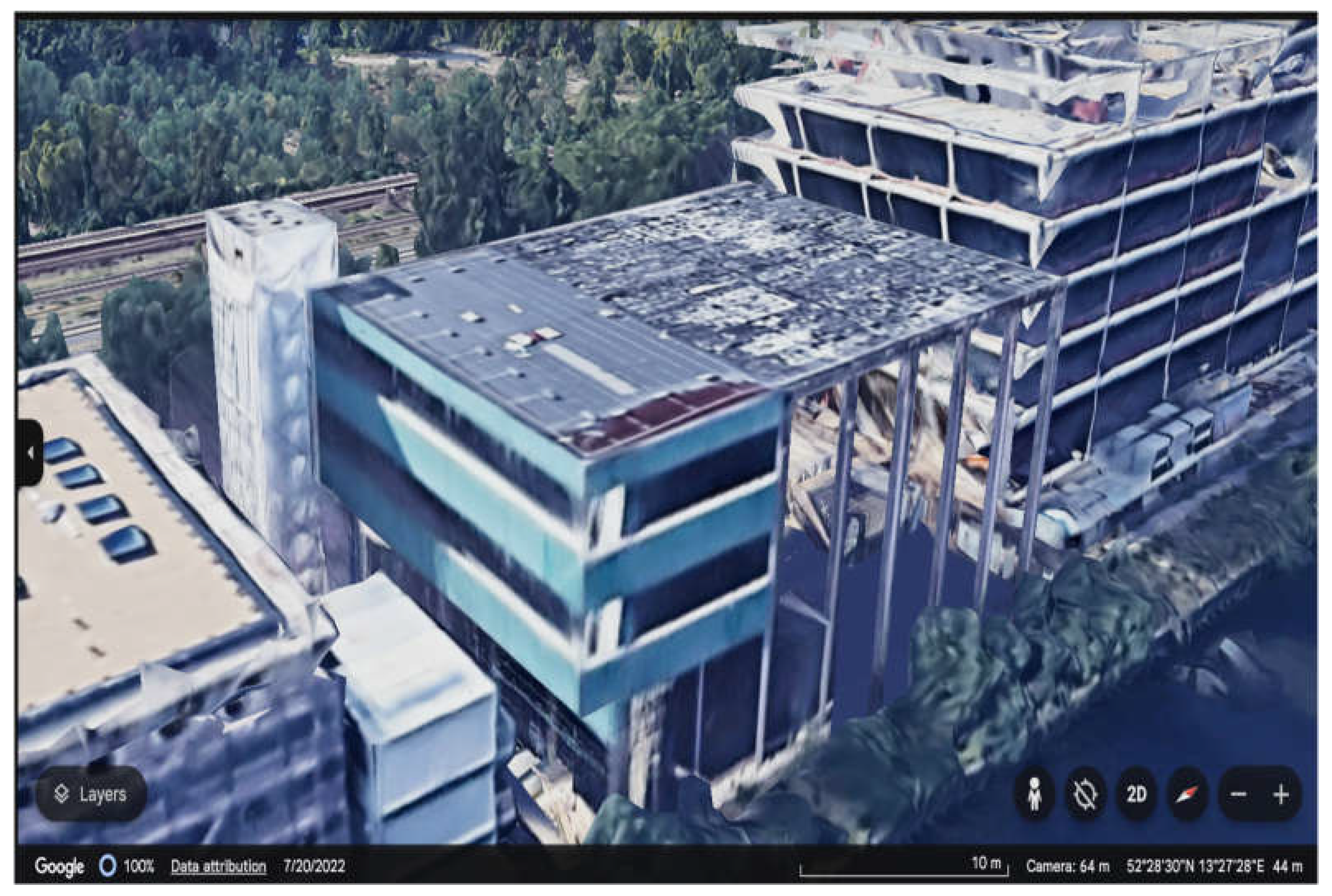

2. Site Selection

3. System Design Parameters

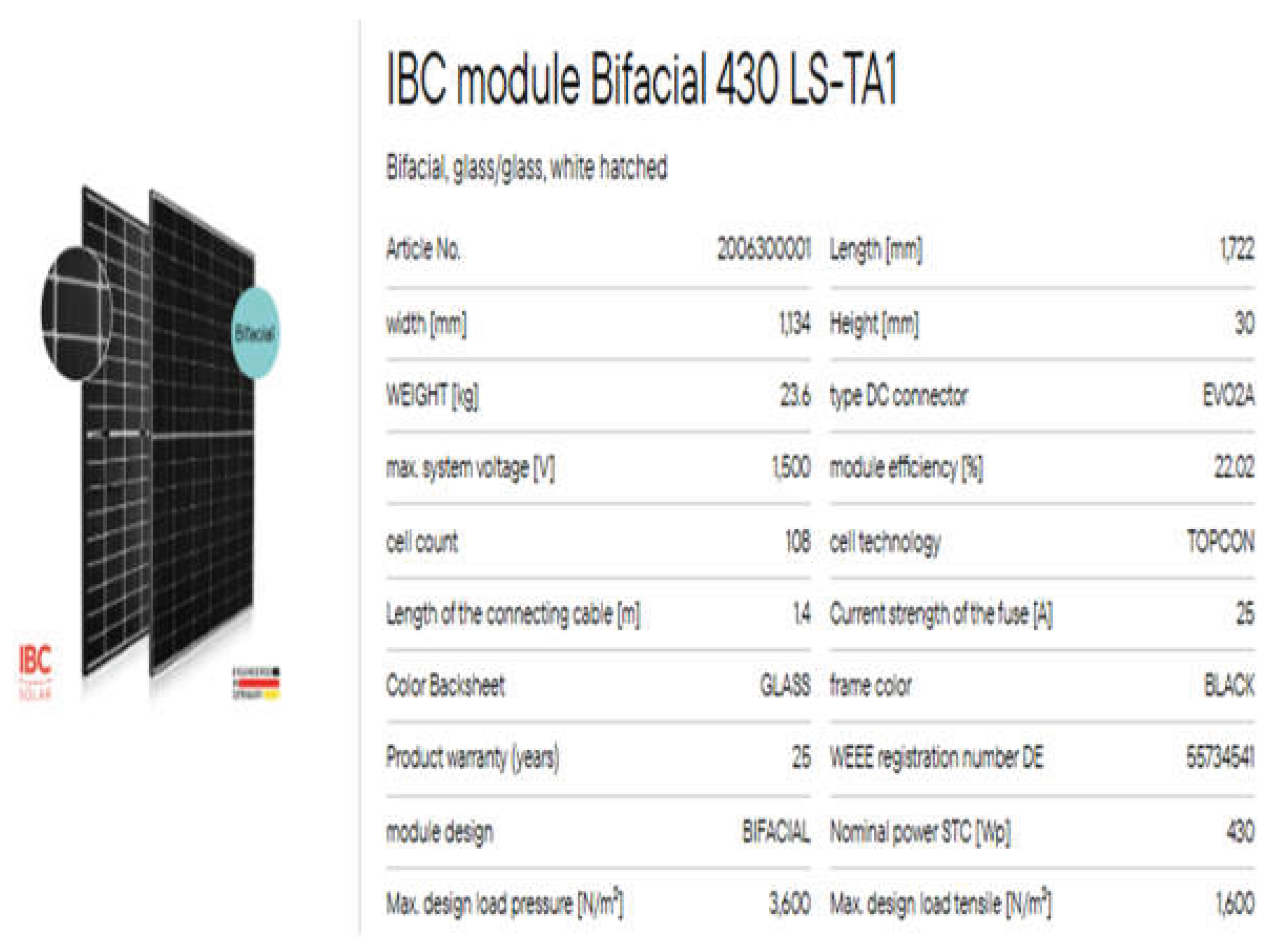

- PV Module Selection

- Module Count and System Capacity

| Sr. No | Cases | South-Oriented System | East–West System |

| 1 | Total Modules | 300 | 360 |

| 2 | Installed Capacity | 129.0 kWp | 154.8 kWp |

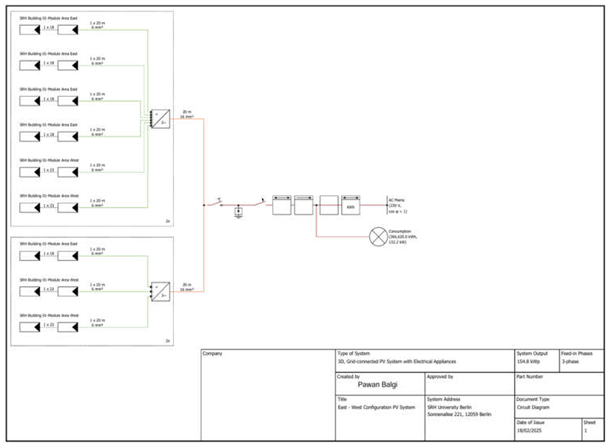

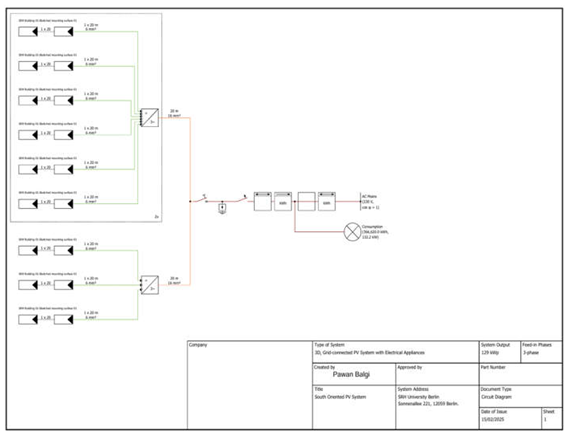

| 3 | Orientation | South (180°) | East (91°) / West (269°) |

| 4 | Tilt angle | 15° | 10° |

| 5 | Rooftop Area Used | 585.8 m² | 703.0 m² |

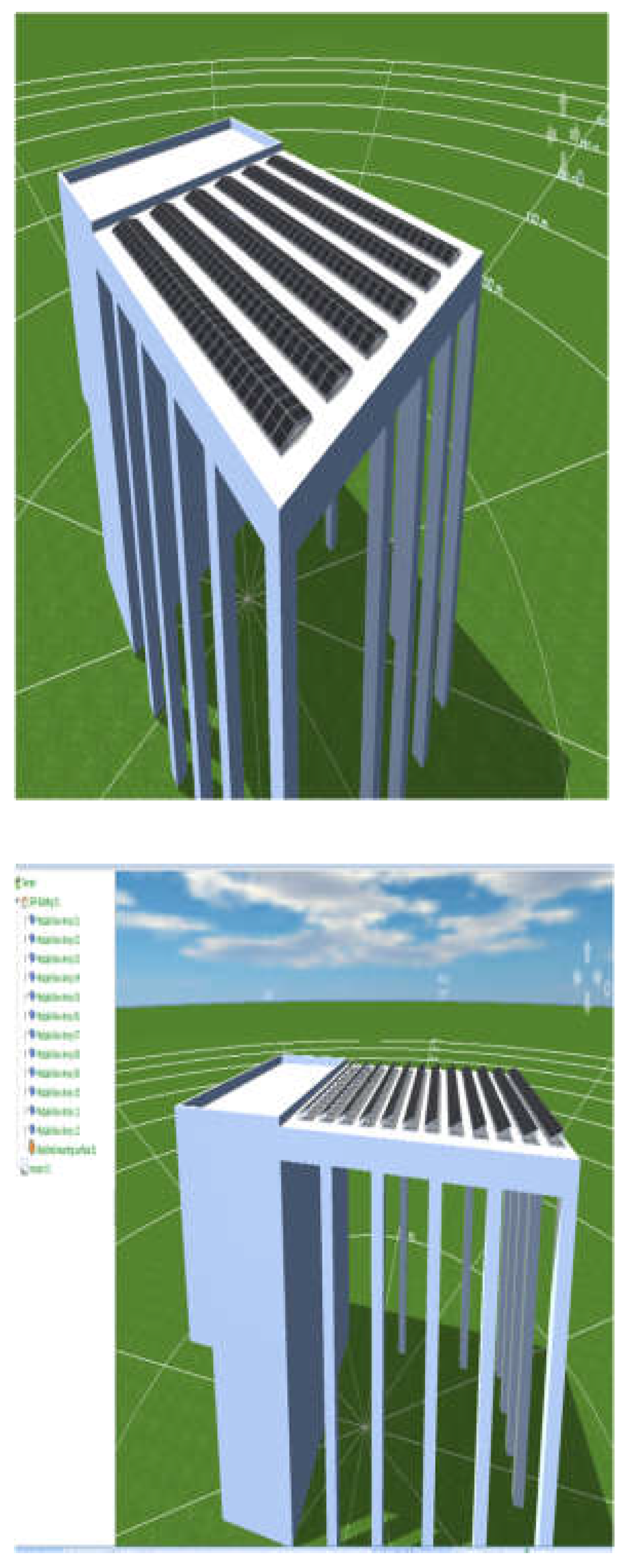

- South-Oriented System: Uses racks with higher tilt for maximum solar exposure during midday hours.

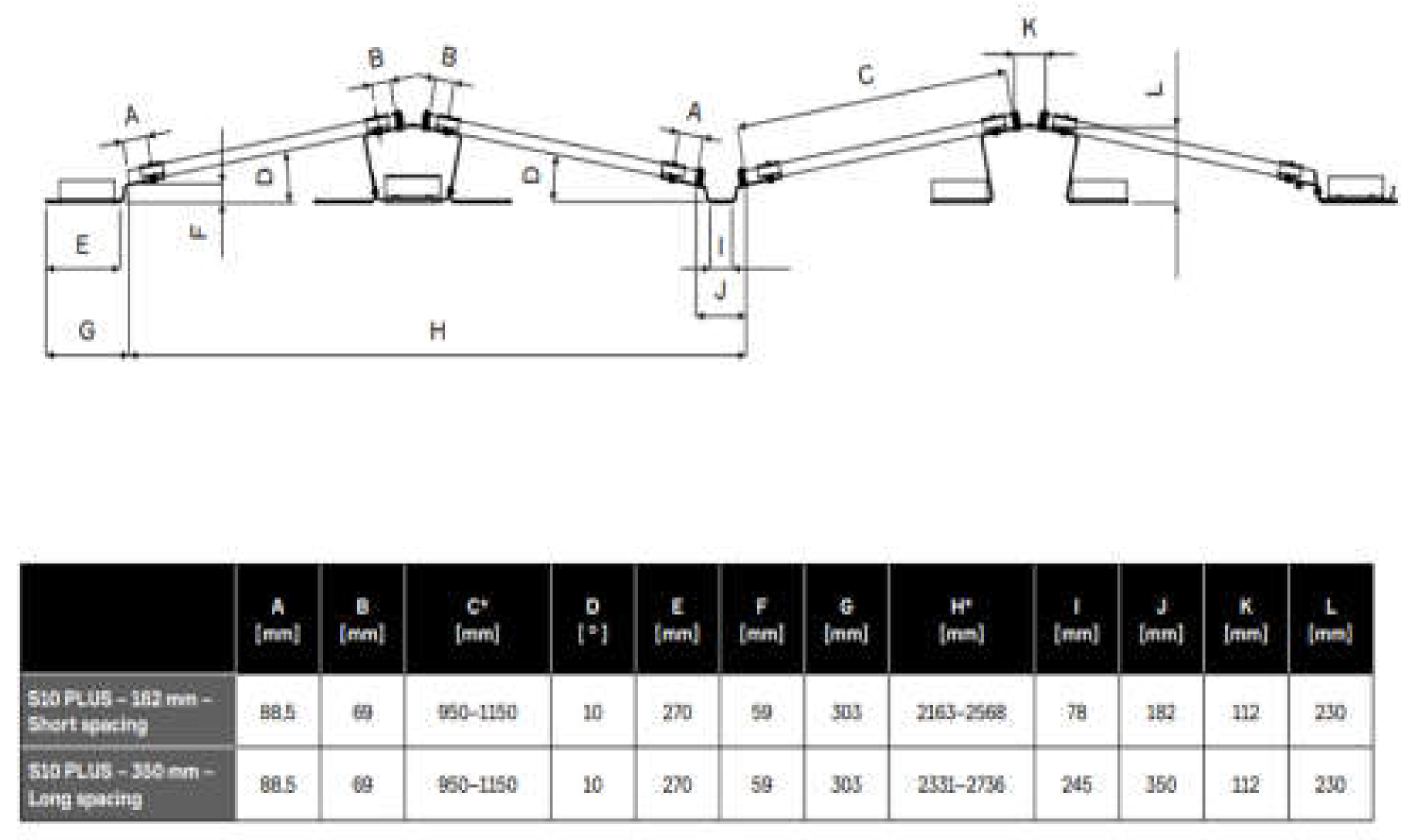

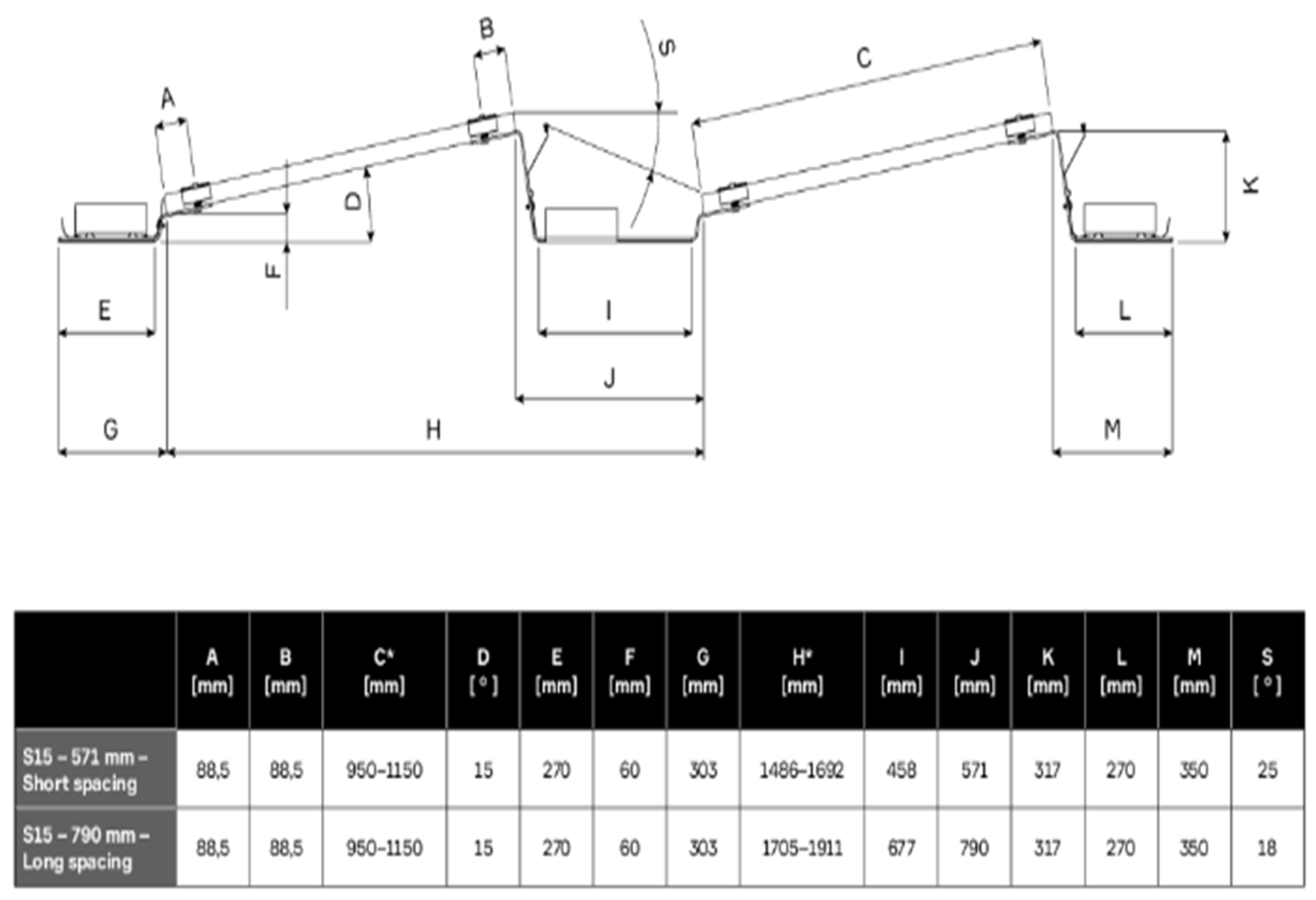

- East-West System: Utilizes a dual-tilt structure that supports both east and west-facing panels back-to-back with a low profile to reduce wind loads and enable closer spacing.

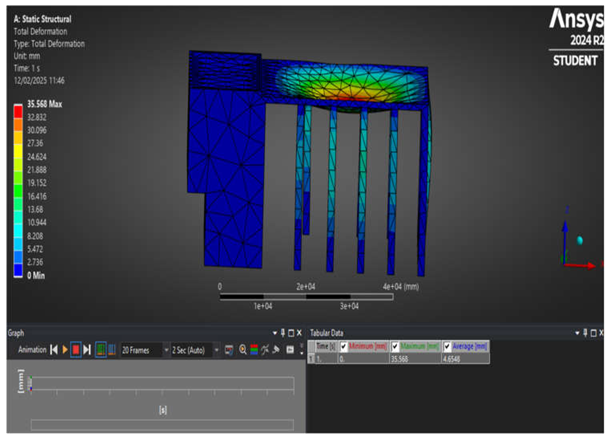

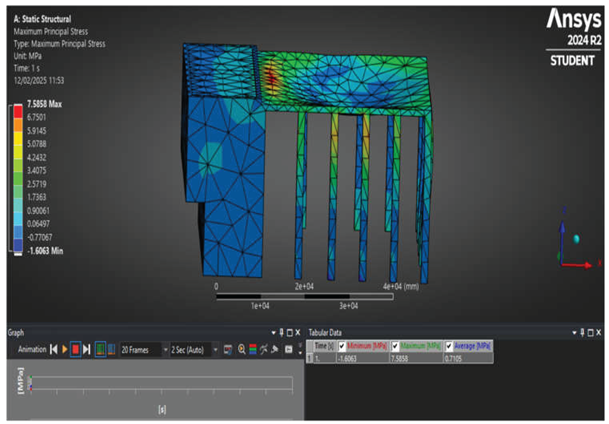

4. Structural Analysis with ANSYS

| Cases | Total Force (N) | Load Description |

| Self-Weight Only | 8.653 x 106 | Normal structure without the load of panels. |

| South-Oriented System | 8.723 x 106 | Weight added over the roof due to South-oriented PV modules. |

| East-West System | 8.736 x 106 | Weight added over the roof due to East-West PV modules. |

5. Simulation Software

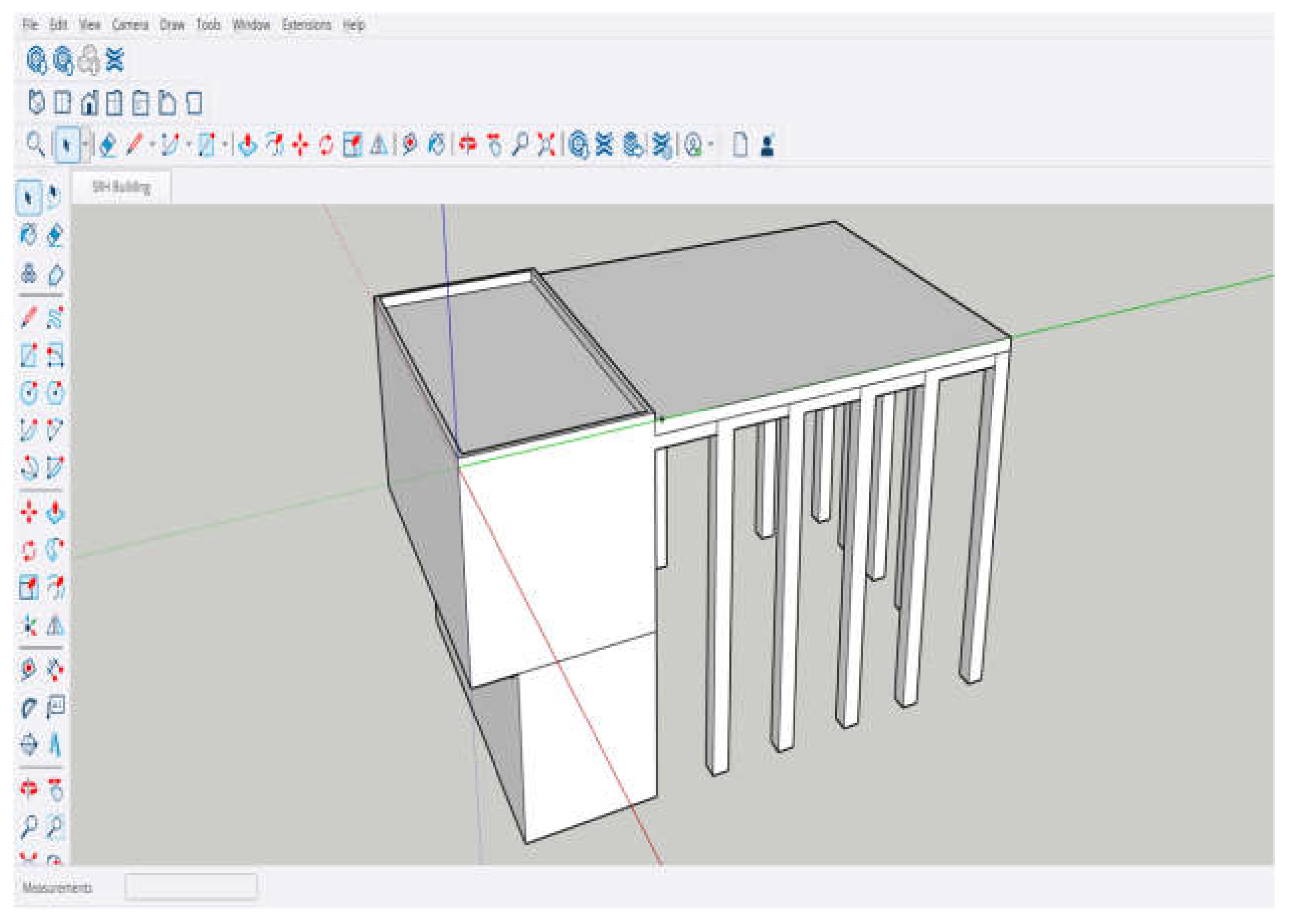

- Sketch-Up Design:

- b.

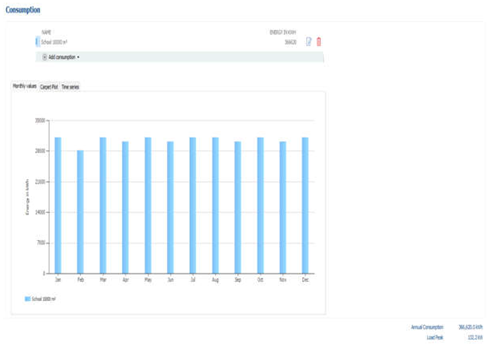

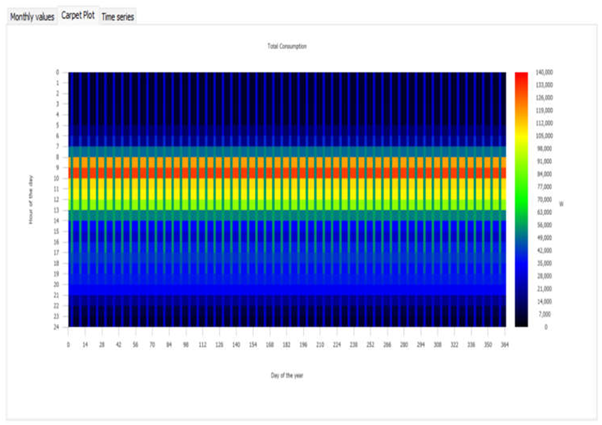

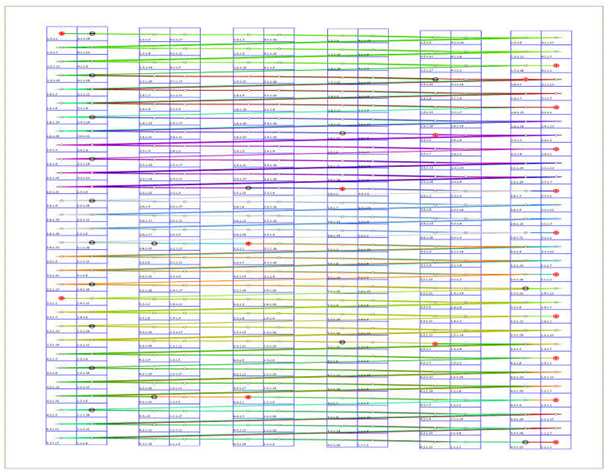

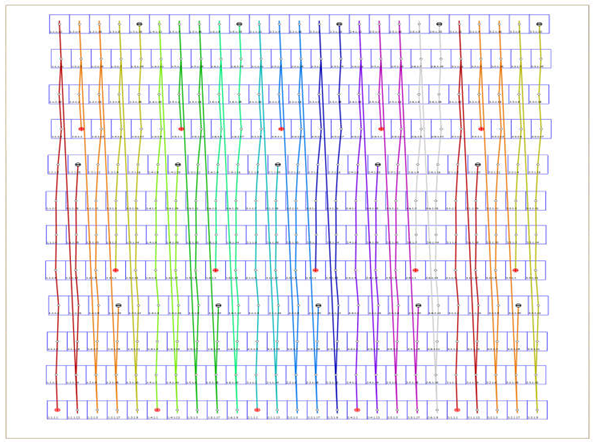

- PV SOL Software Design: In PV SOL, the simulation of the performance of the PV system is done by evaluating financial metrics, energy production, and configurations. This set of software tools promises a thorough method for enhancing the solar energy system's efficiency and design. Defining System Inputs: Important parameters of the building are entered into the software, such as the geographical location of the building (Sonnenallee 221, 12059 Berlin). The necessary specifications details of East-West and South-Oriented PV Systems, and which modules need to be considered, were done with the help of Aero Compact Software. This ensures that the simulations are based on accurate and localized data. IBC Solar company PV modules are taken into consideration in this case, and the design of the PV System.

6. Findings

| Parameter | East–West PV System | South PV System |

|

PV Generator Output |

154.8 kWp |

129 kWp |

|

AnnualYield (kWh/kWp) |

974.96 kWh/kWp |

1096.50 kWh/kWp |

|

Total Energy Production (AC Grid) |

151.011 kWh/year |

141.514 kWh/year |

| Performance Ratio (PR) | 91.03% | 89.06% |

|

Shading Losses |

0.7% |

2.6% |

|

Own Power Consumption |

86.1% |

87.5% |

|

Grid Export |

20.952 kWh/year |

17.729 kWh/year |

| Metric | East-West System | South–Oriented System | Remarks |

|---|---|---|---|

|

Initial Investment (€) |

232.200 |

193.500 |

The South-oriented system has a lower investment cost due to fewer modules being installed. |

|

Net Present Value (NPV) (€) |

33.150,96 |

73.804,75 |

The Net Present Value for the South System is higher than the East-West System due to lower investment cost. |

| Internal Rate of Return (IRR) |

19.89% |

23.09% |

South-Oriented System has a higher Internal Rate of Return. |

|

Accrued Cash Flow (€) |

484.593,68 |

472.273,63 |

The East-West system has higher cash flow as compared to the South System. |

|

Annual Utility Payment (€) |

6.141,93 |

6.908,83 |

Slightly higher annual payments for the South system due to its midday peak generation. |

|

Levelized Cost of Energy (LCOE) |

0.0923 €/kWh |

0.0684 €/kWh |

The South-Oriented System has a lower LCOE as compared to the East-West System. |

|

Minimum Amortization Period |

6.8 years |

7 years |

The South-Oriented System has a slightly higher amortization period. |

| Case | Maximum Deformation (mm) | Average Deformation (mm) |

|---|---|---|

| Self-Weight Only | 35.49 | 4.6452 |

| South-Oriented System | 35.555 | 4.6532 |

| East-West System | 35.568 | 4.6548 |

- = Net Cash Flow in year t

- r = discount rate

| Year | Cash Flow (€) | Discount Factor (1.04)t | Present value (€) |

| 1 | -84.239,30 | 1.04 | −80.999,33 |

| 2 | 31.915,99 | 1.0816 | 29.498,88 |

| 3 | -5.275,53 | 1.1249 | −4.690,22 |

| 4 | -3.845,04 | 1.1699 | −3.288,51 |

| 5 | -2.441,06 | 1.2167 | −2.006,96 |

| 6 | 34.983.65 | 1.2654 | 27.651,30 |

| 7 | 34.895,56 | 1.3161 | 26.520,10 |

| 8 | 34.806,64 | 1.3688 | 25.429,10 |

| 9 | 34.716,77 | 1.4233 | 24.376,72 |

| 10 | 34.625,86 | 1.4800 | 23.361,42 |

| 11 | 34.533,75 | 1.5382 | 22.381,58 |

| 12 | 34.440,34 | 1.5997 | 21.435,90 |

| 13 | 34.345,46 | 1.6637 | 20.523,94 |

| 14 | 34.249,01 | 1.7303 | 19.644,24 |

| 15 | 34.150,85 | 1.7995 | 18.795,42 |

| 16 | 34.050,85 | 1.8715 | 17.976,16 |

| 17 | 33.948,86 | 1.9464 | 17.185,15 |

| 18 | 33.844,74 | 2.0242 | 16.421,30 |

| 19 | 33.738,38 | 2.1042 | 15.683,37 |

| 20 | 33.629,61 | 2.1873 | 14.970,36 |

| 21 | 33.518,28 | 2.2728 | 14.281,04 |

| Year | Cash Flow (€) | Discount Factor (1.04)t |

Present value (€) |

| 1 | -71.773,75 | 1.04 | -68.058,41 |

| 2 | 25.452,61 | 1.0816 | 23.527,14 |

| 3 | 14.265,27 | 1.1249 | 12.685,64 |

| 4 | 15.223,64 | 1.1699 | 13.012,69 |

| 5 | 16.176,10 | 1.2167 | 13.293,42 |

| 6 | 17.122,84 | 1.2654 | 13.538,64 |

| 7 | 18.064,09 | 1.3161 | 13.751,57 |

| 8 | 19.000,02 | 1.3688 | 13.935,16 |

| 9 | 19.930,86 | 1.4233 | 14.091,48 |

| 10 | 20.856,82 | 1.4800 | 14.222,75 |

| 11 | 32.455,41 | 1.5382 | 21.100,95 |

| 12 | 32.837,20 | 1.5997 | 20.529,50 |

| 13 | 33.224,24 | 1.6637 | 19.979,09 |

| 14 | 33.616,63 | 1.7303 | 19.448,66 |

| 15 | 34.014,42 | 1.7995 | 18.937,90 |

| 16 | 34.417,67 | 1.8715 | 18.445,56 |

| 17 | 34.826,45 | 1.9464 | 17.971,60 |

| 18 | 35.240,83 | 2.0242 | 17.514,79 |

| 19 | 35.660,90 | 2.1042 | 17,074.90 |

| 20 | 36.086,69 | 2.1873 | 16.651,83 |

| 21 | 35.574,68 | 2.2728 | 15.649,89 |

- Total Investment Cost: Given in the financial analysis of each system

- Operating Costs: Summed over 20 years.

- Energy Produced: Sum of annual production over 20 years.

- Investment Cost = 232.200 €

- Operating Cost = 2.322 €/year

- Lifetime = 20 years

- Total Operating Cost = 2.322€ × 20 = 46.440 €

- Energy Production = 151.011 kWh/year

- Total Energy Production = 151.011 × 20 = 3020.220 kWh

- No subsidies are mentioned.

- Investment Cost = 193.500 €

- Operating Cost = € 0/year (Operating Cost not considered in PV Sol Software)

- Lifetime = 20 years

- Total Operating Cost = € 0

- Energy Production = 141.514 kWh/year

- Total Energy Production = 141.514 × 20 = 2830.280 kWh

- No subsidies are mentioned.

| PV Systems | LCOE (€/kWh) |

| East-West | 0.0923 |

| South-Oriented | 0.0684 |

- c.

- Return on Investment (ROI)

- Total Net Profit = Total Savings + Total Feed-in Revenue - Operating Costs

- Total Savings = Annual Electricity Savings × Lifetime (20 years)

- Total Feed-in Revenue = Annual Feed-in Revenue × Lifetime (20 years)

- Operating Costs = Annual Operating Cost × 20 years

- Initial Investment Cost = Given in the reports

- Investment Cost = 232.200 €

- Annual Electricity Savings = 28.677,90 €

- Annual Feed-in Revenue = 9.414,47 €

- Operating Costs (Annual) = 2.322 €

- Lifetime = 20 years

-

Total Electricity Savings Over 20 Years = 28,677.90 × 20 = 573.558 €

-

Total Feed-in Revenue Over 20 Years = 9,414.47 × 20 = 188.289,40 €

-

Total Operating Cost Over 20 Years = 2,322 × 20 = 46.440 €

-

Total Net Profit = 573.558 € + 188.289,40 € – 46.440 € = 715.407,40 €

- Investment Cost = 193.500 €

- Annual Electricity Savings = 27.441,17 €

- Annual Feed-in Revenue = 1.761,88 €

- Operating Costs (Annual) = 0

- Lifetime = 20 years

-

Total Electricity Savings Over 20 Years = 27.441,17 × 20 = 548.823,40 €

-

Total Feed-in Revenue Over 20 Years = 1.761,88 × 20 = 35.237,60 €

-

Total Net Profit = 548.823,40 €+ 35.237,60 € = 584.061,00 €

- d.

- Simple Payback Period

- Initial Investment Cost = 232.200 €

- Annual Electricity Savings = 28.677,90 €

- Annual Feed-in Revenue = 9.414,47 €

- Annual Operating Cost = 2.322 €

- Initial Investment Cost = 193.500 €

- Annual Electricity Savings = 27.441,17 €

- Annual Feed-in Revenue = 1.761,88 €

7. Discussion of Findings

- Financial Performance Comparison:

- The investment cost for the East-West PV System is 232.000 €, while the investment cost for the South-Oriented PV System is 193.500 € due to fewer modules in the South-Oriented System.

- While the South-Oriented System appears more cost-effective initially, the higher electricity production of the East-West System compensates for the additional investment over time.

- The higher generation from the East-West System balances additional expenses, assuming that the maintenance and service cost exists for both systems.

- b.

- System Performance Comparison

- The East-West PV System produces a total energy production of 3020.220 kWh while the South Oriented System produces a total energy production of 2830.280 kWh over 20 years.

- This is a 6% increase in energy generation, which translates to higher revenue from electricity savings and feed-in tariffs.

- The Performance Ratio (PR) for East-West System is 91.03% and for the South- Oriented System is 89.06%.

- A higher performance ratio means that the system converts more available sunlight into usable electricity, improving efficiency. The higher performance ratio indicates that the system converts more sunlight into usable electricity, thus improving efficiency.

- The East-West System has a total of 360 modules, while the South-Oriented System has a total of 300 modules.

- The PV output would reduce from 154.8 kWp to approximately 129 kWp if modules for the East-West System and South System were the same.

8. Conclusions

- Higher Electricity Production: 3020.220 kWh for 20 years (6% more than the South Oriented System).

- Better Efficiency: The Performance Ratio (PR) of the East-West System is 91.03%, which ensures better usage of available solar energy.

- Faster Payback Period: The investment recovered in 6.49 years (SPP) for the East-West system, which is faster than the South-Oriented System.

- The East-West System has a better Return on Investment (ROI) as compared to the South System.

- Greater Carbon Reduction: East-West reduces 70,934 kg of CO₂ per year (more than the South System's 66,481 kg CO₂/year).

- Power Output: The number of modules for the East-West System is 360, which is more than the South System and can produce high power output.

- If the East-West System were also limited to 300 modules (same as the South Oriented System), it would lose its energy production advantage, making it less competitive.

- The installed capacity would drop from 154.8 kWp to approximately 129 kWp if the number of modules were reduced to 300.

- Total electricity production would decrease significantly, reducing revenue and financial returns.

- The East-West System maximizes available rooftop space, ensuring long-term financial and operational benefits.

Appendix A

Appendix B

References

- Abba Muhammad Adua, Bashar, Y., Sanda, Sadiq, A., & Musa, J. (2023). COMPARISONS OF EAST/WEST AND SOUTH ORIENTED PHOTOVOLTAIC (PV) SYSTEMS IN TERMS OF PERFORMANCE AND LAND UTILIZATION WITH THE BEST OPTIMUM TILT ANGLES. International Research Journal of Modernization in Engineering Technology and Science, 5(8), 2582–5208. https://www.researchgate.net/publication/373833906_COMPARISONS_OF_EASTWEST_AND_SOUTH_ORIENTED_PHOTOVOLTAIC_PV_SYSTEMS_IN_TERMS_OF_PERFORMANCE_AND_LAND_UTILIZATION_WITH_THE_BEST_OPTIMUM_TILT_ANGLES.

- Elmelegi, A., & AHMED, E. M. (2015, December). Study of Different PV Systems Configurations Case Study: Aswan Utility Company. https://www.researchgate.net/publication/287285879_Study_of_Different_PV_Systems_Configurations_Case_Study_Aswan_Utility_Company.

- Solar panel orientation: How using East-West structures improves the performance of your project — RatedPower. (n.d.). Ratedpower.com. https://ratedpower.com/blog/solar-panel-orientation/.

- East-West Vs North Facing Structures - Lumax Energy. (2024, June 14). Lumax Energy. https://lumaxenergy.com/carports/east-west-vs-north-facing-structures/.

- Amir Asgharzadeh, Deline, C., Stein, J., & Toor, F. (2018). A comparison study of the performance of south/north-facing vs east/west-facing bifacial modules under shading conditions. 1730–1734. [CrossRef]

- Fronius.com.(2016)https://www.fronius.com/~/downloads/Solar%20Energy/Whitepaper/SE_WP_Advantages_of_east-west_systems_EN.pdf.

- Karthikeyan, V., Rajasekar, S., Das, V., Karuppanan, P., & Singh, A. K. (2017). Grid-Connected and Off-Grid Solar Photovoltaic System. Smart Energy Grid Design for Island Countries, 125–157. [CrossRef]

- Difference Between On-Grid and Hybrid Solar System - Uni Solar. (2024, February 9). Uni Solar. https://unisolar.pk/difference-between-on-grid-and-hybrid-solar-system/.

- Squatrito, R., Sgroi, F., Tudisca, S., Trapani, A., & Testa, R. (2014). Post feed-in scheme Photovoltaic system feasibility evaluation in Italy: Sicilian case studies. Energies, 7(11), 7147–7165. [CrossRef]

- Google.com. (2025). https://earth.google.com/web/search/Sonnenallee+221.

- Download Ansys Student | Workbench-based Simulation Tools. www.ansys.com. https://www.ansys.com/academic/students/ansys-student.

- Downloading SketchUp | SketchUp Help. (2017). Sketchup.com. https://help.sketchup.com/en/downloading-sketchup.

- PV*SOL | Photovoltaic design and simulation. (2020, March 16). https://valentin-software.com/en/products/pvsol/.

- AEROCOMPACT Group – Intelligent solar racking. (2025, February 19). Aerocompact.com. https://www.aerocompact.com/en/.

- Bifacial 430-435 LS-TA1. (2024). Enfsolar.com. https://www.enfsolar.com/pv/panel-datasheet/crystalline/63333.

- Post, H. (2024, October 10). What Is Factor of Safety? Definition, Importance, and Formula. TRADESAFE. https://trdsf.com/blogs/news/what-is-factor-of-safety.

- Fernando, J. (2024, August 14). Net Present Value (NPV): What It Means and Steps to Calculate It. Investopedia. https://www.investopedia.com/terms/n/npv.asp.

- European Commission, Joint Research Centre. (n.d.). Photovoltaic Geographical Information System (PVGIS). Retrieved October 9, 2024. https://re.jrc.ec.europa.eu/pvg_tools/en/#MR.

- Cucchiella, F., Rotilio, M., Capannolo, L., De Berardinis, P., & The Authors. (2023). Technical, economic, and environmental assessment towards the sustainable goals of photovoltaic systems. In Renewable and Sustainable Energy Reviews (Vol. 188, p. 113879). [CrossRef]

- Laporte, J. P., & Cansino, J. M. (2024). Energy consumption in Higher education Institutions: A bibliometric analysis focused on scientific trends. In MDPI, Buildings (Vol. 14, p. 323). [CrossRef]

- Ramp. How to calculate operating income and maximize profits. https://ramp.com/blog/operating-income-formula.

- Mubarak, R., Luiz, E. W., & Seckmeyer, G. (2019). Why PV modules should preferably no longer be oriented to the south in the near future. Energies, 12(23), 4528. [CrossRef]

- P An, L. N., P Tran, T. M., & Faculty of Electrical Engineering, The University of Danang - University of Science and Technology, Danang City, Vietnam. (2020). Design of a grid connected PV system via PV*SOL software. IJISET - International Journal of Innovative Science, Engineering & Technology, Vol. 7(Issue 6), 121–123. https://www.ijiset.com.

- Tao, J. Y., & Finenko, A. (2016). Moving beyond LCOE: impact of various financing methods on PV profitability for SIDS. Energy Policy, 98, 749–758. [CrossRef]

- Wang, S., Wilkie, O., Lam, J., Steeman, R., Zhang, W., Khoo, K. S., Siong, S. C., & Rostan, H. (2015). Bifacial Photovoltaic Systems energy yield modelling. Energy Procedia, 77, 428–433. [CrossRef]

- Zengwei, Z., Zhen, Z., Yongfeng, J., Haolin, L., & Shengcheng, Z. (2019). Performance analysis on bifacial PV panels with inclined and horizontal East-West Sun trackers. IEEE Journal of Photovoltaics, 9(3), 636–642. [CrossRef]

- Fronius Efficient East-West Orientated PV Systems with One MPP Tracker. (2025). Pure-Electric.com.au.https://pure-electric.com.au/resources/fronius-efficient-east-west-orientated-pv-systems-one-mpp-tracker.

- Pereira, L. D., Raimondo, D., Corgnati, S. P., Gameiro Da Silva, M., TEBE Research Group, Department of Mechanical Engineering, University of Coimbra and ADAI – LAETA, & Department of Energy, Politecnico di Torino. (2014). Energy consumption in schools – A review paper. In Renewable and Sustainable Energy Reviews (Vols. 40–40, pp. 911–922) [Journal-article]. [CrossRef]

- Ayadi, O., Shadid, R., Bani-Abdullah, A., Alrbai, M., Abu-Mualla, M., & Balah, N. (2022). Experimental comparison between Monocrystalline, Polycrystalline, and Thin-film solar systems under sunny climatic conditions. Energy Reports, 8, 218–230. [CrossRef]

- Beattie, A. (2024, August 22). ROI: Return on Investment meaning and calculation Formulas. Investopedia. https://www.investopedia.com/articles/basics/10/guide-to-calculating-roi.asp.

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).