Submitted:

28 May 2025

Posted:

29 May 2025

You are already at the latest version

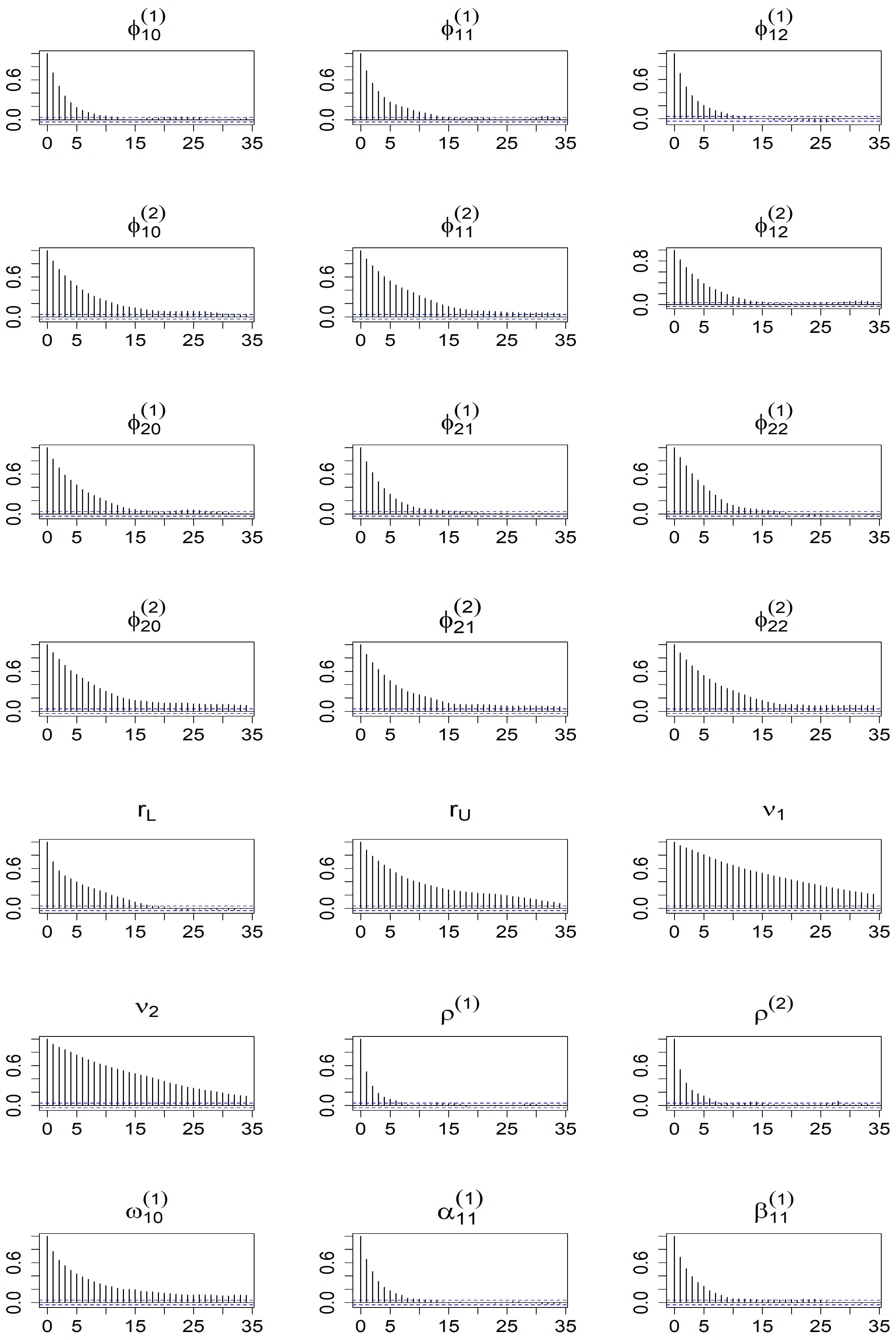

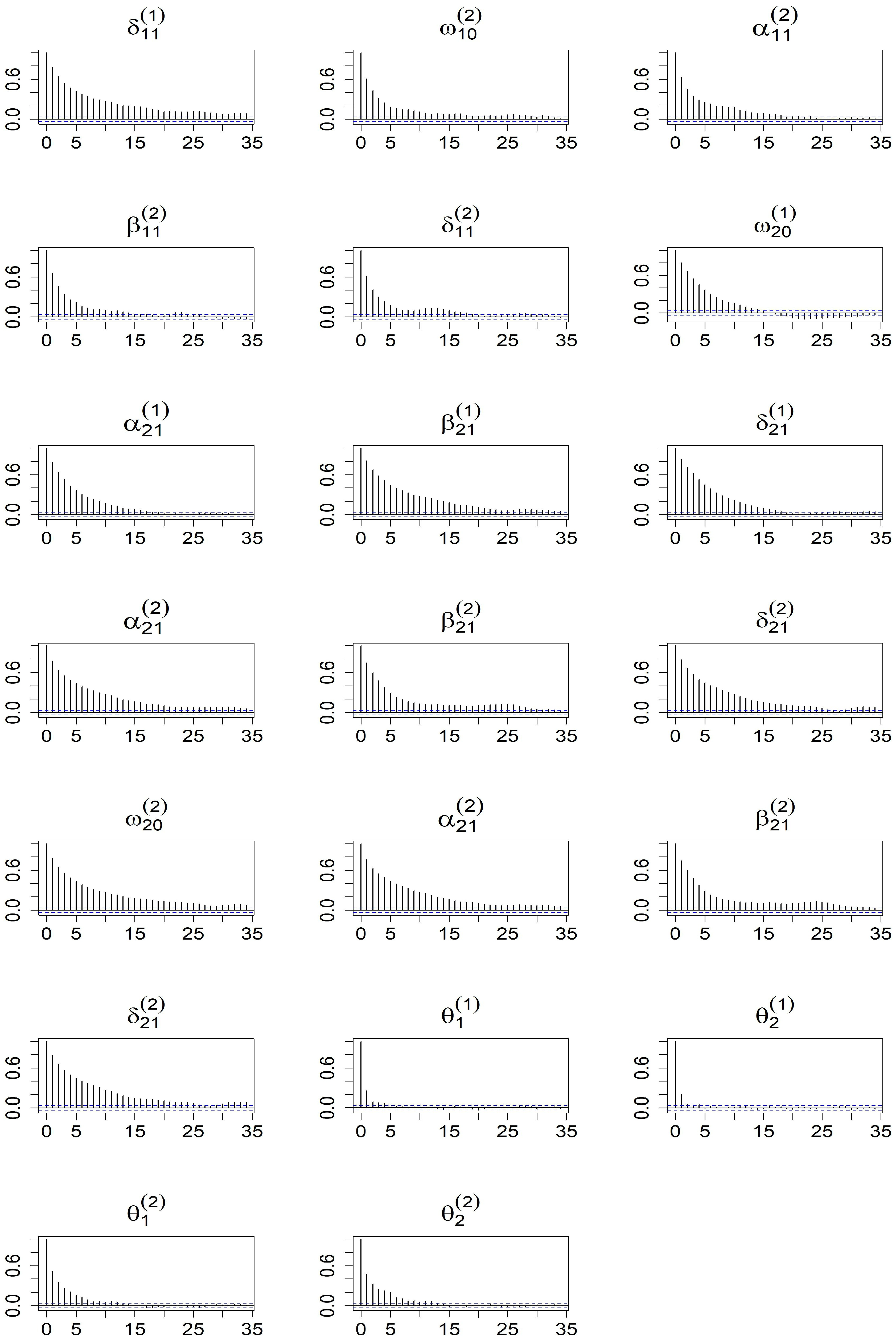

Abstract

Keywords:

1. Introduction

2. Multivariate Hysteretic Autoregressive Model with Asymmetry Structures in Volatility and Time-Varying Correlation

3. Bayesian Inference

4. Forecasting Marginal Expected Shortfall and Value at Risk

5. Simulation Study

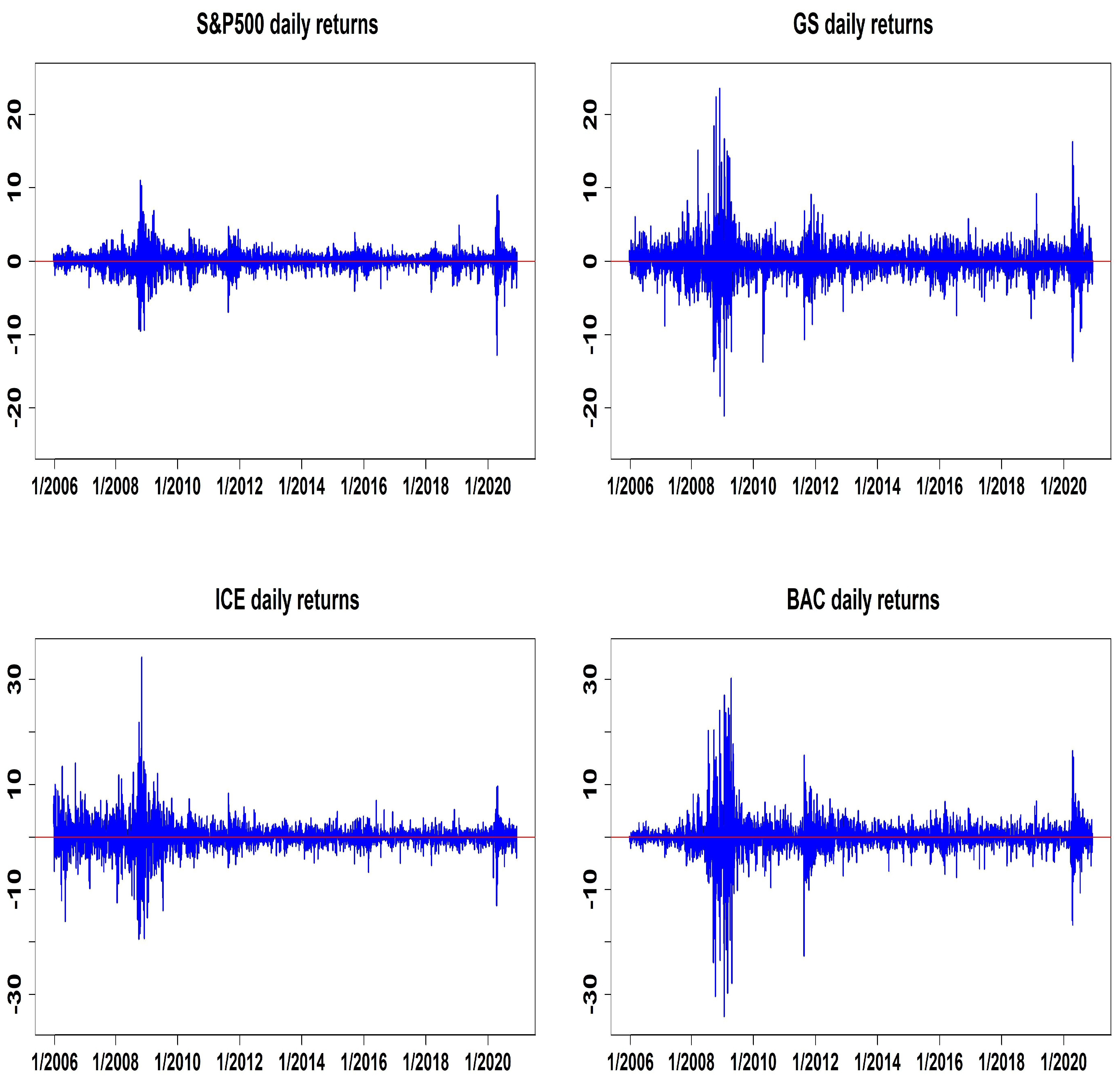

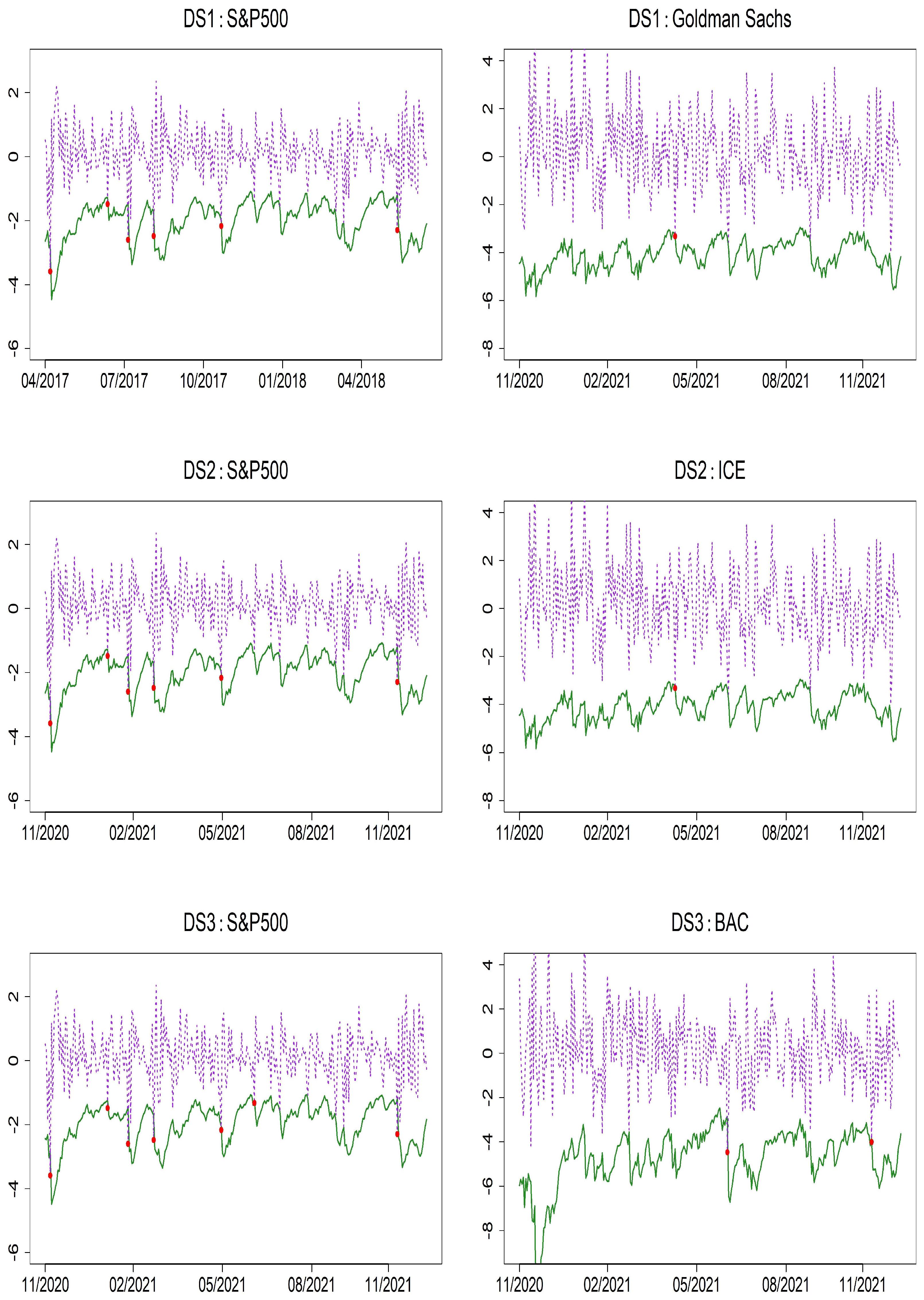

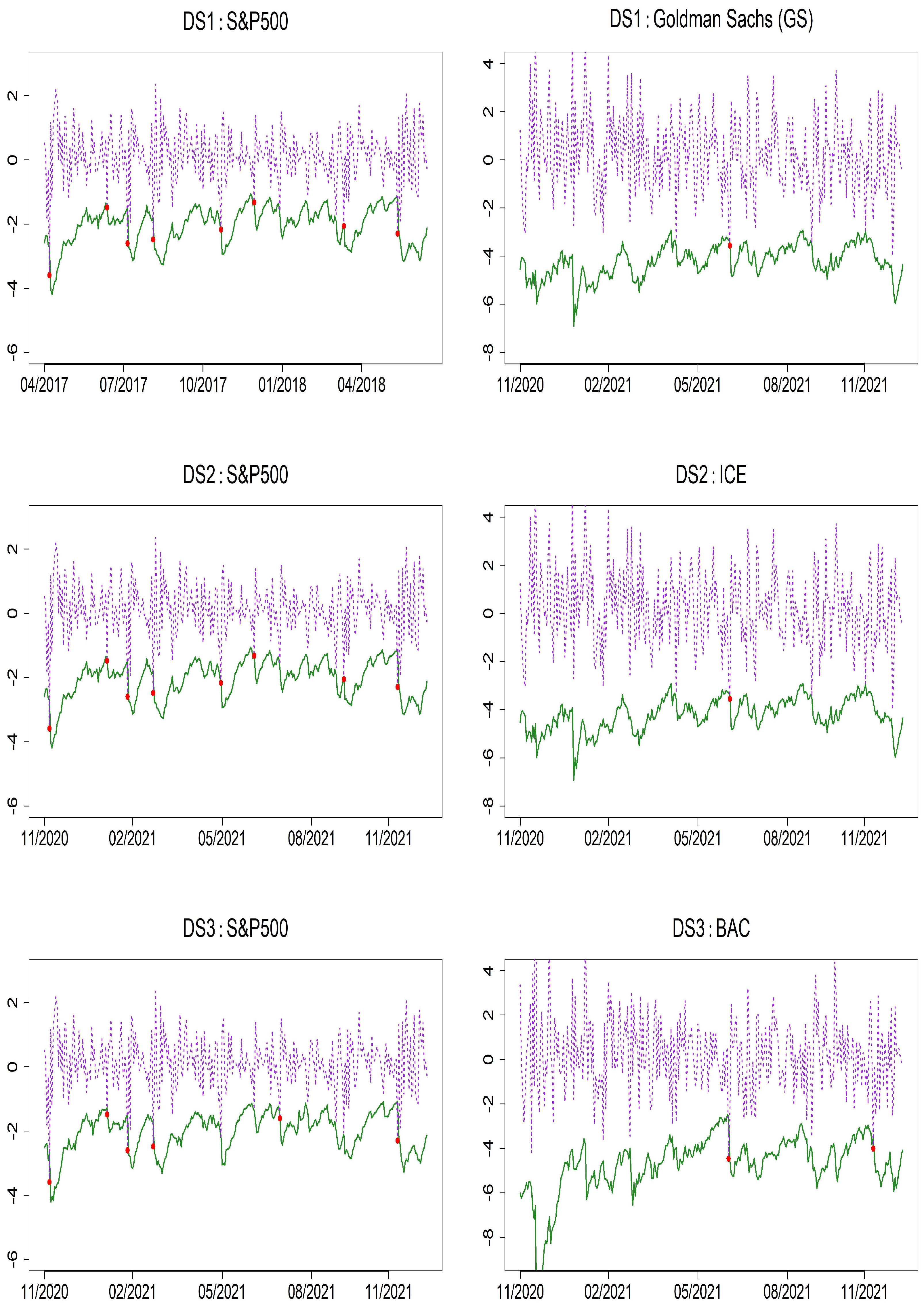

6. Emperical Study

7. Conclusions

References

- Acharya,V. V., Pedersen, L.H., Philippon, T., and Richardson, M. Measuring Systemic Risk. The Review of Financial Studies. 2017, 30, 2–47. [Google Scholar]

- Andrews, D.F. and Mallows, C.L. Scale mixtures of normality. Journal of the Royal Statistical Society Ser. B. 1974, 36, 99–102. [Google Scholar] [CrossRef]

- Cappiello, L. , Engle, R. F., and Sheppard, K. Asymmetric dynamics in the correlations of global equity and bond returns. Journal of Financial Econometrics. 2006, 4, 537–572. [Google Scholar] [CrossRef]

- Brownlees, T.C. , and Engle, R.F. SRISK: A conditional capital shortfall index for systemic risk measurement. The Review of Financial Studies. 2017, 30, 48–79. [Google Scholar] [CrossRef]

- Bollerslev, T. On the correlation structure for the generalized autoregressive conditional heteroskedastic process. Journal of Time Series Analysis. 1988, 9, 121–131. [Google Scholar] [CrossRef]

- Chen, C.W.S. and So, M.K.P. On a threshold heteroscedastic model. International Journal of Forecasting. 2006, 22, 73–89. [Google Scholar] [CrossRef]

- Chen, C.W.S. and Truong, B.C. On double hysteretic heteroskedastic model. Journal of Statistical Computation and Simulation. 2016, 86, 2684–2705. [Google Scholar] [CrossRef]

- Chen, C.W.S. , Than-Thi, H. , and So, M.K.P. On hysteretic vector autoregressive model with applications, Journal of Statistical Computation and Simulation. 2019, 89, 191–210. [Google Scholar]

- Chen, C. W. S. , Than-Thi, H., So, M. K. P., and Sriboonchitta, S. Quantile forecasting based on a bivariate hysteretic autoregressive model with GARCH errors and time - varying correlations. Applied Stochastic Models in Business and Industry. 2019, 6, 1301–1321. [Google Scholar] [CrossRef]

- Choy, S.T.B. , Chen, C.W.S., and Lin, E.M.H. Bivariate asymmetric GARCH models with heavy tails and dynamic conditional correlations. Quantitative Finance. 2014, 14, 1297–1313. [Google Scholar] [CrossRef]

- Christoffersen, P. F. Evaluating interval forecasts. International Economic Review. 1998, 39, 841–862. [Google Scholar] [CrossRef]

- Mardia, KV. Measures of multivariate skewness and kurtosis with applications. Biometrika. 1970, 57, 519–530. [Google Scholar] [CrossRef]

- Henze N and Zirkler, B. A class of invariant consistent tests for multivariate normality. Commun Stat Theory Methods. 1990, 19, 3595–3617. [Google Scholar] [CrossRef]

- Embrechts, P. , Kaufmann, R., and Patie, P. Strategic long-term financial risks: Single risk factors. Computational Optimization and Applications. 2005, 32, 61–90. [Google Scholar] [CrossRef]

- Engle, R. Dynamic conditional correlation: A simple class of multivariate generalized autoregressive conditional heteroskedasticity models. Journal of Business and Economic Statistics. 2002, 20, 339–350. [Google Scholar] [CrossRef]

- Geweke, J. Evaluating the accuracy of sampling - Based approaches to calculating posterior moments. Oxford University Press, Oxford.

- Glosten, L.R. , Jagannathan, R., and Runkle, D.E. On the Relation between the Expected Value and the Volatility of the Nominal Excess Return on Stocks. The Journal of Finance. 1993, 48, 1779–1801. [Google Scholar] [CrossRef]

- Kupiec, P. Techniques for verifying the accuracy of risk measurement models. Journal of Derivatives. 1995, 3, 73–84. [Google Scholar] [CrossRef]

- Li, G.D. , Guan, B., Li, W.K., and Yu, P.L.H. Hysteretic autoregressive time series models. Biometrika. 2015, 102, 717–723. [Google Scholar] [CrossRef]

- Lo, P.H. , Li, W.K., Yu, P.L.H., and Li, G.D. On buffered threshold GARCH models. Statistica Sinica. 2016, 26, 1555–1567. [Google Scholar]

- Sentana, E. Quadratic ARCH models. Review of Economics Studies. 1995, 62, 639–661. [Google Scholar] [CrossRef]

- Tse, Y.K. and Tsui, A.K.C. A multivariate generalized autoregressive conditional heteroscedasticity model with time-varying correlations. Journal of Business and Economic Statistics. 2002, 20, 351–362. [Google Scholar] [CrossRef]

- Tsay, R.S. Multivariate Time Series Analysis. John Wiley & Sons. 2014.

- Truong, B.C. , Chen, C.W., and Sriboonchitta, S. Hysteretic Poisson INGARCH model for integer-valued time series. Statistical Modelling. 2017, 17, 401–422. [Google Scholar] [CrossRef]

- Zhu, K. , Yu, P.L.H., and Li, W.K. Testing for the buffered autoregressive processes. Statistica Sinica. 2014, 24, 971–984. [Google Scholar]

- Zhu, K. , Li, W.K., and Yu, P.L.H. Buffered autoregressive models with conditional heteroskedasticity: An application to exchange rates. Journal of Business and Economic Statistics. 2017, 35, 528–542. [Google Scholar] [CrossRef]

| Parameter | True | Mean | Med | Std | 2.5% | 97.5% | Coverage | |

|---|---|---|---|---|---|---|---|---|

| -0.10 | -0.1022 | -0.1023 | 0.0280 | -0.1573 | -0.0472 | 94.00 | ||

| -0.10 | -0.1014 | -0.1015 | 0.0185 | -0.1375 | -0.0650 | 98.00 | ||

| 0.20 | 0.1992 | 0.1992 | 0.0482 | 0.1048 | 0.2936 | 95.50 | ||

| 0.25 | 0.2465 | 0.2465 | 0.0440 | 0.1602 | 0.3330 | 95.50 | ||

| 0.25 | 0.2510 | 0.2511 | 0.0215 | 0.2089 | 0.2932 | 96.00 | ||

| 0.30 | 0.2959 | 0.2960 | 0.0328 | 0.2312 | 0.3601 | 97.00 | ||

| -0.08 | -0.0811 | -0.0811 | 0.0119 | -0.1045 | -0.0579 | 94.50 | ||

| -0.15 | -0.1512 | -0.1512 | 0.0081 | -0.1671 | -0.1354 | 92.00 | ||

| 0.30 | 0.3005 | 0.3005 | 0.0347 | 0.2323 | 0.3688 | 95.50 | ||

| 0.35 | 0.3472 | 0.3472 | 0.0344 | 0.2797 | 0.4149 | 95.00 | ||

| 0.35 | 0.3514 | 0.3514 | 0.0162 | 0.3197 | 0.3832 | 94.00 | ||

| 0.30 | 0.2972 | 0.2972 | 0.0234 | 0.2513 | 0.3432 | 95.00 | ||

| -0.50 | -0.4989 | -0.4988 | 0.0184 | -0.5334 | -0.4640 | 94.50 | ||

| 0.10 | 0.0885 | 0.0890 | 0.0324 | 0.0266 | 0.1503 | 92.50 | ||

| 8.00 | 9.1324 | 8.9642 | 1.4995 | 6.6907 | 12.5705 | 97.50 | ||

| 10.00 | 10.1588 | 9.9447 | 1.7664 | 7.3307 | 14.2193 | 98.50 | ||

| 0.65 | 0.6460 | 0.6483 | 0.0323 | 0.5758 | 0.7021 | 97.50 | ||

| 0.80 | 0.7990 | 0.7990 | 0.0295 | 0.7414 | 0.8572 | 95.50 | ||

| d | 1.00 | 1.0000 | 1.0000 | 0.0204 | 1.0000 | 1.0000 | 100.00 | |

| 0.07 | 0.0782 | 0.0775 | 0.0144 | 0.0521 | 0.1088 | 89.50 | ||

| 0.20 | 0.2139 | 0.2091 | 0.1148 | 0.0218 | 0.4385 | 100.00 | ||

| 0.20 | 0.2191 | 0.2167 | 0.1143 | 0.0243 | 0.4388 | 100.00 | ||

| 0.40 | 0.3821 | 0.3819 | 0.0613 | 0.2620 | 0.5020 | 91.00 | ||

| 0.03 | 0.0349 | 0.0345 | 0.0073 | 0.0217 | 0.0506 | 91.00 | ||

| 0.20 | 0.2147 | 0.2131 | 0.0356 | 0.1502 | 0.2899 | 96.50 | ||

| 0.25 | 0.2792 | 0.2754 | 0.1150 | 0.0721 | 0.5080 | 97.00 | ||

| 0.55 | 0.5240 | 0.5248 | 0.0492 | 0.4245 | 0.6184 | 93.00 | ||

| 0.04 | 0.0382 | 0.0379 | 0.0068 | 0.0259 | 0.0524 | 93.00 | ||

| 0.25 | 0.2458 | 0.2439 | 0.0682 | 0.1190 | 0.3837 | 97.00 | ||

| 0.10 | 0.1262 | 0.1196 | 0.0694 | 0.0163 | 0.2754 | 97.50 | ||

| 0.40 | 0.3781 | 0.3781 | 0.0677 | 0.2450 | 0.5107 | 96.00 | ||

| 0.02 | 0.0218 | 0.0216 | 0.0039 | 0.0147 | 0.0298 | 94.00 | ||

| 0.30 | 0.3063 | 0.3044 | 0.0441 | 0.2253 | 0.3971 | 97.00 | ||

| 0.15 | 0.1830 | 0.1769 | 0.0830 | 0.0430 | 0.3542 | 95.00 | ||

| 0.40 | 0.3808 | 0.3809 | 0.0525 | 0.2781 | 0.4824 | 94.00 | ||

| 0.40 | 0.3915 | 0.3986 | 0.1819 | 0.0710 | 0.7004 | 97.00 | ||

| 0.10 | 0.1011 | 0.0968 | 0.0476 | 0.0258 | 0.1938 | 96.50 | ||

| 0.50 | 0.4615 | 0.4672 | 0.1083 | 0.2370 | 0.6571 | 96.50 | ||

| 0.20 | 0.2092 | 0.2065 | 0.0412 | 0.1364 | 0.2969 | 95.50 | ||

| Parameter | True | Mean | Med | Std | 2.5% | 97.5% | Coverage | |

|---|---|---|---|---|---|---|---|---|

| -0.10 | -0.1003 | -0.1002 | 0.0203 | -0.1404 | -0.0606 | 94.00 | ||

| -0.08 | -0.0792 | -0.0792 | 0.0153 | -0.1093 | -0.0493 | 93.50 | ||

| 0.32 | 0.3185 | 0.3186 | 0.0351 | 0.2494 | 0.3871 | 94.00 | ||

| 0.30 | 0.2973 | 0.2972 | 0.0292 | 0.2401 | 0.3548 | 97.00 | ||

| 0.37 | 0.3717 | 0.3717 | 0.0217 | 0.3290 | 0.4143 | 94.50 | ||

| 0.35 | 0.3467 | 0.3467 | 0.0250 | 0.2976 | 0.3958 | 95.00 | ||

| -0.08 | -0.0808 | -0.0808 | 0.0108 | -0.1021 | -0.0595 | 96.50 | ||

| -0.08 | -0.0802 | -0.0802 | 0.0070 | -0.0940 | -0.0665 | 95.50 | ||

| 0.35 | 0.3427 | 0.3427 | 0.0394 | 0.2652 | 0.4197 | 94.00 | ||

| 0.30 | 0.3027 | 0.3027 | 0.0372 | 0.2295 | 0.3759 | 95.00 | ||

| 0.33 | 0.3290 | 0.3290 | 0.0183 | 0.2930 | 0.3647 | 94.00 | ||

| 0.37 | 0.3666 | 0.3667 | 0.0235 | 0.3204 | 0.4127 | 95.00 | ||

| -0.45 | -0.4501 | -0.4503 | 0.0069 | -0.4626 | -0.4370 | 93.00 | ||

| 0.10 | 0.0970 | 0.0973 | 0.0113 | 0.0750 | 0.1170 | 93.00 | ||

| 8.00 | 9.2129 | 9.0257 | 1.5569 | 6.7229 | 12.8309 | 93.50 | ||

| 10.00 | 10.2736 | 10.0551 | 1.8017 | 7.3914 | 14.4714 | 99.50 | ||

| 0.50 | 0.4951 | 0.4994 | 0.0563 | 0.3723 | 0.5928 | 92.50 | ||

| 0.85 | 0.8472 | 0.8479 | 0.0257 | 0.7948 | 0.8958 | 94.50 | ||

| d | 1.00 | 1.0000 | 1.0000 | 0.0152 | 1.0000 | 1.0000 | 100.00 | |

| 0.07 | 0.0784 | 0.0778 | 0.0124 | 0.0557 | 0.1040 | 91.50 | ||

| 0.20 | 0.2235 | 0.2213 | 0.0467 | 0.1386 | 0.3220 | 95.00 | ||

| 0.10 | 0.1107 | 0.1098 | 0.0289 | 0.0566 | 0.1704 | 96.00 | ||

| 0.40 | 0.3613 | 0.3628 | 0.0832 | 0.1955 | 0.5205 | 95.50 | ||

| 0.03 | 0.0343 | 0.0340 | 0.0060 | 0.0234 | 0.0470 | 92.00 | ||

| 0.30 | 0.3306 | 0.3282 | 0.0558 | 0.2291 | 0.4473 | 94.00 | ||

| 0.10 | 0.1030 | 0.1032 | 0.0236 | 0.0555 | 0.1490 | 96.50 | ||

| 0.35 | 0.3289 | 0.3285 | 0.0527 | 0.2268 | 0.4339 | 94.00 | ||

| 0.04 | 0.0371 | 0.0369 | 0.0051 | 0.0276 | 0.0478 | 95.00 | ||

| 0.40 | 0.4115 | 0.4095 | 0.0555 | 0.3089 | 0.5284 | 94.50 | ||

| 0.05 | 0.0533 | 0.0525 | 0.0192 | 0.0180 | 0.0932 | 95.00 | ||

| 0.30 | 0.2855 | 0.2850 | 0.0618 | 0.1664 | 0.4087 | 95.00 | ||

| 0.02 | 0.0212 | 0.0211 | 0.0026 | 0.0163 | 0.0267 | 94.50 | ||

| 0.30 | 0.3212 | 0.3197 | 0.0449 | 0.2387 | 0.4122 | 95.50 | ||

| 0.10 | 0.1032 | 0.1031 | 0.0138 | 0.0767 | 0.1308 | 93.00 | ||

| 0.20 | 0.1904 | 0.1892 | 0.0410 | 0.1129 | 0.2733 | 96.00 | ||

| 0.40 | 0.3810 | 0.3847 | 0.1001 | 0.1753 | 0.5660 | 94.00 | ||

| 0.35 | 0.3582 | 0.3561 | 0.0563 | 0.2543 | 0.4744 | 96.00 | ||

| 0.55 | 0.5157 | 0.5244 | 0.0928 | 0.3104 | 0.6746 | 96.50 | ||

| 0.15 | 0.1573 | 0.1531 | 0.0427 | 0.0850 | 0.2535 | 98.00 | ||

| Data | Mean | Std | Min | Max | Skewness | kurtosis | MVN Tests* | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (p-value) | |||||||||||||||||

| Mardia | Henze - Zirkler | ||||||||||||||||

| S&P500 | 0.033 | 1.256 | -12.765 | 10.957 | -0.568 | 16.737 | |||||||||||

| GS | 0.033 | 2.320 | -21.022 | 23.482 | 0.188 | 18.086 | |||||||||||

| ICE | 0.075 | 2.578 | -19.501 | 34.217 | 0.205 | 20.699 | |||||||||||

| BAC | 0.007 | 3.165 | -34.206 | 30.210 | -0.319 | 26.645 | |||||||||||

| S&P500 vs GS | |||||||||||||||||

| S&P 500 vs ICE | |||||||||||||||||

| S&P 500 vs BAC | |||||||||||||||||

| Parameter | Mean | Med | Std | 2.5% | 97.5% | |

|---|---|---|---|---|---|---|

| 0.0453 | 0.0454 | 0.0255 | -0.0043 | 0.0967 | ||

| 0.0525 | 0.0538 | 0.0520 | -0.0580 | 0.1502 | ||

| -0.0914 | -0.0921 | 0.0375 | -0.1624 | -0.0205 | ||

| -0.0023 | -0.0017 | 0.0178 | -0.0371 | 0.0323 | ||

| -0.0274 | -0.0284 | 0.0649 | -0.1506 | 0.0972 | ||

| -0.0198 | -0.0204 | 0.0353 | -0.0880 | 0.0516 | ||

| 0.0408 | 0.0405 | 0.0137 | 0.0147 | 0.0680 | ||

| 0.0010 | -0.0005 | 0.0340 | -0.0648 | 0.0717 | ||

| 0.0054 | 0.0050 | 0.0283 | -0.0500 | 0.0608 | ||

| -0.0265 | -0.0267 | 0.0124 | -0.0499 | -0.0024 | ||

| 0.0339 | 0.0321 | 0.0575 | -0.0792 | 0.1423 | ||

| -0.0421 | -0.0411 | 0.0287 | -0.1000 | 0.0111 | ||

| -0.4935 | -0.4744 | 0.0386 | -0.5667 | -0.4502 | ||

| 0.6388 | 0.6497 | 0.0295 | 0.5541 | 0.6814 | ||

| 8.8291 | 8.7186 | 0.9056 | 7.2395 | 10.9435 | ||

| 7.4454 | 7.4002 | 0.7572 | 6.1675 | 9.1533 | ||

| 0.8766 | 0.8765 | 0.0192 | 0.8393 | 0.9150 | ||

| 0.6681 | 0.6699 | 0.0318 | 0.6014 | 0.7265 | ||

| d | 1.0000 | 1.0000 | 0.0318 | 1.0000 | 1.0000 | |

| 0.0247 | 0.0243 | 0.0042 | 0.0170 | 0.0341 | ||

| 0.0085 | 0.0082 | 0.0049 | 0.0009 | 0.0188 | ||

| 0.1155 | 0.1153 | 0.0078 | 0.1007 | 0.1299 | ||

| 0.9285 | 0.9296 | 0.0073 | 0.9115 | 0.9389 | ||

| 0.0179 | 0.0178 | 0.0024 | 0.0135 | 0.0228 | ||

| 0.0223 | 0.0222 | 0.0053 | 0.0117 | 0.0328 | ||

| 0.2750 | 0.2747 | 0.0137 | 0.2483 | 0.3006 | ||

| 0.8189 | 0.8195 | 0.0114 | 0.7959 | 0.8404 | ||

| 0.0804 | 0.0796 | 0.0158 | 0.0525 | 0.1140 | ||

| 0.0268 | 0.0266 | 0.0086 | 0.0101 | 0.0435 | ||

| 0.0532 | 0.0528 | 0.0082 | 0.0370 | 0.0699 | ||

| 0.9353 | 0.9363 | 0.0112 | 0.9108 | 0.9549 | ||

| 0.0852 | 0.0850 | 0.0154 | 0.0565 | 0.1159 | ||

| 0.0397 | 0.0396 | 0.0052 | 0.0298 | 0.0503 | ||

| 0.0449 | 0.0452 | 0.0107 | 0.0240 | 0.0654 | ||

| 0.8482 | 0.8483 | 0.0139 | 0.8207 | 0.8737 | ||

| 0.8058 | 0.8060 | 0.0200 | 0.7676 | 0.8446 | ||

| 0.0325 | 0.0325 | 0.0030 | 0.0266 | 0.0383 | ||

| 0.8742 | 0.8744 | 0.0162 | 0.8428 | 0.9056 | ||

| 0.0428 | 0.0427 | 0.0032 | 0.0366 | 0.0491 | ||

| DS2 | DS3 | ||||||

|---|---|---|---|---|---|---|---|

| Parameter | mean | 2.5% | 97.5% | mean | 2.5% | 97.5% | |

| 0.0871 | 0.0325 | 0.1398 | 0.0598 | 0.0081 | 0.1094 | ||

| 0.0742 | -0.0073 | 0.1589 | 0.0017 | -0.0931 | 0.0911 | ||

| -0.0331 | -0.0915 | 0.0291 | -0.1103 | -0.1858 | -0.0376 | ||

| -0.0299 | -0.0563 | -0.0035 | 0.0115 | -0.0181 | 0.0395 | ||

| -0.1255 | -0.2212 | -0.0305 | -0.2095 | -0.3419 | -0.0754 | ||

| -0.0393 | -0.0947 | 0.0168 | 0.0721 | 0.0058 | 0.1372 | ||

| 0.0514 | 0.0218 | 0.0787 | 0.0471 | 0.0203 | 0.0728 | ||

| 0.0270 | -0.0346 | 0.0860 | 0.0342 | -0.0222 | 0.0882 | ||

| -0.0372 | -0.0857 | 0.0130 | -0.0299 | -0.0829 | 0.0255 | ||

| -0.0094 | -0.0241 | 0.0043 | -0.0155 | -0.0336 | 0.0018 | ||

| -0.0181 | -0.1160 | 0.0778 | -0.1706 | -0.2781 | -0.0684 | ||

| -0.0553 | -0.1000 | -0.0091 | 0.0213 | -0.0304 | 0.0708 | ||

| -0.5351 | -0.5778 | -0.4536 | -0.5601 | -0.5769 | -0.5315 | ||

| 0.6238 | 0.5814 | 0.6569 | 0.6208 | 0.5852 | 0.6668 | ||

| 6.8541 | 5.6768 | 8.3212 | 8.9290 | 7.2431 | 10.8435 | ||

| 5.1780 | 4.4976 | 6.0264 | 6.1178 | 5.2628 | 7.0598 | ||

| 0.8877 | 0.8006 | 0.9790 | 0.8202 | 0.7953 | 0.8431 | ||

| 0.2767 | 0.1298 | 0.3908 | 0.5443 | 0.4328 | 0.6347 | ||

| d | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | |

| 0.0210 | 0.0145 | 0.0312 | 0.0276 | 0.0174 | 0.0395 | ||

| 0.0115 | 0.0018 | 0.0233 | 0.0148 | 0.0017 | 0.0302 | ||

| 0.0989 | 0.0840 | 0.1132 | 0.1115 | 0.0978 | 0.1253 | ||

| 0.9337 | 0.9178 | 0.9441 | 0.9221 | 0.9013 | 0.9384 | ||

| 0.0142 | 0.0100 | 0.0188 | 0.0169 | 0.0125 | 0.0216 | ||

| 0.0164 | 0.0040 | 0.0305 | 0.0224 | 0.0124 | 0.0336 | ||

| 0.2234 | 0.1814 | 0.2657 | 0.2727 | 0.2426 | 0.2999 | ||

| 0.8368 | 0.8118 | 0.8592 | 0.8261 | 0.8047 | 0.8456 | ||

| 0.0424 | 0.0202 | 0.0703 | 0.1096 | 0.0734 | 0.1484 | ||

| 0.0313 | 0.0118 | 0.0512 | 0.0653 | 0.0401 | 0.0927 | ||

| 0.0481 | 0.0309 | 0.0654 | 0.0472 | 0.0247 | 0.0692 | ||

| 0.9356 | 0.9073 | 0.9562 | 0.8704 | 0.8372 | 0.8974 | ||

| 0.0366 | 0.0206 | 0.0550 | 0.0165 | 0.0020 | 0.0358 | ||

| 0.0533 | 0.0424 | 0.0653 | 0.0540 | 0.0423 | 0.0667 | ||

| 0.0381 | 0.0242 | 0.0525 | 0.0996 | 0.0756 | 0.1234 | ||

| 0.8506 | 0.8217 | 0.8776 | 0.8644 | 0.8381 | 0.8857 | ||

| 0.8311 | 0.7798 | 0.8711 | 0.3327 | 0.2778 | 0.3865 | ||

| 0.0599 | 0.0521 | 0.0683 | 0.1297 | 0.1155 | 0.1438 | ||

| 0.9266 | 0.9114 | 0.9419 | 0.9137 | 0.8977 | 0.9292 | ||

| 0.0254 | 0.0211 | 0.0297 | 0.0340 | 0.0294 | 0.0384 | ||

| Parameter | Mean | Med | Std | 2.5% | 97.5% | |

|---|---|---|---|---|---|---|

| 0.0139 | 0.0128 | 0.0328 | -0.0493 | 0.0796 | ||

| -0.0248 | -0.0279 | 0.0584 | -0.1333 | 0.0933 | ||

| -0.0638 | -0.0663 | 0.0454 | -0.1448 | 0.0290 | ||

| -0.0370 | -0.0370 | 0.0170 | -0.0699 | -0.0039 | ||

| -0.0100 | -0.0138 | 0.0797 | -0.1648 | 0.1542 | ||

| -0.0657 | -0.0651 | 0.0375 | -0.1386 | 0.0053 | ||

| 0.0338 | 0.0336 | 0.0153 | 0.0052 | 0.0658 | ||

| 0.0179 | 0.0191 | 0.0347 | -0.0535 | 0.0869 | ||

| -0.0217 | -0.0224 | 0.0298 | -0.0792 | 0.0379 | ||

| -0.0050 | -0.0048 | 0.0122 | -0.0290 | 0.0201 | ||

| -0.0261 | -0.0244 | 0.0592 | -0.1475 | 0.0836 | ||

| -0.0072 | -0.0071 | 0.0274 | -0.0617 | 0.0481 | ||

| -0.1680 | -0.1595 | 0.0222 | -0.2108 | -0.1405 | ||

| 0.0179 | -0.0013 | 0.0449 | -0.0329 | 0.1243 | ||

| 8.7278 | 8.6580 | 0.9039 | 7.0614 | 10.6549 | ||

| 7.3638 | 7.3355 | 0.6199 | 6.1993 | 8.6153 | ||

| 0.8502 | 0.8501 | 0.0134 | 0.8239 | 0.8759 | ||

| 0.2581 | 0.3011 | 0.2326 | -0.3197 | 0.5698 | ||

| d | 1.0000 | 1.0000 | 0.2326 | 1.0000 | 1.0000 | |

| 0.0817 | 0.0813 | 0.0043 | 0.0742 | 0.0902 | ||

| 0.1243 | 0.1244 | 0.0087 | 0.1066 | 0.1415 | ||

| 0.0092 | 0.0093 | 0.0032 | 0.0026 | 0.0153 | ||

| 0.8724 | 0.8728 | 0.0096 | 0.8534 | 0.8916 | ||

| 0.0036 | 0.0035 | 0.0014 | 0.0009 | 0.0065 | ||

| 0.0201 | 0.0202 | 0.0050 | 0.0106 | 0.0300 | ||

| 0.0037 | 0.0033 | 0.0025 | 0.0002 | 0.0093 | ||

| 0.8448 | 0.8448 | 0.0102 | 0.8237 | 0.8635 | ||

| 0.1986 | 0.1975 | 0.0243 | 0.1490 | 0.2492 | ||

| 0.0886 | 0.0880 | 0.0086 | 0.0732 | 0.1066 | ||

| 0.0310 | 0.0309 | 0.0124 | 0.0083 | 0.0555 | ||

| 0.9002 | 0.9015 | 0.0140 | 0.8686 | 0.9248 | ||

| 0.0435 | 0.0425 | 0.0146 | 0.0150 | 0.0726 | ||

| 0.0422 | 0.0420 | 0.0058 | 0.0314 | 0.0536 | ||

| 0.0123 | 0.0123 | 0.0052 | 0.0029 | 0.0232 | ||

| 0.8589 | 0.8595 | 0.0133 | 0.8316 | 0.8816 | ||

| 0.6106 | 0.6104 | 0.0155 | 0.5806 | 0.6422 | ||

| 0.0407 | 0.0407 | 0.0036 | 0.0338 | 0.0477 | ||

| 0.9163 | 0.9179 | 0.0158 | 0.8818 | 0.9403 | ||

| 0.0503 | 0.0504 | 0.0046 | 0.0425 | 0.0584 | ||

| DS1 | DS2 | DS3 | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Parameter | mean | 2.5% | 97.5% | mean | 2.5% | 97.5% | mean | 2.5% | 97.5% | ||

| 0.0139 | 0.0328 | -0.0493 | 0.0476 | -0.0161 | 0.1136 | 0.0753 | 0.0219 | 0.1301 | |||

| -0.0248 | 0.0584 | -0.1333 | 0.0654 | -0.0425 | 0.1699 | 0.0267 | -0.0725 | 0.1215 | |||

| -0.0638 | 0.0454 | 0.0454 | -0.0579 | -0.1326 | 0.0212 | -0.1049 | -0.1784 | -0.0299 | |||

| -0.0370 | 0.0170 | 0.0170 | -0.0376 | -0.0600 | -0.0135 | 0.0060 | -0.0227 | 0.0332 | |||

| -0.0100 | 0.0797 | 0.0797 | -0.1247 | -0.2361 | -0.0108 | -0.1902 | -0.3188 | -0.0611 | |||

| -0.0657 | 0.0375 | 0.0375 | -0.0581 | -0.1167 | 0.0016 | 0.0550 | -0.0102 | 0.1181 | |||

| 0.0338 | 0.0153 | 0.0153 | 0.0413 | 0.0084 | 0.0738 | 0.0418 | 0.0107 | 0.0692 | |||

| 0.0179 | 0.0347 | 0.0347 | 0.0046 | -0.0635 | 0.0696 | 0.0309 | -0.0239 | 0.0867 | |||

| -0.0217 | 0.0298 | 0.0298 | -0.0236 | -0.0837 | 0.0270 | -0.0236 | -0.0732 | 0.0309 | |||

| -0.0050 | 0.0122 | 0.0122 | -0.0063 | -0.0226 | 0.0099 | -0.0117 | -0.0292 | 0.0059 | |||

| -0.0261 | 0.0592 | 0.0592 | 0.0158 | -0.0893 | 0.1169 | -0.1659 | -0.2692 | -0.0598 | |||

| -0.0072 | 0.0274 | 0.0274 | -0.0475 | -0.0951 | -0.0029 | 0.0314 | -0.0202 | 0.0814 | |||

| -0.1680 | 0.0222 | 0.0222 | -0.2019 | -0.2123 | -0.1811 | -0.5473 | -0.5747 | -0.4611 | |||

| 0.0179 | 0.0449 | 0.0449 | 0.0524 | -0.0385 | 0.1507 | 0.6111 | 0.5527 | 0.6559 | |||

| 8.7278 | 0.9039 | 0.9039 | 6.8073 | 5.5809 | 8.3232 | 8.9350 | 7.3051 | 10.8176 | |||

| 7.3638 | 0.6199 | 0.6199 | 5.2143 | 4.5484 | 5.9952 | 6.0211 | 5.1460 | 7.0315 | |||

| 0.8502 | 0.0134 | 0.0134 | 0.9172 | 0.8269 | 0.9912 | 0.8109 | 0.7864 | 0.8350 | |||

| 0.2581 | 0.2326 | 0.2326 | -0.4946 | -0.9541 | 0.0104 | 0.4795 | 0.0228 | 0.6653 | |||

| d | 1.0000 | 0.2326 | 0.2326 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | ||

| 0.0817 | 0.0043 | 0.0043 | 0.0604 | 0.0510 | 0.0712 | 0.0486 | 0.0357 | 0.0637 | |||

| 0.1243 | 0.0087 | 0.0087 | 0.1046 | 0.0899 | 0.1219 | 0.1214 | 0.1067 | 0.1380 | |||

| 0.0092 | 0.0032 | 0.0032 | 0.0077 | 0.0006 | 0.0159 | 0.0077 | 0.0003 | 0.0228 | |||

| 0.8724 | 0.0096 | 0.0096 | 0.8916 | 0.8704 | 0.9085 | 0.8748 | 0.8573 | 0.8916 | |||

| 0.0036 | 0.0014 | 0.0014 | 0.0033 | 0.0007 | 0.0067 | 0.0194 | 0.0144 | 0.0249 | |||

| 0.0201 | 0.0050 | 0.0050 | 0.0159 | 0.0050 | 0.0275 | 0.0318 | 0.0186 | 0.0472 | |||

| 0.0037 | 0.0025 | 0.0025 | 0.0035 | 0.0005 | 0.0066 | 0.0025 | 0.0003 | 0.0049 | |||

| 0.8448 | 0.0102 | 0.0102 | 0.8628 | 0.8411 | 0.8832 | 0.8427 | 0.8174 | 0.8655 | |||

| 0.1986 | 0.0243 | 0.0243 | 0.0685 | 0.0457 | 0.0938 | 0.1229 | 0.0857 | 0.1593 | |||

| 0.0886 | 0.0086 | 0.0086 | 0.0742 | 0.0578 | 0.0945 | 0.1115 | 0.0883 | 0.1343 | |||

| 0.0310 | 0.0124 | 0.0124 | 0.0127 | 0.0032 | 0.0231 | 0.0149 | 0.0031 | 0.0279 | |||

| 0.9002 | 0.0140 | 0.0140 | 0.9164 | 0.8854 | 0.9391 | 0.8462 | 0.8143 | 0.8775 | |||

| 0.0435 | 0.0146 | 0.0146 | 0.0214 | 0.0037 | 0.0417 | 0.0176 | 0.0025 | 0.0381 | |||

| 0.0422 | 0.0058 | 0.0058 | 0.0539 | 0.0424 | 0.0664 | 0.0650 | 0.0549 | 0.0769 | |||

| 0.0123 | 0.0052 | 0.0052 | 0.0058 | 0.0006 | 0.0122 | 0.0061 | 0.0012 | 0.0119 | |||

| 0.8589 | 0.0133 | 0.0133 | 0.8709 | 0.8462 | 0.8923 | 0.8766 | 0.8514 | 0.8970 | |||

| 0.6106 | 0.0155 | 0.0155 | 0.8121 | 0.7590 | 0.8588 | 0.3322 | 0.2221 | 0.4398 | |||

| 0.0407 | 0.0036 | 0.0036 | 0.0636 | 0.0492 | 0.0774 | 0.1214 | 0.0944 | 0.1499 | |||

| 0.9163 | 0.0158 | 0.0158 | 0.9664 | 0.9447 | 0.9801 | 0.9279 | 0.8839 | 0.9620 | |||

| 0.0503 | 0.0046 | 0.0046 | 0.0124 | 0.0037 | 0.0221 | 0.0340 | 0.0226 | 0.0447 | |||

| Parameter | Statistic | p-value | Statistic | p-value | Statistic | p-value | ||

| -0.0597 | 0.9524 | -0.8079 | 0.4192 | -0.0636 | 0.9493 | |||

| -0.1791 | 0.8579 | -0.3346 | 0.7379 | -0.0162 | 0.9870 | |||

| 1.3573 | 0.1747 | -1.5891 | 0.1120 | -0.2181 | 0.8274 | |||

| 0.7764 | 0.4375 | 1.7514 | 0.0799 | -0.4235 | 0.6720 | |||

| 0.5771 | 0.5639 | -2.2308 | 0.0257 | -0.0380 | 0.9697 | |||

| 0.6501 | 0.5156 | 1.8316 | 0.0670 | -0.7052 | 0.4807 | |||

| 1.8243 | 0.0681 | 0.4597 | 0.6457 | -0.7424 | 0.4579 | |||

| 1.5591 | 0.1190 | 1.8774 | 0.0605 | -0.6209 | 0.5346 | |||

| 0.1958 | 0.8448 | -0.6016 | 0.5474 | -0.9727 | 0.3307 | |||

| -1.1547 | 0.2482 | 1.5224 | 0.1279 | 0.3103 | 0.7564 | |||

| 1.0562 | 0.2909 | -1.2477 | 0.2121 | -0.5624 | 0.5738 | |||

| -1.9255 | 0.0542 | -0.6378 | 0.5236 | -0.0487 | 0.9611 | |||

| -1.1629 | 0.2449 | -2.8326 | 0.0046 | 1.8200 | 0.0688 | |||

| -0.2210 | 0.8251 | 0.2319 | 0.8166 | 1.0950 | 0.2735 | |||

| -1.1139 | 0.2653 | -0.9501 | 0.3421 | 0.9806 | 0.3268 | |||

| -1.6291 | 0.1033 | 0.0019 | 0.9985 | 0.1521 | 0.8791 | |||

| -0.7965 | 0.4258 | 1.1421 | 0.2534 | -1.6976 | 0.0896 | |||

| 1.2195 | 0.2227 | -0.9170 | 0.3591 | 1.2624 | 0.2068 | |||

| -0.9039 | 0.3660 | -0.3661 | 0.7143 | 0.0221 | 0.9824 | |||

| 0.9563 | 0.3389 | -1.2333 | 0.2174 | 0.1894 | 0.8498 | |||

| -1.3752 | 0.1691 | 1.0816 | 0.2794 | 1.2501 | 0.2113 | |||

| -0.0239 | 0.9809 | -0.4108 | 0.6813 | -0.8739 | 0.3822 | |||

| 0.2948 | 0.7682 | -0.4945 | 0.6209 | 0.4263 | 0.6699 | |||

| 0.0896 | 0.9286 | -2.0540 | 0.0400 | -0.2839 | 0.7765 | |||

| -0.0769 | 0.9387 | 0.9074 | 0.3642 | 1.8353 | 0.0665 | |||

| -0.4204 | 0.6742 | -0.8867 | 0.3753 | 0.3284 | 0.7426 | |||

| 1.6858 | 0.0918 | 0.6269 | 0.5307 | -1.2515 | 0.2107 | |||

| -0.8687 | 0.3850 | 1.4275 | 0.1534 | -1.1246 | 0.2608 | |||

| 1.2312 | 0.2182 | -0.6642 | 0.5066 | 0.7641 | 0.4448 | |||

| -1.3606 | 0.1736 | -0.5054 | 0.6133 | 0.5095 | 0.6104 | |||

| 0.0002 | 0.9999 | 0.4037 | 0.6864 | -0.1893 | 0.8499 | |||

| -1.6979 | 0.0895 | 0.6527 | 0.5139 | -0.6733 | 0.5008 | |||

| 1.2623 | 0.2068 | 1.0262 | 0.3048 | -0.4108 | 0.6812 | |||

| 0.0031 | 0.9975 | -1.2335 | 0.2174 | 1.0696 | 0.2848 | |||

| -1.0077 | 0.3136 | 0.2864 | 0.7746 | -0.2729 | 0.7850 | |||

| 0.2581 | 0.7963 | -0.6037 | 0.5460 | 0.1467 | 0.8834 | |||

| 0.6031 | 0.5465 | 0.4883 | 0.6253 | -1.0627 | 0.2879 | |||

| 0.4767 | 0.6336 | -1.0663 | 0.2863 | 1.9815 | 0.0475 | |||

| DS1 | DS2 | DS3 | ||||||

|---|---|---|---|---|---|---|---|---|

| Parameter | Statistic | p-value | Statistic | p-value | Statistic | p-value | ||

| -0.2382 | 0.8117 | 0.8946 | 0.3710 | 0.4246 | 0.6711 | |||

| -0.5397 | 0.5894 | 0.4807 | 0.6308 | 0.2105 | 0.8332 | |||

| -0.3970 | 0.6914 | 1.0016 | 0.3165 | 0.4172 | 0.6765 | |||

| 0.3031 | 0.7618 | -0.4317 | 0.6659 | -0.0186 | 0.9852 | |||

| -0.9387 | 0.3479 | 0.0066 | 0.9947 | 0.6520 | 0.5144 | |||

| 0.6678 | 0.5043 | 0.3082 | 0.7579 | -0.0690 | 0.9450 | |||

| -0.8183 | 0.4132 | -1.0205 | 0.3075 | 1.2391 | 0.2153 | |||

| -1.3403 | 0.1802 | -0.6150 | 0.5386 | 0.8368 | 0.4027 | |||

| 0.9480 | 0.3431 | 0.5433 | 0.5869 | -0.8564 | 0.3918 | |||

| 0.3792 | 0.7045 | 0.1913 | 0.8483 | -0.3520 | 0.7248 | |||

| 1.0261 | 0.3048 | -0.1062 | 0.9154 | 0.2221 | 0.8242 | |||

| -0.1441 | 0.8854 | 0.2735 | 0.7845 | -0.6287 | 0.5295 | |||

| 0.1648 | 0.8691 | -2.0563 | 0.0398 | 0.5816 | 0.5608 | |||

| -0.6512 | 0.5149 | 0.4157 | 0.6777 | -0.8724 | 0.3830 | |||

| -0.0228 | 0.9818 | -0.6572 | 0.5110 | -0.1623 | 0.8711 | |||

| 0.2329 | 0.8159 | -0.3896 | 0.6969 | -0.7089 | 0.4784 | |||

| -0.6398 | 0.5223 | 0.4073 | 0.6838 | -0.3435 | 0.7312 | |||

| 0.5406 | 0.5888 | 0.3116 | 0.7554 | 0.3015 | 0.7630 | |||

| -0.2259 | 0.8213 | 0.5642 | 0.5726 | -1.3067 | 0.1913 | |||

| 0.1495 | 0.8811 | 0.8659 | 0.3866 | 0.5879 | 0.5566 | |||

| 0.9298 | 0.3525 | -0.2060 | 0.8368 | -1.9950 | 0.0460 | |||

| -0.1064 | 0.9153 | -0.6188 | 0.5360 | -0.2741 | 0.7840 | |||

| -0.2187 | 0.8269 | 0.0908 | 0.9277 | 0.6828 | 0.4947 | |||

| -0.6417 | 0.5211 | 0.0376 | 0.9700 | 0.8227 | 0.4107 | |||

| 0.2499 | 0.8027 | 1.5369 | 0.1243 | 0.7921 | 0.4283 | |||

| 0.5778 | 0.5634 | -0.9276 | 0.3536 | -1.1088 | 0.2675 | |||

| 0.0092 | 0.9927 | -0.4402 | 0.6598 | 0.2285 | 0.8193 | |||

| 0.8557 | 0.3922 | -1.3612 | 0.1734 | 0.3195 | 0.7494 | |||

| -1.1870 | 0.2352 | -0.9613 | 0.3364 | 0.8448 | 0.3982 | |||

| -0.7819 | 0.4343 | 1.3219 | 0.1862 | -0.0380 | 0.9697 | |||

| -0.9052 | 0.3654 | -0.1715 | 0.8638 | 1.4796 | 0.1390 | |||

| -0.8971 | 0.3697 | 0.0572 | 0.9544 | 0.3983 | 0.6904 | |||

| 1.0325 | 0.3018 | -0.1454 | 0.8844 | -0.6278 | 0.5301 | |||

| 0.7220 | 0.4703 | 0.1081 | 0.9139 | -0.9705 | 0.3318 | |||

| -0.1814 | 0.8561 | 0.5558 | 0.5783 | 0.3816 | 0.7028 | |||

| 2.2145 | 0.0268 | -0.3652 | 0.7150 | -1.0568 | 0.2906 | |||

| -0.9347 | 0.3500 | -0.4136 | 0.6792 | -0.0394 | 0.9686 | |||

| 0.6555 | 0.5121 | 1.1169 | 0.2640 | -1.2179 | 0.2233 | |||

| BHAR(1) - GJR - GARCH(1,1) | BHAR(1) - QGARCH(1,1) | BHAR(1) - GARCH(1,1) | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1% | p-value | 1% | p-value | 1% | p-value | ||||||||||||

| No | VRate | UC | CC | No | VRate | UC | CC | No | VRate | UC | CC | ||||||

| DS1 | |||||||||||||||||

| S&P500 | 6 | 2.00% | 0.125 | 0.273 | 8 | 2.67% | 0.016 | 0.044 | 8 | 2.67% | 0.016 | 0.045 | |||||

| GS | 1 | 0.33% | 0.178 | 0.402 | 1 | 0.33% | 0.178 | 0.401 | 4 | 1.33% | 0.016 | 0.045 | |||||

| DS2 | |||||||||||||||||

| S&P500 | 6 | 2.00% | 0.125 | 0.273 | 8 | 2.67% | 0.016 | 0.045 | 8 | 2.67% | 0.016 | 0.044 | |||||

| ICE | 1 | 0.33% | 0.178 | 0.401 | 1 | 0.33% | 0.178 | 0.402 | 4 | 1.33% | 0.581 | 0.813 | |||||

| DS3 | |||||||||||||||||

| S&P500 | 7 | 2.33% | 0.048 | 0.119 | 6 | 2.00% | 0.125 | 0.273 | 9 | 3.00% | 0.005 | 0.015 | |||||

| BAC | 2 | 0.67% | 0.537 | 0.815 | 2 | 0.67% | 0.537 | 0.815 | 2 | 0.67% | 0.537 | 0.815 | |||||

| BHAR(1) - GJR - GARCH(1,1) | BHAR(1) - QGARCH(1,1) | BHAR(1) - GARCH(1,1) | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 5% | p-value | 5% | p-value | 5% | p-value | ||||||||||||

| No | VRate | UC | CC | No | VRate | UC | CC | No | VRate | UC | CC | ||||||

| DS1 | |||||||||||||||||

| S&P500 | 17 | 5.67% | 0.604 | 0.313 | 17 | 5.67% | 0.604 | 0.313 | 17 | 5.67% | 0.604 | 0.873 | |||||

| GS | 16 | 5.33% | 0.793 | 0.507 | 14 | 4.67% | 0.789 | 0.344 | 16 | 5.33% | 0.793 | 0.507 | |||||

| DS2 | |||||||||||||||||

| S&P500 | 17 | 5.67% | 0.604 | 0.313 | 17 | 5.67% | 0.604 | 0.313 | 17 | 5.67% | 0.604 | 0.873 | |||||

| ICE | 16 | 5.33% | 0.793 | 0.507 | 14 | 4.67% | 0.789 | 0.344 | 16 | 5.33% | 0.793 | 0.507 | |||||

| DS3 | |||||||||||||||||

| S&P500 | 18 | 6.00% | 0.44 | 0.739 | 17 | 5.67% | 0.604 | 0.313 | 16 | 5.33% | 0.793 | 0.391 | |||||

| BAC | 13 | 4.33% | 0.588 | 0.478 | 13 | 4.33% | 0.588 | 0.478 | 11 | 3.67% | 0.267 | 0.355 | |||||

| DS1 | DS2 | DS3 | ||||

|---|---|---|---|---|---|---|

| At 1% | ||||||

| BHAR(1) - GJR - GARCH(1,1) | 1.855 | 1.855 | 2.953 | |||

| BHAR(1) - QGARCH(1,1) | 1.870 | 1.870 | >2.941 | |||

| BHAR(1) - GARCH(1,1) | 2.055 | 2.055 | 2.960 | |||

| At 5% | ||||||

| BHAR(1) - GJR - GARCH(1,1) | 1.195 | 1.195 | 1.693 | |||

| BHAR(1) - QGARCH(1,1) | 1.253 | 1.253 | >1.664 | |||

| BHAR(1) - GARCH(1,1) | 1.401 | 1.401 | 1.830 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).