Submitted:

22 May 2025

Posted:

23 May 2025

You are already at the latest version

Abstract

Keywords:

I. Introduction

II. Related Works

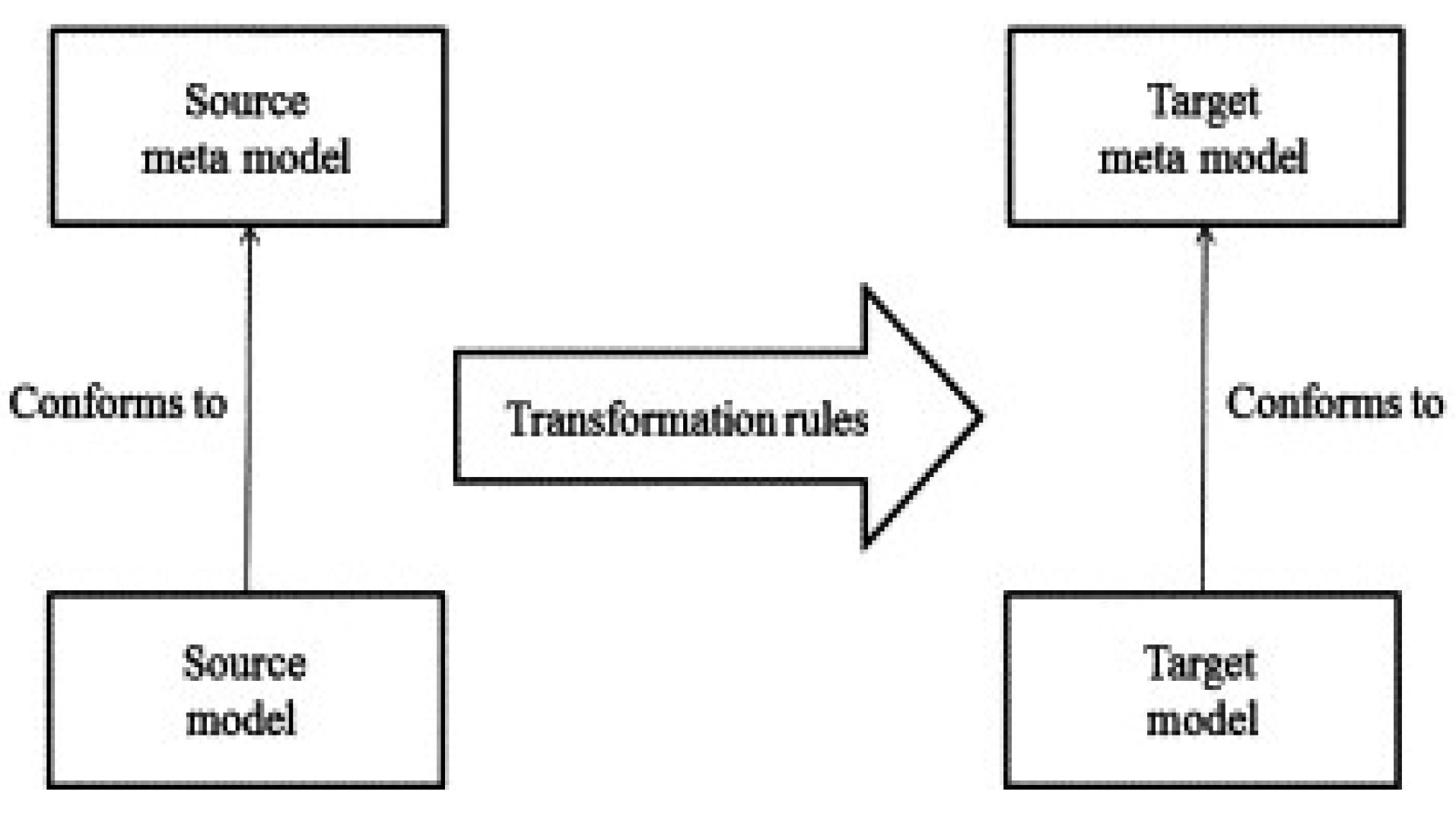

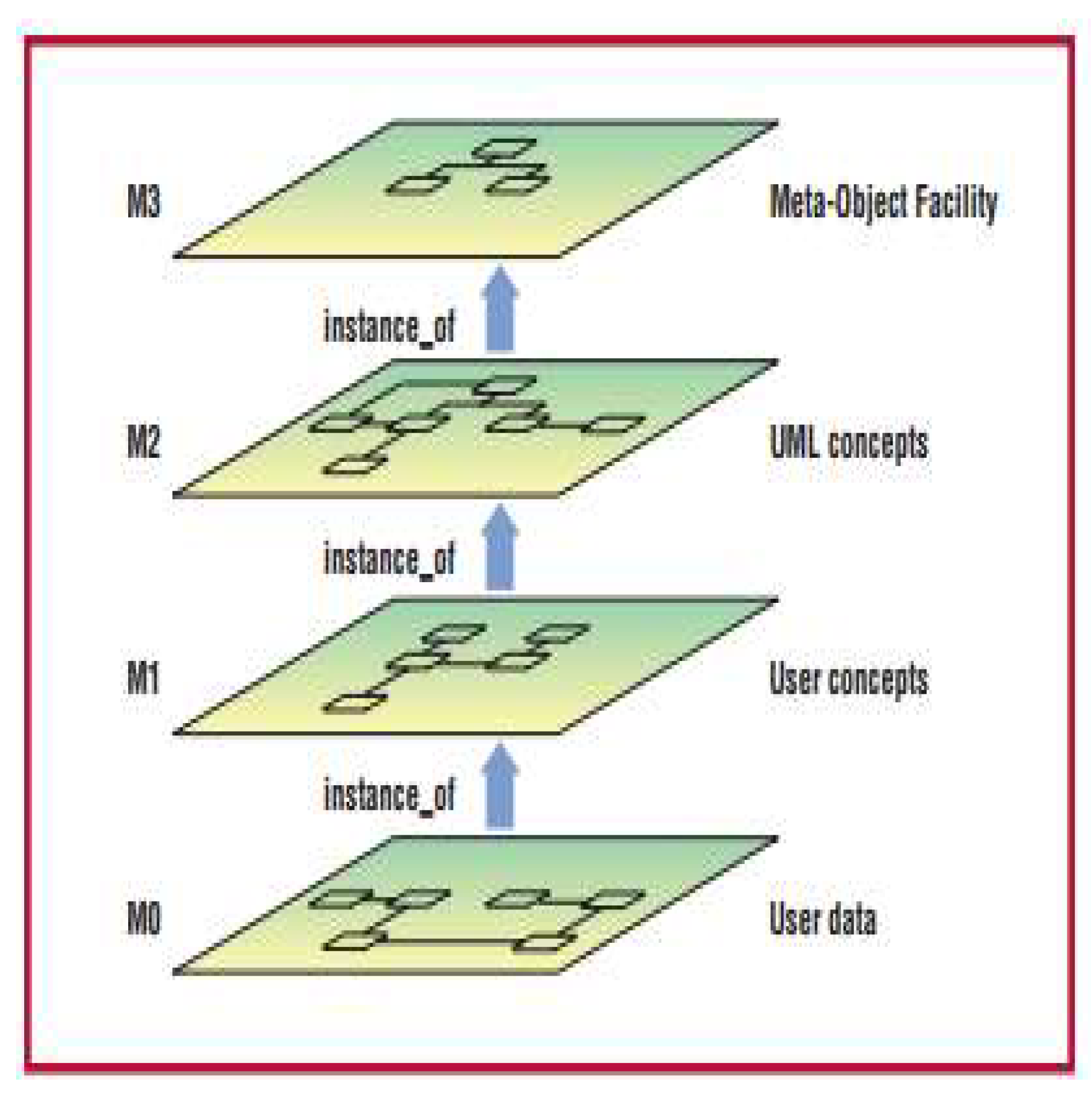

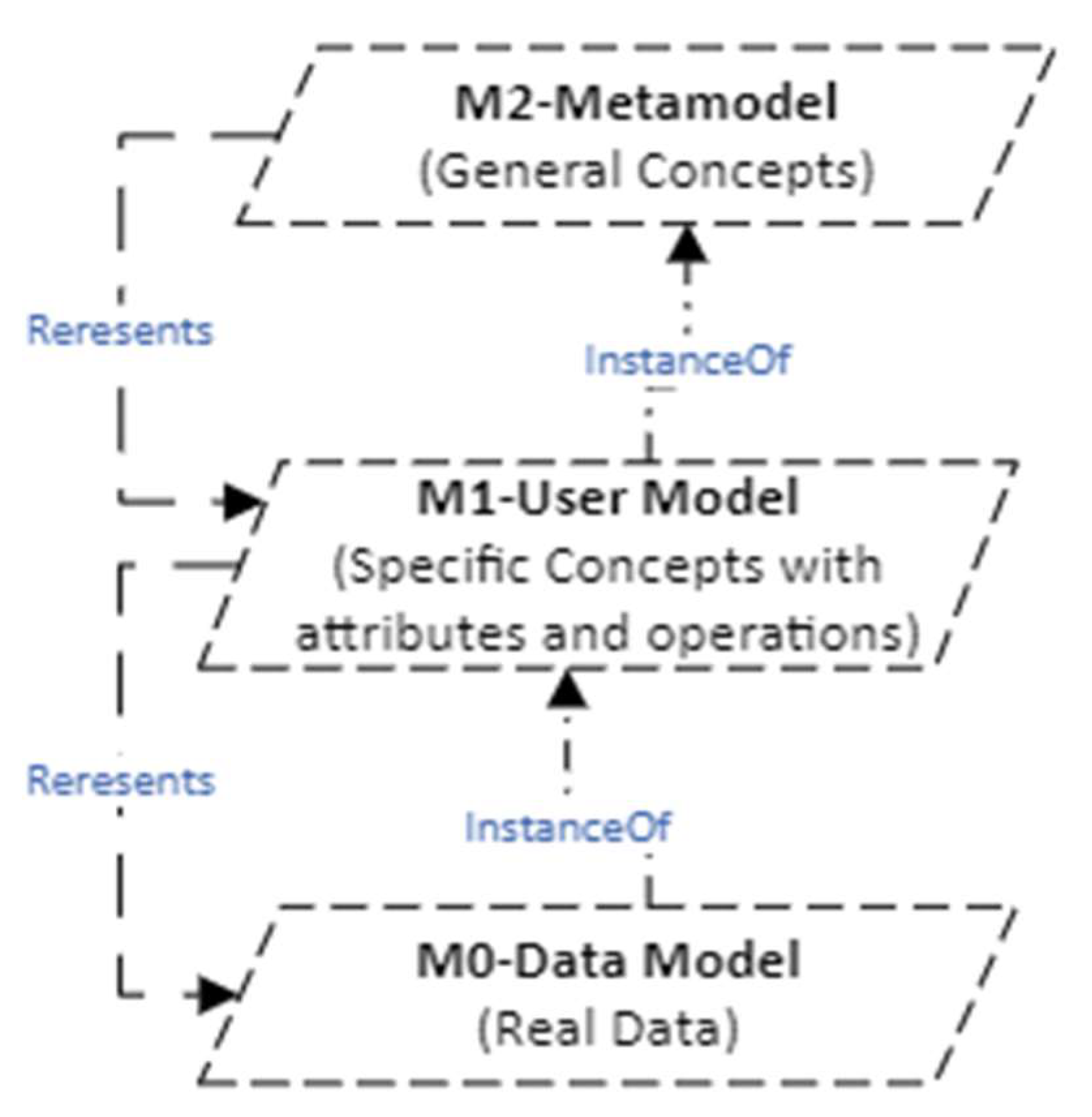

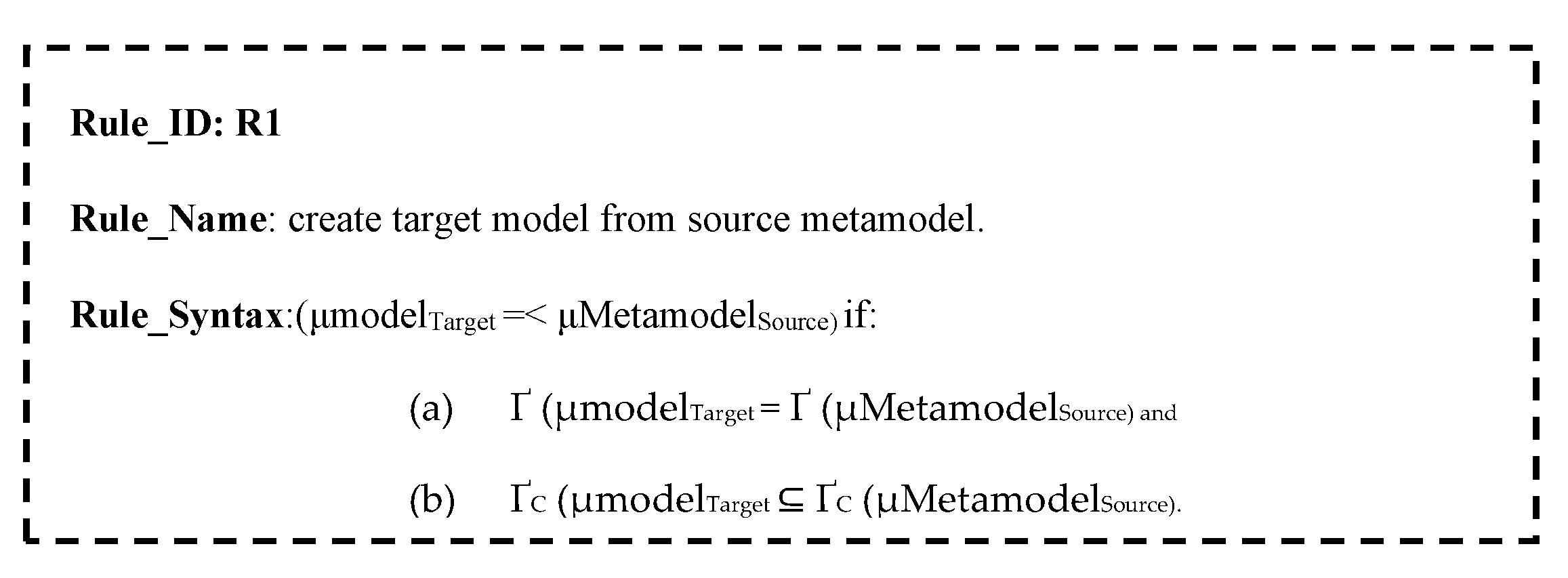

III. Model Driven Engineering

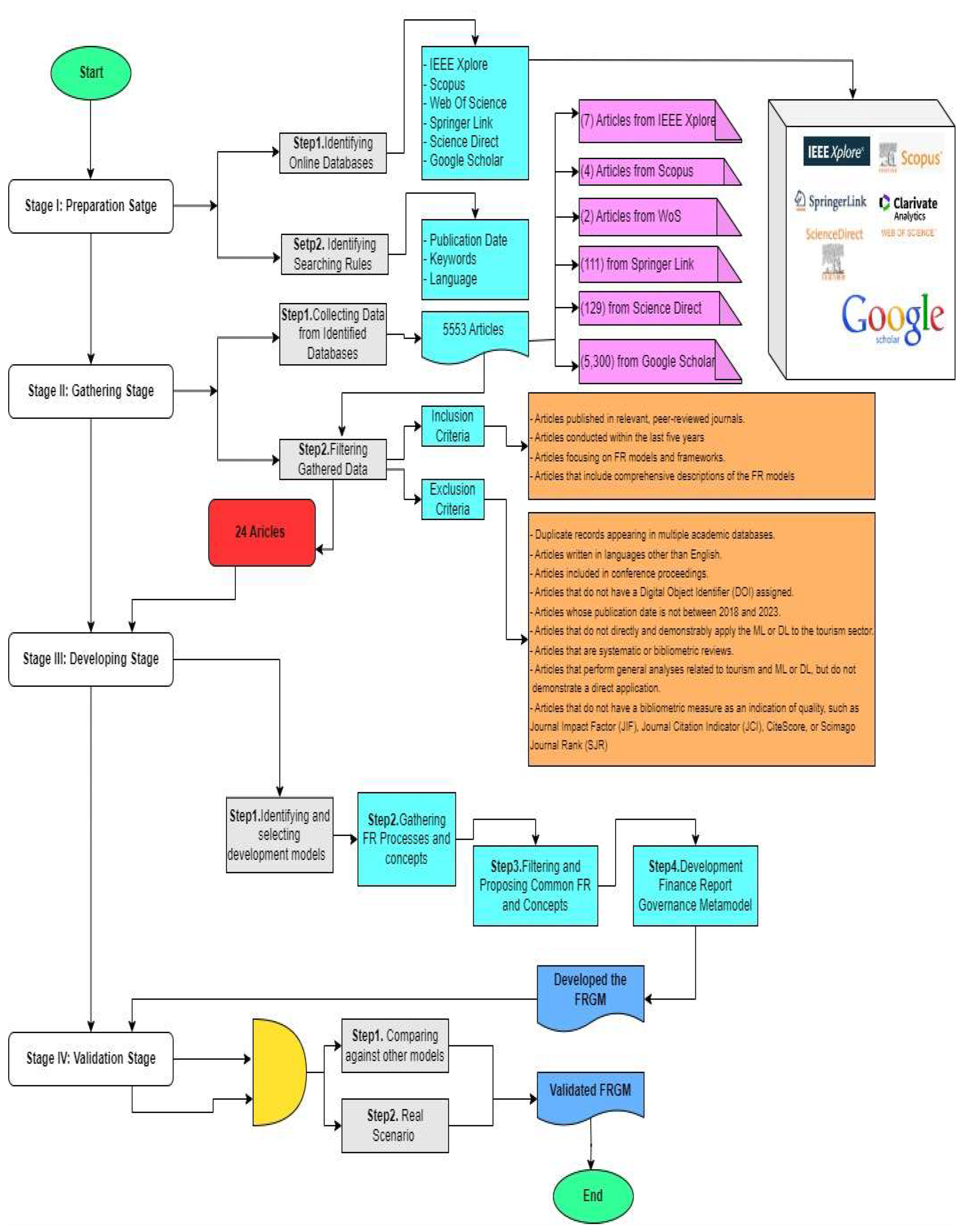

IV. Methodology and Development Processs

- 1.

- Identifying and selecting development models: In this step, the FRG already used in other studies for developing FRPGM were identified and selected. Among the existing models the ones that were focused solely on the FRG process were selected for this study. As a result, 24 FRG models and frameworks were selected as part of the process of developing the FRPGM.

- 2.

- Gathering FRG Processes and concepts: The aim of this step is to gather the main FRG processes and concepts from the 42 mobile forensic models, which could possibly be involved in the FRPGM. The processes and concepts are obtained from the textual contents (main body) of FRG models to prevent any omitted or irrelevant processes or concepts during the extraction process [55,56,57]. However, similar to the procedures in [54,55,57,58], the FRG processes and concepts were extracted manually from each model. Furthermore, this study adapted the concept mining process from [59,60]. As shown in Table 5, 202 FRG processes and concepts have been gathered from 42 FRG models. This step in the metamodeling approach is vital as it lays the groundwork for the development of the FRPGM. By determining essential FRG concepts and processes, we can make informed decisions regarding their inclusion in the metamodel. Next stage step is using to filter and propose the common FRG concepts and processes to develop the FRPGM.

- 3.

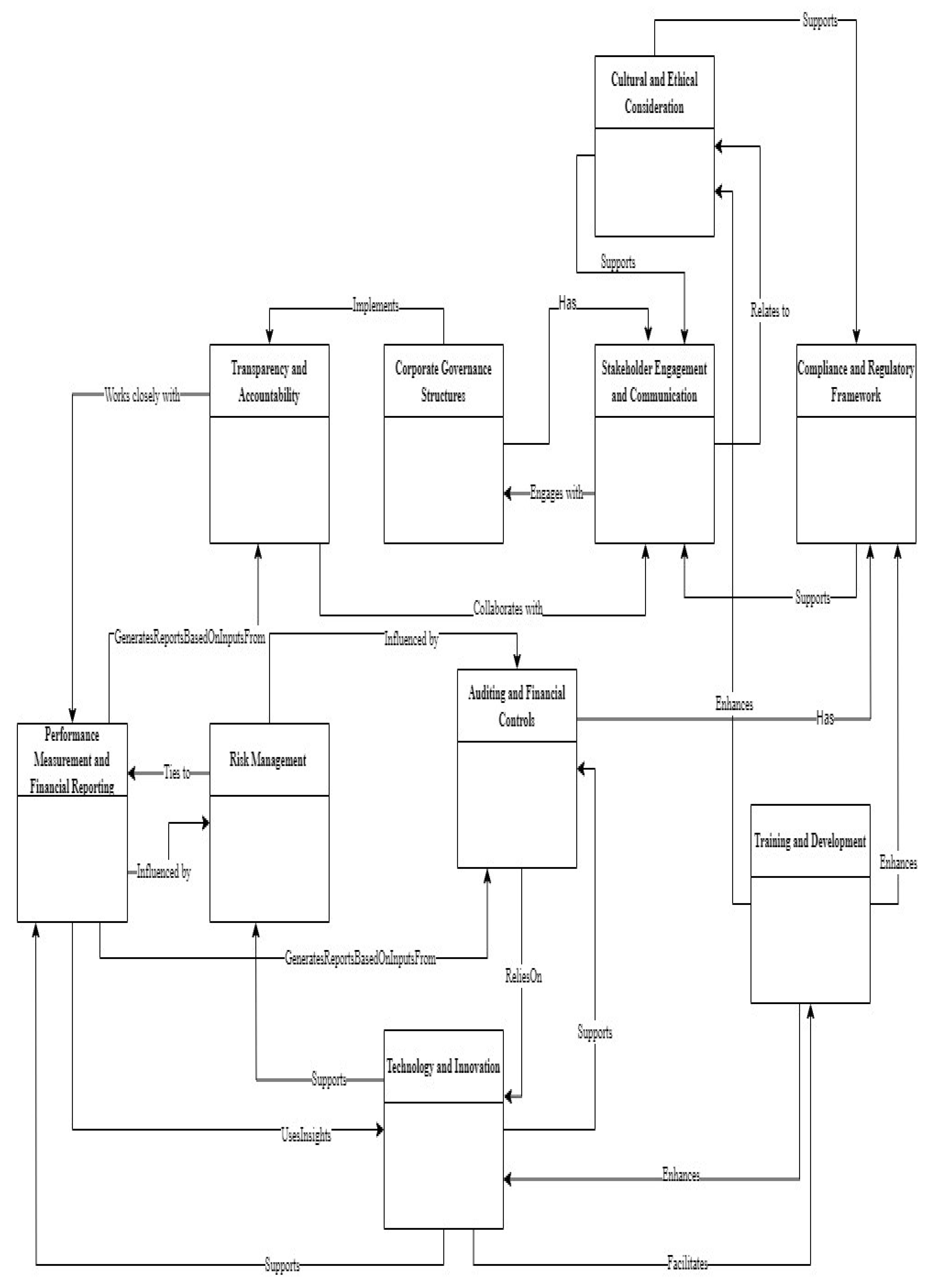

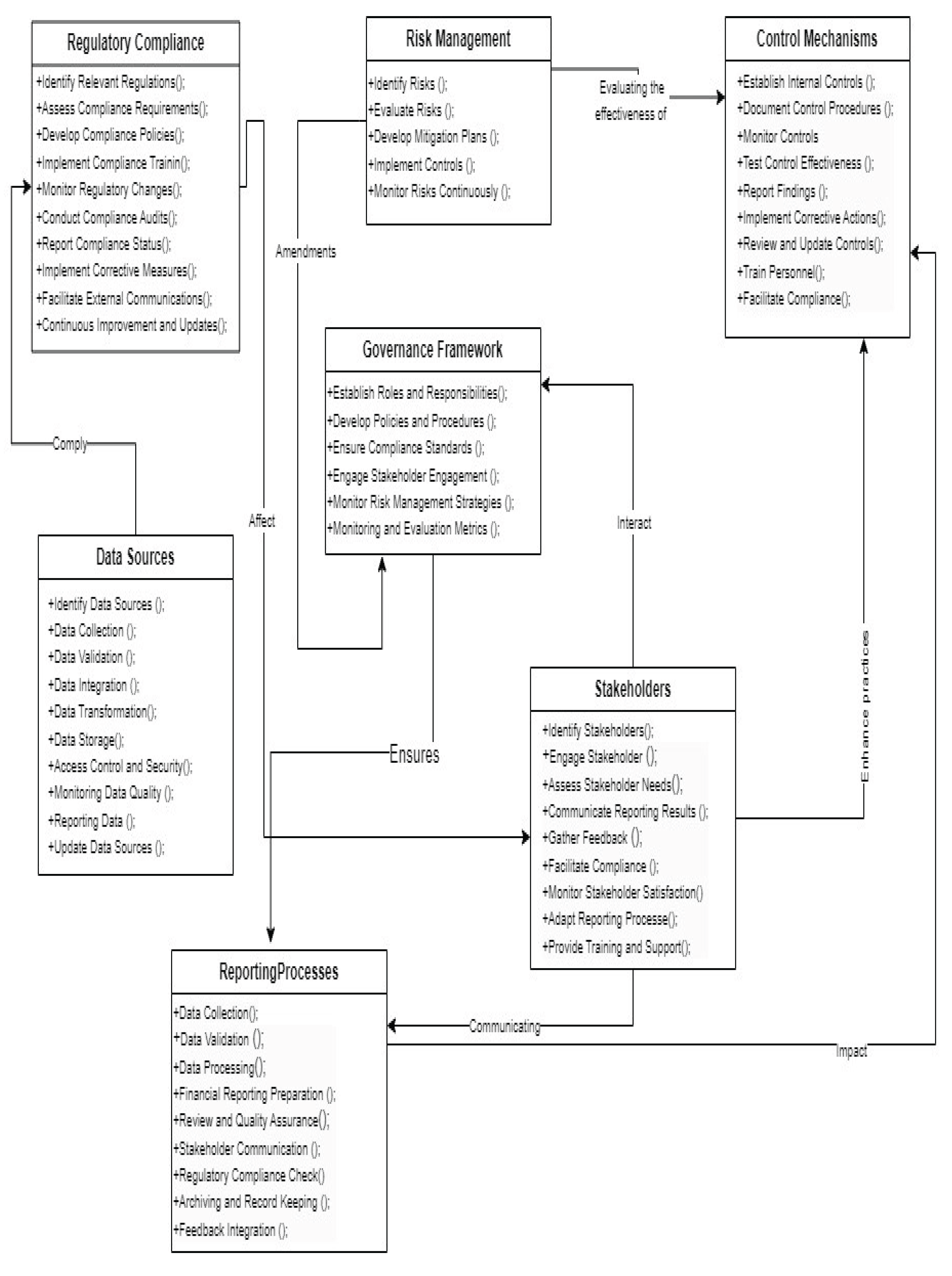

- Filtering and Proposing Common FR Processes and Concepts: This step involved filtering and combining the 202 concepts and processes collected in the previous step based on how similar their meanings and workings are [61,62,63]. For example, the Stakeholder Engagement [14,15,17,18,19,20,21,23,24,25,26,48,49,51,53], and Stakeholder Communication [11,50] mean the same function with different names. Both processes highlight the importance of interacting with various stakeholders (e.g., investors, customers, regulators) to understand their expectations and concerns, promoting transparency and trust. In addition, Sustainability Reporting [48] and Non-Financial have the same meaning; both refer to the disclosure of non-financial impacts or performance, including environmental, social, and governance factors that contribute to stakeholder decision-making. Therefore, the components that have similar semantic meaning or functional meaning are merged into one common category regardless of naming, and then each category is mapped, and the most frequent component of each category is. Therefore, 10 common components were proposed, as shown in Table 6. These components are used as the main inputs for the FRPGM. Table 7 displays the UML relationships among the proposed components.

- 4.

- Development Finance Report Governance Metamodel: This step aims to develop the FRGM. A unified modelling language (UML) relationship was adapted to develop the FRGM. This relationship refers to a link between metamodel components; it combines semantics, called the modelling language [64]. A modelling language is a set of concepts and constructs used to describe the underlying structure of a modelling language, which, if properly organized, allows for the creation of clear and concise representations [64]. As a result of this step, the finance report governance metamodel is developed and depicted in Figure 5.

V. Implement the Developed FRGM in the FRG Domain

VI. Finding and Discussions

- What are the advantages and disadvantages of the current financial reporting governance models and frameworks?

- Does the FRG domain have a structured and organized model to effectively represent its domain knowledge?

- -

- Unifies 10 core components (e.g., corporate governance structures, auditing, compliance, risk management, stakeholder engagement) into a single structured framework.

- -

- Standardizes relationships between components through UML modelling, enabling clarity, interoperability, and adaptability.

- -

- Resolves fragmentation by synthesizing processes and concepts from 24 existing models into a high-level abstract representation.

VII. Conclusions

Funding

References

- Hasan, A.; Aly, D.; Hussainey, K. Corporate governance and financial reporting quality: a comparative study. Corp. Gov. Int. J. Bus. Soc. 2022, 22, 1308–1326. [Google Scholar] [CrossRef]

- Kılıç, M.; Kuzey, C. Assessing current company reports according to the IIRC integrated reporting framework. Meditari Account. Res. 2018, 26, 305–333. [Google Scholar] [CrossRef]

- RISK, C. Risk management framework. 2021.

- Hanson, D.; Straub, J. A Systematic Review of Cybersecurity Audit Frameworks for the Internet of Things. in 2024 IEEE International Conference on Cyber Security and Resilience (CSR), IEEE, 2024, pp. 133–138.

- Kim, H.Y.; Cho, J. Data governance framework for big data implementation with NPS Case Analysis in Korea. J. Bus. Retail Manag. Res. 2018, 12. [Google Scholar]

- Thabit, T.; Solaimanzadah, A.; Al-Abood, M.T. The effectiveness of COSO framework to evaluate internal control system: the case of kurdistan companies. Cihan Int. J. Soc. Sci. 2017, 1, 44. [Google Scholar]

- Ilori, O.; Nwosu, N.T.; Naiho, H.N.N. A comprehensive review of it governance: effective implementation of COBIT and ITIL frameworks in financial institutions. Comput. Sci. IT Res. J. 2024, 5, 1391–1407. [Google Scholar] [CrossRef]

- Ismail, R. An Overview of International Financial Reporting Standards (IFRS). Int. J. Eng. Sci. Invent. 2017, 6, 15–24. [Google Scholar]

- Obeng-Nyarko, J.K. Effects of Sarbanes-Oxley Act 2002 on the quality of corporate reporting by UK listed companies. 2023, University of Essex.

- Zabihollah, R. Corporate Governance Role in Financial Reporting. Res. Account. Regul. 2004, 17, 107–149. [Google Scholar]

- Armstrong, C.; Guay, W.R.; Mehran, H.; Weber, J. The role of information and financial reporting in corporate governance: A review of the evidence and the implications for banking firms and the financial services industry. Econ. Policy Rev. Forthcom. 2015.

- Habib, A.; Jiang, H. Corporate governance and financial reporting quality in China: A survey of recent evidence. J. Int. Accounting, Audit. Tax. 2015, 24, 29–45. [Google Scholar] [CrossRef]

- Rahmatika, D.N.; Afiah, N.N. Factors influencing the quality of financial reporting and its implications on good government governance. Int. J. Buainwaa, Econ. Law 2014, 5, 1552–2289. [Google Scholar]

- Persons, O.S. Corporate governance and non-financial reporting fraud. J. Bus. Econ. Stud. 2006, 12, 27. [Google Scholar]

- Cohen, J.R.; Krishnamoorthy, G.; Wright, A. The corporate governance mosaic and financial reporting quality. J. Account. Lit. 2004, 87–152. [Google Scholar]

- Rostami, V.; Rezaei, L. Corporate governance and fraudulent financial reporting. J. Financ. Crime 2022, 29, 1009–1026. [Google Scholar] [CrossRef]

- Rahman, K.M.; Bremer, M. EFFECTIVE CORPORATE GOVERNANCE AND FINANCIAL REPORTING IN JAPAN. Asian Acad. Manag. J. Account. Financ. 2016, 12. [Google Scholar] [CrossRef]

- Rashid, A.; Akmal, M.; Shah, S.M.A.R. Corporate governance and risk management in Islamic and convectional financial institutions: explaining the role of institutional quality. J. Islam. Account. Bus. Res. 2024, 15, 466–498. [Google Scholar] [CrossRef]

- Yusuf, M.; Dasawaty, E.; Esra, M.; Apriwenni, P.; Meiden, C.; Fahlevi, M. Integrated reporting, corporate governance, and financial sustainability in Islamic banking. Uncertain Supply Chain Manag. 2024, 12, 273–290. [Google Scholar] [CrossRef]

- Yetman, M.H.; Yetman, R.J. The effects of governance on the financial reporting quality of nonprofit organizations. in Conference on not-for-profit firms, Federal Reserve Bank, New York, 2004.

- Hassan, S.U. Corporate governance and financial reporting quality: A study of Nigerian money deposit banks. Chief Patron Chief Patron, 2011. [Google Scholar]

- Şeker, Y.; Şengür, E.D. The impact of environmental, social, and governance (esg) performance on financial reporting quality: International evidence. Ekonomika 2021, 100, 190–212. [Google Scholar] [CrossRef]

- Sanad, Z.; Al-Sartawi, A. Investigating the relationship between corporate governance and internet financial reporting (IFR): evidence from Bahrain Bourse. Jordan J. Bus. Adm. 2016, 12. [Google Scholar]

- Ghuslan, M.I.; Jaffar, R.; Saleh, N.M.; Yaacob, M.H. Corporate governance and corporate reputation: The role of environmental and social reporting quality. Sustainability 2021, 13, 10452. [Google Scholar] [CrossRef]

- Abdulmalik, S.O.; Ahmad, A.C. Audit fees, corporate governance mechanisms, and financial reporting quality in Nigeria. DLSU Bus. Econ. Rev. 2016, 26, 1. [Google Scholar]

- Hichri, A. Corporate governance and integrated reporting: evidence of French companies. J. Financ. Report. Account. 2022, 20, 472–492. [Google Scholar] [CrossRef]

- Zolfaghari, M.; Vaez, S.A.; Khodamoradi, M. Effect of the Corporate Governance Structure on the Performance of Banks in Financial Crises. Int. J. Financ. Manag. Account. 2025, 10, 133–140. [Google Scholar]

- Nguyen, T.T.H.; Phan, H.D. The Role of Governance and Digital Transformation in Enhancing Operational Sustainability of Non-Banking Financial Institutions.

- AGARWAL, Y. KPMG Global AI and Finance Report 2024: Transforming New Era with AI empowered Finance Functions1.

- Kent, S. Model driven engineering. in International conference on integrated formal methods, Springer, 2002, pp. 286–298.

- Muliawan, O.; Van Gorp, P.; Keller, A.; Janssens, D. Executing a standard compliant transformation model on a non-standard platform. in 2008 IEEE International Conference on Software Testing Verification and Validation Workshop, IEEE, 2008, pp. 151–160.

- Djeddai, S.; Strecker, M.; Mezghiche, M. Integrating a formal development for DSLs into meta-modeling. in Model and Data Engineering: 2nd International Conference, MEDI 2012, Poitiers, France, October 3-5, 2012. Proceedings 2, Springer, 2012, pp. 55–66.

- Benhlima, L.; Chiadmi, D. Vers l’interopérabilité des systèmes d’information hétérogènes. 2006.

- EdwardLee, H.G.; Schätz, B.R.B. Model-based engineering of embedded real-time systems. 2010.

- Hommes, B.-J. Evaluating conceptual coherence in multi-modeling techniques. in Information Modeling Methods and Methodologies: Advanced Topics in Database Research; IGI Global, 2005; pp. 43–62. [Google Scholar]

- Trabelsi, C.; Atitallah, R.B.; Meftali, S.; Dekeyser, J.-L.; Jemai, A. A model-driven approach for hybrid power estimation in embedded systems design. EURASIP J. Embed. Syst. 2011, 2011, 1–15. [Google Scholar] [CrossRef]

- Aßmann, U.; Zschaler, S.; Wagner, G. Ontologies, meta-models, and the model-driven paradigm. in Ontologies for software engineering and software technology, Springer, 2006, pp. 249–273.

- Koch, N.; Kraus, A. Towards a common metamodel for the development of web applications. in Web Engineering: International Conference, ICWE 2003 Oviedo, Spain, July 14–18, 2003 Proceedings 3, Springer, 2003, pp. 497–506.

- Atkinson, C.; Kuhne, T. Model-driven development: a metamodeling foundation. IEEE Softw. 2003, 20, 36–41. [Google Scholar] [CrossRef]

- Mens, T.; Van Gorp, P. A taxonomy of model transformation. Electron. Notes Theor. Comput. Sci. 2006, 152, 125–142. [Google Scholar] [CrossRef]

- Gardner, T.; Griffin, C.; Koehler, J.; Hauser, R. A review of OMG MOF 2.0 Query/Views/Transformations Submissions and Recommendations towards the final Standard. in MetaModelling for MDA Workshop, Citeseer Princeton, NJ, USA, 2003, p. 41.

- Rose, L.M.; Kolovos, D.S.; Paige, R.F.; Polack, F.A.C. Model migration with epsilon flock. in International conference on theory and practice of model transformations, Springer, 2010, pp. 184–198.

- Saleh, M.; et al. A Metamodeling Approach for IoT Forensic Investigation. Electron. 2023, 12. [Google Scholar] [CrossRef]

- Al-Dhaqm, A.; et al. Categorization and Organization of Database Forensic Investigation Processes. IEEE Access, 2020; 8. [Google Scholar] [CrossRef]

- Al-Dhaqm, A.; et al. CDBFIP: Common Database Forensic Investigation Processes for Internet of Things. IEEE Access, 2017; 5. [Google Scholar] [CrossRef]

- Alotaibi, F.M.; Al-Dhaqm, A.; Yafooz, W.M.S.; Al-Otaibi, Y.D. A Novel Administration Model for Managing and Organising the Heterogeneous Information Security Policy Field. Appl. Sci. 2023, 13. [Google Scholar] [CrossRef]

- Alotaibi, F.; Al-Dhaqm, A.; Al-Otaibi, Y.D. A Conceptual Digital Forensic Investigation Model Applicable to the Drone Forensics Field. Eng. Technol. Appl. Sci. Res. 2023, 13, 11608–11615. [Google Scholar] [CrossRef]

- Baker, C.R.; Wallage, P. The future of financial reporting in Europe: Its role in corporate governance. Int. J. Account. 2000, 35, 173–187. [Google Scholar] [CrossRef]

- Salehi, M.; Ajel, R.A.; Zimon, G. The relationship between corporate governance and financial reporting transparency. J. Financ. Report. Account. 2023, 21, 1049–1072. [Google Scholar] [CrossRef]

- Botti, L.; Boubaker, S.; Hamrouni, A.; Solonandrasana, B. Corporate governance efficiency and internet financial reporting quality. Rev. Account. Financ. 2014, 13, 43–64. [Google Scholar] [CrossRef]

- Dimes, R.; Molinari, M. Non-financial reporting and corporate governance: a conceptual framework. Sustain. Accounting, Manag. Policy J. 2024, 15, 1067–1093. [Google Scholar] [CrossRef]

- Van Frederikslust, R.A.I.; Ang, J.S.; Sudarsanam, P.S. Corporate governance and corporate finance: a European perspective; Routledge, 2007. [Google Scholar]

- Behbahaninia, P.S.; Safarzadeh, E.; Motahari, F. Corporate Governance, financial reporting quality and Performance in Tehran Stock Exchange with Emphasis on coronavirus. Appl. Res. Financ. Report. 2024, 12, 251–280. [Google Scholar]

- Al-Dhaqm, A.; Razak, S.; Othman, S.H.; Ngadi, A.; Ahmed, M.N.; Mohammed, A.A. Development and validation of a database forensic metamodel (DBFM). PLoS One 2017, 12. [Google Scholar] [CrossRef] [PubMed]

- Caro, M.F.; Josyula, D.P.; Cox, M.T.; Jiménez, J.A. Design and validation of a metamodel for metacognition support in artificial intelligent systems. Biol. Inspired Cogn. Archit. 2014, 9, 82–104. [Google Scholar] [CrossRef]

- Al-Dhaqm, A.; Razak, S.; Ikuesan, R.A.; Kebande, V.R.; Othman, S.H. Face validation of database forensic investigation metamodel. Infrastructures 2021, 6. [Google Scholar] [CrossRef]

- Gómez, A.A.; Caro, M.F. Meta-Modeling process of pedagogical strategies in intelligent tutoring systems. in 2018 IEEE 17th International Conference on Cognitive Informatics & Cognitive Computing (ICCI* CC), IEEE, 2018, pp. 485–494.

- Othman, S.H.; Beydoun, G. A metamodel-based knowledge sharing system for disaster management. Expert Syst. Appl. 2016, 63, 49–65. [Google Scholar] [CrossRef]

- Formica, A.; Missikoff, M. Concept similarity in SymOntos: an enterprise ontology management tool. Comput. J. 2002, 45, 583–594. [Google Scholar] [CrossRef]

- Frantzi, K.T. Automatic term recognition using contextual cues. in Proceedings of the 2nd Workshop on Multilinguality in Software Industry: the AI Contribution (MULSAIC’97), International Joint Conference on Artificial Intelligence (IJCAI), 1997.

- AL-DHAQM, A.M.R. SIMPLIFIED DATABASE FORENSIC INVETIGATION USING METAMODELING APPROACH. 2019, Universiti Teknologi Malaysia.

- Selamat, S.R.; Yusof, R.; Sahib, S. Mapping process of digital forensic investigation framework. Int. J. Comput. Sci. Netw. Secur. 2008, 8, 163–169. [Google Scholar]

- Ibrahim, R.; Leng, N.S.; Yusoff, R.C.M.; Samy, G.N.; Masrom, S.; Rizman, Z.I. E-learning acceptance based on technology acceptance model (TAM). J. Fundam. Appl. Sci. 2017, 9, 871–889. [Google Scholar] [CrossRef]

- Pilone, D.; Pitman, N. UML 2.0 in a Nutshell; O’Reilly Media, Inc., 2005. [Google Scholar]

- Alsulami, M.H. A Preservation Metamodel Based on Blockchain Technology for Preserving Mobile Evidence. IEEE Access 2024. [Google Scholar] [CrossRef]

- Alhussan, A.A.; Al-Dhaqm, A.; Yafooz, W.M.S.; Razak, S.B.A.; Emara, A.-H.M.; Khafaga, D.S. Towards development of a high abstract model for drone forensic domain. Electronics 2022, 11, 1168. [Google Scholar] [CrossRef]

| ID | Year | Ref | Advantages | Disadvantages | Methodology | Output | Contributions |

| 1. | 2004 | [10] | Strong corporate governance fosters enhanced investor confidence by ensuring transparency, accountability, and ethical decision-making within organizations | Merely complying with corporate governance measures may be insufficient to fully restore investor confidence. | The study used a descriptive approach to analyze existing literature and propose a new corporate governance structure. | The paper presented a holistic model of corporate governance consisting of seven interrelated functions and discusses their roles in financial reporting. | The paper offers a comprehensive framework for identifying and recovering corporate governance, particularly in the context of financial reporting. |

| 2. | 2004 | [15] | Enhances the quality of financial reporting and significantly decreases the risk of fraud and earnings manipulation. | Simply meeting regulatory requirements for corporate governance structures may not guarantee improved financial reporting quality or deter fraudulent activity. | The study synthesized prior research on corporate governance, focusing on the roles of the board of directors, audit committees, external and internal auditors. | The paper provided an overview of prior research on corporate governance and its impact on financial reporting, proposes a broader “governance mosaic” model, and identifies significant gaps in existing research | This research expands the understanding of corporate governance by examining the interactions among various stakeholders within a broader “governance mosaic” framework, highlighting the need for more research on the causal relationships between governance mechanisms and financial reporting quality. |

| 3. | 2004 | [20] | Stronger nonprofit financial reporting quality is associated with increased governance, particularly market-based governance from donors and lenders. | Regulatory-based governance measures show a less consistent effect on improving nonprofit financial reporting quality than market-based measures. | The study uses multiple measures of financial reporting quality from IRS Form 990 data, supplemented by a smaller hand-collected sample, and employs both cross-sectional and event study regression analyses to examine the relationship between governance and reporting quality. | The study finds that market-based governance measures are more consistently associated with higher-quality nonprofit financial reporting than regulatory measures, and that certain aspects of regulatory oversight may even negatively impact reporting quality. | This research provides evidence on the effectiveness of different governance mechanisms in enhancing nonprofit financial reporting quality, suggesting that market-based oversight may be more effective than regulatory approaches. |

| 4. | 2011 | [21] | The journal offers a diverse range of research articles on various topics related to computer applications, management, and allied fields, potentially providing valuable insights and knowledge for researchers and practitioners. | The journal’s scope is very broad, potentially leading to a lack of focus and in-depth analysis in specific areas. The small sample sizes in some studies may also limit the generalizability of findings. | The articles in this issue employ a variety of research methodologies, including surveys, experiments, archival data analysis, and case studies, applied to address different research questions across diverse fields. | This issue of IJRCM presents original research findings on various topics, including organizational storytelling, corporate governance, lean management, consumer preferences, and traffic management, along with recommendations for future research. | The collection of articles contributes to the body of knowledge in diverse fields by presenting original research, offering insights into current practices and problems, and proposing avenues for future investigation. |

| 5. | 2014 | [13] | High-quality financial reporting in local governments is crucial for effective resource allocation and good governance, fostering trust and accountability. | Widespread non-compliance with governmental accounting standards in Indonesian local governments, along with significant levels of corruption, highlight the need for improvements in both financial reporting and governance. | The study uses Partial Least Squares (PLS) to analyze primary data from a survey of 70 working units in seven Indonesian local governments to examine the impact of apparatus competence and internal control on financial reporting quality and good governance. | The findings reveal that apparatus competence and internal control significantly influence financial reporting quality, which in turn has a positive impact on good governance. However, no significant differences in these aspects were found across different local governments. | This research provides empirical evidence on the importance of competence and internal controls in achieving high-quality financial reporting and fostering good governance in the Indonesian context, offering insights for policy recommendations. |

| 6. | 2015 | [11] | Transparent financial reporting helps align the interests of managers, directors, and shareholders by reducing information asymmetry and facilitating more efficient contracting, contributing to financial stability. | The complexity of agency problems, along with the inherent costs and frictions of information transmission, means that even well-governed firms may still experience agency conflicts and variations in governance structures across firms and over time. | The paper reviews existing literature on corporate governance, focusing on the role of financial reporting in mitigating agency conflicts, and examines the distinction between formal and informal contracts. | The review highlights key themes such as information asymmetry, credible commitment to transparency, and the role of regulatory supervision, emphasizing that firms’ governance structures and information environments evolve to resolve agency conflicts. | This paper provides a valuable synthesis of existing research, offering a nuanced perspective on the role of financial reporting in corporate governance, and suggesting several avenues for future research, particularly concerning the unique governance challenges faced by banks and other financial institutions. |

| 7. | 2015 | [12] | This paper provides a comprehensive survey of empirical research on corporate governance and financial reporting quality in China, filling a gap in the existing literature. | The paper lacks a commonly accepted definition of financial reporting quality, which poses a challenge for synthesizing the research. | The study uses a systematic review methodology to analyse empirical archival literature on the effects of corporate governance on financial reporting quality in China. | The paper offers a systematic review of the empirical literature on the effects of corporate governance on financial reporting quality in China, identifying research gaps and suggesting areas for future research. | This paper contributes by offering a comprehensive review of the existing literature on corporate governance and financial reporting quality in China, highlighting the unique challenges and opportunities in this context. |

| 8. | 2016 | [17] | The paper provides a comprehensive survey of the empirical literature on corporate governance and financial reporting quality in China, highlighting unique governance factors and regulatory changes that offer valuable insights for regulators and investors. | The paper identifies shortcomings in the existing research, such as the lack of a commonly accepted definition of financial reporting quality and the limited exploration of the moderating role of financial reporting quality in the governance-performance relationship | The paper systematically reviews archival research from 2000 onwards, focusing on studies that examine the association between corporate governance (both internal and external) and financial reporting quality in China | The paper synthesizes findings on the effects of corporate governance mechanisms, such as ownership structure, board characteristics, and external auditing, on financial reporting quality, and provides a summary of key research findings in tabular form. | The paper contributes to the literature by offering a detailed review of the governance-reporting quality relationship in China, identifying gaps in the research, and suggesting directions for future studies, particularly in understanding the role of financial reporting quality in governance-performance outcomes. |

| 9. | 2016 | [23] | This study investigates the relationship between corporate governance and internet financial reporting (IFR) in Bahrain, a context not extensively studied before, adding to the existing literature on IFR | The study is limited by a relatively small sample size (38 companies) and the challenges of data collection from company websites | The study employs a multiple regression analysis of data gathered from company websites and the Bahrain Bourse to examine the relationship between corporate governance and internet financial reporting | The study finds a weak relationship between corporate governance and IFR in Bahrain, with board size and Big 4 auditors showing a positive association with IFR. It recommends guidelines for internet disclosure to enhance transparency | The research contributes original empirical evidence on the relationship between corporate governance and internet financial reporting in the Bahraini context, which has not been widely studied |

| 10. | 2016 | [25] | This study uses a robust methodology (GMM) to examine the impact of audit fees and corporate governance on financial reporting quality in Nigeria, controlling for endogeneity and unobserved heterogeneity. | The study combines audit and non-audit fees, limiting analysis of individual fee components. It only uses accrual earnings management as a measure of financial reporting quality | The study uses Generalized Methods of Moments (GMM) with dynamic panel data to address endogeneity and unobserved heterogeneity in examining the impact of audit fees and corporate governance on financial reporting quality in Nigeria | The study finds that abnormal audit fees in Nigeria do not impair auditor independence but may reflect effort; foreign directors and foreign institutional ownership improve financial reporting quality; local institutional ownership does not. | This study offers novel findings on the relationship between audit fees, corporate governance, and financial reporting quality in Nigeria, addressing limitations of previous studies by using GMM and considering the impact of regulatory changes |

| 11. | 2017 | [6] | This study addresses the lack of research on COSO framework application in Kurdistan, offering valuable insights into internal control system quality in this context | The study relies on a relatively small sample size (50 questionnaires) and uses subjective data from questionnaires, which might limit the generalizability and objectivity of the findings | The study uses questionnaires, Fuzzy Logic, and the Lean Diagnosis Tool (LDT) to analyze the effectiveness of the COSO framework in evaluating internal control systems in a sample of Kurdistan companies | The research reveals a gap between the internal control systems of Kurdistan companies and COSO framework requirements, highlighting areas needing improvement (leadership, culture, lean plant layout). It suggests that the COSO framework is applicable if companies strengthen their internal control | This study provides original research on applying the COSO framework and Lean Diagnosis Tool (LDT) to evaluate internal control systems in Kurdistan companies, filling a gap in the literature |

| 12. | 2017 | [8] | International Financial Reporting Standards (IFRS) offer increased transparency, accountability, and efficiency in global financial markets, facilitating easier comparison of financial statements across borders and potentially reducing costs for international businesses. | Implementing IFRS can be costly, and some believe that the standards may not fully benefit all economies, particularly developing ones, due to a lack of knowledge and appropriate training resources. | The paper offers an unbiased overview of IFRS, aiming to provide a balanced perspective, highlighting both the positive and negative impacts of IFRS adoption | The paper provides an overview of IFRS, including its history, key components, advantages, disadvantages, and its relationship with other accounting standards like GAAP, along with details on the G20 and IASB | The study uses a literature review of existing research, government and private organization reports, website information, and discussions with accounting professionals. |

| 13. | 2018 | [2] | Applying the IIRC integrated reporting framework enhances understanding of integrated reporting practices and evaluates the impact of corporate sustainability characteristics on integrated reporting disclosures | Current company reports mainly present generic rather than company-specific risks, focus on positive information while neglecting negative aspects, present financial and non-financial initiatives separately, lack a strategic focus, and primarily include backward-looking information. | The study uses a sample of non-financial companies listed on Borsa Istanbul, constructs a disclosure index based on IIRC framework elements, and employs statistical analyses to measure the integrated reporting disclosure score and test hypotheses. | The study analyzes the adherence level of current Turkish company reports to the IIRC integrated reporting framework and examines the impact of corporate sustainability characteristics on adherence | This research contributes by applying a checklist based on the IIRC framework to enhance understanding of integrated reporting and by evaluating the impact of corporate sustainability on integrated reporting |

| 14. | 2018 | [5] | A Big Data governance framework facilitates successful Big Data implementation by addressing data quality, personal information protection, and data disclosure/accountability, ultimately improving service quality and preventing problems. | Existing data governance models are insufficient for Big Data’s unique characteristics; challenges include data quality issues, data monopoly concerns, and the need for clear responsibility for data quality and service reliability | The research employs a case study approach analysing the NPS’s Big Data implementation in South Korea, using the proposed Big Data governance framework to identify issues, risks, and solutions | The paper proposes a Big Data governance framework, analyses its application in the National Pension Service (NPS) case study in South Korea, identifies vulnerabilities and risks, and offers recommendations for successful Big Data service implementation | The study develops and proposes a novel Big Data governance framework that considers the unique characteristics of Big Data and addresses issues of data quality, privacy, and accountability, contributing to a more robust approach to Big Data implementation. |

| 15. | 2021 | [3] | The document outlines a robust risk management framework encompassing credit, liquidity, market, and operational risks, ensuring stability and compliance. | The document does not explicitly state any disadvantages. The inherent risks themselves (credit, liquidity, market, and operational) are discussed, but not presented as disadvantages of the system itself. | The risk management methodology employs quantitative and qualitative measures, utilizing models like VAR and stress testing, combined with regular reviews and internal audits. | The document details HSBC Sri Lanka Branch’s risk management framework and capital structure, including policies, processes, and monitoring methods for various risk types. | The document contributes to understanding HSBC Sri Lanka’s comprehensive approach to risk management, ensuring regulatory compliance and financial stability. |

| 16. | 2021 | [22] | The study provides international evidence on the positive relationship between ESG performance and financial reporting quality. | The study’s findings on the social pillar of ESG are mixed, and the time frame is relatively short. | The study uses panel regression analysis on a large international sample of firm-year observations to investigate the relationship between ESG performance and financial reporting quality. | The study found a positive relationship between overall ESG performance and financial reporting quality, with significant positive effects for environmental and governance pillars but not the social pillar. | This study extends existing literature by providing international evidence on the relationship between ESG performance and financial reporting quality, including the impact of each ESG pillar. |

| 17. | 2021 | [24] | The study provides evidence of the positive impact of effective corporate governance and high-quality environmental and social reporting on corporate reputation in Malaysia | The study’s reliance on secondary data and the exclusion of certain industries limit the generalizability of the findings | The study used secondary data from multiple sources and employed multiple regression analysis to test hypotheses on the relationships between corporate governance, environmental and social reporting quality, and corporate reputation | The results showed positive relationships between corporate governance, environmental and social reporting quality, and corporate reputation, with environmental and social reporting quality mediating the relationship between corporate governance and reputation | The study bridges research gaps by providing evidence for the impact of effective corporate governance and environmental and social reporting quality on corporate reputation in Malaysia and the mediating role of reporting quality. |

| 18. | 2022 | [16] | Robust corporate governance significantly reduces fraudulent financial reporting. | The study’s findings may not be generalizable to other countries due to differences in regulations and economic environments | A linear regression model was used to analyze data from 187 listed Iranian companies from 2013-2019 to test the relationship between corporate governance and fraudulent financial reporting | The study found a significant negative relationship between robust corporate governance and fraudulent financial reporting, supporting the hypotheses | The research provides valuable insights into the importance of strengthening corporate governance to prevent fraudulent financial reporting |

| 19. | 2022 | [26] | Integrated reporting improves information quality, promotes compliance, and enhances stakeholder engagement | The study has limitations due to its short time frame, limited scope of governance mechanisms, and reliance on a single reporting medium | The study uses a quantitative, hypothetico-deductive approach with multiple linear regression analysis of 120 French companies’ data from 2016-2019 | The study reveals positive correlations between cognitive diversity, audit committees, and the level of integrated reporting, but not for board size or CEO duality | This research contributes significantly to the literature by empirically examining the influence of corporate governance on the determinants of integrated reporting within French listed companies |

| 20. | 2023 | [9] | The Sarbanes-Oxley Act (SOA) has had a favorable impact on UK corporate reporting quality, particularly for companies listed in the US, by improving transparency and reducing boilerplate language | The study’s relatively short timeframe (2000-2016) and focus on a limited number of companies may limit the generalizability of its findings | The study uses institutional theory to analyze the content of corporate governance, internal control, audit committee, and external auditor reports from UK companies listed in the US and UK-only listed companies, comparing pre- and post-SOA periods | he study finds that SOA compliance led to increased disclosure quantity and quality, changes in communication style (including increased use of pronouns and politeness), and a shift toward greater transparency in internal controls and audit reporting; effects also observed in non-compliant UK companies | This thesis contributes to the understanding of the SOA’s impact on UK corporate reporting and governance by utilizing institutional theory and a qualitative content analysis approach, addressing a gap in extant literature. |

| 21. | 2024 | [7] | Implementing COBIT and ITIL frameworks in financial institutions improves IT governance, enhances operational efficiency, and ensures regulatory compliance. | Challenges include organizational resistance to change, complexity of framework integration, and the need for continuous monitoring and adaptation. | The paper conducts a comprehensive literature review examining the effective implementation of COBIT and ITIL frameworks in financial institutions, supported by case studies | The review highlights the benefits and challenges of implementing COBIT and ITIL, suggesting synergistic application and strategies for overcoming implementation challenges | This research contributes by providing a comprehensive analysis of COBIT and ITIL implementation in financial institutions, offering valuable insights and recommendations for IT leaders and practitioners. |

| 22. | 2024 | [4] | The systematic review identifies gaps in current IoT security auditing practices and proposes areas for future research, leading to improved security standards and methodologies | A lack of widely adopted standards and insufficient research hinders the consistency and effectiveness of current IoT security audits | A systematic literature review of existing frameworks and research on IoT audit security was conducted using Google Scholar, focusing on risk-based approaches | The paper identifies areas of needed research in IoT security auditing, recommends practices for auditors and organizations, and suggests improvements in frameworks and standards | The review highlights the need for improved standards, methodologies, and automation in IoT security auditing, promoting more effective and consistent practices |

| 23. | 2024 | [18] | The study provides valuable insights into the impact of corporate governance on the financial performance of Islamic and conventional financial institutions in Pakistan, considering the moderating role of institutional quality | The study is limited to Pakistan’s financial sector and lacks a broader international comparison | A two-step system GMM analysis of a panel dataset of Pakistani financial institutions from 2006-2017 was used to examine the relationship between corporate governance, institutional quality, and financial performance | The study reveals the differential effects of corporate governance on Islamic and conventional financial institutions and highlights the significant moderating role of institutional quality | The research contributes to the existing literature by analysing the impact of corporate governance on the performance of both Islamic and conventional financial institutions in Pakistan, considering the moderating influence of institutional quality. |

| 24. | 2024 | [19] | This research offers valuable insights into the complex interplay between integrated reporting, corporate governance, and financial sustainability within Islamic banking, highlighting the importance of aligning banking practices with Sharia principles and emphasizing the significance of stakeholder engagement | The study’s scope is limited, focusing primarily on the literature related to Islamic banking and leaving out a broader financial sector comparison. Also, the reliance on a specific set of databases might limit the inclusiveness of the results | A systematic literature review employing bibliometric techniques and content analysis was used to analyze 30 studies selected from various databases based on predefined criteria, focusing on Islamic banks’ integrated reporting, corporate governance, and financial sustainability | The analysis reveals a positive correlation between integrated reporting, robust corporate governance, and strong financial sustainability in Islamic banking, suggesting that aligning operations with Sharia principles fosters these positive outcomes. Areas of high and low disclosure and potential areas for future research are also identified | This study expands the existing literature by providing a comprehensive overview of integrated reporting in Islamic banking, highlighting the importance of Sharia principles, emphasizing the need for stakeholder engagement, and identifying important areas for future research |

| 25. | 2025 | [27] | This study offers a unique perspective on the impact of corporate governance on bank financial performance in the MENA region during the COVID-19 pandemic, filling a gap in existing research. The two-stage least squares regression analysis provides robustness checks | The study is limited in scope (MENA region, one year of data, specific sample of banks), potentially affecting the generalizability of findings. Certain macroeconomic factors affecting bank performance may not be adequately considered | Financial and non-financial data from bank annual reports, Orbis Bank Focus, and World Bank reports were analysed using fixed effects regressions and two-stage least squares (2SLS) to assess the impact of internal and external corporate governance mechanisms on bank performance in the MENA region during the COVID-19 pandemic | The analysis reveals that the presence of independent board members, high ownership concentration, strong legal protection, and effective government oversight positively influence bank performance and reduce credit risk in the MENA region during the pandemic. Other governance mechanisms had no significant impact | This research expands the limited literature on corporate governance and bank performance in the MENA region during a pandemic. It contributes to both theoretical and practical understanding, offering insights for bankers, policymakers, and financial regulators. |

| 26. | 2025 | [28] | The study identifies the key drivers of operational sustainability in Vietnamese NBFIs, offering valuable insights for improving management practices and aligning with technological advancements | The research is limited to Vietnam’s NBFI sector, potentially limiting the generalizability of findings to other countries or financial context | Regression analysis of survey data from Vietnamese NBFI managers was used to examine the impact of governance, digital transformation, business model diversification, cost management, and macroeconomic factors on operational sustainability. Exploratory factor analysis was also conducted | Strong positive relationships were found between governance and digital transformation, and operational sustainability. Business model diversification had a moderate positive effect, while cost management’s impact was minimal. | This research contributes to the existing literature by validating the importance of governance and digital transformation in enhancing the operational sustainability of NBFIs while providing new insights into the dynamic interplay between business strategies and sustainability in this sector. |

| 27. | 2025 | [29] | The KPMG report provides a comprehensive overview of AI adoption in finance across major global markets, highlighting its benefits and potential for transforming financial functions. It offers practical recommendations for businesses | The report’s focus on a limited number of major economies might neglect the unique aspects of AI adoption in other regions. The review lacks critical discussion of the ethical considerations surrounding AI in finance | The KPMG report surveyed 1800 companies (expanded to 2900) across 10 major economies (and later 23) to assess AI adoption in finance, utilizing an AI Maturity Index to categorize companies into leaders, implementers, and beginners | The report indicates widespread AI adoption across various financial functions, with significant benefits observed in efficiency, accuracy, and decision-making. It identifies barriers to AI adoption and provides key recommendations for implementation and governance | The report contributes significantly to the understanding of AI’s impact on the finance industry, providing valuable insights and recommendations for businesses and highlighting the need for effective AI governance. |

| ID | Search Engine | Year | Keywords | Language | Content-Type | |||||

| Chapter | Article | Research Article | Reference Work Entry | Conference paper | Review Article | |||||

| 1 | Springer Link | 2015-2025 | “Finance Report”; “Governance” | English Language | 96 | 15 | 14 | 6 | 3 | 1 |

| 2 | Scopus | 2015-2025 | 0 | 3 | 0 | 0 | 0 | 1 | ||

| 3 | IEEE Xplore | 2015-2025 | 0 | 0 | 0 | 0 | 7 | 0 | ||

| 4 | Web Of Science | 2015-2025 | 0 | 0 | 2 | 0 | 0 | 0 | ||

| 5 | Science Direct | 2015-2025 | 6 | 3 | 107 | 4 | 1 | 6 | ||

| 6 | Google Scholar | 2015-2025 | 590 | 1550 | 835 | 0 | 2100 | 225 | ||

| Inclusion Criteria | Exclusion Criteria |

|

|

| ID | Ref | Regulatory Compliance | Internal Control Systems | External Auditing | Ethical Standards and Corporate Governance | Transparency and Disclosure | Risk Management | Control Processes |

| 1. | [10] | ⮽ | ✓ | ⮽ | ⮽ | ⮽ | ✓ | ⮽ |

| 2. | [48] | ⮽ | ✓ | ✓ | ✓ | ⮽ | ⮽ | ⮽ |

| 3. | [11] | ✓ | ⮽ | ✓ | ✓ | ✓ | ⮽ | ✓ |

| 4. | [12] | ✓ | ✓ | ✓ | ✓ | ✓ | ⮽ | ✓ |

| 5. | [49] | ⮽ | ⮽ | ✓ | ⮽ | ✓ | ⮽ | ⮽ |

| 6. | [13] | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ⮽ |

| 7. | [50] | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| 8. | [14] | ⮽ | ⮽ | ✓ | ⮽ | ✓ | ⮽ | ⮽ |

| 9. | [15] | ✓ | ⮽ | ✓ | ⮽ | ✓ | v | v |

| 10. | [16] | ✓ | ✓ | ✓ | ⮽ | ⮽ | ⮽ | v |

| 11. | [51] | ⮽ | ✓ | ⮽ | ⮽ | ⮽ | ⮽ | ✓ |

| 12. | [17] | ✓ | ⮽ | ✓ | ✓ | ✓ | v | v |

| 13. | [52] | ✓ | ✓ | ✓ | ✓ | ✓ | ⮽ | ✓ |

| 14. | [18] | ✓ | ✓ | ✓ | ✓ | ✓ | ⮽ | ✓ |

| 15. | [19] | ✓ | ✓ | ⮽ | ✓ | ✓ | ⮽ | ✓ |

| 16. | [20] | ✓ | ⮽ | ✓ | ✓ | ✓ | ⮽ | ✓ |

| 17. | [21] | ✓ | ✓ | ✓ | ✓ | ✓ | ⮽ | ✓ |

| 18. | [22] | ✓ | ⮽ | ⮽ | ⮽ | ✓ | ⮽ | ✓ |

| 19. | [23] | ✓ | ⮽ | ✓ | ✓ | ✓ | ⮽ | ⮽ |

| 20. | [24] | ✓ | ✓ | ⮽ | ⮽ | ✓ | ⮽ | ⮽ |

| 21. | [25] | ✓ | ⮽ | ✓ | ✓ | ✓ | ⮽ | ✓ |

| 22. | [26] | ✓ | ⮽ | ⮽ | ✓ | ✓ | ⮽ | ⮽ |

| 23. | [53] | ⮽ | ⮽ | ✓ | ⮽ | ✓ | ⮽ | ⮽ |

| ID | Ref | Extracted Processes and Concepts | Total of concepts |

| [10] | Board of Directors, Audit Committee, Management’s Role, Internal Controls, Audit Function, Internal Audit, External Audit, Compliance, Advisory Function, Monitoring, Accountability, Transparency, Independence, Integrity, Risk Management. | 15 | |

| [48] | Regulatory Framework, Sustainability Reporting, Technology and Innovation, Stakeholder Engagement, Data Analytics, Corporate Governance Practices, Transparency and Accountability, Continuing Education and Skill Development. | 8 | |

| 1. | [11] | Transparency of Financial Information, Risk Management, Regulatory Compliance, Stakeholder Communication, Board Oversight and Accountability, Performance Measurement, Informed Decision-Making, Ethical Standards and Corporate Culture, Technology and Data Analytics, Impact of Globalization. | 10 |

| 2. | [12] | Corporate Governance Framework, Regulatory Environment, Financial Reporting Standards, Board Characteristics, Ownership Structure, Audit Quality, Internal Control Systems, Financial Literacy and Governance Culture, Impact of Corruption and Political Influences, Recent Empirical Evidence. | 10 |

| 3. | [49] | Corporate Governance Framework, Board Structure and Diversity, Accountability Mechanisms, Internal Control Systems, Disclosure Practices, Audit Quality, Regulatory Compliance, Stakeholder Engagement, Cultural Factors, Impact of Governance on Performance. | 10 |

| 4. | [13] | Regulatory Environment, Corporate Governance Structures, Financial Reporting Framework, Management Integrity and Ethic, Internal Control Systems, Audit Quality, | 6 |

| 5. | [50] | Corporate Governance Framework, Board Composition and Independence, Transparency Standards, Regulatory Compliance, Information Technology Infrastructure, Quality Control Mechanisms, Stakeholder Communication, Internet-Based Reporting Tools, Impact of Corporate Culture, Consequences for Decision-Making, Data Security and Privacy. | 11 |

| 6. | [14] | Regulatory Framework, Role of Corporate Governance, Board Oversight, Ethics and Corporate Culture, Internal Control Systems, Stakeholder Engagement, Whistleblower Protections, Audit and Assurance, Consequences of Non-Financial Reporting Fraud, Reporting Frameworks and Standards. | 10 |

| 7. | [15] | Corporate Governance Framework, Board Composition and Independence, Internal Control Systems, Audit Committees, Regulatory Compliance, Transparency and Disclosure, Stakeholder Engagement, Ethical Culture and Corporate Behavior, Auditor Quality and Independence, Technological Influences, Globalization and Standardization, Performance Measurement and Evaluation. | 12 |

| 8. | [16] | Fraudulent Financial Reporting, Corporate Governance Framework, Board Structure and Independence, Internal Control Systems, Risk Assessment and Management, Audit Committees, Ethical Standards and Corporate Culture, Employee Training and Awareness, External Audits and Reviews, Regulatory Compliance, Consequences of Fraudulent Reporting. | 11 |

| 9. | [51] | Non-Financial Reporting, Corporate Governance Framework, Board Oversight, Strategies for Transparency, Stakeholder Engagement, Regulatory Compliance and Standards, Risk Management, Performance Measurement, Impact of Corporate Culture, Technology and Innovation, Audit and Verification, Consequences of Inadequate Non-Financial Reporting. | 12 |

| 10. | [17] | Corporate Governance Framework, Board Composition and Independent Directors, Judicious Use of Committees, Regulatory Environment, Transparency and Disclosure, Internal Control Systems, Role of External Auditors, Stakeholder Engagement, Cultural Factors, Corporate Social Responsibility, Technological Advancements, Continuous Improvement and Reform. | 12 |

| 11. | [52] | Corporate Governance, Financial Accountability, Board Composition and Financial Expertise, Internal Control Systems, Financial Reporting Quality, Risk Management, Executive Compensation and Incentives, Shareholder Rights and Activism, Regulatory Compliance, Audit Function, Performance Measurement, Transparency and Disclosure. | 12 |

| 12. | [18] | Consequences of Governance and Risk Management Failures, Impact of Cultural and Religious Factors, Auditing Practices, Transparency and Disclosure Practices, Stakeholder Engagement, Compliance and Ethical Standards, Board Structure and Composition, Risk Management Frameworks, Corporate Governance. | 9 |

| 13. | [19] | Integrated Reporting Framework, Principles of Islamic Finance, Stakeholder Engagement, Risk Management, Transparency and Accountability, Impact Assessment, Regulatory Environment, Technology, Cultural and Ethical Dimensions, Continuous Improvement and Innovation. | 10 |

| 14. | [20] | Nonprofit Governance, Board Composition and Independence, Financial Accountability, Internal Controls and Procedures, Transparency in Financial Reporting, External Audits, Stakeholder Engagement, Regulatory Compliance, Performance Measurement, Cultural Influences, Management Practices. | 11 |

| 15. | [21] | Corporate Governance Framework, Regulatory Environment, Board Composition and Independence, Internal Control Systems, Audit Committees, Transparency and Disclosure Practices, Risk Management, Stakeholder Engagement, Ethical Standards and Corporate Culture, Financial Reporting Quality, Consequences of Poor Governance, Impact of Training and Development. | 12 |

| 16. | [22] | Financial Reporting Quality, Financial Reporting, Stakeholder Expectations, Regulatory and Compliance Frameworks, Risk Management, Corporate Governance. | 6 |

| 17. | [23] | Internet Financial Reporting, Corporate Governance Framework, Board Characteristics and Composition, Regulatory Environment, Transparency and Accountability, Stakeholder Engagement, Audit and Assurance, Internal Control Systems | 8 |

| 18. | [24] | Corporate Governance, Corporate Reputation, Environmental and Social Reporting, Board Oversight and Accountability, Stakeholder Engagement, Regulatory Compliance, Sustainability Strategies, Risk Management, External Assurance. | 9 |

| 19. | [25] | Audit Fees, Corporate Governance Mechanisms, Financial Reporting Quality, Reporting Quality, Audit Committees, Internal Control Systems, Stakeholder Engagement, Regulatory Environment, Cultural Factors. | 9 |

| 20. | [26] | Integrated Reporting, Corporate Governance Framework, Board Composition and Independence, Stakeholder Engagement, Transparency and Accountability, Risk Management, Regulatory Environment, Cultural Context, Audit and Assurance. | 9 |

| 21. | [53] | Corporate Governance Framework, Financial Reporting Quality, Board Characteristics, Internal Control Systems, Stakeholder Engagement, Performance Measurement, Regulatory Compliance, Risk Management, Transparency and Disclosure, Ethical Considerations. | 10 |

| ID | Ref | Extracted Processes and Concepts | Total of concepts |

| 22. | [10] | Board of Directors, Audit Committee, Management’s Role, Internal Controls, Audit Function, Internal Audit, External Audit, Compliance, Advisory Function, Monitoring, Accountability, Transparency, Independence, Integrity, Risk Management. | 15 |

| 23. | [48] | Regulatory Framework, Sustainability Reporting, Technology and Innovation, Stakeholder Engagement, Data Analytics, Corporate Governance Practices, Transparency and Accountability, Continuing Education and Skill Development. | 8 |

| 24. | [11] | Transparency of Financial Information, Risk Management, Regulatory Compliance, Stakeholder Communication, Board Oversight and Accountability, Performance Measurement, Informed Decision-Making, Ethical Standards and Corporate Culture, Technology and Data Analytics, Impact of Globalization. | 10 |

| 25. | [12] | Corporate Governance Framework, Regulatory Environment, Financial Reporting Standards, Board Characteristics, Ownership Structure, Audit Quality, Internal Control Systems, Financial Literacy and Governance Culture, Impact of Corruption and Political Influences, Recent Empirical Evidence. | 10 |

| 26. | [49] | Corporate Governance Framework, Board Structure and Diversity, Accountability Mechanisms, Internal Control Systems, Disclosure Practices, Audit Quality, Regulatory Compliance, Stakeholder Engagement, Cultural Factors, Impact of Governance on Performance. | 10 |

| 27. | [13] | Regulatory Environment, Corporate Governance Structures, Financial Reporting Framework, Management Integrity and Ethic, Internal Control Systems, Audit Quality, | 6 |

| 28. | [50] | Corporate Governance Framework, Board Composition and Independence, Transparency Standards, Regulatory Compliance, Information Technology Infrastructure, Quality Control Mechanisms, Stakeholder Communication, Internet-Based Reporting Tools, Impact of Corporate Culture, Consequences for Decision-Making, Data Security and Privacy. | 11 |

| 29. | [14] | Regulatory Framework, Role of Corporate Governance, Board Oversight, Ethics and Corporate Culture, Internal Control Systems, Stakeholder Engagement, Whistleblower Protections, Audit and Assurance, Consequences of Non-Financial Reporting Fraud, Reporting Frameworks and Standards. | 10 |

| 30. | [15] | Corporate Governance Framework, Board Composition and Independence, Internal Control Systems, Audit Committees, Regulatory Compliance, Transparency and Disclosure, Stakeholder Engagement, Ethical Culture and Corporate Behavior, Auditor Quality and Independence, Technological Influences, Globalization and Standardization, Performance Measurement and Evaluation. | 12 |

| 31. | [16] | Fraudulent Financial Reporting, Corporate Governance Framework, Board Structure and Independence, Internal Control Systems, Risk Assessment and Management, Audit Committees, Ethical Standards and Corporate Culture, Employee Training and Awareness, External Audits and Reviews, Regulatory Compliance, Consequences of Fraudulent Reporting. | 11 |

| 32. | [51] | Non-Financial Reporting, Corporate Governance Framework, Board Oversight, Strategies for Transparency, Stakeholder Engagement, Regulatory Compliance and Standards, Risk Management, Performance Measurement, Impact of Corporate Culture, Technology and Innovation, Audit and Verification, Consequences of Inadequate Non-Financial Reporting. | 12 |

| 33. | [17] | Corporate Governance Framework, Board Composition and Independent Directors, Judicious Use of Committees, Regulatory Environment, Transparency and Disclosure, Internal Control Systems, Role of External Auditors, Stakeholder Engagement, Cultural Factors, Corporate Social Responsibility, Technological Advancements, Continuous Improvement and Reform. | 12 |

| 34. | [52] | Corporate Governance, Financial Accountability, Board Composition and Financial Expertise, Internal Control Systems, Financial Reporting Quality, Risk Management, Executive Compensation and Incentives, Shareholder Rights and Activism, Regulatory Compliance, Audit Function, Performance Measurement, Transparency and Disclosure. | 12 |

| 35. | [18] | Consequences of Governance and Risk Management Failures, Impact of Cultural and Religious Factors, Auditing Practices, Transparency and Disclosure Practices, Stakeholder Engagement, Compliance and Ethical Standards, Board Structure and Composition, Risk Management Frameworks, Corporate Governance. | 9 |

| 36. | [19] | Integrated Reporting Framework, Principles of Islamic Finance, Stakeholder Engagement, Risk Management, Transparency and Accountability, Impact Assessment, Regulatory Environment, Technology, Cultural and Ethical Dimensions, Continuous Improvement and Innovation. | 10 |

| 37. | [20] | Nonprofit Governance, Board Composition and Independence, Financial Accountability, Internal Controls and Procedures, Transparency in Financial Reporting, External Audits, Stakeholder Engagement, Regulatory Compliance, Performance Measurement, Cultural Influences, Management Practices. | 11 |

| 38. | [21] | Corporate Governance Framework, Regulatory Environment, Board Composition and Independence, Internal Control Systems, Audit Committees, Transparency and Disclosure Practices, Risk Management, Stakeholder Engagement, Ethical Standards and Corporate Culture, Financial Reporting Quality, Consequences of Poor Governance, Impact of Training and Development. | 12 |

| 39. | [22] | Financial Reporting Quality, Financial Reporting, Stakeholder Expectations, Regulatory and Compliance Frameworks, Risk Management, Corporate Governance. | 6 |

| 40. | [23] | Internet Financial Reporting, Corporate Governance Framework, Board Characteristics and Composition, Regulatory Environment, Transparency and Accountability, Stakeholder Engagement, Audit and Assurance, Internal Control Systems | 8 |

| 41. | [24] | Corporate Governance, Corporate Reputation, Environmental and Social Reporting, Board Oversight and Accountability, Stakeholder Engagement, Regulatory Compliance, Sustainability Strategies, Risk Management, External Assurance. | 9 |

| 42. | [25] | Audit Fees, Corporate Governance Mechanisms, Financial Reporting Quality, Reporting Quality, Audit Committees, Internal Control Systems, Stakeholder Engagement, Regulatory Environment, Cultural Factors. | 9 |

| 43. | [26] | Integrated Reporting, Corporate Governance Framework, Board Composition and Independence, Stakeholder Engagement, Transparency and Accountability, Risk Management, Regulatory Environment, Cultural Context, Audit and Assurance. | 9 |

| 44. | [53] | Corporate Governance Framework, Financial Reporting Quality, Board Characteristics, Internal Control Systems, Stakeholder Engagement, Performance Measurement, Regulatory Compliance, Risk Management, Transparency and Disclosure, Ethical Considerations. | 10 |

| Componenet1 | Relationship Type | Relation Name | Componenet2 |

| Corporate Governance Structures | Association | has | Stakeholder Engagement and Communication |

| Corporate Governance Structures | Association | uses | Auditing and Financial Controls |

| Corporate Governance Structures | Association | Implements | Transparency and Accountability |

| Auditing and Financial Controls | Association | Has | Compliance and Regulatory Framework |

| Auditing and Financial Controls | Association | Is influenced by | Risk Management |

| Auditing and Financial Controls | Dependency | Relies on | Technology and Innovation |

| Compliance and Regulatory Framework | Dependency | Depends on | Cultural and Ethical Considerations |

| Compliance and Regulatory Framework | Association | Connects to | Transparency and Accountability |

| Transparency and Accountability | Association | Works closely with | Performance Measurement and Financial Reporting |

| Transparency and Accountability | Association | Collaborates with | Stakeholder Engagement and Communication |

| Risk Management | Association | Ties to | Performance Measurement and Financial Reporting |

| Risk Management | Dependency | Uses insights | Technology and Innovation |

| Stakeholder Engagement and Communication | Association | Engages with | Corporate Governance Structures |

| Stakeholder Engagement and Communication | Association | Relates to | Cultural and Ethical Consideration |

| Performance Measurement and Financial Reporting | Association | Generates reports based on inputs from | Auditing and Financial Controls |

| Performance Measurement and Financial Reporting | Association | Generates reports based on inputs from | Transparency and Accountability |

| Performance Measurement and Financial Reporting | Association | Influenced by | Risk Management |

| Cultural and Ethical Considerations | Association | Supports | Compliance and Regulatory Framework |

| Cultural and Ethical Considerations | Association | Supports | Stakeholder Engagement and Communication |

| Technology and Innovation | Association | Supports | Auditing and Financial Controls |

| Technology and Innovation | Association | Supports | Risk Management |

| Technology and Innovation | Association | Supports | Performance Measurement and Financial Reporting |

| Technology and Innovation | Association | Facilitates | Training and Development |

| Training and Development | Association | Enhances | Compliance and Regulatory Framework |

| Training and Development | Association | Enhances | Technology and Innovation |

| Training and Development | Association | Enhances | Cultural and Ethical Considerations |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).