Submitted:

14 May 2025

Posted:

15 May 2025

You are already at the latest version

Abstract

Keywords:

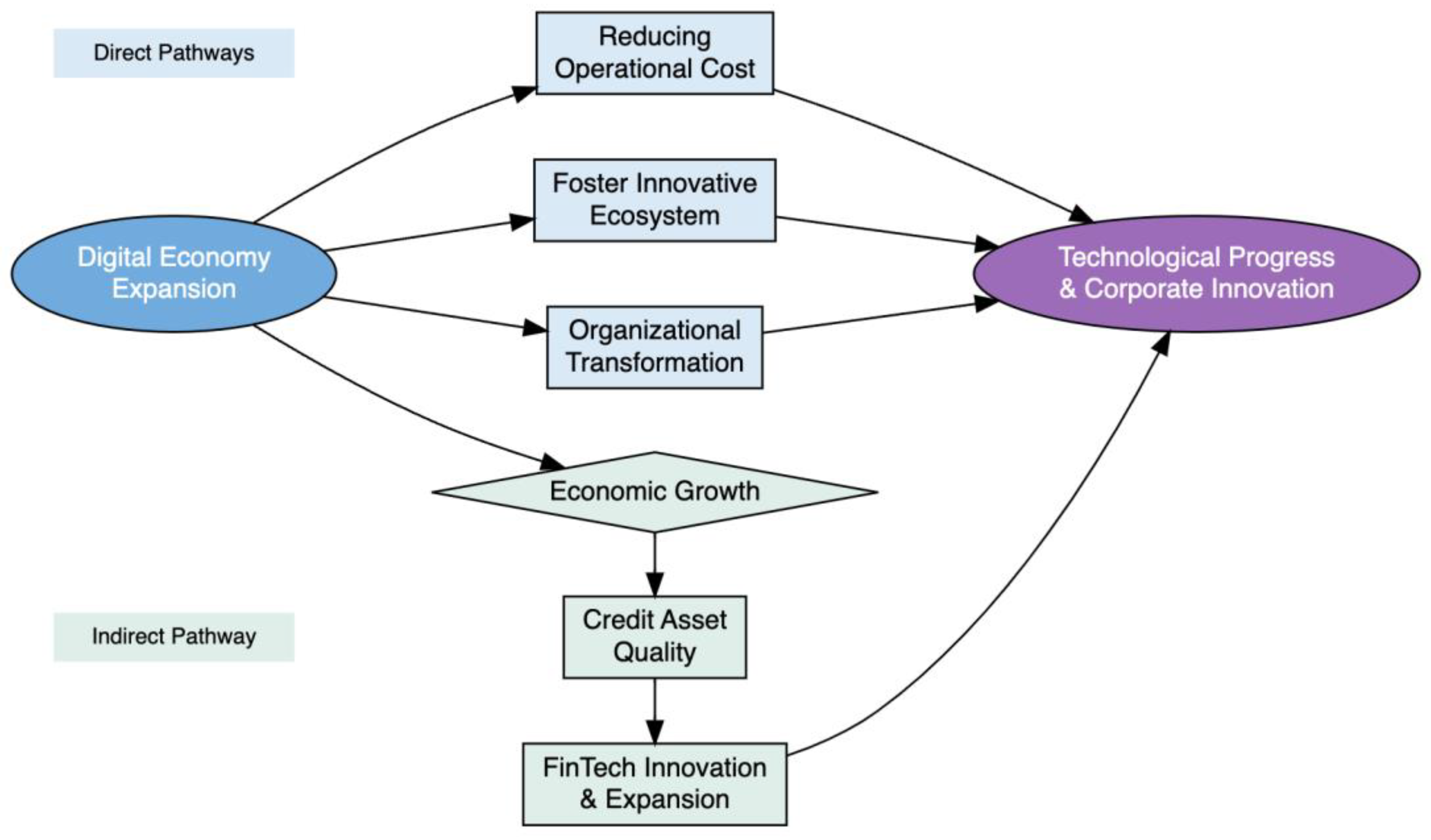

1. Introduction

2. Literature Review

2.1. The Role of the Digital Economy in Enhancing Corporate R&D

2.2. The Role of FinTech in Advancing R&D Investment

2.3. Synergies Between Digital Economy and FinTech in Advancing R&D

3. Materials and Methods

3.1. Variables Selection and Data Processing

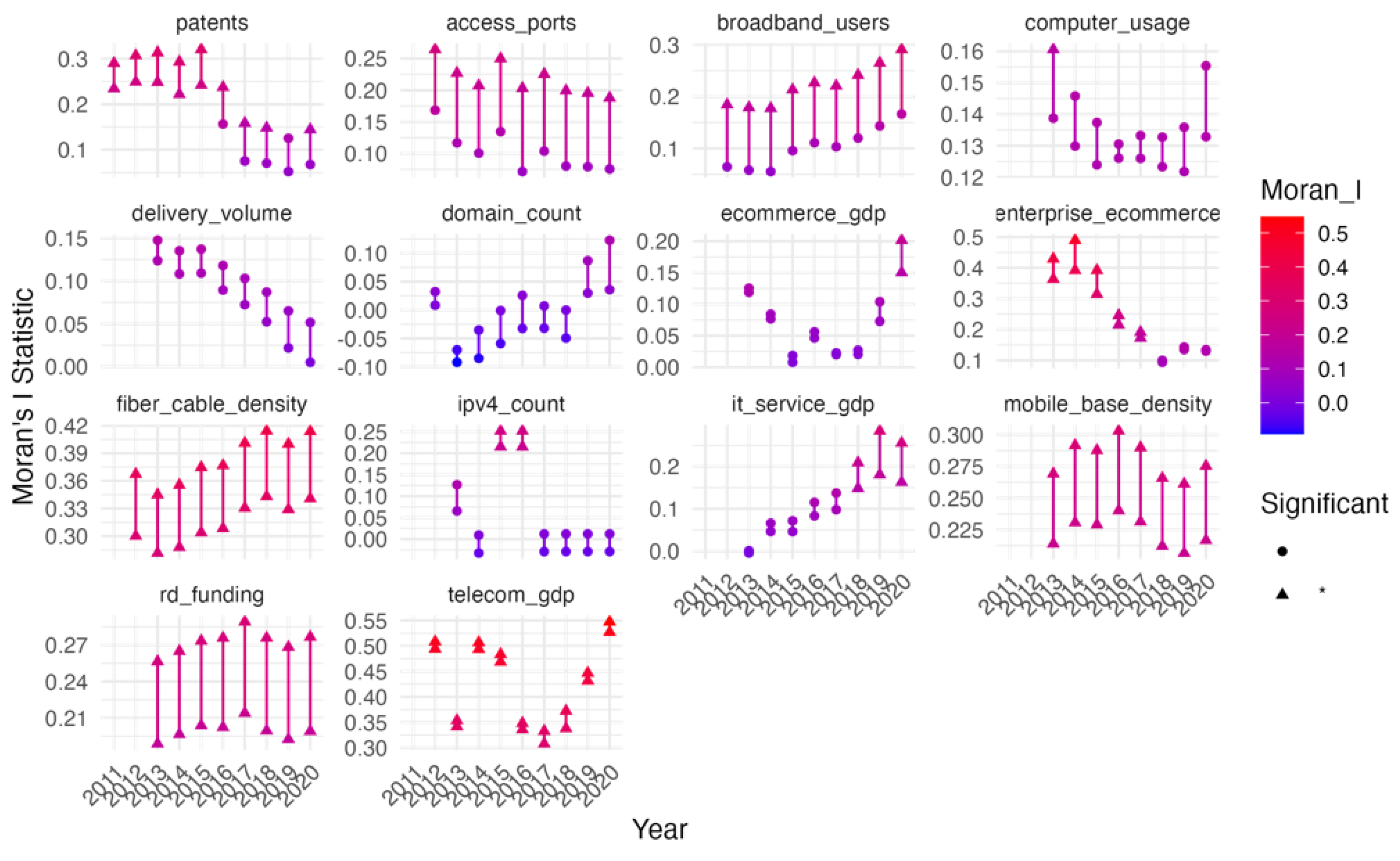

3.2. Spatial Relationship of Variables

3.3. Machine Learning Models for R&D Prediction

3.3.1. Support Vector Machine (SVM)

3.3.2. Extreme Learning Machine (ELM)

3.3.3. Random Forest (RF)

3.3.4. XGBoost

3.4. Stacking Ensemble

3.5. Model Training and Validation

3.6. Testing and Performance Evaluation

4. Results

4.1. Spatial Correlation Analysis

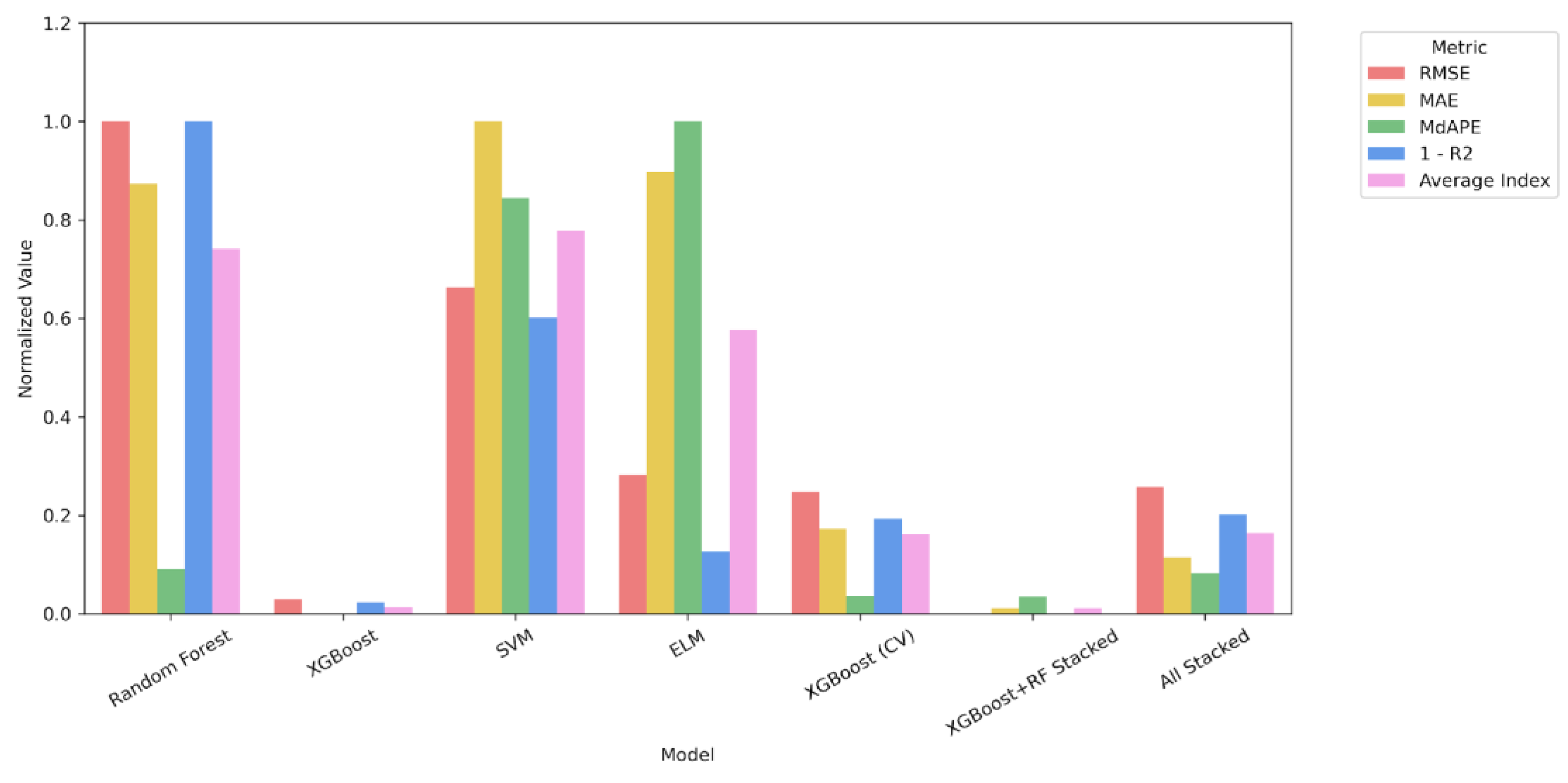

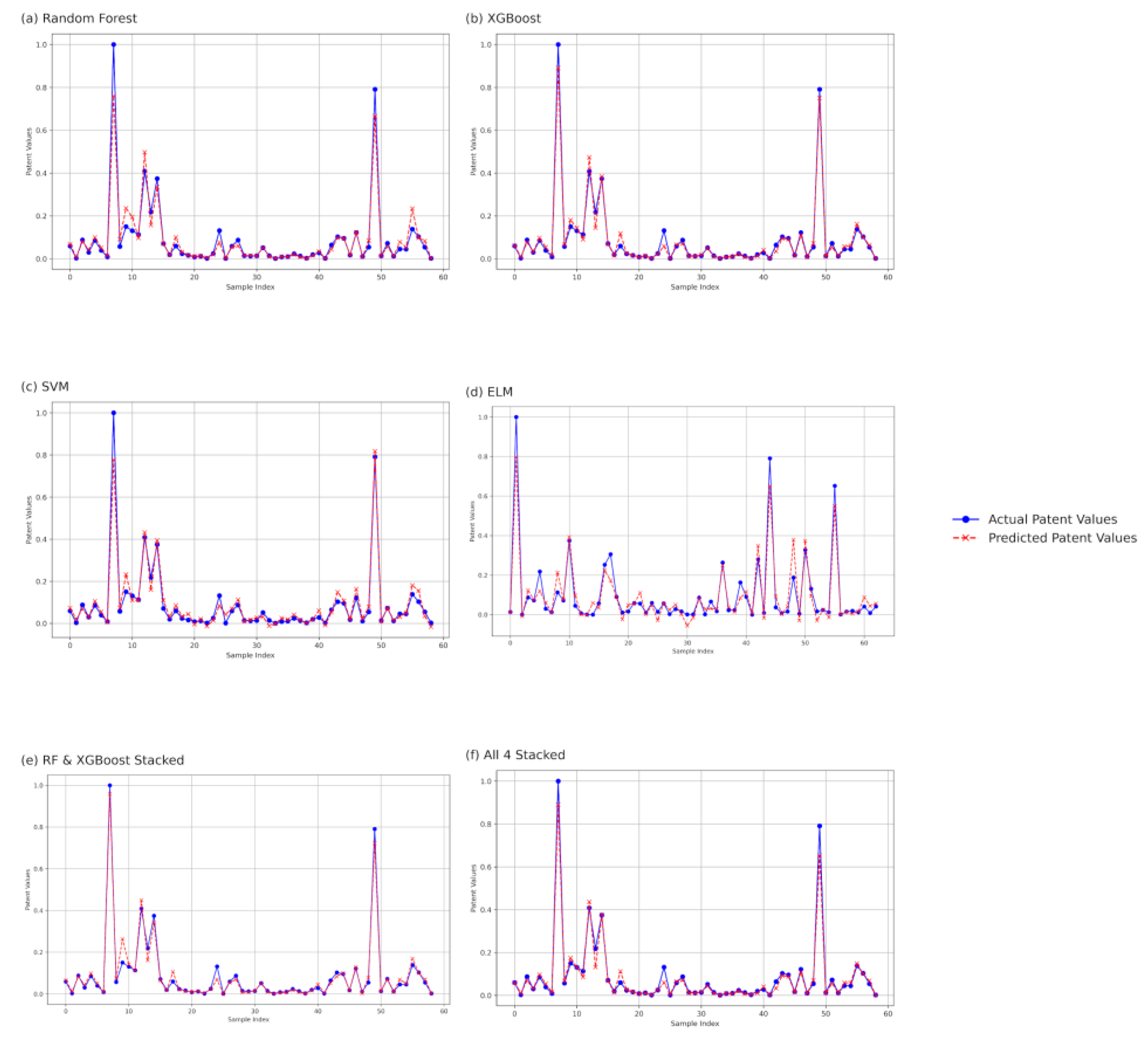

4.2. Machine Learning Outcomes

4.2.1. Model Parameters

4.2.2. Empirical Prediction Results

5. Discussions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Cao, S.; Feng, F.; Chen, W.; Zhou, C. Does Market Competition Promote Innovation Efficiency in China’s High-Tech Industries? Technology Analysis & Strategic Management 2020, 32, 429–442. [Google Scholar] [CrossRef]

- Miller, P.; Wilsdon, J. Digital Futures — An Agenda for a Sustainable Digital Economy. Corporate Environmental Strategy 2001, 8, 275–280. [Google Scholar] [CrossRef]

- Kim, J.; Park, J.C.; Komarek, T. The Impact of Mobile ICT on National Productivity in Developed and Developing Countries. Information & Management 2021, 58, 103442. [Google Scholar] [CrossRef]

- Jin, B.; Han, Y. Influencing Factors and Decoupling Analysis of Carbon Emissions in China’s Manufacturing Industry. Environ Sci Pollut Res 2021, 28, 64719–64738. [Google Scholar] [CrossRef]

- Zhou, C.; Zhang, D.; Chen, Y. Theoretical Framework and Research Prospect of the Impact of China’s Digital Economic Development on Population. Front. Earth Sci. 2022, 10. [Google Scholar] [CrossRef]

- Pradhan, R.P.; Arvin, M.B.; Norman, N.R.; Bennett, S.E. Financial Depth, Internet Penetration Rates and Economic Growth: Country-Panel Evidence. Applied Economics 2016, 48, 331–343. [Google Scholar] [CrossRef]

- Asongu, S.A.; Odhiambo, N.M. Foreign Direct Investment, Information Technology and Economic Growth Dynamics in Sub-Saharan Africa. Telecommunications Policy 2020, 44, 101838. [Google Scholar] [CrossRef]

- Tao, Z.; Zhi, Z.; Shangkun, L. Digital Economy, Entrepreneurship, and High-Quality Economic Development: Empirical Evidence from Urban China. Front. Econ. China 2022, 17, 393–426. [Google Scholar] [CrossRef]

- Yunis, M.; Tarhini, A.; Kassar, A. The Role of ICT and Innovation in Enhancing Organizational Performance: The Catalysing Effect of Corporate Entrepreneurship. Journal of Business Research 2018, 88, 344–356. [Google Scholar] [CrossRef]

- Basu, S.; Fernald, J.G. Information and Communications Technology as a General Purpose Technology: Evidence from U.S. Industry Data.

- Bartel, A.; Ichniowski, C.; Shaw, K. How Does Information Technology Affect Productivity? Plant-Level Comparisons of Product Innovation, Process Improvement, and Worker Skills*. The Quarterly Journal of Economics 2007, 122, 1721–1758. [Google Scholar] [CrossRef]

- Wang, Y.; Han, P. Digital Transformation, Service-Oriented Manufacturing, and Total Factor Productivity: Evidence from A-Share Listed Companies in China. Sustainability 2023, 15, 9974. [Google Scholar] [CrossRef]

- Bresnahan, T.F.; Brynjolfsson, E.; Hitt, L.M. Information Technology, Workplace Organization, and the Demand for Skilled Labor: Firm-Level Evidence. The Quarterly Journal of Economics 2002, 117, 339–376. [Google Scholar] [CrossRef]

- Hall, B.H. The Financing of Research and Development. Oxford Review of Economic Policy 2002, 18, 35–51. [Google Scholar] [CrossRef]

- Cao, Y.; Chen, Z.; Lu, M.; Xu, Z.; Zhang, Y. Does FinTech Constrain Corporate Misbehavior? Evidence from Research and Development Manipulation. Emerging Markets Finance and Trade 2023, 59, 3129–3151. [Google Scholar] [CrossRef]

- Du, L.; Geng, B. Financial Technology and Financing Constraints. Finance Research Letters 2024, 60, 104841. [Google Scholar] [CrossRef]

- Kan, L.; Sun, R. Research on the Impact of Digital Finance on Innovation and R&D of Technology-Based SEMs —Moderating Role Based on Financial Flexibility. American Journal of Industrial and Business Management 2022, 12, 1650–1666. [Google Scholar] [CrossRef]

- Wang, J.-H.; Wu, Y.-H.; Yang, P.Y.; Hsu, H.-Y. Sustainable Innovation and Firm Performance Driven by FinTech Policies: Moderating Effect of Capital Adequacy Ratio. Sustainability 2023, 15, 8572. [Google Scholar] [CrossRef]

- Óskarsdóttir, M.; Bravo, C.; Sarraute, C.; Vanthienen, J.; Baesens, B. The Value of Big Data for Credit Scoring: Enhancing Financial Inclusion Using Mobile Phone Data and Social Network Analytics. Applied Soft Computing 2019, 74, 26–39. [Google Scholar] [CrossRef]

- Zhao, Y.; Wang, P. The Digital Economy, R&D Investments, and CO2 Emissions: Unraveling Reduction Potentials in China. Regional Science and Environmental Economics 2025, 2, 4. [Google Scholar] [CrossRef]

- Tapscott, D. The Digital Economy : Promise and Peril in the Age of Networked Intelligence; McGraw-Hill: New York, 1996; ISBN 978-0-07-062200-5. [Google Scholar]

- CAICT - (上数据)WHITE PAPER Available online:. Available online: https://www.caict.ac.cn/english/research/whitepapers/index_9.html (accessed on 30 April 2025).

- Yoon, S.-C. Servicization with Skill Premium in the Digital Economy. Journal of Korea Trade 2018, 22, 17–35. [Google Scholar] [CrossRef]

- Li, X.; Wu, Q. The Impact of Digital Economy on High-Quality Economic Development: Research Based on the Consumption Expansion. PLOS ONE 2023, 18, e0292925. [Google Scholar] [CrossRef] [PubMed]

- Ren, S.; Hao, Y.; Xu, L.; Wu, H.; Ba, N. Digitalization and Energy: How Does Internet Development Affect China’s Energy Consumption? Energy Economics 2021, 98, 105220. [Google Scholar] [CrossRef]

- Goldfarb, A.; Tucker, C. Digital Economics. Journal of Economic Literature 2019, 57, 3–43. [Google Scholar] [CrossRef]

- Lyu, Y.; Peng, Y.; Liu, H.; Hwang, J.-J. Impact of Digital Economy on the Provision Efficiency for Public Health Services: Empirical Study of 31 Provinces in China. Int J Environ Res Public Health 2022, 19, 5978. [Google Scholar] [CrossRef]

- Xiaoyan, D.; Jiangnan, Z.; Xuelian, G.; Ali, M. The Impact of Informatization on Agri-Income of China’s Rural Farmers: Ways for Digital Farming. Front. Sustain. Food Syst. 2024, 8. [Google Scholar] [CrossRef]

- Saveleva, N.A.; Erdakova, V.P.; Ugriumov, E.S.; Yudina, T.A. The Role of the Digital Economy in the Retail Sphere. In Proceedings of the Artificial Intelligence: Anthropogenic Nature vs. Social Origin; Popkova, E.G., Sergi, B.S., Eds.; Springer International Publishing: Cham, 2020; pp. 104–110. [Google Scholar]

- Jones, C.I.; Tonetti, C. Nonrivalry and the Economics of Data. American Economic Review 2020, 110, 2819–2858. [Google Scholar] [CrossRef]

- Mayo, J.W.; Wallsten, S. From Network Externalities to Broadband Growth Externalities: A Bridge Not yet Built. Rev Ind Organ 2011, 38, 173–190. [Google Scholar] [CrossRef]

- Tang, C.; Xu, Y.; Hao, Y.; Wu, H.; Xue, Y. What Is the Role of Telecommunications Infrastructure Construction in Green Technology Innovation? A Firm-Level Analysis for China. Energy Economics 2021, 103, 105576. [Google Scholar] [CrossRef]

- Forés, B.; Camisón, C. Does Incremental and Radical Innovation Performance Depend on Different Types of Knowledge Accumulation Capabilities and Organizational Size? Journal of Business Research 2016, 69, 831–848. [Google Scholar] [CrossRef]

- Yu, Y.; Xu, W. Impact of FDI and R&D on China’s Industrial CO2 Emissions Reduction and Trend Prediction. Atmospheric Pollution Research 2019, 10, 1627–1635. [Google Scholar] [CrossRef]

- Sun, J.; Wu, X. Research on the Mechanism and Countermeasures of Digital Economy Development Promoting Carbon Emission Reduction in Jiangxi Province. Environ. Res. Commun. 2023, 5, 035002. [Google Scholar] [CrossRef]

- Cheng, Y.; Zhang, Y.; Wang, J.; Jiang, J. The Impact of the Urban Digital Economy on China’s Carbon Intensity: Spatial Spillover and Mediating Effect. Resources, Conservation and Recycling 2023, 189, 106762. [Google Scholar] [CrossRef]

- Grennan, J.; Michaely, R. FinTechs and the Market for Financial Analysis 2020.

- Berger, A.N.; Udell, G.F. Collateral, Loan Quality and Bank Risk. Journal of Monetary Economics 1990, 25, 21–42. [Google Scholar] [CrossRef]

- Romito, S.; Vurro, C. Non-Financial Disclosure and Information Asymmetry: A Stakeholder View on US Listed Firms. Corporate Social Responsibility and Environmental Management 2021, 28, 595–605. [Google Scholar] [CrossRef]

- Brown, J.R.; Martinsson, G.; Petersen, B.C. Law, Stock Markets, and Innovation. The Journal of Finance 2013, 68, 1517–1549. [Google Scholar] [CrossRef]

- Catalini, C.; Gans, J.S. Initial Coin Offerings and the Value of Crypto Tokens 2019.

- Boot, A.; Hoffmann, P.; Laeven, L.; Ratnovski, L. Fintech: What’s Old, What’s New? Journal of Financial Stability 2021, 53, 100836. [Google Scholar] [CrossRef]

- Bollaert, H.; Lopez-de-Silanes, F.; Schwienbacher, A. Fintech and Access to Finance. Journal of Corporate Finance 2021, 68, 101941. [Google Scholar] [CrossRef]

- Berg, T.; Burg, V.; Gombović, A.; Puri, M. On the Rise of FinTechs: Credit Scoring Using Digital Footprints. The Review of Financial Studies 2020, 33, 2845–2897. [Google Scholar] [CrossRef]

- Cookson, J.A.; Niessner, M. Why Don’t We Agree? Evidence from a Social Network of Investors. The Journal of Finance 2020, 75, 173–228. [Google Scholar] [CrossRef]

- Gomber, P.; Kauffman, R.J.; Parker, C.; Weber, B.W. On the Fintech Revolution: Interpreting the Forces of Innovation, Disruption, and Transformation in Financial Services. Journal of Management Information Systems 2018, 35, 220–265. [Google Scholar] [CrossRef]

- Cheng, M.; Qu, Y. Does Bank FinTech Reduce Credit Risk? Evidence from China. Pacific-Basin Finance Journal 2020, 63, 101398. [Google Scholar] [CrossRef]

- Ashta, A.; Herrmann, H. Artificial Intelligence and Fintech: An Overview of Opportunities and Risks for Banking, Investments, and Microfinance. Strategic Change 2021, 30, 211–222. [Google Scholar] [CrossRef]

- Li, H.; Lu, Z.; Yin, Q. The Development of Fintech and SME Innovation: Empirical Evidence from China. Sustainability 2023, 15, 2541. [Google Scholar] [CrossRef]

- Pulse of Fintech H2’21.

- Chaudhry, S.M.; Ahmed, R.; Huynh, T.L.D.; Benjasak, C. Tail Risk and Systemic Risk of Finance and Technology (FinTech) Firms. Technological Forecasting and Social Change 2022, 174, 121191. [Google Scholar] [CrossRef]

- Schindler, J.W. Fintech and Financial Innovation: Drivers and Depth 2017.

- Chen, X.; Yan, D.; Chen, W. Can the Digital Economy Promote FinTech Development? Growth and Change 2022, 53, 221–247. [Google Scholar] [CrossRef]

- Oliveira, L.; Fleury, A.; Fleury, M.T. Digital Power: Value Chain Upgrading in an Age of Digitization. International Business Review 2021, 30, 101850. [Google Scholar] [CrossRef]

- Li, G.; Hou, Y.; Wu, A. Fourth Industrial Revolution: Technological Drivers, Impacts and Coping Methods. Chin. Geogr. Sci. 2017, 27, 626–637. [Google Scholar] [CrossRef]

- Wang, Z.; Peng, D.; Kong, Q.; Tan, F. Digital Infrastructure and Economic Growth: Evidence from Corporate Investment Efficiency. International Review of Economics & Finance 2025, 98, 103854. [Google Scholar] [CrossRef]

- Bu, Y.; Du, X.; Wang, Y.; Liu, S.; Tang, M.; Li, H. Digital Inclusive Finance: A Lever for SME Financing? International Review of Financial Analysis 2024, 93, 103115. [Google Scholar] [CrossRef]

- Bukht, R.; Heeks, R. Defining, Conceptualising and Measuring the Digital Economy 2017.

- Zhang, T.; Li, N. Measurement of the Scale and Development Trend of Digital Economy Core Industries in China’s Provinces. Procedia Computer Science 2024, 242, 1218–1225. [Google Scholar] [CrossRef]

- Kaiser, H.F. The Application of Electronic Computers to Factor Analysis. Educational and Psychological Measurement 1960, 20, 141–151. [Google Scholar] [CrossRef]

- Cortes, C.; Vapnik, V. Support-Vector Networks. Mach Learn 1995, 20, 273–297. [Google Scholar] [CrossRef]

- Svanberg, J.; Ardeshiri, T.; Samsten, I.; Öhman, P.; Neidermeyer, P. Prediction of Controversies and Estimation of ESG Performance: An Experimental Investigation Using Machine Learning. In Handbook of Big Data and Analytics in Accounting and Auditing; Rana, T., Svanberg, J., Öhman, P., Lowe, A., Eds.; Springer Nature: Singapore, 2023; pp. 65–87. ISBN 978-981-19-4460-4. [Google Scholar]

- Breiman, L. Random Forests. Machine Learning 2001, 45, 5–32. [Google Scholar] [CrossRef]

- Chen, T.; Guestrin, C. XGBoost: A Scalable Tree Boosting System. In Proceedings of the Proceedings of the 22nd ACM SIGKDD International Conference on Knowledge Discovery and Data Mining; Association for Computing Machinery: New York, NY, USA, 13 August 2016; pp. 785–794. [Google Scholar]

- Chen, Z.; Xing, R. Digital Economy, Green Innovation and High-Quality Economic Development. International Review of Economics & Finance 2025, 99, 104029. [Google Scholar] [CrossRef]

| Layer | Variable | Variable Abbreviation | Reason for Classification |

|---|---|---|---|

| Core Layer | IPv4 Address Count | ipv4_count | IPv4 addresses are fundamental to internet infrastructure, aligning with IT consulting and telecommunications. |

| Internet Domain Count | domain_count | Internet domains are essential for online services and software-driven activities. | |

| Broadband Internet Users | broadband_users | Broadband access is critical infrastructure for IT services, telecommunications, and digital operations. | |

| Internet Access Ports | access_ports | Internet access ports support foundational IT infrastructure and digital industrial content. | |

| Long-Distance Fiber Optic Cable Length per Unit Area | fiber_cable_density | Fiber optic cables are the backbone of telecommunications and digital industrial services. | |

| Mobile Base Station Density | mobile_base_density | Mobile base stations are critical infrastructure for telecommunications and IT services. | |

| IT Service Revenue as Percentage of GDP | it_service_gdp | IT services, including software development and consulting, are central to the core digital economy. | |

| Telecom Services Revenue as Percentage of GDP | telecom_gdp | Telecom services form a foundational part of the digital industrial content in the core layer. | |

| Broad Layer | E-commerce Revenue as Percentage of GDP | ecommerce_gdp | E-commerce aligns with the broad layer as a key component of digital trade and algorithmic economic activities. |

| Express Delivery Volume | delivery_volume | Express delivery supports the e-commerce ecosystem, which is part of the broad layer. | |

| Proportion of Enterprises Engaged in E-commerce | enterprise_ecommerce | E-commerce enterprise participation is part of the broad layer, supporting the digital trade economy. | |

| Narrow Layer | R&D Funding | rd_funding | R&D funding drives digital services, platform innovations, and advancements in the digital economy. |

| Number of Computers Used per 100 Employees | computer_usage | Computer usage supports the platform economy and digital services by enabling productivity tools and platforms. |

| Metric | Interpretation | Sensitivity to Outliers | Unit Dependence |

|---|---|---|---|

| RMSE | Penalizes large errors | High | Same as target variable |

| MAPE | Median percentage-based error | Moderate | Unitless |

| MAE | Average absolute error | Low | Same as target variable |

| Variable | Weight Type | Moran's Mean | Moran's P-Value | Moran's Significant Years | Moran's Total Years | Moran's Proportion Significant | Geary's Mean | Geary's P-Value | Geary's Significant Years | Geary's Total Years | Geary's Proportion Significant |

|---|---|---|---|---|---|---|---|---|---|---|---|

| access_ports | Binary | 0.211909 | 2.70E-02 | 8 | 8 | 1 | 0.792435 | 0.103647 | 1 | 8 | 0.125 |

| access_ports | Row-standardized | 0.095211 | 1.73E-01 | 0 | 8 | 0 | 0.943141 | 0.348676 | 0 | 8 | 0 |

| broadband_users | Binary | 0.226952 | 2.26E-02 | 8 | 8 | 1 | 0.778581 | 0.093397 | 1 | 8 | 0.125 |

| broadband_users | Row-standardized | 0.106632 | 1.57E-01 | 0 | 8 | 0 | 0.934157 | 0.330132 | 0 | 8 | 0 |

| computer_usage | Binary | 0.127828 | 7.62E-02 | 0 | 8 | 0 | 0.566018 | 0.028701 | 8 | 8 | 1 |

| computer_usage | Row-standardized | 0.141443 | 7.30E-02 | 1 | 8 | 0.125 | 0.695284 | 0.028113 | 8 | 8 | 1 |

| delivery_volume | Binary | 0.105563 | 1.09E-01 | 0 | 8 | 0 | 0.752825 | 0.157597 | 0 | 8 | 0 |

| delivery_volume | Row-standardized | 0.072743 | 1.93E-01 | 0 | 8 | 0 | 1.016883 | 0.537215 | 0 | 8 | 0 |

| domain_count | Binary | 0.017021 | 3.54E-01 | 0 | 8 | 0 | 0.788724 | 0.213897 | 1 | 8 | 0.125 |

| domain_count | Row-standardized | -0.03557 | 5.12E-01 | 0 | 8 | 0 | 0.975974 | 0.446764 | 0 | 8 | 0 |

| ecommerce_gdp | Binary | 0.064524 | 2.05E-01 | 1 | 8 | 0.125 | 0.590345 | 0.048219 | 5 | 8 | 0.625 |

| ecommerce_gdp | Row-standardized | 0.079589 | 1.93E-01 | 1 | 8 | 0.125 | 0.755151 | 0.078031 | 2 | 8 | 0.25 |

| enterprise_ecommerce | Binary | 0.227441 | 4.68E-02 | 5 | 8 | 0.625 | 0.564358 | 0.020763 | 6 | 8 | 0.75 |

| enterprise_ecommerce | Row-standardized | 0.264951 | 4.86E-02 | 5 | 8 | 0.625 | 0.640183 | 0.027061 | 6 | 8 | 0.75 |

| fiber_cable_density | Binary | 0.315709 | 1.11E-05 | 8 | 8 | 1 | 0.339695 | 0.019099 | 8 | 8 | 1 |

| fiber_cable_density | Row-standardized | 0.385109 | 5.96E-07 | 8 | 8 | 1 | 0.435242 | 0.00133 | 8 | 8 | 1 |

| ipv4_count | Binary | 0.085914 | 1.93E-01 | 2 | 8 | 0.25 | 0.635364 | 0.095414 | 2 | 8 | 0.25 |

| ipv4_count | Row-standardized | 0.043446 | 3.34E-01 | 2 | 8 | 0.25 | 0.885228 | 0.260824 | 0 | 8 | 0 |

| it_service_gdp | Binary | 0.096039 | 1.50E-01 | 3 | 8 | 0.375 | 0.619787 | 0.066267 | 3 | 8 | 0.375 |

| it_service_gdp | Row-standardized | 0.141866 | 1.23E-01 | 3 | 8 | 0.375 | 0.722599 | 0.072284 | 4 | 8 | 0.5 |

| mobile_base_density | Binary | 0.222615 | 4.16E-03 | 8 | 8 | 1 | 0.41174 | 0.017976 | 8 | 8 | 1 |

| mobile_base_density | Row-standardized | 0.280395 | 1.11E-03 | 8 | 8 | 1 | 0.532612 | 0.003765 | 8 | 8 | 1 |

| patents | Binary | 0.217555 | 2.51E-02 | 7 | 8 | 0.875 | 0.736945 | 0.136887 | 1 | 8 | 0.125 |

| patents | Row-standardized | 0.141918 | 1.06E-01 | 3 | 8 | 0.375 | 0.974252 | 0.445514 | 0 | 8 | 0 |

| rd_funding | Binary | 0.27263 | 5.11E-03 | 8 | 8 | 1 | 0.744202 | 0.104182 | 0 | 8 | 0 |

| rd_funding | Row-standardized | 0.199609 | 3.31E-02 | 8 | 8 | 1 | 0.869696 | 0.196437 | 0 | 8 | 0 |

| telecom_gdp | Binary | 0.412085 | 9.78E-04 | 8 | 8 | 1 | 0.512501 | 0.002287 | 8 | 8 | 1 |

| telecom_gdp | Row-standardized | 0.417459 | 1.41E-03 | 8 | 8 | 1 | 0.532877 | 0.00165 | 8 | 8 | 1 |

| Model | Tuning Applied | Base Models | Meta-Learner | Hyperparameters (Tuned / Applied) |

|---|---|---|---|---|

| XGBoost | Default | N/A | N/A | n_estimators=100, max_depth=6, learning_rate=0.1, subsample=1, colsample_bytree=1, objective='reg:squarederror' |

| Random Forest | Default | N/A | N/A | n_estimators=100, max_depth=6, random_state=42 |

| SVM | Tuned | N/A | N/A | kernel='rbf'; GridSearchCV tuning for C, gamma |

| Meta-Model (XGBoost) | Tuned | N/A | N/A | GridSearchCV tuning for learning_rate, n_estimators, max_depth, subsample, colsample_bytree |

| Stacked Model (Full Ensemble) | N/A | XGBoost, RF, SVM, ELM | XGBoost | |

| XGBoost: objective='reg:squarederror', n_estimators=100, max_depth=6 | ||||

| RF: n_estimators=100, max_depth=6, random_state=42 | ||||

| SVM: kernel='rbf' | ||||

| ELM: n_hidden=1000 | ||||

| Stacked Model (RF + XGBoost) | N/A | XGBoost, RF | Linear Regression | |

| XGBoost: booster='gbtree', learning_rate=0.2, n_estimators=300, max_depth=6, subsample=0.8, colsample_bytree=1.0, objective='reg:squarederror' | ||||

| RF: n_estimators=300, max_depth=6, min_samples_split=2, min_samples_leaf=1, random_state=42 | ||||

| Model | Sample Size | RMSE | MAE | MdAPE (%) | R² | t-Value | p-Value |

|---|---|---|---|---|---|---|---|

| Random Forest - Training | 136 | 0.0194 | 0.01 | 10.28 | 0.9838 | 0.3392 | 0.735 |

| Random Forest - Testing | 59 | 0.0449 | 0.0212 | 18.9 | 0.9309 | 0.1251 | 0.9008 |

| XGBoost - Training | 136 | 0.0006 | 0.0004 | 0.56 | 1 | 0 | 1 |

| XGBoost - Testing | 59 | 0.0253 | 0.0136 | 16.84 | 0.978 | 0.6143 | 0.5414 |

| SVM - Training | 136 | 0.0088 | 0.0076 | 12.3 | 0.9966 | 0.0574 | 0.9543 |

| SVM - Testing | 59 | 0.0381 | 0.0223 | 36.01 | 0.9501 | 0.1805 | 0.8574 |

| ELM - Training | 136 | 0.0249 | 0.0194 | 33.42 | 0.9683 | -0.0002 | 0.9999 |

| ELM - Testing | 59 | 0.0304 | 0.0214 | 39.56 | 0.973 | -0.2136 | 0.8316 |

| XGBoost - Training (CV) | 136 | 0.0005 | 0.0004 | 0.64 | 1 | -0.0008 | 0.9994 |

| XGBoost - Testing (CV) | 59 | 0.0297 | 0.0151 | 17.65 | 0.9698 | -0.1971 | 0.8444 |

| XGBoost-RF Stacked Model - Training | 136 | 0.0127 | 0.0067 | 5.41 | 0.993 | 0.4404 | 0.6603 |

| XGBoost-RF Stacked Model - Testing | 59 | 0.0247 | 0.0137 | 17.62 | 0.9791 | 0.0171 | 0.9864 |

| 4-Model Stacked - Training | 136 | 0.0007 | 0.0005 | 0.6538 | 1 | 0 | 1 |

| 4-Model Stacked - Testing | 59 | 0.0299 | 0.0146 | 18.7018 | 0.9694 | 1.5252 | 0.1327 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).