Submitted:

19 April 2025

Posted:

21 April 2025

You are already at the latest version

Abstract

Keywords:

I. Introduction

II. Literature Review

2.1. Literature Review on Climate Risk Research

2.2. Literature Review on Economic Resilience Research

III. Theoretical Analysis and Research Hypotheses

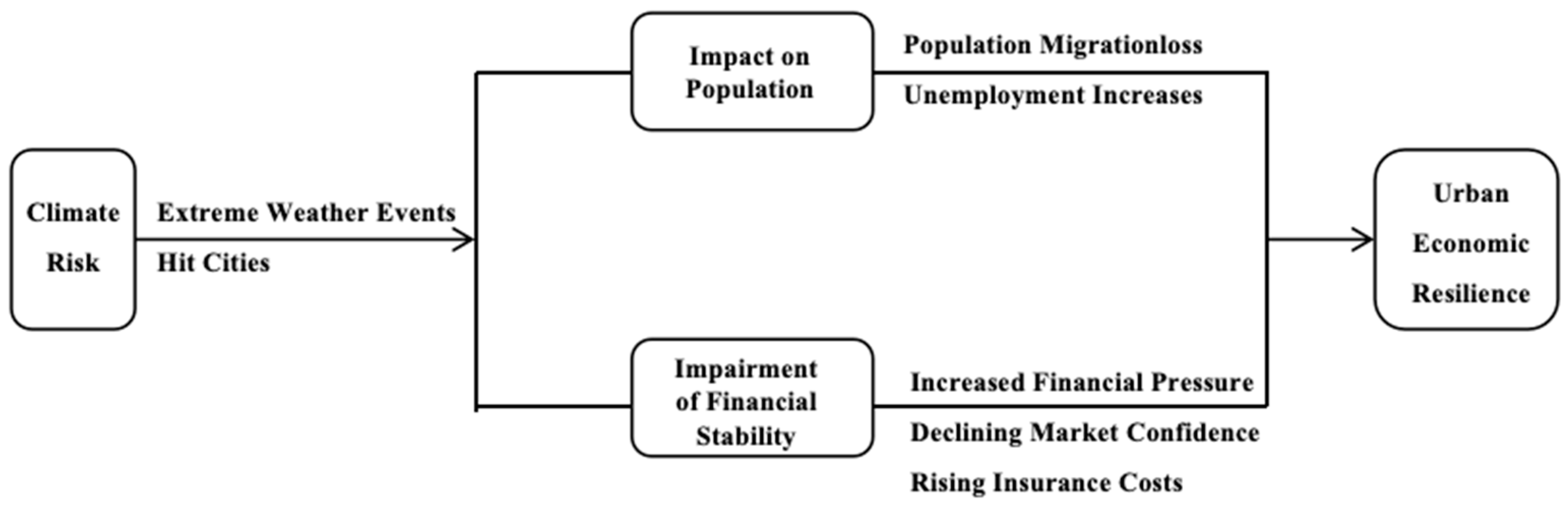

3.1. Direct Impact Mechanisms of Climate Risks on Urban Economic Resilience

3.2. Pathways of Climate Risk Impact on Urban Economic Resilience

3.3. Spatial Spillover Effects of the Negative Impact of Climate Risks on Urban Economic Resilience

IV. Research Design

4.1. Sample Selection and Data Sources

4.2. Variable Measurement

- a.

- Explanatory Variable: Climate Risk Index (CRI)

- b.

- Dependent Variable: Urban Economic Resilience Index (UERI)

- c.

- Mediating Variables

- d.

- Control Variables

4.3. Econometric Model Specification

- a.

- Baseline Regression Model

- b.

- Mediation Mechanism Model

- c.

- Spatial Durbin Model (SDM)

V. Empirical Analysis

5.1. Baseline Regression Analysis

5.2. Robustness Tests

5.3. Endogeneity Treatment

5.4. Mechanism Analysis

5.5. Analysis of Spatial Spillover Effects

5.6. Heterogeneous Effects of Climate Risk on Urban Economic Resilience

VI. Discussion

VII. Conclusions and Policy Implications

7.1. Conclusion

7.2. Policy Implications

- a.

- Increase investment in climate-adaptive infrastructure to enhance the city’s ability to respond to climate risks.

- b.

- Promote the diversification of urban economic structures to enhance urban economic resilience.

- c.

- Establish cross-regional cooperation mechanisms to enhance the synergistic effect of climate risk management.

References

- Abe, M.; Ye, L. Building resilient supply chains against natural disasters: The cases of Japan and Thailand. Global Business Review 2013, 14, 567–586. [Google Scholar] [CrossRef]

- Abid, N.; Ahmad, F.; Aftab, J.; et al. A blessing or a burden? Assessing the impact of climate change mitigation efforts in Europe using quantile regression models. Energy Policy 2023, 178, 113589. [Google Scholar] [CrossRef]

- Anh, D.L.T.; Anh, N.T.; Chandio, A.A. Climate change and its impacts on Vietnam agriculture: A macroeconomic perspective. Ecological Informatics 2023, 73, 101960. [Google Scholar] [CrossRef]

- Briguglio, L.; Cordina, G.; Farrugia, N.; Vella, S. Economic vulnerability and resilience: Concepts and measurements. Oxford Development Studies 2009, 37, 229–247. [Google Scholar] [CrossRef]

- Butsch, C.; Beckers, L.M.; Nilson, E.; et al. Health impacts of extreme weather events – Cascading risks in a changing climate. Journal of Health Monitoring 2023, 8 (Suppl 4). [Google Scholar] [CrossRef]

- Campiglio, E.; Daumas, L.; Monnin, P.; et al. Climate-related risks in financial assets. Journal of Economic Surveys 2023, 37, 950–992. [Google Scholar] [CrossRef]

- Carleton, T.A.; Hsiang, S.M. Social and economic impacts of climate. Science 2016, 353, aad9837. [Google Scholar] [CrossRef]

- Ding, Y.J.; Li, C.Y.; Xiaoming, W.; Wang, Y. An overview of climate change impacts on society in China. Advances in Climate Change Research 2021, 12, 123–134. [Google Scholar] [CrossRef]

- Dutta, A.; Bouri, E.; Rothovius, T.; Uddin, G.S. Climate risk and green investments: New evidence. Energy (Oxford) 2023, 265, 126376. [Google Scholar] [CrossRef]

- Elhorst, J.P. Matlab software for spatial panels. International Regional Science Review 2014, 37, 389–405. [Google Scholar] [CrossRef]

- Gao, H. Urban population size and labor income. The Journal of World Economy 2014, 145–164. [Google Scholar] [CrossRef]

- Guo, K.; Ji, Q.; Zhang, D. A dataset to measure global climate physical risk. Data in Brief 2024, 54, 110502–110502. [Google Scholar] [CrossRef]

- Hu, Z.; Borjigin, S. The amplifying role of geopolitical risks, economic policy uncertainty, and climate risks on energy-stock market volatility spillover across economic cycles. The North American Journal of Economics and Finance 2024, 71, 102114. [Google Scholar] [CrossRef]

- Jiang, T. Mediating effects and moderating effects in causal inference. China Industrial Economics 2022, 5, r120. [Google Scholar] [CrossRef]

- Jiang, Z.; Liu, Q.; Song, J. Pattern characteristics and evolution mechanism of China’s regional economic resilience. Economic Geography 2023, 43, 1–12. [Google Scholar] [CrossRef]

- Kashi, S.M.H.; Farrokhzadeh, S.; Baharvandi, S.; Zolfani, S.H. Effects of extreme weather events and climate change on cities’ livability. Cities 2024, 151, 105114. [Google Scholar] [CrossRef]

- Li, N. Measuring the combining effects of financial stability and climate risk for green economic recovery. Economic Change and Restructuring 2023, 56, 1225–1241. [Google Scholar] [CrossRef]

- Lim, C.H.; Ryu, J.; Choi, Y.; Jeon, S.W.; Lee, W.K. Understanding global PM2.5 concentrations and their drivers in recent decades (1998–2016). Environment International 2020, 144, 106011. [Google Scholar] [CrossRef]

- Lin, B.; Wu, N. Climate risk disclosure and stock price crash risk: The case of China. International Review of Economics & Finance 2023, 83, 21–34. [Google Scholar] [CrossRef]

- Liu, J.; Huang, X.; Chen, J. High-speed rail and high-quality development of urban economy: An empirical study based on the data of prefecture-level cities. Contemporary Finance & Economics 2021, 14–26. [Google Scholar] [CrossRef]

- Liu, L.; Meng, Y.; Wu, D.; et al. Impact of haze pollution and human capital on economic resilience: Evidence from prefecture-level cities in China. Environmental Development and Sustainability 2023, 25, 13429–13449. [Google Scholar] [CrossRef]

- Liu, X.; Zhang, X.; Li, S. Measurement of China’s macroeconomic resilience – A systemic risk-based perspective. China Social Science 2021, 12–32+204.

- Löscher, A.; Kaltenbrunner, A. Climate change and macroeconomic policy space in developing and emerging economies. Journal of Post Keynesian Economics 2022, 46, 113–141. [Google Scholar] [CrossRef]

- Ma, J.; Caldecott, B.; Volz, U. Case studies of environmental risk analysis methodologies. Environmental Risk Analysis Review 2020. [Google Scholar] [CrossRef]

- Martin, R.; Sunley, P.; Gardiner, B.; Tyler, P. How regions react to recessions: Resilience and the role of economic structure. Regional Studies 2016, 50, 561–585. [Google Scholar] [CrossRef]

- Nyarko, I.K. The impact of natural disasters on international trade: The potential effects of April 2024 Dubai floods on Ghana’s economy. Business, Management and Economics: Research Progress 2024, 4, 64–86. [Google Scholar] [CrossRef]

- Parrado, R.; Bosello, F.; Delpiazzo, E.; et al. Fiscal effects and the potential implications on economic growth of sea-level rise impacts and coastal zone protection. Climatic Change 2020, 160, 283–302. [Google Scholar] [CrossRef]

- Perera, A.T.D.; Hong, T. Vulnerability and resilience of urban energy ecosystems to extreme climate events: A systematic review and perspectives. Renewable and Sustainable Energy Reviews 2023, 173, 113038. [Google Scholar] [CrossRef]

- Salimi, M.; Al-Ghamdi, S.G. Climate change impacts on critical urban infrastructure and urban resiliency strategies for the Middle East. Sustainable Cities and Society 2020, 54, 101948. [Google Scholar] [CrossRef]

- Sun, J.; Sun, X. Progress of regional economic resilience research and exploration of its application in China. Economic Geography 2017, 37, 1–9. [Google Scholar] [CrossRef]

- Tran, N.; Uzmanoglu, C. Climate risk and credit ratings. Journal of Financial Research 2024. [Google Scholar] [CrossRef]

- Wang, X.; Li, M. Determinants of regional economic resilience to economic crisis: Evidence from Chinese economies. Sustainability 2022, 14, 809. [Google Scholar] [CrossRef]

- Wang, Y.; Zhou, B.; Ren, Y.; Sun, C. Impacts of global climate change on China’s climate security. Journal of Applied Meteorological Science 2016, 27, 750–758. [Google Scholar] [CrossRef]

- Wang, Z.; Wei, W. Regional economic resilience in China: Measurement and determinants. Regional Studies 2021, 55, 1228–1239. [Google Scholar] [CrossRef]

- Wen, Q.; Feng, J.; Wei, X.; Yang, Y.; Haq, S. ul. Climate change resilience: Cultural insights from diverse Chinese communities and environmental implications. Polish Journal of Environmental Studies 2024. [Google Scholar] [CrossRef]

- Wenz, L.; Willner, S.N. Climate impacts and global supply chains: An overview. Handbook on Trade Policy and Climate Change 2022, 290–316. [Google Scholar] [CrossRef]

- West, C.D.; Stokeld, E.; Campiglio, E.; Croft, S.; Detges, A.; Duranovic, A.; et al. Europe’s cross-border trade, human security and financial connections: A climate risk perspective. Climate Risk Management 2021, 34, 100382. [Google Scholar] [CrossRef]

- Wu, Z.; Sun, S.; Zhang, S.; et al. Assessment of climate resilience of cities in the Yellow River Basin and countermeasures to improve it. Land Resources Science and Technology Management 2024, 41, 62–74. [Google Scholar] [CrossRef]

- Xu, Y.; Zhang, L. The economic resilience and origin of Chinese cities: The perspective of industrial structure diversification. Finance and Trade Economy 2019, 40, 110–126. [Google Scholar] [CrossRef]

- Xie, J.; Zheng, Y.; Dong, Q. The digital and intelligent construction of supply chains enables the new quality productive forces of manufacturing enterprises: A quasi-natural experiment based on the construction of supply-chain innovation and application pilot cities. Journal of Shanghai University of Finance and Economics 2024, 26, 15–29. [Google Scholar] [CrossRef]

- Xie, M.; Feng, Z.; Li, C. How does population shrinkage affect economic resilience? A case study of resource-based cities in Northeast China. Sustainability 2022, 14, 3650. [Google Scholar] [CrossRef]

- Yu, Z.; Li, Y.; Dai, L. Digital finance and regional economic resilience: Theoretical framework and empirical test. Finance Research Letters 2023, 55, 103920. [Google Scholar] [CrossRef]

- Zhang, L.; Xu, M.; Chen, H.; et al. Globalization, green economy and environmental challenges: State-of-the-art review for practical implications. Frontiers in Environmental Science 2022, 10, 870271. [Google Scholar] [CrossRef]

- Zhang, Y.; Deng, S.; Zhang, Y. Research on urban economic resilience: Theoretical progress and future direction. Journal of Management 2022, 54–67. [Google Scholar] [CrossRef]

- Zhao, R.; Li, X.; Wang, Y.; et al. Assessing resilience of sustainability to climate change in China’s cities. Science of The Total Environment 2023, 898, 165568. [Google Scholar] [CrossRef]

- Zhou, C.; Tao, Y.; Wang, W. Can green finance promote urban economic resilience? Collected Essays on Finance and Economics 2024, 40, 70–80. [Google Scholar] [CrossRef]

- Zhou, Q.; Zhu, M.; Qiao, Y.; Zhang, X.; Chen, J. Achieving resilience through smart cities? Evidence from China. Habitat International 2021, 111, 102348. [Google Scholar] [CrossRef]

| Climate Risk Index (CRI) | Sub-indicators | Explanation |

| LTD | The number of extreme low-temperature days | |

| HTD | The number of extreme high-temperature days | |

| ERD | The number of extreme rainfall days | |

| EDD | The number of extreme drought days |

| Dimension and Weight | Indicator Explanation and Units | Nature |

| Resistance and Recovery Capacity (0.178) | Per capita GDP (10,000 yuan) 0.278 | + |

| Per capita disposable income of urban residents (10,000 yuan) 0.126 | + | |

| Household savings deposits (10,000 yuan) 0.401 | + | |

| Average employee wage (yuan) 0.194 | + | |

| Adaptive and Adjustment Capacity (0.445) | Fixed asset investment (10,000 yuan) 0.421 | + |

| Local fiscal expenditure (10,000 yuan) 0.554 | + | |

| Balance of loans and deposits in RMB from financial institution 0.025 | + | |

| Innovation and Transformation Capacity(0.377) | Total number of enterprises above designated size 0.164 | + |

| Education investment (10,000 yuan) 0.272 | + | |

| Science and technology investment (10,000 yuan) 0.541 | + | |

| Urbanization rate 0.023 | + |

| Variable Category | Variable Name | Abbreviation | Variable Description |

| Explanatory Variable | Climate Risk Index | CRI | A composite index derived from the standardized indices of LTD (Extreme Low Temperature Days), HTD (Extreme High Temperature Days), ERD (Extreme Rainfall Days), and EDD (Extreme Drought Days). |

| Dependent Variable | Urban Economic Resilience Index | UERI | Measured using three dimensions: resistance and recovery capacity, adaptive and adjustment capacity, and innovation and transformation capacity, with 11 secondary indicators. |

| Resistance and Recovery Capacity | Rel | Calculated using entropy weighting based on indicators such as per capita GDP and per capita disposable income of urban residents. | |

| Adaptive and Adjustment Capacity | Ada | Calculated using entropy weighting based on indicators like fixed asset investment and local fiscal expenditure. | |

| Innovation and Transformation Capacity | Enpu | Calculated using entropy weighting based on indicators like the total number of large-scale enterprises and fiscal education expenditure in the region. | |

| Mediating Variable | Urban Population Size | Psize | Logarithmic value of the total urban population at the end of the year. |

| Urban Financial Stability | Fin | Ratio of year-end loan balances of financial institutions to regional GDP. | |

| Control Variable | Urban Entrepreneurship Activity | Live | Ratio of the number of private and individual employees in urban areas to the urban population. |

| Urban Facility Development Level | Fund | Per capita road area. | |

| Urban Economic Density | Den | Ratio of regional GDP to urban land area. | |

| Urban Foreign Investment Dependence | Export | Proportion of actual foreign investment in GDP for the city that year. | |

| Urban Human Capital Level | Hr | Ratio of regular college and university students to the permanent urban population. |

| Variable | N | Mean | Sd | Min | Med | Max |

| CRI | 2212 | 0.097 | 0.0947 | 0.0118 | 0.07 | 0.9878 |

| UERI | 2212 | 3.3189 | 0.2408 | 0.2928 | 3.3295 | 4.472 |

| Rel | 2212 | 0.1415 | 0.0816 | 0.016 | 0.1209 | 0.6951 |

| Ada | 2212 | 0.0697 | 0.082 | 0.0048 | 0.0447 | 0.726 |

| Enpu | 2212 | 0.0419 | 0.0657 | 0.0025 | 0.0234 | 0.7941 |

| Live | 2212 | 0.1239 | 0.126 | -0.0231 | 0.0899 | 13,099 |

| Fund | 2212 | 2.5051 | 0.6786 | 0 | 2.5779 | 4.112 |

| Den | 2212 | 0.0403 | 0.0377 | 0.001 | 0.0289 | 0.2712 |

| Export | 2212 | 0.0171 | 0.0182 | 0 | 0.0116 | 0.1361 |

| Hr | 2212 | 0.0188 | 0.0189 | 0.0003 | 0.0122 | 0.1131 |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

| CRI | Rel | Ada | Enpu | CRI | Rel | Ada | Enpu | |

| UERI | -0.6010** | -0.5600 | -0.4552* | -0.3734** | -0.5755** | -0.5191 | -0.4408* | -0.3604** |

| (0.3025) | (0.4156) | (0.2592) | (0.1838) | (0.2546) | (0.3906) | (0.2250) | (0.1484) | |

| Live | 0.1342*** | 0.1232*** | 0.0946*** | 0.0935*** | ||||

| (0.0343) | (0.0281) | (0.0250) | (0.0286) | |||||

| Fund | 0.0078* | 0.0059* | 0.0049 | 0.0069** | ||||

| (0.0042) | (0.0036) | (0.0036) | (0.0031) | |||||

| Den | 0.2519 | 0.0787 | 0.1838 | 0.2497 | ||||

| (0.2413) | (0.2058) | (0.1777) | (0.1955) | |||||

| Export | 0.0430 | -0.1426* | 0.1281 | 0.0015 | ||||

| (0.1107) | (0.0860) | (0.1034) | (0.0853) | |||||

| Hr | 0.0712 | 0.0586 | 0.0992 | -0.0103 | ||||

| (0.3061) | (0.2771) | (0.2542) | (0.2267) | |||||

| City fe | YES | YES | YES | YES | YES | YES | YES | YES |

| Year fe | YES | YES | YES | YES | YES | YES | YES | YES |

| _cons | 0.1170*** | 0.1601*** | 0.0848*** | 0.0543*** | 0.0676*** | 0.1268*** | 0.0488*** | 0.0151 |

| (0.0100) | (0.0138) | (0.0086) | (0.0061) | (0.0187) | (0.0211) | (0.0147) | (0.0141) | |

| R² | 0.9115 | 0.9194 | 0.9161 | 0.8828 | 0.9224 | 0.9318 | 0.9234 | 0.8942 |

| F | 3.9470** | 1.8151 | 3.0849* | 4.1292** | 3.3194*** | 4.9553*** | 3.0265*** | 2.5643** |

| N | 2212 | 2212 | 2212 | 2212 | 2212 | 2212 | 2212 | 2212 |

| Modification of Dependent Variables | High-dimensional Fixed Effects | Lagged Explanatory Variables | Subsample Regression (Excluding COVID-19) | |

| (1) | (2) | (3) | (4) | |

| CRI | CRI | CRI | CRI | |

| UERI | -1.0213** | -0.5413** | -0.8239*** | -0.6597* |

| (0.4538) | (0.2701) | (0.2673) | (0.3344) | |

| Live | -0.0077 | 0.1334*** | 0.1473*** | 0.1749*** |

| (0.0113) | (0.0335) | (0.0352) | (0.0383) | |

| Fund | 0.0011 | 0.0076* | 0.0082* | 0.0065 |

| (0.0032) | (0.0041) | (0.0047) | (0.0043) | |

| Den | -0.0569 | 0.2706 | 0.2287 | 0.0802 |

| (0.0999) | (0.2421) | (0.2425) | (0.2299) | |

| Export | 0.0263 | 0.0460 | 0.0522 | 0.0854 |

| (0.0512) | (0.1092) | (0.1006) | (0.0860) | |

| Hr | 0.1564 | 0.0432 | -0.0340 | -0.3022 |

| (0.2367) | (0.3077) | (0.3141) | (0.3843) | |

| _cons | 0.3624*** | 1.6423 | 0.0801*** | 0.0741*** |

| (0.0173) | (2.2754) | (0.0196) | (0.0184) | |

| City fe | YES | YES | YES | YES |

| Year fe | YES | YES | YES | YES |

| Pro-Year fe | NO | YES | NO | NO |

| R² | 0.8952 | 0.9226 | 0.9360 | 0.9280 |

| F | 0.9047 | 2.9178*** | 3.6837*** | 3.5942*** |

| N | 2212 | 2212 | 2054 | 1738 |

| Instrumental Variables | Heckman | ||

| (1) | (2) | (3) | |

| UERI | CRI | CRI | |

| PM2.5 | 0.003** | ||

| (0.001) | |||

| UERI | -0.773** | -0.597** | |

| (0.302) | (0.254) | ||

| IMR | 1.735** | ||

| (0.725) | |||

| Live | -0.130 | 0.107 | 0.742*** |

| (0.133) | (0.118) | (0.263) | |

| Fund | 0.019 | 0.025 | -0.063** |

| (0.027) | (0.019) | (0.029) | |

| Den | -2.549** | -1.462 | 2.130** |

| (1.212) | (1.003) | (0.840) | |

| Export | -0.148 | -0.148 | 4.644** |

| (0.600) | (0.448) | (1.921) | |

| Hr | 0.259 | 0.721 | -2.096** |

| (2.395) | (1.802) | (0.9881) | |

| -1.841** | |||

| _cons | (0.800) | ||

| City fe | YES | YES | YES |

| Year fe | YES | YES | YES |

| Cragg-Donald Wald F statistic | 10.610 | ||

| Kleibergen-Paap rk LM statistic | 6.623[0.011] | ||

| R² | -2.342 | ||

| F | 2.6305** | ||

| N | 1896 | 1896 | |

| (1) | (2) | |

| Psize | Fin | |

| UERI | -0.0475** | -0.1290*** |

| (0.0183) | (0.0375) | |

| Live | -0.0979 | 0.1447 |

| (0.0961) | (0.1390) | |

| Fund | 0.0165 | -0.0069 |

| (0.0224) | (0.0289) | |

| Den | -0.8592 | 0.9278 |

| (0.9225) | (1.2871) | |

| Export | 0.0209 | 1.2637 |

| (0.3638) | (0.9651) | |

| Hr | -1.0430 | -2.0901 |

| (1.4326) | (3.3169) | |

| _cons | 6.2160*** | 6.7928*** |

| (0.0892) | (0.1670) | |

| City fe | YES | YES |

| Year fe | YES | YES |

| R² | 0.9149 | 0.7515 |

| F | 1.5622 | 2.2147** |

| N | 2212 | 2212 |

| Adjacency | Geography | Economy | |

| (1) | (2) | (3) | |

| CRI | CRI | CRI | |

| UERI | -0.0381*** | -0.0338*** | -0.0363*** |

| (0.0112) | (0.0118) | (0.0126) | |

| Live | 0.3854*** | 0.4021*** | 0.4654*** |

| (0.0400) | (0.0389) | (0.0402) | |

| Fund | 0.0671*** | 0.0677*** | 0.0625*** |

| (0.0113) | (0.0113) | (0.0116) | |

| Den | 1.2401* | 1.4050** | 2.6545*** |

| (0.7054) | (0.7119) | (0.8102) | |

| Export | 0.4033 | 0.7513** | 0.9348*** |

| (0.3274) | (0.3255) | (0.3432) | |

| Hr | -3.7883*** | -3.5612*** | -1.3852 |

| (1.1304) | (1.2308) | (1.2568) | |

| _cons | -0.3300*** | -0.8437*** | -0.3927*** |

| (0.1150) | (0.2286) | (0.1310) | |

| Spatialrho | -0.1983***(0.0701) | -0.6901***(0.1720) | 0.0672(0.0914) |

| Variancelgt_theta | -2.1955***(0.1692) | -2.2189***(0.1690) | -2.4526***(0.1602) |

| sigma2_e | 0.0012*** | 0.0012*** | 0.0013*** |

| (0.0001) | (0.0001) | (0.0001) | |

| LR_Direct | -0.0387*** | -0.0342*** | -0.0358*** |

| (0.0120) | (0.0127) | (0.0129) | |

| LR_Indirect | 0.0196(0.0153) | 0.0185(0.0161) | 0.0099(0.0192) |

| LR_Total | -0.0192(0.0128) | -0.0158(0.0102) | -0.0259(0.0166) |

| Log-likelihood | 715.9163 | 715.2686 | 694.7808 |

| R² | 0.6422 | 0.6470 | 0.3545 |

| Eastern | Central | Western | Core Cities | Non-Core Cities | |

| (1) | (2) | (3) | (4) | (5) | |

| CRI | CRI | CRI | CRI | CRI | |

| UERI | -1.2807*** | -0.1585 | -0.8773 | -2.4546** | -0.5044** |

| (0.4239) | (0.4328) | (0.8129) | (1.0169) | (0.2406) | |

| Live | 0.2022*** | 0.0597 | 0.0971*** | 0.1012 | 0.0701*** |

| (0.0638) | (0.0402) | (0.0345) | (0.0793) | (0.0179) | |

| Fund | 0.0214 | 0.0004 | 0.0094 | 0.0519* | 0.0032 |

| (0.0159) | (0.0051) | (0.0066) | (0.0289) | (0.0023) | |

| Den | -0.7792 | 0.0597 | 2.0551 | -3.1238 | 0.0079 |

| (0.9874) | (0.0731) | (2.0809) | (2.9879) | (0.1984) | |

| Export | 0.2025 | -0.1114 | 0.0796 | 0.9971** | -0.0676 |

| (0.1435) | (0.1585) | (0.2414) | (0.4287) | (0.0788) | |

| Hr | 1.4104 | -0.0366 | -0.0055 | -2.9439 | 0.1252 |

| (1.4252) | (0.6772) | (0.3717) | (2.5310) | (0.2294) | |

| _cons | 0.0860 | 0.0803*** | 0.0034 | 0.4215* | 0.0737*** |

| (0.0817) | (0.0226) | (0.0683) | (0.2018) | (0.0139) | |

| City fe | YES | YES | YES | YES | YES |

| Year fe | YES | YES | YES | YES | YES |

| R² | 0.9361 | 0.8780 | 0.9246 | 0.9255 | 0.9182 |

| F | 4.7442*** | 0.9173 | 3.0807** | 2.7126** | 5.1944*** |

| N | 728 | 676 | 617 | 234 | 1787 |

| Provincial Capitals | Non-Provincial Capitals | Resource Cities | Non-Resource Cities | |

| (1) | (2) | (3) | (4) | |

| CRI | CRI | CRI | CRI | |

| UERI | -1.8574* | -0.7281*** | -0.4482** | -0.6969* |

| (0.8928) | (0.2711) | (0.2073) | (0.3707) | |

| Live | 0.0579 | 0.1395*** | 0.0492** | 0.1825*** |

| (0.0668) | (0.0406) | (0.0198) | (0.0460) | |

| Fund | 0.0241* | 0.0083* | 0.0048** | 0.0168* |

| (0.0131) | (0.0049) | (0.0020) | (0.0099) | |

| Den | 1.1259 | 0.0976 | 0.2119*** | 0.6547 |

| (2.9158) | (0.1853) | (0.0312) | (1.3253) | |

| Export | -0.5324 | 0.1329 | 0.0024 | 0.0951 |

| (0.4431) | (0.0900) | (0.1166) | (0.1340) | |

| Hr | -0.9309 | -0.2721 | 0.3892 | -0.2992 |

| (0.9737) | (0.2869) | (0.2401) | (0.4861) | |

| _cons | 0.1471 | 0.0708*** | 0.0525*** | 0.0419 |

| (0.1818) | (0.0182) | (0.0087) | (0.0709) | |

| City fe | YES | YES | YES | YES |

| Year fe | YES | YES | YES | YES |

| R² | 0.8912 | 0.9309 | 0.9241 | 0.9276 |

| F | 1.4728 | 2.7382** | 12.4263*** | 2.7906** |

| N | 273 | 1748 | 784 | 1326 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).