2.1. Interval Analysis Background

Many relations and operations defined on sets or pairs of real numbers can be extended to operations on intervals. Let

and

be interval numbers as formalized in [

17,

18] and widely used in applications under uncertainty.”. Interval numbers are used to represent imprecise data, where only the lower and upper bounds are available [

1,

12].

Definition 1. The equality between interval numbers is defined as follows:

Definition 2. The median of the interval number

is defined by:

Definition 3. The

product between the real number a and the interval number is defined by:

Let and be interval numbers.

Definition 4. The summation between two interval numbers is defined by:

.

Definition 5. The subtraction between two interval numbers is defined as follows:

.

Definition 6. The product between two interval numbers is defined by:

.

Definition 7. The inverse of the interval number

is defined by:

, if .

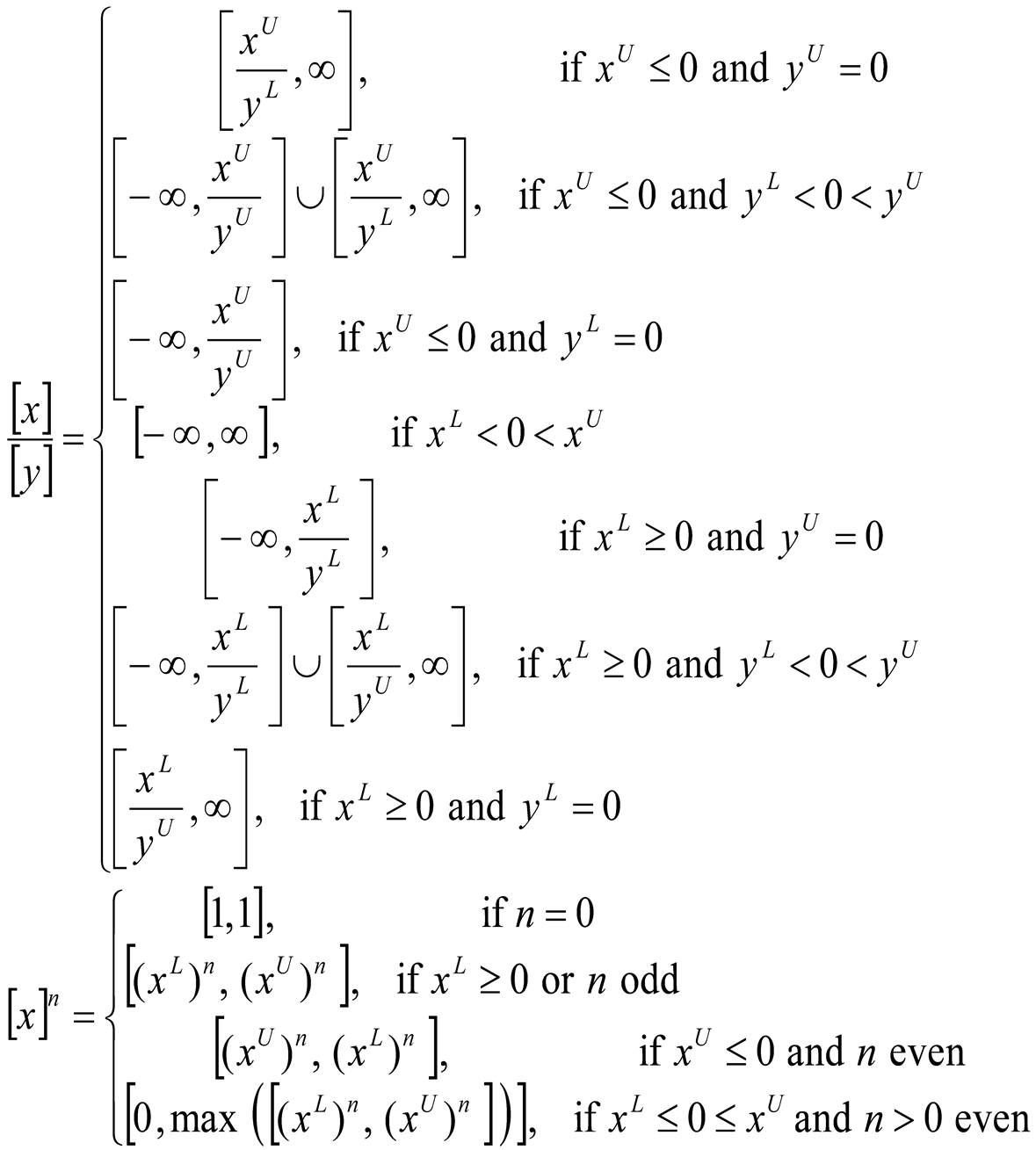

Definition 8. The division between the interval numbers

and is defined by:

, if .

It can be written, if as follows:

Now we will extend the classical inequality relations between real numbers to inequality relations between interval numbers.

Let and be interval numbers, with .

Definition 9. We say that if and .

Definition 10. We say that if or or .

Definition 11. (Ishibuchi and Tanaka,1990)

We say that ≼ if .

If , the interval inequality “≼ ” is said to be optimistic satisfactory.

If, the interval inequality “≼ ”is said to be pessimistic satisfactory.

Definition 12. We say that if .

Definition 13. We say that if and .

2.2. Model Formulation

Notation

We consider a financial market with n risky assets for trading. Suppose that an investor intends to invest his initial wealth W₀ among the n risky assets at the beginning of period 1 for constructing a T-period investment. He can reallocate his wealth at the beginning of each of the following T-1 consecutive time periods. Since the financial market is extremely complex, many non-probabilistic factors affect the financial market. It is impossible to forecast the returns, risk and turnover rates of assets precisely by historical data. We assume that the returns, risk and turnover rates of assets are characterized by interval numbers. Let the returns of portfolios in T different periods be independent of each other. For the sake of description conveniently, let us first introduce the following notations:

the return of risky asset i at period t, where = [ ,

the covariance between and with =[,

the transaction cost rate of risky asset i at period t;

the investment proportion of risky asset i at period t;

the portfolio at period t, where

the interval valued return of portfolio at period t, after paying tranxaction cost

the preset minimum expected interval valued return of the portfolio at period t, where = [,

the preset maximum risk tolerance interval valued return of the portfolio at period t, where = [,

the interval valued turnover rate of risky asset i at period t, where = [,

the preset minimum expected interval valued turnover rate of the portfolio at period t, where = [,

the preset minimum diversification degree of the t th period portfolio;

the available wealth at the end of period t, t = 1,2,…,T.

Objective and Constraints

According to before assumptions, the returns, risk and turnover rates of risky assets are denoted as interval numbers. Then, the return and covariance of the portfolio at period t can be, respectively, represented by

= [ ] (1)

= (2)

For transaction cost, we use V shape function to express it. The transaction cost rate of the portfolio at period t ( t = 1, 2, …,T ) can be expressed as :

(3), where is a crisp number for all i = 1, 2, …, n and t = 1, 2, …,T. From Eqs. (1) and (3), the return of portfolio at period t after paying transaction costs can be represented by

- = [ ] (4)

Then, the wealth at the end of period t can be calculated by

or

(5)

Solving Eq. (5) recursively, the terminal wealth at the end of period T is:

or

(6)

Liquidity is one of the main concerns for investors to make a portfolio decision. It measures the degree of probability of being able to transform an investment into cash without any significant loss in value. The turnover rate of an asset is the proportion of turnover volume to tradable volume of the asset, and is a factor which may reflect the asset's liquidity. Generally, investors prefer greater liquidity, especially in a bull market, returns on assets with high liquidity tend to increase with time. Here, we use the turnover rates of securities to measure their liquidity. It is known that turnover rates of assets in the future cannot be accurately predicted in a financial market. In this paper, we assume that the turnover rates of assets are characterized by interval numbers.

Based on the analysis above, the turnover rate of the portfolio at period t can be expressed by:

(7)

In the traditional portfolio theory, a distributive investment has been regarded as a good policy to reduce the risk of portfolio. Diversification degree of portfolio is also a main factor concerns for investors to make decisions. Because it is usually accepted as an instrument to diversify the unsystematic risk of portfolio. This idea is reflected in a famous saying that "one should not put all the eggs into one basket". In other words, it indicates that investors should not allocate all their money to just a few securities. Allocating all the money in only a few companies may cause financial disaster. How to obtain a well-diversified portfolio has become a problem to researchers. In this paper, we measure the diversification degree measure of portfolio at each period by using the Shannon entropy. Thus, the diversification degree of the portfolio at period t can be represented by

, t = 1, 2, …,T (8)

The Multiperiod Portfolio Optimization Model with Interval Numbers

We assume that the investor is rational. He wants to maximize the terminal wealth obtained at the end of period T. At the same time, he also requires the return, risk and diversification degree of portfolio at each period that must achieve or exceed the given expected interval levels. Besides, the risk of portfolio at each period should be less than the preset maximum risk tolerance interval. Based on the analysis above, an interval multi-period portfolio selection model can be formulated as follows:

[ ] ] (9)

10)

(11)

(12)

where constraint (9) means that the return of the portfolio at period t must be larger than or equal to the given minimum expected interval valued return; constraint (10) indicates that the risk of the portfolio at period t must be smaller than or equal to the preset the maximum risk tolerate interval; constraint; (11) represents that the turnover rate of the portfolio at period t must be no less than the given minimum expected interval valued level; constraint; (12) states that the diversification degree of the portfolio at period t must be no less than the given diversification level ; constraint (13) shows that the proportion at period t sums to one; constraint (14) denotes that short selling is not allowed during the whole investment.

Solution Methodology

Stage 1:Find “the best optimal solution, x(1)” by solving the following problem:

]

.

i = 1,2,…,n and t = 1,2,…,T

Stage 2: Find” the worst optimal solution, x

(2) “ by solving the following problem:

]

.

i = 1,2,…,n and t = 1,2,…,T

Stage 3 : We obtain the optimal solution given by: = λx(1)+ (1-λ)x(2) , λ [0,1].

2.3. Case Study: Multiperiod Portfolio Selection Under Interval Uncertainty

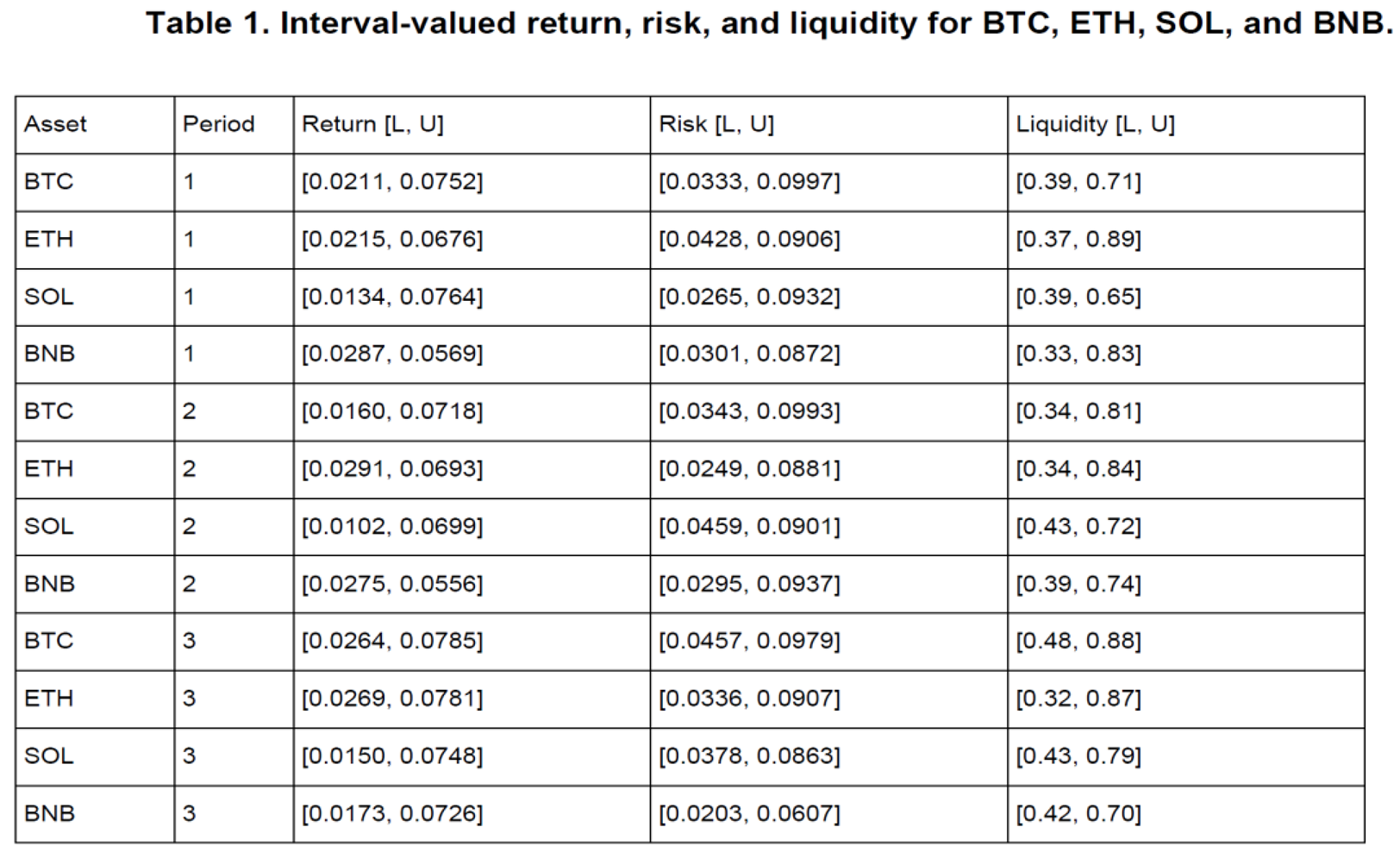

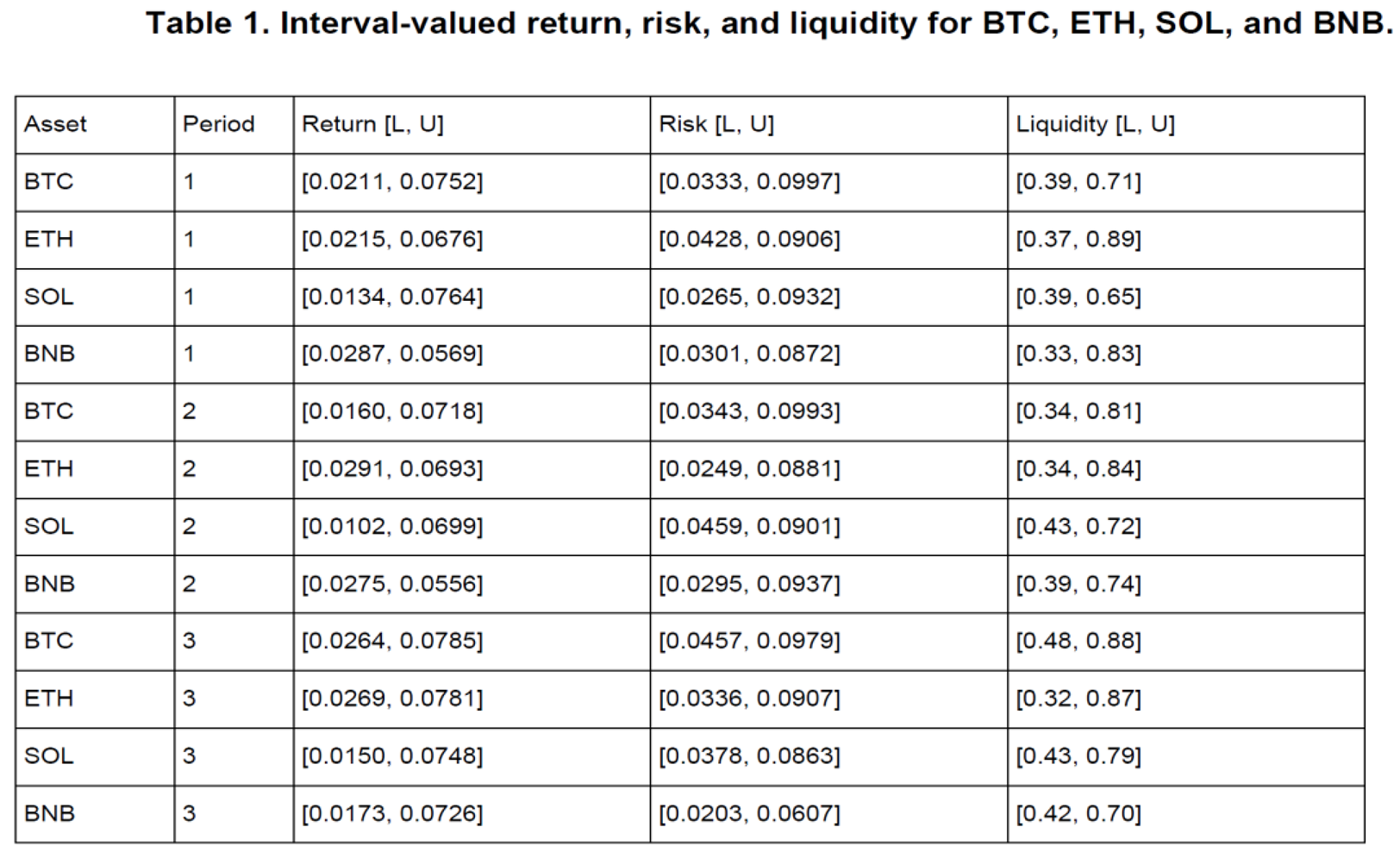

To illustrate the applicability and effectiveness of the proposed multi-period interval-based portfolio optimization model, we conduct a numerical case study using four representative assets: Bitcoin (BTC), Ethereum (ETH), Solana (SOL), and Binance Coin (BNB). The investment horizon is divided into three periods, and all input parameters, including returns, risk levels, and liquidity indicators, are modeled as intervals to reflect real-world uncertainty. The interval bounds for return and risk were derived from simulated time series reflecting historical volatility patterns and expected market dynamics, particularly tailored to the cryptocurrency domain. These intervals capture the natural uncertainty and variability inherent to high-volatility assets, enabling realistic scenario-based modeling. Table 1 presents the interval-valued returns, risk levels, and liquidity measures for each asset across the three investment periods. These values have been generated to simulate the variability and imprecision commonly observed in emerging or highly volatile markets such as cryptocurrencies.

Using the model defined in

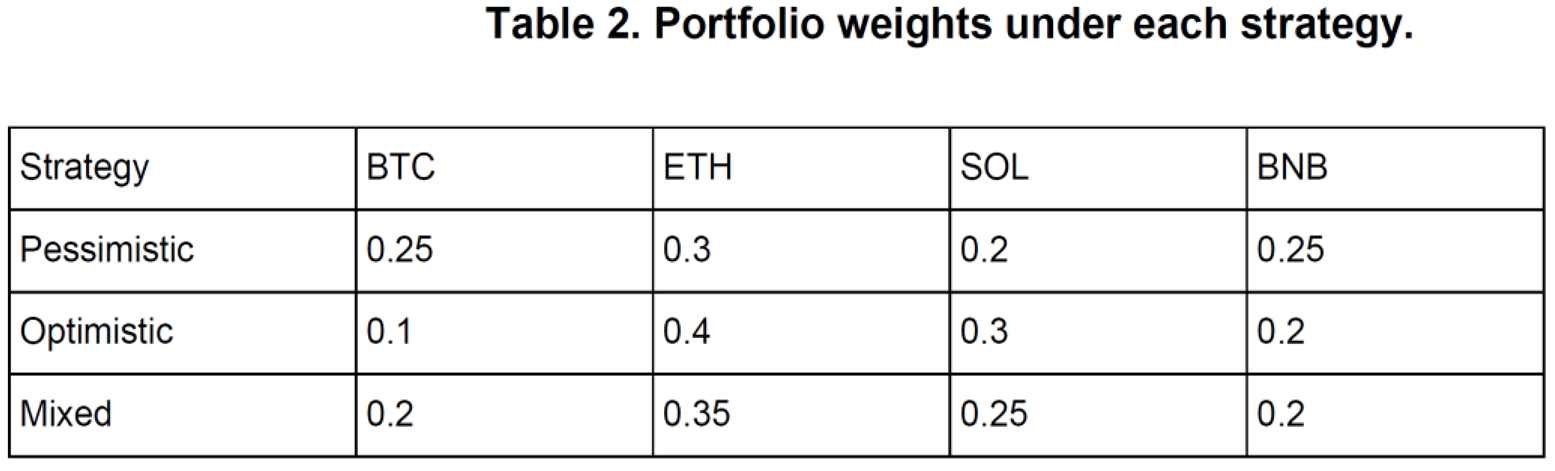

Section 2.2, we optimize the portfolio allocations under three different decision-making strategies:

- -

Pessimistic: based on lower bounds for returns and upper bounds for risk.

- -

Optimistic: using upper bounds for returns and lower bounds for risk.

- -

Mixed: with average values between bounds, reflecting a neutral risk attitude.

The optimization objective is to maximize the interval-valued terminal wealth WT, while satisfying constraints on return, risk, liquidity, and entropy-based diversification at each time step. For simplicity, we assume an initial wealth W0 = 1000 u.m, a fixed transaction cost of 0.2% per asset, and a minimum diversification entropy threshold of et = 0.9 for all t ∈ {1,2,3}.

Optimal allocations obtained from the three strategies are summarized in Table 2.

The pessimistic strategy exhibits a more conservative allocation, emphasizing assets with relatively tighter return intervals and lower downside exposure. The optimistic strategy shifts capital toward higher-return assets with broader intervals, accepting greater risk in pursuit of superior gains. The mixed strategy delivers a balanced allocation, aligning with moderate investor preferences.

The final wealth intervals WT obtained for each strategy are as follows:

Pessimistic: [ 1085.32, 1163.77]

Mixed: [ 1123.89, 1245.16]

Optimistic: [ 1167.42, 1323.55]

These results underline the model’s ability to provide flexible solutions that adapt to different risk attitudes, while managing uncertainty in a structured way through interval analysis and entropy-based diversification.